#InsurancePolicy

Text

What is Commercial Inland Marine Insurance?

– Provides 24/7, 365-day coverage.

– Safeguards businesses involved in importing, exporting, or transporting goods within India.

– Covers goods in transit via various modes, including road, rail, and air.

– Protects against potential damage, loss, accidents, and perils during operations

Key Benefits in a Nutshell

– Extensive coverage for various risks.

– Damage due to accidents, theft, natural disasters, and fire incidents included.

– General expenses like contributions to general average, salvage costs, and sue and labour expenses covered.

– Protection against liabilities arising from collisions, contact with other vessels, or property damage.

– Coverage for delays in transit, quarantine compensation, temperature-controlled cargo, and more.

Who Needs Commercial Inland Marine Insurance?

– Essential for importers, exporters, manufacturers, distributors, and businesses involved in goods transportation.

– Beneficial for those dealing with valuable items.

The Crucial Coverage – Explained

– Comprehensive coverage for goods in transit via various modes.

– Includes protection for damage due to accidents, theft, natural disasters, and fire incidents.

Standard Coverage under Marine Insurance Policy:

1. Accident Cover : This covers damage to cargo due to accidents during transportation.

2. Theft Cover: This covers the loss of cargo due to theft or pilferage.

3. Natural Disaster:This covers damage caused by natural disasters such as storms, floods, or earthquakes.

4. Fire Accident Cover: It provides coverage for losses resulting from fire incidents during transit.

5. General Expenses Cover:This covers general average contributions, salvage, and sue and labor expenses.

6. Liability Cover: It offers protection against liabilities arising from collisions, contact with other vessels, or property damage.

7. Delay in Transit Cover:This provides coverage for delays in transit that lead to financial losses.

8. Quarantine Compensation:This offers compensation for expenses incurred due to vessel detention or quarantine.

9. Temperature Sense Cover:This covers the deterioration or spoilage of perishable goods.

10. Riots, War & Civil War etc:It provides protection against risks associated with war or political unrest affecting transportation routes.

11. Business Financial Safety:It offers financial security for businesses involved in international trade or shipping.

Riding the Wave of Additional Coverage Options.

– Flexibility with additional coverage options.

– Protection for high-value goods.

– Coverage against strikes, riots, civil commotions, war, terrorism, and temperature-controlled cargo.

– Specialized coverage for items exhibited at trade shows or transported via oversized cargo.

Additional Add-ons Under the Open Marine Insurance Policy:

1. Extended Coverage for High-Value Goods: This add-on provides extra protection for transporting

valuable items, ensuring they are fully covered in case of any unforeseen incidents during transit.

2. Strikes, Riots, and Civil Commotions (SRCC) Coverage:This protects against losses or damages

caused by strikes, riots, or civil commotions during transit.

3. War and Terrorism Coverage: This provides coverage for losses or damages resulting from acts of war, terrorism, or political violence.

4. Temperature-controlled Cargo Coverage: This offers protection for perishable goods that require temperature-controlled transportation, covering losses caused by temperature deviations or equipment failures.

5. Exhibition or Trade Show Coverage: This extends coverage to goods displayed or exhibited at trade shows, exhibitions, or fairs.

6. Customised Coverage:This tailors the policy to meet the specific needs and requirements of the insured, providing additional coverage for unique or specialised goods or circumstances.

7. Valuable Papers and Documents Coverage: This add-on ensures the safety of important business documents during transit, covering the loss or damage of these valuable papers, offering financial security and minimising disruptions to your operations.

8. Loading and Unloading Clause: This clause provides coverage for any damages that occur while goods are being loaded onto or unloaded from the transport vehicle, protecting against potential losses during these critical stages.

9. ODC (Over Dimensional Cargo) Clause: The ODC clause offers specialised coverage specifically for transporting large or oversized cargo, ensuring protection for these unique shipments and addressing any potential risks associated with their transportation.

6. The Art of Claiming: How it Works

The claiming process involves systematic steps.

– Promptly notify the insurance company about the loss.

– Provide necessary documentation, including policy copy, a detailed statement, shipping documents, proof of value, and relevant evidence.

– The claim is assessed, and the eligible amount is determined for settlement.

6.1 Where are the following step which are carried out when a claim arises.

Notification: You should promptly inform the insurance company about any loss or damage that occurs during transit.

Documentation:You are required to submit necessary documents, including a copy of the policy, a detailed statement, shipping documents, proof of value, and relevant evidence.

Detailed Sales and Purchase Proofs: These documents should demonstrate your financial transactions from the policy start date to the claim initiation date.

Claim Form: You should complete and submit the provided claim form with essential information.

Additional KYC Documents: This involves including copies of identification documents, such as the Aadhaar card and PAN card, as well as a self-declaration letter of ownership.

Verification:The insurance company assesses the claim, conducts investigations if necessary, and may appoint a surveyor for assessment.

Settlement Decision:The insurance company determines the eligible amount and communicates this decision to the insured.

Additional Supporting Documents: You should also provide an image of a cancelled cheque, a subrogation letter (if applicable), and a discharge voucher.

#insurance#marine#marines#marinelife#marinette#insuranceagent#aquamarine#lifeinsurance#marinettedupaincheng#marinecorps#submariner#spacemarines#healthinsurance#insurancepolicy#policy#marinebiology#mariners#marinedrive#insurancebroker#marineconservation#insuranceagency#marineaquarium#submarine#usmarines#marinetank#carinsurance#autoinsurance#homeinsurance#insuranceagents#marinemammals

2 notes

·

View notes

Text

Discover the Power of IUL with Wealth Protectors Inc.

Unlock the power of Indexed Universal Life (IUL) Insurance with Wealth Protectors Inc.

Our IUL policies offer a unique blend of security and growth, providing a safety net for your loved ones

while accumulating wealth. With customizable premium payments, market-linked growth, and potential tax advantages,

our IUL plans to adapt to your life, offering flexibility for emergencies and opportunities.

Discover the benefits of IUL with Wealth Protectors Inc. and secure your financial future today.

To know more please visit: https://wealthprotectorsinc.com/

call: (469) 262-6864

Tags: payment protection insurance, insurance company, protect insurance, payment insurance,

life insurance for home, redundancy insurance cover, home disability insurance,

disability insurance company, insurance financial, protected insurance company,

insurance for payment protection, annuities insurance companies, insurance to protect your assets,

insurance protect, investing insurance, lifetime annuities, life insurance disability insurance,

insurance companies for disability, insurance to protect assets, home life cover,

#insurancepolicy#investinginsurance#disabilityinsurancecompany#insurancetoprotectassets#homelifecover

2 notes

·

View notes

Text

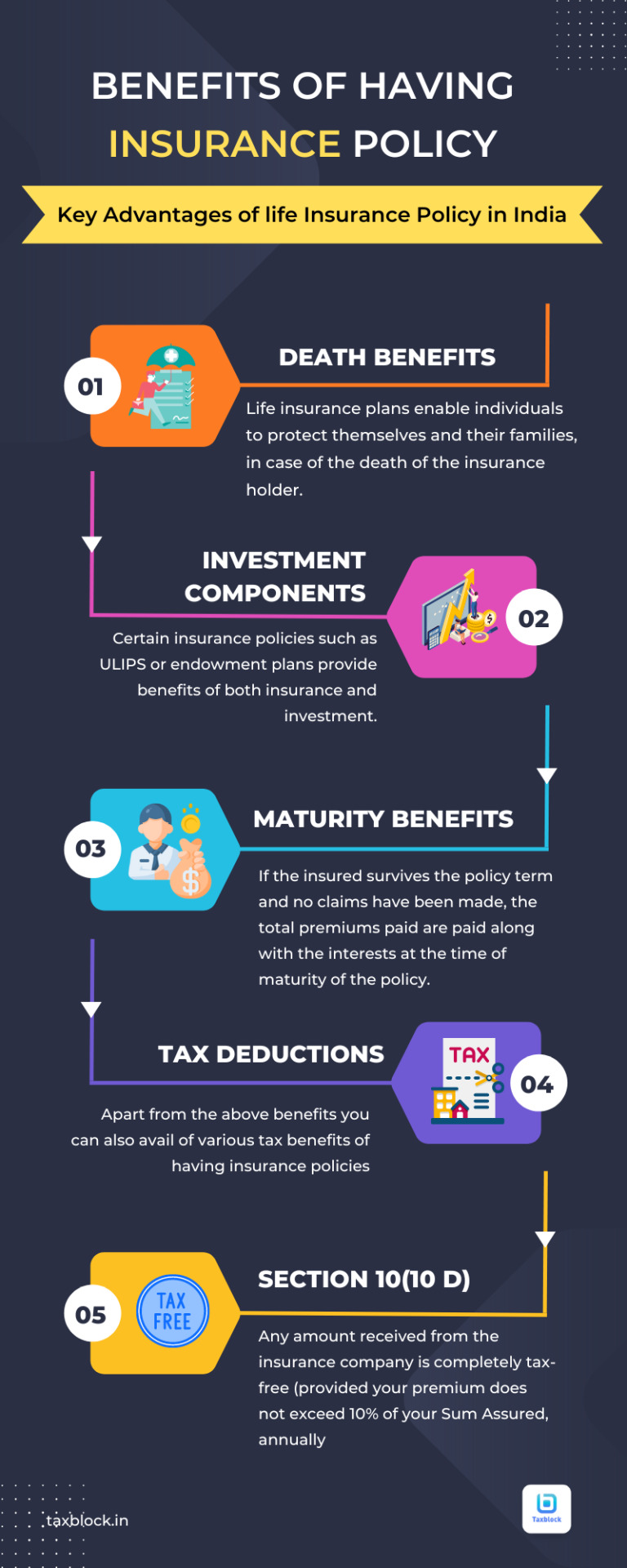

The top five key benefits of having an insurance policy in India Click on the link to learn more about an insurance policy.

#finance#money#investing#financialfreedom#investment#entrepreneur#invest#success#forex#motivation#investor#accounting#personalfinance#financialliteracy#wallstreet#smallbusiness#credit#insurancepolicy#financialservices#infographic#tumblrpost#financeeducation

31 notes

·

View notes

Text

#insurancecompanies#insurance#insurancecompany#insuranceclaims#insurancepolicy#lifeinsurance#maxlifeinsurance#insurancemarket#insurancework

4 notes

·

View notes

Text

DO YOU KNOW THAT YOU CAN USE YOUR LIFE INSURANCE POLICY TO COLLATERALIZE A LOAN

#lifeinsurance#lifeadvice#lifeafterdivorce#lifeinsurancepolicy#insurance#insuranceindustry#insurancebroker#insurancetips#insurancebrokers#insuranceagents#insurancepolicy#insuranceplans#insuranceplanning#insuranceclaims#insurancecompany#insuranceclaim#terminsurance

2 notes

·

View notes

Text

Insurance Plan In India

Insurance is an "Indemnity"-contract, i.e to Indemnify the an uncertain loss happens in the future. Insurance policy/plans is there to provide protection for yourself, your investment and your business. Insurance is chiefly a risk-management tool meant to offer financial protection to your dependents in the unfortunate event of your death. If you are adequately insured, your life insurance should enable your dependents – spouse, children or parents – to maintain their current lifestyle and pursue life’s financial goals till the time that they are able to set up an alternate income stream on their own.

Why choose us?

We offer different kinds of insurance solutions catering to customer’s insurance needs.

Our experts evaluate your specific needs and study the risk profile.

Based on the results of these evaluations, our experts suggest the most cost effective, integrated insurance package that is specifically suited to your risk profile.

Tie-ups with multiple Life & General insurance companies.

Kindly Go Through This Link For More Information :- https://www.tulsiwealth.com/insurance.php

#insurance#insuranceagent#insurancebroker#insoranceagency#lifeinsurance#healthinsorance#insoranceadvisor#insuranceplan#homeinsurance#insoranceconsultancy#insurancecompany#insuracetips#insurancepolicy

2 notes

·

View notes

Text

Why Travel Insurance is Important In International Travel

One of life’s greatest joys is travel insurance policy, which provides opportunities for discovery, relaxation, and cultural immersion. Travel can be highly gratifying, but it can also be unpredictable, and there are some concerns about going abroad that can put people at greater risk.

2 notes

·

View notes

Text

Proton Finserve For Life Insurance Is Like A Spare Tire |

Proton FinServe is a leading insurance agency in Utah, providing a wide range of insurance services to individuals and businesses in the area. We are committed to helping our clients protect their assets and plan for their future with our comprehensive insurance policies.

At Proton FinServe, we understand the importance of having the right insurance coverage in place. That's why we offer a wide range of insurance services, including #lifeinsurance, #termlifeinsurance, and #additionalinsuranceservices to meet the unique needs of our clients.

In addition to traditional insurance services, we also offer a variety of #financialservices, including #annuities, to help our clients plan for their retirement and achieve their financial goals. Our team of experienced #insuranceagents are dedicated to providing personalized service and expert advice to help our clients make informed decisions about their insurance needs.

At Proton FinServe, we are proud to be a locally-owned and operated #insuranceagencyinutah, serving the community for over a decade. We are committed to providing our clients with the highest level of service and support, and we are dedicated to building long-term relationships with our clients based on trust and mutual respect.

If you're in need of #insuranceservices in #Utah, USA, look no further than Proton FinServe. Contact us today to schedule a consultation with one of our experienced insurance agents and learn more about how we can help protect your assets and plan for your future. #proton #protonfinserve

#protonfinserve#proton#inusranceagent#insuranceservices#insuranceagencyinutah#insurancepolicy#lifeinsurance#termlifeinsurance#additionalinsuranceservices#fiancialservices#annuties#utah#usa

2 notes

·

View notes

Text

Life is a rollercoaster of moments, big and small. Whether you're starting a new adventure or settling down, having the right insurance can make all the difference. Reach out to us at Prahim Investments today and let's navigate life's journey together!

Contact us :-

Websites : - https://prahiminvestments.com/

Call today If you have Question Ask us : 093157 11866 , 01204150300

#prahiminvestments#lifeinsurance#insurance#InsuranceAgent#insurancepolicy#InsurancePlan#insuranceplans#terminsurance#termplan#lifeinsurancepolicy#lifeinsurancequotes#finaciallyindependent#financialfreedom#financiallyfree

0 notes

Text

youtube

However, his employer insisted that he come to work, even with the doctor's note. Scott explains the rights of employees in such situations and how to navigate conflicts between the company doctor and your own doctor. He emphasizes the importance of following your doctor's orders to avoid further injury and discusses the potential penalties employers may face for disregarding a doctor's note. Watch the video to learn more about your rights and what to do if faced with a similar situation.

#DeSalvoLaw#WorkersCompRights#DoctorNoteRights#EmployeeRights#caraccident#personalinjury#automobile#insuranceclaim#chicagolawyer#personalinjuryattorney#chicagoinjurylawyer#insurancepolicy#compensation#injurycasevalue#injurycases#injury#case#attorney#injurylawyers#injurylaw#injurylawfirm#personalinjurylawyer#personalinjurylaw#lawfirm#chicagolawfirm#caraccidentlawyers#accidentclaims#accidentlawyer#Youtube

0 notes

Text

Workmen's Compensation Insurance

Some of the benefits of the Workmen’s Compensation Insurance include:

Financial Protection.

Employer insurance coverage

Partial salary repayment and coverage of medical costs.

Recipients Waive the Right to Sue

#svn financial hub#insurancepolicy#Workmen's Compensation Insurance#https://svnfinancialhub.in/labour-insurance/

0 notes

Video

Happy Mother's Day from NRInsured! Celebrate the love and care of mothers everywhere. Just as you protect and nurture your family, let NRInsured protect your future with our reliable insurance solutions. #MothersDay #ProtectWithLove

visit us at :https://nrinsured.com/insurance-1?utm_source=youtube&utm_medium=cpc&utm_campaign=content+Tracking&utm_id=c1&utm_term=nri&utm_content=insurance

0 notes

Text

What is OD Only – Private Car Insurance

it provides a only one-year own damage (OD) premium Coverages .

OD Only – Private Car Insurance provides coverage for damages to your car (Own Damage) caused by accidents, theft, fire, natural disasters, and other perils. Unlike a comprehensive policy, it does not include coverage for third-party liability. This means it does not cover damages or injuries caused to third parties or their property. OD Only policy is suitable for older cars or when third-party liability is covered separately, such as through a long-term third-party insurance plan. It offers cost-effective protection for your car, ensuring you receive compensation for damages without worrying about third-party legal liabilities.

⛦ Example Scenario:

In the case of Rahul’s car accident in Shimla, where his car was washed away in a flood, his Comprehensive Private Car Insurance policy proved to be immensely helpful. The incident was immediately reported to the insurance company, and a surveyor was assigned to assess the damage. As the policy covered damages from natural disasters, the insurance claim was accepted. The car was towed to an authorized garage for repairs, and the insurance company settled the repair bills directly, relieving Rahul from financial burden. The incident highlighted the significance of having a reliable car insurance policy to protect against unforeseen events and ensure peace of mind for Indian car owners.

#insurance#insurancepolicy#insurancecompany#companyinsurance#companyhealthinsurance#car#carinsurance#beemawala#insurancebroker#insuranceagent#automobile insurance#vehicle insurance#vehicleinsurance#commercialvehicleinsurance

1 note

·

View note

Text

Insurance is an integral part of financial planning and wealth management. It protects individuals and businesses against financial losses due to unforeseen circumstances. In this article, we will explore the role of insurance in financial planning and wealth management and how it can help protect and grow your assets. Click the link to learn more.!

#Insurance#insurancepolicy#insuranceagent#insuranceagency#warranty#lifeinsurance#homeinsurance#carinsurance#travelinsurance

0 notes

Text

Strategies for Creating an Effective Sports Bar Marketing Plan

In the competitive landscape of the hospitality industry, having a well-defined marketing strategy is essential for the success of your sports bar. A comprehensive marketing plan can help you attract customers, build brand awareness, and differentiate your establishment from competitors. In this blog, we’ll explore strategies for creating an effective sports bar marketing plan that drives results and boosts your bottom line.

0 notes