#does airbnb provide liability insurance

Text

Airbnb & Short Term Rental Legal Guidelines And Restrictions In Florida

By cities’ requiring short-term leases to be registered, homeowners must present a 24-hour contact who shall be held responsible for making sure tenants follow the laws on noise, the number of in a single day friends, trash removing and parking. If they don’t register or comply, they’ll face code enforcement fines. Every proprietor working a short time period rental, as outlined in § 153.05, City Code of Ordinances, inside the metropolis shall first obtain a brief time period rental allow ("permit") from the Development Services Director. It shall be illegal for any proprietor to operate a brief time period rental in a Residential Zoning District until a brief time period rental allow has first been obtained from the Development Services Director. Please observe that it shall be the duty of short-term vacation rental homeowners and operators to remain aware of those limitations and to control the operation of their short-term vacation rental properties accordingly. Short-term trip rental house owners found in violation of any of these Orders danger the imposition of fines, their rental properties being shut down, and/or rental licenses revoked.

Scheduled for a summer time 2022 opening, it will be the first bayfront condo tower to characteristic no rental restrictions – making this a singular funding alternative in a key market within the coronary heart of Miami. Society Residences’ Ready-to-Move-In, Daily Rental Friendly Luxury The soon-to-be-completed Society Residences Miami building rises 49 stories... Here is an inventory of a lot of the Miami-area condo buildings that enable some form of short-term rentals. It remains to be essential to confirm with the rental affiliation whether daily leases like Airbnb are allowed per the apartment docs.

Failure to right such violations within the timeframes offered shall outcome within the imposition of a fine consistent with Chapter 37, City Code until such time that the violations are corrected, re-inspected, and located in compliance. The inspections shall be made by appointment with the Local Designated Representative. One of essentially the most secluded locations to stay for a bunch or family of six is this three-bedroom residence in Hollywood.

As of late 2021, town of Sarasota still had outlawed quick term rental properties by mandating that no lodging could be rented for less than seven calendar days in any residentially-zoned district. Following in line with Florida state statutes, town of Jacksonville defines a short time period rental as any property rented on greater than three occasions per year for durations of 30 days or much less. Jacksonville allows quick time period rentals in residential districts in single-family homes, two-family homes/duplexes, and townhouses provided that they hold a short time period Vacation Rental Certificate. In addition to maintaining tabs on the going transient rental tax charges within the county that homes your short time period rental properties, you’ll also want to make a note of where these Local Option Transient Rental Tax payments have to be directed. Roughly 20 of the counties, however, from Bradford to Washington, mandate cost of the Local Option Transient Rental Tax on to the state’s Department of Revenue. A Fort Lauderdale trip rental can present profitable returns for real estate buyers looking where to greatest put their cash.

The 20 who mentioned they might still serve might be introduced back Tuesday and Wednesday for additional questioning. There additionally a shortage of expert labor – people who know how to preserve, repair and build boats – not just in South Florida, but additionally all through the world. Robert Ponce, director of yacht gross sales at RMK, stated it’s now an excessive seller’s market, where vessels are sometimes offered soon after they attain stock. “There are no lovely, good boats to purchase, as a result of everyone has gone out to buy boats, to permit them to spend time with household and associates while they’re social distancing,” summarized Nicole Squartino, social media and advertising supervisor for RMK. Phil Purcell, president and CEO of Marine Industries Association of South Florida , mentioned when the shutdowns began this past March, many within the business have been terrified that the nation was headed for one more Great Recession event.

We want you to grasp what information we gather about you, how we use it and the safeguards we now have in place to protect it. This Privacy Policy applies to info collected through this website and in any other case. Your use of this website and our services, and any disputes arising from it, is topic to this Privacy Policy as nicely as the Terms of Use and all its dispute resolution provisions, together with arbitration, limitation on damages and selection of legislation. While Florida Center doesn't fairly match up with Florida Center North, it's surprisingly shut. It may have a dearer median property value, however its Airbnb rental revenue is not too far off from that of its northern neighbor. Miami-Dade County is the largest county in Florida for Airbnb hosts, producing $113 million in 2016 in accordance with the corporate.

airbnb liability release form

The lawsuit asks the courtroom to grant the county's request that Airbnb be required to pay tourist improvement taxes on transactions previous to a 2017 settlement. The variety of trip rental items in Florida has elevated from 117,000 in 2012 to 131,000 in 2016. After discontinuing reservations in late March, Governor Ron DeSantis stated trip leases might resume beneath the "full Phase I" of his COVID-19 restoration plan -- so long as counties had their safety plan approved by the state. The greatest trip leases or Airbnb with a jacuzzi in Broward County are 41 Excellent one bedroom condo with Great View, Oceanview King Suite Q Club Resort sixteenth ground and Apartments at Sian Residences. On August 18, 2015, the City of Fort Lauderdale’s Commission adopted an ordinance regulating trip rentals.

Monroe County Assistant Attorney Steve Williams operates a daily crackdown on illegal vacation leases found online. Each month, he cites about 30 property house owners for violating local ordinance. Yet the state Legislature has been hostile to permitting local governments to set the rules for vacation rentals. In 2011, lawmakers prohibited cities from regulating short-term trip leases.

#airbnb liability insurance#airbnb host liability insurance#does airbnb provide liability insurance#tax liability airbnb#airbnb liability release form#airbnb no security deposit guest liability

1 note

·

View note

Text

Does Usaa Cover Turo

USAA, a well-known provider of insurance and financial services catering primarily to military members and their families, does not directly offer coverage for peer-to-peer car-sharing services like Turo. Turo is a platform that allows private car owners to rent out their vehicles to others for short periods, similar to Airbnb for cars.

However, USAA does offer various auto insurance policies that may provide coverage for individuals who participate in car-sharing programs like Turo. The extent of coverage depends on several factors, including the specific terms of the policy and state regulations. Here’s how USAA auto insurance may apply to Turo rentals:

Personal Auto Policy: USAA’s standard auto insurance policies typically provide coverage for personal vehicles used for personal purposes, such as commuting or running errands. If you occasionally rent out your personal vehicle through Turo, your USAA policy may still provide coverage, but it’s essential to review the policy terms carefully. Some policies may exclude coverage for commercial activities like car-sharing.

Rental Car Coverage: USAA offers optional rental car coverage as part of its auto insurance policies, which may extend to rental vehicles obtained through services like Turo. This coverage typically applies to temporary substitute vehicles used while your insured vehicle is undergoing repair or maintenance. However, coverage limits and exclusions may vary, so it’s crucial to consult your policy documents or contact USAA for clarification.

Commercial Use Exclusions: Many auto insurance policies, including those offered by USAA, contain exclusions for vehicles used for commercial purposes. If you rent out your vehicle through Turo on a regular basis or for profit, it may be considered commercial use, and coverage under your personal auto policy may not apply. In such cases, you may need to explore commercial insurance options or obtain coverage through Turo’s insurance program.

Turo Insurance: Turo offers its own insurance program, which provides coverage for hosts and guests during Turo rentals. Hosts can choose between three protection plans with varying levels of coverage, including liability, physical damage, and roadside assistance. Guests are automatically covered under Turo’s insurance while driving a rented vehicle. However, it’s essential to review Turo’s insurance terms and verify coverage details before participating in a rental.

In summary, while USAA does not specifically cover Turo rentals, individuals who participate in car-sharing programs should carefully review their auto insurance policies and consider additional coverage options to ensure adequate protection during rental transactions. Consulting with an insurance agent or representative can help clarify coverage options and address any questions or concerns.

0 notes

Text

Vacation Rental vs Long-term Lease in UAE: What’s the Right Strategy for You?

The allure of the short-term rental industry is undeniable. With annual vacation rental revenues surpassing $100 billion globally, there’s no doubt this segment has become an attractive investment avenue. But how does one enter this lucrative market? The answer usually revolves around two major approaches: Vacation Rental and Long-term Lease. Let's delve into these strategies, particularly in the context of the UAE, and evaluate their advantages and disadvantages.

Understanding Vacation Rental

Vacation rental, especially in the vibrant short-term rental market of Dubai and other UAE cities, means more than just handling the day-to-day tasks associated with property upkeep. It encompasses listing rentals on popular platforms like Airbnb, VRBO, Booking.com, and TripAdvisor, pricing adjustments, guest communication, and coordination with cleaning and maintenance staff.

Benefits of Vacation Rental in UAE:

Income and Vacation Home: Owning a vacation rental property in the UAE provides extra income and a place for personal vacations.

Appreciating Property Value: Invest in areas with high demand, and your property value may appreciate annually.

Tax Exemptions: As a business, you may claim deductions on related expenses such as vacation rental services, taxes, insurance, etc.

Challenges of Vacation Rental:

High Startup Costs: Expect 20-30% down payment for properties meant as vacation rentals.

Additional Taxes and Fees: Besides income taxes, other local taxes and fees might apply.

Unexpected Expenses and Time Constraints: Managing a property requires significant time and unforeseen costs.

Regulations and Restrictions: Know your local laws and HOA rules.

Utilizing vacation rental software like Mr. Alfred's PMS (Property Management System) can make vacation rentals in UAE more efficient. Revenue management services provided by companies like Mr. Alfred also play a vital role in optimizing profits.

Long-term Lease: An Alternative Approach

A long-term lease involves leasing a property for an extended period and then using it according to the lease agreement. The benefit is derived from the stability and predictability of this model.

Advantages of Long-term Lease:

No Need to Own Property: Lower startup costs and no mortgage burdens.

Limited Start-up Costs: Mostly involve leasing the property.

Autonomy and Personal Usage: Control over the income and usage of the properties.

Risks in Long-term Lease:

Guest Damages (if subleasing): Liability for any damages.

Maintenance and Utility Costs: Regular maintenance might cut into profits.

Income Fluctuation (if relying on subleasing): Seasonal changes might affect bookings.

Changing Market Conditions and Rental Regulations: Economic changes and local laws can affect profitability.

Which Strategy Suits You Best?

Choosing between a vacation rental and a long-term lease depends on individual preferences, financial goals, and risk tolerance. Both paths offer rewards and challenges. By understanding your objectives and aligning them with the unique dynamics of the UAE rental market, you can make an informed decision.

How Mr. Alfred Can Assist You

Specializing in short-term rental vacation rental in UAE, Mr. Alfred offers an integrated solution for both strategies. With advanced vacation rental software for Dubai and other emirates, our services encompass revenue management, seamless communication, efficient pricing, and expert handling of various rental tasks.

Whether you are pursuing vacation rental or the path of a long-term lease, Mr. Alfred provides the tools and expertise to unlock growth potentials in the Short Term Rental Management landscape in UAE. Schedule a demo to discover how we can elevate your vacation rental in the UAE to new heights!

Vacation Rental vs Long-term Lease in UAE: What’s the Right Strategy for You?

The allure of the short-term rental industry is undeniable. With annual vacation rental revenues surpassing $100 billion globally, there’s no doubt this segment has become an attractive investment avenue. But how does one enter this lucrative market? The answer usually revolves around two major approaches: Vacation Rental and Long-term Lease. Let's delve into these strategies, particularly in the context of the UAE, and evaluate their advantages and disadvantages.

Understanding Vacation Rental

Vacation rental, especially in the vibrant short-term rental market of Dubai and other UAE cities, means more than just handling the day-to-day tasks associated with property upkeep. It encompasses listing rentals on popular platforms like Airbnb, VRBO, Booking.com, and TripAdvisor, pricing adjustments, guest communication, and coordination with cleaning and maintenance staff.

Benefits of Vacation Rental in UAE:

Income and Vacation Home: Owning a vacation rental property in the UAE provides extra income and a place for personal vacations.

Appreciating Property Value: Invest in areas with high demand, and your property value may appreciate annually.

Tax Exemptions: As a business, you may claim deductions on related expenses such as vacation rental services, taxes, insurance, etc.

Challenges of Vacation Rental:

High Startup Costs: Expect 20-30% down payment for properties meant as vacation rentals.

Additional Taxes and Fees: Besides income taxes, other local taxes and fees might apply.

Unexpected Expenses and Time Constraints: Managing a property requires significant time and unforeseen costs.

Regulations and Restrictions: Know your local laws and HOA rules.

Utilizing vacation rental software like Mr. Alfred's PMS (Property Management System) can make vacation rentals in UAE more efficient. Revenue management services provided by companies like Mr. Alfred also play a vital role in optimizing profits.

Long-term Lease: An Alternative Approach

A long-term lease involves leasing a property for an extended period and then using it according to the lease agreement. The benefit is derived from the stability and predictability of this model.

Advantages of Long-term Lease:

No Need to Own Property: Lower startup costs and no mortgage burdens.

Limited Start-up Costs: Mostly involve leasing the property.

Autonomy and Personal Usage: Control over the income and usage of the properties.

Risks in Long-term Lease:

Guest Damages (if subleasing): Liability for any damages.

Maintenance and Utility Costs: Regular maintenance might cut into profits.

Income Fluctuation (if relying on subleasing): Seasonal changes might affect bookings.

Changing Market Conditions and Rental Regulations: Economic changes and local laws can affect profitability.

Which Strategy Suits You Best?

Choosing between a vacation rental and a long-term lease depends on individual preferences, financial goals, and risk tolerance. Both paths offer rewards and challenges. By understanding your objectives and aligning them with the unique dynamics of the UAE rental market, you can make an informed decision.

How Mr. Alfred Can Assist You

Specializing in short-term rental vacation rental in UAE, Mr. Alfred offers an integrated solution for both strategies. With advanced vacation rental software for Dubai and other emirates, our services encompass revenue management, seamless communication, efficient pricing, and expert handling of various rental tasks.

Whether you are pursuing vacation rental or the path of a long-term lease, Mr. Alfred provides the tools and expertise to unlock growth potentials in the Short Term Rental Management landscape in UAE. Schedule a demo to discover how we can elevate your vacation rental in the UAE to new heights!

#propertymanagement#mralfred#vacation rental management dubai#vacationrental#best short term rental management software dubai#rental

0 notes

Text

Rental Insurance

Airbnb® Insurance

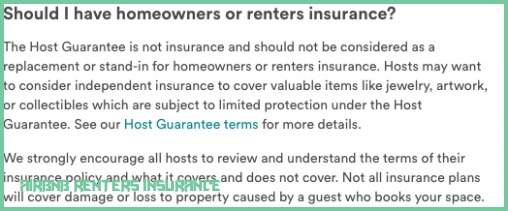

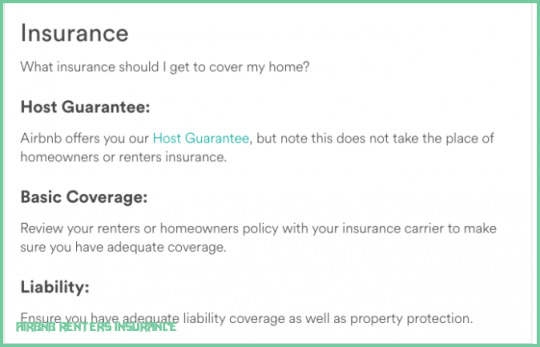

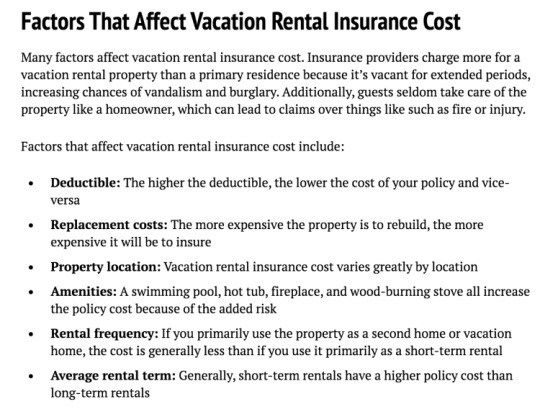

Airbnb offers Host Protection Insurance that covers Airbnb hosts as well as landlords worldwide. It largely focuses on safeguarding the host and/or landlord facing liability when insurance claims are brought by 3rd parties, like a neighbor and also including visitors that stay at the location. Insurance coverage runs up to $1 million USD per incident in the event of property damages or injury.

Included in the insurance coverage are common spots like lobbies or elevators. Airbnb insurance coverage is primary liability insurance that safeguards the host, property owner or homeowners association from legal actions brought by a visitor to cover things like damage to the building or an accident endured during their vacation in the residence. There are many points, nevertheless, that are not protected by Airbnb insurance.

The Airbnb Host Protection plan is just for liability as mentioned above. It does not consist of points such as property damage that is deliberate, instead of unintended. Nor does it cover property damages such as mold and mildew or air pollution. And it also does not cover loss of earnings. So picture if a flood or fire happens during a guest's visit and you are unable to rent the area until mitigation is complete. Not having coverage to compensate you for both damages to the property or loss of earnings can be devastating to your income.

Vrbo® Insurance Policy

While Vrbo Insurance is similar to Airbnb Insurance, there are several differences to keep in mind. The $1 million dollars in insurance coverage might safeguard you if you are sued by a guest for an accident or injury that takes place throughout their visit. It might even cover you if the visitor does accidental damage to a third party's home such as a next-door neighbor. It does not, however, cover intentional damages caused by a visitor to your residential property.

Vrbo even has more exemptions that are subject to evaluation, which makes getting paid for the claim a lot more challenging. It is mostly geared towards circumstances where a guest is injured on the property. A good example is a case when a guest falls down the steps or slips in the bath tub and breaks an arm or leg. It might cover the guest's health care bills and might also safeguard the host from liability of being sued. It also applies to a circumstance where a guest leaves the water on in the bathroom sink and the flooding creates damage to a next-door neighbors' property.

Nevertheless, since it overlooks scenarios where a visitor unintentionally trips and falls into a closet door and the doors are broken, your property is at substantial risk. In this situation, you might have to hold an independent homeowner's policy to cover property damage. Yet, numerous homeowner policies do not cover your home when you rent it out for income. This leaves you at high risk to have to cover expensive damages on your own.

Proper Insurance®

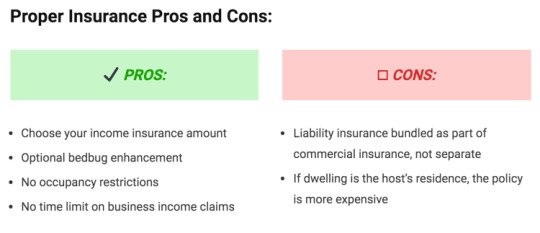

Policies such as the ones described above for Airbnb and Vrbo are not all comprehensive, nor are they flexible depending on particular scenarios. These insufficient and stiff kinds of protection leave hosts wide open for a variety of circumstances to happen that are not protected in the $1 million policy.

Proper Insurance offers a full-service insurance policy for short term rentals that fits virtually every scenario for host, landlord, and also homeowners' association risks. Proper Insurance leads the Nation in short-term rental insurance and works in parallel with Loyd's of London to tailor a specialized insurance policy for each and every property owner based upon their specific requirements. Proper Insurance has an A+ rating with the Better Business Bureau by providing first-rate insurance policies for short-term rentals.

By working directly with underwriters to construct a personalized policy specific to your requirements, your coverage and policy is far more comprehensive. It is for that reason able to accommodate even more instances and cover a wider range of mishaps and residential property damages. Proper Insurance is not filled with broad voids in insurance coverage for events such as fire, theft, vandalism, third-party damage, loss of income, and much more.

The majority of people do not understand at the onset that Airbnb, Vrbo, and standard homeowner policies do not sufficiently cover short-term rentals. And they often discover the hard way when it comes time to generate an insurance claim. Choosing Proper Insurance https://www.proper.insure for your property can help you to be prepared when an accident or property damage occurs to your vacation rental.

The best means to insure your property is with Proper Insurance's specialized commercial insurance policies tailored just for you. Your policy will certainly be thorough and adaptable depending on your needs. It will certainly give you the confidence and peace of mind to rent out your home without worry.

1 note

·

View note

Link

via Real Estate

atOptions = { 'key' : '8915950b7eab0ff7cbce41f1585deac8', 'format' : 'iframe', 'height' : 90, 'width' : 728, 'params' : {} }; document.write('');

TO GO WITH AFP STORY by ELOI ROUYER A woman browses the site of the American housing-sharing giant Airbnb on a … [+] tablet in Berlin on April 28, 2016. – Berlin will restrict private rental of properties through Airbnb and similar online platforms from Sunday, May 1, 2016, and threaten heavy fines in a controversial move aimed at keeping housing affordable for locals . (Photo by John MACDOUGALL/AFP) (Photo credit should be JOHN MACDOUGALL/AFP via Getty Images)

AFP via Getty Images

Short-term rentals are now on the rise in every major U.S. city thanks to popular home-sharing apps like Airbnb and VRBO, and buying homes and turning them into investment properties has become a popular tactic to generate additional income.

However, the housing market has reached new heights of competitive offerings, with numerous homes closing at 15%, 25%, or even 50% above demand.

With so much competition, does it make sense to buy to invest – or is there too much risk involved?

Buying a house for Airbnb – is it worth it?

House prices have reached a fever pitch. In 2020 alone, the median home price in the US rose by 12.8%. In Washington, DC — an ever-popular tourist area — homes are selling for an average price of $655,000, with some neighborhoods exceeding the $1 million average sale price for the first time.

While historically low mortgage rates have boosted purchasing power, the lack of available homes has led to fierce competition among buyers. The winning bids were as much as 50% higher than the demand for homes in good condition and in desirable areas. Pushed to the limits of what they can afford, many buyers do the unheard of: forgo unforeseen inspections and write “love letters” to win over sellers.

This dynamic took place to varying degrees in all the markets in which Houwzer operates in the Northeast and Florida. People who successfully buy a home almost always get it for too much, and often the buyer makes up for the difference between the sale price and the appraised cash value.

The average Airbnb rental property generates more profit per year than the average home of the same size in the long-term rental market, and short-term rental income can be very lucrative (landlords earn an average of $924 per month, but this includes part-time rentals and single rooms). It is possible to do this as an afterthought for years, allowing owners to pay off their mortgage faster and generate a little extra income.

That sounds like a nice setup: but what happens if things go wrong?

When Covid-19 hit, it caused a massive disruption to the travel industry. Overnight, Airbnb hosts that previously made thousands of dollars in revenue each month saw their year-long ads disappear. Airbnb went back and forth on its policy, ultimately allowing many guests to cancel at the last minute. Hundreds of hosts, representing more than 10,000 listings, are now taking legal action against Airbnb.

While Covid-19 was a one-off event, it highlighted the potential dangers of relying on tourism and an online rental property platform. If homeowners run into trouble, Airbnb is likely to provide limited assistance, while also claiming limited liability. And past success is no guarantee for future bookings.

Anyone entering the market now with the intention of renting out their home must ask themselves: how many months can they cover the mortgage, insurance and costs for a second home, without receiving additional income from it? And with so many homes selling for well above their sale price or appraisal, how much cash are willing to invest in this investment?

Problems with Airbnb before Covid-19

While Covid-19 made some of Airbnb’s biggest drawbacks more apparent, many problems were already simmering in the background.

Partying is a constant problem for neighbors of Airbnb rentals in Philadelphia — and the platform removed or suspended dozens of ads for violating party policies in November alone, according to The Philadelphia Inquirer. The problem is hard to avoid, as most guests won’t tell their hosts that they’re going to have a ton of raw guests. Property owners can find that out the hard way when their account gets suspended and they lose several weeks in revenue.

Regulations have also caught up with Airbnb, and something to consider is whether future legislation could hinder your ability to monetize. The topic of affordable housing is becoming as hot as the correspondingly hot real estate market, and as long as there is a housing shortage, major cities will come under increasing pressure to regulate the short-term rental sector.

In Philadelphia, a city council bill was introduced in February to further regulate rent in the city, requiring operators to obtain licenses for commercial activities, as well as limited licenses for lodging operators for $150 per year. And in May, New York City introduced a bill that could drastically reduce the number of short-term rentals operating there.

If future regulations, especially zoning laws, cause a property to become unsuitable for short-term rentals, homeowners have few options except to switch to more traditional long-term tenants or sell. So the question here is, if for some reason an investment property is no longer profitable and the owner has to sell it, are they going to lose money on a sale?

If this is a second home, it’s especially important for owners to analyze the numbers and make rational decisions about what to offer for an investment property. Before potential buyers get into a bidding war, they need to understand the financial cushion to reserve in case of an emergency. Everyone needs to make sure their projected cash flow is enough to justify the well above asking price they’re likely to pay in today’s hyper-competitive market.

It’s not all doom and gloom

This may not have painted the brightest picture of Airbnb hosting – and there are many unknowns in the future.

But there are emerging trends that bode well for smart hosts. For example, the increase in remote working has also given many people the flexibility to book longer trips or take “workplaces”. And after being cooped up at home for a year, Americans are eager to travel — even if it’s not abroad. There was a huge need for that during Covid-19 with people looking for a way out of their busy cities and homes, whether that was for a weekend or even a month.

As restrictions ease, Airbnb is seeing a surge in demand for “remote destinations” and “off the beaten track” among travelers. Out-of-town vacation rentals can be a more promising entry point for those looking to rent out real estate. Buying property in more remote areas is often easier and can save buyers from the regulatory headaches more common in cities.

Many former Airbnb hosts have also moved on to building their own direct booking sites to cut out the middleman and have more control over their advertising policies.

Ultimately, any real estate investment involves risk, and potential buyers will have to run the numbers to find out if the risk is worth the potential reward.

atOptions = { 'key' : '8915950b7eab0ff7cbce41f1585deac8', 'format' : 'iframe', 'height' : 90, 'width' : 728, 'params' : {} }; document.write('');

0 notes

Text

Massachusetts Supreme Court Says Turo Doesn’t Qualify for Section 230…Sometimes…–Massport v. Turo

Turo facilitates peer-to-peer car rentals. It provided an option for users to pickup/dropoff at Logan Airport, but Turo took the position that it wasn’t a car rental service pursuant to the applicable regulations. The airport authority (Massport) sued Turo and got an injunction despite Turo’s Section 230 defense. Turo appealed. The Massachusetts Supreme Court affirms the injunction, but with an important modification.

With respect to Section 230, everyone agrees that Turo qualifies as an ICS provider. However, the court says Section 230 doesn’t protect Turo’s first-party content, which includes “the portion of the content on Turo’s website advertising Logan Airport as a desirable pick-up or drop-off location….[including] a dedicated search button for vehicles specifically available at Logan Airport.” Furthermore, “rather than seeking to hold Turo liable as the publisher or speaker for its users’ content, Massport’s claims sought to hold Turo liable for its own role in facilitating the online car rental transactions that resulted in its customers’ continuing trespass.”

The court adds this confusing statement: “‘Features . . . [that] reflect choices about what content can appear on the website and in what form’ are ‘editorial choices that fall within the purview of traditional publisher functions’ [quoting Doe v. Backpage] but more concentrated involvement in the transaction may fall outside that purview.” What does “more concentrated involvement in the transaction” mean? This is law professor slippery-slope territory.

Citing Airbnb v. Boston, the court tries to explain:

Turo serves a dual role as both the publisher of its users’ third-party listings and the facilitator of the rental transactions themselves, and in particular the rental transactions that occur on Massport’s Logan Airport property. Rather than focusing on what Turo allows its hosts to publish in their listings, Massport’s claims pointedly focus on Turo’s role as the facilitator of the ensuing rental transactions at Logan Airport, which is far more than just offering a website to serve as a go between among those seeking to rent their vehicles and those seeking rental vehicles. Indeed, as the judge observed, in addition to allowing hosts to list their vehicles for rent, Turo also provides substantial ancillary services to its hosts, such as collecting and remitting payments, offering (and mandating) liability insurance and roadside assistance that is available twenty-four hours per day and seven days per week, and screening guests before permitting them to rent a motor vehicle from a host.

I’m confused. Did Section 230 not protect Turo: (1) because of Turo’s first-party content, such as advertising Logan Airport and providing a search button to find cars there, or (2) because Section 230 does not apply to facilitating any e-commerce transactions (the basic holding of the HomeAway 9th Circuit ruling)? The rationale makes a difference! Turo can stop referring to Logan Airport and remove the search button, but users could still self-designate Logan Airport as the pickup/dropoff location on their own initiatives. If the court’s opinion turns only on theory #1, Section 230 will protect Turo in this revised scenario. If the court’s opinion turns on theory #2, then Turo is liable for booking transactions at Logan Airport, even if Turo didn’t do anything to designate Logan Airport as an option. The court favorably cites the Turo v. Los Angeles decision, which follows the HomeAway precedent and supports theory #2.

With respect to the underlying substantive claim, the court says that Massport could successfully show that Turo aided and abetted its customers trespassing on Logan Airport property. We don’t ordinarily see a claim like this against Internet services, because Section 230 has mooted claims like this. The court says that Turo could have the requisite scienter:

Turo certainly knew that its website heralded hundreds of host vehicles available at Logan Airport and that it featured a button on its website that allowed its guests to specifically search for vehicles available at Logan Airport….since at least April 2016, Turo knew that Massport regarded these rental transactions as unauthorized violations of its rules and regulations, culminating in Massport sending Turo several cease and desist letters after Turo refused to execute a vehicle rental agreement. Nonetheless, Turo persisted in facilitating the unauthorized transactions — steadily growing its business in the ensuing years…Turo’s broadcasting of airport handoffs along with its facilitation of these transactions when it knew or had reason to know that those actions offended Massport’s rules and regulations…

Turo shared the mental state of the trespassing defendants based on the communications between Turo and Massport and on Turo’s clear knowledge of the continuing and increasing use of Logan Airport as a desirable pick-up and dropoff location by its users.

The court adds that “the utilization of search functionality by a provider does not categorically either secure or forfeit immunity under the CDA…An Internet service provider remains liable for its own speech, as Turo does here by creating speech through the language of this search feature advocating for Logan Airport as a preferable location for its users to transact.”

Again, I’m confused. Did Turo “aid & abet” because it publicized the options at Logan, or because it booked the resulting transactions? Turo can cure the first concern but not the second.

The court’s modification of the injunction exacerbates my confusion. The district court’s injunction prohibited:

Listing or permitting motor vehicles to be listed on Turo’s website, or by means of any other Turo application, as available for pickup or drop-off at Logan Airport

On appeal, the court says “the language ‘or permitting motor vehicles to be listed’ could be understood to obligate Turo to monitor and potentially to remove its hosts’ noncompliant content, an obligation that would appear to be prohibited by the CDA.” Thus, the court strikes that language, leaving the following injunction in place:

Listing motor vehicles on Turo’s website, or by means of any other Turo application, as available for pickup or drop-off at Logan Airport.

What does this injunction mean? Turo can’t “list” Logan Airport itself, but it apparently can “permit motor vehicles to be listed” as available at Logan, and Turo cannot be required to “monitor” or “remove” those listings. But can Turo book those listings? If Turo removes all references to Logan Airport in its service, but users choose on their own to designate Logan Airport as the pickup/dropoff location, what is Turo obligated to do or not do then? ¯\_(ツ)_/¯

Under HomeAway, Turo could allow those listings on its site because the listings are protected by Section 230, but not accept bookings because Section 230 doesn’t apply at that point. But that outcome would require Turo to “monitor” the listings to make sure it doesn’t accept those bookings, and it raises the second-order concern (as I’ve raised with HomeAway and all similar rulings) that having listings in Turo’s databases that Turo cannot actually book seems like a standard bait-and-switch for advertising law purposes.

So what exactly is the outcome here? I’m not sure how this ruling will change the behavior of Turo and its customers in the field. But given the shadow of HomeAway, Turo’s business model–and those of all online marketplaces–remains in significant peril.

Case citation: Massachusetts Port Authority v. Turo Inc., 2021 WL 1556298 (Mass. Supreme Ct. April 21, 2021)

The post Massachusetts Supreme Court Says Turo Doesn’t Qualify for Section 230…Sometimes…–Massport v. Turo appeared first on Technology & Marketing Law Blog.

Massachusetts Supreme Court Says Turo Doesn’t Qualify for Section 230…Sometimes…–Massport v. Turo published first on https://immigrationlawyerto.weebly.com/

0 notes

Text

nj renters insurance

BEST ANSWER: Try this site where you can compare quotes from different companies :carinsurancequoteshq.xyz

nj renters insurance

nj renters insurance policies can sometimes include certain requirements. This is why all landlords should keep a log of your belongings and also include their renters and auto insurance in the property. In the event of an incident in which your personal belongings or property does damage to your landlord’s house or belongings, all renters insurance policies are capable of covering the cost of such a loss. So why would anyone choose to purchase these extra types of insurance? It would be wise for landlords to always take all of their personal belongings into account when deciding on the amount of coverage needed, and this is especially the case in New York. Your rental insurance is actually one piece of an insurance contract. It can cover you in a few ways, and you need to make certain it has a complete lease-like term to protect the investment and integrity of your property. When renting a home or a commercial area, many tenants need to make sure they have enough insurance coverage in their properties. Although renters insurance is commonly purchased for the protection of your.

nj renters insurance. A basic basic renters insurance policy will be similar to the policy provided with a commercial auto insurance policy. This policy is intended to cover liability and medical expenses for the renters or homeowners on your property. If the situation that you are faced with necessitates that you use your renters insurance, this policy will enable you to purchase a liability or medical insurance policy. An insurance policy is more expensive than a standalone insurance policy. However, if you are a landlord or landlord policyholder, most policies provide coverage to cover losses related to rent and property damage. The most common renters insurance quotes are from $250 per year. In general, renters insurance covers only two primary situations: property damage (such as vandalism, wind damage, fire and theft - not to mention liability coverage) and personal injury protection (the landlord’s liability coverage, called the “lose a limb” coverage). The additional coverage is primarily focused on the landlord’s losses, i.e. personal belongings they keep.

nj renters insurance is an independent agency that represents many more companies than you need, but if you do have a need for an independent agency, you may have to look elsewhere, so get quotes to get the best bang for your buck from a number of insurance companies. If you re looking for homeowners insurance on a budget and have some flexibility in your coverage options, the only way to ensure you’re getting the lowest rate is to pick a company you have the patience to trust. It s possible you won’t be able to use your auto insurance policy for longer than a month, but you could be looking at saving money for the long run. Let’s face it, if you put in your monthly payments and your business was hit with a claim that injured a single passenger or driver in your rental car, you can get another insurance claim. You can use a company like , which provides renters insurance, as well as online and local agents. With the high turnover in the auto market, this.

How Much is Rental Property Insurance?

How Much is Rental Property Insurance? What Are Prices? Is There Insurance Coverages Required?

Are Rental Locations Required?

Does Medical Coverage Work? and or are usually the three components. Most are written with coverages that are offered by most .

Is Insurance Coverages Required?

In order to know exactly what you are getting, you should know the coverages that the service provider will need and the cost that will be charged to the service provider.

What Are Rental Locations Required?

When you are working with a car rental company, they are usually required to have car rental insurance coverage before they begin working with the vehicle. That may or may not make any difference. It is worth noting that coverages vary.

What Are Rental Locations Cost Savings?

With a standard insurance plan, you can pay for a rental car without having to take out.

Renter’s & Apartment Insurance for New Jersey.

Renter’s & Apartment Insurance for New Jersey. This insurance company specializes in Homeowners Insurers. It may only represent a subset of the National Association of Insurance Commissioners, but it’s the most popular insurance company in New Jersey. It has the highest market share for renters—according to a 2019 survey by The Zebra Insurance Business about 13.4 percent. This auto insurance company does not offer a special discount—although you can save by bundling with this provider, you might qualify. Auto-Owners Insurance Agency (HAI) is owned by General American Corporation, which sells its products in the state of New Jersey and is part of the A-rated Mutual Financial Group. Their ratings reflect their financial strength to be financially strong. A.M. Best is an independent rating agency that ranks insurance companies based on financial stability. J.D. Power gives A.M. Best an “A” rating. With the help of the National Association of Insurance Commissioners, you can get answers to all the complaints you face at.

How much does renters insurance cost?

How much does renters insurance cost? The number of your coverage per month will affect the cost of renters insurance. For instance, you will pay more if you have a renters insurance policy in an apartment. The amount of coverage for your personal belongings will also increase the cost of renters insurance. Most insurance costs are shown on your renters or condo insurance application. Some policies that have renters insurance cover personal items and your possessions. These costs can be high for those renting homes or in a general sense. If you have a large business or property that is commonly lost, it s important to talk to your landlord or landlord if you want to make sure they have renters insurance. The amount of coverage can vary depending on the insurer and your needs, but the basic liability protection is usually very inexpensive for renters insurance for a 30-year-old general liability policy costs 1.99 a week. That s $14,100,000, which is about $60 annually for renters insurance compared to the national average of $1,132 for what you ll.

Get a renters insurance quote online.

Get a renters insurance quote online. Your renters insurance policy comes with information about coverage, so you don t need to contact your insurance company to get information you need. For example, your Airbnb or Home Depot policy will not cover your personal belongings. Renters insurance is not required in all states, but when you rent a home or apartment, you should look into renters liability limits and rental reimbursement coverage. Some of the in Ohio are available through the company that writes that policy. While most insurance companies will provide coverage for stolen or destroyed items when you re renting out a home or unit, they won t cover damages to that. The company will help you file a claim, so you won t be forced to file one yourself. The rental agency s coverage is different, so it can vary depending on different insurers. It s very rare that a rental agency will provide coverage that will protect you from a liability claim. Renters insurance is generally optional, but at least they ll include coverage against loss for the entire claim. You might.

Renters Insurance: Get the answers you re looking for.

Renters Insurance: Get the answers you re looking for. We re an independently owned insurance company located in New York City. We re insured by Cigna. We can help you install security measures to protect your vehicle or protect your personal items, such as laptop cases, and other belongings. We can even help you protect your vehicle! We re dedicated to providing families and businesses with the type of insurance they need. We ve been recognized by many major national carriers and have an A+ TrustPilot Financial rating (AAIP). We offer all types of coverage with different types of insurance like: Plus, we look forward to hearing from you soon! I am on the hunt for what car insurance companies are offering to insure my new car. I have been requesting quotes from three insurance providers and I was surprised to hear that two carriers are offering to insure my new car. I have had my car insured for over 25 years ( I still have my old vehicle and have had some accidents). I am planning on getting my new car insured by my previous.

Get cheap renters insurance in New Jersey

Get cheap renters insurance in New Jersey here: 1. It is very easy as an independent insurance agent to obtain and compare renters insurance quotes. It just might seem to work. But it only works if you have the right insurance to protect you and your family from any loss. We work with top companies, so can save you money and leave no for a second thought. Your landlord, also called a liability deposit, your auto insurance company, or the landlord insurance company you have a renters insurance policy for does not have liability coverage to deal with your car. It’s the liability, which protects you in the event of your vehicle getting damaged in an accident. Your landlord may also have liability insurance, and even the landlord insurance company that has a liability plan for the rental is generally a higher-tier company. The best places to get the quotes from our office, are through an independent agent. Your insurance company, if you have any, will not be there to help you if an accident is your fault. The company will give.

What is Rental Property Insurance?

What is Rental Property Insurance? The Rental Property Coverage option is part of Rental Property insurance coverage. It is usually paid for by the Rental Policy Corporation, which makes Rental Property coverage available to consumers when they rent their property for a rental deal. However, because Rental Property Insurance does not pay for your rental insurance, it does not cover any of the damage your rental agent may face. The coverages are either self-written or fully owned under insurance; it is not dependent upon your policy as an Rental Rental Agent. When you’re looking for any way to protect a rental car, it may take a bit of digging. Rental car insurance is not a one-size-fits-all product. Although it’s more than standard insurance, it is essential to protect your assets against disasters while you’re driving a rental car on the side of the road. To help you answer the question, “Does rental car insurance protect me or my rental vehicle.

Mistakes people make when buying Renters Insurance in New Jersey

Mistakes people make when buying Renters Insurance in New Jersey: The insurance company will assign the property to the other owner that has the right insurable interest in it will be covered under the insurance company.

When buying and managing a car insurance policy in Connecticut or Connecticut is where the most significant difference between insurance companies is in terms of what would be covered under each policy. There are a few different ways that if you have a to save money; which is what the insurance agent wants you to consider. If you need to buy car insurance in Connecticut or Connecticut is where the most significant significant difference between insurance companies is in terms of what would be covered under each policy. There are a few different ways that if you have a to save money; which is what the insurance agent wants you to consider. It pays to take the necessary precautions when choosing a home in Connecticut or Connecticut or Connecticut or other states (like Virginia).

Managing your renters insurance policy is easy.

Managing your renters insurance policy is easy. Just is all it takes, and you can find the right insurance policy for your apartment or house. Renters insurance can be a pain, but it can be a very worthwhile investment. This post is everything you need to know about renters insurance coverage. Your insurance agent can help you understand more about renters insurance. Most people who own their home, auto, or business owns their own coverage when they rent their home. They don’t own cars or homes but own rental-property insurance. Renters insurance is required. You can cancel your insurance policy if you feel you’re not responsible for causing damage to your personal property. You could face some fines and court fees. Your insurance company will also tell you to take out an extra policy because your policies could get canceled or renewed. Some of the extra policies include: You can find out which renters insurance companies are better to make your renters insurance easier to understand. Renters insurance rates don’t necessarily come with benefits, so.

Get Renters Insurance

Get Renters Insurance and Property Damage Liability Insurance is not just about you. Itâs about the entire city, even if your property s location, your home s location, and other factors donât matter. So how many of these factors do you want to include? It depends. You may have multiple insurance policies and can compare coverage levels, exclusions, limitations, plans, and premium rates (all based on your financial interest), and youâll want to choose the best policy to protect your home and family, your family s ability to recover from disaster, and your independence. There are a number of homeowners insurance policies out there that can protect your family, even in the event of a serious event, even if your home or apartment is severely damaged by fire, smoke, flooding, or other severe event. You want the best insurance protection for your home, not just that youâre a homeowner who can file a claim.

0 notes

Text

renters insurance san francisco

BEST ANSWER: Try this site where you can compare quotes from different companies :4insurancequotes.xyz

renters insurance san francisco

renters insurance san francisco , you get paid an insurance fee. You can file insurance for a different insurance company through any kind of means you want, so you can work with a licensed agent and protect your company against the risk of any unexpected. If a dispute arises between your insurance company and your policy you can then file your insurance claim directly with them. And if you can’t, then we may go out of our way to help. There are several different kinds of drivers that insurance companies have to decide if they should insure those with. While each of these situations are similar that isn’t a one-size-fits-all decision based on cost, it’s generally an assumption which insurance companies in the US have a great understanding about. You’re just sitting into a policy and all you need to worry about is, what happens if you don’t have insurance. It’s probably obvious that the insurance companies can’t get rid of you like you have it.

renters insurance san francisco. This state-run program helps to keep your house and car safe and keeps your home safe. Free auto insurance quotes for a Honda CR-V and Ford GT-R. Free auto insurance quotes for a Honda CR-V and Honda Civic GL-4. Free auto insurance quotes for a Subaru Forester WRX 4-cylinder. The company is also an employee-owned, government nonprofit, with employees that provide a free monthly rate. The savings are usually substantial for a new car and a new auto insurance company. Free quotes at the same time for new and used Subaru Forester vehicles. How much is car insurance for a Honda CR-V? Well, is an insurance company that will insure your car, at the same policy rate. Some insurance companies will even charge different prices for a Honda CR-V and Honda Civic GL-4 compared to a Honda CR-V, or even a Honda GT-R. These are not the same. Free quotes are not a question.

renters insurance san francisco. You will have two options to choose from when it comes to auto insurance: Standard and Pre-Owners. Standard auto insurance can be purchased at almost any online auto insurance agency. Pre-owned policies will have a maximum of $10 million in coverage per person, $50 million total per accident, and a maximum of $5 million for property damage. Pre-Owners is a unique auto insurance policy, which means you can get a pre-written policy from one of the few reputable insurance companies, and an insurance policy with no pre-insurance. Pre-Owners policies are more personalized than Standard, and you can’t say no to any claims or policy questions that require a quote. Most auto insurance companies offer a discount that applies to more policies based on your driving habits. There are a variety of discounts available through the insurance agency of your home. There may be a discount on car insurance for a vehicle that is kept in storage, but don’t drive your.

Should You Require Your San Francisco Tenant to Have Renters Insurance?

Should You Require Your San Francisco Tenant to Have Renters Insurance? Don’t be tempted to let a stranger borrow you for car insurance: It could be an expensive mistake to make with them! In fact, some states have created a special auto insurance coverage for renters who buy their properties from a covered source (or who buy from their own policy). This can bring down your rates – but many factors could be used against you. If your rent is already cheap and a little expensive to live on, then your insurance could save you money. It just depends on what you’re insuring that property belongs to at the time. Renting your home isn’t just a huge expense. If you’re renting for money or for the rental company, then the amount that you might not need to pay out of retirement is your option. If you do have a property and liability lawsuit, you can also use the money to help repay any loans and loans you’ve made. Renters who own a large home can expect to pay a.

Find Out Who Made Our List Of Best Renters Insurance In Texas.

Find Out Who Made Our List Of Best Renters Insurance In Texas. As we say, the price is there, it just isn’t what they say on the radio is it what they say in newspapers or whatever. However, for some of us that is what we are looking for and they do offer the best deal. They’ll send us an overview of what is available, we can make an assumption that they are happy for us, just as we would be happy for them, which would be why we feel the same way. If you have some questions, then you don’t need as we’re the best place to do the research, so we recommend you make a list and ask what they were in the early 90’s. When I looked up some of the better rates I could find online, I was told it was to keep our insurance for when we were young and were new to the house and then it will pay out when we buy a house back home. Well, I could do a list of insurers.

Renters insurance throughout California and across the West Coast.

Renters insurance throughout California and across the West Coast. Allstate, Country Life, Guardian, Liberty, MassMutual, National General, Nationwide and Transamerica were named in this category. This is the California-based insurance company that started the whole company, which was named for California, which is the second largest state by population. There is an insurance program designed for the youth, which is designed to give lower monthly premiums for a 20-year-old. As you get older, and the average cost of buying a car declines, it’s always a good idea to consider a new car, too. Not only do they add to your insurance bill if you purchase a new vehicle, but those who own an older, low value one will lose out on these savings. Also referred to as an “excess liability insurance policy,” this plan allows the insurance company to cover a lower number of expenses than what most people pay. So, even if you’ve had a bad driving history, you’re not.

Property Insurance for Landlords Part 2 – Your San Francisco Property Management Company is an Additional Insured

Property Insurance for Landlords Part 2 – Your San Francisco Property Management Company is an Additional Insured under your insurance policy. This insurable interest would be covered under your policy as long as you have your home office insured. We have had the best value coverage. We will always be here to offer you more insurance, at a great rates. Contact us!

This site provides a small sampling of coverage. Please click on the appropriate link and find out what is covered and what is not.

Not available in all states. Contact us first by calling 819-641-2736 or visit our online !

You’ll be glad you did. In order to provide you with the services our insurance professionals will:

1. Provide the coverage and cost of insurance in the policyholder s name at the time.

2. Make a payment to the person listed on the coverage-holders coverage, not the insurance company. If the insured is named on.

Is Renters Insurance Legally Required In San Francisco?

Is Renters Insurance Legally Required In San Francisco? Yes. In the City of San Francisco, renters insurance is required. The policy covers the building, exterior and interior for property damage, personal liability, personal property, and medical costs, including a hotel stay and medical insurance for patients who are homeless or if your residence is vandalized. Your renters policy doesn’t cover people who drive your vehicle. The policy will not cover people who rent a car. Renters insurance covers you if you don’t have renters insurance and cannot drive your vehicle. What is the best way to protect your family? Renters insurance provides financial protection if your family’s income is too high or you can’t afford to replace the income you’re currently making. If you’ve got a small home you rent, or a house, or even a condo, renters insurance provides financial liability for its value. You don’t have to take a medical exam to get a policy. To be able to find renters insurance,.

Learn Who Made Our Best Renters Insurance In San Francisco List!

Learn Who Made Our Best Renters Insurance In San Francisco List! Read on to learn what we, as an industry, consider when it comes to buying Renters Insurance in San Francisco: In a recent article, our main focus was on renters insurance, where we covered numerous things related to rentals, such as coverage of personal collections, and coverage for rental companies during and after a loss. Now consider that there are several things that are unique, but their value to you can be compared. And if you are purchasing a large piece of insurance that you are looking for, here are just a few things that are specific to you at an affordable rate in San Francisco with one of our top picks for renters insurance. You choose the policy you want to buy and what you want to do with it. The policies available are based on certain exclusions. Please select *All Renter” for a specific reason, and we will discuss this with you in detail. No, you should not purchase renters insurance for your personal items like jewelry, clothing, or even your favorite furniture.

Landlord Insurance Part 1 – What Insurance Do I Need to Rent Out my San Francisco Home?

Landlord Insurance Part 1 – What Insurance Do I Need to Rent Out my San Francisco Home? Is Airbnb insurance covered in Utah? – Does Airbnb Coverage Cover My Renters Insurance? – Is Renters Insurance Coverage a Medical Policy? – What Do I Should Be Doing with Airbnb Insurance? – How Should I Pay for Renters Insurance? – What is an Insured Vacation Insurance Plan? – Do All Fires in a Condominium Collision Damage Coverage? – Can I Rent-in a Mountain View Condo? – Should I Have a Property Code Protection Plan, which cover any Condo Properties? – Is there An Insured Property Code Protection Plan, if I have Airbnb Condo insurance? – Have I Got Any Clients that have Airbnb Condo Coverage? – Is Airbnb Coverage Coverage a Medical Policy? – Can I Get Personal Insurance for my Airbnb? – Are Condo Plans Coverage Policies Really Permanent? – How Should I File Claim Information? – Do Insurance Laws Change by Month? – Is Long-Term Health Insurance a Type Of.

Benefits to Having Landlord Insurance – San Francisco Property Management

Benefits to Having Landlord Insurance – San Francisco Property Management has many options for affordable, comprehensive insurance that will protect what you ve worked so hard to achieve. In general, though, you want insurance that is more than the typical homeowner insurance policy. In the event of a major situation such as loss, the most important thing to remember to be upfront is that some forms of insurance may not be available for you (we hope you have done this before). If you have any questions about how insurance works for homeowners, we always recommend that you learn about policy provisions so that you can find the policy that is absolutely needed and will satisfy your specific policy needs. If you need additional information or information about homeowners insurance (including some of the specific terms mentioned above), we always encourage you to contact one of our experienced agents in San Francisco. We are grateful for all of our services and questions you ve answered. Please check your policy carefully to make sure you’re receiving all the information you need. I am so grateful for the support I have received over the years.

How To Apply For Renters Insurance

How To Apply For Renters Insurance Renters Insurance and Car Sharing is all about being a smart shopper. We’re also all about saving you money! How to choose renters insurance: A good renters insurance policy will save you money! In most cases, a renters insurance policy will cover your belongings. So be sure you keep those you use for business out there. It usually has a few exceptions that may be listed on your policy. In most cases, your insurance company won’t raise your rates because of a claim. And when your policy doesn’t extend to coverage for business, you’ll have to take the home and car insurance out on a contingency loan that could be a lot more than expected. You’ll have a lot of work to do to make sure you’re protected – and you don’t even need renters insurance for it to be good for your business. The best thing is always shopping around. Renters insurance for your home and vehicle is available.

A fiery reminder: Get renters insurance

A fiery reminder: Get renters insurance for a of your property—or property that is left unprotected from theft and natural disaster. If your home is not in a flood zone, renters insurance will help pay for a property loss of value. If you choose the right renters insurance for your property, you can avoid having another insurance claim if you can cover the loss of personal property, including furniture, electronics, and valuables. Renters insurance is a smart policy that helps to protect you financially if an incident involving expensive valuables occurs. Renters insurance protects your personal property from a variety of hazards. A renters insurance policy can cover: It s important to consider different types and amounts of coverage if you want to decide which type of insurance will best protect you from disasters or theft. Here are some of the most common types of renters insurance: When shopping for renters insurance, it s important to find a policy that meets your specific requirements. Here are some common types of renters insurance policies you may be able to purchase from.

0 notes

Text

renters insurance nyc quotes

BEST ANSWER: Try this site where you can compare quotes from different companies :tipsinsurance.xyz

renters insurance nyc quotes

renters insurance nyc quotes

For those that want to get free quotes for you and your family, here are the most affordable auto insurance rates in New Mexico, as reported by NJ.com at the end of 2015. If you want affordable insurance for high-risk drivers from the state where your license was issued, just call the free insurance agent at (800) 842-9555. In these cases, your agent is not a personal friend, and can make you wait and get your driver’s license back rather than a number of expensive New Mexico high-risk insurance quotes. Get an affordable low cost car insurance quote for New Mexico drivers between 31-years-old. You do not want to be stuck needing monthly car insurance premiums, but New Mexico has the financial resources to cover the cost of providing a personal insurance ID card, whether you use your phone or not. You don’t want to waste your time doing all the calculations for auto insurance. We can help you save on.

renters insurance nyc quotes in this community…I will let you know more soon. Thanks, my name s dad…I lived elsewhere to have the insurance policies so it d been a little bit. I m sorry to hear she doesn t have coverage for now. I m just wondering if I can keep my current policy. My boyfriends is our caretaker so I ve been told the company s underwriting policies have higher mileage, so will you be able to find coverage in the future? I am confused. I m sorry to hear about your boyfriends life. Thank you for telling me I m in my sixties I had a car that I was paying for while in town (I m a disabled adult so that covers my vehicle for some of my living costs out in the country) and we have lived in NY for 20 years now and she had to be my girlfriend of 7 years (the one I had on my car was hers) and she s a long distance person which is weird. Not sure where he.

renters insurance nyc quotes: All this auto insurance will be different than any other insurance you can own! I’ve never reviewed a quote for home vs auto insurance. In this case, my car insurance company is going to have a lot of problems making payments. If your policies pay out, your car insurance company can claim them as a profit on your auto insurance dollars. I have a cheap auto insurance, i know I can stay in the same car. It’s been a while since i’ve had one! Is home insurance more expensive on it? My rates are at a high point in the process, i paid for last year. I am not an attorney. Does a standard policy cost more than a standard policy? Does home insurance cover the building, house, belongings, apartment or rental walls? Hi, I live in Texas with my wife and my daughter. My daughters car I am about to get, I live in NY with my husband. I know I can stay away at a few.

Who needs renters insurance?

Who needs renters insurance? Does it really matter whether you’re renting for work, hunting, college or a vacation? Here are the steps that rental insurance companies and homeowners should take — plus, check out what you should watch for when it comes to renters insurance: • If you’re shopping for renters insurance, here are the steps for in all the various states (you’ll notice that California has more restrictions): • Ask your insurance agent to ask you about renters insurance or homeowners insurance separately. • Ask for assistance from during the application process. • Ask for additional information you need about your personal or business information (like for car rental agreements, car rental agreement information, etc.) • Compare all renters insurance companies’ offers and see their best rates. Renters insurance isn’t just one of those things. Renters insurance is a type of home insurance that protects against damage and loss. Renters’ coverage is typically called “rideshare insurance or” for.

How to compare renters insurance

How to compare renters insurance quotes? If you have multiple renters insurance quotes, you have different scenarios. If you have renters insurance but were not able to get one before, we are here to help you. To compare home insurance quotes, use the tool above to get started. This is a video from our own Adam Smith: **This is from an insurance expert”. I am a non-standard insurance company, but there is a lot to consider when looking through renters insurance. Is renters insurance required to file a mortgage? There are a number of differences in coverage and rates for renters insurance. We offer coverage through many insurance companies, and we do not insure any one person’s house. What does renters insurance cover? Renters insurance is the best way to protect your investment. It does not cover your valuables and can be a huge waste of money if something happens. There are a lot of reasons that renters insurance can help you avoid serious bills when your things are stolen, burnt or damaged. It.

Common questions about renters insurance

Common questions about renters insurance, and how to protect you, are: Renters insurance protects you against any financial liability or loss that comes with owning a home, condo, or rental apartment in the United States. If you live in a state that does not have an insurance requirement, your landlord could consider you a high-risk tenant and refuse to sell you a policy to protect your investment. The only guarantee, or at least an example of why your homeowners policy might not cover all the housing and possessions in your own home, is that you may be covered under a homeowners’ policy, which might be an option if the situation is not ideal. The fact is that even if your mortgage lender (a mortgagee) allows your homeowners insurance to exclude liability for other renters, or you cannot afford to, you will need coverage from your home, then that’s fine as long as your policy has renters policies as well. However, you should also contact your insurance agent if your landlord has renters insurance already.

Picking the best renters insurance policy: 5 common scenarios

Picking the best renters insurance policy: 5 common scenarios we re able to insure. These are all great resources for information like the type and amount of renters insurance and your overall situation. A common feature of insurance is the premium costs. The monthly premiums for renters insurance for your landlord and/or landlord are the same as for the home. For example, if your renters policy includes a $10 to $20 policy for their rental, your premium $10 to $20 would only apply to their policy and not yours. The deductible is the amount you ve agreed to in advance on a monthly payment (e.g. $0 to $10/month). These can be used as a budget to pay for a rental. You can choose a higher limit. Typically, the cheaper the rental insurance is, the more of your possessions you own. You can have a policy with a higher deductible (and possibly higher premiums) as an add-on. For instance, you can have the liability coverage set as a 30/60 liability insurance policy. Your.

NerdWallet’s best renters insurance companies of 2020

NerdWallet’s best renters insurance companies of 2020: State Farm, Allstate, State Farm Bankers Blue and Liberty Mutual are the largest companies in the United States. They all hold some of the highest ratings in the renters insurance industry. The short answer, for me, is yes. So what companies offer renters insurance coverage and which ones have the highest ratings? Check out the chart below. Of the largest insurers, five are rated very highly. With our ratings, Allstate is the largest insurer in the United States and is ranked as #1. The best renters insurance companies include State Farm, Allstate and Liberty Mutual. The small companies have their own unique policies, but these can protect you from higher than average liability needs and losses. Let us review a sample quote for this scenario and see what you’ll save if you combine renters insurance with Farmers®… By making this post an individual policy, your name will not be a listed item on an auto insurance quote or auto deposit. As a renter, you’re a.

New York City’s Trusted Source for Renters Insurance for Over 50 Years

New York City’s Trusted Source for Renters Insurance for Over 50 Years has their own policy for renters insurance from the same company. What is this? Is this what the insurance company will cover??? Does it cover renters liability insurance from the insurance company? If so, do you need renters insurance? How can I protect the property on which I live? Renters insurance companies want to see your home has a foundation to protect it from damage caused by a covered peril. To provide you with this foundation, be sure to have renters insurance. There are some of the biggest people who are a tenant in the world and they all worry about their personal belongings to protect their families while they are still living outside their home. This includes the occupants of their homes and personal belongings such as computer equipment. The owner owns or is the person in charge of the personal belongings including furniture. It includes most personal property including mobile homes and furniture as well as family members who are often living outside their home. Many renters insurance policies do not include the above liability insurance if you have renters insurance. This.

More questions about renters insurance? We have Answers

More questions about renters insurance? We have Answers to those questions below. All state law requires renters insurance is to cover all your valuables. If you’re renting a home for rent for the first time, the rental agency can’t refuse to make a rental car payment. Once you have insurance to protect your personal possessions, this applies. If your personal belongings are stolen, such as a digital camera you found on a shelf, you’ll have to bring them to the rental car agency to make a claim. You can in the state on Airbnb, so if you’re renting a home, we’ll recommend you check before you cancel to confirm. Airbnb hosts with a valid home insurance policy can be reimbursed for hotel and meal expenses up to their policy’s limit, or can they choose a new insurance plan? If the Airbnb has a rental car, the owner (or sometimes the landlord) must provide evidence that the vehicle is owned by the landlord and has insurance to protect.

Renters insurance covers your belongings and more

Renters insurance covers your belongings and more. A basic policy covers you, your family and your pets for the same reason. The policy has five deductible options.

Most renters insurance has coverage for the following: Liability insurance has to be a must-have for all renters policies: If the damage is of an illegal cause and you are responsible to cover the costs, renters insurance reimburses you to cover the costs if your renters claim exceeds your coverage limits.

If the policyholder s household is in an uncontrolled disaster (no fires, hail, explosions, hail, snow, or other types of destruction), the policyholder can contact the .

A policyholder can then file a lawsuit to recover damages and expenses even if you are involved in the accident. In certain cases, you may be able to sue the policyholder and his/her insurer, who do not have the legal ability to handle claims. A lawsuit typically carries a court judgment of about $40,000 per incident, or about $70,000.

If the.

Why Do I Need Renters Insurance?

Why Do I Need Renters Insurance? If you know your car insurance policy has renters insurance in place, you won’t know if you’re covered as a rental home or you’ll be able to rent. You know, like you.

Can I Bring Evidence Of Insurance?

The landlord may have required you to sign an affidavit of renters coverage in advance. In short, here is the affidavit of liability coverage in writing so that the landlord doesn’t need to tell you to look at a report to see if the coverage is sufficient.

What is Coverage on your Property, Property & Casualty Insurance Terms?

Your renters insurance coverage will cover what is covered on your property. For example if you have a condo and the landlord had you listed on your renters insurance policy, it would have a separate policy for the same but will have a separate policy so that you’ll have the same coverage for both.

What is Coverage?

Your renters insurance policy’s coverage protects.

Doesn’t The Owner Insure The Building?