#ethereum merge news

Text

#ethereum merge#ethereum#merge#ethereum merge explained#eth merge#ethereum 2.0#the merge#ethereum news#ethereum price#ethereum merge date#ethereum merge price#ethereum merge uitleg#ethereum price prediction#ethereum merge price prediction#buy ethereum#the merge ethereum#ethereum merge tips#ethereum merge fork#ethereum merge news#ethereum merge prijs#ethereum merge today#ethereum merge event#ethereum merge nedir#ethereum merge update

0 notes

Text

Lider Kripto Para Borsası, O Coin İçin Komisyonu Sıfırladı !

Lider Kripto Para Borsası, O Coin İçin Komisyonu Sıfırladı !

#busd #eth #shiba #volt #lovely

#ethereum#merge#eth#kripto#crypto#kriptohaber#btc#kripto haber#finance#binance#nft#altın#ethereal#bitcoin#ethel cain#ethical#ethnicity#bitcoin latest news

2 notes

·

View notes

Text

#Merge ETH#finance#advertising#entrepreneur#business#marketing#ethereum#crypto#crypto latest news#bitcoin latest news

1 note

·

View note

Text

#cryptocurrencies#crypto trading platform canada#crypto trading#crypto exchange in canada#crypto canada#crypto#canadian crypto trading platform#crypto loans canada#best crypto exchange in canada#ethereum#crypto latest news#ethereum merge

1 note

·

View note

Text

Ethereum merger completes, $195 billion of cryptocurrencies start a new era

Ethereum merger completes, $195 billion of cryptocurrencies start a new era

DENVER, CO – FEBRUARY 18: Ethereum co-founder Vitalik Buterin speaks at ETHDenver on February 18, 2022 in Denver, Colorado. (Photo by Michael Siglo/Getty Images)

Getty Images

Six years of preparation, the most advanced upgrade in crypto history has been completed.

at 6:42 a.m. UTC (2: 42AM EDT), the Ethereum blockchain has merged with a special purpose decentralized ledger called Beacon Chain,…

View On WordPress

0 notes

Text

With the transition of Ethereum to a new algorithm, the popularity of the Ravencoin cryptocurrency has grown.

After the long-awaited Merge update took place on the Ethereum network, and the blockchain changed from Proof-of-Work (PoW) to Proof-of-Stake (PoS), other cryptocurrencies began to grow in popularity, as many miners who remained out of work began to look for alternatives… Detail: https://bitcoingrandee.com/news NEWS

#Cryptocurrency#Blockchain#Business#News#Ethereum#ETH#ETC#Merge#PoW#PoS#Ravencoin#EthereumClassic#ShibaInu#Bitcoin#FTX#Mining#NFT

0 notes

Text

Expectations After ETH 2.0 The Merge!

0 notes

Video

youtube

What is The Blockchain Trilemma ?

#youtube#What is the blockchain trilemma#the blockchain trilemmma#bitcoin#crypto news#price predictions#ethereum 2.0#the ethereum merge

0 notes

Link

#bloomberg#eth#ethereum#merge#ethereum merge#bitcoin#kripto#kripto para#crypto#cryptocurrency#coin#haber#news#bloomedianet#haberler

0 notes

Text

#ethereum#ethereum merge#ethereum news#ethereum 2.0#ethereum news today#ethereum live#ethereum merge explained#ethereum merge date#ethereum merge price prediction#ethereum update#ethereum technical analysis#ethereum merge prediction#the merge ethereum#ethereum merge update

0 notes

Text

Önümüzdeki Yıl Ethereum İçin Başarılı Olacak!

Önümüzdeki Yıl Ethereum İçin Başarılı Olacak!

#eth #ethereum #merge

#ethereum#eth#merge#bitcoin#finance#binance#nft#crypto#kriptohaber#altın#bitcoin latest news#crypto latest news#btc#coinbase#cardano#kripto#kripto haber

0 notes

Link

How The Merge will change DeFi and dApps on the network. “The Merge” – the shift from proof-of-work to proof-of-stake – represents a major paradigm shift for Ethereum.

0 notes

Text

When is the Ethereum Merge? What we know about it

The Ethereum Merge Benefits

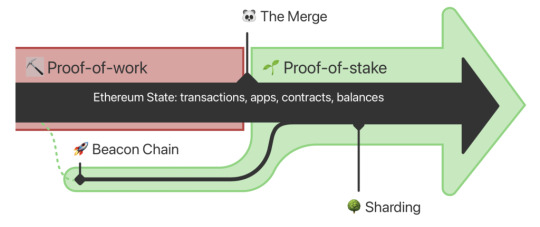

The Ethereum merge is set to take place in September, transitioning the Ethereum Mainnet Network from proof of work to proof of stake.

Not only will the migration enable Ethereum to unlock new scaling capabilities, such as sharding, but it will also reduce Ethereum's energy consumption by up to 99.95%.

Credits: Ethereum Org

Ethereum's Current Energy Consumption

According to the Ethereum Organization, the ethereum network's current annual energy usage is 112TWh, whereas the Netherlands' yearly energy use is 108TWh (As of 2018).

One Terawatt Hour is equivalent to one Trillion Watts, hence the current ethereum energy usage is 112000000000 KWh (112*1TWh).

Source: Ethereum.org

Increased Energy Efficiency

If the merger reduces network consumption by 99.95%, as claimed, the yearly consumption would be 56000000KWh (0.056TWHh), which is 2000 less than the present figure. As a result, the network's efficiency will be TWO THOUSAND TIMES higher.

What will Ethereum Merge with?

What is the Ethereum Merge?The Ethereum Merge is the replacement of Ethereum's existing Proof-of-Work (PoW) mechanism with the Beacon Chain's Proof-of-Stake (PoS) consensus layer. As a result, mining will be useless for Ethereum.

The Beacon Chain

It is a consensus layer that has been operating since December 2020 and will replace the present Proof of Work method with the Proof of Stake protocol.

Sharding

What's Sharding on Ethereum?Sharding on Ethereum will partition the vast quantity of data on the network, decreasing congestion and increasing the network's Transactions per Second (TPS).

What steps must an ethereum holder or user take after or before the merge?

You do not need to do anything if you are an Ethereum user, holder, or non-node-operating staker. Scams will emerge both before and after the merger.

When will the Ethereum Merge Happen?

The Merge has a (soft) deadline, 19 of September in 2022. But it seems that it will happen probably in Q3/Q4 of 2022.

Read the full article

0 notes

Text

Bitcoin dips, Terraform Labs faces new probe, and the Ethereum merge's next steps: CNBC Crypto World

Bitcoin dips, Terraform Labs faces new probe, and the Ethereum merge’s next steps: CNBC Crypto World

ShareShare Article via FacebookShare Article via TwitterShare Article via LinkedInShare Article via Email

CNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Auston Bunsen of…

View On WordPress

#Bitcoin#Bitcoin/USD Coin Metrics#business news#CNBC#Crypto#Cryptocurrency#dips#Ethereum#Ethereum/USD Coin Metrics#faces#Labs#merges#probe#steps#Technology#Terraform#world

0 notes

Text

Ethereum's Successful Merge: A Milestone for Decentralized Finance

In a momentous occasion for the blockchain and decentralized finance (DeFi communities, Ethereum has effectively concluded its eagerly awaited merger. A significant turning point in the history of the Ethereum network is the Ethereum merge, which saw the network switch from a proof-of-work (PoW) to a proof-of-stake (PoS) consensus mechanism. The Ethereum blockchain's scalability, security, and sustainability are all significantly affected by this huge update.

Proof-of-Stake Triumphs Over Proof-of-Work:

For Ethereum, the switch from PoW to PoS is a significant development. The conventional consensus method for blockchain networks, known as proof of work (PoW), has come under fire because of how energy-intensive it is. In contrast, Proof of Stake (PoS) depends on validators who use a specific quantity of cryptocurrency as security to produce new blocks and verify transactions. This shift aims to improve the network's scalability and efficiency in addition to lessening its negative effects on the environment.

Scalability and Transaction Throughput:

Scalability was one of the main issues Ethereum had during its PoW phase. During times of high demand, the network frequently encountered congestion and high transaction fees, which resulted in a subpar user experience. It is anticipated that the switch to PoS will greatly increase scalability, enabling the Ethereum network to handle more transactions every second. The continued expansion and uptake of decentralized apps (DApps) and DeFi platforms constructed on the Ethereum blockchain depend on this scalability boost.

Enhanced Security and Sustainability:

PoS fortifies the Ethereum network with an additional layer of security. Because validators must stake a portion of their cryptocurrency holdings, the network is financially motivated for them to act honorably and securely. The Ethereum blockchain is now more resilient to 51% attacks, a flaw in PoW networks, thanks to this design. Furthermore, the switch to PoS is a component of Ethereum's larger plan to lessen the carbon footprint of the network and address environmental issues related to PoW-based cryptocurrencies.

Economic Implications for Validators and Token Holders:

Following the merger's success, Ethereum validators are now essential to the network's security. When validators create new blocks and validate transactions, they are rewarded with Ether that they have secured as collateral. With this change in the consensus process, the Ethereum ecosystem adopts a new economic model where validators take a more proactive role in preserving network integrity. As a result, token owners gain from a more robust and safe network, which enhances Ether's overall appeal as a digital asset.

Impact on DeFi and Decentralized Applications:

Decentralized apps and DeFi platforms form the core of the Ethereum ecosystem. The DeFi industry is expected to benefit from the merger since it will lower transaction costs and enhance user experience generally. The Ethereum blockchain now enables developers to create more complex and scalable applications, spurring innovation and enhancing the potential of decentralized finance. With this update, Ethereum is now more competitive and appealing to both developers and users.

Conclusion:

For the blockchain industry, Ethereum's successful transition from proof-of-work to proof-of-stake is a revolutionary turning point. This change demonstrates Ethereum's dedication to security, scalability, and sustainability in addition to the technical improvements. Ethereum is positioned as a leader in the decentralized finance space due to the favorable effects on the DeFi ecosystem and the financial implications for validators and token holders. The Ethereum merger paves the way for a more robust, effective, and sustainable future for blockchain technology as the cryptocurrency community rejoices over this accomplishment.

#crypto#digitalcurrency#blockchain#cryptonews#blockchainrevolution#decentralizedworld#ethereum#smartcontracts#altcoins#cryptoinnovation

2 notes

·

View notes

Photo

Read Here

Is It Good To Buy ETH in 2023?

Macro factors like galloping inflation, Fed interest rate hike, oil and food crisis, Ukraine-Russia war gave ripples down the spine to crypto investors in 2022. However the silver-lining beyond the dark clouds have started to surface after bank busts in 2023 and Ethereum’s new upgrades making the next market buzz around. With that being said, Eth has been rocking and rolling above the $1500 levels for quite some time despite the market panic.

The recent Capella and Shanghai event have given fresh impetus to Eth’s demand and we should be going long on ETH for 2023 for the given few reasons;

Top Reasons To Invest in ETH in 2023

The Merge Catalysts

How does an asset derive its value? It derives its value through the utility and scarcity it creates. Post the Merge event, in contrast to the number of ETHs which were produced prior, the numbers have dropped significantly. For example, in comparison to the PoW consensus that created 13,000 Ether per day, the post Merge scenario has brought those numbers to 1300, allegiance to EIP 1559 that burns a part of the gas fees after each block.

With that said, ETH is slowly inching towards becoming ultrasound money. The major trade-off is that at the backdrop of shady practices by the TradFi, users might pivot to DeFi, and Ethereum holds majority of the DeFi, setting a new narrative as a go to ecosystem for building the next face of finance.

Layer 2’s on Fire

Undoubtedly high gas fees were a pressing challenge that the Ethereum chain has dealt with ever since its inception. We have had our share of challenges when the crypto kitty event happened. However Vitalik Buterin took cues from such incidents and moved towards layer 2. Optimism and Arbitrum provided the much needed leverage to Ethereum; however, their computational integrity despite being fast and efficient has often been questioned.

On that note, ETH’s pivot to ZK or Zero Knowledge Proof systems might set-up a new narrative. Vitalik has already said that Sharding and the Merge are watershed moments in ETH’s journey but it will be the layer 2’s that shall carve a new way ahead for massive adoption. Polygon, which is the preferred layer 2 scaling solution for Ethereum, has recently launched ZKeVM which shall give more leverage to such claims. Hence setting a positive narrative for ETH to rage inferno in the coming days.

5 notes

·

View notes