#bittech

Photo

I love these photos, I find 'em hilarious 🤣, there is some Caribbean spot vibes 😅, by the way I was born in Dominican Rep. 🤔 So exactly how small is Piñasphere? 218mm diameter, and 168mm wide. It's an ellipsoid so about 4.2 Liters. It weighs about 2 Kgs, not bad at all. Created with Blender, Tinkercad and Fusion 360 and printed with a Creality Ender 3 Pro. Photo shoot by my brother @denisdeiacovo Specs Sub ITX PC Case: Case: fully 3D models and 3D printed Mobo: Asrock Deskmini X300 M-STX CPU: AMD Ryzen 7 5700G CPU Cooler: AIO Cooler Master MasterLiquid ML120L V2 Fan: Noctua NF-P12 redux-1700 PWM RAM: Corsair vengeance SoDIMM 2x8Gb@3200 1st SSD: Samsung 980 M.2 1Tb 2nd SSD: Samsung 860EVO 2.5" 250 Gb WiFi: Intel WiFi 6 AX200 . . . . #3dprinted #pc #ign #modder #maker #men #design #pcmr #bittech #coolermaster #samsung #amd #tinkercad #corsair #blender #computer #creality #ender #asrock #minipc #custommade #custom #ign #pcgamer #photography #photooftheday #goodvibes #fedora #rayban #asos (at Gambettola) https://www.instagram.com/p/Cena_tZovby/?igshid=NGJjMDIxMWI=

#3dprinted#pc#ign#modder#maker#men#design#pcmr#bittech#coolermaster#samsung#amd#tinkercad#corsair#blender#computer#creality#ender#asrock#minipc#custommade#custom#pcgamer#photography#photooftheday#goodvibes#fedora#rayban#asos

1 note

·

View note

Text

BUS100: BitTech Pte Ltd (BitTech), with headquarters in Singapore, operates a computer server farm in Texas: Business Skills and Management Assignment Help, SUSS, Singapore

0 notes

Text

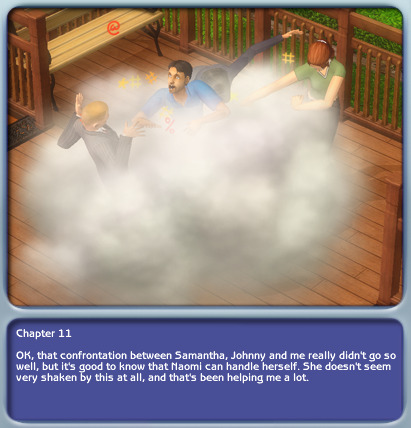

Vincent's Story - Sims Life Stories - Chapter 11

Vincent was doing his after-work meditation when Greg walked in with the news about Samantha and Johnny Cullen.

It seems like BitTech, Johnny Cullen's company, is on the verge of bankruptcy.

And it was Vincent's company that won over the investors. Vincent's couldn't even plan better.

After hanging out a bit, Greg had to go.

And Naomi called Vincent to invite him out.

They met at the Arcadium Plaza.

And Vincent felt really romantic.

Suddenly Samantha and Johnny showed up. Vincent felt like the confrontation cannot be avoided.

He walked up to them to tell Samantha to leave them alone.

Johnny stepped in to defend his wife and poked Vincent.

Vincent poked him back.

And a fight broke out. While Johnny jumped on Vincent, Naomi jumped on Samantha. Vincent and Naomi won.

Naomi was fully on Vincent's side.

As Johnny and Samantha walked away defeated, they shared a kiss and a few words.

Vincent felt victorious. For now.

End of Chapter 11

#sims 2#the sims 2#the sims 2 life stories#the sims life stories#sims life stories#the sims 2 vincent's story#the sims vincent's story

1 note

·

View note

Text

Bitcoin Miner Market Earnings Margins, Value Of Production & Consumption Demand Figures 2021-2027

Global Bitcoin Miner Market Size, Status and Forecast 2020-2026:

The up-to-date research report on Global Bitcoin Miner Market illustrate a detailed fundamental market overview which is fueled by deep research to accustomed the users with latest Bitcoin Miner market trends, current market overview and Bitcoin Miner market development status expected during the forecast period from 2020-2026. Global Bitcoin Miner Report offers a thorough analysis of different Bitcoin Miner market segments like dominant key players their visions which will help the readers in analysing the Bitcoin Miner growth opportunities.

The Bitcoin Miner market is majorly dependent on the two divisions that comprise the production scale and revenue generation. Different factors affecting the global Bitcoin Miner market, that include growth, restrictions, and the premeditated attributes of each point have been thoroughly reported in the report. Based on these attributes, the global Bitcoin Miner market report predicts the ultimate fortune of the market at the global level.

To Understand How Corona Virus Impact on this industry. Get Free Sample Report: https://www.researchmoz.us/enquiry.php?type=S&repid=2757166

The research report includes specific segments by region (country), by company, by Type and by Application. This study provides information about the sales and revenue during the historic and forecasted period of 2015 to 2026. Understanding the segments helps in identifying the importance of different factors that aid the market growth.

Major players covered in this report:

Bitmain Technologies

Canaan Creative

Halong Mining

BitFury Group

ASICminer

Russian Miner Coin

Black Arrow

Innosilicon

Asg-Mining

Zhejiang Ebang Communication

Bittech

On the basis on the end users/applications, this report focuses on the status and outlook for major applications/end users, sales volume, Bitcoin Miner market share and growth rate of Bitcoin Miner for each application, including-

Self-Mining

Cloud Mining Services

Remote Hosting Services

Others

On the basis of product, this report displays the sales volume, revenue (Million USD), product price, Bitcoin Miner market share and growth rate of each type, primarily split into-

Application Specific Integrated Circuits (ASICs)

Field Programmable Gate Arrays (FPGAs)

Graphics Processing Units (GPUs)

Others

With the present market standards revealed, the market research report has also illustrated the latest strategic developments and patterns of the market players in an unbiased manner. The report serves as a presumptive business document that can help the purchasers in the global market plan their next courses towards the position of the market’s future.

Global Bitcoin Miner Market Details Based On Regions

Bitcoin Miner Market in North America (USA, Canada and Mexico).

Europe Bitcoin Miner Market(Germany, France, UK, Russia and Italy).

Bitcoin Miner Market in Asia-Pacific (China, Japan, Korea, India and South-east Asia).

Latin America Bitcoin Miner Market, Middle and Africa.

What Bitcoin Miner Market Report Contributes?

In short the report is a relevant guide for understanding the Bitcoin Miner industry breakthroughs in terms of all vital aspects like In-depth insight of the major players and contributors impacting the Bitcoin Miner market.

The study also focuses on current Bitcoin Miner market outlook, sales margin, details of the Bitcoin Miner market dynamics.

Growth expected during the forecast periods along with the present and historical data of Bitcoin Miner industry is deeply discussed in the report.

The overall report helps the new aspirants to inspect the forthcoming opportunities in the Bitcoin Miner market.

Global Bitcoin Miner Market: This market research report focuses on Past-Current Size, Price, Trends, Shares, Segment & Forecast 2020-2026.

This report provides:

An in-depth overview of the global market for Bitcoin Miner.

Assessment of the global industry trends, historical data from 2011, projections for the coming years, and anticipation of compound annual growth rates (CAGRs) by the end of the forecast period.

Discoveries of new market prospects and targeted marketing methodologies for Global Bitcoin Miner

Discussion of R&D, and the demand for new products launches and applications.

Wide-ranging company profiles of leading participants in the industry.

The composition of the market, in terms of dynamic molecule types and targets, underlining the major industry resources and players.

Study the market in terms of generic and premium product revenue.

Determine commercial opportunities in the market sales scenario by analyzing trends in authorizing and co-development deals.

Do You Have Any Query Or Specific Requirement? Ask to Our Industry Expert@ https://www.researchmoz.us/enquiry.php?type=E&repid=2757166

About ResearchMoz:

ResearchMoz is the one stop online destination to find and buy market research reports & Industry Analysis. We fulfil all your research needs spanning across industry verticals with our huge collection of market research reports. We provide our services to all sizes of organisations and across all industry verticals and markets. Our Research Coordinators have in-depth knowledge of reports as well as publishers and will assist you in making an informed decision by giving you unbiased and deep insights on which reports will satisfy your needs at the best price.

For More Information Kindly Contact:

ResearchMoz

Mr. Rohit Bhisey,

Tel: +1-518-621-2074

USA-Canada Toll Free: 866-997-4948

Email: [email protected]

Follow me on : https://pranrmoz.blogspot.com/

from NeighborWebSJ https://ift.tt/3h8hzNM

via IFTTT

from WordPress https://ift.tt/3erDhul

via IFTTT

1 note

·

View note

Text

888starz Casino & Sportsbook 1500€ bonus and 150 free spins

888starz Casino & Sportsbook 1500€ bonus and 150 free spins

Enjoy the warm hospitality on 888starz from the very first deposit with a welcome pack up to 1500 EUR + 150 free spins! Claim it and may it bring you a magnificent gambling experience.

888starz Casno and Sportsbook Review

888starz is a new-generation platform supporting the world’s leading blockchain technology and smart contracts. 888starz was created in 2020 by Bittech B.V. It has gained the…

View On WordPress

0 notes

Text

What Is Litecoin- Complete Guide For Beginners

If Bitcoin is a gold coin, then Litecoin is a silver coin. What this means is that Litecoin is a fork of Bitcoin core client and it is almost the same as Bitcoin, but the only difference is that Litecoin іѕ far quісkеr аnd cheaper. It is designed to complement Bitcoin, not to compete. Most businesses accept Litecoin for payments and some of the top-most businesses are VPN, Bitcoin Shop, IT Service Ellenet, Sean’s Outpost, eGifter, Benz & Beamer, KnCMiner, VPN, and Bitcoin Shop.

What is Litecoin

Litecoin is a сrурtосurrеnсу which depends upon a peer-to-peer network. It is also an open-source project launched under the MIT/X11 license. On October 7, 2011, it was launched on GitHub by Charlie Lee. On October 13, 2011, its network went live. The crеаtіоn аnd transfer оf Litecoin completely depends upon a ореn source сrурtоgrарhіс рrоtосоl. Its block mining time is 2.5 minutes. The coin limit is 84 million. Litecoin іѕ nоt under the control of the аnу сеntrаl body. It is a Scrypt-based cryptocurrency. Scrypt is a less complex mathematical equation which does not require a high hash rate as SHA-256 requires.

Charlie Lee

Charlie Lee is a computer scientist, a former employee at Google and a former Engineering Director of Coinbase. He is now working with the Litecoin Foundation. He invented Litecoin in order to complement Bitcoin by solving the underlying issues such as transaction times and fees. The main goal behind Litecoin is to confirm more transactions minimizing block confirmation timings from 10 minutes to 2.5 minutes. In his free time, he wrote a Bitcoin-based blockchain technology while working with Google. He attracted to Bitcoin in 2011. He released Litecoin publicly only after mining of 150 coins.

Lee was born in Ivory Coast. At the age of 13, he migrated to the United States. In 1995, he graduated from high school. He has completed his bachelor and master degrees in computer science in 2000 from the Massachusetts Institute of Technology.

Litecoin Mining

Litecoin mining is a process carried out for two purposes viz., to add a new block of transactions and to generate new digital coins. Litecoin works on the basis of a Scrypt-based proof-of-work (PoW). The first miner to find the solution of a Scrypt hash function for adding the new block will be rewarded with validated Litecoin.

Litecoin Mining Difficulty: It is a mathematical equation updated on the network. It will be based on the hashing power of the total network for ensuring that Litecoin blocks are created on every 2.5 minutes.

Litecoin Mining Calculator: Litecoin Mining Calculator is used to calculate Litecoin mining profitability. CryptoCompare.com, CoinWarz, WhatToMine, litecoinpool.org, and CryptoRival are Litecoin mining profitability calculators. Litecoin mining profit depends upon hash rate, power consumption, etc.

Litecoin Mining Software: Litecoin mining software includes BFGMiner, ScryptMiner GUI, CPU Miner, SGMiner, CGminer, CUDA Miner, GUIMiner-scrypt, MultiMiner, and Reaper.

Litecoin Mining Hardware: Litecoin Mining hardware includes Antminer L3++, Bittech L1 and Innosilicon A4.

I. Antminer L3++: It contains 942 watts of power usage, offers a 580 MHz/s and uses Scrypt.

II. Bittech L1: It contains 2600W of power usage, offers 2,300,000,000 Hash/per second rate and uses Scrypt.

III. Innosilicon A4: It offers 4Mhs per chip performance and 1.5W/MHs.

Types of Litecoin Mining

You should have a Litecoin wallet to store and secure your validated tokens before you start mining. There are three types of Litecoin mining viz., Solo mining, Mining pool, and Cloud mining. You can choose any of them to mine Litecoin.

I. Solo mining: It is carried out without any helping hand. A solo miner may not win the block rewards for a longer time, and if the miner wins, then he will not have to share the profits with anyone.

II. Mining pool: A group of miners will have to share processing powers for solving a mathematical equation. The group will have to divide profits accordingly.

III. Cloud mining: It is a process of using a remote data center and sharing processing powers without managing hardware and software. You need to contact a cloud mining company and purchase a plan. The profits will be transferred to your wallets.

Litecoin Wallets

Litecoin wallets store and secure your Litecoin.

Hardware: Ledger Nano X Wallet, Ledger Nano S Wallet, and TREZOR One Wallet

Mobile: Uphold Digital Money Platform

Web: Uphold Digital Money Platform

Desktop: Atomic Wallet

Litecoin Exchange

A Litecoin (LTC) exchange is an online LTC business. BitBay, Coinmama, Uphold, Coinbase Pro, and Gemini are cryptocurrency exchanges where customers can buy and sell LTC. The customers can trade LTC for other cryptocurrencies or fiat currencies like USD, EUR, Yen.

To learn more about cryptocurrency exchanges, click on the link: Cryptocurrency Exchanges: Complete Guide For Beginners-1

Read the full article

0 notes

Text

PR: BITTECH Offers Two Mining Machines, Equipped with Mining Chips Using a Cutting-Edge 10 Nm Process Technology

This is a paid press release, which contains forward looking statements, and should be treated as advertising or promotional material. Bitcoin.com does not endorse nor support this product/service. Bitcoin.com is not responsible for or liable for any content, accuracy or quality within the press release.

BITTECH starts selling a new range of cryptocurrency mining hardware powered by 10 nm semiconductor chips (10 nm BT0010a and BT0010La mining chips). It is to be recalled that BITTECH introduced its first ASIC miner as early as mid-May, 2018. Bittech One based on 14 nm ASIC chip BT0014 is characterized by 28TH/s hashing power, while energy consumption makes 2200W.

A new range of mining hardware includes two models:

1. Bittech One Mini is a 10nm-based ASIC for private mining. ASIC is characterized by compact sizes, SHA-256-based 16TH/s hashing power, and 1150W power consumption. Retail price will make $880, including power supply unit. Pre-ordered mining hardware will be delivered as early as mid-September 15-25.

2. Bittech L-One is a new Scrypt-based solution for cryptocurrency mining (like LiteCoin). This is a 10nm BT0010La-based mining hardware with the hashing power of 2.3GH/s and energy consumption of 2600W. The miner is priced at $1970, including the power supply unit. Pre-ordered mining hardware will be delivered as early as mid-September 15-25.

BITTECH’s mining hardware based on advanced 10nm semiconductor chips is an “all-in-one” solution with Murata/Artesyn inbuilt power supply units, supporting hot replacement. Even a newbie can set up its unsophisticated and user-friendly software. All miners are covered by 180-days warranty.

BITTECH Limited was engaged in R&D with regard to 10 and 14nm advanced chips since early 2017. At the moment, the company has finished its R&D and offered own mining hardware to a wide range of customers. Aside from miners and chips, the company is going to establish four large data centers in Canada, Iceland, Estonia, and Russia. It has started the construction of Russia’s data center for 9000 miners with the total processing power of 21MW in April 2018. The company will lease a part of premises to its customers under colocation agreements.

More information about BITTECH:

Official website: bittech.cn.com

Twitter: twitter.com/bittechI

Press Contact Email Address

[email protected]

Supporting Link

https://bittech.cn.com/news4

This is a paid press release. Readers should do their own due diligence before taking any actions related to the promoted company or any of its affiliates or services. Bitcoin.com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in the press release.

The post PR: BITTECH Offers Two Mining Machines, Equipped with Mining Chips Using a Cutting-Edge 10 Nm Process Technology appeared first on Bitcoin News.

PR: BITTECH Offers Two Mining Machines, Equipped with Mining Chips Using a Cutting-Edge 10 Nm Process Technology published first on https://medium.com/@smartoptions

0 notes

Text

PR: BITTECH Offers Two Mining Machines, Equipped with Mining Chips Using a Cutting-Edge 10 Nm Process Technology

This is a paid press release, which contains forward looking statements, and should be treated as advertising or promotional material. Bitcoin.com does not endorse nor support this product/service. Bitcoin.com is not responsible for or liable for any content, accuracy or quality within the press release.

BITTECH starts selling a new range of cryptocurrency mining hardware powered by 10 nm semiconductor chips (10 nm BT0010a and BT0010La mining chips). It is to be recalled that BITTECH introduced its first ASIC miner as early as mid-May, 2018. Bittech One based on 14 nm ASIC chip BT0014 is characterized by 28TH/s hashing power, while energy consumption makes 2200W.

A new range of mining hardware includes two models:

1. Bittech One Mini is a 10nm-based ASIC for private mining. ASIC is characterized by compact sizes, SHA-256-based 16TH/s hashing power, and 1150W power consumption. Retail price will make $880, including power supply unit. Pre-ordered mining hardware will be delivered as early as mid-September 15-25.

2. Bittech L-One is a new Scrypt-based solution for cryptocurrency mining (like LiteCoin). This is a 10nm BT0010La-based mining hardware with the hashing power of 2.3GH/s and energy consumption of 2600W. The miner is priced at $1970, including the power supply unit. Pre-ordered mining hardware will be delivered as early as mid-September 15-25.

BITTECH’s mining hardware based on advanced 10nm semiconductor chips is an “all-in-one” solution with Murata/Artesyn inbuilt power supply units, supporting hot replacement. Even a newbie can set up its unsophisticated and user-friendly software. All miners are covered by 180-days warranty.

BITTECH Limited was engaged in R&D with regard to 10 and 14nm advanced chips since early 2017. At the moment, the company has finished its R&D and offered own mining hardware to a wide range of customers. Aside from miners and chips, the company is going to establish four large data centers in Canada, Iceland, Estonia, and Russia. It has started the construction of Russia’s data center for 9000 miners with the total processing power of 21MW in April 2018. The company will lease a part of premises to its customers under colocation agreements.

More information about BITTECH:

Official website: bittech.cn.com

Twitter: twitter.com/bittechI

Press Contact Email Address

[email protected]

Supporting Link

https://bittech.cn.com/news4

This is a paid press release. Readers should do their own due diligence before taking any actions related to the promoted company or any of its affiliates or services. Bitcoin.com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in the press release.

The post PR: BITTECH Offers Two Mining Machines, Equipped with Mining Chips Using a Cutting-Edge 10 Nm Process Technology appeared first on Bitcoin News.

READ MORE http://bit.ly/2nCnc9Q

#cryptocurrency#cryptocurrency news#bitcoin#cryptocurrency market#crypto#blockchain#best cryptocurren

0 notes

Video

vimeo

I AM WAX 4K VERSION ( NSFW ) from IAMWAX on Vimeo.

60 Second Promo for our new 100% Natural WETWAX Massage Oil.

Shot in 4K and you can download the 4K video now on Vimeo use the download button below.

Produced by: IAMWAX

Directed by: Alexander Savoy

Talent; Isabella Kanova twitter.com/isabellakanova

Executive Producers: Alejandro Bates, Albert Morrison

Postproduction: BitTech Crunch Labs

Postproduction Coordinator: Albert Oliver

Line Producer: Alejandro Bates

Production Manager: Greg Horsley

Sound Desing: Luis Contreras

Director of Photography: Fitz Bowman

Art director: Ivan Houston

Stylist: Dana Davis

Make up: Gerald rey

VISIT US AT IAMWAX.COM

1 note

·

View note

Text

Crypto Currency Mining Machines Market 2020 Industry Growth, Share, Trends, Demand, Analysis and Forecast to 2025

This report focuses on Crypto Currency Mining Machines volume and value at global level, regional level and company level. From a global perspective, this report represents overall Crypto Currency Mining Machines market size by analyzing historical data and future prospect. Regionally, this report focuses on several key regions: North America, Europe, China and Japan.

At company level, this report focuses on the production capacity, ex-factory price, revenue and market share for each manufacturer covered in this report.

The following manufacturers are covered:

Bitmain Technologies

Canaan Creative

Halong Mining

BitFury Group

ASICminer

Russian Miner Coin

Black Arrow

Innosilicon

Asg-Mining

Zhejiang Ebang Communication

Bittech

Request a Free Sample Report, Click Here @ https://www.wiseguyreports.com/sample-request/4975717-global-crypto-currency-mining-machines-market-research-report-2020

Segmentation

The Crypto Currency Mining Machines market is segmented on the basis of product type, product application, distribution channel, and region. The segmentation of product type offers the reader an understanding of the different products available in the Crypto Currency Mining Machines market. Product application segmentation details the use for each of the products, along with the industrial applications for the same. The distribution channel segmentation offers the reader an understanding of the different sales and distribution channels employed by the market, and how the product reaches the end consumer.

Segment by Type

Application Specific Integrated Circuits (ASICs)

Field Programmable Gate Arrays (FPGAs)

Graphics Processing Units (GPUs)

Others

Segment by Application

Self-Mining

Cloud Mining Services

Remote Hosting Services

Others

Regional Overview

The Crypto Currency Mining Machines market is regionally segmented in order to identify the region which portrays market dominance, as well as the reasons for the same. Our Crypto Currency Mining Machines market survey report covers North America, South America, Middle East, Europe, and Asia Pacific. This regional segmentation reveals the ability of different regions to emerge as highly profitable areas of development, and discusses the factors that enable this growth.

Table of Contents

1 Crypto Currency Mining Machines Market Overview

1.1 Product Overview and Scope of Crypto Currency Mining Machines

1.2 Crypto Currency Mining Machines Segment by Type

1.2.1 Global Crypto Currency Mining Machines Production Growth Rate Comparison by Type 2020 VS 2026

1.2.2 Application Specific Integrated Circuits (ASICs)

1.2.3 Field Programmable Gate Arrays (FPGAs)

1.2.4 Graphics Processing Units (GPUs)

1.2.5 Others

1.3 Crypto Currency Mining Machines Segment by Application

1.3.1 Crypto Currency Mining Machines Consumption Comparison by Application: 2020 VS 2026

1.3.2 Self-Mining

1.3.3 Cloud Mining Services

1.3.4 Remote Hosting Services

1.3.5 Others

1.4 Global Crypto Currency Mining Machines Market by Region

1.4.1 Global Crypto Currency Mining Machines Market Size Estimates and Forecasts by Region: 2020 VS 2026

1.4.2 North America Estimates and Forecasts (2015-2026)

1.4.3 Europe Estimates and Forecasts (2015-2026)

1.4.4 China Estimates and Forecasts (2015-2026)

1.4.5 Japan Estimates and Forecasts (2015-2026)

1.4.6 South Korea Estimates and Forecasts (2015-2026)

1.5 Global Crypto Currency Mining Machines Growth Prospects

1.5.1 Global Crypto Currency Mining Machines Revenue Estimates and Forecasts (2015-2026)

1.5.2 Global Crypto Currency Mining Machines Production Capacity Estimates and Forecasts (2015-2026)

1.5.3 Global Crypto Currency Mining Machines Production Estimates and Forecasts (2015-2026)

2 Market Competition by Manufacturers

2.1 Global Crypto Currency Mining Machines Production Capacity Market Share by Manufacturers (2015-2020)

2.2 Global Crypto Currency Mining Machines Revenue Share by Manufacturers (2015-2020)

2.3 Market Share by Company Type (Tier 1, Tier 2 and Tier 3)

2.4 Global Crypto Currency Mining Machines Average Price by Manufacturers (2015-2020)

2.5 Manufacturers Crypto Currency Mining Machines Production Sites, Area Served, Product Types

2.6 Crypto Currency Mining Machines Market Competitive Situation and Trends

2.6.1 Crypto Currency Mining Machines Market Concentration Rate

2.6.2 Global Top 3 and Top 5 Players Market Share by Revenue

2.6.3 Mergers & Acquisitions, Expansion

…..

7 Company Profiles and Key Figures in Crypto Currency Mining Machines Business

7.1 Bitmain Technologies

7.1.1 Bitmain Technologies Crypto Currency Mining Machines Production Sites and Area Served

7.1.2 Bitmain Technologies Crypto Currency Mining Machines Product Introduction, Application and Specification

7.1.3 Bitmain Technologies Crypto Currency Mining Machines Production Capacity, Revenue, Price and Gross Margin (2015-2020)

7.1.4 Bitmain Technologies Main Business and Markets Served

7.2 Canaan Creative

7.2.1 Canaan Creative Crypto Currency Mining Machines Production Sites and Area Served

7.2.2 Canaan Creative Crypto Currency Mining Machines Product Introduction, Application and Specification

7.2.3 Canaan Creative Crypto Currency Mining Machines Production Capacity, Revenue, Price and Gross Margin (2015-2020)

7.2.4 Canaan Creative Main Business and Markets Served

7.3 Halong Mining

7.3.1 Halong Mining Crypto Currency Mining Machines Production Sites and Area Served

7.3.2 Halong Mining Crypto Currency Mining Machines Product Introduction, Application and Specification

7.3.3 Halong Mining Crypto Currency Mining Machines Production Capacity, Revenue, Price and Gross Margin (2015-2020)

7.3.4 Halong Mining Main Business and Markets Served

7.4 BitFury Group

7.4.1 BitFury Group Crypto Currency Mining Machines Production Sites and Area Served

7.4.2 BitFury Group Crypto Currency Mining Machines Product Introduction, Application and Specification

7.4.3 BitFury Group Crypto Currency Mining Machines Production Capacity, Revenue, Price and Gross Margin (2015-2020)

7.4.4 BitFury Group Main Business and Markets Served

7.5 ASICminer

7.5.1 ASICminer Crypto Currency Mining Machines Production Sites and Area Served

7.5.2 ASICminer Crypto Currency Mining Machines Product Introduction, Application and Specification

7.5.3 ASICminer Crypto Currency Mining Machines Production Capacity, Revenue, Price and Gross Margin (2015-2020)

7.5.4 ASICminer Main Business and Markets Served

7.6 Russian Miner Coin

7.6.1 Russian Miner Coin Crypto Currency Mining Machines Production Sites and Area Served

7.6.2 Russian Miner Coin Crypto Currency Mining Machines Product Introduction, Application and Specification

7.6.3 Russian Miner Coin Crypto Currency Mining Machines Production Capacity, Revenue, Price and Gross Margin (2015-2020)

7.6.4 Russian Miner Coin Main Business and Markets Served

7.7 Black Arrow

7.7.1 Black Arrow Crypto Currency Mining Machines Production Sites and Area Served

7.7.2 Black Arrow Crypto Currency Mining Machines Product Introduction, Application and Specification

7.7.3 Black Arrow Crypto Currency Mining Machines Production Capacity, Revenue, Price and Gross Margin (2015-2020)

7.7.4 Black Arrow Main Business and Markets Served

7.8 Innosilicon

7.8.1 Innosilicon Crypto Currency Mining Machines Production Sites and Area Served

7.8.2 Innosilicon Crypto Currency Mining Machines Product Introduction, Application and Specification

7.8.3 Innosilicon Crypto Currency Mining Machines Production Capacity, Revenue, Price and Gross Margin (2015-2020)

7.8.4 Innosilicon Main Business and Markets Served

7.9 Asg-Mining

7.9.1 Asg-Mining Crypto Currency Mining Machines Production Sites and Area Served

7.9.2 Asg-Mining Crypto Currency Mining Machines Product Introduction, Application and Specification

7.9.3 Asg-Mining Crypto Currency Mining Machines Production Capacity, Revenue, Price and Gross Margin (2015-2020)

7.9.4 Asg-Mining Main Business and Markets Served

7.10 Zhejiang Ebang Communication

7.10.1 Zhejiang Ebang Communication Crypto Currency Mining Machines Production Sites and Area Served

7.10.2 Zhejiang Ebang Communication Crypto Currency Mining Machines Product Introduction, Application and Specification

7.10.3 Zhejiang Ebang Communication Crypto Currency Mining Machines Production Capacity, Revenue, Price and Gross Margin (2015-2020)

7.10.4 Zhejiang Ebang Communication Main Business and Markets Served

……Continued

Make an enquiry of this Report @ https://www.wiseguyreports.com/enquiry/4975717-global-crypto-currency-mining-machines-market-research-report-2020

Contact Us:

Norah Trent

Partner Relations & Marketing Manager

Ph: +1 (339) 368 6938 (US)

Ph: +44 208 133 9349 (UK)

0 notes

Photo

Piñasphere video recorded by my brother @denisdeiacovo is online on my YouTube channel, link in Bio. More pics reels in the next days, for now enjoy the video. I will start the build logs for those interested. Had to learn A LOT this winter about 3D modeling and 3D printing but I love the results. Created with a mix of @blender.official @tinkercad and @adskfusion360 ❤️ Sliced with @ultimaker Cura and printed with my @crealityofficial Ender 3 Pro ❤️ Specs: Mobo: @asrock_official Deskmini X300 CPU: @amd Ryzen 7 5700G CPU Cooler: AIO @coolermaster MasterLiquid ML120L V2 Fan: @noctua_at NF-P12 redux-1700 PWM RAM: @corsair vengeance SoDIMM 2x8Gb@3200 1st SSD: @samsung 980 M.2 1Tb 2nd SSD: @samsung 860EVO 2.5" 250 Gb WiFi: @intel WiFi 6 AX200 . . . . #bittech #pcmr #pcgamer #ign #techradar #coolermaster #asrock #intel #noctua #corsair #amd #ryzen #3dprinted #modding #extremepc #ender #tinkercad #blender #fusion360 #creality #sff #pc #computer #technology #design #pcmod (at Gambettola) https://www.instagram.com/p/CdKdtlwoIqu/?igshid=NGJjMDIxMWI=

#bittech#pcmr#pcgamer#ign#techradar#coolermaster#asrock#intel#noctua#corsair#amd#ryzen#3dprinted#modding#extremepc#ender#tinkercad#blender#fusion360#creality#sff#pc#computer#technology#design#pcmod

0 notes

Text

Bitcoin Miner Market Growth Factors and Business Development Strategy from 2020-2026 |Bitmain Technologies |Canaan Creative |Halong Mining

Global “Bitcoin Miner” market is a detailed research study that helps provides answers and related questions with respect to the emerging trends and rise moment in this particular industry. It helps select each of the easily seen barriers to rise, apart from identifying the trends within various application sector of the global market.

The study focuses on the driving factors, restraints and hurdles for the expansion of the market. The research worker offers Industry insights with reference to the approaching areas within the business and therefore the impact of technological innovations on the expansion of the market.

Request for Free Sample Copy at: http://www.researchreportcenter.com/request-sample/1333003

Major Key Vendors:-

Bitmain Technologies, Canaan Creative, Halong Mining, BitFury Group, ASICminer, Russian Miner Coin, Black Arrow, Innosilicon, Asg-Mining, Zhejiang Ebang Communication, Bittech

Types is divided into:

Application Specific Integrated Circuits (ASICs)

Field Programmable Gate Arrays (FPGAs)

Graphics Processing Units (GPUs)

Others

Applications is divided into:

Self-Mining

Cloud Mining Services

Remote Hosting Services

Others

Significant Regions covered in this report:

North America, China, Rest of Asia-Pacific, UK, Europe, Central & South America, Middle East & Africa

Get Discount on this Report: http://www.researchreportcenter.com/check-discount/1333003

What the Bitcoin Miner report offers:

market definition of the worldwide Bitcoin Miner beside the analysis of various influencing factors like drivers, restraints, and opportunities.

Extensive analysis on the competitive landscape of worldwide Bitcoin Miner market.

Identification and analysis of small and macro factors are have an effect on on the expansion of the market.

Analysis of the various Bitcoin Miner market segments like sort, size, applications, and end-users.

It offers a descriptive analysis of demand-supply chaining within the international Pre Trade Risk Management answer Market.

Statistical Bitcoin Miner analysis of some important social science facts.

To Clear Any Query about Report, Please Refer Link: http://www.researchreportcenter.com/send-an-enquiry/1333003

Customization of the Report: This report can be customized as per your needs for additional data or countries.Please connect with our sales team ([email protected])

0 notes

Text

Tweeted

The latest Mingo Boys Nerdstuff News! https://t.co/BruWXDXRgu Thanks to @bittech @bghgfjh1 @sonoftilly #gaming #videogames

— Mingo (@MBNerdStuff) September 29, 2019

0 notes

Text

Crypto Currency Mining Machines Market: Global Segments, Top Key Players, Size And Recent Trends By Forecast To 2027

Global Crypto Currency Mining Machines Market Size, Status and Forecast 2020-2026:

The up-to-date research report on Global Crypto Currency Mining Machines Market illustrate a detailed fundamental market overview which is fueled by deep research to accustomed the users with latest Crypto Currency Mining Machines market trends, current market overview and Crypto Currency Mining Machines market development status expected during the forecast period from 2020-2026. Global Crypto Currency Mining Machines Report offers a thorough analysis of different Crypto Currency Mining Machines market segments like dominant key players their visions which will help the readers in analysing the Crypto Currency Mining Machines growth opportunities.

The Crypto Currency Mining Machines market is majorly dependent on the two divisions that comprise the production scale and revenue generation. Different factors affecting the global Crypto Currency Mining Machines market, that include growth, restrictions, and the premeditated attributes of each point have been thoroughly reported in the report. Based on these attributes, the global Crypto Currency Mining Machines market report predicts the ultimate fortune of the market at the global level.

To Understand How Corona Virus Impact on this industry. Get Free Sample Report: https://www.researchmoz.us/enquiry.php?type=S&repid=2757165

The research report includes specific segments by region (country), by company, by Type and by Application. This study provides information about the sales and revenue during the historic and forecasted period of 2015 to 2026. Understanding the segments helps in identifying the importance of different factors that aid the market growth.

Major players covered in this report:

Bitmain Technologies

Canaan Creative

Halong Mining

BitFury Group

ASICminer

Russian Miner Coin

Black Arrow

Innosilicon

Asg-Mining

Zhejiang Ebang Communication

Bittech

On the basis on the end users/applications, this report focuses on the status and outlook for major applications/end users, sales volume, Crypto Currency Mining Machines market share and growth rate of Crypto Currency Mining Machines for each application, including-

Self-Mining

Cloud Mining Services

Remote Hosting Services

Others

On the basis of product, this report displays the sales volume, revenue (Million USD), product price, Crypto Currency Mining Machines market share and growth rate of each type, primarily split into-

Application Specific Integrated Circuits (ASICs)

Field Programmable Gate Arrays (FPGAs)

Graphics Processing Units (GPUs)

Others

With the present market standards revealed, the market research report has also illustrated the latest strategic developments and patterns of the market players in an unbiased manner. The report serves as a presumptive business document that can help the purchasers in the global market plan their next courses towards the position of the market’s future.

Global Crypto Currency Mining Machines Market Details Based On Regions

Crypto Currency Mining Machines Market in North America (USA, Canada and Mexico).

Europe Crypto Currency Mining Machines Market(Germany, France, UK, Russia and Italy).

Crypto Currency Mining Machines Market in Asia-Pacific (China, Japan, Korea, India and South-east Asia).

Latin America Crypto Currency Mining Machines Market, Middle and Africa.

What Crypto Currency Mining Machines Market Report Contributes?

In short the report is a relevant guide for understanding the Crypto Currency Mining Machines industry breakthroughs in terms of all vital aspects like In-depth insight of the major players and contributors impacting the Crypto Currency Mining Machines market.

The study also focuses on current Crypto Currency Mining Machines market outlook, sales margin, details of the Crypto Currency Mining Machines market dynamics.

Growth expected during the forecast periods along with the present and historical data of Crypto Currency Mining Machines industry is deeply discussed in the report.

The overall report helps the new aspirants to inspect the forthcoming opportunities in the Crypto Currency Mining Machines market.

Global Crypto Currency Mining Machines Market: This market research report focuses on Past-Current Size, Price, Trends, Shares, Segment & Forecast 2020-2026.

This report provides:

An in-depth overview of the global market for Crypto Currency Mining Machines.

Assessment of the global industry trends, historical data from 2011, projections for the coming years, and anticipation of compound annual growth rates (CAGRs) by the end of the forecast period.

Discoveries of new market prospects and targeted marketing methodologies for Global Crypto Currency Mining Machines

Discussion of R&D, and the demand for new products launches and applications.

Wide-ranging company profiles of leading participants in the industry.

The composition of the market, in terms of dynamic molecule types and targets, underlining the major industry resources and players.

Study the market in terms of generic and premium product revenue.

Determine commercial opportunities in the market sales scenario by analyzing trends in authorizing and co-development deals.

Do You Have Any Query Or Specific Requirement? Ask to Our Industry Expert@ https://www.researchmoz.us/enquiry.php?type=E&repid=2757165

About ResearchMoz:

ResearchMoz is the one stop online destination to find and buy market research reports & Industry Analysis. We fulfil all your research needs spanning across industry verticals with our huge collection of market research reports. We provide our services to all sizes of organisations and across all industry verticals and markets. Our Research Coordinators have in-depth knowledge of reports as well as publishers and will assist you in making an informed decision by giving you unbiased and deep insights on which reports will satisfy your needs at the best price.

For More Information Kindly Contact:

ResearchMoz

Mr. Rohit Bhisey,

Tel: +1-518-621-2074

USA-Canada Toll Free: 866-997-4948

Email: [email protected]

Follow me on : https://pranrmoz.blogspot.com/

from NeighborWebSJ https://ift.tt/3usHFyy

via IFTTT

from WordPress https://ift.tt/33o1yuI

via IFTTT

0 notes

Text

Litecoin Digital Asset Report: LTC Token Review And Investment Grade

Litecoin Digital Asset Report: Introduction

Litecoin is a peer-to-peer cryptocurrency that is meant to serve as digital money. It was founded by Charlie Lee in October 2011 as a hard fork of Bitcoin, and has been called the silver to Bitcoin’s gold.

Despite the fact that Litecoin is one of the oldest cryptocurrencies, its long-term prospects are questionable. Since technologies in the blockchain space develop very rapidly, Litecoin faces a lot of competition. There are both old and new cryptocurrencies that can offer better technological solutions, have stronger community support and wider merchant networks, and have better prospects in terms of scalability than Litecoin.

Still, Litecoin has one of the most experienced teams, and is actively engaged in ecosystem development. Its solid token economics also help to provide a more promising outlook for the asset’s future value.

Litecoin’s team has to focus on the active implementation of technological innovations and its worldwide adoption as a payment system to maintain and strengthen its position in the cryptocurrency market, otherwise, it may lose a huge chunk of its market share and perish in the shadows of more technologically advanced rivals.

This report is the Initiation Report – our first deep dive into the performance and risk/reward factors. The analysis, verdict and accompanying grade reflect our opinion on the long-term value prospects of a given token based on the current state of project development and indicators of future commercial viability – they are not designed to be indicative of short-term trading opportunities.

You can see a full explanation of how our reports are constructed and what they mean at the bottom of this page.’s

Part One: The Business Case

Litecoin Market Opportunities

The main purpose of Litecoin is to function as a global payment system that enables users to send and receive near instant, borderless payments with low transaction costs. Litecoin covers a part of the digital global remittance and the contactless payment markets, which are expected to grow significantly by 2025. Specifically, the global remittance market is expected to reach $8.59 billion by 2025, while the contactless payment market is expected to reach $801.4 billion by the same year.

Litecoin was one of the first cryptocurrencies in the blockchain space. People can buy/sell LTC through exchanges, over-the-counter markets (Coinbase), and using ATMs. In addition, debit cards exist that support LTC: people can use plastic cards to pay for goods and services with LTC.

Moreover, Litecoin has partners who have implemented LTC for bill payments. In general, there are a significant number of platforms on which people can pay for goods and services with LTC.

But even this seemingly wide distribution of LTC does not allow it to dominate the payment systems market because there are many competitors that have more advanced technologies, and higher impact on the community.

Competition in the Blockchain Space

Its closest competitor is Bitcoin, which calls into question the necessity of Litecoin’s existence. It is possible to consider two cases of using cryptocurrency – a checking and a saving account.

Bitcoin is the most widespread cryptocurrency in the blockchain industry and it serves more like digital gold. Thus, Litecoin has no chance to overtake it as a saving account in the industry. Yet, Litecoin also has little chance of taking its place as a checking account, because Litecoin has no significant technological differences from Bitcoin.

Bitcoin and Litecoin have both launched technologies like SegWit, Lightning Network, and Atomic Swaps: as a result, it is difficult to highlight the significant advantages of Litecoin over Bitcoin. In the absence of further technological innovations, Litecoin will remain in the shadow of Bitcoin and could lose a large part of its market.

Another competitor is Dash, a fork of Litecoin and a representative of payment systems with a hybrid consensus algorithm. Dash is a direct competitor to Litecoin and poses a direct threat to it, because Dash can cover most of the Litecoin payment market.

Litecoin is inferior to Dash technologically, since Dash is a two-tier network that supports technologies such as InstantSend and PrivateSend. InstantSend allows for an instant transaction that is fully confirmed within 2-3 seconds and PrivateSend gives an opportunity to maintain full anonymity of transaction.

Litecoin, in turn, offers to use the Lightning Network that is a good alternative, and intends to launch confidential transactions technology: however, it will not make Litecoin more competitive because the team has not developed anything substantially different from its rivals.

In addition, Litecoin has less developed infrastructure and smaller merchant network. For instance, Litecoin merchant network has about 1000 merchants (reached because Coingate started supporting Lightning Network payments), while Dash boasts over 4500 and its network is growing fast. It is a direct threat to Litecoin.

There are also privacy coins in the blockchain industry like Monero that can be used as a means of payment. Monero’s main application is ensuring full transaction anonymity. Litecoin is a non-private blockchain, therefore, it essentially has no influence on the privacy coins market.

Even if Litecoin launches the technology of confidential transactions, it will not be able to take away a part of the private blockchain market, since Monero has already proven itself in this market and has better community support and even more advanced technology. It will simply become an additional function for existing Litecoin clients.

It can handle almost 1,700 transactions per second, transactions on the Monero blockchain are 1.5-2 times cheaper, and the Monero team also intends to launch the Lightning Network. Therefore, Litecoin has no significant advantages entering the market of privacy coins.

There are also multi-functional blockchains such as Stellar, which has many applications such as a payment system, a trading exchange, a dApp platform. However, let’s consider Stellar only as a payment system here.

It is possible to claim that in the long run, Litecoin will not be able to compete with a blockchain such as Stellar because of the fact that the latter has much more advanced technology. For instance, Stellar can handle 1000 tps with confirmation time of 3-5 seconds, meanwhile, Litecoin can handle only 56 tps with confirmation time of 30 minutes. In addition, Stellar transactions are many times cheaper than Litecoin transactions. Moreover, Stellar intends to launch the Lightning Network, therefore, in terms of technology, Litecoin has no advantages.

Although Litecoin has a wider merchant network Stellar has a better chance of worldwide adoption since it has partnered with big companies like Deloitte, IBM, Tempo Money Transfer, etc.

In order to compare how the market prices one unit of on-chain transactions we can use the NVT ratio. This indicator reveals that Dash and Stellar transactions are priced higher than Litecoin, but Bitcoin transactions are valued nearly at the same rate.

Stellar and Dash have more advanced technologies than Litecoin, so the community believes in their long-term viability to a greater degree. Meanwhile, Bitcoin and Litecoin are almost the same cryptocurrencies in terms of technology, therefore their NVT values are almost the same.

NVT Comparison

Besides competitors in the blockchain sphere, there are still many other major players in the global payment market, for example, Western Union, Visa, PayPal, etc.

Given the active interest of Visa, Western Union, and PayPal into blockchain technologies (these companies have several patents) and their financial resources, such renowned players in the payment market can become very strong competitors in the blockchain industry as well. This poses a direct threat to Litecoin.

Litecoin faces tough competition in the payment market. Its rivals are more competitive and their technologies are more advanced. Therefore, to maintain its position, Litecoin needs to be more innovative and active, otherwise, it risks losing its place in the space.

Litecoin Ecosystem Development

The Litecoin ecosystem is one of the key factors that determine its further growth and development. The Litecoin Foundation is actively working to attract new partners, develop new products, expand the merchant network, and interact with its community to spread knowledge and inform them about the ecosystem development. This shows that the team believes in their product and works hard on its development. However, the presence of centralization of power can divert interest in this technology.

First, the centralization of power is manifested in the mining structure, which makes the Litecoin network more vulnerable to attacks.

Litecoin is a peer-to-peer cryptocurrency that uses Scrypt PoW consensus algorithm. It is a sequential memory-hard function that is the faster and easier algorithm in comparison of SHA-256.

Litecoin initially decided to use the Scrypt algorithm to make mining more accessible and decentralized. This goal was achieved because it was difficult to develop special mining hardware, based on the Scrypt algorithm, like ASICs for mining LTC, therefore, mostly, people used PCs. This was Litecoin’s competitive advantage over other cryptocurrencies because there were no organizations that could accumulate enough computing power to dominate others.

Unfortunately, in November 2014, Alpha Technology developed Litecoin Mining Hardware. Currently, it is more profitable to use ASICs (Antminer L3++, Bittech L1, Innosilicon A4, etc.) for mining LTC than CPU or GPU devices.

Consequently, nowadays, the hash rate distribution looks very centralized because 5 mining pools hold 75% share of the hash rate power and the centralization of power may increase with time.

Second, the centralization of power is manifested in the wealth distribution of LTC, which strengthens the speculative nature of the price changes and reduces the client confidence towards future price stability. Price stability is important for the good functioning of the merchant network.

For example, the table below shows the distribution of LTC among the top-10 richest wallets of Litecoin holders. Their total share is 7.66%, while this value is 5.30% and 5.63% for Bitcoin and Dash, respectively.

If we look at the top-100 richest wallets of Litecoin holders, we will see that their total share is 40.7% of the total supply. Meanwhile, this value is 15.8% and 14.9% for Bitcoin and Dash, respectively, which makes for a substantial difference.

Moreover, there are 42 Litecoin holders who hold 300,000 LTC (~$9.3mln or 0.50%) each. In total, this amounts to 21.1% (12.6 mln of LTC or $390.6 mln) of the total market. This makes the network vulnerable to potential manipulation by whales.

Litecoin Foundation

A key player in the ecosystem development is the Litecoin Foundation, a non-profit organization registered in Singapore. This organization has a number of goals:

– Participate in projects which aim to advance blockchain technologies;

– Stimulate the worldwide adoption of cryptocurrency;

– Education purposes;

– Support projects that incentivize the use of blockchain technologies to speed up the economic progress of the developing countries.

The Litecoin Foundation works closely with the Core team and supports them financially. This organization is funded through donations. There are three sponsors programs to attract investors such as: “Portion of Sales Sponsors”, “Marketing Sponsors”, and “Friends of Litecoin”. These programs are aimed at raising funds, after which sponsors can publicly state that they are Litecoin donors, or publish their services on the Litecoin Foundation website.

It also entitles them to receive a special badge “@Litecoin Members” in a Litecoin telegram group.

Financial statements reveal that the team collects almost $830,000 per 12 months in this way.

In addition, the Litecoin Foundation created The Litecoin School of Crypto where you can find the information about how Litecoin works.

Litecoin has substantial industry support, trade volume, liquidity, and a wide merchant network. After the development of the Lightning Network, the number of merchants increased up to 1000.

The Litecoin Foundation also interacts with a number of payment gateways (Coingate, Coinpayments, Bitrefill, etc.). This ongoing infrastructure development allows Litecoin to expand its client base more quickly.

The Litecoin Foundation also actively works on attracting partners for ecosystem development – some of which are less successful than others. It is important to note that on March 27, 2018, the Litecoin Foundation announced the closure of “Litepay”, a potential Litecoin merchant solution similar to BitPay.

However, on July 10, 2018, Litecoin partnered with a decentralized payment platform TokenPay, which acquired 9.9% of WEG Bank in Germany. Litecoin will help TokenPay with the development of its blockchain, meanwhile, TokenPay will integrate Litecoin into their merchant platform and into the WEG Bank.

As a result of the activity of the Litecoin Foundation, Litecoin has a greater number of active addresses than its rivals, and the community support in the social networks is almost the same. Still, Bitcoin’s adoption is significantly higher than that of the other cryptocurrencies.

Community Involvement Comparison

The Litecoin Foundation is an active participant in the Litecoin ecosystem. In addition, not only the core development team is engaged in the development of new products of the Litecoin project, there is also a community of developers who support the development of Litecoin, which increases the decentralization of power.

The Litecoin ecosystem is quite active, and the team is working hard on its development. The project is alive, it has a live client base, partner base, and support from external developers, as seen on GitHub. Despite some problems of centralization, Litecoin maintain a large number of active users.

The Litecoin ecosystem has a well-built model that has a positive effect on successful long-term development.

Litecoin Token Economics

Litecoin utilizes the Proof-of-Work consensus algorithm.

Reward – miners are rewarded with 25 LTC for block creation every 2.5 minutes. Therefore, miners have a good incentive to maintain the Litecoin network.

Litecoin’s block mining reward halves every 840,000 blocks. In August 2015, at the 840,000 block, the reward per block fell from 50 to 25 LTC. The next time the block reward will be halved on 8 August 2019.

The block reward halving process may have a negative effect on the profitability of mining since the block reward will be reduced in half. As a result, some miners may leave the space, that is, there will be a lower amount of nodes that run the Litecoin network. Consequently, this network may become less decentralized.

However, in August 2015 the Litecoin community observed that the block reward halving process did not significantly affect the work of miners. The expected significant negative effect did not occur, but it does not mean that this cannot happen in the future when the block reward will fall below 1 LTC.

To calculate the profitability of mining it is necessary to know the hash power of a mining device, the total hash rate of the Litecoin network, the block reward value, costs per kWh ($) and power consumption (W), and the block generation time.

The actual hash rate is 177.7 TH/s, difficulty – 5.99M, the LTC price – $31.1. The graph below shows that the hash rate and difficulty increased until the end of May because the mining of LTC was profitable. After that point of time, the hash rate and difficulty started falling down gradually. It is likely that some non-efficient miners left the market because the price decreased below a certain threshold.

Hash Rate, Difficulty and Price of Litecoin

Fees – The current transaction fees on the Litecoin network depends on the priority degree:

– High Priority (1-2 blocks) – 0.00119 LTC/kB ($0.03701);

– Medium Priority (3-6 blocks) – 0.0001 LTC/kB ($0.00311);

– Low Priority (7+ blocks) – 0.00003 LTC/kB ($0.00093).

The transaction fees are also used as an incentive tool for miners.

Overall, the average transaction fees on the Litecoin network is lower than on Bitcoin and Dash, 1.5-2 times larger than on the Monero network and many times larger than on the Stellar blockchain. This means that, in terms of transaction costs, Litecoin can compete with cryptocurrencies like Bitcoin, Dash, Monero in long run, but not Stellar.

Speculation – LTC is traded on many of the popular crypto-exchanges.

Litecoin has a deflationary model that has a positive long-term effect on the LTC value. That is, its value will increase due to limited supply and unlimited demand, but this effect may not be observed until after 2142 (the year, not the time!)

Currently, Litecoin has the highest daily inflation rate among its rivals and, the deflationary model of Litecoin will not have any advantages over inflationary models of its competitors for the next hundred years.

Supply and Inflation Comparison

Litecoin has well-built token economics and its deflationary model suggests that LTC value will only increase in the future, but the demand for it depends on its level of adoption.

Lead Team

Charlie Lee – Charlie is the Managing Director of the Litecoin Foundation. He founded Litecoin in October 2011. Charlie Lee graduated from MIT in Computer Science and has more than 15 years of experience in software engineering. He worked as a software engineer at Google, and was engaged in the development of YouTube Mobile, Chrome OS, and Play Games. After that, he held the position of Director of Engineering at Coinbase, a digital cryptocurrency wallet, and platform for merchants and consumers. He has been involved in the blockchain industry since 2011.

Franklyn Richards – Franklyn is the Founding member & Director of the Litecoin Foundation. He began working with blockchain technologies in 2013. Since then he has participated in many blockchain conferences, creates a number of educational resources, and provided private consulting for many individuals, investors, and business. In 2018 he took over operations for Litecoin.com and founded LitecoinHaus, a private company for the Litecoin ecosystem development. In addition, in 2018 Franklyn Richards started working as the COO of Zulu Republic to lead development of the Litecoin products: LiteVault.net – the largest trustless web wallet for Litecoin; Lite.IM – the first trustless wallet for social media and SMS.

Xingi Wang – Xingi is the Founding member & Director of the Litecoin Foundation. He received his Ph.D. in Computer Science in the National University of Singapore. Xingi Wang has 10+ years of experience in trading, he founded Coinut PTE LTD, a comprehensive exchange platform for trading cryptocurrencies and its derivatives. Xingi Wang worked as a Boost VC Accelerator at Boost VC for 4 months, the #1 accelerator in the world for Crypto and VR startups. In addition, he is an Angel Investor at Overlay Technologies, 1st augmented reality community collaboration platform, and also works as a core developer at Litecoin.

Zing Yang – Zing is the Director of the Litecoin Foundation. She graduated from the Singapore Management University with Bachelor of Business Administration in Finance and Marketing, and she is also a Certified Associate in Project Management. Zing Yang has over 10 years of experience in investments.

In addition to the Board of Directors, the company has 3 directors: Keith Yong, John Eidson, David Schwartz; 2 full-time developers: Adrian Gallagher, Loshan T.; and 18 volunteers and key contributors.

Keith Yong – Director of Operations at the Litecoin Foundation, he has over 20 years of experience in finance and banking.

John Eidson – Director of Marketing & Communications at the Litecoin Foundation, he has 10 years of experience in marketing and public relations.

David Schwartz – Project Director at the Litecoin Foundation, he has 15+ years of experience in HR management.

Volunteers and key contributors are responsible for partnerships, business development, events organization, social media, PR, legal, merchant network development, etc.

The Litecoin Foundation works closely with the Litecoin Core development team of the Litecoin project, and supports them financially.

It should be noted that Charlie Lee has a huge impact on the development of Litecoin. He has been accused of influencing the price of LTC with his tweets, for his personal interests. In December 2017, Lee sold almost all of his coins at the top of the market to “avoid a conflict of interest”, and he now holds only a number of physical ‘coins’ as collectibles.

Part Two: The Technology Case

Underlying Technology

Litecoin is a fork of Bitcoin that utilizes a PoW consensus protocol and the X11 hash algorithm. Litecoin is a distributed ledger technology and, basically, functions in the same way as Bitcoin does, but it has its own characteristics and technological innovations.

Despite of the implementation of technologies like SegWit, LN, Atomic Swaps, this does not add technological advantages to Litecoin over its competitors: Bitcoin has also developed the same technologies, Stellar and Monero intends to build the LN on top of their blockchains as well. However, there is information that Litecoin intends to develop a number of other technologies in the near future, which could make Litecoin more competitive.

Its advantages are:

– Faster transactions – Litecoin generates a block every 2.5 minutes, can handle 56 transactions per second and takes 30 minutes to confirm a transaction. It allows transfers to be made much faster than banks do.

– Higher liquidity (supply is 84 million) and lower transaction fees

Segregated Witnesses – is a technology that removes signature data from the transaction altering the block size limit from 1 MB to 4 MB. The main benefit of implementing SegWit is an opportunity to build the Lightning Network on top of Litecoin.

Lightning Network is a network of micropayment channels supporting an unlimited number of instant and low-fee transactions off-chain through a multisig address. The multiple signature wallet is a wallet that is controlled by multiple people. It functions in the same way as a regular wallet, but in order to receive/send LTC within a channel, it is necessary that a certain number of wallet owners sign a transaction (the number is set by a smart contract; for example, 2 out of 3 or 3 out of 3 must sign the transaction). In the Lightning Network, you will only have to pay small transaction fees to open and close a channel. The main benefit of implementing LN is a creation of channels for an unlimited number of low-fee transactions that enables to grow the merchant network.

In addition, this technology allows for Atomic Swaps – it is a smart contract technology that enables users to trade between two cryptocurrencies without going through an exchange. Atomic Swaps can be conducted off-chain as well. In September 2017 the first atomic swap occurred between Decred and Litecoin.

Nevertheless, the implementation of these technologies by Litecoin does not add competitive advantages: but the Litecoin team intends to realize other technologies such as MAST, Covenants, Colored Coins, and Confidential Transactions.

MAST (Merkelized Abstract Syntax Trees) – is a data structure that is converted into a compact hash called Merkle Root. This technology allows you to check if specific data is somewhere in the Merkle Tree by reading only the top of the tree. Below is a diagram of the Merkle Tree.

For example, Merkle Root “z” allows you to verify that “CDz” transaction has occurred, while information about “ABz” transaction is not disclosed, which ensures high confidentiality. MAST will enable to write and execute smart contracts on the Litecoin blockchain.

If this technology is realized by the Litecoin team, then it will expand the use of Litecoin, improve the security of the Lightning Network, and avoid further scalability issues, which will make Litecoin more competitive in the market.

Covenants – is a set of promises to perform a certain action or refrain from a certain action. This enables one to restrict the future use of coins after a transaction has occurred.

A transaction output contains an output script program and an amount that can be restricted by the Covenants Protocol (new operations of the scripting language). Such an operation has its own form: an output index, an amount, and a pattern. This technology enables to develop Colored Coins.

Colored Coins – are specific coins to which it is possible to attach a “distinguishable mark’ using the Covenants Protocol. This enables users to control and track their coins.

There are three possible use cases for Colored Coins:

– Create ICO utility tokens like Ether.

– Associate digital coins with physical assets and use them as a digital asset exchange mechanism.

– As an Airbnb host, for example, you could potentially send your renters colored coins that time out at the end of three days. These colored coins would function like keys that give your renters access to the apartment. Should they be tempted to stay longer, they would be shut out because the colored coins will have expired.

The combination of Colored Coins with the Lightning Network will give the Litecoin blockchain more tools for financial services that implies that the payment system will be used more widely.

Confidential Transactions (CT) – is a protocol that hides the address of the receiver and the amount of coins a user sends. This technology allows transactions anonymity similar to Monero.

The format of the confidential transaction consists of a scriptPubKey, Pedersen commitment, and ecdh nonce.

To hide the LTC address and LTC amount on the public blockchain a blinding key is used. This blinding key and a regular LTC address are hashed and such hash called the confidential transaction address (CTA) that is contained alongside with a mathematical condition (it proves that LTC can be spent) in the scriptPubKey.

Pedersen commitments have a unique mathematical property that enables to convey information without revealing the data itself. A Pedersen commitment is a hash of the total LTC output and a blinding key.

The ecdh nonce is used to unlock the confidential transaction.

Overall, confidential transactions are a powerful tool to increase transactions anonymity on the public blockchain. This technology will make the Litecoin blockchain more functional, but it will not have any advantages over Monero or Zcash.

Monero utilizes technologies such as ring signatures, stealth addresses and confidential transactions to hide the receiver and sender’s addresses and to hide the number of coins a user sends. Zcash uses specific zero-knowledge proofs called zk-SNARKs, which allow transaction data to be validated without revealing any information about the transaction.

These two privacy coins use more advanced technologies and provide better transactions anonymity than Litecoin could do. Therefore, Litecoin cannot be considered as a threat to existing privacy coins.

Slow transaction confirmation on the Litecoin blockchain make it less competitive in the market compared to Dash, Monero, Stellar and others.

Scalability Comparison

Despite the fact that the Litecoin team is working hard on new developments, which shows their intention to maintain their competitiveness in the blockchain space, Litecoin may fail in the long-term.

Competitors have already developed analogues of Litecoin technologies or may follow Litecoin and implement them too.

Therefore Litecoin may find it hard to compete in the market in the long-term, because it will not be sufficiently distinguishable for any feature, or set of features.

Litecoin Roadmap

The official development roadmap of the Litecoin project is missing. This demonstrates a low level of transparency since the community cannot track the future plans of the team and the progress of the project. The Litecoin Foundation publishes news about the Litecoin development updates from time to time, but there is no clear picture of the project development.

There is an approximate roadmap of Litecoin published in the Litecoin School of Crypto. The article is called “Upcoming Litecoin Technology and General Timelines”, and it is only an informative guide for the Litecoin community.

MAST.

What does it do? It allows more privacy by hiding lumped transactions through a Merkle root. It also allows for complicated smart contracts. Smart contracts are currently capable on the LTC blockchain, it just takes up a lot of space.

When will it be released? Of all the tech, this is the closest to being released.

The Lightning Network.

What does it do? Allows instant transactions and reduced fees.

When will it be released? The LN isn’t being developed by the Litecoin Foundation specifically. It is being developed by Lighting Labs. There is a prototype wallet called ZAP! by Jack Mallers. If you’re a coder, you can help them test it. That being said, it will take a significant amount of time in order for the LN to be a fully functional product. Perhaps a year to create stable wallets. Multiple years to scale it out.

Atomic Swaps.

What does it do? It allows people to trade one coin for a different coin without an exchange. This is called cross-chain swaps. It actually utilizes LN to do it.

When will it be released? LTC performed a test run of on-chain Atomic Swaps with Decred/Vertcoin/Bitcoin. This means it was not through the LN. If it takes a year for stable LN wallets, it will take longer to build AS on top of that and longer still to integrate it into the mainstream.

Covenants.

What does it do? You are able to select LTC to be bound together and stay together no matter what. When LTC blocks are formed, all the LTC are lumped together. Covenants will allow chosen LTC not to be lumped in with the other coins but be continually bound together in blocks. This allows the Colored Coin protocol to be implemented.

When will it be released? Unknown.

Colored Coins.

What does it do? Allows LTC to be repurposed to be attached to an asset. That means ICO’s. Johnson Lau speculated you can assign LTC to a computerized car like Tesla. In other words, your LTC could be given the property to act like a key to your car which you could send via your mobile phone. *mind blown*

When will it be released? I’m not sure this is very high on their priority list. BTC might take the lead before LTC on this one. Maybe 2 years?

Confidential Transactions.

What does it do? Allows anonymity between LTC transactions, something similar to Monero.

When will it be released? Charlie Lee recently expressed in an interview that he thinks this might be the next project to work on.

Atomic Swaps and the Lightning Network have already been implemented, but there is no official information about the launch of other technologies.

GitHub Activity

Part Three: The Investment Case

LTC Token Performance

Litecoin is a top-10 blockchain project based on market cap, and a top-6 based on 24-hour volume rankings. The bear market has strongly affected the price of LTC that has fallen around 91% from the January ATH. The same price dynamics are observed in its competitors.

Bitcoin / Litecoin / Dash / Monero / Stellar Price Comparison

LTC trading volume is mainly represented by pairs LTC/USDT (~46%) and LTC/BTC (45%). Its rivals have the same picture – over 80% of trading volume is represented by the same two pairs. In addition, Litecoin (LTC) has a high liquidity and more than 85% of LTC/BTC and LTC/USDT volumes are traded on the top-10 exchanges.

Volume Comparison

Trading volumes began to grow gradually after a significant drop and the same behavior is observed among competitors except for Monero. This, in turn, reflects the presence of speculations that led to the fall of the market in November-December.

Litecoin volume comparison

Litecoin volatility has similar behavior and takes on approximately the same value as that of competitors, with Bitcoin exhibiting lower volatility. The last increase in volatility is due to a sharp drop in the market in November-December.

The charts are so similar because there is a correlation between Bitcoin and altcoins. Therefore, the dynamics of changes in the price of Bitcoin finds their reflection in the dynamics of changes in the prices of its competitors.

Litecoin 30-day volatility comparison

Litecoin

(LTC)

Price

$31.76

Market Cap

$1,915,682,654.69

Litecoin Initiation Report: C

Market Opportunity5

Ecosystem Structure7

Token Economy8

Token Performance5

Core Team7

Underlying Technology6

Roadmap Progress6

6.4

Final Grade And Verdict

Litecoin is one of the oldest cryptocurrencies, designed for use primarily as a means of payment. On the one hand, this project looks very good as its token economics is solid, and the team is one of the most experienced and active.

On the other hand, the market competition for Litecoin is very tough. The level of development of the technology is weaker compared to its rivals: and there are more promising blockchains, which are more scalable, can process more and faster transactions with lower transaction fees, and offer multi-functional solutions.

In addition, the competitors have greater community support and wider merchant networks, which is a threat to Litecoin.

The lack of an official development roadmap reduces the transparency of the project and increases doubts about its long-term prospects.

Due to the risks associated with the project, Litecoin is graded C.

We consider a C Grade to mean that the project exhibits moderate indications of progress but still faces above average level of risk; token price is highly volatile, prospects for adoption are uncertain due to factors such as poor marketing, lack of developers or dApp projects, irrelevancy of tech, or critical governance issues.

Additional Information

Litecoin Website

Digital Asset Evaluation & Report (DARE) Methodology

Introduction To The Framework

The Digital Asset Report and Evaluation (DARE) is a standardized, dynamic approach to evaluating blockchain-based projects and identifying value in the associated crypto-assets.

The report is the result of an exhaustive research and analysis process based on seven fundamental factors. Based on a weighted grading of these seven project fundamentals, a verdict and letter grade conclude each report, which is followed up with periodic updates, released over a quarterly basis.

The analysis, verdict and accompanying grade reflect our opinion on the long-term value prospects of a given token based on the current state of project development and indicators of future commercial viability.

The state of product development and indicators of commercial viability derive from an analysis of seven principle project fundamentals – market opportunity, ecosystem structure, token economics, core team, underlying technology, and roadmap progress.

The underlying methodology involves both quantitative and qualitative analysis to ensure that we produce the most accurate picture possible at the time we conduct our evaluation.

As a publication focused on assessing the long-term value and associated risks of a token project, we do not encourage the use of DARE as a short-term buy/sell indicator and this report does not represent financial advice.

The Initiation Report

Our first look at a token or cryptocurrency employs the Initiation report as a vehicle for delivery. Initiation reports provide readers a comprehensive analysis of the project fundamentals and draws hard conclusions from our assessment.

The details of the Initiation report include a project summary, project introduction, presentation and analysis of seven key project fundamentals, concluding with a grade and final verdict derived from our weighted evaluation system.