#SuccessInTrading

Text

Dive into the Exciting World of Financial Accumulator Options Trading with Deriv.

Dive into Financial Accumulator Options Trading with Deriv

___________________________________________________________

Introduction

Accelerate Your Earnings: With accumulator options, your payout skyrockets as long as the spot price remains within a specific range from the previous spot. Remember to close your trade before it reaches the upper or lower barrier to lock in your profits.

With accumulator options, your risk is clear-cut: it's limited to your initial stake or premium, say $5, with no margin requirements. The potential profit is boundless and can skyrocket as long as the upper or lower barrier isn't breached. At a 5% growth rate, your maximum profit is capped at 230 ticks, triggering automatic expiration and profit transfer to your account. Plus, there's a $10,000 ceiling on single-trade payouts; once reached, your trade closes, funnelling the earnings directly into your account. Accumulator options enable you to forecast whether the market spot price will remain within a specified range, offering an opportunity for potential gains.

Embark on Your Financial Journey: Exploring Accumulator Options Trading with Deriv

Accumulator options are presently available on derived indices, with future expansions into additional markets anticipated. Currently, traders can engage in trading the renowned Deriv volatility indices, ranging from the relatively stable 10 Index to the highly dynamic 100 Index. These derived indices operate 24/7/365, ensuring constant volatility and enabling traders worldwide to participate at their convenience, free from the constraints of traditional market hours.

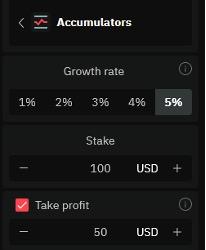

Understanding Your Growth Rate

Beyond choosing the underlying index to determine your preferred volatility level, you also have the option to set your growth rate at 1%, 2%, 3%, 4%, or 5%. This decision is finalised upon opening your contract and remains fixed throughout the duration of the trade.

Balancing Risk and Reward

Opting for a higher growth rate entails a narrower range, increasing the chance of your option expiring with no value. However, it also elevates the potential profits. It's the age-old trading conundrum: weighing risk against reward. Conversely, selecting a lower growth rate appeals to traders seeking reduced risk and aiming to minimise the likelihood of their accumulator option expiring worthless.

Exploring Growth Rate: Two Real-Life Examples

5% growth rate

Following the entry spot tick, your stake will steadily increase by 5% for each tick, as long as the spot price stays within ± 0.0049358253% of the previous spot price. It's important to note that with a 5% growth rate, the range is relatively narrow.

1% growth rate

Following the entry spot tick, your stake will steadily increase by 1% for each tick, as long as the spot price remains within ± 0.0064867741% of the previous spot price. With a 1% growth rate, the trading range is wider, resulting in a lower risk of knockout. Traders can also opt for growth rates between 1% and 5% for a balanced risk-reward ratio, tailored to their individual risk tolerance levels.

Manual vs. Automatic Profit Taking

Manual Profit Taking

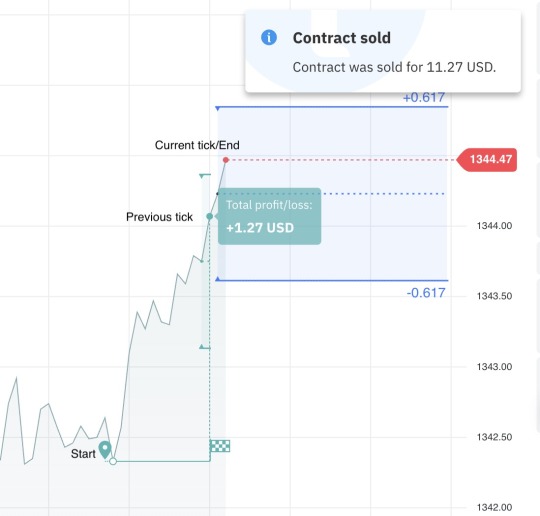

You have the flexibility to close an accumulator option at any time after the initial tick by simply clicking the SELL button. This instantly credits your stake and profits to your account, mitigating any additional risk exposure. However, if the upper or lower barrier is breached before you execute the trade closure, the option will expire worthless.

Clicking the Sell button will close the trade

If you choose to press SELL in this scenario, you will receive $134.01, comprising $100 as your original stake returned and an additional $34.01 as profit. It's important to be aware of the slippage risk, which entails the potential for slight price fluctuations in either direction by the time your trade is closed.

Automatic profit taking

In addition to manually closing a position to secure profits, you have the option to utilise the take profit feature. This feature enables you to set a predetermined level at which a trade will automatically close. For instance, you could set your take profit level at $50. Once the option reaches this threshold, the trade will close automatically, and your account will be credited with the profits and stake.

On the right, you'll find an illustration featuring a 5% growth rate, a $100 stake, and a $50 take profit. It's important to note that the take profit level cannot be adjusted once the trade is initiated. However, you still retain the ability to manually close the trade before it reaches the specified level. For example, if the trade achieves a $25 profit and you decide to secure gains, you can do so by clicking the sell button.

Take profit is set to $50.

Navigating Option Expiration

If you fail to close an accumulator option prior to the upper or lower barrier level being breached, it will automatically close. This results in the loss of any unrealized accumulated gains along with your stake. Until you initiate a new trade, you will not have any exposure. The following example illustrates a losing accumulator trade in which the market spot price dropped below the lower barrier price.

Lower barrier is breached, so the option closes at zero.

Short-Term Options: A Closer Look

Accumulator options are inherently short-term, ranging from 45 to 230 ticks in duration. This results in rapid realisation of potential losses or profits. For traders interested in longer-term opportunities, it's advisable to explore alternative options available on the deriv platform.

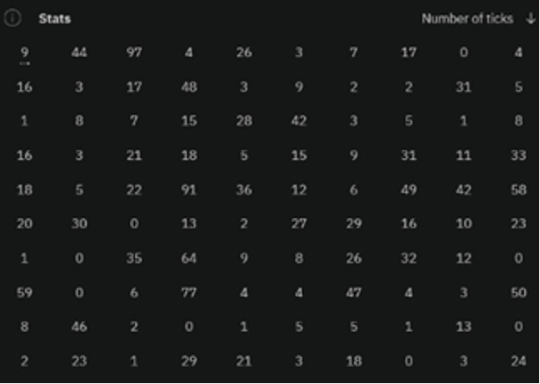

Utilising Statistics for Informed Decisions

To review the outcomes of the past 100 trades, simply click on 'Stats' and expand the view. The 'Stats' section showcases the history of consecutive tick counts, illustrating the duration the price remained within the specified range. Additionally, you can observe the number of ticks accumulated by the current option (open trade), denoted by the first number in the top left-hand column (as shown by '9' in this instance). Further details can be accessed by clicking on the three dots below. Furthermore, a summary of the last 10 trades is presented in the chart located at the bottom.

Statistical overview of historical accumulator option trades

Harnessing Technical Analysis and Charting

For traders keen on pattern analysis, transferring this data into a spreadsheet is an option. Additionally, the underlying index data (e.g., Volatility 100 Index) can be downloaded in CSV format. Given the short-term nature of these options, the default chart is a tick chart, also referred to as a line chart. Users can further augment this chart with widely-used technical analysis tools such as Moving Averages, Bollinger Bands, and MACD.

A chart enhanced with Bollinger Bands and MACD

Emphasising Full Fair Transparency

Similar to all Deriv products, every accumulator option undergoes thorough auditing and maintains complete transparency. Upon opening and closing each trade, regardless of its magnitude, a distinctive reference ID number is assigned. This meticulous process guarantees that every trade can be easily verified in the event of disputes or inquiries.

Exploring Effective Strategies for Accumulator Options

While it's essential for each trader to formulate their own trading strategy, here are several crucial factors to contemplate:

Mastering Money Management Techniques

Although you're cognizant of your maximum risk with an accumulator option, prudent money management remains paramount. For instance, if your overall risk threshold is $500, opting to risk 3% per trade equates to $15 per trade, affording you the opportunity for 33 trades. Naturally, you can adjust this percentage based on your individual risk tolerance.

Optimising Profit-Taking Strategies

Considering the rapid pace of accumulator options, adopting a lower-risk approach involves capturing profits after a few ticks, such as 3 ticks. Although this may result in modest gains, it mitigates the risk of the option expiring worthless. Conversely, some traders pursue a contrasting strategy by aiming for profits of 20 ticks or more. While this tactic may result in more trades expiring worthless, the successful trades yield substantially larger returns.

Maintaining Emotional Discipline

Maintaining emotional discipline is crucial, regardless of the market you're trading in. Numerous traders establish daily thresholds, ceasing trading once a predetermined profit target is reached or if losses exceed a set limit. It's advisable to refrain from trading on days where outcomes are unfavourable, opting instead to regroup. Furthermore, persist in utilising a demo account to explore new trading methodologies while temporarily stepping away from live trading.

Summary and Next Steps

Prior to committing actual funds, it's prudent to acquaint yourself with the product through a demo account, readily available at deriv.com. Here, you can explore accumulator options within authentic market environments and pricing dynamics, all without incurring financial risk. Once you've gained confidence in its functionality, transitioning to a funded account enables you to commence trading accumulator options with a nominal investment starting from just $5.

Here's to your trading success!

Dancun Juma.

Frequently Asked Questions

Q: On which markets are accumulator options available for trading?

A: Currently, accumulator options are accessible on volatility indices within derived indices. Expansion into additional markets is planned for the future.

Q: Can I open multiple accumulator options simultaneously?

A: While you're limited to one contract per instrument at a time, you can have multiple accumulator options open across different instruments. For example, you can have trades on Volatility 10, 75, and 100 Indices concurrently, but not multiple trades on the same instrument simultaneously.

Q: Is there a possibility of Deriv manipulating accumulator options?

A: Absolutely not. Deriv maintains a sterling reputation for fairness and ethical conduct across its 25-year tenure. With robust automation on its trading platforms, alterations to terms or prices for individual trades are prevented. Every trade undergoes auditing and receives a unique ID number, ensuring transparency and accountability.

Q: Are there any disparities between a Deriv demo and real account aside from funding sources?

A: No, both accounts operate identically on the same platform, featuring uniform pricing and terms. Consequently, performance on a demo account typically mirrors that of a real account, and vice versa.

Q: Can I automate accumulator options using Deriv Bot?

A: Presently, Deriv Bot does not support accumulator options automation. Trades must be executed manually, although the take profit feature remains available for use.

Q: Can I close an accumulator option at any time?

A: Yes, you have the flexibility to close your accumulator contract whenever you're content with the payout amount. However, if the spot price breaches the predefined range limits, your contract will automatically close, resulting in the loss of accumulated payout.

Q: Can I initiate an accumulator option trade at any time?

A: Indeed, accumulator options are tradable whenever the underlying market is operational, offering 24/7 availability for derived indices. However, temporary unavailability may occur if Deriv's internal stake limits are reached. Upon closure of existing positions, these limits reset, enabling normal contract opening.

Q: Is the accumulator option payout influenced by the direction of the underlying index?

A: No, payout escalation depends solely on the tick-by-tick movement of the underlying index within a predetermined range, unaffected by its overall trend. Only breaching the range limits impacts the outcome, resulting in potential losses.

Join derive today the best online trading platform and stand a chance of skyrocketing your earnings

#FinancialFreedom#DerivTrading#AccumulatorOptions#VolatilityIndices#TradingStrategies#RiskManagement#TechnicalAnalysis#ProfitTaking#EmotionalDiscipline#MarketAnalysis#OnlineTrading#Fintech#InvestmentStrategies#TradingTips#FinancialEducation#DayTrading#TradingPlatform#DerivBot#FreelanceCareer#OnlineIncome#WorkFromHome#FinancialIndependence#InvestmentOpportunities#TradingCommunity#FinancialMarkets#TraderLife#SuccessInTrading#PassiveIncome#EarnFromHome

0 notes

Text

Success in Forex trading comes from knowledge and strategy. Equip yourself with the right tools and techniques to navigate the dynamic market! 🛠️📊

#ForexKnowledge#TradingStrategy#SuccessInTrading#cates#forex#trade#GalaxyS24#Samsung#successful#succession#motivationalquotes#mindset#motivational#void success#loa success#success#successmindset#gift#men#learn#company#generation loss#girls generation#generation 1#techniques#case#star trek the next generation#experience#solutions#ai art generation

0 notes

Text

Pivot Power Unleashed: Elevate Your Trading with MSP Traders' Secret Weapon

Welcome to the trading revolution with MSP Traders! 🚀 In our latest video, we’re decoding the art of Pivot Trading and revealing the unbeatable advantages that can skyrocket your success in the markets! 🌐💹 Discover the power of clear decision-making, realistic target setting, and adaptability with Pivot Points. 🎯💡 Uncover the time-efficient strategies that make your trades more precise, and learn…

youtube

View On WordPress

#FinancialFreedom#MarketAnalysis#PivotPoints#PivotTrading#ProfitableDecisions#RiskManagement#SuccessInTrading#TechnicalAnalysis#TradingStrategies#Youtube

0 notes

Text

"4 Life-Changing Trading Rules That Made Trading Easy!"

youtube

In this week’s video, I am thrilled to share my personal journey and reveal the 4 life-changing trading rules that completely transformed my day trading experience. If you've struggled with day trading before, fret no more. These rules hold the key to unlocking success in the dynamic world of day trading!

#DayTrading#TradingRules#TradingSuccess#DayTradingStrategies#StockMarket#FinancialTrading#DayTrader#TradingTips#TradingExperience#SuccessInTrading#Youtube

0 notes

Text

Our Trading Courses have everything you need for your success.

🚀 Looking to skyrocket your trading career? 💰 Want to boost your daily earnings? Look no further! 🌟 InvestChannels Trading Courses have got you covered! 🎯

📈 Gain the knowledge, skills, and strategies you need to excel in the world of trading. Our comprehensive courses are designed to empower traders of all levels, from beginners to seasoned professionals. 📚

💡 With InvestChannels, you'll have access to a wealth of valuable resources that will help you navigate the complex world of trading with confidence. Our courses cover a wide range of topics, including:

✅ Technical analysis: Learn how to analyze charts, identify trends, and make informed trading decisions based on price action and indicators.

✅ Fundamental analysis: Discover how to assess the financial health of companies, analyze economic data, and make smart investment choices.

✅ Risk management: Master the art of preserving capital and managing risk effectively to safeguard your trading portfolio.

✅ Trading psychology: Understand the emotions and mindset that can impact your trading performance and learn techniques to stay focused and disciplined.

✅ Trading strategies: Explore a variety of proven trading strategies that suit different market conditions and trading styles.

🎓 Led by industry experts with years of experience, our courses provide practical, actionable insights that you can apply in real-world trading scenarios. Our instructors are dedicated to your success and will guide you every step of the way. 💪

🌍 Whether you're interested in stocks, forex, cryptocurrencies, or any other financial markets, our courses cater to a wide range of trading instruments. You'll gain the flexibility to choose the path that aligns with your goals and interests.

🔒 Rest assured, InvestChannels prioritizes the security of your financial information and personal data. We adhere to the highest standards of data protection, ensuring a safe and secure learning environment for our students.

💼 Don't miss this opportunity to invest in yourself and take your trading career to new heights. Join InvestChannels Trading Courses today and unlock the potential for greater financial success! 💸

🌟 Ready to get started? Visit our website (www.investchannels.com) to explore our course offerings and enrol today. Let's embark on this exciting journey together! 🚀

#InvestChannels#TradingCourses#FinancialEducation#GrowYourCareer#DailyEarnings#TradingStrategies#SuccessInTrading#InvestInYourself#LearnAndEarn#JoinUsToday#TradingCommunity#StockMarket#ForexTrading#CryptoTrading#DayTrading#InvestmentStrategies#TechnicalAnalysis#FundamentalAnalysis#RiskManagement#TradingPsychology#FinancialFreedom#MarketAnalysis#WealthCreation#TradingTips#TradeSmart#ProfitableTrades#MarketTrends#FinancialMarkets#TradingExperts#TradingMastery

0 notes

Photo

Are you ready to become a successful trader? It's no secret that trading can be a highly rewarding but challenging endeavor. To help you achieve your trading goals, we've compiled three tips for success in trading. First, it's important to set clear goals and develop a trading plan. Your trading plan should include your investment goals, risk tolerance, and trading strategy. By having a plan in place, you'll be better equipped to make informed trading decisions. Second, stay disciplined and stick to your plan, even when emotions are high. Emotions such as fear and greed can cloud your judgment and lead to impulsive trading decisions. By staying disciplined and sticking to your plan, you'll be able to make rational decisions based on your trading strategy. Finally, continuously educate yourself and stay up-to-date on market trends. The world of trading is constantly evolving, and staying informed is crucial to success. Consider reading trading books, attending webinars, and networking with other traders to gain new insights and ideas. Remember, trading is a marathon, not a sprint. Success requires patience, persistence, and a willingness to learn from your mistakes. Start small, stay focused, and never stop improving. With dedication and hard work, you can achieve your trading goals. Happy trading! #tradingtips #successintrading #patience #persistence #neverstoplearning (at New York, New York) https://www.instagram.com/p/CpVQONsust7/?igshid=NGJjMDIxMWI=

0 notes

Text

youtube

https://tradegenie.com/ - Welcome to our YouTube video, "Markets and YOU." In this insightful and transformative presentation, we delve deep into the world of trading, unveiling crucial elements that separate the best traders from the rest.

Join us as we explore recent Calls and Puts trades, uncovering how they play a pivotal role in shaping your trading journey. Learn about the delicate balance between Responsibility and Success, and discover the single most important factor that can make or break your trading career.

The heart of this video is "YOU." We reveal the secrets of the top traders who unconsciously perform self-analysis, but more importantly, we equip you with the tools to join the elite 11% of traders who consciously engage in self-analysis. Understand the profound impact of your Beliefs, the Outcome Attribution Bias, and the interplay between You, the Market, Your Trading System, and Strategy.

Unlock the key components of successful trading, and learn how your contribution can significantly impact your journey towards becoming a successful trader. Dive into Risk Control Components, and understand their pivotal role in minimizing losses and maximizing profits.

"Markets and YOU" is not just about trading, it's about mastering the psychology, strategy, and risk management that can lead to success. So, join us as we guide you on a path to becoming a more confident and informed trader.

Stay tuned to the end, where we discuss "How I Feel Today" and why your emotional state is a vital factor in your trading decisions. Don't miss this opportunity to elevate your trading skills and embark on a journey towards financial success. Like, subscribe, and hit that notification bell to stay updated with our latest content on trading and finance.

Limited-Time Offer: Join Swing Options Service

Join our Swing Options Service monthly at a trial price of $97 instead of the regular price of $197.

Use promo code "SAVE100" to get an incredible $100 OFF!

For more information and resources, visit our coaching page: https://tradegenie.com/coaching/

Connect with us on Facebook: / therealtradegenie

Head Office:

Trade Genie Inc.

315 South Coast Hwy 101,

Encinitas, CA 92024

Phone Number: 212-930-2245

Email: [email protected]

#TradingTips

#MarketAnalysis

#SuccessInTrading

#RiskManagement

#TradingPsychology

#InvestmentStrategies

#FinancialSuccess

#SelfAnalysis

#CallsAndPuts

#TradingJourney

#TopTraders

#BeliefsMatter

#ProfitMaximization

#StayInformed

#TradingEducation

#MarketInsights

#FinancialLiteracy

#Trading-Tips#Market-Analysis#SuccessIn-Trading#Trading-Psychology#Investment-Strategies#Financial-Success#Youtube

0 notes

Photo

Journey of a Thousand Miles begins with a Single Step. -Lao Tzu #Tempertrader #tradingphycology #mindsetforsuccess #technicalanalysis #tecphycoanalysis #successintrading #forex #forexforbeginners #novicetraders #forexknowledge #stockmarket #stocksanalysis #stocksforbeginners #tradingforbeginners #tradefromhome #howtomakemoney #howtomakemoneyfromhome #howtoearnmonneyfrommybedroom #lowrisk #lowriskytrader #lowrisktradingmethods #lowrisktradingstrategies #strategictrading #strategicinvesting #strategictradeplanning #tradingknowledge #setlonggoals #tradingbehavior #letsdoit #challengeaccepted https://www.instagram.com/p/CAzzNtoJEH3/?igshid=n5ptjvvqws31

#tempertrader#tradingphycology#mindsetforsuccess#technicalanalysis#tecphycoanalysis#successintrading#forex#forexforbeginners#novicetraders#forexknowledge#stockmarket#stocksanalysis#stocksforbeginners#tradingforbeginners#tradefromhome#howtomakemoney#howtomakemoneyfromhome#howtoearnmonneyfrommybedroom#lowrisk#lowriskytrader#lowrisktradingmethods#lowrisktradingstrategies#strategictrading#strategicinvesting#strategictradeplanning#tradingknowledge#setlonggoals#tradingbehavior#letsdoit#challengeaccepted

7 notes

·

View notes

Photo

#Patience is the key to #success in #trading - Be patient with your trades and be patient with your progress - #Success doesn't come overnight. #TradingTips #TradingEdge #SuccessInTrading #EliteZone #ForexTrading #ForexTrader #Stocks #OptionsTrading #Options #Investing #SuccessInLife #SecondIncome #forexmentor #successquotes #successful #entrepreneur http://ift.tt/2i9DsiG

1 note

·

View note

Text

3 Most Important Steps In Trading - Dynamic Technologies

Mastering the Art of Trading: 3 Essential Steps 📊

1️⃣ Knowledge is Key: Educate yourself about market trends, strategies, and risk management.

2️⃣ Practice Makes Perfect: Utilize demo accounts and simulation tools to hone your skills.

3️⃣ Discipline is Everything: Stick to your trading plan, manage emotions, and avoid impulsive decisions.

#StockMarket#TradingTips#TradingStrategies#FinancialEducation#RiskManagement#MarketAnalysis#TradingSkills#InvestmentStrategies#TradeSmart#TradingCommunity#DisciplineInTrading#TradingSuccess#FinancialFreedom#TradingMindset#TradingGoals#TradingJourney#SuccessInTrading#daytrader#stocktrader#swingtrading

1 note

·

View note

Photo

“You don't think of what you want, you think about what you want to avoid and invert.” -Charlie Munger Charlie has been a big proponent of solving problems by inverting. The way it works is that if you are trying to succeed at something, you figure out all the ways that you could fail at it, and then pursue a plan that avoids those ways. Applying that to investing, how would you lose the most money possible? It would be by investing in bad businesses, at high prices, with weak balance sheets managed by dishonest or incompetent people. Avoiding all those attributes in an investment is very likely to improve your investing results. #Tempertrader #tradingphycology #mindsetforsuccess #tecphycoanalysis #successintrading #forex #forexforbeginners #novicetraders #forexknowledge #stockmarket #stocksanalysis #stocksforbeginners #tradingforbeginners #tradefromhome #howtomakemoney #howtomakemoneyfromhome #howtoearnmonneyfrommybedroom #lowrisk #lowrisktradingmethods #lowrisktradingstrategies #strategic #strategictrading #strategicinvesting #strategictradeplanning #strategicplanningofinvesting #tradingknowledge #setlonggoals #tradingbehavior #letsdoit #challengeaccepted https://www.instagram.com/p/CAsTB5DJyey/?igshid=3pon954lb7gf

#tempertrader#tradingphycology#mindsetforsuccess#tecphycoanalysis#successintrading#forex#forexforbeginners#novicetraders#forexknowledge#stockmarket#stocksanalysis#stocksforbeginners#tradingforbeginners#tradefromhome#howtomakemoney#howtomakemoneyfromhome#howtoearnmonneyfrommybedroom#lowrisk#lowrisktradingmethods#lowrisktradingstrategies#strategic#strategictrading#strategicinvesting#strategictradeplanning#strategicplanningofinvesting#tradingknowledge#setlonggoals#tradingbehavior#letsdoit#challengeaccepted

4 notes

·

View notes

Text

youtube

https://tradegenie.com/ - In this 50-minutes session from Trade Genie (https://tradegenie.com), I have explained why traders succeed and why they fail. What are the qualities of successful traders and what wrongs things they do to fail? I have also shown via example what mountain a trader must climb in order to be successful.

Websites:

https://mytradegenie.com/

https://financialmarketswizard.com/

https://nosheekhan.com/

Twitter - https://twitter.com/marketswizard

Facebook - https://www.facebook.com/financialmar...

Head Office:

Trade Genie Inc.

315 South Coast Hwy 101,

Encinitas, CA 92024

Phone Number: 212-408-3000

Contact: [email protected]

#TechnicalAnalysis#SuccessinTrading#FailureinTrading#BreakoutStrategy#BreakoutReversalStrategy#OpeningRangeBreakout#GapUp#GapDown#MarketsAnalysis#Youtube

0 notes