#Ixigo IPO

Text

Ixigo Share Price Riding High On The Market

Introduction

In the dynamic world of finance, certain entities emerge as beacons of success, capturing the attention of investors and analysts alike. Ixigo, a prominent player in the travel technology sector, has recently experienced a notable surge in Ixigo Share Price, reflecting its robust performance and strategic positioning in the market. Ixigo, operating under the banner of Le Travenues Technology Pvt. Ltd., stands as a pioneering force in the realm of technology-driven travel solutions, dedicated to empowering Indian travelers in every aspect of their journey planning and management. Through their innovative OTA platforms encompassing websites and mobile applications, Ixigo harnesses the power of artificial intelligence, machine learning, and data science to equip travelers with the tools and insights needed to make informed and efficient travel decisions. By aggregating and comparing real-time travel information, prices, and availability across a comprehensive spectrum of travel options including flights, trains, buses, and hotels, Ixigo facilitates seamless ticket booking experiences through its associated websites and apps. Founded by Rajnish Kumar and Aloke Bajpai in June 2007, Ixigo embarked on its journey with the launch of its flights meta-search website, marking the inception of its mission to revolutionize the travel industry. Subsequently, in 2008, Ixigo expanded its offerings with the introduction of a hotel search engine on its website, further enhancing its capabilities in catering to diverse traveler needs. Building upon its success and momentum, Ixigo continued to innovate, launching its trains app in early 2014, thereby solidifying its position as a frontrunner in providing comprehensive and user-centric travel solutions.

A Glimpse into Ixigo

Ixigo stands as a shining example of innovation and ingenuity in the realm of travel technology. Established with a vision to revolutionize the way travelers plan and manage their journeys, Ixigo has emerged as a trusted platform for millions of users seeking seamless travel solutions.

Unveiling the Share Price Surge

The recent surge in Ixigo's share price is a testament to the company's resilience and growth trajectory. Fueled by a combination of factors, including strong financial performance, strategic partnerships, and industry trends, Ixigo has garnered investor confidence and positioned itself as a frontrunner in the travel technology landscape.

Factors Driving the Surge

Several key factors have contributed to the surge in Ixigo's share price, underscoring the company's competitive advantage and market appeal:

Financial Performance: Ixigo's robust financial performance, characterized by steady revenue growth and profitability, has been a key driver of its share price surge. With a focus on sustainable growth and operational efficiency, Ixigo has delivered consistent results, earning the trust of investors and stakeholders.

Strategic Partnerships: Strategic partnerships with leading players in the travel industry have further bolstered Ixigo's market position and contributed to its share price surge. By collaborating with airlines, hotels, and other travel service providers, Ixigo has expanded its reach and diversified its revenue streams, enhancing its overall value proposition.

Technological Innovation: Ixigo's commitment to technological innovation has been instrumental in driving its share price upwards. By leveraging cutting-edge technologies such as artificial intelligence and machine learning, Ixigo has enhanced its product offerings and user experience, setting itself apart from competitors and attracting investor interest.

Market Trends: The surge in Ixigo's share price also reflects broader market trends, including the increasing demand for digital travel solutions and the growing preference for convenience and flexibility among travelers. As consumers continue to embrace online travel platforms, Ixigo stands poised to capitalize on this trend and sustain its upward momentum.

Conclusion

In conclusion, Ixigo's share price surge is a testament to its strategic vision, operational excellence, and unwavering commitment to customer satisfaction. As the company continues to innovate and expand its presence in the travel technology sector, investors can expect continued growth and value creation. With a solid foundation and a clear growth trajectory, Ixigo is well-positioned to ride the wave of success and deliver value to shareholders in the years to come.

0 notes

Text

Unraveling the Ixigo Share Price: Latest News & Updates

Introduction to Ixigo Share Price:

In the dynamic realm of the stock market, every move of a company's share price unfolds a story of its own. One such intriguing tale is that of Ixigo, a prominent player in the Indian travel industry. This blog delves into the latest news and updates surrounding Ixigo share price, shedding light on the factors influencing its fluctuations and the broader implications for investors and stakeholders.

1. Understanding Ixigo:

Ixigo, founded in 2007 by Aloke Bajpai and Rajnish Kumar, has emerged as a frontrunner in the Indian travel and tourism sector. Initially launched as a travel search engine, Ixigo has evolved into a comprehensive travel platform offering flight and hotel bookings, train reservations, bus tickets, and more. With its user-friendly interface and innovative features, Ixigo has garnered a significant market share and earned the trust of millions of users across the country.

2. Recent Performance:

Over the past few years, Ixigo has witnessed remarkable growth, buoyed by increasing internet penetration, rising disposable incomes, and a burgeoning travel culture in India. The company's revenue trajectory has been impressive, reflecting its ability to capitalize on emerging trends and adapt to evolving consumer preferences. However, like any other publicly traded entity, Ixigo's journey hasn't been devoid of challenges, as it grapples with market volatility, regulatory changes, and competitive pressures.

3. Factors Influencing Ixigo Share Price:

a. Industry Trends: The travel industry is inherently cyclical, sensitive to economic fluctuations, geopolitical events, and unforeseen crises such as the COVID-19 pandemic. Any developments impacting travel demand, fuel prices, or regulatory frameworks can exert significant influence on Ixigo share price.

b. Financial Performance: Investors closely scrutinize Ixigo's financial reports, focusing on key metrics like revenue growth, profit margins, and cash flow. Strong financial performance often translates into bullish sentiments, driving up the Ixigo share price.

c. Technological Innovations: Ixigo ability to innovate and stay ahead of the curve in terms of technology and user experience plays a crucial role in shaping investor perceptions. Breakthroughs in artificial intelligence, data analytics, and mobile applications can enhance Ixigo competitive edge and bolster its market position, thereby positively impacting its share price.

d. Competitive Landscape: The travel industry is fiercely competitive, with players vying for market share and customer loyalty. Investors monitor Ixigo's competitive positioning vis-à-vis rivals such as MakeMyTrip, Cleartrip, and Yatra, as well as emerging disruptors, to gauge its long-term growth prospects and assess potential risks.

e. Regulatory Environment: Regulatory changes, including government policies related to travel, taxation, and e-commerce, can have profound implications for Ixigo's operations and financial performance. Any regulatory hurdles or compliance issues may trigger volatility in the Ixigo share price.

4. Recent Developments:

a. Strategic Partnerships: Ixigo has been proactive in forging strategic partnerships with airlines, hotels, and other travel service providers to enhance its offerings and expand its customer base. Recent collaborations with leading industry players have bolstered Ixigo market presence and reinforced investor confidence.

b. Product Innovations: Ixigo continues to invest in product development and innovation, introducing new features and services to enrich the user experience. From AI-powered travel assistants to personalized recommendations, these innovations are instrumental in driving user engagement and fostering revenue growth.

c. Expansion Plans: With an eye on capturing untapped market opportunities, Ixigo has embarked on an ambitious expansion strategy, both geographically and vertically. The company's foray into adjacent sectors such as fintech and lifestyle services underscores its commitment to diversification and sustainable growth.

d. Financial Performance: Ixigo latest financial results, including quarterly earnings reports and guidance for the upcoming fiscal year, are closely scrutinized by investors and analysts. Any deviations from market expectations, whether positive or negative, can trigger fluctuations in the company's share price.

5. Investor Sentiment and Market Outlook:

The sentiment surrounding Ixigo share price is a reflection of broader market dynamics, investor perceptions, and macroeconomic trends. While short-term fluctuations may be driven by sentiment and speculative trading, long-term value creation hinges on Ixigo ability to execute its strategic vision, navigate challenges, and deliver sustainable growth.

Looking ahead, the outlook for Ixigo share price remains contingent upon its ability to capitalize on emerging opportunities, mitigate risks, and deliver consistent value to shareholders. As the travel industry continues to evolve in response to changing consumer behavior and technological advancements, Ixigo is poised to play a pivotal role in shaping the future of travel in India and beyond.

Conclusion:

In conclusion, the trajectory of Ixigo share price embodies the intricacies of the travel industry and the broader investment landscape. As investors and stakeholders monitor the latest news and updates surrounding Ixigo, they gain valuable insights into the company's performance, prospects, and potential risks. By staying abreast of market trends, regulatory developments, and competitive dynamics, investors can make informed decisions and navigate the ever-changing terrain of the stock market with confidence.

0 notes

Text

Ixigo Pre IPO Buzz: Key News and Updates

Ixigo is a leader in the rapidly changing Indian travel business, revolutionizing how travelers book and enjoy their travels. The financial community is ablaze with anticipation as ixigo IPO is highly anticipated, and important updates and news are eagerly awaited. We'll examine the most recent Ixigo Share Price, developments and the elements that fuel the Ixigo pre-IPO hype.

Ixigo's Unlisted shares Journey Overview:

Founded in 2007 by Aloke Bajpai and Rajnish Kumar. Now Ixigo IPO has become a household name in India. It’s one-stop platform for travel-related services Become the USP of the company. From flight bookings to hotel reservations and train journeys, Ixigo has carved a niche for itself by providing users with a seamless and comprehensive travel planning experience. The company has become a major participant in the Indian travel IT market by evolving and adapting to the changing needs of travelers over time.

They assist travelers in making smarter travel decisions by leveraging AI, machine learning and data science led innovations on their OTA platforms, comprising their websites and mobile applications.

Ixigo IPO compares real-time travel information, prices and availability for flights, trains, buses, and hotels for users for transparency along with helping user to take right decision, and also Ixigo allows ticket booking through its associate websites and apps.

In 2008, it introduced a hotel search engine on its website. In early 2014 it launched a trains app as well.

Ixigo Pre IPO Details

Ixigo Pre Ipo have received in-principle approvals from BSE and NSE for the listing of the Equity Shares pursuant to letters. Ixigo upcoming IPO proposes to make an IPO which comprises a fresh issue of its equity shares of Re. 1 each and offer for sale by certain shareholders’ existing equity shares of Re 1 each at such premium arrived at by the book building process (referred to as the ‘Issue’), as may be decided by the Company’s Board of Directors.

The company plans to come with an Ixigo IPO by 2024

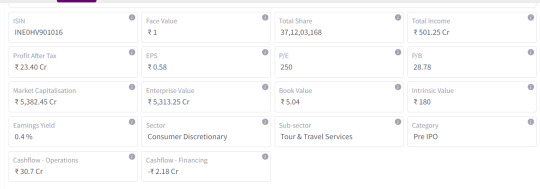

Current Ixigo Share Price

The face value of each Ixigo share is ₹ 1. Ixigo stock price is ₹ 145/share. Ixigo IPO price band is not disclosed yet.

Ixigo Unlisted share Merger & Acquisition

Ixigo purchased Abhibus on August 5, 2021. By providing its combined user base of almost 25.5 crore customers with a multi-modal transportation experience spanning trains, aircraft, and buses, the agreement will assist Ixigo Group in solidifying its position in tier 2, 3, and 4 markets.

Investments

It is true that Ixigo owns stock in FreshBus, an electric intercity bus service company with headquarters in Bengaluru. Ixigo gave FreshBus Rs 26 million in startup finance in February 2023. This was a calculated financial risk taken to facilitate the introduction of FreshBus's intercity electric bus services throughout India.

Ixigo share price Market Size:

The online travel market in India is expected to reach US$ 31 billion by the end of FY25, growing at a 14% CAGR from FY20.

Travel and tourism, one of the fastest-growing economic sectors in India, contributed US$ 178 billion to the nation’s GDP in 2021.

The India Brand Equity Foundation (IBEF) states that there is a sizable travel and tourist market in India. It provides a wide range of specialised travel products, including cruises, outdoor activities, wellness, medical, sports, MICE, eco-tourism, movies, rural, and religious travel. Both domestic and foreign travellers have acknowledged India as a spiritual tourism destination.

As per the IBEF’s February 2023 report on Tourism and Hospitality, the contribution to the GDP is expected to reach US$ 512 billion by 2028, at a strong CAGR growth of 16% between 2021-28.

The travel industry bounced back remarkably in FY23 after being severely affected by the pandemic and is expected to move at an exponential pace. As per the data published by Directorate General of Civil Aviation (DGCA), the number of passengers that travelled by airlines domestically increased 62% YoY to 136 million passengers in FY23, as compared to 84 million passengers in FY22.

As indicated in the February 2023 IBEF Report on Aviation, India is poised to become the third-largest air passenger market globally by 2024, encompassing both domestic and international travel, and is expected to host over 480 million air travellers by 2036.

According to WTTC, India is ranked 10th among 185 countries in terms of travel & tourism’s total contribution to GDP in 2019.

Ixigo pre ipo User and Involvement:

When assessing Ixigo unlisted share chances of continuing to develop, the size of its user base is crucial. As signs of a strong and devoted customer base, investors will probably closely examine user acquisition tactics, user engagement measures, and customer retention programmes.

In conclusion:

We are in the midst of a critical juncture in the development of the Indian travel tech industry. The ixigo pre-IPO excitement keeps growing. Not only is the success of Ixigo's IPO evidence of the company's accomplishments, but it also shows how confident the market is in travel technology overall. We hope to have a great opening in Ixigo upcoming ipo so that we can book tremendous profit in Ixigo share price.

0 notes

Link

Ixigo Share Price is evaluated by analysing different financial details including balance sheet, Profitability, CAGR etc. If you want to see the correct analysis of these unlisted shares, then you can visit Planify's website, you will also find many other unlisted shares and their evaluation.

#Ixigo Share Price#Ixigo Unlisted shares#ixigo ipo date#ixigo ipo price#Ixigo IPO#Ixigo Pre IPO#ixigo stock price#ixigo share price today#Ixigo Upcoming IPO

0 notes

Text

Upcoming IPOs in India 2023

The IPO is an Initial Public Offer in which companies offer their privately held shares to the public for the first time, i.e, they sell their shares to the public. Companies that wish to change their company status from Private Limited to Limited must draft a DRHP with SEBI. Here is the list of upcoming IPOs in the year 2023:

S.No

Company

Issue Size (in Rs. Crores)

Sector

1.

Infinion Biopharma

Yet to be updated

Health Care

2.

Go Airlines India Ltd.

3,600

Aviation

3.

Snapdeal Ltd.

1,250 + OFS

E-commerce

4.

Skanray Technologies Ltd.

400

Healthcare technology

5.

One Mobikwik Systems Ltd

1,900

Technology

6.

Ixigo

1,600

Travel & Hospitality

7.

Sterlite Power Transmissions Ltd.

1,250

Industrials

8.

Gemini Edibles and Fats

2,500

Consumer Staples

9.

Bajaj Energy

5,450

Electric utilities

10.

Arohan Financial Services Pvt Ltd.

1,800

Financials

11.

Capillary Technologies India Ltd.

850

Technology

12.

Uma Converter Limited

Yet to be updated

Packaging

13.

Emcure pharmaceuticals

Around 4,500-5,000

Health Care

Here are some factors you should consider before investing in an IPO:

Company’s background: Before investing in any IPO, look for the company’s past background, and understand its business model and how it is operated. Also, look for their financials. It would be a good investment if revenues and profits are increasing consistently.

Valuation: Another factor is to check the company’s valuation. The best way to assess a company's valuation is to compare its price to that of its listed peers. Look for various ratios like price-to-earnings ratio, return on equity, etc.

Future prospects: Now try to understand the reason behind the IPO. And also understand the industry and business in detail to make sure it will sustain itself in the future. Also, the reason behind bringing the IPO can be many, so try to understand whether the money will be used for expansion, paying off loans or anything else.

Conclusion IPOs have rarely seen such strong investor demand as they have in recent years. According to data, the total collection for IPOs has well surpassed the INR 100 lakh crore mark this year. With less than a month until the end of the year, investors may see similar investor participation in upcoming IPOs.

Source - https://justpaste.it/2q3cc

#Upcoming IPOs in India#Upcoming IPOs in India 2023#Upcoming IPOs in India2022#Upcoming IPOs in India 2021#Upcoming IPOs#stocktrading#stock markerting#stock broker in india

2 notes

·

View notes

Text

Ixigo IPO GMP, Price, Allotment, Profit Estimate 2024

Le Travenues Technology IPO Description – Le Travenues is a technology company focused on empowering Indian travellers to plan, book and manage their trips across rail, air, buses and hotels. The company assists travellers in making smarter travel decisions by leveraging artificial intelligence, machine learning and data science led innovations on its OTA platforms, comprising websites and mobile…

View On WordPress

0 notes

Text

2024 IPO Checklist: A Comprehensive List of Upcoming Public Offerings

The Indian stock market continues to be a hotbed for activity, with several exciting Initial Public Offerings (IPOs) on the horizon in 2024. This comprehensive guide will equip you with the knowledge you need to navigate the upcoming IPO landscape, including details on expected offerings, IPO Grey Market Premium (GMP), and a sneak peek at the upcoming SME IPO list 2024

Upcoming Public Offerings (IPOs):

The remainder of 2024 promises a healthy pipeline of IPOs across various sectors. Here's a glimpse at some of the highly anticipated offerings:

Ebixcash: A leading provider of B2B on-demand services specializing in insurance, travel, and financial technologies.

Indiafirst Life Insurance: A prominent private life insurance company known for its innovative product portfolio and customer-centric approach.

SPC Life Sciences: A fast-growing pharmaceutical company engaged in manufacturing and marketing a diverse range of formulations.

Tata Play: A subsidiary of the Tata Group, offering a comprehensive bouquet of DTH and broadband services.

Lohia Corp: A leading manufacturer of PET packaging solutions with a strong presence in the global market.

Nova Agritech: An agritech company focused on developing and distributing high-quality crop protection products.

What is IPO GMP?

IPO Grey Market Premium (GMP) refers to the unofficial premium investors are willing to pay for shares in an upcoming IPO before they are listed on the stock exchange. It's important to understand that GMP is not an official indicator of the IPO's performance and should be considered speculative. However, it can provide some insight into investor sentiment surrounding a particular offering.

Resources for Tracking Upcoming IPOs and GMP:

Several valuable resources can help you stay updated on upcoming IPOs and track their associated GMP. Here are a few popular options:

Moneycontrol: provides a dedicated IPO section with detailed information on upcoming offerings and historical performance.

Chittorgarh: features a user-friendly IPO calendar with live updates and GMP trends.

The Rise of SME IPOs:

The Indian stock market has witnessed a surge in interest for Small and Medium Enterprises (SME) IPOs. These offerings allow smaller companies to raise capital and expand their operations. Here are some of the advantages of investing in SME IPOs:

High Growth Potential: SME companies often exhibit high growth trajectories, offering the potential for significant capital appreciation.

Diversification: SME IPOs can help diversify your investment portfolio by including companies from various sectors not typically represented in large-cap offerings.

Early Investment Opportunity: Investing in an SME IPO allows you to participate in a company's growth story at an early stage.

A Glimpse into Upcoming SME IPOs (Disclaimer: Listing subject to change):

While the specific SME IPO listings can be dynamic, here are some examples of companies that might be considering an SME IPO in the near future:

Indegene Ltd: A contract research organization providing drug discovery and development services.

Aadhar Housing Finance: A housing finance company catering to the underserved and affordable housing segments.

TBO Tek: A leading player in the travel technology space.

MobiKwik: A popular digital payments platform offering a wide range of financial services.

Ixigo: A prominent online travel aggregator facilitating hotel bookings, flight reservations, and travel packages.

Important Considerations Before Investing in an IPO:

Before investing in any IPO, including upcoming SME offerings, it's crucial to conduct thorough research. Here are some key factors to consider:

Company Financials: Analyze the company's financial health, profitability, and growth prospects.

Industry Outlook: Evaluate the overall health and growth potential of the industry the company operates in.

Management Team: Assess the experience and capabilities of the company's management team.

IPO Valuation: Compare the IPO price with the company's fundamentals to determine if it's fairly valued.

Remember: IPOs can be a lucrative investment opportunity, but they also carry inherent risks. By conducting thorough research, understanding IPO GMP (while acknowledging its limitations), and carefully considering the factors mentioned above, you can make informed investment decisions in the exciting world of upcoming IPOs and the growing SME IPO market.

Disclaimer: This blog post is for informational purposes only and should not be considered financial advice. Please consult with a qualified financial advisor before making any investment decisions.

Gandhar Oil IPO GMP Today

Fedbank Financial Services IPO GMP Today

Tata Technologies IPO GMP Today

Flair Writing IPO GMP Today

Allied Blenders and Distillers IPO GMP Today

AMIC Forging IPO GMP Today

Net Avenue Tech IPO GMP Today

Marinetrans India IPO GMP Today

Graphisads IPO GMP Today

Sheetal Universal IPO GMP Today

Presstonic Engineering IPO GMP Today

S J Logistics IPO GMP Today

Shree OSFM E-Mobility IPO GMP Today

DCG Wires and Cables IPO GMP Today

Ramdevbaba Solvent IPO GMP Today

WINSOL ENGINEERS IPO GMP Today

Shivam Chemicals IPO GMP Today

Emmforce Autotech IPO GMP Today

Grill Splendour Services IPO GMP Today

Teerth Gopicon IPO GMP Today

Chatha Foods IPO GMP Today

Gabriel Pet Straps IPO GMP Today

Baweja Studios IPO GMP Today

Mayank Cattle Food IPO GMP Today

Docmode Health Technologies IPO GMP Today

Megatherm Induction IPO GMP Today

Siyaram Recycling IPO GMP Today

Accent Microcell IPO GMP Today

SLONE INFOSYSTEMS IPO GMP Today

Greenhitech Ventures IPO GMP Today

0 notes

Text

Embark on a journey into the future of investments with Unizon's

Embark on a journey into the future of investments with Unizon's exclusive access to Unlisted and Pre-IPO shares!

Discover the untapped potential of powerhouse companies like Chemenergy, Chennai Super Kings, HDB Financial Services, BOAT, NSE, TATA Technologies, OYO, IXIGO, and BIRA 91!

Seize the opportunity to invest in these industry leaders before they hit the public market. Your chance to be a part of the next big success story is NOW!

Don't miss out on this exclusive opportunity! Invest in Unlisted Shares NOW and watch your portfolio soar to new heights!

Buy Sell Unlisted Shares from Unizon

#buy and sell unlisted shares#sell unlisted shares#buy unlisted shares#commercial#buy sell unlisted shares

0 notes

Text

An Overview of the Most Anticipated Upcoming IPOs in the Tech Industry

The technology industry is one of the vital driving factors shaping the stock market in India, apart from commodity trading and the mutual funds market. Therefore, the IPOs in the tech industry are often highly anticipated events.

Market experts expect some stability in the first half of 2023. Many of the planned IPOs of 2022 could get a green signal in 2023. For those considering the IPO, Motilal Oswal has the right tools and guidance to make it a success.

Upcoming Tech IPOs

Here is a list of the highly anticipated upcoming IPOs.

Snapdeal

Founded in 2007, Snapdeal expanded into a complete online marketplace in 2011, selling a wide selection of merchandise and value-for-money goods across different lifestyle categories. Its target customers mainly belong to the mid-income segment, and the target market is 3x more significant than the other leading e-commerce players.

The company mainly derives its revenues from marketing and freight fees that it collects from its sellers. It has filed for an IPO and will be listed in the Indian market in late 2023, tentatively.

Tata Technologies Ltd

Business behemoth Tata Group plans to add one more addition to its army of companies listed on the Indian stock market. It is a product engineering and digital services provider that serves four key industry verticals- automobile, aerospace, industrial machinery, and industrial sectors.

The company has started the process and is slated to become one of the most awaited IPOs of 2023.

Droom

Droom is a data science and technology-focused online marketplace that buys and sells used and new automobiles. Reports suggest that it holds over 65% of the market share, and it is the third-largest e-commerce entity in the country concerning GMV.

The company has already filed its papers with SEBI for IPO listing for Rs. 3000 crores and is planning to take the plunge in 2023. It is also one of the top choices among investors due to the company’s sound financial profile.

Ixigo

La Travenues technology, better known as Ixigo, was founded in 2007. It is a digital platform that helps customers track travel trips, book flights, buses, hotels, and cabs, and make travel convenient. Initially, it began just as a flight and hotel search engine but later diversified into train travel as well.

It leverages AI to provide simplified access to travel information and booking itineraries as per customer convenience. It has already filed its papers with SEBI for an IPO listing and aims to raise Rs.1600 crores. The tentative IPO launch date has been scheduled for the second half of 2023.

Conclusion

Although numerous companies have filed for IPO this year, the plans might be executed or delayed depending on the state of the market economy and investor sentiments. Therefore, before making any kind of decision, you must consider these factors.

Did you know having a Demat account is necessary to invest in an IPO, mutual fund, or commodity trading market? Motilal Oswal helps new investors open their accounts at reasonable prices and begin their stock market investment journey systematically.

0 notes

Text

Ixigo (Le Travenues Technology Limited) IPO

Ixigo (Le Travenues Technology Limited) IPO

Ixigo (Le Travenues Technology Limited) is a technology company focused on empowering Indian travellers to plan, book and manage their trips across rail, air, buses and hotels. They assist travellers in making smarter travel decisions by leveraging artificial intelligence, machine learning and data science-led innovations on their OTA platforms, comprising their websites and mobile…

View On WordPress

#investing#investment#IPO#irctc#Ixigo#Ixigo ipo#kite#makemytrip#market#Marketnews#OTA#sharemarket#STOCK#stockmarket#Travel#travelling#upcoming ipo#zerodha

0 notes

Text

ixigo IPO and the Indian Travel Industry: Facts, Stats, Opportunities and Risks

It’s a new week and of course we have a new IPO to talk about!

This time around, it’s travel booking platform ixigo.

While ixigo will join a long list of companies that have made their bourse debuts this year, its listing would be unique for two main reasons.

One, it would be a gauge of investor sentiment for the travel sector. And two, ixigo would be one of the very few new-age internet startups to go public as a profitable company.

What are the facts, stats, opportunities and risks you need to know about before investing in ixigo? And what do you need to know about the larger Indian travel industry?

Click link to read: https://transfin.in/ixigo-ipo-and-the-indian-travel-industry-facts-stats-opportunities-and-risks

0 notes

Text

Ixigo Share Price News & Latest Updates: Deciphering the Travel Tech Enigma

Ixigo, India's leading online travel aggregator, has captivated the travel tech industry with its innovative platforms and strategic partnerships. However, Ixigo Share Price journey has been marked by volatility, mirroring the uncertainties of the post-pandemic travel landscape. This article delves into the latest news, financial performance, and key factors influencing Ixigo Share Price, offering a comprehensive overview for informed investment decisions.

Current Ixigo Share Price and Performance:

As of February 12, 2024, Ixigo Share Price stands at ₹71.70, reflecting a significant decline of 30.30% from its IPO price of ₹103.30 in November 2022.

The past month has witnessed considerable fluctuations, with the stock price ranging between ₹68.00 and ₹75.00.

While Ixigo boasts a user-friendly platform and strong brand recognition, concerns regarding industry recovery and intense competition have weighed on Ixigo Share Price.

Recent News and Events:

Acquisition: Ixigo's acquisition of the bus ticketing platform Abhibus in October 2023 expanded its product portfolio and strengthened its presence in the bus travel segment. This news initially boosted investor confidence.

Funding: The company secured ₹400 crore in fresh funding from marquee investors like GIC and CarTrade Tech in December 2023, showcasing continued support for its long-term vision.

Financial Results: Ixigo is yet to release its December 2023 quarter financial results. However, market analysts anticipate improved revenue and bookings compared to the previous quarter, potentially buoying investor sentiment.

Industry Recovery: The travel and tourism industry is witnessing a gradual recovery post-pandemic, presenting a positive backdrop for Ixigo's growth. Continued recovery will be crucial for its success.

Financial Analysis:

Positives: Ixigo boasts a loyal user base, a user-friendly platform, and strategic partnerships with leading airlines and hotels. Additionally, its focus on mobile-first technology positions it well for future growth.

Negatives: The company is yet to achieve profitability, raising concerns about its long-term financial sustainability. Furthermore, its dependence on volatile travel industry trends presents inherent risks.

Investment Outlook:

Ixigo's future trajectory hinges on several key factors:

Industry Recovery: The pace and sustainability of the travel and tourism industry's recovery will significantly impact Ixigo's performance. Favorable industry trends could act as a catalyst for growth.

Competition: The online travel aggregator space is fiercely competitive, with established players like MakeMyTrip and Cleartrip posing significant challenges. Ixigo's ability to differentiate itself through innovation and targeted marketing will be crucial.

Profitability: Demonstrating a clear path to profitability is critical for investor confidence and Ixigo Share Price stability. Achieving this in a competitive and dynamic industry will require strategic cost management and revenue diversification.

Conclusion:

Ixigo presents an intriguing investment opportunity for those seeking exposure to the burgeoning Indian travel tech market. However, the company's path to profitability remains uncertain, and intense competition poses significant challenges. Investors should carefully consider their risk tolerance, investment horizon, and conduct thorough due diligence before making any investment decisions. This article provides a starting point for further analysis, but individual investors should consult with qualified financial advisors for personalized advice.Disclaimer: This article is for informational purposes only and should not be considered as investment advice. Please consult with a qualified financial advisor before making any investment decisions.

0 notes

Text

What is Private Equity Investment ? and How can it give Multifold Return ?

What is Private Equity Investment ?

Private Equity is an alternative investment option which consists of companies that are not yet listed on a public exchange. Private equity consists of funds and investors who have the ability to make direct investments in private businesses. Institutional and retail investors provide the capital for private equity firms, and the capital can be utilized to fund these companies for different new technologies, or to make acquisitions, expand business, and make a solid balance sheet.

How to Invest in Private Equity?

To invest in private equity directly, the easiest and simplest method is to invest in

unlisted shares

or pre ipo shares of these private companies which are not yet listed but are being traded in the unlisted market.

To know and get the list of these unlisted companies you can visit planify’s website there you will not only get the list of these shares but also the financials and other important factors for which investors look into before investing.

What are Unlisted Shares?

Unlisted shares are the shares of the companies who introduced their shares in the unlisted market for distribution of equity shares for further growth or for any reason.

The difference between unlisted shares and listed shares is that the powers of listed company shareholders is much higher from the unlisted shareholders.

What are Pre IPO Shares?

Unlisted Shares get converted into Pre IPO shares when companies file their DRHP (Draft Red Herring Prospectus) to SEBI and after SEBI’s approval before

IPO

Then these shares get traded at much higher speed depending upon the company’s strong financials and company profitability or performance.

How to buy Unlisted shares and Pre IPO Shares?

To buy unlisted shares or Pre IPO shares you can visit planify, they have created many research reports around these private companies, there are more than 200+ companies they have research reports on created by planify’s experienced financial analysts.

Some recommended Unlisted shares and Pre IPO Shares are:

HDB Financial Services

Urban Tots

Ixigo Le Travenues Technology Limited

B9 Beverages Pvt Ltd.

Sigachi Laboratories Limited

Martin and Harris Laboratories Limited

Signify Innovations India Limited

Motilal Oswal Home Finance Limited

Five Star Business Finance Limited

Bikaji Foods International Ltd

Bagrrys India Ltd

Inkel Limited

Mohan Meakin Limited

East India Pharmaceutical Works Limited

Indofil Industries Ltd

For more information visit: https://www.planify.in/research-report

0 notes

Video

3 More Companies Get Go-Ahead From SEBI For IPO.

Watch The Video To Find Out More.

0 notes

Text

Online travel aggregator ixigo gets Sebi nod for Rs 1,600-crore IPO

Online travel aggregator ixigo gets Sebi nod for Rs 1,600-crore IPO

Le Travenues Technology, which operates online travel aggregator ixigo, has received stock market regulator nod to launch its Rs 1,600-crore share- sale offer.

The offer comprises fresh issue of shares worth Rs 750 crore and an offer for sale (OFS) of equity shares of Rs 850 crore by existing shareholders.

According to sources, the firm is expected to list early next year. Proceeds of the fresh…

View On WordPress

0 notes

Text

Another company's IPO is coming, investors will get a chance to make profits

Another company’s IPO is coming, investors will get a chance to make profits

Travelnews Technology Limited, which operates travel platform Exigo, is in the process of going through an initial public offering (IPO). Through this the company wants to raise Rs 1,600 crore. For this the company…

Disclaimer: This story or news has been auto-aggregated by a computer program, As well as few words that have been auto-convert with the same synonyms. This is not manually created…

View On WordPress

#another#business#Business news#Business News in Hindi#chance#coming#company&8217;s#eczema#files draft papers#get#Hindi News#hindustan#investors#ipo#ixigo#make#news in hindi#profits#SEBI#SEBI IPO#Travel platform ixigo#Travenues Technology#Will

0 notes