#it’d be nice to get traction on multiple platforms

Text

thought i’d post this

when i finish my fics on wp, i’ll reupload them onto here. i thought i’d give name sneak peeks 🤭

IN ORDER OF PUBLISHING

MINDBENDER (vol. l)

BLUE MONDAY

MINDBREAKER (THE GOOD ENDING)

MINDBREAKER (THE BAD ENDING)

SMASHING PUMPKINS

KEROSENE

TIME WARP

also, this is out!

rio’s rants (and recommendations)

will 100 percent be updated

#riosrevenge#rio#wattpad#fanfic#i’m kinda excited to post these on here#it’d be nice to get traction on multiple platforms#@beautifulresistance on wattpad#go follow me

0 notes

Text

Narrative edition, Week in Ethereum News, Jan 12, 2020

This is the 5th edition of the 6 annotated versions that I committed in my head to doing when I decided to see how an annotated edition would be received.

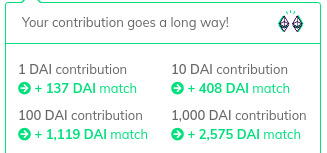

Given the response on my Gitcoin matching grant, I may have to keep going. Check it out - giving 1 DAI right now will get more than 100x matching.

Thanks to everyone who has given on my Gitcoin grant. It’s the best way to show you want these annotated editions to continue.

Even 1 Dai is super appreciated given the matching! Since Tumblr adds odd forwarders to links, here’s the text of the link: https://gitcoin.co/grants/237/week-in-ethereum-news

Eth1

Latest core devs call. Notes from Tim Beiko, discussion of EIPs 2456, 1962, 2348

EthereumJS v4.13 – bugfix release for Muir Glacier

Slockit released a stable version of their Incubed stateless ultralight client, aimed at IoT devices. 150kb to verify transactions or 500kb including EVM. incentive layer coming soon.

A little slow on in the eth1 section, but Incubed getting to be stable is cool. Obviously if they can get the incentive layer worked out, that will be fantastic.

When I think about that that I was wrong about, definitely if I go back to q1 or q2 2017, I thought that IoT Ethereum was much more of a thing. There was Brody’s early washing machine prototype, Airlock->Oaken, Slockit had some stuff 3 years ago, etc. It hasn’t really happened.

Why not? It seems to me like most of those things require enterprises to take the plunge. No one is going to go out and manufacture a domestic electronic device just yet with all the uncertainty there.

And light client server incentivization hasn’t happened yet. There’s just things to be built still. So it’s cool to see Incubed hitting a stable release. Slowly but surely all the necessary primitives get built. I still think there will be lots of robots transacting some day.

Eth2

Latest Eth2 implementer call. Notes from Mamy and from Ben.

Latest what’s new in Eth2

Spec version v0.10 with BLS standards

Prysmatic restarted its testnet with a newer version of the spec and mainnet config

Lodestar update on light clients and dev tooling

3 options for state providers

Eth2 for Dummies

Exploring validator costs

Eth2 for dummies was the most clicked this week. Even within the universe of people who subscribe to the newsletter, there’s always demand for high level explainers.

The spec is essentially finalized and out the door for auditing, so now it’s a sprint towards shipping, though of course there may be some minor changes as a result of further networking and of course from the audit.

Lately some in the community have been promoting a July ship date and I personally would be disappointed if it slipped that far.

Layer2

Optimistic rollup for tokens Fuel ships first public testnet

Optimistic Game Semantics for a generalized layer2 client

Loopring presents full results of their zk rollup testing

StarkEx says they can do 9000 trades per second at 75 gas per trade with offchain data, with the limiting factor being the prover, not onchain throughput.

9000 is a pretty crazy number, although since the data is offchain that makes it a Plasma construct and not a rollup. StarkWare to my memory hasn’t provided details on what the exit game is - as an end user do i get a proof I can submit if i need to exit? I have no idea.

Anyway, it’s very cool that the limiting factor is the prover, ie, nothing about Ethereum is what is currently limiting the 9000 transactions per second number.

Of course Loopring would also have a fairly crazy number if they did offchain data, but they have a thousand or 2k tps per second number with onchain data, and let’s be honest: right now the limiting factor here is the demand for dexes. No dex at the moment can fill even a hundred transactions per second. But as trades get cheaper, presumably there is more demand. And token trading will certainly increase in the next bull market.

Meanwhile Fuel shipped its first testnet. Very neat.

Stuff for developers

An update on the Vyper compiler: there’s now two efforts, a new one in Rust using YUL to target both EVM & ewasm as well as the existing one in Python.

A look at vulnerabilities of deployed code over time

a beginner’s guide to the K framework

Vulnerability: hash collisions with multiple variable length arguments

Verifying wasm transactions (and part2)

Austin Griffith’s eth.build metatransactions

Build your own customized Burner Wallet

Abridged v2 aiming to make it easy to onboard new users of web2 networks

Ethcode v0.9 VSCode extension

Embark v5

The Vyper saga is interesting. The existing Vyper compiler had a number of security holes found. EF’s Python team decided they didn’t like the existing codebase. So now some of the existing Vyper team is continuing on with the existing Python compiler, whereas there will also be an effort to write a Vyper compiler in Rust but to the intermediate language Yul, which means it will have both ewasm and EVM.

Also interesting to see the data viz of depoyed vulnerabilities over time. App security has been improving!

Ecosystem

RicMoo: SQRLing mnemonic phrases

ethsear.ch – Ethereum specific search engine

Avado’s RYO node – nodes opt-in and let users access them via load balancer

30 days of Eth ecosystem shipping

Aztec’s BN-254 trusted setup ceremony post-mortem. Confidential transactions launching this month

RicMoo always has interesting posts on techniques to use in Ethereum that aren’t mainstream. This one is pretty interesting.

I’m very excited about Aztec’s confidential transactions shipping this month. Much like Tornado, this is huge. The difference is that Aztec is about obscuring transaction amounts. Well, it’s about more than that and will be an interesting primitive for people to build with.

Enterprise

700m USD volume on Komgo commodity trade finance platform

TraSeable seafood tracker article on the challenges points out the troubles with no private chain interoperability

Caterpillar business process management system

Q&A with Marley Gray about the EEA’s Token Taxonomy Initiative

700m USD. It continues to strike me that enterprise is one of Ethereum’s biggest moats, and yet I don’t think I do a great job covering it. Much of what gets published is press release rewrites.

And of course I did a small bit of editorializing by noting that an article on private chains was finding how hard it was to have all these private chains. They need mainnet!

Governance and standards

EIP1559 implementation discussion

EIP2456: Time based upgrades

Metamask’s bounty for a generalized metatransaction standard

1559 is important because it kills economic abstraction forever! It’s happening in eth2, it’d be nice to have it happen in eth1. While I think some of the tradeoffs have not been written about - and that originally caused me to be a bit skeptical, perhaps i’ll write a post about that -- it’d be great to get 1559 into production.

In general, Eth needs better standardization around wallets for frontend devs.

Application layer

Flashloans within one transaction using Aave Protocol are live on mainnet

Orchid’s decentralized VPN launches

Data viz on dexes in 2019

ZRXPortal for ZRX holders to delegate their tokens to stakers

Dai Stability Fee and Dai Savings Rate go up to 6%, while Sai Stability Fee at 5%

EthHub’s new Ethereum user guides

It’s great that EthHub is doing user guides, that’s something that is missing. What’s also missing is a concerted Ethereum effort to link to stuff so that old uncle Google does a better job of returning search results.

Aave’s flashloans is another neat primitive. Things unique to DeFi.

Tokens/Business/Regulation

David Hoffman: the money game landscape

Australia experimenting with a digital Aussie dollar, with a prototype on a private Ethereum chain

3 cryptocurrency regulation themes for 2020

OpenSea’s compendium of NFT knowledge

A newsletter to keep track of the NFT space

Initial Sardine Coin Offering

NBA guard Spencer Dinwiddie’s tokenized contract launches January 13

Progressive decentralization: a dapp business plan

I wrote a Twitter thread about Dinwiddie’s tokens. I’m curious how they do, given that the NBA made him change plans and just do a bond. I haven’t seen the prospectus, and press accounts have conflicting information, but it appears that the annual interest rate is 14%. In that case, I wonder who puts fiat in? I doubt anyone would sell their ETH at these prices for a 14% USD return. There is some risk, but it basically requires Dinwiddie to lose the plot and get arrested or fail a drug test. So it seems like quite a good return given the low risk (assuming it is indeed 14%)

That Sardine token is wild, but not crazy. I won’t even try to summarize it, but perhaps even weirder is that they announced it at CES. Is your average CES attendee going to have any idea what ETH is during the depths of cryptowinter? Unclear to me.

Lots of good stuff in this section this week. Jesse Walden wrote up the “get product market fit, then community, then decentralize” which has worked for a bunch of DeFi protocols.

It’s also the opposite of what folks like Augur and Melon have done. So far the “decentralize later” camp has gotten more traction, but I personally don’t consider this argument decided at all, especially if you are in heavily regulated industries like Augur or Melon where regulators might put you into bankruptcy just because they got up on the wrong side of the bed that morning.

I also think Augur could be a sleeper hit for 2020, and I think Melon’s best days are still in front of it.

General

Andrew Keys: 20 blockchain predictions for 2020

Haseeb Qureshi’s intro to cryptocurrency class for programmers

Ben Edgington’s BLS12-381 for the rest of us

Visualizing efficient Merkle trees for zero knowledge proofs

Eli Ben-Sasson’s catalog of the Cambrian zero knowledge explosion

Bounty for breaking RSA assumptions

It’s amusing how heavy crypto stuff often gets put into this section. The cryptography stuff is all super interesting, but not sure I can provide much more context for it.

Juxtaposed with intense cryptography in this section is Andrew Keys’ annual new year predictions. Always a fun read.

Haseeb’s class looked great. A place to pick up all the knowledge that has taken some of us years to piece together, blog post by blog post.

Full Week in Ethereum News issue.

0 notes