#Underwater: How Our American Dream of Homeownership Became a Nightmare

Text

By Thom Hartmann

Back in 1967, a friend of mine and I hitchhiked from East Lansing, Michigan to San Francisco to spend the summer in Haight-Ashbury. One ride dropped us off in Sparks, Nevada, and within minutes of putting our thumbs out a city police car stopped and arrested us for vagrancy.

The cop, a young guy with an oversized mustache who was apologetic for the city’s policy, drove us to the desert a mile or so beyond the edge of town, where we hitchhiked standing by a distressing light-post covered with graffiti reading “39 hours without a ride,” “going on our third day,” and “anybody got any water?”

Vagrancy laws were so 20th century.

Today, the US Supreme Court heard a case involving efforts by the City of Grants Pass, Oregon to keep homeless people off its streets and out of its parks and other public property. The city had tried a number of things when the problem began to explode in the last year of the Trump administration, as The Oregonian newspaper notes:

“They discussed putting them in their old jail, creating an unwanted list, posting signs at the city border or driving people out of town... Currently, officers patrol the city nearly every day, Johnson said, handing out [$295] citations to people who are camping or sleeping on public property or for having too many belongings with them.”

The explosion in housing costs has triggered two crises: homelessness and inflation. The former is harming the livability of our cities and towns, and the Fed’s reaction to the latter threatens an incumbency-destroying recession just as we head into what will almost certainly be the most important election in American history.

The problem with housing inflation is so severe today that without it the nation’s overall core CPI inflation rate would be in the neighborhood of Fed Chairman Jerome Powell’s 2% goal.

Graphic based on BLM data and interpretation by The Financial Times

Both homelessness and today’s inflation are the result of America — unlike many other countries — allowing housing to become a commodity that can be traded and speculated in by financial markets and overseas investors.

Forty-three years into America’s Reaganomics experiment, homelessness has gone from a problem to a crisis. Rarely, though, do you hear that Wall Street — a prime beneficiary of Reagan’s deregulation campaign — is helping cause it.

32% seems to be the magic threshold, according to research funded by the real estate listing company Zillow. When neighborhoods hit rent rates in excess of 32% of neighborhood income, homelessness explodes.

And we’re seeing it play out right in front of us in cities across America because a handful of Wall Street billionaires want to make a killing.

It wasn’t always this way in America.

Housing prices have spun out of control since my dad bought his house in 1957 when I was six years old. He got a Veteran’s Administration-subsidized loan and picked up the brand-new 3-bedroom-1-bath ranch house my 3 brothers and I grew up in, in suburban south Lansing, Michigan. It cost him $13,000, which was about twice what he made every year working a good union job in a tool-and-die shop.

When my dad bought his home in the 1950s the median price of a single-family house was 2.2 times the median American family income. Today, the Fed says, the median house sells for $479,500 while the median American personal income is $41,000 — a ratio of more than ten-to-one between housing costs and annual income.

As the Zillow study notes:

“Across the country, the rent burden already exceeds the 32% [of median income] threshold in 100 of the 386 markets included in this analysis….”

And wherever housing prices become more than three times annual income, homelessness stalks like the grim reaper.

We’re told that America’s cities have seen this increase in housing costs since the 1950s in some part because of the growing wealth and population of this country. There were, after all, 168 million people in the US the year my dad bought his house; today there are 330 million.

And it’s true that we haven’t been building enough new housing, particularly low-income housing, as 43 years of neoliberal Reaganomics have driven down wages and income for working-class people relative to all of their expenses while stopping the construction of virtually any new subsidized low-income housing.

But that’s not the only, or even the main dynamic, driving housing prices into the stratosphere — and, as a consequence, the crisis in homelessness — over the past decade. You can thank speculation for much of that.

As the Zillow-funded study noted:

“This research demonstrates that the homeless population climbs faster when rent affordability — the share of income people spend on rent — crosses certain thresholds. In many areas beyond those thresholds, even modest rent increases can push thousands more Americans into homelessness.”

So how did we get here?

It started with a wave of foreign buyers over the past 30 years (particularly from China, Canada, Mexico, India and Colombia) who, in just the one single year of 2020, picked up over 154,000 homes as their way of parking money in America. Which is part of why there are over 20 times more empty houses in America than there are homeless people.

As Marketwatch noted in a 2015 article titled “The Danger of Foreign Buyers Gobbling Up American Homes”:

“Unusual high appreciation of the aforementioned urban centers is due to the ever growing influx of foreign buyers — mostly wealthy Chinese — who view American residential real estate as the safest investment commodity. … According to a National Realtors Association survey, the Chinese spent $22 billion on U.S. housing in 12 months through March 2014…. [Other foreign buyers primarily include] Canadians, British, Indians and Mexicans.”

But foreign investment has been down for the past few years; what’s taken over and is really driving home prices today are massive, multi-billion-dollar US-based funds that sweep into neighborhoods and buy everything available, bidding against families and driving up housing prices.

As noted in a Wall Street Journal article titled “Meet Your New Landlord: Wall Street,” in just one suburb (Spring Hill) of Nashville, “In all of Spring Hill, four firms … own nearly 700 houses … [which] amounts to about 5% of all the houses in town.”

This is the tiniest tip of the iceberg.

“On the first Tuesday of each month,” notes the Journal article about a similar phenomenon in Atlanta, investors “toted duffels stuffed with millions of dollars in cashier’s checks made out in various denominations so they wouldn’t have to interrupt their buying spree with trips to the bank…”

The same thing is happening in cities and suburbs all across America; the investment goliaths use finely-tuned computer algorithms to sniff out houses they can turn into rental properties, making over-market and unbeatable cash bids often within minutes of a house hitting the market.

After stripping neighborhoods of homes families can buy, they then begin raising rents as high as the market will bear.

In the Nashville suburb of Spring Hill, for example, the vice-mayor, Bruce Hull, told the Journal you used to be able to rent “a three bedroom, two bath house for $1,000 a month.” Today, the Journal notes:

“The average rent for 148 single-family homes in Spring Hill owned by the big four [Wall Street investor] landlords was about $1,773 a month…”

Ryan Dezember, in his book Underwater: How Our American Dream of Homeownership Became a Nightmare, describes the story of a family trying to buy a home in Phoenix. Every time they entered a bid, they were outbid instantly, the price rising over and over, until finally the family’s father threw in the towel.

“Jacobs was bewildered,” writes Dezember. “Who was this aggressive bidder?”

Turns out it was Blackstone Group, now the world’s largest real estate investor. At the time they were buying $150 million worth of American houses every week, trying to spend over $10 billion. And that’s just a drop in the overall bucket.

In 2018, corporations bought 1 out of every 10 homes sold in America, according to Dezember, noting that, “Between 2006 and 2016, when the homeownership rate fell to its lowest level in fifty years, the number of renters grew by about a quarter.”

This all really took off around a decade ago, when Morgan Stanley published a 2011 report titled “The Rentership Society,” arguing that — in the wake of the 2008 Bush Housing Crash — snapping up houses and renting them back to people who otherwise would have wanted to buy them could be the newest and hottest investment opportunity for Wall Street’s billionaires and their funds.

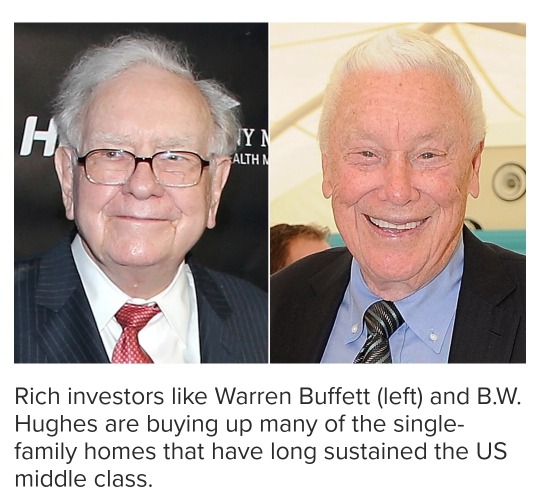

Turns out, Morgan Stanley was right. Warren Buffett, KKR, and The Carlyle Group have all jumped into residential real estate, along with hundreds of smaller investment groups, and the National Home Rental Council has emerged as the industry’s premier lobbying group, working to block rent control legislation and other efforts to regulate the industry.

As John Husing, the owner of Economics and Politics Inc., told The Tennessean newspaper:

“What you have are neighborhoods that are essentially unregulated apartment houses. It could be disastrous for the city.”

Meanwhile, as unionization levels here remain among the lowest in the developed world, Reagan’s ongoing war on working people continues to wipe out America’s families.

At the same time that housing prices, both to purchase and to rent, are being driven through the roof by foreign and Wall Street investors, a survey published by NPR, the Robert Wood Johnson Foundation, and the Harvard TH Chan School of Public Health found that American families are in crisis.

Their study found:

— “Thirty-eight percent (38%) of [all] households across the nation report facing serious financial problems in the previous few months.

— “There is a sharp income divide in serious financial problems, as 59% of those with annual incomes below $50,000 report facing serious financial problems in the past few months, compared with 18% of households with annual incomes of $50,000 or more.

— “These serious financial problems are cited despite 67% of households reporting that in the past few months, they have received financial assistance from the government.

— “Another significant problem for many U.S. households is losing their savings during the COVID-19 outbreak. Nineteen percent (19%) of U.S. households report losing all of their savings during the COVID-19 outbreak and not currently having any savings to fall back on.

— “At the time the Centers for Disease Control and Prevention’s (CDC) eviction ban expired, 27% of renters nationally reported serious problems paying their rent in the past few months.”

These are not separate issues, and they are driving an explosion in homelessness.

The Zillow study found similarly damning data:

— “Communities where people spend more than 32% of their income on rent can expect a more rapid increase in homelessness.

— “Income growth has not kept pace with rents, leading to an affordability crunch with cascading effects that, for people on the bottom economic rung, increases the risk of homelessness.

— “The areas that are most vulnerable to rising rents, unaffordability, and poverty hold 15% of the U.S. population — and 47% of people experiencing homelessness.”

The Zillow study makes grim reading and is worth checking out. In community after community, when rent prices exceeded 32% of median household income, homelessness exploded. It’s measurable, predictable, and is destroying what’s left of the American working class, particularly minorities.

The loss of affordable homes also locks otherwise middle-class families out of the traditional way wealth is accumulated — through homeownership: Over 61% of all American middle-income family wealth is their home’s equity. And as families are priced out of ownership and forced to rent, they become more vulnerable to long-term economic struggles and homelessness.

Housing is one of the primary essentials of life. Nobody in America should be without it, and for society to work, housing costs must track incomes in a way that makes housing both available and affordable. This requires government intervention in the so-called “free market.”

— Last year, Canada banned most foreign buyers from buying residential property as a way of controlling their housing inflation.

— New Zealand similarly passed its no-foreigners law (except for Singaporeans and Australians) in 2018.

— Thailand requires a minimum investment of $1.2 million and the equivalent of a green card.

— Greece bans most non-EU citizens from buying real estate in most of the country.

— To buy residential housing in Denmark, it must be your primary residence and you must have lived in the country for at least 5 years.

— Vietnam, Austria, Hungary, and Cyprus also heavily restrict who can buy residential property, where, and under what terms.

This isn’t rocket science; the problem could be easily fixed by Congress if there was a genuine willingness to protect our real estate market from the vultures who’ve been circling it for years.

Unfortunately, when Clarence Thomas was the deciding vote to allow billionaires and hedge funds to legally bribe members of Congress in Citizens United, he and his four fellow Republicans opened the floodgates to “contributions” and “gifts” from foreign and Wall Street interests to pay off legislators to ignore the problem.

Because there’s no lobbying group for the interests of average homeowners or the homeless, it’s up to us to raise hell with our elected officials. The number for the Congressional switchboard is 202-224-3121.

If ever there was a time to solve this problem — and regulate corporate and foreign investment in American single-family housing — it’s now.

#us politics#op ed#thom hartmann#hartmann report#common dreams#homelessness#end homelessness#housing#housing market#2024#Reaganomics#zillow#foreign buyers#Marketwatch#the Oregonian#Wall Street Journal#Ryan Dezember#Underwater: How Our American Dream of Homeownership Became a Nightmare#The Rentership Society#Morgan Stanley#The Tennessean#NPR#Robert Wood Johnson Foundation#Harvard TH Chan School of Public Health#affordable housing

16 notes

·

View notes

Link

Underwater: How Our American Dream of Homeownership Became a Nightmare by Ryan Dezember https://amzn.to/32nNeTK

#Underwater: How Our American Dream of Homeownership Became a Nightmare#american dream#homeownertips#Ryan Dezember#economics#2008 financial crisis

0 notes

Text

https://nypost.com/2020/07/18/corporations-are-buying-houses-robbing-families-of-american-dream/amp/?__twitter_impression=true&s=09

One of his employees, trying to bid on a house they wanted at auction, told him the price had reached their agreed-upon ceiling of $85,000 — a rare occurrence, since they usually snagged the homes they wanted without competition.

Jacobs told his employee to go up to $87,000. But the price kept rising.

“The price jumped to $90,000. Then $95,000. The home wound up selling for about $100,000,” writes Ryan Dezember in his new book, “Underwater: How Our American Dream of Homeownership Became a Nightmare” (Thomas Dunne Books), out now.

“Jacobs was bewildered. Who was this aggressive bidder? By the end of the day, he had a name. The bidder was from an outfit called Invitation Homes."

Invitation Homes, it turned out, was owned by Blackstone Group, the world’s largest real-estate investor. Created after a company called Treehouse Group was folded into Blackstone, then renamed in 2012, Invitation Homes was on a $10 billion spree, purchasing $150 million worth of houses per week.

“At an auction in Sacramento, a house flipper named Ryan Heck was bewildered by a bidder who bought every house that hit the block,” Dezember writes, noting that the bidder went one dollar over every other bid until the other bidders conceded.

“Neither Heck nor the other regulars recognized the dollar-over guy. It turned out he was with an out-of-town concern called Treehouse and had instructions to buy everything that cost less than what it would cost to build a similar house. Every house auctioned that day fit the bill.”

Moving forward, Heck tried to compete, sometimes even peeking over other bidders’ shoulders to “run the dollar-over routine on them.” But he was outmatched.

“He had a handful of cashier’s checks,” Dezember writes. “The new guys had duffle bags full.”

‘Underwater” describes how, in the wake of the 2008 financial crisis, corporations began buying suburban houses en masse and then renting them out, often for more than residents would have otherwise paid in rent or mortgage.

This has become so common that, while the phenomenon “didn’t exist a decade ago,” corporations bought one out of every 10 suburban homes sold in 2018.

Corporate homeownership can not only subject tenants to higher living costs, but often destroys their ability to buy these homes themselves, as companies pay top dollar to take them off the market.

0 notes

Text

Mortgage relief scammers hit with $18.5 million judgment

Owning a home has long been a symbol of the American dream.

For some, however, homeownership turns into a nightmare.

Those horrid homeowner dreams became evident in the Great Recession.

In the late 1990s through the mid-2000s, artificially high home prices, questionable lending practices and an explosion of subprime mortgages to buyers who under regular lending standards would not have been given a home loan, created a housing bubble.

It finally burst in 2007, leaving many homeowners broke as the loans on their properties suddenly were many thousands more than their homes were worth.

Many went into foreclosure or walked away from their financially underwater properties.

Others were able to refinance their loans or have some of the debt forgiven by the lenders. These options, while preferable for many, did produce some tax issues that will be discussed a bit later in this post.

Guilty of scamming over-leveraged homeowners: The bottom line, both financially and emotionally, was that these desperate homeowners were just trying to hang onto their homes.

That made them prime targets for scammers.

Now it's some of those scam operators who are paying the price.

The U.S. District Court for the District of Nevada last month slapped the operators of a mortgage relief scheme with an almost $18.5 million judgment.

The precise court-ordered fine is $18,428,370. That's also this week's early By the Numbers honoree.

False claims aimed at desperate homeowners: The scammers deceived financially distressed homeowners by falsely promising to make their mortgages more affordable, according to court documents and the Federal Trade Commission's (FTC) Dec. 30, 2019, announcement of the ruling.

The companies also charged consumers illegal advance fees and unlawfully told consumers not to pay their mortgages to or communicate with their lenders.

In the original charges filed in January 2018 by the FTC, the defendant companies and their operators typically charged consumers $3,900 in unlawful advance fees, to be paid in $650 monthly installments.

The FTC charged that the mortgage relief scheme promised that the money would go toward providing the homeowners with expert legal assistance, which the companies touted as having a near 100 percent success record. They also allegedly misrepresented they would cut homeowners' interest rates in half and reduce their monthly mortgage payments by hundreds of dollars, according to the FTC.

"In many instances, consumers paid hundreds or thousands of dollars only to learn that the defendants had not obtained the promised loan modifications, and in some cases had never even contacted the lenders," said in announcing its case almost two years ago. "As a result, many people incurred substantial interest charges and other penalties for paying the defendants instead of their mortgage payments, and some lost their homes to foreclosure."

Bank accounts, other assets confiscated: In order to help satisfy the Nevada federal court's $18.5 million judgment, the contents of numerous bank accounts also have been ordered to be turned over to the FTC.

Additionally, the court ordered that assets belonging to the defendants, including an office building, ski chalet in Park City, Utah, and two luxury vehicles also will be sold by the federal government.

These funds then can be used by the FTC to provide compensation to the homeowners affected by the mortgage relief scheme.

Finally, U.S. District Judge James C. Mahan's final order granting the FTC's motion for summary judgment also states that "the defendants will be permanently banned from the debt relief business and will be banned from misleading consumers about the terms of other financial services they may offer, as well as from making misleading claims in advertisements."

The defendants subject to the order are Preferred Law PLLC; Consumer Defense LLC (Nevada); Consumer Defense LLC (Utah); Consumer Link Inc.; American Home Loan Counselors; American Home Loans LLC; Consumer Defense Group LLC, formerly known as Modification Review Board LLC; Brown Legal Inc.; AM Property Management LLC; FMG Partners LLC; Zinly LLC; Jonathan P. Hanley; and Sandra X. Hanley.

Legitimate mortgage and tax relief: Reworking a mortgage's terms so that the homeowners can keep the property is legal.

In some of these cases, the lender also agrees to write off, or forgive, a portion of the original loan amount to account for the new, much lower value of the property.

Tax law says that loan forgiveness, be it for a mortgage or consumer credit card, is considered to be income for the person who had his or her debt suddenly lessened.

If you're having a couple thousand in Visa or Mastercard debt forgiven, the tax bill might not be that big. Plus, you no longer have to worry about those payments, so for many it's an acceptable price to pay.

But when you're talking tens of thousands in a home loan, the tax bill can be daunting.

So in the wake of the bursting housing bubble and ensuing recession, Congress offered some tax relief for homeowners seeking ways to rework their mortgages so they could keep their houses.

The Mortgage Forgiveness Debt Relief Act was enacted on Dec. 20, 2007, allowing certain homeowners to avoid taxes on the portion of a mortgage that is partly or entirely forgiven when the lender restructures the loan or the property goes into foreclosure.

The law was designed to be temporary, providing short-term relief to help struggling homeowners (and the housing industry) recover during the economic downturn of the late 2000s.

But the provisions, part of the perpetually expiring tax breaks known as extenders, has been renewed repeatedly since their creation more than a dozen years ago. The latest extension was granted as part of the federal spending measure signed on Dec. 22, 2019.

Now the amount of a forgiven mortgage remains tax free through 2020.

If you do find yourself needing to restructure your home loan to avoid foreclosure, make sure you find reputable help in setting up your new mortgage.

Your best bet generally is to start with the lender that currently owns our loan.

If, however, that route isn't feasible and you are contacted by a company or person offering to help you save your home by restructuring your loan, check them out thoroughly. The FTC has additional information on mortgage relief scams and how to avoid them.

You also might find these items of interest:

4 tax law changes home buyers need to heed

Will your state make you pay up on forgiven federal mortgage debt?

Missouri county property tax collector refuses to be nickeled (or, presumably dimed)

Advertisements

// <![CDATA[ // <![CDATA[ // <![CDATA[ // <![CDATA[ // <![CDATA[ // <![CDATA[ // <![CDATA[ // <![CDATA[ // <![CDATA[ // <![CDATA[ // <![CDATA[ // <![CDATA[ // <![CDATA[ // <![CDATA[ // <![CDATA[ // <![CDATA[ // <![CDATA[ (adsbygoogle = window.adsbygoogle || []).push({}); // ]]> // ]]> // ]]> // ]]> // ]]> // ]]> // ]]> // ]]> // ]]> // ]]> // ]]> // ]]> // ]]> // ]]> // ]]> // ]]> // ]]>

0 notes