#Bull vs Bear Market

Text

Warren Buffett’s Advice for How to Making Money in the Stock Market – 2023

Warren Edward Buffett is an American business tycoon and investor. He has the best financial advice for the Indian stock market. if you want to invest in stocks so you look out for warren buffett's investment advice he is the best investor and has top stock Knowledge. Check the Bull vs Bear Market detail here!

#warren buffett's advice#warren buffett investment advice#Bull vs Bear Market#warren buffett stock advice#warren buffett financial advice#investors like warren buffett#bad investment#good stock#bull market#big bull of indian stock market#bear market#currently trading#online investment service#warren buffett top stocks#warren buffett best investments

1 note

·

View note

Text

Bear Market: The Shadow of Darth Vader

In contrast to the optimism and growth of a bull market, a bear market represents a period of pessimism, declining stock prices, and investor fear. Drawing parallels to the ominous presence of Darth Vader, this topic explores the characteristics of a bear market and its association with uncertainty, darkness, and downturns in the stock market.

a. Defining the Bear Market: Just as Darth Vader casts a shadow of darkness across the galaxy, a bear market casts a shadow of uncertainty and fear over the stock market. Nikhil Pankaj Shah delves into the defining features of a bear market, including declining investor confidence, economic recession, and sustained periods of market downturns leading to falling stock prices.

b. Strategies for Surviving in a Bear Market: Much like confronting the dark side, investors in a bear market must employ strategies to protect their portfolios and minimize losses. Nikhil Pankaj Shah explores defensive investment strategies such as diversification, capital preservation, and reducing exposure to high-risk assets. By adopting a defensive stance and staying disciplined amidst market turmoil, investors can weather the storm of a bear market.

c. Challenges and Opportunities: While a bear market presents challenges for investors, it also brings opportunities for value investors to find bargains amid market downturns. Nikhil Pankaj Shah discusses how contrarian investors can capitalize on undervalued stocks, distressed assets, and market dislocations during bear markets. By maintaining a long-term perspective and seizing opportunities amidst adversity, investors can emerge stronger from the depths of a bear market.

d. Psychological Impact and Investor Sentiment: The fear and uncertainty prevailing in a bear market can weigh heavily on investor sentiment and decision-making. Nikhil Pankaj Shah explores the psychological factors driving market participants, such as panic selling, herd mentality, and the fear of further losses. By understanding the psychological dynamics at play, investors can maintain emotional resilience and avoid succumbing to the dark side of fear and despair.

e. Navigating the Bear Market Terrain: Just as navigating through treacherous terrain requires caution and foresight, navigating a bear market requires careful planning and risk management. Nikhil Pankaj Shah discusses strategies for navigating the challenges of a bear market, such as setting stop-loss orders, rebalancing portfolios, and focusing on quality defensive stocks with strong fundamentals. By staying vigilant and adapting to changing market conditions, investors can navigate the bear market terrain with resilience and determination.

In the narrative of the stock market, the bear market represents a period of darkness, uncertainty, and fear, akin to the shadow cast by Darth Vader in the Star Wars saga. By drawing parallels between the ominous presence of Darth Vader and the challenges of a bear market, investors can better understand the characteristics, challenges, and opportunities associated with periods of market downturns. Through education, awareness, and disciplined investing, investors can navigate the challenges of a bear market with resilience and determination, just as heroes confront the darkness and emerge stronger from adversity.

Nik Shah | Nikhil Shah | Nikhil Pankaj Shah | nshah01801

0 notes

Text

Understanding the Difference Between Bull and Bear Markets: A Comprehensive Guide

Are you confused about the terms bull and bear markets? Do you want to understand the differences between these two types of markets and how they can affect your investments? Look no further, as this comprehensive guide will provide you with a clear understanding of these concepts and their impact on the stock market. Whether you are a beginner or an experienced investor, this article will offer…

View On WordPress

0 notes

Text

Differences Between Crypto Bull Market and Bear Market

Let's discuss the key differences between bull and bear markets. This will assist you in making better crypto investment decisions for you.

#crypto market bull or bear indicator#what is bear market in crypto#what is a bear market in crypto#bull market vs bear market crypto#difference between a bull and bear market#Securell

0 notes

Text

{ MASTERPOST } Everything You Need to Know about Investing for Beginners

Fundamentals of investing:

What’s the REAL Rate of Return on the Stock Market?

Do NOT Make This Disastrous Beginner Mistake With Your Retirement Funds

The Dark Magic of Financial Horcruxes: How and Why to Diversify Your Assets

Dafuq Is Interest? And How Does It Work for the Forces of Darkness?

Booms, Busts, Bubbles, and Beanie Babies: How Economic Cycles Work

When Money in the Bank Is a Bad Thing: Understanding Inflation and Depreciation

Investing Deathmatch series:

Investing Deathmatch: Managed Funds vs. Index Funds

Investing Deathmatch: Traditional IRA vs. Roth IRA

Investing Deathmatch: Investing in the Stock Market vs. Just… Not

Investing Deathmatch: Stocks vs. Bonds

Investing Deathmatch: Timing the Market vs. Time IN the Market

Investing Deathmatch: Paying off Debt vs. Investing in the Stock Market

Investing Deathmatch: What Happens in a Bull Market vs. a Bear Market

Now that we’ve covered the basics, are you ready to invest but don’t know where to begin? We recommend starting small with micro-investing through our partner Acorns. They’ll round up your purchases to the nearest dollar and invest the change in a nicely diversified portfolio of stocks, bonds, and ETFs. Easy as eating pancakes:

Start saving small with Acorns

Alternative investments:

Small Business Investing: A Kinder, Gentler Alternative to the Stock Market

Bullshit Reasons Not to Buy a House: Refuted

Investing in Cryptocurrency is Bad and Stupid

So I Got Chickens, Part 1: Return on Investment

Twelve Reasons Senior Pets Are an Awesome Investment

How To Save for Retirement When You Make Less Than $30,000 a Year

Understanding the stock market:

Ask the Bitches Pandemic Lightning Round: “Did Congress Really Give $1.5 Trillion to Wall Street?”

Season 3, Episode 2: “I Inherited Money. Should I Pay Off Debt, Invest It, or Blow It All on a Car?”

Money Is Fake and GameStop Is King: What Happened When Reddit and a Meme Stock Tanked Hedge Funds

Season 3, Episode 7: “I’m Finished With the Basic Shit. What Are the Advanced Financial Steps That Only Rich People Know?”

Wait… Did I Just Lose All My Money Investing in the Stock Market?

Season 4, Episode 1: “Index Funds Include Unethical Companies. Can I Still Invest in Them, or Does That Make Me a Monster?”

Retirement plans:

Dafuq Is a Retirement Plan and Why Do You Need One?

Procrastinating on Opening a Retirement Account? Here’s 3 Ways That’ll Fuck You Over

How to Painlessly Run the Gauntlet of a 401k Rollover

Ask the Bitches: “Can I Quit With Unvested Funds? Or Am I Walking Away From Too Much Money?”

Workplace Benefits and Other Cool Side Effects of Employment

You Need to Talk to Your Parents About Their Retirement Plan

Season 4, Episode 5: “401(k)s Aren’t Offered in My Industry. How Do I Save for Retirement if My Employer Won’t Help?”

Got a retirement plan already? How about three or four? Have you been leaving a trail of abandoned 401(k)s behind you at every employer you quit? Did we just become best friends? Because that was literally my story until recently. Our partner Capitalize will help you quickly and painlessly get through a 401(k) rollover:

Roll over your retirement fund with Capitalize

Recessions:

Season 1, Episode 12: “Should I Believe the Fear-Mongering about Another Recession?”

There’s a Storm a’Comin’: What We Know About the Next Recession

Ask the Bitches: How Do I Prepare for a Recession?

A Brief History of the 2008 Crash and Recession: We Were All So Fucked

Ask the Bitches Pandemic Lightning Round: “Is This the Right Time To Start Investing?”

#investing#how to invest#stock market#finance#personal finance#investing in stocks#retirement fund#retirement account#investing for beginners#investing 101

72 notes

·

View notes

Text

Understanding The Basics Of Stock Market Investing

INTRODUCTION :

Investing in the stock market can seem really difficult, especially if you're new to it. But with the right information and the proper approach, it can be a profitable way to increase your money over time. In this blog, we'll explain the basic ideas and strategies behind stock market investing to help make this complex financial world easier to understand.

WHAT IS STOCK MARKET ?

At its core, the stock market is a platform where investors can buy and sell shares of publicly traded companies. When you purchase shares of a company's stock, you essentially become a part-owner of that company, entitled to a portion of its profits and losses.

WHY INVEST IN STOCKS ?

Stock market investing offers the potential for significant returns over the long term. Historically, stocks have outperformed other asset classes such as bonds and cash equivalents. Additionally, investing in individual stocks allows for diversification, enabling investors to spread risk across different companies and sectors.

BULLS AND BEARS :

Bulls: Imagine a bull charging ahead with its horns up. In the stock market, "bulls" are investors who are optimistic and believe that the market or a specific stock is going to go up in value. They think good times are ahead and are ready to buy stocks, anticipating profits.

Bears: Now, think of a bear standing on its hind legs and swiping downward with its paws. In the stock market, "bears" are the opposite of bulls. They're pessimistic about the market or a stock and believe that prices are going to fall. They're cautious or even selling stocks, expecting losses.

Bulls think prices will go up, so they buy.

Bears think prices will go down, so they sell.

KEY CONCEPTS OF STOCK INVESTING :

1. Stocks vs. Other Investments: Stocks represent ownership in a company, while bonds represent debt. Stocks offer the potential for higher returns but come with greater risk compared to bonds.

2. Risk and Reward: The relationship between risk and reward is a fundamental principle of investing. Generally, higher-risk investments have the potential for higher returns, but they also carry a greater chance of loss.

STRATEGIES FOR STOCK MARKET INVESTING:

1. Long-Term Investing: Adopting a long-term perspective allows investors to ride out short-term market fluctuations and capitalize on the power of compounding returns over time.

2. Dollar-Cost Averaging: By investing a fixed amount of money at regular intervals, investors can take advantage of market fluctuations to buy more shares when prices are low and fewer shares when prices are high.

3. Value Investing: Value investors seek out undervalued stocks trading below their intrinsic value. They believe that over time, the market will recognize the true worth of these companies, resulting in price appreciation.

4. Growth Investing: Growth investors focus on companies with strong growth potential, even if their current stock prices may seem high relative to earnings. They believe that these companies will continue to outperform over the long term.

CONCLUSION :

While investing in the stock market carries inherent risks, understanding the basics and employing sound investment strategies can help mitigate those risks and increase your chances of success. Remember to conduct thorough research, diversify your portfolio, and remain disciplined in your approach. By staying informed and patient, you can harness the power of the stock market to achieve your financial goals. Happy investing!!

2 notes

·

View notes

Text

⭐ Bitcoin on February 18th 2023 🚀✨

The price as I'm writing this is $24,470 per btc.

youtube

Astro 🔮💫

Venus is approaching a conjunction to Bitcoin's moon in Aries starting today, then subsequently Jupiter (On March 2nd). This likely points to a boost in people's investments (especially the jupiter conjunction). The stock market is likely to rally as well. Venus rules money & investments.

Super positive for bitcoin 👍

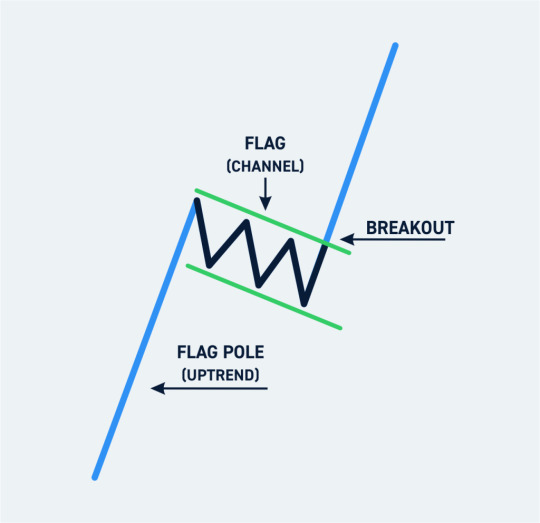

Cup & Handle Pattern:

- Invalidation vs. Breakout zones: $24,300 ❌ & $24,950 ✅

- Triple Bullish Scenario ♉♉♉

Cup Handle - 4h chart

Bull flag - 1h chart

W-pattern (2x-bottom) - 15m chart

-=-=-=-

1: 💹 Trends

Monthly, we are in a downtrend 📉.

Meaning, we can expect prices less than $17,000 Bitcoin in the next 12 months.

Weekly, we are in an uptrend 📈.

Meaning we can expect prices higher than $25,300 Bitcoin within the next 8 weeks

So long as we close Sunday above $23,900 btc (So far, ✅)

Daily, we are in an uptrend* 📈

IF we close the day above $24,300 BTC. (@ 7pm EST)

However yesterday, we have made lower highs than the 15th, when we retested $25,000. Which is bearish.

4h we are in a seeming downtrend. Marked by a distinct lower high in the chart. Simply one strong candle downwards on this timeframe is confirmation and We are looking horrendous for Bitcoins price over the next 3 days.

Right now, it seems we are in this ambiguous/pivotal energy like yesterday. So it's a time for relative inaction. Volume is eerie and low at the moment. Not much pressure from either the bull or the bears 😐

Hourly, we are in a downtrend 📉

Meaning we can expect prices lower than $24,300 bitcoin within the next day.

That is just the fact of the matter... Despite that we are forming a sort of distribution pattern known as a bull flag. A sort of last minute attempt to break the down trend. If that is validated, this could lead us powerfully to our next leg up. The measured move would lead us precisely to our next target: $26,250 dollar btc. ⚠️

The bull flag would be confirmed by any intraday closure above the "pole" of the flag: ~ 24,950. Usually by bullish candles with high volume

2: 🔮 Conclusion

I am in a small long position as of the bottom of the bullflag Entered at ~$24,480. I will add more once there is confirmation of a breakout. Placing my stop-loss price at the bottom of the flag (channel).

And taking some profits at $25K!

3: 💰 Current Portfolio

18.5% USDs (+8.65%)

17.15% BTC (-4%)

64.35% Alts (-4.65%)

In Alts [24% is ETH 🔵, 17% is BNB 🟡, Rest is a combination of ADA, LINK, LTC & SHIB]

That's all For now!

2 notes

·

View notes

Text

Best Option Trading Telegram Channels

If you’re confused about which skills to learn in 2024 to earn up to Rs 50,000 a day, trading can be a great way to make good money. You might be wondering how to learn trading. This article has the solution for you! I’ve put together a list of the Best Telegram channels for option trading in 2024.

Top 10 Telegram channels for Option Trading

1.Honest Stock Traders

2. Trading Master

3. Trade Onomics

4. Ghanshyam tech Analysis

5. Option Trading Masters

6. Option Tradex

7. NSE STOCK PRO

8. Mehul Option Trading

9. Stock market Ninjas

10. Stockpro Official

Best Telegram Channels for Option Trading in 2024 (Free Calls)

Honest Stock Traders

If you’re not very familiar with option trading but still want to make money from it, consider joining the Honest Stock Traders channel. Here, you’ll get free option trading calls, trading setups, and chart analysis for Bank Nifty and Nifty. With over 31k subscribers, this channel provides valuable insights at no cost.

Option Trading Bulls

Option Trading Bulls is a legit Telegram channel that offers investment ideas, free Banknifty option calls, and detailed information on stock, equity, future, and options trading. With over 20k members, this channel can help you recover your losses.

Stock Market Ninjas

Stock Market Ninjas is a SEBI-registered Telegram channel that offers trading tips for option trading, crypto trading, intraday trading, and swing trading. The owner has a lot of experience in trading, making it a great resource if you want to learn how to make money from trading.

Bull vs Bears Traders

Bull vs Bears Traders helps you set targets and achieve daily profits of Rs 3000 to 5000+. It offers live chart analysis, ideal setups for trading, buying, and selling ideas, along with free Bank Nifty calls. Join now to increase your profits.

Trading Wallah

Trading Wallah is famous for option trading. It provides stock market views, Nifty investment calls, chart indicators, and free trading calls. There’s also a premium membership plan available.

Stock Gainers

Stock Gainers is a popular SEBI-registered Telegram channel offering free materials on stock market and option trading calls. You get 1–2 intraday option trading calls with proper strategies. With over 80k members, this channel can help you make over 10k profit daily.

Option Trading Hub

This channel provides free stock market tips, trading tips, and free intraday calls. They also offer premium services like live training and free webinars. If you want to invest your money wisely in 2024.

StockPro®Official (SEBI Registered)

StockPro Official, run by Seema Jain, is a trusted SEBI-registered channel. It offers free Bank Nifty training and free videos on share market and trading on YouTube. With over 300k members, it’s a great community to join if you want to learn and trade.

Growth Trading

Growth Trading is a great channel to learn about investing in trading. It offers regular intraday trading tips on equity, futures, options trading, and stock market news. If you want 1–2 free calls daily with 90% accuracy.

Trading Phoenix

Trading Phoenix covers option trading, intraday, crypto, and swing trading. It’s one of the fastest-growing channels, offering investment and financial advice.

Option Trading Masters

Option Trading Masters is an authentic channel focused on educating beginners. It provides detailed information on stock market and trading, along with free trading calls, Bank Nifty calls, chart analysis, and risk management services.

GHANSHYAM TECH ANALYSIS

GHANSHYAM TECH ANALYSIS provides free Bank Nifty, intraday, and option trading calls. It also offers free YouTube videos for beginners to learn trading in simple language. For stock market tips, free trading knowledge, and more

Elite Traders

Elite Traders offers information on the stock market, trading, business news, and investment ideas. It provides Nifty and Bank Nifty calls, intraday calls, and stock options calls.

Option Trade Order

Option Trade Order is a great channel for short-term or long-term investment ideas. It provides fundamental stock market analysis, free investment ideas, risk management, and chart analysis. With over 40k active members, this channel is worth joining.

Option Trading Gainers

If you want to build a career in the stock market and trading, this channel offers online trading classes. It covers chart analysis, risk management, and more. Join today to learn trading from start to finish.

Bull’s Thrive

Bull’s Thrive is a fast-growing channel known for its option trading tips and tricks, free live chart analysis, and ideal setups for trading. Join this channel in 2024 to make money from trading.

Market Master

Market Master is a SEBI-certified channel that helps you become financially free. It offers various investment ideas, stock market research, Bank Nifty, expiry levels, breakouts, and more.

0 notes

Text

Stock Market Outlook: Bullish vs Bearish? What Experts Say for 2024

As of May 5, 2024, the stock market is acting more like a seesaw at a children's playground than a mature, predictable financial entity. One minute, certain sectors are reaching for the sky like kids on a sugar high, and the next, they’re taking a nosedive just as dramatic as a toddler’s mood swings. This financial rollercoaster ride has everyone wondering whether 2024 will be packed with thrilling gains or if we should strap in and prepare for a potential plummet. To get a grip on this amusement park adventure, let’s tap into the wisdom of market gurus and uncover some savvy moves for tiptoeing around this year’s market mayhem.

Bullish vs. Bearish: Understanding the Landscape

Before diving into specific predictions, it's crucial to understand the two main outlooks for the stock market: bullish and bearish. A bullish market is characterized by rising stock prices and investor optimism. Conversely, a bearish market signifies a decline in prices and a more cautious investor sentiment.

Proponents of a bullish 2024 market point to several positive economic indicators. Recent job reports have shown continued growth, and interest rates might see cuts after their significant hikes in 2023. This could stimulate borrowing and investment, potentially boosting the market. Additionally, specific sectors like infrastructure, capital goods, and renewables are expected to perform well due to government initiatives and global trends towards sustainable development.

However, concerns remain that could usher in a bearish 2024. Geopolitical tensions continue to simmer, potentially disrupting global trade and supply chains. Inflationary pressures, while showing slight signs of easing, haven't completely subsided, and the lingering threat of a recession cannot be ignored. These factors could lead to investor anxiety and a pullback from the market, causing prices to fall.

Expert Opinions: Navigating a Sea of Predictions

Financial institutions and analysts have offered a diverse range of predictions for the 2024 stock market. Morgan Stanley, for instance, expresses cautious optimism, citing five reasons to believe in a continued rally, although with more volatility compared to 2023 . Conversely, Dipan Mehta, Director of Elixir Equities, advises caution, emphasizing the need for liquidity and careful stock selection in a potentially “bull market with bear phases” .

Variations in predictions also exist for different markets. While some analysts might be bullish on the US market based on specific domestic factors, others might be bearish on emerging markets due to potential currency fluctuations or regional economic challenges.

Investing Strategies for Uncertain Times

Given the inherent uncertainty of market forecasts, relying solely on expert opinions would be unwise. Here are some general strategies to consider when navigating a volatile market:

- Diversification: Mix it up with your investments! Throw some cash into stocks, bonds, real estate, you name it. If one area flops, you’ve got backup from the others to keep you afloat. This way, you're not putting all your financial hopes in one basket, and it can really save your skin when one market takes a nosedive.

- Long-Term Perspective: Forget the daily market drama. Think about the big picture and stick to companies that have been solid performers over the years. Long-term investing isn’t about catching every wave; it’s about staying steady and seeing solid gains over time. Patience pays off, so focus on growth, not the bumps along the way.

- Risk Management: Know your limits when it comes to risks and spread out your investments. Don't freak out during tough times and use things like stop-loss orders to help cut your losses if things go south. Remember, managing your risk isn't just a safety net—it's a strategic move that keeps you in the game and ready to capitalize on opportunities as they arise.

Conclusion: The Market Whisperer Doesn't Exist

While the contrasting outlooks of experts paint a picture of a market brimming with uncertainty, it doesn't have to be paralyzing. Remember, there's no single definitive answer to whether 2024 will be a bullish or bearish year. The reality is likely more nuanced, with pockets of growth and decline across different sectors and markets.

The key takeaway lies in thorough research and understanding your own risk tolerance. Don't chase fleeting trends or rely solely on expert predictions. Conduct your own due diligence, develop a diversified investment strategy, and maintain a long-term perspective. By adopting these practices, you'll be well-equipped to navigate the uncertainties of the 2024 stock market, regardless of its ultimate direction.

Additional Tips:

No.Advice1Stay informed: Keep yourself updated on economic news, company earnings reports, and global events that may impact the market.2Consider professional guidance: Consulting a financial advisor can be beneficial, especially for those new to investing.3Remember, investing is a marathon, not a sprint. Be patient, disciplined, and focus on building wealth over the long term.

By following these steps and keeping a level head, you can approach the 2024 stock market with a sense of cautious optimism, prepared to capitalize on opportunities and weather potential storms.

Read the full article

0 notes

Text

Bull vs bear: When will Nifty 50 hit 25K, Sensex climb to one lakh?

After reaching recent record highs previous week, the main indices of the Indian stock market couldn't maintain those levels and saw significant drops thereafter.

This might have raised concerns among investors about whether the market has reached its highest point and if a bearish trend is approaching.

Experts say that in the post-COVID period, the Indian markets have experienced three periods of both rising and falling trends.

Based on the performance since COVID-19, it is predicted that the Nifty 50 index could touch 25,000 by the end of the current financial year or by February-March 2025.

Ganesh Dongre, Senior Manager at a research firm expects that the Sensex would increase three times the rally of the Nifty 50 index within a given period.

Sandeep Pandey, Founder of Basav Capital, suggests focusing on stocks that have potential for wealth creation.

He suggests looking at companies that don't have any debt, have consistently reported positive quarterly results in the past, and examining their forward PE and last five years CAGR to find good investment opportunities for the long-term investment.

For Trade Insights: thebusinesscorridor

0 notes

Text

if I knew like 5% less about the stock market I'd assume that bear vs bull was a gay porn category

1 note

·

View note

Text

Investing Deathmatch: What Happens in a Bull Market vs. a Bear Market

If you found this helpful, consider joining our Patreon.

8 notes

·

View notes

Text

Solana's $200 Battle: Bulls vs. Bears in the Crypto Arena

Solana (SOL), the blockchain platform known for its high-speed transactions and scalability, finds itself at a critical juncture as its native token, SOL, faces a pivotal battle around the $200 price level. With both bulls and bears vying for control, the outcome of this showdown will have significant implications for Solana's short-term price trajectory and broader market sentiment.

The $200 price level has emerged as a key psychological barrier for Solana, representing a crucial inflection point where bullish momentum could either propel SOL to new heights or succumb to bearish pressure, leading to a potential correction. As SOL hovers around this critical level, traders and investors are closely monitoring price action and market dynamics for clues about the direction of the next major move.

On the bullish side, proponents of Solana point to its impressive technological fundamentals and growing adoption as key drivers of continued upward momentum. Solana's innovative approach to blockchain scalability, which leverages a unique consensus mechanism called Proof of History (PoH), has positioned it as a leading contender in the race for blockchain scalability solutions. Additionally, Solana's vibrant ecosystem of decentralized applications (dApps) and its burgeoning DeFi ecosystem further bolster its bullish case, attracting developers and users alike.

Moreover, recent partnerships and integrations with prominent projects and protocols have added to the bullish narrative surrounding Solana, reinforcing its position as a leading blockchain platform with real-world utility and relevance. With institutional interest in Solana on the rise and the broader cryptocurrency market experiencing renewed bullish sentiment, proponents believe that SOL is poised for further upside potential, potentially breaking through the $200 resistance level and setting new all-time highs.

However, bears remain vigilant, citing concerns over market overheating and potential profit-taking as reasons for caution. Despite Solana's strong fundamentals, skeptics warn of the possibility of a market correction or consolidation phase, particularly if SOL fails to decisively breach the $200 resistance level and establish sustained bullish momentum. Additionally, external factors such as regulatory developments or macroeconomic trends could also exert downward pressure on SOL's price in the short term.

As the battle for Solana's $200 price level unfolds, traders and investors are advised to exercise caution and closely monitor key technical indicators and market sentiment for potential signals of trend reversal or continuation. While bullish momentum may prevail in the near term, prudent risk management strategies and disciplined trading approaches are essential to navigating the volatile cryptocurrency market landscape.

In conclusion, Solana's $200 battle represents a pivotal moment for the cryptocurrency and its community. Whether bulls will prevail and propel SOL to new heights or bears will seize control and lead to a corrective phase remains uncertain. As the outcome of this showdown unfolds, the broader cryptocurrency market watches closely, eager to decipher the implications for Solana's short-term price trajectory and long-term prospects within the ever-evolving digital asset landscape.

0 notes

Text

🌟 Step into the financial jungle of 2024 with Sage Street Realty! 🐾🏡 Explore the roaring Bull market and cautious Bear trends in real estate investing. 📈🐻 Dive into our latest blog to uncover tips for navigating these wild markets! 🌿

🔍 Read more at https://www.sagestreetrealty.com/bulls-vs-bears-the-markets-wild-safari/?source=2550! #RealEstateInvesting #BullAndBearMarket #2024Trends #SageStreetRealty

0 notes

Text

Stock Market Basics For Beginners

Certainly! Understanding the basics of the stock market is crucial for beginners. Here's a simplified overview:

If you want to learn more about trading then joinInvestingdaddy.com

What is the Stock Market?

The stock market is a place where investors buy and sell shares of publicly traded companies. Publicly traded companies issue shares to raise capital, and investors buy these shares, becoming partial owners of the company.

Key Concepts:

Stocks:

Shares: Represent ownership in a company. Owning shares means owning a portion of the company.

Ticker Symbol: A unique series of letters assigned to a security for trading purposes (e.g., AAPL for Apple).

Exchanges:

NYSE (New York Stock Exchange): One of the largest stock exchanges in the world.

NASDAQ: Another major stock exchange, known for technology and internet-based companies.

Bulls and Bears:

Bull Market: A period of rising stock prices.

Bear Market: A period of falling stock prices.

Brokers:

Brokerage: A firm that facilitates buying and selling of stocks. E*TRADE, Charles Schwab, and Robinhood are examples.

Market Orders vs. Limit Orders:

Market Order: A request to buy or sell a stock at the current market price.

Limit Order: A request to buy or sell a stock at a specific price or better.

Basic Strategies:

Long-Term Investing:

Buy and hold stocks for an extended period, aiming for long-term growth.

Day Trading:

Buy and sell stocks within a single trading day, taking advantage of short-term price movements.

Diversification:

Spread investments across different stocks and industries to reduce risk.

Financial Metrics:

Earnings Per Share (EPS):

Company's profit divided by the number of outstanding shares.

Price-to-Earnings Ratio (P/E):

Current stock price divided by earnings per share. Indicates how much investors are willing to pay for a company's earnings.

Dividends:

Payments made by some companies to shareholders. Typically a portion of profits.

Risks:

Market Risk:

The overall market can fluctuate, affecting all stocks.

Company-Specific Risk:

Individual companies face risks such as competition, management issues, etc.

Volatility:

The extent of price fluctuation. High volatility can mean higher potential returns but also higher risk.

Tips for Beginners:

Educate Yourself:

Learn the basics and stay informed about market trends.

Diversify:

Don't put all your money into one stock. Diversification helps manage risk.

Start Small:

Begin with a small investment and gradually increase as you gain experience.

Stay Informed:

Keep up with financial news and company reports.

Long-Term Perspective:

Don't get swayed by short-term market fluctuations. Think long-term.

One of the best way to start studying the stock market to Join India’s best comunity classes Investing daddy invented by Dr. Vinay prakash tiwari . The Governor of Rajasthan, the Honourable Sri Kalraj Mishra, presented Dr. Vinay Prakash Tiwari with an appreciation for creating the LTP Calculator.

LTP Calculator the best trading application in india.

You can also downloadLTP Calculator app by clicking on download button.

Remember, investing always involves risks, and it's essential to do thorough research or consult with a financial advisor before making investment decisions.

0 notes