#Bajaj finance deposits

Text

Senior Citizens FDs: This NBFC offers special fixed deposits at 7.45% rate

Fixed deposits are the easiest and safest form of savings scheme to grow your income. They are risk-free and come with guaranteed returns. Senior citizens are the biggest beneficiaries of having FDs. Banks, NBFCs, and other financial institutions do offer fixed deposits scheme with attractive interest rates. Notably, NBFC major Bajaj Finance offers special FDs which give a 7.2% rate to citizens…

View On WordPress

#bajaj finance#Bajaj finance deposits#Bajaj Finance FD rates#bajaj finance fixed deposits benefits#Bajaj Finance fixed deposits interest rates#bajaj finance fixed deposits minimum amount#bajaj finance fixed deposits offers#bajaj finance news#Bajaj Finance senior citizens 7.45% interest rate#Bajaj Finance senior citizens FD rates#Bajaj Finance special FDs interest rates#Bajaj Finance special fixed deposits#fixed deposit

0 notes

Text

Invest in High-Return Bonds and Debt Securities in India | Altifi.ai

With AltiFi, you can invest in bonds and debt securities from leading institutions, including financial institutions, large and emerging mid sized corporates, start ups, and unicorns Our products are backed by high standards of corporate governance, and we offer a variety of investment options to meet your individual needs

#bonds#investinbonds#bondsinindia#corporatebonds#debtseccurities#altifi#Fixed deposit#types of bonds#bonds india#Bond market#Invest in bonds India#Bajaj finance limited fd#how to invest in bond

1 note

·

View note

Text

How to Get Instant Help on Term Deposit in India

0 notes

Text

Bajaj Finance Fixed Deposit: Empowering the women of today to grow their savings

Bajaj Finance Fixed Deposit: Empowering the women of today to grow their savings

Bajaj Finance Fixed Deposit: Empowering the women of today to grow their savings

Bajaj Finance Fixed Deposit: Empowering the women of today to grow their savingsFinancial independence empowers an individual to live a fulfilling life. Therefore, it is of utmost importance to have your finances organised to feel confident you can have decent spending capacity and have a fall-back option in case of…

View On WordPress

0 notes

Text

Why It's the Perfect Time to Invest in Fixed Deposits

In the world of personal finance, timing is everything. And right now, the timing couldn't be better to consider investing in Fixed Deposits (FDs). Here's why:

Interest Rates Worldwide Are Peaking :

Across the globe, interest rates have hit their highest point in recent times. Central banks are maintaining interest rates at higher levels to stabilize economies. This translates to a higher fixed deposit interest rate.

RBI Signals Potential Rate Cuts :

Reserve Bank of India (RBI) has also signaled at future rate cuts. With India's GDP showing strong growth, the RBI aims to sustain this momentum. Rate cuts could be on the horizon, meaning the current high-interest-rate environment may not last long.

When the RBI cuts rates, banks and NBFCs usually follow suit by lowering the fixed deposit interest rate. This means the attractive rates we're seeing now might not stick around for long.

By investing in Fixed Deposits(FDs) now, you can lock in the higher interest rates before they potentially drop. It's a simple move that could pay off big in the long run.

In summary, the timing couldn't be better for Fixed Deposit investors. With interest rates reaching their peak globally and the possibility of rate cuts on the horizon, now is the perfect moment to consider investing.

Additionally, it's worth noting that Fixed Deposits offered by Housing Finance companies& NBFCs provide higherinterest rates than traditional banks, adding another layer of appeal to this investment avenue.

Don't hesitate – take advantage of this opportune time in the financial market and make the most of potential higher return.

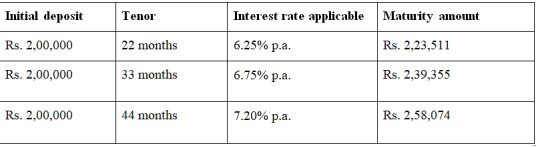

The following are the Interest Rates for Fixed Deposits offered -:

Rate

HDFC fixed deposit interest rate:-7% - 7.75%

PNB fixed deposit interest rate:- 6.79% - 7.40%

Mahindra Finance fixed deposit rates:-7.05% - 8.05%

Bajaj Finserv fixed deposit rates :-7.11% - 8.35%

Shriram Finance fixed deposit rates:- 7.34% - 8.50%

0 notes

Text

Bajaj Finance FD 8100: Secure Investments with Confidence

Elevate your financial portfolio with Bajaj Finance Limited FD 8100. This feature-rich fixed deposit from a trusted financial company offers stability, attractive interest rates, and flexible tenure options. Explore a reliable avenue for wealth creation and financial security.

Visit Us: https://altifi.ai/

0 notes

Text

How To Close A Fixed Deposit Account Before Maturity

Have you found yourself in a situation where and How To Close A Fixed Deposit Account Before Maturity? Life is unpredictable, and sometimes financial needs arise that require immediate attention. In this article, we will guide you through the simple steps to close a Fixed Deposit account before maturity without any hassle.

How To Close A Fixed Deposit Account Before Maturity

Closing a fixed deposit account before maturity may seem like a complicated process, but with a bit of understanding and guidance, it can be done smoothly. Whether you need funds for an unexpected expense or want to explore better investment opportunities, here's a simple guide to help you navigate through the steps of closing a fixed deposit account before its maturity date.

How To Close A Fixed Deposit Account Before Maturity Offline

1. Understand the Terms and Conditions:

Before taking any action, familiarize yourself with the terms and conditions of your fixed deposit account. Look for information regarding premature withdrawal, penalties, and procedures.

2. Visit Your Bank:

To close a fixed deposit account before maturity, you'll need to visit your bank in person. Locate the nearest branch and head over to the customer service or banking counter.

3. Carry Identification Documents:

Ensure you have the necessary identification documents with you, such as your government-issued ID, PAN card, and a copy of your fixed deposit certificate.

4. Speak to a Bank Representative:

Approach a bank representative and express your intention to close the fixed deposit account before maturity. Provide them with your account details and fixed deposit certificate for verification.

5. Request the Closure Form:

Ask the bank representative for the premature closure form. This form is specifically designed for customers looking to close their fixed deposit accounts before the agreed-upon maturity date.

6. Fill Out the Closure Form:

Carefully fill out the closure form, providing accurate details about your fixed deposit account, including the account number, maturity date, and the reason for premature withdrawal.

7. Understand the Penalty:

Be aware that premature closure of a fixed deposit usually incurs a penalty. The penalty amount varies from bank to bank, so make sure you understand the financial implications before proceeding.

Bank Name

Premature Withdrawal Charges

SBI

0.50% – 1%

ICICI Bank

0.50% – 1%

Axis Bank

1%

HDFC Bank

1%

Kotak Mahindra Bank

0.50%

IDFC First Bank

1%

Union Bank of India

1%

Canara Bank

1%

IDBI Bank

1%

Punjab National Bank

1%

Bank of India

0.50% – 1%

Citibank

1%

Bank of Baroda

1%

STFC Fixed Deposit

2% – 3%

Bajaj Finance FD

0.55% – 1%

8. Receive the Amount:

Once the closure form is submitted and processed, the bank will release the funds into your linked savings or current account. Confirm the transaction details with the bank representative.

9. Update Passbook or Statement:

If your bank provides a physical passbook or statement for your fixed deposit account, ensure that it is updated to reflect the closure. This documentation is essential for maintaining accurate financial records.

10. Confirm Closure in Writing:

Request a written confirmation of the closure of your fixed deposit account. This document serves as proof and can be handy for future reference.

How To Close A Fixed Deposit Account Before Maturity Online

Are you wondering *how to close a Fixed Deposit account before maturity online*? It's not as complicated as it might seem. Here's a straightforward guide for you:

1. Log In to Your Online Banking Account:

Open your web browser and log in to your online banking account where your Fixed Deposit is held.

2. Locate the Fixed Deposit Section:

Look for the section dedicated to Fixed Deposits. It might be under the 'Accounts' or 'Investments' tab.

3. Identify the Close or Withdraw Option:

Once you're in the Fixed Deposit section, search for the 'Close' or 'Withdraw' option. It's usually prominently displayed.

4. Fill Out the Closure Form:

You might be required to fill out an online closure form. Provide the necessary details, including your account information and reasons for premature closure.

5. Confirm Closure Terms:

Review the terms and conditions related to premature closure. Ensure you understand any penalties or fees associated with closing the Fixed Deposit before maturity.

6. Submit the Request:

After filling out the form and understanding the terms, submit your request for closure.

7. Await Confirmation:

Once you've submitted the request, wait for confirmation from your bank. This might be via email or a notification within your online banking portal.

FAQ:

Q: Can I close my Fixed Deposit (FD) with SBI before it reaches maturity?

A: Yes, you can, SBI allows premature withdrawal of FDs.

Q: Is it possible to withdraw money from a Fixed Deposit before the maturity date?**

A: Yes, it is possible to withdraw money from a Fixed Deposit before maturity, but it comes with certain conditions.

Conclusion:

Closing a fixed deposit account before maturity is a financial decision that requires careful consideration. By following these simple steps and being aware of the associated terms and penalties, you can efficiently navigate the process and access your funds when needed. Always consult with your bank if you have any questions or concerns regarding the premature closure of your fixed deposit account.

Read the full article

0 notes

Text

Grow Your Money Safely with Exciting Bajaj Finance FD Rates

Source – Business Upside India

Growing your money is crucial in light of the constantly rising rate of inflation. The best method to grow your money is through investing in mutual funds and the stock market, but there are hazards involved. What then is your most secure guess? Of course, fixed deposits (FDs) are the answer. However, the returns on your FDs from conventional banks are extremely poor. And this is the intervention of Bajaj Finance. A reputable name in the financial industry, Bajaj Finance provides you with a safe sanctuary for your hard-earned money while guaranteeing you a competitive return. You have to utilise the FD rates offered by Bajaj Finance.

Understanding Bajaj Finance FD rates

A non-banking financial company called Bajaj Finance provides FDs with terms varying from one year to five years. Investors are drawn to it by its attractive interest rates, which aim to optimise profits. Their favourable interest rates are higher than those of conventional baking establishments. The interest rates are influenced by various factors, including the length of the FD, new or current customers, etc. In addition, you can select cumulative or non-cumulative FDs based on your preferences.

Read More

1 note

·

View note

Text

Why Should You Add Bajaj Finance Digital Fixed Deposits to Your Portfolio

Investors are constantly on the lookout for investment avenues that provide stability, growth, and convenience all together. Amidst the many available options, FixedDeposits (FDs) have consistently held their ground as a reliable choice, providing a secure option for financial growth. BajajFinance has introduced a game-changer – the Digital FD which is only available via the Bajaj Finserv website…

View On WordPress

0 notes

Text

Personal Loan in Delhi without Income Proof

A personal loan can be a valuable financial tool to meet various needs, from funding a wedding or a vacation to covering medical expenses or debt consolidation.

However, traditional lenders often require income proof as a crucial criterion to assess a borrower's creditworthiness before approving a personal loan.

Collateral-Based Loans

One option for obtaining a personal loan without income proof is to opt for a collateral-based loan.

In this arrangement, you pledge an asset, such as property, fixed deposits, gold, or valuable items, as collateral against the loan.

The lender evaluates the value of the asset and offers a loan amount based on the collateral's worth. Collateral provides security to the lender, mitigating the risk associated with the absence of income proof.

Bank Statement Loans

Some financial institutions offer personal loans based on the applicant's bank statements rather than conventional income proofs.

Lenders assess the applicant's transaction history, average monthly credits, and account balance to gauge their repayment capacity.

A healthy bank statement with consistent deposits can improve the likelihood of loan approval, even without formal income documents.

Co-Applicant or Guarantor

Adding a co-applicant or a guarantor with a stable income and good credit history can significantly increase your chances of getting a personal loan without income proof.

The co-applicant's or guarantor's income and creditworthiness act as a reassurance to the lender, making them more confident about granting the loan.

Peer-to-Peer (P2P) Lending Platforms

P2P lending platforms have emerged as an alternative source of personal loans. These platforms connect borrowers directly with individual lenders.

Some P2P lenders may be more flexible in their eligibility criteria, allowing borrowers without income proof to state their financial situation and seek funding from willing lenders.

Non-Banking Financial Companies (NBFCs)

NBFCs are financial institutions that offer various loan products, including personal loans. Some NBFCs may have more relaxed income proof requirements compared to traditional banks.

They often consider factors beyond formal income documentation to assess a borrower's creditworthiness.

Some Popular Private Personal Loan Providers in Delhi

Vintage Finance

HDBFS

Bajaj Finance

Piramal Capital Housing Finance

Muthoot Finance

In Conclusion

Securing a personal loan in Delhi without proof of income is difficult, but not impossible. Alternative choices, such as collateral-based loans, bank statement loans, and P2P lending platforms, might provide opportunities for those with unusual revenue sources. Before accepting a loan offer, it is critical to do research on several lenders and compare interest rates, processing costs, and conditions.

0 notes

Text

Innovative Approaches For Net Interest Margin Improvement In Financial Institutions

In the ever-evolving world of finance, staying ahead of the game is crucial for financial institutions. One significant aspect that demands attention is the Net Interest Margin (NIM) – a key indicator of a bank's profitability. As interest rates fluctuate and competition intensifies, financial institutions are constantly seeking innovative ways to boost their NIM. In this article, I'll explore some creative approaches that can help financial institutions improve their NIM and stay on the cutting edge.

1. Data-Driven Decision Making: The Power of Insights

Data is the new goldmine in the financial world. By analyzing customer behavior, preferences, and spending patterns, institutions can tailor personalized offers and optimize pricing. Data-driven decision-making can lead to better risk assessment, smarter lending, and increased NIM.

Also Read: The Future of Banking: Digital Transformation and the Era of Neo Banks

2. Fee-Based Revenue: Beyond Interest Income

Financial institutions can explore fee-based revenue streams to supplement interest income. By offering value-added services like wealth management, insurance, and advisory services, banks can diversify their revenue sources and boost NIM.

3. Embracing Technology: The Digital Revolution

Incorporating technology is no longer an option; it's a necessity. Leveraging digital platforms can streamline processes, reduce operating costs, and enhance customer experience. Finance experts like Abhay Bhutada, MD of Poonawalla Fincorp, and Sajiv Bajaj, MD of Bajaj Finance strongly believe in technology-driven lending. With online banking, mobile apps, and AI-powered chatbots, financial institutions can attract tech-savvy customers while improving efficiency.

4. Targeted Marketing: The Art of Cross-Selling

Knowing your customers is essential for effective cross-selling. By identifying their needs and preferences, banks can offer relevant products and services, leading to increased customer loyalty and higher NIM through repeat business.

5. Risk Management: Balancing Returns and Safety

Achieving the perfect balance between risk and reward is a delicate skill. Financial institutions must adopt robust risk management practices to minimize credit losses and non-performing assets. A well-managed loan portfolio can lead to higher interest income and improved NIM.

6. Efficient Asset-Liability Management: The Financial Puzzle

Financial institutions must manage their assets and liabilities effectively to optimize NIM. By matching the maturity and interest rate characteristics of assets and liabilities, banks can mitigate interest rate risks and capitalize on favorable market conditions.

7. Relationship Banking: Building Trust and Loyalty

Building strong relationships with customers is a win-win strategy. Financial institutions that focus on personalized services, timely support, and customer satisfaction tend to enjoy higher customer retention rates, leading to improved NIM over the long term.

8. Capitalizing on Low-Cost Funding Sources: The Smart Borrowing

Strategically tapping into low-cost funding sources like retail deposits can reduce borrowing costs for financial institutions. By offering attractive deposit rates, banks can attract more customers and secure stable funding for lending activities.

Also Read: Unlocking The Secrets Of Compound Interest

Conclusion

In conclusion, net interest margin improvement is crucial for the success of financial institutions. By embracing innovation, leveraging technology, and focusing on customer relationships, banks can navigate the dynamic financial landscape and secure a prosperous future.

#customer satisfaction#risk management#relationship banking#finance#digitalization#Net interest margin#financial institutions

0 notes

Text

9th Car Distributed In Two Months.. OHITWORKS.net

Documentation beats conversation Drive Your Dream Car for $33 a month*

(terms & conditions apply)

No Credit Check

No Deposit

No Financing

No Insurance Payments

No Maintenance Cost

No Tax/Tag Payments

All you do is put gas in it & DRIVE!

Ask me how comment below---> OhitWorks.net <---

Let's Welcome Our New Members !!

To “MY CAR CLUB”

Where you can drive your dream car for just $33 a month. “Membership has its privileges” 🚙💵🏆

Arsenia Espinal,

Ashley Marshall,

Abbie Abang,

Elizabeth Esther,

Keisha Sanchez,

Carlos Wiley,

Seth Michael,

James JR Hicks,

James JaiDiddy Bowens,

Ahesha Catalano,

Dwayne Tyga Ruffin,

Jermaine Johnson,

Altaneshya Re'jh Gordon,

Darius Hester,

Lenora Rich,

Janice Darby-Coleman,

Revan S T Naik,

Anthony Gomes,

Jacqueline Marquez,

Shauntel Beauvais,

Heather Hodges,

Karla Wiley,

Edit Erdősi,

Paras Bajaj,

Nikole Carpenter,

Katara Clark,

Michaeline Johnson,

Celesta Williams,

Phidelmah Lovelleen Phiri,

Beck Neil,

Don Millions,

David Castro,

John Jt Thomas,

Carlos Collier,

Joella Phillip,

Shwand Washington,

Trey Johnson,

Princess Mayte,

Rakeeb Jannathee,

Constance Hughes,

Shaunna Allen,

Stacy Grant,

Gwendolyn Webster,

Brittany MsPriss Williams,

Kevin E. Young,

Jeannette McAdory,

Tasha Holliday,

P'Angela Jones,

Kahadeja Streater,

Carol Chandler,

Tahdra Harrison,

Jerald J. Evans,

Daqqualla Conwright,

James Highstakes Gray Jr.,

T-raw Davis,

Jacoby Rice,

Quincy Wells,

Laura Kathleen Saul,

Chino Lucci,

Lynnette Beamon,

Theo Strong,

Turtle Hickman,

Dicaprio ThecreditPrince Leaderhouse,

Corey Clemons,

Djnothin Nice,

Dedee Marquez,

Ashleigh Bryant,

Heather Hodges,

Dwayne M. Golden,

Allegra Collins,

Chris Ant,

Michelle Gilford,

EastTexas Starsfootball,

Carl OhitWorks Greene,

Mandee N Adam,

Kendrick Wakefield,

Bryan Riser,

Latanya Gerald Ruffin,

Maricruz Saucedo,

James Davis Jr.,

Daniel Borrego,

RoadRunna Freeway,

Kas Pat,

Jey Praise,

Alexandria Bamborough,

Tabitha Vance,

Loyetta Corbyn,

Key Note,

Saladine EL,

Germaine Monroe,

Queenie Annette,

Laura Weathersby,

Ashley Jackson,

Nora Jones,

Demetra Glaze-Harris

0 notes

Link

Is Bajaj Finance Fixed Deposit the Safest Investment Option in 2023?

0 notes

Link

#AUMgrowth#BajajFinance#bankinglicense#bearishbias#BollingerBands#customeracquisitions#digitalecosystem#fintechinitiatives#loangrowth#loantrajectory#NBFC#netinterestmargin#NIMcompression#oversoldzone#paymentslandscape#RoE#stockmarket#targetprice#Tractor

0 notes

Text

Bajaj Finance Hikes FD Rates, Investors can Earn Upto 8.2% Return- Check New Rates of Fixed Deposits

Depositors under the age of 60 might earn up to 7.95 percent annually. Non-senior individuals can take advantage of FD interest rates of up to 7.75 percent per annum.

source https://zeenews.india.com/personal-finance/bajaj-finance-hikes-fd-rates-investors-can-earn-upto-8-2-return-check-new-rates-of-fixed-deposits-2579935.html

View On WordPress

0 notes

Text

Earn Up To 8.1% Interest Rate On This Non-Bank FD; Check Details About NBFC Bajaj Finance's FD

Last Updated: February 06, 2023, 16:22 IST

Check details about Bajaj Finance’s fixed deposit.

Bajaj Finance is offering FD rates for investors up to 8.10 per cent per annum on their deposits

Bajaj Finance FD: Given the current market scenario and volatility, investing in a fixed-income instrument that gives profitable returns is a smart call. It not only diversifies your investments but also…

View On WordPress

0 notes