#irsgarnishment

Text

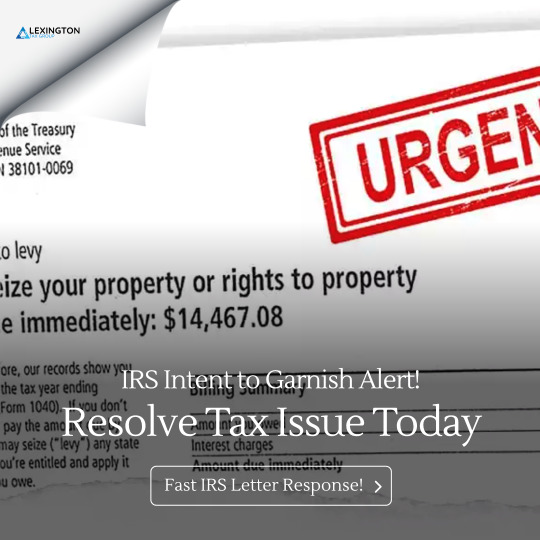

Navigating an IRS Intent to Seize Property: How Lexington Tax Group Can Help

Are you facing the daunting prospect of an IRS intent to seize your property? The situation may seem overwhelming, but you're not alone. Lexington Tax Group understands the stress and uncertainty that comes with receiving such notices, and we're here to offer expert guidance and support.

Understanding Your Options

When you receive an intent to seize property from the IRS, it's crucial to act swiftly and strategically. Ignoring the notice or attempting to handle the situation alone can lead to severe consequences. However, with the right assistance, you can explore various options to protect your assets and resolve the issue effectively.

How Lexington Tax Group Can Assist You

At Lexington Tax Group, we specialize in helping individuals navigate complex tax matters, including those involving property seizure notices. Our team of experienced professionals is dedicated to providing personalized solutions tailored to your specific circumstances.

Here's how we can help:

Expert Guidance: Our knowledgeable experts will review your case thoroughly, ensuring that you understand your rights and options. We'll guide you through the process step by step, empowering you to make informed decisions.

Strategic Planning: We'll work closely with you to develop a strategic plan to address the IRS intent to seize property. Whether it involves negotiating with the IRS, exploring alternative resolutions, or representing you in hearings, we'll leverage our expertise to protect your interests.

Asset Protection: Protecting your assets is our top priority. We'll explore every available avenue to safeguard your property and financial stability, helping you mitigate the impact of the IRS's actions.

Take Action Today

Don't wait until it's too late. Contact Lexington Tax Group now to take proactive steps toward resolving your IRS property seizure notice. Our team is ready to provide the personalized assistance you need to navigate this challenging situation successfully.

Reach out to us at www.LexingtonTaxGroup.com or call us at 800-328-8289 to schedule a consultation. Let us help you protect what matters most.

#assetprotection#irsgarnishment#cp504#intenttoseize#tax debt#irs lawyer#tax debt attorney#irs audit#irs#i owe irs

0 notes

Link

FLAT FEE TAX RELIEF 1-866-747-7435

Coast to Coast - IRS Help

IRS Tax Relief - Tax Debt Help

AN IRS levy is an asset seizure designed to both confiscate assets and shake you up. Contact Flat Fee for details on a levy release.

0 notes

Text

Can I extend filing my taxes past October 15?

You can’t extend your tax deadline past October 15, but you can still file your return after October.

Just remember that after the October deadline, you’ll have failure-to-file penalties added to your account until you file your tax return. The rule of thumb is to file as soon as you can.

File your taxes now to avoid costly penalties!!!

#businesstaxes #taxpreparation #bookkeeping #contabilidad #smallbusiness #taxes #business #businessowner #businesswoman #businesslife #photooftheday #happy #followme #friends #business #love #motivation #inspiration #instagram #instagood #bitcoin #entrepreneur #empresas #entrepreneurship #español #contabilidad #llc #taxes #taxpreparation #smallbusiness #corporations #scorp #taxsavings #taxstrategy #taxdeduction #taxcredits #irs #irsgarnishment #irstaxresolution #taxresolution #backtaxes #irsletters #tax

0 notes

Photo

IRS GARNISHMENT ON SOCIAL SECURITY BENEFITS - Advance Tax Relief

Lately, we have seen an increase in calls to our office from retirees who have received an IRS levy on their Social Security benefits. In most every case, the levy (1) relates to conduct from self-employment when they were younger, and that conduct has long ago ended and (2) creates a substantial hardship for the retiree, who needs the levied money for to pay for prescriptions, food, utilities and rent.

The IRS is authorized to levy on Social Security benefits under section 6331(h) of the Internal Revenue Code. These levies are continuous and take 15% of Social Security benefit, a real hardship to those on a fixed budget.

The IRS makes the levy by matching its records against those of the government’s Financial Management Service. Once a match is made, the IRS will send a Final Notice Before Levy on Social Security Benefits (CP 91). If no action is taken within 30 days as to the notice (i.e, collection appeal), the IRS electronically transmits the levy to FMS for a reduction in the benefit.

The IRS had previously used a income filter to systematically exclude those with income below a specified threshold. The Government Accountability Office (GAO) found the filter flawed, and in 2006 the IRS eliminated it.

If your social security wages is being garnished, call our office for a quick release and a possible tax settlement.

Get a free consultation from an experienced tax relief expert today (800)790-8574 or visit our www.advancetaxrelief.com

Google: https://plus.google.com/+ADVANCETAXRELIEFLLCHouston

Bing:

https://binged.it/2lkDqWb

Foursquare:

https://foursquare.com/v/advance-tax-relief-llc/54e8a112498ecdc6df298ad7

Yelp:

https://www.yelp.com/biz/advance-tax-relief-llc-houston1

BBB:

https://www.bbb.org/houston/business-reviews/taxes-consultants-and-representatives/advance-tax-relief-llc-in-houston-tx-90024857/reviews-and-complaints

0 notes

Link

IRS TAX DEBT HELP - WHAT IF YOU OWE THE IRS Most taxpayers who file their taxes get money back in refund form as a result. Getting a tax refund isn't always possible. If you have been collecting unemployment along with the $600.00 federal "kicker" and you haven't had taxes taken out will result in tax debt.

0 notes

Link

Once an IRS wage garnishment is filed with your employer, your employer is required by law to collect a large percentage of each of your paychecks. Your employer has no choice but to comply with IRS salary garnishment notices and will continue to garnish your wages until your IRS debt is paid off.

0 notes

Link

The IRS has the power to garnish or legally seize any income you make to satisfy federal tax debt or taxes owed. An IRS Garnishment (IRS tax levy) can apply to your wages and bank accounts. Stop an IRS tax levy in one day. Call 1-866-747-7435 to stop IRS garnishment.

0 notes

Link

When you have an IRS tax debt, you may be subject to an IRS tax levy. A tax levy may seize your wages, bank accounts, social security or other assets. Call the IRS tax relief team and find out what can be done for you.

0 notes

Link

What You Need To Know If The IRS Levies

Your Social Security Benefits

Many people rely on their social security benefits as a way to bridge the gap between their retirement income and their monthly expenses. For others, their social security may be their only source of income in retirement. Whichever may be the case,

0 notes

Link

IRS GARNISHMENT - IRS WAGE GARNISHMENT It is always best to try to stop an IRS garnishment (wage garnishment) before it hits you. Stop an IRS garnishment in one day. Find out how you can save your wages and paycheck. Call Flat Fee Tax Service at 1-866-747-7435.@flatfeetaxsvc

0 notes

Video

youtube

The IRS Can And Will Seize Your Money | Flat Fee Tax Service

0 notes

Link

FLAT FEE TAX RELIEF 1-866-747-7435IRS Help - Tax Debt HelpFederal Payment Levy Program

The IRS can seize your Social Security when a tax levy has been ordered. A tax levy can be stopped and released. Contact Flat Fee Tax Relief.

#federalpaymentlevyprogram #FPLP #irslevy #taxlevy #irsgarnishment #irsseizure #irshelp #irstaxrelief #irsdebt #taxproblems #taxdebthelp #taxdebtrelief #irstaxproblems #taxrelief #taxhelp #taxlawyer #taxattorney #irslawyer #irsattroney

0 notes

Link

FLAT FEE TAX RELIEF

TAX RELIEF PROGRAMS

1-866-747-7435

The IRS has full authority to seize your paycheck, bank account, or real property. Action can be taken to protect you from a tax levy.

#taxlevy #IRSgarnishment #IRSwagegarnishment #IRSlevy #IRSwagelevy

0 notes

Link

FLAT FEE TAX RELIEF

TAX RELIEF PROGRAMS

1-866-747-7435

The IRS has the authority to levy and seize your wages, bank account, and property. Tax professionals can protect you from an IRS levy. Contact Flat Fee Tax Relief. 1-866-747-7435.

#IRSLEVY #TAXLEVY #IRSWAGELEVY #IRSGARNISHMENT #IRSWAGEGARNISHMENT #WAGEGARNISHMENT

0 notes

Link

According to the IRS, a tax levy is a legal seizure of your property to satisfy a tax debt. Call Flat Fee Tax Service. 1-866-747-7435. Flat Fee Tax Service has been helping clients with their tax debt problems for over a decade.

0 notes

Link

Tax Garnishment - IRS Garnishment - IRS Wage Garnishment - Experienced Tax Attorney - If you owe an IRS tax debt, you will face a tax garnishment. Stop and release IRS garnishment today. Call 1-866-747-7435.

0 notes