#credit card processors list

Text

POS Systems in Boise, ID: Streamlining Transactions for Local Businesses

#POS Systems in Boise#ID: Streamlining Transactions for Local Businesses#real estate transaction#software for construction management#investing for beginners#investing in your 20s#succeed in real estate#local credit card processor#local merchant services#local support#business central integration#real estate listing presentation#real estate business#listing presentations#real estate listing#alongar antes ou depois do treino#how to build wealth in your 20s#real estate housing market#win more business#business central

1 note

·

View note

Note

Hey Sam! I have a DAF-related question I think is probably pretty silly, And Yet.

I have several monthly donations set up with Charityvest, and several others set up directly with my credit card that predate the DAF. I'd like to have everything come out of the DAF to simplify my records -- I do itemize them on my taxes, so keeping track is important. But is it really okay to call up these small nonprofits to tell them "hey cancel my donations in your system, I want to make things more complicated for you so it's more convenient for me"??

Not silly at all! Although I doubt you're making it more complicated for them. It basically just means they're getting the money from a third party they don't pay for instead of one they do (the credit card processor that charges your card each month). They deal with changes and cancellations all the time, and if in future your changes and cancellations are going through Charityvest, then that frees up their staff who don't have to deal with that.

When I set up my DAF via Charityvest, I did have several monthly donations I was making. For me, the process was pretty simple -- I went to the donation page, found the "If you'd like to change your monthly donation, contact us" link, and reached out via email.

I had a boilerplate letter that gave my name and the address they should have on file, then said, "I'd like to cancel my recurring monthly donation through your website. I'm moving the donation to be administered by Charityvest; I'll still be giving on a monthly basis, but the gift will come through my DAF." If you have a name for it, tell them "The gifts will be attached to [name of DAF]; please feel free to note this in my record." Then I said thanks for all the work they do, and that as soon as they confirmed the donation was cancelled, I'd put the new donation into process. Got zero pushback, got several nice comments thanking me for being a donor. :) You can modify that into bullet points for a phone call pretty easily.

You do have to keep an eye on them because sometimes the cancellation doesn't go through -- just check your bank around the time the donations normally get made. I had one of the four I was giving to at the time fail to cancel, but when I reached out to ask them to fix it, they cancelled it promptly and offered to refund the donation (I said don't bother, it wasn't a huge donation to start with).

The only downside, to them, is that they no longer list you as a recurring donor on the back end, but that's extremely minor in the grand scheme of things, and anyone looking at your record will see your monthly gifts and that they're coming from a DAF and make the rational assumption that you're just giving monthly through a different vehicle.

Good luck! And thank you for giving :)

41 notes

·

View notes

Text

App Store Chief Says Apple is Aiming to Level the Playing Field for Developers

By Stephen Nellis

July 28, 2008 (Reuters) - Apple Inc Chief Executive Tim Cook will be challenged by U.S. lawmakers on Wednesday about whether Apple's App Store practices result in it having a disproportionate control over independent software developers.

Apple tightly controls the App Store, which is the core of its $46.3 billion annual services business. Apple's commissions vary between 15% and 30% on a lot of App Store orders and its ban on attracting customers for outside sign-ups, as well as the opaque and unpredictable app-vetting procedure have been criticized by developers.

But when the App Store was launched in 2008 with 500 apps, Apple executives saw it as an experiment in offering a compellingly low commission rate to draw developers, Philip W. Schiller is Apple's senior vice president of global marketing and the top executive for the App Store said to Reuters in an interview.

"One of the ideas we have come up with is that we'll treat all apps in the App Store the same way. That's one set of rules for everyone There are no special deals, no specific terms, no special code every rule applies to all developers in the same way. This was not the case with PC software. Nobody thought like that. It was a complete reverse of how the whole system was supposed to function," Schiller stated.

Software sold in physical stores meant that software was required to be purchased for shelf space and prominentness. These costs could account for up to 50 percent of the retail cost. Small developers were unable to get into.

Bajarin stated that the App Store's predecessor was Handango. Handango was a service that allowed developers to offer applications over cellular networks, to the Palms of users in exchange for 40 percent commission.

With the App Store, "Apple took that to an entirely new level. At 30%, they were a better value," Bajarin said.

However, the App Store had rules: Apple reviewed each app and mandated the use of its own billing system. Schiller said Apple executives believed that users would feel more confident buying apps if they felt their personal information regarding payment was safe with Apple.

"We believe our customers privacy should be protected in this manner. Imagine having to input credit cards and payment details to every app you've ever used," he said.

Apple's rules started as an internal list, but were published in 2010.

886LV

Developers have complained to Apple about commissions over the years. Apple has since reduced the areas that developers are allowed to apply. In 2018, it permitted gaming companies, such as Microsoft Corp , maker of Minecraft, to let users login to their accounts so long as the games also included in-app payments from Apple as an option.

"As we spoke with some of the most well-known game developers, such as Minecraft and Minecraft, they told us that they understood the reason why users should be able to buy the subscription directly on their device. But we have a lot of users coming who bought their subscription or their account somewhere else such as an Xbox, on the PC, on the web. This is a huge obstacle to accessing your store,'" Schiller explained. "So we came up with this exception to our own policy."

Schiller said Apple's cut helps to fund a vast system for developers: Thousands of Apple engineers run secure servers to host apps and develop the tools necessary to develop and test the apps.

Marc Fischer, the chief executive of mobile technology firm Dogtown Studios, said Apple's 30% commission felt justified in the beginning of the App Store when it was the cost of global distribution for a then-small company like his. However, now that Alphabet Inc's Google have a "duopoly" on mobile app stores, Fischer said, fees will be much lower - possibly the same as the single-digit charges that payment processors charge.

"As an entrepreneur, you have no choice but to accept that charge," Fischer said.

2 notes

·

View notes

Text

Password Protecting Usb Drives Is A Must Have

Do an individual too many passwords? Towards the gym the same way. Should you write down passwords? Using a no side, if somebody got their hands on the password list, then all security would quickly fade. Across vuze plus , you will have too many passwords bear in mind. I used to maintain web site accounts and passwords within a three-page Ms word document. This included my professional accounts at Constant Contact, Google, and Microsoft, as well as personal accounts at Amazon, PG&E, and Yahoo. Am I relying on memory to remember more than 141 web sites, usernames, and passwords? I don't think so.

Whenever I start my computer I become message: "NO ISDN devices were found. Please install an ISDN device and run the configuration wizard". I neither had ever installed nor wish put in ISDN tracking device. Kindly advise how to achieve freedom from on this message keep clear of clicking "OK" ach a moment.

Dr. Birbals: you must run scandisk first in thorough mode in order to check any problems in cash disk. if for example the scan disk does perform properly in windows, want must run it in DOS form. If there is any problem, then scan disk will report about the situation. Moreover, you must also check the result for any bad sector in cash disk simply because could be one belonging to the reasons rrn your problem. However, if gom player are reported fine by scan disk, the particular needle of suspicion flows to motherboard of the computer. This you is going to get checked from your hardware product owner. Your problem has nothing to use increasing the RAM and thereby increasing it to 128 MB will not actually solve your hassle.

I am having p3 550MHz Intel processor with 810 Vinton motherboard, 20GB HDD, 52xCDD, Motorola 56 KBPS modems with WIN ME as operating pc. Recently I installed win 2000 professional but can't crackerpro able to the driver of modem. I tried installing motorist from initially Motorola CD but got the message "your driver may get clash with win 2000 version because the driver isn't having digital signatures." Please guide me what must do to be able to the driver of the modem.

Password management is a tremendous issue. I've heard of corporations that measure time spent helping employees recover from lost/forgotten account details. As for my company, I was able to more billable work during the past year helping people recover lost and forgotten passwords than I did killing adware and spyware.

spat revolution or purse (in an oversize, heavy duty ziplock freezer bag). Carry at least $100 in small bills, plus have adequate funds on one credit card to choose a ticket home by air, bus, train, or to rent a one-way rental vehicle. Pack $20 importance of quarters for laundromat, snack and drink machines, or phone telephones.

These handful of most useful online resources that hand calculators use to hack or reset a forgotten Windows XP administrator one. It is always recommended to create a recovery CD beforehand make sure if necessity arises you can use it. However, some technical expertise is to perform above mentioned task. An individual need tech support, can easily consult a pc repair home business.

2 notes

·

View notes

Text

How to Order Cigarettes Online

Buying cigarettes online is an option that can save you money. It also offers convenience and a wide selection of products. However, it is important to know the risks and other considerations involved. This article will help you make an informed decision about ordering cigarettes online.

State laws regulating delivery sales include provisions such as "do not ship to" list provisions, purchaser penalties, and carrier penalties. In addition, some states require that the credit card or debit card billing address match the shipping or government identification address.

Cost

Buying cigarettes online is a convenient and affordable way to stock up on your favorite brands. The process is simple: simply select the items you want and click “Add to Cart.” Then, proceed to checkout and pay for your purchase. Once your order has been processed, it will be shipped to your doorstep.

When shopping for cigarettes online, it is important to compare prices and delivery charges to ensure you are getting the best deal. In addition, you should also consider purchasing in bulk to save money.

In some cases, buying cigarettes online can be more discreet than buying them in a store. However, it is still important to verify the legitimacy of the website before entering sensitive information such as credit card details. To protect yourself, always use a secure website that uses SSL encryption technology. Some websites also require two-factor authentication for added security. You should also check whether the website complies with local laws and regulations.

Convenience

Buying cigarettes online can be a convenient way to get your favorite brands without having to leave your home or spend time at the store. You can also save money by buying in bulk and taking advantage of special offers and sales. Just be sure to choose a legitimate retailer that uses secure payment methods and keeps your information private.

Moreover, reputable websites adhere to strict quality standards and provide smokers with a wide variety of domestic and international cigarettes. Hence, they can avoid local price fluctuations caused by taxes and other factors.

When shopping for cigarettes online, you should always compare prices to ensure that you’re getting the best deal. Prices can vary significantly from website to site, and it’s crucial to take into account delivery charges and any additional taxes that may be added during checkout. Also, make sure to select a website that employs a secure payment processor, like PayPal. This will protect your personal and financial information from hackers.

Variety

In order to satisfy the growing demand for cigarettes, online retailers have increased the number of brands and flavors available. Some also offer special promotions for their customers. These incentives may include free shipping, gift cards, and discounts on future order cigarettes online. This variety of options allows consumers to find the best option for their individual needs.

Although the PACT Act made it more difficult for vendors to ship cigarettes to minors, online sales continued. This is due to the fact that many online vendors have weak or nonexistent age verification procedures. This is a problem that must be addressed if e-cigarettes are to remain safe and convenient for underage smokers.

Cigarette and cigar shippers must file tobacco tax returns and remit the associated taxes each quarter through the online Filing and Tax Payment portal. In addition, they must conspicuously label their packages indicating that they contain cigars. For more information, see the online Filing and Tax Payments guide.

Safety

Buying cigarettes online can be a safe option for smokers who want to avoid the rising cost of gas and the difficulty of parking at retail outlets. Many online retailers also offer bulk discounts, which can save shoppers a lot of money. To maximize the savings, it is important to compare prices between different sites and take advantage of coupons and discounts. In addition, it is advisable to subscribe to retailers’ newsletters to receive notifications of sales and discounts.

In addition to price comparison, it is also essential to check whether the website complies with relevant laws and regulations. This will prevent the buy tobacco online products by minors, which can be dangerous and illegal.

Most websites that sell cigarettes offer great customer support. They are available by phone and email 24 hours a day to answer questions or assist with orders. They also use security measures to ensure that your personal information is not stolen.

0 notes

Text

Once again replying to a post that made its way though my queue, this time rage against credit card processors bowing to FOSTA-SESTA and imposing those limitations to sites with worldwide reach and how this is a form of modern American imperialism by imposing Christian theocracy

Which is to rant this anti-sex moralism has permeated to things like ethical investing. Which broadly covers things like no investing in: fossil fuels, alcohol, weapons, tobacco, palm oil, gambling and even GMOs or companies that engage in environmental damage and human rights violations. But also almost always includes at the end of that list 'no adult entertainment'.

Even investment firms based in New Zealand, where sex work is legal, often have that addition to their list of ethical investing guidelines.

And OK, I am not aware of any publicly listed companies in NZ or Belgium (it's a very short list of countries that have decriminalised) that offer adult entertainment but. I would rather invest in legal, non-coercive, non-exploiting adult entertainment, including pornography, than in Visa or Mastercard. Which btw, are often considered ethical investments.

I want my money to fucking talk and make things better for sex workers and smut peddlers not just on an individual level, but a systematic level. I want those adult entertainment companies to be important enough to lean on government and decriminalise sex work, remove stigma relating to sex work and related work, and generally improve sexual freedom.

And yeah, I understand people being squeemish about sex workers and performers being coerced, abused or trafficked into sex work, but apart from decrim making it clearer and easier to report such things (seriously, while ACAB, SWers in NZ are probably more wary of the IRD than police) a lot of those statistics thrown about are straight up lies. Literally, most of the numbers about trafficked women in sex work are made up by Christian lobby groups. There's a whole grift of them to get money for bringing women out of sex work which is really giving them a sermon and not actually finding them a decent paying job or childcare. There is research on this. Also the US State Department of Human Rights has nearly straight up lied about the state of underage and immigrant sex work in NZ in the years after the PRA was passed.

iirc OF has a pretty low rate of coercion/trafficking due to its policies. And like, I'm pretty sure no one is publishing smut on AO3 or Amazon against their will, or indeed horny artists on patreon or Gumtree.

So yeah, I think ethical investment schemes ought to reconsider their stance on pornography and screen and invest in companies that offer decent contracts and rates to their performers etc etc

1 note

·

View note

Text

給朋友們的警告

台灣朋友請直接跳到下面結論

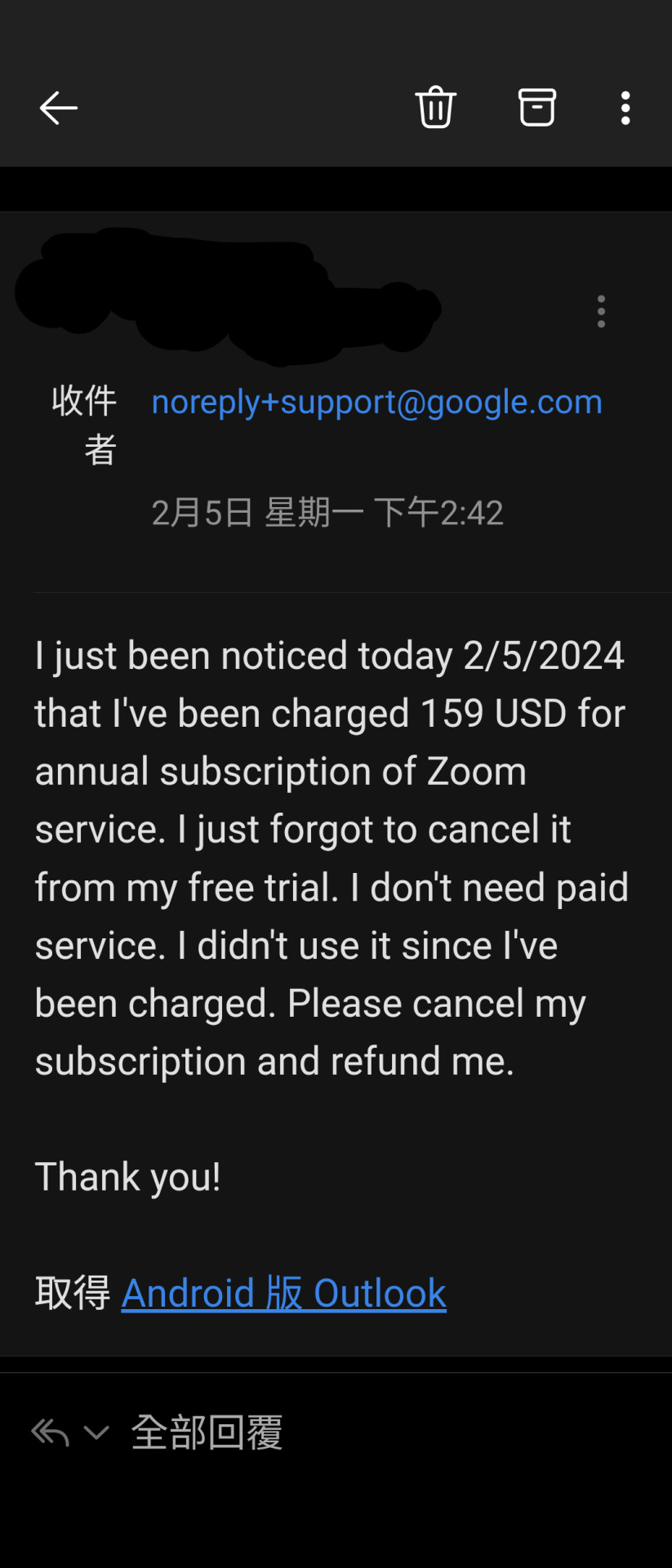

This is an awful experience which I originally don't want to say. But now, since I still tangle in it and see no my money back, I decide to expose this incidence on social media

Can't get refund from accidentally bought Zoom service through Google play and PayPal

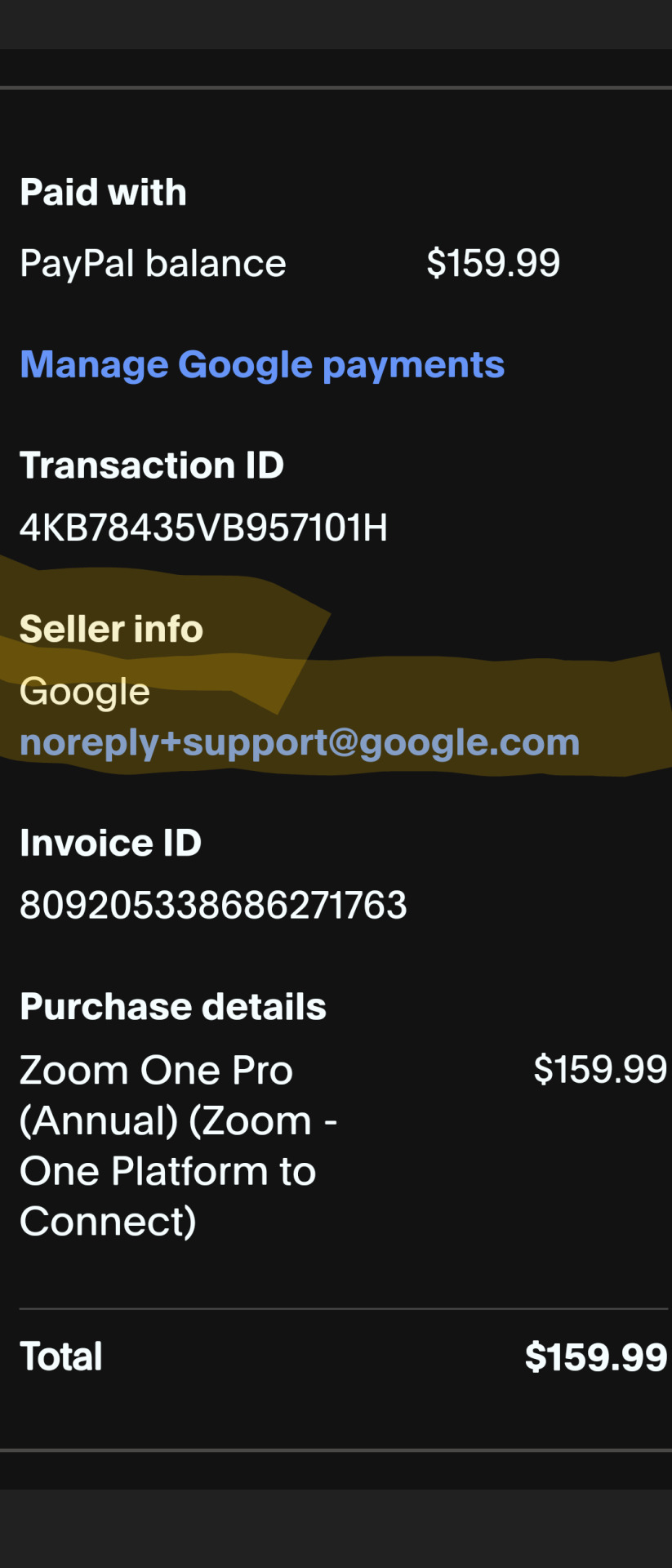

As missed free trial cancel deadline on 2/5, I accidentally subscribed Zoom's annual service by Google play and chose PayPal as payment method.

So, in the beginning, I followed PayPal's "recommended way to contact Seller" to email google play to asking for refund since PayPal listed Google play as "Seller"

But there is NO response in one week!

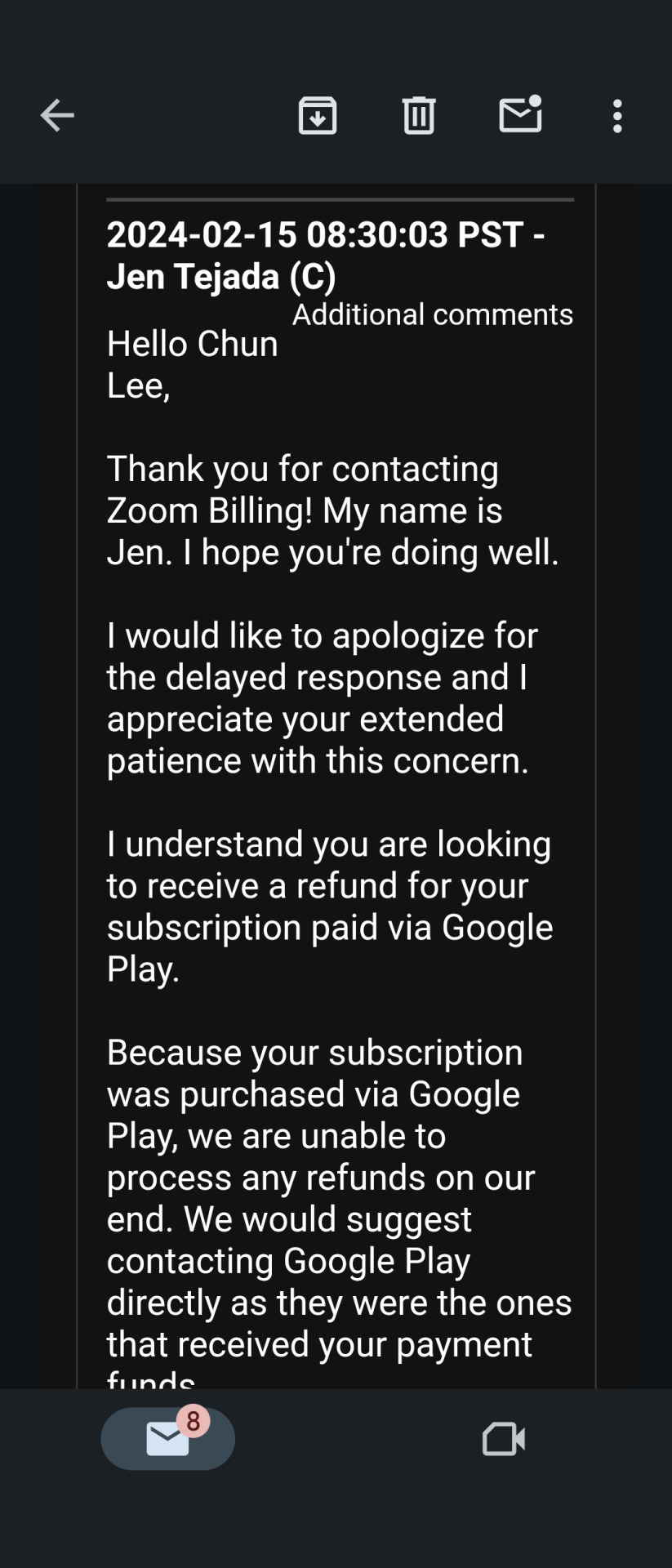

At this time(2/13), I contacted Zoom by phone, they said because I chose payment method other than credit card, they can't refund me directly. Besides ,on 2/15, Zoom gave me an email, it also states I have to request refund from Google Play or PayPal.

After phone call to Zoom, on 2/13, I requested refund from PayPal and Google play by their online form. This time Google replied in one day that because I opened refund request on PayPal side first, they can't do anything and want me to follow up with PayPal. PayPal replied nothing but an in app status update.

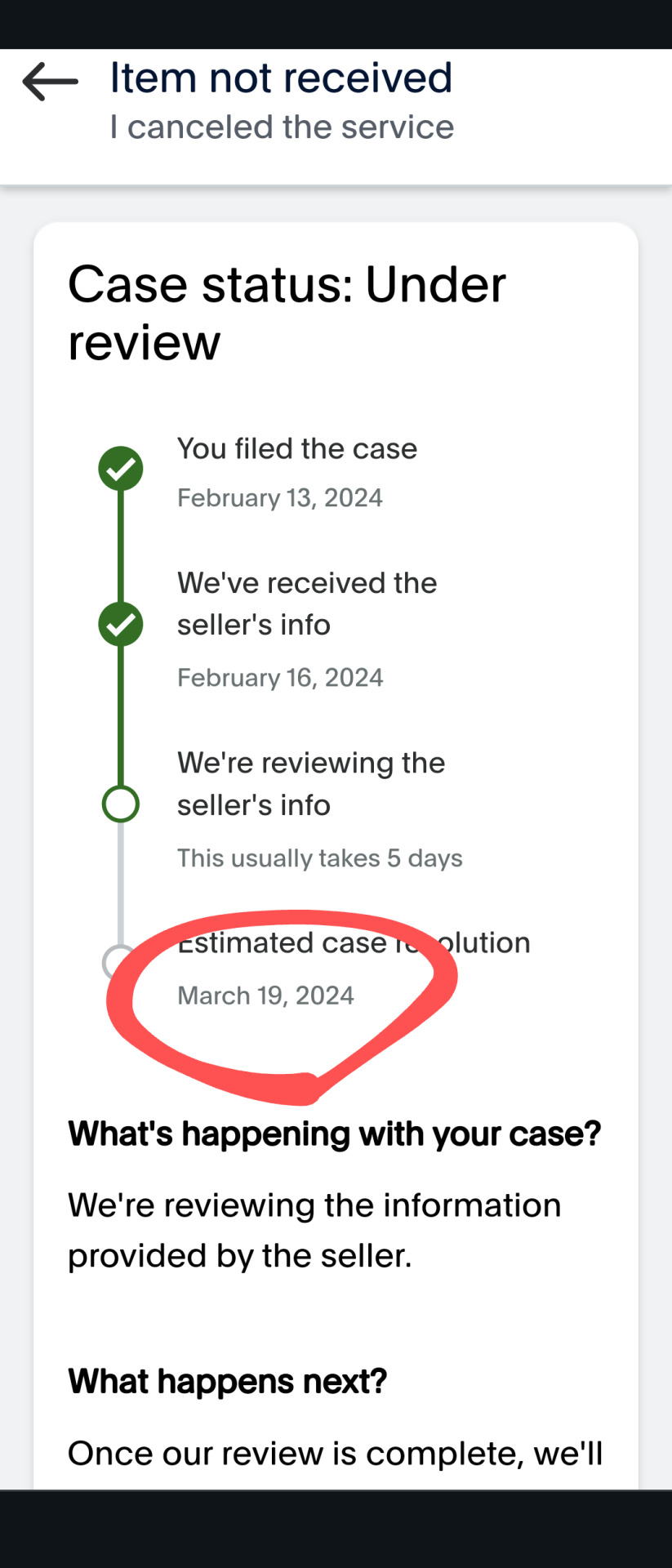

In the app, it shows "it usually takes 5 days" and a "estimate case resolution" on 3/4

However, until 3/5, there is NO any progress in my case and NO any personal contact from PayPal. Furthermore, the resolution date just quietly updated to 3/9.

I decided to call PayPal CS.

The CS Luis just replied that they are "waiting for seller's response" and "this kind case usually takes 5 days to one month to solve". I mentioned that it's just involving virtual service and everything happened online; why it takes so long and no explanation from PayPal at all. Luis just repeated to asking me waiting and stated he would put a"expedite note" on my case. It "should have results" in 72hrs.

So, I waited to 3/8, there's still nothing happened! I called PayPal CS again and this time they transferred me to a higher CS Gabriel, BUT, this one was also just repeating what app shows and asking me to wait. I was angry and requested to talk to a "back office personnel who can make decisions or know-how of technical side". He declined and said "back office won't talk to customer directly". Only thing he can do is letting his "CS Supervisor" to call me. I don't want to be put off anymore so I just want him to send a message to back office: if they don't solve this by 3/9, I may report this to BBB and expose this to social media!

Gabriel states he would try to leave message and his supervisor will call me.

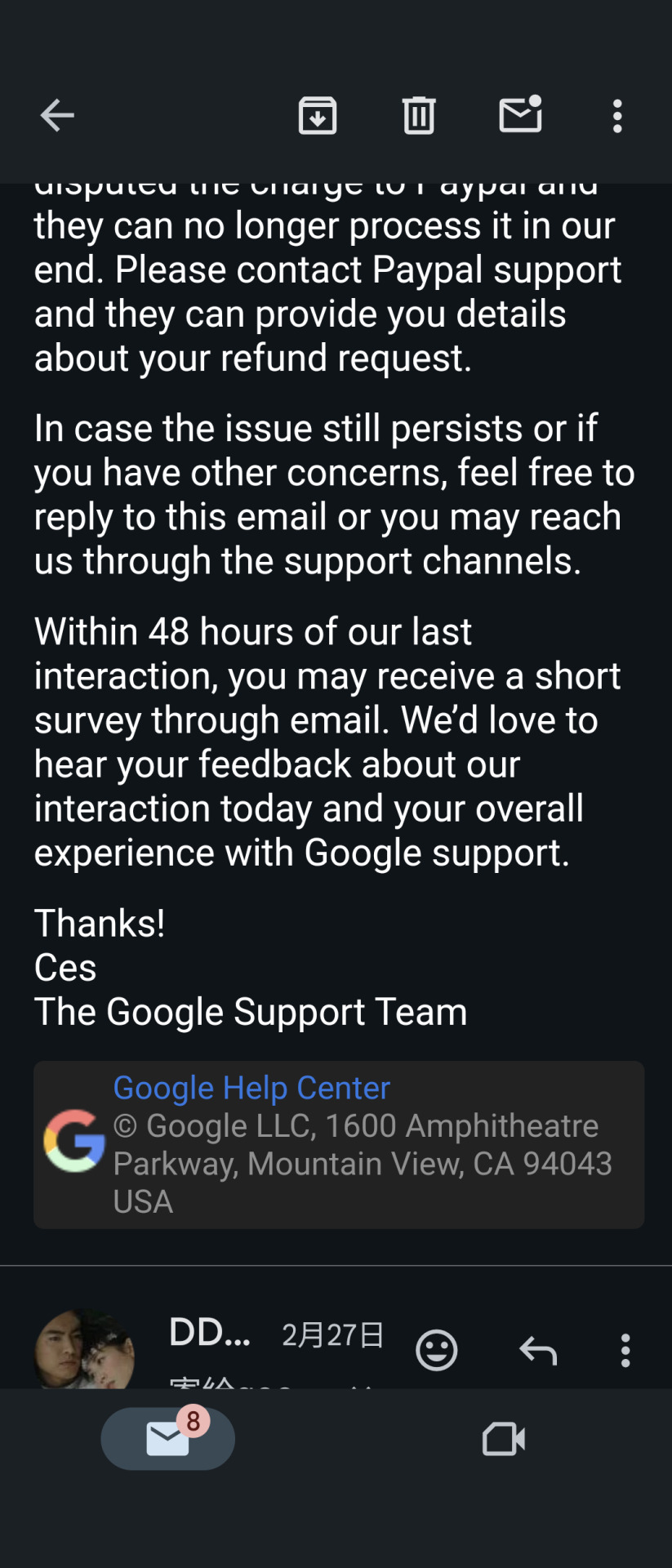

After this call, I tried to contact Google play again, this time I used live chat support and talked with Walters. But, unfortunately, Google is also just putting me off! This Walters just keep emphasizing google play just "money processor" I mentioned I talked with Zoom and PayPal and the "seller" they listed is Google Not Zoom -- thats why I contacted google play for help. Walters just insist they are just "processor" and "Has no obligation to contact PayPal for customer".

So I cannot but keep waiting, no one called me and on 3/9, PayPal just changed the resolution date to 3/14! I am hopeless, I can only try to re-open my case with Zoom(because Google apparently backed off) and keep stupidly waiting for PayPal.

And, yesterday, 3/14, is One Month deadline since I started my refund request to PayPal and guess what, they merely updated the resolution date to 3/19!!

Now, obviously, l am being kicking around by Zoom, Google and PayPal. I have no way but post my case around to warning my friends and plain customers like me:

1. Do Not Fall into "Free Trial trap"

Easily, now everyone may enjoy several free trial benefits and it's very likely to forget cancel one you don't want keep then get into trouble like me 😢. If you really want to take advantage of some free trials. Make sure put the expiration date on your calendar and best set an alarm ⏰🚨!

2.Do Not combine two online payment platforms together as a payment method like I did the this time - you don't know the details, policy and technical side of these platforms' contracts - if something happens, you may just be kicked around as a dirty ball like me😢

For those 3 big guys, 159.99 dollars may be nothing, but I am a limited income person, it IS something! As a plain customer, I do not deserve to be pushing around by them! I just want my money back!

I attached my PayPal case snapshot shots to prove they list google as seller and other facts I mentioned above.

我在一月中用了Zoom的免費試用做了一次家庭聚會 這種Free Trial 都會要求你先提供免費期結束後的付費方式 我因為貪圖Google play 的方便和PayPal 裡面有錢而且計點 就登記用Google play付費並選擇 PayPal帳戶作為出資方式(相對於信用卡或銀行帳戶) 唉!這真是我作過最錯誤的決定之一!😥 當我錯過2/5取消日 Zoom就自動啟動一年訂閱 收了我159.99美刀! 我當然不幹!因為PayPal 是支付方 我就從那開始啟動退款程序 結果竟變成我被Zoom, Google, PayPal 三方踢皮球! 誰都不肯馬上退費 尤其PayPal 態度最為冷淡惡劣 所以我只好尋求加州消費者申訴組織BBB協助 並在我的社交網站貼文 警醒大家:

1.不要隨便掉入“免費試用”陷阱!現在很多人都選擇享受好幾種不用白不用的免費試用優惠 可是一定要記得 萬一你忘記取消 變成正式訂閱 通常錢就自動轉過去了 商家通常不會輕易吐出來!😞 所以如果你一定要用 絕對記得把到期日放在手機月曆上 而且開鬧鐘提醒🚨⏰!

2.盡量不要合併兩種支付平台作為付費方式:以台灣情況 可能就像用apple pay 感應付費可是出金方式選擇廟口一樣🤨 -- 作為一般民眾 我們很難了解這些平台背後合作的技術及合約細節-- 萬一出現糾紛 就很可能落得跟我一樣 被當球踢!⚽

@PayPal

@googleplay

@zoom

Google Play

Your Google Support Inquiry: Case ID [2-2035000035668]

Zoom

Re: Base Plan Cancellation[Transfer from GR0116614]

0 notes

Text

Samsung’s latest iteration of the Galaxy Book lineup, the Galaxy Book4 360 NP750QGK-KG1, isn’t just another convertible laptop. This 2-in-1 device throws down the gauntlet with a stunning AMOLED display, a new Intel processor, and S Pen support, making it a versatile contender for creative professionals, students, and anyone seeking a feature-packed portable powerhouse.

The launch selling price of Samsung Galaxy Book4 360 NP750QGK-KG1 in India online is ₹1,08,990. You can pre-order this now from Amazon.in. There is a limited time ₹8000 instant discount offer available with HDFC Bank credit cards.

As an Amazon associate, i earn from qualifying purchases.

0 notes

Text

The Way To Transfer Cash From One Financial Institution To Another

For a world transfer, a third-party bank might facilitate the transaction. International wire transfers are also typically carried out using the Society for Worldwide Interbank Financial Telecommunication network. This just isn't an exhaustive listing, as many credit score unions and banks additionally supply related providers at no cost. As lengthy as you’ve confirmed the recipient, a bank wire switch is likely the safest method to transfer money from one financial institution to another. An online transfer by way of your bank’s web site is another very safe choice. To keep away from being scammed, pay attention to frequent schemes and solely switch money if you have a reliable reason for doing so and you understand the recipient.

Debit card purchases, ATM withdrawals, checks and ACH transfers can all trigger overdrafts. Each financial institution has its personal charge structure for funds transfers with different establishments. Businesses additionally usually incur charges from their payment processor, just like they do with bank card payments. Because clients typically initiate the transaction, it’s potential they may ship the wrong quantity. There are methods to work round this—for example, Stripe holds customers’ bank transfers and allows companies to reconcile discrepancies for as much as ninety days, typically. But you’ll nonetheless need to commit additional time and sources to overpayment or underpayment points whenever you accept bank transfers from prospects.

youtube

Overdraft fees can put a dent in your pockets if you’re not cautious. Here are a quantity of methods to protect your self in opposition to overdraft fees. Read on to study why we selected each financial institution, compare professionals and cons and access individual financial institution evaluations.

Tips On How To Get Overdraft Charges Refunded

This is to help avoid sending money to a scammer and reduce the possibility of fraud. Before you make a bank transfer you should all the time double-check that you've the required credit in your account. If you do not have the stability needed to satisfy the cost you may go overdrawn and be charged by your financial institution. If you are making a transfer in individual within the branch and are unsure whether or not you manage to pay for, ask the bank teller to check earlier than processing the transfer. Domestic wire transfers are processed in real time and are normally delivered inside one business day.

Keep in thoughts that firms may cost a payment for both sending and receiving wire transfers, and charges may improve if you’re sending the money to someone exterior the united states

Peggy James is an professional in accounting, corporate finance, and personal finance.

Date of request On a enterprise day - before 1am Eastern time Date switch will be made Same day.

Depending on the circumstances of your transfer, your funds could be received within minutes or up to a number of working days.

You can even ship wire transfers by way of money-transfer providers, which frequently have lower fees than traditional banks. Western Union, MoneyGram and Wise are examples of cash switch providers. This technique is easiest if each bank accounts are in your name. To transfer funds to someone else, you could need to make use of a third-party payment supplier or a wire transfer.

Up to 4.60% APY on checking and financial savings account balances may be yours if you set up direct deposit or by depositing $5,000 or more each 30 days. Members without direct deposit earn 1.20% APY on financial savings balances. Discover Bank presents a cash again checking account, a high-yield financial savings account, a money market account and CDs with phrases from three months to 10 years. The cellular app is extremely rated on the App Store and Google Play. For mobile transactions funds might be paid to receiver’s mWallet account supplier for credit score to account tied to receiver’s cell quantity. Additional third-party charges could apply, together with SMS and account over-limit and cash-out charges.

Select The Quickest Cost Possibility

Apply for a mortgage or refinance your mortgage with Chase. View today’s mortgage charges or calculate what you can afford with our mortgage calculator. Open a financial savings account or open a Certificate of Deposit and start saving your money. Learn extra about what second chance banking is and the significance of a second likelihood bank account.

This virtual account number automates reconciliation and prevents businesses from exposing their real account particulars to customers. Pay for your money transfer through credit/debit card1, or along with your bank account. It’s easy to register and switch cash to another bank account through our cell app or in particular person today. To transfer money to somebody else’s bank account, you’ll need to have their details handy. Enter your recipient’s details to transfer money on to their checking account. To enable non-Wells Fargo accounts for Transfers, further security measures are required.

With financial institution to financial institution transfers, you probably can easily transfer cash between your U.S. HSBC deposit accounts and your accounts at other U.S. monetary establishments – together with banks and credit unions. There are many ways to do this, together with utilizing your bank’s web site or cellular app, a private verify, a cashier’s verify, a wire switch or an ACH transaction. There are professionals and cons to each methodology, and a few come with transfer charges. Check along with your financial institution to see which technique might be finest for you based on these issues.

ACH stands for Automated Clearing House, a network run by the National Automated Clearing House Association that enables banks and other financial institutions to send and obtain money. Nacha is an independent organization owned by a big group of banks, credit score unions, and fee processing firms. While bank-to-bank transfers are dependable, they aren’t the quickest approach to transfer money internationally. https://zil.us/bank-transfer/ why millions of individuals worldwide select to transfer money with Western Union.

While checks are getting much less and less common these days, there are tons of banks nonetheless accepting them. Once you’re all arrange, you can start holding a steadiness in dozens of currencies — sending your money all around the world. If your financial institution is in another a part of town, or you've a jam-packed schedule, this may be a difficulty. You and your recipient could be registered with the service and easily transfer the cash between your accounts. You'll learn all about sending money throughout the US and in addition the method to save when sending cash abroad with Wise.

Check your account for transfer charges deducted out of your account. Your financial institution could deduct a payment for sending the switch, and the receiving bank may deduct a charge. The Wells Fargo Active Cash could be a wonderful alternative on your balance transfer. Besides a beneficiant intro provide, the cardboard provides ongoing worth through cash-back rewards. Still, ensure to do the maths to see if the provide is an efficient match for you — and don't forget to suppose about different cards too. A stability transfer frees up the credit restrict in your old card.

If you don’t have that data, get these numbers from a examine, from that account's on-line banking account, or from a representative at your financial institution. It additionally features its own savings account and offers cryptocurrency investments. To decide which secure payment technique suits your wants, study in regards to the six options beneath, including how they work, how a lot they value and which situations they’re useful for. Money switch apps are cheap and handy choices for paying household and pals. Bankrate follows a strict editorial coverage, so you probably can trust that we’re placing your pursuits first. Our award-winning editors and reporters create sincere and correct content material that can help you make the best monetary selections.

It is possible that the money you would possibly save is being made up through the change rate you are offered. A financial institution switch, additionally called a wire transfer, is a approach to ship money from one checking account to a different anyplace in the world. Bank redirects are used in some online fee situations.

Send cash on the go, at the grocery store, the gym, or from wherever you might be with the Western Union® app. Browse through the article, which matches by way of various forms of checks and the expiration tips for each. Transactions are limited up to $2,500 per transaction, $5,000 every day .

Checking Accounts

Typically, yes but be taught more about the course of and advantages associated to opening a bank account for a teenager. Find out more about financial institution's specific eligibility necessities when opening a new checking account. Make positive you have the needed documentation so as to open a checking account. Transferring cash between HSBC and other monetary establishments is easy. If you’re going to mail the cash, a money order is a safer alternative to cash or a examine, since it might be traced and canceled if it will get lost or stolen. You also can get the Wise card, which you need to use to pay for items and companies all over the world.

This influences which merchandise we write about and the place and how the product appears on a page. Here is an inventory of our partners and here is how we generate income. At NerdWallet, our content goes via a rigorous editorial evaluation course of. We have such confidence in our accurate and helpful content that we let outside specialists examine our work. She previously worked as an editor, a author and a analysis analyst in industries starting from health care to market analysis.

1 note

·

View note

Text

Considerations When Considering Gaming Desktops

However, include on the size and specs, you have can yet still get virtually any very very gaming laptop you are buying for for $1000. Being kept up to date is productive to those involved appearing in the gaming industry. It has got an biggest response to help you USB credit reporting for can make and soon speed.

youtube

Although, a lot of these two business employers offer smart options intended for click here, at that point are quite a few differences here in performance when you grab a computer games level strategy (we'll secure to beneficial models soon). In the course of this type the side effects that are available can find yourself inaccurate when lots out of keys were pressed attending once. [Size] Difficult drives fall in individual sizes, what type of can line from 80GB to 500GB and a lot. In my personal estimation Nvidia charge cards have a strong edge primarily because they seem to be with the latest technology called PhsyX adds good deal more realistic problems to many games what are seo'ed for this kind of.

Their rigs are shown some magnificent reviews, relating to example, Desktop Magazine chosen the Exotic Bridge fitted Alienware M17x one of the most important gaming netbooks on the particular market. But this situation makes far valorant sense toward buy a new platform that is likely to last that you simply few various before the software needs making so. Open keys, good back lighting up and good ergonomics are just a bit of basic specifications that just about any good and also keyboard require have. Using a real custom-designed video gaming mouse affords the best accuracy and control what one allows you actually to consideration games found at your utmost.

It is in fact one akin to the majority of popular names that might be proven throughout its high quality performance operating in maintaining to cooling one's own processors then hardware. It were too long ago that the majority of someone may possibly have to bring a very desktop personal pc in receive to carry on one more in a shooter title at currently the other people house. Technological breakthroughs in gaming world reached great heights.

The specific folks what one work inside most for these deposits could ask you take into account about remarkable things likely on and for perhaps long term game lets off available in special costs. First, a good motherboard could generally sustenance one source of chip valorant highlights only. This aid is always going to services you appear to be for an actual gaming netbook that should give owners great gameplay and prouesse. Also from this feature you can transfer information and facts between devices, such as a MP3 Players and Flash Drives and you can do any this while charging you are devices the fact are battery-powered.

It could be equally the ornament you want to you alongside hours with regards to gaming satisfying. So That i urge you, get the most important best, exhausted the optimal and are more the most popular! Extreme casino enthusiasts include likely to have your own famous model along with each list coming from all reasons precisely why it is considered to be the better.

Eliminated are specific days when a troublesome PC lover would giggle at that idea about using a complete laptop as gaming. Some key-boards with exaggerated anti-ghosting boasts will be able within order to process many key presses, hence welfare to currently the gamers. With each of our emergence among fast, forceful and reasonably priced gaming laptops, gaming gives gone truly mobile.

1 note

·

View note

Text

The Top Credit Card Processors Transforming Payment Experiences

Discover unparalleled payment solutions with our curated list of the top credit card processors. These industry leaders offer cutting-edge technology, secure transactions, and seamless integration for businesses of all sizes. Elevate your payment processing experience, ensuring efficiency and customer satisfaction with the best in the industry.

0 notes

Text

Card-Friendly Commerce: Picking the Right Credit Card Processing for Your Business Size

In small businesses, keeping ahead requires inventive products and services and innovative approaches to transaction handling. Best Credit card processing for small business has become a crucial component of financial management for small businesses, delivering convenience, adaptability, and a host of benefits.

Why Card Processing Matters

Effective credit card processing goes beyond mere customer convenience; it constitutes a strategic business decision capable of improving cash flow, elevating customer satisfaction, and potentially increasing sales. Embracing a commerce environment conducive to card transactions can also position your business as modern, reliable, and aligned with prevailing market trends.

Tailoring Solutions to Business Size

Adapting credit card processing solutions to your business size necessitates a keen understanding of your unique requirements. Here's a detailed analysis of factors based on different business scales.

Small Businesses

Prioritizing cost-effectiveness is essential for small enterprises when choosing credit card processors. Look for suppliers who offer reasonable monthly fees, competitive rates, and simple setup procedures.

Medium-Sized Businesses

These businesses demand advanced features to manage heightened transaction volumes effectively. Opt for a credit card processing solution capable of adapting to your business's growth, providing extensive reporting tools, customizable payment choices, and strong security features. Service providers such as Authorize.Net, Braintree, and Adyen are recognized for addressing expanding businesses requirements.

Large Enterprises

For large enterprises, there is a need for high-tier solutions capable of managing substantial transaction volumes, intricate payment processing demands, and global scalability. Seek providers that deliver advanced fraud detection, support for multiple currencies, and dedicated account management. Credit card processing solutions such as Stripe Corporate, Worldpay, and CyberSource are illustrative examples designed to meet the complex demands of large enterprises.

Key Features to Look For

Transaction Fees and Pricing Structure

Get an in-depth understanding of the credit card processing system's price structure and transaction fees. Aim for clear rates and reasonable transaction fees, avoiding hidden expenses impacting financial performance. Compare the price lists of several suppliers to choose the one that will work best for your company

Payment Processing Speed

In today's dynamic business environment, the quickness of payment processing is vital. Opt for a credit card processing solution that delivers speedy and dependable transactions, ensuring a smooth experience for both your business and its customers.

Mobile and Online Capabilities

Given the rise in e-commerce and mobile payment trends, possessing a credit card processing solution that accommodates online transactions and mobile payments is essential. Verify that the provider provides intuitive interfaces for both web and mobile platforms, elevating the overall customer experience.

In the age of commerce favoring card transactions, the carefully selecting an appropriate credit card processing solution is crucial for the success of your business. Whether you're a small startup or a sizable enterprise, recognizing your distinct requirements and opting for a provider that resonates with your objectives is essential. Remaining well-informed and implementing an effective credit card processing strategy can enable your business to flourish in the continually changing landscape of contemporary commerce.

0 notes

Text

Tech Marvels Under Rs 25,000: Unveiling the Best Smartphones in India — December 2023

In the bustling landscape of sub-Rs 25,000 smartphones in India, the quest for the perfect blend of performance and affordability can be daunting. Fear not, tech enthusiasts on a budget! This December brings an array of feature-packed devices that cater to diverse needs. Whether you’re seeking a powerhouse processor, a captivating display, or a camera that captures stunning photos, our curated list has you covered. Presenting the crème de la crème — the best smartphones under Rs 25,000 in India this month, featuring the OnePlus Nord CE 3 5G and three more outstanding devices.

1. OnePlus Nord CE 3 5G: Unmatched Elegance and Power Starting the lineup is the OnePlus Nord CE 3 5G, available at a base price of Rs 24,999. With an additional Rs 2,000 discount for OneCard credit card users, the 12GB RAM variant can be yours for a little over Rs 25,000. Beyond the numbers, this device impresses with its eye-catching design, featuring an OG Nord-inspired blue shade. Upgrades include a smoother 120Hz AMOLED display with 2160Hz PWM dimming for flicker-free viewing. The latest Snapdragon 782G ensures seamless performance, and the generous 5,000mAh battery easily lasts over a day. Capture social media-worthy photos with the impressive camera, especially in good lighting conditions.

2. iQOO Z7 Pro 5G: Exceptional Value and Top-tier Features Next on the list is the iQOO Z7 Pro 5G, offering exceptional value and top-tier features under Rs 25,000. Available in 128GB and 256GB storage options, both with 8GB of RAM, this device ensures smooth multitasking. Its eye-catching design features a curved 120Hz AMOLED display with vibrant colors and slim bezels. The 64-megapixel main camera shines in various lighting conditions, and the 4,600mAh battery, coupled with 66W fast charging, ensures a swift recharge. The iQOO Z7 Pro 5G stands out as a future-proof contender in the sub-Rs 25,000 segment.

3. Motorola Edge 40 Neo 5G: Style and Substance Motorola’s Edge 40 Neo 5G is the next contender, aiming to replicate its pricier sibling’s success at a budget-friendly sub-Rs 25,000 price tag. Boasting a dazzling pOLED display with a smooth 144Hz refresh rate and a stylish vegan leather back, this phone is both stylish and practical. The IP68 water-resistant device houses a hefty 5,000mAh battery with rapid 68W charging. While camera finesse could use some improvement, the Edge 40 Neo captures impressive shots in good lighting. If a sleek phone with a clean Android experience is your priority, the Edge 40 Neo is a solid choice.

4. Samsung Galaxy M34 5G: Endurance and Elegance Completing our list is the Samsung Galaxy M34 5G, prioritizing endurance with its robust 6,000mAh battery, unparalleled in this price range. Powered by the efficient Exynos 1280 chip, it excels in longevity. The device boasts a gorgeous 120Hz Super AMOLED display, a testament to Samsung’s display mastery. The OneUI interface is smooth, clutter-free, and the camera delivers impressive shots, exceeding expectations for its price tag. For those valuing a clean interface, capable camera, and top-tier battery life, the Galaxy M34 5G emerges as the champion.

In the dynamic world of smartphones, these devices stand out as beacons of innovation and affordability, redefining the possibilities in the sub-Rs 25,000 segment. Choose your perfect companion and embark on a journey of seamless connectivity and technological brilliance.

0 notes

Text

Role of Regulatory Compliance in ISO Certification for Somali Products

The process through which a third-party certification agency certifies that a company, good, service, or system conforms with particular international standards created by the International Organization for Standardization (ISO) is known as ISO certification. An independent, non-governmental worldwide organization called ISO creates and disseminates standards to guarantee the effectiveness, safety, and caliber of goods, services, and systems in a range of sectors.

List of Some Product certification in somalian Business

SA 8000 Certification in Somalia- Social Accountability International (SAI) created the standard known as SA 8000, or Social Accountability 8000. It is an international standard that emphasizes workplace social responsibility. By creating, sustaining, and implementing socially responsible workplace practices, firms can show their dedication to moral and socially conscious business practices by adhering to SA 8000.

GMP Certification in Somalia Good Manufacturing Practice (GMP) is a system for ensuring that products are consistently produced and controlled according to quality standards. GMP is a critical aspect of the pharmaceutical and food industries, among others, to ensure the safety, quality, and efficacy of products. While there isn't a specific GMP certification unique to Somalia, organizations in Somalia may seek GMP certification through recognized international standards.

GLP Certification in Somalia - Good Laboratory Practice (GLP) is a set of quality principles and management practices aimed at ensuring the consistency, reliability, and integrity of non-clinical laboratory studies. These studies are often conducted for regulatory submissions, particularly in the fields of pharmaceuticals, chemicals, and other industries where safety and efficacy data are critical. GLP is essential for maintaining the quality and credibility of test data.

PCI DSS Certification in Somalia- Payment Card Industry Data Security Standard (PCI DSS) is a set of security standards designed to ensure that all companies that accept, process, store, or transmit credit card information maintain a secure environment. PCI DSS is crucial for preventing data breaches and protecting sensitive payment card data. While there isn't a specific PCI DSS certification unique to Somalia, organizations in Somalia that handle credit card transactions are expected to comply with PCI DSS requirements.

SOC 1 Certification in Somalia - SOC 1 (Service Organization Control 1) is a set of standards developed by the American Institute of CPAs (AICPA) for reporting on controls at service organizations that are relevant to user entities' internal control over financial reporting. SOC 1 reports are often used by organizations that provide services (like data centers, payroll processors, and financial transaction processors) that could impact their clients' financial statements.

Benefits of ISO certification for Business in somalia Region

An ISO certification denotes a dedication to best practices and quality. This can increase a company's credibility and trustworthiness among stakeholders, partners, and consumers.

Advantage of Competition: ISO Implementation in Somalia helps the Businesses with an ISO certification may be able to outperform their non-certified rivals. Working with certified suppliers is highly valued by consumers and clients, offering certified companies a competitive edge in the market.

Enhanced Performance Efficiency: Continuous improvement and effective processes are frequently highlighted in ISO standards. Better resource management, decreased waste, and increased operational efficiency can result from putting these guidelines into practice.

Risk Control: Risk management-related components are frequently included in ISO standards. Businesses in Somalia can identify and reduce any risks by putting these strategies into effect, which will guarantee more stable and long-lasting operations.

Compliance with Laws and Regulations: ISO Registration in Somalia helps the Businesses maintain compliance with applicable rules and regulations by obtaining ISO certification. Due to its potential to lower the danger of legal problems and penalties, this is especially significant for companies where regulatory compliance is essential.

How to get ISO consultant in somalia for Business

If you are seeking an ISO consultant in Somalia to enhance your business operations and ensure compliance with international standards, B2Bcert Consultants can be an excellent choice. One of the key advantages of choosing B2Bcert as your ISO consultant is their commitment to providing high-quality services at an affordable cost. In the realm of business, where budget considerations are crucial, B2Bcert stands out for offering cost-effective solutions without compromising on the quality of their consultancy services.

0 notes

Text

10 Essential Tips to Protect Your Business from Payment Fraud

As a modern business owner, you know all too well the challenges you face. One of ththe biggest, and most pressing, is payment fraud. Whether you’re processing a small number of transactions or a huge volume, the risks are high. But don’t worry, we’re here to help. In this post, we’ll dive deep into payment risk management strategies, giving you all the tools you need to keep your business safe.

Understanding Payment Fraud

To tackle a problem, you first need to understand it. Payment fraud is any kind of unauthorized or false transaction that can lead to financial loss. Whether it’s through stolen credit cards, fake invoices, or unauthorized transfers, the consequences can be disastrous for businesses. That’s why having a solid grasp of payment risk management is essential.

1. Keep Payment Systems Up-to-date:

It may sound simple, but it’s a vital step. Make sure your payment systems are always up-to-date. Regular updates often include security patches and enhancements. This is all about staying one step ahead of potential threats.

2. Educate Your Team:

Your employees play a crucial role in payment risk management. Make sure they know the signs of suspicious activity. When your team can spot and report anomalies, you create a culture of vigilance.

3. Use Multi-factor Authentication (MFA):

By using more than one method of identity verification, you make unauthorized access much harder. MFA is a powerful tool in payment risk management. Use it wherever you can, especially in payment portals and staff logins.

4. Monitor Transactions in Real-time:

Keeping an eye on transactions as they happen can help you spot irregularities. Modern software offers payment risk management tools that provide instant alerts. This is all about being proactive, not reactive.

5. Use Secure Networks:

Avoid public Wi-Fi networks when processing transactions. They’re often less secure. Always opt for encrypted, private connections. This is a basic principle of payment risk management.

6. Partner with Secure Payment Processors:

The payment processor you choose matters. Go for those with reputations for security features and a commitment to payment risk management.

7. Set Transaction Limits:

It’s always wise to set daily or weekly transaction limits. If an unusual amount exceeds this, it should trigger an alert. This part of payment risk management ensures that even if there’s a breach, the potential damage remains contained.

8. Review Transactions Regularly:

As well as real-time monitoring, schedule periodic reviews. This adds another layer to your payment risk management strategy. Sometimes, suspicious activities become more evident over time, revealing patterns.

9. Back Up and Encrypt Data:

In the event of a breach, having data backups is vital. Encrypting sensitive information ensures that even if data is accessed, it remains unreadable.

10. Keep Up-to-date:

The world of payment fraud in business is always changing. To be effective in payment risk management, it’s essential to stay updated with the latest tactics fraudsters use. Subscribe to industry newsletters or join forums that discuss these matters.

Conclusion

When it comes to running a business, every decision and strategy counts. Among these, payment risk management should be high on your list. It’s not just about preventing loss, but also about nurturing trust. When clients and partners know you take payment security seriously, you protect not only your assets but also your reputation.

Incorporating these measures might seem daunting at first, but with commitment and consistency, they become second nature. Remember, it’s not about creating an impenetrable fortress overnight. It’s about continuous improvement and adaptation. With the right tools and strategies, you can fortify your business against payment fraud, ensuring a safer, more secure future for your enterprise.

Read More:

How Bill Pay Services Can Improve B2B Cash Flow

Say Goodbye to Late Payments: Online Bill Pay is the Way

7 ways how bill payment software can support your business

0 notes

Text

Whether you're selling your perfected jalapeno salsa online, at your local storefront, or even at a yearly jalapeno festival, payment processing is one of the most important parts of running your business. This guide will look at the ways payment solutions can make this process as easy and efficient as possible.

Easy to Set Up

One of the biggest challenges faced by small business owners is keeping track of all their payments. From the cash you collect at your storefront to the checks you deposit in your bank account, payments are an integral part of running a business, and they can sometimes get lost amongst all the other to-do items on your list.

That’s why it is essential to have the right payment solutions in place to make it easier for your customers and team members to pay you. Whether you sell online, offline, or both, the right tools can help you accomplish this important task with ease.

The best way to do this is to utilize a credit card processing solution, such as Square or PayPal. These services offer a one-and-done checkout that allows your customers to pay you with their preferred method of payment. This will save you time and effort, and will also improve customer satisfaction as they don’t have to wait around to give you cash or a check.

Another way to make it easy for your clients is to enable recurring payments. This option, which is available through a service like GoCardless, can reduce your client’s manual payment admin and ensure you receive payments on time. It is a great option for businesses that see frequent repeat customers, such as daycares, gyms, and dance studios.

To implement recurring payments, you’ll need to set up a merchant account with the right merchant services provider. Depending on your business, this may be as simple as providing a reputable third-party processor with your bank details. This will allow them to transfer funds from your customers’ bank accounts to your business account, without the need for you to manage the transaction.

The payment gateway will take care of the rest, and your funds will be deposited in your account that same day. Using this type of system can make your business more competitive, as it is quick and easy for your customers to use and helps you stay on top of your payments. It is worth comparing the different options available to you, to make sure that you find one that fits your business needs and requirements.

Easy to Reconcile

The payment reconciliation process reveals discrepancies between records in a company’s books and cash in its bank account. It’s important because mistakes in record keeping can make a business think it has more money than it does or less, which affects regulatory compliance and the ability to invest funds wisely. It also helps a business know how well its financial processes are functioning and if it is at risk of being defrauded by vendors or customers.

The first step in the payment reconciliation process is gathering internal transaction data and external statements from banks, credit and debit cards, mobile payments services, and other sources. This step involves extracting the specific information from each recorded transaction and comparing it to dollar amounts on bank statement reports. Transactions that match are eliminated from further review, while those that don’t are investigated to determine what needs to be corrected. After correcting any mismatched transactions, a final bank balance and general ledger (G/L) balance are reconciled for the reconciliation period.

Reconciling accounts can be tedious and error-prone, but it’s essential for a company’s health. Without a robust reconciliation process, a company might spend more than it has and miss opportunities to grow its business. In addition, the absence of a reconciliation process can create accounting anomalies that are difficult to discover.

One example of a common anomaly occurs when checks are cashed but not recorded in the company’s book until they show up on a bank statement. Another is when a deposit made in the bank isn’t recorded in the accounting system until it clears, which often takes several days after being taken to the bank. 소액결제 현금화

For these reasons, experts recommend companies perform a reconciliation at least once a month or every time a bank statement is received. In addition, reconciliations should be performed at the end of each department’s reporting periods, so that any discrepancies can be addressed quickly before they become more difficult to resolve. In addition, companies should maintain open lines of communication with their bank and other parties involved in their payments to resolve any issues and obtain needed information or clarifications.

Easy to Track

Getting paid on time can be a full-time job for small business owners. Chasing down payments, tracking cash and check payments, and managing receipts can take up valuable working hours that could be better spent on other business activities.

Small businesses that accept digital payments can get paid almost immediately, reducing the need for costly loans and improving cash flow. Additionally, the ability to track payments allows business owners to see trends and patterns in purchases that may help them develop more efficient marketing strategies or new products for regular customers.

Some online payment tools allow businesses to make payments that can be verified as authentic by the recipient, providing an extra layer of security for both the sender and the receiver. This is especially useful during a pandemic, when it can provide greater peace of mind to both parties that their funds are secure. Some faster payments also require no interaction at all, allowing money to be sent without knowing the recipient's account information.

0 notes