#Hearn's Department Store

Text

Isabel Bishop, Hearn's Department Store—Fourteenth Street Shoppers, 1927. Oil on canvas.

Bishop’s Hearn’s Department Store—Fourteenth Street Shoppers, 1927, painted in tandem with her enrollment in Kenneth Hayes Miller’s mural painting class at the Art Students League, clearly applies formal Renaissance composition and flat perspective to the very contemporary subject matter of the urban middle-class shoppers dressed in the latest fashions that frequented the Union Square shopping district for the latest deals. While fellow Fourteenth Street School artists Kenneth Hayes Miller, Reginald Marsh, and Raphael Soyer frequently depicted the “New Women” of Union Square through a highly sexualized lens of judgment, desire, and sometimes pity, Isabel Bishop approaches her subjects as peers. Ephemeral movements, exchanges, and moments of solitude are the primary subject matter of the paintings, all depicted in a dynamic style of painting that is unfinished and tenuous but somehow glowing. Even in the paintings depicting office girls in a moment of relaxation while taking a quick 15, the energy and hope of upward mobility in the face of the mundane are apparent in the brushwork. Isabel Bishop’s painting style and subject choice are uniquely responsive to the built environment of Fourteenth Street and Union Square.

—Anna Marcum, Village Preservation blog

Photo: Vero Beach Museum of Art

#New York#NYC#vintage New York#1920s#Isabel Bishop#painting#Hearn's Department Store#14th St.#shoppers#Union Square#social realism#Fourteenth Street School#urban realism#oil painting

90 notes

·

View notes

Text

One Hundred Years Ago, A Cincinnati Newspaper Campaigned For A Ban On Pistols

Cincinnati has never developed a taste for satire or parody. From Lafcadio Hearn’s and Henry Farny’s 1874 “Ye Giglampz” to Frank Diekmann’s 1983 “Cincinnati Inquirer,” our town has proven to be pathetically satire resistant. That was surely the situation one hundred years ago in 1923 when a Cincinnati Post stalwart attempted to use satire in a campaign against cheap pistol sales.

In 1923, the United States was far more violent than it is today, with around 8 murders per every 100,000 people, compared to 6.5 murders per 100,000 people today. Over the years, the primary weapon of choice was a firearm of some sort.

Al Segal of the Cincinnati Post was fed up. In addition to reporting on all sorts of incidents, Segal wrote two columns for the Post, one under the byline “Cincinnatus” and one as “The Village Gossip,” and he brought all his journalistic weight to bear on the city’s carefree attitude towards pistol sales. On 24 September 1923, Segal’s “Village Gossip” column published a letter purportedly written by a Chicago burglar, signed “X-23,” who had relocated to Cincinnati to ply his trade. At the time, every hardware store, sporting goods store, and department store in the city carried a selection of firearms and our burglar found no difficulty at all in procuring a pistol. He effused over the courtesy extended by Cincinnati’s arms merchants, but admitted he had run into a bit of a problem:

“I found a woeful lack here of the other tools of my trade. I need a jimmy, a crowbar, some nitroglycerin and a noiseless sledgehammer. I am not writing this in a spirit of criticism, but merely to give a business tip to the people of your city. I suggest that a line of jimmies, noiseless hammers, crowbars and nitroglycerine would go well with a line of pistols.”

The Village Gossip responded to X-23 by announcing his plans to open just such an emporium:

“Taking X-23’s tip, I beg to announce that I have opened a store for the sale of pistols and other tools of burglary and banditry. I feel as X-23 does about it. We offer pistols for the asking to men of his profession and yet we prevent them from obtaining the other necessary tools of their profession. My card reads:

Village Gossip,

Gun Dealer,

Also, Full Line of Jimmies,

Nitroglycerine, Crowbars

And Noiseless Hammers.”

As expected, Segal got a lot of pushback from the Post’s readers, accusing him and his newspaper of promoting crime and lawlessness by selling criminal tools to criminals. He attempted a reasoned response [25 September 1923], but discovered, as so many others have, that Cincinnati is immune to satire.

“It seems to me absurdly unfair that we should permit the sale of pistols to burglars and yet deny them the right to buy other tools, less deadly, such as jimmies, crowbars, noiseless hammers and nitroglycerine. In justice to burglars, I have opened my burglar tool store and intend to keep it open until Council passes an ordinance prohibiting the sale of pistols as well as other burglar tools.”

The impetus for Segal’s crusade were two murders committed with cheap, locally purchased, pistols. The first was Cincinnati Policeman Lawrence Klump, killed while breaking up a boisterous crowd in the West End on 11 August 1923. Klump’s assailant shot him at point-blank range with a pistol he had purchased for $3. As the Post pointed out, that $3 pistol cost the City of Cincinnati $7,500 after the murderer’s trial rang up $3,000 in expenses and the city paid out $4,500 to Officer Klump’s widow.

It was the murder of 14-year-old Minnie McFerrin of Covington that truly fired up Segal’s righteous anger. Minnie and her 12-year-old sister Mattie were the daughters of a drunken ne’er-do-well named William McFerrin. Their mother had deserted the family because of McFerrin’s cruel treatment. The girls were taken in by a neighbor, Sallie Padlon. McFerrin resented the bond his daughters formed with Mrs. Padlon and was jealous of the affection the girls showed to her. One night, McFerrin got roaring drunk and wandered over to Cincinnati, where he purchased a pistol, then took a streetcar back to Covington. He decided to confront the woman his daughters called “Aunt Sallie” and barged into the kitchen where Mrs. Padlon and Minnie were cleaning. He fired one shot at Mrs. Padlon, who fled the room and fired a second round after her, which fatally wounded his daughter.

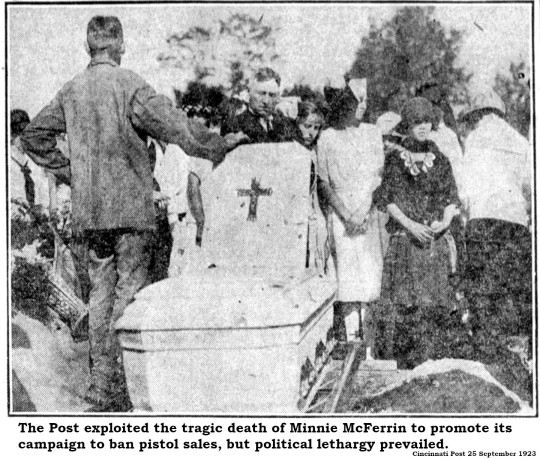

The Post spread coverage of Minnie McFerrin’s funeral across the front page on 25 September 1923. Minnie’s white coffin was carried to her grave in St. Mary’s Cemetery in Fort Mitchell. The pallbearers were Minnie’s classmates from Saint Walburg’s Academy in Covington. The Post’s front-page news story included an indictment of Cincinnati’s reluctance to enact regulations on pistol sales:

“Since Minnie McFerrin was killed with a pistol bought by her father in Cincinnati the day before her death, her funeral was a proper occasion on which to ask Mayor George Carrell a certain question, namely: ‘Mr. Mayor, what are you going to do with the ordinance to regulate the sale of pistols in Cincinnati, as proposed by the Post?’”

The answer, despite continual nudging by Segal and the Post, was nothing. Cincinnati in 1923 remained in the clutches of the Boss Cox machine. Although George Barnsdale Cox himself had been dead for several years, his minions kept the sputtering political machine alive. When the city solicitor, finally bowing to public pressure, sent a draft ordinance regulating pistol sales to council, it was met with a legislative yawn. The Post [29 October 1925] was livid:

“The city solicitor sent it to Council to be presented there. But ‘party responsibility’ that governs all acts of Council would have nothing to do with it. ‘Party responsibility’ that approves a bootlegger and a bribe-giver in Council would not give its approval to this ordinance to keep guns out of irresponsible hands.”

Within two weeks of that complaint, Cincinnati had a new City Council, dominated by the new Charter Party and mostly free of Cox Machine interference. When presented with a new version of a city ordinance to regulate handgun sales, the new, progressive council punted. The state, they said, should oversee firearm laws.

Al Segal may have sighed in frustration, but his days as a satirist were over.

6 notes

·

View notes

Photo

1927 Painting of shoppers at Hearn’s Department Store, 14th Street, Manhattan by Isabel Bishop. From New York City History and Memories, FB.

41 notes

·

View notes

Text

Morose Mononokean II 1 | Mob Psycho 100 II 1 | Meiji Tokyo Renka 1 | My Roommate is a Cat 1 | Promised Neverland 1

I think I’ve got too many cute fluffy creatures this season...

Mononokean II 1

For some reason, before I started watching this I kept reminding myself of Tomodachi Metre and fearing the new OP (because there’s almost always a new OP when dealing with a second season) would be faster-paced…the song is faster-paced, but not in the way I thought it would be (I thought it was going to be hard rock kind of pace, but it’s at least a tad slower than that).

Utakuni is such a fluffy kitty!

Ah, Moja Moja is best moja, indeed. Gossamers from As Miss Beelzebub Likes just don’t compare, y’know?

The Legislator is practically the king of “You mad, bro?”. (LOL)

Okay-dokay, lemme explain. There are 3 arms of government (known as the separation of powers, in order to have a series of checks and balances) – the Legislative, Executive and the Judiciary, meaning we’re missing that final one at the moment…

I never knew Morose Mononokean was so obsessed with comedy…or maybe I’m just noticing it now that I have experience with comedy I get bored at…

Abeno’s face of disgust really sold that moment with Moja, LOL.

Well, by virtue of being a sequel to something I watched previously, it’s more likely to get coverage, but you can never say for certain until the first episodes are over and done. On to the next thing – Mob Psycho!

Mob Psycho 100 II 1

Alright, all these “II 1”s are going to make me confused someday, aren’t they…?

I think the dude’s Suisho simply means “water crystal”. But I’m only guessing as to what kanji are being used here, so I could be wrong.

The pixel art bit was good. More like that, please!

“Your life is your own” – is that Mob Psycho’s slogan, in the same way Symphogear has that thing about “holding courage to fist” and whatnot?

Unlike Mononokean, which you only need to know the very basics (which are in turn explained in the episode itself), it seems Mob Psycho is playing hardball in that department – if you don’t remember that time Kamuro started kicking his lackeys around, you’re going to have to watch it again. (Either that, or you watch the Reigen recap.)

Hmm…”[something to help Mob] grow” sounds a bit odd, but that’s a correct translation. That’s what seichou suru means.

Oh great…you know how I said I was cleaning out the house lately? Someone found an old copy of this book called Inventing Elliot, which I despised studying about (because it got me some of the lowest grades in my school life, aside from outright failures and close scrapes with failure). The problem is, I’m getting Inventing Elliot vibes from this particular plotline…and since that’s Mean Girls in a boys’ private school + Mob Psycho is all about the abuse of power, that’s completely a storyline the show would go with. *gulp*

Hey, they have actual eyecatches now! Hooray!

A certain kanji for “Emi” (with a mi in hiragana, IIRC) is “smile” in English, so I find it interesting they paired Mob up with a girl like her. (Then again, if it were a hiragana/kanji mix, that’s not a name.)

Oh yeah, the hitode (starfish) shirt.

Rinshi! Ekoda-chan 1

Why am I covering an R18+ series? It’s a long story…

The jokes are, as of this segment with the old lady, only about 50% hits. That seems to be a pretty bad track record. The thing about Ekoda being identified as 3 years older than what she really is is also relatable, since I don’t think I’ve grown much past a certain age.

Note there’s a Japanese store called JUSCO. There was one in Hong Kong, which was full of cool stationery.

Wait…that’s it? So why’s it 26 minutes??? Documentary…okay, I’m getting the heck out of here.

Meiji Tokyo Renka 1

I heard Ume was here…? More bishies and more Ume for me!

What’s up with the Haikara-san ga Tooru outfit, anyway?

Who dis boy? He kinda looks like Mikoshiba from Gekkan Shoujo Nozaki-kun…Update: That’s Ougai.

At least the jazz music is cool. Also, the episode title should be “Suddenly, under a Strawberry Moon…” or something, since it went totsuzen ni.

*Mei checks her phone* - This is why you don’t text and walk across the road, kids!

Ougai…y’mean, Mori Ougai? The loli dude from Bungou Stray Dogs is this redhead?! EHHHHHHHHHHHH?

Oh great. Amnesia plotline…

Hishida Shunso…a painter.

Okay…that’s a really obvious point where you’d be able to insert your own name if you were a gal (or if you wante to play as a gal).

The age of the Rokumeikan seems to pin the timeline down to “after 1883”. For some reason, it sounded familiar, but I wasn’t familiar with why - so maybe I’ll learn about it someday.

“Little Squirrel”?(!) (lowkey laughs for all the wrong reasons) And here I thought “Little Flower” (from Magic-kyun’s Louis and Dame x Pri’s Vino) was awkward-sounding but still endearing.

Okay, second redhead. When I saw him in the OP, I swore he was Ancient Magus’ Bride’s Chise…

So the germophobe redhead is Izumi Kyoka…but I’m not sure who this Kawakami is…

I don’t know how anyone could make a germophobe endearing, much less make him romanceable…

Otojiro Kawakami. Comedian and actor.

Lafcadio…wuh? Update: (Patrick) Lafcadio Hearn, Greek dude with a Japanese penname. He seems to have written stuff on Japan as well as other places.

“…that collection of ghost stories…”

Everyone seems to have forgotten about the roast beef but the animators…LOL…oh, spoke too soon. Kawakami just walked it back to the table.

Wowwwwwwwwwwww, Mei is so easily distracted by roast beef and pretty boys who, to be honest, aren’t that pretty…I’m just waiting for the long-haired dude and/or Ume and I’ll kick my butt out of here.

I thought Fujita was voiced by a familiar voice and turns out I was right – it’s Fukuyama Jun.

Well, that was mildly unsatisfying. I think I spent more time watching Mei getting blushy at dudes and not feeling an attraction myself. Fujita was the only one I wanted and he didn’t even do much but swing a sword. Seriously, though, what the heck was Charlie doing turning off the lights all of a sudden?

My Roommate is a Cat 1

Well, it’s either that title or Dokyounin wa Hiza, Tokidoki Atame no Ue. …which is a lot to write in one shot.

Why’s the cat on Subaru’s…junk?

The cat appears to be typing out the Dancing Men from Sherlock Holmes…except they’re cats. The Dancing Men are basically what made me think I had a career in computer security in the first place, come to think of it…but I’ve abandoned that kind of thinking now. Modulos are way too hard for me.

Them spoilers! I know that feel.

Koguma = small bear, in a story about a small cat. LOL.

Hiroto…I thought about this during the funeral scene, but…why does he look like Suzaku from Code Geass???

Hmm, yeah. I can see why Hiroto isn’t all that convinced – I’m a similar kind of person, with only a small pool of pursuits that keep me going for a long, long time. *looks at rabbit outside and remembers when I saw it in the darkness about 3 years ago*

Oh, so Subaru was so absorbed in his manuscript he forgot to eat, huh?

Kitty show too cute! Ehehehee… <- (ecstatic about having a new weekly dose of cuteness)

Promised Neverland 1

I’ve read the first volume of this. I’m not 100% in love with it, but if I can have bragging rights over finding the next big hit, why not?

Noitamina…now that’s a name I haven’t seen in a few years…*grumbles at Amazon*

For some reason Norman (white-haired boy) has this “betrayer” vibe written all over him. It’s because I know in BnHA and Ao no Exorcist, there are betrayals by certain people.

The aesthetic of this thing is like a fairytale and not like a typical anime. That’s probably one thing that convinced people to give it a shot.

LOL, there’s a Detective Conan door..well, it kind of looks like one.

The word for “tag” in Japanese is onigokko and “It” is an oni. That gives a whole new meaning to “playing tag with monsters”, doesn’t it?

Update: I can sort of feel my “this is popular, so I won’t like it” radar going off...so I’ll put it on hold until I get over that feeling.

#simulcast commentary#the morose mononokean#fukigen na monokean tsuzuki#fukigen na mononokean#mob psycho 100#mob psycho season 2#My Roommate is a Cat#doukyonin wa hiza tokidoki atama no ue#the promised neverland#yakusoku no neverland#meiji tokyo renka#Chesarka watches MP100#Chesarka watches Doukyonin wa Hiza Tokidoki Atama no Ue.#Chesarka watches Fukigen na Mononokean

2 notes

·

View notes

Text

Bitcoin is 10 years old: Here’s what to expect in the cryptocurrency’s second decade

Bitcoin is 10 years old: Here’s what to expect in the cryptocurrency’s second decade

Oct. 31 marks the 10th birthday of one of the most promising, yet divisive technological advancements of the 21st century: Bitcoin.

In the aftermath of the global financial crisis, the first and most famous cryptocurrency emerged from an underground network of libertarian-leaning cypherpunks. Over the past decade its popularity has soared, but so has the number of its detractors. On the eve of its anniversary, here’s a look back at some of the glorious — and infamous — moments in the short life of the world’s most famous cryptocurrency.

And where it all began:

‘I’ve been working on a new electronic cash system that’s fully peer-to-peer, with no trusted third party’

Satoshi Nakamoto, Oct. 31, 2008, 06:10:00 PM

That was the first email in a series of messages sent by Satoshi Nakamoto, the presumed pseudonym adopted by the creator of bitcoin, in a proposal for a payment system that is completely anonymous running on a decentralized distributed ledger, known as the blockchain.

Today, there are over 2,000 cryptocurrencies, most of which will fail and become worthless, according to Barry Silbert, chief executive officer of the Digital Currency Group, and there are already close to 1,000 dead coins, ones that either failed before launching or have ceased operation, according to a website that tracks such failures.

But the very first digital currency is still going strong, albeit with plenty of ups and downs. Once worth less than 1 cent, a single bitcoin fetched nearly $20,000 in December 2017. Today, one bitcoin

BTCUSD, +3,419.44%

changes hands for about $6,500.

Bitcoin’s 10-year run The early days

After the release of the Bitcoin white paper a decade ago, Satoshi started a chain of emails to a cryptography mailing list, largely made up of cypherpunks — those who promote increased financial privacy — looking to spread and champion computer encryption. The early emails were met with both enthusiasm and skepticism.

“Bitcoin seems to be a very promising idea. I like the idea of basing security on the assumption that the CPU power of honest participants outweighs that of the attacker,” wrote computer programmer Hal Finney in an email exchange with the group.

Read: Here are all the early email exchanges between Satoshi and the cryptographers

It was at least two months before the blockchain and bitcoin experiment got under way with the creation of the Genesis Block, the first 50 bitcoins ever mined.

A note that accompanied the copy of the Genesis Block gave rise to the notion that bitcoin, in part, may have been a response to the financial crisis. “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks,” the message said.

However, in an interview with MarketWatch, New York University professor David Yermack, debunked this theory, but did say that the timing definitely contributed to the hype around bitcoin.

The Genesis block

Read: Here’s how much it costs to mine a single bitcoin in your country

But what were people meant to do with these bitcoins once they had been created, or mined?

“I guess the key problem right now is that once you generate coins, there’s nobody to test it with, even for dummy transactions. Is there a plan for a mailing list or some kind of trivial marketplace to give people something to do with their newly minted bitcoins?” wrote Mike Hearn, a software developer and early bitcoin developer in the cryptography email chain.

One year later, his question was answered.

First recorded transaction

While there were a number of early test transactions — the first being a transfer between Satoshi and Finney — the first documented transaction didn’t occur until 2010.

On May 22, 2010, Jacksonville programmer Laszlo Hanyecz, convinced Jeremy Sturdivant to send him two pizzas, and in return, Hanyecz would give him 10,000 bitcoin, which in today’s terms is more than $30 million per pizza. The transaction would become part of crypto folklore and May 22 will always be known as Bitcoin Pizza Day.

Eight years on, bitcoin is traded freely on more than 200 exchanges, with volume dominated by speculators hoping to make a quick buck buying and selling the most liquid cryptocurrency. There are now more than 250,000 on-ledger transactions per day, according to data from Blockchain.com.

Transactions per day, per Blockchain.com

At its peak in late 2017, there were nearly half a million transactions happening each day.

Mt. Gox hack

Four years after the first bitcoin transaction, the industry hit one of its lowest points. In February 2014, Japanese-based cryptocurrency exchange Mt. Gox was hacked, resulting in the loss of more than 800,000 bitcoins. At the time, Mt. Gox was handling more than half of all bitcoin transactions world-wide. The heist was the first big snag in the coming out of the opaque industry.

The Mt. Gox scandal was met with hostility and the company was forced to move its headquarters to its previous offices citing security concerns, the company said at the time.

But what it did do was put bitcoin on the front page of the news.

“I became enthralled in bitcoin when Mt. Gox ‘disappeared’ my bitcoin,” said Tim Draper, founder and director of Draper Associates. “When that happened, I thought bitcoin would collapse, but it didn’t, so I knew it was more important than it seemed on the surface.”

Draper would later become a household name in the crypto industry when he purchased the bitcoins the U.S. Justice Department seized in the Silk Road case. The bitcoins were sold for an average price of just over $300. Draper said he weighed the risk/reward at the time and figured there is a chance they could be worth hundreds or even thousands of dollars at some stage. “At this point, It looks like it will be the former, so I lucked out,” he said.

Read: Former Mt. Gox CEO does not want his billion dollars

Yet, security remains one of the technology’s biggest hurdles.

Limitations and headwinds

The Mt. Gox hack is just one in a number of thefts that has undermined the integrity of digital assets. In 2016, two years after the Mt. Gox fiasco, the Bitfinex exchange was infiltrated resulting in the theft of 120,000 bitcoins. All totaled, some estimate that more than 1 million bitcoins have been stolen.

However, the pressing question for bitcoin evangelists is adoption: Is there a place for it in the financial ecosystem? Right now that answer is not quite yet.

As a payment device, bitcoin can process around five transactions per second, while credit card companies like Visa

V, +4.31%

and Mastercard

MA, +4.74%

can process more than 5,000 per second. As a store of wealth its security flaws, as discussed earlier, mean it is far from becoming digital gold.

But according to Nigel Green, founder and CEO of deVere Group, a U.K. consulting firm, that will change: “There’s an ongoing shift away from fiat money, and the momentum of this is only set to increase over the next 10 years.”

Read: Winklevoss: If you can’t see bitcoin at $320,000, you just lack imagination

On the eve of its 10th birthday, 2018 has unveiled another flaw in bitcoin: volatility. While the trading community lap up the wild price swings, those pushing for mainstream use have had to withstand a collapse in the price of the No. 1 digital currency.

As euphoria was building, highlighted by the introduction of bitcoin futures, bitcoin fell more than 60% from its all-time high on Dec 17, 2017.

Read: What’s more volatile than bitcoin? You may be surprised

What the future holds

Depending on who you ask, the future of bitcoin looks like anything from the next U.S. dollar or digital gold, to a total bust that will be nothing but a footnote in financial textbooks.

As bitcoin proponents push for more complex financial products, most notably a bitcoin-backed exchange-traded fund, or ETF, regulators now play a pivotal role in the advancement of the cryptocurrency and blockchain movement. Lawmakers and regulators are weighing investor protection in an industry that is rife with nefarious characters, yet offers much potential.

Read: These may be the 3 biggest hurdles to a bitcoin ETF

For detractors, bitcoin is just a passing fad. One of the most vocal critics is prominent New York University economics professor, Nouriel Roubini, who has called bitcoin the mother of all bubbles, compared blockchain with a glorified excel spreadsheet and lambasted the crypto community as a bunch of “self-serving white men pretending to be messiahs for the world’s impoverished, marginalized, and unbanked masses.”

Read: Opinion: Roubini calls out the big blockchain lie

However, the nascent product may have received its biggest stamp of approval just weeks before its 10th birthday when financial services giant Fidelity Investments announced it was opening a cryptocurrency trading service for funds and sophisticated investors. Previously, large institutions had largely remained on the sidelines.

But now, coming upon 10 years since the inception of cryptocurrencies, the decentralized technology that began with bitcoin may have started a path where the so-called trusted third parties are mining bitcoin instead of printing money.

“I see bitcoin becoming the most important and most transacted currency in the world, not just for remittances, or cross-border transactions, but for every use currency. It won’t be long before bitcoin eclipses the dollar as the most popular currency,” said Draper.

Read: This is where cryptocurrencies are actually making a difference in the world

Providing critical information for the U.S. trading day. Subscribe to MarketWatch’s free Need to Know newsletter. Sign up here.

Source link http://bit.ly/2LS7FOo

1 note

·

View note

Text

Cooper Hewitt Short Stories: Hewitt Sisters Collect Wallcoverings

In last month’s Cooper Hewitt Short Story, we buttoned up with a rousing exploration of the history of the button as illustrated by Cooper Hewitt’s expansive collection. This month, we delve into the uniquely Cooper Hewitt collection of historical and contemporary wallcoverings. Greg Herringshaw, the museum’s curator of wallcoverings, outlines three key areas collected by the Hewitt sisters, and how the wallcoverings department has grown from then.

Margery Masinter, Trustee, Cooper Hewitt, Smithsonian Design Museum

Sue Shutte, Historian at Ringwood Manor

Matthew Kennedy, Publishing Associate, Cooper Hewitt, Smithsonian Design Museum

Medieval leathers to Digital Prints

Eleanor and Sarah Hewitt began collecting wallpapers for the Cooper Union Museum in 1900, and today the Wallcoverings collection at Cooper Hewitt, Smithsonian Design Museum is the largest in North America, containing over 10,000 samples. The Hewitt sisters confined their wallcoverings acquisitions to three main areas: gilt leathers, antique wallpapers, and American bandboxes. They had collected nearly 500 wallcoverings by the time of Sarah’s death in 1930 (Eleanor died in 1924). This included 104 gilt leather wallcoverings, 64 bandboxes, and nearly 300 wallpapers, primarily French, from the late eighteenth and early nineteenth centuries. Due to space constrictions, Eleanor and Sarah made a general rule not to collect or exhibit any objects produced after 1825. They had an eye for quality, and, while most of the wallpapers they collected show exquisite design and craftsmanship, many of the pieces had condition issues. But as the objects were acquired to inspire students, designers, and the public, this was not viewed as a problem.

Leather, 1750–99; Leather, painted, varnished, stamped; H x W: 32 x 28 cm (12 5/8 in. x 11 in.); Gift of George Arnold Hearn, 1903-9-13-a,b

Gilt leather wallcoverings have been produced since the middle ages and originally consisted of a painted design over a smooth gilt leather surface. Wood molds used to press a relief pattern into the leather’s surface were developed in Holland in 1628 and made a noticeable change in the appearance of the leathers. Gilt leather wallcoverings were produced by covering the tanned hides with tin-foil, then coating with yellow varnish to create the appearance of gold. The leather was then pressed into a mold to create a relief pattern, and finally the design was painted on using oil colors. These were used for wallcoverings, folding screens, and upholstery, as well as pouches and to wrap boxes. Some of the early leathers donated to the collection came from Mrs. James O. Green—aka Amy Hewitt (1856–1922), sister of Eleanor and Sarah—who made frequent donations to support their museum. Another large group of leathers was donated by George A. Hearn, founder of Hearn’s Department store and collector of contemporary American art. He was also a major benefactor to the museum, offering both financial assistance and objects for the collection.

(left) Leather, ca. 1750; Gift of Mrs. James O. Green, 1903-8-1. (right) Leather (Holland), ca. 1700; Gift of Eleanor Garnier Hewitt, 1903-12-5

Leather (Flanders), ca. 1700; Gift of George Arnold Hearn, 1903-9-9

Bandboxes were initially used for storing and transporting men’s collar bands, but sizes evolved to accommodate hats and for use as general carryalls. In America, bandboxes were most popular from about 1800 to 1850. Most often these boxes were composed of pasteboard stitched together and covered with either wallpaper or specially printed bandbox papers. The more interesting boxes were covered with bandbox papers documenting historic events produced during the 1830s and ‘40s, including a record-setting hot air balloon launch, the Erie or Grand Canal, the first steam-powered boat, and Castle Garden in New York City. Many of the museum’s boxes had come from the collection of Alexander Wilson Drake, the artist, author, and passionate collector. Another group was donated by Amy Hewitt.

Bandbox, Walking Beam Sidewheeler, ca. 1840; Block printed paper on pasteboard support; 39.5 x 29 x 26 cm (15 9/16 x 11 7/16 x 10 1/4 in.); Gift of Mrs. Frederick F. Thompson, 1913-45-8-a,b

(left) Bandbox with Drapery Wallpaper (USA); ca. 1830; Gift of Eleanor and Sarah Hewitt, 1913-17-26-a,b. (right) Bandbox with Squirrels (USA); ca. 1830; Gift of Alexander Wilson Drake, 1913-9-1-a,b

Hatbox in Shape of Top Hat (USA), 1840s; Gift of Alexander Wilson Drake, 1913-9-4-a,b

The antique wallpapers the sisters collected include a mix of borders, friezes, dados, sidewall papers, firescreens or overdoors, and domino papers, designed to cover every part of the wall. The first wallpaper collected was produced by premier French manufacturer John-Baptiste Réveillon, whose factory was one of the first casualties of the French Revolution. The paper is from the John Lincklaen house in Cazenovia, New York, said to have been hung in honor of the marriage between John Lincklaen and Helen Ledyard. This was donated by Mrs. Charles S. Fairchild (Helen Lincklean, great granddaughter of John), whose husband served as Secretary of the Treasury under Grover Cleveland and was a leader on Wall Street. A political figure in her own right, Helen worked alongside Eleanor Hewitt on the New York State Association Opposed to Suffrage. Leading wallpaper manufacturers and distributors also pitched in and donated papers from their archives, including Cowtan & Sons, Ltd., Charles Grimmer & Son, W.H.S. Lloyd Co., Inc., and Richard Thibaut, Inc.

Sidewall (France), 1785–90; Made by Jean-Baptiste Réveillon (French, 1725–1811); Block printed on handmade paper; H x W: 107 x 52.5 cm (42 1/8 x 20 11/16 in.); Gift of Mrs. Charles S. Fairchild, 1900-5-3

(left) Wallpaper with Scenes from The Horse Fair by Rosa Bonheur, 1855–75; Gift of Eleanor and Sarah Hewitt, 1928-2-73. (right) French Revolution Wallpaper, 1792–93; Jacquemart & Benard (Paris, France); Purchased for the Museum by the Advisory Council, 1925-1-370

Border, France, 1810–20; Gift of Eleanor and Sarah Hewitt, 1928-2-68

Records indicate the museum acquired its first contemporary wallpapers in 1930. These were predominantly modernist in design, produced in Germany, Austria, France, and the USA. Many of the smaller samples were pasted into the legendary scrapbooks maintained by the Hewitt sisters, of which over one thousand were created. These scrapbooks contained designs of every aspect of the decorative arts and were readily accessible for study. (FN 1) Other modernist wallpapers were given for an exhibition at the Cooper Union in 1930. (FN 2) The wallpapers were donated by a number of prominent sources, including the Paul Frankl Gallery and wallpaper distributor W.H.S. Lloyd.

Sidewall, Celui qui aime ecrit sur les murs [One who loves writes on the walls], ca. 1924; Designed by Jean Lurçat (French, 1892–1966); France; block printed on paper; Overall: 47.5 x 47 cm (18 11/16 x 18 1/2 in.); Gift of Mrs. Cornelius Sullivan; 1930-21-1-e

Another interesting donor of modernist wallpapers is Mrs. Cornelius Sullivan (Mary Josephine Quinn, 1877–1939), whose gift included designs by renowned French designers Jean Lurçat (1892–1966) and Paul Vera (1882–1957). She was trained as an artist and moved to New York City to study at Pratt Institute. After her marriage to Cornelius in 1917, the couple began collecting works of modern art and Mary was a founding member of the Museum of Modern Art. No doubt she offered encouragement to Cooper Union to collect modernist designs.

(left and right) Sidewalls, European Wallpapers: Modern Designs, 1928; Designed by Tommi Parzinger, Paul Poiret and Dagobert Peche; machine printed on paper; Gift of Lois and William Katzenbach, 1969-167-1-21

The popularity of wallpaper has had its ups and downs, as all trends do. When the Cooper Union Museum began collecting wallpaper in 1900, the fashion for papered walls was at an all-time high. Developments in machine printing made wallpaper very affordable, while hand woodblock-printed wallpapers were still being produced by a handful of prestigious manufacturers. Wallpaper remained in high demand until the start of the Great Depression in 1929, with continued dips during the war years when government-imposed moratoriums limited production, but came back with renewed vigor in 1946. At this same time silk-screen printing was changing the look of wallpapers as small print runs allowed studios to print specialty papers for niche markets. In contemporary design, digital printing again changed the market by allowing designs to be scalable.

(left) Early screen-printed wallpaper, Palms, 1947; Designed by Winold Reiss (American, b. Germany, 1886–1953), made by Robinson & Barber (American); Gift of Robinson and Barber, 1947-80-8. (right) Contemporary digital print wallpaper, Ara, 2009; Made by Trove (New York, New York, USA); Gift of Trove, 2009-32-2.

And the best news is wallpapers can still be found today printed with any of these techniques, making it easy to find the perfect wallpaper to customize your home.

Sources

FN 1. Lynes, Russell, More Than Meets the Eye, The History and Collections of Cooper-Hewitt Museum, Eastern Press, Inc., 1981

FN 2. Cooper Union Chronicle, Vol. 1, No. 4, April 1938

from Cooper Hewitt, Smithsonian Design Museum http://ift.tt/2AYbqia

via IFTTT

3 notes

·

View notes

Text

A Continuing Journey In The Magic History Of Singapore

This article is to introduce magicians and magic fanatics to the rich records of magic in Singapore. It honours the exquisite achievements, prominence and significance of nearby magicians from the beyond and gift.

The starting of Modern Magic in Singapore

It is the general consensus that contemporary magic in Singapore (post World War 2) started out with the overdue-Ng Bo

Oen AKA The Great Wong. Information on nearby magic pre-battle is very scarce. The handiest facts found has been on The Great Wong performing at the New World Amusement Park (then positioned at Kitchener Road) inside the Thirties.

The Great Wong changed into born in 1908 in Shanton, a town of the Guangdong Province, China and immigrated to Singapore in 1933. He was the only professional magician of his time in Singapore and performed throughout South East Asia. He became known for his sharp stage magic, Linking Rings routine and Sword Basket phantasm. He become also an professional craftsman who built all of his props via hand. He had the present of identifying the mechanics and method of magic props and fabricating them from scratch.

In 1962, The Great Wong made a huge contribution to the global magic network through publishing his famous linking earrings recurring with English script written by Tudor Brock. Davenports Magic in London distributes his manuscript to date. In 1982, he became invited by way of the Federation Internationale des Societes Magiques (FISM) to carry out at the fifteenth World Congree of Magic in Lausanne, Switzerland.

(For extra information on The Great Wong; talk to 'The Great Wong Story' in The International Brotherhood of Magicians Singapore Ring 115 The Quantum Ring Golden Jubilee Issue)

Another local magician who become instrumental in developing cutting-edge magic in Singapore all through the beginning became the past due-Tan Hock Chuan. He changed into a instructor via profession however executed for annual unique occasions, charity indicates and personal events. He was (and nonetheless is) across the world acknowledged for his magical innovations. His outcomes and ideas are nonetheless marketed provider gadgets today and have been published in endless publications (of that point) consisting of Gen, Spinx, Pentagram, New Pentagram, Swami Mantra, Abracadabra and even Tarbell's Course in Magic. He is the first Asian magician to receive the Spinx Award (1936-37)

Both The Great Wong and Tan Hock Chuan have been critical impacts to most of the first era of Singapore present day-magicians who have paved the manner for future generations.

1950s

It became simplest after the warfare and at some stage in the British Military Administration that magic in Singapore started its upward thrust to where it is today. 1950 become the yr that the Singapore Magician's Club changed into formed by using a collection of novice magicians, comprising of English-educated specialists.

In 1951 the Singapore Magician's Club obtained their charter from The International Brotherhood of Magicians HQ in America and become from then on changed into formally known as The International Brotherhood of Magicians Singapore Ring one hundred fifteen. Founding individuals of the membership at that point covered Tan Ewe Chee (President), Yeo Soon Kian, Lim Kim Tian, Lim Hap Hin, J.H Stafford, L.A Joseph, J.W Jackson (Vice-President) and Tan Hock Chuan (Secretary).

The 50's gave birth to Singapore's first generation of cutting-edge magicians. Besides the founding members of the IBM Ring and The Great Wong (who joined the Ring in 1952 through invitation), a few prominent first technology magicians blanketed Lim Hap Hin, Tan Choon Tee, Tan Bah Chee, Yeo Soon Kian and his student Michael Lim.

The Great Wong operated the first magic shop from his domestic cum showroom/ workshop in Singapore at 255-A Jalan Besar where he sold his very own hand made props in addition to imported provider gadgets from Japan. (This home/ keep changed into destroyed in a fireplace in Dec 1988 inflicting him to lose maximum of his books and props)

1960s

During this era, magicians like The Great Wong, Tan Bah Chee, Lim Hap Hin and Tan Choon Tee carried out magic guides on the National Theatre Club and the YMCA. They have been responsible for producing active magicians along with Charles Choo, Wong Fok Choy, Chia Hearn Jiang, Gwee Thiam Hock and the overdue-Vijeyacone.

The early 60s also saw the 'Golden Age' of magic with magicians performing at different venues across the country. Besides local magicians appearing in night time golf equipment, foreign magicians consisting of Socar accomplished a grand illusion display to a full house at the Capitol Theatre (along Stamford Road) and The Great Nicholas at the Sky Theater in The Great World Amusement Park at Kim Seng Road (Now, Great World City).

In the late 60s, Wee Peng Guan (Uncle of Charles Choo), opened the second magic keep in Singapore at a store residence alongside Robinson Road. Around that point, famous entertainer Victor Khoo's father Khoo Teng Heng who become a magician, a ventriloquist and hypnotist opened his magic store at Bras Basah. (in which Carlton Hotel stands presently).

During this decade, Tan Choon Tee was creating a name for himself inside the worldwide magic community inside the field of Mentalism. He won numerous worldwide Linking Ring Awards for his One-Man Parades and has books posted by way of Micky Hades. He changed into also a normal contributor to numerous international magic magazines such as Gen, New Pentagram, Magicgram, Magicana and The Linking Ring.

Overseas magicians whom exceeded via Singapore protected Milo & Roger, Milbourne Christopher and Maurice Fogel.

1970s

The 1970s saw the start of the second one era of Singapore magicians. Some well-known magicians who got started out during this time covered; The Great Wong's son Ng Kee Chee, John Teo, Tang Sai Thong, Ng Seow Kiat, Tang Yeng Fun, Bob Chua, Eric Leong, Tan Teck Seng, Lawrence Tham, Tan Tuan Seng, Lawrence Khong and Andrew Kong.

The Singapore Association of Magicians became founded on 10 March 1973 in pleasant 'contention' to the IBM Ring. The membership was led via Tan Bah Chee with prominent founding members consisting of Lim Hap Hin, Tan Hock Chuan and Charles Choo.

Magic stores in Singapore started to spring up at some stage in the overdue seventies. Ng Kee Chee installation a magic stall at Yaohan in Plaza Singapura and Wang Leng opened his shop in Peninsula Plaza. Charles Choo opened his shop in August 1978 on the sixth ground of Far East Shopping Centre. (It could move numerous instances to numerous department stores however finally lower back back to Far East). His shop would soon grow to be an group in which magicians could buy diverse magic products as well as join up and study from each different.

It became a variety hang-out for lots magicians in the years yet to come till the shop closed inside the new millennium.

During this era, The Tropicana Night Club, which become situated at Pacific Plaza, was a venue that had normal magic performances. Several famous magicians also visited Singapore within the 70s. In 1970, John Calvert executed on the National Theatre. In 1972, Albert Goshman visited Ring 115 to give a lecture. In that identical 12 months, "The Professor" Dai Vernon also visited Singapore, lectured and interacted with nearby magicians. Other touring magicians protected Andre Kole, Billy McComb, and Ali Bongo.

Nineteen Eighties

By the Nineteen Eighties, the nearby magic scene was flourishing with healthful memberships for the two main magic clubs in addition to a surge within the quantity of appearing magicians. Many of state-of-the-art veterans made their name in the 80s. Familiar names like Richard Ang, Patrick Wan, Patrick Ng Wang Lin, Tan Hai Yan AKA Gician, Paul Koh, AB Francis and Gordon Koh had been acting often at public and personal shows throughout this decade. Popular local venues for public magic indicates by magic clubs held on a everyday basis at that point blanketed the Drama Centre and the National Museum Theatrette.

The popularity of magic shops also grew and in 1982, Chew Kin Song opened a Magic & Novelty Corner on the Chinese Book Section of Popular Book Co Pte Ltd on the 4th Floor of Bras Basah Complex. Gician Tan additionally unfolded his first magic store at Parkway Parade which subsequently moved to Marina Square and was managed by Richard Ang. Besides this fundamental store, he dispensed magic items and sets through branch stores

in Singapore and South East Asia.The Singapore target market become additionally uncovered to world-class magic via several magic tv shows and collection that have been aired on nearby TV such as the David Copperfield specials, Magic Magic and The Best of Magic.

Foreign magicians who visited Singapore throughout this time included David Copperfield, Mark Wilson, Ben Harris, Paul Daniels and Gene Anderson.

Nineteen Nineties

The beginning of this decade saw the creation of the u . S .'s third generation magicians into the local magic scene. Prominent budding magicians covered Enrico Varella, Sherman Tjiong, J C Sum, Joe Yu (Chan Ee Kang), Nique Tan Li Keong, Prakash Puru, Kiki Tay, Alex Tan and Jeremy Pei.

The neighborhood chapter of International Magicians Society changed into fashioned, based by means of its President, Tan Bah Chee; although the club's presence in Singapore became brief-lived.

The past due-Nineteen Nineties noticed a large surge in magic international recognition due to David Blaine's street magic specials. Many human beings started out to 'get into' magic and had new mediums to examine the craft which include the introduction of DVDs and the Internet.

A new magic keep, Magic Castle & Promotions, spread out through Vijay Kumar at Shaw Towers soon became 'the area to be' wherein new magicians would dangle out and meet.

During this decade, Wang Leng's keep in Peninsula Plaza turned into bought to Patrick Wan. The save was in the end offered to Richard Ang and is now properly known as Ang House of Magic. Patrick Wan opened his new save, Magic Wand, which has spawned into several stores in numerous elements of Singapore. Steven Sim also opened Magic Supreme at Coronation Plaza which has subsequently moved to Park Mall.

The 90s turned into an exciting decade with many visits and performances with the aid of well-known magicians. Apart from lectures by Michael & Hannah Ammar, Mark Leveridge and Wolfgang & Sonja Riebe there had been also public theatre performances by way of the Pendragons, Princess Tenko, Andre Kole, Franz Harary, David Copperfield, Rudy Coby and Robert Gallop. Other journeying magicians included Larry Becker, Tim Ellis, Terry Seabrooke, Phil Cass and Albert Tham.

2000 - Present

Magic has endured to flourish at the neighborhood degree on this decade. New opportunities and capabilities have emerged to raise the artwork in Singapore. In May 2000, J C Sum staged the primary ever nearby full-night theatre display 'Magic at the Theatre' at Victoria Theatre. Just a month later, greater than a dozen magicians from the US and Canada got here all the way down to Singapore as a part of the Magic Festival prepared by way of the Malls of Centrepoint. Magicians such as Robert Baxt, Rocco and Peter Gossamer completed multiple shows at numerous Centrepoint Malls for over a week.

In 2004, the Singapore Magic Circle (SMC) was created via Aloysius Yeo and with its online forum drew a brand new pool of magic fans together. SMC has because grown to over 1000 members and regularly organize gatherings, occasions in addition to the recent Concept:Magic Micro MAGIC Convention in January 2007.

Through a huge-scale theatre magic musical 'Magic of Love', Lawrence Khong, a pastor with Faith Community Baptist Church and his daughter Pricilla, unfold the gospel message.

The multi-million dollar manufacturing has been staged usually over the years internationally to spread the word of Christ. Subsequently, the identical crew prepared International Festival of Magic conventions in 2003 & 2005. The first of its kind massive magic occasions included competitions, lectures, a sellers' room and performances. International performers such as Jeff McBride, Max Maven, Johnny Thomspon, The Pendragons, Lee Eun Gyeol and Tommy Wonder were booked to carry out on the gala suggests and lectures.

In current years, J C Sum has end up arguably the maximum outstanding Singapore magician of this era. His magic has been seen by way of millions via his live performances throughout Asia in addition to his landmark mass media initiatives on MediaCorp Studio's Ch eight as well as next 'Street Illusions' compilation DVD/ VCD.

His 24-episode 'Magic in Motion' series can currently be visible each day on Singapore Press Holdings MediaBoxOffice via 2007. In the international magic community, J C has additionally hooked up himself as an elite phantasm designer from Asia with the e-book of his three seriously acclaimed illusion books that have been sold in extra than 30 international locations so far.

Another talented award-triumphing magician, Jeremy Pei, is elevating the profile of Singapore magic in the regional magic community along with his theatre suggests, prepared lectures, workshops and energetic participation in magic conventions & competitions in Japan, Korea, China, Thailand and Australia. His special North-Asian affect fashion of magic performance has garnered him a following with new budding magicians whom he teaches and courses. He has additionally released multiple unique magic merchandise that are available to magicians global.

In every other first, award-triumphing junior magician, Kyle Ravin secured a thirteen-episode weekly Street Magic series, "Maya" on MediaCorp Studios' Vasantham Central. This 30min series noticed him carry out magic for the Indian community and celebrities across the united states of america.

This decade has visible the advent of even more magic shops and dealers run by young magicians to satisfy the demand of magic fanatics and magicians. These include new 'brick & mortar' magic stores such as Street Magic by Tan Wei Ping, Tricky Business by means of Jimmy Wong, The Magic Hall by way of Kenneth Peh as well as on-line stores like The Little Magic Shop by way of Ning.

Visiting magicians to this point for the brand new millennium have covered Joshua Jay, Shoot Ogawa, Charles Gucci, Nicholas Einhorn.

And the Magic History of Singapore continues to be written...

See more- https://www.australiaeta.com.sg/

0 notes

Text

Bitcoin is 10 years old: Here’s what to expect in the cryptocurrency’s second decade

Bitcoin is 10 years old: Here’s what to expect in the cryptocurrency’s second decade

Oct. 31 marks the 10th birthday of one of the most promising, yet divisive technological advancements of the 21st century: Bitcoin.

In the aftermath of the global financial crisis, the first and most famous cryptocurrency emerged from an underground network of libertarian-leaning cypherpunks. Over the past decade its popularity has soared, but so has the number of its detractors. On the eve of its anniversary, here’s a look back at some of the glorious — and infamous — moments in the short life of the world’s most famous cryptocurrency.

And where it all began:

‘I’ve been working on a new electronic cash system that’s fully peer-to-peer, with no trusted third party’

Satoshi Nakamoto, Oct. 31, 2008, 06:10:00 PM

That was the first email in a series of messages sent by Satoshi Nakamoto, the presumed pseudonym adopted by the creator of bitcoin, in a proposal for a payment system that is completely anonymous running on a decentralized distributed ledger, known as the blockchain.

Today, there are over 2,000 cryptocurrencies, most of which will fail and become worthless, according to Barry Silbert, chief executive officer of the Digital Currency Group, and there are already close to 1,000 dead coins, ones that either failed before launching or have ceased operation, according to a website that tracks such failures.

But the very first digital currency is still going strong, albeit with plenty of ups and downs. Once worth less than 1 cent, a single bitcoin fetched nearly $20,000 in December 2017. Today, one bitcoin

BTCUSD, +3,419.44%

changes hands for about $6,500.

Bitcoin’s 10-year run The early days

After the release of the Bitcoin white paper a decade ago, Satoshi started a chain of emails to a cryptography mailing list, largely made up of cypherpunks — those who promote increased financial privacy — looking to spread and champion computer encryption. The early emails were met with both enthusiasm and skepticism.

“Bitcoin seems to be a very promising idea. I like the idea of basing security on the assumption that the CPU power of honest participants outweighs that of the attacker,” wrote computer programmer Hal Finney in an email exchange with the group.

Read: Here are all the early email exchanges between Satoshi and the cryptographers

It was at least two months before the blockchain and bitcoin experiment got under way with the creation of the Genesis Block, the first 50 bitcoins ever mined.

A note that accompanied the copy of the Genesis Block gave rise to the notion that bitcoin, in part, may have been a response to the financial crisis. “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks,” the message said.

However, in an interview with MarketWatch, New York University professor David Yermack, debunked this theory, but did say that the timing definitely contributed to the hype around bitcoin.

The Genesis block

Read: Here’s how much it costs to mine a single bitcoin in your country

But what were people meant to do with these bitcoins once they had been created, or mined?

“I guess the key problem right now is that once you generate coins, there’s nobody to test it with, even for dummy transactions. Is there a plan for a mailing list or some kind of trivial marketplace to give people something to do with their newly minted bitcoins?” wrote Mike Hearn, a software developer and early bitcoin developer in the cryptography email chain.

One year later, his question was answered.

First recorded transaction

While there were a number of early test transactions — the first being a transfer between Satoshi and Finney — the first documented transaction didn’t occur until 2010.

On May 22, 2010, Jacksonville programmer Laszlo Hanyecz, convinced Jeremy Sturdivant to send him two pizzas, and in return, Hanyecz would give him 10,000 bitcoin, which in today’s terms is more than $30 million per pizza. The transaction would become part of crypto folklore and May 22 will always be known as Bitcoin Pizza Day.

Eight years on, bitcoin is traded freely on more than 200 exchanges, with volume dominated by speculators hoping to make a quick buck buying and selling the most liquid cryptocurrency. There are now more than 250,000 on-ledger transactions per day, according to data from Blockchain.com.

Transactions per day, per Blockchain.com

At its peak in late 2017, there were nearly half a million transactions happening each day.

Mt. Gox hack

Four years after the first bitcoin transaction, the industry hit one of its lowest points. In February 2014, Japanese-based cryptocurrency exchange Mt. Gox was hacked, resulting in the loss of more than 800,000 bitcoins. At the time, Mt. Gox was handling more than half of all bitcoin transactions world-wide. The heist was the first big snag in the coming out of the opaque industry.

The Mt. Gox scandal was met with hostility and the company was forced to move its headquarters to its previous offices citing security concerns, the company said at the time.

But what it did do was put bitcoin on the front page of the news.

“I became enthralled in bitcoin when Mt. Gox ‘disappeared’ my bitcoin,” said Tim Draper, founder and director of Draper Associates. “When that happened, I thought bitcoin would collapse, but it didn’t, so I knew it was more important than it seemed on the surface.”

Draper would later become a household name in the crypto industry when he purchased the bitcoins the U.S. Justice Department seized in the Silk Road case. The bitcoins were sold for an average price of just over $300. Draper said he weighed the risk/reward at the time and figured there is a chance they could be worth hundreds or even thousands of dollars at some stage. “At this point, It looks like it will be the former, so I lucked out,” he said.

Read: Former Mt. Gox CEO does not want his billion dollars

Yet, security remains one of the technology’s biggest hurdles.

Limitations and headwinds

The Mt. Gox hack is just one in a number of thefts that has undermined the integrity of digital assets. In 2016, two years after the Mt. Gox fiasco, the Bitfinex exchange was infiltrated resulting in the theft of 120,000 bitcoins. All totaled, some estimate that more than 1 million bitcoins have been stolen.

However, the pressing question for bitcoin evangelists is adoption: Is there a place for it in the financial ecosystem? Right now that answer is not quite yet.

As a payment device, bitcoin can process around five transactions per second, while credit card companies like Visa

V, +4.31%

and Mastercard

MA, +4.74%

can process more than 5,000 per second. As a store of wealth its security flaws, as discussed earlier, mean it is far from becoming digital gold.

But according to Nigel Green, founder and CEO of deVere Group, a U.K. consulting firm, that will change: “There’s an ongoing shift away from fiat money, and the momentum of this is only set to increase over the next 10 years.”

Read: Winklevoss: If you can’t see bitcoin at $320,000, you just lack imagination

On the eve of its 10th birthday, 2018 has unveiled another flaw in bitcoin: volatility. While the trading community lap up the wild price swings, those pushing for mainstream use have had to withstand a collapse in the price of the No. 1 digital currency.

As euphoria was building, highlighted by the introduction of bitcoin futures, bitcoin fell more than 60% from its all-time high on Dec 17, 2017.

Read: What’s more volatile than bitcoin? You may be surprised

What the future holds

Depending on who you ask, the future of bitcoin looks like anything from the next U.S. dollar or digital gold, to a total bust that will be nothing but a footnote in financial textbooks.

As bitcoin proponents push for more complex financial products, most notably a bitcoin-backed exchange-traded fund, or ETF, regulators now play a pivotal role in the advancement of the cryptocurrency and blockchain movement. Lawmakers and regulators are weighing investor protection in an industry that is rife with nefarious characters, yet offers much potential.

Read: These may be the 3 biggest hurdles to a bitcoin ETF

For detractors, bitcoin is just a passing fad. One of the most vocal critics is prominent New York University economics professor, Nouriel Roubini, who has called bitcoin the mother of all bubbles, compared blockchain with a glorified excel spreadsheet and lambasted the crypto community as a bunch of “self-serving white men pretending to be messiahs for the world’s impoverished, marginalized, and unbanked masses.”

Read: Opinion: Roubini calls out the big blockchain lie

However, the nascent product may have received its biggest stamp of approval just weeks before its 10th birthday when financial services giant Fidelity Investments announced it was opening a cryptocurrency trading service for funds and sophisticated investors. Previously, large institutions had largely remained on the sidelines.

But now, coming upon 10 years since the inception of cryptocurrencies, the decentralized technology that began with bitcoin may have started a path where the so-called trusted third parties are mining bitcoin instead of printing money.

“I see bitcoin becoming the most important and most transacted currency in the world, not just for remittances, or cross-border transactions, but for every use currency. It won’t be long before bitcoin eclipses the dollar as the most popular currency,” said Draper.

Read: This is where cryptocurrencies are actually making a difference in the world

Providing critical information for the U.S. trading day. Subscribe to MarketWatch’s free Need to Know newsletter. Sign up here.

Source link http://bit.ly/2LS7FOo

0 notes

Text

Bitcoin is 10 years old: Here’s what to expect in the cryptocurrency’s second decade

Bitcoin is 10 years old: Here’s what to expect in the cryptocurrency’s second decade

Oct. 31 marks the 10th birthday of one of the most promising, yet divisive technological advancements of the 21st century: Bitcoin.

In the aftermath of the global financial crisis, the first and most famous cryptocurrency emerged from an underground network of libertarian-leaning cypherpunks. Over the past decade its popularity has soared, but so has the number of its detractors. On the eve of its anniversary, here’s a look back at some of the glorious — and infamous — moments in the short life of the world’s most famous cryptocurrency.

And where it all began:

‘I’ve been working on a new electronic cash system that’s fully peer-to-peer, with no trusted third party’

Satoshi Nakamoto, Oct. 31, 2008, 06:10:00 PM

That was the first email in a series of messages sent by Satoshi Nakamoto, the presumed pseudonym adopted by the creator of bitcoin, in a proposal for a payment system that is completely anonymous running on a decentralized distributed ledger, known as the blockchain.

Today, there are over 2,000 cryptocurrencies, most of which will fail and become worthless, according to Barry Silbert, chief executive officer of the Digital Currency Group, and there are already close to 1,000 dead coins, ones that either failed before launching or have ceased operation, according to a website that tracks such failures.

But the very first digital currency is still going strong, albeit with plenty of ups and downs. Once worth less than 1 cent, a single bitcoin fetched nearly $20,000 in December 2017. Today, one bitcoin

BTCUSD, +3,419.44%

changes hands for about $6,500.

Bitcoin’s 10-year run The early days

After the release of the Bitcoin white paper a decade ago, Satoshi started a chain of emails to a cryptography mailing list, largely made up of cypherpunks — those who promote increased financial privacy — looking to spread and champion computer encryption. The early emails were met with both enthusiasm and skepticism.

“Bitcoin seems to be a very promising idea. I like the idea of basing security on the assumption that the CPU power of honest participants outweighs that of the attacker,” wrote computer programmer Hal Finney in an email exchange with the group.

Read: Here are all the early email exchanges between Satoshi and the cryptographers

It was at least two months before the blockchain and bitcoin experiment got under way with the creation of the Genesis Block, the first 50 bitcoins ever mined.

A note that accompanied the copy of the Genesis Block gave rise to the notion that bitcoin, in part, may have been a response to the financial crisis. “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks,” the message said.

However, in an interview with MarketWatch, New York University professor David Yermack, debunked this theory, but did say that the timing definitely contributed to the hype around bitcoin.

The Genesis block

Read: Here’s how much it costs to mine a single bitcoin in your country

But what were people meant to do with these bitcoins once they had been created, or mined?

“I guess the key problem right now is that once you generate coins, there’s nobody to test it with, even for dummy transactions. Is there a plan for a mailing list or some kind of trivial marketplace to give people something to do with their newly minted bitcoins?” wrote Mike Hearn, a software developer and early bitcoin developer in the cryptography email chain.

One year later, his question was answered.

First recorded transaction

While there were a number of early test transactions — the first being a transfer between Satoshi and Finney — the first documented transaction didn’t occur until 2010.

On May 22, 2010, Jacksonville programmer Laszlo Hanyecz, convinced Jeremy Sturdivant to send him two pizzas, and in return, Hanyecz would give him 10,000 bitcoin, which in today’s terms is more than $30 million per pizza. The transaction would become part of crypto folklore and May 22 will always be known as Bitcoin Pizza Day.

Eight years on, bitcoin is traded freely on more than 200 exchanges, with volume dominated by speculators hoping to make a quick buck buying and selling the most liquid cryptocurrency. There are now more than 250,000 on-ledger transactions per day, according to data from Blockchain.com.

Transactions per day, per Blockchain.com

At its peak in late 2017, there were nearly half a million transactions happening each day.

Mt. Gox hack

Four years after the first bitcoin transaction, the industry hit one of its lowest points. In February 2014, Japanese-based cryptocurrency exchange Mt. Gox was hacked, resulting in the loss of more than 800,000 bitcoins. At the time, Mt. Gox was handling more than half of all bitcoin transactions world-wide. The heist was the first big snag in the coming out of the opaque industry.

The Mt. Gox scandal was met with hostility and the company was forced to move its headquarters to its previous offices citing security concerns, the company said at the time.

But what it did do was put bitcoin on the front page of the news.

“I became enthralled in bitcoin when Mt. Gox ‘disappeared’ my bitcoin,” said Tim Draper, founder and director of Draper Associates. “When that happened, I thought bitcoin would collapse, but it didn’t, so I knew it was more important than it seemed on the surface.”

Draper would later become a household name in the crypto industry when he purchased the bitcoins the U.S. Justice Department seized in the Silk Road case. The bitcoins were sold for an average price of just over $300. Draper said he weighed the risk/reward at the time and figured there is a chance they could be worth hundreds or even thousands of dollars at some stage. “At this point, It looks like it will be the former, so I lucked out,” he said.

Read: Former Mt. Gox CEO does not want his billion dollars

Yet, security remains one of the technology’s biggest hurdles.

Limitations and headwinds

The Mt. Gox hack is just one in a number of thefts that has undermined the integrity of digital assets. In 2016, two years after the Mt. Gox fiasco, the Bitfinex exchange was infiltrated resulting in the theft of 120,000 bitcoins. All totaled, some estimate that more than 1 million bitcoins have been stolen.

However, the pressing question for bitcoin evangelists is adoption: Is there a place for it in the financial ecosystem? Right now that answer is not quite yet.

As a payment device, bitcoin can process around five transactions per second, while credit card companies like Visa

V, +4.31%

and Mastercard

MA, +4.74%

can process more than 5,000 per second. As a store of wealth its security flaws, as discussed earlier, mean it is far from becoming digital gold.

But according to Nigel Green, founder and CEO of deVere Group, a U.K. consulting firm, that will change: “There’s an ongoing shift away from fiat money, and the momentum of this is only set to increase over the next 10 years.”

Read: Winklevoss: If you can’t see bitcoin at $320,000, you just lack imagination

On the eve of its 10th birthday, 2018 has unveiled another flaw in bitcoin: volatility. While the trading community lap up the wild price swings, those pushing for mainstream use have had to withstand a collapse in the price of the No. 1 digital currency.

As euphoria was building, highlighted by the introduction of bitcoin futures, bitcoin fell more than 60% from its all-time high on Dec 17, 2017.

Read: What’s more volatile than bitcoin? You may be surprised

What the future holds

Depending on who you ask, the future of bitcoin looks like anything from the next U.S. dollar or digital gold, to a total bust that will be nothing but a footnote in financial textbooks.

As bitcoin proponents push for more complex financial products, most notably a bitcoin-backed exchange-traded fund, or ETF, regulators now play a pivotal role in the advancement of the cryptocurrency and blockchain movement. Lawmakers and regulators are weighing investor protection in an industry that is rife with nefarious characters, yet offers much potential.

Read: These may be the 3 biggest hurdles to a bitcoin ETF

For detractors, bitcoin is just a passing fad. One of the most vocal critics is prominent New York University economics professor, Nouriel Roubini, who has called bitcoin the mother of all bubbles, compared blockchain with a glorified excel spreadsheet and lambasted the crypto community as a bunch of “self-serving white men pretending to be messiahs for the world’s impoverished, marginalized, and unbanked masses.”

Read: Opinion: Roubini calls out the big blockchain lie

However, the nascent product may have received its biggest stamp of approval just weeks before its 10th birthday when financial services giant Fidelity Investments announced it was opening a cryptocurrency trading service for funds and sophisticated investors. Previously, large institutions had largely remained on the sidelines.

But now, coming upon 10 years since the inception of cryptocurrencies, the decentralized technology that began with bitcoin may have started a path where the so-called trusted third parties are mining bitcoin instead of printing money.

“I see bitcoin becoming the most important and most transacted currency in the world, not just for remittances, or cross-border transactions, but for every use currency. It won’t be long before bitcoin eclipses the dollar as the most popular currency,” said Draper.

Read: This is where cryptocurrencies are actually making a difference in the world

Providing critical information for the U.S. trading day. Subscribe to MarketWatch’s free Need to Know newsletter. Sign up here.

Source link http://bit.ly/2LS7FOo

0 notes

Text

Bitcoin is 10 years old: Here’s what to expect in the cryptocurrency’s second decade

Bitcoin is 10 years old: Here’s what to expect in the cryptocurrency’s second decade

Oct. 31 marks the 10th birthday of one of the most promising, yet divisive technological advancements of the 21st century: Bitcoin.

In the aftermath of the global financial crisis, the first and most famous cryptocurrency emerged from an underground network of libertarian-leaning cypherpunks. Over the past decade its popularity has soared, but so has the number of its detractors. On the eve of its anniversary, here’s a look back at some of the glorious — and infamous — moments in the short life of the world’s most famous cryptocurrency.

And where it all began:

‘I’ve been working on a new electronic cash system that’s fully peer-to-peer, with no trusted third party’

Satoshi Nakamoto, Oct. 31, 2008, 06:10:00 PM

That was the first email in a series of messages sent by Satoshi Nakamoto, the presumed pseudonym adopted by the creator of bitcoin, in a proposal for a payment system that is completely anonymous running on a decentralized distributed ledger, known as the blockchain.

Today, there are over 2,000 cryptocurrencies, most of which will fail and become worthless, according to Barry Silbert, chief executive officer of the Digital Currency Group, and there are already close to 1,000 dead coins, ones that either failed before launching or have ceased operation, according to a website that tracks such failures.

But the very first digital currency is still going strong, albeit with plenty of ups and downs. Once worth less than 1 cent, a single bitcoin fetched nearly $20,000 in December 2017. Today, one bitcoin

BTCUSD, +3,419.44%

changes hands for about $6,500.

Bitcoin’s 10-year run The early days

After the release of the Bitcoin white paper a decade ago, Satoshi started a chain of emails to a cryptography mailing list, largely made up of cypherpunks — those who promote increased financial privacy — looking to spread and champion computer encryption. The early emails were met with both enthusiasm and skepticism.

“Bitcoin seems to be a very promising idea. I like the idea of basing security on the assumption that the CPU power of honest participants outweighs that of the attacker,” wrote computer programmer Hal Finney in an email exchange with the group.

Read: Here are all the early email exchanges between Satoshi and the cryptographers

It was at least two months before the blockchain and bitcoin experiment got under way with the creation of the Genesis Block, the first 50 bitcoins ever mined.

A note that accompanied the copy of the Genesis Block gave rise to the notion that bitcoin, in part, may have been a response to the financial crisis. “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks,” the message said.

However, in an interview with MarketWatch, New York University professor David Yermack, debunked this theory, but did say that the timing definitely contributed to the hype around bitcoin.

The Genesis block

Read: Here’s how much it costs to mine a single bitcoin in your country

But what were people meant to do with these bitcoins once they had been created, or mined?

“I guess the key problem right now is that once you generate coins, there’s nobody to test it with, even for dummy transactions. Is there a plan for a mailing list or some kind of trivial marketplace to give people something to do with their newly minted bitcoins?” wrote Mike Hearn, a software developer and early bitcoin developer in the cryptography email chain.

One year later, his question was answered.

First recorded transaction

While there were a number of early test transactions — the first being a transfer between Satoshi and Finney — the first documented transaction didn’t occur until 2010.

On May 22, 2010, Jacksonville programmer Laszlo Hanyecz, convinced Jeremy Sturdivant to send him two pizzas, and in return, Hanyecz would give him 10,000 bitcoin, which in today’s terms is more than $30 million per pizza. The transaction would become part of crypto folklore and May 22 will always be known as Bitcoin Pizza Day.

Eight years on, bitcoin is traded freely on more than 200 exchanges, with volume dominated by speculators hoping to make a quick buck buying and selling the most liquid cryptocurrency. There are now more than 250,000 on-ledger transactions per day, according to data from Blockchain.com.

Transactions per day, per Blockchain.com

At its peak in late 2017, there were nearly half a million transactions happening each day.

Mt. Gox hack

Four years after the first bitcoin transaction, the industry hit one of its lowest points. In February 2014, Japanese-based cryptocurrency exchange Mt. Gox was hacked, resulting in the loss of more than 800,000 bitcoins. At the time, Mt. Gox was handling more than half of all bitcoin transactions world-wide. The heist was the first big snag in the coming out of the opaque industry.

The Mt. Gox scandal was met with hostility and the company was forced to move its headquarters to its previous offices citing security concerns, the company said at the time.

But what it did do was put bitcoin on the front page of the news.

“I became enthralled in bitcoin when Mt. Gox ‘disappeared’ my bitcoin,” said Tim Draper, founder and director of Draper Associates. “When that happened, I thought bitcoin would collapse, but it didn’t, so I knew it was more important than it seemed on the surface.”

Draper would later become a household name in the crypto industry when he purchased the bitcoins the U.S. Justice Department seized in the Silk Road case. The bitcoins were sold for an average price of just over $300. Draper said he weighed the risk/reward at the time and figured there is a chance they could be worth hundreds or even thousands of dollars at some stage. “At this point, It looks like it will be the former, so I lucked out,” he said.

Read: Former Mt. Gox CEO does not want his billion dollars

Yet, security remains one of the technology’s biggest hurdles.

Limitations and headwinds

The Mt. Gox hack is just one in a number of thefts that has undermined the integrity of digital assets. In 2016, two years after the Mt. Gox fiasco, the Bitfinex exchange was infiltrated resulting in the theft of 120,000 bitcoins. All totaled, some estimate that more than 1 million bitcoins have been stolen.

However, the pressing question for bitcoin evangelists is adoption: Is there a place for it in the financial ecosystem? Right now that answer is not quite yet.

As a payment device, bitcoin can process around five transactions per second, while credit card companies like Visa

V, +4.31%

and Mastercard

MA, +4.74%

can process more than 5,000 per second. As a store of wealth its security flaws, as discussed earlier, mean it is far from becoming digital gold.

But according to Nigel Green, founder and CEO of deVere Group, a U.K. consulting firm, that will change: “There’s an ongoing shift away from fiat money, and the momentum of this is only set to increase over the next 10 years.”

Read: Winklevoss: If you can’t see bitcoin at $320,000, you just lack imagination