Text

Facing IRS Debt? Discover Affordable and Straightforward Solutions at Lexington Tax Group

Dealing with IRS debt can feel like carrying a heavy backpack that you just can't take off. It’s stressful, it’s overwhelming, and frankly, it can be quite scary. But what if I told you there’s a way to lighten that load without emptying your wallet? That’s where Lexington Tax Group comes into the picture.

Why Choose Lexington Tax Group?

At Lexington Tax Group, we believe that resolving tax issues shouldn’t drain your bank account. We’re here to offer you easy-to-understand, affordable solutions that actually work. No more confusing tax jargon, no more astronomical fees—just clear, straightforward help.

What We Offer:

Budget-Friendly Rates: High-quality service shouldn’t come with a high price tag. We provide top-notch tax assistance that won’t break the bank.

Simple Solutions: Our approach to tax debt relief is designed to be as simple and stress-free as possible. We handle the complexities so you don’t have to.

Free Initial Consultation: Still on the fence? Why not start with a free consultation? There’s absolutely no cost to simply talking to us about your situation.

How to Reach Us:

Ready to ditch the tax debt weight? Here’s how you can reach out:

Phone: 800-328-8289

Visit Our Website: www.lexingtontaxgroup.com

Tax problems can be daunting, but you don’t have to face them alone. With Lexington Tax Group, you’re choosing a partner who understands your needs and is ready to help you step back into financial freedom.

Don't let IRS debt hold you back any longer. Give us a call, and let’s get started on your path to a lighter, brighter financial future!

#IRSDebtRelief#TaxHelp#DebtSolutions#FinancialFreedom#TaxConsultation#AffordableTaxHelp#TaxReliefServices#ResolveTaxDebt#LexingtonTaxGroup#TaxAdvice#tax debt attorney#tax debt#irs lawyer#irs audit

0 notes

Text

If you find yourself grappling with IRS debt, you're far from alone—but navigating the path to resolution can feel daunting. That's where Lexington Tax Group steps in. Specializing in IRS debt resolution, we offer a comprehensive approach to not only address your current tax liabilities but also to secure your financial future. Let's delve deeper into how we can turn your tax woes into a manageable plan.

Understanding Your Debt

The journey to resolution begins with a full assessment of your tax situation. This means a thorough review of your tax filings, identifying any discrepancies, unfiled taxes, and calculating the accumulated penalties and interest. Understanding the scope of your IRS debt is critical in crafting a tailored resolution strategy.

Exploring Resolution Options

With a clear understanding of your debt, we explore various resolution avenues. Each option is designed to cater to different circumstances, ensuring that the chosen path is the best fit for your financial situation.

Installment Agreements: Suitable for those who can repay their debt over time, this option allows for a monthly payment plan that fits your budget.

Offer in Compromise: A valuable option for those who might struggle to repay the full amount, allowing you to settle your debt for less than what is owed, subject to IRS approval.

Currently Not Collectible Status: If you're facing financial hardship, this status temporarily halts collection efforts by the IRS.

Penalty Abatement: For those who have a history of compliance, negotiating to reduce or eliminate penalties can significantly lower the debt owed.

Customized Implementation

Choosing the right strategy is just the beginning. At Lexington Tax Group, we navigate the complexities of IRS negotiations and paperwork on your behalf. From filing the necessary documents to setting up payment plans, we ensure each step is executed efficiently, always with your best interest at heart.

Ensuring Future Compliance

Beyond resolving your current IRS debt, our mission is to help you maintain financial health. This includes advising on future tax filings, strategies for financial management, and tips to avoid future tax liabilities. Our comprehensive approach not only addresses your immediate needs but also sets you up for long-term success.

Why Choose Lexington Tax Group?

At Lexington Tax Group, we understand the stress and anxiety that come with IRS debt. Our dedicated team offers personalized service, tailored strategies, and the expertise to navigate the IRS's complex processes. We're committed to resolving your tax issues and guiding you towards a stable financial future.

Facing IRS debt doesn't have to be a solitary journey. With Lexington Tax Group, you have a partner every step of the way—from understanding your debt to ensuring future compliance. Visit us at www.LexingtonTaxGroup.com or call 800-328-8289 to learn how we can help you resolve your IRS debt efficiently and effectively.

#IRSDebtHelp#TaxResolutionServices#FinancialFreedom#BackTaxes#TaxRelief#DebtFreeJourney#OfferInCompromise#TaxDebtSolution#IRSDebtRelief#LexingtonTaxGroup.#tax debt#irs lawyer#tax debt attorney#irs audit#i owe irs

0 notes

Text

Don't Sleep on This: Nearly $1 BILLION in Unclaimed 2020 Tax Refunds Awaiting Rescue!

Did you know that a treasure chest worth over $1 billion is sitting unclaimed with the IRS? Yep, you read that right. And guess what? Some of that treasure might just have your name on it! We're talking about tax refunds from 2020 that nearly 940,000 Americans haven't claimed. With the May 17, 2024, deadline looming, it's high time to dive into those dusty folders (or email archives) and check if you’re one of the lucky ones.

Why Is This a BFD?

The average refund waiting to be claimed is a sweet $932. That’s not pocket change! Especially when you think about all the ways you could use that money. New books, a gaming console, helping out a friend, or even starting your savings account.

And here's the kicker: if you don't claim it by May 17, 2024, that money goes bye-bye into the depths of the U.S. Treasury. Poof! Gone forever.

Who Should Be Rushing?

Students

Part-time workers

ANYONE who didn’t file their tax return for 2020

There’s More!

For many, there’s an additional goldmine - the Earned Income Tax Credit (EITC). It’s like finding a bonus level in your favorite game but in real life. Depending on your situation, the EITC could boost your refund by up to $6,660.

What Can You Do?

Start by gathering any 2020 financial documents you can get your hands on. Missing something? The IRS has tools and resources to help you track down what you need. And guess what, if diving into tax forms and numbers isn’t your jam, there are professionals out there who live for this stuff.

Need a Hero? Lexington Tax Group to the Rescue!

Feeling overwhelmed? Don’t worry. The folks at Lexington Tax Group are like the Gandalf of taxes. They can help you navigate the murky waters of tax filing and ensure you claim what’s rightfully yours.

Give them a shout at 800-328-8289 or wave your digital flag at www.LexingtonTaxGroup.com. Don’t let bureaucracy scare you. It’s your money. Claim it!

TL;DR

$1 billion in unclaimed 2020 tax refunds is out there.

Avg. refund = $932.

Deadline: May 17, 2024.

EITC could mean more $$$.

Lexington Tax Group can help.

So, what are you waiting for? Get on it, and let’s make sure that money finds its way home – to you.

#TaxRefundRescue#ClaimYourCash2020#DeadlineMay17#UnclaimedBillions#EITCBonus#TaxProTips#IRSDeadlineAlert#FindYourRefund#2020TaxReturn#MoneyWaitingForYou#tax debt#irs lawyer#tax debt attorney#i owe irs#irs audit

0 notes

Text

Beat the IRS Deadline with Lexington Tax Group: Your Guide to a Stress-Free Tax Season

As the calendar pages turn and the IRS filing deadline inches closer, a sense of urgency begins to build for many taxpayers, especially those facing unresolved tax issues. The stress of potential penalties, compounded interest, and the looming deadline can be overwhelming. However, there's a beacon of hope for those navigating these turbulent tax waters: Lexington Tax Group.

The Importance of Meeting the IRS Filing Deadline

Meeting the IRS deadline is crucial for avoiding late filing penalties, additional interest charges, and the stress that comes with uncertainty. These penalties can significantly increase the amount owed, turning a manageable situation into a financial burden. Moreover, timely filing is your first step towards regaining control over your financial situation.

Why Choose Lexington Tax Group?

At Lexington Tax Group, we understand the challenges you face during tax season. Our team of experienced tax professionals is dedicated to providing personalized, effective solutions for our clients. Here’s why partnering with us is the key to a stress-free tax season:

Expertise in IRS Negotiations: Our seasoned tax professionals have extensive experience negotiating with the IRS, ensuring you receive the best possible outcome.

Swift, Efficient Resolutions: We prioritize quick resolution of your tax issues, minimizing your stress and maximizing your peace of mind.

Comprehensive Tax Services: Whether you're dealing with back taxes, unfiled returns, or other tax-related concerns, we offer a full suite of services to meet your needs.

How We Can Help

Personalized Consultation

Every tax situation is unique, which is why we start with a personalized consultation to understand your specific circumstances. This allows us to tailor a resolution strategy that best fits your needs.

Action Plan

Our experts will then craft a detailed plan to tackle your tax debts or disputes, focusing on the most efficient and effective solutions. We aim not just to resolve your current tax issues but also to provide guidance to prevent future problems.

Ongoing Support

From the initial consultation to the resolution of your tax issues, Lexington Tax Group is with you every step of the way. Our commitment to our clients goes beyond simple tax resolution; we aim to provide peace of mind and a path forward.

Take Action Today

The IRS filing deadline won't wait, but there’s still time to act. By addressing your tax issues now, you can avoid penalties, interest, and the last-minute rush. Lexington Tax Group is here to guide you through every step of the process, ensuring a smooth and stress-free tax season.

Ready to take the first step towards resolving your tax issues? Contact us today at 800-328-8289 or visit our website at www.LexingtonTaxGroup.com to schedule your free consultation. Don't let the IRS deadline set the tone for your year—take control of your tax situation now.

#TaxSeason2024 #IRSHelp #TaxResolution #TaxDeadlineAlert #AvoidTaxPenalties #TaxPreparation #FinancialFreedom #TaxStressRelief #TaxAdvice #TaxFilingTips

#TaxSeason2024#IRSHelp#TaxResolution#TaxDeadlineAlert#AvoidTaxPenalties#TaxPreparation#FinancialFreedom#TaxStressRelief#TaxAdvice#TaxFilingTips#tax debt#tax debt attorney#irs lawyer

0 notes

Text

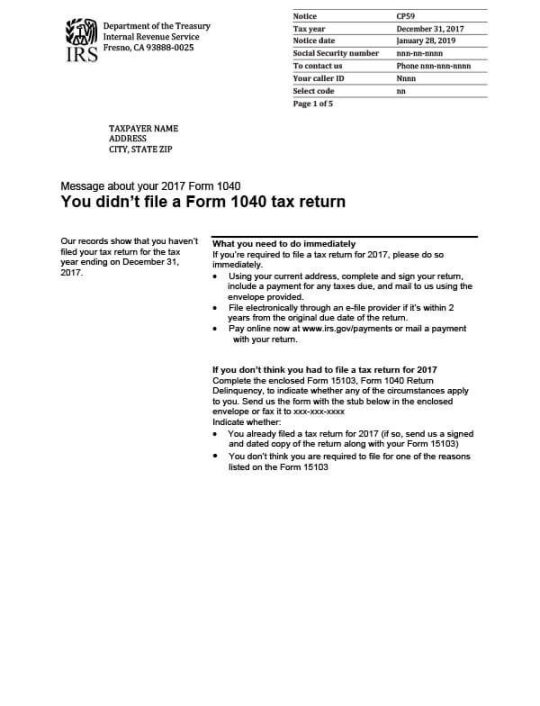

Navigating the Maze: How to Handle IRS Letter CP59 with Lexington Tax Group

Received the IRS Letter CP59? Here’s What You Need to Know

Opening your mailbox to find an IRS Letter CP59 can be an intimidating experience. This letter is the IRS's way of informing you that they have no record of your personal tax return for the prior year. Before panic sets in, know that there's a clear path forward, and Lexington Tax Group is here to light the way.

Immediate Steps to Take After Receiving IRS Letter CP59

First and foremost, understanding the message behind Letter CP59 is crucial. It's not just a reminder but a prompt for immediate action to avoid potential penalties or more serious consequences. This is where Lexington Tax Group steps in, offering a comprehensive service specifically designed for CP59 recipients.

Lexington Tax Group’s Comprehensive Approach

Swift Action: Our first order of business is to protect you from immediate collection actions by the IRS. We understand the urgency of the situation and prioritize halting any collections process in its tracks.

Gathering Information: We then proceed to contact the IRS on your behalf. Our team works diligently to obtain all reported income information necessary to address the discrepancies highlighted by the CP59 letter. This step is fundamental in ensuring that we have a complete understanding of your tax situation.

Filing and Compliance: With all the necessary information in hand, we assist you in preparing and filing any missing tax returns. Our goal is to make this process as smooth and straightforward as possible, ensuring your tax records are accurate and up-to-date.

Resolving Tax Debts: For those who find themselves facing tax debts as a result of the filing process, worry not. Lexington Tax Group is well-versed in a myriad of debt resolution strategies. Whether it's arranging a payment plan or exploring hardship programs, we are committed to finding a solution that best fits your financial situation.

Why Choose Lexington Tax Group?

Choosing Lexington Tax Group means opting for peace of mind. Led by CEO Adam Hastie, our team is not only experienced in tax law and IRS procedures but is also empathetic towards the stress and confusion that can accompany IRS notices. Our personalized approach ensures that your case is handled with the attention and urgency it deserves.

Take Action Today

If you’ve received an IRS Letter CP59, now is the time to act. Lexington Tax Group is ready to guide you through the process, from understanding your notice to achieving tax compliance and resolving any ensuing financial matters. Don’t navigate this alone; our experts are here to support you every step of the way.

For more information or to schedule a consultation, contact us at 800-328-8289 or visit our website at www.LexingtonTaxGroup.com. Let us help you turn this challenge into a step toward financial stability and peace of mind.

#IRS Letter CP59 help#What to do if I received IRS Letter CP59#Missing tax return notice CP59 resolution#CP59 IRS letter assistance#How to respond to IRS Letter CP59#Tax preparation services for CP59 notice#IRS CP59 letter tax resolution services#Filing back taxes after receiving CP59#FIling Back Taxes#Tax advisor for CP59 IRS notice#CP59 tax notice debt resolution options

0 notes

Text

Unlock Your Financial Freedom with the IRS Fresh Start Program

Facing IRS Tax Debt? You're Not Alone

Tax debt can feel like an overwhelming burden, casting a shadow over your financial freedom and peace of mind. If you're one of the many Americans struggling with the stress of owing money to the IRS, you might feel like there's no way out. But there's good news: The IRS Fresh Start Program, and Lexington Tax Group is here to guide you through it.

What is the IRS Fresh Start Program?

The IRS Fresh Start Program is designed to make it easier for taxpayers to pay back taxes and avoid tax liens. This initiative offers several relief options, including installment agreements, offers in compromise, and penalty abatement, which can make dealing with tax debt more manageable and even reduce the amount owed.

Why Choose Lexington Tax Group?

At Lexington Tax Group, we specialize in navigating these complex relief options to find the best solution for you. Here's why countless clients have trusted us to guide them to financial freedom:

Expert Guidance: Our team of seasoned tax professionals provides knowledgeable support every step of the way.

Personalized Solutions: We understand that everyone's situation is unique. We tailor our strategies to fit your specific needs, ensuring the best possible outcomes.

Save Money: Our primary goal is to help you save money by reducing your overall tax debt, including penalties and interest.

Peace of Mind: With us by your side, you can focus on what matters most in your life, knowing that your tax issues are being handled by experts.

The Lexington Tax Group Difference

What sets us apart is not just our expertise in tax law and the IRS Fresh Start Program but also our commitment to providing compassionate, personalized service. We know that behind every tax issue is a person or family seeking relief and a fresh start. Our approach is not just about resolving tax debts but about restoring peace of mind and laying the groundwork for a secure financial future.

Ready to Begin Your Journey to Financial Freedom?

If you're ready to take the first step towards resolving your tax issues, we're here to help. Contact Lexington Tax Group today to learn how we can assist you in taking full advantage of the IRS Fresh Start Program. Your path to a brighter financial future begins here.

📞 Call us now at 800-328-8289

🌐 Visit us at www.LexingtonTaxGroup.com

Don't let tax debt define your life. With Lexington Tax Group, discover how the IRS Fresh Start Program can open the door to your financial freedom.

#best irs tax relief programs#tax resolution services#tax relief help#tax forgiveness program#tax forgiveness#tax debt relief#tax debt relief program#tax debt help#tax debt forgiveness

0 notes

Text

Navigating an IRS Intent to Seize Property: How Lexington Tax Group Can Help

Are you facing the daunting prospect of an IRS intent to seize your property? The situation may seem overwhelming, but you're not alone. Lexington Tax Group understands the stress and uncertainty that comes with receiving such notices, and we're here to offer expert guidance and support.

Understanding Your Options

When you receive an intent to seize property from the IRS, it's crucial to act swiftly and strategically. Ignoring the notice or attempting to handle the situation alone can lead to severe consequences. However, with the right assistance, you can explore various options to protect your assets and resolve the issue effectively.

How Lexington Tax Group Can Assist You

At Lexington Tax Group, we specialize in helping individuals navigate complex tax matters, including those involving property seizure notices. Our team of experienced professionals is dedicated to providing personalized solutions tailored to your specific circumstances.

Here's how we can help:

Expert Guidance: Our knowledgeable experts will review your case thoroughly, ensuring that you understand your rights and options. We'll guide you through the process step by step, empowering you to make informed decisions.

Strategic Planning: We'll work closely with you to develop a strategic plan to address the IRS intent to seize property. Whether it involves negotiating with the IRS, exploring alternative resolutions, or representing you in hearings, we'll leverage our expertise to protect your interests.

Asset Protection: Protecting your assets is our top priority. We'll explore every available avenue to safeguard your property and financial stability, helping you mitigate the impact of the IRS's actions.

Take Action Today

Don't wait until it's too late. Contact Lexington Tax Group now to take proactive steps toward resolving your IRS property seizure notice. Our team is ready to provide the personalized assistance you need to navigate this challenging situation successfully.

Reach out to us at www.LexingtonTaxGroup.com or call us at 800-328-8289 to schedule a consultation. Let us help you protect what matters most.

#assetprotection#irsgarnishment#cp504#intenttoseize#tax debt#irs lawyer#tax debt attorney#irs audit#irs#i owe irs

0 notes

Text

Don't Let the IRS Win: Reclaim Your Refund and Resolve IRS Debt with Lexington Tax Group!

Are you tired of waiting for your tax refund while the IRS holds onto your hard-earned money? You're not alone. Many taxpayers find themselves in a frustrating situation when their refunds are delayed or when they're facing IRS debt. But here's the good news: you don't have to let the IRS win. At Lexington Tax Group, we're here to help you reclaim what's rightfully yours and resolve any IRS debt you may have.

Understanding IRS Debt: IRS debt can arise for various reasons, including unpaid taxes, penalties, or interest. It's a daunting situation that can lead to stress and financial uncertainty. However, ignoring IRS debt won't make it go away. In fact, it can result in severe consequences such as wage garnishment, bank levies, or even legal action. That's why it's crucial to address IRS debt proactively and seek professional assistance.

Lexington Tax Group's Expertise: With years of experience in IRS debt resolution, Lexington Tax Group has helped countless individuals and businesses overcome their tax challenges. Our team of experts understands the intricacies of IRS regulations and knows how to negotiate with the IRS on your behalf. Whether you're facing back taxes, audits, or liens, we have the knowledge and resources to develop a personalized solution tailored to your specific situation.

Reclaiming Your Refund: In addition to resolving IRS debt, Lexington Tax Group can also help you reclaim any tax refunds that may be rightfully yours. If the IRS has been holding onto your refund or if you've encountered delays in receiving it, our team can expedite the process and ensure that you get every dollar you're owed. With our expertise and attention to detail, you can rest assured that your refund will be in your hands sooner rather than later.

How We Can Help: By contacting Lexington Tax Group at 800-328-8289 or visiting www.LexingtonTaxGroup.com, you can take the first step towards reclaiming your refund and resolving your IRS debt. Our dedicated professionals will work tirelessly to assess your situation, develop a strategic plan, and advocate on your behalf with the IRS. We'll handle all communication and paperwork, allowing you to focus on what matters most – regaining financial stability.

Conclusion: Don't let the IRS win. Whether you're struggling with IRS debt or waiting for your tax refund, Lexington Tax Group is here to help. Our proven track record of success and commitment to client satisfaction make us the top choice for IRS debt resolution and tax services. Contact us today and let's reclaim your refund and resolve your IRS debt together.

0 notes

Text

Embrace Winter with Tax Savings: Lexington Tax Group's Exclusive Offer

As the winter winds howl and the snow falls softly outside, it's time to cozy up indoors and take stock of your finances. At Lexington Tax Group, we believe that every season should be embraced, especially when it comes to maximizing your tax savings. That's why we're thrilled to announce our exclusive winter tax savings offer, designed to help you weather the cold and emerge with a warmer financial outlook.

Embracing Winter Tax Savings: Winter is the perfect time to focus on your financial health. With the holidays behind us and tax season looming ahead, now is the ideal moment to ensure that your finances are in order. Our team at Lexington Tax Group is dedicated to helping you navigate the complexities of tax season with ease, maximizing your refunds and minimizing your stress along the way.

Exclusive Offer: This winter, we're excited to offer our valued clients an exclusive opportunity to save big on their taxes. Whether you're a seasoned taxpayer or a first-time filer, our team is here to provide expert guidance and support every step of the way. From maximizing deductions to ensuring compliance with the latest tax laws, we've got you covered.

Act Now: Don't let this opportunity slip through your fingers! Our winter tax savings offer won't last forever, so be sure to take advantage of it while you still can. Schedule your appointment with Lexington Tax Group today and take the first step towards a brighter financial future.

Contact Us: Ready to take advantage of our exclusive winter tax savings offer? Contact Lexington Tax Group today to schedule your appointment. Call us at 800-328-8289 or visit our website at www.LexingtonTaxGroup.com to learn more and get started.

Conclusion: Winter may bring cold temperatures and icy roads, but it also presents an opportunity to embrace change and set yourself up for financial success. With Lexington Tax Group by your side, you can navigate tax season with confidence, knowing that you have a dedicated team of experts working tirelessly on your behalf. Don't let the winter blues get you down – embrace the season and take control of your finances today!

Stay warm and financially savvy with Lexington Tax Group.

0 notes

Text

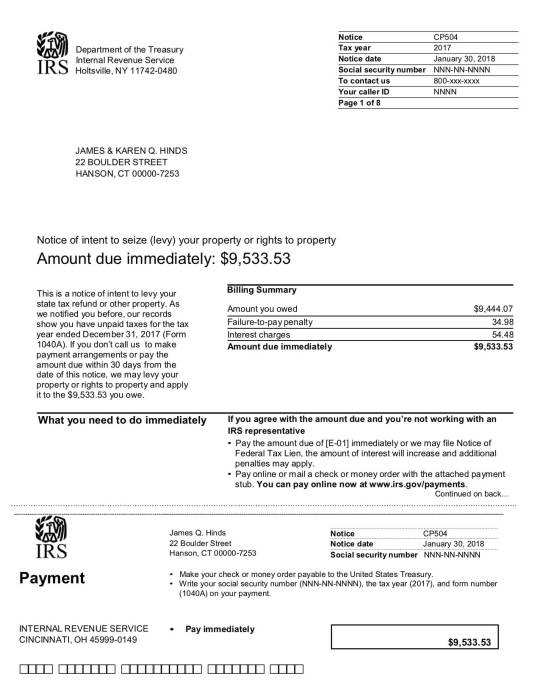

Understanding IRS CP-504 Notices and How Lexington Tax Group Can Help

If you've recently received an IRS CP-504 notice, you may be feeling overwhelmed and uncertain about your financial future. This notice is a clear indication that the Internal Revenue Service (IRS) has not received payment for an unpaid balance, and it serves as a Notice of Intent to Levy under Internal Revenue Code section 6331(d). The implications of ignoring this notice can be daunting, including the possibility of income and bank account levies, property seizures, and even the interception of your state income tax refund.

But fear not, because in this blog post, we'll shed light on how Lexington Tax Group can be your trusted partner in resolving IRS CP-504 notices and ensuring your financial stability.

Understanding the IRS CP-504 Notice

Before diving into how Lexington Tax Group can assist, let's first understand the IRS CP-504 notice in detail. This notice is essentially a warning from the IRS that they are prepared to take serious action to collect the unpaid tax debt. Here's what it signifies:

Notice of Intent to Levy: The CP-504 notice is a formal notification from the IRS, indicating their intention to levy your income, bank accounts, and possibly even seize your property or other assets to settle the outstanding tax debt.

Now that you have a grasp of what you're dealing with, let's explore how Lexington Tax Group can provide valuable assistance in this challenging situation.

How Lexington Tax Group Can Help

🌟 Immediate Action: One of the first steps in addressing an IRS CP-504 notice is to respond promptly. Lexington Tax Group will ensure that you take the necessary action quickly to prevent further IRS enforcement actions.

🔒 Negotiation: Our team of experienced tax professionals will work diligently to negotiate with the IRS on your behalf. We'll explore options like setting up a reasonable payment plan or pursuing a settlement through programs such as an Offer in Compromise.

💼 Asset Protection: Worried about losing your assets or income to IRS levies? We've got your back. Lexington Tax Group will employ strategies to protect your assets and income while working towards the resolution of your tax debt.

🤓 Expert Advice: No two tax situations are identical. That's why our experts will provide you with personalized advice and tailored strategies to address the specific complexities of your case.

📊 Audit Representation: In cases where an underlying issue may have contributed to your tax debt, we offer audit representation services to ensure that any concerns are addressed thoroughly and professionally.

Why Choose Lexington Tax Group?

Lexington Tax Group is not just any tax assistance firm; we're your dedicated partner in navigating the complexities of IRS CP-504 notices. Here's why you should choose us:

Experienced Professionals: Our team consists of tax experts with a deep understanding of tax laws, regulations, and IRS procedures.

Tailored Solutions: We recognize that every individual's tax situation is unique. Our commitment is to find the best solution that aligns with your specific needs and financial circumstances.

Stress-Free Resolution: We understand that dealing with the IRS can be stressful. With Lexington Tax Group on your side, you can focus on your life and business while we handle all communication with the IRS, ensuring a stress-free resolution process.

Take Control of Your Financial Future

Don't let an IRS CP-504 notice create unnecessary stress or financial hardship in your life. Contact Lexington Tax Group today to regain control of your finances and your peace of mind.

📞 Call us at 800-328-8289or visit www.LexingtonTaxGroup.com to schedule your free consultation. Take the first step towards a brighter financial future with Lexington Tax Group!

#LexingtonTaxGroup #IRSNoticeCP504 #TaxReliefExperts #FinancialFreedom

#tax debt#cp504#wagegarnishment#irsprotection#tax debt attorney#irs lawyer#irs audit#irs#irsdebtrelief#IRSDebt

0 notes

Text

Experience a Merry, Debt-Free Christmas with Lexington Tax Group!

🎄🌟 Find Your Festive Financial Freedom! 🌟🎄

The holiday season is upon us, and it's a time for joy, celebration, and giving. But for those grappling with IRS debt, it can also be a season of stress and worry. At Lexington Tax Group, we believe that everyone deserves a merry and bright Christmas, free from the shadows of tax burdens. This is why we're dedicated to bringing you the best IRS debt help this holiday season!

🎁 Unwrap the Gift of Expert Tax Assistance

We understand how overwhelming and confusing dealing with the IRS can be. Like Santa’s workshop, our team is bustling with experienced tax professionals — our version of elves — skilled in navigating the complexities of IRS negotiations. They're ready to work tirelessly to resolve your tax issues, allowing you to focus on what truly matters during the holidays: family, friends, and festive cheer.

🛷 Sleigh Your IRS Worries Away!

No matter how big or small your tax issue may seem, we approach each case with the same level of commitment and care. We'll analyze your situation, explain your options, and develop a strategy tailored to your unique needs. Our goal? To help you sleigh your IRS fears and step into the New Year with confidence and a clean financial slate.

❄️ A Season of Support and Guidance

At Lexington Tax Group, we're more than just tax professionals; we're your advocates and guides through the sometimes snowy path of tax resolution. Whether it's negotiating a settlement, setting up a payment plan, or finding other solutions, we're here to ensure your journey toward financial freedom is smooth and stress-free.

🎅 Join Our List of Happy Clients

Don't let IRS debt be the Grinch that steals your holiday joy this Christmas. Join the ranks of our many clients who have found relief and peace through our services. Let us be your festive financial helpers this season!

👉 Take the First Step Toward a Brighter New Year

Ready to tackle your IRS issues and enjoy a truly happy holiday? Click www.LexingtonTaxGroup.com or call 800-328-8289 to get started with Lexington Tax Group today. We're here to make your Christmas merry and your future bright!

🌟 Here’s to a joyful, peaceful, and debt-free holiday season! 🌟

#MerryDebtFreeChristmas #IRSRelief #HolidayHelp #LexingtonTaxGroup

0 notes

Text

Get Professional and Affordable Help Today

0 notes

Text

Title: A Helping Hand for the Food Service Industry: Navigating Through Tax Debts with Lexington Tax Group

👩🍳👨🍳 Introduction

The food service industry has always been the backbone of our communities, filling our lives with flavors and memorable experiences. However, the recent years have served up an unpalatable share of challenges, especially when it comes to handling financial matters such as tax debts. Lexington Tax Group recognizes these struggles and is here to extend a helping hand! 🤝

The Heat of Tax Debts 🔥

Working in the food service industry often comes with its own set of financial intricacies. From fluctuating incomes due to seasonal variations, reliance on tips, to managing operational costs - it's a lot on your plate. Adding the stress of owing money to the IRS can really turn up the heat. But fret not - we’ve whipped up a special offer just for YOU, to help navigate through the complex world of tax debts and find financial stability.

✨ Special Offer: Complimentary Consultation 🆓

Understanding the uniqueness of your situation, Lexington Tax Group is offering a complimentary consultation to all food service industry professionals grappling with tax debts. Our seasoned tax consultants are ready and equipped to guide you through the tailored recipe for tax relief, garnishment prevention, and most importantly, helping you find an effective resolution that works in your favor.

📅 Don't stew in your worries! Schedule your FREE consultation today and step towards a fresh start on your financial future.

Our Ingredients for Your Financial Stability

Here’s what we bring to the table, ensuring you are served with the utmost professionalism and expertise:

Customized Tax Solutions: Crafting strategies that cater directly to your unique financial situation.

Negotiation with the IRS: Acting on your behalf, we take the stress out of dealing directly with the IRS.

Professional & Empathetic Advisors: A team that not only understands tax but also understands your struggles.

Confidentiality & Trust: Your information and journey with us will be handled with the strictest confidentiality and trust.

Let's Simmer Down Those Tax Worries Together 💙

Navigating through tax issues can be overwhelming and daunting, but you don't have to do it alone. Lexington Tax Group is here to help simmer down those boiling tax worries. Together, we can find a way to garnish your financial future with stability and peace of mind.

Connect with us today via our website, and let’s get started on your journey towards financial serenity!

Remember to add a call to action, inviting readers to share the post with others who might benefit from this special offer, and encouraging them to connect with Lexington Tax Group through various channels.

Adding some visuals, client testimonials, or case studies in the blog could further enhance its appeal and effectiveness. Always ensure the information provided is accurate and compliant with legal and regulatory guidelines.

0 notes

Text

Navigating the IRS: A Guide for Homesteaders and Farmers

Introduction

Farming and homesteading are not just careers; they're a way of life. But when it comes to handling your taxes, the complexities can often divert your attention away from your crops and livestock. It's no secret that tax laws are complicated, and for those in the agriculture sector, they bring their own unique set of challenges. If you've been scratching your head trying to figure out IRS Schedule F or want to know which deductions and credits you can claim, you're in the right place. In this blog, we will guide you through some key points you should know about your taxes.

Understanding IRS Schedule F

One of the most critical tax forms for farmers and some homesteaders is the IRS Schedule F. This form is your primary report for farming income and expenses. It's crucial to understand how to correctly fill it out, as mistakes here can either lead to missed savings opportunities or worse, penalties.

Key Points on Schedule F:

Farm Income: List all the revenue from your farming activities.

Farm Expenses: Report all costs incurred while running your farm.

Accounting Methods: You can use either the Cash or Accrual accounting method, but it's vital to be consistent.

Common Deductions for Farmers and Homesteaders

When it comes to deductions, the opportunities are vast but often overlooked. Here are some common deductions you should consider:

Seed and Feed: Costs incurred for buying seeds or animal feed are fully deductible.

Equipment Depreciation: Farming equipment depreciates over time, and this depreciation is deductible.

Fuel and Utilities: The cost of fuel for your farming machinery and utilities for your farm is also deductible.

Insurance: Crop insurance or insurance for your livestock can also be deducted.

Tax Credits You Should Know About

Tax credits can offer dollar-for-dollar reductions in your tax bill. There are several tax credits that farmers and homesteaders may be eligible for:

Alternative Fuel Credit: If you use alternative fuels, you could be eligible for this credit.

Renewable Electricity Production Credit: If you produce your electricity through renewable means like wind or solar, this could apply to you.

Homestead Tax Exemptions

Many states offer a Homestead Tax Exemption that can reduce the property tax for individuals on their primary residence. This can be particularly beneficial for homesteaders who live on the property where they farm.

Direct Communication with the IRS

Facing an audit or have received a notice from the IRS? Do not ignore it. We can communicate directly with the IRS on your behalf, sorting out any issues while you focus on your farm.

Conclusion

Farming is an honorable and essential profession, but it's not without its challenges—especially when it comes to navigating the IRS. Our expertise in tax laws and our deep understanding of the agriculture sector make us uniquely positioned to help you through this. With our help, you can stop worrying about your taxes and return to what you love—your land, your crops, and your livestock.

Interested in Learning More?

We're here to help you. Contact us at [Your Contact Information] to schedule a consultation. Don’t let IRS worries distract you from your passion and hard work. Leave the numbers to us, and you can focus on the land and animals you love. www.LexingtonTaxGroup.com 800-328-8289

0 notes

Text

Navigating IRS Debts: The Lexington Tax Group is Here to Support Small Business Owners

In the ever-changing labyrinth of the business world, small businesses are the stalwarts that forge ahead, fueled by innovation and tenacity. However, encountering IRS debts can sometimes feel like a setback that is hard to navigate. At the Lexington Tax Group, we understand that facing the IRS can be intimidating, but we want you to know that you are not alone. We are here to extend a helping hand and guide you towards financial stability.

Your Trusted Partner in Financial Crisis

Running a business comes with its share of ups and downs. Financial hiccups should not define your journey. The Lexington Tax Group stands by your side, offering not just expert advice but also empathetic guidance to help you overcome your IRS debts.

Customized Strategies to Meet Your Unique Needs

Your business is one-of-a-kind, and we believe the solutions to your financial concerns should be too. Our team is adept at crafting strategies that are tailored to meet the specific financial intricacies of your business. Together, we can work towards settling your IRS debts in a way that allows your business to continue thriving.

Confidential and Judgment-Free Consultations

Your privacy is our priority. We offer confidential consultations where you can freely discuss your concerns without the fear of judgment. Our goal is to understand your situation fully and provide you with the best possible solutions, devoid of any bias.

Expert Guidance to Navigate IRS Negotiations

The world of IRS negotiations can be complex and unforgiving. Our team of seasoned professionals uses their wealth of experience to navigate these waters smoothly. We are committed to helping you settle your debts while preserving the integrity and financial stability of your business.

Taking the Next Step Towards Financial Freedom

Remember, encountering financial hurdles does not signify the end of the road for your business. With the right support and guidance, you can overcome these challenges and steer your business towards a prosperous future.

If your business is grappling with IRS debts, don't hesitate to reach out to the Lexington Tax Group. Your journey towards financial freedom and business growth is just a consultation away. Reach us at [your contact details] or drop us a message to schedule a no-obligation consultation today.

Together, we can work towards building a brighter, financially secure future for your business, because every big business was once a small business that refused to give up.

0 notes

Text

Navigating Tax Season as a Gig Driver: Let Lexington Tax Group Guide You

The gig economy offers unparalleled freedom and flexibility in choosing your work hours. But when it comes to navigating the complex world of taxes, many gig drivers find themselves in a fix. Tax obligations can sometimes take a back seat amidst your busy schedule, leading to unwanted stress and potential debts to the IRS. If you find yourself in this situation, fear not! Lexington Tax Group is here to steer you in the right direction.

Understanding Your Tax Obligations

As a gig driver, it's essential to understand that your earnings are subject to tax. The IRS requires you to report your income and pay the necessary taxes accordingly. However, calculating what you owe can sometimes be a complex process given the numerous potential deductions and expenses you can claim.

Personalized Tax Plans

Every gig driver has a unique financial landscape. At Lexington Tax Group, we believe in creating personalized tax plans that cater to your specific needs. Our experts work closely with you to develop a strategy that aligns with your financial goals and helps you stay compliant with the IRS regulations.

Expert IRS Negotiation

Owing money to the IRS can be a daunting situation. But there's no need to lose sleep over it. Our team of professionals specializes in negotiating with the IRS to find a settlement that's reasonable for you. We guide you through the process, helping you to avoid hefty fines and potential legal issues.

Claiming Your Tax Deductions

One of the key ways to minimize your tax liability is by claiming all the tax deductions available to you. Our experts can help you identify these deductions, ensuring you don't pay more than you need to. From vehicle expenses to supplies and even a portion of your mobile phone bill, there are several deductions gig drivers can claim to reduce their taxable income.

Get Started Today

Tax season doesn't have to be a source of anxiety. With the right guidance and support, you can navigate it with ease and confidence. Get in touch with Lexington Tax Group today and drive your tax worries away. We're here to help you at every turn, making sure your journey in the gig economy is smooth and successful.

Contact Us Today Call us at 1-800-328-8289 or visit our website at www.LexingtonTaxGroup.com to schedule a consultation.

0 notes

Text

Did your IRS Debt Go To The Moon?

The Day Trader's Guide to Navigating Tax Challenges with the IRS

Day trading, with its rapid buy-and-sell strategy, is a unique beast in the financial world. But while it offers opportunities for significant gains, it also comes with a complex tax landscape. If you're a day trader, you'll know that the roller coaster doesn't just stop at market fluctuations—it extends to the realm of taxation too.

Understanding the Day Trader's Tax Landscape

The world of day trading taxation isn't straightforward. Capital gains, trading-related deductions, and numerous other facets can quickly become a maze for traders. Often, traders find themselves stuck between optimizing their trading strategies and ensuring they stay compliant with tax regulations.

Why Day Traders Face Unique Tax Challenges

Day trading isn't just about swift transactions; it's about volume, frequency, and strategy. These elements don't just affect market outcomes but also how the IRS views your trading activity. And that view can determine a lot: Are your gains short-term or long-term? Can you claim that new software as a deduction? Are your trades considered a business activity or a hobby?

Lexington Tax Group: Your Ally in Trading and Taxation

At Lexington Tax Group, we understand these challenges. Our expertise spans both the intricacies of trading and the nuances of taxation. We believe that every trader deserves clarity and peace of mind when it comes to their tax obligations.

How We Can Help:

Expert Advice: We help you comprehend the complex tax regulations related to trading, ensuring you never miss out on a deduction or make a costly mistake.

Tailored Solutions: Every trader is unique. Whether you're into stocks, forex, or crypto, we offer solutions molded to your specific needs.

Confidential Consultations: We prioritize your trust. All consultations are handled with the utmost discretion, ensuring your financial details remain confidential.

Final Thoughts

Tax concerns shouldn't stand in the way of your trading aspirations. With the right guidance, you can focus on what you do best: trading. So, if you're a day trader looking for a reliable ally to help navigate the challenges of IRS tax obligations, look no further than Lexington Tax Group. Your trades should work for you, not against you. Let's embark on a journey to stress-free trading together.

Remember to add appropriate CTAs (Calls to Action) at the end of your blog post, perhaps directing readers to a contact page or offering them a downloadable guide related to trading and taxes. This can help in converting readers into potential clients.

www.LexingtonTaxGroup.com

800-328-8289

0 notes