#asiapac

Photo

October 23, 2010 - Yeongam-gun, South Korea

Source: Mark Thompson/Getty Images AsiaPac

174 notes

·

View notes

Text

Twitter Erupts with Welcome Wishes as Rafael Nadal Announces Comeback

Rafael Nadal of Spain holds a Koala on day two of the 2017 Brisbane International at Pat Rafter Arena on January 2, 2017 in Brisbane, Australia. (Jan. 1, 2017 – Source: Bradley Kanaris/Getty Images AsiaPac)

In a thrilling announcement earlier today, 22-time Grand Slam champion Rafael Nadal shared a video confirming his return to the courts at the Brisbane International warm-up event for the…

View On WordPress

4 notes

·

View notes

Text

Although it was a short while but had alot of fun boothing again! Thanks to all who came and supported me! Shout out to the peeps at asiapac and comix sg for doing this too!

gonna go lay down and rest my legs now 🙃

2 notes

·

View notes

Text

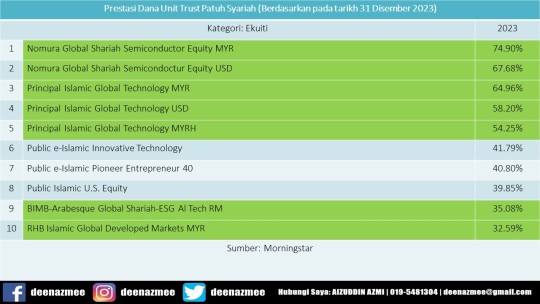

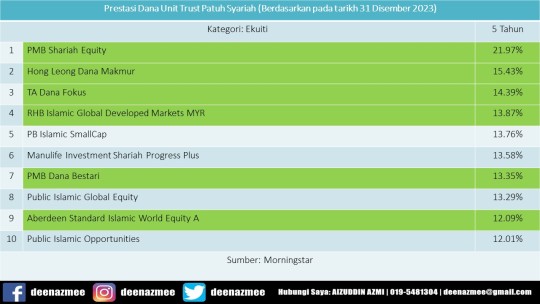

PRESTASI DANA UNIT TRUST PATUH SYARIAH TAHUN 2023

Assalamualaikum & Salam Sejahtera

Sebelum ini saya telah berkongsi tentang apakah itu unit trust? Saya juga telah berkongsi artikel dari laman sesawang FIMM mengenai "Tabung Unit Trust sebagai pelaburan masa depan anda?" dan "Mengumpulkan kekayaan dengan Unit Trust dan PRS". Kali ini saya sekadar hendak berkongsi tentang prestasi dana Unit Trust patuh syariah tahun 2023.

Nak buka akaun pelaburan unit trust secara online? Klik https://tinyurl.com/f4m340F.

Prestasi Dana Unit Trust Patuh Syariah Tahun 2023

Prestasi Dana Unit Trust Patuh Syariah (Berdasarkan Pada Tarikh 31 Disember 2023)

Pulangan YTD (Berdasarkan pada tarikh 31 Disember 2023)

Dana Ekuiti

Nomura Global Shariah Semicondctr Equity MYR (74.90%)

Nomura Global Shariah Semicondctr Equity USD (67.68%)

Principal Islamic Global Technology MYR (64.96%)

Principal Islamic Global Technology USD (58.20%)

Principal Islamic Global Technology MYRH (54.25%)

Public e-Islamic Innovative Technology (41.79%)

Public e-Islamic Pioneer Entrepreneur 40 (40.80%)

Public Islamic U.S. Equity (39.85%)

BIMB-Arabesque Global Shariah-ESG Al Tech RM (35.08%)

RHB Islamic Global Developed Markets MYR (32.59%)

RHB Global Shariah Equity Index USD (31.78%)

Manulife Shariah India Equity A RM (31.68%)

Nomura Global Shariah Sustainable Equity MYR A (31.18%)

RHB Global Shariah Equity Index MYR Hedged (29.89%)

RHB i-Global Sustainable Disruptors USD (29.84%)

BIMB-Arabesque Global Shariah-ESG Al Tech USD (29.16%)

RHB i-Global Sustainable Disruptors MYR Hedged (28.72%)

Public Islamic Global Equity (28.22%)

TA Global Absolute Alpha-i MYR (27.94%)

BIMB-Arabesque Global Shariah Sustainable Equity RM (27.89%)

AHAM Aiiman Global Multi Thematic USD (27.80%)

BIMB-Arabesque i Global Dividend 1 MYR (27.21%)

TA Global Absolute Alpha-i RMB Hedged (26.96%)

Manulife Shariah India Equity A USD (26.29%)

Nomura Global Shariah Sustainable Equity USD A (25.77%)

Aberdeen Standard Islamic World Equity A (25.64%)

AHAM Aiiman Global Multi Thematic SGD Hedged (25.29%)

RHB Islamic Global Developed Markets SGD (25.03%)

Public e-Islamic Sustainable Millennial (24.92%)

AHAM Aiiman Global Multi Thematic AUD Hedged (24.31%)

AHAM Aiiman Global Multi Thematic MYR Hedged (24.10%)

BIMB-Arabesque Global Shariah-ESG Al Tech RM Hedged (24.01%)

PMB Shariah Tactical (24.00%)

Kenanga Global Islamic (23.93%)

BIMB-Arabesque Global Shariah Sustainable Equity RM Hedged (23.15%)

Maybank Global Sustainable Equity-I MYR (22.98%)

TA Global Absolute Alpha-i USD (22.64%)

BIMB-Arabesque Global Shariah Sustainable Equity USD (22.56%)

BIMB-Arabesque Global Shariah Sustainable Equity AUD (22.33%)

BIMB-Arabesque Global Shariah Sustainable Equity SGD (22.32%)

BIMB-Arabesque i Global Dividend 1 USD (21.56%)

TA Global Absolute Alpha-i GBP Hedged (20.88%)

TA Global Absolute Alpha-i SGD Hedged (20.63%)

Phillip Dana Dividen Inc (20.30%)

Principal DALI Global Equity MYR (19.65%)

TA Global Absolute Alpha-i MYR Hedged (18.92%)

BIMB-Arabesque i Global Dividend 1 MYR Hedged (18.62%)

Maybank Global Sustainable Equity-I USD (17.70%)

Manulife Investment Shariah Asia-Pacific ex Japan (17.43%)

BIMB-Arabesque Asia Pacific Shariah-ESG Equity MYR (17.12%)

BIMB-Arabesque i Global Dividend 1 SGD (17.06%)

Maybank AsiaPac Ex-Japan Equity-I (16.89%)

Principal Islamic Asia Pacific Dynamic Equity (16.77%)

Aiiman Global Equity MYR (16.58%)

TA Global Absolute Alpha-i AUD Hedged (16.46%)

PMB Shariah Equity (16.08%)

Maybank Global Sustainable Equity-I MYR Hedged (14.94%)

ICD Global Sustainable (14.81%)

PMB Shariah Dividend (14.49%)

Public e-Islamic Asia Thematic Growth (13.45%)

PMB Dana Bestari (13.28%)

PMB Shariah Global Equity (12.69%)

PB Islamic Asia Strategic Sector (12.38%)

BIMB-Arabesque Asia Pacific Shariah-ESG Equity USD (12.24%)

Aiiman Global Equity USD (12.11%)

Public Asia Ittikal (12.07%)

Public Islamic Asia Dividend (11.88%)

Principal DALI Asia Pacific Equity Growth (11.38%)

RHB Shariah Asia Ex-Japan Growth MYR (11.20%)

Global Islamic Equity (11.19%)

Principal Islamic Asia Pacific Dynamic Income & Growth MYR (10.94%)

Principal Islamic Aggressive Wholesale Fund-Of-Funds (10.88%)

Muamalat Invest Islamic Equity (10.60%)

Public Islamic Select Treasures (10.27%)

AmIslamic Global SRI RM Class (10.19%)

Principal Islamic Small Cap Opportunities (10.15%)

Public Ittikal Sequel (9.81%)

Aiiman Global Equity MYR Hedged (9.16%)

Manulife Investment Shariah Progress Plus (9.09%)

Principal Islamic Enhanced Opportunities (8.95%)

KAF Dana Adib (8.79%)

AHAM Aiiman Quantum (8.78%)

Manulife Investment Al-Faid (8.66%)

KAF Islamic Dividend Income (8.53%)

Principal Islamic Malaysia Opportunities (8.19%)

Public Islamic Optimal Growth (7.99%)

PMB Dana Al-Aiman (7.98%)

Public Islamic Savings (7.93%)

Public Islamic Select Enterprises (7.71%)

TA Islamic (7.47%)

Public Islamic Opportunities (7.41%)

PMB Shariah Index (7.29%)

Public Islamic Alpha-40 Growth (7.17%)

Public Islamic Asia Leaders Equity (7.15%)

Principal DALI Equity (7.04%)

PB Islamic SmallCap (6.94%)

Public Islamic Dividend (6.63%)

Public Islamic Emerging Opportunities (6.50%)

Manulife Shariah - Dana Ekuiti (6.44%)

AHAM Aiiman Asia (Ex Japan) Growth MYR (6.35%)

Aiiman Asia Pacific (Ex Japan) Dividend (6.35%)

Principal Islamic Asia Pacific Dynamic Income & Growth USD (6.26%)

TA Dana Fokus (6.26%)

Public Islamic Enterprises Equity (6.07%)

AmIslamic Global SRI USD Class R (5.96%)

AmIslamic Growth (5.70%)

Eastspring Investments Islamic Small-cap (5.58%)

Manulife Investment Shariah Progress (5.28%)

AHAM Aiiman Growth (5.20%)

Manulife Investment Al-Fauzan (5.10%)

Principal Islamic Asia Pacific Dynamic Income & Growth SGD (4.63%)

PB Islamic Equity (4.60%)

Principal DALI Equity Growth (4.41%)

Public Islamic Equity (4.33%)

BIMB-Arabesque Malaysia Shariah-ESG Equity Myr (4.14%)

Principal DALI Opportunities MYR (4.13%)

Phillip Dana Aman (4.09%)

Kenanga Ekuiti Islam (4.02%)

Public Islamic Optimal Equity (4.02%)

ASEAN Equity (4.00%)

Dana Aset Campuran/Seimbang

Maybank Global Mixed Assets-I USD Institutional Distribution (63.91%)

InterPac Dana Abadi (55.88%)

Public Islamic Asia Tactical Allocation (28.62%)

InterPac Dana Saadi (26.52%)

PB Islamic Dynamic Allocation (24.46%)

Public Islamic Global Balanced (21.58%)

Aiiman Smart Invest Portfolio - Growth (21.16%)

United-i Global Balanced MYR (17.14%)

Maybank Global Mixed Assets-I MYR (16.78%)

Principal Islamic Global Selection Aggressive MYR (15.06%)

Maybank Global Wealth Growth-I USD Acc (14.86%)

United-i Global Balanced SGD Hedged (14.78%)

United-i Global Balanced GBP Hedged (14.27%)

AHAM Aiiman Global Thematic Mixed Asset USD Institutional (13.97%)

PMB-An-Nur Waqf Income A (13.73%)

AHAM Aiiman Global Thematic Mixed Asset USD (13.09%)

AHAM Aiiman Global Thematic Mixed Asset AUD Hedged (12.74%)

United-i Global Balanced RMB Hedged (12.46%)

Nomura Global Shariah Strategic Growth A (12.34%)

United-i Global Balanced USD (12.29%)

Nomura Global Shariah Strategic Growth B (12.00%)

Maybank Global Mixed Assets-I USD (11.90%)

AHAM Aiiman Global Thematic Mixed Asset SGD Hedged (11.30%)

PMB-An-Nur Waqf Income B (11.14%)

Maybank Global Wealth Growth-I MYRH Acc (10.79%)

Bank Islam Premier (10.58%)

RHB Global Shariah Dynamic Income MYR Hedged (10.58%)

Public Islamic Mixed Asset (10.53%)

Principal Islamic Global Selection Aggressive USD (10.33%)

AHAM Aiiman Global Thematic Mixed Asset MYR Hedged (10.10%)

Maybank Global Mixed Assets-I SGD Hedged (9.94%)

Maybank Global Mixed Assets-I AUD Hedged (9.78%)

Public Islamic Enhanced Bond (9.29%)

Maybank Global Mixed Assets-I MYR Hedged (8.77%)

Manulife Investment Al-Umran (8.59%)

Maybank Global Wealth Moderate-I USD Acc (8.47%)

Maybank Global Wealth Moderate-I USD Dis (8.47%)

Principal Islamic Lifetime Balanced (8.24%)

United-i Global Balanced MYR Hedged (8.20%)

United-i Global Balanced AUD Hedged (7.65%)

Manulife Investment-ML Shariah Flexi (7.54%)

Principal Islamic Global Selection Moderate Conservative MYR (6.77%)

Manulife Investment-CM Shariah Flexi (6.67%)

Maybank Malaysia Balanced I (6.64%)

AHAM Aiiman Select Income (6.60%)

Astute Dana Al-Faiz-I Inc (6.55%)

Principal Islamic Global Selection Moderate MYR (6.45%)

RHB Islamic Regional Balanced MYR (6.42%)

Public Ehsan Mixed Asset Conservative (6.34%)

Principal Islamic Lifetime Balanced Growth (6.32%)

KAF Dana Alif (6.14%)

TA Dana Optimix (6.11%)

Principal Islamic Conservative Wholesale Fund-Of-Funds (6.05%)

Public Islamic Growth Balanced (5.95%)

Maybank Global Wealth Moderate-I MYRH Acc (5.94%)

Principal Islamic Balanced Wholesale Fund-Of-Funds (5.81%)

Maybank Global Wealth Moderate-I MYRH Dis (5.78%)

Public Ehsan Mixed Asset Growth (5.77%)

AmIslamic Balanced (5.60%)

Principal Islamic Lifetime Enhanced Sukuk (5.53%)

RHB Dana Hazeem (4.78%)

Public e-Islamic Flexi Allocation (4.41%)

Manulife Investment-HW Shariah Flexi (4.35%)

Kenanga SyariahExtra (4.07%)

Dana Bon/Sukuk

Principal Islamic Wholesale Sukuk C (9.48%)

Principal Islamic Wholesale Sukuk B (9.47%)

Principal Islamic Wholesale Sukuk A (9.39%)

AmDynamic Sukuk – Class B (8.44%)

AmDynamic Sukuk – Class A (8.42%)

Public Islamic Infrastructure Bond (8.14%)

PB Aiman Sukuk (7.76%)

United-I ESG Series-High Quality Sukuk SGD Hedged (7.69%)

Public e-Sukuk (7.57%)

Public Islamic Bond (7.54%)

Public Sukuk (7.33%)

KAF Sukuk (7.24%)

PB Islamic Bond (7.24%)

AHAM Aiiman Global Sukuk MYR (7.15%)

AmBon Islam (7.22%)

Opus Shariah Income (6.91%)

PB Sukuk (6.90%)

Maybank Malaysia Income-I C MYR (6.79%)

Maybank Malaysia Income-I A MYR (6.77%)

Franklin Malaysia Sukuk I MYR Inc (6.72%)

Principal Islamic Lifetime Sukuk (6.67%)

AHAM Aiiman Income Plus (6.65%)

Opus Shariah Income Plus (6.58%)

Franklin Malaysia Sukuk A MYR Inc (6.51%)

Public Islamic Strategic Bond (6.32%)

AmanahRaya Syariah Trust (6.30%)

Kenanga AsnitaBond (6.26%)

Nomura i-Income 2 H USD Hedge (6.22%)

Maybank Income Management-I (6.01%)

Opus Shariah Dynamic Income (5.99%)

TA Dana Afif (5.78%)

Kenanga Bon Islam (5.76%)

Maybank Malaysia Sukuk (5.74%)

RHB Shariah Income (5.53%)

RHB Global Sukuk RM Class B (5.43%)

Phillip Dana Murni (5.36%)

Principal Islamic Global Sukuk MYR (5.29%)

BIMB ESG Sukuk Class A (5.23%)

BIMB ESG Sukuk Class D (5.23%)

AmanahRaya Syariah Income (4.99%)

AmIslamic Institutional 1 (4.96%)

Public Islamic Income (4.94%)

MAMG Global Income-I B USD (4.90%)

Public Islamic Select Bond (4.88%)

Principal Islamic Malaysia Government Sukuk D (4.37%)

United-i Conservative Income (4.27%)

Nomura i-Income 2 S (4.25%)

Nomura i-Income 2 I (4.14%)

Principal Islamic Malaysia Government Sukuk B (4.14%)

Principal Islamic Malaysia Government Sukuk C (4.14%)

Nomura i-Income 2 R (4.00%)

Dana Pasaran Wang

AmanahRaya Syariah Cash Management (13.30%)

Dana Hartanah

Manulife Shariah Global REIT MYR Inc (12.68%)

Manulife Shariah Global REIT USD Inc (8.02%)

Dana Lain-lain

AHAM Shariah Gold Tracker (19.00%)

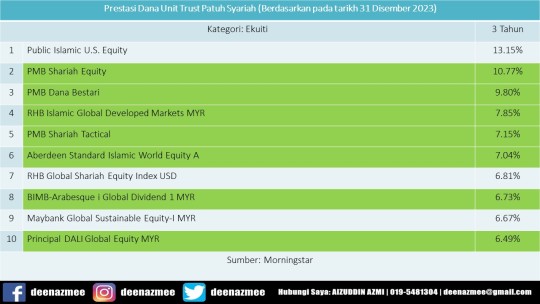

Purata Pulangan Tahunan 3 Tahun (Berdasarkan pada tarikh 31 Disember 2023)

Dana Ekuiti

Public Islamic U.S. Equity (13.15%)

PMB Shariah Equity (10.77%)

PMB Dana Bestari (9.80%)

RHB Islamic Global Developed Markets MYR (7.85%)

PMB Shariah Tactical (7.15%)

Aberdeen Standard Islamic World Equity A (7.04%)

RHB Global Shariah Equity Index USD (6.81%)

BIMB-Arabesque i Global Dividend 1 MYR (6.73%)

Maybank Global Sustainable Equity-I MYR (6.67%)

Principal DALI Global Equity MYR (6.49%)

Public e-Islamic Sustainable Millennial (6.44%)

RHB Global Shariah Equity Index MYR Hedged (6.41%)

TA Dana Fokus (6.26%)

Public Islamic Global Equity (5.96%)

Global Islamic Equity (5.76%)

Manulife Investment Shariah Progress Plus (4.51%)

PB Islamic SmallCap (4.46%)

KAF Dana Adib (4.30%)

KAF Islamic Dividend Income (4.25%)

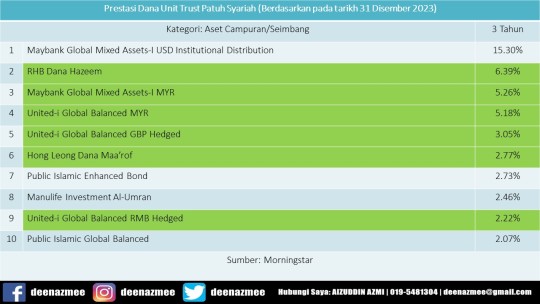

Dana Aset Campuran/Seimbang

Maybank Global Mixed Assets-I USD Institutional Distribution (15.30%)

RHB Dana Hazeem (6.39%)

Maybank Global Mixed Assets-I MYR (5.26%)

United-i Global Balanced MYR (5.18%)

United-i Global Balanced GBP Hedged (3.05%)

Hong Leong Dana Maa’rof (2.77%)

Public Islamic Enhanced Bond (2.73%)

Manulife Investment Al-Umran (2.46%)

United-i Global Balanced RMB Hedged (2.22%)

Public Islamic Global Balanced (2.07%)

Dana Bon/Sukuk

Principal Islamic Wholesale Sukuk C (4.39%)

Principal Islamic Wholesale Sukuk B (4.36%)

Principal Islamic Wholesale Sukuk A (4.32%)

AmanahRaya Syariah Trust (3.72%)

RHB Shariah Income (3.18%)

KAF Sukuk (3.01%)

Franklin Malaysia Sukuk I MYR Inc (3.00%)

Maybank Malaysia Income-I A MYR (2.93%)

PB Aiman Sukuk (2.92%)

Franklin Malaysia Sukuk A MYR Inc (2.79%)

AHAM Aiiman Global Sukuk MYR (2.69%)

Maybank Income Management-I (2.69%)

Principal Islamic Lifetime Sukuk (2.68%)

Public e-Sukuk (2.63%)

Public Islamic Bond (2.63%)

Kenanga AsnitaBond (2.53%)

Public Islamic Strategic Bond (2.46%)

AmDynamic Sukuk – Class B (2.45%)

Phillip Dana Murni (2.37%)

United-i Conservative Income (2.33%)

AmBon Islam (2.26%)

Opus Shariah Short Term Low Risk Asset (2.13%)

PB Sukuk (2.11%)

Maybank Malaysia Income-I C MYR (2.10%)

Maybank Malaysia Sukuk (2.03%)

Public Islamic Select Bond (2.03%)

United-I ESG Series-High Quality Sukuk MYR (2.03%)

PB Islamic Bond (2.01%)

Dana Hartanah

Manulife Shariah Global REIT MYR Inc (4.54%)

Dana Lain-lain

AHAM Shariah Gold Tracker (6.15%)

Purata Pulangan Tahunan 5 Tahun (Berdasarkan pada tarikh 31 Disember 2023)

Dana Ekuiti

PMB Shariah Equity (21.97%)

Hong Leong Dana Makmur (15.43%)

TA Dana Fokus (14.39%)

RHB Islamic Global Developed Markets MYR (13.87%)

PB Islamic SmallCap (13.76%)

Manulife Investment Shariah Progress Plus (13.58%)

PMB Dana Bestari (13.35%)

Public Islamic Global Equity (13.29%)

Aberdeen Standard Islamic World Equity A (12.09%)

Public Islamic Opportunities (12.01%)

PMB Shariah Tactical (11.17%)

KAF Islamic Dividend Income (10.94%)

Kenanga Shariah Growth Opportunity (10.48%)

Principal DALI Global Equity MYR (10.36%)

KAF Dana Adib (9.39%)

PMB Shariah Growth (9.13%)

Principal Islamic Asia Pacific Dynamic Equity (8.82%)

Manulife Investment Shariah Asia-Pacific ex Japan (8.55%)

Principal Islamic Small Cap Opportunities (8.46%)

TA Islamic (8.44%)

Public Islamic Select Treasures (8.36%)

Global Islamic Equity (7.85%)

PMB Shariah Index (7.48%)

Maybank AsiaPac Ex-Japan Equity-I (7.40%)

Kenanga Global Islamic (7.25%)

BIMB-Arabesque i Global Dividend 1 MYR (7.21%)

PMB Dana Al-Aiman (6.94%)

AHAM Aiiman Quantum (6.78%)

ICD Global Sustainable (6.73%)

RHB Islamic Emerging Opportunity (6.68%)

Principal DALI Asia Pacific Equity Growth (6.45%)

Pheim Asia Ex-Japan Islamic (6.41%)

Manulife Shariah - Dana Ekuiti (6.21%)

Manulife Investment Al-Fauzan (6.10%)

Public Islamic ASEAN Growth (5.92%)

Public Islamic Treasures Growth (5.90%)

Public Islamic Emerging Opportunities (5.89%)

BIMB i Growth (5.86%)

Public Islamic Alpha-40 Growth (5.78%)

Manulife Investment Al-Faid (5.69%)

Public Islamic Asia Leaders Equity (5.53%)

Kenanga Ekuiti Islam (5.40%)

AHAM Aiiman Growth (5.33%)

Public Asia Ittikal (5.15%)

Manulife Investment Shariah Progress (5.07%)

Public Islamic Savings (5.01%)

BIMB-Arabesque i Global Dividend 1 USD (4.98%)

PB Islamic Asia Strategic Sector (4.83%)

Public Islamic Asia Dividend (4.78%)

Public Ittikal Sequel (4.66%)

Principal Islamic Aggressive Wholesale Fund-Of-Funds (4.64%)

Precious Metals Securities (4.56%)

Kenanga Amanah Saham Wanita (4.41%)

PMB Dana Mutiara (4.40%)

AmIslamic Growth (4.22%)

Astute Dana Al-Sofi-i (4.17%)

Kenanga Syariah Growth (4.14%)

Principal Islamic Malaysia Opportunities (4.03%)

RHB Shariah Asia Ex-Japan Growth MYR (4.03%)

Dana Aset Campuran/Seimbang

Hong Leong Dana Maa’rof (10.45%)

Public Islamic Asia Tactical Allocation (8.95%)

InterPac Dana Safi (8.52%)

PB Islamic Dynamic Allocation (7.76%)

Kenanga SyariahExtra (7.74%)

TA Dana Optimix (6.62%)

Manulife Investment-ML Shariah Flexi (6.57%)

RHB Dana Hazeem (6.31%)

Public Islamic Growth Balanced (6.05%)

Public Ehsan Mixed Asset Conservative (6.03%)

Manulife Investment Al-Umran (5.77%)

Public e-Islamic Flexi Allocation (5.53%)

Dana Makmur Pheim (5.47%)

AmIslamic Balanced (5.45%)

Manulife Investment-HW Shariah Flexi (5.41%)

Public Islamic Mixed Asset (5.34%)

Astute Dana Aslah (4.87%)

Public Islamic Enhanced Bond (4.69%)

Principal Islamic Lifetime Balanced (4.47%)

Kenanga Islamic Balanced (4.11%)

Dana Bon/Sukuk

AmanahRaya Syariah Trust (6.16%)

PB Aiman Sukuk (4.73%)

Maybank Malaysia Income-I A MYR (4.46%)

AmDynamic Sukuk – Class B (4.35%)

KAF Sukuk (4.35%)

Principal Islamic Lifetime Sukuk (4.30%)

Franklin Malaysia Sukuk I MYR Inc (4.22%)

Maybank Malaysia Sukuk (4.19%)

AmBon Islam (4.14%)

Kenanga AsnitaBond (4.13%)

Public Islamic Bond (4.05%)

Franklin Malaysia Sukuk A MYR Inc (4.01%)

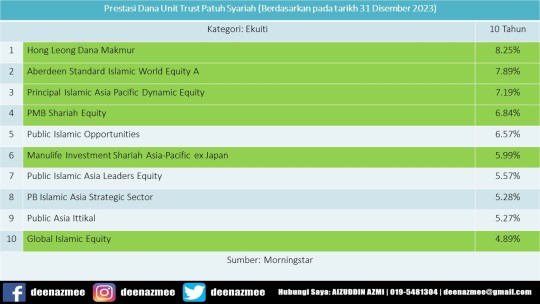

Purata Pulangan Tahunan 10 Tahun (Berdasarkan pada tarikh 31 Disember 2023)

Dana Ekuiti

Hong Leong Dana Makmur (8.25%)

Aberdeen Standard Islamic World Equity A (7.89%)

Principal Islamic Asia Pacific Dynamic Equity (7.19%)

PMB Shariah Equity (6.84%)

Public Islamic Opportunities (6.57%)

Manulife Investment Shariah Asia-Pacific ex Japan (5.99%)

Public Islamic Asia Leaders Equity (5.57%)

PB Islamic Asia Strategic Sector (5.28%)

Public Asia Ittikal (5.27%)

Global Islamic Equity (4.89%)

Public China Ittikal (4.85%)

TA Dana Fokus (4.69%)

Pheim Asia Ex-Japan Islamic (4.67%)

Principal DALI Asia Pacific Equity Growth (4.61%)

Public Islamic Asia Dividend (4.61%)

Public Islamic Select Treasures (4.36%)

Kenanga Shariah Growth Opportunity (4.35%)

PMB Dana Bestari (4.33%)

PMB Shariah Growth (4.26%)

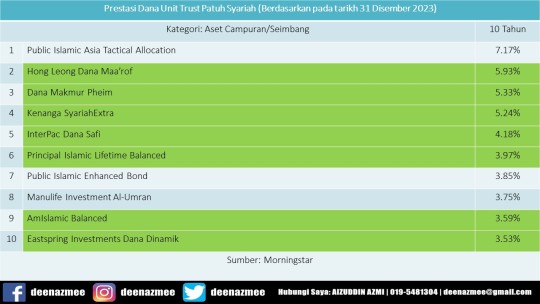

Dana Aset Campuran/Seimbang

Public Islamic Asia Tactical Allocation (7.17%)

Hong Leong Dana Maa’rof (5.93%)

Dana Makmur Pheim (5.33%)

Kenanga SyariahExtra (5.24%)

InterPac Dana Safi (4.18%)

Principal Islamic Lifetime Balanced (3.97%)

Public Islamic Enhanced Bond (3.85%)

Manulife Investment Al-Umran (3.75%)

AmIslamic Balanced (3.59%)

Eastspring Investments Dana Dinamik (3.53%)

Principal Islamic Lifetime Enhanced Sukuk (3.30%)

Manulife Investment-HW Shariah Flexi (3.24%)

TA Dana Optimix (3.05%)

Dana Bon/Sukuk

AmanahRaya Syariah Trust (5.18%)

PB Aiman Sukuk (4.84%)

KAF Sukuk (4.71%)

Kenanga AsnitaBond (4.60%)

Maybank Malaysia Income-I A MYR (4.55%)

Public Islamic Bond (4.34%)

Principal Islamic Lifetime Sukuk (4.29%)

PB Islamic Bond (4.23%)

AmBon Islam (4.20%)

AmDynamic Sukuk – Class A (4.17%)

Public Islamic Infrastructure Bon (4.08%)

PB Sukuk (4.04%)

Sumber: my.morningstar.com

P/S: Prestasi masa lalu tidak semestinya menunjukkan atau menjamin prestasi masa hadapan. Jom pelbagaikan pelaburan. Sekarang telah ada satu platform di mana pelabur mempunyai pilihan untuk melabur ke 300 lebih dana unit trust swasta daripada 20 lebih syarikat pengurusan unit trust yang tersenarai di Malaysia sama ada untuk melabur secara tunai atau melalui akaun 1 KWSP. Tiada pelaburan awal jika berminat untuk melabur secara simpanan tetap. (Hanya 90 dana unit trust swasta patuh syariah tertentu) Adakah simpanan anda mencukupi? Dimanakah tempat anda membuat simpanan? Jom gandakan simpanan di tempat yang kalis Inflasi! Berminat? Nak buka akaun pelaburan unit trust secara online? Klik https://tinyurl.com/f4m340F.

Untuk keterangan lanjut & temujanji, sila hubungi:

Aizuddin Azmi

Perunding Unit Amanah

Single License Investment

Emel: [email protected]

H/P: 019-548 1304

Alamat: No. 29A (Ground Floor), Lebuh Pantai 10300 Pulau Pinang

Sekian, wassalam.

0 notes

Text

Mahasiswa FEB UGM Juarai Kompetisi Bisnis Asia Pasifik 2023

BALIPORTALNEWS.COM, YOGYAKARTA - Tim Gama Fakultas Ekonomika dan Bisnis (FEB) UGM berhasil menyabet gelar juara pertama dalam Institute of Management Accountants (IMA) Student AsiaPac Case Competition 2023 yang diselenggarakan pada bulan Maret 2023.

“Menjadi sebuah kebanggan bagi kami bisa terpilih menjadi First Place dalam IMA AsiaPac Student Case Competition 2023,” tutur Azzahra Aulia Hasibuan, Jumat (31/3/2023).

Aulia menjelaskan IMA AsiaPac Student Case Competition 2023 merupakan kompetisi yang diselenggarakan oleh IMA untuk mahasiswa di tingkat Asia Pasifik. Dalam IMA AsiaPac Student Case Competition 2023 mempertemukan mahasiswa dari universitas di seluruh kawasan Asia-Pasifik untuk bersaing dan menunjukkan keahliannya memecahkan masalah bisnis di dunia nyata. Selain di regional Asia Pasifik, IMA AsiaPac Student Case Competition juga diadakan untuk mahasiswa di lima reginal lainnya yakni USA, India, Eropa, China, dan Timur Tengah.

Pada IMA AsiaPac Student Case Competition 2023, Tim GAMA yang terdiri dari tersebut lima mahasiswa program Sarjana Akuntansi angkatan 2020 yaitu Aura Putri Buwono Dewi, Azzahra Aulia Hasibuan, Adisty Cantika Paramadhina (IUP), Afif Haidar Endraswara (IUP), dan Khofifah Rizza Firmansyah berkompetisi dengan tim-tim kuat lainnya di Asia Pasifik menganalisis kasus bisnis tentang Kunapipi Gardens: Transfer Pricing in The Service Industry. Dalam persiapannya tim GAMA dibimbing oleh Arief Surya Irawan, S.E., M.Com. Ak., CA.

Aulia menjelaskan dalam kompetisi tersebut setiap tim diminta membuat powerpoint dan diseleksi hingga mendapatkan empat tim terbaik. Setelah itu, keempat tim yang dipilih diminta untuk mempresentasikan powerpoint melalui zoom meetings. Peserta harus menganalisis kasus bisnis yang kompleks tersebut secara berkelompok dan komprehensif serta memberikan solusi yang inovatif untuk mengatasi permasalahan di kasus. Setiap tim harus menunjukkan keterampilan analitis, pemikiran kritis, dan pemecahan masalah yang baik melalui solusi inovatif yang ditawarkan.

Tiga tim terbaik pada final competition IMA AsiaPac Student Case Competition 2023 memperoleh hadiah berupa Beasiswa U.S. CMA® (Certified Management Accountant) dengan nilai lebih dari US$ 2.000, kupon Amazon, dan kesempatan mengikuti ‘Team Membership Program’ dengan IMA di wilayahnya.

Selain itu, Team GAMA yang berhasil menjadi juara pertama mendapatkan kesempatan mengikuti sesi eksklusif tentang persiapan dan pengembangan karier bersama Dr. Josh Heniro selaku Senior Director, Asia Tenggara and Australasia, IMA.(bpn)

Read the full article

#BaliPortalNews#FakultasEkonomikadanBisnis#InstituteofManagementAccountants#KompetisiBisnisAsiaPasifik2023#MahasiswaFEBUGM#UGM

0 notes

Text

สถาบันนักบัญชีบริหารเปิดรับสมัครนักศึกษาเข้าร่วมการแข่งขันแก้ปัญหาธุรกิจในภูมิภาคเอเชียแปซิฟิก ประจำปี 2566

ผู้ชนะจะได้รับทุนการศึกษาวุฒิบัตรนักบัญชีบริหารระดับสูง และบัตรของขวัญจากแอมะซอน

สถาบันนักบัญชีบริหาร (Institute of Management Accountants หรือ IMA(R)) หนึ่งในสมาคมที่ใหญ่ที่สุดและน่าเชื่อถือมากที่สุดในด้านการพัฒนาผู้ประกอบวิชาชีพนักบัญชีบริหาร ประกาศเปิดรับสมัครนักศึกษาเข้าร่วมการแข่งขันแก้ปัญหาธุรกิจ IMA AsiaPac Student Case Competition ประจำปี 2566 ตั้งแต่วันนี้จนถึงวันที่ 3 กุมภาพันธ์ 2566…

View On WordPress

0 notes

Text

Carrier named MS Amlin Underwriting chief executive

Carrier named MS Amlin Underwriting chief executive

Executive succeeds Johan Slabbert, who is taking up a new role driving parent company Mitsui Sumitomo Insurance's growth strategy in…

Related Stories

MGA Focus – Africa Specialty Risks: Derisking Africa

P&I market has not turned corner yet, West CEO warns

Liberty GTS makes AsiaPac hires

Source link

View On WordPress

0 notes

Text

From British to Chinese rule: Hong Kong, in photos

From British to Chinese rule: Hong Kong, in photos

Chinese national and Hong Kong regional flags decorate a public housing building ahead of the city’s 25th handover anniversary.

Anthony Kwan/Getty Images AsiaPac/Getty Images

By Xueying Chang, CNN

Updated 10:48 AM ET, Fri July 1, 2022

Chinese national and Hong Kong regional flags decorate a public housing building ahead of the city’s 25th handover anniversary.

Anthony Kwan/Getty Images…

View On WordPress

0 notes

Photo

April 15, 2011 - Shanghai, China

Source: Mark Thompson/Getty Images AsiaPac

205 notes

·

View notes

Text

Why do Singapore businesses require managed IT services?

The digital world is a chaotic place. Imagine going smoothly as usual until an untimely outage occurs, resulting in a disaster for your company. According to Singtel, unplanned downtime costs Singaporean businesses over $1 billion annually in lost income, data loss and recovery, and product development delays.

While you may be comfortable with your present IT infrastructure, managing your day-to-day IT environment is critical. Salesforce, the world's biggest CRM service provider, experienced an outage on May 19, 2021, preventing thousands of organizations from accessing their software and impacting numerous global businesses. What is the reason for this? It was taking shortcuts in ordinary procedures that resulted in poor decisions.

What are the uses of Managed IT Services for Businesses?

It's not just about preventing outages regarding IT management; it's also about protecting your company from cyber-attacks. Vulnerabilities in software are the culprit, which hackers take advantage of. In March of this year, Google warned the 2.6 billion individuals who use the browser, advising them to expect an increase in cyberattacks.

While you may believe that an outage at your firm isn't as severe as one at Salesforce, it's always better to be cautious than sorry. According to a study conducted in 2018, an alarming 69 per cent of Singapore-based organizations admitted to being unprepared for cloud service outages and had yet to assess the consequences. There is, however, a simple remedy. Entrusting their IT management to a reputable supplier of managed IT services in Singapore might be a simple and cost-effective approach to avoid such unwanted events.

When you commit the administration of your IT to AsiaPac, we deliver a comprehensive Managed Services IT framework that optimizes IT operations so you can devote more resources and time to other elements of your organization that will help you develop.

Here are some of the bundles we provide:

IT Backup Management

Our Singapore Managed IT Backup Services help to ensure that your vital data is always safe and secure. Our engineers will analyze your information and devise a complete backup strategy. In addition, as part of our service, we will deploy our enterprise Cloud-based backup and recovery system. With regular reporting, we will conduct routine checks on the data's integrity and ensure that resources are used efficiently. We also offer disaster recovery services. When critical systems fail, or a site goes down, such services try to recover lost data and restore operations.

Detection and Response for Management

With our Managed Endpoint Detect & Response (EDR) program, you can protect your IT infrastructure from ransomware. Unlike traditional antivirus software, a Managed EDR application may restore devices to their pre-infection state with a single click. Artificial Intelligence is also used in Managed EDR to detect threats and provide real-time monitoring. It also detects threats before they become a problem, allowing it to keep ahead of even the most advanced ransomware technologies. Say goodbye to time-consuming and ineffective virus scans. Have peace of mind knowing that your systems are monitored in real-time and protected 24 hours a day, seven days a week.

Email Archiving and Protection

With the rise of email scams, Outlook and Gmail's built-in features cannot effectively block harmful and malicious emails. According to Earthweb, phishing emails account for 3.4 billion of all emails received daily around the world. Closer to home, the Singapore Police Force estimated that in 2021, internet scam victims in Singapore lost at least S$633.3 million. More advanced procedures would be required.

AsiaPac's email protection and archiving package integrate malware detection and antivirus technologies to give you the best of both worlds. We monitor your company's emails 24 hours a day, seven days a week, and our round-the-clock defence system eliminates threats before they appear.

Reasons to Choose Managed IT Services

Proactive and encompassing

When you work with AsiaPac, we aren't just there to assist you in the aftermath of an incident. Our expert managed services support team is dedicated to proactively helping you develop and maintain a robust IT infrastructure and network. It is to avoid any problems or undesirable situations as much as possible before they occur. We greatly anticipate your IT needs and manage your IT environment as if it were our own. We don't believe in taking shortcuts since we want to give our clients the best service possible.

Round-the-Clock Assistance

We stay vigilant and watch your IT systems so you may sleep soundly. We'll keep an eye on your systems around the clock, seven days a week, 365 days a year. Our cutting-edge Next-Generation United Operations Monitoring Center (UOMC) monitors all your networks and equipment around the clock and provides predictive data. We predict approaching equipment failure before it occurs, making IT incident management more efficient. Furthermore, our centre has skilled IT support technicians on standby, ready to respond quickly to emergencies.

Packages that are both affordable and flexible

While we strive to provide our clients with cost-effective, comprehensive solutions, we recognize that one size does not fit all. Every organization is unique, with its own set of IT requirements and service level expectations. As a result, we allow you to mix and match different programs to fulfil and supplement your needs. As a result, you won't have to worry about overpaying for services that aren't being used.

Increased Efficiency in the Workplace

Say goodbye to swarms of notifications, ruined backups, and strings of alarms in server logs. Minor activities, such as software updates, are frequently swept under the rug by businesses. However, doing so may result in a backlog of unrelated work that will take valuable time to resolve and business interruptions.

Our services can help your company become more productive by keeping track of and updating inventory reports. As a result, before advising and conducting essential changes, we may eliminate outdated network information, discrepancies, or shortcomings.

Conclusion

Use technology to carry out your business and growth strategy, and don't be afraid to use it. We'll help you avoid the nightmare of outages and cyber-attacks. AsiaPac's comprehensive suite of managed IT services in Singapore addresses all concerns, big and small. AsiaPac is also a cloud service providers in Singapore. We take pleasure in providing dependable service so you may focus on your business goals. Contact us for a free, non-obligatory consultation to begin your journey to worry-free IT management.

0 notes

Photo

helen clark -

- born february 26, 1950 in hamilton, new zealand

- in 1993 she was elected head of the labour party, therefore becoming the first woman in new zealand to lead a major party

- new zealand politician who was prime minister (1999–2008)

- she was the first woman in new zealand to hold the office of prime minister immediately following an election

- also served as the minister for arts, culture and heritage throughout her premiership

- global leader in sustainable development, gender equality and international co-operation

- she also then became the united nations development programme (UNDP) administrator for two terms from 2009 to 2017, the first woman to lead the organisation

- while in term clark addressed many issues that were deemed to be controversial, including maori rights, same-sex civil unions, and prostitution, which was legalized in 2003

- she was the first new zealand prime minister to secure three consecutive terms in office

- she was awarded the peace prize from the danish peace foundation in 1986

- in 2009 she was made a member of the order of new zealand

- the helen clark foundation was established in 201

photo: Marty Melville—Getty Image News/Getty Images AsiaPac

0 notes

Photo

There are many activities to do this weekend with your loved ones! One of them is the @affordableartfairsg!

There’s art activities for both kids and adults, a wide selection of art pieces and sculptures to select from. (do go to @affordableartfairsg

IG to find out more info!)

Thank you, AAF, for inviting me to the Art Preview! 😍 And Happy 10th Anniversary! 🎉

Here’s some of my favorite pieces from the exhibition.

*this is not a sponsored post. Just want to share this event as it is something good. 😉👍

#TGIF people!!!! #ArtHappy #AAF #seoulart #asiaart #apacart #apac #asiapac #regionalart #asiaartist #seoul #taiwan #hongkong #thailand #globalart

#art #inspiration #sgart #paint #sculptures #silkscreen

#artdecoring #artshow #singapore (at F1 Pit Building)

https://www.instagram.com/p/B5JrODDnjyW-UNnsmYQOYNl_S2LY9hcpACk4a40/?igshid=1kl5ldro62cuz

#tgif#arthappy#aaf#seoulart#asiaart#apacart#apac#asiapac#regionalart#asiaartist#seoul#taiwan#hongkong#thailand#globalart#art#inspiration#sgart#paint#sculptures#silkscreen#artdecoring#artshow#singapore

0 notes

Photo

New Post has been published on http://www.herebegeeks.com/uncategorized/sgcc-hopes-to-connect-aspiring-creators-with-publishers-with-new-initiative/

SGCC hopes to connect aspiring creators with publishers with new initiative

If you're an artist or comic writer looking for your big break, here's your chance: The Singapore Comic Con (SGCC) is introducing a new initiative: The "Work In Progress" (WIP) programme with the hope of connecting aspiring creators and publishers. The WIP programme will allow aspiring

#AsiaPac#Darkbox Studio#SGCC#Shogakukan#Singapore Comic Con#Vividthree#WIP programme#Work in Progress programme#Uncategorized

0 notes

Photo

OnRobot opens Asia-Pac HQ in Singapore, eyes booming regional market Singapore DENMARK-BASED robotics company OnRobot wants its Singapore office to focus on meeting South-east Asia's growing demand for devices attached to the end of robotic arms that can pick up objects. OnRobot now has nine products, including grippers, sensors and tool changers. ... The Business Times

0 notes

Photo

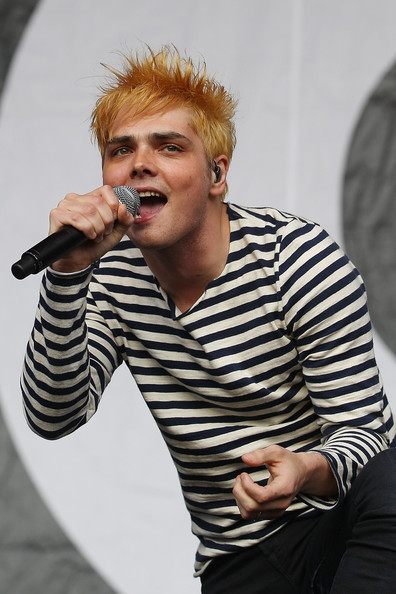

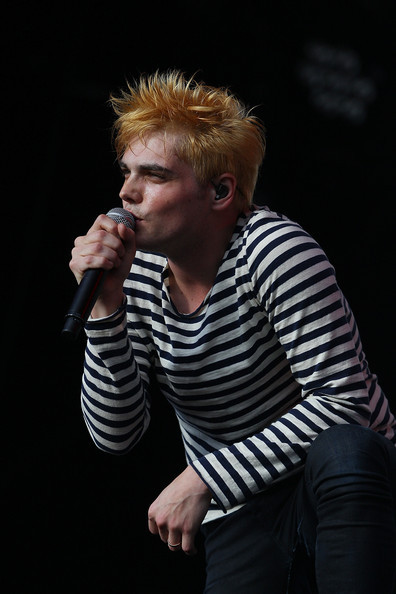

Performing on stage as part of Big Day Out Festival.

Location: Gold Coast Parklands, Gold Coast, Australia.

Date: January 22, 2012

(Source: Chris Hyde/Getty Images AsiaPac)

#gerard way#mikey way#ray toro#frank ireo#mcr#My Chem#my chemical romance#Danger Days#mcr fans#mcr stans#mcr army#Welcome to the Black Parade#The Umbrella Academy#australia#2012

667 notes

·

View notes

Text

สถาบันนักบัญชีบริหารเปิดรับสมัครนักศึกษาเข้าร่วมการแข่งขันแก้ปัญหาธุรกิจในภูมิภาคเอเชียแปซิฟิก ประจำปี 2566

ผู้ชนะจะได้รับทุนการศึกษาวุฒิบัตรนักบัญชีบริหารระดับสูง และบัตรของขวัญจากแอมะซอน

สถาบันนักบัญชีบริหาร (Institute of Management Accountants หรือ IMA(R)) หนึ่งในสมาคมที่ใหญ่ที่สุดและน่าเชื่อถือมากที่สุดในด้านการพัฒนาผู้ประกอบวิชาชีพนักบัญชีบริหาร ประกาศเปิดรับสมัครนักศึกษาเข้าร่วมการแข่งขันแก้ปัญหาธุรกิจ IMA AsiaPac Student Case Competition ประจำปี 2566 ตั้งแต่วันนี้จนถึงวันที่ 3 กุมภาพันธ์ 2566…

View On WordPress

0 notes