#fabless

Text

The CHIPS Act treats the symptoms, but not the causes

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/02/07/farewell-mr-chips/#we-used-to-make-things

There's this great throwaway line in 1992's Sneakers, where Dan Aykroyd, playing a conspiracy-addled hacker/con-man, is feverishly telling Sydney Poitier (playing an ex-CIA spook) about a 1958 meeting Eisenhower had with aliens where Ike said, "hey, look, give us your technology, and we'll give you all the cow lips you want."

Poitier dismisses Aykroyd ("Don't listen to this man. He's certifiable"). We're meant to be on Poitier's side here, but I've always harbored some sympathy for Aykroyd in this scene.

That's because I often hear echoes of Aykroyd's theory in my own explanations of the esoteric bargains and plots that produced the world we're living in today. Of course, in my world, it's not presidents bargaining for alien technology in exchange for cow-lips – it's the world's wealthy nations bargaining to drop trade restrictions on the Global South in exchange for IP laws.

These bargains – which started as a series of bilateral and then multilateral agreements like NAFTA, and culminated in the WTO agreement of 1999 – were the most important step in the reordering of the world's economy around rent-extraction, cheap labor exploitation, and a brittle supply chain that is increasingly endangered by the polycrisis of climate and its handmaidens, like zoonotic plagues, water wars, and mass refugee migration.

Prior to the advent of "free trade," the world's rich countries fashioned debt into a whip-hand over poor, post-colonial nations. These countries had been bankrupted by their previous colonial owners, and the price of their freedom was punishing debts to the IMF and other rich-world institutions in exchange for loans to help these countries "develop."

Like all poor debtors, these countries were said to have gotten into their predicament through moral failure – they'd "lived beyond their means."

(When rich people get into debt, bankruptcy steps in to give them space to "restructure" according to their own plans. When poor people get into debt, bankruptcy strips them of nearly everything that might help them recover, brands them with a permanent scarlet letter, and subjects them to humiliating micro-management whose explicit message is that they are not competent to manage their own affairs):

https://pluralistic.net/2021/08/07/hr-4193/#shoppers-choice

So the poor debtor nations were ordered to "deregulate." They had to sell off their state assets, run their central banks according to the dictates of rich-world finance authorities, and reorient their production around supplying raw materials to rich countries, who would process these materials into finished goods for export back to the poor world.

Naturally, poor countries were not allowed to erect "trade barriers" that might erode the capacity of this North-South transfer of high-margin goods, but this was not the era of free trade. It wasn't the free trade era because, while the North-South transfer was largely unrestricted, the South-North transfer was subject to tight regulation in the rich world.

In other words, poor countries were expected to export, say, raw ore to the USA and reimport high-tech goods, with low tariffs in both directions. But if a poor country processed that ore domestically and made its own finished goods, the US would block those goods at the border, slapping them with high tariffs that made them more expensive than Made-in-the-USA equivalents.

The argument for this unidirectional trade was that the US – and other rich countries – had a strategic need to maintain their manufacturing industries as a hedge against future geopolitical events (war, but also pandemics, extreme weather) that might leave the rich world unable to provide for itself. This rationale had a key advantage: it was true.

A country that manages its own central bank can create as much of its own currency as it wants, and use that money to buy anything for sale in its own currency.

This may not be crucial while global markets are operating to the country's advantage (say, while the rest of the world is "willingly" pricing its raw materials in your country's currency), but when things go wrong – war, plague, weather – a country that can't make things is at the rest of the world's mercy.

If you had to choose between being a poor post-colonial nation that couldn't supply its own technological needs except by exporting raw materials to rich countries, and being a rich country that had both domestic manufacturing capacity and a steady supply of other countries' raw materials, you would choose the second, every time.

What's not to like?

Here's what.

The problem – from the perspective of America's ultra-wealthy – was that this arrangement gave the US workforce a lot of power. As US workers unionized, they were able to extract direct concessions from their employers through collective bargaining, and they could effectively lobby for universal worker protections, including a robust welfare state – in both state and federal legislatures. The US was better off as a whole, but the richest ten percent were much poorer than they could be if only they could smash worker power.

That's where free trade comes in. Notwithstanding racist nonsense about "primitive" countries, there's no intrinsic defect that stops the global south from doing high-tech manufacturing. If the rich world's corporate leaders were given free rein to sideline America's national security in favor of their own profits, they could certainly engineer the circumstances whereby poor countries would build sophisticated factories to replace the manufacturing facilities that sat behind the north's high tariff walls.

These poor-country factories could produce goods ever bit as valuable as the rich world's shops, but without the labor, environmental and financial regulations that constrained their owners' profits. They slavered for a business environment that let them kill workers; poison the air, land and water; and cheat the tax authorities with impunity.

For this plan to work, the wealthy needed to engineer changes in both the rich world and the poor world. Obviously, they would have to get rid of the rich world's tariff walls, which made it impossible to competitively import goods made in the global south, no matter how cheaply they were made.

But free trade wasn't just about deregulation in the north – it also required a whole slew of new, extremely onerous regulations in the global south. Corporations that relocated their manufacturing to poor – but nominally sovereign – countries needed to be sure that those countries wouldn't try to replicate the American plan of becoming actually sovereign, by exerting control over the means of production within their borders.

Recall that the American Revolution was inspired in large part by fury over the requirement to ship raw materials back to Mother England and then buy them back at huge markups after they'd been processed by English workers, to the enrichment of English aristocrats. Post-colonial America created new regulations (tariffs on goods from England), and – crucially – they also deregulated.

Specifically, post-revolutionary America abolished copyrights and patents for English persons and firms. That way, American manufacturers could produce sophisticated finished goods without paying rent to England's wealthy making those goods cheaper for American buyers, and American publishers could subsidize their editions of American authors' books by publishing English authors on the cheap, without the obligation to share profits with English publishers or English writers.

The surplus produced by ignoring the patents and copyrights of the English was divided (unequally) among American capitalists, workers, and shoppers. Wealthy Americans got richer, even as they paid their workers more and charged less for their products. This incubated a made-in-the-USA edition of the industrial revolution. It was so successful that the rest of the world – especially England – began importing American goods and literature, and then American publishers and manufacturers started to lean on their government to "respect" English claims, in order to secure bilateral protections for their inventions and books in English markets.

This was good for America, but it was terrible for English manufacturers. The US – a primitive, agricultural society – "stole" their inventions until they gained so much manufacturing capacity that the English public started to prefer American goods to English ones.

This was the thing that rich-world industrialists feared about free trade. Once you build your high-tech factories in the global south, what's to stop those people from simply copying your plans – or worse, seizing your factories! – and competing with you on a global scale? Some of these countries had nominally socialist governments that claimed to explicitly elevate the public good over the interests of the wealthy. And all of these countries had the same sprinkling of sociopaths who'd gladly see a million children maimed or the land poisoned for a buck – and these "entrepreneurs" had unbeatable advantages with their countries' political classes.

For globalization to work, it wasn't enough to deregulate the rich world – capitalists also had to regulate the poor world. Specifically, they had to get the poor world to adopt "IP" laws that would force them to willingly pay rent on things they could get for free: patents and other IP, even though it was in the short-term, medium-term, and long-term interests of both the nation and its politicians and its businesspeople.

Thus, the bargain that makes me sympathetic to Dan Aykroyd: not cow lips for alien tech; but free trade for IP law. When the WTO was steaming towards passage in the late 1990s, there was (rightly) a lot of emphasis on its deregulatory provisions: weakening of labor, environmental and financial laws in the poor world, and of tariffs in the rich world.

But in hindsight, we all kind of missed the main event: the TRIPS (Agreement on Trade-Related Aspects of Intellectual Property Rights). This actually started before the WTO treaty (it was part of the GATT, a predecessor to the WTO), but the WTO spread it to countries all over the world. Under the TRIPS, poor countries are required to honor the IP claims of rich countries, on pain of global sanction.

That was the plan: instead of paying American workers to make Apple computers, say, Apple could export the "IP" for Macs and iPhones to countries like China, and these countries would produce Apple products that were "designed in California, assembled in China." China would allow Apple to treat Chinese workers so badly that they routinely committed suicide, and would lock up or kill workers who tried to unionize. China would accept vast shipments of immortal, toxic e-waste. And China wouldn't let its entrepreneurs copy Apple's designs, be they software, schematics or trademarks.

Apple isn't the only company that pursued this strategy, but no company has executed it as successfully. It's not for nothing that Steve Jobs's hand-picked successor was Tim Cook, who oversaw the transfer of even the most exacting elements of Apple manufacturing to Chinese facilities, striking bargains with contractors like Foxconn that guaranteed that workers would be heavily – lethally! – surveilled and controlled to prevent the twin horrors of unionization and leaks.

For the first two decades of the WTO era, the most obvious problems with this arrangement was wage erosion (for American workers) and leakage (for the rich). China's "socialist" government was only too happy to help Foxconn imprison workers who demanded better wages and working conditions, but they were far more relaxed about knockoffs, be they fake iPods sold in market stalls or US trade secrets working their way into Huawei products.

These were problems for the American aristocracy, whose investments depended on China disciplining both Chinese workers and Chinese businesses. For the American people, leakage was a nothingburger. Apple's profits weren't shared with its workforce beyond the relatively small number of tech workers at its headquarters. The vast majority of Apple employees, who flogged iPhones and scrubbed the tilework in gleaming white stores across the nation, would get the same minimal (or even minimum) wage no matter how profitable Apple grew.

It wasn't until the pandemic that the other shoe dropped for the American public. The WTO arrangement – cow lips for alien technology – had produced a global system brittle supply chains composed entirely of weakest links. A pandemic, a war, a ship stuck in the Suez Canal or Houthi paramilitaries can cripple the entire system, perhaps indefinitely.

For two decades, we fought over globalization's effect on wages. We let our corporate masters trick us into thinking that China's "cheating" on IP was a problem for the average person. But the implications of globalization for American sovereignty and security were banished to the xenophobic right fringe, where they were mixed into the froth of Cold War 2.0 nonsense. The pandemic changed that, creating a coalition that is motivated by a complex and contradictory stew of racism, environmentalism, xenophobia, labor advocacy, patriotism, pragmatism, fear and hope.

Out of that stew emerged a new American political tendency, mostly associated with Bidenomics, but also claimed in various guises by the American right, through its America First wing. That tendency's most visible artifact is the CHIPS Act, through which the US government proposes to use policy and subsidies to bring high-tech manufacturing back to America's shores.

This week, the American Economic Liberties Project published "Reshoring and Restoring: CHIPS Implementation for a Competitive Semiconductor Industry," a fascinating, beautifully researched and detailed analysis of the CHIPS Act and the global high-tech manufacturing market, written by Todd Achilles, Erik Peinert and Daniel Rangel:

https://www.economicliberties.us/our-work/reshoring-and-restoring-chips-implementation-for-a-competitive-semiconductor-industry/#

Crucially, the report lays out the role that the weakening of antitrust, the dismantling of tariffs and the strengthening of IP played in the history of the current moment. The failure to enforce antitrust law allowed for monopolization at every stage of the semiconductor industry's supply-chain. The strengthening of IP and the weakening of tariffs encouraged the resulting monopolies to chase cheap labor overseas, confident that the US government would punish host countries that allowed their domestic entrepreneurs to use American designs without permission.

The result is a financialized, "capital light" semiconductor industry that has put all its eggs in one basket. For the most advanced chips ("leading-edge logic"), production works like this: American firms design a chip and send the design to Taiwan where TSMC foundry turns it into a chip. The chip is then shipped to one of a small number of companies in the poor world where they are assembled, packaged and tested (AMP) and sent to China to be integrated into a product.

Obsolete foundries get a second life in the commodity chip ("mature-node chips") market – these are the cheap chips that are shoveled into our cars and appliances and industrial systems.

Both of these systems are fundamentally broken. The advanced, "leading-edge" chips rely on geopolitically uncertain, heavily concentrated foundries. These foundries can be fully captured by their customers – as when Apple prepurchases the entire production capacity of the most advanced chips, denying both domestic and offshore competitors access to the newest computation.

Meanwhile, the less powerful, "mature node" chips command minuscule margins, and are often dumped into the market below cost, thanks to subsidies from countries hoping to protect their corner of the high-tech sector. This makes investment in low-power chips uncertain, leading to wild swings in cost, quality and availability of these workhorse chips.

The leading-edge chipmakers – Nvidia, Broadcom, Qualcomm, AMD, etc – have fully captured their markets. They like the status quo, and the CHIPS Act won't convince them to invest in onshore production. Why would they?

2022 was Broadcom's best year ever, not in spite of its supply-chain problems, but because of them. Those problems let Broadcom raise prices for a captive audience of customers, who the company strong-armed into exclusivity deals that ensured they had nowhere to turn. Qualcomm also profited handsomely from shortages, because its customers end up paying Qualcomm no matter where they buy, thanks to Qualcomm ensuring that its patents are integrated into global 4G and 5G standards.

That means that all standards-conforming products generate royalties for Qualcomm, and it also means that Qualcomm can decide which companies are allowed to compete with it, and which ones will be denied licenses to its patents. Both companies are under orders from the FTC to cut this out, and both companies ignore the FTC.

The brittleness of mature-node and leading-edge chips is not inevitable. Advanced memory chips (DRAM) roughly comparable in complexity to leading-edge chips, while analog-to-digital chips are as easily commodified as mature-node chips, and yet each has a robust and competitive supply chain, with both onshore and offshore producers. In contrast with leading-edge manufacturers (who have been visibly indifferent to the CHIPS incentives), memory chip manufacturers responded to the CHIPS Act by committing hundreds of billions of dollars to new on-shore production facilities.

Intel is a curious case: in a world of fabless leading-edge manufacturers, Intel stands out for making its own chips. But Intel is in a lot of trouble. Its advanced manufacturing plans keep foundering on cost overruns and delays. The company keeps losing money. But until recently, its management kept handing its shareholders billions in dividends and buybacks – a sign that Intel bosses assume that the US public will bail out its "national champion." It's not clear whether the CHIPS Act can save Intel, or whether financialization will continue to hollow out a once-dominant pioneer.

The CHIPS Act won't undo the concentration – and financialization – of the semiconductor industry. The industry has been awash in cheap money since the 2008 bailouts, and in just the past five years, US semiconductor monopolists have paid out $239b to shareholders in buybacks and dividends, enough to fund the CHIPS Act five times over. If you include Apple in that figure, the amount US corporations spent on shareholder returns instead of investing in capacity rises to $698b. Apple doesn't want a competitive market for chips. If Apple builds its own foundry, that just frees up capacity at TSMC that its competitors can use to improve their products.

The report has an enormous amount of accessible, well-organized detail on these markets, and it makes a set of key recommendations for improving the CHIPS Act and passing related legislation to ensure that the US can once again make its own microchips. These run a gamut from funding four new onshore foundries to requiring companies receiving CHIPS Act money to "dual-source" their foundries. They call for NIST and the CPO to ensure open licensing of key patents, and for aggressive policing of anti-dumping rules for cheap chips. They also seek a new law creating an "American Semiconductor Supply Chain Resiliency Fee" – a tariff on chips made offshore.

Fundamentally, these recommendations seek to end the outsourcing made possible by restrictive IP regimes, to undercut Wall Street's power to demand savings from offshoring, and to smash the market power of companies like Apple that make the brittleness of chip manufacturing into a feature, rather than a bug. This would include a return to previous antitrust rules, which limited companies' ability to leverage patents into standards, and to previous IP rules, which limited exclusive rights chip topography and design ("mask rights").

All of this will is likely to remove the constraints that stop poor countries from doing to America the same things that postcolonial America did to England – that is, it will usher in an era in which lots of countries make their own chips and other high-tech goods without paying rent to American companies. This is good! It's good for poor countries, who will have more autonomy to control their own technical destiny. It's also good for the world, creating resiliency in the high-tech manufacturing sector that we'll need as the polycrisis overwhelms various places with fire and flood and disease and war. Electrifying, solarizing and adapting the world for climate resilience is fundamentally incompatible with a brittle, highly concentrated tech sector.

Pluralizing high-tech production will make America less vulnerable to the gamesmanship of other countries – and it will also make the rest of the world less vulnerable to American bullying. As Henry Farrell and Abraham Newman describe so beautifully in their 2023 book Underground Empire, the American political establishment is keenly aware of how its chokepoints over global finance and manufacturing can be leveraged to advantage the US at the rest of the world's expense:

https://pluralistic.net/2023/10/10/weaponized-interdependence/#the-other-swifties

Look, I know that Eisenhower didn't trade cow-lips for alien technology – but our political and commercial elites really did trade national resiliency away for IP laws, and it's a bargain that screwed everyone, except the one percenters whose power and wealth have metastasized into a deadly cancer that threatens the country and the planet.

Image:

Mickael Courtiade (modified)

https://www.flickr.com/photos/197739384@N07/52703936652/

CC BY 2.0

https://creativecommons.org/licenses/by/2.0/

#pluralistic#chips act#ip#monopolies#antitrust#national security#industrial policy#american economic liberties project#tmsc#leading-edge#intel#mature node#lagging edge#foundries#fabless

251 notes

·

View notes

Text

Genio 510: Redefining the Future of Smart Retail Experiences

Genio IoT Platform by MediaTek

Genio 510

Manufacturers of consumer, business, and industrial devices can benefit from MediaTek Genio IoT Platform’s innovation, quicker market access, and more than a decade of longevity. A range of IoT chipsets called MediaTek Genio IoT is designed to enable and lead the way for innovative gadgets. to cooperation and support from conception to design and production, MediaTek guarantees success. MediaTek can pivot, scale, and adjust to needs thanks to their global network of reliable distributors and business partners.

Genio 510 features

Excellent work

Broad range of third-party modules and power-efficient, high-performing IoT SoCs

AI-driven sophisticated multimedia AI accelerators and cores that improve peripheral intelligent autonomous capabilities

Interaction

Sub-6GHz 5G technologies and Wi-Fi protocols for consumer, business, and industrial use

Both powerful and energy-efficient

Adaptable, quick interfaces

Global 5G modem supported by carriers

Superior assistance

From idea to design to manufacture, MediaTek works with clients, sharing experience and offering thorough documentation, in-depth training, and reliable developer tools.

Safety

IoT SoC with high security and intelligent modules to create goods

Several applications on one common platform

Developing industry, commercial, and enterprise IoT applications on a single platform that works with all SoCs can save development costs and accelerate time to market.

MediaTek Genio 510

Smart retail, industrial, factory automation, and many more Internet of things applications are powered by MediaTek’s Genio 510.

Leading manufacturer of fabless semiconductors worldwide, MediaTek will be present at Embedded World 2024, which takes place in Nuremberg this week, along with a number of other firms. Their most recent IoT innovations are on display at the event, and They’ll be talking about how these MediaTek-powered products help a variety of market sectors.

They will be showcasing the recently released MediaTek Genio 510 SoC in one of their demos. The Genio 510 will offer high-efficiency solutions in AI performance, CPU and graphics, 4K display, rich input/output, and 5G and Wi-Fi 6 connection for popular IoT applications. With the Genio 510 and Genio 700 chips being pin-compatible, product developers may now better segment and diversify their designs for different markets without having to pay for a redesign.

Numerous applications, such as digital menus and table service displays, kiosks, smart home displays, point of sale (PoS) devices, and various advertising and public domain HMI applications, are best suited for the MediaTek Genio 510. Industrial HMI covers ruggedized tablets for smart agriculture, healthcare, EV charging infrastructure, factory automation, transportation, warehousing, and logistics. It also includes ruggedized tablets for commercial and industrial vehicles.

The fully integrated, extensive feature set of Genio 510 makes such diversity possible:

Support for two displays, such as an FHD and 4K display

Modern visual quality support for two cameras built on MediaTek’s tried-and-true technologies

For a wide range of computer vision applications, such as facial recognition, object/people identification, collision warning, driver monitoring, gesture and posture detection, and image segmentation, a powerful multi-core AI processor with a dedicated visual processing engine

Rich input/output for peripherals, such as network connectivity, manufacturing equipment, scanners, card readers, and sensors

4K encoding engine (camera recording) and 4K video decoding (multimedia playback for advertising)

Exceptionally power-efficient 6nm SoC

Ready for MediaTek NeuroPilot AI SDK and multitasking OS (time to market accelerated by familiar development environment)

Support for fanless design and industrial grade temperature operation (-40 to 105C)

10-year supply guarantee (one-stop shop supported by a top semiconductor manufacturer in the world)

To what extent does it surpass the alternatives?

The Genio 510 uses more than 50% less power and provides over 250% more CPU performance than the direct alternative!

The MediaTek Genio 510 is an effective IoT platform designed for Edge AI, interactive retail, smart homes, industrial, and commercial uses. It offers multitasking OS, sophisticated multimedia, extremely rapid edge processing, and more. intended for goods that work well with off-grid power systems and fanless enclosure designs.

EVK MediaTek Genio 510

The highly competent Genio 510 (MT8370) edge-AI IoT platform for smart homes, interactive retail, industrial, and commercial applications comes with an evaluation kit called the MediaTek Genio 510 EVK. It offers many multitasking operating systems, a variety of networking choices, very responsive edge processing, and sophisticated multimedia capabilities.

SoC: MediaTek Genio 510

This Edge AI platform, which was created utilising an incredibly efficient 6nm technology, combines an integrated APU (AI processor), DSP, Arm Mali-G57 MC2 GPU, and six cores (2×2.2 GHz Arm Cortex-A78& 4×2.0 GHz Arm Cortex-A55) into a single chip. Video recorded with attached cameras can be converted at up to Full HD resolution while using the least amount of space possible thanks to a HEVC encoding acceleration engine.

FAQS

What is the MediaTek Genio 510?

A chipset intended for a broad spectrum of Internet of Things (IoT) applications is the Genio 510.

What kind of IoT applications is the Genio 510 suited for?

Because of its adaptability, the Genio 510 may be utilised in a wide range of applications, including smart homes, healthcare, transportation, and agriculture, as well as industrial automation (rugged tablets, manufacturing machinery, and point-of-sale systems).

What are the benefits of using the Genio 510?

Rich input/output choices, powerful CPU and graphics processing, compatibility for 4K screens, high-efficiency AI performance, and networking capabilities like 5G and Wi-Fi 6 are all included with the Genio 510.

Read more on Govindhtech.com

#genio#genio510#MediaTek#govindhtech#IoT#AIAccelerator#WIFI#5gtechnologies#CPU#processors#mediatekprocessor#news#technews#technology#technologytrends#technologynews

2 notes

·

View notes

Text

MediaTek Unveils Dimensity 8300 Chipset, Latest Sub-Premium SoC From The Company

As promised, today the Taiwanese fabless semiconductor company, MediaTek, made an official announcement of its latest sub-premium chipset dubbed Dimensity 8300.

MediaTek Dimensity 8300 Details

The Dimensity 8300 arrival comes just a couple of days after the launch of its rival, Snapdragon 7 Gen 3 processor. Like their predecessors, these SoCs will fuel the next-gen upper-range midrange devices…

View On WordPress

2 notes

·

View notes

Text

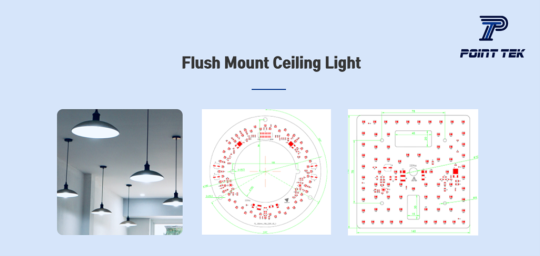

AC LED Driver Module | Dimmable LED Module | POINT TEK

POINT TEK is a fabless semiconductor design and development company committed to providing the best possible product SINCE 2009. A recessed ceiling light is often referred to as a recessed light and is a type of lighting fixture designed to be placed straight. Against the ceiling, creating a seamless installation close to the ceiling. Recessed ceiling lights are a popular choice for many different types of residential and commercial applications. Introducing the revolutionary flicker-free technologybased AC LED driver. Below are some important features and attributes of recessed ceiling lights:

Versatility: These fixtures come in a wide range of styles, designs, and finishes to complement various interior aesthetics. You can find simple, modern designs or more decorative and ornate options.

Lighting Types: Flush mount ceiling lights can accommodate different types of light sources, including incandescent, fluorescent, LED, or even integrated smart lighting systems. LED flush mount lights have become popular due to their energy efficiency and longevity.

Easy Installation: Installation of flush mount lights is typically straightforward and can be done by homeowners with basic electrical skills. They attach directly to the ceiling junction box.

Diffused Light: In order to produce soft, uniform, and glare-free lighting, diffusers like frosted glass or acrylic shades are incorporated into the design of many flush mount lamps. This contributes to supplying consistent illumination and removing harsh shadows.

Low Profile: Flush mount lights are installed flush against the ceiling surface, which means they don't hang down like pendant or chandelier lights. This makes them well-suited for rooms with limited ceiling clearance.

Applications: Flush mount ceiling lights are commonly used in various areas of a home, including hallways, bedrooms, kitchens, bathrooms, and closets. They are also suitable for commercial spaces like offices and corridors.

Outdoor Versions: Some flush mount lights are designed for outdoor use and can be installed on covered porches, entryways, or in outdoor living spaces.

When choosing a flush mount ceiling light, consider factors such as the room's size, decor, and the desired light output. The fixture's size, the number of bulbs or LED module, and the color temperature of the light are all important factors to consider for achieving the right ambiance and functionality in a space.

If you are looking for characteristics of flicker free, you can find it on POINT TEK

Click here to contact POINT TEK

View more: Dimmable LED Module

0 notes

Text

Qualcomm terminates acquisition of Autotalks

March 25, 2024 /SemiMedia/ — Qualcomm recently announced that it had terminated its Autotalks acquisition offer announced in May 2023.

Autotalks is an Israeli fabless semiconductor company that has been working on V2X communications since 2009. The company provides car-grade dual-mode global V2X solutions that are compatible with multiple V2X standards, aiming to reduce vehicle collisions and…

View On WordPress

0 notes

Text

Lean fungerar bra... på kort sikt.....

“CAR har hittat 290 elektroniska komponenter, de flesta från missilens navigationssystem. 75 procent av dem tillverkas och säljs av företag i USA, medan 16 procent kommer från europeiska företag. ” från länken nedanQUIZ: i vilken del av USA tillverkas dessa chip? På någon ö utanför USA? Kanske långt utanför t.o.m.?T.O.M. i USA har man förstått att “fabless” inte är det bästa…Inte ens då det…

View On WordPress

0 notes

Text

Intel Announces Plans to Acquire Silicon Mobility, A French Start-Up specializing in Fabless Automotive Chips and Software. Intel Plans to Expand Its AI Everywhere Strategy to Automotive. Silicon Mobility specializes in the Design, Development and Deployment of Electric Vehicle (EV) Energy Management System-on-Chips (SoC). Silicon Mobility's Technology Portfolio is expected to augment Intel's capabilities in Intelligent and Programmable Power Devices for Vehicles.

0 notes

Text

Taiwei Microelectronics IPO Delayed Due to High Debt and Expenses

<h3>Taiwei Microelectronics IPO Delayed Due to Debt and High Expenses</h3>

<p>The initial public offering (IPO) of Taiwei Microelectronics (Shanghai) Co., Ltd. (Taiwei Micro), a fabless IoT chip manufacturer, has been postponed on the Sci-Tech Innovation Board. This is because the actual controller still has significant unpaid debt and sales costs are much higher than industry averages.</p>

<p>The company said actual controller Wang Weihang's total disposable assets and cash inflows before debt due dates are expected to cover repayments. Additionally, an old colleague of Wang's provided a ¥100 million zero-interest loan over ten years in support. However, sales expenses reveal over 80% goes to employee salaries, with overseas salaries 47% higher than domestic.</p>

<p>At a January 12th issuance review meeting, listing committee members directly questioned Taiwei Micro and its sponsor on six topics including a memorandum verification and 2021 performance. Wang's equity pledge ratio had approached close to the warning threshold. Two key issues - Wang's large unpaid debt and high sales cost ratio versus industry - require further clarification before review can resume.</p>

<p>It is understood Wang took on significant debt to fund an equity acquisition and complete a shareholder restructuring. As of January 5th, Wang's stock pledge loans totaled ¥185 million and acquisition loans ¥332 million, together over ¥500 million. Taiwei Micro stated Wang's assets and expected cash inflows should cover repayments without major control issues.</p>

<p>Wang plans to repay through reducing a 5.31% stake in Huitian Technology worth an estimated ¥315 million, properties worth ¥150 million, personal income of ¥18 million, and external investment returns of ¥170 million - totaling over ¥650 million. However, Huitian's poor performance and secondary market weakness raise uncertainty. Wang may start reducing his stake there by 1.33% within six months.</p>

<p>Regarding high costs, the company attributed overseas salaries to experience differences and market rates, but sales remain 55% domestic. Expenses will need more rigorous verification given 2022 saw revenue decline 6-5% to ¥610-620 million and net profits fall 51-56% to ¥33-36 million year-on-year, reflecting downstream weakness.</p>

<p>Taiwei Micro expressed optimism in IoT's long-term growth prospects and hopes to gain first-mover advantages, but close monitoring of controls and finances will be crucial to justify costs and reassure regulators for a successful listing.</p>

1 note

·

View note

Text

China's Semiconductor Industry Surging Ahead with 30% Annual Growth

<h2>Rapid Growth of China's Semiconductor Industry</h2>

<p>According to an article published by the U.S.-based Semiconductor Industry Association (SIA) on January 10, 2022, sales of chips by Chinese companies are growing rapidly. This is mainly due to increasing competition between China and the U.S., as well as China's efforts to develop the domestic semiconductor industry through government subsidies, preferential procurement policies, and other incentives.</p>

<p>Just five years ago, semiconductor sales in China totaled $13 billion, accounting for only 3.8% of the global market. However, SIA analysis found that in 2020, China's semiconductor industry experienced unprecedented year-over-year growth of 30.6%, with annual sales reaching $398 billion. This surge helped China capture 9% of the worldwide semiconductor market share in 2020, surpassing Taiwan for two consecutive years and closing in on Japan and the EU, each with 10% market share.</p>

<p>If China's semiconductor sector continues growing at a compound annual rate of 30% over the next three years, while other regions maintain their current growth rates, China's annual chip industry revenue could reach $1.16 trillion by 2024—accounting for over 17.4% of the global market. This would put China second only to the U.S. and South Korea in worldwide semiconductor sales.</p>

<h3>Surge in New Chip Companies</h3>

<p>The influx of new entrants into China's semiconductor sector has also been astonishing. In 2020, nearly 15,000 Chinese companies registered as semiconductor enterprises. Many of these startups specialize in GPUs, EDA, FPGAs, AI, and other advanced chip design. Several are developing cutting-edge chips using leading-edge manufacturing processes.</p>

<p>Sales of China's high-performance logic devices are accelerating as well. Combined revenue from CPUs, GPUs, and FPGAs grew 128% annually to reach nearly $10 billion in 2020—far exceeding the $600 million recorded in 2015.</p>

<h3>Rapid Growth Across the Supply Chain</h3>

<p>Per SIA, all four segments of China's semiconductor supply chain—fabless, IDM, foundry, and OSAT—experienced strong revenue growth in 2020, with annual increases of 36%, 23%, 32%, and 23% respectively. Leading Chinese chip companies show potential to expand their presence in both domestic and global submarkets.</p>

<p>In fabless semiconductor design specifically, SIA data shows China captured 16% of the global market share in 2020—third behind only the U.S. and Taiwan, and up from 10% in 2015.</p>

<p>Major players like HiSilicon, Spreadtrum, Goodix, and leading sensor designers generated 20-40% annual revenue jumps, cementing their positions among China's top fabless firms.</p>

<h3>Advancing Domestic Manufacturing</h3>

<p>China also maintained robust growth in building out its chip manufacturing infrastructure. In 2021, 28 new fab projects were announced totaling $26 billion in planned investment.</p>

<p>While entities like Huawei facing U.S. restrictions led China to pause developing the most advanced Logic nodes for now, it successfully boosted capacity at more mature process technologies. Mainland capacity growth alone accounted for 26% of the worldwide increase over this period.</p>

<p>Signs indicate China's fast-paced semiconductor sector growth will likely continue. Though domestic leaders have much ground still to cover versus industry heavyweights, the technology gap with global peers is expected to gradually narrow in the decade ahead.</p>

0 notes

Text

Dimensity 9400: Here’s What You Need to Know

High-end mobile CPU MediaTek Dimensity 9400 is planned to ship in Q4 2024. The first Dimensity series model made utilizing TSMC’s 3nm manufacturing node, the N3E, promises enhanced performance and energy efficiency.

MediaTek has set the scene with the introduction of the Dimensity 9400, signaling to its competitors that it is back in the high-end Android smartphone market and ready to cause a stir. Vivo is reported to seek a first pass at the company’s flagship chip, and it may have already acquired the first batch for itself. Aside from Google and Apple, the Taiwanese business has signed on as a client with every other phone manufacturer. A recent study found a 20% performance gain between the Dimensity 9400 and Dimensity 9300.

The Dimensity 9300 sold $1 billion, and MediaTek intends to continue its supremacy in the high-end Android phone market with the 9400.

Shipments of the Dimensity 9300 have been steady since October 2023, and a report from the China Times states that MediaTek’s flagship chipset currently in production brought in almost $1 billion for the business. Undoubtedly, MediaTek hopes to build on this success when the Dimensity 9400 launches in the second half of 2024. Vivo seems to have begun taking action against its rivals by being the first user of the next SoC.

Sadly, neither the pricing per Dimensity 9400 device nor the number of units that the Chinese phone manufacturer has acquired for its first run are indicated in the story. But, MediaTek could have made a respectable concession to Vivo based on the first volume. The fabless semiconductor firm will get more customers if the Dimensity 9400 is cheaper than the Snapdragon 8 Gen 4.

According to the analysis, the Dimensity 9400 surpasses the 9300 by 20%. The performance difference may be due to single-core, multi-core, graphics, AI, or other factors, making this assertion rather ambiguous. Therefore, take this statistic with a grain of salt. Unfortunately, the Dimensity 9400’s Cortex-X5 is said to overheat and perform poorly.

Given that MediaTek’s next flagship chipset is said to arrive without any efficiency cores, adopting a strategy like to that of the Dimensity 9300, it may be difficult to maintain suitable temperatures, which might lead to silicon that performs poorly under pressure. Let’s check whether MediaTek and Vivo have worked together behind closed doors to improve the Dimensity 9400. Naturally, some tinkering is required. We will have all the information you need soon, as always.

Dimensity 9400 specs:

CPU: 1x Cortex-X5 Prime, 3x X4 Prime, 4x A720.

Possible GPU co-development with Nvidia NPU: Performance improved over Dimensity 9300, with 20%-50% quicker Large Language Model production and 15% faster picture generation.

The Dimensity 9400 will power late 2024 top smartphones competing with the Snapdragon 8 Gen 4 and Samsung’s Exynos 2500.

These specs are according to rumor’s.

FAQS

What processor is in the Dimensity 9400?

One Cortex-X5 Prime CPU core, four Cortex-X4 Prime CPU cores, and four Cortex-A720 performance CPU cores are anticipated to be included in the Dimensity 9400’s configuration. Even though Chairman Tsai’s statements are consistent with what MediaTek disclosed, the chip is not specifically referred to as the Dimensity 9400.

What is the clock speed of Dimensity 9400?

It also has five cores clocked at 2.96GHz and two cores with a maximum frequency of 2.27GHz.

What phones will use the Dimensity 9400?

Although certain phone models are yet unknown, it is expected to power next flagship smartphones from several manufacturers in late 2024.

What are the competitors to the Dimensity 9400?

Samsung’s Exynos 2500 and Qualcomm’s Snapdragon 8 Gen 4 are anticipated to be the primary rivals.

How powerful is the Dimensity 9400?

Although there are currently no official benchmarks, leaks indicate a significant increase in CPU performance compared to the Dimensity 9300. GPU increases seem to be modest.

Is the Dimensity 9400 good for gaming?

With its enhanced GPU and anticipated strong CPU, the Dimensity 9400 is probably a great gaming laptop.

What manufacturing process is used for the Dimensity 9400?

The first device in the series to be constructed using TSMC’s cutting-edge 3nm process (N3E) is the Dimensity 9400, which is expected to enhance performance and battery life.

Does the Dimensity 9400 have an integrated modem?

Integrated modems are often found in MediaTek processors, which enable cellular access. The modem’s specifics for the Dimensity 9400 are yet unknown.

How are the AI capabilities of the Dimensity 9400?

It is anticipated that the Dimensity 9400 will outperform the 9300 in terms of AI capabilities, processing jobs like huge language models and picture production more quickly.

Does the Dimensity 9400 have a dedicated NPU?

Leaks imply an upgraded Neural Processing Unit (NPU) for managing AI activities on the device, while specifics are yet unknown.FeatureSpecificationCPU1x Cortex-X5 Prime core, 3x Cortex-X4 Prime cores, 4x Cortex-A720 coresGPUPossibly a co-developed GPU with NvidiaManufacturing ProcessTSMC 3nm (N3E)Expected LaunchQ4 2024

Read more on Govindhtech.com

#Dimensity9400#Dimensity9300#news#govindhtech#mediatek#meditekdimensity#technews#technology#technologynews#technologytrends

0 notes

Text

The Professional Journey of Nav Sooch - From Silicon Labs to Ketra, Inc.

Silicon Labs' remarkable success can be attributed to the unparalleled vision, unwavering dedication, and exceptional leadership of one of its co-founders, Nav Sooch. Since the company's inception in 1996, he has been a driving force, shaping its trajectory and propelling it to the forefront of the semiconductor industry. His strategic insights, innovative thinking, and relentless pursuit of excellence have been instrumental in establishing the company as a trailblazer in the field. With a deep passion for technology and a commitment to pushing boundaries, Mr. Sooch continues to inspire and lead the company towards even greater achievements in the future.

As the Chairman of the Board during its formative years and beyond, he has been an unwavering and steadfast guiding force for the company, providing invaluable insights, strategic direction, and unwavering support. In the early days, he fearlessly took on the mantle of Chief Executive Officer, skillfully steering the young enterprise through the challenging waters of start-up growth and expansion, while navigating the ever-changing landscape of the industry. With his watchful eye and exceptional strategic acumen, he played a pivotal role in nurturing the company from a fledgling entity into a renowned and respected player within the industry, establishing a strong foundation for continued success and innovation.

Even after stepping down as CEO at the end of 2003, his influential presence continued to resonate within the very fabric of the company. Demonstrating his unwavering commitment to the organization, he graciously returned as interim Chief Executive Officer between April and September 2005. During this period, he skillfully navigated the company through a series of strategic initiatives, ensuring it remained on a path of sustained success. His exceptional leadership and unwavering dedication left an indelible mark on the organization, setting the stage for continued growth and prosperity.

Notably, Nav Sooch’s impact extended far beyond this fabless global technology company. He made significant contributions to the field of solid-state lighting during his tenure as the CEO of Ketra, Inc. From October 2011 to April 2018, he spearheaded the development of groundbreaking technologies and innovative solutions that revolutionized the industry. Despite his ventures outside of Silicon Labs, his unwavering commitment and enduring ties to the company served as a testament to the legacy of his exceptional leadership and unwavering vision. His remarkable achievements continue to inspire and shape the future of the industry.

A cornerstone of his remarkable success at the company can be attributed to his exceptional educational background. With a Bachelor of Science degree in Electrical Engineering from the University of Michigan, Dearborn, and a Master of Science degree in Electrical Engineering from Stanford University. He not only brought a wealth of knowledge and expertise to the table but also demonstrated a strong commitment to academic excellence. His credentials, combined with his seasoned leadership, played a pivotal role in propelling the company forward in its journey towards continuous innovation and the pursuit of excellence in the field.

The company product portfolio is as diverse as it is innovative, reflecting the company's commitment to pushing the boundaries of technology. One of the pillars of this portfolio is the company's microcontrollers and wireless products, designed with a focus on energy-efficiency and high performance. These products redefine the realm of possibility for Internet of Things (IoT) devices, enabling seamless and secure connectivity across a range of applications, from smart home devices to industrial automation systems.

The company's exceptional timing devices represent another crucial area of focus. With their remarkably precise frequency control and highly flexible clock tree solutions, these cutting-edge devices offer unparalleled reliability and performance. They are designed to support a wide range of applications across diverse industries, including telecommunications, data centers, and consumer electronics. Whether it's ensuring seamless communication networks, optimizing data processing capabilities, or enhancing user experiences, these devices play a pivotal role in driving innovation and efficiency in today's rapidly evolving technological landscape.

The company is a leading provider of isolation and power solutions, offering a comprehensive range of products that are meticulously designed to guarantee the safe and efficient operation of electronic equipment. With a focus on meeting stringent safety standards, the company’s product portfolio includes a wide array of solutions for signal isolation, power isolation, and gate driver isolation. These cutting-edge products not only deliver exceptional performance but also provide the critical functions required to ensure reliable and secure operation in various applications. Whether it's in industrial automation, telecommunications, or automotive systems, Silicon Labs' isolation and power products are trusted by engineers worldwide for their unmatched quality and reliability.

The company's sensor products have earned a reputation for their high accuracy and reliability. Whether it's environmental sensors for measuring factors such as humidity and temperature, or optical sensors for detecting proximity and ambient light, Silicon Labs' sensors play a crucial role in a wide range of applications. From smart home automation to health and fitness devices, these products help enable a more connected and efficient world. In every product category, the company’s offerings stand out for their cutting-edge technology, superior performance, and unmatched reliability. They reaffirm Nav Sooch's vision for a company that pushes the boundaries of what's possible, setting new industry standards and leading the way in technological innovation.

Nav Sooch's indelible footprint at the company continues to inspire and shape the company's purpose and future. With his unwavering commitment and tireless dedication, he has left an enduring impact on the organization. Through his profound passion for innovation and deep expertise in the semiconductor industry, Nav Sooch Marriage has played a pivotal role in defining the company as a true powerhouse of technological advancements. As the company sets its sights on continued growth, his visionary leadership and entrepreneurial spirit serve as a guiding light for the generations to come, fostering a legacy that will inspire and empower future innovators.

0 notes

Text

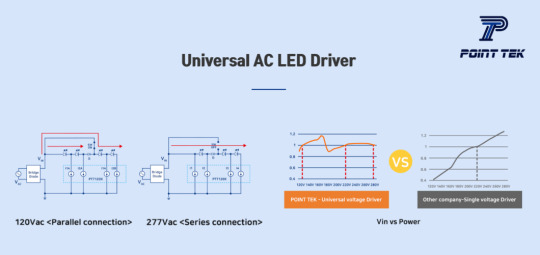

High Efficiency AC LED Driver | AC LED Driver IC | POINTTEK

POINTTEK a fabless semiconductor design and development company, has been continuously working to produce high quality products since 2009. This makes it as a company with superior AC direct driver technology. In particular, their high efficiency LED drive technology makes them among the best in the world. They have less than 1% flicker and can drive an LED module with a single LED at a universal voltage. An LED driver known as a universal AC LED driver is designed to operate with a wide input voltage range and is generally compatible with many AC power supply standards used worldwide. Because these LED drivers are designed for a wide range of input voltages and frequencies, they can be used in various geographical locations where typical AC power specifications may vary.

Key features of a Universal AC LED Driver typically include:

Constant Current Output: Many Universal AC LED drivers provide a constant current output to ensure consistent and stable illumination of the LEDs.

Wide Input Voltage Range: Universal AC LED drivers can usually accept a broad input voltage range, such as 120-277V AC. This range encompasses the voltage standards used in many countries and regions.

Compatibility with Multiple Frequencies: They are designed to work with various AC frequencies, including 50Hz and 60Hz, which are the most common frequencies used worldwide.

Energy Efficiency: These drivers are often designed for high energy efficiency to reduce power consumption and minimize energy costs.

Dimming and Control Options: Some universal AC LED drivers offer dimming and control features, allowing for adjustable brightness levels and integration into lighting control systems.

Overcurrent and Overvoltage Protection: These drivers typically include protection mechanisms to safeguard the LEDs from overcurrent and overvoltage conditions.

Lighting applications such as street lighting, commercial lighting, industrial lighting, and residential lighting frequently use universal AC LED drivers. They provide the versatility to be utilized in many settings with varied electrical standards, eliminating the need for unique drivers for every area.

If you are looking for dimmable LED module, you can find it on POINTTEK

Click here to contact POINTTEK

View more: High Efficiency AC LED Driver | AC LED Driver IC

0 notes

Text

Qualcomm opens new 5G/ Wi-Fi connectivity design center in Chennai, India

March 19, 2024 /SemiMedia/ — According to reports, Qualcomm announced a new design center in Chennai, India, specializing in wireless connectivity solutions. This fabless semiconductor company will help India conduct 5G and 6G research.

The design center, which will cost Rs 177.27 crore and will create 1,600 jobs, will work on 5G cellular technology and will also drive Qualcomm’s roadmap in…

View On WordPress

#electronic components news#Electronic components supplier#Electronic parts supplier#Qualcomm Chennai

0 notes

Text

6138 茂達

國泰證期研究部

茂達(6138 TT)

Call memo

20231122

1. 茂達成立於1997年,資本額 746M,員工人數400人,Mixed -Signal & Power/Analog IC Fabless Design House,總部位於新竹

2. 茂達集團中,茂達(6138)主要提供IC Solution,大中(6435)提供Discrete Power Device,Supec(中國子公司)也是提供IC Solution給中國在地客戶。

3. 電源管理、多媒體音頻放大、馬達驅動、LED驅動以及感測晶片,提供客戶一次購足與全方位之解決方案

4.…

View On WordPress

0 notes

Text

Larsen and Toubro’s bold step into the world of fabless semiconductor chip design represents a strategic move that leverages the company’s engineering capabilities, brand recognition, and intellectual property opportunities. With an initial investment of ₹830 crore and a focus on design rather than manufacturing, L&T is poised to make a significant impact in this rapidly evolving sector. This venture, combined with their diverse portfolio and global ambitions, sets the stage for exciting developments in the semiconductor industry.

0 notes