Text

It is a good time to mine Ethereum?

Yes, It is the good time to miner mine ethereum, It is a good time to mine ethereum. Be-causing ethereum as a network is growing at a good .

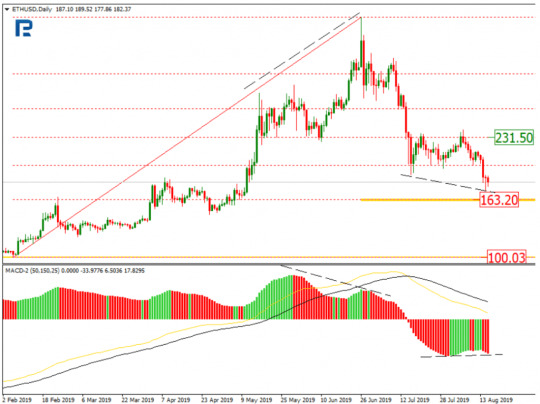

Ethereum Price Prediction and Analysis For August 16th – ETH Declining, Crypto Community Expecting Growth

The second cryptocurrency in terms of capitalization, the Ethereum, continues a declining correction. The test of the important support level of $165 is close. If it happens, the buyers will have to demonstrate a bounce in order to prevent further decline.

It is possible that the ETH is falling in connection with a strong correction of the Bitcoin. All altcoins, in general, remain under pressure, and some say that the times of the bullish rally are nearly over. It is a good time to mine ethereum

However , on August 10th , 2019 Nick Patel carried out a poll on his Twitter account , asking the crypto community about the possibility of the EUR-USD rise above $1,000 . 54% of the answers turned out in favor of such growth. So, most are still sure of an upcoming wave of growth.

At the same time 34% of non-professional interviewees voted against . The growth of the second world cryptocurrency to the area of last year local maximums .

The ETH is trading around $180 , so the rise above $1,000 is more than 5.5 times growth , It is a good time to mine ethereum , which seems too optimistic in the current market situation.

The market is overwhelmed by positive forecasts about the future of the BTC , none has come true yet , what is more , the digital gold is declining.

As we remember Max Keiser , the TV-show host , expected a breakaway of $15,000 , then the Goldman Sachs promised growth to $13,971 . It is a good time to mine ethereum .

The leading analyst of Fundstrat Global Advisor , Tom Lee voiced another support of the Bitcoin in relation to the general world instability . However, he had predicted new and new heights by the end of 2019 before.

A positive sign of potential growth of the leading altcoin is the fact that Coinbase started using. The Ethereum update for better receiving of payments in USDC .

The innovation not only decreases the expenses on payments but also inhibits fraud transactions. This is the first project of commercial payments based on the Ethereum for Coinbase Commerce.

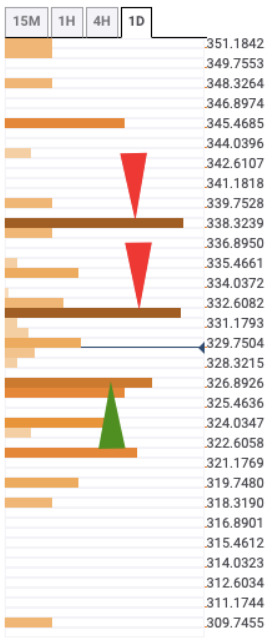

On the daily time frame, the Ethereum demonstrates another impulse of decline, aiming at the correctional level of 76.0% ($163.20) Fibo. With such a pace of decline , the most probable scenario may not just be a correctional phase but a decrease aiming at the main support at $100.03 .

However , a bounce and forming of an impulse of growth are not to be excluded . A convergence, forming on the MACD, confirms this idea. The goal of the pullback lies near the resistance around 50.0% ($231.50) Fibo.

On H4, the Ethereum demonstrates a steep decline, nearing 76.0% ($163.20) Fibo. Meanwhile, the Stochastic has entered the oversold area, which is another confirmation of the pullback.

However, a clear signal of the pullback would only be a Gold Cross in the oversold area of the oscillator. The short-term goal of the pullback may be at $200.50.

How Ethereum Mining Works

Today, miners play an important role in making sure ethereum works.

This role isn’t immediately obvious, though.

Many new users think that the sole purpose of mining is to generate ethers in a way that doesn’t require a central issuer (see our guide "What is Ether ? "). This is true. Ethereum tokens are created through the process of mining at a rate of 5 ether per mined block . But mining also has another at least as important role.

Usually, banks are in charge of keeping accurate records of transactions. They ensure that money isn’t created out of thin air , and that users don’t cheat and spend their money more than once .

Blockchains , though , introduce an entirely new way of record-keeping , one where the entire network , rather than an intermediary , verifies transactions and adds them to the public ledger .

Although a ‘trustless’ or ‘trust-minimizing’ monetary system is the goal , someone still needs to secure the financial records, ensuring that no one cheats .

Mining is one innovation that makes decentralized record-keeping possible.

Miners come to consensus about the transaction history while preventing fraud (notably the double spending of ethers . An interesting problem that hadn’t been solved in decentralized currencies before proof-of-work blockchains . It is a good time to mine Ethereum.

Although ethereum is looking into other methods of coming to consensus about the validity of transactions . Mining currently holds the platform together . It is a good time to mine Ethereum.

How mining works

Today, ethereum’s mining process is almost the same as bitcoin’s.

For each block of transactions , Miners use computers to repeatedly and very quickly guess answers to a puzzle until one of them wins .

More specifically , the miners will run the block’s unique header metadata (including timestamp and software version). Through a hash function (which will return a fixed-length . Scrambled string of numbers and letters that looks random), only changing the ‘nonce value’ , which impacts the resulting hash value .

If the miner finds a hash that matches the current target , the miner will be awarded ether and broadcast the block across the network for each node to validate and add to their own copy of the ledger.

It is a good time to mine Ethereum , If miner finds the hash, miner A will stop work on the current block and repeat the process for the next block .

It’s difficult for miner to cheat at this game. There’s no way to fake this work and come away with the correct puzzle answer. That’s why the puzzle-solving method is called ‘proof-of-work’ .

It is a good time to mine Ethereum for GPU.

On the other hand , It takes almost no time for others to verify that the hash value is correct , which is exactly what each node does .

Approximately every 12–15 seconds, a miner finds a block. If miners start to solve the puzzles more quickly or slowly than this . The algorithm automatically readjusts the difficulty of the problem so that miners spring back to roughly the 12-second solution time .

The miners randomly earn these ether , and their profitability depends on luck and the amount of computing power they devote to it .

The specific proof-of-work algorithm that ethereum uses is called ‘ethash’ , designed to require more memory to make it harder to mine using expensive ASICs – specialized mining chips that are now the only profitable way of mining bitcoin .

In a sense , ethash might have succeeded in that purpose , since dedicated ASICs aren’t available to mine ethereum .

Furthermore, since ethereum aims to transition from proof-of-work mining to ‘proof of stake’ . which we discuss below – buying an ASIC might not be a smart option since it likely won’t prove useful for long .

Shift to proof of stake.

Ethereum might not need miners forever,

Developers plan to ditch proof-of-work , the algorithm that the network currently uses to determine which transactions are valid and protect it from tampering , in favor of proof of stake , where the network is secured by the owners of tokens.

If and when that algorithm is rolled out , proof-of-stake could be a means for achieving distributed consensus that uses fewer resources .

Read the full article

#bestethereumminersoftware#CanImineethereumwithmyPC?#CanyoumineethereumwithASIC?#claymoreethereumminer#ethereumminerasic#ethereumminingpool#ethereumminingprofitability#ethereumminingrig#freeethereummining#Howmuchdoesitcosttomineethereum?#miningethereum2019#Whatdoesitmeantomineethereum?

0 notes

Text

Ethereum Price Prediction 2020 : From Zero to $100k – What do the Experts Think?

What is ethereum?

This personal thesis keeps me confident of the longer term state of crypto and Early Bitcoin Adopters Ethereum Price Prediction 2020 my investment. Ethereum is a digital platform which allows people to build a range of decentralized applications.

These applications can include security programs, voting systems and

methods of payment. Like bitcoin, ethereum operates outside the mandate of

central authorities such as banks and governments.

The idea behind ethereum was created by Vitalik Buterin. He launched the

first version of the platform in 2015, with the help of several co-founders.

Since then it has grown rapidly in popularity and has helped prompt an increase

of new rivals to bitcoin.

How does ethereum work?

Ethereum

works as an open software platform functioning on blockchain technology. This

blockchain is hosted on many computers around the world, making it

decentralised. Each computer has a copy of the blockchain, and there has to be

widespread agreement before any changes can be implemented to the network.

The

ethereum blockchain is similar to bitcoin’s in that it is a record of the

transaction history. However, the ethereum network also allows developers to

build and deploy decentralised applications (‘dapps’). These are also stored on

the blockchain along with records of transactions.

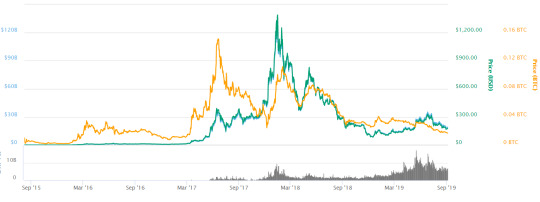

What is ethereum price?

Ethereum Price

Is Ethereum a good investment?

Which cryptocurrencies will be Google, Facebook, Apple, Amazon and Nasdaq of the crypto world? Because of the depth and complexity of the crypto world, it is not easy to answer this question. In addition to the investment objective.

I am looking for the answer to this question to get to know the blockchain universe and satisfy my intellectual curiosity. To answer such a question, it would be the best way to study the significant cryptocurrencies one by one.

I tried to evaluate Bitcoin comprehensively in my previous post. You can reach the post containing my reviews on Bitcoin from here.

I would like to analyse Ethereum, the second most valuable cryptocurrency in my article today. Ether is the name of the crypto money of the Ethereum ecosystem. However, since crypto is listed as "Ethereum" in the exchanges, I used the name "Ethereum" in order not to create confusion.

Ethereum

is an open-source, blockchain-based operating system designed to create smart

contracts.

Ethereum

was introduced by cryptocurrency scientist and coder Vitalik Buterin at the top

of 2013. The system was launched on 30 July 2015 with the sale of 11.5 million

coins.

As a

result of security problems in 2016, Ethereum blockchain was divided into two.

The original Ethereum blockchain is called Ethereum Classic. Ethereum is still

the 2nd most valuable crypto and Ethereum Classic is the 18th most valuable

crypto.

It is

an interesting choice to give the name of ether, a volatile gas for a Crypto

money, on a monetary issue where trust is essential. Buterin said that he chose

this name because the environment in which light is moving is called as

"ether" and because it sounds pleasant.

In March 2017, the Enterprise Ethereum Alliance (EEA) was established with the participation of various blockchain startups, research groups and companies. By July 2017, the Union had more than 150 members. There are 100,88 million Ethereum coins in the market.

Ethereum's total market value as of today is $ 46.42 billion. This represents 16% of the total cryptocurrency volume, which is 288.4 billion dollars.

What price did ethereum start?

Ethereum Price Prediction 2020

The first prediction I needed to speak to you

concerning was free by a web analyst known as police officer Ullery. The model

that Ullery uses relies on the world economy and also the assumption that

blockchain technology can play a way larger role in international trade.

According to the analyst, Bitcoin and Ethereum will each hold 25% of the entire cryptocurrency industry, which he predicts will have a total market capitalization of $4.5 trillion in 2020. Ethereum Price Prediction 2020 ?

Market capitalization is employed to calculate the full price of a cryptocurrency, much in the same way as real-world companies are valued. It is achieved by multiplying the current market price of a coin by the total amount of coins in circulation.

For example, if the value of the coin was worth $20 and there were 10 million coins in circulation, then the total market capitalization would be $200 million.

Now, within the case of Ethereum, although

there is no fixed supply, Ullery uses a total coin circulation of 100 million

as this is what Vitalik Buterin has suggested will happen.

So, considering all of the higher than, this

particular Ethereum price prediction 2020 believes that Ethereum will be worth

$11,375. This would provide Ethereum a complete market capitalisation of over $1

trillion! So, is this possible?

For Ullery’s Ethereum price prediction 2020

to come true, it would need to increase its all-time high of just over $1300,

by 775%. This really isn’t Associate in Nursing surrealistic prediction once

you think about that Ethereum hyperbolic its value by ten,000% in 2017! But

what do you think?

Ethereum Real-World Events

You might remember how I discussed earlier

that the Ethereum blockchain is only able to process about 15 transactions per

second. This is actually a really big problem for the project as it needs to

increase significantly to handle global demand.

For example, in late 2017, a new

decentralization application (dApp) called CryptoKitties was processing so many

transactions that it almost brought the network down! This was just one dApp,

so think about how bad it would be if other dApps become more and more popular?

As a result, there are now other smart

contract blockchains that perform much better than Ethereum. For example, NEO

can process transactions in the thousands per second and there are other

blockchains being built that claim to be able to handle millions per second!

The Ethereum team have recognized these

challenges and have a few ideas which they are working on, with each of them

holding the potential answer to “Why is Ethereum going up” in the future.

So, let’s start with proof-of-stake!

Proof-of-stake

Every blockchain platform has its own “consensus mechanism”, which determines how transactions are verified on the network. Ethereum uses constant model as Bitcoin, that is named “proof-of-work”.

The proof-of-work mechanism creates really complex puzzles that no human can solve, so they require powerful computers instead. Providing that you have the right equipment, you can connect your device to the system to help solve the puzzle. If you are successful, you earn the cryptocurrency as a reward. This is called mining.

However, Proof-of-work requires a very large

amount of electricity. Furthermore, because the puzzle becomes more and more difficult

as more users start to mine the cryptocurrency, you need really expensive

hardware to have a chance of winning the reward.

This is why Ethereum wants to switch its consensus mechanism over to proof-of-stake. The model works in a different way to proof-of-work as it makes it fairer for other people to get involved in the mining process, and it also requires far less electricity.

Using Proof-of-Stake, your chances of winning

the mining reward are based on the amount you have “staked”, which means the

number of coins you have invested in the system. The theory is that the more

coins you have, the more motivation you will have to ensure the blockchain

remains safe and secure.

So, that’s Proof-of-Stake. The next part of my Ethereum price prediction 2020 guide is going to look at how they plan on improving the number of transactions the network can process at any given time.

Sharding

Sharding is a protocol that the developers

are working on to change the way that transactions are verified. Under the current

model, every single “node” that is supporting the blockchain needs to confirm

every transaction that has been submitted.

Note: A node is used to describe a device

that has been connected to the blockchain to help verify transactions. The a

lot of nodes there ar, the more secure the network is. At the time of writing

in June 2018, Ethereum has more than 16,000 individual nodes!

Anyway, as AN example, let’s imagine that 100

transactions have been sent within the Ethereum system. Which means that they

must all be verified by the blockchain before they are confirmed as valid. This

would mean that all 16,000 nodes would need to verify all 100 transactions

individually, which isn’t very efficient.

Sharding does things differently though. It puts nodes into groups. Each group of nodes is called a “shard”, with different groups working on different parts of a transaction.

Ultimately, it creates a more efficient way to confirm transactions and allow the network to increase the amount it can process every second.

Plasma

The plasma protocol is concerned with

unnecessary data and wants to remove it from the main blockchain to free up

space. For example, once someone creates a replacement sensible contract, it's

mechanically denote to the most Ethereum blockchain. Even though the smart

contract might not be completed for a long time (or possibly never at all) it

is still sent to the blockchain.

This has caused a lot of problems because

nodes still need to verify the transactions, meaning that it slows down the

network. The plasma solution is planning on creating an additional layer on top

of the main blockchain, which will be used for incomplete smart contracts.

Once the smart contract is in operation, it

can then be sent to the main blockchain. Vitalik Buterin has stated that he is

looking to install both plasma and sharding, which means that if successful,

the Ethereum blockchain could soon be processing thousands, potentially

millions of transactions per second!

If this is the case, there is a very good chance

that these will be the reason why is Ethereum going up in the near future, as

many analysts believe these problems are holding the project back from growing.

However, once implemented, who knows how high can Ethereum goes.

However, it is important to remember that all

three of the above solutions are still in their very early days, so there is no

knowing when they will be truly ready. The best thing to do is to regularly

check for updates online.

How do you buy ethereum?

LocalEthereum - LinkBinance - LinkKucoin - Link

Read the full article

#EthereumReal-WorldEvents#Howdoyoubuyethereum?#Howdoesethereumwork?#Isethereumagoodinvestment?#Plasma#Proof-of-stake#Sharding#Whatisethereum?#Whatisethereumprice?#Whatpricedidethereumstart?

0 notes

Text

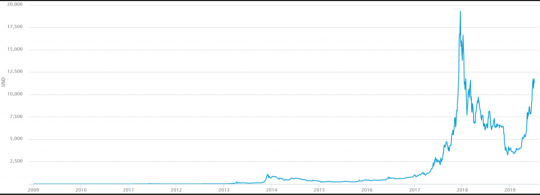

Bitcoins Future Price: bitcoin future value predictions ?

Will Bitcoins Future Price keep rising again?

Bitcoins Future Price: cryptocurrency and blockchain in the last several months, you could become quite pessimistic about the cryptocurrency future. It seems like, for a certain category of people it has become a trend to criticize blockchain technology.

Luckily, these materials are rarely based on serious facts. But this type of “eye-opening” critical content always gives its author an immediate rise in popularity and some kind of an “expert” status.

Today

I want to dispel all the pessimistic forecasts and give you a realistic view of

the current market situation.

I’d like to mention that I’m not going to quote any of the dozens of pseudo analysts with their crazy declarations about Bitcoins Future Price to be $20000. I do think that predictions on the market future should be based on facts, in accordance with fundamental economic laws, and not on pure emotions or a desperate need for buzz.

At

the instant of writing Bitcoin worth is around $3600 mark. Yes, this is the

bottom. But what comes next? Plain and simple: the bull market. And the reasons

why i believe that Bitcoin can rise once more in 2019.

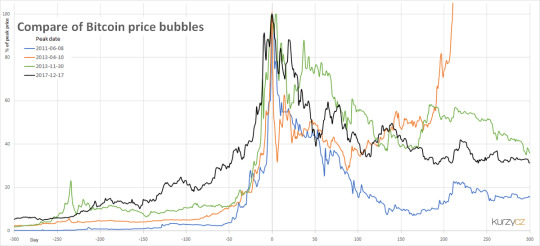

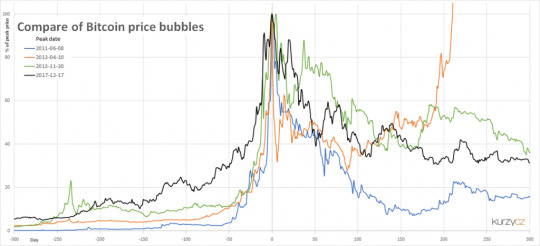

1) Bitcoins Future Price technical analysis

Let’s analyze what was happening with Bitcoin price in the last months.

Bitcoins Future Price Chart analysis

The rise of trading volume and an increase in the number of trading positions in December 2018 indicated that the market had touched its bottom, which was $3200 on December 15. Bitcoin price had reached its lowest point, and the upward movement started again.

Besides, the trading volume has noticeably increased, which has led to an increase in volatility. These factors will likely lead to a significant rise in buyers/investors entering the field. And this, in turn, will lead to an increase in Bitcoins Future Price, as I said in one of my previous articles.

Moreover,

on the daily chart, we can also see the typical False Breakout pattern, which

is a classic sign that the market is going to move upwards.

Surely,

a rational investor shouldn’t make his assumptions based entirely on technical

analysis. It should be used together with fundamental analysis which considers

the overall economic situation, the potential of the technology staying behind

the asset, and many other factors. So let’s move on to the next points.

2) The history examples

A new, breakthrough

technology arises all of a sudden out of nowhere. Unfortunately, in the

beginning, its full potential is obvious only for a small “technical nerd”

community, and initially, it is supported solely by these people.

Then, little by little, it becomes more and more popular. Companies and entrepreneurs start to pay attention to the opportunities the technology gives. More and more people start to invest in it. At some point interest for this technology gets to a critical level.

Mass media start to cover it all day long, and everyone is interested. Any company which is somehow concerned with the technology starts to attract enormous sums of investors’ money. Even having a specific technical term in a company’s name is enough to get a buzz and increase a company’s value.

It goes this way to a

certain point, and after that, it looks like the story is over. The hype is

gone. The bubble has burst. The prices of all the technology related assets

fall to the minimum.

Nothing like? Yes, I’m talking about the dot-com bubble. Its story is suspiciously similar to the situation which is happening with cryptocurrency now. But did the Internet end together with the end of the dot-com companies?

Hell no. Moreover, as we

can see now, the value of many top internet companies which were founded before

the dot-com bubble did fall after the bubble had burst, but afterward, it has

risen again with the vengeance. What’s worth only Amazon!

Amazon was one of the leading companies in times of the dot-com bubble. Its value increased together with other similar companies in late 1990th, and it also significantly fell in price after the dot-com bubble had burst. Luckily, it didn’t ruin the company. The potential behind online retailers stayed very high, and since 2008 we’ve been watching a significant growth of the company’s value.

Bitcoin Price history examples

3) Development of the cryptocurrency field

It’s

clear that at the moment the blockchain technology is still far from the point

of its maximum development.

The

cryptocurrency infrastructure has been built over the last several years. Now

we have a number of acting and reliable cryptocurrency

exchanges, cryptocurrency wallets and mining pools. At the same time, the existing

infrastructure does not cease to develop.

A lot of great ideas which has been

proposed before are being implemented now, like crypto loans or Bitcoin

futures. The Bitcoin protocol itself is also being developed in a more perfect

state with different Bitcoin forks and implementation of such protocols

as SegWit.

Needless

to say, cryptocurrency is not the one and only possible application of

blockchain technology. A number of ICO projects, offering different adaptations

of blockchain technology, were under development in the last couple of years

and only now many of them are starting to act.

So the field is still highly prospective. Just look at the current crypto services and companies: exchanges, wallets, coins, ICOs. They continue to develop, investing more and more money in the field.

Look at the banks and governments which are working on the development of blockchain-based law- and banking systems. Do you believe that these people could invest in something unpromising? Consider these guys with pockets full of money as a role model for your cryptocurrency investment career.

Another good thing which happened in the last couple of years is purifying of the market from the scam projects together with the projects which didn’t survive the market competition.

This natural selection is a necessary step for the further development for every new and competitive field, so the cryptocurrency market enters 2019 being much stronger than before. Isn’t it a good sign?

4) Market stabilization and the end of mass hysteria

The huge blockchain and cryptocurrency hype in the second half of 2017 and the first half of 2018 wasn’t actually an entirely positive phenomenon for the cryptocurrency field.

Of course, it has drawn the attention of hundreds of millions of people to the Bitcoin phenomenon and made cryptocurrency a valuable asset as opposed to its previous small experimental role, which is definitely a good thing.

But besides that, it has led in the cryptocurrency field millions of people following the hype and hoping to get rich doing absolutely nothing.

This mass hysteria somehow devalued the cryptocurrency phenomenon, making it a target for serious criticism. Since that many skeptics criticized the blockchain and cryptocurrency technologies, claiming it to be more of a “hype” thing than really a breakthrough technology.

So the fact that the cryptocurrency field is gradually getting rid of the people hoping to get rich doing absolutely nothing and not having even basic economic or investment knowledge is a good thing.

I’d really like to believe that now the cryptocurrency market will be evolving not because of hype, but owing to creating real value. Serious investors, who are necessary for the development of the field, are used to think with their own heads. They don’t follow the crowd but instead make decisions based on real facts and analytics.

5) Large investors are coming

Let’s say Bitcoins Future Price has declined once again and you are selling your assets. For you, it may look like the best and most obvious decision.

Well,

who do you think is on another side of your trades? Why are they accumulating

thousands of BTC and ETH on their accounts? Believe me, it isn’t just because

they are happy to help you to secure your investments. There is always an inner

reason.

An

interesting fact is that when some asset’s price declines, small players

usually sell it in fear to lose even more than they have already lost. On the

contrary, the big players such as banks and hedge funds will often buy these

assets for cheap while everyone else is getting rid of it.

Needless

to say, when the asset’s price rises again, the big players make really big

profits. Being major companies and having strong risk management systems, they

can afford risks concerned with holding big volumes of highly volatile assets.

Even though we haven’t seen much official information about the large investors entering the field, the cryptocurrency market fluctuations of the last couple of years.

The big players have already started to act anonymously, making large trading operations with different cryptocurrencies. These actions heavily influence the cryptocurrency prices, making it go up and down.

what we are able to see on cryptocurrency charts. It’s a typical way of actions for large investors before they enter a new market: they test it first and only after that the official arrival is made and announced.

This strategy is especially applicable to the cryptocurrency field. Unfortunately, cryptocurrency is still concerned with a big number of rumors and misconceptions. Any big investment firm entering the field may face misunderstanding in the financial community.

So it’s still a common practice for big investment companies to act anonymously through the third parties until the cryptocurrency market gets more stable and widely recognized.

Which is the best Bitcoin investment site?

Buying bitcoin or other cryptocurrencies can be a fun way to

explore an experimental new investment. But it’s also true that any investment

in cryptocurrency should carry a warning label like cigarettes: “This product

may be harmful to the health of your finances. Never buy more than you can

afford to lose.”

The value of bitcoin — the

world’s first and most popular cryptocurrency — has risen from recent lows

but is still trading far below 2017 highs. Like all cryptocurrencies, bitcoin

is experimental and subject to much more volatility than many tried-and-true

investments, such as stocks, bonds and mutual funds.

NerdWallet advises

investing no more than 10% of your portfolio in individual stocks or risky

assets like bitcoin. If you’re new to investing, find out more about how

to invest money.

You

can purchase bitcoin from several cryptocurrency exchanges. Many charge a

percentage of the purchase price. Do your due diligence to find the right one

for you. Some of the more popular exchanges include:

Coinbase: This is a popular choice for U.S. bitcoin buyers, in part because you can easily link your bank account. Coinbase also offers access to etherium, litecoin and other cryptocurrencies.

On each transaction, Coinbase charges a spread (an adjustment in the purchase or sale price of an investment) of about 0.5%, plus a fee.

The fee is the greater of a variable percentage based on region and payment type — for example, 1.49% for a purchase funded by a U.S. bank account — or a flat fee that ranges from $0.99 to $2.99, depending on the amount transferred.

Binance: The world’s largest exchange by volume for all cryptocurrencies, Binance charges a 0.1% fee for all crypto trades (some discounts are available), plus a withdrawal fee. Generally, you can only make purchases using cryptocurrency, though Binance did recently add the option to pay by credit card for an additional fee (this option is unavailable in some U.S. states).

Bitcoin Future ATMs. These work like normal ATMs, only you can use them to buy and sell bitcoin. Coin ATM Radar shows more than 3,000 bitcoin ATMs around the U.S.

Peer-to-peer bitcoin owners. You can buy bitcoins directly from other bitcoin owners, much like you would buy items on Craigslist, through peer-to-peer tools like Bisq, Bitquick and LocalBitcoins.com. Use extreme caution if buying bitcoin directly from individuals.

Bitcoins Future, Trade Station offers a way for investors to trade on bitcoin futures, but this is pro-level stuff, not for amateurs. Here’s how to get started trading futures.

Grayscale funds. Grayscale Investments is a digital currency asset manager. Two of its investment trusts — Grayscale Bitcoin Trust (its ticker symbol is GBTC) and Grayscale Ethereum Classic Trust (ETCG) — are publicly traded over the counter, which means you can buy them through many discount brokers.

There are fees, and GBTC often trades at a premium, that is, GBTC shares often cost more than bitcoin, even though bitcoin is its only holding. The thinking is that some investors are willing to pay extra to buy bitcoin through a traditional exchange, without needing to worry about wallets and storage.

Will a bitcoin hit 1 million dollars?

Bitcoins Future Price are a dime a dozen. They can go anywhere from zero to over a million dollars. Some bettors like John McAfee are so confident that they are ready to go through absurd lengths (such as consuming their own member) to show their conviction. Do these crazy predictions hold ground?

We scoured the web and discovered that John McAfee is

not alone in his prediction that the king of cryptocurrencies will reach a

million dollar valuation. Here are the most insane bitcoin predictions bravely

shared by reputable financial figures.

Jesse Lund, Former VP of Blockchain and Digital

Currencies for IBM

The former IBM executive is a bitcoin bull after stating during an interview that the price of BTC will eventually tap $1 million. In the interview, Lund says that at $1 million, a Satoshi would equal one U.S. penny.

He also noted that liquidity would skyrocket to over $20 trillion if one bitcoin is valued at Bitcoins Future Price $1 million. In his view, the $20 trillion liquidity would be a massive game-changer in the global financial services sector.

Wences Casares, Member, PayPal Board of Directors

Casares also hopped on the bitcoin $1 million valuation,

but his prediction comes with a somewhat reasonable timeframe. According to the

newest addition to PayPal’s board of directors: “One bitcoin may be worth more

than $1 million in seven-to-10 years.” In his forecast, Casares emphasized

stats that are often overlooked such as:

Ten years of uninterrupted progress

Over 60 million holders

1 million new holders each month

Global transactions of over $1 billion per day

Julian Hosp, Author and Crypto Analyst

Like Casares, Hosp is also a big believer that Bitcoins Future Price will hit $1 million in the next decade. To make this prediction, he relied on the metric called the stock-to-flow ratio.

The metric computes the current supply of the asset and divides it by the annual amount produced to estimate future valuation. Using this ratio to compute for bitcoin’s future value, the limited supply of 21 million coins will eventually play a huge factor.

Will Bitcoin halving increase price?

The

bitcoin block halving is the moment that the miner reward per block is divided

by two. This halving takes place every 210,000 blocks. Mining one block takes

ten minutes on average, so it can be estimated that there is a bitcoin block

halving approximately every four years. This continues until 21 million

bitcoins are circulating. On top of this page you can see how long it will take

until the next halving.

What

does the bitcoin block halving mean for miners?

Creating

bitcoin is expensive, but miners can make a profit when their income, the block

reward, exceeds the costs. These costs include energy bills, equipment, and

insurance for the equipment.

The

bitcoin block halving can be predicted, so miners know precisely to the day

when the reward in bitcoin is halved. In that respect, the block halving

provides some certainty for miners. But there is also uncertainty. The

computing power on the network has been unstable for years, just like the

delivery time of mining equipment.

It may

sound as if the miners receive less income after the halving, but halving the

reward in bitcoin does not necessarily mean halving the reward in euros or

dollars. Does the demand remain constant and is the supply growth slowing down?

Then the price can rise in the future. But the role of transaction costs can

also become greater. In this way, miners still receive sufficient compensation

for their work.

What

happens to the bitcoin price after a block halving?

After a block halving, the amount of bitcoin a miner receives when he finds a block gets halved. When the very first block was mined, the reward was a staggering 50 bitcoin, although the market value at that time was nearly zero. After the first halving, the reward was reduced to 25 bitcoin, and the current reward per block is 12.5 bitcoin.

The corresponding value in a fiat currency such as the dollar or euro is different at any given time, depending on the bitcoin price.

Some

traders believe that a bitcoin block halving affects the price directly. The

first halving took place in 2012. A year later, bitcoin reached a provisional

all-time high. The same thing happened a year after the next halving, in 2017.

Is the block halving responsible for such price activity or is it just speculation? Currently there are 1,800 bitcoins mined each day, and the vast majority of those coins are sold instantly to cover for the mining expenses.

When there is a halving, the number of coins that will be brought into the market will consequently decrease, leading to more scarcity. This is the best logical explanation that reflects on the price increases following block halving.

But

will this happen during the next halving in 2020 as well? We really can’t say;

the bitcoin price is volatile and since the halving dates are known, the

increasing scarcity could already be taken into account leading up to the

halving.

What

happens after the last block halving ever?

After

the last bitcoin block halving, miners will no longer receive a block reward.

By this time they will only earn bitcoins through transaction costs. This means

transaction costs will play a bigger role in the future.

Does this mean transactions will become more expensive? That doesn’t have to be the case necessarily. There are many developments on the network that will make the expenses manageable.

For example, with the implementation of the Lightning Network. This new technique makes it possible for transactions to take place on a second layer instead of on the actual blockchain itself.

Perhaps

smaller transactions will take place on this second layer in the future. The

transaction costs for sending coins on the Lightning Network aren’t high, which

ensures affordable transactions in the future.

But

this is all in the future; we won’t even experience the last block halving

ourselves. It is estimated that the last (piece of) bitcoin is mined in the

year 2140.

https://www.bitcoinblockhalf.com/

Bitcoin Bull Rally Coming?

Bitcoins Future Price, Bitcoin (BTC) has a finite supply. There will only ever be 21 million Bitcoin in existence. This is a key factor in the value of Bitcoin and is crucial to understanding why Bitcoin is rising in value today.

I’m not a prophet, I don’t own any magical crystal balls, I don’t even own any magic 8 balls — I don’t claim to know every factor that contributed to the price of Bitcoins Future going up.

I

do know, however, that all the factors below are contributing to its’ next parabolic

run.

So,

let’s talk about why Bitcoin is going up in 2019.

A

Shrinking Supply

The

chart above plots the price of Bitcoin (the black line) over time, compared

against the colored bands, which represent the % of Bitcoins supply that has

not been spent within a certain time frame. The blue bands at the top represent

the % of Bitcoin in existence that hasn’t been spent in over 5 years. The red

bands at the bottom represent the percentage of Bitcoin that hasn’t been spent

in less than 1 day.

What

does this all mean?

There

are more HODL’ers

You’ll

notice that while the total supply of Bitcoin is rising, the liquid supply of

Bitcoin is decreasing. This is represented by the growth of the blue bands in

the top right corner of the chart. As mentioned, these bands represent the % of

Bitcoin in circulation that hasn’t been moved or spent in over 5 years, it

represents the HODL’ers.

Right

now, around 20% of the total supply of Bitcoin hasn’t been spent in over 5

years, meaning 20% of the supply is currently being held for the long term, or

maybe even lost due to forgotten keys and passphrases.

For the past week news about Project Libra has been all

over my Twitter feed, Medium, and even traditional media outlets. Forbes, Fast

Money, Financial Times; everyone is covering Facebook's entrance into

crypto markets.

This is amazing for Bitcoins Future. The retail investor wave hasn’t begun even begun. I don’t have old friends from school calling me asking me about Bitcoin just yet, we haven’t hit critical mass.

The search volume on Google for “Bitcoin” is still at relatively

low levels compared to the last time the price saw this much growth. As the

retail market catches on, we’ll see that search volume rise, and FOMO will

kick in.

Read the full article

#BitcoinBullRallyComing?#CanBitcoinhitamillion?#IsitsmarttoinvestinBitcoin?#WhatisBitcoinhalving?#WillBitcoinpricekeeprisingagain?

0 notes

Text

Cardano Transitioning to a Decentralized Network [Updated]

Update, July 24, 0800 PST : IOHK contacted Crypto Slate indicating the information had not been leaked because the GitHub is “ already and very deliberately in the public domain .” Cardano Transitioning to a Decentralized Network Update. IOHK reaffirms that the project is on schedule to be delivered by 2020 and that the information does not represent a leak.

The first development phase of Cardano(ADA) was the “Byron era,” marked by the September 2017 launch of the network.

From “federated” to decentralized nodes

ADA is a “third-generation” blockchain platform with an emphasis on research and peer review.

Byron focused on the core needs of the network, such as wallets and the first incarnation of the blockchain’s “ Ouroboros ” proof-of-stake consensus.

Coinciding with Byron is the “Bootstrap era,” where a group of “trusted nodes” maintain the network. Cardano Transitioning to a Decentralized-Network, These nodes are likely orchestrated by IOHK.

The technology startup founded by Charles Hoskinson and Jeremy Wood responsible for building the first iteration of ADA.

Following Byron is the “Shelley era” of development, marking the shift toward a more decentralized community-run network.

This will transition the network from the Bootstrap to “Reward era,” enabling users to stake their Ada to earn rewards amongst the decentralized community nodes.

“Once the majority of nodes are run by network participants . ADA will be more decentralized and enjoy greater security and robustness as a result” , claims the Cardano(ADA) roadmap.

Cardano Price Chart

Cardano (ADA) Buy for Right Time, Price Low and get more Offer.

https://twitter.com/Cardano

Read the full article

#cardanoada#cardanocoinprice#cardanocoinbase#cardanoprice#cardanopricechart#cardanopriceprediction#cardanoreddit#cardanoroadmap#cardanowallet#cardanowiki#WhatisCardanocoin?#WhatisCardanousedfor?#WhatisthepriceofCardano?#WhocreatedCardano?

0 notes

Text

Cardano Transitioning to a Decentralized Network [Updated]

Update, July 24, 0800 PST : IOHK contacted Crypto Slate indicating the information had not been leaked because the GitHub is “ already and very deliberately in the public domain .” Cardano Transitioning to a Decentralized Network Update. IOHK reaffirms that the project is on schedule to be delivered by 2020 and that the information does not represent a leak.

The first development phase of Cardano(ADA) was the “Byron era,” marked by the September 2017 launch of the network.

From “federated” to decentralized nodes

ADA is a “third-generation” blockchain platform with an emphasis on research and peer review.

Byron focused on the core needs of the network, such as wallets and the first incarnation of the blockchain’s “ Ouroboros ” proof-of-stake consensus.

Coinciding with Byron is the “Bootstrap era,” where a group of “trusted nodes” maintain the network. Cardano Transitioning to a Decentralized-Network, These nodes are likely orchestrated by IOHK.

The technology startup founded by Charles Hoskinson and Jeremy Wood responsible for building the first iteration of ADA.

Following Byron is the “Shelley era” of development, marking the shift toward a more decentralized community-run network.

This will transition the network from the Bootstrap to “Reward era,” enabling users to stake their Ada to earn rewards amongst the decentralized community nodes.

“Once the majority of nodes are run by network participants . ADA will be more decentralized and enjoy greater security and robustness as a result” , claims the Cardano(ADA) roadmap.

Cardano Price Chart

Cardano (ADA) Buy for Right Time, Price Low and get more Offer.

https://twitter.com/Cardano

Read the full article

#cardanoada#cardanocoinprice#cardanocoinbase#cardanoprice#cardanopricechart#cardanopriceprediction#cardanoreddit#cardanoroadmap#cardanowallet#cardanowiki#WhatisCardanocoin?#WhatisCardanousedfor?#WhatisthepriceofCardano?#WhocreatedCardano?

0 notes

Text

Crypto Fastest Exchange Launches | Crypto Surveillance System is Fake News | New Zealand government to tax salaries paid in crypto

Fastest Crypto Exchange Launches, Zcash Founder, Fighting Fraud

Crypto euphoria is wearing off as skepticism around Facebook's Libra project grows, but Mark Zuckerberg isn't throwing in the towel. In the company's earnings call Wednesday, the CEP said he will win over Libra regulators ‘however long it takes.’ Sean Keefe, Managing Partner, Straight Up Capital, came on Cheddar to discuss Facebook’s chances at pulling off a successful launch.

FATF’s New Crypto Surveillance System is Fake News

On August 9th, a story that seems to have originated on Japan-based news source Nikkei Asian Review spread across the crypto media. The story claimed that under the guidance of the Financial Action Task Force (FATF), 15 countries had teamed up to create a new system that would collect and share personal data.

The story was reported on a number of reputable crypto industry websites, including Finance Magnates. However, the story is, in fact, incorrect–there is no such task force being formed.

London Summit 2019 Launches the Latest Era in FX and Fintech

FATF Senior Policy Analyst Tom Neylan has confirmed in a call with Finance Magnates that “the not developing any systems–and we wouldn’t take the data anyway,” Neylan confirmed–after all, FATF is not a law enforcement body, nor is it in the business of creating technological solutions; it merely “set standards and promotes their effective implementation.”

However, the FATF is “talking to and working with the private sector as they are developing systems, but it’s important that they are their systems and that they own them.”

In late June, the FATF released a new set of guidelines for the crypto currency industry requiring that many of the regulations that are applied to banks more “traditional” financial institutions also be applied to crypto currency exchanges.“ new standards require all crypto exchanges in all jurisdictions to know who their customers are.”

Crypto Payment

“The new standards require all crypto exchanges in all jurisdictions to know who their customers are–so they’ve got to do customer due diligence,” Neylan explained.They need to keep that information securely and privately so that it’s available to law enforcement authorities when it’s needed to investigate money laundering and terrorist financing.

Additionally, “they’ve got to be able to know who they’re doing business with in order to screen for sanctions–for example, against Al Qaeda or against North Korea.”“We’ve asked the crypto sector themselves–because they know their technology better than we do–to develop systems to make sure they can apply the Travel Rule.”

“These are the same requirements that already apply to banks and other financial institutions,” Neylan said. “So it’s not something new that we’re doing with the crypto sector–it’s the same sort of customer due diligence that is already applied by traditional financial institutions.”

One of FATF’s new requirements is the application of the travel rule to crypto currency exchanges. The travel rule requires financial institutions to pass on certain pieces of identifying information to the next financial institution that a transaction.

“We’ve asked the crypto sector themselves–because they know their technology better than we do–to develop systems to make sure they can apply the Travel Rule.”“This isn’t meant to breach everybody’s privacy. This is meant to ensure that criminals and terrorists can be identified once law enforcement are aware that they’re involved.”

Neylan said that reactions from the industry so far have been existed on a spectrum: “some of the industry are very resistant to regulation in general, and particularly the travel rule.”

“On the other end of the spectrum, there are a lot of the more developed exchanges, particularly from the countries that already regulate this sector, who are comfortable with being regulated and are already working on the design and the governance, the technical solutions to implement the travel rule.”

“They’re very concerned about data privacy–which, to be honest, we are as well,” he added. “This isn’t meant to breach everybody’s privacy. This is meant to ensure that criminals and terrorists can be identified once law enforcement are aware that they’re involved.”

Neylan said that the FATF is already “working with a couple of industry groups who are actively starting to develop .”

“We’re talking to the International Digital Asset Exchange Association (IDAXA), a number of other groups and experts who are using FATF’s standards as a starting point for industry-led efforts to work out exactly how to implement this globally.”

However, “we’re not picking favorites,” Neylan added–no entity has been chosen as The Developer for a compliance solution. “This is about the industry collectively adopting one or more solutions…virtual asset service providers have got to be able to exchange information between each other in a way that protects data and privacy.”

“They’re the ones who need to protect their customers’ information, so they’re the ones that have to figure out a solution that they can all apply.”

Although it is unlikely that anyone sought to deliberately mislead anyone else in this instance, there are quite a few companies who may seek to opportunistically assert their products as the industry’s solution to FATF’s compliance demands. This kind of opportunism could potentially contribute to the spread of misinformation.

After all, when FATF announced its crypto currency industry guidelines in mid-June, the industry was abuzz with concerns over how cryptocurrency exchanges and other service providers could become compliant with them. After all, the new set of standards contained requirements that, while easy for banks to comply to, are very difficult–practically impossible–for crypto currency service providers.

As such, a number of individuals and organizations saw an opportunity: if they can manage to create a solution to FATF compliance that could be adopted by exchanges, serious money can be made.

So, there is quite a bit of interest in creating a compliance solution that could be quickly and easily adopted by major industry players–and while a number of organizations and individuals have begun developing these solutions, none has emerged as the clear leader.

Therefore, it could be in the interest of some of these opportunistic organizations to begin “priming the ears” of the industry for the announcement of a possible compliance solution, without naming themselves or anyone else directly–so, while ill-intent is unlikely, it certainly could be possible.

Crypto Price UP / DOWN

At press time, Nikkei had not responded to requests for commentary. Finance Magnates will update the story if commentary is provided.

New Zealand government to tax salaries paid in crypto

The New Zealand government has, after a dry internal debate, decided companies can pay salaries using crypto currency—so it can tax it. But, despite the state being all too happy to tax such payments, it steadfastly maintains that crypto isn’t money.

In a long and rambling document, Susan Price, the report’s author and director of public rulings at the Inland Revenue used the Oxford English Dictionary’s definition of “salary” as a justification for why crypto is taxable.

The document, quoting the dictionary, notes that a salary is generally composed of regular payments, in money, at a fixed rate, in exchange for work done, before going further. “Where an employee has agreed to receive part of their regular remuneration in the form of crypto-assets, most of these requirements would be met,” the document states.

It concludes that cryptocurrencies when used as regular payments in exchange for work, function like money does. And yet, even though it treats it as money, and taxes it as money, the New Zealand government says it’s something completely different. Instead, it views it as property.

“Crypto-assets are not “money” as commonly understood (at least not at the present time). In particular, because crypto-assets are not issued by any government, they are not legal tender anywhere,” the report adds.

This touches upon a bigger idea swirling around digital money: If everyone were to adopt the use of crypto currencies, then governments wouldn’t have as much control over their economies—such as printing money to help control inflation, or not. Despite this, the New Zealand government is willing to not look this particular gift horse in the mouth.

Read the full article

0 notes

Text

Crypto Earn Free Coins | Coinbase Free Crypto Earn | Earn Cryptocurrency

How to get free stellar on coinbase Crypto Earn $50 FREE Stellar (XLM), $20 FREE Dia, $50 FREE EOS, $10 FREE Basic Attention Token (BAT) with Coinbase. Crypto Earn Free Coins XLM Get $50 Stellar Lumen, Coinbase Free Crypto Earn Stellar(XLM), Dai, EOS, Basic Attention Token (BAT).

Crypto Earn Opportunity

Coinbase Crypto Earn permits users to cryptocurrencies, whereas learning regarding them in a very easy and fascinating manner. The idea is for users to know a lot of regarding AN asset’s utility and its underlying technology, whereas obtaining a touch of the quality to do out. To manage demand, we’re launching Coinbase Crypto Earn today in invite-only mode with a single asset:

Free Crypto Earn

Earn Dai ( $20 )

Dai may be a stablecoin that aims to be value precisely one US dollar. Learn how it works and you’ll Dai.

Earn EOS ( $50 )

EOS IO is a protocol designed for fast and free blockchain apps. Learn how it works and you’ll Earn EOS.

Learn Stellar XLM. ( $50 )

Stellar may be a platform that connects banks, payment systems, and people. Learn how it works and you’ll Earn XLM.

More & more Crypto Earn

Earn the Basic Attention Token ( $10 )

Brave is on a mission to mend what it believes may be a broken internet. Learn about Brave and you'll the Basic Attention Token (BAT).

Opportunities square measure solely on the market for a restricted time to alittle set of shoppers. You’ll receive Crypto Earn in your Coinbase pocketbook for each quiz you complete. After every video you’ll receive an easy quiz testing what you’ve learned. We’ve created academic videos to show you concerning totally different cryptocurrencies.

Free Crypto Earn

The simplest way to get your hands on crypto today is arguably by buying it, but there are plenty of sites that will net you some crypto Earn for free for you to try before you buy, or to simply grow your portfolio.

In this article, we'll keep an updated selection of the best sites to Crypto earn free, so you can grow your crypto Earn & savings, from small amounts to big bounties. And with Cloud bet's new lowest minimum bets at only 10 Satoshi, even the smallest proceeds can turn into big winner amounts.

In fact, once you've gathered your free crypto, and won some more on our site, you'll probably start to wonder what exactly you can do with your coin. Well, wonder no more, as we've scoped out the best places for you to spend your bitcoin.

From retail shops to travel services, there are a growing number of companies and establishments that now accept BTC as a form of payment - making it the perfect time to get your hands on some. So, without further ado, here are the top ways to free crypto earn, divided by category.

Coin Staking

Coin Staking, in Proof-of-Stake blockchains, is the process by which active cryptocurrency holders participate in the decision making of new changes to be implemented in the network. Holders that become active participants in the consensus process are rewarded with a sort of passive interest in the same cryptocurrency in the case of Stellar XLM, or through another currency in the case of NEO and GAS.

Although the average holders may not have the technical knowledge, time or desire to be active participants; there are still ways to earn staking rewards by staking through exchanges or staking pools.

KuCoin

Kucoin also provides staking services for ATOM, EOS, TRX, IOST, NEBL, ONION, NRG, NULS and TOMO with an estimate annual ROI between 0.5%-22%, distributed every 5th day of the month.

TRX ( Crypto Earn )

Additionally, KuCoin is launching the KCS Lockup, offering between 35% to 50% annual interest on KuCoin Shares (KCS) for locking up the tokens for a period of 3 months, starting at any point from the 1st of August to the 30th of August. To minimise the rest for the program participants, once the tokens are unlocked users will be able to sell their tokens to KuCoin for 90% of the KCS - USD price at the day the lockup period started.

KCS Crypto Earn

*Staking coins on Binance and KuCoin doesn’t involve any lockup, with the exception of the KCS lockup. Users will be able to trade or withdraw their coins freely but they should be aware that the rewards are calculated daily and an empty balance will impact the monthly staking reward.

Bitcoin Buy Last Opportunity - Buy & Hold

Earn Crypto - Link

Bitcoin Leverage Trading (100x) - Link

Read the full article

0 notes

Text

Bitcoin Bullrun all time High | Crypto Bullrun | Altcoins next Bullrun

Bullrun: The 2018 bitcoin selloff that culminated in the mid-November crash is drawing parallels to that of previous years, which has one chart watcher wondering if the disastrous year has been put to bed.

Much like the 2014-2015 bear market, losses for bitcoin BTC USD, -0.94% have surpassed 80%, but of more interest is how the 2014-2015 bottom ended. In the initial time period of 2015, bitcoin fell forty third to $178 before launching its recovery. In the two weeks ending Nov. 25 of this year, bitcoin lost forty fifth of its worth.

“In distinction to bounces that have developed through 2018, weekly RSI is now at levels not seen since BTC’s last bear market low in early 2015 and BTC Bullrun is showing terribly early proof of responding to its semipermanent uptrend when 3 major draw back moves through 2018,” wrote Rob Sluymer, technical strategian at Fundstrat world Advisors.

Bitcoin Bullrun 2015-2017

Sluymer’s colleague Tom Lee, managing partner at Fundstrat, at one stage predicted bitcoin would reach $25,000 by year-end, before dropping his target to $15,000. But if history does repeat itself, Lee may be correct, but a few months early: In the six months following the 2015 low, bitcoin oscillated in a tight trading range before breaking out and staging a monster pitched battle, culminating in a 1,000% surge in 2017 to Bullrun an all-time high near $20,000.

But others need more convincing. Jani Ziedins of the Cracked Market blog, who correctly predicted the bitcoin selloff from above $8,000, expects the bounce off $3,500 to be short-lived.

“Most likely this relief rally will carry us back above $5k over the next week or two,” he said. “But this can be nothing quite a dead-cat bounce and bitcoin remains not investible for the long Bullrun.”

Analyst: Next Bitcoin Bullrun Could Send BTC to $100k – $328k

Next Bullrun

Crypto Analyst Says Bitcoin Price Could Hit $100,000 During Next Bullrun

Think Markets chief analyst Naeem Aslam predicts that bitcoin (BTC) can hit somewhere between $60,000 and $100,000 throughout its next Battle of Bullrun, consistent with a Fox Business interview on St John's Day.

Aslam had previously predicted on June 17 that BTC would hit $10,000 in “a couple of weeks,” citing institutional involvement as a major driver. Bitcoin successfully reached the five figure mark on June 22, marking a record high that has not been seen in over one year.

According to Aslam, the major price points to look out for now are $20,000 and $50,000. He argues that by hitting $20,000, discussion will move from conservative estimates exceeding the number one cryptocurrency’s all-time high to forecasts of $50,000; from there, breaking $50,000 will move the price target to $100,000 Bullrun.

Aslam additionally mentioned the employment of BTC as a method to avoid risk, comparing BTC Bullrun, which is often called “digital gold,” with gold. He remarks that in the last two months, there is a huge spike in price for these two assets, which he attributes to a lack of confidence in the stock market along with the ongoing U.S.–China trade war.

Aslam

also points to unrest and even a potential war in the Middle East as the

biggest driver of recent growth in these diversifying assets. He additionally

remarks that BTC currently encompasses a name as a secure haven for storing

wealth, saying there is evidence of investors “parking” their capital in the

leading crypto.

As antecedently reportable by Cointelegraph, Bitcoin podcast host Trace Mayer same that the bitcoin worth in 2019 can probably shut at $21,000, in keeping with the flight posited by his ‘Mayer Multiple’ price indicator. The Mayer Multiple reportedly is an equation that involves dividing current BTC price by its 200-day moving average.

Bitcoin Buy - Link

Read the full article

0 notes

Text

KuCoin Announces, KCS Lockup Burn & Cashback|Stake Tokens Now

KuCoin Launches Cash Back Program and Burn Plan

KuCoin, an IDG-backed cryptocurrency exchange, announced that it will launch the KCS Lockup & Cash Back Program and Burn Plan. The program will officially start on August 1. Users who lock up their KCS tokens will be able to receive an annualized rate of return up to 50%. This program is believed to promote the diversity of KCS ecosystem, enrich the rights of KCS users, and increase the market potential of KCS.

According to the rules of the program, during the period from August 1 to August 31, 2019 (UTC+8), users will be able to join the program by withdrawing KCS to a specific wallet address. The lockup period will be 90 days. The minimum amount for a single lockup is 200 KCS while the daily maximum lockup amount per person is 10,000 KCS. The daily maximum lockup amount for the entire platform is 500,000 KCS, and when the total lockup amount reaches 5,000,000 KCS, users will not be able to lock their KCS.

Staking economy is one of the hottest topics in 2019 and many well-known projects like ATOM, EOS and TRX are offering staking services. The annualized rate of return of staking is usually 6%-12%, while in the KCS Lockup & Cash Back Program, the highest annualized rate of return is up to 50%, with a minimum of 35%. The earlier you lock KCS, the higher the rate of return you will get. All the lockup revenue will be distributed along with the principal on day of unlocking.

KuCoin also introduced the KCS Burn mechanism in this program. According to the announcement, KuCoin will additionally burn the same number of KCS based on the number of total KCS locked by all users. The burn plan will be implemented in December 2019.

In addition, to further protect its investors, after the KCS unlocks, KuCoin will provide a service for repurchasing the user’s locked KCS at the price of 10% off the average KCS price (USDT price) on the day of the user’s lockup. Users can apply for repurchase services on their own.

As the native token of KuCoin, the exchange has continuously introduced initiatives to empower KCS this year. KCS holders now can get a daily KuCoin Bonus and enjoy a trading fee discount. After the official release of KuMEX, the cryptocurrency contracts trading platform developed by the KuCoin team, the exchange will use 50% of the net revenue from KuMEX for KuCoin Bonus distribution to KCS holders.

With the gradual adoption of blockchain technology, KCS has also begun to expand its use cases, enhancing its intrinsic value. Now, KCS can be used to get a loan on ETHLend, perform real-time transfers through ADAMANT Messenger, and play online games on PlayGame.com. With the recent collaboration with CoinPayments, KCS opened its door to over 2.4 million merchants worldwide.

This move will further enhance the underlying value of KCS. KuCoin recently announced that it will upgrade its KuCoin Bonus Plan in the third quarter of this year, and before its launch, KuCoin will execute the Temporary KCS Buy Back and Burn Plan every week to accelerate the burn process of KCS.

About KuCoin — The People’s Exchange

The KuCoin Exchange opened for cryptocurrency trading in September 2017 and has enjoyed steady growth into 2019. The KuCoin Exchange puts a high priority on the quality of the projects listed based on a well-trained research department that scours the blockchain industry for the highest quality projects.

KuCoin provides an exchange service for users to conduct digital asset transactions securely and efficiently. Over time, KuCoin aims to provide long-lasting, increased value to its more than five million registered users, in over 100 countries. In November 2018, ‘The People’s Exchange’ officially partnered with IDG Capital and Matrix Partners.

Proof Of Stake On Kucoin Exchange! Stake Tokens Now

Everyone likes getting something with little to no effort, which is why the idea of getting a passive income with cryptocurrency attracts a lot of attention. There are a few different methods that enable crypto traders to earn crypto passively. Whatever the method, they can utilize the crypto they are holding and get something in return. Staking is one such way to achieve this. Not only can users earn rewards through PoS, but they can also feel good knowing that they are playing an integral role in securing promising blockchain developments.

The Role Of Proof Of Stake In Earning Cryptocurrency Passively

kucoin,com

Proof of Stake or PoS involves staking some amount of crypto in order to reach a distributed consensus and validate transactions in the network. The creators of the block are chosen at random, though the amount of a particular cryptocurrency they are holding and how long they have held it can also influence the decision. Rewards are given out for this process, based on the proportion of their holding.

There are different ways in which staking can occur. One such way is through a provided wallet. Projects that develop their own wallet are often seen as promising, as it reflects a lot of time and work being put into the project. It can be convenient too, especially for the purposes of staking.

Those looking for how to make a passive income from crypto through PoS have many choices. Here are a few different tokens that enable users to earn more crypto passively using their own wallets.

Start Trading Now. Join KuCoin Today

Energi (NRG): A New Approach To Cryptocurrency

Energi is a project famous for its unique self-funding treasury system, where it allocates funds for development, growth, and other areas. It is a decentralized cryptocurrency that takes solutions to existing problems in the blockchain space while improving upon the strengths that have made other blockchain projects successful. NRG is the token that powers the project.

Having transitioned to proof of stake consensus earlier this year, Energi offers the opportunity for users to stake their tokens in order to earn rewards. The project designates and distributes 10% of the newly emitted Energi each month to the stakers.

Staking involves just holding NRG in an Energi Core Wallet that is connected and synced to the network. A minimum of one NRG is needed to use the Energi PoS, though staking more will allow users to earn a larger reward.

KuCoin users can also simply leave NRG tokens and receive automatic rewards thanks to KuCoin’s Energi soft staking.

MetaHash Coin (MHC): Earn Crypto Just For Being Online

MHC is the token of the MetaHash network, which aims to help the building of a new internet with decentralized applications that work in real-time, and are fast and secure due to its unprecedented speed and enhanced security based on a unique consensus technology. So, how can Metahash’s token, MHC, be used to get a passive income?

MetaHash uses forging for block generation and validation. Described as the ‘evolutionary form of mining’, it is a new concept for protecting network consensus based on proof of stake rather than proof of work. This allows for the project to ensure scalability and speed, with hardware requirements kept lower. In return, it is possible to earn higher, more fair rewards. There are two forms of forging: Passive and Active.

Rewards for passive forging are earned just for being online on MetaGate for at least 4 hours, and users only need to hold and stake as little as 100 MHC. MetaHash also offers a daily reward pool for passive forgers. A pool of 19k MHC is shared out amongst passive forgers, who receive one share every four hours they stake their tokens.

Active forgers automatically participate in passive forging, along with all the other benefits. For 1000 MHC, it is possible to start earning tickets for a daily lottery every 4 hours. An amount of around 170k MHC is given away in this lottery, with the possibility to receive up to 60 tickets each day. The daily reward is around 0.13% for active forgers. Distribution occurs every 24 hours, meaning it is possible to receive a daily passive income of cryptocurrency through the project.

Delegation can also earn users a passive income through rewards. Staking 512 MHC or more will earn the everyday reward.

TomoChain (TOMO): Using The Proof Of Stake Voting Consensus

As a highly secure, low latency blockchain, TomoChain is the ideal platform for developing and building DApps. The project introduces itself as an innovative solution to the Ethereum blockchain’s scalability problem, thanks to its masternode and consensus mechanism.

TomoChain uses Proof of Stake Voting (PoSV) consensus, which utilizes both staking and a fair voting mechanism for governance. For the purposes of earning a passive income, there is the opportunity here for users to stake their TOMO in order to vote for masternodes and earn rewards.

TOMO rewards for staking are about 0.00625 per 900 blocks for a user with 1000 TOMO staked. That is around 2.1 TOMO per week. Minimum stake amount is 10 TOMO. Voting can also be done to earn rewards by depositing tokens into a smart contract associated with a node candidate through the TomoMaster system.

NIX (NIX): Off-Chain Governance With Staking

NIX is a privacy currency and cross-chain privacy platform designed with the aim to deliver completely anonymous, decentralized blockchain transactions. The project is able to achieve this by combining atomic swaps and privacy, using a ‘Ghost Protocol’ in order to provide anonymous and decentralized transfer of assets.

NIX uses an off-chain governance model that secures the blockchain through ghost nodes and staking. Having transitioned from proof of work to proof of stake, NIX has developed an inflation schedule that increases the staking reward as the network matures. LPoS, or Leased Proof of Stake, where users can lease their coins to a merchant to stake for them, is possible too.

There is no minimum amount of NIX when it comes to staking passively. The reward will always be around 2.5 NIX per successful stake, with an expected ROI of approximately 12%. While the reward amount is fixed, those with a smaller stake will be chosen less frequently than those with a higher holding.

Neblio (NEBL): Start Staking With No Minimum

Neblio is a platform that is built for enterprise applications and services. The goal of the project is to make it easier for businesses to develop and deploy distributed applications that drive business value through blockchain technology. The NEBL token is the lifeblood of this Neblio Blockchain platform.

As a PoS project, the Neblio Network needs users to stake their NEBL in order to ensure all members of the network are behaving honestly. Those who choose to stake their coins and thus secure the network will be rewarded for their time and effort.

There is actually no minimum amount of NEBL required to start staking and the minimum staking time is 24 hours. The age of staked tokens impacts the reward that is earned.

KuCoin users can also simply leave NEBL tokens and receive automatic rewards thanks to KuCoin’s Neblio soft staking.

It is fair to say that there are many different projects that allow crypto holders to make their crypto work for them. Staking is one of the prominent ways that users can achieve this. While the cost of entry does vary, it is quite easy to get started. Generally, the bigger the input, the greater the reward, as projects want to incentivize users to play a role and hold their tokens. This is what should be kept in mind when finding the best passive income cryptocurrency.

Cryptoindex.com Listed On KuCoin Cryptocurrency Exchange

The leading index for investors in the crypto space, has announced that the KuCoin exchange has listed it as a tool for people looking to evaluate the performance and credibility of digital assets. Cryptoindex.com lets novice investors and experienced crypto enthusiasts access information on the 100 best-performing digital tokens and cryptocurrencies based on trading volumes and social media followings.

The KuCoin exchange reached unicorn status faster than any company in history (under four months) and achieved a billion-dollar valuation in large part due to its ability to choose tokens users are interested in—ones that have genuine potential blockchain applications. This will be further enhanced by Cryptoindex.com, which uses its proprietary AI technology Zorax to analyse tens of millions of trades and news announcements, letting investors view the top coins.

VJ Angleo, CEO at Cryptoindex.com, said: "The team at Cryptoindex.com is honoured to be listed on the KuCoin exchange and looks forward to providing its investors with insights based on data analysis, volume trades, predictive analytics, and social media investor sentiment. As investors become increasingly bullish on cryptocurrency, we will be able to provide the right platform and tools to properly assess and engage in this rapidly evolving area of finance."

Michael Gan, CEO at KuCoin, commented: "As the People's Exchange, we are committed to providing secure and reliable trading to retail traders and institutional investors. The Cryptoindex.com team is dedicated to helping traders of all kinds make better investments. We are happy to work with them to reach this goal."

Cryptoindex.com is the result of a comprehensive analysis of over 1,800 coins subjected to fixed filters. Over 33 Terabytes of data is analysed to extract over 200 factors to create a refined ranking, which is then put into a neural network to create a final rating. Cryptoindex.com is composed of the top 100. Re-evaluation happens monthly; on average, the index changes 12%.

The index aims to improve information access and transparency for investors, particularly since the traditional financial services sector is accustomed to greater disclosure and regulation. Cryptoindex.com goes to the heart of the crypto universe while offering a methodology fully suited to the needs and requirements of heavily regulated asset managers, institutional and professional investors. The CIX100 index has outperformed Bitcoin over the last 30 days.

Read the full article

0 notes

Text

Bitcoin Price Prediction 2020 (Halving) | Goldman Sachs Analyst Bitcoin Price | Bitcoin Cash Price Prediction BCH/USD

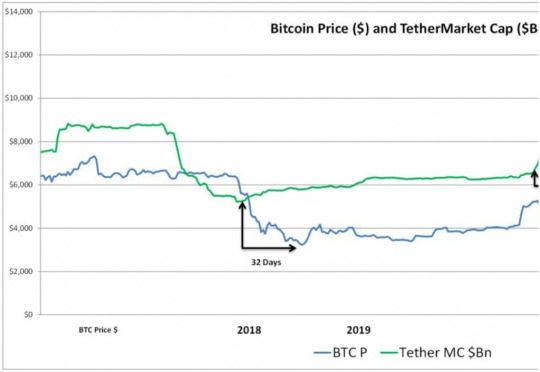

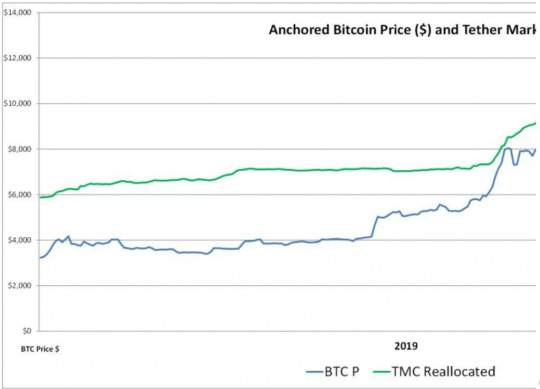

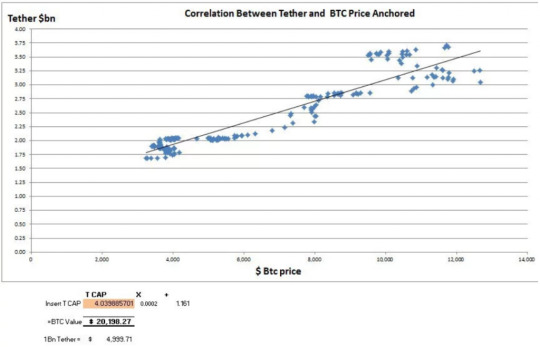

Current Tether offer Suggests Bitcoin Price is Correcting to $20,000

Bitcoin price charting on a longer time frame, market structure and the issuance of 1 billion Tether so far this year are making crypto and equities analyst FilbFilb incredibly bullish on BTC/USD within the run up to the 2020 halving.

Bitcoin

traders split into 3 groups

Since correcting from 2019’s

uncomparable high of $13,800 and thrice failing to break above $12,500, crypto

investors broke into three camps.

The

first took the bearish perspective and predicted a pullback to $8,500-$7,500,

often citing the CME gap.

The second visualised a protracted amount of consolidation wherever Bitcoin value would stay stapled between $9,000 and $12,000, providing the opportunity for savvy traders and institutional investors to accumulate prior to the 2020 halving.

The third cluster taken the

parabolic breakdown as nothing quite a blip and stay steadfast in their belief

that the digital plus can eventually rally back to $13,500 and higher.

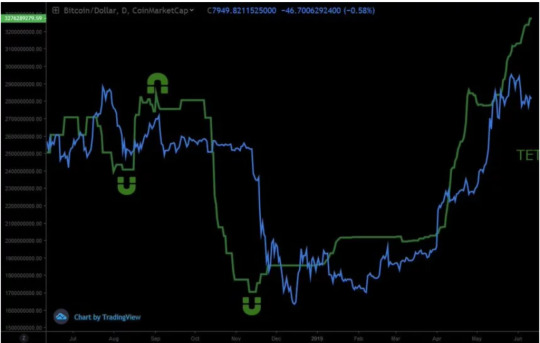

4 ways Bitcoin price structurally shifted in 2019

According to popular crypto and equities analyst Filb Filb, Bitcoin price has undergone a structural shift for several reasons, he explained in his weekly newsletter.

The digital plus is consolidating