#accounts and records under gst

Text

10 GST Compliance Solutions Every Indian Business Needs

Navigating the complexities of Goods and Services Tax (GST) compliance can be a daunting task for many Indian businesses. Since its implementation in 2017, GST has revolutionized the Indian tax system, aiming to simplify tax administration and eliminate tax flows. However, ensuring GST compliance is a big challenge for companies across the country. In this article, we take an in-depth look at 10 GST compliance solutions that every Indian business should adopt for smooth operation and compliance.

i]. Strong accounting software

For businesses to successfully manage their GST compliance, investing in robust accounting software is key. Modern accounting software has features specifically designed to meet GST requirements, such as automatic tax calculation, GST billing and return filing

ii]. Regular GST training for employees

Ensuring that your employees are fully informed about GST laws is crucial for compliance. Providing regular GST training to your employees will give them the ability to navigate their GST-related tasks more effectively, reducing the risk of errors and non-compliance.

iii]. Fair distribution of goods and services

Proper classification of goods and services according to GST value is important to avoid penalties and lawsuits. Companies can invest time and resources to properly categorize their supply chain to determine the appropriate GST rate for them.

iv]. Timely filing of GST returns

It is not conceivable for companies to file a GST return within the stipulated time frame. Filing late can result in costly fees and compliance issues. Implementing a system to ensure timely filing of GST returns will help businesses avoid such consequences.

v]. Regular GST audit

Regular GST audits help businesses quickly identify any discrepancies or non-compliance issues. By proactively using such information, companies can avoid penalties and maintain clean compliance records.

vi]. Compliance with e-invoicing requirements

With the implementation of e-invoicing under GST rules, businesses need to ensure compliance with electronic invoicing standards. Install e-invoicing solutions that seamlessly integrate with accounting software to streamline invoicing processes and ensure compliance.

vii]. Contacting GST consultants

Seeking professional guidance from GST consultants can provide businesses with valuable insight and assistance in navigating complex GST regulations. Consultants can provide customized solutions to address specific compliance challenges faced by businesses.

viii]. Connection with GSTN Portal

Connecting your accounting software to the GSTN portal facilitates easy data transfer and simplifies the process of filing a GST return. This integration ensures consistency and reduces the manual effort required for compliance tasks.

xi]. Compliance with Input Tax Credit (ITC) rules

It is important for companies to understand and comply with Investment Tax Credit (ITC) rules to improve their tax compensation. By applying for and implementing ITC effectively, companies can reduce their tax burden by ensuring compliance with GST rules.

x]. Adoption of GST compliance automation tools

The implementation of GST compliance automation tools can significantly simplify the compliance process and reduce the burden on businesses. These tools automate various GST-related tasks, such as return filing, reconciliation and compliance monitoring, saving time and resources.

Conclusion

Ensuring GST compliance is essential for any Indian business to operate legally and successfully. By implementing the 10 GST compliance solutions outlined in this article, businesses can reduce compliance risk, avoid penalties and optimize their tax system Technical recognition, currency investing in training and employee orientation is an important step towards achieving smooth GST compliance. Stay nimble, stay compliant and thrive in the dynamic Indian tax environment.

0 notes

Text

Navigating Tax return: A Comprehensive Guide

Tax season can be a daunting time for many individuals and businesses alike. With laws and regulations constantly evolving, it's essential to stay informed and prepared when it comes to filing your tax return. For residents and businesses on the Gold Coast, understanding the specific nuances of tax requirements in this region is crucial for compliance and maximizing returns. In this comprehensive guide, we'll explore everything you need to know about navigating tax return.

Understanding Gold Coast Tax Regulations:

Before diving into the specifics of filing your tax return, it's essential to understand the unique tax regulations that apply to the Gold Coast. Like the rest of Australia, the Gold Coast operates under the Australian Taxation Office (ATO). However, certain factors, such as regional tax incentives and deductions, may vary.

For individuals, common tax considerations include income tax, capital gains tax (CGT), and goods and services tax (GST). Additionally, residents of the Gold Coast may be eligible for specific deductions related to expenses incurred in the region, such as travel expenses for work-related activities.

For businesses operating on the Gold Coast, tax obligations extend beyond income tax to include payroll tax, fringe benefits tax (FBT), and various industry-specific taxes. Understanding these obligations and leveraging available incentives can significantly impact your bottom line.

Preparing Your Tax Return:

Preparation is key when it comes to filing your tax return Gold Coast. Whether you're an individual or a business entity, gathering relevant documentation and staying organized throughout the year can streamline the process and minimize potential errors.

For individuals, key documents include PAYG summaries, bank statements, receipts for deductible expenses, and any investment-related documents. Keeping digital copies of these documents can make it easier to access and reference them when needed.

For businesses, maintaining accurate financial records is essential. This includes income statements, expense reports, payroll records, and details of any assets or investments. Utilizing accounting software or hiring a professional accountant can help ensure compliance and accuracy.

Maximizing Deductions and Tax Credits:

One of the primary goals when filing a tax return is to maximize deductions and tax credits to minimize your tax liability. On the Gold Coast, there may be specific deductions and incentives available to individuals and businesses.

For individuals, common deductions include work-related expenses, charitable donations, and investment-related expenses. Additionally, residents of the Gold Coast may be eligible for deductions related to property ownership, such as mortgage interest and maintenance costs.

For businesses, deductions can vary depending on the industry and nature of operations. Common deductions include wages, rent, utilities, and depreciation of assets. Additionally, businesses may be eligible for tax credits for research and development activities or employing apprentices.

Seeking Professional Advice:

Navigating the complexities of tax return can be challenging, especially for individuals and businesses with unique circumstances. Seeking professional advice from a qualified accountant or tax advisor can provide invaluable assistance.

An experienced advisor can help you identify potential deductions, ensure compliance with regulations, and optimize your tax strategy to achieve the best possible outcome. Additionally, they can provide guidance on long-term tax planning and help you stay abreast of any changes in tax laws that may affect you.

Filing your tax return doesn't have to be a daunting task. By understanding the specific regulations, preparing diligently, and leveraging available deductions and incentives, you can navigate the process with confidence. Whether you're an individual or a business entity, seeking professional advice can help ensure compliance and maximize your returns. With careful planning and attention to detail, you can navigate tax season on the Gold Coast smoothly and efficiently.

0 notes

Text

Navigating Tax return: A Comprehensive Guide

Tax season can be a daunting time for many individuals and businesses alike. With laws and regulations constantly evolving, it's essential to stay informed and prepared when it comes to filing your tax return. For residents and businesses on the Gold Coast, understanding the specific nuances of tax requirements in this region is crucial for compliance and maximizing returns. In this comprehensive guide, we'll explore everything you need to know about navigating tax return.

Understanding Gold Coast Tax Regulations:

Before diving into the specifics of filing your tax return, it's essential to understand the unique tax regulations that apply to the Gold Coast. Like the rest of Australia, the Gold Coast operates under the Australian Taxation Office (ATO). However, certain factors, such as regional tax incentives and deductions, may vary.

For individuals, common tax considerations include income tax, capital gains tax (CGT), and goods and services tax (GST). Additionally, residents of the Gold Coast may be eligible for specific deductions related to expenses incurred in the region, such as travel expenses for work-related activities.

For businesses operating on the Gold Coast, tax obligations extend beyond income tax to include payroll tax, fringe benefits tax (FBT), and various industry-specific taxes. Understanding these obligations and leveraging available incentives can significantly impact your bottom line.

Preparing Your Tax Return:

Preparation is key when it comes to filing your tax return Gold Coast. Whether you're an individual or a business entity, gathering relevant documentation and staying organized throughout the year can streamline the process and minimize potential errors.

For individuals, key documents include PAYG summaries, bank statements, receipts for deductible expenses, and any investment-related documents. Keeping digital copies of these documents can make it easier to access and reference them when needed.

For businesses, maintaining accurate financial records is essential. This includes income statements, expense reports, payroll records, and details of any assets or investments. Utilizing accounting software or hiring a professional accountant can help ensure compliance and accuracy.

Maximizing Deductions and Tax Credits:

One of the primary goals when filing a tax return is to maximize deductions and tax credits to minimize your tax liability. On the Gold Coast, there may be specific deductions and incentives available to individuals and businesses.

For individuals, common deductions include work-related expenses, charitable donations, and investment-related expenses. Additionally, residents of the Gold Coast may be eligible for deductions related to property ownership, such as mortgage interest and maintenance costs.

For businesses, deductions can vary depending on the industry and nature of operations. Common deductions include wages, rent, utilities, and depreciation of assets. Additionally, businesses may be eligible for tax credits for research and development activities or employing apprentices.

Seeking Professional Advice:

Navigating the complexities of tax return can be challenging, especially for individuals and businesses with unique circumstances. Seeking professional advice from a qualified accountant or tax advisor can provide invaluable assistance.

An experienced advisor can help you identify potential deductions, ensure compliance with regulations, and optimize your tax strategy to achieve the best possible outcome. Additionally, they can provide guidance on long-term tax planning and help you stay abreast of any changes in tax laws that may affect you.

Filing your tax return doesn't have to be a daunting task. By understanding the specific regulations, preparing diligently, and leveraging available deductions and incentives, you can navigate the process with confidence. Whether you're an individual or a business entity, seeking professional advice can help ensure compliance and maximize your returns. With careful planning and attention to detail, you can navigate tax season on the Gold Coast smoothly and efficiently.

0 notes

Text

GST Registration For VAT & Service Tax Holders

If you were previously registered under VAT (Value Added Tax) or Service Tax and need to transition to GST (Goods and Services Tax) registration, the process typically involves the following steps:

Check Eligibility:

Determine if your business meets the threshold for GST registration. As of my last update, the threshold for GST registration varies based on location and type of business.

Obtain Documents:

Gather necessary documents such as PAN (Permanent Account Number) card, proof of business registration, identity and address proof of promoters/partners/directors, bank account details, etc.

Online Registration:

Visit the GST online portal and fill out the registration form. Provide accurate details about your business, such as the nature of business activities, turnover, etc.

Verification:

After submission, the details will be verified by the GST department. They may seek additional information or documents if required.

Issuance of GSTIN:

Upon successful verification, you'll be issued a GST Identification Number (GSTIN). This is a unique 15-digit identification number that is used for all GST-related transactions.

Transition Period:

Depending on the regulations in your jurisdiction, there may be a transition period during which you'll need to comply with both the old tax system (VAT/Service Tax) and GST.

Compliance:

Ensure compliance with GST regulations, including filing of GST returns, payment of taxes, and maintenance of proper records.

Cancellation of Old Registrations:

Once you are successfully registered under GST, you may need to cancel your old VAT and Service Tax registrations. This step ensures that you're not liable to pay taxes under the previous regime.

It's important to note that the process might vary slightly based on your location and specific circumstances.

Therefore, it's advisable to consult with a tax professional or visit the official GST portal of your country for the most accurate and up-to-date information. For all your business solutions efiletax.

0 notes

Text

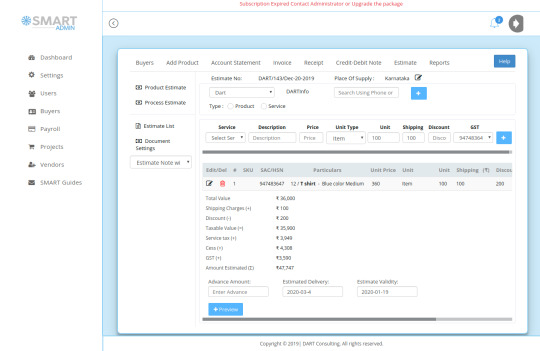

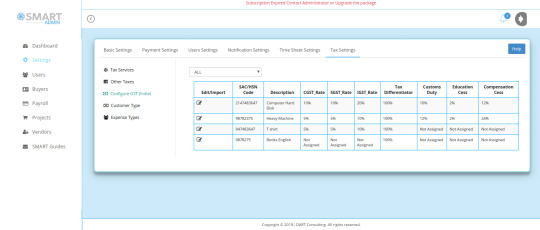

Best GST Invoice Software

The invoicing option of Smart Admin links estimate/quote, invoice, receipt, and Credit/Debit to ensure accurate flow of data points in the overall invoicing process. This will ensure zero error in all statutory filings connected with invoicing. The invoice management software captures data points associated with each of the documents and numbers it properly. The Import and Export transactions as well as SEZ transactions of both products and services are listed in the process.

Need for using GST Invoice Software

GST Invoice Software has been designed to meet the challenges as posed by GST implementation and its frequent updates. The implementation of GST has brought multitude of challenges to small and medium business owners. The larger businesses were fully equipped to meet challenges because of their affordability to invest in costly software whereas for small businesses, it turned out to be a nightmare. The organized sector with its regular stream of tax payment process was least affected by GST and the need for GST invoice generator. The small and medium segments were bogged down by the burden of generating GST Compliant Invoice and fear of reporting wrong data. In addition, there were compelled to route transactions through banking channels to meet the requirement of large suppliers. This posed additional challenges of keeping record of each and every transaction and its proper reporting.

Smart Admin stepped into this need and developed invoice management software to match up with the requirements of GST filing and minimize errors in transactions. The billing software has been designed taking into account of the level of expertise of common man. The Smart Admin Invoice Software can be operated by anyone who can handle Gmail and WhatsApp.

Further, Smart Admin has been configured to handle the future requirements of e-invoicing as if it is going to be implemented by GST Council for B2B transaction at any time in future. With such implementation, the e-invoice generated needs to be validated at Invoice Registration Portal (IRP). This will generate a unique Invoice Reference Number (IRN) and digitally sign the e-invoice and also generate a QR code. The QR Code will contain vital parameters of the e-invoice and return the same to the taxpayer who generated the document in first place. The IRP will also send the signed e-invoice to the recipient of the document on the email provided in the e-invoice. Smart Admin GST invoice software has the option to update the invoice with IRN as generated and send the same to buyers once the feature has been implemented at any time .

The options as given for GST Invoicing Software India are expected to speed up the filing process and minimize errors. With Smart Admin, users can go for multiple GST invoice formats, receipt and cr/dr vouchers according to requirements for generating Tax Invoices under GST.

The invoice management software is linked with all other transactions to avoid duplication of efforts and missing of entries. Once you subscribe for the mobile app, then invoice can be generated on the go. Invoice will be sent to the recipients over email or SMS instantly. If you are looking for best GST Invoice Software, then we can confirm that Smart Admin is one of the best invoicing software India, a solution for you.

0 notes

Text

Why GSTR-9 Filing is Essential ?

1. Legal Compliance:

GSTR-9 filing is a legal requirement for businesses registered under the GST regime. It ensures that your business is compliant with GST regulations and avoids any penalties or fines for non-compliance.

2. Transparency and Accountability:

Filing GSTR-9 provides transparency and accountability in your business transactions. It helps in maintaining accurate records of your sales, purchases, and input tax credits, enabling better financial management and decision-making.

3. Avoidance of Penalties:

Timely and accurate GSTR-9 filing helps in avoiding penalties imposed by the tax authorities for non-filing or incorrect filing. It ensures that your business remains in good standing and avoids any unnecessary financial burdens.

refer to our blog !

#gstfiling#gstreturns#businesstaxes#gststructure#businesscompliance#businesssupport#taxcompliance#financialhealth#financialmanagement#taxregulations

0 notes

Text

A Comprehensive Guide on How to Register a Company in India

In the vibrant landscape of India's business ecosystem, registering a company marks the first significant step towards turning entrepreneurial dreams into reality. Whether you're a seasoned entrepreneur or a budding visionary, understanding the process of company registration in India is crucial. In this guide, we'll walk you through the essential steps to register a company in India.

Understanding the Basics

Before diving into the registration process, it's vital to grasp the different types of companies recognized under Indian law:

Private Limited Company: Ideal for small to medium-sized businesses, offering limited liability to its shareholders and restricting share transfers.

Public Limited Company: Suited for larger enterprises, with shares publicly traded on the stock exchange and more stringent regulatory requirements.

Limited Liability Partnership (LLP): Combines the benefits of a partnership with limited liability, popular among professionals and small businesses.

Step-by-Step Registration Process

Choose a Suitable Business Structure:

Selecting the right business structure is the cornerstone of company registration. Consider factors such as liability, taxation, ownership, and compliance requirements before making a decision.

Obtain Digital Signature Certificate (DSC) and Director Identification Number (DIN):

Directors of the proposed company must obtain a DSC, necessary for digitally signing documents, and a DIN, which serves as an identification number.

Name Approval:

Choose a unique name for your company and ensure it complies with the naming guidelines prescribed by the Ministry of Corporate Affairs (MCA). Conduct a name availability search on the MCA portal and apply for name approval.

Drafting Memorandum and Articles of Association:

Prepare the Memorandum of Association (MoA) and Articles of Association (AoA), outlining the company's objectives, rules, and regulations. These documents define the company's structure and operations.

Filing Incorporation Documents:

Complete the incorporation process by filing the necessary documents, including MoA, AoA, and Form SPICe (Simplified Proforma for Incorporating Company electronically) with the Registrar of Companies (RoC).

Payment of Registration Fees:

Pay the requisite registration fees based on the authorized capital of the company. The fee structure varies depending on the type and size of the company.

Certificate of Incorporation:

Upon verification of documents and compliance with regulatory requirements, the RoC issues a Certificate of Incorporation, officially recognizing the establishment of the company.

Apply for PAN and TAN:

Obtain a Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN) from the Income Tax Department. These are essential for tax compliance and financial transactions.

Registration for Goods and Services Tax (GST):

If your company's turnover exceeds the prescribed threshold, register for GST, a unified tax system applicable to the supply of goods and services.

Compliance Requirements:

Fulfill ongoing compliance obligations, including maintaining statutory records, holding annual general meetings, and filing annual returns with the RoC.

Conclusion

Registering a company in India is a well-defined process that requires careful planning, adherence to regulatory guidelines, and compliance with legal formalities. By following the step-by-step procedure outlined in this guide, entrepreneurs can navigate the complexities of company registration with confidence and set the stage for a successful business venture. Whether it's a private limited company, public limited company, or LLP, the key lies in understanding the nuances of each structure and making informed decisions. So, embark on your entrepreneurial journey armed with the knowledge of how to register a company in India, and let your business aspirations soar to new heights.

Remember, the keyword "how to register a company in India" signifies the importance of understanding the process thoroughly, ensuring that your business starts off on the right foot within the regulatory framework of the country.

0 notes

Text

Get Ahead on the CA Final IDT Exam with These Insider Tips and Strategies!

Introduction to CA Final IDT

The Chartered Accountancy (CA) journey in India reaches its pinnacle with the CA Final, the last and most challenging phase. The CA Final Indirect Tax (IDT) exam stands out as a significant hurdle in this prestigious qualification process. Taking place twice a year in May and November, this examination demands meticulous preparation and strategic planning for success.

Syllabus Overview

The CA Final IDT paper, classified into three key sections, plays a pivotal role in shaping a candidate’s success:

Central Excise

Rules, Circulars, and Notifications related to the Central Excise Act of 1944 and the Central Excise Tariff Act of 1985.

Service Tax

In-depth exploration of the Service Tax framework.

GST (Goods and Services Tax)

Detailed coverage of GST, encompassing the levy and collection of CGST and IGST, concept of supply, place of supply, time and value of supply, input tax credit, and more.

Study Material for CA Final IDT

Effective preparation for the CA Final IDT exam begins with the right study material. The Institute of Chartered Accountants of India (ICAI) provides comprehensive study material, covering all essential chapters and units. This official material can be complemented with additional course books and online resources for a holistic understanding.

CA Final IDT Study Material:

Module-wise breakdown including chapters like Supply Under GST, Charge Of GST, Place of Supply, Exemptions from GST, Time of Supply, and more.

Vsmart Academy offers valuable notes and techniques for effective preparation.

Previous Year Exam Papers

Practicing with previous year exam papers is a strategic approach to excel in the CA Final IDT exam. This practice provides insights into the exam pattern, question formats, and the level of difficulty. Here are essential resources for candidates:

CA Final IDT Question Papers with Suggested Answers 2024:

Access to previous year’s question papers for May 2022, December 2021, July 2021, and January 2021.

CA Final IDT Paper Mock Test Papers 2024:

Utilize revised mock test papers for Series I and Series II to gauge your preparation level and enhance performance.

CA Final IDT Paper 2024 Weightage - Chapter Wise for New Course

Sections

Part I – GST (75 Marks)

Weightage

Section IChapter 1: Levy and collection of CGST and IGST – Application of CGST/IGST law; Concept of supply including composite and mixed supplies, inter-state supply, intra-state supply, supplies in territorial waters; Charge of tax (including reverse charge); Exemption from tax; Composition levy45%-65%Section IIChapter 1(vii): Procedures under GST including registration, tax invoice, credit and debit notes, electronic waybill, accounts and records, returns, payment of tax including tax deduction at source and tax collection at source, refund, job work Chapter 1(viii): Liability to pay in certain cases<10%-30%Section IIIChapter 1(xi): Demand and Recovery Chapter 1(xii): Offences and Penalties Chapter 1(xiii): Advance Ruling Chapter 1(xiv): Appeals and Revision10%-25%Section IVChapter 1: Introduction to GST in India including Constitutional Aspects Chapter 1(ix): Administration of GST; Assessment and Audit Chapter 1(x): Inspection, Search, Seizure, and Arrest Chapter 1(xv): Other Provisions5% -10%

Sections

Part II – Customs and FTP (25 Marks)

Weightage

Section IChapter 1(ii): Levy of and exemptions from customs duties – All provisions including the application of customs law, taxable the event, a charge of customs duty, exceptions to levy of customs duty, exemption from customs duty Chapter 1(iii): Types of customs duties Chapter 1(iv): Classification of imported and export goods Chapter 1(iv): Valuation of imported and export goods40% -65%Section IIChapter 1(vi): Import and Export Procedures including special procedures relating to baggage, goods imported or exported by post, stores Chapter 1(ix): Drawback Chapter 1(x): Refund Foreign Trade Policy Chapter 2(ii): Basic concepts relating to export promotion schemes provided under FTP20% – 45%Section IIIChapter 1(1): Introduction to customs law including Constitutional aspects Foreign Trade Policy Chapter 2(1): Introduction to FTP – legislation governing FTP, salient features of an FTP, administration of FTP, contents of FTP and other related provisions Chapter 2(i): Basic concepts relating to import and export10% – 20%

Preparation Tips for CA Final IDT

Paper Pattern:

Understand the subjective nature of the paper.

Total questions: 100

Exam duration: 3 hours

Maximum marks: 100

Answering 5 out of 6 questions.

Must Read – https://www.vsmartacademy.com/blog/preparation-strategy-to-score-good-marks-in-ca-final-idt/

Assessment Pattern Ratio:

30:70 ratio for analytical skills, comprehensive knowledge, and reporting efficiency.

Verb Usage:

Follow ICAI’s list of verbs with illustrations, such as recommend, evaluate, advice, produce, prioritize, interpret, discuss, and more.

Weightage Allocation:

Chapter-wise weightage for GST, Customs, and FTP to prioritize preparation effectively.

Revision Techniques:

Regular revisions of important chapters.

Utilize ICAI’s recommended reference for quick revision.

Sample questions for the 30:70 assessment to enhance learning.

Conclusion

In conclusion, success in the CA Final IDT exam requires a strategic and comprehensive approach. By understanding the syllabus, utilizing study materials effectively, practicing with previous year’s papers, and following the recommended preparation tips, candidates can position themselves for success in this challenging examination.

0 notes

Text

What is "GST Registration"?

"GST registration" refers to the process of registering a business entity under the Goods and Services Tax (GST) system implemented by the government. GST is a comprehensive indirect tax levied on the supply of goods and services at each stage of the supply chain, from manufacturer to consumer. GST registration is mandatory for businesses that meet certain criteria regarding their annual turnover or nature of operations.

The key aspects of GST registration:-

Mandatory Requirement: Businesses whose aggregate turnover exceeds the threshold limit specified by the authorities must register for GST. The threshold limit may vary by country.

Voluntary Registration: Even if a business's turnover does not exceed the mandatory threshold, it can choose to register voluntarily for GST. This may provide certain benefits, such as claiming input tax credits and enhancing credibility in the market.

Multiple Registrations: A business may need to obtain multiple GST registrations if it operates in multiple states or engages in different types of business activities subject to GST.

Application Process: The process of GST registration typically involves submitting an online application on the designated portal provided by the tax authorities. The application requires details about the business, its promoters, directors, partners, address proof, bank account details, and other relevant information.

Issuance of GSTIN: Upon successful registration, the business is issued a unique Goods and Services Tax Identification Number (GSTIN). This number serves as the identification for the registered entity under the GST regime.

Compliance Requirements: Registered businesses are required to comply with various GST provisions, including filing periodic GST returns, maintaining proper records of transactions, collecting GST from customers, and remitting the tax to the government within the stipulated timelines.

Input Tax Credit: One of the significant benefits of GST registration is the ability to claim input tax credit on GST paid on purchases of goods and services used in the course of business. This helps prevent cascading tax effects and reduces the overall tax burden on businesses.

If you want to know more about us then, you can also read these pages:- Internal Audit Applicability, CSR Registration, and Trademark Registration.

#GST, #GoodsAndServicesTax, #Taxation, #IndirectTax, #GSTIndia, #TaxReform, #GSTRegistration, #InputTaxCredit, #GSTCompliance, #GSTReturns, #GSTCouncil

0 notes

Text

Why Personal Tax Services Calgary Are Important?

Getting personal tax services in Calgary and nearby areas is crucial to get complete peace of mind. No matter, whether you are earning or you don’t have any income, you should file a return to get some key benefits. Some of the tax benefits of Government apply to Canadians regardless of their employment status. No matter, whether you haven’t earned an income or you’re between jobs, you should file a return to get some benefits that include:

You may be eligible for the Canada Child Benefit or CCB tax-free monthly payment to payments and guardians raising children under 18 years of age.

You can claim provincial credits like the Alberta Family Employment Tax Credit that pays a tax-free amount to families with children and has no minimum working requirement.

You can also qualify for the GST/HST tax credit - offsets some or all of the tax you pay.

You will be missing out on the tax benefits that you can legally claim, even if you would rather not file your taxes. The monthly and one-time payments will make a difference and help you sustain a dignified lifestyle as you search for a new job.

Some Other Benefits You Will Get

Filing zero income tax returns isn’t a useless exercise. It will be beneficial in a number of ways. The most crucial thing is to look for personal tax services in Calgary and nearby areas.

Professional chartered accountants or tax experts help you at every step by providing you with the personal tax services in Calgary. They do your tax planning - offering you a gamut of benefits.

They use tax credits and tax deductions - applying absolute and deferred tax saving strategies

You will get a review of previous 5 years’ tax filings and implement tax deferral and tax split in the current format

They help you reduce taxable income through approved income adjustment like investment loan, child care costs and a lot more.

They also optimize tax goals by reducing income subject to tax, increasing tax deductions and maximizing tax credits. There is a lot more provided to you. Here, what all you have to do is search for the top accounting firm or stay in touch with professional chartered accountants in Calgary. Go online and it will surely provide you with the right solutions and complete peace of mind. Among some of the top names in this domain, you will find name of Sara Accounting on top - offering you the right solutions. Check all details and get the right solutions.

Summary: The personal tax services Calgary are provided by professional chartered accountants who have proven track record and years of experience. You will get amazing benefits of personal tax services.

0 notes

Text

GST Made Easy: Step-by-Step e-Filing Strategies for Businesses

Introduction

Navigating the intricacies of Goods and Services Tax (GST) often poses a significant challenge for businesses. However, armed with the right strategies and a comprehensive step-by-step tax filing guide, the GST process can become more manageable. In this blog, we will explore effective e-filing strategies tailored for businesses, ensuring a seamless and stress-free experience. Additionally, we'll delve into essential Taxation strategies for businesses can adopt to optimize their overall tax filing process.

Understanding GST

Goods and Services Tax, commonly referred to as GST, stands as a comprehensive indirect tax levied on the supply of goods and services. Compliance with GST regulations is pivotal for businesses to evade penalties and maintain a smooth flow of operations. Let's dissect the process with a detailed step-by-step guide to e-filing.

Step 1: Registration and Documentation:

The initial stride in the GST e-filing process involves ensuring that your business is duly registered under GST. Gather all necessary documents, including business registration details, PAN card, and proof of address. A robust registration process lays the groundwork for a seamless e-filing experience.

Step 2: Determine Your GST Liability:

Pinpoint the applicable GST rates for your goods and services. Accurate classification is paramount for calculating your GST liability correctly. This step guarantees compliance with GST rules and mitigates errors in your e-filing.

Step 3: Maintain Accurate Records:

Maintain meticulous records of all business transactions. Utilize accounting software to streamline the process and uphold transparent records of financial activities. This approach facilitates easy reconciliation and aids in generating precise GST returns.

Step 4: Timely Invoicing:

Issue invoices promptly, ensuring compliance with GST regulations. Include all necessary details such as GSTIN, HSN codes, and tax rates. Timely and accurate invoicing is pivotal in averting discrepancies in your e-filing.

Step 5: File Your Returns Regularly:

Regular filing of GST returns is imperative for staying compliant. Utilize the GST portal or reliable GST software to file returns accurately and on time. This step is critical to preventing late fees and maintaining an untarnished tax record.

Taxation Strategies for Businesses:

In addition to mastering the GST e-filing process, businesses can embrace effective taxation strategies to optimize their financial position. Let's explore some key strategies:

Tax Planning: Implement a robust tax planning strategy to legally minimize your tax liability. Explore available deductions, exemptions, and credits to optimize your overall tax position.

Expense Tracking: Maintain a detailed record of business expenses. Proper expense tracking enables you to claim legitimate deductions, ultimately reducing your taxable income.

Invest in Tax-Advantaged Assets: Consider investments in tax-advantaged assets to optimize your tax position. Explore options such as tax-saving mutual funds and other instruments offering tax benefits.

Utilize Tax Credits: Identify and leverage available tax credits, which may include research and development credits, energy credits, or other incentives provided by the government.

Conclusion:

Mastering GST e-filing is an integral facet of financial management for businesses. By adopting a strategic step-by-step tax filing guide and implementing effective taxation strategies, businesses can not only stay compliant but also optimize their overall tax position. Stay informed, maintain accurate records, and leverage technology to simplify the process. With these strategies in place, businesses can confidently and efficiently navigate the complex world of taxation.

0 notes

Text

Crypto Profits and Taxes: What Indian Investor Needs to Know | ICODesk

Decoding Crypto Profits: A Comprehensive Guide to Taxes for Indian Investors

The world of cryptocurrency investing offers exciting opportunities but comes with the responsibility of understanding and managing taxes. As an Indian investor, it is important to know the tax implications associated with crypto profits. In this guide, we explore what Indian investors need to know about the taxation of cryptocurrency gains and how to navigate this aspect in the rapidly evolving digital asset landscape.

Understanding Crypto Profits:

Cryptocurrency profits are derived from a variety of uses, including trading, mining, and investing in initial coin offerings (ICOs). Tracking and documenting all transactions is essential to accurately calculate profitability.

Taxation of Cryptocurrency Gains in India:

The Indian government treats cryptocurrency as a taxable currency. Gains from crypto transactions fall under the category of capital gains. Short-term gain (STCG) applies if the holding period is less than 36 months, while long-term gain (LTCG) applies to deposits exceeding 36 months.

Classification of capital gains:

Short-term capital gains (STCG): taxable at the investor’s applicable income tax bracket.

Long-term gain (LTCG): 20% tax, plus indexation gain.

Tax implications for cryptocurrency traders:

Traders engaged in buying and selling conventional cryptocurrencies are considered to be engaged in trading activities. Profits from such businesses are treated as business income and are subject to ordinary income tax as a merchant.

Crypto Transaction Report:

Indian investors should proactively declare their cryptocurrency transactions during income tax filing. Platforms such as cryptocurrency exchanges and wallets can provide transaction history, which should be used for accurate reporting.

Goods and Services Tax (GST):

Currently, cryptocurrencies are not subject to GST in India. However, transactions involving crypto transactions, such as currency exchange, may attract GST.

Seeking Professional Advice:

Given the complexity of cryptocurrency taxes, seeking advice from a tax professional or chartered accountant who specializes in dealing with digital assets can help ensure compliance with Indian tax laws.

Educate yourself on legislative changes:

The legal process for cryptocurrencies is dynamic. Indian investors must be informed of any changes in legislation that may affect the taxation of crypto assets.

Record Keeping and Documentation:

Keep detailed records of all cryptocurrency transactions, including buying and selling dates, amounts, and prices. Maintaining proper records is critical for appropriate tax reporting.

Future Development and Compliance:

Check back regularly for updates on cryptocurrency regulations in India. Complying with tax laws and adapting exchanges ensures a smooth and legal crypto investment journey.

For more updates:

Visit: https://icodesk.io/

#capital gains tax#crypto profits#cryptocurrency taxes#indian investors#tax implications#cryptocurrency#cryptocurrency prices#blockchain#crypto price#bitcoin#crypto news#crypto#icodesk#icodesknews#icodeskupdate

0 notes

Text

Streamlining Invoicing Processes: How GST E-Invoicing Enhances Transparency

In the era of digital transformation, the adoption of e-invoicing under the Goods and Services Tax (GST) regime in India has emerged as a transformative initiative aimed at streamlining invoicing processes, enhancing transparency, and curbing tax evasion. E-invoicing, which involves the electronic generation, transmission, and authentication of invoices in a standardized digital format, offers a myriad of benefits for businesses and tax authorities alike, revolutionizing the way invoices are generated, managed, and reported.

Let's explore how GST e-invoicing enhances transparency and accountability in tax administration:

1. Real-Time Reporting:

E-invoicing enables real-time reporting of invoices to the GSTN platform, providing tax authorities with instant access to transaction data, invoice details, and compliance status. The seamless integration between the e-invoicing system and GSTN ensures timely submission of invoice data, facilitating prompt verification, validation, and reconciliation of invoices by tax authorities.

2. Auditable Trail:

E-invoicing creates a digital trail of transactions that can be easily audited, monitored, and analyzed by tax authorities for compliance verification and enforcement purposes. The digital trail includes a timestamped record of invoice generation, transmission, receipt, and authentication, providing irrefutable evidence of transactional activity and compliance with GST regulations.

3. Authentication Mechanisms:

The GST e-invoice system incorporates robust authentication mechanisms, such as digital signatures and QR codes, to enhance the authenticity and traceability of e-invoices. Digital signatures provide cryptographic assurance of the origin, integrity, and non-repudiation of e-invoices, while QR codes contain vital information for easy verification and validation by stakeholders.

4. Automated Validation:

E-invoicing enables automated validation and verification of invoices against predefined rules, formats, and data fields prescribed by the GST authorities. Any discrepancies, errors, or non-compliance with e-invoicing standards are promptly detected and flagged for rectification, ensuring accuracy, consistency, and compliance in invoice reporting and submission.

5. Transparency and Accountability:

E-invoicing fosters transparency and accountability in tax administration by providing stakeholders, including businesses, tax authorities, and consumers, with real-time visibility into transaction data, invoice details, and compliance status. The standardized digital format of e-invoices ensures uniformity, consistency, and accuracy in reporting, enhancing trust and confidence in the integrity of electronic transactions.

6. Reduced Tax Evasion:

E-invoicing acts as a powerful deterrent against tax evasion and fraud by creating a digital trail of transactions that can be easily audited, monitored, and analyzed by tax authorities. The real-time reporting of invoices facilitates timely detection of discrepancies, unauthorized transactions, and non-compliance with GST regulations, enabling prompt enforcement action and deterrence of fraudulent practices.

7. Enhanced Data Analytics:

E-invoicing enables tax authorities to leverage advanced data analytics tools and techniques for trend analysis, anomaly detection, and risk profiling of taxpayers. By analyzing transaction data, invoice patterns, and compliance behavior, tax authorities can identify potential tax evasion, fraud, or non-compliance, enabling targeted enforcement measures and revenue recovery efforts.

In summary, the adoption of e-invoicing under GST enhances transparency, accountability, and compliance in tax administration, creating a level playing field for businesses, promoting fair competition, and bolstering trust and confidence in the tax ecosystem. By leveraging the capabilities of e-invoicing, businesses and tax authorities can collaborate effectively to combat tax evasion, foster compliance, and uphold the integrity of the GST regime.

#gst#gst services#business#taxes#gst filing#GST e-invoice#gst registration#business ideas#finance#business growth#entrepreneur

0 notes

Text

Ensuring Compliance: Streamlined GST Registration Verification

GST number registration online verification is a crucial step in confirming the authenticity and accuracy of GST details furnished during the registration process. It serves as a pivotal measure in validating the information provided by taxpayers, ensuring compliance with GST regulations set by the government.

The verification process involves a meticulous examination of the submitted documents, including PAN (Permanent Account Number), Aadhaar card, business address proof, bank account details, and other essential credentials. Authorities cross-verify these details against the information provided in the GST registration application to validate their authenticity.

Once the verification process commences, officials may conduct physical or virtual inspections to validate the operational existence of the business. This may involve visits to the registered business address to verify its existence and assess its operational activities. Additionally, the GST authorities might cross-check the furnished bank account details to ensure accuracy and legitimacy.

The objective behind GST number registration verification is to curb any potential instances of fraud or misrepresentation while ensuring that only eligible and genuine businesses are registered under the GST regime. It acts as a safeguard against malpractices, aiming to maintain the integrity of the taxation system.

It's imperative for businesses to ensure that the information provided during GST registration aligns accurately with the actual business operations and details. Any discrepancies discovered during the verification process might lead to delays, penalties, or even cancellation of the GST registration.

Maintaining meticulous records and ensuring compliance with GST regulations is paramount. Seeking professional guidance and expertise can greatly aid in navigating the complexities of GST registration verification, ensuring adherence to regulatory standards and mitigating the risk of non-compliance.

Conclusion

GST registration verification stands as a critical step in confirming the legitimacy of business entities registering under the GST framework, ensuring the integrity and credibility of the taxation system while fostering a transparent and compliant business environment.

0 notes

Text

Australia company formation

Australia company formation involves several steps. Keep in mind that legal requirements and processes may change, so it's always a good idea to consult with a professional or check the latest information on government websites. As of my last update in January 2022, here is a general guide to forming a company in Australia:

1. Choose a Business Structure:

Sole Trader: You operate the business as an individual.

Partnership: A business structure where two or more people manage and operate a business in accordance with the terms and objectives set out in a Partnership Deed.

Company: A legal entity separate from its shareholders.

2. Registering the Business Name:

You need to register the business name unless you operate under your own name. Check the availability of your desired business name and register it through the Australian Securities and Investments Commission (ASIC) website.

3. Register for an Australian Business Number (ABN):

An ABN is a unique 11-digit identifier that makes it easier for businesses to interact with the government. You can apply for an ABN online through the Australian Business Register (ABR) website.

4. Choose and Register a Domain Name:

If you plan to have an online presence, consider registering a domain name for your business.

5. Register for Goods and Services Tax (GST):

If your business has a GST turnover of $75,000 or more, you must register for GST. You can do this through the ABR website.

6. Create a Constitution (for a Company):

If you choose to structure your business as a company, you need to create a constitution. This document outlines the rules governing the company's internal management.

7. Register as an Employer:

If you plan to hire employees, you must register as an employer with the Australian Taxation Office (ATO).

8. Financial Records:

Set up a system for keeping financial records. This is important for tax and other reporting requirements.

9. Comply with Industry Regulations:

Depending on your industry, there may be specific licenses or permits you need to obtain.

10. Seek Professional Advice:

It's advisable to consult with professionals such as accountants, legal advisors, or business consultants to ensure compliance with all legal requirements.

11. Ongoing Compliance:

Stay informed about ongoing compliance requirements, including annual reports, tax filings, and changes in regulations.

Important Resources:

ASIC (Australian Securities and Investments Commission)

Australian Business Register

Australian Taxation Office (ATO)

Keep in mind that the steps and requirements can vary depending on the type of business and the state or territory in which you are operating. Always refer to the latest information and seek professional advice to ensure compliance with current regulations.

0 notes

Text

Navigating GST Return Filing: A Complete Handbook for Taxpayers

The Goods and Services Tax (GST) regime has transformed India's tax landscape since its inception in 2017. Among its fundamental components, GST return filing emerges as a pivotal process, ensuring compliance and transparency in the taxation system. Understanding the nuances and intricacies of this filing procedure is essential for every taxpayer operating under the GST framework.

Unraveling GST Return Filing

At its core, GST return filing involves the submission of details pertaining to a taxpayer's sales, purchases, tax collected on sales (output tax), and tax paid on purchases (input tax). This comprehensive documentation aids in computing the tax liability of a taxpayer and facilitates adherence to GST regulations.

Diverse Array of GST Returns

The multifaceted nature of GST manifests through various types of returns, each tailored to cater to specific categories of taxpayers and transactions:

GSTR-1: Captures details of outward supplies of goods or services by the taxpayer.

GSTR-3B: A summary return for both outward and inward supplies along with the tax payment.

GSTR-4: Intended for taxpayers operating under the composition scheme.

GSTR-9: An annual return consolidating information from regular returns filed during the financial year.

GSTR-6: Filed by Input Service Distributors (ISDs) to distribute the input tax credit.

The Significance of Timely Filing

Timely and accurate submission of GST returns holds immense importance. Apart from ensuring compliance, it facilitates the seamless flow of input tax credit. Delays or inaccuracies in filing may attract penalties, interest payments, or even suspension of GST registration, potentially disrupting business operations.

Navigating the Process of GST Return Filing

Data Compilation: Collecting and organizing all relevant information related to sales, purchases, input tax credit, etc.

Preparing the Return: Utilizing GST-compatible accounting software or the GSTN portal to input necessary details.

Verification: Scrutinizing the furnished information for accuracy and compliance with GST guidelines.

Filing the Return: Uploading the prepared return on the GSTN portal and formally submitting it.

Overcoming Common Challenges

1. Classification Complexity:

Challenge: Determining the accurate classification of goods/services for precise tax calculation.

Solution: Regular training sessions and leveraging technological aids for classification assistance.

2. Technological Hurdles:

Challenge: Technical glitches or portal downtimes during the filing process.

Solution: Maintaining backup files, using alternative browsers, or selecting less congested time slots to mitigate these issues.

3. Input Tax Credit Reconciliation:

Challenge: Matching claimed input tax credit with that reflected in vendors' returns.

Solution: Regular reconciliation practices and open communication with vendors to address discrepancies.

Efficient Practices for GST Return Filing

Meticulous Record-Keeping: Maintaining accurate and detailed records of all transactions and invoices.

Regular Reconciliation: Consistently comparing input tax credit and sales data for discrepancies.

Adherence to Timelines: Strictly following the prescribed due dates for filing returns.

Continuous Learning and Updates: Staying abreast of GST law amendments and procedural changes.

Concluding Remarks

GST return filing is the cornerstone of GST compliance, ensuring accountability and transparency within the taxation system. Successful navigation of this process demands a comprehensive understanding of regulations, meticulous record-keeping, and adept utilization of technology. By adopting efficient practices and addressing challenges proactively, taxpayers can adeptly maneuver through the complexities of GST return filing, contributing to a robust and thriving economic ecosystem.

0 notes