#gbtc

Text

🌟 Grayscale "Mini-Me": Sfida all'orizzonte per gli ETF Bitcoin con commissioni elevate. Una vittoria per la concorrenza e un segnale di maturità per il mercato crypto.

🌟 Il lancio del fondo Bitcoin "Mini-Me" da parte di Grayscale rappresenta una mossa importante nel panorama degli ETF Bitcoin. Con le sue commissioni di gestione inferiori rispetto agli ETF Bitcoin tradizionali, "Mini-Me" ha il potenziale per attirare un gran numero di investitori che attualmente preferiscono alternative con costi più elevati.

🌟 Questa novità rappresenta un beneficio significativo per gli investitori, che potranno beneficiare di un accesso più economico a Bitcoin e di una maggiore diversificazione all'interno del mercato crypto. Inoltre, la concorrenza generata da "Mini-Me" spingerà gli altri gestori di ETF a rivedere le proprie strategie di pricing, favorendo una riduzione complessiva delle commissioni per tutti gli investitori.

🌟 L'arrivo di "Mini-Me" è anche un segnale di maturità per il mercato crypto. Dimostra che il Bitcoin è ormai considerato un asset di investimento legittimo e che gli investitori istituzionali sono sempre più interessati a esporsi a questa classe di asset. Bisogna però fare una importante divisione e sottolineare che, seppur a livello istituzionale questa è una ottima notizia, ha il potenziale distruttivo di un temporale a Dubai per la community che per mancanza di ideali e di cultura base potrebbe essere attratta da questi ETF, andando a rinunciare al potere dato dall'autocustodia.

🌟 Questa notizia rappresenta un'ulteriore conferma del fatto che il Bitcoin è in continua evoluzione e che sta attirando l'attenzione di un numero sempre maggiore di persone. La concorrenza e l'innovazione all'interno del mercato crypto sono elementi cruciali per la sua crescita e il suo successo a lungo termine.

Seguici sui nostri canali social ed unisciti al nostro gruppo Telegram:

https://t.me/Bitcoin_Report_Italia

#criptovalute#cripto#halving#mini me#btc#bitcoin#world economic forum#wef#Ishare#gbtc#blackrock#bitcoinreportitalia#etf#grayscale

0 notes

Text

Genesis Completes Redemption of GBTC Shares, Buys 32K Bitcoins with Proceeds

Bankrupt crypto lender Genesis has completed the sale of its Grayscale Bitcoin Trust (GBTC) shares and used the proceeds to purchase 32,041 bitcoins, according to court documents filed Friday.

The sale of GBTC shares was completed on April 2, the documents show.

On Feb. 15, Genesis received permission from a New York bankruptcy court to sell the nearly 36 million shares in GBTC, as well as…

View On WordPress

0 notes

Text

GBTC satışları ve Bitcoin ETF piyasasında güncel durum

Bitcoin borsa yatırım fonları (ETF'ler), kripto piyasasında önemli bir etki yaratmış durumda. Ancak Grayscale’s Bitcoin Trust (GBTC) gibi önde gelen ürünlerdeki sürekli çıkışlar, gelecekteki gidişatı belirsizleştiriyor.

Grayscale’in Bitcoin Rezervleri Azalıyor

Blockchain analiz firması Arkham Intelligence'ın verilerine göre, GBTC'nin Bitcoin rezervleri hızla azalıyor. Bu itfa oranı devam ederse, GBTC'nin rezervlerinin önümüzdeki 96 gün içinde tükenmesi bekleniyor. Ocak ayından bu yana GBTC'nin Bitcoin bakiyesi 266.470 Bitcoin azaldı, bu da başlangıçtaki 620.000 Bitcoin'in üzerinden önemli bir düşüş olduğunu gösteriyor.

Arkham Intelligence analistlerinin yaptığı açıklamaya göre, Grayscale'in yılın başında Bitcoin Trust GBTC için 618,280 Bitcoin'e sahip olduğu belirlendi. Ancak şu anda ellerinde sadece 356,440 Bitcoin bulunuyor. Bu durumda, mevcut hızla devam ederlerse, Grayscale'in tüm Bitcoin rezervlerini tamamen tüketmesine sadece 14 hafta kaldığı öngörülüyor. Bu, fonun Bitcoin rezervlerindeki hızlı azalmanın ve çıkışların devam etmesi durumunda, fonun varlıklarının tükenmesine işaret ediyor. Arkham Intelligence analistleri, bu trendin sürmesi halinde Grayscale'in GBTC fonunun eldeki varlıklarını 14 hafta içinde tamamen elden çıkarmış olacağını öngörüyor.

CEO’dan Açıklama Geldi

Grayscale’in CEO’su Michael Sonnenshein, beklenen çıkışları kabul etti ve bunları öncelikle kar elde eden yatırımcılara ve fondan çıkan arbitrajcılara bağladı. Ayrıca piyasa gözlemcileri, GBTC çıkışlarını yüksek ücret yapısına bağladı.

Arayışlar ve Planlar

Grayscale, GBTC çıkış eğilimine karşı koymak için çeşitli stratejiler üzerinde çalışıyor. Bu stratejiler arasında uygun maliyetli bir alternatif sağlayan mini bir fonun tanıtılması ve yüksek ücretlerin düşürülmesi yer alıyor. Sonnenshein, %1,5'lik ücretin zamanla düşeceğini ve piyasanın olgunlaştıkça bu tip ücretlerin azalacağını belirtti.

Sonuç ve Beklentiler

GBTC satışları, Bitcoin ETF piyasasında belirsizlik yaratıyor. Ancak Grayscale ve benzer şirketlerin geliştirdiği stratejiler, gelecekte daha sürdürülebilir bir piyasa dinamiği oluşturabilir. Yatırımcılar, bu gelişmeleri yakından takip etmeye devam edecek. Bu süreçte, Bitcoin'in fiyatı ve piyasadaki genel etkisi üzerindeki etkileri dikkatle izlenmelidir.

Önemli uyarı: Bu içerik yatırım tavsiyesi değildir ve yalnızca bilgilendirme amaçlıdır.

Read the full article

0 notes

Text

Ark's Strategy Shift: Cathie Wood Trims Holdings in Chipmakers, Coinbase, and Robinhood

Cathie Wood's Ark Invest, renowned for its forward-thinking investment strategies, has recently made strategic adjustments to its portfolio in response to the evolving market dynamics, particularly the surges in the chip and cryptocurrency sectors.

Ark Invest's recent actions involve trimming positions in chipmakers Taiwan Semiconductor Manufacturing Company (TSMC) and Nvidia, alongside cryptocurrency exchange Coinbase and online brokerage Robinhood. The decision to sell 2,362 Nvidia shares while holding approximately 221,848 TSMC shares underscores the firm's tactical approach to portfolio management.

In addition to these adjustments, Ark Invest sold around 96,435 Coinbase shares, amounting to roughly $16 million across three ETFs in the past week. These moves align with the firm's ongoing portfolio rebalancing strategy, strategically optimizing holdings in response to significant price increases witnessed by the mentioned companies. Notably, Nvidia's stock price has surged by 59% year-to-date, and TSMC has experienced a 25% climb. Meanwhile, Coinbase's share price recorded a 30% surge in the past month, albeit below its all-time high.

Ark Invest's strategic acquisitions reveal a diversified investment approach, capitalizing on emerging opportunities. The firm has invested in Roku, a leading streaming platform provider, Veracyte, a precision oncology company, and 10x Genomics, a trailblazer in single-cell analysis technologies. Additional investments in Twist Bioscience, 908 Devices, Intellia Therapeutics, and Mass devices contribute to a well-rounded portfolio spanning various innovative sectors.

While the specific reasons behind Ark Invest's decisions remain undisclosed, these strategic moves reflect a calculated approach to managing risk and leveraging potential opportunities in a rapidly changing market. This careful and strategic portfolio adjustment underscores the firm's commitment to staying ahead of the curve and adapting to emerging trends.

0 notes

Text

rayscale Bitcoin Trust BTC, a leading cryptocurrency investment trust, reported balanced books of $0.00 per share in the fiscal fourth quarter of 2023, compared to the same period the previous year. This steady financial performance demonstrates the trustns ability to maintain stability amidst market fluctuations. The revenue for the quarter remained unaffected, holding at $0.00 million, a slight decrease from the prior reporting seasonns $21.56 million.Despite the challenging economic landscape, Grayscale Bitcoin Trust BTCns net deficit remained unchanged at $0.000 million for the fiscal fourth quarter of 2023, compared to the same period a year ago. This indicates effective financial management strategies employed by the trust.Throughout the fiscal year 2023, the trust recorded a loss of $0.00 million, with revenue also re https://csimarket.com/stocks/news.php?code=GBTC&date=2024-02-23192607&utm_source=dlvr.it&utm_medium=tumblr

0 notes

Text

BlackRock's Bitcoin ETF Holds 105,280 BTC, iShares Bitcoin Trust (IBIT) Sees Remarkable Growth

BlackRock's Crypto ETF Reaches 105,280 BTC Under Management

The cryptocurrency exchange-traded fund (ETF) managed by BlackRock now holds 105,280 BTC, marking a significant milestone for the iShares Bitcoin Trust (IBIT). With this achievement, IBIT becomes the first crypto fund, excluding Grayscale Investments' converted investment product, to reach this level of Bitcoin holdings.

Impressive Growth Since Launch in January 2024

Since receiving approval from the U.S. Securities and Exchange Commission on January 10, 2024, BlackRock's spot Bitcoin ETF has experienced a remarkable growth of 3700%. The quantity of Bitcoin under its management has surged from 2,621 BTC to 105,280 BTC.

Analysts Note Growing Assets in Crypto Funds

Analysts observe that BlackRock's product is among nine crypto funds witnessing asset growth. Fidelity Investments' spot Bitcoin ETF is also nearing the 100,000 BTC mark, currently managing 83,925 BTC.

The only investment product experiencing active fund outflows is Grayscale's GBTC. On its first trading day, GBTC held 619,220 BTC, but this figure decreased by 25% to 463,475 BTC within 22 working days.

Record Inflows Reported on February 13, 2024

On February 13, 2024, net capital inflows into spot Bitcoin ETFs reached a record high of $631.23 million. This marks a new historical peak since the commencement of trading in this position.

According to Soso Value, positive trends have persisted for 13 consecutive days, with GBTC being the only spot Bitcoin ETF experiencing outflows.

BlackRock's Growing Interest in Bitcoin

It's worth mentioning that BlackRock has signaled its readiness to increase its Bitcoin holdings in its portfolio, indicating a growing institutional interest in cryptocurrencies.

Read the full article

#BitcoinETF#BlackRock#FidelityInvestments#GBTC#GrayscaleInvestments#iSharesBitcoinTrust(IBIT)#Netcapitalinflows#SosoValue

0 notes

Text

Bitcoin hits US$50K for 1st time since 2021. What’s behind the surge

Bitcoin BTC= hit the $50,000 level for the first time in more than two years as the world’s largest cryptocurrency was buoyed by expectations of interest rate cuts later this year and last month’s regulatory nod for U.S. exchange-traded funds designed to track its price.

The cryptocurrency has risen 16.3 per cent so far this year, on Monday touching its highest since Dec. 27, 2021. At 12:56 p.m. EST (1756 GMT), bitcoin was up 4.96 per cent on the day at $49,899, having oscillated around the $50,000 level.

“$50,000 is a significant milestone for bitcoin after the launch of spot ETFs last month not only failed to elicit a move above this key psychological level but led to a 20 per cent sell-off,” said Antoni Trenchev, co-founder of crypto lending platform Nexo.

Crypto stocks also enjoyed a boost on Monday, with crypto exchange Coinbase COIN.O up 4.9 per cent and crypto miners Riot Platforms RIOT.O and Marathon Digital MARA.O up 10.8 per cent and 11.9 per cent, respectively. Shares of software firm MicroStrategy MSTR.O — a notable buyer of bitcoin — were up 10.2 per cent.

The price of ether, the second-largest cryptocurrency, was up 4.12 per cent at $2,607.57.

Global stock indexes also edged higher on Monday, as traders looked for cues on when the U.S. Federal Reserve might begin cutting interest rates. Analysts and financial market expectations both point to May as a potential start for rate cuts this year.

ETF exuberance

The primary driver behind bitcoin’s recent price appreciation “can be attributed to the increased inflow into BTC spot ETFs,” said Matteo Greco, a research analyst at fintech investment firm Fineqia International, in a research note.

The U.S. securities regulator on Jan. 10 approved the first U.S. spot bitcoin ETFs, a watershed for the world’s largest cryptocurrency and the broader crypto industry, which had been trying to bring such a product to market for more than a decade.

Greco in particular noted that outflows from Grayscale Investment’s Grayscale Bitcoin Trust GBTC.P — which received approval from the U.S. Securities and Exchange Commission (SEC)in January to convert to an ETF — have begun to slow.

“While GBTC recorded a cumulative outflow of $415 million last week, representing a significant reduction from previous weeks, BTC Spot ETFs saw a total net inflow of about $1.2 billion during the same period, marking the highest weekly inflow since their launch,” he said.

Analysts at Bernstein have estimated that flows into the new ETFs will build up gradually to cross $10 billion in 2024, while Standard Chartered analysts have said the products could draw $50 billion to $100 billion this year alone. Other analysts have said inflows could be $55 billion over five years.

The market is also eyeing seven pending applications in front of the U.S. SEC for ETFs tied to the spot price of ether. The SEC is due to deliver a final decision on several of those proposals by May.

Investors are also looking eagerly to the next bitcoin “halving,” expected in April, analysts say. That process is designed to slow the release of bitcoin, whose supply is capped at 21 million tokens – of which 19 million have already been created. Bitcoin rallied on the previous three halvings, the most recent of which was in 2020.

“With fourth bitcoin halving, a first Fed interest rate cut and potential ethereum spot ETF approval, all are significant for what is the smallest, youngest and most retail-dominated asset class,” said Ben Laidler, global markets strategist at eToro.

Read the full article

0 notes

Text

Bitcoin’s Price Stabilizes with Surge in Stablecoin Supply, Growing 3.5% in a Month

Bitcoin is experiencing a boost from an increase in stablecoin purchasing power, as reflected by the rising supply trends. According to Glassnode, an on-chain analytics firm, the stablecoin supply ratio (SSR) oscillator is showing a continuous decline. This key stablecoin metric has dropped significantly, by 80%, from its peak.

SSR oscillator. Source: Glassnode

From a high of 4.13 in October to 0.74 in January, the SSR oscillator’s sharp decline coincides with a notable increase in stablecoin supply, as pointed out by James Van Straten, a research analyst at CryptoSlate. He observed a notable rotation of stablecoins into Bitcoin, which contributed to Bitcoin surpassing the $42,000 mark. This shift represents a significant recovery from a previous downturn in stable coin supply between May 2022 and October 2023.

“Stablecoin supply is now 10B higher from the low, and 3.5% higher in the past 30 days.”

Stablecoin aggregate market cap change. Source: James Van Straten/X

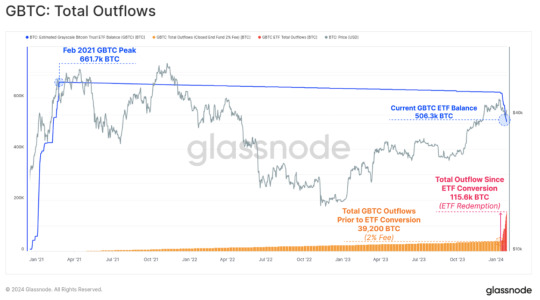

Meanwhile, Bitcoin is also undergoing changes in its own supply dynamics, partly due to the introduction of spot Bitcoin exchange-traded funds (ETFs) in the United States. These ETFs have facilitated institutional investment, altering the flow of capital in the crypto market. The Grayscale Bitcoin Trust (GBTC), which recently transitioned to a spot ETF, is undergoing a major rebalancing, leading to the redemption of approximately 115.6k BTC and impacting market dynamics.

“Around ~115.6k BTC have been redeemed from the GBTC ETF since conversion, creating significant market headwinds.”

GBTC outflows annotated chart (screenshot). Source: Glassnode

Glassnode, in its latest report, acknowledges that on-chain flows are adjusting three weeks post-ETF launches. With these redemptions expected to decrease soon, selling pressure is likely to diminish. Glassnode also notes an overall increase in institutional on-chain volumes, indicating a broader shift in market trends.

M.Hussnain

Visit us on social media: Facebook | Twitter | LinkedIn | Instagram | YouTube TikTok

0 notes

Text

Bitcoiner nach dem ETF: Himmelhoch jauchzend - oder zu Tode betrübt?

Bitcoiner nach dem ETF: Himmelhoch jauchzend - oder zu Tode betrübt?

Seitdem die Bitcoins-ETFs auf dem Markt sind, kennt der Kurs nur eine Richtung - abwärts. Wir erörtern Gründe und Umstände durch eine Kollektion an Tweets, die uns näher an die materiellen Geschehnisse auf dem Markt führen.

Seitdem die Bitcoins-ETFs auf dem Markt sind, kennt der Kurs nur eine Richtung – abwärts. Wir erörtern Gründe und Umstände durch eine Kollektion an Tweets, die uns näher an die materiellen Geschehnisse auf dem Markt führen.

Continue reading Bitcoiner nach dem ETF: Himmelhoch jauchzend – oder zu Tode betrübt?

View On WordPress

0 notes

Text

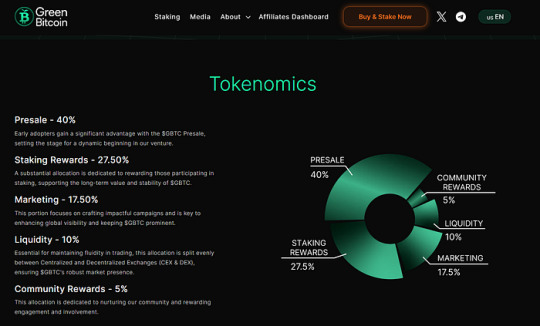

Green Bitcoin token pre-sale — an opportunity for investors

Green Bitcoin — Sustainable cryptocurrencies with the potential for large profits

Green Bitcoin is a new cryptocurrency project that combines the legacy of Bitcoin with an environmentally friendly blockchain Ethereum . This project offers an innovative solution that allows users to earn big money while contributing to environmental protection.

Go to the project website by clicking here

How does Green Bitcoin work ?

Green Bitcoin uses a staking model that allows users to earn rewards for locking their tokens . Green Bitcoin (GBTC) tokens are mined sustainably using only renewable energy sources.

In addition to staking , Green Bitcoin also offers a unique Bitcoin price prediction system . Users can earn rewards by correctly predicting Bitcoin’s future price trends .

Go to the project website by clicking here

Why is it worth investing in Green Bitcoin ?

There are many reasons why you should consider investing in Green Bitcoin . Firstly, this project is environmentally sustainable. Green Bitcoin uses only renewable energy sources, which helps reduce its impact on the environment.

Secondly, Green Bitcoin offers the potential for large profits.

Users can earn rewards for staking and predicting Bitcoin prices .

Thirdly, Green Bitcoin is a new and innovative project that has the potential for development. This project is only in the pre — sale phase, which means that now is a good time to get on board .

Go to the project website by clicking here

What threats should be expected?

Of course, like any cryptocurrency project , Green Bitcoin comes with some risks. One of the main risks is that this project may fail. Please note that Green Bitcoin is still in development and there is no guarantee that it will be successful.

Another risk is that the price of GBTC may drop. The price of GBTC depends on many factors, including the overall cryptocurrency market , the development of the Green Bitcoin project , and general economic conditions.

Go to the project website by clicking here

Coinspect and security audit

Coinspect is a cryptocurrency security company that offers security audits for cryptocurrency projects .

A security audit is a crucial step for any cryptocurrency project that wants to ensure the security of its users and assets.

Coinspect security audit includes the following elements:

· Code Assessment: Analyzing the project’s source code for potential security vulnerabilities.

· Infrastructure Assessment: Analysis of the project infrastructure, including servers, networks and databases.

· Process Assessment: Analyze the project’s security processes, such as risk management and access control.

Coinspect uses a team of cryptocurrency security experts who are experienced in conducting security audits for cryptocurrency projects . This company also has a good reputation in the cryptocurrency industry .

As Green Bitcoin points out , the audit can be viewed via the link on their official website — https://coinsult.net/projects/green-bitcoin .

Go to the project website by clicking here

Bitcoin Purchasing Methods

Green Bitcoin can be pre-purchased as follows:

· Metamask

· Wallet Connect

· Best Wallet

· BNB Chain — If you purchase on BNB during the pre-sale, you will not be eligible for the 350% annual staking return .

Green Bitcoin — an ecological alternative to Bitcoin

As environmental awareness increases around the world, more and more people are looking for ways to reduce their impact on the environment. Also in the cryptocurrency industry , there are more and more projects that focus on sustainable development. One of them is Green Bitcoin .

Green Bitcoin is a new cryptocurrency project that uses only renewable energy sources for mining. Thanks to this, its CO2 emissions are much lower than those of traditional Bitcoin .

Go to the project website by clicking here

What are the benefits of Green Bitcoin ?

In addition to lower CO2 emissions, Green Bitcoin also offers other benefits such as:

· Lower mining costs: Green Bitcoin is cheaper to mine than traditional Bitcoin , which may lead to lower prices for GBTC tokens .

· Increased security: Green Bitcoin is considered more secure than traditional Bitcoin because it does not require as many nodes to verify transactions.

Go to the project website by clicking here

Is Green Bitcoin the future of cryptocurrencies ?

It’s still too early to say whether Green Bitcoin will be successful. However, this project has the potential to become a popular alternative to traditional Bitcoin in a world that focuses on ecology.

Go to the project website by clicking here

GBTC pre-order page

Green Bitcoin official pre-sale website — https://greenbitcoin.xyz

Click to go ( click )

Summary

Green Bitcoin is an ecological alternative to traditional Bitcoin . This project uses only renewable energy sources for extraction, which makes its CO2 emissions much lower. Green Bitcoin also offers other benefits such as lower mining costs and higher levels of security.

Before investing in cryptocurrencies or a pre -sale project, you should carefully analyze the risks and potential benefits. It is also important to remember that you should not invest more money than you can afford to lose.

Attention!

This article is not an encouragement to invest in cryptocurrencies , pre -sale projects or providing investment advice. Investing in cryptocurrencies and pre -sale projects involves high risk.

Green Bitcoin Scam ? - Coinsult Audit

Green Bitcoin is a new cryptocurrency project that combines the legacy of Bitcoin with the eco-friendly Ethereum blockchain. The project offers an innovative solution that allows users to earn big money while contributing to environmental protection.

Go to the project website by clicking here

Coinsult Audit

The Green Bitcoin GBTC protocol has been audited by Coinsult. The audit was conducted by a team of experienced blockchain security experts.

The audit concluded that the Green Bitcoin GBTC protocol is safe and secure. The audit did not identify any critical security vulnerabilities.

The Coinsult audit is a significant sign of confidence in the Green Bitcoin GBTC protocol. The audit confirms that the protocol is safe and secure, and can be used by users without concern for their security.

Audit page: https://coinsult.net/projects/green-bitcoin/

Go to the project website by clicking here

No KYC Audit — What is it?

KYC collects and verifies customer information. This helps exchanges build trust in the cryptocurrency industry, and also protects their users and their assets. KYC is standard for cryptocurrency exchanges. The verification process cannot be denied to provide security to market participants, but for some it is unnecessary, and even annoying.

Go to the project website by clicking here

Environmental Impact

Green Bitcoin GBTC aims to reduce the environmental impact of bitcoin. Bitcoin is considered to be one of the most energy-intensive cryptocurrencies.

The Green Bitcoin GBTC protocol uses the proof-of-stake mechanism, which is more energy-efficient than proof-of-work, which is used by bitcoin. Proof-of-stake requires less energy to verify transactions.

Users who store bitcoins on the Green Bitcoin GBTC protocol can help reduce the environmental impact of bitcoin.

Go to the project website by clicking here

Attention!

This article is not an encouragement to invest in cryptocurrencies, pre-sale projects or providing investment advice. Investing in cryptocurrencies and pre-sale projects involves high risk.

#crypto#cryptocurrencies#cryptocurency news#cryptoexchange#ethereum#binance#bnbchain#bnb#coinbase#green bitcoin#GBTC#pre-sale#foryou#forypupage#investing#trader

0 notes

Text

Ark Invest Offloads GBTC Shares As Bitcoin Spot ETF Brews On Horizon

As the much-awaited deadline for Bitcoin Spot ETF applications is drawing near, Ark Investment Management under the direction of Cathie Wood has sold off its entire Grayscale Bitcoin Trust (GBTC) holdings.

Ark Invest Bitcoin Investment Strategy Shift

Bloomberg Intelligence ETF analyst Eric Balchunas recently reported the development on X (formerly Twitter) on Thursday, December 28. According to…

View On WordPress

0 notes

Text

☄️ GBTC dimezzato: il dominio di Grayscale vacilla, nuove opportunità per gli ETF Spot?

🌟 Il Grayscale Bitcoin Trust (GBTC), un tempo gigante indiscusso degli investimenti Bitcoin istituzionali, ha subito un duro colpo: le sue partecipazioni in Bitcoin sono dimezzate da quando gli ETF Spot Bitcoin sono stati lanciati all'inizio di quest'anno. Questo calo significativo solleva dubbi sul futuro di GBTC e sul suo ruolo dominante nel panorama degli investimenti Bitcoin.

🌟 L'ascesa degli ETF Spot Bitcoin, strumenti di investimento più accessibili e regolamentati, ha favorito un esodo di investitori istituzionali da GBTC. Questi investitori, attratti dalla maggiore trasparenza e flessibilità degli ETF Spot, hanno preferito spostare i propri capitali verso questi nuovi prodotti.

🌟 La situazione attuale apre nuove opportunità per gli ETF Spot Bitcoin, che potrebbero raccogliere il testimone da GBTC come strumento preferito dagli investitori istituzionali per l'esposizione al Bitcoin. La loro semplicità d'uso e la maggiore familiarità con gli ETF da parte degli investitori tradizionali potrebbero accelerare questo passaggio di consegne.

🌟 E' però importante sottolineare che il futuro di GBTC rimane incerto. Il trust potrebbe cercare di adattarsi al nuovo panorama competitivo, diversificando i propri investimenti o riducendo le sue commissioni. Solo il tempo dirà se GBTC riuscirà a riconquistare la fiducia degli investitori o se sarà definitivamente surclassato dagli ETF Spot Bitcoin.

Seguici sui nostri canali social ed unisciti al nostro gruppo Telegram:

https://t.me/Bitcoin_Report_Italia

#cripto#criptovalute#halving#criptocurrency#bitcoin#gbtc#grayscale#etf#bitcoin etf#btc#BitcoinReportItalia

0 notes

Text

Spot Bitcoin ETFs See New Net Outflow: What's Happening?

Spot Bitcoin ETFs returned to daily net outflows. Grayscale’s GBTC total outflows exceeded $15 billion. Ark Invest 21Shares’ ARKB product also had its first daily exit with a fund outflow of $300,000.

Spot Bitcoin ETFs return to net outflows!

cryptokoin.com As you follow from , the aggregate of US spot Bitcoin ETFs recorded a total net inflow of $860 million on each trading day last week.…

View On WordPress

0 notes

Text

Market Turmoil Warning: Bitcoin Bulls on Alert as Spot vs. Perps Clash Raises Concerns

Recent analyses within the Bitcoin (BTC) market have unveiled compelling patterns, offering a deeper understanding of trading behaviors and market flows. Skew, a notable analyst, takes center stage in this exploration, shedding light on the nuanced interactions between the spot market and perpetual contracts (perps). The study provides insights into investor sentiment and potential shifts in market dynamics that could influence BTC prices.

In the spot market, a clear trend emerges, characterized by the prevalence of limit selling during price rebounds, particularly around the critical $50K mark. This observation is substantiated by spot order book data. Concurrently, price dips trigger a surge in taker buy volume, indicating a collective inclination to view these dips as opportune buying moments. Sustaining this buying behavior is pivotal for the continuity of bullish momentum, necessitating an upward trend in buy volume and active price pursuit by takers.

Contrastingly, the perpetual contracts market tells a different story. Escalating sell volume, combined with a noticeable lack of momentum or volatility, raises concerns about potential traps for short positions. This concern is exacerbated if not complemented by analogous spot selling. The divergence between spot and perps trading emphasizes the intricate dynamics at play, demanding careful analysis from market participants.

The examination of spot market flows across different platforms, such as Binance and Coinbase, introduces further complexity. Binance's ability to anticipate US session flows through front running stands in contrast to Coinbase's trading pattern, which involves a mix of time-weighted average price (TWAP) bids at the US market open and prevalent limit selling into the market.

The movement of funds into and out of Spot Exchange-Traded Funds (ETFs) like IBIT, FBTC, and GBTC plays a significant role in shaping market dynamics. These fund flows serve as a valuable barometer for investor sentiment and potential shifts in market direction, providing a nuanced view of the broader market landscape.

Comprehending the intricacies of BTC market flows necessitates a holistic perspective that considers both spot and derivatives markets, along with ETF movements. As the cryptocurrency market matures, these insights become indispensable for investors navigating the multifaceted and dynamic landscape of cryptocurrency trading.

0 notes

Text

Bitcoin Ready Bottom?

GBTC printed a bullish reversal on Tuesday.

Tuesday was day 49 for the daily cycle. That places GBTC deep in its timing band for a DCL. Tuesday’s bullish reversal eases the parameters for forming a swing low. A swing low and a close back above the 10 day MA will signal that day 49 hosted the DCL. Long positions could be entered on a swing low with stops being placed at the 50 day MA.

View On WordPress

0 notes