#Gold Price Forecast or Gold Rate Prediction for Year 2023

Text

youtube

Gold Price Forecast or Gold Rate Prediction for Year 2023

In this video, we are sharing Gold Rate Prediction for the Year 2023, Please watch the full video and share it with your friends also.

Be a member of This "Ankit Jain-Official" youtube channel, where we will share Trading related updated on a Daily, Weekly, and Yearly basis with technical analysis on Nifty,BankNifty, DowJones, Nasdaq, Nikkei, Dax, Hangseng, Gold, Silver, and Oil.

Like, Share, and Subscribe to "Ankit Jain-Official" Youtube Channel Now...

0 notes

Text

World Bank: Commodity Prices Stability Threatens Inflation

As the dust settles on a steep descent in global commodity prices, a lingering question remains: what’s next for global inflation?

According to the latest World Bank’s Commodity Markets Outlook, while the plunge in prices helped temper inflation rates, their current stabilization could challenge future economic adjustments.

The New Landscape of Global Commodities

Stabilization After the Fall

Between mid-2022 and mid-2023, commodity prices saw a near 40% drop, significantly influencing global inflation rates. This price reduction contributed to a roughly 2-percentage-point decrease in global inflation. However, since mid-2023, these prices have barely moved, suggesting that the easy gains for central banks aiming to control inflation might be over.

Forecasting the Future

The World Bank predicts a modest decline in global commodity prices by 3% in 2024 and an additional 4% in 2025. However, these reductions may not be sufficient to impact the inflation rates that are currently above the targets set by many central banks worldwide.

The Impact of Middle-Eastern Tensions

Geopolitical Risks on the Rise

The specter of escalating conflict in the Middle East looms large, threatening to disrupt this fragile equilibrium. The region's instability could lead to significant disruptions in oil supplies, pushing prices upward. For instance, Brent crude oil prices surged to $91 per barrel earlier this month, a stark increase from the 2015-2019 average of $57 per barrel.

Scenario Analysis: Conflict Consequences

Should these tensions escalate into further conflict, the World Bank warns that oil supply disruptions could inflate Brent prices to over $100 per barrel in 2024, potentially elevating global inflation by nearly one percentage point. This scenario would undoubtedly undermine the progress made in tempering inflation over the past two years.

Commodity Prices and Central Bank Strategies

Central Banks at a Crossroads

With commodity prices hitting a plateau, central banks may find themselves maintaining higher interest rates for longer than anticipated. This persistence of high rates could dampen economic growth prospects and complicate financial conditions for countries still recovering from the pandemic's impacts.

A Call for Vigilance

Indermit Gill, the World Bank Group’s Chief Economist, emphasizes the critical moment the global economy is facing: "A major energy shock could undermine much of the progress in reducing inflation over the past two years." This statement highlights the necessity for central banks to remain vigilant and proactive in their monetary policies.

Looking Ahead: Commodities and Global Growth

Divergence Between Growth and Prices

Ayhan Kose, Deputy Chief Economist at the World Bank, notes a striking divergence between global growth and commodity prices. Despite forecasting weaker global growth, ongoing geopolitical tensions and market dynamics are expected to keep commodity prices elevated.

The Role of Safe Havens

Amidst these uncertainties, gold prices are anticipated to reach record highs in 2024, reflecting its status as a 'safe haven' during times of geopolitical and economic turmoil. This surge underscores the broader market sentiment towards seeking stability in uncertain times.

Navigating Uncertain Waters

As the world grapples with these evolving challenges, the interplay between commodity prices and inflation remains a critical area for policymakers, investors, and economists.

The coming years will likely call for a balanced approach, blending vigilance with innovation in economic strategies to ensure stability and growth in an increasingly interconnected global economy.

This strategic navigation will determine how well the global community can weather potential storms on the horizon, making the role of informed analysis and foresight more crucial than ever.

Sources: THX News & World Bank.

Read the full article

#Brentcrudepriceforecast#centralbankinflationtargets#commoditypricestability#economicimpactMiddleEast#geopoliticaltensionscommodities#globalinflationforecast#inflationreductionstrategies#MiddleEastconflictinflation#oilpricefluctuation#WorldBankcommodityreport

0 notes

Text

Manapakkam and Thirumullaivoyal: Progress and Investment

In the following year, growth is anticipated to be very healthy, and the surge in the number of launches can serve as an indicator of the upcoming era. As per Anarock Research, the year 2023 has witnessed two localities emerging as vibrant, showing the maximum builder's positivity in developing new units.

Manapakkam and Tirumullaivoyl together witnessed an estimated 6,537 new units between January and December 2023, as the demand for new houses from buyers has been going up. The price per square foot in charges in Manapakkam and Tirumullaivoyl districts varied from Rs 6,497 to Rs 7,328, whereas the price in Chromepet and Kodambakkam was within the range of Rs 6,437 to Rs 6,693.

Forecasts for 2024 remain hopeful in these markets thanks to the continued demand. These markets, however, are about demand. Demands fund the operation.

Manapakkam:

Features:

Manapakkam develops into a top locality with a significant population, residence and business entities, luxury, and accelerated urban services. Stealth bricks among the astonishing beauty of the hills and the peaceful stream of the Adyar River, this place draws a fascinating combination influencing the well-being of a person again.

Showposting and building up a vibrant urban lifestyle, the Manapakkam area is decorated with IT companies, shopping malls, and recreational places.

Attending to the requirements of a diverse mix of people.

The main thing that distinguishes the area is its Tamil population, which presents itself as having a culturally rich background along with its beautiful street food culture and historical past.

Manapakkam is a place everyone would love to visit, as it combines traditional and modern living styles and is only a stone’s throw away from the banks of the Adyar River along the scenic trail.

Vibrant sunrises and kaleidoscopic entertainment options contribute to its zest.

Limiting itself to nearby towns, which are Guindy and Mugalivakkam.

This locality has the most efficient connectivity and accessibility in town.

Its peaceful and nearby location with various options makes it a perfect venue for both workers and local residents looking to rent flats in Manapakkam.

Property rates:

Manapakkam alone showcases around 33% of properties within the price range of ₹1-1.30 crore, and another 16% for ₹0.60-0.80 crore. The highly favored apartments for sale in Manapakkamare 3 BHKs, which account for nearly 47% of the total available properties.

Multistory apartments take up 80 percent of the properties in Manapakkam, of which a large portion of the aforesaid listings represent agents.

The mean price of a multistorey flat in Manapakkam was predicted at ₹7,204 for Q1 of January 2024. This was down by -0.81% from the pointer decade of October 2023.

Recent Developments:

It is a fact that Manapakkam, Chennai, does not lack transportation.

The city's road infrastructure is popularly employed, and frequent bus services, the metro, and local trains are also on offer.

The scene is a gold mine of commercial gains as the area accommodates several educational establishments, IT centers, hospitals, banks, and residential pockets.

Among these, the residential projects that ICPA Amora and Casagrand Woodside are putting up are the kinds of developments that define the geography of the area while pointing to a brighter future.

Thirumullaivoyal:

Thirumullaivoyal, where a thousand years ago the Chola Empire had built it. The Masilmaninathar Temple is situated in Thirumullaivoyal and Annanur Railway Stations and within a reasonable distance (a few miles) from natural tourist spots, which are also the site of the Masilmaninathar temple, a pilgrimage site.

Initially, it was known often as the "Mullaivanam." Hence, it was one of the sections of the 7th Siqalas department, or taluk.

Features:

Thirumullaivoyal public buses are operated by the government, and the local train runs in this area.

Ebenezer Modern School offers two types of extracurricular activities, including sports and drama.

There is a popular nightlife here, often with late opening restaurants.

While Bheeshma Park features kids' joy rides and an adequate play area, the newly proposed safari park has new possibilities for children.

We need to expect that the rising number of people in the Thirumullaivoyal region will drive up property prices.

Property rates:

As an investor, there is a need to closely track real estate markets in Chennai to capture the best opportunities and realize full potential in the capital appreciation of the property in Thirumullaivoyal.

At present, we have a total of 70+ properties available at Amarante, covering a price range that goes from ₹6.40 lakhs to ₹1.80 crore.

The average median price of villas for sale in Thirumullaivoyal only goes up to ₹50.14 lakhs, and it is much lower than ₹90.50 lakhs, which is Chennai's average.

There has been an upward trend in the price of the assets in Chennai and Thirumullaivoyal in the past six months too.

Recent Developments:

The Chennai-Anantpur highway is directly linked to "Gopat Street," which is currently going through expansion to handle the growing traffic volumes.

Several speed breakers have been placed by Easwaran Koli Street, which leads to the Chennai-Anantpur highway.

The neighborhood, in fact, is experiencing the launch of new industrial facilities, which has led to an increase in demand for flats for rent in Thirumullaivoyal.

The way to design public washrooms in the area is to increase convenience and pleasure for the community.

Through the placement of dustbins along the area, cleanliness is being taken care of.

#property#realestate#residential#guide#rentalproperty#commercial#apartments for rent#property for sale#apartments in chennai#villas in chennai#villas for sale in Chennai

0 notes

Text

Market Review / Outlook of the day Primary Sentiment : Neutral Immediate Trend : Slightly Positive BMD Market Re-cap: - BMD FCPO futures retreated from their one-month high on Friday as traders mulled lower-than-expected production declines in Malaysia and awaited fresh industry insights from a major conference in Kuala Lumpur next week. - The Southern Peninsula Palm Oil Millers' Association (SPPOMA) estimates Malaysian palm oil output in February dipped only 2.9%, defying market expectations of a steeper decline. - The Indonesia Palm Oil Association predicts a 5% increase in palm oil output to 57.6 million tons this year, with exports projected to remain stable at 32 - 33 million tons. - Indonesia will lower its crude palm oil reference price to $798.90 for March 1-31, keeping export tax at $33 per ton and levy at $85. World Oil and Grains - CBOT soybean futures rebounded on Friday after earlier lows, fueled by bargain hunters and short-covering. However, sluggish exports and abundant global stockpiles continue to cap prices. - Despite the rebound, favorable weather conditions in South America, lackluster U.S. export sales, and higher-than-anticipated contract deliveries continue to dampen market enthusiasm. - According to weekly CFTC data, money managers increased their bearish bets on soybeans, adding 23,976 net-short positions to reach a total of 160,653. - Analyst raised its forecast for Brazil's 2023/2024 soybean crop to 151.5 million metric tons on Friday. This revision comes after improved weather conditions in key growing regions, like central-west Brazil, which had previously faced excessive heat and dryness. Base and Precious Metals - Copper futures rebounded Friday after the dollar weakened. This follows earlier losses due to concerns about slowing demand in China, where factory activity has contracted for five consecutive months. - Disappointing U.S. manufacturing data increased the likelihood of interest rate cuts by the Federal Reserve. This weakened the dollar, making dollar-denominated metals like copper more attractive for buyers holding other currencies. - Gold futures kicked off March on a strong note, surging to a two-month high on Friday. This followed subdued economic data that solidified investor expectations of a U.S. Federal Reserve rate cut by June. - A confluence of weak economic data emerged in February. Manufacturing output contracted further, consumer confidence dipped according to the University of Michigan's surveys, and inflation slowed to its lowest level in nearly three years. This combination of factors bolstered expectations of a potential Federal Reserve rate cut by June. Market Outlook - Palm oil prices saw some profit-taking last Friday, despite remaining elevated after recent gains. The price opened at RM3,961 and fluctuated between RM3,940 and RM3,997 before closing at RM3,966. While the market is experiencing a healthy correction from a recent uptrend, the hourly indicator points north, suggesting an underlying bullish outlook. The key resistance level remains near RM4,000. - Palm oil could open cautiously lower today, reflecting softening prices in Dalian palm oil and U.S. soybean oil. The market is expected to trade sideways between RM3,900 and RM4,000 ahead of the palm oil market outlook from industry analysts at the upcoming Bursa Palm Oil Conference 2024. Opening range: 3930 to 3940 Projected range of the day: 3850 to 4050 Support 3800 Next 3750 Resistance 3900 Next 4050 BMD FCPO Total Open Interest 15/02/2024: 225,284 (-600) 19/02/2024: 230,991 (+5,707) 20/02/2024: 233,386 (+2,395) 21/02/2024: 240,043 (+6,657) 22/02/2024: 238,958 (-1,085) 23/02/2024: 234,976 (-3,982) 26/02/2024: 237,902 (+2,926) 27/02/2024: 241,314 (+3,412) 28/02/2024: 243,724 (+2,410) 29/02/2024: 253,387 (+9,663) 01/03/2024: 257,308 (+3,921) Source: Bursa Malaysia Futures

0 notes

Text

Catalyst Market: Charting New Pathways for Growth in an Evolving Market

The global catalyst market size is expected to reach USD 42.63 billion by 2030, as per the new report by Grand View Research, Inc. The market is expected to expand at a CAGR of 4.6% from 2024 to 2030. Catalyst refers to the class of compounds or chemicals that enables a chemical reaction to proceed at a pace faster than otherwise possible. Depending on the similarity or dissimilarities of the catalyst with the reactants, a catalyst can be either homogeneous or heterogeneous. Therefore, based on product type, the market is segmented as homogeneous and heterogeneous catalysts.

Catalyst Market Report Highlights

Chemical compounds dominated the market with a volume share of 39.8% in 2023, it is used as catalyst raw materials for numerous applications in chemical, petrochemical, and polymer industries

Homogenous is predicted to witness the fastest growth, in terms of revenue, with a CAGR of 4.9% from 2023 to 2030. The growing popularity of organometallic compounds to produce polyethylene and polypropylene is further expected to fuel their demand in the near future

Asia Pacific dominated the catalyst market with a volume share of 34.8% in 2023. This can be attributed to the rapid development of the chemical industry, predominantly in the emerging economies of the region such as China and India

In June 2020, Albemarle Corporation entered into a definitive agreement with W. R. Grace & Co. for selling its polyolefin catalyst and components business for a value of around USD 416 million

With the escalating demand from applications including chemical synthesis, petroleum refining, polymers and petrochemicals, and environmental there has been an upsurge in demand for catalysts for process optimization, yield improvement, cost-saving, and energy saving amongst the manufacturers globally

For More Details or Sample Copy please visit link @: Catalyst Market Report

The raw materials used for catalyst manufacturing include acids, peroxides, and amines, which are generally classified as chemical compounds. Metals including precious metals and base metals besides zeolites are the prominent raw material market segments. A catalyst finds numerous applications in end-use industries such as chemicals (adsorbents, polyolefins); petroleum refining (alkylation, hydrotreating, hydrocracking, catalytic reforming); polymers and petrochemicals; and automotive (motorbikes, light-duty, and heavy-duty vehicles) owing to the benefits obtained by the application of a catalyst in any particular chemical reaction.

The global market has witnessed a significant growth rate over the past few years owing to the benefits it has gained from high-value product segments. For instance, the application of catalysts in an automobile reduces carbon emissions that are harmful to the environment and, thus, their application is highly promoted by governments globally. Favorable government regulations, in turn, have increased the demand for catalysts in the automotive industry across regions.

Catalysts are increasingly being used to reduce the processing time of crude oil refining along with improving refining equipment efficiency. These factors are likely to fuel the demand for catalysts over the projected forecast period. However, volatile prices of raw materials, including gold and platinum, are expected to hamper the manufacturing output of catalysts, thereby restraining the market growth. Nonetheless, the introduction of biocatalysts is expected to open new avenues for the market over the forecast period.

Key market players include BASF, Johnson Matthey, W.R. Grace, Albemarle Corporation, Evonik Industries AG, and DuPont. In July 2014, Johnson Matthey Process Technologies established a new production site in Brazil which manufactures catalyst for captive hydrogen production in the refining sector. This initiative was taken to ensure product supply to refining companies located in Latin America over the next eight years.

#Catalysts#ChemicalIndustry#CatalystMarket#CatalystTechnology#CatalystApplications#CatalystInnovation#CatalystManufacturing#CatalystSupplyChain#CatalystResearch#CatalystTrends#CatalystDemand#CatalystFuture#SustainableCatalysts#GlobalCatalystMarket#CatalystIndustry#CatalystAnalysis#CatalystDynamics#CatalystPerformance#CatalystSolutions

0 notes

Text

During the forecast period, the underground mining equipment market is anticipated to grow at a lower CAGR of 2.3%. The market is predicted to generate US$ 16.37 billion in sales in 2023 and reach US$ 20.55 billion by 2033.

Rising adoption of automatic underground mining equipment among manufacturers to sync with the ongoing trends in the ever-evolving mining industry is set to incur tech-driven transformations in this landscape, opines the study.

In addition, stringent emission regulations regarding controlled diesel emission and personnel safety in the mining industry are likely to stimulate innovations that can enable dealing with the relentless pricing pressure more efficiently, and mitigate the environmental impacts of new-age underground mining equipment.

Request Sample Report: Empower Your Industry Understanding with Invaluable Insights

https://www.futuremarketinsights.com/reports/sample/rep-gb-6296

Advanced techniques of mining and their impacts on various socio-economic factors have been a prolonged concern worldwide. The shift of a majority of miners from surface or open pit mining to underground mining has further amplified concerns vis-à-vis human safety and environmental impacts.

Technology is emerging as the most efficient tool for introducing enhanced features in underground mining equipment, and FMI’s study examines the influence of advancements in technologies and other microeconomic factors on the growth of the underground mining equipment landscape.

Mineworkers’ Staunch Inclination towards Hard Rock Mining Equipment

FMI’s study finds that every 7 out of 10 underground mining equipment sold in 2022 were designated to applications associated with hard rock mining platforms. Increasing demand for hard rock minerals, such as copper, gold, zinc, and lithium, in wide-ranging industries has given rise to hard rock mining activities in the mining industry. Leading players in the underground mining equipment landscape are focusing on catering to the thriving need for improved productivity in underground hard rock mines with the launch of next-generation mining equipment.

In addition, conventional hard rock mining techniques result in the release of toxic gases including carbon dioxide (CO2), and Sulphur dioxide (SO2) among others, which is triggering the adoption of electric equipment in hard rock mines. In addition, the study finds that coupling of underground mining equipment that can carry out multiple operations including parallel cutting, loading, and hauling operations are likely to witness high demand in the coming years.

Visibly Growing Preference for ‘Rental’ over New

In rough terrains such as the mining industry, constant wear and tear of mining equipment lead to high replacement rates, incurring significant depreciation costs to the end users. As large mining machinery, including underground mining equipment, come with a significantly high price tag, purchasing new equipment creates the need for high capital investments.

A majority of miners are inclined towards purchasing used or refurbished equipment, even considering the option of renting rather than investing in new underground mining equipment. Since a majority of mining businesses are looking for reducing their initial investments, rental service providers are likely to gain traction among in the coming years.

FMI’s study finds that more than half the revenue share is accounted by rental service providers in the underground equipment market. Increasing end-user preferences for rental equipment are fostering the progression of this trend in the market. A mounting number of rental service companies are offering refurbished mining equipment that are specifically tailored to suit the requirements of the underground mining sector. The FMI report also finds that leading stakeholders and investors in the underground mining equipment landscape are zooming in their strategic focus on providing rental service packages to suit changing needs of their customers, regarding the inventory of equipment.

0 notes

Text

Why Bitcoin's Price Plunged After ETF Approval, and Where It's Headed

On Jan. 10, the U.S. Securities and Exchange Commission (SEC) approved the market's first 11 Bitcoin (BTC 😔) exchange-traded funds (ETFs). Unlike previous "Bitcoin ETFs," which were pinned only to future contracts or held shares of Bitcoin-related companies, these new funds directly hold Bitcoins. Over the long term, these ETFs should closely track the spot price of Bitcoin and represent a much easier way to invest in the cryptocurrency than stand-alone crypto wallets. The SEC's approvals also represent a big vote of confidence in Bitcoin's future as a mainstream asset. But Bitcoin's price tumbled after the first batch of ETFs started trading on Jan. 11. As of Jan. 13, it trades at about $42,500 -- representing a near-10% decline in just five days. Let's see why its price dropped and where it might be headed over the next 12 months. Bitcoin's price is volatile and difficult to predict. It hit its all-time high of about $69,000 during the peak of the crypto rally in Nov. 2021 but dropped to just $16,000 by the end of 2022. That decline was caused largely by rising interest rates, which drove investors away from speculative investments, the failures of several high-profile tokens and exchanges, and concerns regarding tighter regulations for the crypto industry. But in 2023, Bitcoin's price soared 154% to over $42,000. That rally was driven by slower rate hikes and the market's renewed interest in the crypto market. Many investors also expected the SEC to finally approve Bitcoin's first spot price ETFs. Therefore, Bitcoin's recent decline only erased its gains since the beginning of 2024. It seems like some short-term traders bid up the digital currency's price in anticipation of the recent ETF approvals and then quickly took profits as the euphoria faded. Bitcoin's price could remain under pressure as it moves past the ETF approvals. However, three catalysts that could drive its price higher remain on the horizon. First, the ETF approvals will make it easier for large institutional investors to accumulate Bitcoin on the open market. Ark Invest's Cathie Wood, who oversees the recently approved Ark 21Shares Bitcoin ETF (ARKB 😕), believes the price of Bitcoin will hit $1.5 million as institutional investors buy more. Fidelity, the investment giant that just launched the Fidelity Wise Origin Bitcoin Fund (FBTC), claims Bitcoin's price will hit $100 million by 2035 and $1 billion by 2038. Those long-term estimates might be too bullish, but I think it's reasonable to assume the Bitcoin ETF approvals will set a floor under its volatile price. That stabilization could bring back big investors and drive Bitcoin's price back toward its all-time highs. According to Coin Price Forecast's more moderate estimates, its price might reach $240,000 by the end of 2035. Second, Bitcoin experiences a "halving" every four years, which cuts the rewards for Bitcoin mining in half. That isn't great news for miners like Marathon (MARA 😞) and Riot (RIOT 😞) because it increases their mining costs, but it will likely drive Bitcoin's market price higher by reducing the available supply. The next halving will occur in the first half of 2024. Last but not least, persistent inflation could drive more investors to accumulate Bitcoin and gold as hedges against the devaluation of fiat currencies. More countries struggling with hyperinflation might even follow El Salvador's lead and adopt Bitcoin as a national currency -- which would further solidify its reputation as a safe haven asset. Bitcoin will likely go through more wild swings and double-digit drops over the next 12 months. But over the next decade, it could generate triple-digit gains for investors who tune out all the near-term noise and focus on the long-term catalysts. Simply put, investors should consider its recent post-ETF approval pullback a good buying opportunity. Read the original article: https://www.fool.com/investing/2024/01/13/why-bitcoins-btc-price-plunged-this-week/

Tags: Bitcoin, cryptocurrency, investment, crypto

0 notes

Text

Electronics Recycling Market Analysis , Dynamics, Players, Type, Applications, Trends, Regional Segmented, Outlook & Forecast till 2033

The Global Electronics Recycling market is worth USD 35 billion in 2023 and anticipated to reach USD 120 billion by 2033, expanding at a high-value 13.1% CAGR from 2024 to 2033.

The competitive analysis of the Electronics Recycling Market offers a comprehensive examination of key market players. It encompasses detailed company profiles, insights into revenue distribution, innovations within their product portfolios, regional market presence, strategic development plans, pricing strategies, identified target markets, and immediate future initiatives of industry leaders. This section serves as a valuable resource for readers to understand the driving forces behind competition and what strategies can set them apart in capturing new target markets.

Market projections and forecasts are underpinned by extensive primary research, further validated through precise secondary research specific to the Electronics Recycling Market. Our research analysts have dedicated substantial time and effort to curate essential industry insights from key industry participants, including Original Equipment Manufacturers (OEMs), top-tier suppliers, distributors, and relevant government entities.

Receive the FREE Sample Report of Electronics Recycling Market Research Insights @ https://stringentdatalytics.com/sample-request/electronics-recycling-market/12548/

Market Segmentations:

Global Electronics Recycling Market: By Company

• Eco-Tech Environmental Services Inc.

• American Retroworks Inc.

• AERC Recycling Solutions

• Dlubak Glass Company

• MBA Polymers Inc.

• Universal Recyclers Technologies

• CRT Recycling Ltd.

• Fortune Plastic & Metal Inc.

• Sims Metal Management Limited

• A2Z Group

Global Electronics Recycling Market: By Type

• Steel

• Tin

• Nickel

• Aluminum

• Copper

• Zinc

• Gold

• Silver

• Plastic Resins

Global Electronics Recycling Market: By Application

• Computers

• Mobile Phones

• Other

Regional Analysis of Global Electronics Recycling Market

All the regional segmentation has been studied based on recent and future trends, and the market is forecasted throughout the prediction period. The countries covered in the regional analysis of the Global Electronics Recycling market report are U.S., Canada, and Mexico in North America, Germany, France, U.K., Russia, Italy, Spain, Turkey, Netherlands, Switzerland, Belgium, and Rest of Europe in Europe, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, China, Japan, India, South Korea, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), and Argentina, Brazil, and Rest of South America as part of South America.

Click to Purchase Electronics Recycling Market Research Report @ https://stringentdatalytics.com/purchase/electronics-recycling-market/12548/

Key Report Highlights:

Key Market Participants: The report delves into the major stakeholders in the market, encompassing market players, suppliers of raw materials and equipment, end-users, traders, distributors, and more.

Comprehensive Company Profiles: Detailed company profiles are provided, offering insights into various aspects including production capacity, pricing, revenue, costs, gross margin, sales volume, sales revenue, consumption patterns, growth rates, import-export dynamics, supply chains, future strategic plans, and technological advancements. This comprehensive analysis draws from a dataset spanning 12 years and includes forecasts.

Market Growth Drivers: The report extensively examines the factors contributing to market growth, with a specific focus on elucidating the diverse categories of end-users within the market.

Data Segmentation: The data and information are presented in a structured manner, allowing for easy access by market player, geographical region, product type, application, and more. Furthermore, the report can be tailored to accommodate specific research requirements.

SWOT Analysis: A SWOT analysis of the market is included, offering an insightful evaluation of its Strengths, Weaknesses, Opportunities, and Threats.

Expert Insights: Concluding the report, it features insights and opinions from industry experts, providing valuable perspectives on the market landscape.

Report includes Competitor's Landscape:

➊ Major trends and growth projections by region and country

➋ Key winning strategies followed by the competitors

➌ Who are the key competitors in this industry?

➍ What shall be the potential of this industry over the forecast tenure?

➎ What are the factors propelling the demand for the Electronics Recycling?

➏ What are the opportunities that shall aid in significant proliferation of the market growth?

➐ What are the regional and country wise regulations that shall either hamper or boost the demand for Electronics Recycling?

➑ How has the covid-19 impacted the growth of the market?

➒ Has the supply chain disruption caused changes in the entire value chain?

Customization of the Report:

This report can be customized to meet the client’s requirements. Please connect with our sales team ([email protected]), who will ensure that you get a report that suits your needs. You can also get in touch with our executives on +1 346 666 6655 to share your research requirements.

About Stringent Datalytics

Stringent Datalytics offers both custom and syndicated market research reports. Custom market research reports are tailored to a specific client's needs and requirements. These reports provide unique insights into a particular industry or market segment and can help businesses make informed decisions about their strategies and operations.

Syndicated market research reports, on the other hand, are pre-existing reports that are available for purchase by multiple clients. These reports are often produced on a regular basis, such as annually or quarterly, and cover a broad range of industries and market segments. Syndicated reports provide clients with insights into industry trends, market sizes, and competitive landscapes. By offering both custom and syndicated reports, Stringent Datalytics can provide clients with a range of market research solutions that can be customized to their specific needs.

Reach US

Stringent Datalytics

+1 346 666 6655

Social Channels:

Linkedin | Facebook | Twitter | YouTube

0 notes

Text

Costco, the retail giant renowned for offering a wide range of products at discounted prices, has recently added an unexpected item to its inventory: 1-ounce gold bars.

While the exact price is available only to Costco members, online discussions suggest that the bars were priced at just under $1,900. As of 1:30 p.m. UTC on 28 September 2023, the spot gold price stood at $1,874.50 per ounce.

On 26 September 2023, during Costco’s Q4 2023 Earnings Call, Richard Galanti, who is Costco’s Executive Vice President and Chief Financial Officer, had this to say:

“I’ve gotten a couple of calls that people have seen online that we’ve been selling one-ounce gold bars, yes, but when we load them on the site, they’re typically gone within a few hours and we limit two per member.“

The gold bars are exclusively available online and can be purchased only by Costco members. Membership fees for the retail giant range from $60 to $120 per year, depending on the chosen program.

According to a report by CNBC published yesterday, Jonathan Rose, co-founder of Genesis Gold Group, sees this move as a strategic promotion that could attract a specific segment of Costco’s customer base. According to Rose, Costco has recently expanded its range of survivalist goods, including a 150-serving emergency food preparedness kit and he addition of gold bars aligns well with these products, especially at a time when concerns about economic stability are high:

“They’ve done their market research. I think it’s a very clever way to get their name in the news and have some great publicity. There is definitely a crossover of people living off the land, being self-sufficient, believing in your own currency. That’s the appeal to gold as a safe haven as people lose faith in the U.S. dollar.“

Earlier this month, during a recent discussion with Michelle Makori, the Editor-in-Chief at Kitco News, Michael Lee, founder of Michael Lee Strategy, forecasted that gold prices could escalate to $5,000 per ounce within the next three years. Lee attributes this prediction to the current recessionary state of the U.S. economy and the impending wave of defaults. He pointed out that the yield curve has inverted, a historically reliable sign of an upcoming recession, and noted that both businesses and consumers are already overleveraged, making defaults likely.

Lee also questioned the current gold price, which remains under the significant psychological threshold of $2,000 per ounce. He suspects market manipulation by banks and financial institutions, citing the buying activities of BRICS nations and past manipulations in the silver market. Lee further speculated that China and Europe would be the first regions to seek safety in gold, driving its price up. He views gold as a long-term investment, serving as a hedge against inflation and economic instability.

Additionally, Lee expressed skepticism about the accuracy of labor market data, noting that reports have consistently been revised downward. He questioned whether this pattern is due to government bureaucracy, flawed models, or intentional manipulation. Finally, Lee criticized the Federal Reserve’s decision to raise interest rates, arguing that it would exacerbate the recession and that other methods, like quantitative easing, should be employed to control inflation.

[embed]https://www.youtube.com/watch?v=2Ic70nqCqpI[/embed]

Featured Image via Unsplash

Source

0 notes

Text

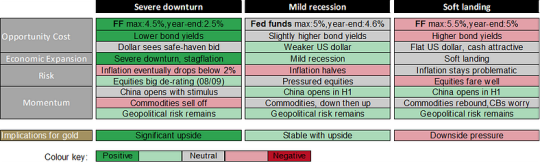

Analysis of Gold Opportunities in 2023

The world economy has reached a turning point after experiencing several shocks during the previous year. The largest was brought on by central banks, who intensified their strong campaign against inflation.

This interaction between inflation and central bank intervention will heavily influence the outlook for 2023 and the performance of gold.

The consensus view on the economy predicts slower global growth, similar to a brief, possibly localized recession, dropping but still high inflation, and the end of rate increases in most developed economies.

An exceptionally high amount of uncertainty surrounds consensus projections for 2023. For instance, excessive tightening by central banks could cause a more serious and widespread downturn.

The global economy might be left teetering dangerously close to stagflation if central banks unexpectedly reverse direction and stop or reverse rises before inflation is under control. Gold has typically reacted favorably to these circumstances.

Analysis of Hot Events Affecting Gold Prices in 2022

Central Bankers were awakened from their policy slumber by persistently high inflation.

A considerably more resilient inflation pulse than the market (and central banks) anticipated has been the underlying macro driver pushing down both stocks and bonds in 2022 and favoring gold. Inflation was very high at the beginning of this year (6.7% in the US), but it was anticipated to decline, especially throughout the second half of this year.

The Russian invasion of Ukraine did not help at all, as prices for many commodities shot up in the first quarter and stayed high for most of the year.

Although headline inflation peaked relatively early in the year (at least in the US), it turned out to be more of a plateau than a peak. Due to this persistent inflation trend, the Fed’s increasingly hawkish policy measures and language alarmed investors.

Long-term interest rates have increased this year due to rising inflation and higher cash rates.

The US 10-year bond yield increased from 1.5% at the beginning of the year to a peak of 4.2% in October before declining as inflation and Fed rate concerns subsided somewhat. Higher rates increase the opportunity cost of owning gold.

The uncertainty surrounding the forecast for the global economy and corporate earnings through 2023 has grown due to this year’s strong cash and bond rates increase. Global growth decreased in 2022, but growth in the US is still very resilient due to the tight labor market and the services sector’s ongoing rebound.

China’s Slowdown.

China’s zero-covid policy and a broken property market contributed to its lower-than-expected growth this year, which has hurt gold demand, making it probably an even larger growth disappointment than Europe. The outlook for China’s economic development has improved in recent weeks as evidence mounts that the country is gradually bolstering the property market and setting the basis for a departure from its zero-covid policy.

Gold Performance and Investment Data in 2022

Despite a downward trend in gold prices in 2022, analysts say that the yellow metal has kept its worth well in the current inflationary atmosphere.

In 2022, when the yellow metal faced challenges from a strong US currency and the US Federal Reserve’s war on inflation, gold’s role as a haven and a hedge against inflation gave support.

Gold, which is on track to lose 1.6 percent for the year, could not hold onto gains achieved in the first quarter when a price surge in response to Russia’s invasion of Ukraine brought the precious metal to a 19-month high of US$2,053 an ounce. The price jump in March represented a 13% increase from the beginning value in January, but it was short-lived as gold fell back to the US$1,939 level after Q1.

Gold fell to US$1,811 during the year’s second quarter, and market volatility caused the Dow Jones Industrial Average and the very tech-heavy NASDAQ Composite to enter the bear market territory.

Seasonal weakness and a rising US dollar in Q3 drove gold to a 30-month low of US$1,691 per ounce.

Early in 2022, as economies worldwide were still recovering from the pandemic, Russia’s war on Ukraine sparked uncertainty, which helped gold in the year’s first quarter.

According to Philip Newman, managing director at Metals Focus, there were two main causes for the performance of gold in 2022.

“Of course, the first one is the war, during which several precious metals experienced sharp price increases. You had that flight to safe havens, which, as you might assume, certainly predominated everything before dissipating.

After the initial shock, the gold price stabilized, and long-term influences started to show.

“The macro backdrop, and diving down deeper, the actions and intentions of the Fed, are what came to the forefront and are still the most crucial,” said Newman.

US inflation in June hit a four-decade high of 9.1 percent as gold started to fall below US$1,800 in the year’s second half.

Some market participants questioned the usefulness of gold as a hedge due to its weakness in the face of inflation. However, according to other specialists, the yellow metal did its job.

According to Juan Carlos Artigas, worldwide head of research for the World Gold Council, gold has fared significantly better than many of the typical inflation hedges most investors hold.

Gold’s price reached a more than two-year low in Q3 as output reached a record high for the year. Mining output increased to about 950 metric tons for the three months, up 2 percent from the previous year.

Despite a sharp fall in investment demand, demand improved by 28% year over year in the September quarter. Even though purchases of bars and coins increased by 36 percent, exchange-traded funds (ETFs) struggled with larger outflows.

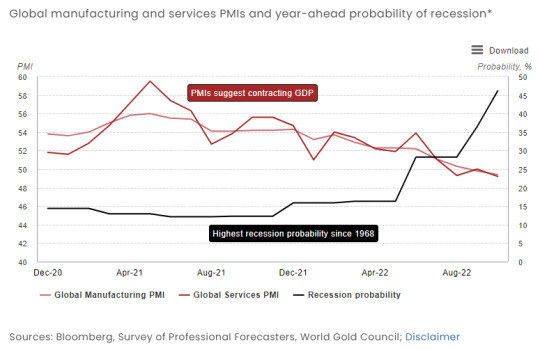

Gold Fundamental Analysis and Forecast 2023

Poor Economic Growth Ahead

Due to the speed of central banks’ interest rate hikes, there are now several indications of declining output. Global purchasing manager indexes (PMI), which are currently in contraction territory, show that the global economic crisis is getting worse and that a significant chance of recession exists.

According to current consensus predictions, the global GDP will only grow by 2.1% in 2023. This would be the slowest global growth rate in four decades, excluding the global financial crisis and COVID, and would fulfill the IMF’s old definition of a global recession, which is growth below 2.5%.

Investors must be vigilant due to a complex mix of lowered but still high inflation and slowing GDP. The prospect of a recession in major economies poses a threat to prolonging the weak performance of corporate bonds and equity markets observed in 2022.

Contrarily, gold normally performs well during recessions, generating positive returns in five of the last seven recessions, and could offer safety. However, a recession is not necessary for gold to perform. A sharp decline in growth is all gold needs to do well, especially if inflation is on the rise.

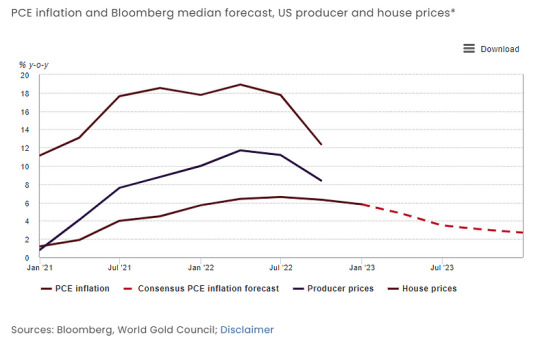

Inflation and Policy

Next year will almost certainly see a fall in inflation as further declines in commodity prices push down the cost of food and energy. Additionally, moderate inflation is consistently depicted by leading indicators of inflation.

Nearly all central banks are currently facing a particularly difficult policy trade-off as the likelihood of weaker growth collides with high, albeit dropping, inflation.

There is a considerable bias in favor of battling inflation over maintaining growth because no central bank wants to lose control over inflationary expectations. Therefore, tight monetary policy may last until the middle of the year.

Markets in the US anticipate that the Fed will begin lowering rates in the second half of 2023. Markets anticipate that policy rates will decline everywhere more gradually than they will in the US, but by 2024, most major central banks are anticipated to be in easing mode.

Even though there is a chance that inflation may decline in the upcoming year, there are still some significant factors that affect the gold market.

First, while a lower inflation rate is important, more is needed for central bankers to abandon their hawkish policies. Central bankers have inflation targets. Inflation must reach its target level or lower for policies to change.

Second, given lower access to inflation hedges, the individual investor appears to care more about inflation than institutional investors, according to the World Gold Council. They are also concerned with pricing ranges. Prices will still be high and likely impact household decision-making even if inflation hits zero in 2023.

Last but not least, institutional investors frequently evaluate their level of inflation protection using real yields. These grew throughout 2022, presenting obstacles for gold.

The dynamics that were in play in 2022 — high retail investment demand but low institutional demand — could partially reverse in 2023.

Indeed, any indication of declining yields could spur increased institutional interest in gold. Overall, decreased inflation should result in less demand for gold from an inflation-hedging standpoint.

Gold Technical Forecast for 2023

On the technical side, gold futures are pointing to a new bullish move. Throughout most of 2022, the price traded within a downtrending channel. However, the price broke above the channel resistance in Q4 and pushed above the 30-SMA showing a shift in sentiment.

The price then retested the 1820.2 resistance level. At this current level, the price might break above the resistance and start making higher highs and higher lows, or it might bounce lower and resume the downtrend.

The indicators, including the RSI, which is above 50, favor bullish momentum. Therefore the price will likely push higher with the next key resistance at around 1999.2.

What are the Advantages of Trading Gold on Margin?

An investor who buys an asset on margin takes out a broker loan for the remaining amount. When an investor purchases an asset on margin, they make a smaller initial payment to the broker and put up collateral in the form of marginable securities in their brokerage account.

Profiting from leverage is the main motivation for investors to engage in margin trading. By boosting the funds available to buy securities, margin trading centers increase purchasing power. Investors can use their capital as collateral for loans larger than their available capital to purchase more assets instead of using their own money.

Margin trading can, therefore, greatly increase profits. Again, having more securities means that value increases will have a bigger impact because you have a bigger investment. Similarly, if the assets placed as collateral increase in value, you can use leverage even more because your collateral basis has grown.

Additionally, margin trading typically offers greater flexibility compared to other loan forms. Your broker’s maintenance margin requirements might be straightforward or automatic, and there might not be a set repayment schedule.

What are the Best Ways to Invest in Gold?

Don’t limit your gold investment to purchasing only real gold in coins or bullion. Purchasing shares of gold mining firms or exchange-traded funds (ETFs) are alternative to investing in gold. Options trading and futures trading are other ways to invest in gold.

Investing in real gold can be difficult for investors more used to internet stock and bond trading. You’ll typically interact with dealers rather than standard brokerages when buying physical gold, and you’ll probably have to pay for storage and insurance for your investment. Bullion, coins, and jewelry are the three primary forms of physical gold investment.

Gold Bullion

This type of direct gold ownership is possibly the most well-known. Bullion gold is frequently associated with the enormous gold bars kept at Fort Knox. In reality, gold bullion is any kind of pure or almost pure gold, verified for its purity and weight. This includes gold bars, coins, and other gold-containing objects of any size.

Although big gold bars (up to 400 troy ounces) are impressive to own, their illiquidity makes them expensive to buy and sell.

Purchase Stock in Gold Miners to Invest in Gold

A much simpler option than purchasing physical gold is investing in the stock of firms that mine, process, and trade gold. You can invest using your brokerage account because doing this entails purchasing equities in gold mining firms.

However, keep in mind that while the stock prices of gold mining businesses are associated with gold prices, they also depend on fundamentals such as each company’s current profitability and costs. Due to this, investment in individual gold businesses entails the same risks as investing in other stocks. Single stocks do not offer you the security of diversified portfolios and may experience some volatility.

Purchase Gold-related ETFs and Mutual Funds.

You can gain exposure to gold’s long-term stability by investing in gold ETFs and mutual funds, which offer greater liquidity than physical gold and diversity than individual gold equities. Gold funds come in a wide variety of forms. Some are passively managed index funds that use futures or options to track market trends or the price of gold.

However, investors should be aware that just a few mutual funds concentrate completely on gold investing; the majority possess a variety of other commodities. Many mutual funds own gold bullion and gold firms as part of their regular portfolios.

Buy Gold Using Futures and Options.

Trading futures or options contracts, a type of speculative investing, is the riskiest way to invest in gold. Futures and options are derivatives, meaning that the underlying asset’s price is the sole basis for determining its value.

Futures are contracts to purchase or sell a specific quantity of an asset — in this case, gold — on a specific future date. Standardized futures contracts represent a predetermined quantity of gold. Futures are better suited for seasoned investors due to the large amounts. Futures are frequently used because they have very low commissions and substantially lower margin requirements than regular equities transactions.

Alternatives to buying a futures contract outright include options on futures. These grant the option holder the right to purchase the futures contract at a given time frame and a predetermined price. An option has the advantages of leveraging your initial investment and preventing losses from the amount paid.

Investing in Gold CFDs

Gold CFD investment is a new investment method that can buy gold through overseas brokerages. It is a relatively simple way, and it is also a gold investment tool that we recommend. CFD can earn price difference through global gold fluctuations, because it does not involve direct purchase of gold, so there is no quota limit.

Advantages: With reference to the global gold market, the trading time can reach 24 hours a day, the liquidity is higher than all products, you can use 100 times leverage, reduce the investment cost to make a small fortune, you can short two-way transactions, and there are more opportunities. No handling fee, no delivery time. Opening an account is simple and requires no capital verification.

Disadvantages: Due to the high degree of trading freedom and high leverage ratio, the risk rate is higher than other products.

Profit: If the gold price falls by 30% based on the above judgment, and the investment in gold futures is $300 short (no transaction threshold), the profit can be obtained: principal * profit percentage * leverage = 300 * 30% * 100 = $9000

Final Thoughts

2023 will offer good gold investment opportunities, as we have seen above. Investors can take advantage of these opportunities by keeping the following key things in mind.

Gold has historically benefited from moderate recessions and declining profits. Therefore a global recession and poor earnings would be good indicators for investment opportunities.

Gold may be supported if the dollar continues to deteriorate as inflation declines. Inflation is already declining, with the latest November report for the US coming in lower than expected. A continuation of this trend is good for gold.

Gold should remain an effective risk hedge due to geopolitical unrest. The Ukraine war is still going on, and investors will need safety against the uncertainties of 2023.

The Chinese economy should grow faster next year, increasing consumer demand for gold. This growth will come as the country reopens from its COVID lockdowns.

Long-term bond yields will probably stay high, but at levels that historically haven’t hurt gold.

In H1, gold is projected to face headwinds from pressure on commodities brought on by a weakening economy.

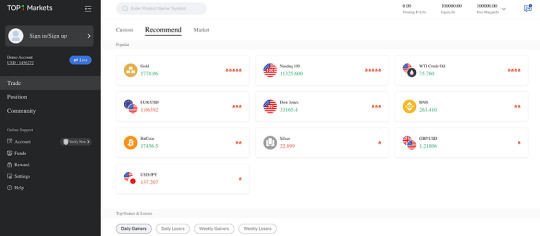

How to Trade Gold on TOP1 Markets?

You can apply online through the webpage or mobile app, which is convenient and fast. TOP1Markets offers two account types: demo account, real account. If you are a newbie trader, you can also practice trading through the DEMO account (with $100,000 in virtual currency).

Find the price chart on TOP1Markets and choose the right time to trade based on your analysis of the currency pair. Mitrade also provides trading tools such as market forecasts, trading strategies, sentiment indexes, and economic calendars.

When you see an investment opportunity, you can start to act. TOP1Markets supports two-way trading of buying and selling. Support pending orders, stop loss stop profit, moving stop loss, etc. Easy transaction!

0 notes

Text

Gold Rate Forecast 2023

Gold is considered one of the most precious assets that will never lose its authenticity in the market for long. The article solely deals with the Gold Rate Forecast or the prediction for the Gold Rate for tomorrow. Also, there is an overview of the prediction of this entire month, next month, and the whole financial year 2020-21. If you want to have an overview of the prediction for the next financial years 2021-22 & 2022-23 is also given.

The prices of Gold usually depend on the Re-emergence of Covid, the World Economic Situation, US Dollar Value, US-China-Reset of the World Relations, Inflation/ Interest Rates, Printing of Money, and many other similar reasons. According to the prediction, the gold rate will move up after the pandemics come to a halt.

Read more

0 notes

Video

youtube

According To Economists, They Can See Recession Coming

The 2023 "growth Recession" Won't Feel Or Look The Same As Past Ones

When the US central bank raises interest rates, as it has been doing since March, it makes the dollar more appealing to investors around the world. The Ascent is a Motley Fool service which rates and reviews essential products to help you with your everyday money matters. We are firm believers in The Golden Rule. Our editorial opinions are solely ours gold ira physical possession and have not previously been approved, endorsed or reviewed by advertisers. The Ascent editorial content is distinct from The Motley Fool editorial material and is created by a separate analyst team. You could be spending serious money if your debit or credit card is not correct.

It is important to remember that even a very bad thing can bring out some good things. Another tool is more obscure, but could be even more useful. A "investor Teardown" can allow companies to see themselves as activist investment. It's been said that sunlight is best disinfectant. A gimleteyed review can help managers best gold ira companies 2021 get past their biases, and see the true strengths and limitations of their companies. Activist investors can identify the core reasons behind underperformance.

Is There A Possibility Of A Recession By 2023? Analyzing Risks & Impacts

Dynamically search and compare data about law firms, companies, lawyers, and industry trends. Senior Fed officials insist that they will keep interest rates at a high level for a while, before lowering them. The Fed intends to drive inflation to pre-pandemic levels of around 2% a year, which is less than the 8.2% rate currently. Markowska stated that Fed's rate increases have not had an effect on inflation or slowing down the economy. Economists argue that the central banking's fear of falling behind in fighting inflation underlines their resolve and explains why recessions are becoming more likely.

Companies experience a decrease in sales during times of recession. This causes economic growth to slow down or even stop altogether.

Its primary goal is to bring down prices for Americans. But the problem is how aggressive is too aggressive. While raising interest rates may slow the economy down, it could also lead to a recession.

Investors have a greater incentive to buy dollars in a turbulent environment, such as a pandemic or war in Eastern Europe.

Many firms look to diversify their offerings and shift lawyers around in times of a downturn.

This top pick is loved by our expert. It features a 0% intro interest rate until 2024 and an insane cashback rate of up to 5%, and all somehow for no annual fee. Jamie Dimon (CEO of JP Morgan) also predicted a slump in 2023. Bloomberg economists agreed, stating that there is a 100% chance for a recession in the next year based upon the Bloomberg Economics probability model.

A Recession Is Widely Expected Here's How To Prepare

Some securities mentioned in this material may not be registered under U.S. law. Securities Act of 1933, as amended, and, if not, may not be offered or sold absent an exemption therefrom.

Many economists believe that the U.S. will experience a recession soon, due to mounting fears. Bank of America strategists stated earlier this month that they expect a "mild depression" to hit next year. Others, such former Treasury Secretary Larry Summers have been more bearish about their recession forecasts. They predicted that only a deep downturn would be enough to reverse the 40-year high inflation.

Services

Many utility providers offer programs to help you pay your bills on a later date, or for other assistance in times of need. If you don’t inquire, you will never know what agreement your creditor and you can reach. You can also apply for a personal loan at your local bank, credit union, or other financial institution. Online lenders are also available. Your employer might offer a short-term loan program if you are in trouble.

What would a recess mean for me

Although experts do expect a recession to occur, it is not possible to predict its severity or length. This makes it difficult for workers in the UK to see the real impact. Businesses will likely try to save money in a recession. This could lead to job losses and spiralling inflation. Also, wages may not be enough to cover the cost for everyday necessities. For context, the unemployment rate in the UK during 2008's recession was 10 percent. Nothing is certain yet, but with a potential recession looming, paying down any expensive debt might be a good option - if you can. Building an emergency fund is also recommended, as this will help protect against the worst effects. You may have already built up a savings pot on the back of the coronavirus pandemic, if you were in a position fortunate enough to do so. These rainy-day savings will be crucial in cushioning any blow to your income posed by a potential recession. To learn more about how you can prepare for whatever the future holds, speak to an Match meI'd like to speak to a financial adviser

Recipients are required to comply with any legal or contractual restrictions on their purchase, holding, and sale, exercise of rights or performance of obligations under any securities/instruments transaction. Giving back is a core value at Morgan Stanley and a central part our culture worldwide. We live that commitment through long-lasting partnership, community-based service and engaging our best asset, Morgan Stanley employees. Our firm's strong commitment to sustainability is evident in our operations, governance as well as risk management, diversity efforts. Philanthropy and research are all part of our business. Morgan Stanley's distinctiveness is due to the calibre of our diverse team.

https://vimeopro.com/cryptoeducation/gold-ira-guide/video/781175685

Watch Video

0 notes

Text

These are the most recent news items and commentary about economics, stock trends, stocks and investing opportunities. Hedges, derivatives and obscura are also covered. These items come from the "tangibles-heavy" contrarian perspective of SurvivalBlog’s Senior Editor, JWR. Today we will examine the conflict of worldviews that exists between those who promote private cryptocurrency and those who promote sovereign CBDCs.

Precious Metals:

Prices of gold and silver rise as USDX rallies. Crude oil weaker.

o o o

Egon von Greyerz It's Time To Jump On The Goldwagon And Get Off The Crashing Cryptowagon

Economy and Finance

CNBC As Americans get deeper in debt, credit card balances rise 15%

o o o

Update (9/11/2009): Conference Board Economic Forecast for US Economy. Here's a quote from the opening

The Conference Board predicts that the US economy will experience economic weakness in the next months. A recession is expected to start around 2022. This outlook is associated to persistent inflation and growing hawkishness of the Federal Reserve. 2022 real GDP growth is expected to be 1.8 percent, while 2023 growth is projected to slow down to zero percent.

o o o

Wolf Street - Where is the Contagion from Crypto Implosion?

Commodities:

Charted : The most expensive of the battery metals.

o o o

US NatGas Thrills on Bloomberg Report that Freeport LNG May Increase Plant Outage

o o o

Zero Hedge: Black Sea Grain Deal Extension.

Inflation Watch

Experts Say That High Inflation Will Not Go Away Soon, Even If the Worst Is Behind You

o o o

Wolf Street: Expectations for Inflation Throw a Curveball.

o o o

Over at Middle: What Inflation Will Do to The 2020s and 2030s.

o o o

AAA Gas Prices Report November 7, 20,22: Gas Prices Rise.

Forex and Cryptos

FOREX-U.S. Dollar gains ground as investors concentrate on future Fed path

o o o

Goldman Sachs FX Trader Suspended over Rate Rigging Probe: WSJ.

o o o

NY Fed launches 12-week pilot CBDC program with major banks.

o o o

Two recent headlines (post-Sam Bankman-Fraud crypto meltdown):

Crypto could "crash" the financial system, warns a US lawmaker.

And,

The failure of the Crypto-giant exposes Washington ties and weak regulation .

JWR’s Comment: These articles keep the "CBDCs good but private cryptos poor" story going. This trend is only going to get more intense in the next months. Federal regulators will be tough on crypto exchanges and demand "transparency." They want to demonize the private cryptos and make them irrelevant to the general public.

o o o

US crypto exchanges are leading Bitcoin exodus: More than $1.5B in BTC was withdrawn in just onek. JWR's comment: These coins should have been kept in hardware wallets that are air-gapped.

Tangibles in Investing

Generation: Millionaire millennials have given up stocks and bonds. This could have "significant implications" for the future. Here's a quote:

"Most wealthy millennials believe that real estate and digital assets offer the greatest growth opportunities, while older investors still have faith in the stock and bond market.

Around 80% of investors between 21 and 42 have made alternative investments, including commodities, real property, cryptocurrencies, private capital, and other tangible assets. These younger investors allocate three times as much to an asset class (16%) than those who are 43 years old or older (5 %).").

o o o

Palmetto State Armory is offering an incredible special: A PSA dagger (Glock 19 clone), Compact 9mm RMR Threaded Barrel Pistol, 10 MAG 27-round, and 15-round magazines, as well as a PSA Pistol bag, for only $399. (Must ship to an FFL. It's hard to believe they are able to include a bonus of $220 worth MagPul PMAG9mm magazines. This short-term deal can be found by entering SKU 53555128306 into their search box.

Provisos:

SurvivalBlog Editors and their staff are not licensed to act as investment advisors.

For more information, please visit our Provisos webpage.

News tips:

JWR can receive your investing and economic news tips. You can send your information via the Contact form. These news are often particularly relevant as they come directly from people who monitor specific markets. Please send any news you find that might be of interest to SurvivalBlog users. Local news items that have been missed by news wire services are particularly appreciated. It doesn't have to be just about commodities or precious metals. Thanks!

0 notes

Text

Market Talk - August 9, 2022

ASIA:

China’s export sector posted strong growth in July, providing a much-needed boost to the world’s second-largest economy, which is almost certain to miss its GDP target this year. Exports measured in US dollars jumped 18% in July from a year earlier, marking the fastest pace of growth this year, according to Chinese customs statistics released on Sunday. Analysts polled by Reuters had predicted a 15% increase. In June, exports increased by 17.9%. Imports, meanwhile, rose 2.3% from a year earlier, slightly missing expectations and suggesting domestic demand remains weak. July’s strong exports sent China’s trade surplus to a record $101 billion for the month, the first time it has surpassed the $100 billion mark. By comparison, the trade surplus in July 2021 was just $56.6 billion.

India’s central bank kept rates at record lows on Friday but raised its inflation forecast and said it would normalize liquidity conditions in a signal that policymakers may be moving closer to tapering pandemic-induced stimulus. As widely predicted, the RBI kept the repo rate, its key lending rate, at 4% and the reverse repo rate, the borrowing rate, unchanged at 3.35%. The RBI has cut the repo rate by a total of 115 basis points (bps) since March 2020 to cushion the blow from the health crisis and tough austerity measures. This comes after cutting rates by 135 basis points since the start of 2019. The consensus in the latest Reuters poll expects the RBI to raise rates twice by 25 basis points in the next fiscal year, with the repo rate reaching 4.50% by the end. March 2023.

The major Asian stock markets had a mixed day today:

- NIKKEI 225 decreased 249.28 points or -0.88% to 27,999.96

- Shanghai increased 10.50 points or 0.32% to 3,247.43

- Hang Seng decreased 42.33 points or -0.21% to 20,003.44

- ASX 200 increased 9.20 points or 0.13% to 7,029.80

- Kospi increased 10.36 points or 0.42% to 2,503.46

- SENSEX closed

- Nifty50 closed

The major Asian currency markets had a mixed day today:

- AUDUSD decreased 0.00271 or -0.39% to 0.69635

- NZDUSD decreased 0.00056 or -0.09% to 0.62814

- USDJPY increased 0.143 or 0.11% to 135.047

- USDCNY decreased 0.00625 or -0.09% to 6.75555

Precious Metals:

l Gold increased 6.96 USD/t oz. or 0.39% to 1,795.48

l Silver decreased 0.142 USD/t. oz or -0.69% to 20.506

Some economic news from last night:

Japan:

M2 Money Stock (YoY) increased from 3.3% to 3.4%

M3 Money Supply (Jul) increased from 2,061.7T to 2,067.1T

Australia:

Westpac Consumer Sentiment (Aug) remain the same -3.0%

NAB Business Confidence (Jul) increased from 2 to 7

NAB Business Survey (Jul) increased from 13 to 20

New Zealand:

Electronic Card Retail Sales (MoM) (Jul) decreased from 0.1% to -0.2%

Electronic Card Retail Sales (YoY) (Jul) decreased from 1.9% to -0.5%

Some economic news from today:

Japan:

Machine Tool Orders (YoY) decreased from 17.1% to 5.5%

EUROPE/EMEA:

Britain’s economy will plunge into recession for more than a year this autumn as rising energy prices push inflation above 13%, the Bank of England has warned. In a bleak outlook for consumers and businesses, the bank forecasts five quarters of economic contraction and a 5% drop in real living standards and has raised interest rates by 0.5 percentage point, the biggest single increase in 27 years. The bank’s baseline forecast sees GDP falling by 1.25% in 2023 and 0.25% in 2024, the first two years of annual economic decline since the 1960s. The interest rate rise will add around £650 to annual repayments for those with an average mortgage. The rise in monthly repayments for homeowners since rates started rising from a low of 0.1% last December is around £170.

Optimism among high-net-worth investors has fallen to early-pandemic levels amid continued concerns about the economic and market impact of inflation and the war in Ukraine, according to the latest quarterly Investor Sentiment survey from UBS, the world’s leading wealth manager. The survey of more than 2,800 investors and 1,100 business owners in 14 markets found that investors are focusing on their retirement savings, with some putting off big purchases. As investor optimism wanes, nearly three out of four investors are now worried about poor investment decisions in the current environment and are holding cash. In contrast, business owner optimism has rebounded after the biggest drop in two years, and most business owners plan to continue hiring and investing in their businesses over the next 12 months. Almost half of business owners expect to raise prices in the next six months due to rising material costs and concerns about wage inflation.

The major Europe stock markets had a mixed day:

l CAC 40 decreased 34.44 points or -0.53% to 6,490.00

l FTSE 100 increased 5.78 points or 0.08% to 7,488.15

l DAX 30 decreased 152.72 points or -1.12% to 13,534.97

The major Europe currency markets had a mixed day today:

- EURUSD increased 0.00184 or 0.18% to 1.02165

- GBPUSD decreased 0.00019 or -0.02% to 1.20822

- USDCHF decreased 0.0011 or -0.12% to 0.95390

Some economic news from Europe today:

UK:

BRC Retail Sales Monitor (YoY) (Jul) increased from -1.3% to 1.6%

ENERGY:

The oil markets had a mixed day today:

l Crude Oil decreased 0.592 USD/BBL or -0.65% to 90.168

l Brent decreased 0.66 USD/BBL or -0.68% to 95.990

l Natural gas increased 0.1806 USD/MMBtu or 2.38% to 7.7696

l Gasoline increased 0.0651 USD/GAL or 2.26% to 2.9513

l Heating oil increased 0.1556 USD/GAL or 4.89% to 3.3347

The above data was collected around 13:32 EST on Tuesday

l Top commodity gainers: Lumber (6.87%), Heating Oil(4.89%), Soybeans (3.81%) and Cotton (2.74%)

l Top commodity losers: Feeder Cattle (-1.05%), Rice (-0.87%), Silver (-0.69%) and Oat (-2.19%)

The above data was collected around 13:40 EST on Tuesday.

US/AMERICAS:

President Joe Biden is signaling his support for bringing Sweden and Finland into NATO. The US Senate approved the measure last week in a 95 to 1 vote.

President Biden officially signed a semiconductor chip manufacturing bill this Tuesday that will provide domestic manufacturers with $52 billion in funds. The Chips and Science Act received bipartisan support and is slated to boost domestic production from 10% to 2%. The White House anticipates that the measure will create 8,000 new jobs as well. Lawmakers hope that the funding will help the US gain a competitive edge over China’s hold on the industry and help with supply shortages.

US Market Closings:

- Dow declined 58.13 points or -0.18% to 32,774.41

- S&P 500 declined 17.59 points or -0.42% to 4,122.47

- Nasdaq declined 150.53 points or -1.19% to 12,493.93

- Russell 2000 declined 28.31 points or -1.46% to 1,912.89

Canada Market Closings:

- TSX Composite declined 90.87 points or -0.46% to 19,578.3

- TSX 60 declined 4.35 points or -0.37% to 1,181.76

Brazil Market Closing:

- Bovespa advanced 248.78 points or 108,651.05

BONDS:

Japan 0.186%(+1.7bp), US 2’s 3.28% (+0.060%), US 10’s 2.7993% (+3.63bps); US 30’s 3.01% (+0.009%), Bunds 0.9250% (+2.8bp), France 1.4810% (+4.2bp), Italy 3.062% (+2.3bp), Turkey 16.19% (-9bp), Greece 3.188% (+10.5bp), Portugal 1.9800% (+4.1bp); Spain 2.066% (+6.8bp) and UK Gilts 1.9770% (+2.5bp).

Original Article

Original Article Here:

Read the full article

0 notes

Text

Prime lending rate increased to 7.75%

For the second time this year, the South African Reserve Bank's Monetary Policy Committee increased the repo rate by 25 basis points to 4.25%, bringing the prime lending rate to 7.75%.

Three committee members voted for the announced increase, and the other two members suggested a 50-basis point rise in the repo rate.

In his statement, the South African Reserve Bank Governor Lesetja Kganyago said that, given the inflation forecast, the implied policy rate path of the bank's Quarterly Projection Model (QPM) indicates gradual normalisation through to 2024.

"As usual, the repo rate projection from the QPM remains a broad policy guideline, changing from one meeting to the next in response to new data and risks," said Kganyago.

The governor said the SARB's forecast for global growth in 2022 is revised down to 3.7% - from 4.4% - and for 2023 is lowered to 2.8% - from 3.3%. This is as a result of the war in Ukraine and the ongoing spread of the Covid virus in Asia and elsewhere. For 2024, expected global growth is unchanged at 2.7%.

"Dramatically higher oil, commodity and food prices, additional constraints to trade and finance, and rising debt costs, create more adverse economic conditions for most emerging and developing economies," said Kganyago.

Industry comment

"The MPC's decision was in line with predictions from most economists, who expected a slow and steady rise in interest rates as the SARB attempts to normalise the aggressive cuts that were made early in the pandemic," says Tony Clarke, managing director of the Rawson Property Group.

"Global economic conditions have also become a lot more complicated with the war between Russia and Ukraine. Factors such as global supply chains, food production and fuel prices will inevitably put pressure on inflation in several countries, including South Africa. An adjustment to the repo rate is one of the few mechanisms the SARB has for managing inflation, so we believe further increases are on the cards."

Chas Everitt International property group chief executive, Berry Everitt, says the fact that the economic growth forecast for SA was raised to 2 percent this year from 1.7 percent just two months ago should, in due course, translate into more employment opportunities.

"At the same time, the rand has been strengthening in anticipation of the repo rate increase, and this will help to contain the "imported inflation" that SA experiences due to higher global prices for fuel and basic foodstuffs. This will hopefully bring some relief to the many households already struggling to make ends meet."

Gerhard Kotze, managing director of the RealNet estate agency group, says the 25-basis point increase takes account of the difficulties many households are already facing due to steeply rising fuel, food and utility costs.

Pam Golding Property group chief executive, Dr Andrew Golding, says that by increasing the repo rate by a moderate 25 basis points for the third consecutive MPC meeting, the SARB endeavours to normalise interest rates in line with its stated strategy. This is amid a resurgence in inflationary pressures and a lukewarm economic growth outlook.

"Although we would have preferred an unchanged repo rate, this moderate approach has in all likelihood already been factored in by the housing market," says Golding.

"Attempting to tighten monetary policy to dampen price pressures without derailing the economic recovery was already challenging. Now the war in Ukraine has created further uncertainty and financial market turmoil. This, together with the West's sanctions against Russia, has sent global commodity prices soaring while surging food and energy prices, in particular, have forced local analysts to revise their inflation forecasts."

Chairman of the Seeff Property Group, Samuel Seeff says: "We had hoped for a pause in interest rate hikes to provide some reprieve for homeowners and buyers who are facing rising costs. However, we believe the market is now well aware that the rate is stepping up this year to counter inflation and to normalise it after the sharp rate cuts in 2020.