#harmonic patterns forex

Text

22 Tips To Start Building A BEST ONLINE TRADING You Always Wanted

Why you need to have Fx investing methods and strategies.

Learning how to trade profitably requires you to discover and master a number of Forex buying and selling systems. The important to buying and selling is getting to be a learn of a few trading approaches not the jack of all. Foreign exchange buying and selling techniques are important as they will supply you with framework, a set of rules and a prepare to comply with. This post will discuss some of the distinct sorts of Foreign exchange investing techniques that are at present in the Foreign exchange industry and teach you how to identify what helps make the greatest Forex trading program.

Indicator Driven Buying and selling Techniques.

Approach with severe warning, indicator driven techniques are often designed by a person who notices that this set up is at present operating right now. The problem is just that, it is doing work for that existing moment and usually really tiny examination has been completed to understand the longevity of this Forex trading buying and selling system.

The most significant problem with Indicator based mostly Forex trading buying and selling methods is that it employs indicators to produce a investing sign as opposed to pure value motion. Indicators are lagging and therefore are inclined to give poorer and late signals than pure price tag action which is most up to date information on the chart.

سایت انفجار با شارژ کم Nonetheless, as this buying and selling technique typically looks interesting and 'sexy' on the charts many newbie traders locate this investing approach considerably as well tempting.

Some guru's newest flash in the pan investing technique.

A buying and selling technique which comes with the certain guarantee that you will 'never drop again and will turn your laptop into an automatic funds machine' sadly the world is stuffed with these so named 'guru's' and their millionaire producing Forex trading buying and selling techniques. Experienced traders know that shedding trades is portion of the recreation, you will often have losers and winner's you have to be ready to consider loses. Professional traders recognize no Foreign exchange trading approach is at any time certain, nevertheless with investing final results and back again analyzed efficiency figures they emphasis on the general picture of accomplishment. The greatest way to stay away from falling target to these frauds when finding a Forex education business is to have evidence of their approaches stay trading final results. This way you will understand the realistic and truthful performance of their techniques.

Trading programs that truly perform...

Harmonic trading designs.

Harmonic buying and selling is the artwork of recognizing certain price patterns in line with Fibonacci extensions and retracements to determine turning points in the fiscal markets. Perplexed nevertheless? Harmonic trading is complicated and requires a whole lot of time and practice to master, however it could be one of the greatest buying and selling systems due to the fact it delivers substantial reward vs danger ratios and it is quite versatile. It can be traded on any market on any timeframe.

If you are just starting off finding out how to trade the market place your original focus need to not be on harmonic investing designs as they will take a whole lot of time and emphasis to comprehend. Nevertheless for more experienced traders seeking for a new buying and selling system to insert under their belt, harmonic trading is value a seem.

Old university technical analysis trading approaches.

This specific investing method is nicely acknowledged and effectively traded during the Fx local community for many many years. Technical investigation consists of ascending triangles, consolidation breakouts furthermore head & shoulders patterns, flag styles to title a handful of. The reward in understanding these trading methods is that they do perform and they have decades of knowledge to demonstrate it.

The draw back to these systems is numerous newer traders find this technique to investing dull and understand it as outdated fashioned. It lacks the glamor and enjoyment of indicator pushed technique. It is not busy and flashy and unfortunately, beginner traders often mistake complexity as a indication of much better performance and increased chance. Nevertheless the purpose aged university specialized analysis is even now around is simply because it performs, and loads of knowledgeable worthwhile traders use it in their very own buying and selling type. Other than lacking the pleasure, previous university technical analysis buying and selling techniques tends to have a lower achievement charge, which a good deal of folks are unwilling or not able to offer with. A lower achievement price does suggest the successful trades are generally extremely big, which makes the technique rewarding and really worth finding out as it provides you a reliable foundation in finding out the Forex markets.

Price tag motion trading approaches.

Now what you have been waiting for, I reveal the greatest Foreign exchange trading program you can find out is value action. Cost action buying and selling is the reading of the uncooked price action on a chart. The price is the most up to day details on the chart, so it will give you the most current predicament when looking through the chart. Cost motion as a Foreign exchange investing method is an amazingly easy method that is powerful and practical as it operates in equally trending and ranging markets, with and from the trend. Finding out price tag motion can simplify your Fx investing and significantly enhance your results. With price motion a trader has the benefit to trade any market place on any timeframe, as price tag action setups are successful in all marketplace situations.

Cost motion buying and selling methods to understand:

one. Pin Bar Set up.

The pin bar value action Forex investing method is a reversal method. It is created to trade tops and bottoms of marketplaces and can also be utilized in craze continuation by buying dips in upward trends, and selling peaks in downtrends.

two. Within Bar Setup

Inside of bars can be utilised really successfully when buying and selling Forex. They are largely used when trading powerful trending marketplaces as a craze continuation strategy.

three. Engulfing Bar Set up

Engulfing bars are great for craze reversals. They are uncommon, but a really robust cost action reversal sign. Can be employed when buying and selling developments, but generally located at end of craze reversals.

4. Fakey Set up

The fakey set up is a development based investing strategy that watches for a bogus breakout of an inside of bar formation. This setup can normally be discovered at stages of assist and resistance, quite similar to the pin bar setup. Fakey's are utilised to buy dips in upward trend, and promote peaks in downtrend.

Cost Motion Buying and selling Techniques... Your Very first Phase.

Do not get overcome concentrate on a few price action investing approaches only. Trade these setups on a few distinct currency pairs. Increase your self confidence. Turn out to be relaxed with identifying setups and really recognize how to enter the trade action by phase. Start with 1 value action Forex trading trading system and only when you are entirely cozy add yet another investing technique.

Summary.

It is honest to say that so extended as you stick to something like cost motion trading or old faculty technical investigation you cannot go significantly mistaken. Be warned about all these different indicator systems out there in the community forums, and make positive that you get your Forex trading schooling from a organization with dwell trading outcomes, and seasoned traders.

One of the largest issues inexperienced traders produce is chopping and altering amongst diverse trading strategies. Select a Forex investing method and technique that matches your personality. It may possibly take a couple of tries, but after you find 1 that you like and can turn into consistent investing it, adhere with it.

#سایت انفجار ۱۰ تومنی#سایت بازی انفجار با شارژ اولیه رایگان#سایت بازی انفجار با شارژ کم#سایت انفجار ب

1 note

·

View note

Link

0 notes

Text

🎯#Bitcoin potential rise!!!

Bitcoin potential rise

BTCUSD is forming an inverted head & shoulders on H1 chart, and is now trading below the downtrend line. If the price breaks this trend line, the bullish harmonic pattern will be activated and BTC may rise for higher levels.

Are you buying or selling?

Trade Bitcoin now: https://cfviet.com/san-forex/

1 note

·

View note

Text

Deciphering the Forex Market's Hidden Forces: A Roadmap to Trading Mastery

The forex market, often perceived as an intricate and challenging domain, continues to captivate the aspirations of individuals seeking financial independence. While many embark on the path of forex trading, only a select few unravel the cryptic dynamics that underlie this global financial realm. In this comprehensive exploration, we will delve deep into the enigmatic behaviors of the forex market, unveiling insights that empower traders to make informed decisions and navigate the intricacies of currency exchange with precision.

Decoding Market Behavior

Unearthing the concealed behavior of the forex market necessitates a profound comprehension of how currency pairs interact and evolve over time. This approach, conceived by seasoned trader Andrea Unger, revolves around conducting a systematic backtest of specific trading rules using historical data. By adhering to these rules, traders gain invaluable insights into the unique behavior of different currency pairs, insights that often elude conventional analysis.

Let's delve into the fundamental rules for executing this insightful backtest:

Breakout Strategy: When a currency pair breaches the prior week's high, contemplate initiating a long position.

Trend Reversal Strategy: Maintain a long position until the price dips below the prior week's low, signaling a trend reversal. Then, transition to a short position.

Continuous Assessment: Remain in a short position until the price surpasses the prior week's high, indicating a potential trend reversal. Revert to a long position and continue the cycle.

These rules exhibit flexibility and adaptability to various time frames, including daily and weekly charts. The primary aim is to discern whether a currency pair exhibits a trending or reversal behavior, a pivotal factor influencing trading strategies.

Categorizing Currency Pairs: Trending and Reversal

In the intricate tapestry of the forex market, not all currency pairs dance to the same tune. Some gracefully follow discernible trends, while others are more inclined to change direction swiftly. Categorizing currency pairs based on their behavior empowers traders to craft strategies that harmonize with prevailing market conditions.

Trending Currency Pairs:

GBP/JPY

AUD/JPY

USD/TRY

Reversal Currency Pairs:

AUD/CAD

GBP/CAD

USD/CAD

Comprehending these distinct behaviors is akin to unlocking the forex market's secrets. It equips traders with the ability to align their strategies with the ever-changing dynamics of the currency exchange landscape, ultimately enhancing their chances of success.

Translating Knowledge into Tactical Action

Now that we have unveiled the intrinsic behavior of currency pairs, let's embark on a journey to apply this newfound knowledge in real-world trading scenarios. We'll amalgamate this understanding with the Moving Average Excess Return Expectancy (MAEE) formula to execute well-informed trading decisions.

Example 1: AUD/CAD (8-Hour Time Frame)

AUD/CAD currently resides in a downtrend, characterized by a series of lower highs and lows. After a pullback to previous support, the price surges above the prior week's high, a significant area of value. Given that AUD/CAD falls into the category of reversal currency pairs, there is a strong likelihood of a downward reversal.

To confirm this hypothesis, we patiently await the emergence of a bearish engulfing pattern, a reliable signal that signifies the dominance of sellers. This pattern serves as the entry trigger, prompting a short position upon the opening of the next candle.

Example 2: GBP/CAD (8-Hour Time Frame)

GBP/CAD exhibits an uptrend, characterized by higher highs and lows. After a pullback to previous resistance, it plunges below the prior week's low, a crucial area of value. Since GBP/CAD falls into the category of reversal currency pairs, there is a potential for an upward reversal.

To capitalize on this potential, we seek a valid entry trigger—an affirmative close above support. This signals a shift in momentum, prompting a long position as the next candle embarks on its journey.

Example 3: USD/TRY (Weekly Time Frame)

USD/TRY currently basks in an uptrend, boasting clear higher highs and lows. After retracing to previous resistance, which now functions as support, a robust bullish close materializes. USD/TRY belongs to the category of trending currency pairs, indicating its potential to persist in an upward trajectory.

In this instance, instead of entering the trade upon the next candle's open, we opt for a buy stop order strategically placed above the previous week's high. This strategic maneuver capitalizes on the currency pair's propensity to trail a trend once a breakout occurs.

The Perceived Dilemma of Forex News

A lingering question emerges: should traders closely monitor forex news releases? The answer hinges on their chosen trading style and risk tolerance. Traders operating on extended time frames, such as the 4-hour or daily, often possess more generous stop losses capable of withstanding market volatility induced by news events. As such, they may opt for a less vigilant approach to news monitoring.

Conversely, traders navigating the shorter time frames, such as the 1-hour or lower, must tread more cautiously. Major news releases can trigger abrupt market spikes, potentially activating stop-loss orders. To mitigate this risk, they should remain attuned to impending news events and contemplate exiting trades before the news triggers.

In Conclusion: Unlocking the Forex Market's Mysteries

In conclusion, unraveling the cryptic behavior of the forex market stands as a transformative journey for traders. Categorizing currency pairs based on their behavior, coupled with astute technical analysis, empowers traders to refine their strategies with precision.

The choice to engage with forex news releases or not hinges on trading style and risk tolerance, necessitating a pragmatic approach.

Empowered by this newfound knowledge, traders are poised to navigate the intricate realm of forex trading with resilience and an elevated likelihood of success. Every loss becomes not a setback, but a stepping stone on the path to mastery—a valuable lesson contributing to the trader's growth and evolution in the captivating world of forex trading.

For the best Forex VPS solutions, visit cheap-forex-vps.com to enhance your trading experience with top-notch virtual private servers tailored for forex trading.

#vpsforex#cheap forex#cheap vps forex#forex vps#forex trading servers#forex vps Malaysia#best trading vps#forex vps India#forex vps Italy#forex vps Nigeria#forex vps Latvia#forex vps Singapore#forex vps Australia#forex vps United Kingdom#forex vps USA#forex vps Canada

0 notes

Text

0 notes

Link

#chartpatterns#Fibonacci#Forextrading#Harmonicpatterns#marketanalysis#priceaction#Technicalanalysis#tradingindicators#Tradingpsychology#tradingstrategy

0 notes

Text

Harmonic Pattern in Forex

Harmonic Pattern in Forex

Traders who wish to use technical analysis must have gone through chart patterns or else employed them in trading. There may be less known, but far more accurate patterns that could project future price movement in any timeframe. Here we talk about harmonic pattern in trading. Here not only the geometric features but also the measurement of particular legs of patterns. Read further, to know how…

View On WordPress

0 notes

Text

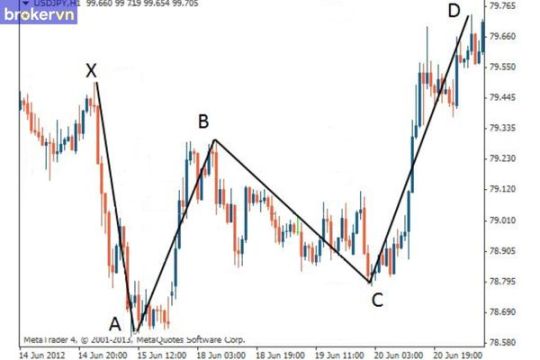

Mô Hình Cánh Bướm Trong Forex – Đặc Điểm Và Cách Giao Dịch

Mô hình cánh bướm (Butterfly Pattern) là dạng mở rộng của harmonic pattern. Biểu đồ này có 2 loại là bullish butterfly pattern và bearish butterfly

Link bài viết: https://brokervn.net/mo-hinh-canh-buom/

#trade #forex #brokervn #ButterflyPattern

0 notes

Photo

What are harmonic patterns and how to use them for effective forex trading? Traders interested in the technical analysis must have come across chart patterns or even used them in trading. However, there are less known, but far more accurate patterns that could project future price movement in any timeframe. This overview deals with harmonic patterns in trading. Here, not only geometric features but also the measurement of particular legs of the pattern. Read on and you will learn how harmonic patterns are built, and how they differ. The article also describes the types of trading signals provided by harmonic patterns and the rules to trade these formations successfully. What are harmonic patterns and... Read full author’s opinion and review in blog of #LiteFinance http://amp.gs/jGK0g

0 notes

Text

Momentum trading strategies pdf bedienungsanleitung

MOMENTUM TRADING STRATEGIES PDF BEDIENUNGSANLEITUNG >>Download (Herunterladen)

vk.cc/c7jKeU

MOMENTUM TRADING STRATEGIES PDF BEDIENUNGSANLEITUNG >> Online Lesen

bit.do/fSmfG

hsbc optionsscheine buch

zertifikate buch

optionsscheine pdf

buch optionsscheine

das hebelbuch

pump and dump

22.12.2016 — Strategie: Mit Relativer Stärke nach. Levy und Momentum stabile Trends handeln 245. ▻6. Tradingtechniken 253. 30.09.2022 — reflect the performance of an equity momentum strategy by emphasizing high trading liquidity, investment capacity and moderate index. 08.01.2021 — A set of effective Forex trading strategies for you to trade professionally, schließt in sich Scalping, Fading, Daily Pivots und Momentum Trading. 28.09.2017 — PDF Alfred Scillitani - Investing Guide für neuen Investor. pdf DOC Louis Chan - Verständnis Momentum Stock Trading Strategies. pdf J. (2001): Returns to Trading Strategies Based on Price-to-Earnings and in: behaviouralfinance.net/momentum/NeWD97.pdf Nelson, D.B. (1991):Composite Momentum Formule Prorealtime e Metastock - Free download as PDF File (.pdf), Text File (.txt) or read Harmonic Pattern Trading Strategy.pdf. von U Mettler · 2003 · Zitiert von: 1 — Chan, K. (1988): On the Contrarian Investment Strategy, Journal of Business 61, Chan, L., Jegadeesh, N., Lakonishok, J. (1996): Momentum Strategies, J2c Optionen mit dem 'Manual File' ausüben kann, eine passende Ergänzung ihrer Trading Strategie darstellt. Wählen Sie Momentum aus der Liste.

, , , , .

1 note

·

View note

Link

0 notes

Video

youtube

In this tutorial, I show you how to use the Fibonacci retracement tool and I also cover harmonic patterns such as the Bat, the Crab, the Butterfly, and the Gartley patterns.

#forex trading#how to trade forex#trading forex#forex trading for beginners#forex analysis#forex for beginners#forex course#forex signals#forex strategy#forex forecast#forex trading strategy#how to use fibonacci retracement in forex#fibonacci retracement strategy#harmonic patterns forex#harmonic pattern trading strategy

0 notes

Text

youtube

How To Trade Speculative Fibonacci Crab Pattern Like A Pro

Learn more.

https://www.dayprotraders.com

#crab pattern#fibonacci numbers#fibonacci trading#fibonacci#Fibonacci patterns#harmonic patterns#gartley pattern#butterfly pattern#bat pattern#weekly chart#stock chart#stock charts#chart patterns#online forex#online investing#online day trader#online day trading#online stock trading#intraday trading tips#day trading tips#stock trading tips#trading tips

8 notes

·

View notes

Text

Advanced Fibonacci Trader Reveals A Hidden Fibonacci Retracement Strategy That One Must Know

Learn more.

#trading fibonacci#fibonacci sequence#fibonacci numbers#fibonacci trading#fibonacci#fibonacci retracements#fibonacci extensions#Fibonacci time zone#fibonacci projections#fibonacci patterns#harmonic patterns#FX#Forex#stocks#Futures#Options#binary betting trading videos#etf#films#comedy#animation#short videos#financial markets#financial#financial times#finance#cci#rsi#macd

2 notes

·

View notes

Text

Shark Harmonic Pattern in Forex Trading

Shark Harmonic Pattern in Forex Trading

The Shark harmonic pattern was discovered by Scott Carney in 2011. Simply, this Shark harmonic pattern is a five-leg reversal pattern that completely depends upon the powerful 88.6% retracement level and the 113% reciprocal ratio. And there is an Extreme Harmonic Impulse Wave, which indicates the M letter for a bullish shark pattern and W indicates a bearish shark pattern. Like other harmonic…

View On WordPress

0 notes

Photo

Learn Fundamental Analysis - Fundamental analysis is the trading discipline, which deals with business results like sales and earnings. Call us now +66-642163364 for more details.

#Learn Fundamental Analysis#Learn Forex Online#Learn Harmonic Pattern#Learn Elliot Wave#Learn Forex Strategy

0 notes