#CompanyLaw

Text

When Does a UK Board of Directors Must Take Special Resolutions?

In corporate governance, the decisions crafted by a board of directors serve as the compass guiding a company’s trajectory. Among these decisions, special resolutions stand out as significant milestones, marking pivotal moments in a company’s evolution. But what specific scenarios prompt a UK board of directors to convene and pass a special resolution?

Understanding the Significance of Special…

View On WordPress

#ArticlesOfAssociation#BoardOfDirectors#businesstips#CompanyLaw#CompanyStatus#CompanyStructure#CorporateDecisions#CorporateGovernance#CorporateTransparency#DirectorialChanges#FinancialDecisions#GovernancePractices#LegalCompliance#LegalFramework#ShareCapital#ShareholderDemocracy#ShareholderRights#SpecialResolution#StakeholderEngagement#UKBusiness#WindingUpProcess

0 notes

Text

Sumana Baliga M

Started from 2003

Animal Laws,Company Law / Business Laws,Civil Laws,Labour Laws,Criminal Laws,Documentation,Insurance

Verified Lawyer

Kannada, English, Hindi

0 notes

Text

Ensuring Compliance: How CS Professionals Can Benefit from Secretarial Audit in India

In the dynamic business environment of India, regulatory compliance is of utmost importance for companies. To ensure adherence to legal and statutory requirements, businesses often turn to secretarial audits. Secretarial audit is a comprehensive examination of a company's compliance with the provisions of various laws and regulations. It helps identify any non-compliance or irregularities, thereby mitigating legal risks. In this article, we will explore the significance of secretarial audits for businesses in India and how Company Secretaries (CS) professionals can play a crucial role in this process.

Importance of Secretarial Audit for Businesses in India

In India, secretarial audit has gained tremendous importance due to the complex regulatory framework governing companies. With the Companies Act, of 2013, and other relevant laws, the compliance burden on businesses has increased significantly. Non-compliance can lead to severe penalties, reputational damage, and even legal actions. Here, a secretarial audit acts as a safeguard, providing an independent assessment of a company's compliance practices.

Secretarial audit covers various aspects, including corporate governance, regulatory compliance, record-keeping, filing of forms and returns, and adherence to board and shareholder resolutions. By conducting a secretarial audit, businesses can identify gaps and rectify any deviations from the legal requirements. This not only ensures compliance but also instills confidence among stakeholders, including investors, lenders, and regulators.

Understanding the Role of CS Professionals in Secretarial Audit

CS professionals, with their in-depth knowledge of corporate laws and regulations, play a pivotal role in conducting secretarial audits. As per the Companies Act, 2013, every company that falls under the prescribed criteria is required to appoint a CS professional secretarial audit. The CS professional brings expertise in company law, corporate governance, and compliance management to the audit process.

CS professionals are responsible for conducting a comprehensive review of the company's compliance practices, systems, and processes. They assess the adequacy and effectiveness of internal controls, review board and shareholder resolutions, examine minutes of meetings, scrutinize statutory registers and records, and verify compliance with filing requirements. Their expertise ensures that the secretarial audit is conducted with precision and integrity, providing an unbiased evaluation of the company's compliance status.

Key Requirements and Regulations for Secretarial Audit in India

To ensure the effectiveness and integrity of secretarial audits, certain key requirements and regulations are in place in India. The Companies Act, of 2013, and the rules framed thereunder lay down the framework for secretarial audit. According to the Act, certain classes of companies are required to obtain a secretarial audit report from a CS professional. These include public companies, listed companies, and companies with a paid-up share capital of a specified amount.

The secretarial audit report must be prepared in the prescribed format and submitted to the regulatory authorities within the specified timelines. The report provides an assessment of the company's compliance with applicable laws, rules, and regulations. It also highlights any non-compliance or deviations and suggests remedial actions. CS professionals must adhere to these requirements and regulations to ensure the accuracy and reliability of the secretarial audit report.

Benefits of Secretarial Audit for Private Companies

While secretarial audit is mandatory for certain classes of companies, private companies can also benefit significantly from conducting a voluntary secretarial audit. Private companies, even though not obligated by law, can proactively opt for a secretarial audit to ensure robust compliance practices. Some of the key benefits of secretarial audit for private companies are as follows:

Risk Mitigation: Conducting a secretarial audit helps identify any non-compliance or irregularities, enabling timely corrective actions. This reduces the risk of penalties, legal actions, and reputational damage.

Enhanced Corporate Governance: Secretarial audit evaluates a company's adherence to corporate governance norms. It helps in identifying gaps in the governance framework and implementing best practices, ultimately enhancing transparency and accountability.

Improved Investor Confidence: A secretarial audit report assures investors and lenders about the company's compliance practices. This builds trust and confidence, attracting potential investors and lenders.

Avoidance of Legal Complications: By ensuring compliance with laws and regulations, secretarial audit helps companies avoid legal complications and reputational harm. It acts as a preventive measure against future legal disputes.

Opportunity for Continuous Improvement: Secretarial audit provides valuable insights into a company's compliance practices. It enables companies to identify areas for improvement, streamline processes, and enhance overall operational efficiency.

How CS Professionals Can Assist in Conducting a Secretarial Audit

CS professionals, with their expertise in company law and compliance management, are the key facilitators of secretarial audits. They bring a unique set of skills and knowledge to ensure a thorough and accurate assessment of a company's compliance practices. Here are some ways in which CS professionals can assist in conducting a secretarial audit:

Planning and Scoping: CS professionals help in developing a comprehensive audit plan, considering the specific requirements of the company and applicable laws. They identify the scope of the audit, determine the key areas to be assessed, and establish a timeline for the audit process.

Data Collection and Review: CS professionals collect and review relevant documents, including board and shareholder resolutions, statutory registers, minutes of meetings, and compliance records. They analyze the data to identify any gaps or deviations from legal requirements.

Compliance Assessment: CS professionals assess the company's compliance with applicable laws, rules, and regulations. They verify the accuracy and completeness of filings, adherence to timelines, and maintenance of necessary records. Any non-compliance or irregularities are appropriately documented.

Reporting and Recommendations: Based on the findings of the secretarial audit, CS professionals prepare a comprehensive report. The report highlights areas of non-compliance, suggests remedial actions, and provides recommendations for strengthening compliance practices. CS professionals also assist in implementing the recommended actions.

Post-Audit Compliance Support: CS professionals provide ongoing support to the company in addressing the identified gaps and improving compliance practices. They help in developing robust systems and processes, conducting training programs, and monitoring compliance on an ongoing basis.

Steps Involved in the Secretarial Audit Process

The secretarial audit process comprises several steps that ensure a comprehensive assessment of a company's compliance practices. CS professionals follow these steps to conduct an effective secretarial audit. The key steps involved in the secretarial audit process are as follows:

Planning and Scoping: CS professionals collaborate with the company's management to define the scope of the audit, identify the key areas to be assessed, and establish a timeline for the audit process. They develop an audit plan that aligns with the company's specific requirements and applicable laws.

Data Collection and Review: CS professionals collect and review relevant documents, including board and shareholder resolutions, statutory registers, minutes of meetings, and compliance records. They analyze the data to identify any non-compliance or irregularities.

Compliance Assessment: CS professionals assess the company's compliance with applicable laws, rules, and regulations. They verify the accuracy and completeness of filings, adherence to timelines, and maintenance of necessary records. Any gaps or deviations are appropriately documented.

Reporting and Recommendations: Based on the findings of the secretarial audit, CS professionals prepare a comprehensive report. The report highlights areas of non-compliance, suggests remedial actions, and provides recommendations for strengthening compliance practices. The report is submitted to the company's management and regulatory authorities, as required.

Implementation and Follow-up: CS professionals assist the company in implementing the recommended actions and addressing the identified gaps. They provide ongoing support in developing robust systems and processes, conducting training programs, and monitoring compliance on an ongoing basis. Regular follow-up audits may be conducted to ensure the effectiveness of the implemented measures.

Challenges and Common Issues Faced During Secretarial Audits

While the secretarial audit is a crucial tool for ensuring compliance, several challenges and common issues are faced during the audit process. CS professionals need to be aware of these challenges and address them effectively. Some of the common challenges and issues faced during secretarial audits are as follows:

Lack of Awareness: Companies may lack awareness of the specific compliance requirements, leading to unintentional non-compliance. CS professionals need to educate companies about their obligations and the consequences of non-compliance.

Inadequate Record-Keeping: Poor record-keeping practices can hinder the secretarial audit process. CS professionals must ensure that necessary registers, books, and records are maintained accurately and updated regularly.

Complex Regulatory Framework: The regulatory framework in India is complex and subject to frequent changes. CS professionals need to stay updated with the latest legal and regulatory developments to conduct effective secretarial audits.

Resistance to Change: Companies may resist implementing recommended actions due to various reasons, such as cost implications or organizational resistance. CS professionals must effectively communicate the benefits of compliance and address any concerns.

Limited Resources: Companies with limited resources may face challenges in dedicating sufficient time and personnel for the secretarial audit process. CS professionals can guide resource optimization and help in prioritizing compliance activities.

Secretarial Audit Training and Certification for CS Professionals

To excel in the field of secretarial audit, CS professionals can undergo specialized training and obtain relevant certifications. Training programs and certifications equip CS professionals with the necessary knowledge and skills to conduct effective secretarial audits. These programs cover various aspects, including company law, corporate governance, compliance management, and auditing techniques.

Certifications such as the Certified Secretarial Auditor (CSA) provide recognition of expertise in secretarial audit. They demonstrate the professional's commitment to continuous learning and staying updated with the latest legal and regulatory developments. CS professionals can enhance their career prospects and credibility by pursuing these certifications.

Conclusion and the Future of Secretarial Audit in India

In conclusion, secretarial audit plays a crucial role in ensuring compliance for businesses in India. It helps identify any non-compliance or irregularities, mitigating legal risks and enhancing corporate governance. CS professionals, with their expertise in company law and compliance management, are instrumental in conducting secretarial audits. By following a systematic audit process, they provide an unbiased evaluation of a company's compliance status and assist in implementing remedial actions.

The future of secretarial audit in India looks promising, given the increasing regulatory scrutiny and the growing emphasis on corporate transparency. With the evolving legal and regulatory landscape, the role of CS professionals in secretarial audits will continue to evolve. They will need to stay updated with the latest developments, enhance their skills, and embrace technology-driven solutions to conduct more efficient and effective audits. Secretarial audit, combined with the expertise of CS professionals, will remain a cornerstone of corporate compliance in India.

#AUDIT#AUDITADVISORY#AUDITEXPERTISE#secretarial audit#Secretarial audit in India#AUDITBESTPRACTICES#AUDITFRAMEWORK#AUDITINNOVATION#AUDITINSIGHTS#AUDITTRENDS#AUDITUPDATES#COMPANYLAW#COMPANY

0 notes

Text

Memorandum of Association (MoA): Concept And Laws

This article on 'Memorandum of Association (Moa): Concept And Laws' was written by Ashok Kumar Chaudhary, an intern at Legal Upanishad.

INTRODUCTION

A company is born when individuals unite with a common purpose to achieve commercial success. To establish a company, an application must be filed with the Registrar of Companies (ROC), accompanied by essential documents. One crucial document is the Memorandum of Association (MoA), which captures the company's essence. The MoA is a meticulously crafted manuscript that outlines the business's ambitions, serving as a beacon of uniqueness. It sets the stage for innovation, growth, and a resolute journey towards prosperity.

MEMORANDUM OF ASSOCIATION (MOA): MEANING AND CONCEPT

The Memorandum of Association (MoA) is defined under the Companies Act, which may vary depending on the jurisdiction. In India, the definition of MoA can be found in Section 2(56) of the Companies Act, 2013. This section defines the MoA as a legal document that sets out the company's constitution, objectives, and scope of activities. It serves as a foundational document for the company's incorporation and operation. It is important to note that the specific section numbers and acts may differ in other jurisdictions, and it is advisable to refer to the Companies Act applicable to the respective jurisdiction for accurate details.

The Memorandum of Association (MoA) emerges as the guiding compass that navigates a company's voyage through the vast business ocean. Within its sacred contents lies the profound purpose that breathes life into the company's existence. This distinguished document not only delineates the powers bestowed upon the company but also unfurls the tapestry of rules and regulations governing its interactions with the world beyond. Imbued with mandatory significance, the MoA stands as an unyielding sentinel, defining the boundaries within which the company must thrive. Should the company venture beyond these boundaries, it treads upon the treacherous ground, with actions deemed ultra vires and rendered void. The MoA thus assumes a sacred mantle, preserving the sanctity of the company's operations.

- At its core, the MoA becomes the bedrock upon which the company erects its majestic structure. Every beam, foundation, and intricate detail finds expression within its hallowed pages. It is a testament to the ingenuity and foresight of the company's creators, encapsulating the very essence of its being. This solemn document transcends the confines of secrecy, transforming into a public artefact that opens the gateway for potential collaborations and partnerships. To gain insight into the company's inner workings, one need only seek the MoA, obtained by paying the requisite fees to the Registrar of Companies. Through its enlightening contents, a world of knowledge unfolds, allowing all who engage with the company to understand its principles and directives.

- It becomes the solemn duty of any individual seeking to transact with the company to delve into its MoA, for therein lies the foundation of trust and comprehension. Armed with the MoA's wisdom, one can navigate the currents of business, assured of their understanding of the company's mission, values, and operational boundaries. It is the key that unlocks the gateways to collaboration, signalling a profound commitment to transparency and mutual understanding.

OBJECT OF REGISTERING A MEMORANDUM OF ASSOCIATION OR MOA

The primary objective of registering a Memorandum of Association (MoA) is to legally establish a company and define its fundamental characteristics, objectives, and scope of operations. The MOA serves several purposes:

- Legally binding document: By registering the MoA with the relevant authorities, the company gains legal recognition as a separate legal entity.

- Defines company's purpose: The MoA outlines the specific purpose for which the company is formed, whether it is for profit, non-profit, or any other designated objective.

- Scope of operations: The MoA defines the scope and nature of the company's activities, outlining the industries or sectors within which it can operate.

- Powers and limitations: The MoA outline the powers and limitations of the company, including the authority of its directors, shareholders, and officers. It sets the boundaries within which the company can operate.

- Protection for stakeholders: The MoA provides a level of protection for stakeholders, including shareholders, by ensuring that the company operates within the defined parameters and does not exceed its authorized activities.

- Contracts and legal obligations: The MoA serve as a reference point for external parties entering into contracts or transactions with the company. It provides crucial information about the company's structure, objectives, and authorized operations.

- Public disclosure: As a registered document, the MoA becomes a public record, accessible to anyone interested in understanding the company's purpose and operations.

Memorandum Of Association (Moa): Concept And Laws

FORMAT OF MEMORANDUM OF ASSOCIATION

The format of a Memorandum of Association (MoA) may vary depending on the jurisdiction and the specific requirements of the Companies Act. However, a typical MoA generally includes the following components:

- Name Clause: States the name of the company, which should be unique and compliant with the naming guidelines set by the Companies Act.

- Registered Office Clause: Specifies the registered office address of the company, where official communications and legal documents can be sent.

- Object Clause: Describes the main objectives and activities that the company intends to pursue. It defines the scope and nature of the company's business operations.

- Liability Clause: Indicates the liability of the company's members, whether it is limited by shares or by guarantee.

- Capital Clause: Specifies the authorized share capital of the company, i.e., the maximum value of shares that the company can issue.

- Association Clause: Declares the intention of the subscribers (founders) to form a company and their willingness to be associated with it.

- Subscription Clause: Contains the details of the subscribers, including their names, addresses, and the number of shares subscribed by each.

- Witness Clause: Provides space for witnesses to sign and attest to the subscribers' signatures.

CONCLUSION

The Memorandum of Association (MoA) is a cornerstone in the formation and operation of a company, providing a guiding document that outlines its purpose, objectives, and legal framework. This document ensures clarity and transparency, fostering effective communication both within the company's stakeholders and with external parties. By meticulously crafting and adhering to the MoA, companies can establish a robust foundation that aligns their activities with their intended goals.

It precisely defines the company's scope of operations, sets boundaries, and guarantees compliance with legal requirements, thus safeguarding the interests of shareholders and stakeholders. As companies evolve and progress, the MoA can be amended or altered by prescribed legal procedures and regulatory obligations. This flexibility allows companies to adapt to changing circumstances while upholding the integrity of their operations.

The MoA's significance extends beyond internal affairs, serving as a public record that enables external parties to comprehend the company's purpose, structure, and authorized activities. This transparency not only nurtures trust but also facilitates collaborations and fosters accountability. In essence, the Memorandum of Association serves as a testament to a company's vision, mission, and values. It establishes the framework within which the company operates, reflecting its unwavering commitment to legal compliance, transparency, and responsible business practices. As companies embark on their journey, the MoA acts as a guiding light, providing direction, stability, and assurance that their operations are rooted in a solid legal and ethical foundation.

REFERENCES

- All-About the Memorandum of Association, Taxmann, 25 March 2023, available at: https://www.taxmann.com/post/blog/memorandum-of-association/

- Memorandum of Association – MoA Format, Clear Tax, 15 February 2023, available at: https://cleartax.in/s/memorandum-of-association-moa

- Understanding Memorandum of Association: Meaning, Content, and Forms, Aditya Birla Capital, 29 March 2023, available at: https://www.adityabirlacapital.com/abc-of-money/memorandum-of-association-moa

Read the full article

0 notes

Text

General Circular No. 01/2023-Release Plan of 45 company e-Forms in MCA 21 Version 3.0-reg.

General Circular No. 01/2023 MCA

I am directed to inform all the stakeholders that this Ministry is in the process of introducing certain company e-Forms in MCA21 Version 3.0 (as per Annexure) and thus these e-Forms will not be available in MCA21 Version-2 from 07.01.2023 to 22.01.2023.

Therefore, keeping in view the fact above, it has been decided by the Competent Authority to allow additional time of 15 days, without levying additional fees, to the stakeholders, in cases where the due dates for filing of these 45 e-Forms fall during the period between 07.01.2023 and 22.01.2023.

MCA General Circular No. 01/2023 Attachment

Click Here for "All MCA Circulars"

Read the full article

0 notes

Text

Make your Career in Accountancy

#bba#bachelorincommerce#financialaccounting#stockbroker#ecommerce#companylaw#macroeconomics#salestrader#accountant#commoditybroker#costaccounting#businessfinance#financialadvisor#masterincommerce#bachelorinbusinessadministration

0 notes

Photo

Graduated part 2. Next to the bar and bench master, I got this year my second degree for the master company law. 🥳 #companylaw #erasmusstudent #makeithappen #rotterdam #erasmusuniversity @erasmuslawschool @erasmusuniversity #futurelawyer https://www.instagram.com/p/Cj0rSGBozJ2/?igshid=NGJjMDIxMWI=

0 notes

Text

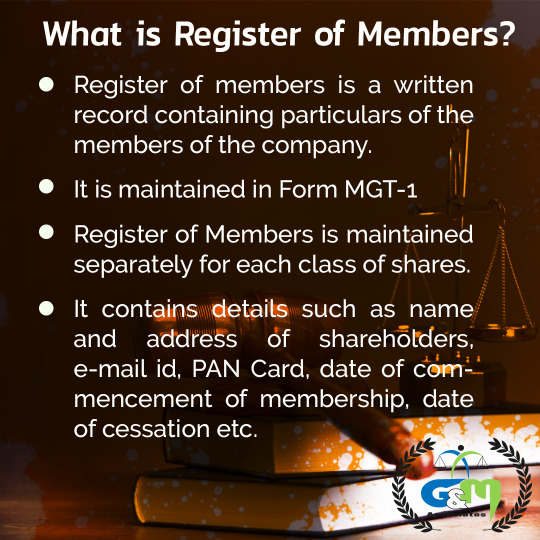

#register#members#form#mgt1#record#details#pancard#cessation#registernow#company#companyact#indianlaw#law#lawlife#lawyers#lawstudents#associates#companylaw#lawfirm#firm#cafirm#ca#gandmassociates

1 note

·

View note

Photo

How Employment Law Can Benefit Employers? Take a look at the top 8 reasons how employment law benefits employers.

For further reading, refer to this article by Adv. Sonia Rajesh

Follow us On Social Media:

Facebook: https://www.facebook.com/SOciallyOptimizedLEGAL/

Linkedin: https://www.linkedin.com/company/soolegal-advisor

Twitter: https://twitter.com/Soo_Legal

Instagram: https://www.instagram.com/soo_legal/

Pinterest: https://in.pinterest.com/soolegal/

#EmploymentLaw#EmployerLaw#Employer#Employee#EmployeeLaw#BusniessLaw#Employment#LabourLaw#SoOlegal#HRLaw#EmployerBenefits#CompanyLaw#EmployeeBenefits#Law#LegalHelp

0 notes

Text

PAID UP CAPITAL 2(64) COMPANIES ACT 2013

0 notes

Text

Contract Disputes: These arise from conflicts over terms, performance, or breaches of contracts within corporations. Issues include non-payment, delivery failures, or disagreements over contract interpretation.

Corporate Frauds: Involves deceptive practices for financial gain, like accounting fraud, insider trading, embezzlement, or bribery. Regulatory authorities often intervene, leading to legal actions.

Employment Disputes: Cover wrongful termination, discrimination, harassment, wage disputes, or breaches of employment contracts. Conflicts arise from workplace policies, benefits, or unfair treatment.

Tort Claims: Relate to civil wrongs causing harm or injury within corporations. Examples include negligence in providing a safe work environment, product liability, defamation, or intentional infliction of emotional distress. Legal action seeks compensation or defense against such claims.

#companylaw #corporatelawyer

(Corporate Lawyer) (Company Law) patparganj industrial area

#advocate#lawyer#law and legal system#consumer law#property lawyers#advocates#delhi#insurance lawyer#shahdara#corporate lawyer#law firm#legal services#criminal defense lawyer

0 notes

Text

🚀 Unlock Your Legal Potential! 📚 Ambition Law Institute is thrilled to announce 10 HOURS of FREE Company Law Classes! 🏛️ Whether you're a dedicated student or a seasoned advocate, this is your chance to elevate your understanding. 🌐 Dive deep into the intricacies of Company Law and sharpen your legal prowess. Spread the word to friends and colleagues - knowledge knows no bounds! 🗣️ Join us on this educational journey and empower your legal ambitions. For details, contact 8800662140 or visit www.ambitionlawinstitute.com. 📲 Don't miss out on this golden opportunity! #LegalEducation #CompanyLaw #FreeClasses #AmbitionLawInstitute #EmpowerYourAmbition

#lawnews#lawexam#student life#study motivation#judicial system#judicial ethics#judiciary#judicial review#cuet 2024#cuet exam#clat 2024#clat preparation#clatexam

0 notes

Text

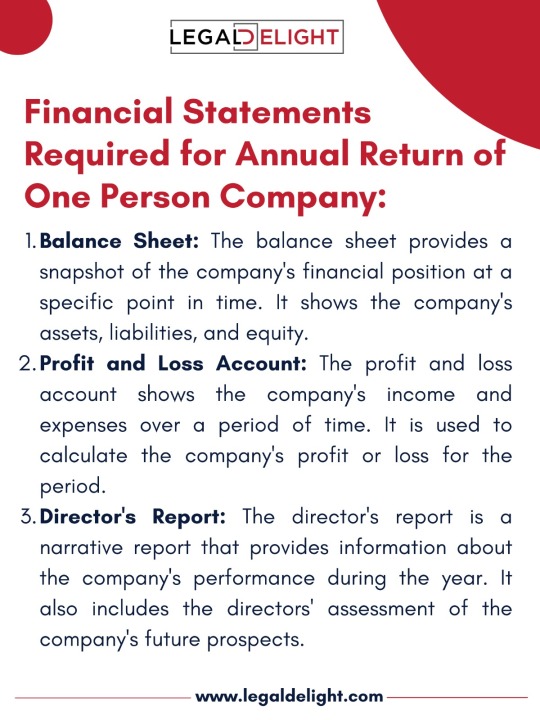

Legal Delight can help you prepare your financial statements for the annual return of your OPC quickly and easily. Our team will ensure that your financial statements are accurate, complete, and compliant with all applicable laws and regulations. To know more click link below:

https://legaldelight.com/CorporateCompliance/OPCAnnualFiling

#OPCs #AnnualReturn #FinancialStatements #Accounting #ROC #CompanyLaw #LegalDelight #OPCCompliance #BusinessCompliance

0 notes

Text

Class Action Suit under the Companies Act, 2013: Explained!

This article on 'Class Action Suit under the Companies Act: All you need to know' was written by an intern at Legal Upanishad.

Introduction

Class action suits are commonly used in cases of consumer fraud, product liability, and securities fraud, where a large number of people have been affected by the same wrongful conduct. This mechanism allows for a more efficient and cost-effective way for individuals to seek legal redressal, as opposed to filing individual lawsuits.

In India, the Companies Act, 2013 provides for class action suits in case of fraud, mismanagement, or oppression by the company's management. Members of a company, Investors, or any other person can file an application before the National Company Law Tribunal seeking relief through a class action suit. This article tries to analyse the concept of Class action suits along with the laws governing it in India. The author also sheds light on the landmark cases related to class action suits in India.

Class Action suits: Meaning and Purpose

A class action suit, also known as a class action lawsuit, is a legal mechanism that enables a group of people who have suffered similar losses or injuries caused by a common defendant to collectively sue the defendant in a single lawsuit. In a class action suit, one or more individuals, called class representatives, represent the interests of the entire class of individuals who have suffered similar harm.

The primary purpose of class action suits under the Companies Act is to provide a mechanism for shareholders to seek redress for any breach of their rights or loss suffered as a result of the actions of a company. In many cases, the damages suffered by individual shareholders may be too small to justify the cost of filing a separate lawsuit. By pooling their claims together, shareholders can increase the size of the claim and reduce the cost of litigation.

In addition to providing a cost-effective means of seeking redress, class action suits under the Companies Act also serve to promote corporate accountability. By holding companies accountable for any harm caused to shareholders, the threat of litigation can act as a deterrent against misconduct and encourage companies to act in the best interests of their shareholders.

Legal Framework for Class Action Suits under the Companies Act

Section 245 of the Companies Act, 2013 provides the legal framework for class action suits in India. The provision enables members of a company, Investors or any other persons, to file an application before the National Company Law Tribunal (NCLT) for relief against any oppression or mismanagement in the company. The section also allows any class of members or Investors to file such an application if the members or Investors who constitute that class have an aggregate value of not less than a specified percentage of the share capital, debt or deposits of the company.

The Companies Act further empowers the NCLT to make orders to rectify any acts of oppression or mismanagement in the company. The orders may include directing the company to refrain from doing any act that the tribunal deems oppressive or prejudicial to the interests of the members or directing the company to compensate the aggrieved party or parties. The NCLT may also pass orders for the winding up of the company if it is of the opinion that it is just and equitable to do so.

Procedures for Initiating a Class Action Suit under the Companies Act

The procedures for initiating a class action suit under the Companies Act are set out in Section 245 of the Act. In order to initiate a class action suit, one or more shareholders must satisfy the following conditions:

- The shareholders must hold at least 2% of the total voting power of the company or have a total value of shares of at least Rs. 1 crore;

- The shareholders must have a common grievance or claim against the company, which arises from the same or similar transactions;

- The class action suit must be in the interest of the company as a whole, and not just the interests of the shareholders initiating the suit.

Once these conditions are met, the shareholders may file an application with the National Company Law Tribunal (NCLT) seeking permission to initiate a class action suit. The application must include details of the nature of the claim, the relief sought, and the names and addresses of all the members of the class.

If the NCLT is satisfied that the conditions for initiating a class action suit have been met, it may grant permission for the suit to proceed. The NCLT may also appoint a lead plaintiff to represent the interests of the class and may require the plaintiffs to give security for the costs of the suit

Process for Filing Class Action Suits

The process for filing class action suits under the Companies Act begins with the filing of an application before the NCLT. The application must be made by any member of the company, Investor, or any other person who has an interest in the company. The application must specify the grounds for the relief sought and must be supported by such evidence as the tribunal may require.

If the NCLT is satisfied that the application discloses a prima facie case, it will issue notice to the company and any other person it deems necessary. The company must then file a reply to the application within the time prescribed by the tribunal. The NCLT may also direct the company to circulate the notice to its members, Investors or any other class of persons as it deems fit.

Benefits of Class Action Suits to Shareholders and Investors

- Class Action Suits allow shareholders and investors who have suffered similar harm to join forces and bring a lawsuit together. This collective strength allows them to pool their resources and increase their chances of success.

- It can be more cost-effective than individual lawsuits. The costs of litigation can be shared among the members of the group, making it more affordable for individual investors to pursue legal action.

- It can be a more efficient use of resources as they avoid the need for multiple lawsuits, which can lead to duplicative efforts and waste of resources.

- It serves as a deterrent for companies that may be tempted to engage in wrongful conduct, knowing that they may face legal action from a large group of shareholders or investors.

- It promotes transparency and accountability in the corporate sector by providing a mechanism for minority shareholders to hold companies and their management accountable for any acts of fraud, mismanagement or oppression.

- It can provide relief to shareholders and investors who have suffered harm due to the actions or omissions of a company or its management. The damages awarded in such cases can compensate shareholders for their losses and help restore their confidence in the company and the market.

Outlook of Courts

- National Consumer Disputes Redressal Commission vs. Laxmi Engineering Industries (2015): This Supreme Court judgment recognized the concept of "Public Interest Litigation" (PIL) in class action suits and emphasized the importance of protecting the rights and interests of consumers, especially those from marginalized or disadvantaged communities.

- Association of Victims of Uphaar Tragedy vs. Union of India (2011): This judgment by the Supreme Court of India allowed the victims of the Uphaar Cinema tragedy to file a class action suit against the owners of the cinema for the deaths and injuries caused by a fire in the cinema hall.

- Securities and Exchange Board of India vs. Sahara India Real Estate Corporation (2012): In this case, the Supreme Court allowed a class action suit to be filed against Sahara India Real Estate Corporation for illegal fundraising and the non-payment of dues to investors.

- National Stock Exchange vs. SEBI (2019): In this case, the Securities Appellate Tribunal allowed a class action suit to be filed against the National Stock Exchange for allegedly unfair trading practices and manipulation of currency derivatives.

Conclusion

Class action suits under the Companies Act play an important role in promoting corporate accountability and providing a mechanism for shareholders to seek redress for any harm caused to them by a company's actions. By allowing shareholders to pool their claims together, class action suits provide a cost-effective means of seeking justice, particularly in cases where the damages suffered by individual shareholders are too small to justify the cost of filing a separate lawsuit.

However, there are several limitations to class action suits under the Companies Act that must be taken into account. Eligibility criteria may limit the number of individuals who can participate in the suit, and the relief that can be obtained is limited to damages or compensation. The success of a class action suit also depends on the strength of the underlying claim and the procedures for initiating a suit can be complex and costly.

Despite these limitations, class action suits remain an important tool for promoting corporate accountability and protecting the rights of shareholders. By holding companies accountable for any harm caused to shareholders, class action suits can act as a deterrent against misconduct and encourage companies to act in the best interests of their shareholders.

In order to ensure that class action suits are used effectively, it is important for shareholders to be aware of their rights and to work together to initiate suits where necessary. Companies also have a responsibility to act in a transparent and accountable manner, and to take steps to prevent any harm being caused to their shareholders.

List of References:

- Prachi Narayan and Shambo Dey, Class Action under Companies Act 2013- A Quagmire in Disguise?, Vinod Kothari, 15 January 2014, available at: https://vinodkothari.com/wp-content/uploads/2017/03/Class_Action_Companies_Act_2013.pdf

- CS Madhur Gandhi, Class Action Suit – Explained, tax Guru, 2 February 2023, available at: https://taxguru.in/company-law/class-action-suit-explained.html#:~:text=TheCompaniesAct2013of,filingtheirownindividuallawsuit.

- PK Mittal, CLASS ACTION, The Institute of Company Secretaries of India, available at: https://www.icsi.edu/media/portals/70/316102013.pdf

Read the full article

0 notes

Text

MCA General Circular No. 19/2013

MCA General Circular No. 19/2013:-Clarification with regard to the applicability of section 182(3) of the Companies Act, 2013

Ministry has received representations seeking clarification on disclosures to be made under section 182 of the Companies Act, 2013. The same have been examined. with the coming into force of the scheme relating to 'Electoral Trust companies' in terms of section (24AA) of the Income Tax Act, 1961 read with Ministry of Finance Notification No. s.o.309(E) dated 31st January 2013 it will be expedient to explain the requirements of disclosure on part of a company of any amount or amounts contributed by it to any political parties under section 182(3) of the Companies Act, 2013.

It is hereby clarified as under;

(i) Companies contributing any amount or amounts to an 'Electoral Trust Company' for contributing to a political party or parties are not required to make disclosures required under section 182(3) of Companies Act 2013. It will suffice if the Accounts of the company disclose the amount released to an Electoral Trust Company.

(ii) Companies contributing any amount or amounts directly to a political party or parties will be required to make the disclosures laid down in section 192(3) of the Companies Act, 2013.

(iii) Electoral Trust Companies will be required to disclose all amounts received by them from other companies/sources in their Books of Accounts and also disclose the amount or amounts contributed by them to a political party or parties as required by section 182(3) of Companies Act, 2013.

MCA General Circular No. 19/2013-Attachment

Click here for "All MCA Circulars"

Read the full article

0 notes

Text

How To Develop Employees Handbook?

An employee handbook is a billable resource for the employer and employee. Where not provides guidance and information related organisation's history, mission, value, policies, procedures and benefits in a written format. It helps to protect the employees against discriminate n or unfair treatment claims. It is an easily accessible guide and gets companies' policies and practices with the overview of expectations management. Employers require every employee to provide and written acknowledgement that you can revive the handbook and save the employee's personnel file in an organized way.

#business #mangement #legal #law #companylaw #employeebenefits

0 notes