#homeinsurance

Text

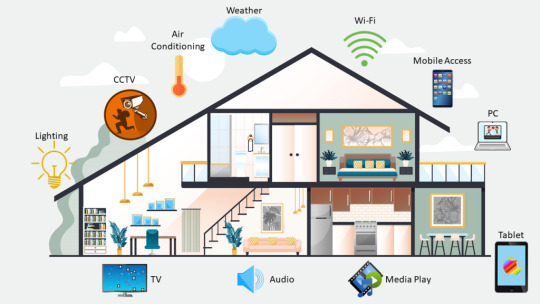

A smart home is a home that is equipped with technology that allows you to control and automate various aspects of your home, such as lighting, heating, and security. Here are 20 tips for building a smart home:

6 notes

·

View notes

Text

5 Ways to Save Money on Home Insurance

A homeowners insurance policy will provide financial protection if your home or its contents are damaged or destroyed, and it will also protect you if you or a family member is held legally accountable for the injuries or damage to others' property.

1.Keep your credit in good standing. According to studies, those with weak credit may pay at least twice as much for homes insurance as those with great credit. Those who invest the time and money necessary to learn about this score and seek to improve it can protect their credit status.

2. Shop around and compare insurance policies. Homeowners insurance is offered from a variety of providers, and individuals that shop about can compare and contrast prices until they discover the best deal. Consumer guides, insurance agents, and online insurance quote services can all assist you in locating the best deals.

3. Protect your residence. Updating a cove smart home security system needs an initial investment, and a homeowner who does his or her study will ensure that a short-term home security investment results in long-term insurance savings. This could result in a 20% reduction in your home insurance cost.

4. Stick with your insurer. Staying with one insurance carrier may allow you to minimize your home insurance prices over time. If you stay with a specific provider for six years or more, you may be eligible to reduce your house insurance cost by up to ten percent.

5. Increase your auto and house insurance coverage. Did you know you might save money by getting your auto and house insurance from the same company? That's right—some insurance companies give reductions ranging from 5% to 15% off your price if you purchase multiple policies from them.

#homeinsurance#home & lifestyle#modern home#ideal home#smarthome#homeautomation#covesecurity#covesmart#homesecurity

2 notes

·

View notes

Text

The Insurance Lady Inc. is your trusted partner in protecting your future and securing your peace of mind. With over 20 years of experience in the insurance industry, our team of experts is committed to finding the best coverage options that suit your needs and budget. We offer a wide range of insurance products, including home, auto, life, and business insurance, and our personalized approach ensures that you receive tailored solutions that meet your unique circumstances. Let us help you safeguard your tomorrow by contacting us today.

#Insurance#AutoInsurance#HomeInsurance#BusinessInsurance#LiabilityInsurance#PropertyInsurance#HealthInsurance#LifeInsurance#InsuranceAgent#IndependentInsuranceAgency

2 notes

·

View notes

Photo

7 Things You Should Know Before Buying A Home In New Orleans

If you're considering taking the big step of buying real estate here in "The Big Easy," then you should be aware of all the important facts before going further down that path. In this post, we are going to discuss some important things you need to know if you're thinking about purchasing a home in New Orleans.

#home#architecture#property#quarter#homebuyers#repairs#renovations#landscaping#homerepairs#plumbing issues#professionalhomeinspector#homeinsurance

2 notes

·

View notes

Text

Insurance Plan In India

Insurance is an "Indemnity"-contract, i.e to Indemnify the an uncertain loss happens in the future. Insurance policy/plans is there to provide protection for yourself, your investment and your business. Insurance is chiefly a risk-management tool meant to offer financial protection to your dependents in the unfortunate event of your death. If you are adequately insured, your life insurance should enable your dependents – spouse, children or parents – to maintain their current lifestyle and pursue life’s financial goals till the time that they are able to set up an alternate income stream on their own.

Why choose us?

We offer different kinds of insurance solutions catering to customer’s insurance needs.

Our experts evaluate your specific needs and study the risk profile.

Based on the results of these evaluations, our experts suggest the most cost effective, integrated insurance package that is specifically suited to your risk profile.

Tie-ups with multiple Life & General insurance companies.

Kindly Go Through This Link For More Information :- https://www.tulsiwealth.com/insurance.php

#insurance#insuranceagent#insurancebroker#insoranceagency#lifeinsurance#healthinsorance#insoranceadvisor#insuranceplan#homeinsurance#insoranceconsultancy#insurancecompany#insuracetips#insurancepolicy

2 notes

·

View notes

Link

Does your Relationship affect your insurance needs?

You may be surprised!

#valentines#valentine#valentinesday2023#valentinesgift#valentines_day#home#house#love#realestate#realtor#DisasterBlaster#insurance#homeinsurance#engaged#married#scranton#wilkesbarre#hazleton#nepa

2 notes

·

View notes

Photo

Mold is not always an easy issue to handle, so it shouldn't be done with simple, unprofessional techniques. Mold exposure is a very serious issue that has to be removed as quickly as possible. #homeowner #propertymanagement #movingcompanies #localbusiness #hoamanager #commercialpropertymanagement #residentialproperty #insuranceagents #insuranceclaim #propertymanager #homeinsurance #insurancebroker #realestate #floridalife #restoration #affordable #affordablemoldremoval #homeinspection #homecleaning (at Boca Raton, Florida) https://www.instagram.com/p/Cl88AgqOPgG/?igshid=NGJjMDIxMWI=

#homeowner#propertymanagement#movingcompanies#localbusiness#hoamanager#commercialpropertymanagement#residentialproperty#insuranceagents#insuranceclaim#propertymanager#homeinsurance#insurancebroker#realestate#floridalife#restoration#affordable#affordablemoldremoval#homeinspection#homecleaning

2 notes

·

View notes

Text

When you think about factors that affect your insurance premiums, things like your driving record, age, and location may come to mind. However, one often overlooked factor is your credit score. In this article, we'll explore why your credit score matters to insurance companies, how it can affect your premiums, and how you can improve your score and potentially save money on your insurance. Click the link!

https://neodrafts.com/impact-of-your-credit-score-on-your-insurance-premiums

#Insurance#insurancepolicy#insuranceagent#insuranceagency#warranty#lifeinsurance#homeinsurance#carinsurance#travelinsurance

0 notes

Text

Climate change is a global concern that impacts every sector of society, including the insurance industry. As the world continues to experience the consequences of climate change—rising sea levels, droughts, and extreme weather events, insurers are struggling to manage the financial risks associated with these events—click the link!

https://neodrafts.com/navigating-the-challenges-and-embracing-solutions-climate-change-and-the-insurance-industry

#insurance#insurancepolicy#insuranceagent#insuranceagency#warranty#lifeinsurance#homeinsurance#carinsurance#travelinsurance

0 notes

Text

How much coverage do you need to replace your home?

0 notes

Text

According to Bankrate, U.S. home insurance premiums are up an average of 23% in 2024.

But, you can still save on rates if you’re strategic. Here are a few of our top tips:

Shop Around

We recommend that you review at least three estimates while taking into account any differences in the policy terms.

Increase Your DeductibleAccording to Nerdwallet, raising your deductible from $1,000 to $2,500, for example, could save you an average of 11% each year.

Make Strategic Home Improvements

Some projects—like updating your electrical system—can reduce your rates by making your home safer or less prone to damage.

Check out our blog post for even more ways to save on home insurance!

217 Livingston Dr. Website:

Visit Our Blog Today!

Contact Us Today!

Ebby Halliday

The Shuler Group

Billy Shuler

Cell: 972.977.7311

Email: [email protected]

Website: https://www.ebby.com/bio/billyshuler

#forneyrealestate#forneyhomes#northtexasrealestate#northtexashomes#theshulergroup#sold#sellingforney#billyshuler#julieshuler#realestate#realestateagent#homeownertips#homeinsurance#homeinsurancerates

0 notes

Text

Top 10 Best Home Insurance Companies in New York

When it comes to protecting your home and belongings, having the right insurance is essential. In New York, there are numerous insurance companies vying for your attention, each offering different coverage options and rates. To help you navigate through the plethora of choices, we've compiled a list of the top 10 home insurance companies in New York:

1. Help Point

Help Point is renowned for its comprehensive coverage options and excellent customer service. They offer customizable policies tailored to your specific needs, ensuring you get the protection you require without paying for unnecessary extras.

2. HCP Insurance

HCP Insurance is a trusted name in the insurance industry, known for its competitive rates and hassle-free claims process. With a wide range of coverage options, including liability, property, and additional living expenses, HCP Insurance provides peace of mind to homeowners across New York.

3. JNR Insurance Agency Inc.

JNR Insurance Agency Inc. specializes in providing personalized insurance solutions to homeowners in New York. Their team of experienced agents works closely with clients to assess their needs and find the best coverage options at affordable rates.

4. Castle Rock Capacity Insurance Agency

Castle Rock Capacity Insurance Agency offers comprehensive home insurance policies designed to protect against various risks, including fire, theft, and natural disasters. With flexible coverage options and competitive rates, Castle Rock provides reliable protection for your most valuable asset.

5. K&N Insurance

K&N Insurance is known for its commitment to customer satisfaction and transparent pricing. Whether you're a first-time homeowner or looking to switch providers, K&N Insurance offers personalized service and comprehensive coverage options to meet your needs.

6. First Premier Home Warranty

First Premier Home Warranty specializes in home warranty plans that complement your existing insurance coverage. With a focus on reliability and affordability, First Premier ensures that unexpected repairs and replacements are taken care of without breaking the bank.

7. Bolt Insurance

Bolt Insurance offers a wide range of home insurance products tailored to fit your budget and lifestyle. With competitive rates and flexible coverage options, Bolt Insurance makes it easy to protect your home and belongings against unforeseen events.

8. Dur America Brokerage

Dur America Brokerage is known for its expertise in the insurance industry and commitment to client satisfaction. With a focus on personalized service and comprehensive coverage, Dur America Brokerage provides peace of mind to homeowners throughout New York.

9. Liberty Home Guard

Liberty Home Guard offers customizable home warranty plans designed to protect against the high cost of home repairs and replacements. With a network of trusted service providers and 24/7 customer support, Liberty Home Guard ensures that your home is well taken care of.

10. Next Century Insurance

Next Century Insurance prides itself on offering innovative insurance solutions tailored to meet the evolving needs of homeowners in New York. With flexible coverage options and competitive rates, Next Century Insurance provides reliable protection for your home and belongings.

Choosing the right home insurance company is crucial for protecting your investment and ensuring peace of mind. Consider factors such as coverage options, rates, and customer service when selecting a provider, and don't hesitate to shop around and compare quotes to find the best fit for your needs.

0 notes

Link

0 notes

Text

Best Home Insurance policy in India

Magma HDI offers comprehensive home insurance policy online in India. It offers coverage for property and its contents against a variety of risks. Buy or renew your home insurance policy online.

0 notes

Photo

Don't be that person who finds out AFTER the disaster that their home insurance sucks. Get informed with this guide 👇

0 notes