#KYC

Text

There’s never just one ant

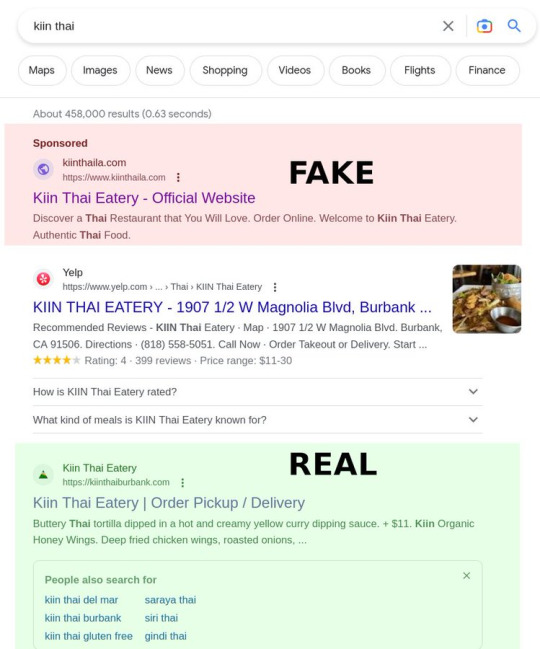

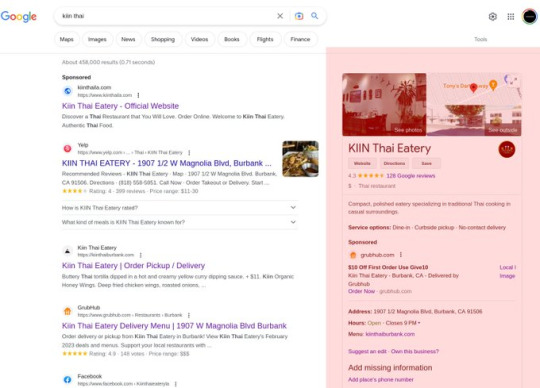

So there's a great Thai restaurant in my neighborhood called Kiin. Yesterday, I searched for their website to order some takeout. Here's the Google result.

That top result (an ad)? It's fake. It goes to https://kiinthaila.com, which is NOT the website for Kiin.

The *third* result is real: https://kiinthaiburbank.com

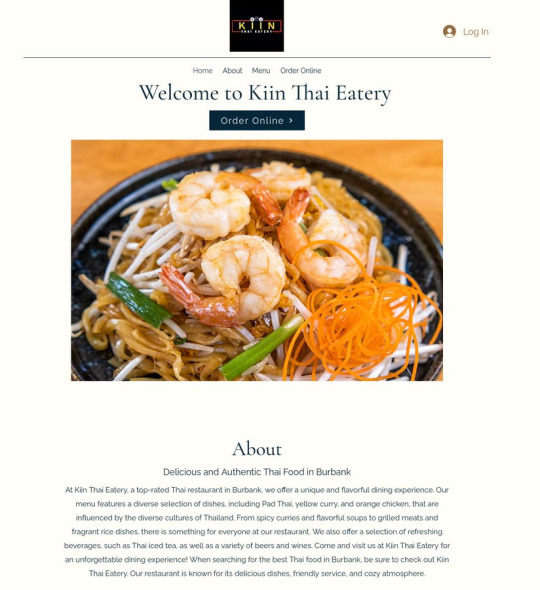

Fake site:

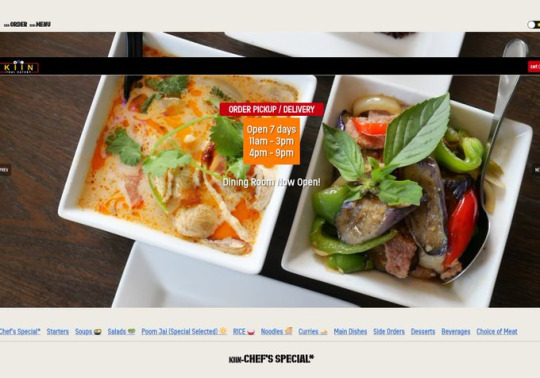

Real site:

I got duped. I placed an order with the fake site. The fake site then placed the order - in my name! - with the real site, having marked up the prices by 15%. Kiin clearly knows they're doing this (presumably by the billing data on the credit card the fakesters use to place the order). They called me within minutes to tell me they'd cancelled the fakesters' order.

I could still come pick it up, but I'd have to pay them, and cancel the payment to the fakesters with Amex. Actually, as it turns out, I have to cancel TWO payments, because the fakesters DOUBLE-charged me.

Here's what that charge looks like on my Amex bill. See that phone number? (415) 639-9034 is the number for Wix, who provides the scammers' website.

How the actual FUCK did these obvious scammers get an Amex merchant account in the name of "KIINTHAILA" by after supplying the phone number for a website hosting company? What is Amex's KYC procedure? Do they even call the phone number?

And why the actual FUCK is Google Ads accepting these scam artists' ads for a business that they already have a knowledge box for?! Google KNOWS what the real KIIN restaurant is, and yet they are accepting payment to put a fake KIIN listing two slots ABOVE the real one.

To be fair to these scammer asshole ripoff creeps who are trying to steal from my local mom-and-pop, single location Thai eatery, they're just following in the shoes of Doordash and Uber Eats, who did the same thing to hundreds (thousands?) of restaurants during lockdown.

Doug Rushkoff says that the ethic of today's "entrepreneur" is to “Go Meta” - don't provide a product or a service, simply find a way to be a predatory squatter on a chokepoint between people who do useful things and people who use those things.

These parasites have turned themselves into landlords of someone else's home, collecting rent on a property they don't own and have no connection to.

There's NEVER just one ant. I guaran-fucking-tee you that these same creeps have 1,000 other fake Wix websites with 1,000 fake Amex merchant accounts for 1,000 REAL businesses, and that Google has sold them ads for every one of them. Amex and Google and Wix should be able to spot these creeps FROM ORBIT. Holy shit do we live in the worst of all possible timelines. We have these monopolist megacorps that spy on and control everything we do, wielding the most arbitrary and high-handed authority.

And yet they do NOT ONE FUCKING THING to prevent these petty scammers from using their infra as force-multipliers to let them steal from every hungry person patronizing every local restaurant.

I mean, what's the point of letting these robber-barons run the entire show if they're not even COMPETENT?

ETA: Dinner was delicious

11K notes

·

View notes

Text

I have an interview tomorrow and I’m shit scared.

#mine: text#bpd#college#currently watching#identity crisis#dark academia#exams#movies#job interview#finance#aml#kyc

3 notes

·

View notes

Text

Sweden's Exemplary Anti-Corruption Stand: A Deep Dive into KYC and AML Practices

In the realm of global integrity and transparency, Sweden stands tall as the paragon of virtue, earning the coveted title of the world's least corrupt country, as per the Corruption Perceptions Index (CPI).

Behind this remarkable achievement lies Sweden's unwavering commitment to combat corruption through robust Anti-Money Laundering (AML) laws, particularly focusing on stringent Know Your Customer (KYC) protocols. These protocols require financial institutions to verify the identity of their customers and any transactions they make. Furthermore, Sweden has implemented measures to protect whistleblowers and to ensure that any instances of corruption are investigated and prosecuted.

The Pillars of Trust: KYC in Sweden

Sweden's success in maintaining its reputation for integrity is deeply rooted in its proactive approach to KYC. The KYC process, an integral part of financial and business operations, plays a pivotal role in preventing corruption and money laundering by ensuring thorough identification and verification of customers. Sweden has invested heavily in its KYC system, building a comprehensive database of customer information. It has also implemented strict regulations requiring companies to report suspicious activity to the government. As a result, Sweden has become a world leader in the fight against financial crime.

KYC Solutions: More than a Mandate

KYC in Sweden goes beyond mere compliance; it serves as a comprehensive solution to safeguard the financial ecosystem. The emphasis on accurate customer identification, risk assessment, and ongoing monitoring establishes a formidable defense against illicit financial activities. Sweden's KYC system also promotes customer trust and increases customer convenience. By streamlining the onboarding process, customers can easily open an account and start trading. Additionally, the KYC system provides customers with better control over their money, as they can easily monitor their account activity.

Compliance at the Core

Sweden's commitment to compliance is evident in its KYC practices. Striking a delicate balance between stringent regulations and practical implementation, the country has fostered an environment where businesses operate with transparency and adhere to the highest ethical standards. Sweden's KYC regulations are designed to prevent money laundering and financial crime. The country has put in place a comprehensive set of measures, including customer due diligence, to ensure that businesses comply with the law. Additionally, Sweden has implemented a reporting system that allows authorities to track suspicious activity in real time.

AML Laws in Sweden: A Global Benchmark

Sweden's AML laws are not just a legal requirement but a testament to its commitment to global financial integrity. The country's legal framework provides a solid foundation for detecting and preventing money laundering activities, contributing significantly to its stellar position on the CPI. Sweden also has a strong commitment to international cooperation and information sharing, which helps to further strengthen the AML legal framework. Additionally, the country has implemented strict regulations on financial institutions, including requirements to report suspicious transactions.

KYC Service Providers – KYC Sweden Leading the Way

Sweden has emerged as a frontrunner in KYC solutions, with a focus on providing efficient and reliable services. KYC service providers in Sweden leverage advanced technologies and methodologies to offer the best-in-class identification and verification processes, setting the gold standard for global counterparts. Swedish KYC providers also provide the highest level of security, protecting customer data and complying with all local regulations. Furthermore, Swedish KYC providers offer a wide range of services, including onboarding, identity verification, and fraud prevention.

KYC for Swedish Businesses: A Necessity, not an Option

For businesses operating in Sweden, KYC is not merely a regulatory checkbox but a fundamental practice. The stringent KYC requirements ensure that businesses are well-acquainted with their clients, mitigating the risk of involvement in any illicit or corrupt activities. It also helps to protect the rights of customers, as it ensures that they are aware of who is handling their data. KYC also helps businesses to identify any potential risks associated with doing business with a particular customer.

Global Impact: KYC Sweden's Ripple Effect

Sweden's commitment to KYC and AML has a ripple effect beyond its borders. Businesses operating globally, including Swedish enterprises with international footprints, benefit from the robust KYC measures in place. This not only safeguards these businesses but also contributes to the overall global effort against corruption. As a result, other countries and organizations are encouraged to implement strong KYC and AML measures, which help to create a safer business environment for everyone. Additionally, these measures help to protect consumers from malicious actors and financial crimes.

Conclusion

Sweden's standing as the world's least corrupt country is a testament to its meticulous implementation of KYC and AML laws. By placing compliance, integrity, and transparency at the forefront of its financial practices, Sweden has set a precedent for nations worldwide. As businesses and governments grapple with the challenges of maintaining trust and financial integrity, KYC Sweden's model of KYC and AML serves as an exemplary beacon guiding the way forward. The integration of KYC solutions is not just a legal requirement for Sweden; it is a proactive strategy that continues to fortify its position as a global leader in the fight against corruption.

#compliance#kyc#kyc compliance#kyc solutions#kyc and aml compliance#kyc api#kyc services#kyc verification#digital identity#kyc sweden

2 notes

·

View notes

Text

Discover a new era of banking possibilities with Simplici

Simplify and elevate your banking operations with Simplici’s cutting-edge solutions. Our transformative technologies empower banks to stay ahead of the competition, deliver seamless experiences, and drive customer loyalty.

2 notes

·

View notes

Text

KYC API Provider in UK

Stay secure and protect your business from financial fraud using the KYC API. KYC helps verify business identities and facilitate fast customer onboarding for almost every UK industry's business. We are one of the most trusted KYC API providers in the UK and instantly deliver the most matching results for banking, finance, cryptocurrency, insurance, fintech, healthcare, and online gaming sectors.

#kyc verification#kyc#kyc api#KYC Solution Provider UK#KYC API Providers#KYC Companies#KYC Software#banking#finance#healthcare#insurance#cryptocurrency#gaming#fintech#UK KYC

3 notes

·

View notes

Text

The Yo bit cryptocurrency exchange has been operating since 2014.

There are several thousand currency pairsVery.

Simple and uncomplicated registration without KYC (no photos or documents required)

Replenishment of the account in any cryptocurrency without a minimum amount and commission, as well as in payeer, advcash, perfect money.

Payouts are also for all crypto. trading commission 0.2% There is an investment platform

Sign up in Yobit

#crypto#cryptocurrencies#blockchain#bitcoin cryptocurrency crypto altcoin altcoin daily blockchain decentralized news best investment top altcoins ripple ethereum tron stellar#yobit#binance#KYC#exchanges#etherium#crypto market#crypto token#crypto money#dogecoin (doge)#litecoin#cardano#polkadot#payeer#perfect money etc.#advcash

6 notes

·

View notes

Text

#Finance Management Software#Small business financial management#bank balance check online#Financial Management Software#ACH payment processing software#Bank PDF Statements#automated income verification#finance#fintech#kyc

2 notes

·

View notes

Text

How will digital banking units (DBUs) transform banking in India?

Read this blog to learn how digital banking units are transforming banking services in India and how you can benefit from this huge change.

Learn More: https://nbfcadvisory.com/how-will-digital-banking-units-dbus-transform-banking-in-india/

2 notes

·

View notes

Photo

MCA Filing Calender for financial year 2021-2022

https://taxrupees.com/

2 notes

·

View notes

Text

Best Id & Document Scan Verification in 2022

Melissa's ID & Document Verification is service enables businesses to confidently onboard new customers with cutting-edge technology integrating the use of AI, machine learning, and biometrics.

2 notes

·

View notes

Text

(Via https://x.com/LinaSeiche/status/1783965281921986979)

0 notes

Text

Five Tips for Enhancing Your KYC Compliance and AML Procedures

In today's rapidly evolving regulatory landscape, maintaining robust Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance processes is more crucial than ever for businesses. These processes go beyond mere regulatory requirements; they form the cornerstone of secure operations, global expansion, customer trust, and data-driven insights. In this article, we'll delve into five essential tips to optimize your KYC processes and ensure AML compliance.

Understanding KYC and AML Compliance

KYC, short for Know Your Customer, refers to the practice of verifying and assessing the identities and risk levels of your customers. This procedure is vital for adhering to regulatory mandates and mitigating risks associated with financial crimes like money laundering and fraud. KYC plays a pivotal role in maintaining a secure business environment and building trust with clients.

Non-compliance with KYC regulations can lead to severe repercussions such as hefty fines, legal actions, reputational damage, and business disruptions. Therefore, adhering to KYC regulations is not just a necessity; it's a protective measure for your business.

1. Screening Against Current Lists

Efficient KYC begins with screening customers against relevant, up-to-date lists. Utilizing comprehensive KYC solutions equipped with advanced technology and access to databases containing sanction lists, politically exposed persons (PEPs) databases, and other watchlists enhances the accuracy of your screening processes.

By incorporating these KYC screening tools, you minimize risks and ensure compliance while reducing false positives, which ultimately saves valuable time and resources.

2. Integration with Risk Assessment

Integrating KYC into your broader risk assessment framework is crucial for maintaining an effective process. Customer information can change rapidly, necessitating continuous monitoring. Regularly reviewing and updating KYC data enables you to adapt to shifting risk profiles and make informed decisions.

Furthermore, integrating KYC data into your risk assessment facilitates a seamless link to ongoing due diligence processes. For instance, if a customer's risk profile changes due to a new business venture, you can proactively adjust your risk mitigation strategies.

3. Establishing Scalability

Keeping up with new clients and evolving compliance requirements requires a flexible and scalable KYC process. Onboarding new clients, regardless of their type, should be a consistent and streamlined process rather than a burden.

Investing in a scalable KYC solution capable of handling increasing data volumes and simplifying onboarding processes is key. Such a solution enables instant screening and efficient onboarding, allowing you to focus on growth without hindrances.

4. Preparing for Regulatory Challenges

The landscape of AML and KYC compliance is continually evolving, with regulators worldwide tightening their grip on financial institutions. Preparing for these challenges by embracing technology-driven KYC solutions can lead to automation, enhanced accuracy, and improved customer experiences.

Automated KYC solutions provide the means to avoid the hefty fines and regulatory scrutiny associated with non-compliance. Staying ahead of regulatory changes through technology-driven approaches is a strategic move for safeguarding your business.

5. Seeking Expert Assistance

In the face of complex regulatory requirements and the ever-changing landscape of AML and KYC compliance, seeking expert assistance can prove invaluable. Companies like KYC Sweden offer AML platforms that seamlessly integrate KYC responses with transaction monitoring.

This integration allows for quick identification of unusual transaction behavior, reducing the risk of being unwittingly involved in money laundering or terrorist financing. Outsourcing transaction monitoring to experts through a Managed Service can streamline your compliance efforts.

In conclusion, optimizing your KYC and AML processes is not only about regulatory compliance but also about safeguarding your business and fostering trust with clients. By following these five tips, incorporating technology-driven solutions, and staying prepared for regulatory changes, you can streamline your KYC and AML compliance, ensuring a secure and successful business journey.

Is your business prepared for the potential consequences of regulatory audits? Have you integrated transaction monitoring with your KYC processes? If you seek further guidance on these crucial matters, don't hesitate to contact us at KYC Sweden.

#kyc sweden#kyc#kyc solutions#kyc services#kyc verification#kyc api#kyc compliance#kyc and aml compliance#compliance#digital identity#digital world

2 notes

·

View notes

Text

2 notes

·

View notes

Text

youtube

cripto criptomoeda launchpad memecoins bitmart criptomonedas

#crypto#criptomoedas#cripto#criptomonedas#cryptocurrency#token#bitcoin#btc#ethereum#bnb#launchpad#memecoin#memecoins#bitmart#exchange#kyc#Youtube

0 notes

Text

Global E-KYC Market Size & Growth Outlook 2023-2030

0 notes