#albert kinross

Text

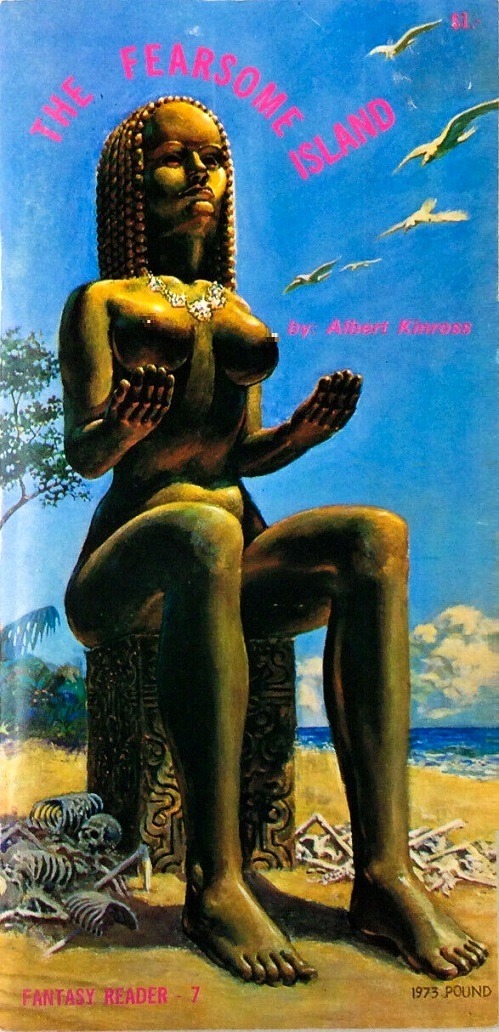

Albert Kinross - The Fearsome Island - Shroud - 1975 (cover illustration by John Pound)

#witches#islanders#occult#vintage#the fearsome island#fearsome#island#shroud books#fantasy reader#albert kinross#john pound#1975#1973

42 notes

·

View notes

Photo

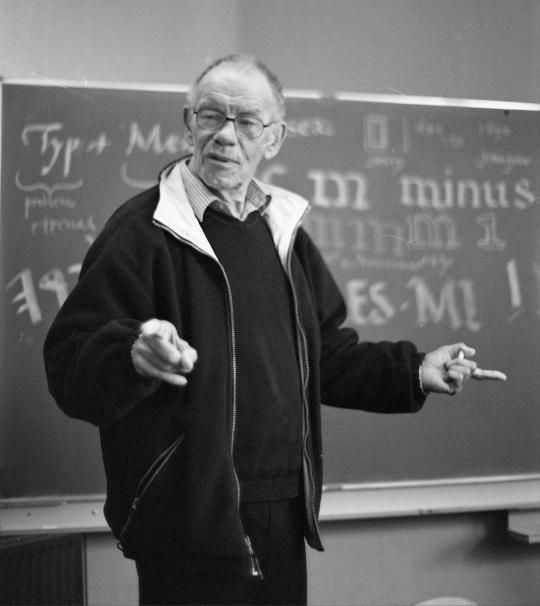

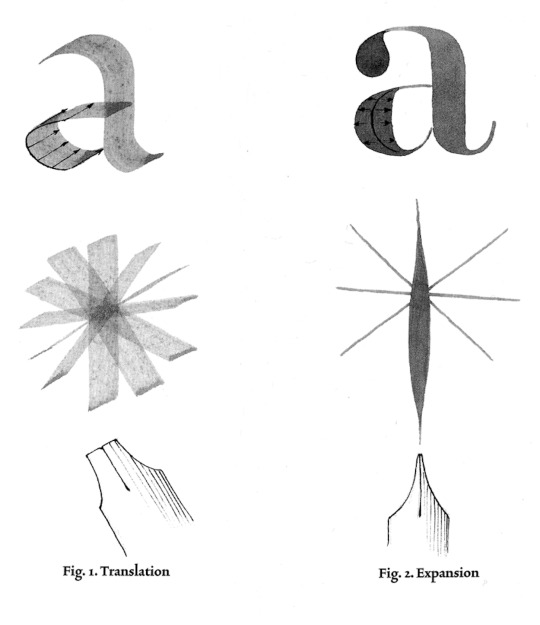

Gerrit Noordij - The Stroke: A theory of writing

I’d come across this book in the past but had never read gone further than a google search. In this book, Noordij proposes a new method of categorising fonts based on the elements of translation and expansion - thick, thin contrast. He draws the relationships between good type design, beginning with good calligraphic skills. Which, I’d argue, is not necessarily the case, Kris Sowersby attests to this in his ‘no such thing as an NZ typeface’ lecture. However, Noordij was influential in terms of shaping the digital font landscape. Some of his former students that have gone on to be internationally recognised are Petr and Erik van Blokland, Just van Rossum, Lucas de Groot, Albert-Jan Pool, Frank E. Blokland and Peter Verheul.

Robin Kinross interviews Gerrit Noordzij, 2001: https://typemedia.org/noordzij/interview.html

Typemedia - Gerrit Noordzij resources: https://typemedia.org/noordzij/

Typemag - It all starts with writing: An influential influence of Gerrit Noordzij: https://www.typemag.org/post/it-all-starts-with-writing-gerrit-noordzij

0 notes

Photo

The Fearsome Island. Albert Kinross. Chicago: Printed for Herbert S. Stone & Company, 1896. First U.S. edition.

A shipwrecked sailor in the Atlantic in 1560 discovers an island that is apparently enchanted but actually the result of an extended (and malevolent) experiment carried out by a mad scientist. Don Diego Rodriguez is an evil scientific genius with technology far in advance of his era. Banished during the Inquisition as a menace to the State, he moves to the New World -- before its discovery by Columbus -- and sets up a massively booby-trapped island.

10 notes

·

View notes

Text

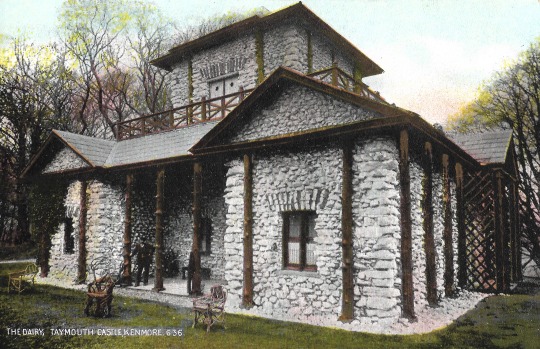

The Dairy, Taymouth Castle, Perth & Kinross

The Dairy, Taymouth Castle, Perth & Kinross

In September 1842 the 2nd Marquis of Breadalbane and his family welcomed Queen Victoria and Prince Albert to Taymouth Castle. They were greeted, with great ceremony, by pipers and by crowds of well-wishers in full highland costume, and a gun salute was fired. The Queen was charmed. During their brief stay Albert went hunting and shooting, returning with a bumper bag each evening, whilst the young…

View On WordPress

#Kenmore#Loch Tay#Marquis of Breadalbane#Perthshire#Prince Albert#Queen Victoria#river Tay#Scotland#Taymouth Castle#Temple of Venus#The Dairy Taymouth Castle#William Atkinson

0 notes

Link

For just $3.99 Released on December 23, 1942: The story of the British Battleship HMS Torrin is told in flashback by the men that fought WWII with her. Genre: Drama Duration: 1h 55min Director: Noel Coward Actors: Noel Coward (Captain E.V. Kinross R.N.), Derek Elphinstone (Number 1), Michael Wilding (Flags), Robert Sansom (Guns), Philip Friend (Torps), Chimmo Branson (Midshipman), Ballard Berkeley (Engineer Commander), Hubert Gregg (Pilot), James Donald (Doc), Michael Whittaker (Sub), Kenneth Carten (Sub-Lieutenant, R.N.), John Varley (Secco), Bernard Miles (Chief Petty Officer Hardy), Caven Watson (Brodie), John Mills (Ordinary Seaman Blake), Geoffrey Hibbert (Joey Mackenridge), Frederick Piper (Edgecombe), Lionel Grose (Reynolds), Leslie Dwyer (Parkinson), Charles Russell (Fisher), John Singer (Moran), Robert Moreton (Coombe), , John Boxer (Hollett), Kenneth Evans (Posty), Johnnie Schofield (Coxswain), Franklyn Bennett (Commander Spencer), Charles Compton (Number 1, Tremoyne), Walter Fitzgerald (Colonel Lumsden), Gerald Case (Jasper), Celia Johnson (Mrs. Kinross / Alix), Daniel Massey (Bobby), Ann Stephens (Lavinia), Joyce Carey (Mrs. Hardy / Kath), Kay Walsh (Freda Lewis), Kathleen Harrison (Mrs. Blake), Dora Gregory (Mrs. Lemmon), Penelope Dudley-Ward (Maureen), Barbara Waring (Mrs. Macadoo), Eileen Peel (Mrs. Farrell), Lesley Osmond (Nell Fosdick), Josie Welford (Emily), Kay Young (barmaid), Trixy Scales (Mona Duke), George Carney (Mr. Blake), Wally Patch (Uncle Fred), Michael Anderson (Albert Fosdick), Jill Stephens (May Blake), Everley Gregg (nurse), Roddy Hughes (photographer), Norman Pierce (Mr. Satterthwaite), Juliet Mills (Freda's baby), Richard Attenborough (the young powder handler), John Brabourne (the soldier in the Dunkirk scene), Leslie Howard (narrator voice). *** This item will be supplied on a quality disc and will be sent in a sleeve that is designed for posting CD's DVDs *** This item will be sent by 1st class post for qui...

0 notes

Text

Canadian Explorer Advances Two Projects, Including ‘Intriguing’ Site in Yukon Territory

Source: Thibaut Lepouttre for Streetwise Reports 07/26/2017

With the summer exploration season well underway, Thibaut Lepouttre of Caesar’s Report takes a look at a Canadian explorer with a full exploration program this summer.

Now that the summer exploration season is in full swing, Comstock Metals Ltd. (CSL:TSX.V) is also getting ready to provide the market with new drill results. A summer drill campaign has started at the Preview SW project in Saskatchewan, while the Yukon-based QV Gold project will be drilled later this summer.

Comstock’s two main projects

A) Preview SW, Saskatchewan

Drilling has already started at Preview, and it shouldn’t be too difficult for Comstock Metals to add more ounces to the current 430,000-ounce (Indicated + Inferred) resource estimate.

The project is located in Saskatchewan, covers a total surface area of just over 850 hectares and is located approximately 250 kilometers north of Prince Albert and 40 kilometers northeast of La Ronge.

Although the previous operators and Comstock have discovered seven gold prospects on the property, the current resource estimate containing almost 430,000 ounces at an average grade of approximately 1.61 g/t is limited to just one part of the property, the Preview SW zone.

The gold deposit consists of several sub-parallel gold-bearing structures, which seem to trend toward the northeast. All these structures are very close to each other, and the width of the mineralized “corridor” remains limited to approximately 150 meters. While the argument could be made the relatively narrow width of this zone will result in a relatively high strip ratio, it doesn’t have to be a deal breaker. Comstock will, indeed, have to deal with lower-grade mineralization in between the structures, but as the average grade of the resource estimate is relatively high for an open pit project, it does look like the project could handle a higher strip ratio as the cost to remove waste is negligible.

As mentioned before, the Preview SW resource estimate was completed on just one of the gold occurrences, and six more (known) targets remain virtually untested. The company has completed a 1,770-meter winter drill program with a specific focus on the Preview North zone, and the assay results of the past winter drill program are very encouraging, with an impressive 105 meters containing 1.01 g/t gold at Preview North and 5 meters at 10.33 g/t gold.

Needless to say, this type of drill results definitely justified a summer drill program, which is currently in full swing with the first two holes completed by now.

B) QV Gold, Yukon Territory

Comstock Metals’ second project is the QV Gold Project in Canada’s Yukon Territory. What’s really intriguing here is the fact QV is located right across the river from the Golden Saddle project, which was sold by Underworld Resources to Kinross Gold Corp. (K:TSX; KGC:NYSE), only to see Kinross Gold sell the asset to White Gold (WGO.V) a little while ago.

This was an important transaction as it establishes White Gold as a dominant Yukon-focused exploration company, which really brought a lot of attention back to the region.

As the QV property is located really close to White Gold’s Golden Saddle property, it would make a lot of sense to assume all options and possibilities will be thoroughly investigated farther down the road.

Over the past year, Comstock Metals has made a lot of progress to advance the property. Although it hasn’t always been easy to raise money for exploration projects in the Yukon, Comstock was able to identify the VG zone and drill off an initial resource within a 350-square-meter area. The company also confirmed the rock type and style of mineralization at the VG zone is similar to what has been found at Golden Saddle.

Not only does the VG gold zone of the QV project already contain 230,000 ounces of gold, it also still remains open in all directions. This means it should also be relatively easy to add more ounces to the resource estimate, which was completed in 2014 (none of the 20142017 exploration results are included in the current resource).

Even though last year’s RAB drill program was relatively small, it was able to extend the VG zone by in excess of 50 meters toward the east after intersecting in excess of 18 meters containing in excess of 1.8 g/t gold, and 50 meters to the west with an intercept of 12.19 meters averaging 5.53 g/t gold (blue rectangle), but it also confirmed the mineralization continues approximately 200 meters toward the northeast of the Telegraph fault, the “yellow zone.”

None of these holes was drilled inside the current resource, so the path to define a million ounces at QV is not unrealistic, especially considering Comstock Metals is still working on three additional “high priority” exploration targets.

There’s very little doubt the current 230,000-ounce resource at QV is just the beginning, as last year’s exploration program successfully extended the known mineralization, while three other high-priority mineralized zones on the wider land package also have the potential to add several hundred thousand near-surface ounces to the mix. RAB drilling is ineligible for resource calculations, and that’s why Comstock is also planning to complete up to 2,000 meters in diamond drilling this year, which would indeed qualify to expand the resource base.

What’s next for Comstock?

Comstock Metals is blessed with two resource-stage projects, although it’s still valued as a greenfield exploration company with a market capitalization of just CA$10M (despite a cash position of approximately CA$3M). That cash position will obviously be used to complete the summer exploration programs, which will hopefully result in an increased gold resource on both projects.

While the Preview SW project hosts the largest resource, the market will very likely be more excited by the prospects of the QV project in the Yukon, as the entire region enjoys some “special attention” these days. Thanks to the renewed interest in the Yukon Territory, it will be very interesting to see the “end game” for the QV project. Unless you have in excess of 2 million ounces, it’s really difficult to develop a gold project in the Yukon Territory on a standalone basis. Goldcorp will be able to build the Coffee mine, but Kinross’ Golden Saddle project probably was (and is) too small to be viable on a standalone basis.

Comstock Metals isn’t a one-trick pony, and both assets have a good shot at reaching the critical mass needed to start thinking about developing the projects into mines. The company’s first priority will be to build ounces and cash position of approximately CA$3M; Comstock Metals is in a good shape to continue its exploration activities on both projects.

At its current market capitalization of CA$10M is trading at just US$11 per ounce of gold in the ground, and that’s indeed quite cheap considering the exploration potential on both projects.

It’s now up to David Terry and his team to advance both QV and Preview SW, and we expect to see a steady flow of assay results being released to the market from August on.

Thibaut Lepouttre is the editor of the Caesars Report, a newsletter and mining portal based in Belgium that covers several junior mining companies with a special focus on precious metals and base metals. Lepouttre has a Bachelor of Law degree and two economics masters degrees that have forged his analytical approach to the mining sector. Considered a number cruncher, Lepouttre focuses on the valuations of companies and is consistently on the lookout for the next undervalued mining company.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you’ll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Thibaut Lepouttre: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: a long position in Comstock Metals. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: Comstock Metals. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: None. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Comstock Metals, a company mentioned in this article.

( Companies Mentioned: CSL:TSX.V,

)

from The Gold Report – Streetwise Exclusive Articles Full Text http://ift.tt/2eP7WVK

from WordPress http://ift.tt/2v0CppV

0 notes

Text

Canadian Explorer Advances Two Projects, Including 'Intriguing' Site in Yukon Territory

Source: Thibaut Lepouttre for Streetwise Reports 07/26/2017

With the summer exploration season well underway, Thibaut Lepouttre of Caesar's Report takes a look at a Canadian explorer with a full exploration program this summer.

Now that the summer exploration season is in full swing, Comstock Metals Ltd. (CSL:TSX.V) is also getting ready to provide the market with new drill results. A summer drill campaign has started at the Preview SW project in Saskatchewan, while the Yukon-based QV Gold project will be drilled later this summer.

Comstock's two main projects

A) Preview SW, Saskatchewan

Drilling has already started at Preview, and it shouldn't be too difficult for Comstock Metals to add more ounces to the current 430,000-ounce (Indicated + Inferred) resource estimate.

The project is located in Saskatchewan, covers a total surface area of just over 850 hectares and is located approximately 250 kilometers north of Prince Albert and 40 kilometers northeast of La Ronge.

Although the previous operators and Comstock have discovered seven gold prospects on the property, the current resource estimate containing almost 430,000 ounces at an average grade of approximately 1.61 g/t is limited to just one part of the property, the Preview SW zone.

The gold deposit consists of several sub-parallel gold-bearing structures, which seem to trend toward the northeast. All these structures are very close to each other, and the width of the mineralized "corridor" remains limited to approximately 150 meters. While the argument could be made the relatively narrow width of this zone will result in a relatively high strip ratio, it doesn't have to be a deal breaker. Comstock will, indeed, have to deal with lower-grade mineralization in between the structures, but as the average grade of the resource estimate is relatively high for an open pit project, it does look like the project could handle a higher strip ratio as the cost to remove waste is negligible.

As mentioned before, the Preview SW resource estimate was completed on just one of the gold occurrences, and six more (known) targets remain virtually untested. The company has completed a 1,770-meter winter drill program with a specific focus on the Preview North zone, and the assay results of the past winter drill program are very encouraging, with an impressive 105 meters containing 1.01 g/t gold at Preview North and 5 meters at 10.33 g/t gold.

Needless to say, this type of drill results definitely justified a summer drill program, which is currently in full swing with the first two holes completed by now.

B) QV Gold, Yukon Territory

Comstock Metals' second project is the QV Gold Project in Canada's Yukon Territory. What's really intriguing here is the fact QV is located right across the river from the Golden Saddle project, which was sold by Underworld Resources to Kinross Gold Corp. (K:TSX; KGC:NYSE), only to see Kinross Gold sell the asset to White Gold (WGO.V) a little while ago.

This was an important transaction as it establishes White Gold as a dominant Yukon-focused exploration company, which really brought a lot of attention back to the region.

As the QV property is located really close to White Gold's Golden Saddle property, it would make a lot of sense to assume all options and possibilities will be thoroughly investigated farther down the road.

Over the past year, Comstock Metals has made a lot of progress to advance the property. Although it hasn't always been easy to raise money for exploration projects in the Yukon, Comstock was able to identify the VG zone and drill off an initial resource within a 350-square-meter area. The company also confirmed the rock type and style of mineralization at the VG zone is similar to what has been found at Golden Saddle.

Not only does the VG gold zone of the QV project already contain 230,000 ounces of gold, it also still remains open in all directions. This means it should also be relatively easy to add more ounces to the resource estimate, which was completed in 2014 (none of the 20142017 exploration results are included in the current resource).

Even though last year's RAB drill program was relatively small, it was able to extend the VG zone by in excess of 50 meters toward the east after intersecting in excess of 18 meters containing in excess of 1.8 g/t gold, and 50 meters to the west with an intercept of 12.19 meters averaging 5.53 g/t gold (blue rectangle), but it also confirmed the mineralization continues approximately 200 meters toward the northeast of the Telegraph fault, the "yellow zone."

None of these holes was drilled inside the current resource, so the path to define a million ounces at QV is not unrealistic, especially considering Comstock Metals is still working on three additional "high priority" exploration targets.

There's very little doubt the current 230,000-ounce resource at QV is just the beginning, as last year's exploration program successfully extended the known mineralization, while three other high-priority mineralized zones on the wider land package also have the potential to add several hundred thousand near-surface ounces to the mix. RAB drilling is ineligible for resource calculations, and that's why Comstock is also planning to complete up to 2,000 meters in diamond drilling this year, which would indeed qualify to expand the resource base.

What's next for Comstock?

Comstock Metals is blessed with two resource-stage projects, although it's still valued as a greenfield exploration company with a market capitalization of just CA$10M (despite a cash position of approximately CA$3M). That cash position will obviously be used to complete the summer exploration programs, which will hopefully result in an increased gold resource on both projects.

While the Preview SW project hosts the largest resource, the market will very likely be more excited by the prospects of the QV project in the Yukon, as the entire region enjoys some "special attention" these days. Thanks to the renewed interest in the Yukon Territory, it will be very interesting to see the "end game" for the QV project. Unless you have in excess of 2 million ounces, it's really difficult to develop a gold project in the Yukon Territory on a standalone basis. Goldcorp will be able to build the Coffee mine, but Kinross' Golden Saddle project probably was (and is) too small to be viable on a standalone basis.

Comstock Metals isn't a one-trick pony, and both assets have a good shot at reaching the critical mass needed to start thinking about developing the projects into mines. The company's first priority will be to build ounces and cash position of approximately CA$3M; Comstock Metals is in a good shape to continue its exploration activities on both projects.

At its current market capitalization of CA$10M is trading at just US$11 per ounce of gold in the ground, and that's indeed quite cheap considering the exploration potential on both projects.

It's now up to David Terry and his team to advance both QV and Preview SW, and we expect to see a steady flow of assay results being released to the market from August on.

Thibaut Lepouttre is the editor of the Caesars Report, a newsletter and mining portal based in Belgium that covers several junior mining companies with a special focus on precious metals and base metals. Lepouttre has a Bachelor of Law degree and two economics masters degrees that have forged his analytical approach to the mining sector. Considered a number cruncher, Lepouttre focuses on the valuations of companies and is consistently on the lookout for the next undervalued mining company.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Thibaut Lepouttre: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: a long position in Comstock Metals. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: Comstock Metals. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: None. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Comstock Metals, a company mentioned in this article.

( Companies Mentioned: CSL:TSX.V, )

from The Gold Report - Streetwise Exclusive Articles Full Text http://ift.tt/2eP7WVK

0 notes

Text

Canadian Explorer Advances Two Projects, Including ‘Intriguing’ Site in Yukon Territory

Source: Thibaut Lepouttre for Streetwise Reports 07/26/2017

With the summer exploration season well underway, Thibaut Lepouttre of Caesar’s Report takes a look at a Canadian explorer with a full exploration program this summer.

Now that the summer exploration season is in full swing, Comstock Metals Ltd. (CSL:TSX.V) is also getting ready to provide the market with new drill results. A summer drill campaign has started at the Preview SW project in Saskatchewan, while the Yukon-based QV Gold project will be drilled later this summer.

Comstock’s two main projects

A) Preview SW, Saskatchewan

Drilling has already started at Preview, and it shouldn’t be too difficult for Comstock Metals to add more ounces to the current 430,000-ounce (Indicated + Inferred) resource estimate.

The project is located in Saskatchewan, covers a total surface area of just over 850 hectares and is located approximately 250 kilometers north of Prince Albert and 40 kilometers northeast of La Ronge.

Although the previous operators and Comstock have discovered seven gold prospects on the property, the current resource estimate containing almost 430,000 ounces at an average grade of approximately 1.61 g/t is limited to just one part of the property, the Preview SW zone.

The gold deposit consists of several sub-parallel gold-bearing structures, which seem to trend toward the northeast. All these structures are very close to each other, and the width of the mineralized “corridor” remains limited to approximately 150 meters. While the argument could be made the relatively narrow width of this zone will result in a relatively high strip ratio, it doesn’t have to be a deal breaker. Comstock will, indeed, have to deal with lower-grade mineralization in between the structures, but as the average grade of the resource estimate is relatively high for an open pit project, it does look like the project could handle a higher strip ratio as the cost to remove waste is negligible.

As mentioned before, the Preview SW resource estimate was completed on just one of the gold occurrences, and six more (known) targets remain virtually untested. The company has completed a 1,770-meter winter drill program with a specific focus on the Preview North zone, and the assay results of the past winter drill program are very encouraging, with an impressive 105 meters containing 1.01 g/t gold at Preview North and 5 meters at 10.33 g/t gold.

Needless to say, this type of drill results definitely justified a summer drill program, which is currently in full swing with the first two holes completed by now.

B) QV Gold, Yukon Territory

Comstock Metals’ second project is the QV Gold Project in Canada’s Yukon Territory. What’s really intriguing here is the fact QV is located right across the river from the Golden Saddle project, which was sold by Underworld Resources to Kinross Gold Corp. (K:TSX; KGC:NYSE), only to see Kinross Gold sell the asset to White Gold (WGO.V) a little while ago.

This was an important transaction as it establishes White Gold as a dominant Yukon-focused exploration company, which really brought a lot of attention back to the region.

As the QV property is located really close to White Gold’s Golden Saddle property, it would make a lot of sense to assume all options and possibilities will be thoroughly investigated farther down the road.

Over the past year, Comstock Metals has made a lot of progress to advance the property. Although it hasn’t always been easy to raise money for exploration projects in the Yukon, Comstock was able to identify the VG zone and drill off an initial resource within a 350-square-meter area. The company also confirmed the rock type and style of mineralization at the VG zone is similar to what has been found at Golden Saddle.

Not only does the VG gold zone of the QV project already contain 230,000 ounces of gold, it also still remains open in all directions. This means it should also be relatively easy to add more ounces to the resource estimate, which was completed in 2014 (none of the 20142017 exploration results are included in the current resource).

Even though last year’s RAB drill program was relatively small, it was able to extend the VG zone by in excess of 50 meters toward the east after intersecting in excess of 18 meters containing in excess of 1.8 g/t gold, and 50 meters to the west with an intercept of 12.19 meters averaging 5.53 g/t gold (blue rectangle), but it also confirmed the mineralization continues approximately 200 meters toward the northeast of the Telegraph fault, the “yellow zone.”

None of these holes was drilled inside the current resource, so the path to define a million ounces at QV is not unrealistic, especially considering Comstock Metals is still working on three additional “high priority” exploration targets.

There’s very little doubt the current 230,000-ounce resource at QV is just the beginning, as last year’s exploration program successfully extended the known mineralization, while three other high-priority mineralized zones on the wider land package also have the potential to add several hundred thousand near-surface ounces to the mix. RAB drilling is ineligible for resource calculations, and that’s why Comstock is also planning to complete up to 2,000 meters in diamond drilling this year, which would indeed qualify to expand the resource base.

What’s next for Comstock?

Comstock Metals is blessed with two resource-stage projects, although it’s still valued as a greenfield exploration company with a market capitalization of just CA$10M (despite a cash position of approximately CA$3M). That cash position will obviously be used to complete the summer exploration programs, which will hopefully result in an increased gold resource on both projects.

While the Preview SW project hosts the largest resource, the market will very likely be more excited by the prospects of the QV project in the Yukon, as the entire region enjoys some “special attention” these days. Thanks to the renewed interest in the Yukon Territory, it will be very interesting to see the “end game” for the QV project. Unless you have in excess of 2 million ounces, it’s really difficult to develop a gold project in the Yukon Territory on a standalone basis. Goldcorp will be able to build the Coffee mine, but Kinross’ Golden Saddle project probably was (and is) too small to be viable on a standalone basis.

Comstock Metals isn’t a one-trick pony, and both assets have a good shot at reaching the critical mass needed to start thinking about developing the projects into mines. The company’s first priority will be to build ounces and cash position of approximately CA$3M; Comstock Metals is in a good shape to continue its exploration activities on both projects.

At its current market capitalization of CA$10M is trading at just US$11 per ounce of gold in the ground, and that’s indeed quite cheap considering the exploration potential on both projects.

It’s now up to David Terry and his team to advance both QV and Preview SW, and we expect to see a steady flow of assay results being released to the market from August on.

Thibaut Lepouttre is the editor of the Caesars Report, a newsletter and mining portal based in Belgium that covers several junior mining companies with a special focus on precious metals and base metals. Lepouttre has a Bachelor of Law degree and two economics masters degrees that have forged his analytical approach to the mining sector. Considered a number cruncher, Lepouttre focuses on the valuations of companies and is consistently on the lookout for the next undervalued mining company.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you’ll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Thibaut Lepouttre: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: a long position in Comstock Metals. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: Comstock Metals. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: None. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Comstock Metals, a company mentioned in this article.

( Companies Mentioned: CSL:TSX.V,

)

from The Gold Report – Streetwise Exclusive Articles Full Text http://ift.tt/2eP7WVK

from WordPress http://ift.tt/2uDt8ly

0 notes

Text

Canadian Explorer Advances Two Projects, Including 'Intriguing' Site in Yukon Territory

Source: Thibaut Lepouttre for Streetwise Reports 07/26/2017

With the summer exploration season well underway, Thibaut Lepouttre of Caesar's Report takes a look at a Canadian explorer with a full exploration program this summer.

Now that the summer exploration season is in full swing, Comstock Metals Ltd. (CSL:TSX.V) is also getting ready to provide the market with new drill results. A summer drill campaign has started at the Preview SW project in Saskatchewan, while the Yukon-based QV Gold project will be drilled later this summer.

Comstock's two main projects

A) Preview SW, Saskatchewan

Drilling has already started at Preview, and it shouldn't be too difficult for Comstock Metals to add more ounces to the current 430,000-ounce (Indicated + Inferred) resource estimate.

The project is located in Saskatchewan, covers a total surface area of just over 850 hectares and is located approximately 250 kilometers north of Prince Albert and 40 kilometers northeast of La Ronge.

Although the previous operators and Comstock have discovered seven gold prospects on the property, the current resource estimate containing almost 430,000 ounces at an average grade of approximately 1.61 g/t is limited to just one part of the property, the Preview SW zone.

The gold deposit consists of several sub-parallel gold-bearing structures, which seem to trend toward the northeast. All these structures are very close to each other, and the width of the mineralized "corridor" remains limited to approximately 150 meters. While the argument could be made the relatively narrow width of this zone will result in a relatively high strip ratio, it doesn't have to be a deal breaker. Comstock will, indeed, have to deal with lower-grade mineralization in between the structures, but as the average grade of the resource estimate is relatively high for an open pit project, it does look like the project could handle a higher strip ratio as the cost to remove waste is negligible.

As mentioned before, the Preview SW resource estimate was completed on just one of the gold occurrences, and six more (known) targets remain virtually untested. The company has completed a 1,770-meter winter drill program with a specific focus on the Preview North zone, and the assay results of the past winter drill program are very encouraging, with an impressive 105 meters containing 1.01 g/t gold at Preview North and 5 meters at 10.33 g/t gold.

Needless to say, this type of drill results definitely justified a summer drill program, which is currently in full swing with the first two holes completed by now.

B) QV Gold, Yukon Territory

Comstock Metals' second project is the QV Gold Project in Canada's Yukon Territory. What's really intriguing here is the fact QV is located right across the river from the Golden Saddle project, which was sold by Underworld Resources to Kinross Gold Corp. (K:TSX; KGC:NYSE), only to see Kinross Gold sell the asset to White Gold (WGO.V) a little while ago.

This was an important transaction as it establishes White Gold as a dominant Yukon-focused exploration company, which really brought a lot of attention back to the region.

As the QV property is located really close to White Gold's Golden Saddle property, it would make a lot of sense to assume all options and possibilities will be thoroughly investigated farther down the road.

Over the past year, Comstock Metals has made a lot of progress to advance the property. Although it hasn't always been easy to raise money for exploration projects in the Yukon, Comstock was able to identify the VG zone and drill off an initial resource within a 350-square-meter area. The company also confirmed the rock type and style of mineralization at the VG zone is similar to what has been found at Golden Saddle.

Not only does the VG gold zone of the QV project already contain 230,000 ounces of gold, it also still remains open in all directions. This means it should also be relatively easy to add more ounces to the resource estimate, which was completed in 2014 (none of the 20142017 exploration results are included in the current resource).

Even though last year's RAB drill program was relatively small, it was able to extend the VG zone by in excess of 50 meters toward the east after intersecting in excess of 18 meters containing in excess of 1.8 g/t gold, and 50 meters to the west with an intercept of 12.19 meters averaging 5.53 g/t gold (blue rectangle), but it also confirmed the mineralization continues approximately 200 meters toward the northeast of the Telegraph fault, the "yellow zone."

None of these holes was drilled inside the current resource, so the path to define a million ounces at QV is not unrealistic, especially considering Comstock Metals is still working on three additional "high priority" exploration targets.

There's very little doubt the current 230,000-ounce resource at QV is just the beginning, as last year's exploration program successfully extended the known mineralization, while three other high-priority mineralized zones on the wider land package also have the potential to add several hundred thousand near-surface ounces to the mix. RAB drilling is ineligible for resource calculations, and that's why Comstock is also planning to complete up to 2,000 meters in diamond drilling this year, which would indeed qualify to expand the resource base.

What's next for Comstock?

Comstock Metals is blessed with two resource-stage projects, although it's still valued as a greenfield exploration company with a market capitalization of just CA$10M (despite a cash position of approximately CA$3M). That cash position will obviously be used to complete the summer exploration programs, which will hopefully result in an increased gold resource on both projects.

While the Preview SW project hosts the largest resource, the market will very likely be more excited by the prospects of the QV project in the Yukon, as the entire region enjoys some "special attention" these days. Thanks to the renewed interest in the Yukon Territory, it will be very interesting to see the "end game" for the QV project. Unless you have in excess of 2 million ounces, it's really difficult to develop a gold project in the Yukon Territory on a standalone basis. Goldcorp will be able to build the Coffee mine, but Kinross' Golden Saddle project probably was (and is) too small to be viable on a standalone basis.

Comstock Metals isn't a one-trick pony, and both assets have a good shot at reaching the critical mass needed to start thinking about developing the projects into mines. The company's first priority will be to build ounces and cash position of approximately CA$3M; Comstock Metals is in a good shape to continue its exploration activities on both projects.

At its current market capitalization of CA$10M is trading at just US$11 per ounce of gold in the ground, and that's indeed quite cheap considering the exploration potential on both projects.

It's now up to David Terry and his team to advance both QV and Preview SW, and we expect to see a steady flow of assay results being released to the market from August on.

Thibaut Lepouttre is the editor of the Caesars Report, a newsletter and mining portal based in Belgium that covers several junior mining companies with a special focus on precious metals and base metals. Lepouttre has a Bachelor of Law degree and two economics masters degrees that have forged his analytical approach to the mining sector. Considered a number cruncher, Lepouttre focuses on the valuations of companies and is consistently on the lookout for the next undervalued mining company.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Thibaut Lepouttre: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: a long position in Comstock Metals. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: Comstock Metals. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: None. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Comstock Metals, a company mentioned in this article.

( Companies Mentioned: CSL:TSX.V, )

from https://www.streetwisereports.com/pub/na/17582

0 notes

Text

Coronavirus: Dundee school closed after six adults test positive

Represent copyright

Google

Represent caption

A variety of the kids at Kingspark luxuriate in further bodily disabilities or scientific complications

A college in Dundee for pupils with further strengthen needs has been closed after six adults linked to it examined certain for coronavirus.

Dundee Metropolis Council and NHS Tayside said the switch to shut down Kingspark College became a “precautionary measure”.

The college will no longer open on Thursday and Friday whereas a deep excellent is implemented.

Kingspark has about 185 pupils, old between five and 18, and all luxuriate in further strengthen needs.

A variety of the kids furthermore luxuriate in further bodily disabilities or scientific complications.

Dr Ellie Hothersall, manual in Public Health Remedy with NHS Tayside, said: “We would enjoy to reassure folks that we are taking this measure as a precaution attributable to the moderately a pair of needs of the pupils who aid the college.”

A resolution is yet to be taken on whether the college will reopen on Monday.

Paul Clancy, Dundee Metropolis Council’s govt director of Children and Families Services and products, said the challenges faced by the college’s pupils meant “safety wanted to be paramount.”

‘Other mitigations’

He said: “There are sturdy hygiene measures and other mitigations in space all over Kingspark College. Alternatively, given the vulnerabilities and intricate needs of the pupils, we is no longer going to determine any dangers.

“This has been a elaborate resolution to attain, however it completely is one I’m hoping that families can realize and fancy.”

It comes as a total class of predominant pupils and their trainer luxuriate in been requested to self-isolate after a case of coronavirus.

Contact tracers are working to name shut contacts at St Albert’s Foremost College in Pollokshields on the south side of Glasgow.

A council spokeswoman said “control measures are in space at the college, and there is currently no proof of transmission within the college itself”.

Represent copyright

Google

Represent caption

Contact tracers are figuring out contacts at the college in Pollokshields

The option of pupils and crew requested to self-isolate has no longer been confirmed.

In other locations, a fourth pupil at a college in Coatbridge examined certain for coronavirus.

The pupil from St Ambrose Excessive had already been is believed as a contact and is segment of a cluster in North Lanarkshire and North East Glasgow.

In Perth and Kinross, two predominant pupils – one at Newhill Foremost in Blairgowrie and one more at Oakbank Foremost in Perth – luxuriate in been confirmed as having the virus.

In Renfrewshire a pupil at Todholm Foremost in Paisley has examined certain and phone tracing is taking space at Wallace Foremost in Elderslie after a undeniable take a look at.

from WordPress https://ift.tt/3hq8Bsx

via IFTTT

0 notes

Text

Canadian Explorer Advances Two Projects, Including 'Intriguing' Site in Yukon Territory

Source: Thibaut Lepouttre for Streetwise Reports 07/26/2017

With the summer exploration season well underway, Thibaut Lepouttre of Caesar's Report takes a look at a Canadian explorer with a full exploration program this summer.

Now that the summer exploration season is in full swing, Comstock Metals Ltd. (CSL:TSX.V) is also getting ready to provide the market with new drill results. A summer drill campaign has started at the Preview SW project in Saskatchewan, while the Yukon-based QV Gold project will be drilled later this summer.

Comstock's two main projects

A) Preview SW, Saskatchewan

Drilling has already started at Preview, and it shouldn't be too difficult for Comstock Metals to add more ounces to the current 430,000-ounce (Indicated + Inferred) resource estimate.

The project is located in Saskatchewan, covers a total surface area of just over 850 hectares and is located approximately 250 kilometers north of Prince Albert and 40 kilometers northeast of La Ronge.

Although the previous operators and Comstock have discovered seven gold prospects on the property, the current resource estimate containing almost 430,000 ounces at an average grade of approximately 1.61 g/t is limited to just one part of the property, the Preview SW zone.

The gold deposit consists of several sub-parallel gold-bearing structures, which seem to trend toward the northeast. All these structures are very close to each other, and the width of the mineralized "corridor" remains limited to approximately 150 meters. While the argument could be made the relatively narrow width of this zone will result in a relatively high strip ratio, it doesn't have to be a deal breaker. Comstock will, indeed, have to deal with lower-grade mineralization in between the structures, but as the average grade of the resource estimate is relatively high for an open pit project, it does look like the project could handle a higher strip ratio as the cost to remove waste is negligible.

As mentioned before, the Preview SW resource estimate was completed on just one of the gold occurrences, and six more (known) targets remain virtually untested. The company has completed a 1,770-meter winter drill program with a specific focus on the Preview North zone, and the assay results of the past winter drill program are very encouraging, with an impressive 105 meters containing 1.01 g/t gold at Preview North and 5 meters at 10.33 g/t gold.

Needless to say, this type of drill results definitely justified a summer drill program, which is currently in full swing with the first two holes completed by now.

B) QV Gold, Yukon Territory

Comstock Metals' second project is the QV Gold Project in Canada's Yukon Territory. What's really intriguing here is the fact QV is located right across the river from the Golden Saddle project, which was sold by Underworld Resources to Kinross Gold Corp. (K:TSX; KGC:NYSE), only to see Kinross Gold sell the asset to White Gold (WGO.V) a little while ago.

This was an important transaction as it establishes White Gold as a dominant Yukon-focused exploration company, which really brought a lot of attention back to the region.

As the QV property is located really close to White Gold's Golden Saddle property, it would make a lot of sense to assume all options and possibilities will be thoroughly investigated farther down the road.

Over the past year, Comstock Metals has made a lot of progress to advance the property. Although it hasn't always been easy to raise money for exploration projects in the Yukon, Comstock was able to identify the VG zone and drill off an initial resource within a 350-square-meter area. The company also confirmed the rock type and style of mineralization at the VG zone is similar to what has been found at Golden Saddle.

Not only does the VG gold zone of the QV project already contain 230,000 ounces of gold, it also still remains open in all directions. This means it should also be relatively easy to add more ounces to the resource estimate, which was completed in 2014 (none of the 20142017 exploration results are included in the current resource).

Even though last year's RAB drill program was relatively small, it was able to extend the VG zone by in excess of 50 meters toward the east after intersecting in excess of 18 meters containing in excess of 1.8 g/t gold, and 50 meters to the west with an intercept of 12.19 meters averaging 5.53 g/t gold (blue rectangle), but it also confirmed the mineralization continues approximately 200 meters toward the northeast of the Telegraph fault, the "yellow zone."

None of these holes was drilled inside the current resource, so the path to define a million ounces at QV is not unrealistic, especially considering Comstock Metals is still working on three additional "high priority" exploration targets.

There's very little doubt the current 230,000-ounce resource at QV is just the beginning, as last year's exploration program successfully extended the known mineralization, while three other high-priority mineralized zones on the wider land package also have the potential to add several hundred thousand near-surface ounces to the mix. RAB drilling is ineligible for resource calculations, and that's why Comstock is also planning to complete up to 2,000 meters in diamond drilling this year, which would indeed qualify to expand the resource base.

What's next for Comstock?

Comstock Metals is blessed with two resource-stage projects, although it's still valued as a greenfield exploration company with a market capitalization of just CA$10M (despite a cash position of approximately CA$3M). That cash position will obviously be used to complete the summer exploration programs, which will hopefully result in an increased gold resource on both projects.

While the Preview SW project hosts the largest resource, the market will very likely be more excited by the prospects of the QV project in the Yukon, as the entire region enjoys some "special attention" these days. Thanks to the renewed interest in the Yukon Territory, it will be very interesting to see the "end game" for the QV project. Unless you have in excess of 2 million ounces, it's really difficult to develop a gold project in the Yukon Territory on a standalone basis. Goldcorp will be able to build the Coffee mine, but Kinross' Golden Saddle project probably was (and is) too small to be viable on a standalone basis.

Comstock Metals isn't a one-trick pony, and both assets have a good shot at reaching the critical mass needed to start thinking about developing the projects into mines. The company's first priority will be to build ounces and cash position of approximately CA$3M; Comstock Metals is in a good shape to continue its exploration activities on both projects.

At its current market capitalization of CA$10M is trading at just US$11 per ounce of gold in the ground, and that's indeed quite cheap considering the exploration potential on both projects.

It's now up to David Terry and his team to advance both QV and Preview SW, and we expect to see a steady flow of assay results being released to the market from August on.

Thibaut Lepouttre is the editor of the Caesars Report, a newsletter and mining portal based in Belgium that covers several junior mining companies with a special focus on precious metals and base metals. Lepouttre has a Bachelor of Law degree and two economics masters degrees that have forged his analytical approach to the mining sector. Considered a number cruncher, Lepouttre focuses on the valuations of companies and is consistently on the lookout for the next undervalued mining company.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Thibaut Lepouttre: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: a long position in Comstock Metals. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: Comstock Metals. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: None. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Comstock Metals, a company mentioned in this article.

( Companies Mentioned: CSL:TSX.V, )

from The Gold Report - Streetwise Exclusive Articles Full Text http://ift.tt/2eP7WVK

0 notes

Text

Coronavirus: Primary class and teacher self-isolate in Glasgow

Picture copyright

Google

Picture caption

Contact tracers are identifying contacts at the college in Pollokshields

A total class of essential pupils and their trainer had been asked to self-isolate after a case of coronavirus.

Contact tracers are working to name finish contacts at St Albert’s Important College in Pollokshields on the south facet of Glasgow.

A council spokeswoman acknowledged “regulate measures are in quandary at the college, and there would possibly per chance be at the moment no evidence of transmission throughout the college itself”.

The amount of pupils and personnel asked to self-isolate has not been confirmed.

All families with pupils at the college received a letter from NHS Better Glasgow and Clyde on Wednesday.

It acknowledged pupils and personnel would perchance well proceed to serve the college unless identified by contact tracers as a finish contact requiring self-isolation for 14-days.

The council confirmed that preparations had been made so as that any pupils required to self-isolate can proceed engaged on-line.

Picture caption

A pupil has tested sure at Oakbank Important in Perth

It comes as an further make stronger desires school in Dundee used to be closed for deep cleansing after six adults with connections with the college tested sure.

NHS Tayside and Dundee Metropolis Council acknowledged the resolution to finish Kingspark College used to be taken because of of the complicated desires of the pupils.

In other locations a fourth pupil at a school in Coatbridge tested sure for coronavirus.

The student from St Ambrose Excessive had already been identified as a contact and is phase of a cluster in North Lanarkshire and North East Glasgow.

In Perth and Kinross, two essential pupils – one at Newhill Important in Blairgowrie and one other at Oakbank Important in Perth – had been confirmed as having the virus.

In Renfrewshire a pupil at Todholm Important in Paisley has tested sure and safe in contact with tracing is taking quandary at Wallace Important in Elderslie after a sure test.

A member of personnel at Kinmylies Important College in Inverness has additionally tested sure for the virus, as has a pupil at Dalneigh Important College in the city.

from WordPress https://ift.tt/3iWL9Di

via IFTTT

0 notes