#frc double trouble

Text

Game animations (or photos cause there aren’t animations) below the cut.

Double Trouble:

Triple Play:

youtube

#first robotics competition#frc#robotics#frc robotics#triple play#frc triple play#double trouble#frc double trouble#poll#frc poll#Youtube

2 notes

·

View notes

Text

Hey folks!

Simple question: any fic challenges you’d like to see for next year’s 2022 Fic Reading Challenge?

And an update: I’ve been severely ill and in and out of the hospital (thank goodness it’s not Covid, I’m double vaxxed though that’s not guaranteed, but I’m on body-messing antiemetic chemo drugs to prevent further complications while waiting on further imaging, diagnostics, and blood work to tell me I’m as usual perfectly normal and then struggle for years to understand how all this could possibly be because fuck the world—*coughs* excuse me—)

BUT! The beautiful, incomparable, kind, and vivacious @saganarojanaolt and I have been brainstorming what will surely be 3 AWESOME completion badges for this event, and I am super totally stoked! (This is @juuls of course, dear!)

Re: your last mental image you gave me:

Or the epitome of this gif:

… but with some dude just reading and not even noticing what’s going on. Those totally popped into my mind when you messaged me (and yeah I’ll DM you back, dear. 😘😅)

ANYWAY!

I’m definitely digging into getting the 2022 challenge finished and ready to go, old and new tasks included alike. But this is 100% a community-interactive event and I want anyone who wants to participate to feel they are fully welcome with open arms. ☺️

I worry a little about my health and mental fortitude for getting this done on my way own, what with my grandmother also passing away tomorrow… but I mean, that’s been coming for a while and even if I can be strong mentally, my body is the issue, and I just gotta push. But… any help is wonderful and will never be denied. We’re in this together, even when we think the issues are so indelibly personal that they shouldn’t matter. But I’vre never prescribed to that. I welcome help and oppenness with the widest arms, and I’m sure my family and furbaby will appreciate any help, big or smile.

We’re in this life together— not just Covid and lockdown and quarantines and all that. Life, in essence, is a co-op game with various levels of lag and more good guys than bad guys who care for their fellow players. I hope you’re one of them.

Never be afraid to approach me. I will never take insult at any suggestions or offers of help you may have. My grandmother, her son/my dad, taught me to be pragmatic and fatalistic…. But to love all those who put themselves out there to express care for those of us who may just need it.

But yes.

P.S. if you’re having trouble submitting forms because google is bullshit at times, please feel free to just send me your completed FRC to the email here: [email protected]

You are wonderful, and this first year’s success has been so much more than I expected!!!!

Have some happy. ☺️💜💙❤️❤️🐶🐾 More personal, so below the cut:

There may be a new puppy member of the family next spring oooooo! Dad pretends he’s annoyed but I think he’s a lying liar who lies.

15 notes

·

View notes

Text

History of 135

1998: Ladder Logic

During our rookie year, The Black Knights began to steadily climb the ladder to success. In 1998, Team 135’s inaugural year, the class began with 14 members. We competed in the Motorola Midwest Regional and won the Against All Odds award. We even qualified for the National Championship at Epcot Center in Florida!

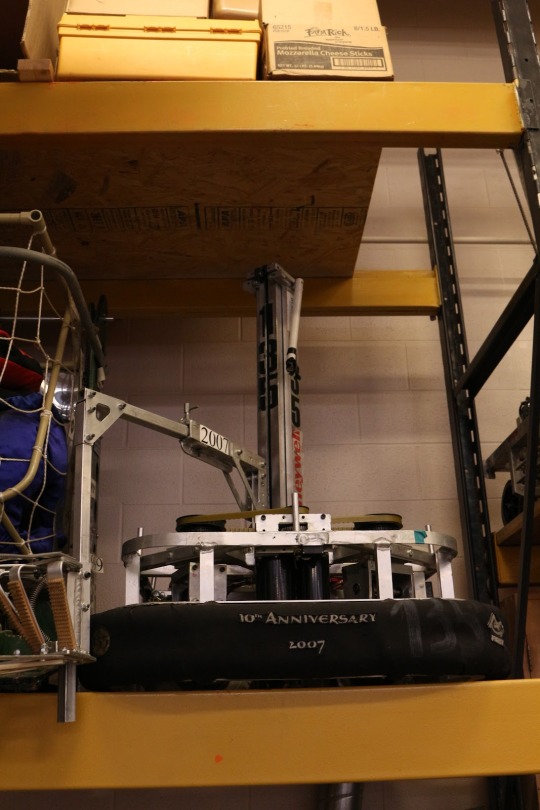

1999: Double Trouble

We doubled down this year! In 1999, our second year, our team built a strong robot for the Double Trouble game. We competed in the Great Lakes Regional and brought home the Best Offensive Round award for our robot’s performance. We also qualified for the National Championships for the second time!

2000: Co-opertition FIRST

Team 135 learned the true meaning of co-opertition in 2000. We competed at the Motorola Midwest Regional and won the Featherweight in the Finals Award! We also competed at the National Championships for the third time.

2001: Diabolic Dynamics

Team 135’s success in 2001 was nearly diabolical! We competed at the Motorola Midwest Regional and made it all the way to the finals, and even won the Delphi: “Driving Tomorrow’s Technology” Award! We also made it farther at the National Championships than any year prior. Our alliance finished as the Galileo Division Runners-Up.

2002: Zone Zeal

We were in the creative zone this year - 2002 was when our ubiquitous logo was created. Our team attended the Buckeye Regional and finished as a quarter-finalist.

2003: Stack Attack

Team 135 raised the bar for success in 2004. This year, we competed at both the St. Louis and the Midwest Regionals, where we won our second consecutive Kleiner Perkins Caufield & Byers Entrepreneurship Award! We competed at the National Championship in the Galileo Division.

2004: FIRST Frenzy: Raising the Bar

Team 135 raised the bar for success in 2004. This year, we competed at both the St. Louis and the Midwest Regionals, where we won our second consecutive Kleiner Perkins Caufield & Byers Entrepreneurship Award! We competed at the National Championship in the Galileo Division.

2005: Triple Play

We played hard in 2005, which was one of our most successful years to date. At the Inaugural Boilermaker Regional at Purdue, our alliance was runners-up, and we won the Quality Award for our ability to score exceptionally well. Team 135 was also a regional finalist at the Buckeye Regional, and we won our third Kleiner Perkins Caufield & Byers Entrepreneurship Award as well as the Motorola Quality Award and the Autodesk Visualization Award! Our team was ranked 15th at the National Championships in the Newton Division.

2006: Aim High

Penn Robotics continued to aim high in 2006. We competed at the Buckeye and the Boilermaker Regional. We also qualified to compete at the National Championships and made it to the quarterfinals!

2007: Rack ‘n Roll

Team 135 rocked and rolled in 2007! We competed at the Boilermaker and Palmetto Regionals, and won the Regional Engineering Inspiration award. We also competed at the off-season Indiana Robotics Invitational for the first time, and met lots of great teams!

2008: FIRST Overdrive

In 2008, our team went into overdrive. We competed at both the Boilermaker and St. Louis Regionals, where we won the Autodesk Visualization award. We also competed at both Nationals and IRI. One of our members, Whitney Grace, also started a Women In Technology Day to introduce more girls to STEM and FIRST.

2009: Lunacy

Team 135’s success in 2009 was crazy - you could even call it lunatic! We competed at the Midwest Regional and captained the 4th seed alliance. We also made it to semifinals at the Boilermaker Regional! Team 135 also was chosen by the 1st seed alliance at Nationals, and we advanced to the finals at IRI.

2010: Breakaway

We broke away from tradition in 2010 - for the first time ever, we competed at the Greater Kansas City Regional! We also attended the Boilermaker Regional.

2011: Logomotion

Team 135 truly moved towards excellence in 2011. Our Coach, Mr. Jim Langfeldt, was recognized for his excellence as a mentor and won the Woodie Flowers award at the Wisconsin Regional. After competing at the Boilermaker Regional, we advanced to the World Competition and ranked 11th in the Curie Division. One of our members, Michael Schrager, won the National Dean’s List Award as well. We also helped revive Team 3494 The Quadrangles in Bloomington, Indiana in 2011.

2012: Rebound Rumble

In 2012, Team 135 continued to excel, and rumbles of our successes reverberated in the FIRST community! We competed at the Boilermaker and Wisconsin Regionals.

2013: Ultimate Ascent

Our team continued to ascend far beyond our goals in 2013. We competed at the Boilermaker and the Wisconsin Regionals. We qualified to attend the World Championships, and made it to the quarterfinals in the Curie Division!

2014: Aerial Assist

In 2014, lots of factors assisted in our success, such as our various outreach events (like Women In Technology Day and our PRIDE Summer Camp) and our stellar robot DAVE (Drives Around Various Engineers)! We excelled this year, winning both the Crossroads and the Boilermaker Regionals. We also won the Judges’ Award for our outreach events. We were also an alliance captain at the World Championships for the Curie Division!

2015: Recycle Rush

In 2015, Team 135 rushed to victory! We built a strong robot called ROSIE (Recycling Of Stacks Internally and Externally). We won the Kokomo City District event, and also took home the Chairman’s award for the first time! We won Chairman’s again at the state competition. At the World Championships, we made it to the finals in the Archimedes Division.

2016: FIRST Stronghold

Team 135 continued to hold onto their strengths in 2016. Our team won the district Engineering Inspiration Award. We also advanced to the World Championships, making it to the quarterfinals in the Carson Division.

2017: FIRST Steamworks

Penn Robotics went full steam ahead in 2017! We excelled in the judges’ room, taking home the district and state Chairman’s award. Our team also performed well at the World Championships, making it to the quarterfinals in the Carson Division.

2018: Power Up

Penn Robotics powered up at our St. Joseph District Event, winning the District Chairman’s Award. At the Plainfield Event, we were able to take home the Gracious Professionalism award and set the world record for a FRC match with the score of 1080. One of our members, McKenna Hillsdon-Smith won the Dean’s List Award at the World Championship.

2019: Destination Deep Space

Penn Robotics is venturing to new destinations this year as we travel to IMTS and ATIA. This year, we won the District Chairman’s Award at the St. Joseph event and Gracious Professional at Tippecanoe. At St. Joseph, we ranked 2nd and we ranked 7th at Tippecanoe.

1 note

·

View note

Photo

Carillion inquiry: missed red lights, aggressive accounting and the pension deficit

In a series of scathing joint committee sessions MPs took to task Carillion directors, pension regulators and KPMG and Deloitte auditors– grilling them on missed red lights, aggressive accounting and the pension deficit reaching nearly £1bn. In a joint statement after the session probing Carillion directors, committee co-chairs Rachel Reeves and Frank Field said: “This morning, a series of delusional characters maintained that everything was hunky dory until it all went suddenly and unforeseeably wrong.” Reeves asked former CFO Zafar Khan if he had been “asleep at the wheel” for remaining oblivious to Carillion’s mounting financial issues. This was a similar theme in the session interviewing Carillion’s auditors, as KPMG were grilled over why they had signed off on Carillion’s 2016 accounts on 31 March 2017, just months before the construction company issued its first profit warning in July and announced a £845m write-down in the value of its contracts. Just six months later the company was insolvent, collapsing with only £29m left in cash and over £1.3bn in debt. In a post-hearing statement Field said: “I fear it is not only Carillion that is built on sand: it is our whole system of corporate accountability.” Missed red flags At the crux of the committee’s line of questioning to the auditors was how the assessment of Carillion’s accounts was able to change so drastically between March and July. MPs brought questions to Michelle Hinchcliffe, head of audit at KPMG, Peter Meehan, Carillion’s external auditor from KPMG, and Michael Jones, Carillion’s internal auditor from Deloitte. Meehan attributed this dramatic re-assessment to the complex nature of the contracts, the wide number of judgements needed to be made and a range of developments that transpired between the March 2017 accounts sign-off and the July profit warning. MPs expressed incredulity that KPMG saw no red flags prior to March, particularly in relation to several problem contracts in which debt was mounting. Meehan said that he was aware the company had its challenges but he believed it “had the reserves to deal with those challenges.” Further red flags included the fact that Carillion stock was the most shorted on the stock market, which auditors confirmed they were aware of at the time, and that key investors such as Kiltearn and Standard Life Aberdeen (SLA) had begun divesting as early as 2015. SLA wrote to the committee explaining they began divesting “due to concerns on a number of issues including strategy, financial management and corporate governance.” Referring to the increasingly tenuous position of Carillion, and KPMG’s insistence that it only came to light between March-July 2017, Reeves commented: “Investors seemed to know, people who worked for the company seemed to know, the only people who didn’t see what was happening were those who were paid to– the directors and the auditors of the company.” In a statement following the session, Reeves added that it seemed regulators and auditors are “mere spectators – commentators at best, certainly not referees – at the mercy of reckless and self-interested directors.” When asked whether he would have done anything differently with the benefit of hindsight, Meehan said: “I think me and my team all did the best we could and I stand by the decision we gave on the 31 December 16 accounts.” KPMG received £29m in audit fees from Carillion while Deloitte netted £11m. Reeves said these audits “appear to be a colossal waste of time and money, fit only to provide false assurance to investors, workers and the public.” Problem contracts and cash flow constraints The committee drew attention to four problem contracts that were at the root of Carillion’s downfall – one in Qatar, the Royal Liverpool University Hospital, the Sandwell Midland Metropolitan Hospital and the Aberdeen bypass. Carillion directors and auditors pointed to the Qatar contract as a major factor in the collapse, as the contract racked up £200m in unpaid bills and exacerbated pre-existing cash flow problems. Under questioning by MPs, former chief executive Richard Howson said he was going to Qatar at least 10 times a year for the past six years to chase up the money, describing that he “felt like a bailiff.” Keith Cochrane, interim chief executive, added that the Qatar job had doubled in size, the architect had been changed three times, and as a result it had stretched from the original three years to six years. He said: “It had 2,500 design variations to it, and essentially we were not paid for 18 months prior to the business failing.” However, due to the nature of the contract, Howson explained Carillion could not “wilfully abandon” the project despite not being paid, as Msheireb Properties, the Qatari client company, would “pull the performance bonds.” Peter Meehan admitted to visiting the site in 2014 and 2015, but not in 2016, when issues surrounding the contract were escalating. Despite unpaid bills piling up and auditors being aware of the problems surrounding the Qatari contract, no provision was made in the March 2017 accounts, which said that Msheireb owed a mere £70m in comparison with Carillion’s estimate which was closer to £180m at the time. When KPMG auditors were in the hot seat MPs also raised the issue that Msheireb disputes the £200m bill, who claim that in fact they are owed that figure. MP Peter Kyle questioned Meehan over why this debt was not recognised in the accounts signed off on in March 2017, asking incredulously: “You don’t know whether your client was owed £200m or it owed £200m?” He added: “I wouldn’t hire you to do an audit of the contents of my fridge.” Msheireb Properties said that Carillion’s blame of the company was “deeply troubling and inaccurate”, and as a result it was exploring all legal options. Turning to the Liverpool hospital contract, worth £350m, MPs pointed to a number of cracked beams that were discovered and had to be replaced. Meehan admitted to not visiting the site after the issues were first flagged up in November 2016, until a visit in January 2018. Continued oversight seemed to be a persistent issue on both the part of directors and auditors, but the reason these contracts had such a disastrous impact on Carillion, as MP Heidi Allen pointed out to former directors, was because “you had no means of dealing with that, because you were absolutely on your knees financially the whole time.” Frank Field said the discovery of cracked beams was “a perfect parable for the whole company– the cracks were visible long before the directors or auditors admit”. Aggressive accounting, revenue recognition and goodwill Former CFO Emma Mercer said that after three years working in Canada she returned to the UK in April 2017, to find “a slightly more aggressive trading of the contracts than I had previously experienced in the UK before I left.” Referring to the practices she inherited from predecessor Zafar Khan, Mercer added: “What I saw when I returned to the UK is that both the number of contracts we were taking judgment on and the size of those judgments had increased.” When MPs asked the auditors whether they recognised these practices, Meehan said “I personally would not use the word more aggressive” but said that he told Carillion directors that on the spectrum of cautious to optimistic, they had moved towards the optimistic end when it came to appraising “riskier contracts”. He said that despite raising this concern, management said they were happy with their position. Zafar Khan insisted “I do not believe that there were any instances of earnings manipulation” and said that the numbers were reached after making a range of judgements using the information available at the time. In the 9 July assessment KPMG concluded there was a general lack of consistency around how the group recognised value on claims, with claims being booked earlier in comparison with others in the industry. Meehan was steadfast that this only came to light after the March sign-off. The auditors clarified several times during the session that their role was to assess management’s judgements, rather than make their own. When Michelle Hinchliffe was asked where the line lies between aggressive accounting and fraud, she cited a range of factors to consider, including management overriding controls and a shift from cautious to optimistic judgements. However, she stopped short of saying whether any of these practices at Carillion had become inappropriate, stating these are simply factors to probe. The Financial Reporting Council’s (FRC) investigation into KPMG’s role as auditor is ongoing and will look at the “recognition of revenue on significant contracts” among other issues. MPs noted that issues with revenue recognition in KPMG’s audits had previously been flagged up by the FRC, as well as “insufficient testing of the reliability of cash flow within the impairment assessment of goodwill” in other audits between the years 2014-2017. Carillion’s high reliance on goodwill in valuing its assets was also a problem referenced by MPs. Ruth George pointed out to Carillion directors that in 2016 “84% of your balance sheet was made up of goodwill”, amounting to £1.57bn, which essentially disappeared overnight when the company’s troubles came to a head. In Carillion’s 2016 accounts it is stated that management decided that no impairment to goodwill was necessary. Hinchcliffe clarified that it is not the auditors responsibility to calculate goodwill, but rather to assess management’s judgements of it. However, she added that new processes surrounding the testing of goodwill had been implemented at KPMG since October 2017, and that the firm has an ongoing internal investigation into the audits of Carillion. Pension deficit nearing £1bn Carillion’s collapse put thousands of jobs at risk and jeopardised the pensions of around 27,000 individuals, resulting in a £990m pension deficit. MPs questioned former executives and The Pensions Regulator (TPR) over whether it was worrying that the company was paying “mega dividends” and large bonuses while such a large pension deficit persisted and continued to grow. In late 2017 Carillion’s contribution payments to the pension scheme were deferred. Zafar Khan, former financial director of Carillion, explained that due to cash flow constraints decisions had to be made about the “allocation of that between the pension scheme, the dividend and re-investment in the business.” MPs pointed to the fact that in 2016 higher dividends were paid than the previous year. Put simply, MP Andrew Bowie said: “You were prioritising the share price and dividend over funding the pension scheme.” A 15 year deficit recovery plan was agreed with trustees, which MPs said seemed unacceptably long. When queried over how many other existing recovery plans are over 10 years long, TPR could not answer. MPs took a hard line with TPR for their inaction, who said they threatened to use their Section 231 powers but never actually did. They attributed this to the assessment of Carillion’s “strength of covenant”, which led them to believe the pension deficit would be addressed in time. TPR did finally launch an anti-avoidance investigation into Carillion, but three days after the firm’s collapse. Big Four oligopoly In the years leading up to Carillion’s collapse the Big Four firms banked a total of £72m from it, leading MPs to accuse them of “feasting on what was soon to become a carcass.” Field asked the auditors whether the committee should recommend breaking up the Big Four due to an “oligopoly” in the industry. MPs questioned whether the dominance of the four firms was a problem, especially considering the fact that KPMG audited Carillion, investor SLA, The Hospital Company and the pension scheme. Not only was KPMG responsible for a range of interlinked audits, Peter Meehan specifically was the partner in charge of several of these. MPs asked whether this was a conflict of interest and something that would prevent an auditor from remaining impartial. Meehan said this was not unusual. A further potential source of conflict lies in the fact that two former financial directors of Carillion were previously with KPMG, including Emma Mercer. Michael Jones disagreed, saying “it didn’t feel like a cosy club”. He added that while audit share of FTSE 100 companies does tend to be split between the Big Four, there is competition in other areas. The inquiry continues, and pressure on Carillion’s former directors and its auditors shows no signs of letting up. With directors and auditors insisting they were taken by surprise by the company’s rapid decline, the joint committee will soon determine whether Carillion’s collapse could have been foreseen and prevented, and to what degree of responsibility each party should be held. The post Carillion inquiry: missed red lights, aggressive accounting and the pension deficit appeared first on Accountancy Age.

https://www.accountancyage.com/2018/02/26/carillion-inquiry-missed-red-lights-aggressive-accounting-pension-deficit/

0 notes

Text

Meet the newest star of Heartland, Calgary's Lucian-River Chauhan

9-year-old actor plays a troubled youth on the popular CBC show

If you're one of the many fans of the CBC TV series Heartland, you know there's a new character this season — a troubled youngster now living at the Bartlett Ranch.

The character, Luke, is played by nine-year-old Lucian-River Chauhan, of Calgary.

Chauhan also starred in Theatre Calgary's Secret Garden, and ATP's Zorro: Family Code.

He caught up with Doug Dirks on The Homestretch to talk about his four-episode experience.

Here is an abridged version of their conversation.

Q: Tell us about your character on Heartland.

A: Well, I play Luke, and he is a good kid at heart, but he's going through some challenges at home.

Q: Can you tell us about some of the trials and tribulations that your character goes through?

A: Well he arrives at the Bartlett ranch and he's just he's in a bad mood, right? And he's like 'Oh, yeah. What do you want from me? I don't want to be here.' And he's always closed off but he doesn't give attitude. OK. He's just really quiet. He doesn't really warm up to Ty yet, or Amy.

Q: So when you got the call and they said you got the role of Luke, what was your reaction?

A: I was like, 'Yeeeees! My first TV role! It's so cool! And, well, during the audition, I was I was quite nervous and I was like 'You're OK. You got to get this. You're OK, you're OK.'

Q: And so your first TV role and here you are in this iconic series. Twelve seasons. I mean it started before you were born. You're nine. So what's it like to be part of this?

A: It's fantastic. The the directors are awesome, the creative team is awesome. Oh my gosh, the cast — I learned so much from them. I've done a few theatre roles and I've been like very over the top and theatrical. And I've learned how to just make that great transition over to acting for TV.

Q: What is the difference between acting on stage like you did in the Secret Garden and Zorro, and playing a role on television?

A: So, theatre is more, it's a lot of high energy. And TV is more toned down.

Q: We've known Amber Marshall and interviewed her since she was a teenager; she was 18 I think when she started the show. So what have you learned from Amber, and Graham (Wardle, who plays Ty), and Shaun Johnston who plays Grandpa?

A: I've been learning the transition, and also how to say my lines like, basically, to put more emotion behind it than just blurting out the lines.

Q: So the episode that aired on Jan 20. Where did you watch that?

A: I was actually having a viewing party in my car with my family. I'm doing a show at FRC (Front Row Centre Players) called Evita right now. But I was in between a double-show day and (Heartland) was airing, and I was like 'Oh, I want to watch it!' And we were actually having pizza that day. So I had a hot dog because I can't have cheese. But yeah, I just went into my car and I was like, 'Oh, this is so cool!'

Q: When did you start acting?

A: I started acting when I was five.

Q: So, you're doing Evita now. You've got four episodes on this season of Heartland. So, what's next?

A: I actually do have another thing coming on, it's for Citadel Theatre. I'm going to be in Matilda. I'm playing Bruce, and I'm touring. I'm going to Edmonton and Vancouver.

Q: Do you have any advice for other kids who who think they might want to get involved in acting?

A: I would say get an agent, and like, basically, get your parents to find auditions, and go there and put effort into it. Not just go in there and then lie your parents and be like 'Oh yeah, I did a great job.' No. I guess you go through a whole process, like learning the lines first of all and then learning the emotion behind it, and then putting it all together and being like, 'OK I think I got this.'

Source

8 notes

·

View notes