#bitcoin elliott wave count

Text

#bitcoin price#bitcoin price prediction#bitcoin price analysis#bitcoin price today#bitcoin btc price#btc price#bitcoin#bitcoin news#bitcoin prediction#bitcoin analysis#bitcoin news today#bitcoin today#bitcoin crash#bitcoin technical analysis#bitcoin live#bitcoin now#bitcoin technical analysis today#bitcoin drop today#bitcoin chart today#bitcoin elliott wave count#bitcoin elliott wave analysis#bitcoin price news today

0 notes

Text

Navigating XRP: Analyst's Bullish Perspective Amid Whale Activities and Bearish Market Trends

Ethereum has been testing the critical $3,200 mark, with analysis pointing to potential bullish trends supported by Fibonacci and Elliott Wave theories. Additionally, open interest in Ethereum has reached near-2021 highs, indicating increased investor engagement and optimism in its future trajectory.

Key Points:

Critical Ethereum Price Level: Ethereum, the second-largest cryptocurrency by market capitalization, is currently testing the critical $3,200 mark. This level is seen as significant within the market and has sparked detailed analysis of Ethereum's technical landscape.

Bullish Signals from Analysis: More Crypto Analysis on YouTube has conducted an in-depth analysis of Ethereum's technical landscape, utilizing tools such as Fibonacci and Elliott Wave theories. The analysis suggests that Ethereum's market peaked near $3,128, prompting discussions about potential future movements. Key indicators, including the 78.6 extension level, hint at potential upward momentum, although caution is advised regarding local resistance.

Elliott Wave Price Predictions: The analysis explores various Elliott Wave price predictions for Ethereum, considering patterns such as diagonal and impulsive counts. The analyst suggests that Ethereum may have completed a complex five-wave pattern, with a focus on vigilance around the previous swing low at $330 for top indications.

Open Interest Reaches Highs: CoinGlass reports that Ethereum's open interest is nearing its 2021 all-time high. This is interpreted as a reflection of growing market engagement and investor interest in Ethereum. Rekt Capital, a notable figure in cryptocurrency analysis, has also highlighted Ethereum's significant moment on X.

Optimism in the Market: The overall market scenario implies that traders and investors are closely monitoring the charts. Combining ongoing market conditions with historical data paints an optimistic picture for Ethereum's potential trajectory.

Bitcoin's Impact: Crypto Rover, founder of Cryptoseacom, adds weight to the idea that understanding Bitcoin's historical patterns could be crucial for predicting its future movements. Bitcoin's performance is often seen as a key influencer of the broader cryptocurrency market.

Dynamic Nature of the Market: The discussion around Ethereum's market behavior emphasizes the dynamic nature of the cryptocurrency space. As the market evolves, so does the strategy of those navigating it.

As Ethereum continues to interact with key indicators and historical patterns, insights from analysts and observers provide valuable perspectives for traders and investors. Ethereum's current stance, along with its historical performance, contributes to the ongoing narrative of the cryptocurrency market's complexity and potential opportunities.

0 notes

Text

Market Comment

A long while back, I overheard a trader say that markets have become nothing more than liquidity gauges.

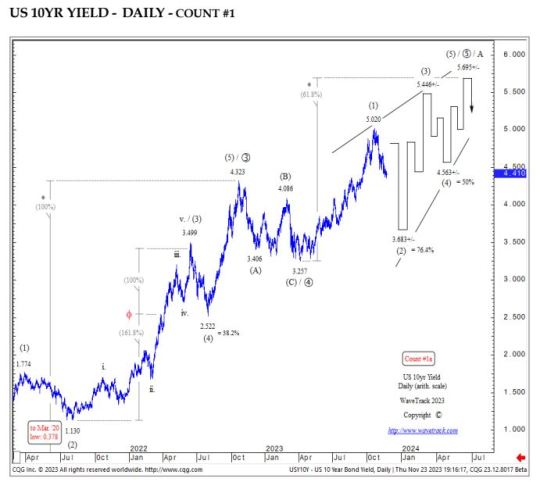

That's what inspires me about this provocative chart of US 10-year yields courtesy of Peter Goodburn, Managing Director of WaveTrack International GmbH.

It brings into context some aberrant market action over the last several days that may presage something lurking below the surface of the pool.

WTI tracks thousands of instruments across the global financial markets -- that's thousands of snapshots of liquidity, where it's flowing and how.

With equity traders intoxicated with visions of rate cuts dancing in their heads, WTI's chart of US 10-yr yields suggests the current decline in yields could be misinterpreted, as in as c'mon in boys, the water's fine.

What is dancing in my head is the effect a rate surprise might have on equities and crypto, two darlings of late. Neither one feels right.

Bitcoin, while benefitting from a possibly too-much-anticipated ETF and institutional boom, has morphed from having a 90% correlation to tech stocks during the 2020-2021 rally to currently having an 88% correlation to bonds and the US dollar.

It must be noted that correlations can swing wildly and quit suddenly. Yet if yields head to new highs, bitcoin's all-clear-for-risk-on rally may be in jeopardy. (Note its recent 4-day 10% correction coinciding with US Senator Warren's Crypto "crackdown" bill gaining momentum.)

Perhaps that's why yesterday saw the "Magnificent 7" tech stocks suddenly drop $200 billion in market cap. Yes, it could have been due to the NDX special rebalancing announcement, or even better, a broadening of the tech rally into more value names.

But regardless, where there's smoke there is usually fire.

Interestingly, the US dollar is higher since late November and bond yields rose for a third consecutive day yesterday.

Are some market participants slowly sniffing out the implications of the chart above?

Simply put, I feel that bitcoin and "Mag 7" are about to get sucker punched...by Elliott "B-waves."

Mood Report has shown the SPX B-wave count since April of 2023, also flagging both the 4662.85 gap and 4685.92 90% level (allowing for a possible Elliott "flat" retracement).

My thesis here is if yields rally per WTI's chart, both bitcoin and equities could top together in twin B-waves.

Both could still head higher. SPX could even head higher to a 127% Fib extension target at 5179.57. Bitcoin's 61.8% retracement level is 48,547 per the above chart. (Note the Elliott labels are for simplicity only and do not conform to proper Elliott nomenclature.)

Perhaps yesterday's action was nothing more than a foreshadowing of what could happen if rates do surprise.

With both spigots of liquidity -- fiscal & monetary -- having flooded the economy, it seems sophomoric to expect the Fed to lower rates for any reason other than a calamity.

Perhaps a calamity would be the "Mag 7" stocks losing a few trillion in market cap.

Finally, today being a New Moon (6:32pm NY time), I will be on the lookout for the possibility of a new market direction.

Lest I be perceived as nuts for mentioning the moon, please note the RBS moon trading study which was backtested to 1928 and showed an astonishing edge.

Many thanks to WaveTrack International (WTI) for permission to publish their 10-yr yield chart.

###

For big picture, institutional-quality work at a retail price, I swear by WTI's bi-yearly three-part report spanning stocks, commodities, and interest rates & currencies with about 300 charts, in-depth written commentary, and an hour+ video for each edition.

Part 1 should be ready in a few weeks. Highly recommended.

I have received no compensation for my comments.

0 notes

Text

The biggest October crypto predictions deal with Bitcoin Cash (BCH), Ethereum (ETH) and EOS.

October has been a roller-coaster ride so far. A significant increase on October 1 was followed by a sharp drop the next day. With that in mind, BeInCrypto looks at the crypto predictions for the month of October.

Bitcoin Cash Will Reach a New Yearly High

The BCH price has been falling since reaching its yearly high of $329 on June 30. The decrease was contained inside a descending parallel channel, which is considered a corrective pattern.

The movement inside the channel led to a low of $165 on August 17. The ensuing bounce validated the channel’s support line and initiated an upward movement, which is still ongoing. BCH broke out from the channel on August 29.

The main reason for the bullish prediction comes from the wave count. Elliott Wave theory involves the analysis of recurring long-term price patterns and investor psychology to determine the direction of a trend.

The most likely wave count suggests that the BCH price is in the fifth and final wave of an upward movement (white), which began in November 2022.

If the count is correct, BCH will reach a new yearly high near $425. The target is found by wave four’s 1.61 external Fib retracement (black). It is 75% above the current price.

BCH/USDT Daily Chart. Source: TradingView

Despite this bullish BCH price prediction, a close below the minor horizontal support area at $225 will mean that the count is invalid and the price is still being corrected.

In that case, a 28% decrease to the August 17 lows at $168 will likely be the future price outlook.

EOS Will Fall to a New All-Time Low

The EOS price has fallen under a descending resistance trendline since May 2021.

More recently, the line caused a rejection on April 10 (red icon). This led to a low of $0.50 in August.

The low was important since it coincided with the all-time low support level, which had not been reached since 2017. The accurate all-time low is at $0.48, nearly 20% below the current price.

A breakdown from the $0.50 region could cause EOS to decrease to $0.13, 80% below the current price.

Since there is no horizontal support below $0.50, the 1.61 external Fib retracement of the most recent bounce determines areas for a potential bottom.

EOS/USD Weekly Chart. Source: TradingView

Despite this bearish EOS price prediction, a breakout from the descending resistance trendline will invalidate the bearish forecast.

In that case, a 120% increase to the next closest resistance at $1.25 will likely be the future price scenario.

Ethereum Concludes October Crypto Predictions

Ethereum has fallen in a descending wedge against Bitcoin (BTC) for over a year. More specifically, the wedge has been in place since July 2022. The ETH price currently trades very close to the wedge’s support line.

The point of convergence between the resistance and support trendlines is approaching, so a decisive movement outside of it is likely to occur soon.

ETH/BTC Daily Chart. Source: TradingView

Besides the wedge being considered a bullish pattern, the daily Relative Strength Index (RSI) supports the possibility of a breakout.

The RSI is a popular metric among traders for gauging momentum and informing their buy or sell decisions on assets.

Readings above 50 and an upward trend suggest that bulls still have an advantage, while readings below 50 indicate the opposite.

The indicator has generated bullish divergence (green line), an occurrence when a price decrease is combined with a momentum increase. This divergence often leads to bullish trend reversals.

If ETH breaks out from the wedge, it can increase by 25% to the ₿0.075 resistance region. On the other hand, a breakdown from the wedge’s support line will invalidate this bullish prediction, likely causing a 12% drop to the ₿0.052 support.

0 notes

Text

FORECASTING THE MARKET ONE WAVE AT A TIME - PROMO EVENT !

Our analysts at CWCOUNT.com use a proprietary counting method when applying Elliott Wave principle. We have over 30 years of experience in Wall Street as head traders for major wirehouses, who are well versed in technical analysis, especially with Elliott Wave analysis.

Our EW charts display key Elliott Wave counts, whether you are a swing trader, or a day trader or a long term investor, we provide 1 hour, 4 hour, daily, weekly, and monthly counts on all the assets we cover. More specifically, we provide key levels in the price action that results in changes in the Elliott Wave patterns coupled with the Fibonacci target levels and common relationship analysis between all the waves.

If you are a trader and if your goal is to maximize trading opportunities please send us an email to https://cwcount.com/contact/ with the words ‘FORECASTING THE MARKET ONE WAVE AT A TIME’ and we will send you a promo code to receive a discount to our membership plans. Please expedite your decision because our promotion will be valid only through the end of this year.

Current Wave Inc.

Official site : https://cwcount.com

Korean site : https://cwcount.co.kr/

Contact us : [email protected]

Blog - S&P 500 Lookout Below!!

https://cwcount.com/blog/sp-500-lookout-below/

Blog - BITCOIN will thrive once again!

https://cwcount.com/blog/bitcoin-will-thrive-once-again/

Blog - ETHEREUM’s ecosystem will grow exponentially

https://cwcount.com/blog/ethereums-ecosystem-will-grow-exponentially/

0 notes

Text

Bitcoin Wave Count Provides Some Indications As To The Future Trend's Direction

read more cryptocurrency news

During the past few months, has been on a tear. Bitcoin's price has risen dramatically, reaching recent highs of $19,400 from lows of $3,200 in December and previous lows of $3,200 in October. There has been a lot of discussion about where BTC might go next as a result of its recent value spike. There has been a correction after the parabolic climb came to a halt. There has been a correction after the parabolic climb came to a halt. Whether the correction will be deeper or shallower is the question. There may yet be further downside to the range of 13k–10k before this trend finishes, according to the wave count, which indicates that we are currently in an ending diagonal from wave 4. The chart of Bitcoin resembles an Elliott wave.

read more https://www.tumblr.com/blog/topcryptocurrencynews

0 notes

Text

undefined

youtube

How To Trade Energy Sector ETF XLE Using Elliott Wave Strategies Like A Pro

Elliott wave trading video that shows the application of the Elliott

wave strategies in view to interpret the energy sector ETF's (XLE)

price structures more accurately. This Elliott wave tutorial was recorded because an Elliott wave and ETF trader wanted to compare his waves count to the one shown in this video.

Begin to polish your ETF Elliott wave strategies today.

Free Elliott Wave Trading Strategies

https://www.youtube.com/playlist?list=PLxd-PAEHxqCe6W-i4bk04sOn5xk5AGPzz

https://www.24elliottwaves.com/

https://www.24elliottwaves.com/waveprincipletrading.htm

#XLE#etf trader#etf strategies#etf#bitcoin etf#etfbitcoin#btc etf#Elliott Wave Strategies#energy sector#crude oil trading#crude oil prices#crude oil#crude oil tips#crude oil news#crude oil reviews#trading like a pro#like a pro#how to count waves#elliott wave#elliott wave principle#elliott#animation#comedy#funny viral#funny films#funny videos#short videos#short film#short clips#Day Trading

6 notes

·

View notes

Text

Eagle Eyes Frankfurt Trader Uses Elliott Wave Theory To Interpret DAX 30 Index

Learn more.

#dax 30#dax#trading indices#indices trading#indices#cac40#spx#ndx#ftse#elliott wave international#elliott wave forecast#elliott wave principle#elliott wave#elliott#how to count waves#elliott wave patterns#elliott wave structures#trading tips and tricks#bitcoin investing#bitcoin#bitclub#funny films#films#animation#comedy#binary options trading#binary options#day trading system#day trade#swing trade

9 notes

·

View notes

Video

youtube

Elliott Wave Trader Talks About Cryptocurrency Bitcoin Learn how to quickly improve your cryptocurrencies and Bitcoin technical trading using the Elliott wave principle precisely. Learn more.

#cryptocurrency#bitcoin#foreign exchange#currency#technical trading#blomberg#financial times#FT#Elliott Wave#wave count#how to count waves#waves#elliott#finance#investing#investors#ethereum#litecoin

8 notes

·

View notes

Text

Free Practical application of Elliott wave theory course

This is a free share market course on Elliott Wave Theory. This Elliott wave theory course if combined with our Demand supply trading course will work like a charm and will give traders ultimate confidence. In this learning series we shall learn below mentioned topics.

Topic covered under our free Elliott wave theory course :

Concept of Elliot Wave Theory- Wave cycle

Rules of Elliott wave Theory

Fibonacci Ratio.

Component of EWT

Elliott Wave Personality

Application of fib ratio in EWT

Elliot wave patterns

Different Patterns in EWTImpulse

Leading Diagonal Triangle

Ending Diagonal Triangle

Simple Zigzag correction

3-3-5 Flat Correction

Irregular Correction

Formation of Irregular Correction

Complex correction.

Extended and failure wave

Rules of alteration

Combining patterns with Fibonacci ratio

Importance of 38% retracement ,alternate wave count and reflex point.

Time frame to use in Elliot wave analysis

Identifying multibagger stock

Practical use of the theory

Combining Demand and supply trading strategy with Elliot wave theory.

Trade selection

Risk Management

Trading psychology

Also read our best articles below.

demand-supply-trading-course-free

Nifty-prediction-for-tomorrow

Sbi-share-price-prediction

Bitcoin-price-prediction

Ethereum-price-prediction

Bank-nifty-prediction-for-tomorrow

Eur-to-inr-forecast

In-future-gold-price

1 note

·

View note

Text

September was a relatively neutral month for the cryptocurrency market. This was noticeable in the case of both Bitcoin (BTC) and various altcoins.

However, October is shaping up to be a more positive month for these altcoins, which have bullish-looking formations. With that said, BeInCrypto looks at the top altcoins for October that could hit new all-time highs.

Injective (INJ) Price Breakout Can Lead to All-Time High

The INJ price has increased significantly since the beginning of the year. The upward movement caused a breakout from a descending resistance trendline, which had previously been in place since the all-time high.

Afterward, the altcoin reached a new yearly high of $9.97 in April.

Since then, the Injective price has consolidated inside a symmetrical triangle, which is considered a neutral pattern. However, since the triangle transpires after an upward movement, an eventual breakout from it is the most likely future price scenario.

Furthermore, the Eliott Wave count supports the continuing increase. To determine the direction of a trend, technical analysts use the Elliott Wave theory, which involves studying recurring long-term price patterns and investor psychology.

If the count is correct, the INJ price is approaching the end of the fourth wave, after which the fifth and final increase will be expected.

Measuring the length of waves one and three, it is possible to project the length of wave five using Fib projections. According to the Fibonacci retracement levels theory, following a significant price change in one direction, the price is expected to partially return to a previous price level before continuing in the same direction.

This theory can also be used to identify the peak of future upward movements.

The 0.382 length of waves one and three would take the INJ price to a new all-time high price of $25, an increase of 250% measuring from the current price.

INJ/USDT 3-Day Chart. Source: TradingView

This bullish INJ price prediction would be invalidated by a breakdown from the triangle’s support line at $6.50. In that case, INJ could fall by 40% to $4.25.

OKB Price Wave Count Also Leads to New Highs

The OKB price movement is similar to INJ’s, mostly because of the wave count.

In the same fashion as Injective, the price trades inside a symmetrical triangle, in what is likely wave four of a five-wave upward movement. The price is rapidly approaching the end of the pattern, at which time a decisive movement is likely.

Due to the wave count and the fact that the triangle transpires after an upward movement, a breakout from it is the most likely future outlook.

If this occurs, the next likely area for the top will be at $72. The target is found by projecting the triangle’s length to the breakout level (white line) and the 1.61 external Fib retracement of the most recent decrease. The target is 67% above the current price.

OKB/USDT Daily Chart. Source: TradingView

Despite this bullish OKB price prediction, a breakdown from the triangle will invalidate the count. The price could fall by 50% to $21 in that case.

Toncoin (TON) Breakout Catalyzes Rally

The TON price had been below a descending resistance trendline since the start of the year. This led to a low of $0.96 on June 11.

However, the price created a very long lower wick (green icon) and has increased since. In September, TON broke out from the aforementioned descending resistance line, reaching a high of $2.60.

If the increase continues, the 1.61 Fib extension of the most recent decrease is at $4.08. This is 85% above the current price and slightly below the all-time high of $4.90.

TON/USDT Weekly Chart. Source: TradingView

If the rally loses momentum, TON could decrease by 27.50% and reach the descending resistance line at $1.60.

0 notes

Text

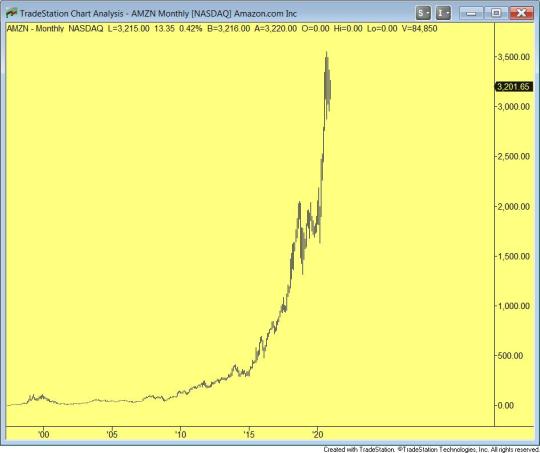

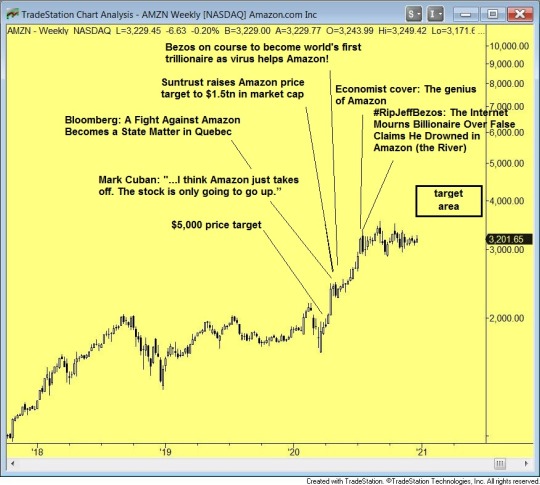

The Amazon Signal Revisited

Real-time social mood analysis is fraught with peril which is probably why no one else does it. A great example is the Amazon Signal from back in April that hasn’t panned out yet.

Yet this doesn’t mean that it won’t.

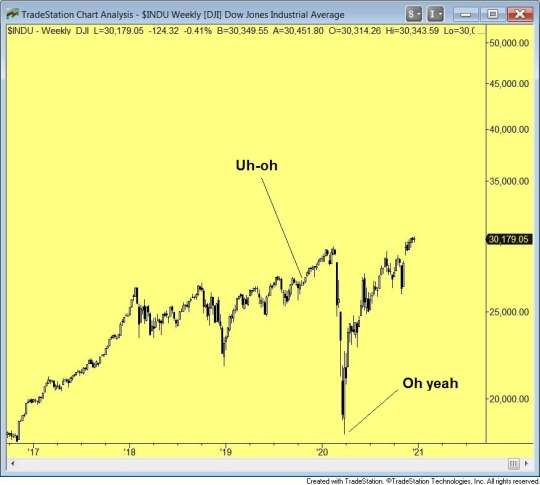

Recall a similar “signal” that seemingly took forever. This chart was posted October 28th, 2019 (before I switched to the yellow “legal pad” look).

Here was the outcome:

Given the current bitcoin mania (which will be addressed in a future post), it may be a good time to keep an eye on anything that has bubble characteristics.

Amazon, from a socionomic standpoint, certainly fits. And on an arithmetic chart, it certainly has the “right look.”

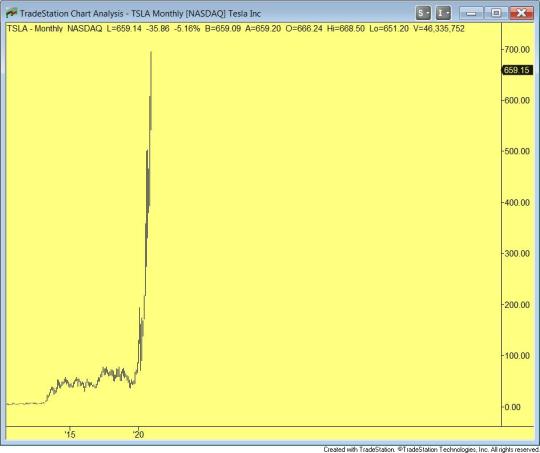

Uh, so does Tesla (which also needs its own post).

Arithmetic charts, admittedly, contain drama. But when paired up with extreme social mood sentiment, they help make the point clear.

Optimism surges near tops because investors become certain the trend will continue.

Onto the chart of the Amazon Signal:

Probably not finished yet, and most likely a full year lag. It’s also interesting how #RIPJeffBezos seemed to cap the rally’s momentum. Bezos ain’t “dead” by a long shot. But if his stock can make higher highs on falling momentum coupled with some more extreme social mood cues, there might be one hell of trade.

I had thought there was a real opportunity back in April, but it turned out to be incorrect. The one person who got the pattern correct was @doption who correctly flagged it as an Elliott running flat that completed at the March low. Thus the correct expectation was for a persistent rally and not a c-wave down from the April high as I had speculated.

In other words, the Corona crash was the c-wave down.

Thus the better interpretation of the social mood “signal” is not to assume that clustering of social mood cues automatically imply ending action. They can also flag a psychological “kick off.”

Social mood clusters can therefore “announce” the start of impulsive market behavior.

Lesson learned.

Here’s the chart labeled correctly (hopefully):

Notice this is not trying to call THE top in Amazon, but simply “wave 3 of a developing Elliott 5-wave progression.”

And this time I have some other charts below to back up my idea. Not all are intended to be 100% correct, but as markets in the age of ZIRP have morphed toward simply being liquidity gauges, many of these illustrate what could be the same giant wave.

The idea is this: I think things are about as good as they’re going to get for Amazon, and possibly the broader market...for a while. Some backing and filling could be the result.

So after a possible new high in the 1st quarter, maybe things could look like this:

Doesn’t look like much on the chart, but if Amazon were to reach 4000 and then fall 1500, that’s a Fibonacci 62% decline.

At some point the deep pullback from the 2000 Tech crash will need to be balanced out somehow (if one believes in symmetry). It will be interesting to see if Amazon becomes an anti-trust target, or just falls of its own weight.

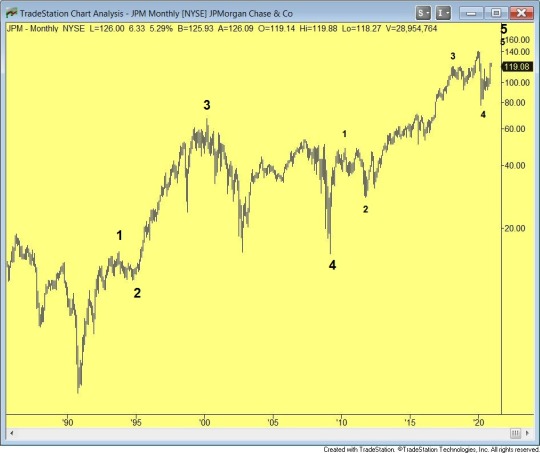

Following the same wave of liquidity, here are some other examples from the S&P 100 index, some with bizarre implications. Regardless whether these counts are correct, a case can be made that the markets may need a rest soon:

A couple quick thoughts:

Not sure if banks have a very bright future 10+ years from now, but they’re probably still so oversold that they might hold their value, or slightly increase it, from here.

Nike, while quite possible that the wave count is wrong, might be the most ominous of the bunch (unless it’s really a big “3″ at the top). As a consumer discretionary item, this could mean a much weaker economy tilted more toward essentials in the future, or it could mean something going wrong internally. Hard to say, but something I’ll be exploring elsewhere within the sector looking for confirmation (or not).

Bottom line: the Amazon Signal was not and is not a sell signal just yet, but it might become one soon, when its social mood overtones might encapsulate a larger “signal” for the entire market.

0 notes

Text

Bitcoin Dropped Below $18,000 This Morning—What's Next?

New Post has been published on https://perfectirishgifts.com/bitcoin-dropped-below-18000-this-morning-whats-next/

Bitcoin Dropped Below $18,000 This Morning—What's Next?

Bitcoin prices have been trading mostly range-bound today after dropping below $18,000 and then … [] recovering. (Photo by Jordan Mansfield/Getty Images)

Bitcoin prices fell to nearly $17,600 today, declining to their lowest since late November before bouncing back.

Since experiencing this volatility, the digital currency has been trading primarily within a relatively tight range between $18,000 and $18,500, CoinDesk figures show.

Following this pullback, and the subsequent recovery, several market observers helped shed some light on the cryptocurrency’s situation.

[Ed note: Investing in cryptocoins or tokens is highly speculative and the market is largely unregulated. Anyone considering it should be prepared to lose their entire investment.]

Analysts Weigh In

Joe DiPasquale, CEO of cryptocurrency hedge fund manager BitBull Capital, emphasized that “even though the price dropped below $18,000, the bounce back above this level means the support is still valid.”

He predicted that in the “near-term,” $18,000 will provide support, while $18,500 will serve as “immediate resistance.”

Ilia Maksimenka, CEO and founder of global payment platform PlasmaPay, also weighed in.

“Bitcoin was unable to make a significant move past the December 2017 all-time high,” he stated.

“The bears stepped in to prevent the price from breaking above the $20,000 psychological price point and were able to push it back below $18,000, tagging the 61.8% Fibonacci retracement level of the previous major pivot low,” said Maksimenka.

“The bulls quickly stepped in to buy Bitcoin at this price and kept the price within the well defined parallel channel,” he stated.

Expert Predictions

Focusing on key price levels, Maksimenka offered some forecasts.

“If $17,600 is defended and respected, then the bullish Elliott wave count shows a move up to test the $21,000 resistance level,” he stated.

“If this level is not defended, I expect the bears to push it all the way back down to $16,000, where the median line of the pitchfork should act as support.”

Jason Lau, COO of cryptocurrency exchange OKCoin, also leveraged technical analysis to offer a price prediction for the digital currency.

Lau emphasized that he is playing close attention to bitcoin’s monthly trendline, and if the cryptocurrency closes below this line, he will “expect a drop to $16,000s range.”

Disclosure: I own some bitcoin, bitcoin cash, litecoin, ether and EOS.

More from Crypto & Blockchain in Perfectirishgifts

0 notes

Text

Elliott Wave Trader Puts Bitcoin On The Spot

Learn more.

#bitcoin#ethereum#zcash#cryptocurrency#crypto/bitcoin future#crypto news#cryptocoin#fx#FOREX#currency trading#currency exchange#currencytrading#elliott wave international#elliott wave forecast#elliott wave principle#elliott wave#how to count waves#trading tips and tricks#animation#comedy#films#short clips#short videos#video tutorial#forex trading education#forex education#educational videos#finance#financial news#financial market

3 notes

·

View notes

Video

youtube

Elliott Wave Technical Trader Compares Bitcoin Analysis To Technology Stocks Learn more.

#elliott wave#Elliott wave trader#bitcoin#cryptocurrency#blockchain#digital currency#tech#technology#stocks#CISCO#Intel#Microsoft Stock#how to count waves#Elliott wave analysis#elliott wave international#elliott wave forecast

2 notes

·

View notes