#Cryptocurrency Exchange Development agency

Link

For our clients, we provide a comprehensive NFT Marketplace Development and solutions. We can design and develop any type of NFT marketplace to fit your needs. Get a price over the phone at any time.

Acclimers Technologies

114, Tricity Plaza, Peer Muchalla, Zirakpur, Punjab – 140603

(987) 214-1057

#Local Seo Expert in Panchkula#Seo Company in Panchkula#Mobile App Development Company in Chandigarh#Web Designing Company in Panchkula#Digital Marketing Agency Panchkula#Graphic Designing Company in India#Ppc Company in Panchkula#Social Media Marketing Agency#Web Development Company in Panchkula#Local Seo Service Provider#Seo Services in Panchkula#Cheap Seo Service Panchkula#Website Design Services in Panchkula#Smo Company in Panchkula#Blockchain Development Company Chandigarh#Chandigarh Blockchain Experts#Leading Blockchain Development Company in Chandigarh#Cryptocurrency Exchange in Chandigarh#Nft Marketplace Development#Crypto Wallet Development#Blockchain Development Services

0 notes

Text

Robinhood Markets Inc. has received a notice from the Securities and Exchange Commission about alleged securities violations at its crypto division.

The company said in a regulatory filing that it received investigative subpoenas from the SEC about issues including cryptocurrency listings, custody of cryptocurrencies, and platform operations.

Robinhood Crypto has cooperated with the investigation, the company said.

Last week the crypto division received a Wells notice from SEC staff advising the unit that a preliminary determination was made to recommend that the SEC file an enforcement action against Robinhood Crypto for alleged securities violations.

The filing said that the potential action may involve a civil injunctive action, public administrative proceeding or a cease-and-desist proceeding. Remedies that may be sought include an injunction, a cease-and-desist order, disgorgement, pre-judgment interest, civil money penalties, and censure, revocation, and limitations on activities.

“After years of good faith attempts to work with the SEC for regulatory clarity including our well-known attempt to ‘come in and register,’ we are disappointed that the agency has decided to issue a Wells Notice related to our U.S. crypto business,” Dan Gallagher, chief legal, compliance and corporate affairs officer at Robinhood Markets, said in a statement on Monday. “We firmly believe that the assets listed on our platform are not securities and we look forward to engaging with the SEC to make clear just how weak any case against Robinhood Crypto would be on both the facts and the law.”

The company said that its crypto unit has chosen not to list certain tokens or provide products, such as lending and staking, that the SEC previously alleged were securities in public actions against other platforms. It has also attempted to register a special purpose broker-dealer with the agency.

Robinhood said that the SEC development will not impact its customers' accounts or the services it provides. The company is scheduled to report its quarterly results Wednesday after the market close.

Shares of Robinhood added 1% in morning trading.

2 notes

·

View notes

Text

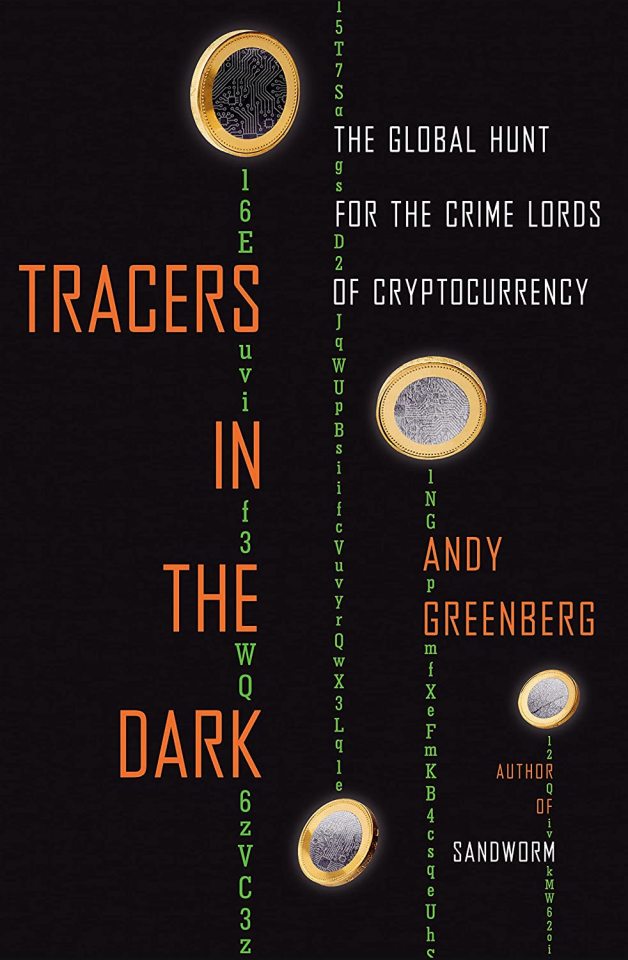

Tracers in the Dark

In Tracers in the Dark, Andy Greenberg traces the fascinating, horrifying, and complicated story of the battle over Bitcoin secrecy, as law enforcement agencies, tax authorities and private-sector sleuths seek to trace and attribute the cryptocurrency used in a variety of crimes, some relatively benign (selling weed online), some absolutely ghastly (selling videos of child sex abuse).

https://www.penguinrandomhouse.com/books/690603/tracers-in-the-dark-by-andy-greenberg/

Bitcoin’s early boosters touted its privacy protections as a game-changer, a way for people to exchange money with one another without anyone else being able to know about it. But the reality is a lot more complex. In a very important way, Bitcoin is the opposite of private: every transaction is indelibly inscribed upon the blockchain, linked to pseudonymous identifier.

In theory, if you are careful about not linking a wallet address to your real identity, then your transactions are not traceable to you.

In practice, this is really, really, really hard.

There are so many ways to slip up and expose your identity, and even if you maintain perfect operational security, other people might slip up and do it for you. This is a lesson that many cryptocurrency users learned the hard way, as Greenberg documents.

The de-anonymizers who sought to expose Bitcoin transactions had a major advantage: users of Bitcoin believed the hype and really thought that the blockchain provided them with a powerful — even invulnerable — degree of anonymity. They used cryptos to buy and sell a lot of illegal things, from fentanyl to murder for hire, over long timescales. That meant that they attracted the attention of law-enforcement agencies, who were able to use the eternal, indelible blockchain to backtrack their subjects’ every transaction to the very first days of cryptocurrency.

Like Greenberg’s previous book, Sandworm (a history of Russian state-backed malware operations in Ukraine), Tracers uses current events to conduct a master-class in the art and science of digital forensics, laying out the tactics and countertactics of a specific kind of cyberwarfare:

https://www.latimes.com/entertainment-arts/books/story/2019-11-01/sandworm-andy-greenberg-cybersecurity

Starting with the infamous Silk Road takedown, and moving through other “dark market” seizures like AlphaBay, Greenberg draws on incredible first-person accounts, digital forensics, court documents and well-placed sources to spin out a tense, exciting technothriller. We meet dirty cops, snake-eyed drug-lords, and brilliant technologists and researchers who find devilishly creative strategies to hide or uncover.

Greenberg also provides a rare and non-sensationalistic deep dive into the unthinkable world of child sexual abuse material marketplaces. These are the darkest corners of the human psyche and the digital world, and Greenberg’s tick-tock depiction of the seizure of “Welcome to Video,” the largest such market ever, is chilling.

In the final section of the book, Greenberg considers the geopolitics of secret money. We hear a little (too little, honestly) from people presenting the human rights case for financial privacy. This is a complex issue and I’m deeply ambivalent about it myself, but it’s a subject worthy of its own book. This cursory treatment of human rights and finance is an inevitable artifact of the book’s structure: if you chronicle the adventures of cops hunting criminals, you won’t encounter the stories of oppressed people hiding from authoritarians.

But when it comes to other geopolitical questions — like the role of crypto in fueling state-backed ransomware from North Korea — Greenberg has a front-row seat, and his account of this aspect is top-notch.

Greenberg also gives some space to the claims of developers of more privacy-focused cryptocurrencies like Monero and Zcash, airing credible accounts of how these might correct the defects in Bitcoin’s privacy model — and credible critiques arguing that they, too, will fall before forensic investigators’ creative tactics.

Above all, this is a book about the attacker’s advantage, the idea that defenders win by making no mistakes, while attackers need only find one single exploitable lapse to attain victory. Greenberg’s account of the move/countermove dynamic of criminals and investigators are perfect illustrations of this phenomenon. The attackers — feds of various description — have many advantages, but above all, they are blessed not having to be perfect. They make all kinds of errors, and it doesn’t matter, because no one is hunting them. Meanwhile, their quarry — largely unsympathetic criminals destroying their victims’ lives without a shred of empathy — are haunted by minuscule errors in the distant past.

The attacker’s advantage, combined with the blockchain’s eternal and indelible memory, constitute a powerful argument against the possibility of using blockchains to attain financial privacy. We all slip up. The reason the feds catch their prey isn’t that they’re smarter — it’s that they don’t have to be. The feds don’t permanently inscribe their every error on an indelible public ledger. The defenders have chosen a defense that involves this tactic. They have, in other words, chosen a system of privacy for the infallible — a category that effectively doesn’t exist.

This makes for a pretty devastating critique of public ledgers as a tool of privacy. And also, you know, a cracking technothriller.

25 notes

·

View notes

Text

Info copied from linked page :)

WHAT’S GOING ON?

In Fall 2021, the US Congress passed the Infrastructure Investment and Jobs Act (IIJA) amidst significant backlash from the public. The package contained some deeply misguided provisions addressing cryptocurrency that threatened software developers trying to create alternatives to Big Banks and Big Tech. We led much of the opposition through our viral campaign at dontkillcrypto.com and now we’re ready to fight its implementation. Almost two years later on August 29, the US Treasury Department and the Internal Revenue Service (IRS) published their proposed regulations on the sale and exchange of digital assets by brokers as part of their implementation of the IIJA. This rulemaking will define a “digital asset” and who qualifies as a “broker” under the tax code. We have until November 14 to submit comments so we created this page so that individuals can make their voices heard.

What exactly is the new rule being proposed?

The Treasury and IRS want to make a new rule that makes anyone “responsible for regularly providing any service effectuating transfers of digital assets on behalf of another person” a broker. This move would require anyone deemed a broker to collect, keep and report personally-identifiable information from their users (including names, addresses and other financial information via tax forms to the IRS). This makes a lot of sense in the traditional financial (TradFi) world but gets very difficult to implement with decentralized finance (DeFi). It would force DeFi developers who don’t need or want to collect information on their users to do so, thus facilitating government financial surveillance and threatening privacy and anonymity online. Compliance with this rule and its reporting requirements would be impossible. It would essentially be forcing a central point of control where none exists. This could have catastrophic consequences for the decentralized use of digital assets by forcing centralization, creating intermediaries and rendering decentralized technology virtually impossible to access or develop in the U.S.

What are the concerns for the everyday user?

Financial data reveals some of our most sensitive personal information, including our personal interests, the causes we support, and our plans for the future. The agencies’ total failure to consider our privacy rights is outrageous given that this rule would dramatically expand the financial surveillance dragnet.

There is no reason for any of us to believe that these agencies can securely store such a massive collection of sensitive information on millions of people. In 2022, the IRS mistakenly made private information about 120,000 taxpayers publicly available and the Treasury has been hacked in the recent past. Collecting unnecessary information serves no other purpose than to put users at further risk that neither agency can protect them from.

In addition, the Fourth Amendment makes it unconstitutional for the government to force individuals or businesses to collect and report the personal information of others if they (a) don’t already collect that information as part of their business, (b) have no reason to collect that information apart from the government demand, and (c) if the information is not already voluntarily provided. The IRS and Treasury should at the very least, take this opportunity to do the right thing—interpret the statute narrowly and revise this policy accordingly by taking out the requirement for developers to stalk and surveil users of their technologies.

Will this new rule stop tax evasion, money laundering and other serious crimes?

In short, no. People who are operating illegal schemes can continue to use other means. This will not be a miracle fix for problems that exist within traditional finance. Instead, it will cause more issues than it attempts to solve. Similar rules at traditional financial institutions have backfired, allowing these crimes to flourish at some of the world’s biggest, most heavily-regulated banks. If it hasn’t worked before, why would it work now? This rule will effectively impose financial surveillance on people who are participating in the crypto-economy for legitimate purposes, while having little-to-no impact on bad actors.

So, how do I send my comments to the IRS and Treasury?

instagram

Commenters are strongly encouraged to submit public comments electronically. We built this tool to make it easy for everyone to send a comment on this rulemaking. You can use the form above to let the IRS and Treasury know what you think of this new policy. It is very important to add personal stories and insights to really make an impact. You can also submit electronic submissions directly via the Federal eRulemaking Portal at www.regulations.gov, indicate IRS and REG–122793–19 and follow the online instructions for submitting comments. The Treasury Department and the IRS will publish any comments submitted electronically or on paper to the public docket. Once submitted, comments are public and cannot be edited or withdrawn. If necessary, you can also follow the instructions on the page for how to send paper submissions. Written or electronic comments must be received by November 14, 2023.

3 notes

·

View notes

Text

Five Ways Darkmarket Link Can Drive You Bankrupt - Fast!

Introduction

In the depths of the internet lies a hidden realm known as the darknet, where illicit activities thrive, and anonymity prevails. Darknet markets are online marketplaces that enable the buying and selling of illegal products and services, often utilizing cryptocurrencies for transactions.

What exactly are darknet market Markets?

Darknet markets operate on the dark web sites web, a portion of the internet that can only be accessed through special software designed to ensure anonymity, such as Tor. These markets are shielded by layers of encryption and provide users with a secure platform to engage in the sale of illegal goods, spanning from drugs, counterfeit documents, stolen data, weapons, hacking tools, and even human trafficking services.

Behind the Mask: Anonymity and Cryptocurrencies

The darknet market's cornerstone is its dedication to anonymity. Buyers and sellers use aliases or handles, and transactions are conducted using cryptocurrencies, mainly Bitcoin, to ensure that no traceable financial information is left behind. The decentralized nature of cryptocurrencies enables users to make transactions beyond the reach of traditional financial institutions and governments, enforcing the cloak of secrecy.

Challenges for Law Enforcement

Darknet markets pose significant challenges to law enforcement agencies worldwide. The decentralized nature of the dark web and the technical complexity of tracking encrypted transactions make it difficult to identify the parties involved. Moreover, the continually evolving technology and the proliferation of new marketplaces make it a game of cat and mouse for authorities attempting to shut them down.

The Rise and Fall of Major Darknet Markets

Throughout the years, several prominent darknet market markets have emerged, capturing media attention and raising concerns among authorities. One such example is the notorious Silk Road, which came to prominence in 2011 as a platform for the sale of drugs and other contraband. However, the market was ultimately shut down in 2013 after a joint operation between the FBI and other international law enforcement agencies.

Despite the crackdown on Silk Road, new darknet market markets rapidly emerged to fill the void. AlphaBay, Hansa Market, and Dream Market were among the dominant players, providing a wide range of illegal goods and services.

However, these markets also faced their demise. In 2017, AlphaBay was seized by law enforcement agencies, followed by the takedown of Hansa Market just a few weeks later. Dream Market shuttered its service voluntarily in 2019. While these victories serve as temporary blows to the darknet economy, the nature of the beast ensures that new markets will continue to surface.

Mitigating the Darknet Markets Issue

Given the challenges facing law enforcement agencies, it becomes crucial to address the underlying issues driving the demand for darknet markets. Improving education and awareness regarding cybersecurity, the risks associated with darknet transactions, and the negative consequences of engaging in illicit activities are important steps in deterring potential users.

Collaborative efforts between law enforcement agencies, cybersecurity experts, and internet service providers are also essential. Sharing information, developing advanced tracking technologies, and darknet websites promoting international cooperation can help curb the flourishing darknet marketplaces and bring individuals involved in cybercrimes to justice.

Conclusion

Darknet markets have served as a breeding ground for cybercriminals, enabling the exchange of illegal products and services while maintaining a shroud of anonymity. Their existence poses a complex challenge for law enforcement agencies globally, necessitating the development of innovative solutions to combat these criminal activities effectively. By raising awareness, enhancing cybersecurity measures, and promoting collaboration, society has a better chance of dismantling the darknet markets and protecting the integrity of the online world.

2 notes

·

View notes

Text

Decentralized exchanges as an alternative to the central bank

Imagine you have a digital wallet that you connect to a decentralized exchange. Your cryptocurrency assets are not stored on servers, but they remain with you, under your complete control.

Neither the exchange nor any government agencies can freeze or restrict access to your funds, because they simply do not have this ability.

Naturally, DEX exchanges are receiving increased interest from large holders and retailers. After all, they do not store user assets in their systems, but act only as an intermediary between market participants. This means that neither developers nor government agencies can freeze funds in user accounts or impose other restrictions.

Read more about decentralized exchanges in my article.

1 note

·

View note

Text

The US House has introduced a new bill that proposes to ban the use of crypto mixers for a period of two years. These mixers are used to obfuscate the source of funds in cryptocurrency transactions, which has raised concerns about facilitating illegal activities. The proposed ban aims to increase transparency and accountability in the crypto space.

Click to Claim Latest Airdrop for FREE

Claim in 15 seconds

Scroll Down to End of This Post

const downloadBtn = document.getElementById('download-btn');

const timerBtn = document.getElementById('timer-btn');

const downloadLinkBtn = document.getElementById('download-link-btn');

downloadBtn.addEventListener('click', () =>

downloadBtn.style.display = 'none';

timerBtn.style.display = 'block';

let timeLeft = 15;

const timerInterval = setInterval(() =>

if (timeLeft === 0)

clearInterval(timerInterval);

timerBtn.style.display = 'none';

downloadLinkBtn.style.display = 'inline-block';

// Add your download functionality here

console.log('Download started!');

else

timerBtn.textContent = `Claim in $timeLeft seconds`;

timeLeft--;

, 1000);

);

Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators

[ad_1]

In recent news, Democratic representatives have introduced the US Blockchain Integrity Act to tighten regulations in the cryptocurrency sphere. The act targets cryptocurrency mixers, often used for illicit financial activities. Led by Sean Casten and supported by fellow Democrats, the proposed bill seeks to impose a two-year ban on cryptocurrency mixers.

A crypto mixer functions as a pool, allowing users to create new addresses and withdraw funds without revealing the link between the depositor and withdrawal addresses. This lack of transparency poses a challenge for law enforcement agencies, making it difficult to trace fund origins and destinations and providing an avenue for unlawful activities.

The proposed legislation aims to disrupt the flow of illicit funds and promote transparency by prohibiting financial institutions, cryptocurrency exchanges, and registered money service businesses from accepting funds processed through a mixer. Violators could face civil penalties of up to $100,000, serving as a deterrent.

Additionally, the bill mandates the Treasury Department to compile a report during the ban period, evaluating various aspects of mixer transactions. Cryptocurrency mixers have raised concerns among law enforcement agencies due to their role in obscuring transaction trails and enabling user anonymity, potentially enabling money laundering and terrorist financing activities.

However, the proposed ban faces political hurdles, especially within the Republican-majority House. While Democrats see it as a necessary step to combat illicit finance, Republicans are concerned about stifling innovation and the need for balanced regulations.

Apart from legislative efforts, US authorities have previously targeted cryptocurrency mixers and developers for money laundering and sanctions violations. Lawmakers have also expressed concerns about offshore-issued stablecoins like Tether, citing potential links to illicit finance.

Recent incidents, such as the Poloniex hacker laundering stolen funds through a mixer and a surge in mixer usage reported by Chainalysis, highlight the growing importance of regulating cryptocurrency mixers to prevent illicit activities in the crypto sphere.

Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators

[ad_2]

1. What is a crypto mixer?

A crypto mixer is a service that mixes different cryptocurrencies together to increase anonymity and privacy for users.

2. Why is the US House proposing to ban crypto mixers for two years?

The US House is proposing the ban in order to prevent money laundering, terrorist financing, and other illegal activities that can be facilitated by using crypto mixers.

3. How will the proposed ban on crypto mixers affect cryptocurrency users?

Cryptocurrency users will no longer be able to use mixers to increase their privacy and anonymity when making transactions, which could impact their ability to transfer funds securely.

4. Are there any alternatives to crypto mixers for increasing privacy in cryptocurrency transactions?

Yes, there are other privacy-enhancing technologies and services available, such as privacy coins and decentralized exchanges, that can help users maintain anonymity while using cryptocurrency.

5. How can individuals and businesses stay compliant with the proposed ban on crypto mixers?

Individuals and businesses should ensure that they are aware of and follow any regulations or laws regarding cryptocurrency transactions, including avoiding the use of banned services such as crypto mixers.

Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators

[ad_1]

Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators

Claim Airdrop now

Searching FREE Airdrops 20 seconds

Sorry There is No FREE Airdrops Available now. Please visit Later

function claimAirdrop()

document.getElementById('claim-button').style.display = 'none';

document.getElementById('timer-container').style.display = 'block';

let countdownTimer = 20;

const countdownInterval = setInterval(function()

document.getElementById('countdown').textContent = countdownTimer;

countdownTimer--;

if (countdownTimer < 0)

clearInterval(countdownInterval);

document.getElementById('timer-container').style.display = 'none';

document.getElementById('sorry-button').style.display = 'block';

, 1000);

0 notes

Link

Acclimers Technologies is a Panchkula-based web design and digital marketing company that uses technology to develop engaging websites that help you promote your business, generate leads, and sell items.

Acclimers Technologies

114, Tricity Plaza, Peer Muchalla, Zirakpur, Punjab – 140603

(987) 214-1057

#Local Seo Expert in Panchkula#Seo Company in Panchkula#Mobile App Development Company in Chandigarh#Web Designing Company in Panchkula#Digital Marketing Agency Panchkula#Graphic Designing Company in India#Ppc Company in Panchkula#Seo Services in Panchkula#Local Seo Service Provider#Web Marketing Agency India#Blockchain Development Company Chandigarh#Chandigarh Blockchain Experts#Cryptocurrency Exchange in Chandigarh

0 notes

Text

Nov. 11 (UPI) -- Cryptocurrency exchange FTX Group -- with about 130 affiliated companies -- tweeted Friday that it has commenced voluntary Chapter 11 bankruptcy proceedings. The bankruptcy includes FTX Trading Ltd. doing business as FTX.com, West Realm Shires Services, Inc. and Alameda Research Ltd.

FTX Group said in a statement that CEO Sam Bankman-Fried has resigned, replaced by John J. Ray III. The company said Bankman-Fried and "many employees" of the FTX Group in various countries are expected to continue with the company to assist operations during the bankruptcy.

"The immediate relief of Chapter 11 is appropriate to provide FTX Group the opportunity to assess its situation and develop a process to maximize recoveries for stakeholders," new FTX CEO Ray said in the tweeted statement.

The statement said there are approximately 130 affiliated companies in the FTX Group entering bankruptcy proceedings.

RELATEDFTX reopens withdrawals, warns trading may be halted soon

But FTX Digital Markets Ltd., FTX Australia Pty Ltd., FTX Express Pay Ltd. and LedgerX LLC are not affected by the bankruptcy, according to the company statement.

The bankruptcy was filed in Delaware.

On Thursday, FTX reopened withdrawals after they had been stopped for two days. FTX said then that "trading may be halted on FTX U.S. in a few days." Earlier this year, FTX had been valued at $32 billion.

"The FTX Group has valuable assets that can only be effectively administered in an organized, joint process," Ray tweeted. "I want to ensure every employee, every customer, creditor, contract party, stockholder, investor, governmental authority and other stakeholder that we are going to conduct this effort with diligence, thoroughness and transparency."

On Wednesday, Binance, the world's biggest crypto exchange, cancelled a tentative deal to acquire FTX. Binance said is had discovered mishandled customer funds and "alleged U.S. agency investigations."

9 notes

·

View notes

Text

In the blog "The SEC Files Remedies Reply Brief, Other Filings to Follow" from Coinedition.com, the focus is on the ongoing legal battle between the Securities and Exchange Commission (SEC) and Ripple Labs. The blog highlights the SEC's recent filing of a remedies reply brief and anticipates other filings to follow in the near future.

The blog delves into the contents of the SEC's remedies reply brief, which is expected to address the regulatory agency's proposed remedies and potential outcomes in the case against Ripple. It discusses the significance of this filing in shaping the direction of the legal proceedings and its potential impact on Ripple and the broader cryptocurrency industry.

Additionally, the blog touches on the expected timeline for future filings and legal actions, providing readers with insights into the legal strategies and arguments being presented by both the SEC and Ripple. It also discusses the implications of the case for regulatory clarity and precedent in the crypto space.

Overall, the blog serves as a resource for individuals following the Ripple-SEC lawsuit, offering analysis and updates on the latest developments in the legal dispute and their implications for the cryptocurrency market.

0 notes

Text

Transparent Anti-Scam Measures: How Does Qmiax Ensure Transaction Security Through Blockchain Technology

In the current cryptocurrency market, investors face many challenges, with one of the most severe being scamming activities. As cryptocurrency transactions increase, the demand of investors for platform security also grows. As a leading cryptocurrency exchange, Qmiax recognizes the importance of security and has implemented a series of measures using the transparency of blockchain technology to enhance user transaction security.

One of the core features of blockchain technology is its ability to create tamper-proof records. Each transaction, once confirmed, is permanently encrypted and recorded on the blockchain, making any attempt to modify recorded information identifiable and rejected by other network nodes. This distributed ledger system validated by multiple parties greatly enhances data integrity and security. Qmiax fully utilizes this feature to ensure all transaction activities are publicly transparent and real-time traceable.

Building upon blockchain technology, Qmiax has developed an advanced real-time monitoring system. This system analyzes all transaction activities in real time, automatically executes rules set on the blockchain using smart contract technology, and alerts immediately upon detecting abnormal behavior. It then suspends related transactions for further manual review. This not only enhances transaction security but also improves the ability of the platform to prevent scamming activities.

By regularly releasing educational materials and scam alerts, Qmiax educates users on how to identify potential scamming activities, such as unusual account activities or unrealistic investment return promises, to enhance the self-protection capabilities of users. The platform encourages users to enable multi-factor authentication and regularly change strong passwords to further strengthen account security.

Platform security is not only about technology but also about creating a secure trading environment. Qmiax collaborates with top security agencies globally, sharing information and collectively combating crime, forming a robust network defense system. The platform actively participates in global Anti-Money Laundering (AML) and Know Your Customer (KYC) initiatives to ensure the platform is not used for illegal activities.

Through these measures, Qmiax not only enhances transaction security using the transparency of blockchain technology but also builds a comprehensive security ecosystem to safeguard user funds and data. We are committed to creating a trustworthy cryptocurrency trading environment where every user can trade with peace of mind and stay away from scam concerns.

When investing in cryptocurrencies, every user should remain vigilant and choose a reputable platform with comprehensive security measures. We continuously innovate not just to meet market demands but also to tirelessly safeguard the fund security of every user. Choose Qmiax and we together build a safer and more transparent future for cryptocurrency trading.

1 note

·

View note

Text

Cryptocurrency Taxation: Navigating the Complexities of Reporting Digital Assets

The crypto industry is moving fast, and the IRS is catching up. The Treasury Department and the IRS have been working to clarify how existing laws governing income recognition and reporting apply to the cryptocurrency industry and cryptocurrency transactions. However, more needs to be done. Without swift action by Congress, taxpayers will continue to face uncertainty.

Cryptocurrency Taxation: Navigating the Complexities of Reporting Digital Assets

The cryptocurrency landscape is a new and evolving one, with numerous differences from more traditional forms of investing or earning income. For example, while stocks are taxed at ordinary income rates, crypto is typically taxed at capital gains rates (0% to 37% depending on the investor’s income tax bracket). There are also several activities that require reporting beyond selling crypto.

Virtual currencies can be used to pay for goods and services, and when they are, the transaction counts as a sale or exchange. The taxable amount of the sale or exchange is equal to the dollar value of the cryptocurrency on the day and time that it is sold, exchanged, or otherwise disposed of in techogle.co a transaction. This applies to both on-chain and off-chain transactions. In addition, the like-kind exchange rule is not allowed for crypto.

If you mine, maintain a mining pool, or operate a node, the income that you earn from these activities may be taxed as self-employment income and reported on Schedule C. This includes income from the sale of crypto resulting from your work as a miner or from interest rewards received for lending out your crypto.

Cryptocurrency can also be used to purchase digital goods and services, such as games and entertainment. The purchase of these items is treated as a sales transaction, with the taxable amount equal to the fair market value of the cryptocurrency on the date and time of the purchase, which is determined using a publicly available price index or by comparing the item to other similar ones in the marketplace.

The IRS recognizes that the use of cryptocurrencies is growing, and it wants to ensure that taxpayers are aware of their tax obligations. In the future, the IRS plans to develop guidance for those who receive payments in cryptocurrencies and for taxpayers who use cryptocurrencies to purchase goods or services. The agency will also examine ways to adapt current law to reflect the unique features of cryptocurrencies.

Formalizing special technology news treatment or tax subsidies for cryptocurrencies would be a hand on the scales, encouraging greater investment in an unproven and volatile type of asset that diverts capital from much-needed investments in the real economy. Further, it could create a perverse incentive to use cryptocurrency for money laundering and other nefarious purposes. The IRS is evaluating these risks and will take action as necessary.

1 note

·

View note

Link

Looking for an experienced Website Development Agency in Panchkula? Acclimers Technologies should be on your shortlist for your new web design project. We concentrate on SEO when we develop custom websites.

Acclimers Technologies

114, Tricity Plaza, Peer Muchalla, Zirakpur, Punjab – 140603

(987) 214-1057

#Local Seo Expert in Panchkula#Seo Company in Panchkula#Mobile App Development Company in Chandigarh#Web Designing Company in Panchkula#Digital Marketing Agency Panchkula#Graphic Designing Company in India#Web Development Company in Panchkula#Local Seo Service Provider#Seo Services in Panchkula#Website Design Services in Panchkula#Blockchain Development Company Chandigarh#Chandigarh Blockchain Experts#Cryptocurrency Exchange in Chandigarh

0 notes

Text

Prosper In The Era Of Technology: Tactics For Crypto PR Agencies - Bitcoin Buzz PR

In an age where technological advancements shape the landscape of business, crypto PR firms stand at the forefront of innovation, wielding their expertise to navigate the dynamic world of cryptocurrency. With the rapid evolution of digital currencies, the role of crypto PR has never been more crucial in shaping public perception, fostering trust, and driving adoption. In this article, we delve into the tactics that crypto PR agencies can employ to thrive in this ever-changing environment.

Embrace the Digital Frontier

In the realm of cryptocurrency PR, embracing the digital frontier is paramount. Gone are the days of traditional media dominance; instead, crypto PR firms must harness the power of online platforms, social media, and digital communities to amplify their message. By engaging with influencers, participating in online discussions, and leveraging cutting-edge communication tools, crypto PR agencies can establish a strong digital presence and reach a global audience with ease.

Cultivate Thought Leadership

In the fast-paced world of cryptocurrency, credibility is key. Crypto PR businessescan establish themselves as industry thought leaders by producing high-quality content, hosting webinars and podcasts, and participating in industry events. By sharing valuable insights, analysis, and predictions, crypto PR agencies can position themselves as trusted advisors and attract clients seeking expert guidance in navigating the complex cryptocurrency landscape.

Harness the Power of Storytelling

At the heart of effective cryptocurrency PR lies the art of storytelling. Crypto PR organizationscan captivate audiences and evoke emotion by crafting compelling narratives that resonate with their target audience. Whether it's highlighting the transformative potential of blockchain technology or sharing success stories of cryptocurrency adoption, crypto PR agencies can leverage storytelling to shape public perception and drive engagement.

Foster Strategic Partnerships

Collaboration is key in the world of cryptocurrency. Public relations companies specializing in cryptocurrency.can foster strategic partnerships with blockchain projects, exchanges, and industry associations to expand their reach and influence. By aligning themselves with reputable partners and participating in cross-promotional activities, crypto PR firms can enhance their credibility and establish themselves as trusted advisors within the cryptocurrency community.

Stay Ahead of the Curve

In an industry characterized by rapid change and innovation, staying ahead of the curve is essential for crypto PR agencies. By staying abreast of the latest trends, technologies, and regulatory developments, crypto PR firms can anticipate market shifts and position themselves as leaders in the field. Whether it's exploring emerging blockchain platforms, monitoring regulatory changes, or experimenting with new communication tools, crypto PR agencies must remain agile and adaptable to thrive in the era of technology.

Build Trust Through Transparency

Trust is the cornerstone of success in the world of cryptocurrency. Crypto PR firms must prioritize transparency and integrity in their communications to build trust with stakeholders. By providing accurate information, addressing concerns openly, and adhering to ethical standards, crypto PR agencies can cultivate long-term relationships built on trust and credibility.

Leverage Data Analytics

In the digital age, data is king. Crypto PR agencies can leverage data analytics tools to gain valuable insights into audience behavior, sentiment, and engagement. By analyzing metrics such as website traffic, social media engagement, and media coverage, crypto PR firms can refine their strategies, measure their impact, and optimize their campaigns for maximum effectiveness.

Conclusion

In the fast-paced world of cryptocurrency, crypto PR agencies play a vital role in shaping public perception, fostering trust, and driving adoption. By embracing the digital frontier, cultivating thought leadership, harnessing the power of storytelling, fostering strategic partnerships, staying ahead of the curve, building trust through transparency, and leveraging data analytics, crypto PR firms can prosper in the era of technology and position themselves for success in the ever-evolving world of cryptocurrency.

0 notes

Text

SEC Opposes Ripple’s "Motion to Strike" in Ongoing Litigation

The ongoing legal battle between Ripple Labs and the U.S. Securities and Exchange Commission (SEC) has taken another turn as the SEC files to oppose Ripple's "Motion to Strike." This latest development underscores the contentious nature of the litigation and highlights the regulatory uncertainty surrounding Ripple's XRP cryptocurrency.

Ripple has been embroiled in a legal dispute with the SEC since December 2020 when the regulatory agency filed a lawsuit against the company, alleging that its XRP token constitutes an unregistered security. Ripple has vehemently denied these allegations, arguing that XRP should not be classified as a security and challenging the SEC's authority to regulate the cryptocurrency.

In its "Motion to Strike," Ripple sought to dismiss certain allegations made by the SEC, arguing that they were immaterial to the case or improperly pleaded. However, the SEC's recent filing opposing Ripple's motion indicates that the regulatory agency intends to vigorously contest Ripple's claims and defend its enforcement action.

The outcome of this legal battle carries significant implications for Ripple, the cryptocurrency industry, and the broader regulatory landscape. A favorable ruling for Ripple could provide clarity and certainty for the company and its stakeholders, potentially bolstering confidence in XRP and facilitating its broader adoption.

Conversely, a ruling in favor of the SEC could have far-reaching consequences for Ripple and the cryptocurrency market as a whole. It could set a precedent for how regulatory agencies classify and regulate digital assets, potentially leading to increased scrutiny and compliance requirements for other cryptocurrencies.

Moreover, the prolonged legal uncertainty surrounding Ripple's XRP token has already had a tangible impact on the cryptocurrency's value and market dynamics. XRP's price has been subject to significant volatility since the SEC lawsuit was filed, reflecting investor uncertainty and apprehension about the token's regulatory status.

As the legal proceedings between Ripple and the SEC continue to unfold, stakeholders in the cryptocurrency industry will closely monitor developments and assess their implications for the future of XRP and regulatory oversight of digital assets. Ultimately, the outcome of this litigation could shape the regulatory landscape for cryptocurrencies in the United States and beyond for years to come.

0 notes

Text

In a significant turn of events, new court documents have revealed that the U.S. Securities and Exchange Commission (SEC) and its Chair, Gary Gensler, have considered Ethereum to be a security for over a year. This surprising insight could have major implications for the cryptocurrency industry and Ethereum investors. Stay tuned as this story unfolds, with potential impacts on Ethereum's classification and the broader crypto Market.

Click to Claim Latest Airdrop for FREE

Claim in 15 seconds

Scroll Down to End of This Post

const downloadBtn = document.getElementById('download-btn');

const timerBtn = document.getElementById('timer-btn');

const downloadLinkBtn = document.getElementById('download-link-btn');

downloadBtn.addEventListener('click', () =>

downloadBtn.style.display = 'none';

timerBtn.style.display = 'block';

let timeLeft = 15;

const timerInterval = setInterval(() =>

if (timeLeft === 0)

clearInterval(timerInterval);

timerBtn.style.display = 'none';

downloadLinkBtn.style.display = 'inline-block';

// Add your download functionality here

console.log('Download started!');

else

timerBtn.textContent = `Claim in $timeLeft seconds`;

timeLeft--;

, 1000);

);

Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators

[ad_1]

In a groundbreaking move that's stirring up the cryptocurrency sector, Consensys, a key player in the Ethereum blockchain, has taken legal action against the Securities and Exchange Commission (SEC). The root of the lawsuit is the contentious debate over whether Ethereum, the world's second-largest cryptocurrency, should be classified as a security. This legal battle highlights a significant shift in how digital assets might be regulated, potentially impacting millions of investors.

For a while, the SEC, led by Chairman Gary Gensler, has hinted at its belief that Ethereum operates outside of current federal regulations for securities. This viewpoint came into sharper focus when documents from Consensys revealed that the agency has considered Ethereum a security since at least last year. The case was initiated after Consensys responded to a Wells notice from the SEC, which suggested imminent legal action for not complying with securities laws.

The cryptocurrency community is closely watching this case, as it challenges the previously somewhat harmonious stance between the crypto industry and regulators. In 2018, comments made by then SEC official Bill Hinman indicated that Ethereum, along with Bitcoin, wasn't viewed as a security due to its decentralized nature. This position was a comfort to investors and developers who saw it as a green light for further innovation without the fear of regulatory crackdowns.

Should the SEC's current stance lead to Ethereum being officially classified as a security, it could overturn previous guidance and significantly alter the cryptocurrency landscape. This has raised concerns among stakeholders about the criteria used to evaluate digital assets and the future of decentralized technologies.

The legal challenge by Consensys signifies a critical point in the ongoing dialogue between regulatory bodies and the crypto industry. It underscores the industry's determination to fight for clarity and fairness in regulatory practices that could shape its evolution. With the SEC appearing to tighten its grip on the rapidly growing digital asset Market, all eyes will be on the outcome of this lawsuit and its implications for the future of cryptocurrency regulation.

Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators

[ad_2]

1. What do the new court filings reveal about the SEC's view on Ethereum?

The court filings show that the chair of the SEC, Gensler, thought Ethereum was a security for at least a year.

2. Who is the SEC Chair mentioned in the filings?

The SEC Chair mentioned in the filings is Gensler.

3. For how long did the SEC Chair believe Ethereum was a security?

According to the filings, the SEC Chair believed Ethereum was a security for at least one year.

4. Does believing Ethereum is a security affect its status?

Yes, if the SEC officially classifies Ethereum as a security, it could affect how it's traded and regulated.

5. What could be the impact of these filings on Ethereum and its users?

If Ethereum is officially deemed a security, it might face stricter regulations, affecting its trading, usage, and possibly its value.

Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators

[ad_1]

Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators

Claim Airdrop now

Searching FREE Airdrops 20 seconds

Sorry There is No FREE Airdrops Available now. Please visit Later

function claimAirdrop()

document.getElementById('claim-button').style.display = 'none';

document.getElementById('timer-container').style.display = 'block';

let countdownTimer = 20;

const countdownInterval = setInterval(function()

document.getElementById('countdown').textContent = countdownTimer;

countdownTimer--;

if (countdownTimer < 0)

clearInterval(countdownInterval);

document.getElementById('timer-container').style.display = 'none';

document.getElementById('sorry-button').style.display = 'block';

, 1000);

0 notes