#Cash flow experts in Australia

Text

Cash Flow Vs Profit: The Difference

There's a familiar adage in bookkeeping that goes: "benefits are an assessment, cash is a reality." What this implies is that while being beneficial is significant in the long haul, having sufficient money to work every day — that is, having a positive income — is a prompter, squeezing concern.

As an entrepreneur, it's vital to figure out the contrast between income and benefit, and how both elements into business achievement. In spite of the fact that it's unreasonable, a productive business could be constrained due to unfortunate income. Likewise, a business could be income positive, yet be losing cash. To avoid such scenario, consult VNC – one of the most distinguished Cash flow specialists in Australia.

So what's the distinction between income and benefit? All the more critically, how might you ensure that you're both productive AND have positive income?

What is Cash Flow?

Basically, income alludes to the progression of cash into and out of a business during a set timeframe. Income bookkeeping records exchanges exactly when cash enters or leaves your financial balance, as opposed to when a receipt is sent or gotten.

Dissimilar to a Profit and Loss explanation, income incorporates cash development that isn't rigorously benefit, similar to capital infusions from proprietors or financial backers, or cash from the offer of a resource. Essentially, it does exclude credit from providers, cash owed from clients, or cash you as of now have in the bank.

Positive income implies that you have more money approaching than active at some random moment, and you're meeting all your monetary commitments as they emerge. It's a measurement frequently used to gauge the strength of a business, and can show banks, investors, and financial backers how well an organization is doing every day. Streamline your business cash flow with one of the excellent Cash flow experts in New Zealand, VNC.

What is Profit?

Profit, otherwise called Income, is how much amount remaining when you deduct costs from the revenue. There are two primary kinds of profit:

Profit = Total Revenue – Total Expenses

Not at all like with income, a month to month or quarterly Profit and Loss explanation considers what you owe, and what you are owed for the period. Along these lines, it's a decent pointer whether your business is getting more cash than it spends generally speaking — yet won't let you know whether you presently have sufficient cash in the bank to take care of the bills.

The Difference Between Cash Flow and Profit

Set forth plainly, a Profit and Loss explanation shows whether your business is procuring more than its spending, while a Cash Flow proclamation shows when you'll have cash close by. Benefit is about the master plan, while income centers around everyday reasonability.

For a business to find lasting success, it needs a decent net revenue and positive income.

Great Profit, Poor Cash Flow

Selina possesses a little, local area centered pastry kitchen that serves great cakes to a nearby group.

A companion of hers posts an image of her smash hit chocolate croissants to Instagram, and interest in her bread shop gets. In a little more than a month, interest for croissants duplicates, and Selina winds up routinely running unavailable.

To stay aware of interest, she puts resources into new gear, and duplicates her ordinary request of provisions.

Tragically, albeit the new income would more than cover the costs in a couple of months' time, Selina is in the red when it comes time to pay her providers. She is compelled to take out an exorbitant loan to meet her obligations, driving her further into the red.

Regardless of sound overall revenue, unfortunate income stops Selina's development plans from really developing. Never let your business stop from developing, consult VaderanCo – one of the top Cash flow experts in Australia.

Great Cash Flow, Poor Profit

Parita possesses a development organization, zeroing in on building high-thickness, reasonable lodging. She's constantly highly esteemed paying her laborers, providers, and bills on time.

Parita works carefully, keeping away from credits at every possible opportunity, timing approaches and outgoings so she can constantly meet her commitments. In spite of her emphasis on reasonableness, the business has consistently turned a clean benefit.

What she doesn't expect anyway are the increasing expenses related with production network interruption. The pandemic creates setbacks and increments costs across the business, and Parita's business is the same. Since contracts were at that point set up with purchasers for her assembles, the expenses eat into her all around thin overall revenues.

Parita's business remains income positive all through the monetary year, yet the absence of benefit implies her plan of action is at this point not viable.

The Right Balance

Johnny is a performer, with a genuinely enormous global following. In line with his fans, he's arranging his very first abroad visit.

He and his supervisory crew rapidly resolve that a visit is possible, yet Johnny needs more money in the bank to pay forthright costs like setting recruit, sound and lighting professionals, ticket administrations and so on.

They set up a financial plan for the excursion, and make a gauge investigating the number of tickets that they'd need to offer to repay a bank credit. They likewise take a gander at a most dire outcome imaginable, in which they sell 20% less tickets than they expect. They find what is going on, they can in any case take care of their expenses and create a gain in the event that they track down less expensive convenience, and take public vehicle between urban communities.

Equipped with this data, Johnny can unhesitatingly apply for a bank credit. The visit goes off effortlessly, and Johnny winds up selling out a large portion of his shows. The bank credit is reimbursed on time, and Johnny and his supervisory group leave with a robust benefit.

Step by step instructions to Ensure Good Profit and a Healthy Cash Flow with VNC Edge

Overseeing income and overall revenues implies estimating, observing, and making an arrangement to meet your objectives. The simplest method for doing the above is all to make a monetary figure. This is where VNC Edge can help.

VNC being one of the most trusted Cash flow specialists in New Zealand offers you a three-way gauging programming to project your future income, spending plan, and benefit and misfortune, so you can remain ready for whatever lies ahead. You can likewise make a scope of situations and assembled a strategy for various possibilities.

In particular, you can utilize VNC Edge to guarantee ideal overall revenues, and distinguish times of low income so you can repay likewise. It's like having the option to investigate the monetary future — without the problem of a precious stone ball.

#Cash flow specialists in Australia#Cash flow experts in New Zealand#Cash flow experts in Australia#Cash flow specialists in New Zealand

3 notes

·

View notes

Text

Within one week Australia gave us this guy

and now there’s this guy

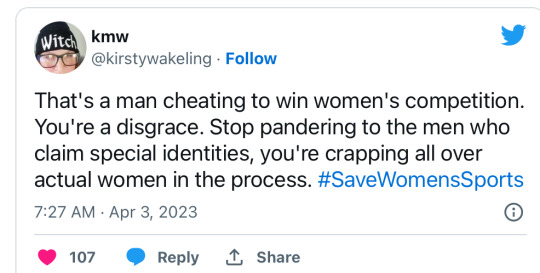

A trans-identified male has taken home the championship at the Australian Women’s Classic golf tour which took place at the Bonvile Golf Resort in New South Wales this weekend.

Breanna Gill, a trans-identified male, made off with a women’s professional golfing trophy and a large cash prize. While WPGA Tour of Australia stated that it was Gill’s first professional win, he has dominated competitions in the past. In 2019, Gill was named the New Zealand Professional Women Golfers Trust Pro-Am champion.

The year prior, in 2018, Gill was named the “first woman” to win an official women’s professional golf tournament held in the South Pacific Islands after taking home the Pro-Am title at the New Caledonia Deva Golf Resort.

On Twitter, WPGA Tour of Australasia posted multiple photos of Gill holding the prize, and even changed their Twitter account header to a picture of Gill, but were met with overwhelming backlash as users piled into their replies to denounce them for allowing a male to participate in the women’s tournament.

Some name-dropped Danni Vasquez, the female golfer who placed second, as the “true winner” of the competition. Vasquez and Gill were in stride throughout the match, and the winner was ultimately decided after they faced each other in a sudden death playoff.

WPGA Tour of Australasia quickly locked down their replies section as negative sentiment flowed in, preventing public comments. The users who had been able to slip in their replies before the setting was changed on the tweet have since all had their comments “hidden” by WPGA Tour of Australasia.

“Why are men allowed in women’s sports? Why has a woman been cheated of her prize,” Haringey ReSistersasked as one of the few users who had been able to leave comments prior to WPGA Tour of Australasia turning their replies off.

“This is not fair. Keep men out of women’s sport,” Speak Up For Women responded.

“This is cheating you are allowing someone with a known male physical advantage to steal females prizes [and] prize money that should be theirs! It’s sex discrimination [and] shameful inequality in sport, a physical activity,” Olympian Sharron Davies added in a quote-retweet.

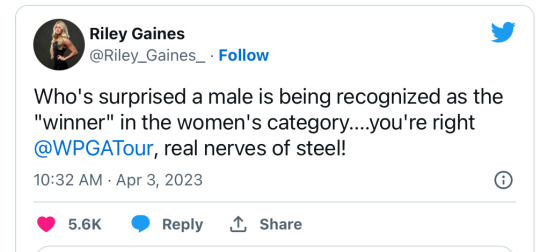

Riley Gaines, a spokeswoman for the Independent Women’s forum and an accomplished All American swimmer, also brought attention to Gill’s trophy-kissing photo, condemning WPGA Tour of Australasia with a cutting remark.

“Who’s surprised a male is being recognized as the ‘winner’ in the women’s category… you’re right @WPGATour, real nerves of steel,” Gaines wrote.

As of the writing of this article, there are over 2,600 overwhelmingly negative quote-retweets compared to just 95 ‘likes’ on WPGA Tour of Australasia’s tweet about Gill.

Women’s athletic competitions have become a major issue in the debate on gender ideology and its impact on women.

The issue mounted in public attention after a trans-identified male swimmer, Lia Thomas, began breaking women’s records and winning medals intended for female athletes in 2021. Since then, there have been several instances of trans-identified male athletes taking the podium in women’s sporting events. But multiple cases of resistance by female athletes and their allies have also been recorded.

Last week, Reduxx reported that a male powerlifting coach in Canada self-identified into a women’s category in order to mock the gender self-identification policies. Avi Silverberg, a powerlifting expert who has worked with Team Canada, participated as a woman at the Heroes Classic Powerlifting Meet held in Lethbridge, Alberta, in order to highlight the unfair advantage males have when competing in women’s athletics.

In February, a young women’s basketball team made international headlines after withdrawing from their state tournament in protest of a trans-identified male being on the opposing team. The Mid Vermont Christian School Eagles (MVCS) forfeited their playoff game against the Long Trail School Mountain Lions (LTS) after learning that LTS star player Rose Johnson is male, and have since been banned from participating in state competitions.

While fairness and opportunity have been cited as primary causes of the backlash against “inclusive” sport policy, others have also noted that women or girls competing against male athletes would be at higher risk for injury.

Last week, thousands of complaints were submitted to Football New South Wales in Australia after a trans-identified male reportedly left multiple female players injured after competing in the female leagues. One female player allegedly had to seek medical attention as a result of her injuries.

After some digging I found that it’s another older man in women’s sports

While Danni is within that range Gill is 32

#Australia#men in Women’s sports#Australian Women’s Classic golf tour#New South Wales#Bonvile Golf Resort#Breanna Gill is a man#Danni Vasquez is the true winner#Speak Up for Women#Haringey ReSisters#32 isn’t old but it is for sports

12 notes

·

View notes

Text

Mastering Bookkeeping for Tradies: Your Path to Financial Success

Running a successful trade business involves more than just delivering high-quality services to your clients. One critical aspect that often gets overlooked is bookkeeping. Proper bookkeeping is the backbone of a financially healthy business, providing insights into your profitability, cash flow, and overall financial health. This guide aims to demystify bookkeeping for tradies, offering a step-by-step approach to managing your financials effectively. Whether you're a seasoned tradies or just starting, this guide will equip you with the knowledge to streamline your bookkeeping processes and ensure your business's success.

Challenges Tradies Face with Bookkeeping

Bookkeeping can be particularly challenging for tradies due to the nature of their work. Here are some common challenges:

Time Constraints: Tradies often work long hours on-site, leaving little time for administrative tasks like bookkeeping.

Lack of Knowledge: Many tradies are experts in their trade but lack formal training in accounting or bookkeeping.

Inconsistent Income: The fluctuating nature of contract work can make it difficult to maintain consistent financial records.

Cash Transactions: Handling cash payments can complicate record-keeping and increase the risk of errors or omissions.

Compliance Requirements: Keeping up with tax laws and compliance requirements can be daunting without proper bookkeeping practices.

Addressing these challenges requires a solid understanding of bookkeeping fundamentals and the implementation of efficient processes.

Step-by-Step Guide to Bookkeeping for Tradies

1. Understand the Basics of Bookkeeping

Before diving into the specifics, it's important to grasp the basic concepts of bookkeeping. This includes understanding:

Income and Expenses: Track all money coming into and going out of your business.

Accounts Receivable and Payable: Monitor what you're owed and what you owe to others.

Bank Reconciliation: Ensure your bank statements match your financial records.

Financial Statements: Familiarize yourself with key financial reports like profit and loss statements and balance sheets.

2. Set Up a Bookkeeping System

Choose a bookkeeping system that suits your needs. This could be a manual ledger, spreadsheets, or bookkeeping software. For most tradies, using bookkeeping software is the most efficient option due to its ease of use and ability to automate many tasks.

Recommended Bookkeeping Software for Tradies:

QuickBooks: Ideal for small to medium-sized businesses, offering robust features for invoicing, expense tracking, and financial reporting.

Xero: A cloud-based option that is user-friendly and integrates with many other business tools.

MYOB: Popular in Australia, providing comprehensive accounting solutions tailored for local compliance.

3. Create a Chart of Accounts

A chart of accounts is a listing of all the accounts your business uses to record transactions. It categorizes your income, expenses, assets, liabilities, and equity. Setting up a detailed chart of accounts helps in organizing your financial data and simplifies the process of generating reports.

4. Record Transactions Regularly

To maintain accurate financial records, it's crucial to record transactions regularly. This includes:

Invoicing Clients: Generate and send invoices promptly. Follow up on overdue invoices to ensure timely payments.

Tracking Expenses: Record all business expenses, including materials, tools, and operational costs. Keep receipts and categorize expenses for tax purposes.

Managing Cash Flow: Monitor your cash flow to ensure you have enough funds to cover your expenses. Consider using a cash flow statement to track this.

5. Reconcile Your Bank Statements

Bank reconciliation involves matching your bank statements with your bookkeeping records to identify any discrepancies. This process helps in detecting errors, preventing fraud, and ensuring that your financial records are accurate.

6. Maintain Accurate Records for Tax Purposes

Tax compliance is a critical aspect of bookkeeping. Keep accurate records of all income and expenses, and stay informed about the tax laws applicable to your business. Consider consulting with a tax professional to ensure you're maximizing deductions and staying compliant.

7. Generate Financial Reports

Regularly generate financial reports to gain insights into your business's performance. Key reports to focus on include:

Profit and Loss Statement: Shows your revenue, expenses, and profits over a specific period.

Balance Sheet: Provides a snapshot of your business’s financial position, including assets, liabilities, and equity.

Cash Flow Statement: Tracks the flow of cash in and out of your business.

8. Use Bookkeeping to Make Informed Decisions

Leverage your bookkeeping data to make informed business decisions. Analyze your financial reports to identify trends, assess profitability, and plan for future growth. Effective bookkeeping enables you to:

Budget Effectively: Create and stick to a budget to control your spending.

Plan for Taxes: Estimate your tax liabilities and set aside funds accordingly.

Manage Debts: Keep track of your debts and plan for repayments.

Case Study: How Effective Bookkeeping Transformed a Tradie Business

Let’s look at a real-life example of how effective bookkeeping transformed a tradie business.

Background

John, a self-employed plumber, was struggling to keep his business's finances in order. He was losing track of invoices, failing to follow up on late payments, and had no clear picture of his profitability. John’s bookkeeping system was a mix of paper receipts and an outdated spreadsheet, making it nearly impossible to stay organized.

Challenges

Disorganized Records: John had piles of receipts and no structured system to record transactions.

Cash Flow Issues: Inconsistent invoicing and follow-ups led to cash flow problems.

Tax Compliance: Without proper records, John was uncertain about his tax obligations and missed out on potential deductions.

Solution

John decided to overhaul his bookkeeping system by implementing the following steps:

Adopted Bookkeeping Software: John chose QuickBooks for its user-friendly interface and robust features.

Set Up a Chart of Accounts: He created a detailed chart of accounts to categorize his income and expenses.

Regular Transaction Recording: John made it a habit to record transactions daily, ensuring nothing was missed.

Bank Reconciliation: He started reconciling his bank statements monthly to catch any discrepancies.

Generated Financial Reports: John used the software to generate profit and loss statements and cash flow reports.

Results

Within a few months, John saw significant improvements in his business:

Improved Cash Flow: Timely invoicing and follow-ups reduced outstanding payments and improved cash flow.

Better Financial Insight: Regular financial reports gave John a clear understanding of his business’s performance.

Tax Savings: Accurate record-keeping enabled John to claim all eligible deductions, reducing his tax liability.

Conclusion

Effective bookkeeping is essential for the success of any trade business. By understanding the basics, setting up a reliable system, and regularly maintaining your financial records, you can overcome common challenges and gain valuable insights into your business’s performance. Just like John, you can transform your business's financial health and set the stage for long-term success.

Bookkeeping might seem daunting, especially for tradies who are more accustomed to working with their hands than crunching numbers. However, by following this ultimate guide to bookkeeping, you can simplify your financials and focus on what you do best—delivering top-notch services to your clients.

Remember, the key to successful bookkeeping is consistency. Regularly recording transactions, reconciling bank statements, and generating financial reports will help you stay on top of your finances. Don’t hesitate to invest in good bookkeeping software or seek professional help if needed. With proper bookkeeping practices in place, you can ensure your business’s financial stability and pave the way for continued growth and success.

By adopting these strategies, you can transform your trade business into a well-oiled financial machine. Start today and experience the peace of mind that comes with knowing your financials are in order.

For more detailed advice and personalized solutions, consider consulting with a bookkeeping professional. They can provide tailored guidance to help you optimize your bookkeeping processes and achieve financial success.

0 notes

Text

Benefits Businesses Can Enjoy with Skip Tracing in Australia

Introduction

If you are running a business whether it is a small or large one, you will understand the importance of maintaining a consistent cash flow. And for this, you need to ensure that all the debts are being collected on time. What if the debtors go missing and you don’t have any other options to contact them? Well, this is where skip tracing in Australia service comes into play. This is an advanced method of locating debtors who want to evade payments or have gone missing. In Australia, opting for such a service is legal and skip tracing services are regulated by Australian Privacy Principles and the Privacy Act 1988. Now, let’s talk about some benefits these services can offer you.

Helps Find Incommunicado Debtors Quickly

In the B2B business industry, most businesses sell goods on credit. While the buyers need to clear the payments within a certain time period, some may intentionally delay the payment. For a small business, late payments can be a serious concern and these businesses have limited financial resources. It has also been seen that some debtors change their contact number and address, making it more challenging to recover the debts. Are you dealing with such issues? Take the help of skip tracing in Australia and the experts will locate your debtors quickly. They deploy advanced tools to get the task done as soon as possible.

Helps Save Money and Time

Financial constraints make it more important for small businesses to be very careful about their resource allocation. You may not carry out all the tasks in-house, especially skip tracing. This is a highly specialized task that should be conducted by an experienced expert. Besides, doing it in-house means, you will have to spend money on costly tools or software programs However, when you hire an expert for this, you will save resources as well as time. In fact, you spend more time on your business. Trust these experts to keep your business safe from financial losses.

Lowers the Chances of Financial Losses

Effective and prompt skip-tracing services offered by registered agencies can lower the chances of financial losses related to bad debts. They guarantee the recovery of your unpaid debts and this, in turn, can increase your business liquidity, protect your financial health and enhance your business cash flow.

Legal Compliance

While skip tracing, it is crucial to adhere to the required legal frameworks and laws. Only professionals know about these legal frameworks. By ensuring proper compliance with all legal provisions, you can protect debtors’ rights, develop trust and avoid possible legal disputes.

Closing Thoughts

You may think that you can handle such tasks. Well, it may be possible, but the experienced and highly trained skip tracers are perfect to handle skip tracing. One of the most important reasons behind this is they have access to the latest and advanced skip-tracing software. So, if you want to conduct skip tracing in Australia and are searching for a reliable expert for this, then you can trust MGM Investigations. They can quickly find out personal details along with the legal history of your debtors. For more information, please feel free to get in touch with their customer support team now.

0 notes

Text

A Comprehensive Guide to Buying a Business in Australia

Introduction: Buying a business can be an exciting venture, but it also requires careful consideration and strategic planning. In Australia, the process involves navigating legal requirements, financial considerations, and market analysis. Whether you're a seasoned entrepreneur or a first-time buyer, understanding the nuances of buying a business in Australia is crucial for success.

1. Research and Due Diligence: Before diving into any purchase, thorough research is essential. Identify industries and markets that align with your interests, skills, and financial capabilities. Conduct comprehensive due diligence on potential businesses, including their financial records, legal status, market position, and growth potential. Engage professionals like accountants, lawyers, and business valuation experts to assist in this process.

2. Understand Legal and Regulatory Frameworks: Australia has specific legal and regulatory frameworks governing business acquisitions. Familiarize yourself with relevant laws related to business structures, taxation, employment, intellectual property, and industry-specific regulations. Seek legal advice to ensure compliance and mitigate risks associated with the purchase.

3. Financing Options: Consider your financing options when buying a business. Depending on the size and nature of the acquisition, you may opt for self-funding, bank loans, venture capital, or seller financing. Evaluate the pros and cons of each option and choose the one that best suits your financial situation and risk tolerance.

4. Negotiation and Valuation: Negotiation plays a crucial role in the buying process. Assess the value of the business based on its assets, cash flow, growth prospects, and market comparables. Factor in intangible assets like brand reputation and customer base. Work with sellers to negotiate a fair price and deal structure that aligns with your goals and expectations.

5. Consider Market Trends and Opportunities: Australia offers diverse opportunities across various industries, including technology, healthcare, hospitality, and retail. Analyze market trends, consumer behavior, and competitive landscapes to identify lucrative sectors and growth prospects. Look for businesses with sustainable revenue streams and potential for expansion or diversification.

6. Seek Professional Guidance: Navigating the complexities of buying a business requires expertise in various disciplines. Engage professionals such as lawyers, accountants, business brokers, and financial advisors to guide you through the process. Their insights and experience can help streamline transactions, mitigate risks, and ensure a successful acquisition.

7. Plan for Integration and Growth: Post-acquisition integration is critical for maximizing the value of your investment. Develop a comprehensive integration plan to align operations, systems, and cultures seamlessly. Identify synergies and opportunities for growth, whether through cost efficiencies, market expansion, product diversification, or strategic partnerships.

8. Exit Strategy: While buying a business is a long-term commitment, it's essential to have an exit strategy in place. Anticipate future scenarios and plan accordingly, whether it involves selling the business, passing it on to successors, or pursuing other ventures. Maintain flexibility and adaptability to navigate changing market conditions and personal objectives.

Conclusion: Buying a business in Australia can be a rewarding endeavor for aspiring entrepreneurs and seasoned investors alike. By conducting thorough research, understanding legal frameworks, securing financing, negotiating effectively, and seeking professional guidance, you can increase your chances of success in the competitive business landscape. With strategic planning, diligence, and perseverance, you can embark on a journey towards business ownership and prosperity in the land down under.

#finance#buying a business in australia#buy an existing business#buying a small business in australia

1 note

·

View note

Text

A Must Know Guide To Investment Property In Australia

Investing in property remains a highly effective strategy for wealth accumulation in Australia. This detailed guide aims to enlighten both seasoned and novice investors on optimal locations, property types, and purchasing strategies to enhance Investment property returns.

Selecting the Ideal Location The choice of location is pivotal in property investment. Extensive research is required to identify the best opportunities:

Growth Areas: Focus on regions with appreciating property values, low vacancy rates, and increasing rental prices, indicating future high demand.

Infrastructure Developments: Seek areas experiencing new infrastructure projects like roads, shopping centers, schools, and business districts, as these typically elevate property values.

Proximity to Amenities: Properties near public transport, schools, and shopping areas are more attractive to renters, boosting investment potential.

Choosing the Right Property The characteristics of your investment property can influence tenant demographics and maintenance costs:

Property Age and Style: While newer properties generally incur lower maintenance costs, older properties with unique features can attract a niche tenant market.

Desirable Tenant Features: Properties offering appealing amenities like gardens, balconies, multiple bathrooms, and modern kitchens can command higher rents. In apartments, features such as secure parking and good security are highly valued.

Navigating the Purchase Process Effective property investment requires meticulous planning and informed decision-making:

Educational Resources: Participate in property investment seminars to gain deeper market insights.

Professional Advice: Consult with reputable professionals to scrutinize your investment choices thoroughly. Nfinity Financials offers expert advice for swift and informed decision-making.

Financial Planning: Ensure that your property choice aligns with your financial objectives and budget. Consulting with mortgage specialists familiar with investor needs can help secure appropriate financing.

Understanding Investment Home Loans Investment properties can enhance your financial portfolio through rental income and potential property appreciation. However, investment property loans typically have higher interest rates due to their increased risk:

Loan Features: Features such as offset accounts, fixed interest rates, and the option for extra payments can help manage costs effectively.

Tax Benefits: Investment properties may qualify for tax benefits, including capital gains discounts and deductions for negative gearing.

Features of Investment Loans Investment loans offer features that enhance financial management flexibility:

Offset Accounts and Fixed Interest Rates: Help reduce interest costs and provide financial stability.

Extra Payments and Interest-Only Options: Allow faster principal reduction and lower initial payments.

Repayment Holidays and Redraw Facilities: Provide financial flexibility throughout the loan term.

Examining Interest-Only Loans Interest-only loans are especially attractive in the investment sector, allowing interest-only payments for a set period to aid cash flow management:

Qualifying for an Investment Loan Investment loans require stricter qualifications due to the higher risks involved:

Financial Health: Lenders evaluate your debt-to-income ratio and credit history.

Investment Experience: A solid investment track record can be advantageous.

Assets and Liabilities: Lenders assess the balance between your assets and liabilities.

Choosing Between Fixed and Variable Interest Rates Your decision should be based on your financial situation and investment strategy:

Fixed Rates: Offer stability and predictable payments.

Variable Rates: Provide flexibility and potential cost savings but come with increased risk.

Making Strategic Investment Decisions Investment decisions should align with your broader financial goals and require careful planning and expert advice. Understanding market trends and thorough preparation can significantly enhance your success in the competitive real estate market.

For personalized guidance through the complexities of property investment, contact Nfinity Financials. Our team of experts is ready to assist you every step of the way, ensuring you maximize your investment potential. Schedule a consultation at 1300 GET LOAN today.

#Investment property#investment property mortgage#low deposit houses#Investment property home loan rates#investment property calculator#investment property mortgage broker#investment property interest rate#Mortgage broker near me

0 notes

Text

The Essential Guide to Finding the Best Truck Finance Broker in Australia

In the dynamic world of trucking and logistics, finding the right financial partner can make all the difference. Whether you're a seasoned fleet operator or a budding entrepreneur looking to expand your transportation business, Truck Finance Broker Australia partnering with a reputable truck finance broker in Australia can unlock a world of opportunities. In this comprehensive guide, we delve into the key aspects of choosing the best truck finance broker tailored to your needs.

Understanding the Role of a Truck Finance Broker

A truck finance broker serves as an intermediary between borrowers (truck buyers or businesses) and lenders (financial institutions or banks). Their expertise lies in navigating the complex landscape of truck finance options, negotiating favorable terms, and securing competitive rates for their clients. By leveraging their industry knowledge and network, a skilled broker can streamline the financing process and help you access the funds needed to acquire new trucks or upgrade your existing fleet.

Qualities to Look for in a Truck Finance Broker

Industry Experience: Seek a broker with a proven track record in the trucking and finance sectors. Experience often translates into a deeper understanding of market trends, lender preferences, and strategic insights that can benefit your business.

Specialization: Look for brokers specializing in truck finance. Their focused expertise means they are well-versed in the nuances of truck loans, lease options, and asset financing, ensuring tailored solutions for your specific requirements.

Lender Network: A robust network of lenders is crucial. Top brokers have established relationships with a range of financial institutions, allowing them to shop around for the best rates and terms that align with your financial goals.

Transparency and Communication: Clear communication and transparency are paramount. A reputable broker will explain all terms, fees, and conditions upfront, empowering you to make informed decisions without hidden surprises.

Customer Service: Superior customer service sets exceptional brokers apart. Look for testimonials and reviews from past clients to gauge their service quality, responsiveness, and dedication to client satisfaction.

Why Choose I Want Finance?

At I Want Finance, we embody these qualities and more, making us your trusted partner in navigating the complex landscape of truck finance in Australia. Our team of seasoned experts brings years of industry experience, a vast network of lenders, and a customer-centric approach to every client engagement.

Here's why clients choose I Want Finance for their truck finance needs:

Tailored Solutions: We understand that one size does not fit all. Our customized finance solutions are designed to match your unique business requirements, whether you're a small operator or a large fleet owner.

Competitive Rates: Leveraging our extensive lender network, we negotiate competitive rates and favorable terms on your behalf, maximizing your financial benefits.

Streamlined Process: Our efficient and transparent process ensures a seamless experience from application to approval, saving you time and effort.

Dedicated Support: Our team is committed to providing personalized support at every step, offering expert guidance and prompt assistance whenever you need it.

Get Started Today

Ready to take your trucking business to new heights? Partner with I Want Finance, your reliable truck finance broker in Australia. Visit our website at https://iwantfinance.com.au/ to learn more about our services and begin your journey towards financial success in the transportation industry.

Remember, choosing the right finance partner is not just about securing funds—it's about unlocking growth opportunities, optimizing your cash flow, and driving long-term profitability. Trust I Want Finance to be your ally on this transformative journey.

I've created an article for backlinking with the keyword "Truck Finance Broker Australia" targeting the page https://iwantfinance.com.au/. Let me know if you need any further adjustments or additional information!

0 notes

Text

The Ultimate Guide to Heavy Truck Financing in Australia

Are you looking to expand your business fleet with heavy trucks in Australia? Financing such large investments can be a game-changer for your operations, Heavy Truck Financing Australia allowing you to take on more projects and increase your revenue. In this comprehensive guide, we'll delve into everything you need to know about heavy truck financing in Australia, from understanding the types of financing available to tips on how to secure the best deals.

Understanding Heavy Truck Financing

Heavy trucks, including semi-trailers, dump trucks, and construction vehicles, are crucial assets for many industries across Australia. However, their high cost can be a barrier for businesses looking to acquire them. That's where heavy truck financing comes in. This type of financing enables businesses to purchase or lease these vehicles with manageable payment plans.

Types of Heavy Truck Financing

Commercial Hire Purchase (CHP): With CHP, you hire the truck from the lender and make regular payments over a fixed term. Once the final payment is made, you own the truck outright.

Chattel Mortgage: Similar to CHP, a chattel mortgage involves a fixed-term loan where the truck serves as security. You own the truck from the beginning, and once the loan is repaid, the mortgage is removed.

Finance Lease: In a finance lease, the lender owns the truck, and you make regular lease payments for the agreed term. At the end of the lease, you may have the option to purchase the truck at a residual value.

Operating Lease: An operating lease is more like a rental agreement where you use the truck for a set period without the obligation to buy it. This option is suitable for businesses that prefer flexibility and may want to upgrade to newer models regularly.

Tips for Securing Heavy Truck Financing

Know Your Budget: Determine how much you can afford to repay each month based on your business's cash flow and budget constraints.

Compare Lenders: Shop around and compare offers from different lenders to find the most competitive interest rates and favorable terms.

Check Eligibility Criteria: Understand the eligibility criteria for heavy truck financing, including credit score requirements, business history, and financial documentation.

Consider Residual Value: If opting for a lease, consider the residual value of the truck at the end of the term and how it impacts your overall costs.

Negotiate Terms: Don't hesitate to negotiate with lenders to secure better terms, such as lower interest rates, longer repayment periods, or flexible payment schedules.

Conclusion

Heavy truck financing is a valuable tool for businesses in Australia looking to invest in essential assets for their operations. By understanding the types of financing available, comparing lenders, and negotiating favorable terms, Heavy Truck Financing Australia you can make informed decisions that benefit your business in the long run. Whether you choose a commercial hire purchase, chattel mortgage, finance lease, or operating lease, the key is to align the financing option with your business goals and financial capabilities.

For reliable heavy truck financing solutions in Australia, visit I Want Finance to explore their tailored options and expert advice.

This article provides comprehensive information about heavy truck financing in Australia, highlighting the types of financing available and offering tips for securing the best deals. It also includes a backlink to the target page, https://iwantfinance.com.au/, for readers to explore financing options further.

0 notes

Text

Chartered Accountants Chermside

Chartered accountants (CA) are financial professionals who have special designations in different countries. They are responsible for filing taxes, applying finance, and performing auditing and management accounting.

CAs often work within a large accountancy firm or oversee the finances of another business. They can also provide expert testimony in legal cases.

Taxation

Eva Chan is an accredited chartered accountants chermside and CPA Australia member who has been providing comprehensive business accounting services for small businesses and individuals in Chermside for over 10 years. Her clients range from a range of industries including retail, restaurant & cafe, online business, manufacturing, real estate, NDIS support workers and more. She is also a Xero Advisor and has extensive experience in implementing cloud-based accounting systems.

Chartered accountants can provide specialist advice in a number of areas, from working with high net worth individuals to assisting with corporate transactions. In addition to offering traditional accounting services, they can help with business planning, tax preparation and audits.

Chartered accountants are financial professionals who work for individuals, corporations and governments around the world. They often have specialized in one of the following areas: audit and assurance, financial accounting and reporting, applied finance or management accounting. Some chartered accountant institutions have reciprocity agreements with the United States, allowing CA professionals to pass certain exams and work as CPAs in the US.

Auditing

Auditing services are an important part of the accounting process and help ensure that financial information is accurate, fair, and complies with regulations and standards. An accountant can also help you make informed business decisions based on their expertise. Whether you need assistance with tax compliance or need advice on a major acquisition, a chartered accountant can offer specialist accountancy services and business advice to meet your needs.

The auditing process involves planning, collecting artifacts (such as bank statements, invoices, receipts, and sales orders), and testing and verifying financial information. For example, if you report that your sales exceed your reported revenue, the auditor will examine documentation and interview personnel to find out why.

Chartered accountants have extensive experience in auditing and can provide valuable insight into the overall health of your business. They also have excellent analytical skills and are great at finding out the truth behind even the most innocuous of errors. For this reason, they are often sought out by businesses that need to meet strict regulatory standards.

Financial Reporting

Having an accurate financial reporting system is vital to your business’s success. It can help you identify and manage complex ethical dilemmas and prepare for future changes to accounting standards. Moreover, it can help you develop broader professional and business skills in problem solving, critical thinking and research.

Generally, financial reporting includes a company’s core financial statements, such as the balance sheet, income statement and statement of cash flows. These statements disclose a company’s financial health and performance over a given period of time. This information is used by shareholders, lenders and potential investors to make decisions about the company.

A chartered accountant is an expert in a wide range of areas, from taxation to financial reporting. They have studied accounting to a high level and have many years of experience in the industry. Moreover, they adhere to strict ethical and professional codes. This ensures that they give you the best possible advice. Moreover, they can offer you advice on all aspects of your business structure to maximise profits.

Business Advice

A chartered accountants north side can help you with a wide range of financial issues. Some of these include taxation, budgeting, and cash flow forecasting. Some can even offer business advice. It is important to find a professional who has extensive experience and understands the current economic landscape.

In addition to being well-qualified, a chartered accountant must have excellent written and oral communication skills. They must also have sound ethical principles as they deal with sensitive financial information.

Chartered accountants can advise their clients on the risks and benefits of buying or selling businesses. They can also help their clients develop a strategic plan, including forecasting trends and suggesting cost-saving opportunities. They also play a vital role in helping companies fulfil their taxation obligations, which can save them money and avoid penalties. Moreover, they can assist their clients with corporate restructuring and mergers. This helps them improve their competitive position and increase profitability. Moreover, they can also provide legal testimony as experts in court cases.

0 notes

Text

How does Immediate Edge work?

Immediate Edge framework is controlled by smart exchanging robots that perform exchanges for clients. Subsequent to making a record, the client puts aside an installment and initiates the live exchanging highlight.

At the point when this is finished, the exchanging robots investigate the cryptographic money market to identify productive exchanges that should be possible with kept reserves.

All exchanges are reviewed by dealers to guarantee the clients will bring in cash prior to handling. Toward the finish of an exchanging meeting, clients can pull out benefits and reinvest the funding to get more cash-flow.

We saw that the exchanging robots work with an interesting calculation that is impeccable. This is the manner by which the robots can examine a huge measure of information from the cryptographic money market rapidly to guarantee clients don't lose procuring open doors.

We are dazzled with Immediate Edge; we saw tributes of clients who make somewhere in the range of $1,500 and $5,000 consistently.

If it's not too much trouble, note that the digital currency market is exceptionally unstable, and there are chances. Be that as it may, the quick cycles on Immediate Edge lower these dangers and increments acquiring possibilities for all clients.

It is essential to test the dependability of a digital currency exchanging robot. Financial backers are keen on a wellspring of customary pay. From our expert appraisal, the designers of Immediate Edge have set up every one of the assets and apparatuses to guarantee the exchanging stage is consistently on the web.

We know the number of our perusers rely upon this report as a venture guide. It is so natural with these exchanging robots. The client should simply support their Immediate Edge record and sit back, to watch the exchanging robots accomplish practically everything. Toward the finish of an exchanging meeting, there is a critical benefit ready to be removed.

1 note

·

View note

Text

Navigating the World of Mortgages with Mortgages Solutionz

In the realm of real estate, the journey towards homeownership often begins with finding the right mortgage solution. With countless options available in the market, it can be overwhelming to navigate through the sea of choices. That's where Mortgages Solutionz steps in - to guide you through the complexities of mortgages and help you find the perfect solution tailored to your needs.

Who We Are

At Mortgages Solutionz, we're more than just mortgage brokers; we're your partners in realizing your homeownership dreams. With years of experience serving clients across Australia, we've established ourselves as trusted advisors in the industry. Our team is comprised of seasoned professionals who are dedicated to providing personalized service and expert guidance every step of the way.

What Sets Us Apart

What sets Mortgages Solutionz apart is our commitment to putting our clients first. We understand that every individual and family has unique financial circumstances and goals. That's why we take the time to listen and understand your needs before crafting customized solutions that best fit your situation. Whether you're a first-time homebuyer, a seasoned investor, or looking to refinance your existing mortgage, we have the expertise and resources to help you achieve your objectives.

Our Services

Our comprehensive range of services is designed to address all your mortgage needs:

Home Loans: We offer a variety of home loan options tailored to your specific requirements, whether you're purchasing your first home or upgrading to your dream property.

Investment Loans: If you're considering property investment as a wealth-building strategy, our investment loan solutions can help you finance your investment properties and maximize your returns.

Refinancing: Refinancing your mortgage can help you secure better terms, lower your interest rate, or consolidate debt. Our refinancing experts will guide you through the process and ensure you make the most informed decisions.

Debt Consolidation: Streamline your finances and reduce your debt burden with our debt consolidation services. We'll help you consolidate high-interest debts into a single, more manageable loan, freeing up your cash flow and improving your financial situation.

Why Choose Mortgages Solutionz?

Expertise: With our extensive knowledge of the mortgage market and years of experience, you can trust us to provide you with expert advice and guidance.

Personalized Service: We believe in building long-term relationships with our clients, which is why we take a personalized approach to every interaction. Your success is our success, and we'll go above and beyond to help you achieve your goals.

Transparency: We believe in transparency and integrity in all our dealings. You can count on us to provide you with honest advice and clear communication throughout the process.

Customer Satisfaction: Your satisfaction is our top priority. We pride ourselves on delivering exceptional service and ensuring that every client leaves satisfied with their mortgage solution.

Get Started Today

Ready to embark on your homeownership journey? Visit our website at www.mortgagesolutionz.com.au to learn more about our services and schedule a consultation with one of our experienced mortgage advisors. Let Mortgages Solutionz be your trusted partner in navigating the world of mortgages and achieving your homeownership goals.

0 notes

Text

The Benefits of Using Xero for Your Business and How Experts Can Help You Get the Most Out of It

As a business owner, you know how important it is to stay on top of your finances. You need to keep track of your income and expenses, manage payroll, and stay compliant with tax laws. But with so much to do, it can be overwhelming to manage everything manually. That's where Xero comes in. Xero is a cloud-based accounting software that can help streamline your financial management processes and save you time and money. In this blog, we'll discuss the benefits of using Xero for your business and how Xero experts in Australia can help you get the most out of it.

Cloud-Based Convenience:

One of the primary benefits of using Xero is that it's cloud-based, meaning you can access your financial information from anywhere with an internet connection. This is especially beneficial for businesses with remote employees or those that require frequent travel. You can also collaborate with your accountant or bookkeeper in real-time, which means you can make financial decisions faster and with more accuracy.

Automated Processes:

Xero's automation features can help you save time on manual tasks like data entry, bank reconciliation, and invoicing. Xero can integrate with your bank accounts and credit cards to automatically import transactions, making it easy to reconcile accounts. You can also set up rules to categorize transactions automatically and even create recurring invoices for regular customers.

Comprehensive Reporting:

Xero offers a variety of reports that can help you gain insight into your business's financial health. You can create reports on cash flow, profit and loss, balance sheets, and more. These reports can help you identify areas where you can save money, plan for future growth, and make informed financial decisions.

Scalability:

Xero is designed to grow with your business. Whether you're a sole trader or a large corporation, Xero can adapt to your needs. You can add users, integrate with other software, and customize your dashboard to suit your business's specific requirements.

How Xero Experts in Australia Can Help:

While Xero is designed to be user-friendly, it can still be overwhelming for some business owners. That's where Xero experts in Australia come in. Xero experts, also known as Xero Champions, are certified advisors who can help you get the most out of the software. They can help you set up your account, integrate Xero with other software, and provide ongoing support and training. With their expertise, you can maximize the benefits of Xero and make informed financial decisions for your business.

In conclusion, Xero is an excellent accounting software for businesses of all sizes. Its cloud-based convenience, automation features, comprehensive reporting, and scalability make it a valuable tool for managing your finances. By working with Xero Champions in Australia, you can ensure that you're using the software to its fullest potential and make the most out of your investment.

2 notes

·

View notes

Text

How We Helped Australian Businesses Save Money With Business Growth Strategies

Running a successful business in Australia involves more than just offering great products or services. One important thing that people sometimes forget about is smart tax planning. In this article, we'll talk about how thinking ahead about taxes has helped Business Growth Strategies save money and stay financially strong. Utilising accounting services has been instrumental in implementing effective planning strategies, ensuring compliance with regulations, and maximising tax savings for sustained business growth.

Understanding Strategic Planning

Being savvy about taxes isn't just about meeting obligations; it's a way to improve your business's overall financial situation. Unlike basic planning which looks at the short term, planning thinking involves planning for the long term. It's all about using clever strategies to legally pay as little in taxes as possible.

The Australian Business Scene

Doing business in Australia comes with lots of challenges, especially when it comes to dealing with taxes. Because the tax laws and rules keep changing, Business Growth Strategies need to be on top of things and plan. That's where smart strategies become important – they help businesses navigate through the complicated tax system successfully.

Key Components of Strategic Planning

When it comes to smart planning, the first step is looking closely at how much money is coming in and going out. This means carefully checking all the financial information to find chances to save money by getting more deductions and paying less in taxes.

After that, long-term plans are put in place to make sure these financial benefits keep going. Engaging public accountants can provide businesses with the expertise needed to thoroughly analyse financial data, identify opportunities for tax deductions, and develop sustainable long-term plans to optimise financial benefits.

The Role of Professional Advisors

Understanding the complicated tax laws is not easy. That's why it's a good idea to work with expert tax advisors who are good at strategic tax planning. They can give Business Growth Strategies advice and make sure they're following all the newest rules. Partnering with accounting services that specialise in tax planning further enhances the ability of businesses to navigate complex tax laws and their financial strategies for long-term success.

Recent Changes in Tax Laws

It's super important to know about the latest updates. Smart strategies mean being able to adjust to these changes, making sure businesses can quickly respond to shifts in the rules and regulations.

Common Misconceptions about Taxes

It's important to clear up misunderstandings about taxes. Smart strategies aren't about avoiding taxes illegally; they're about finding clever ways to reduce the amount of taxes a Business Growth Strategies has to pay while still promoting steady and lasting growth.

Benefits Beyond Saving Money

Saving money is important, but smart strategies do more than that. They help businesses stay financially stable, improve the flow of cash, and create chances for more growth and investments.

Implementing Tax Planning in Your Business

If your business wants to start smart financial management, here's a simple guide to follow. From checking where your finances stand now to putting in personalised strategies, these practical tips will help you move towards financial success.

Measuring Success and Adjusting Strategies

It's important to set up key performance indicators (KPIs) to see how well your smart financial strategies are working. Keep checking the results regularly and be ready to change your approaches based on what you find. Working closely with public accountants can provide valuable insights into interpreting KPIs effectively, ensuring that businesses can make informed decisions and adjust their financial strategies as needed to achieve their goals.

Challenges in Implementing Strategic Planning

While the benefits are significant, challenges may arise during the implementation of strategic planning. Identifying potential obstacles and having solutions in place ensures a smoother execution of your strategies.

Future Trends in Planning

Looking ahead, understanding future trends in planning is vital for Business Growth Strategies to stay ahead of the curve. Proactively preparing for upcoming changes ensures that your strategic planning remains effective in the long run.

FAQs

1. Is strategic planning only for large businesses?

No, businesses of all sizes can benefit from strategic tax planning. Tailored strategies can be designed based on the specific needs and goals of each business.

2. How often should we review our strategies?

Regular reviews are recommended, at least annually. However, major Business Growth Strategies changes, such as expansion or restructuring, may require more frequent reviews.

3. Are there risks associated with strategic planning?

When done legally and ethically, strategic planning carries minimal risks. Engaging professional advisors helps mitigate any potential issues.

4. Can strategic planning help in times of economic uncertainty?

Yes, having a well-thought-out strategy provides financial stability, making businesses more resilient during economic challenges.

5. Is it too late to start strategic planning for this financial year?

It's never too late to start. While early planning is beneficial, businesses can implement strategic planning strategies at any time to optimise their financial position.

0 notes

Text

Mastering Bookkeeping for Tradies: Your Path to Financial Success

Running a successful trade business involves more than just delivering high-quality services to your clients. One critical aspect that often gets overlooked is bookkeeping. Proper bookkeeping is the backbone of a financially healthy business, providing insights into your profitability, cash flow, and overall financial health. This guide aims to demystify bookkeeping for tradies, offering a step-by-step approach to managing your financials effectively. Whether you're a seasoned tradies or just starting, this guide will equip you with the knowledge to streamline your bookkeeping processes and ensure your business's success.

Challenges Tradies Face with Bookkeeping

Bookkeeping can be particularly challenging for tradies due to the nature of their work. Here are some common challenges:

Time Constraints: Tradies often work long hours on-site, leaving little time for administrative tasks like bookkeeping.

Lack of Knowledge: Many tradies are experts in their trade but lack formal training in accounting or bookkeeping.

Inconsistent Income: The fluctuating nature of contract work can make it difficult to maintain consistent financial records.

Cash Transactions: Handling cash payments can complicate record-keeping and increase the risk of errors or omissions.

Compliance Requirements: Keeping up with tax laws and compliance requirements can be daunting without proper bookkeeping practices.

Addressing these challenges requires a solid understanding of bookkeeping fundamentals and the implementation of efficient processes.

Step-by-Step Guide to Bookkeeping for Tradies

1. Understand the Basics of Bookkeeping

Before diving into the specifics, it's important to grasp the basic concepts of bookkeeping. This includes understanding:

Income and Expenses: Track all money coming into and going out of your business.

Accounts Receivable and Payable: Monitor what you're owed and what you owe to others.

Bank Reconciliation: Ensure your bank statements match your financial records.

Financial Statements: Familiarize yourself with key financial reports like profit and loss statements and balance sheets.

2. Set Up a Bookkeeping System

Choose a bookkeeping system that suits your needs. This could be a manual ledger, spreadsheets, or bookkeeping software. For most tradies, using bookkeeping software is the most efficient option due to its ease of use and ability to automate many tasks.

Recommended Bookkeeping Software for Tradies:

QuickBooks: Ideal for small to medium-sized businesses, offering robust features for invoicing, expense tracking, and financial reporting.

Xero: A cloud-based option that is user-friendly and integrates with many other business tools.

MYOB: Popular in Australia, providing comprehensive accounting solutions tailored for local compliance.

3. Create a Chart of Accounts

A chart of accounts is a listing of all the accounts your business uses to record transactions. It categorizes your income, expenses, assets, liabilities, and equity. Setting up a detailed chart of accounts helps in organizing your financial data and simplifies the process of generating reports.

4. Record Transactions Regularly

To maintain accurate financial records, it's crucial to record transactions regularly. This includes:

Invoicing Clients: Generate and send invoices promptly. Follow up on overdue invoices to ensure timely payments.

Tracking Expenses: Record all business expenses, including materials, tools, and operational costs. Keep receipts and categorize expenses for tax purposes.

Managing Cash Flow: Monitor your cash flow to ensure you have enough funds to cover your expenses. Consider using a cash flow statement to track this.

5. Reconcile Your Bank Statements

Bank reconciliation involves matching your bank statements with your bookkeeping records to identify any discrepancies. This process helps in detecting errors, preventing fraud, and ensuring that your financial records are accurate.

6. Maintain Accurate Records for Tax Purposes

Tax compliance is a critical aspect of bookkeeping. Keep accurate records of all income and expenses, and stay informed about the tax laws applicable to your business. Consider consulting with a tax professional to ensure you're maximizing deductions and staying compliant.

7. Generate Financial Reports

Regularly generate financial reports to gain insights into your business's performance. Key reports to focus on include:

Profit and Loss Statement: Shows your revenue, expenses, and profits over a specific period.

Balance Sheet: Provides a snapshot of your business’s financial position, including assets, liabilities, and equity.

Cash Flow Statement: Tracks the flow of cash in and out of your business.

8. Use Bookkeeping to Make Informed Decisions

Leverage your bookkeeping data to make informed business decisions. Analyze your financial reports to identify trends, assess profitability, and plan for future growth. Effective bookkeeping enables you to:

Budget Effectively: Create and stick to a budget to control your spending.

Plan for Taxes: Estimate your tax liabilities and set aside funds accordingly.

Manage Debts: Keep track of your debts and plan for repayments.

Case Study: How Effective Bookkeeping Transformed a Tradie Business

Let’s look at a real-life example of how effective bookkeeping transformed a tradie business.

Background

John, a self-employed plumber, was struggling to keep his business's finances in order. He was losing track of invoices, failing to follow up on late payments, and had no clear picture of his profitability. John’s bookkeeping system was a mix of paper receipts and an outdated spreadsheet, making it nearly impossible to stay organized.

Challenges

Disorganized Records: John had piles of receipts and no structured system to record transactions.

Cash Flow Issues: Inconsistent invoicing and follow-ups led to cash flow problems.

Tax Compliance: Without proper records, John was uncertain about his tax obligations and missed out on potential deductions.

Solution

John decided to overhaul his bookkeeping system by implementing the following steps:

Adopted Bookkeeping Software: John chose QuickBooks for its user-friendly interface and robust features.

Set Up a Chart of Accounts: He created a detailed chart of accounts to categorize his income and expenses.

Regular Transaction Recording: John made it a habit to record transactions daily, ensuring nothing was missed.

Bank Reconciliation: He started reconciling his bank statements monthly to catch any discrepancies.

Generated Financial Reports: John used the software to generate profit and loss statements and cash flow reports.

Results

Within a few months, John saw significant improvements in his business:

Improved Cash Flow: Timely invoicing and follow-ups reduced outstanding payments and improved cash flow.

Better Financial Insight: Regular financial reports gave John a clear understanding of his business’s performance.

Tax Savings: Accurate record-keeping enabled John to claim all eligible deductions, reducing his tax liability.

Conclusion

Effective bookkeeping is essential for the success of any trade business. By understanding the basics, setting up a reliable system, and regularly maintaining your financial records, you can overcome common challenges and gain valuable insights into your business’s performance. Just like John, you can transform your business's financial health and set the stage for long-term success.

Bookkeeping might seem daunting, especially for tradies who are more accustomed to working with their hands than crunching numbers. However, by following this ultimate guide to bookkeeping, you can simplify your financials and focus on what you do best—delivering top-notch services to your clients.

Remember, the key to successful bookkeeping is consistency. Regularly recording transactions, reconciling bank statements, and generating financial reports will help you stay on top of your finances. Don’t hesitate to invest in good bookkeeping software or seek professional help if needed. With proper bookkeeping practices in place, you can ensure your business’s financial stability and pave the way for continued growth and success.

By adopting these strategies, you can transform your trade business into a well-oiled financial machine. Start today and experience the peace of mind that comes with knowing your financials are in order.

For more detailed advice and personalized solutions, consider consulting with a bookkeeping professional. They can provide tailored guidance to help you optimize your bookkeeping processes and achieve financial success.

0 notes

Text

Hire Qualified Tax Accountants in St Kilda for Getting Beat Financial Services

Renowned accounting companies provide professional tax accountants in St Kilda who have undergone financial training to provide high quality financial services using wide knowledge, innovative solutions and the most effective strategies. These tax accountants can offer a variety of services that are appropriate for both individual and corporate clients, including tax preparation. They assert that when their clients hire them, they receive the outcomes they want. Before completing any tax returns on your behalf, these accountants promise to carefully analyse all aspects of Australia's tax legislation. By taking into account all potential deductions, they utilize their in-depth understanding of taxes to maximize your tax refund and make sure you pay the least amount of tax possible. These tax preparers offer services for both individual and corporate tax preparation.

These tax accountants also provide small business accounting services such as accounting & bookkeeping, benchmarking, budgeting, cash-flow forecasting, management consulting and more at reasonable prices. They contend that by handling all of your bookkeeping and accounting requirements, including the creation of your annual accounts and periodic management accounts for tax, business appraisal, and planning purposes, these small business accounting services can relieve you and your team of a great deal of burden. As part of their small business tax preparation, business evaluation, and planning services, they will regularly discuss your needs and offer customized information and helpful recommendations. They promise that you can see how your company stacks up against the competition with their precise, timely, and comprehensive benchmarking and other reports. Summarise the workings of your sector as well as others.

Importance of Hiring Qualified Tax Accountants:

Accountants for tax returns are said to be a great resource for any person or company, according to a number of websites. They can assist with filing taxes, offer tax advice, and make sure that all available deductions are taken. Possessing the necessary training and expertise, they can offer wise counsel on effectively and lawfully handling taxes. In the end, choose the correct accountant is a crucial choice that should not be made hastily because it can have long-term effects on your company's finances. To provide their clients with the most accurate advice possible, tax accountants maintain up to date information on the latest advancements in the field.

To conclude, accounting companies provide expert tax accountants for your various financial services such as tax return, bookkeeping, accounting and more. Someone looking for these services should contact a nearby accounting company.

Source

0 notes

Text

Business Consultants Brisbane Drive Growth

Companies in Brisbane, like their global counterparts, continually seek innovative strategies to navigate this intricate terrain successfully. This is where the expertise of business consultants in Brisbane comes to the forefront. These professionals serve as catalysts for growth, offering invaluable insights, strategies, and solutions to help businesses thrive and prosper. Brisbane, a vibrant hub of economic activity in Australia, is home to a diverse range of industries, from technology and finance to manufacturing and healthcare. Business consultants in this region understand the unique challenges and opportunities that local businesses face. They leverage their in-depth knowledge, experience, and a vast network of resources to assist organizations in realizing their full potential. In this dynamic and evolving market, the role of business consultants is instrumental in driving growth, optimizing operations, and enhancing competitiveness. This article delves into the ways these experts in Brisbane are reshaping the local business landscape, providing innovative solutions, and fostering a culture of growth and success.

Understanding Your Business Needs

In the world of ever-evolving markets, successful business consultant Brisbane understand the critical importance of staying adaptable and responsive. To drive growth effectively, business consultants in Brisbane first immerse themselves in comprehending your unique needs. They take the time to assess your current situation, goals, and challenges. By gaining a deep understanding of your business, they lay the foundation for a tailored growth strategy that suits your specific circumstances.

Strategic Planning and Market Analysis

Business consultants in Brisbane employ strategic planning and market analysis as pivotal tools in driving business growth. They meticulously study the local market dynamics, competition, and emerging trends, allowing them to identify new opportunities and areas for improvement. Armed with this knowledge, they help you create a roadmap for your business that not only tackles immediate obstacles but also positions your organization for sustainable growth in the long term.

Implementing Innovative Solutions

Business consultants in Brisbane are well-versed in the art of innovation. They know that growth often hinges on the ability to adopt and integrate new technologies, strategies, and processes. These experts work alongside you to identify innovative solutions that can streamline operations, enhance product or service offerings, and better engage with your target audience. Their role is to drive change and ensure your business is future-ready.

Financial Management and Investment Strategies

Effective financial management is a cornerstone of business growth. Business consultants in Brisbane leverage their expertise in managing finances, optimizing cash flow, and identifying sound investment opportunities. They help you strike the right balance between reinvesting in your business and safeguarding your financial stability, ensuring your growth trajectory remains sustainable.

People and Culture Development

Business consultants recognize that growth is not just about numbers; it's also about the people who drive your business. They help you nurture a positive and growth-oriented organizational culture. This means assisting with talent acquisition, providing leadership training, and fostering an environment where employees are empowered to contribute their best. Your human capital is a valuable asset in the quest for growth.

Risk Management and Contingency Planning

In an ever-changing business landscape, risks are inevitable. Business consultants in Brisbane are adept at identifying potential risks and developing contingency plans to mitigate their impact. By proactively addressing risks, they help ensure that unexpected challenges don't hinder your growth journey. Their expertise in risk management provides peace of mind as you navigate the path to expansion.

Monitoring and Adaptation

The process of driving business growth is an ongoing journey, not a one-time event. Brisbane business consultants understand the need for continuous monitoring and adaptation. They help you establish key performance indicators (KPIs) and provide the tools to measure progress. If deviations from the growth plan occur, they assist in making necessary adjustments to stay on course, ensuring that your business keeps evolving and thriving.

Conclusion

In conclusion, business consultants in Brisbane play a vital role in driving growth for organizations in this dynamic and competitive business environment. Through their expertise and experience, they offer invaluable insights and strategies that enable companies to adapt to changing market conditions, maximize their potential, and overcome challenges.

0 notes