#WhatisBitcoinhalving?

Text

Bitcoins Future Price: bitcoin future value predictions ?

Will Bitcoins Future Price keep rising again?

Bitcoins Future Price: cryptocurrency and blockchain in the last several months, you could become quite pessimistic about the cryptocurrency future. It seems like, for a certain category of people it has become a trend to criticize blockchain technology.

Luckily, these materials are rarely based on serious facts. But this type of “eye-opening” critical content always gives its author an immediate rise in popularity and some kind of an “expert” status.

Today

I want to dispel all the pessimistic forecasts and give you a realistic view of

the current market situation.

I’d like to mention that I’m not going to quote any of the dozens of pseudo analysts with their crazy declarations about Bitcoins Future Price to be $20000. I do think that predictions on the market future should be based on facts, in accordance with fundamental economic laws, and not on pure emotions or a desperate need for buzz.

At

the instant of writing Bitcoin worth is around $3600 mark. Yes, this is the

bottom. But what comes next? Plain and simple: the bull market. And the reasons

why i believe that Bitcoin can rise once more in 2019.

1) Bitcoins Future Price technical analysis

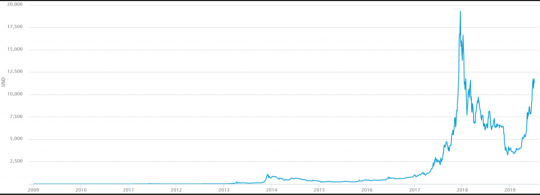

Let’s analyze what was happening with Bitcoin price in the last months.

Bitcoins Future Price Chart analysis

The rise of trading volume and an increase in the number of trading positions in December 2018 indicated that the market had touched its bottom, which was $3200 on December 15. Bitcoin price had reached its lowest point, and the upward movement started again.

Besides, the trading volume has noticeably increased, which has led to an increase in volatility. These factors will likely lead to a significant rise in buyers/investors entering the field. And this, in turn, will lead to an increase in Bitcoins Future Price, as I said in one of my previous articles.

Moreover,

on the daily chart, we can also see the typical False Breakout pattern, which

is a classic sign that the market is going to move upwards.

Surely,

a rational investor shouldn’t make his assumptions based entirely on technical

analysis. It should be used together with fundamental analysis which considers

the overall economic situation, the potential of the technology staying behind

the asset, and many other factors. So let’s move on to the next points.

2) The history examples

A new, breakthrough

technology arises all of a sudden out of nowhere. Unfortunately, in the

beginning, its full potential is obvious only for a small “technical nerd”

community, and initially, it is supported solely by these people.

Then, little by little, it becomes more and more popular. Companies and entrepreneurs start to pay attention to the opportunities the technology gives. More and more people start to invest in it. At some point interest for this technology gets to a critical level.

Mass media start to cover it all day long, and everyone is interested. Any company which is somehow concerned with the technology starts to attract enormous sums of investors’ money. Even having a specific technical term in a company’s name is enough to get a buzz and increase a company’s value.

It goes this way to a

certain point, and after that, it looks like the story is over. The hype is

gone. The bubble has burst. The prices of all the technology related assets

fall to the minimum.

Nothing like? Yes, I’m talking about the dot-com bubble. Its story is suspiciously similar to the situation which is happening with cryptocurrency now. But did the Internet end together with the end of the dot-com companies?

Hell no. Moreover, as we

can see now, the value of many top internet companies which were founded before

the dot-com bubble did fall after the bubble had burst, but afterward, it has

risen again with the vengeance. What’s worth only Amazon!

Amazon was one of the leading companies in times of the dot-com bubble. Its value increased together with other similar companies in late 1990th, and it also significantly fell in price after the dot-com bubble had burst. Luckily, it didn’t ruin the company. The potential behind online retailers stayed very high, and since 2008 we’ve been watching a significant growth of the company’s value.

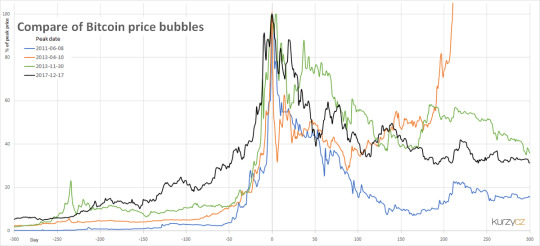

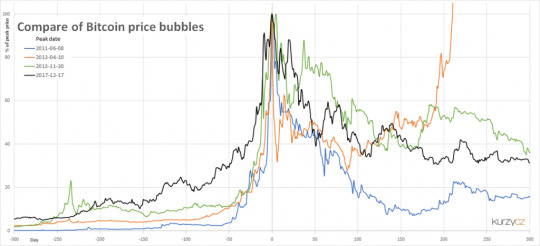

Bitcoin Price history examples

3) Development of the cryptocurrency field

It’s

clear that at the moment the blockchain technology is still far from the point

of its maximum development.

The

cryptocurrency infrastructure has been built over the last several years. Now

we have a number of acting and reliable cryptocurrency

exchanges, cryptocurrency wallets and mining pools. At the same time, the existing

infrastructure does not cease to develop.

A lot of great ideas which has been

proposed before are being implemented now, like crypto loans or Bitcoin

futures. The Bitcoin protocol itself is also being developed in a more perfect

state with different Bitcoin forks and implementation of such protocols

as SegWit.

Needless

to say, cryptocurrency is not the one and only possible application of

blockchain technology. A number of ICO projects, offering different adaptations

of blockchain technology, were under development in the last couple of years

and only now many of them are starting to act.

So the field is still highly prospective. Just look at the current crypto services and companies: exchanges, wallets, coins, ICOs. They continue to develop, investing more and more money in the field.

Look at the banks and governments which are working on the development of blockchain-based law- and banking systems. Do you believe that these people could invest in something unpromising? Consider these guys with pockets full of money as a role model for your cryptocurrency investment career.

Another good thing which happened in the last couple of years is purifying of the market from the scam projects together with the projects which didn’t survive the market competition.

This natural selection is a necessary step for the further development for every new and competitive field, so the cryptocurrency market enters 2019 being much stronger than before. Isn’t it a good sign?

4) Market stabilization and the end of mass hysteria

The huge blockchain and cryptocurrency hype in the second half of 2017 and the first half of 2018 wasn’t actually an entirely positive phenomenon for the cryptocurrency field.

Of course, it has drawn the attention of hundreds of millions of people to the Bitcoin phenomenon and made cryptocurrency a valuable asset as opposed to its previous small experimental role, which is definitely a good thing.

But besides that, it has led in the cryptocurrency field millions of people following the hype and hoping to get rich doing absolutely nothing.

This mass hysteria somehow devalued the cryptocurrency phenomenon, making it a target for serious criticism. Since that many skeptics criticized the blockchain and cryptocurrency technologies, claiming it to be more of a “hype” thing than really a breakthrough technology.

So the fact that the cryptocurrency field is gradually getting rid of the people hoping to get rich doing absolutely nothing and not having even basic economic or investment knowledge is a good thing.

I’d really like to believe that now the cryptocurrency market will be evolving not because of hype, but owing to creating real value. Serious investors, who are necessary for the development of the field, are used to think with their own heads. They don’t follow the crowd but instead make decisions based on real facts and analytics.

5) Large investors are coming

Let’s say Bitcoins Future Price has declined once again and you are selling your assets. For you, it may look like the best and most obvious decision.

Well,

who do you think is on another side of your trades? Why are they accumulating

thousands of BTC and ETH on their accounts? Believe me, it isn’t just because

they are happy to help you to secure your investments. There is always an inner

reason.

An

interesting fact is that when some asset’s price declines, small players

usually sell it in fear to lose even more than they have already lost. On the

contrary, the big players such as banks and hedge funds will often buy these

assets for cheap while everyone else is getting rid of it.

Needless

to say, when the asset’s price rises again, the big players make really big

profits. Being major companies and having strong risk management systems, they

can afford risks concerned with holding big volumes of highly volatile assets.

Even though we haven’t seen much official information about the large investors entering the field, the cryptocurrency market fluctuations of the last couple of years.

The big players have already started to act anonymously, making large trading operations with different cryptocurrencies. These actions heavily influence the cryptocurrency prices, making it go up and down.

what we are able to see on cryptocurrency charts. It’s a typical way of actions for large investors before they enter a new market: they test it first and only after that the official arrival is made and announced.

This strategy is especially applicable to the cryptocurrency field. Unfortunately, cryptocurrency is still concerned with a big number of rumors and misconceptions. Any big investment firm entering the field may face misunderstanding in the financial community.

So it’s still a common practice for big investment companies to act anonymously through the third parties until the cryptocurrency market gets more stable and widely recognized.

Which is the best Bitcoin investment site?

Buying bitcoin or other cryptocurrencies can be a fun way to

explore an experimental new investment. But it’s also true that any investment

in cryptocurrency should carry a warning label like cigarettes: “This product

may be harmful to the health of your finances. Never buy more than you can

afford to lose.”

The value of bitcoin — the

world’s first and most popular cryptocurrency — has risen from recent lows

but is still trading far below 2017 highs. Like all cryptocurrencies, bitcoin

is experimental and subject to much more volatility than many tried-and-true

investments, such as stocks, bonds and mutual funds.

NerdWallet advises

investing no more than 10% of your portfolio in individual stocks or risky

assets like bitcoin. If you’re new to investing, find out more about how

to invest money.

You

can purchase bitcoin from several cryptocurrency exchanges. Many charge a

percentage of the purchase price. Do your due diligence to find the right one

for you. Some of the more popular exchanges include:

Coinbase: This is a popular choice for U.S. bitcoin buyers, in part because you can easily link your bank account. Coinbase also offers access to etherium, litecoin and other cryptocurrencies.

On each transaction, Coinbase charges a spread (an adjustment in the purchase or sale price of an investment) of about 0.5%, plus a fee.

The fee is the greater of a variable percentage based on region and payment type — for example, 1.49% for a purchase funded by a U.S. bank account — or a flat fee that ranges from $0.99 to $2.99, depending on the amount transferred.

Binance: The world’s largest exchange by volume for all cryptocurrencies, Binance charges a 0.1% fee for all crypto trades (some discounts are available), plus a withdrawal fee. Generally, you can only make purchases using cryptocurrency, though Binance did recently add the option to pay by credit card for an additional fee (this option is unavailable in some U.S. states).

Bitcoin Future ATMs. These work like normal ATMs, only you can use them to buy and sell bitcoin. Coin ATM Radar shows more than 3,000 bitcoin ATMs around the U.S.

Peer-to-peer bitcoin owners. You can buy bitcoins directly from other bitcoin owners, much like you would buy items on Craigslist, through peer-to-peer tools like Bisq, Bitquick and LocalBitcoins.com. Use extreme caution if buying bitcoin directly from individuals.

Bitcoins Future, Trade Station offers a way for investors to trade on bitcoin futures, but this is pro-level stuff, not for amateurs. Here’s how to get started trading futures.

Grayscale funds. Grayscale Investments is a digital currency asset manager. Two of its investment trusts — Grayscale Bitcoin Trust (its ticker symbol is GBTC) and Grayscale Ethereum Classic Trust (ETCG) — are publicly traded over the counter, which means you can buy them through many discount brokers.

There are fees, and GBTC often trades at a premium, that is, GBTC shares often cost more than bitcoin, even though bitcoin is its only holding. The thinking is that some investors are willing to pay extra to buy bitcoin through a traditional exchange, without needing to worry about wallets and storage.

Will a bitcoin hit 1 million dollars?

Bitcoins Future Price are a dime a dozen. They can go anywhere from zero to over a million dollars. Some bettors like John McAfee are so confident that they are ready to go through absurd lengths (such as consuming their own member) to show their conviction. Do these crazy predictions hold ground?

We scoured the web and discovered that John McAfee is

not alone in his prediction that the king of cryptocurrencies will reach a

million dollar valuation. Here are the most insane bitcoin predictions bravely

shared by reputable financial figures.

Jesse Lund, Former VP of Blockchain and Digital

Currencies for IBM

The former IBM executive is a bitcoin bull after stating during an interview that the price of BTC will eventually tap $1 million. In the interview, Lund says that at $1 million, a Satoshi would equal one U.S. penny.

He also noted that liquidity would skyrocket to over $20 trillion if one bitcoin is valued at Bitcoins Future Price $1 million. In his view, the $20 trillion liquidity would be a massive game-changer in the global financial services sector.

Wences Casares, Member, PayPal Board of Directors

Casares also hopped on the bitcoin $1 million valuation,

but his prediction comes with a somewhat reasonable timeframe. According to the

newest addition to PayPal’s board of directors: “One bitcoin may be worth more

than $1 million in seven-to-10 years.” In his forecast, Casares emphasized

stats that are often overlooked such as:

Ten years of uninterrupted progress

Over 60 million holders

1 million new holders each month

Global transactions of over $1 billion per day

Julian Hosp, Author and Crypto Analyst

Like Casares, Hosp is also a big believer that Bitcoins Future Price will hit $1 million in the next decade. To make this prediction, he relied on the metric called the stock-to-flow ratio.

The metric computes the current supply of the asset and divides it by the annual amount produced to estimate future valuation. Using this ratio to compute for bitcoin’s future value, the limited supply of 21 million coins will eventually play a huge factor.

Will Bitcoin halving increase price?

The

bitcoin block halving is the moment that the miner reward per block is divided

by two. This halving takes place every 210,000 blocks. Mining one block takes

ten minutes on average, so it can be estimated that there is a bitcoin block

halving approximately every four years. This continues until 21 million

bitcoins are circulating. On top of this page you can see how long it will take

until the next halving.

What

does the bitcoin block halving mean for miners?

Creating

bitcoin is expensive, but miners can make a profit when their income, the block

reward, exceeds the costs. These costs include energy bills, equipment, and

insurance for the equipment.

The

bitcoin block halving can be predicted, so miners know precisely to the day

when the reward in bitcoin is halved. In that respect, the block halving

provides some certainty for miners. But there is also uncertainty. The

computing power on the network has been unstable for years, just like the

delivery time of mining equipment.

It may

sound as if the miners receive less income after the halving, but halving the

reward in bitcoin does not necessarily mean halving the reward in euros or

dollars. Does the demand remain constant and is the supply growth slowing down?

Then the price can rise in the future. But the role of transaction costs can

also become greater. In this way, miners still receive sufficient compensation

for their work.

What

happens to the bitcoin price after a block halving?

After a block halving, the amount of bitcoin a miner receives when he finds a block gets halved. When the very first block was mined, the reward was a staggering 50 bitcoin, although the market value at that time was nearly zero. After the first halving, the reward was reduced to 25 bitcoin, and the current reward per block is 12.5 bitcoin.

The corresponding value in a fiat currency such as the dollar or euro is different at any given time, depending on the bitcoin price.

Some

traders believe that a bitcoin block halving affects the price directly. The

first halving took place in 2012. A year later, bitcoin reached a provisional

all-time high. The same thing happened a year after the next halving, in 2017.

Is the block halving responsible for such price activity or is it just speculation? Currently there are 1,800 bitcoins mined each day, and the vast majority of those coins are sold instantly to cover for the mining expenses.

When there is a halving, the number of coins that will be brought into the market will consequently decrease, leading to more scarcity. This is the best logical explanation that reflects on the price increases following block halving.

But

will this happen during the next halving in 2020 as well? We really can’t say;

the bitcoin price is volatile and since the halving dates are known, the

increasing scarcity could already be taken into account leading up to the

halving.

What

happens after the last block halving ever?

After

the last bitcoin block halving, miners will no longer receive a block reward.

By this time they will only earn bitcoins through transaction costs. This means

transaction costs will play a bigger role in the future.

Does this mean transactions will become more expensive? That doesn’t have to be the case necessarily. There are many developments on the network that will make the expenses manageable.

For example, with the implementation of the Lightning Network. This new technique makes it possible for transactions to take place on a second layer instead of on the actual blockchain itself.

Perhaps

smaller transactions will take place on this second layer in the future. The

transaction costs for sending coins on the Lightning Network aren’t high, which

ensures affordable transactions in the future.

But

this is all in the future; we won’t even experience the last block halving

ourselves. It is estimated that the last (piece of) bitcoin is mined in the

year 2140.

https://www.bitcoinblockhalf.com/

Bitcoin Bull Rally Coming?

Bitcoins Future Price, Bitcoin (BTC) has a finite supply. There will only ever be 21 million Bitcoin in existence. This is a key factor in the value of Bitcoin and is crucial to understanding why Bitcoin is rising in value today.

I’m not a prophet, I don’t own any magical crystal balls, I don’t even own any magic 8 balls — I don’t claim to know every factor that contributed to the price of Bitcoins Future going up.

I

do know, however, that all the factors below are contributing to its’ next parabolic

run.

So,

let’s talk about why Bitcoin is going up in 2019.

A

Shrinking Supply

The

chart above plots the price of Bitcoin (the black line) over time, compared

against the colored bands, which represent the % of Bitcoins supply that has

not been spent within a certain time frame. The blue bands at the top represent

the % of Bitcoin in existence that hasn’t been spent in over 5 years. The red

bands at the bottom represent the percentage of Bitcoin that hasn’t been spent

in less than 1 day.

What

does this all mean?

There

are more HODL’ers

You’ll

notice that while the total supply of Bitcoin is rising, the liquid supply of

Bitcoin is decreasing. This is represented by the growth of the blue bands in

the top right corner of the chart. As mentioned, these bands represent the % of

Bitcoin in circulation that hasn’t been moved or spent in over 5 years, it

represents the HODL’ers.

Right

now, around 20% of the total supply of Bitcoin hasn’t been spent in over 5

years, meaning 20% of the supply is currently being held for the long term, or

maybe even lost due to forgotten keys and passphrases.

For the past week news about Project Libra has been all

over my Twitter feed, Medium, and even traditional media outlets. Forbes, Fast

Money, Financial Times; everyone is covering Facebook's entrance into

crypto markets.

This is amazing for Bitcoins Future. The retail investor wave hasn’t begun even begun. I don’t have old friends from school calling me asking me about Bitcoin just yet, we haven’t hit critical mass.

The search volume on Google for “Bitcoin” is still at relatively

low levels compared to the last time the price saw this much growth. As the

retail market catches on, we’ll see that search volume rise, and FOMO will

kick in.

Read the full article

#BitcoinBullRallyComing?#CanBitcoinhitamillion?#IsitsmarttoinvestinBitcoin?#WhatisBitcoinhalving?#WillBitcoinpricekeeprisingagain?

0 notes