#ARPA American Rescue Plan Act of 2021

Text

Solid waste rate proposal to be presented to City Council

New Post has been published on https://aroundfortwayne.com/news/2022/08/05/solid-waste-rate-proposal-to-be-presented-to-city-council/

Solid waste rate proposal to be presented to City Council

Today, the City of Fort Wayne Indiana Administration announced a solid waste rate resolution and ordinance will be introduced to City Council on Tuesday, August 9, 2022.

#ARPA American Rescue Plan Act of 2021#City of Fort Wayne Annual Leaf Collection#City of Fort Wayne Garbage and Recycling Collection#City of Fort Wayne Indiana#City of Fort Wayne Solid Waste Department#City of Fort Wayne Solid Waste Fund#Consumer Price Index#Consumer Price Index for All Urban Consumers#Fort Wayne City Council#Fort Wayne Indiana#G-22-08-04#garbage and recycling#R-22-08-03#Red River Waste Solutions

0 notes

Text

As data continues to accumulate on how local governments are using their flexible funds from the American Rescue Plan Act (ARPA), a picture is forming around the priorities these places sought to address through the first year of the program. Last month, our analysis found that large cities had committed about 40% of the total flexible dollars available to them under ARPA’s State and Local Fiscal Recovery Funds (SLFRF) through the end of 2021—a plurality of which they invested in basic government operations.

While restoring state and local government services and basic fiscal health was a central purpose of ARPA, so too was addressing the economic needs of populations and communities that suffered the most from the pandemic. These included lower-income households and people of color who faced higher rates of unemployment and a lack of basic necessities such as food and housing, as well as historically disinvested communities that saw higher business closures, declines in public safety, and degraded infrastructure. Other statutory SLFRF priorities included public health responses to the pandemic, investments in water and sewer projects, and premium pay for frontline workers.

The latest data from our Local Government ARPA Investment Tracker—a joint project with the National League of Cities and National Association of Counties—sheds light on the degree to which large cities and counties are using their funds to address the needs of these impacted populations and communities. Large cities and counties (those with populations of at least 250,000) report on individual SLFRF-supported projects to the Treasury Department, and the Tracker places each project into one of seven spending groups and one of 41 spending sub-groups, based on its purpose.

This analysis classifies 19 of those sub-groups as principally related to addressing the needs of impacted or historically disinvested populations and communities.[1] It also includes projects outside these categories that recipients classified as providing “services to disproportionately impacted communities” per Treasury’s own reporting system, such as Buffalo, N.Y.’s investment in a low-income neighborhood park, San Diego County’s provision of public transportation subsidies for lower-income young people, or Washington County, Minn.’s investment in new staff capacity to better address socioeconomic disparities in health outcomes.[2]

This approach cannot fully capture the desired intent or practical effect of each city and county’s spending plans. For instance, several cities (e.g., Chicago, San Francisco, Tampa, Fla.) have made generous use of the SLFRF’s revenue replacement provisions. That classification may allow them to reinvest in programs and services that benefit lower-income households and communities, though not necessarily in ways that are apparent in their project reports to Treasury. Moreover, other types of SLFRF investments that don’t by definition address economic disadvantage—say, premium pay for city/county workers, or public goods like water/sewer upgrades—could still combat economic disadvantage, depending on their implementation details. Still, this analysis offers a useful benchmark for where the needs of these populations and places stood within cities’ and counties’ initial prioritization.

A little more than one-quarter of budgeted project dollars explicitly address economic disadvantage

6 notes

·

View notes

Text

One of the most prominent figures in the Republican Party, Florida Governor Ron DeSantis, has announced his intention to run for president in 2024. In his campaign launch, he declared that he would eradicate leftism from the country if he wins the White House. He accused leftists of undermining America's freedom and prosperity, and vowed to undo the policies of the Biden administration that he deemed detrimental to the nation.

However, DeSantis seems to overlook the fact that many of the social and economic policies that Americans benefit from today were fought for by liberals and progressives. The social safety net that the GOP has tried to dismantle for four decades, such as Social Security, Medicare, Medicaid, unemployment insurance, food stamps, and the Affordable Care Act, are all examples of leftist policies that help millions of Americans in need. According to the Center on Budget and Policy Priorities, these programs lifted 47 million people out of poverty in 2019. The civil rights movement, the women's movement, the environmental movement, and the LGBTQ movement are also examples of leftist movements that have advanced the cause of justice and equality in America.

DeSantis also seems to forget that his own state of Florida has benefited from leftist policies. For instance, Florida received $10.2 billion in federal aid from the American Rescue Plan Act of 2021 (ARPA), a stimulus package passed by Democrats without any Republican support. DeSantis used some of that money to fund his $1,000 bonuses for teachers and first responders, which he touted as his own initiative. Florida also relies heavily on tourism and agriculture, two sectors that depend on immigrant workers and climate protection, both of which are issues that leftists care more about than conservatives.

Therefore, DeSantis' rhetoric of wiping out leftism is not only divisive and dangerous, but also hypocritical and ungrateful. He should acknowledge the contributions of leftists to America's history and present, and work with them to find common ground and solutions for the future.

: https://www.cbpp.org/research/poverty-and-inequality/poverty-reduction-programs-help-adults-lacking-college-degrees-the

: https://www.floridapolicy.org/posts/a-guide-to-the-american-rescue-plan-act

: https://www.floridadisaster.org/dem/recovery/american-rescue-plan-act/

0 notes

Link

0 notes

Text

A Comprehensive Guide to Employee Retention Tax Credit

In this write-up, we'll discover the Employee Retention Credit (ERC), a refundable tax credit history created to urge businesses to retain their staff members throughout uncertain economic times. We'll break down what the ERC is, who certifies, exactly how to calculate qualified salaries, how to declare the credit history, and also the role of Form 941-X while doing so. Additionally, we'll deal with whether family members of business owners can be consisted of in the ERC.

What Is the Employee Retention Credit?

The Employee Retention Credit is a provision of the Coronavirus Help, Alleviation, and Economic Safety And Security (CARES) Act introduced in March 2020. It was later broadened under the Consolidated Appropriations Act of December 2020 and also the American Rescue Plan Act (ARPA) of March 2021. The ERC intends to assist businesses affected by the COVID-19 pandemic keep their staff members on pay-roll, maintain operations, and also inevitably recuperate from the situation.

This credit score is refundable for a certain portion of certified earnings that qualified employers pay to their employees. It is claimed on the employer's government work income tax return, minimizing the total quantity of tax obligations owed to the Irs (IRS).

Just how Does the Employee Retention Credit Work?

The Employee Retention Credit is available to eligible employers who have actually experienced a significant decline in gross receipts or were required to fully or partially put on hold operations due to COVID-19. The credit rating is equal to 50% of qualified wages paid to employees, up to an optimum of $10,000 per worker per calendar quarter. This implies that the optimum debt per staff member is $5,000 per calendar quarter.

Qualified wages consist of salaries as well as settlement paid to staff members, in addition to qualified health plan expenses. However, the debt can not be asserted on salaries that are paid using Income Security Program (PPP) financing proceeds that have actually been forgiven.

Companies can assert the credit for earnings paid between March 13, 2020, and December 31, 2021. The credit report is asserted on the employer's government work income tax return, Kind 941. If the debt exceeds the employer's overall federal employment tax responsibility, the excess debt is refundable to the company.

Who Is Qualified for the Employee Retention Credit?

Qualified employers consist of those that experienced a significant decrease in gross receipts or were forced to fully or partly put on hold operations as a result of COVID-19. Companies who had approximately 500 or less permanent employees in 2019 can declare the credit on all incomes paid to workers throughout the eligibility period. Companies that had an average of greater than 500 full-time workers in 2019 can just claim the credit score on wages paid to workers that were not giving solutions because of the COVID-19-related circumstances.

Self-employed people are likewise qualified for the credit scores if they satisfy particular standards. They must have experienced a substantial decrease in gross invoices or be unable to do services due to COVID-19-related circumstances. They have to likewise have one or more certifying businesses that were either partially or fully put on hold as a result of COVID-19.

How To Calculate Qualified Incomes for Employee Retention Credit

Who Gets approved for the Employee Retention Credit?

In order to receive the Employee Retention Credit (ERC), an employer should meet one of the complying with standards:

Have completely or partially suspended procedures as a result of federal government orders related to the COVID-19 pandemic.

Experienced a considerable decrease in gross invoices, specified as a drop of a minimum of 50% in 2020, or 20% in 2021 when contrasted to the same quarter in the previous fiscal year.

Eligibility for the ERC Credit likewise encompasses tax-exempt companies, with details guidelines that relate to governmental employers as well as tribal entities. Freelance people may not claim the ERC for their own earnings however can do so for the salaries they paid to their staff members.

If you're asking yourself whether your service qualifies for the ERC, you're not the only one. The internal revenue service has given advice to aid companies identify their eligibility. If you're still unclear, it's best to consult with a tax professional that can assist you browse the policies and guidelines surrounding the credit score.

What are qualified incomes?

Certified earnings are defined as incomes paid to a staff member throughout the period when the employer is qualified for the ERC. This consists of incomes, tips, and particular health insurance costs. The interpretation of certified wages varies depending upon the size of the employer:

For companies with 100 or less full-time employees in 2020, or 500 or less in 2021, all wages paid to staff members during the eligible duration are taken into consideration certified salaries.

For employers with more than 100 full time staff members in 2020, or more than 500 in 2021, qualified wages are those paid to employees that are not providing solutions due to the suspension of procedures or the decrease in gross invoices mentioned over.

The optimum quantity of qualified earnings that can be taken into consideration for the credit score is $10,000 per staff member in 2020 as well as $10,000 per employee per quarter in 2021.

It is necessary to note that not all earnings paid throughout the eligible period will certainly get the debt. As an example, incomes paid to member of the family of the company might not be eligible. In addition, wages paid to workers that are related to the employer or who possess a considerable portion of the business might undergo additional scrutiny by the internal revenue service.

Companies ought to maintain comprehensive records of all qualified salaries paid throughout the qualified period, consisting of documents of the reasons that certain employees were not providing solutions throughout that time.

If you're considering declaring the ERC, it is essential to act rapidly. The debt is readied to end at the end of 2021, so qualified employers will need to act quick to make use of this beneficial tax obligation break.

Exactly how To Claim the Employee Retention Credit

Are you a company looking to declare the Employee Retention Credit (ERC)? The ERC is a refundable tax credit report made to motivate services to maintain employees on their pay-roll throughout the COVID-19 pandemic. Here's a detailed guide on how to declare the ERC:

youtube

Step 1: Determine Your Eligibility

Before you can declare the ERC, it is necessary to identify whether you're eligible. Typically, companies that experienced a significant decrease in gross invoices or were required to put on hold procedures because of government orders are eligible for the credit history. Nonetheless, there are specific constraints as well as restrictions that apply, so it's important to assess the internal revenue service guidelines very carefully.

Action 2: Compute Your Credit Report Quantity

The ERC is equal to 50% of certified incomes paid to workers between March 12, 2020, and December 31, 2021. The optimum credit quantity per employee is $5,000. To calculate your credit score quantity, you'll require to determine the number of certified staff members as well as the overall quantity of qualified incomes paid during the eligible period.

Action 3: Send Kind 941

Companies assert the ERC on their government work tax return, usually by submitting Type 941, Company's Quarterly Federal Tax Return. Along with providing information concerning your payroll tax obligations, you'll need to include info about your ERC estimations and any other relevant credit ratings or changes.

Step 4: Wait for Reimbursement or Carryforward

The credit rating is used against the company's share of Social Security tax obligations, with any kind of excess debt reimbursed or continued to balance out future employment tax obligation obligations. If you're qualified for a refund, you must obtain it within a few weeks of submitting your tax return. If you're carrying the credit onward, make sure to keep precise records of your calculations as well as any carryforward amounts.

In general, claiming the ERC can be a complicated process, however it can supply considerable financial alleviation to eligible companies. If you have questions or need aid, consider talking to a tax obligation professional or getting in touch with the internal revenue service directly.

What is Form 941-X as it relates to the Employee Retention Credit?

Form 941-X is a Modified Employer's Quarterly Federal Tax Return or Claim for Reimbursement, used to correct mistakes on formerly filed Types 941. Employers that uncover mistakes in their work tax returns after submitting them can make use of Type 941-X to make necessary adjustments or claim reimbursements.

In the context of the Employee Retention Credit (ERC), companies that have actually determined extra qualified salaries and also are qualified for a higher credit scores amount can file Form 941-X to ask for an adjustment or reimbursement of overpaid tax obligations related to the ERC. This is specifically pertinent for companies who were influenced by the COVID-19 pandemic and also had to shut their organizations or experienced a substantial decline in gross receipts.

The ERC is a refundable tax obligation credit scores that was introduced as part of the Coronavirus Aid, Relief, and Economic Security (CARES) Act in 2020. The credit report is made to urge companies to maintain their workers on pay-roll during the pandemic as well as is equal to 50% of qualified wages paid to employees, approximately an optimum of $10,000 per worker per quarter.

Certified salaries include earnings and also settlement paid to workers between March 13, 2020, and December 31, 2021. Eligible employers consist of those who experienced a full or partial suspension of operations due to government orders related to COVID-19 or had a considerable decrease in gross invoices compared to the very same quarter in the previous year.

Employers that asserted the ERC on their quarterly Kind 941 yet later on identified extra qualified earnings can file Type 941-X to claim the extra credit. The kind must be filed within three years of the original Form 941 filing date. It is important for employers to keep exact documents of their certified salaries and seek advice from a tax professional to guarantee they are asserting the appropriate quantity of the ERC.

In summary, Form 941-X is a beneficial device for employers that need to correct errors or case refunds connected to their employment income tax return. In the context of the ERC, employers can use Type 941-X to case additional credit reports and also recoup overpaid taxes. As the pandemic continues to influence companies, it is important for companies to stay informed regarding the most recent tax credit scores and also motivations offered to them.

Can relative of the business proprietors be included in the ERC Credit rating?

According to the internal revenue service, specific relative of entrepreneur are not qualified to have their wages taken into consideration as certified incomes for the Employee Retention Credit (ERC). This is because the purpose of the ERC is to incentivize companies to maintain their staff members on the payroll, rather than incentivizing companies to pay their relative.

The disqualified member of the family consist of youngsters or a descendant of a child, brothers, siblings, stepbrothers, or stepsisters, fathers, moms, or forefathers of moms and dads, stepfathers or stepmothers, nieces or nephews, aunts or uncles, as well as sons-in-law, daughters-in-law, fathers-in-law, mothers-in-law, brothers-in-law, or sisters-in-law.

Find out more

It is essential to keep in mind that while member of the family may not be qualified for the ERC, various other employees may still qualify. Qualified staff members have to have been used by the employer during the appropriate amount of time as well as need to have experienced a reduction in hrs or earnings because of the COVID-19 pandemic.

Along with understanding the eligibility standards for the ERC, it's likewise crucial for companies to understand the procedure of determining and also declaring the credit. The quantity of the debt is based upon a percent of qualified salaries paid to qualified workers during the relevant amount of time. Employers can declare the credit report on their quarterly employment income tax return or can request a development repayment of the debt from the internal revenue service.

Finally, recognizing the Employee Retention Credit as well as the process of calculating and also claiming it can considerably benefit services affected by the COVID-19 pandemic. Employers ought to thoroughly examine the eligibility criteria, certified salaries, and certified approaches for declaring the ERC to ensure they receive the proper credit scores to assist maintain their workforce as well as maintain procedures throughout these challenging times. By doing so, businesses can not only make it through however grow despite adversity.

1 note

·

View note

Text

HOW TO PREPARE FOR A SUCCESSFUL DCAA AUDIT

We're arriving at the finish of the bookkeeping course, so we should assemble this all at this point. We should accept that you've recently been informed that DCAA is sending an examiner to your office. Everybody is anxious whenever they first get this news. Yet, there are various ways that you can lessen the pressure both in anticipation of a review and as the review is happening. Knowing what's in store during a review offers you the chance to get ready appropriately and have the certainty to answer even the most requesting review questions. US FED Government contracts

In past instructional exercises we've examined the different sorts of reviews a DoD SBIR/STTR awardee may experience. Luckily, the construction and extent of these reviews are very distinct and accessible to general society on the DCAA.mil site. The public authority, as the Protection Agreement Review Organization (DCAA), generally gives you their playbook. As a method of readiness, it could be valuable to get to these assets for the specific review that is being performed. US FED Government Grants

You can likewise find the Registry of Review Projects on the DCAA.mil site, where you can download the review cycle for your specific review. Feel free to inquire as to whether you don't know which review program applies. The language in these directions may not be natural. There's a ton of conversation encompassing the interior DCAA managerial cycles that inspectors should follow. What is useful is the part enumerating the real review steps. US FED Government Compliance

When you knew about the review steps, this can now be your aide in playing out your own inward review, whether it be formal or casual. Playing out a self-review, or a trial run review, will assist you with distinguishing holes in your preparation, admittance to records, and bookkeeping issues that could be revealed during a review. Nothing gets your heart pulsating quicker than an inspector finding a troublesome state of your bookkeeping framework before you do.

see more about American Rescue Plan Act - ARPA 2021

It's valuable to realize that pretty much every review will start, or ought to start, with an entry meeting. The special case for this standard is the timekeeping review, where a DCAA examiner is permitted to visit the project worker unannounced. It bears rehashing that a DCAA consistent timekeeping framework is basic while performing cost-repayment type contracts, including most SBIR Stage II agreements. So groundwork for a timekeeping review is one of a kind in that you could have an unexpected visit by the DCAA whenever. An evaluator may likewise lead a timekeeping review as a feature of another review. Normal preparation and observing the consistence of staff on your timekeeping methodology are the best strategies for groundwork for this specific review. Acquisition Planning

Back to entrance gatherings. This is commonly an eye to eye meeting the DCAA will plan. The evaluator will visit your office and may request a visit and afterward make sense of the reason and extent of the review, alongside their cutoff time for finishing the review. The evaluator might pose general inquiries about the firm as an approach to situating oneself to the remarkable characteristics of your business. Several standard inquiries might be posed to distinguish the chance of extortion. After this for the most part basic meeting, the examiner might plan a return visit to review source material, or may demand electronic conveyance of information and reports. Strategy

The examiner will normally begin with a survey of your bookkeeping reports, for example, your Preliminary Equilibrium or Benefit Misfortune Proclamation. On the off chance that it's a charging review, they will need to survey one of your new vouchers. They will segregate quite a few exchanges from these reports or vouchers, then, at that point, follow those exchanges through the bookkeeping framework back to its source. Capability statement

For instance, travel costs will quite often be evaluated during a review. The examiner will need all the source documentation legitimizing the expense of a specific outing. They will expect some kind of cost report that gives the subtleties expected by the expense guidelines found at FAR 31.205-46. The cost report ought to likewise have the receipts appended that approve the costs. DFAR

For work, the inspector will follow an exchange through the bookkeeping framework as far as possible back to an endorsed timesheet alongside a check stub

See more about DCAA Audit

0 notes

Text

Employee Retention Credit Eligibility | Mainstreet Insurance

Mainstreet Insurance & Financial Services is your one-stop destination for wholesome insurances that cover all aspects of your life. We offer customized services that befit our client's needs and situations.

Employer incentives are one of the services we provide on employee retention tax credits. The most current version of the tax credit was signed into law as a result of the COVID-19 crisis with the CARES Act in 2020. It was then updated by the CAA and then again by ARPA.

The purpose of the tax credit is to keep workers on the payroll during the pandemic. The Employee Retention Tax Credit is an offset to payroll taxes, not an income tax credit. The original credit began March 12, 2020, and its original expiration date was the end of 2020. The Consolidated Appropriations Act of 2021 extended ERC through the first half of 2021, and then the American Rescue Plan (ARPA) extended it through the end of 2021.

1 note

·

View note

Text

St. Louis Mayor Signs Largest Road & Pedestrian Safety Bill

Mayor Tishaura O. Jones Signs St. Louis Safer Streets Bill, Makes City’s Largest-Ever Investment in Road and Pedestrian Safety

The bill fulfills Mayor Jones’ commitment to dedicate at least $40 million in American Rescue Plan Act (ARPA) funds to calm and redesign city streets.

ST LOUIS, MO (STL.News) Joined by Board President Megan E. Green, Board of Public Service President Rich Bradley, and multi-modal transit advocates, Mayor Tishaura O. Jones signed the St. Louis Safer Streets bill (BB120) to make the first citywide investment in road and pedestrian safety. The bill fulfills Mayor Jones’ commitment to dedicate at least $40 million in American Rescue Plan Act (ARPA) funds to calm and redesign city streets.

“Traffic violence tears families and communities apart, and to all those who say they feel scared on our roads: I hear you,” said Mayor Tishaura O. Jones. “Parents in our City are asking ourselves: How can we teach our teenagers how to drive in a city where the rules of the road can feel more like suggestions? This bill makes a historic investment in St. Louis’ infrastructure, prioritizing road safety to help calm our streets while discouraging dangerous driving. Engineering is just one piece of road safety strategy, and the City is also exploring automated enforcement like red light cameras to help hold reckless drivers accountable when they break the law.”

St. Louis Safer Streets will improve road and pedestrian safety through a series of infrastructure projects: Implementing already completed traffic studies that have previously lacked funding; making improvements in ten dangerous, high-crash intersections; and improving main thoroughfares already set for repaving through the St. Louis Infrastructure Act signed last year (Goodfellow, Union, Jefferson, Kingshighway, and Grand). The bill also puts St. Louis on the path to its first-ever mobility and transportation master plan, moving away from a ward-by-ward traffic safety approach to a true citywide effort while opening up opportunities for federal resources currently unavailable to the City.

The investment comes after 2022 was marked the second-deadliest year in the City’s history for traffic violence, which claimed 78 lives. The previously highest year on record, 2020, saw 80 crash deaths. In 2020 nationally, 17 percent of fatal traffic crashes in the U.S. involved pedestrians. In the City of St. Louis, that figure was 28 percent in 2021. In addition, the United States has had a steady increase in the number of pedestrian fatalities from 2010 to 2020. Pedestrian deaths increased by 54 percent, while all other fatalities increased by 13 percent.

“Deploying traffic calming solutions is a multi-step process: Study, design, bids, then construction,” said BPS President Rich Bradley. “Currently, the City has traffic studies in key areas that lack the funding to move forward. This bill will move these studies into the design phase. Once the designs are complete, the work is then bid out. Infrastructure work is complicated and time-consuming, but BPS is moving as quickly as possible towards constructing road and pedestrian safety measures.”

BPS will review the list of possible projects and locations, matching funding to move along the most impactful improvements. The design process for improvements begins in spring 2023, with designers ready to start work. Designs will be complete by the end of this year and the first quarter of 2024. Construction will begin in 2024.

Mayor Jones also stressed that along with engineering, the City would work to improve education and enforcement around current driving laws. In 2022, SLMPD issued 8,132 speeding tickets and 2,718 tickets for signal violations. In addition, Mayor Jones has tasked city departments with exploring the operational use of red light cameras, which have been proven in other cities to reduce crashes, traffic violence, and reckless driving behavior . Any red light camera program deployed by the City would safeguard privacy, ensure due process as outlined by the Missouri Supreme Court, and be continuously assessed for effectiveness and impact on communities of color.

PDF for Board Bill 120

Read the full article

0 notes

Text

The Outlook for the Municipal Bond Market

You need to understand a few things about the municipal bond market, whether you're a long-term or short-term muni investor. We have thoroughly analyzed some of the most important trends you need to be aware of.

The risk of higher inflation remains as the current economy's growth slows. Since it affects the lives of lower-income families, this is an important issue. Additionally, it disproportionately impacts our society's most vulnerable members.

A major threat to the world economy in the upcoming year is inflation. As a result, many forecasters are worried about the danger posed in the upcoming months by high inflation. High inflation is caused by some factors. Product shortages and disruptions in the global supply chain are two. These elements will probably still be present in 2022.

In the first nine months of 2021, the Consumer Price Index grew at an annualized rate of 6.5 percent. Additionally, it is expected to rise to its highest level since 1981. The credit that inflation merits haven't exactly been given, though. The main cause of high inflation is careless fiscal policy, which boosts demand but doesn't always boost supply.

High inflation is also a major threat to the world economy because it can interfere with economic expansion. Additionally, it may prevent lower-income families from rising the economic ladder. Congress may be able to alter the tax code sooner than anticipated, depending on the results of the upcoming federal elections. As a result, the taxable municipal bond market will likely continue to be affected.

Retail investors have driven demand for muni bonds in the past. State and local tax deductions were previously limited by the Tax Cuts and Jobs Act (TCJA), which changed that. As a result, many taxpayers won't be able to itemize their deductions anymore. They can still invest in tax-exempt municipal bonds, though. This may provide a portfolio with diversification and a low correlation to equities.

Tax-exempt municipal bonds have held up well in recent years, especially compared to other fixed-income assets. This indicates that investors will keep looking for top-notch, tax-exempt munis.

In advanced refunding transactions, the TCJA set a limit on using tax-exempt bonds. Due to this, city bond issuers have been unable to refinance debt at low-interest rates. The tax code also restricts the use of tax-exempt bonds to municipal refinancing.

Despite a rough start to the year, the market for municipal bonds has nicely recovered. Overall returns have outperformed the Treasury market, and the Bloomberg Municipal Bond Index's yield is currently at its highest point in more than ten years.

This year has seen significant volatility in the municipal bond market. This reflects the runoff of the Fed's balance sheet and interest rate increases. But the market's underlying fundamentals are sound, and demand for municipal bonds is still high.

States and cities have benefited significantly from federally funded assistance, including the American Rescue Plan Act (ARPA) and the Coronavirus Aid, Relief and Economic Security (CARES) Act, in addition to strong economic growth. States and cities' financial situations have improved thanks to these reliefs. As a result, states, cities, and local governments have made additional tax relief payments.

Despite a rocky start to the year for the municipal bond market, investors still have plenty of opportunities given the strong fundamentals at play. Individual investors should keep the main advantages of municipal bonds in mind.

Your investment goals and risk tolerance will determine the best municipal bond fund for you. Even though there isn't a single index that provides complete exposure to the $4 trillion market, some of the biggest exchange-traded funds (ETFs) provide extensive exposure to the municipal bond market.

Although a broad index may have greater income potential than a narrow index, some risks could hurt the bond's performance. Municipal bonds may also be subject to state and local taxes and interest rate risk.

The iShares National Muni Bond is one of the biggest fixed-income ETFs available if you're interested in investing in the market for tax-exempt municipal bonds. At least 90% of the assets in this fund will be allocated to fixed-income securities that are part of the underlying index.

Municipal bonds can offer opportunities for income as well as interest rate protection. Compared to other market opportunities, they frequently trade at a premium. In highly regarded market segments, the yield advantage might be more significant.

0 notes

Text

March 2022 marked the first anniversary of the passage of the American Rescue Plan Act (ARPA). It also marked nearly one year since states, counties, cities, and tribal governments began receiving their shares of the $350 billion ARPA provided toward public sector fiscal recovery.

Now, we have data on how cities and counties allocated these funds across that first year. Our Local Government ARPA Investment Tracker has been monitoring how large cities and counties are using flexible State and Local Fiscal Recovery Fund (SLFRF) dollars, and the latest update highlights a few key trends for projects funded through March 31, 2022.

As of March, large cities and counties had committed half of their total flexible ARPA dollars

By the end of 2021, large cities and counties (90 cities/consolidated city-counties and 236 counties with populations of at least 250,000) had committed SLFRF dollars to nearly 4,600 specific projects across a range of eligible uses. And they expanded those commitments significantly in the first three months of 2022. By the end of March, large cities and counties had committed funds to more than 6,200 projects—a 35% increase from the prior reporting period.

As the number of committed projects increased, the committed share of total SLFRF dollars grew as well. By the end of March, large cities and counties had budgeted 51% of their combined total allocation ($34 billion of $66 billion overall). Because the Treasury Department delivered the funds to local governments in two roughly equal tranches in May 2021 and May 2022, this 51% figure reflects that cities and counties had, in the aggregate, budgeted their entire first tranche of funding, plus a small share of their second tranche. This figure was up considerably from the 40% of SLFRF dollars they had budgeted through December 2021.

City and county ARPA expenditures grew as well. Through the first quarter of 2022, large cities and counties had expended $11 billion in SLFRF resources—roughly one-sixth (17%) of their total combined allocation. This was up from 10% in December 2021, signaling that the pace of local ARPA budgeting continues to run ahead of ARPA spending.

3 notes

·

View notes

Text

ERTC 2022 Tax Credit

Employee Retention Credit: What It Is And How To Claim

This credit is calculated differently for eligible quarters in 2020 or 2021. Eligible employers can claim up $5,000 per employee in 2020, and up to $7,000 per qualified quarter in 2021. After the American Rescue Plan Act was passed, most employers, including colleges, universities hospitals and 501 organisations, could be eligible for the credit.

The employee retention tax credit

vimeo

The maximum credit was raised to $21,000 with its renewal and expansion as part of the Consolidated Appropriations Act 2021. Businesses had to choose which option to use when the ERC and Paycheck Protection Program were rolled-out under the CARES Act. Many selected PPP because it was easier to sign up for a Small Business Administration-backed loan than to learn the details of eligibility for ERC.

Great news for owners of construction and home improvement service companies that were impacted by Covid-19. Your business could be eligible for the #employeeretentioncredit

Watch this video to find out! #constructionindustry https://t.co/pUTEh0RB3s

— CryptoCrisps (??,??) 9452 (@CryptoCrispsBee) November 11, 2022

Working With Employee Retention Credit

You must have paid employees in the quarter you are claiming credit for. Credits up to $50,000 per calendar quarter for Recovery Startup Companies in Q3 2021 and Q4 2021. The ERC was expected be available for all 2021 under the ARPA and CAA expansions. The Infrastructure Investment and Jobs Act was signed by President Biden in November 15. It ended the ERC retroactively at September 30, 2021, for most employers.

The amounts of these credits will need to be reconciled by the employer at quarter's end on Form 941.

It is important for businesses to understand that they cannot claim a payroll expenses as both an ERTC pay and a forgivable expense on the PPP forgiven application.

Follow BDO?s Tax Policy Watch to see how possible tax law modifications may affect you and your company.

Many companies are now eligible to apply for the 2020 ERC under the Government Mandate Test.

ERC can provide financial relief for businesses that are struggling with keeping their employees.

An employer cannot be considered partially suspended if its business operations were affected by a federal or state order, proclamation, decree or other law.

Karamon and his colleagues answer the most frequently-asked questions about ERC.

Businesses had to choose which option to use when the ERC and Paycheck Protection Program were rolled-out under the CARES Act.

https://ertc2022taxcredit.blogspot.com/2022/11/ertc-2022-tax-credit.html

employee retention credit for staffing agencies

https://www.babbittcu.com/retroactive-filing-for-employee-retention-tax-credit-is-ongoing-through-2024/

https://twitter.com/CryptoCrispsBee/status/1590825637560086529/

https://storage.googleapis.com/v7g/employeeretentioncredit/index.html

https://vz6.z33.web.core.windows.net/employeeretentiontaxcredit/

https://limoservicenyc282.blogspot.com/

https://kraveseo1.tumblr.com/

https://kraveseo1.tumblr.com/rss

https://onlineertcapplicationforresta627.blogspot.com/2022/10/online-ertc-application-for-restaurants.html

https://ir-dr.tumblr.com/

0 notes

Text

(Download Book) J.K. Lasser's Your Income Tax 2022: For Preparing Your 2021 Tax Return - J.K. Lasser Institute

Download Or Read PDF J.K. Lasser's Your Income Tax 2022: For Preparing Your 2021 Tax Return - J.K. Lasser Institute Free Full Pages Online With Audiobook.

[*] Download PDF Here => J.K. Lasser's Your Income Tax 2022: For Preparing Your 2021 Tax Return

[*] Read PDF Here => J.K. Lasser's Your Income Tax 2022: For Preparing Your 2021 Tax Return

Prepare your 2021 taxes with ease! J.K. Lasser's Your Income Tax 2022: For Preparing Your 2021 Tax Return is a bestselling tax reference that has been trusted by taxpayers for over eighty years. Updated to reflect the changes to the 2021 tax code, this authoritative text offers step-by-step instructions that guide you through the worksheets and forms you need to file your taxes according to the best tax strategy for your financial situation. Approachable yet comprehensive, this highly regarded resource offers tax-saving advice on maximizing deductions and sheltering income and provides hundreds of examples of how up to date tax laws apply to individual taxpayers. Additionally, special features inserted throughout the text highlight important concepts, such as new tax laws, IRS rulings, court decisions, filing pointers, and planning strategies. It will include important information that the American Rescue Plan Act (ARPA) and the Consolidated Appropriations Act, 2021 (CAA) have on tax

0 notes

Text

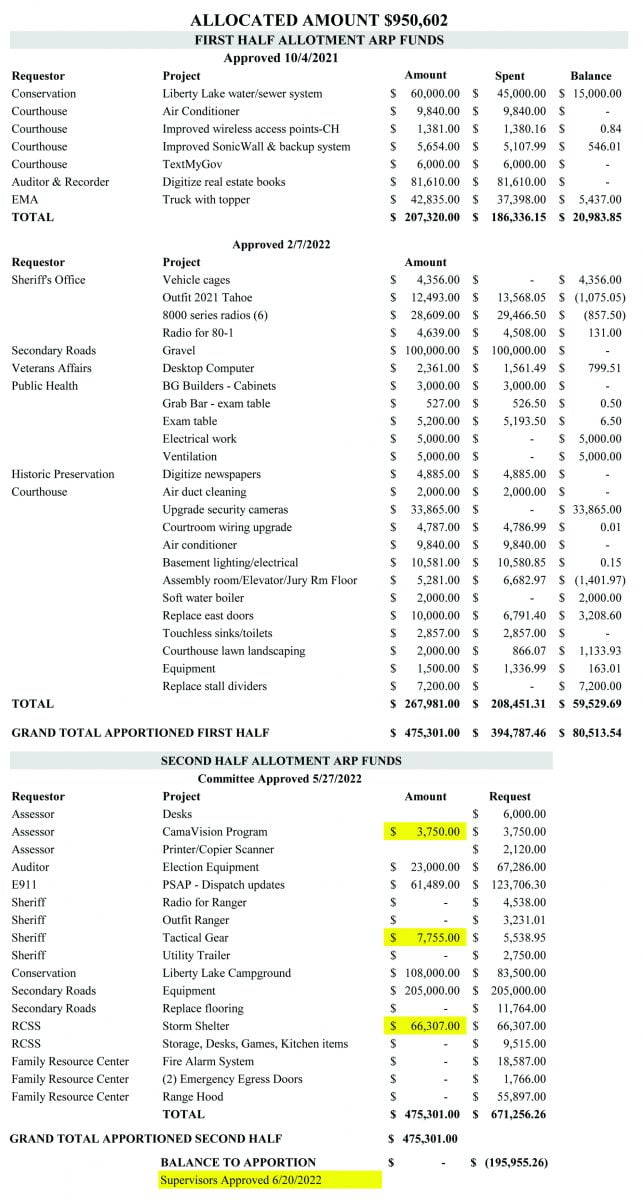

County allots ARPA funding

County allots ARPA funding

by Chanse Hall

Ringgold County received ARPA funds back in 2021, in the amount of $950,602, but what is ARPA?

ARPA stands for American Rescue Plan Act.

The American Rescue Plan Act was signed on March 11, 2021 by President Joe Biden, giving $1.9 trillion to State governments to aid public health and economic recovery from the COVID-19 pandemic.

When ARPA was approved, certain rules governed how…

View On WordPress

0 notes

Link

0 notes