#Leading Companies KSA Warehouse Automation Market

Text

Decoding KSA's Warehousing Automation: Demand and Supply Insights: Ken Research

Saudi Arabia (KSA) drives warehousing automation as a regional logistics epicenter, fueled by a consolidated market and booming e-commerce demand.

Storyline

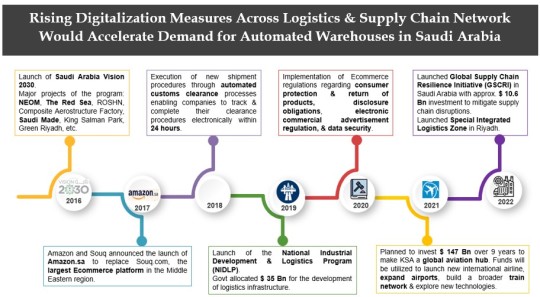

Saudi Arabia's infrastructure initiatives drive demand for automated warehouses.

Growing demand for cold storage services presents growth opportunities.

Focus on e-commerce and retail fuels demand for automation.

As per Ken Research estimates, Warehousing and logistics industry poised to undergo a transformative automation phase.

Existence of a consolidated market scenario amongst the growing warehousing automation industry globally, KSA’s government has made the push to turn the nation into a Regional Logistics Epicenter necessitating automation as the key parameter for a Regional Logistics Chain, enabling faster growth of KSA’s warehouse automation industry. On the other hand, an unprecedented surge in E-commerce market has balanced the demand side of the market. In this piece, we uncover the industry landscape, demand & supply side of KSA’s Warehousing automation industry.

1.Supply side boost: Government Plans and E-commerce Fuel Automated Warehouses in KSA.

To learn more about this report Download A Free Sample Report

Saudi Arabia's ambitious government infrastructure plans, including initiatives like NEOM, The Red Sea, ROSHN, and the National Industrial Development & Logistics Program (NIDLP), have created a solid foundation for the logistics network in the country. These developments, supported by a $35 Bn allocation for logistics infrastructure, have led to an increased demand for automated warehouses. (~$ 100 Bn in its transportation & logistics infrastructure) The focus on efficiency, speed, and accuracy in the supply chain has made the implementation of automated warehouse solutions essential. This growing demand is driven by the booming e-commerce industry's evolving requirements, the need to streamline operations, and ensure timely deliveries.

2.Demand Surge: Saudi Arabia's Rise as a Transshipment Hub Spurs Demand for Affordable Modern Warehouse Solutions.

Visit This Link: - Request For Custom Report

The rising demand for cold storage services in Saudi Arabia, primarily driven by the food and beverage (F&B) and pharmaceutical sectors, is leading to significant growth opportunities. To cater to this demand, companies are adopting asset-light models and relying on third-party logistics (3PL) providers who offer specialized cold storage solutions, given that only 5% of the warehouses are currently automated. These providers leverage innovative technologies to ensure efficient operations and maintain the quality and integrity of stored products. As a result, companies are strategically expanding their warehouses and investing in cutting-edge solutions. This transformative phase is focused on meeting the evolving needs of the F&B and pharmaceutical sectors while gaining a larger market share.

3.“A balance to be the solution:” The demand and market share of e-commerce and retail is expected to increase in the future due to increasing focus towards reducing the overall sales cycle duration.

Request For 30 Minutes Analyst Call

Experience the transformative power of automation as it reshapes the warehousing and logistics landscape, propelling the retail and e-commerce industry into a new era. In this fast-paced world, e-commerce automation software becomes the key driver, enabling businesses to focus on their core strengths and strategic goals. The adoption of automated warehouse management systems empowers 3PL companies to achieve unprecedented efficiency, accuracy, and real-time inventory visibility, while reducing costs and enhancing customer service. As per our estimates at Ken Research, the market will grow at a steady pace undergoing transformative warehouse automation process.

#KSA Warehouse Automation Market#KSA Supply Chain Automation Market#KSA Inventory Automation Market#Trends KSA Warehouse Automation Market#KSA Warehouse Automation Market Opportunities#Challenges KSA Warehouse Automation Market#Number of Warehouses in KSA#Number of Logistics Service Providers in KSA#Competition KSA Warehouse Automation Markets#Schaffer Warehouse Automation KSA Market Share#Oracle KSA Market Share#Swisslog KSA Market Revenue#CIN7 KSA Annual Revenue#Grey Orange KSA Market Share#Ancra KSA Market Revenue#Fizyr KSA Market Share#Caja KSA Annual growth#Investment KSA Warehouse Automation Market#Leading Companies KSA Warehouse Automation Market#Emerging Companies KSA Warehouse Automation Market#Major Players KSA Warehouse Automation Market#KSA AMR Market#Handplus Robotics KSA Market Share#Fetchr KSA Market Revenue#Flytbase KSA Market#Warehouse Automations Lab KSA Market#Saco KSA Market Share#Actiw KSA Market Revenue#Airmap KSA Market Share#Welcome Bank KSA Market Share

0 notes

Text

GCC Logistics Industry Assessment 2020

Governments in the region have undertaken policy measures to reduce their dependency on oil exports by strengthening economic diversification initiatives, and tax reforms, improving the investment climate, increasing investment in food security, and encouraging private sector participation. The region’s geographical location in the trans-continental trade has facilitated its focus on the development of logistics hubs for both domestic and transit goods.

Stringent containment measures to arrest the spread of Coronavirus 2019 (COVID-19) have resulted in a sharp decline in economic and trade activities. Some of these measures include the imposition of travel restrictions, border closures, and lockdowns which have impacted freight capacity and flow of goods in the GCC region. The region is anticipated to see a contraction in the first two quarters of 2020. As the curfews and lockdowns are relaxed, trade activities are expected to pick up in the second half of 2020.

During the rebound phase from the pandemic, digital transformation initiatives are likely to be undertaken in the region with the support of government initiatives that call for the application of digital technologies in both government and private sectors. United Arab Emirates (UAE) and the Kingdom of Saudi Arabia (KSA) are likely to emerge as front runners in technology adoption in the areas of customs clearance and port terminal operations. The logistics start-up ecosystem has benefited from government initiatives, increased internet penetration, and mobile technologies. Modern warehouses are becoming automated with more use of robotics, and companies are experimenting with the use of autonomous vehicles and drones for efficient and faster last-mile deliveries. Lamyaa Logistics

Advancements in digital technologies are expected to influence manned and unmanned connected autonomous transportation as well as connected physical transportation infrastructure driven by the application of smart sensors. In addition, automation, robotics, autonomous vehicles, and Big Data analytics are expected to either transform or disrupt logistics service offerings.

Key Issues Addressed

What are the key freight market and warehousing trends that are likely to shape the future of the GCC logistics industry? What is the impact of COVID-19 on the GCC economy and on the logistics industry?

What are the major digital technologies that are transforming freight transportation, warehousing, logistics, and supply chain solutions, and what is their impact on logistics industry value chain participants?

What are the emerging business model-driven disruptive digital technologies that are expected to open up new business opportunities for service providers?

What are the strategic considerations for leading logistics business through the COVID-19 crisis period? Lamyaa Logistics

Key Topics Covered

1. Executive Summary

Executive Summary – Key Developments in 2019

Executive Summary – Industry Size by Country and Segments

Executive Summary – Logistics Industry Outlook

Digitalization and the Emergence of Digital Platforms

Key Findings – Top Predictions for 2020

2. Research Scope and Segmentation

Research Scope

Definitions

Research Aim and Objectives

Key Questions this Study will Answer

Research Background

3. Key Trends to Watch – Transportation and Logistics Industry

COVID-19 – Confirmed Cases and Recovery Rates

GCC – Government Response to COVID-19

GCC – Economic Profile and Key Indicators

Economic Diversification and Logistics Capacity Development

Regional Trade Integration and Transhipment Hub

Demography and Changing Structure of Population

Farm Outsourcing and Transformations in Food

Expo2020 Dubai and Logistics Growth Prospects

Logistics Technologies and Segments

Digitalization and Logistics Process Automation

4. GCC Logistics Industry – Regional Outlook

Industry Structure by Segments

Logistics Industry Size Forecasts

Regional Logistics Industry – GCC

Logistics Industry Segments

Classification of Logistics Service Providers

Key Industry Challenges

COVID-19 Impact and Measures

Major Service Providers in Action

5. GCC Freight Transportation Trends

Sea Freight – Container Throughput

Sea Freight – General and Bulk Cargo

Sea Freight Developments

Digitalization of Port Infrastructure

Air Freight – Cargo Handled by Major Airports

Air and Sea Freight Partnerships

Logistics Start-ups – Freight Management and Tracking

Road Freight

GCC Rail Freight

6. GCC Freight Forwarding Trends

Digital Forwarding Solutions

Digital Technologies

7. GCC Warehousing Market Trends

Warehouse Clusters

Warehousing Service Providers

Economic Free Zones and Major Economic Cities

Digital Warehouse Technologies

8. GCC CEP Market Trends

eCommerce and Innovations in Last-Mile Delivery

Competitive Environment – CEP

eCommerce Logistics – Cross-border

Digital Technologies

Last-Mile Delivery Innovations

Logistics Start-ups – Last-Mile Delivery

9. Growth Opportunities and Companies to Action

Key Growth Opportunities

Growth Opportunity – Logistics Services

Strategic Imperatives for Success and Growth

1 note

·

View note

Photo

Swisslog appoints David Dronfield as the new GM In response to the growing interest in robotic automation throughout the region, David will be responsible to secure new business, manage technology and service support for Swisslog’s customer base Leading automation expert, Swisslog announced the appointment of David Dronfield as the new General Manager for its Middle Eastern operations. David brings more than 35 years of professional experience in the warehouse automation sector with expertise across sales, marketing, business development, project management and in managing senior leadership roles. With the increased interest in warehouse automation, David will be responsible for growing Swisslog’s regional customer base and creating awareness about the need for professionally integrated warehouse automation systems. As the new General Manager, David will support businesses with the provision of custom solutions that gives them a competitive advantage. Having worked in the industry for more than three decades, David brings with him a wealth of experience and industry expertise. Prior to joining Swisslog Middle East, David has served as Founder & Managing Director of Intralogistic Solution, a company providing intralogistic design, supply chain consulting & turnkey equipment solutions. Additionally, he has worked as the Regional General Manager for Al Futtaim Auto & Machinery Company LLC, implementing initiatives for a strategic expansion of UAE based Industrial Storage & Handling Solutions business operations across the GCC region, namely Oman, Qatar, Bahrain and KSA #automation #supplychain #logistics (at Emirate of Dubai) https://www.instagram.com/p/CSJVh_ABiWD/?utm_medium=tumblr

0 notes