#aminterview

Photo

Arctic Monkeys Interview, Junuary, 2019 #alexturner #arcticmonkeys #am #matthelders #jamiecook #nickomalley #doiwannaknow #indierock #music #tlsp #rock #indie #band #mojointerview #mojo #mojomagazine #aminterview #tbhnc #tbhcera #tranquilitybasehotelandcasino #tranquilitybasehotelandcasinoalbum #thelastshadowpuppets #milexisreal #tumblr #amfans #amfandom https://www.instagram.com/p/CejesMAOuRF/?igshid=NGJjMDIxMWI=

#alexturner#arcticmonkeys#am#matthelders#jamiecook#nickomalley#doiwannaknow#indierock#music#tlsp#rock#indie#band#mojointerview#mojo#mojomagazine#aminterview#tbhnc#tbhcera#tranquilitybasehotelandcasino#tranquilitybasehotelandcasinoalbum#thelastshadowpuppets#milexisreal#tumblr#amfans#amfandom

3 notes

·

View notes

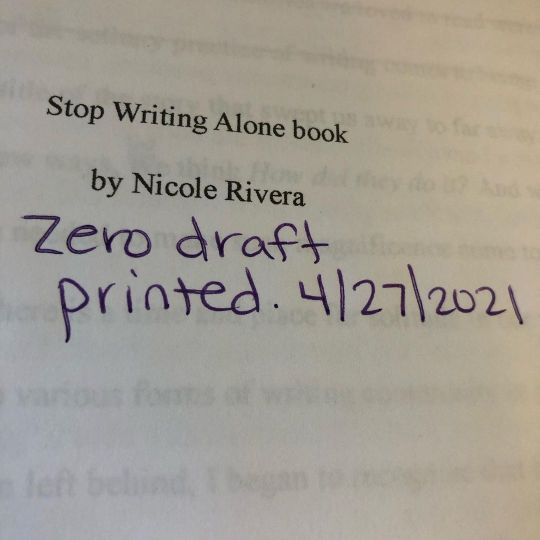

Photo

So much work still needs to be done!! #amwrtiting #amreading #amrewriting and soon... #aminterviewing https://www.instagram.com/p/COLXzRNrKcB/?igshid=14uk1rfvsp91

0 notes

Link

Markets are trading marginally higher even as global markets slipped on Tuesday. Asian shares dropped in tentative morning trade on Tuesday as sentiment remained fragile in the face of tense trade relations between the United States and major economies, with investors braced for another potentially rocky day for Chinese markets.Markets are trading marginally higher even as global markets slipped on Tuesday. Asian shares dropped in tentative morning trade on Tuesday as sentiment remained fragile in the face of tense trade relations between the United States and major economies, with investors braced for another potentially rocky day for Chinese markets.

Investors, worried the trade row could derail a rare period of synchronized global growth, have pulled out of riskier assets in the past month or so.

The Asia Pacific MSCI index ex-Japan dropped 0.66 per cent on early Tuesday trade, while Japan’s Nikkei average was little changed.

In China, the Shanghai Composite Index shed 0.23 per cent and the blue chip CSI300 index fell 0.19 per cent.

The Shanghai bourse hit more than two-year lows on Monday, and the yuan fell amid jitters ahead of a July 6 deadline when the United States is set to impose tariffs on $34 billion worth of goods from China, the epicenter of a heated trade dispute between Washington and major economies that has convulsed financial markets.

Back home, growth in output of the crucial eight core industries declined to a 10-month low of 3.6 per cent in May due to a fall in the pace of growth of steel, cement as well as contraction in crude and natural gas.

This might have an adverse impact on the index of industrial production (IIP) as core industries have 40 per cent weightage in the index.CATCH ALL THE LIVE UPDATES10:00 AMMarket Check

Index Current Pt. Change % Change S&P BSE SENSEX 35,360.56 +96.15 +0.27 S&P BSE SENSEX 50 11,198.70 +26.16 +0.23 S&P BSE SENSEX Next 50 31,733.46 +24.34 +0.08 S&P BSE 100 10,955.85 +23.06 +0.21 S&P BSE Bharat 22 Index 3,295.14 +6.12 +0.19(Source: BSE)09:45 AMINTERVIEW OF THE DAY Market correction isn't due to Sebi's new rules: CEO, Edelweiss AMC

The share markets, particularly mid-cap and small-cap stocks, have seen a big price fall. Some are blaming the Securities and Exchange Board of India's new categorisation norms for the sell-off. In an interview with Jash Kriplani, RADHIKA GUPTA, chief executive officer, Edelweiss Asset Management, talks about the issue and her company's growth plans. CLICK HERE FOR MORE

09:35 AMSebi directs ICICI Prudential MF to refund Rs 2.4 billion to five schemes The Securities and Exchange Board of India (Sebi) has issued a directive to ICICI Prudential Mutual Fund (MF) for allegedly violating the MF code of conduct by making a large investment in the initial public offering (IPO) of its group firm ICICI Securities. The investment allowed the IPO to meet a minimum subscription requirement, without which it would have failed. The market regulator has directed the fund house to refund Rs 2.4 billion with an annual interest of 15 per cent to five schemes of the MF which invested in the IPO. READ MORE09:26 AMF&O Strategies JUBLFOOD JULY FUTURES: Buy around 1410-1412 for a potential upside target of 1450 with a stop below 1385 (spot levels) RELCAPITAL JULY FUTURES: Sell around 370-372 for a potential downside target of 352 with a stop loss placed above 380 (spot levels) COVERED PUT IN JINDALSTEL : Sell one lot of JINDALSTEL JUL FUT @ 207-208 and Sell one lot of JINDALSTEL JUL 190 PE @ 5.50-6 | Max Profit: 50625 | Max Loss: Unlimited Above BEP | BEP: 212.50 | Positional SL: 220 (Spot Levels)

(Source: Karvy)09:20 AMNifty sectoral trend

09:18 AMBSE Sensex heatmap

09:16 AMMarket at open At 9:15 AM, the S&P BSE Sensex was trading at 35,236, down 28 points while the broader Nifty50 was ruling at 10,644, down 13 points.09:10 AMStocks in news

Tech Mahindra partners US-based LIFARS for digital forensics platform

Hero MotoCorp hikes prices by up to Rs 500 to offset rising input costs

Nestle India introduces NESPLUS - a new range of breakfast cereals

Aurobindo Pharma has received USFDA approval for Ibuprofen OTC capsules.

Capital First entered into agreement to acquire 7.03% of stake in Village Financial Services

ITC and Ballarpur Industries clarify that no negotiations have taken place for ITC acquiring BILT’s Telengana unit.

Fortis Healthcare has said that today is the last day for submission of binding bids for the hospitals business

Parag Milk Foods board approved acquiring patented product rights from Sweden-based organization.

Strides Shasun received U.S. FDA approval for Ibuprofusen tablets.

Mahindra Lifespace Developers managing director Anita Arjundas resigned.

Rico Auto Industries shut loss making unit in Haryana.

Greenply Industries commences commercial production of Medium Density Fibreboard (MDF) at its Andhra Pradesh manufacturing unit

(Source: Nirmal Bang report)09:08 AMToday's picks Hero MotoCorp Current price: Rs 3,415Target price: Rs 3,360 Keep a stop at Rs 3,450 and go short. Add to the position between Rs 3,370 and Rs 3,380. Book profits at Rs 3,360. HPCL Current price: Rs 260Target price: Rs 255 Keep a stop at Rs 262 and go short. Add to the position between Rs 256 and Rs 257. Book profits at Rs 255. Click here for more09:01 AMMarkets at pre-open

Index Current Pt. Change % Change S&P BSE SENSEX 35,346.68 +82.27 +0.23 S&P BSE SENSEX 50 11,179.09 +6.55 +0.06 S&P BSE SENSEX Next 50 31,684.43 -24.69 -0.08 S&P BSE 100 10,937.32 +4.53 +0.04 S&P BSE Bharat 22 Index 3,295.60 +6.58 +0.20(Source: BSE)08:57 AMStock pick by Anand Rathi: HINDUSTAN ZINC - BUYTARGET: Rs 295STOP LOSS: Rs 272 HINDZINC has formed a falling wedge pattern on the daily charts and the stock has reversed from the lower end of the pattern which is a bullish reversal patter. The momentum indicator MACD has reversed from an oversold territory on the hourly charts which are quite a positive thing in the short term. A minimum of 23.60% to 38.2% retracement of the fall can’t be ruled out; hence we recommend a buy on it. Click here for more08:54 AMNifty outlook by Anand Rathi Research NIFTY - BUYTARGET: 10,740STOP LOSS: 10,590 The Index has been consolidating within a range of 10,550-10,590 on the lower side to 10,700-10,740 on the upside. Now, in the yesterdays trading session the Index has reversed from the lower end of the range, hence a bounce back towards the upper end of the range is expected, so we recommend initiating a buy for the target of 10,740 with a stop loss of 10,590.08:50 AMTechnical calls by Prabhudas Lilladher: BUY SBICMP: Rs 258.85TARGET: Rs 282STOP LOSS: Rs 250 The stock has witnessed a decent erosion from the peak of 290 to show signs of bottoming out at around 255 levels which is also where the significant 50 DMA moving average lies. The chart looks attractive and we anticipate a bounce back from here on in the coming days. With good volume participation witnessed, we recommend a buy in this stock for an upside target of 282 keeping a stop loss of 250.Click here for more08:48 AMSECTOR WATCH Edelweiss on consumer sector

Most of the consumer goods companies are likely to see double digit volume growth aided by recovery in rural and a soft base. The Edelweiss consumer goods pack’s revenue, EBITDA and PAT growth is likely to be 12.2%, 16.5% and 16.0% YoY respectively (Q4FY18 saw 7.8%, 15.0% and 16.4% YoY respectively). Rural cluster should continue to revive and grow a tad higher than urban.

Wholesale and trade pipeline are out of woods which is another comforting factor. On international front too, we expect good pick up across geographies. Gross margin expansion will be limited owing to crude oil related inflation coupled with depreciating rupee. To counter the same, companies have started taking price hikes in calibrated manner. In spite of pick up in ads by most players, there is likely EBITDA margin expansion on the back of cost rationalization measures

08:45 AMNifty outlook by Prabhudas Lilladher: Nifty has its trend of all periodicities down, however for now 10,550 holds to be a crucial support level & a decisive move past 10,730-10,750 would make way for higher targets. The support for the day is seen at 10,600 while resistance is seen at 10,710. Paint stocks and energy sector should do well in days to come. With the onset of result earnings, we anticipate stock specific momentum.08:41 AMMARKET COMMENT Amar Ambani, head of research, IIFL

The cloudy skies of Mumbai are more or less a reflection of the sentiment on the bourses. The week got off to a rangebound trade with main indices recovering most of the losses suffered in the first half of the day. Losses were seen in the telecom, metal, power and realty indices.

The outlook is a cautious start. The Nikkei Manufacturing Purchasing Managers' Index, rose to 53.1 in June from May's 51.2, the highest since December. However, infrastructure sector growth declined to a 10-month low. This was on the back of decreasing crude oil and natural gas production. US Commerce Secretary Wilbur Ross said that there was no bright line level of the stock market, which could influence Trump’s mind on trade policy. Asian markets are trading mixed with China struggling and yuan sliding. 08:41 AMAt 3.6%, eight core sector growth declines to 10-month low in May Growth in output of the crucial eight core industries declined to a 10-month low of 3.6 per cent in May due to a fall in the pace of growth of steel, cement as well as contraction in crude and natural gas. This might have an adverse impact on the index of industrial production (IIP) as core industries have 40 per cent weightage in the index. Now, much will depend on the remaining 60 per cent of the IIP. READ MORE08:39 AMRESULT PREVIEW Information Technology sector

We expect the 1QFY19 results season to deliver a steady revenue growth (CC, QoQ) of 2.0% which would be offset by 130bps headwinds from cross-currency movements, due to stronger USD against other global currencies. Large-caps would grow 1.1% CC QoQ whereas mid-caps would outperform with average revenue growth of 2.1% QoQ on deal ramp-ups.

Several companies and macro indicators have pointed to an improvement in the overall demand, though BFSI still has a mixed outlook. Hence, reaffirmation of their initial commentary through FY19 guidance would be critical. We expect INFO to maintain its 6-8% CC revenue growth guidance though USD guidance could be cut due to cross currency impact. Margins will remain largely flat as wage hikes, cross currency and visa costs will offset INR depreciation. We fine tune estimates and retain preference for INFO, HCLT (large caps) and CYL, MPHL (mid-caps).

(Source: IIFL)

08:37 AMMarkets on Monday

S&P BSE Sensex 35,264.41 Up -0.45% Nifty 50 10,657.30 Up -0.53% S&P BSE 200 4,585.16 Up -0.50% Nifty 500 9,109.00 Up -0.58% S&P BSE Mid-Cap 15,335.47 Up -0.75% S&P BSE Small-Cap 15,920.44 Up -0.70%08:35 AMSECTOR WATCH Nomura on Autos

Volume growth across passenger vehicles (PV), medium and heavy commercial vehicles (MHCV) and two-wheelers (2W) continued to remain strong in June and was better than our estimate. We note that auto industry is likely to have its best year in FY19 after a long period (last in FY11) with healthy double-digit growth across all segments. We believe strong demand environment will lead to pricing power and operating leverage benefits for companies, thereby supporting margins despite rising commodity costs.

Maruti Suzuki remains our long-term top pick in the sector, given its high volume visibility and strong model cycle. We also remain positive on Hero Motocorp (HMCL IN), Bajaj Auto (BJAUT IN) and M&M (MM IN).

08:33 AMSGX Nifty Trends on SGX Nifty indicate a flat opening for the broader index in India, a rise of 5 points or 0.05 per cent. Nifty futures were trading around 10,655-level on the Singaporean Exchange.08:30 AMMARKET COMMENT Sameet Chavan of Angel Broking

The market is not at willing to give up completely as there was strong buying seen at lower levels and thereby defended 10600 successfully. We reiterate that the market is in a mood of deceiving us and hence, it’s advisable not to pre-empt any direction soon. Let the market do whatever it wants to and any convincing breakout in either side should make things more clear. As far as trading strategy is concerned, looking at the sharp recoveries in individual stocks, it appears that some of the stocks do now have enough strength to continue this southward move and hence, anytime soon would look to give decent relief rallies. We believe that one should target such potential candidates as long as 10600 – 10550 remains intact on a closing basis08:27 AMOil rises as Libya declares force majeure on supplies Oil prices climbed on Tuesday after Libya declared force majeure on significant amounts of its supply, but rising overall output from OPEC as well as in the United States was dragging on markets. Brent crude oil futures were at $78.06 per barrel up 76 cents, or 1 percent, from their last close. US West Texas Intermediate (WTI) crude futures were up 75 cents, or 1 percent, at $74.69.08:22 AMAsian shares falter, China under renewed pressure on trade war fears Asian shares dropped in tentative morning trade on Tuesday as sentiment remained fragile in the face of tense trade relations between the United States and major economies, with investors braced for another potentially rocky day for Chinese markets. The Asia Pacific MSCI index ex-Japan dropped 0.66 per cent on early Tuesday trade, while Japan’s Nikkei average was little changed. In China, the Shanghai Composite Index shed 0.23 per cent and the blue chip CSI300 index fell 0.19 per cent.08:17 AMWall Street ends higher, helped by tech rally Wall Street ended higher on Monday after a choppy session, with gains in Apple and other technology stocks offsetting worries about an escalating trade war between Washington and its trading partners. The Dow Jones Industrial Average rose 0.15 per cent to end at 24,307.18 points, while the S&P 500 gained 0.31 per cent to 2,726.71. The Nasdaq Composite added 0.76 per cent to 7,567.69.08:15 AMGood Morning!

Welcome to market's live blog. Catch all live market action here

0 notes

Text

Project Fellow Posts at KFRI Recruitment 2018

Candidates are invited by Kerala Forest Research Institute (KFRI) to attend walk-in-interview to be held on 05 Feb 2018 10:00 AM for 1 vacancy. Project Maintenance of Butterfly Garden at KFRI-Peechi Campus and Establishment of New Gardens in Schools Total Vacancies 1 Start Date 24 Jan 2018 Last Date 05 Feb 2018 10:00 AMInterview Job LocationKerala Forest Research Institute, Peechi,…

View On WordPress

0 notes

Note

Posts after posts about him not saying anything to stop the rumors about him hating the band, not tweeting the boys (and before his bday no one tweeted him too for years), his team might be shit, but they don't have to put down every single rumors about Harry when 1 he's on a break 2 those rumors aren't going away and they're from the same shitty sources 3 he made pretty clear where he stands in the AMinterview, his words.

exactly!!!

0 notes

Photo

ENTREVISTA REVISTA INTRO - Arctic Monkeys - Alex Turner, 2018 (ESPAÑOL) #intromagazine #interview #arcticmonkeys #arcticmonkeysband #am #alexturner #alexdavidturner #matthelders #nickomalley #jamiecook #aminterview #arcticmonkeysinterview #español (en Intro Magazine) https://www.instagram.com/p/CW51K4YLgf1/?utm_medium=tumblr

#intromagazine#interview#arcticmonkeys#arcticmonkeysband#am#alexturner#alexdavidturner#matthelders#nickomalley#jamiecook#aminterview#arcticmonkeysinterview#español

0 notes

Photo

INTRO MAGAZINE INTERVIEW Arctic Monkeys - Alex Turner, 2018 (ENGLISH) #intromagazine #interview #arcticmonkeys #arcticmonkeysband #am #alexturner #alexdavidturner #matthelders #nickomalley #jamiecook #aminterview #arcticmonkeysinterview #english (en Intro Magazine) https://www.instagram.com/p/CW50O67r5Pn/?utm_medium=tumblr

#intromagazine#interview#arcticmonkeys#arcticmonkeysband#am#alexturner#alexdavidturner#matthelders#nickomalley#jamiecook#aminterview#arcticmonkeysinterview#english

1 note

·

View note