#bajaj finance fd rates

Text

Grow Your Money Safely with Exciting Bajaj Finance FD Rates

Source – Business Upside India

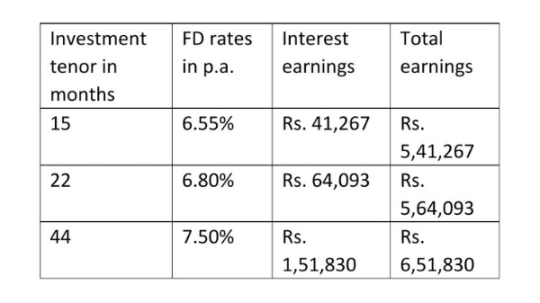

Growing your money is crucial in light of the constantly rising rate of inflation. The best method to grow your money is through investing in mutual funds and the stock market, but there are hazards involved. What then is your most secure guess? Of course, fixed deposits (FDs) are the answer. However, the returns on your FDs from conventional banks are extremely poor. And this is the intervention of Bajaj Finance. A reputable name in the financial industry, Bajaj Finance provides you with a safe sanctuary for your hard-earned money while guaranteeing you a competitive return. You have to utilise the FD rates offered by Bajaj Finance.

Understanding Bajaj Finance FD rates

A non-banking financial company called Bajaj Finance provides FDs with terms varying from one year to five years. Investors are drawn to it by its attractive interest rates, which aim to optimise profits. Their favourable interest rates are higher than those of conventional baking establishments. The interest rates are influenced by various factors, including the length of the FD, new or current customers, etc. In addition, you can select cumulative or non-cumulative FDs based on your preferences.

Read More

1 note

·

View note

Text

Bajaj Finance increased FD interest rates, know key features of Bajaj Finance FD

Bajaj Finance increased FD interest rates, know key features of Bajaj Finance FD

0 notes

Text

Why It's the Perfect Time to Invest in Fixed Deposits

In the world of personal finance, timing is everything. And right now, the timing couldn't be better to consider investing in Fixed Deposits (FDs). Here's why:

Interest Rates Worldwide Are Peaking :

Across the globe, interest rates have hit their highest point in recent times. Central banks are maintaining interest rates at higher levels to stabilize economies. This translates to a higher fixed deposit interest rate.

RBI Signals Potential Rate Cuts :

Reserve Bank of India (RBI) has also signaled at future rate cuts. With India's GDP showing strong growth, the RBI aims to sustain this momentum. Rate cuts could be on the horizon, meaning the current high-interest-rate environment may not last long.

When the RBI cuts rates, banks and NBFCs usually follow suit by lowering the fixed deposit interest rate. This means the attractive rates we're seeing now might not stick around for long.

By investing in Fixed Deposits(FDs) now, you can lock in the higher interest rates before they potentially drop. It's a simple move that could pay off big in the long run.

In summary, the timing couldn't be better for Fixed Deposit investors. With interest rates reaching their peak globally and the possibility of rate cuts on the horizon, now is the perfect moment to consider investing.

Additionally, it's worth noting that Fixed Deposits offered by Housing Finance companies& NBFCs provide higherinterest rates than traditional banks, adding another layer of appeal to this investment avenue.

Don't hesitate – take advantage of this opportune time in the financial market and make the most of potential higher return.

The following are the Interest Rates for Fixed Deposits offered -:

Rate

HDFC fixed deposit interest rate:-7% - 7.75%

PNB fixed deposit interest rate:- 6.79% - 7.40%

Mahindra Finance fixed deposit rates:-7.05% - 8.05%

Bajaj Finserv fixed deposit rates :-7.11% - 8.35%

Shriram Finance fixed deposit rates:- 7.34% - 8.50%

0 notes

Text

Bajaj Finance FD 8100: Secure Investments with Confidence

Elevate your financial portfolio with Bajaj Finance Limited FD 8100. This feature-rich fixed deposit from a trusted financial company offers stability, attractive interest rates, and flexible tenure options. Explore a reliable avenue for wealth creation and financial security.

Visit Us: https://altifi.ai/

0 notes

Text

My Main Strategy

- Groww Portfolio

- Zerodha Portfolio

- Paytm Portfolio

### Groww Portfolio

Put stocks in here for tracking the worthiness of the stocks over the long term.

- You like it well

- Earning growth is consistent

- Huge earnings potential

- Small enough for hyper growth

- Unique business

### Zerodha Portfolio

Stocks which are out of favour from the markets.

Trading at historical lowest PE, but has good business growth.

- Big enough

- Unique Business

- Lowest PE

- Consistent Earnings Growth

### Paytm Portfolio

Micro cap companies with good potential.

- Unique Business

- Micro Cap

- Huge hyper growth potential.

## Sectoral KB

### NBFC

High CAR is desirable, Bajaj Finance had high CAR at critical juncture (GFC, Covid).

Customer breakup - high share of salaried or consistent income, high auto loans, high consumer durable.

Cost of fund is higher as compared to banks, hence need to lend in segments where interest margin is higher.

Turn around time for money is quite less, as raw material is money and final product is money. You the return from reinvested profits quickly.

RBI has made NPA norms stricter in recent years.

| Institution | Cost of Funds | NIM | Remarks |

| --- | --- | --- | --- |

| NBFC | around 7% | |Comparable to FD rates of the time |

| Banks | 3.5% | 4% |Comparable to repo rate of the time |

Banks don't unsecured loans, whereas for NBFCs they are ideal customers.

#### [[Bajaj Finance Ltd]]

For banks, ideal customer are

- Mortgages

- Auto Loans

- Personal Loans

### Banks

Book Value compounding is important than PE.

High Return on Equity is important too.

Good Management is important, since accounting in banking very arbitrary, one can show same npa in a very attractive way.

Counter Cyclical Lending

High CASA

## Screening Tools and Resources

- [[Screener.in]]

- [[Tickertape]]

- [[Tijori]]

- [[Moneycontrol]] [[Research]]

- Value picker Forum

- India's macro data

- Energy demand

- Oil Import demand

- (link::https://www.indiainvestments.wiki/)

## Investing Strategies

- Intraday trading

- Positional Trading

- HODL

- Securities Lending and Borrowing

- straddle strategy.

- short volatility.

- sell straddle

## Checklist for Shortlisting

(link::https://www.indiainvestments.wiki/stocks/due-diligence-checklist)

==Replace the below with above link==

- Outperform the NIfty 50

- Good Revenue/Sales Growth

- [[Company Fundamental's Glossary#ROCE|ROCE]] >15 | High ROCE

- Profit/Net-Income Growth > 10

- Profit Margin Growth

- Read about the company & sector

- Check the Chart of PE & EPS

- Debt levels

- Promotor Holding Increase

- Product mix is good

- Unique business model.

- Cashflow

- Growth Guidance.

## Unique Businesses

- Titan

- Mapmyindia

- **Elasticrun**, it seems, has managed to crack an elusive code—hyper-scale without upsetting incumbents. Which, in this case, are distributors of FMCG products.

- **Atomionics** - they into using quantum sensors to create the map of the earths crust, so that mining can be made green and more exact process.

- Infoedge

- EaseMyTrip

## Shorthands

### Rule of 72

Divide 72 with rate of return, the number you get is the no of year it takes to double your investment.

## Things that are everyone needs

1. Paints

2. Wires & Cables

3. Medicines

4. FMCG

5. Fashion

6. Fast Food

7. Laptops

8. Batteries

1. Electric Vehicles

2. Mobile

3. Electronics

## Advices

- Lowest PB Ratio

- Put a Keywords Alert on Google or other such sites to know when that particular stock is getting popular aka euphoria

- Boring is Beautiful

- Sit on Cash, if not finding ideas

- Be a Dumpster Diver

- Look at Sector that have tanked due to some problems.

- Small in size, Medium in experience, Large in aspiration and Extra-large in market potential - SMILE

- Look for companies that are going to manufacture laptops.

- Buy companies after a scandal or spooky regulation changes [[#^p1]] [[#^p2]] [[#^p3]]

- Pharmas, etc

- Buy companies that might go bankrupt but has huge moat or historical significance. [[#^p1]] [[#^p4]]

- Look for companies that have moat that is difficult to replicate.

- Stay invested during last and first week of year. Preferably stay invested all the time.

- Nifty Basis Charts for seeing the buying and selling pressures.

- Watch for Dairy Industry for coming decade.

- Bet on aspects that if stayed the same, will result in multi baggers. Look at past performance rather than future speculations.

- Like people, companies have character, which pays off in long term. Bet on that character staying the same.

- Sameness means the persistence of history.

![[Benner-Cycle.webp]]

## Cutouts

## Related

- [[Company Fundamental's Glossary]]

- [[Nifty Index Constituent's Perf Evaluation]]

- [[Interesting Sectors]]

- [[Good Stocks]]

0 notes

Text

Bajaj Finance hikes FD rates by 40 bps, senior citizens earn as high as 8.6%; check new interest rates here

http://dlvr.it/Snr6lx

0 notes

Link

Is Bajaj Finance Fixed Deposit the Safest Investment Option in 2023?

0 notes

Text

Bajaj Finance Hikes FD Rates, Investors can Earn Upto 8.2% Return- Check New Rates of Fixed Deposits

Depositors under the age of 60 might earn up to 7.95 percent annually. Non-senior individuals can take advantage of FD interest rates of up to 7.75 percent per annum.

source https://zeenews.india.com/personal-finance/bajaj-finance-hikes-fd-rates-investors-can-earn-upto-8-2-return-check-new-rates-of-fixed-deposits-2579935.html

View On WordPress

0 notes

Text

Earn Up To 8.1% Interest Rate On This Non-Bank FD; Check Details About NBFC Bajaj Finance's FD

Last Updated: February 06, 2023, 16:22 IST

Check details about Bajaj Finance’s fixed deposit.

Bajaj Finance is offering FD rates for investors up to 8.10 per cent per annum on their deposits

Bajaj Finance FD: Given the current market scenario and volatility, investing in a fixed-income instrument that gives profitable returns is a smart call. It not only diversifies your investments but also…

View On WordPress

0 notes

Link

From higher FD rates for senior citizens to tax benefits, a fixed deposit offers many perks to investors in their golden years. A majority of FD issuers also offer higher interest to seniors, which aids them during retirement since these rates are directly proportional to the payout. It is no wonder that a lot of … The post How Seniors Can Benefit From Bajaj Finance Fixed Deposit Rates and More! appeared first on Viral Bake.

0 notes

Text

Bajaj Finance FD rates are better than those of other banks or financial institutions providing FD interest. Know why you should choose Bajaj Finance.

1 note

·

View note

Text

Bajaj Finance's Fixed Deposit Rates Increased Up To 25 Basis Points

Bajaj Finance’s Fixed Deposit Rates Increased Up To 25 Basis Points

Bajaj Finance Ltd is a deposit-taking Non-Banking Financial Company.(Representational)

Pune:

With effect from December 22, 2022, Bajaj Finance, the lending division of Bajaj Finserv Limited, increased its fixed-deposit (FD) rates by up to 25 basis points for terms of 12 to 24 months. The updated Bajaj Finance FD rates will apply to new deposits as well as renewals of maturing accounts up to Rs 5…

View On WordPress

0 notes

Text

Bajaj Finance has Raised its FD Rates by up to 10 bps. Now Earn Returns up to 7.85 percent p.a.

Bajaj Finance has Raised its FD Rates by up to 10 bps. Now Earn Returns up to 7.85 percent p.a.

The CRISIL AAA/STABLE and [ICRA]AAA(Stable), Bajaj Finance has good news for all its investors. With effect from November 8, 2022, the fixed deposit rates for all investments starting at Rs. 15,000 have been changed. In order to speed up the growth of an investors capital, all investor categories and tenors now get higher FD interest rates up to 7.85% p.a.

Customers under the age of 60 can now…

View On WordPress

0 notes

Text

Bajaj Finance hikes FD interest rates, check new rates

Bajaj Finance hikes FD interest rates, check new rates

Highlights

Bajaj Finance has increased the interest rates on FDs up to Rs 5 crore.

New rates of Bajaj Finance effective from October 7, 2022

Effect of hike in repo rate by RBI

New Delhi. After the increase in the repo rate by the Reserve Bank of India (RBI), banks have also started increasing the interest rates. Apart from increasing the interest rate on loans, interest rates on bank deposits…

View On WordPress

0 notes

Text

Bajaj Finance Fixed Deposit: Enjoy high FD rates and grow your wealth

Bajaj Finance Fixed Deposit: Enjoy high FD rates and grow your wealth

With the recent hikes to the repo rate, many banks, NBFCs, and financial institutions have responded by increasing their FD rates. It is good news for a retail investor looking for a safe and reliable investing avenue. Take this opportunity to book an FD from a leading issuer now and enjoy superior returns over your chosen tenor. Among the many fixed deposit options available, the Bajaj Finance…

View On WordPress

0 notes

Photo

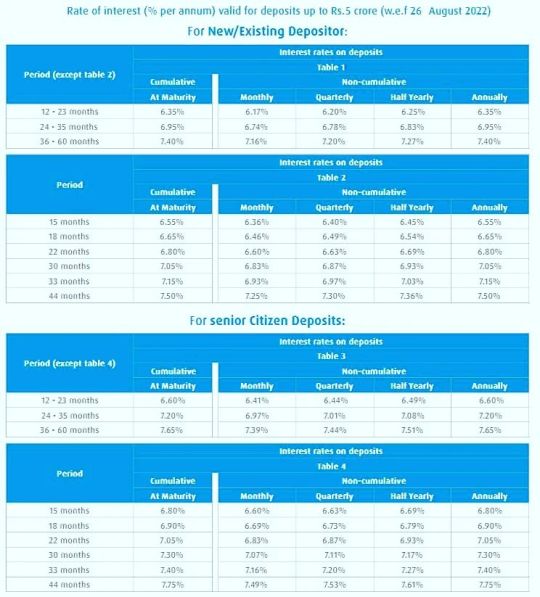

Bajaj Finance FD new deposit rates w.e.f. 26th August 2022. https://www.instagram.com/p/Chrn6ObhyoT/?igshid=NGJjMDIxMWI=

0 notes