#jactravels

Text

💣 Jack & Jones S Jactravel Kit Regular Basic Boxer a Pantaloncino

🤑 a soli 16,86€ invece di 64,99€

➡️ https://www.scontomio.com/coupon/jack-jones-s-jactravel-kit-regular-basic-boxer-a-pantaloncino/?feed_id=39592&_unique_id=637dd5a7b50f9&utm_source=Tumblr&utm_medium=social&utm_campaign=Poster&utm_term=Jack%20%26amp%3B%20Jones%20S%20Jactravel%20Kit%20Regular%20Basic%20Boxer%20a%20Pantaloncino

#coupon #jackjones #intimolingerieeabbigliamentodanotte #amazon #scontomio

0 notes

Text

PRIVATE JETS & FLYING ON JETBLUE * JACQUELINE TRAVELS

PRIVATE JETS & FLYING ON JETBLUE * JACQUELINE TRAVELS

WATCH HERE

Hello hello! There are more airplanes than usual in this vlog. In the first half I work on a private jet as a flight attendant and in the second half of the video I fly back to New York as a passenger and get to enjoy the amazing city skyline from a commercial plane. Just a typical day in the life of a flight attendant! As always, thank you for watching and make sure you’re subscribed…

View On WordPress

#airplane#airplane jobs#airplanes#airport life#airports#corporate flight attendant vlog#corporate flight attendant vlogmas#does a flight attendant pay for hotel on layover#flight attendant layover hotel#flight attendant vlog#flight attendant vlogger#flight attendant vlogmas#jac travels#jacqueline answers#jacqueline travels#jacqueline travels youtube#jacquelinetravels#jactravels#JET BLUE#jet blue flight attendant#JETBLUE#layover#layover life#layover life style#layover lifestyle#LGA#new york#new york city#private flight attendant vlogmas#private jet

1 note

·

View note

Link

Manaslu Circuit Trek in Nepal begins by sightseeing of the UNESCO World Heritage Sites in Kathmandu to trekking in the beautiful Manaslu Circuit Region. We get to marvel at the magnificent views of Mt. Manaslu (8163m), the eighth tallest mountain in the world.

The highest point in Manaslu Circuit Trek is the ‘Larkya La Pass’ believed to be considered as one of the most dramatic passes crossing the Himalayas. Much of the trek involves walking on mountain trails. Still, it is important to note that trekking at altitudes above 3000m/10,000ft is more demanding on the body than walking at low elevations.

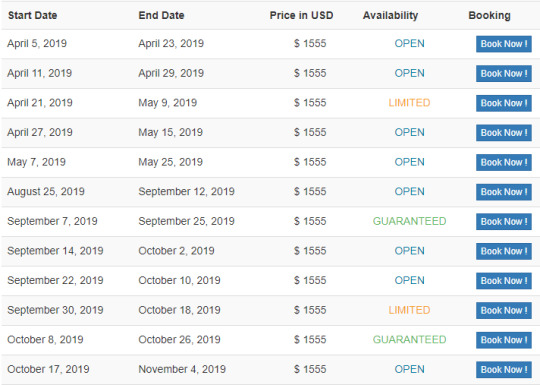

Brief Overview of Manaslu Circuit Trek Cost as per Company is around $1,500 to $2,000. But In Nepal Guide Treks and Expedition, We are providing just $1,555

The Brief Overview of Manaslu Circuit Trek in Nepal as:

Manaslu Circuit Trek with Nepal Guide Treks and Expedition starts with a day drive to Soti Khola from Kathmandu. Our Hidden Culture Village Valley drive leads through the zigzag hilly road of Prithvi Highway up to Malekhu. From there we will leave the main highway and continue our drive along the gravel road passing through Arughat Bazaar to reach Soti Khola. Solo Trekking Nepal also starts following several ascending and descending trails, passing through dense forests, beautiful paddy fields, Hidden Culture Village and mind capturing valleys. We will spend an acclimatization day at Samagaun and Samdo in order to avoid altitude sickness problems and for exploration. We will visit several Non-Tourist Region Trekking in Nepal like Buddhist monasteries and classic lama settlement areas that are highly influenced by the Tibetan culture.

After a day exploration at Samdo, our trail heads up to Larkya Phedi situated at the base of Larkya La Pass. Next day, we cross the adventurous Larkya La Pass at 5135 meters. Our off the beaten path climbing to the top of the pass is rewarded with striking views of Annapurna II, Gyagi Kang, Menjung, Kang Guru, Himlung and Cheo Himals. After a short rest, we begin to descend over a steep slope towards Bimtang. Our Hidden Culture Village trail descends downhill through serene alpine forest and meadows towards the main trail of the Annapurna circuit at Dharapani. Our memorable Manaslu Circuit Trek Nepal Trekking with Nepal Guide Treks and Expedition and Peak Climbing Nepal ends with a scenic drive from Syange back to Kathmandu.

Outline Itinerary

Day 01: Arrive at Kathmandu [1345m/4411ft] and transfer to Hotel.

Day 02: Sightseeing at Kathmandu

Day 03: Drive to Soti Khola [712m/2335ft] [9-10 hrs Drive]

Day 04: Trek from Soti Khola to Maccha Khola [883m/2896ft] [5-6 hrs Trek]

Day 05: Trek from Machha Khola to Jagat [1415m/4641ft] [5-6 hrs Trek]

Day 06: Trek from Jagat to Deng [1804m/5917ft] [6-7 hrs of Trek]

Day 07: Trek from Deng to Namrung [2670m/8757ft] [6-7 hrs of Trek]

Day 08: Trek from Namrung to Shya [3530m/11578ft] [5-6 hrs Trek]

Day 09: Trek from Shya to Samagaon [3541m/11614ft] [2-3 hrs Trek]

Day 10: Acclimatization day at Samagaon.

Day 11: Trek from Samagaon to Samdo [3872m/12700ft] [3-4 hrs Trek]

Day 12: Acclimatization day at Samdo.

Day 13: Trek from Samdo to Larkya Pedhi [4494m/14740ft] [5-6 hrs Trek]

Day 14: Trek to Bimtang [3720m/12201ft] via Larkya La Pass [5135m/16842ft] [8-9 hrs Trek]

Day 15: Trek from Bimtang to to Dharapani [2006m/6579ft] [7-8 hrs Trek]

Day 16: Trek from Dharapani to Syange [1194m/3916ft] [5-6 hrs Trek]

Day 17: Drive back to Kathmandu [8-9 hrs Drive]

Day 18: Free day at Kathmandu.

Day 19: Transfer to International Airport for departure.

Note: The above itinerary outline can be easily tailor-made according to your preference, purpose of visit, and length of stay. Contact us to customize this trip as per your requirement.

For Getting More information about other similar Classic Adventure Destination in Nepal. Please Visit:

Ganesh Himal Base Camp Trek

Kanchenjunga Circuit Trek

Lower Dolpo Trek

Makalu Trek with Sherpani Col

Rara Lake Trek

Upper Dolpo Circuit Trek

Manaslu Circuit Trek

#manaslucircuittrek#manaslucircuittrekinnepal#visitnepal2020#trustpilot#travelzoo#mountainplanet#lonelyplanet#jactravel#goabroad#getyourguide

0 notes

Link

JacTravel Hotel API is the most demanding Hotel XML API for integration. They deal with travel agents and you can easily connect with all over the world at an affordable rate. Teamindia Webdesign provides the best services for JacTravel XML API Integration.

0 notes

Text

Visit Britain fará capacitações em São Paulo; veja o calendário

O Visit Britain realizará uma série de capacitações em São Paulo nesta semana. Entre amanhã (26) e quinta-feira (28), uma série de atividades serão realizadas. Neles, estarão presentes oito dos principais fornecedores do Reino Unido para o trade de viagens do Brasil.

Confira o calendário:

26/03 27/03 28/03 Workshop da manhã: 8h30 – 12h45 Workshop da manhã: 8h30 – 12h45 Brunch com Compradores do Mercado de Luxo 9h – 11h30

A organização destaca que os workshops serão realizados no Centro Brasileira Britânico. O espaço fica localizado na rua Ferreira de Araújo, 741, em Pinheiros, São Paulo (SP). Já o brunch acontecerá no Hotel Tivoli Mofarrej, também na capital paulista.

LEIA MAIS: + Com Airbnb, Visit Britain visa somar 83 mil pernoites na Grã-Bretanha + Brasil bate recorde de turistas à Grã-Bretanha + VisitBritain anuncia nomeação de Gavin Landry como VP das América

Entre os fornecedores britânicos confirmados, estão nomes como:

Angela Shanley Associates, Ltd (ASA)

JacTravel

Bustronome

RailEurope

EuroWelcome

Strawberry Field (Liverpool, Inglaterra)

Historic Royal Palaces

Unique Connections

Para que servirão os workshops?

Nunca foi tão fácil para os brasileiros visitar a Grã-Bretanha. A Norwegian Airlines, por exemplo, iniciará novos voos em 31 de março ligando o Rio de Janeiro a Londres (Gatwick). Já a Virgin Atlantic acaba de anunciar um novo serviço diário entre São Paulo e Londres (Heathrow) que começará a operar em 2020.

Ademais, essas novas opções se unem aos voos diários da British Airways do Rio de Janeiro e de São Paulo para Londres (Heathrow). Há, ainda, as operações da Latam, com a frequência diária entre São Paulo e Londres.

Além disso, os dados mais recentes da Forward Keys mostram a tendência ascendente entre a América do Sul e Reino Unido. Entre março a agosto deste ano, aliás, as reservas de voos futuros entre as regiões de aumentaram 9% em comparação com o mesmo período de 2018.

Para confirmar sua participação, entre em contato com Malcolm Griffiths, diretor do Visit Britain no Brasil. Os contato dele são: [email protected] ; +55 (11) 98266-0059.

LEIA TAMBÉM:

– WTM Latin America lança prêmio de Turismo Responsável; veja

– Parau Parau 2019 chega ao último dia no Taiti

O post Visit Britain fará capacitações em São Paulo; veja o calendário apareceu primeiro em Brasilturis Jornal – Tudo sobre o mercado de turismo no Brasil.

O post Visit Britain fará capacitações em São Paulo; veja o calendário foi postando originalmente em Elen Venâncio Rio.

0 notes

Text

Destinations of the World overgenomen door Webjet

Webjet heeft voor 173 miljoen Amerikaanse dollar de beddenbank Destinations of the World gekocht. DOTW is ook actief op de Nederlandse B2B-reismarkt. Met de overname wil Webjet, een Australische online reisagent, haar WebBeds-beddenbank versterken. De DOTW-merken JacTravel, TotalStay, Sunhotels, Lots of Hotels en Fit Ruums worden in WebBeds opgenomen. Naar eigen zeggen wordt het hierdoor de nummer twee B2B-beddenbank. DOTW wordt verkocht door Gulf Capital en heeft het hoofdkantoor in Dubai staan. Het portfolio bestaat uit zo’n 12.300 hotels waarmee directe prijsafspraken zijn gemaakt. Hiervan zijn er 5.600 nieuw voor WebBeds. Hiermee groeit de inventaris naar 28.500 hotels. DOTW is sterk in Azië, een focusmarkt van WebBeds. http://dlvr.it/QqT8jr

0 notes

Text

Key differences between Apache Ignite, Hazelcast, Cassandra and Tarantool

New Post has been published on Java Code Geeks

Key differences between Apache Ignite, Hazelcast, Cassandra and Tarantool

Apache Ignite is widely used around the world and is growing all the time. Companies like Barclays, Misys, Sberbank (3r largest bank in Europe), ING, JacTravel all use Ignite to power pieces of their architecture that are critical to the day-to-day operations of those organizations. Moreover, t...

Read more at : https://www.javacodegeeks.com/2018/10/differences-apache-ignite-tarantool.html

0 notes

Text

Webjet Provides JacTravel Depreciation Amortisation Update

Webjet Provides JacTravel Depreciation Amortisation Update

Webjet Limited (Webjet) has become aware of an error in the depreciation and amortisation (D&A) costs in the pro forma Continuing Operations table set out in the appendix to its 1H18 Financial Results presentation released on 22 February 2018. The error has no impact on reported results or guidance.

The previous owner of JacTravel incurred a $3.1 million D&A charge in July and August 2017,…

View On WordPress

#asx#Australia#Australian shares#Australian stocks#dividend#dividend stocks#dividends#webjet limited

0 notes

Photo

http://livingstonepartners.com/us/transactions/vitruvian-partners-backs-jactravel-buy-out-to-support-growth-3/

0 notes

Photo

Terry Williamson to go away JacTravel following Webjet acquisition http://ift.tt/2zeIfpt

0 notes

Text

Hotelbeds Eyes a Viable Wholesaler Path in the Shadows of Priceline and Expedia

Hotelbeds filled about 25 million room nights last year by suppling hotels to travel agencies, tour operators, and airlines. Joan Vilà (right) , executive chairman of Hotelbeds Group, is shown with Tourico Holidays CEO Uri Argov when announcing their merger on February 7, 2017. Hotelbeds Group

Skift Take: Since 2016, the quiet wholesaler marketplaces for hotel supply have become noisy as private equity firms invested $2.9 billion to make Hotelbeds Group a market leader. Expect more consolidation.

— Sean O'Neill

Everyone knows that hotels increasingly rely on two conglomerates — Expedia Inc. and Priceline Group — to distribute their inventory globally to a large chunk of leisure travelers. Some hotels rely on the giants to fill as many as half of their rooms on any given night.

Yet an alternative distribution path may be gaining small but noticeable momentum — namely, business-to-business (B2B) marketplaces.

The largest of these is Hotelbeds, which distributes rooms at wholesale rates to about 35,000 retail travel agencies, small online travel agencies (such as Getaroom and Travel Republic), tour operators who build vacation packages (such as TUI Deutschland), and airlines who upsell passengers with accommodation offers (such as EasyJet).

In spring 2016, the B2B accommodation sector heated up when private equity firm Cinven and the Canada Pension Plan Investment Board led a consortium that bought parent company Hotelbeds Group from tour operator TUI for $1.32 billion (€1.165 billion).

Since then, the owners of the Palma de Mallorca, Spain-based Hotelbeds Group have been investing for growth.

This year, they funded its acquisitions of its smaller peers GTA and Tourico Holidays for a combined cost of $1.5 billion (€1.3 billion), according to sources familiar with the companies’ finances.

The deals make Hotelbeds Group the market leader in the B2B hotel sector, holding around 15 percent of the global market — roughly double what it had before the two acquisitions.

When Hotelbeds Group made the acquisitions, it did so with the backing of the Cinven-led consortium. That means, in effect, that private equity has placed a $2.93 billion bet on this sector in the past couple of years.

The second-largest wholesaler platform is Australia-based travel booker Webjet, with about 3 percent of the global accommodation market — assuming its $265 million offer to acquire JacTravel that was announced this summer is approved.

After that, there’s long-tail of players — led by MTS Globe and World2Meet. The wide field leaves opportunity for further consolidation.

On Wednesday, Hotelbeds’ acquisition of GTA officially closed. In the next 12 months, the companies expect to fill about 55 million room nights together. Hotelbeds Group now has 8,300 employees after the acquisitions, making its workforce about as large as better-known travel players like EasyJet and Sabre.

Geographic Targeting

The larger of Hotelbeds’ two acquired companies, GTA, is particularly strong in its coverage of Asia Pacific and the Middle East.

Like Hotelbeds, GTA provides hotels and other products to travel intermediaries, smaller online travel agencies, and traditional travel agencies via an online booking platform or an integration with its API (application programming interface, or a method used for retrieving data).

The leader in the Americas is Tourico Holidays. Hotelbeds’s acquisition of it closed this summer.

In spring 2016, Hotelbeds said it had a database of 72,000 rooms. This week it said it has about 120,000 — not counting the ones it will inherit from its new acquisitions — including inventory from global chains Hilton, InterContinental Hotels Group, and AccorHotels.

Upon Wednesday’s transaction close, the group began the process of discovering how much overlap there is between its listings and those of its newly acquired companies, with GTA claiming about 100,000 and Tourico Holidays., claiming about 50,000. Hotelbeds will move all of the brands onto its revamped technology platform — an open-source, cloud-based IT structure — to try and generate efficiencies.

One path Hotelbeds uses to distribute rooms is to make them available via the reservation system run by Amadeus, a Madrid-based global travel marketplace, but not Amadeus’ rivals Sabre and Travelport. Use of this channel may grow, the company said.

Joan Vilà, executive chairman of Hotelbeds Group, also wants to grow business lines in airport transfers, activities like big bus tours and Broadway show tickets, cruises, and — eventually — corporate hotel booking.

The conventional wisdom is that most of those products do not have margins as high as hotels do, on average. If so, that calls into question whether Hotelbeds can maintain its double-digit growth rates by moving into other products.

Hotelbeds disagreed with this line of thinking, saying that some types of product have a higher margin than others — such as excursions instead of walking tours. It added that, cross-selling and a more sophisticated use of technology than its competitors will give it gains in efficiency and drive higher average revenue for agencies, vacation packagers, and airlines. That would encourage those suppliers to use it more frequently for distribution, the company said.

Overpromising or Holding Its Own?

Conventional wisdom is that — while not as bad as for airplane tickets — the wholesale market for hotel rooms is under margin pressure. These critics doubt that so-called bed banks have a future.

While a few B2B marketplace businesses like Hotelbeds have high margins, partly by essentially buying blocks of rooms with commissions estimated at effectively about 25 percent, many smaller players appear to be competing by charging lower commissions of around 15 percent.

The cuts in commissions may deepen: Many small players tell hotels that they’re selling rooms to tour operators and offline agencies but, in reality, are selling to smaller online travel sites, such as Amoma, which rely heavily on wholesaler inventory.

The bottom line: Online competitive pressures are driving down commissions.

In other words, hotels may not realize how much of their inventory is ending up on sites like Amoma. If they do, they might discover that they’re accidentally competing against the rates they offer on their direct brand sites, according to Guilain Denisselle, a Paris-based industry consultant and the editor of trade publication Tendance Hotellerie.

Hotelbeds isn’t to blame for this phenomenon.

Yet among smaller players, low-margin tactics are becoming common, experts said. This phenomenon may reduce the pool of high-margin wholesalers that Hotelbeds could snap up to maintain its pace of growth.

Chairman Interview

Hotelbeds said it is not noticing margin pressure in its own business. While it did not say this, experts believe it may have avoided margin pressure by emphasizing sales to tour operators, who do not compete as directly with online travel agencies, and by relying on high-quality, upscale properties, which have more demand from upscale consumers who don’t balk at high prices.

Despite its acquistions, Hotelbeds said it drives a lot growth organically to meet its objectives. It does not need additional acquisitions to drive growth, it claims.

Vilà, Hotelbeds Group’s executive chairman, told Skift he thought the portfolio of brands and their geographic coverage is adequate now. But he added that the company would remain opportunistic.

“We are pretty well-represented in all of the key destinations worldwide now,” Vilà said. “Additional acquisitions are not something we’re thinking about for the next several months at least, though I can’t say we would rule it out entirely.”

Vilà said the company is more interested in high-quality properties that will lead to repeat bookings rather than simply having the largest possible inventory.

The company also stands out from other wholesalers by its technology investment, he said. Unlike most others, it can handle dynamically changing rates.

A case in point: One of its partners, AccorHotels, can adjust the rates it allows Hotelbeds to sell its properties for based marketplace conditions rather than the old model of setting rates months in advance.

Some experts believe Hotelbeds sees itself as primarily competing with the global conglomerates for premier inventory in popular destinations.

By that measure, a wholesaler’s average 25 percent is higher than a typical 15 percent Booking.com commission. It would be on par with Booking.com, though, when a traveler books through the Booking Genius program — a service used disproportionately by business travelers. Under that program, Booking.com charges a commission of 15 percent plus a 10 percent additional fee when a traveler makes a booking at a rate provided by the hotel that is a 10 percent discount off published rates.

Booking.com and Expedia often add fees for premium placement in their search results which, in effect, brings them closer to 20 to 25 percent commission levels.

If the rates are roughly comparable, why would hoteliers use the business-to-business channel?

One answer: by participating in and expanding the wholesale channel as a competitive model, hoteliers can put pressure on the duopoly to reign in their commissions — if the volumes are significant. Hotelbeds is nowhere near producing a volume that would impact companies like the Priceline Group. But its goal is to build a viable distribution business in the shadows of the Big Two.

Another answer: Wholesalers take net rates, a different model than is used by online travel giants like Booking.com, which have an agency, model. As part of a distribution mix, some hotels like a mix of models.

Wholesalers like Hotelbeds also don’t have consumer-facing brands, so aren’t spending marketing dollars competing for user acquisition against the hotels the way other companies do.

That said, one competes with a superstar company like the Priceline Group at one’s own peril, as summarized by Skift Research’s new report on the colossus. Priceline and its rival Expedia already are involved in the business-to-business segment via their affiliate businesses that provide inventory to tour operators and other players.

Vilà, who has led Hotelbeds since its creation in 2001, said his ultimate goal is to position Hotelbeds Group in “the champions league of the big travel companies.”

“We transcend our business-to-business segment,” Vilà said. “Our value proposition to our hotel partners is to enable them to diversify their distribution strategies and undermine the perhaps oligopolistic position of certain travel players.”

0 notes

Text

A WEEKEND IN THE WOODS * FLIGHT ATTENDANT LIFE ON VACATION

A WEEKEND IN THE WOODS * FLIGHT ATTENDANT LIFE ON VACATION

WATCH HERE

Hello hello! I am taking a small break from my Corporate Flight Attendant vlogs and sharing a personal weekend in the woods with you guys. Let me know your thoughts about personal vlogs compared to Flight Attendant vlogs.

My husband Jonny and I spent a weekend in a log cabin with most of my family. Unfortunately one of my sisters was not able to join us, but we still had a wonderful…

View On WordPress

#a weekend in the woods#cabin life#family activities in the woods#family getaway#FAMILY TRIP#FAMILY VACATION#family vacation ideas#flight attendant travel tips#jac travels#jacqueline travels#jacquelinetravels#jactravels#lake life#lake vacation#log cabin#log cabin life#luxury travel#mountain#mountain vacation#standby travel#things to do in the woods#tips for traveling with a baby#tips for traveling with family#tips for traveling with kids#travel#travel blog#travel bucket list#travel in style#travel like a flight attendant#travel photo blog

0 notes

Text

Hotelbeds Eyes a Viable Wholesaler Path in the Shadows of Priceline and Expedia

Hotelbeds filled about 25 million room nights last year by suppling hotels to travel agencies, tour operators, and airlines. Joan Vilà (right) , executive chairman of Hotelbeds Group, is shown with Tourico Holidays CEO Uri Argov when announcing their merger on February 7, 2017. Hotelbeds Group

Skift Take: Since 2016, the quiet wholesaler marketplaces for hotel supply have become noisy as private equity firms invested $2.9 billion to make Hotelbeds Group a market leader. Expect more consolidation.

— Sean O'Neill

Everyone knows that hotels increasingly rely on two conglomerates — Expedia Inc. and Priceline Group — to distribute their inventory globally to a large chunk of leisure travelers. Some hotels rely on the giants to fill as many as half of their rooms on any given night.

Yet an alternative distribution path may be gaining small but noticeable momentum — namely, business-to-business (B2B) marketplaces.

The largest of these is Hotelbeds, which distributes rooms at wholesale rates to about 35,000 retail travel agencies, small online travel agencies (such as Getaroom and Travel Republic), tour operators who build vacation packages (such as TUI Deutschland), and airlines who upsell passengers with accommodation offers (such as EasyJet).

In spring 2016, the B2B accommodation sector heated up when private equity firm Cinven and the Canada Pension Plan Investment Board led a consortium that bought parent company Hotelbeds Group from tour operator TUI for $1.32 billion (€1.165 billion).

Since then, the owners of the Palma de Mallorca, Spain-based Hotelbeds Group have been investing for growth.

This year, they funded its acquisitions of its smaller peers GTA and Tourico Holidays for a combined cost of $1.5 billion (€1.3 billion), according to sources familiar with the companies’ finances.

The deals make Hotelbeds Group the market leader in the B2B hotel sector, holding around 15 percent of the global market — roughly double what it had before the two acquisitions.

When Hotelbeds Group made the acquisitions, it did so with the backing of the Cinven-led consortium. That means, in effect, that private equity has placed a $2.93 billion bet on this sector in the past couple of years.

The second-largest wholesaler platform is Australia-based travel booker Webjet, with about 3 percent of the global accommodation market — assuming its $265 million offer to acquire JacTravel that was announced this summer is approved.

After that, there’s long-tail of players — led by MTS Globe and World2Meet. The wide field leaves opportunity for further consolidation.

On Wednesday, Hotelbeds’ acquisition of GTA officially closed. In the next 12 months, the companies expect to fill about 55 million room nights together. Hotelbeds Group now has 8,300 employees after the acquisitions, making its workforce about as large as better-known travel players like EasyJet and Sabre.

Geographic Targeting

The larger of Hotelbeds’ two acquired companies, GTA, is particularly strong in its coverage of Asia Pacific and the Middle East.

Like Hotelbeds, GTA provides hotels and other products to travel intermediaries, smaller online travel agencies, and traditional travel agencies via an online booking platform or an integration with its API (application programming interface, or a method used for retrieving data).

The leader in the Americas is Tourico Holidays. Hotelbeds’s acquisition of it closed this summer.

In spring 2016, Hotelbeds said it had a database of 72,000 rooms. This week it said it has about 120,000 — not counting the ones it will inherit from its new acquisitions — including inventory from global chains Hilton, InterContinental Hotels Group, and AccorHotels.

Upon Wednesday’s transaction close, the group began the process of discovering how much overlap there is between its listings and those of its newly acquired companies, with GTA claiming about 100,000 and Tourico Holidays., claiming about 50,000. Hotelbeds will move all of the brands onto its revamped technology platform — an open-source, cloud-based IT structure — to try and generate efficiencies.

One path Hotelbeds uses to distribute rooms is to make them available via the reservation system run by Amadeus, a Madrid-based global travel marketplace, but not Amadeus’ rivals Sabre and Travelport. Use of this channel may grow, the company said.

Joan Vilà, executive chairman of Hotelbeds Group, also wants to grow business lines in airport transfers, activities like big bus tours and Broadway show tickets, cruises, and — eventually — corporate hotel booking.

The conventional wisdom is that most of those products do not have margins as high as hotels do, on average. If so, that calls into question whether Hotelbeds can maintain its double-digit growth rates by moving into other products.

Hotelbeds disagreed with this line of thinking, saying that some types of product have a higher margin than others — such as excursions instead of walking tours. It added that, cross-selling and a more sophisticated use of technology than its competitors will give it gains in efficiency and drive higher average revenue for agencies, vacation packagers, and airlines. That would encourage those suppliers to use it more frequently for distribution, the company said.

Overpromising or Holding Its Own?

Conventional wisdom is that — while not as bad as for airplane tickets — the wholesale market for hotel rooms is under margin pressure. These critics doubt that so-called bed banks have a future.

While a few B2B marketplace businesses like Hotelbeds have high margins, partly by essentially buying blocks of rooms with commissions estimated at effectively about 25 percent, many smaller players appear to be competing by charging lower commissions of around 15 percent.

The cuts in commissions may deepen: Many small players tell hotels that they’re selling rooms to tour operators and offline agencies but, in reality, are selling to smaller online travel sites, such as Amoma, which rely heavily on wholesaler inventory.

The bottom line: Online competitive pressures are driving down commissions.

In other words, hotels may not realize how much of their inventory is ending up on sites like Amoma. If they do, they might discover that they’re accidentally competing against the rates they offer on their direct brand sites, according to Guilain Denisselle, a Paris-based industry consultant and the editor of trade publication Tendance Hotellerie.

Hotelbeds isn’t to blame for this phenomenon.

Yet among smaller players, low-margin tactics are becoming common, experts said. This phenomenon may reduce the pool of high-margin wholesalers that Hotelbeds could snap up to maintain its pace of growth.

Chairman Interview

Hotelbeds said it is not noticing margin pressure in its own business. While it did not say this, experts believe it may have avoided margin pressure by emphasizing sales to tour operators, who do not compete as directly with online travel agencies, and by relying on high-quality, upscale properties, which have more demand from upscale consumers who don’t balk at high prices.

Despite its acquistions, Hotelbeds said it drives a lot growth organically to meet its objectives. It does not need additional acquisitions to drive growth, it claims.

Vilà, Hotelbeds Group’s executive chairman, told Skift he thought the portfolio of brands and their geographic coverage is adequate now. But he added that the company would remain opportunistic.

“We are pretty well-represented in all of the key destinations worldwide now,” Vilà said. “Additional acquisitions are not something we’re thinking about for the next several months at least, though I can’t say we would rule it out entirely.”

Vilà said the company is more interested in high-quality properties that will lead to repeat bookings rather than simply having the largest possible inventory.

The company also stands out from other wholesalers by its technology investment, he said. Unlike most others, it can handle dynamically changing rates.

A case in point: One of its partners, AccorHotels, can adjust the rates it allows Hotelbeds to sell its properties for based marketplace conditions rather than the old model of setting rates months in advance.

Some experts believe Hotelbeds sees itself as primarily competing with the global conglomerates for premier inventory in popular destinations.

By that measure, a wholesaler’s average 25 percent is higher than a typical 15 percent Booking.com commission. It would be on par with Booking.com, though, when a traveler books through the Booking Genius program — a service used disproportionately by business travelers. Under that program, Booking.com charges a commission of 15 percent plus a 10 percent additional fee when a traveler makes a booking at a rate provided by the hotel that is a 10 percent discount off published rates.

Booking.com and Expedia often add fees for premium placement in their search results which, in effect, brings them closer to 20 to 25 percent commission levels.

If the rates are roughly comparable, why would hoteliers use the business-to-business channel?

One answer: by participating in and expanding the wholesale channel as a competitive model, hoteliers can put pressure on the duopoly to reign in their commissions — if the volumes are significant. Hotelbeds is nowhere near producing a volume that would impact companies like the Priceline Group. But its goal is to build a viable distribution business in the shadows of the Big Two.

Another answer: Wholesalers take net rates, a different model than is used by online travel giants like Booking.com, which have an agency, model. As part of a distribution mix, some hotels like a mix of models.

Wholesalers like Hotelbeds also don’t have consumer-facing brands, so aren’t spending marketing dollars competing for user acquisition against the hotels the way other companies do.

That said, one competes with a superstar company like the Priceline Group at one’s own peril, as summarized by Skift Research’s new report on the colossus. Priceline and its rival Expedia already are involved in the business-to-business segment via their affiliate businesses that provide inventory to tour operators and other players.

Vilà, who has led Hotelbeds since its creation in 2001, said his ultimate goal is to position Hotelbeds Group in “the champions league of the big travel companies.”

“We transcend our business-to-business segment,” Vilà said. “Our value proposition to our hotel partners is to enable them to diversify their distribution strategies and undermine the perhaps oligopolistic position of certain travel players.”

0 notes

Text

Better buy: Webjet Limited or Flight Centre <b>Travel</b> Group Ltd?

Online travel agency Webjet Limited (ASX:WEB) reported strong first half FY18 results, with revenues up a whopping 266% on the prior corresponding period to nearly $360 million. A major contributor to this big jump in revenues was JacTravel, a UK-based tour and accommodation supplier which ...

from Google Alert - travel agency https://ift.tt/2vxUL3u

0 notes

Link

JacTravel is a leading supplier of online hotel bookings. They deal with travel agents and you can easily connect with all over the world at an affordable rate.Teamindia Webdesign provides the best services for JacTravel XML API Integration.

0 notes

Link

via TravelMole Media Group, L.L.C. | UK Breaking News

0 notes