#australian taxation office (ato)

Text

"A voice identification system used by the Australian government for millions of people has a serious security flaw, a Guardian Australia investigation has found.

Centrelink and the Australian Taxation Office (ATO) both give people the option of using a “voiceprint”, along with other information, to verify their identity over the phone, allowing them to then access sensitive information from their accounts.

But following reports that an AI-generated voice trained to sound like a specific person could be used to access phone-banking services overseas, Guardian Australia has confirmed that the voiceprint system can also be fooled by an AI-generated voice.

Using just four minutes of audio, a Guardian Australia journalist was able to generate a clone of their own voice and was then able to use this, combined with their customer reference number, to gain access to their own Centrelink self-service account.

The voiceprint service, described as the “digital representation of the sound, rhythm, physical characteristics and patterns of your voice”, was used by 3.8 million Centrelink clients as of the end of February, and more than 7.1 million people had verified their voice with the ATO.

Services Australia, the department that oversees Centrelink, says on its website the service is “secure, accurate and reliable”."

"Voice cloning, a relatively new technology using machine learning, is offered by a number of apps and websites either free or for a small fee, and a voice model can be created with only a handful of recordings of a person.

While the voice generated is better with high-quality recordings, anyone with public recordings of themselves on social media, or who has been recorded elsewhere, could be vulnerable to having their voice reproduced."

125 notes

·

View notes

Photo

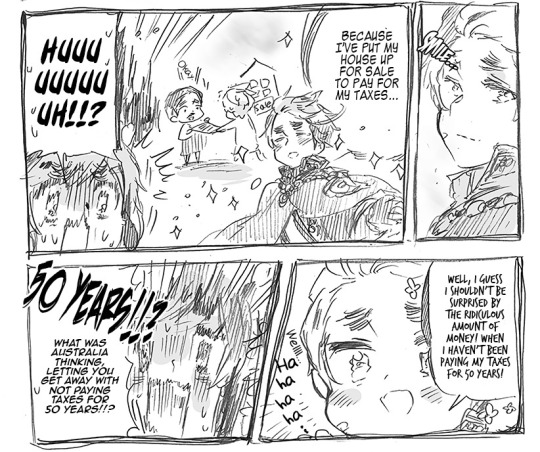

“The founders of Australia's oldest micro-nation, the Hutt River Province in Western Australia, have been ordered to pay more than A$3 million (£1.8m; $2.3m) in taxes owed.

The former self-proclaimed sovereign Prince Leonard Casley set up the independent state of Hutt River 47 years ago after a stoush with the State Government over wheat production quotas, and anointed himself sovereign.

The province near Northampton in Western Australia's Mid West, about 500 kilometres north of Perth, is not legally recognised by the Australian Government.

Prince Leonard was ordered to pay $2.7 million to the ATO, while his son Arthur was ordered to pay $242,000. They would also have to pay an undisclosed sum in interest and court costs.

The principality has long been pursued by the Australian Taxation Office. In 1977, following repeated demands for payments from the ATO, the province declared war on Australia, which it withdrew several days later.” [x][x]

(more at @annotated-hetalia)

94 notes

·

View notes

Text

5 Reasons You Shouldn’t Wait to Catch Up on Bookkeeping in 2023

As a business owner, bookkeeping is likely not the most exciting aspect of your job. In fact, it may even be something you dread or put off for as long as possible. However, delaying your bookkeeping tasks can have serious consequences for your business. Here are five reasons why you shouldn't wait to catch up on bookkeeping in 2023.

Stay on Top of Finances:

One of the most important reasons to keep up with bookkeeping is to ensure that you have an accurate understanding of your business's financial health. When you delay bookkeeping tasks, you may be unaware of your current financial situation, which can lead to poor decision-making and financial mismanagement. By staying on top of your bookkeeping services provider in Australia, you can make informed decisions and take action to address any financial concerns before they become major issues.

Avoid Penalties and Fines:

Late or inaccurate bookkeeping can result in penalties and fines from tax authorities. In Australia, the Australian Taxation Office (ATO) has strict regulations and deadlines for business reporting and payments. Failure to comply with these requirements can result in significant penalties, which can have a significant impact on your business's bottom line. By keeping up with your bookkeeping, you can avoid these penalties and ensure that you remain in compliance with ATO regulations.

Save Time and Reduce Stress:

Bookkeeping can be a time-consuming and stressful task, particularly if you are behind on your records. By catching up on your bookkeeping regularly, you can save time and reduce stress in the long run. You'll also have more time to focus on other aspects of your business, such as growth and development.

Better Decision-Making:

Accurate and up-to-date bookkeeping allows you to make informed decisions about your business. You can see where your money is going, identify areas of overspending, and make adjustments to your budget accordingly. With this information, you can also make more informed decisions about investments, hiring, and other important business decisions.

Get Professional Help:

If you're struggling to keep up with bookkeeping tasks, it may be time to consider outsourcing to a bookkeeping services provider in Australia. Outsourced bookkeeping services in Australia can provide expert help with managing your books, freeing up your time to focus on other aspects of your business. Additionally, bookkeepers services provider in Australia can ensure that your records are accurate and up-to-date, helping you to avoid penalties and make better decisions.

In conclusion, keeping up with bookkeeping tasks is crucial for the financial health and success of your business. By staying on top of your records, you can avoid penalties, make informed decisions, and save time and stress in the long run. If you need help with bookkeeping, consider outsourcing to a bookkeeping services provider in Australia.

3 notes

·

View notes

Text

Benefits of Professional Tax Return Services in Melbourne

Tax season can be a daunting time for many, filled with intricate forms, numerous receipts, and the pressure of ensuring everything is accurate. This is where professional Tax Return services come in. In Melbourne, leveraging the expertise of a professional accountant can make a significant difference. Here’s why:

1. Maximize Your Refund

One of the primary benefits of hiring a professional tax return service is the potential to maximize your refund. Experienced accountants are well-versed in the latest tax laws and regulations. They know all the deductions and credits you’re eligible for, ensuring you receive the maximum refund possible. This expertise can result in significant savings that you might miss out on if you were to file on your own.

2. Save Time and Reduce Stress

Filing taxes can be a time-consuming and stressful process, especially if you’re not familiar with the latest tax codes. Professional tax return services streamline the process, handling all the paperwork and complex calculations for you. This saves you valuable time and eliminates the stress associated with Tax Season, allowing you to focus on other important aspects of your life or business.

3. Avoid Costly Mistakes

Errors on your tax return can lead to penalties, delays in your refund, or even audits. Professional accountants have the expertise to ensure your tax return is accurate and compliant with all regulations. They double-check all entries and ensure that everything is in order, significantly reducing the risk of costly mistakes.

4. Personalized Advice and Planning

A professional accountant provides more than just Tax Return Services. They offer personalized financial advice and tax planning tailored to your specific situation. Whether it’s planning for retirement, managing investments, or strategizing for next year’s taxes, a professional accountant can provide valuable insights and help you make informed financial decisions.

5. Stay Updated with Tax Law Changes

Tax laws are constantly evolving, and staying updated with these changes can be challenging for individuals. Professional accountants keep abreast of all the latest tax law changes and ensure that your tax return complies with current regulations. This ensures that you are always in good standing with the tax authorities and can take advantage of any new deductions or credits.

6. Support During Audits

In the unfortunate event that you are audited by the Australian Taxation Office (ATO), having a professional accountant by your side can be invaluable. They can represent you during the audit process, communicate with the ATO on your behalf, and ensure that you have all the necessary documentation and information. This can significantly reduce the stress and complexity of an audit.

7. Long-Term Financial Benefits

Engaging in a professional tax return service is an investment in your long-term financial health. By ensuring accurate and optimized tax returns, providing strategic financial advice, and helping you plan for the future, professional accountants contribute to your overall financial well-being. This can result in substantial long-term benefits, including improved financial management and greater savings.

Conclusion

In Melbourne, professional tax return services offer numerous benefits that extend beyond just filing your taxes. From maximizing your refund and saving time to providing personalized advice and support during audits, the advantages are clear. By entrusting your tax returns to a professional accountant, you can navigate the complexities of tax season with confidence and ease, ensuring your financial affairs are in expert hands.

#Tax Return#tax return melbourne#accounts nextgen#accounting training#accounting training courses#accounting internship#accounting training melbourne#tax accountant programs#australia#finance#loans#tax returns

0 notes

Text

Understanding Crypto Tax in Australia: A Comprehensive Guide for Investors

Dive into the essential aspects of crypto tax in Australia with our detailed guide. Learn about the Australian Taxation Office's (ATO) regulations, how to report your cryptocurrency transactions, and the implications for capital gains tax. Whether you're a new investor or an experienced trader, this resource will help you navigate the complexities of crypto taxation, ensuring compliance and optimizing your tax strategy in the evolving digital currency landscape.

#crypto tax australia#crypto tax#r&d tax consultants#cfo advisory#ecommerce accountant#r&d tax incentive australia#startup accountant#bookkeeping services#crypto tax accountant#business bookkeeping

0 notes

Text

Understanding SMSF Audit Cost: A Comprehensive Guide by Wise Audits

Introduction

Self-Managed Superannuation Funds (SMSFs) have gained significant popularity among Australians seeking greater control over their retirement savings. Managing an SMSF involves several responsibilities, one of which is ensuring compliance with Australian Taxation Office (ATO) regulations through regular audits. The cost of these audits can be a concern for many trustees. In this comprehensive guide, Wise Audits aims to demystify SMSF audit cost and provide valuable insights for trustees.

What is an SMSF Audit?

An SMSF audit is a thorough examination of a fund’s financial statements and compliance with superannuation laws. It is mandatory for all SMSFs and must be conducted by an independent auditor approved by the ATO. The audit ensures that the fund’s operations align with the regulatory framework, safeguarding members’ retirement savings.

Factors Influencing SMSF Audit Cost

SMSF audit costs can vary widely based on several factors. Here are the key elements that influence the pricing:

Complexity of the Fund

The complexity of the fund’s investments and transactions directly impacts the audit cost. Funds with a high volume of transactions, multiple asset classes, or investments in overseas properties tend to require more time and expertise to audit.

Number of Members

The number of members in an SMSF can affect the audit cost. Funds with more members may have more complex financial arrangements and transactions, increasing the audit’s scope and duration.

Quality of Record-Keeping

Well-organized and accurate record-keeping can significantly reduce the time required for an audit. Trustees who maintain thorough records of all transactions and compliance documents can expect lower audit costs compared to those with disorganized or incomplete records.

Previous Audit Findings

If previous audits have uncovered compliance issues or discrepancies, the auditor may need to conduct a more detailed review to ensure all issues have been resolved. This can increase the audit cost.

Auditor’s Expertise and Reputation

Experienced auditors with a strong reputation in the industry may charge higher fees due to their expertise and reliability. While opting for a cheaper auditor might seem cost-effective, it’s crucial to balance cost with quality to ensure a thorough and compliant audit.

Average SMSF Audit Cost

While SMSF audit cost can vary, Wise Audits offers a general overview of what trustees can expect to pay:

Basic SMSF Audit

For straightforward funds with minimal transactions, the cost can range from $300 to $500.

Moderate Complexity Audit

For funds with a moderate level of transactions and investments, the audit cost typically ranges from $500 to $800.

Highly Complex Audit

For funds with numerous transactions, diverse investments, or compliance issues, the audit cost can exceed $800 and may go up to $1,500 or more.

Ways to Manage and Reduce SMSF audit cost

Wise Audits understands that managing costs is crucial for SMSF trustees. Here are some strategies to help reduce

audit expenses

Maintain Accurate Records

Keeping detailed and organized records of all transactions, investments, and compliance documents can significantly reduce the time an auditor needs to spend reviewing the fund, thereby lowering costs.

Conduct Regular Reviews

Regularly reviewing and reconciling the fund’s accounts can help identify and address any issues before the audit, streamlining the process and potentially reducing costs.

Choose the Right Auditor

Selecting an auditor with expertise in SMSFs can ensure a thorough and efficient audit. While it’s essential to consider cost, the cheapest option may not always provide the best value.

Stay Informed About Regulations

Staying up-to-date with the latest superannuation regulations and ensuring the fund’s compliance can prevent costly mistakes and reduce the need for extensive corrective audits.

Use SMSF Administration Services

Engaging professional SMSF administration services can help manage the fund’s day-to-day operations, ensuring compliance and accurate record-keeping, which can lead to lower audit costs.

Why Choose Wise Audits for Your SMSF Audit?

At Wise Audits , we specialize in providing comprehensive and cost-effective SMSF audit services. Here’s why you

should consider us for your next audit:

Experienced Auditors

Our team comprises highly experienced auditors with in-depth knowledge of SMSF regulations and compliance requirements. We bring a wealth of expertise to every audit, ensuring accuracy and reliability.

Transparent Pricing

We offer transparent and competitive pricing for our audit services. Our goal is to provide value for money while ensuring your SMSF remains compliant with all regulatory standards.

Personalized Service

We understand that every SMSF is unique. Our auditors take the time to understand your fund’s specific needs and tailor our services accordingly, providing a personalized audit experience.

Efficient Processes

Our streamlined audit processes and use of advanced technology enable us to conduct thorough audits efficiently, minimizing disruption and reducing costs for our clients.

Commitment to Quality

At Wise Audits, we are committed to maintaining the highest standards of quality in our audit services. Our rigorous review processes and adherence to industry best practices ensure that your audit is conducted with precision and integrity.

Conclusion

Understanding and managing SMSF audit cost looking to maximize their retirement savings. By considering factors such as the complexity of the fund, quality of record-keeping, and choosing the right auditor, trustees can effectively manage their audit expenses. Wise Audits is dedicated to providing high-quality, cost-effective audit services tailored to meet the unique needs of each SMSF. Trust us to help you navigate the complexities of SMSF audits and ensure your fund’s compliance with confidence.

For more information or to request a quote, visit our website or contact Wise Audits today. Let us help you secure your retirement future with professional and reliable SMSF audit services.

0 notes

Text

How to Set Up a Self-Managed Super Fund with Planet Wealth

Setting up a self-managed super fund (SMSF) offers control and flexibility for your retirement savings. Planet Wealth provides expert guidance to ensure a seamless process. Here’s a step-by-step guide to help you set up your SMSF efficiently.

Determine Eligibility and Objectives

Firstly, ensure you meet the eligibility criteria. You must be under the age of 75 and either employed or self-employed. Next, define your financial goals and investment strategy. This clarity will guide your fund's direction and help in making informed decisions.

Choose Trustees and Structure

An SMSF can have up to four members, all of whom must also act as trustees. You can choose between individual trustees or a corporate trustee structure. Each option has its benefits, so consider which suits your situation best.

Create the Trust and Trust Deed

The trust deed forms the legal foundation of your SMSF. It outlines the fund's rules and operations. Ensure the trust deed complies with the Superannuation Industry (Supervision) Act 1993 (SIS Act). Register the trust deed with the Australian Taxation Office (ATO) to gain an Australian Business Number (ABN) and Tax File Number (TFN).

Open a Bank Account

Open a separate bank account for your SMSF. This account will manage contributions, rollovers, and investment earnings. Ensure you use this account exclusively for SMSF transactions to maintain compliance and transparency.

Develop an Investment Strategy

Create a comprehensive investment strategy considering your risk tolerance, diversification, and liquidity needs. This strategy will guide your investment decisions and ensure they align with your financial goals.

Manage Compliance and Administration

Ensure you adhere to all regulatory requirements. This includes annual audits, financial statements, and tax returns. Planet Wealth’s SMSF specialists can assist with ongoing compliance and administration to keep your fund in good standing.

By following these steps, you can set up an SMSF that aligns with your retirement goals and financial strategy. Planet Wealth offers the expertise and support needed to navigate this complex process, ensuring your SMSF operates smoothly and effectively.

Source

0 notes

Text

Navigating the Australian Tax Landscape

Introduction:

The Australian tax landscape is a complex and ever-evolving terrain that individuals and businesses must navigate to meet their fiscal responsibilities. Understanding the intricacies of the Australian tax system is crucial for both compliance and optimizing one’s financial position. In this comprehensive guide, we will explore the key aspects of the Australian tax system, recent changes in tax laws, common deductions and credits, and strategies to optimize your tax position.

Brief Overview of the Australian Tax System:

The Australian tax system is based on a self-assessment model, where taxpayers are responsible for accurately reporting their income and claiming deductions. Key components include the Goods and Services Tax (GST), income tax, and various other levies. Understanding the different tax brackets, exemptions, and obligations is essential for individuals and businesses to fulfil their tax obligations.

Common Deductions and Credits:

To minimize tax liabilities, individuals and businesses can leverage various deductions and credits provided by the Australian Taxation Office (ATO). Common deductions may include expenses related to work, education, health, and charitable contributions. Understanding which deductions apply to specific circumstances is vital for optimizing tax outcomes.

Strategies to Optimize Tax Position:

Optimizing your tax position involves proactive planning and strategic decision-making. Individuals and businesses can employ various strategies to legally reduce their tax liabilities. This may include effective use of tax credits, restructuring business entities, and utilizing investment incentives. Seeking professional advice from tax experts can provide valuable insights tailored to specific financial situations.

Conclusion:

Navigating the Australian tax landscape requires a comprehensive understanding of the system’s intricacies, recent changes in tax laws, common deductions and credits, and effective strategies for optimizing one’s tax position. Staying informed, seeking professional advice, and maintaining accurate financial records are essential practices for individuals and businesses alike. By taking a proactive approach to tax management, taxpayers can not only meet their obligations but also make informed decisions that positively impact their financial well-being.

Contact Expertax Consulting for your tax needs in Australia. We are the best tax agents in Preston, Victoria. We offer both individual taxation services and business taxation services in Victoria.

0 notes

Text

Why New House and Land Packages Are Ideal for Investors?

Are you considering investing in real estate? If so, you're likely exploring various options to make the most out of your investment. One avenue that has been gaining traction in recent years is new house and land packages.

These packages offer a unique opportunity for investors to enter the property market with confidence and reap substantial rewards.

In this blog post, we'll delve into why new house and land packages Christchurch are ideal for investors and how they can unlock significant benefits for your investment portfolio.

Understanding New House and Land Packages

Before we dive into the advantages of new house and land packages for investors, let's first clarify what these packages entail. Essentially, a new house and land package Christchurch involves purchasing a parcel of land along with a newly built home as a single transaction from a developer. This means investors acquire both the land and the house simultaneously, often at a fixed price.

Stability in Property Values

One of the primary reasons why new house and land packages are attractive to investors is the stability they offer in property values.

Unlike purchasing an existing property where market fluctuations can impact its worth, investing in a new house on a newly developed land parcel provides a certain level of predictability.

With new house and land packages, investors can capitalise on the initial growth phase of a property as the surrounding infrastructure develops. Additionally, new homes often come with warranties and are built to modern standards, reducing the likelihood of costly repairs in the near future.

Tax Benefits and Depreciation

Investing in new house and land packages can also yield significant tax benefits for investors. The Australian Taxation Office (ATO) provides various tax deductions for property investors, including depreciation on the building and fixtures.

Newly constructed properties typically attract higher depreciation benefits compared to older homes, allowing investors to maximise their tax deductions and improve overall cash flow. By leveraging these tax incentives, investors can enhance their return on investment and build long-term wealth.

Customisation and Appeal to Tenants

Another advantage of new house and land packages is the opportunity for customisation and appeal to tenants. Since these properties are newly built, investors have the flexibility to choose finishes, fixtures, and layouts that align with current market preferences and tenant demands.

By investing in a new house, investors can attract high-quality tenants who are willing to pay a premium for modern amenities and design features. This not only enhances rental income but also reduces vacancy rates, providing a steady stream of cash flow for investors.

Lower Maintenance Costs

Investing in a new house as part of a new house and land package also translates to lower maintenance costs for investors. New homes are built to comply with stringent building codes and standards, reducing the likelihood of structural issues and maintenance requirements in the initial years.

Additionally, many developers offer warranties on new constructions, covering defects and structural issues for a specified period. This gives investors peace of mind, knowing that their investment is protected against unforeseen expenses, allowing them to allocate resources more efficiently.

Capital Growth Potential

Last but not least, new house and land packages Christchurch present significant potential for capital growth over the long term. As the property market continues to evolve, newly developed areas often experience rapid appreciation in value due to increased demand and limited supply.

Investing in emerging suburbs and growth corridors through new house and land packages can position investors for substantial capital gains as infrastructure and amenities expand to accommodate population growth.

By identifying areas with strong growth prospects, investors can capitalise on market trends and generate substantial returns on their investments.

Conclusion

In conclusion, new house and land packages offer a myriad of benefits for investors looking to diversify their portfolios and achieve long-term financial success. From stability in property values to tax advantages and customisation opportunities, these packages provide a comprehensive investment solution that caters to both seasoned investors and newcomers alike.

By leveraging the advantages of new house and land packages, investors can enhance their cash flow, mitigate risk, and unlock significant growth potential in the ever-evolving property market.

Whether you're a seasoned investor or a first-time buyer, considering new house and land packages Christchurch could be the key to unlocking your financial goals and securing a prosperous future.

Source By - https://tinyurl.com/3y7bbt6s

0 notes

Text

Why You Need Expert SMSF Accounting and Administration Providers

Managing an SMSF effectively requires a deep understanding of complex superannuation regulations, investment strategies, and record-keeping practices. This is where expert SMSF accounting and administration providers come in. Here's why partnering with such professionals is crucial for the success and security of your SMSF:

The Maze of SMSF Regulations

The Australian Taxation Office (ATO) sets strict guidelines for SMSF operation. Expert SMSF administration providers stay current on these ever-evolving regulations, ensuring your SMSF remains compliant and avoids costly pitfalls. These regulations cover everything from investment limitations to contribution caps and tax reporting requirements. Even minor breaches can lead to hefty penalties and compliance headaches.

Beyond the Numbers: Time-Consuming Administration

Managing an SMSF involves more than just crunching numbers. Day-to-day tasks include record keeping, preparing financial statements, handling contributions and distributions, and lodging tax returns. These tasks can be time-consuming and tedious, taking away your valuable time and potentially leading to errors. Expert providers streamline these processes, freeing you to focus on other priorities and ensuring everything is completed accurately and on time.

Finding the Right Fit: Choosing an Expert Provider

The ideal SMSF accounting and administration provider should be a perfect fit for your specific needs and budget.

Qualifications and Experience: Look for providers with registered tax agents on staff and a proven track record of managing SMSFs.

Service Offerings: Ensure they offer a comprehensive range of services, including accounting, administration, and (if needed) referrals for financial advice.

Communication Style: Choose a provider who prioritizes clear and regular communication, keeping you informed throughout the process.

Fees and Transparency: Get clear quotes outlining the fees associated with their services. Don't be afraid to shop around to find a provider that offers value for money.

Don't go it alone – find the right expert provider today and unlock the full potential of your SMSF for a secure and prosperous retirement.

Source

0 notes

Text

Unlocking Your Dental Care Potential with Super Funds

In today's world, where dental care is increasingly recognized as a crucial aspect of overall health and well-being, accessing quality dental services can sometimes be financially challenging. However, there's a lesser-known avenue that could potentially alleviate this burden: using super for dental. In this comprehensive guide, we delve into the intricacies of leveraging your superannuation to finance your dental needs.

Understanding the Basics of Superannuation and Dental Care

Superannuation, often referred to simply as "super," is a long-term savings plan designed to provide financial support for retirement. However, what many individuals may not realize is that under certain circumstances, you can access your super funds early to cover essential medical expenses, including dental treatments. This option can be particularly beneficial for individuals facing urgent dental issues or those seeking elective procedures to enhance their oral health and appearance.

To explore this avenue effectively, it's essential to understand the eligibility criteria, the types of dental expenses covered, and the process involved in accessing your super funds for dental care purposes.

Eligibility Criteria for Accessing Super for Dental Purposes

Before delving into the specifics of using super for dental, it's crucial to ascertain whether you meet the eligibility criteria outlined by the Australian Taxation Office (ATO). Generally, individuals seeking early access to their super funds for dental treatment must satisfy one or more of the following conditions:

Medical Treatment: You require dental treatment to address a diagnosed medical condition or illness.

Preventive Surgery: Your dental treatment is deemed necessary to prevent the progression of a current medical condition.

Enhanced Quality of Life: The dental procedure aims to improve your overall quality of life, such as restoring oral function or alleviating chronic pain and discomfort.

Meeting these criteria is pivotal in facilitating a smooth and successful application process for accessing your super funds for dental purposes.

Types of Dental Expenses Covered by Super Funds

Super funds can be utilized to cover a wide range of dental expenses, including but not limited to:

General Dental Care: Routine check-ups, cleanings, and fillings.

Restorative Procedures: Crowns, bridges, and dental implants.

Orthodontic Treatment: Braces or clear aligner therapy to correct misaligned teeth.

Cosmetic Dentistry: Teeth whitening, veneers, and smile makeovers.

Surgical Interventions: Oral surgeries, such as wisdom tooth extraction or dental implant placement.

Understanding the scope of coverage provided by your super fund is essential to ensure that your desired dental treatments are eligible for early release of funds.

Navigating the Process of Accessing Super Funds for Dental Care

Accessing your super funds for dental purposes involves a structured process that typically includes the following steps:

Assessment by a Qualified Dentist: Schedule an appointment with a partner dentist who specializes in assessing and treating patients seeking to access their super funds for dental care. During this consultation, the dentist will evaluate your dental needs and provide recommendations for eligible treatments.

Completion of Necessary Documentation: Upon confirming your eligibility for early release of super funds for dental treatment, your dentist will assist you in completing the requisite documentation, including the Early Release of Superannuation (ERS) form.

Submission to the ATO: The completed ERS form, along with supporting documentation such as treatment plans and invoices, is submitted to the ATO for review and approval. It's essential to ensure that all documentation is accurate and comprehensive to expedite the processing of your application.

Approval and Disbursement of Funds: Once the ATO approves your application, your super funds will be released directly to your nominated dental provider to cover the cost of the approved treatments.

By following these steps diligently and working closely with your dental provider, you can navigate the process of accessing your super funds for dental care with confidence and ease.

Benefits of Using Super for Dental Care

The option to use super funds for dental care offers several significant benefits for individuals seeking to prioritize their oral health:

Financial Accessibility: By tapping into your super savings, you can access the funds needed to undergo essential dental treatments without experiencing financial strain.

Timely Intervention: Early access to super funds enables you to address dental issues promptly, preventing potential complications and ensuring optimal oral health outcomes.

Comprehensive Treatment Options: With the financial flexibility afforded by super funds, you can explore a broader range of treatment options, including advanced procedures that may not be feasible through traditional payment methods.

Improved Quality of Life: Investing in your dental health can have far-reaching benefits, including enhanced confidence, improved chewing ability, and a brighter, healthier smile.

Risks and Considerations

While using super for dental care can be a valuable resource, it's essential to weigh the associated risks and considerations:

Impact on Retirement Savings: Withdrawing funds from your super account may affect your long-term retirement savings goals, potentially reducing the amount available for future use.

Tax Implications: Depending on your individual circumstances, accessing super funds early for dental purposes may have tax implications that need to be carefully evaluated and understood.

Limitations of Coverage: Not all dental treatments may be eligible for early release of super funds, necessitating thorough research and consultation with your dental provider to determine the feasibility of using this option for your specific needs.

By conducting due diligence and seeking guidance from financial and dental professionals, you can mitigate potential risks and make informed decisions regarding the use of super funds for dental care.

Partnering with Our Dedicated Dental Professionals

We connect you with one of our partner dentists, who can assess your dental needs and help you access your super to fund any dental work you are eligible for. Our team is committed to providing personalized care and guidance throughout the process, ensuring that you receive the comprehensive support needed to achieve optimal oral health and well-being.

Empower yourself to prioritize your dental care journey by exploring the possibilities offered by accessing your super funds for dental purposes. With the right knowledge, guidance, and support, you can take proactive steps towards enhancing your smile and preserving your oral health for years to come.

getdentalimplants.com.au

Frequently Asked Questions (FAQs) About Using Super for Dental

Can I Use My Super to Pay for Dental Treatment?

Yes, under certain circumstances, you may be able to access your super funds early to cover essential dental treatments. Eligibility criteria apply, and the process involves obtaining approval from the Australian Taxation Office (ATO).

What Types of Dental Expenses Are Covered by Super Funds?

Super funds can be used to cover a wide range of dental expenses, including routine check-ups, fillings, crowns, bridges, orthodontic treatment, cosmetic dentistry, and surgical interventions.

How Do I Determine If I'm Eligible to Access My Super for Dental Purposes?

Eligibility criteria typically include requiring dental treatment for a diagnosed medical condition, preventive surgery to prevent the progression of a current medical condition, or procedures aimed at enhancing your overall quality of life.

What Is the Process for Accessing Super Funds for Dental Care?

The process involves scheduling an assessment with a qualified dentist, completing necessary documentation, submitting the application to the ATO, and upon approval, disbursement of funds directly to the dental provider.

Will Using Super for Dental Care Affect My Retirement Savings?

Withdrawing funds from your super account for dental purposes may impact your long-term retirement savings goals, potentially reducing the amount available for future use.

Are There Tax Implications Associated with Accessing Super for Dental Treatment?

Depending on your individual circumstances, accessing super funds early for dental purposes may have tax implications that need to be carefully evaluated and understood.

What Happens If My Application to Access Super for Dental Care Is Denied?

If your application is denied by the ATO, you may need to explore alternative financing options or reassess your dental treatment plan in consultation with your dentist.

Can I Access My Partner's Super for My Dental Treatment?

In certain situations, such as financial hardship or compassionate grounds, you may be able to access your partner's super funds for your dental treatment. However, specific eligibility criteria apply.

Is There a Limit to How Much I Can Withdraw from My Super for Dental Care?

The amount you can withdraw from your super for dental purposes may vary depending on factors such as your super balance, the type of treatment required, and any restrictions imposed by your super fund.

How Long Does It Take to Receive Approval for Accessing Super Funds for Dental Treatment?

The processing time for approval can vary, but it typically takes several weeks from the submission of the application to receive a decision from the ATO. Ensuring that all documentation is accurate and complete can help expedite the process.

Follow Us

Blogger | Weebly | Twitter | Gravatar | Disqus | Google Sites | Youtube | About.me

1 note

·

View note

Text

Tax Brackets Explained: How They Affect Your Taxes and What You Can Do

Tax season can be an overwhelming experience, particularly with the use of unfamiliar terms and complicated computations. To make the process easier, it's important to have a basic understanding of tax brackets.

What are Tax Brackets?

Tax brackets are used to calculate the tax rate you pay on your taxable income, which can significantly impact the amount you owe or the refund you receive.

It is a system used by the Australian Taxation Office (ATO) to categorize taxable income into different ranges. Each tax bracket is assigned a specific tax rate. The higher your taxable income, the higher the tax bracket you fall into, and consequently, the higher the tax rate you pay.

Australia uses a progressive tax system, meaning tax rates increase as your taxable income increases. This ensures that higher earners contribute a larger proportion of their income towards tax compared to lower earners.

How Do Tax Brackets Affect Your Taxes?

Understanding tax brackets is important in estimating your potential tax liability and identifying strategies to reduce your tax bill.

The first step is to determine your taxable income, which is your total income minus any allowable deductions and offsets. Once you have calculated your taxable income, you can identify the tax bracket you fall into. The ATO website provides a tax bracket table that outlines the income thresholds for each bracket and the corresponding tax rate.

It's essential to understand that tax brackets function incrementally. This means that you only pay the higher tax rate on the portion of your income that falls within that bracket. The remaining income is taxed at the rate of the previous bracket(s).

What Can You Do?

Tax brackets are a fixed system that determines the rate at which you pay income tax. However, there are some ways you can potentially reduce your tax burden and increase your refund amount:

Claim all eligible deductions: You can claim work-related expenses, charitable donations, and other costs as deductions, which can reduce your taxable income and potentially move you into a lower tax bracket.

Maximise offsets: Offsets are like tax credits that directly reduce your tax liability. There are various government offsets available, such as the low-income offset and the private health insurance offset. Make sure you claim all the offsets you're eligible for.

Consider salary packaging: If your employer offers salary packaging, you can receive some of your salary as non-cash benefits, like meal allowances or novated leases. This can reduce your taxable income and potentially save you money.

Seek professional advice: For complex financial situations, it's a good idea to consult a registered tax agent. They can provide personalised strategies to optimise your tax position within the framework of tax brackets.

Conclusion

Understanding tax brackets is an essential tool for managing your taxes in Australia. If you know how tax brackets work and how they affect your taxes, you can take a proactive approach to managing your tax situation. It helps you to estimate your tax liability, identify potential tax savings, and ultimately make informed decisions to optimise your tax outcome.

0 notes

Text

Understanding Self-Managed Superannuation Funds (SMSFs): A Comprehensive Guide

In today's world, financial security is paramount. As we journey through life, planning for retirement becomes increasingly important. One avenue that individuals explore to secure their financial future is through self-managed superannuation funds (SMSFs). SMSFs offer a unique opportunity for Australians to take control of their retirement savings and tailor investment strategies to suit their specific needs and objectives. In this comprehensive guide, we delve into what SMSFs are, how they work, their benefits and considerations, and essential tips for managing one effectively.

What is an SMSF?

A self-managed superannuation fund (SMSF) is a private superannuation fund that individuals manage themselves, unlike industry or retail superannuation funds, which are managed by professionals. SMSFs can have up to four members, all of whom act as trustees and are responsible for complying with superannuation and taxation laws.

How Does an SMSF Work?

SMSFs operate similarly to other superannuation funds but provide members with greater control over their investment decisions. Members of an SMSF pool their funds and invest in a range of assets, including cash, shares, property, and managed funds, to build their retirement savings.

Benefits of SMSFs

Control and Flexibility: One of the primary advantages of an SMSF is the control and flexibility it offers. Members have the autonomy to choose their investment strategy, asset allocation, and retirement planning approach.

Tax Efficiency: SMSFs can provide significant tax benefits, particularly for those in retirement. Income generated within the fund is generally taxed at a concessional rate, and capital gains on investments held for more than 12 months are taxed at a discounted rate.

Estate Planning: SMSFs offer greater flexibility in estate planning compared to other superannuation funds. Members can nominate beneficiaries and tailor succession plans to ensure their wealth is distributed according to their wishes.

Cost-Effective for Larger Balances: While SMSFs may have higher setup and ongoing costs compared to other superannuation funds, they can be more cost-effective for individuals with larger balances, as fees are typically fixed rather than percentage-based.

Considerations Before Establishing an SMSF

Before establishing an SMSF, individuals should carefully consider the following:

Time and Expertise: Managing an SMSF requires time, knowledge, and expertise. Trustees are legally responsible for the fund's compliance with superannuation and taxation laws, investment decisions, record-keeping, and reporting.

Risk Management: SMSFs require a diversified investment strategy to manage risk effectively. Trustees should assess their risk tolerance, investment goals, and seek professional advice if needed.

Costs and Fees: While SMSFs offer control and flexibility, they also come with costs and fees, including setup, administration, investment, and compliance costs. Trustees should evaluate whether the benefits outweigh the expenses.

Legal and Compliance Obligations: SMSFs must comply with strict legal and compliance obligations set by the Australian Taxation Office (ATO). Trustees must stay informed about changes in legislation, reporting requirements, and ensure the fund operates within the law.

Tips for Effective SMSF Management

Seek Professional Advice: Engage qualified professionals, such as accountants, financial advisors, and legal experts, to assist with setup, investment strategy, compliance, and ongoing management of the SMSF.

Diversify Investments: Adopt a diversified investment strategy to spread risk across different asset classes and achieve long-term financial objectives.

Regular Review and Monitoring: Continuously review the SMSF's investment performance, asset allocation, and compliance with regulatory requirements. Make adjustments as necessary to align with changing market conditions and personal circumstances.

Stay Informed: Stay informed about changes in superannuation and taxation laws, industry trends, and economic developments that may impact the SMSF's performance and compliance obligations.

0 notes

Text

Australia pursues crypto buyers' info in tax probe

The Australian Taxation Office (ATO) is seeking transaction data on 1.2 million accounts from crypto exchanges to identify users who are evading taxes. This news follows recent reports that a spot Bitcoin (BTC) exchange-traded fund has been approved May soon appear on the Australian ASX stock exchangeAccording to reports.

According to a notice issued last month and Reported by Reuters, the ATO…

View On WordPress

0 notes

Text

Exploring the Tax Accountant Program in Melbourne

Melbourne, a bustling hub of commerce and culture, offers a fertile ground for aspiring Tax Accountants. With its vibrant economy and diverse business landscape, the city is an ideal place to pursue a career in tax accounting. This guide provides an in-depth look at the tax accountant programs available in Melbourne, highlighting key educational institutions, certification processes, and career opportunities that await you in this dynamic field.

Why Study Tax Accounting in Melbourne?

Melbourne is home to a plethora of reputable educational institutions and professional networks, making it an excellent choice for studying tax accounting. Here are a few reasons why Melbourne stands out:

High-Quality Education: Melbourne's universities and colleges are renowned for their rigorous academic standards and comprehensive accounting programs.

Industry Connections: The city's strong business community provides ample networking opportunities and practical experiences.

Diverse Economy: Melbourne's economy spans various industries, offering tax accountants exposure to a wide range of financial scenarios.

Professional Growth: The demand for qualified Tax Accountants In Melbourne remains robust, ensuring plentiful job prospects and career advancement opportunities.

Career Opportunities in Melbourne:

Melbourne's diverse economy offers a wide range of career opportunities for tax accountants. Some potential career paths include:

Public Accounting Firms: Working for firms like Deloitte, PwC, or KPMG provides exposure to various clients and complex tax issues.

Corporate Tax Departments: Large corporations in Melbourne, such as ANZ and BHP, have in-house tax teams that handle corporate tax planning and compliance.

Government Agencies: Opportunities exist within agencies like the Australian Taxation Office (ATO), where tax accountants can work on policy, compliance, and enforcement.

Independent Practice: Experienced tax accountants can establish their practices, offering tax advisory and preparation services to individuals and businesses.

Conclusion

Pursuing a Tax Accountant Program in Melbourne is a strategic choice for those looking to build a successful career in this essential field. With top-tier educational institutions, robust certification pathways, and a wealth of career opportunities, Melbourne provides an ideal environment for aspiring tax accountants. Whether you aim to work for a prestigious firm, a major corporation, or as an independent consultant, the journey begins with the right education and professional development. Start your path to becoming a tax accountant in Melbourne today and unlock a world of possibilities in the dynamic field of taxation.

#Tax Accountant Program#accounting training melbourne#tax return melbourne#accounting training#accounts nextgen#accounting internship#accounting training courses#tax accountant programs#australia#finance#loans

0 notes

Text

Navigating Crypto Tax in Australia: What You Need to Know

As cryptocurrency continues to gain popularity in Australia, understanding the tax implications is essential. Crypto tax regulations in Australia can be complex, with guidelines provided by the Australian Taxation Office (ATO). Individuals and businesses involved in crypto transactions need to consider factors such as capital gains tax, income tax, and GST.

When it comes to capital gains tax (CGT), profits made from selling or exchanging cryptocurrency are typically subject to taxation. The ATO considers cryptocurrency as property, and CGT applies to any capital gain resulting from the disposal of cryptocurrency.

Navigating crypto tax in Australia requires diligence and understanding of tax laws. Consulting with a tax professional experienced in cryptocurrency taxation can provide invaluable guidance and ensure compliance with regulations. Stay informed and proactive to manage your crypto tax obligations effectively.

#crypto tax australia#crypto tax#r&d tax consultants#cfo advisory#ecommerce accountant#r&d tax incentive australia#startup accountant#bookkeeping services#crypto tax accountant#business bookkeeping

0 notes