Text

Three Iconic American Companies with Warren Buffett’s Stamp of Approval

Warren Buffett purchased his first Coca-Cola shares in 1988. More than 25 years later, the beverage giant remains one of the billionaire’s top holdings – something that’s not likely to change anytime soon. “We’ve never sold a share of Coca-Cola stock, and I wouldn’t think of selling a share,” he remarked at the annual Coca-Cola shareholders meeting in 2013.

Coca-Cola is more than a “wonderful” company in which Warren Buffett has invested – it’s an iconic one as well. The Oracle of Omaha, an American icon himself, is betting on these three quintessential U.S. companies as well:

Deere & Company (NYSE:DE), better known as John Deere, is a dominant force in agriculture and construction. Founded in 1837, the company is listed 80th on the 2014 Fortune 500 list, ahead of Delta Air Lines, Oracle and Morgan Stanley. It has a $29 billion market cap and over the past decade has produced annualized returns of 13%.

Warren Buffett initiated a position in Deere & Company during the third quarter of 2012 with the purchase of 3.98 million shares – a stake he has maintained ever since. Thus far, the investment has yet to pay off in a big way for the billionaire, as DE is up just +1.95% over the past year. In fact, it has declined more than -8% in 2014. However, Deere & Company is a long-term play for Buffett, and it has an attractive dividend yield of 2.87%.

Johnson & Johnson (NYSE:JNJ) has been in Buffett’s investment portfolio for years, though it’s no longer a protagonist. As of the second quarter of this year, the Berkshire Hathaway head holds 327,000 JNJ shares – just a fraction of the 41.3 million assets he owned during the same period in 2010.

A major player in the health care field, Johnson & Johnson’s reach stretches across 60 countries worldwide. It has a $299.26 billion market cap and a dividend yield of 2.64. This year has been a good one for JNJ, which is up over +15% in 2014. And Buffett isn’t the only billionaire with a stake in the company – Ray Dalio, George Soros and Richard Chilton are shareholders as well.

General Electric Company (NYSE:GE) – and Warren Buffett’s position in it – took many by surprise in February. The billionaire’s 13F filing revealed a 10.59-million-share stake in the company (the result of an exercised warrant on a preferred shares deal made during the financial crisis of 2008). And while Buffett could have cashed in the investment, he has instead held onto his stake in subsequent quarters.

Ranked ninth on this year’s Fortune 500 list, GE’s reach stretches across a number of sectors, including energy, technology, industrials and finance. It has a $263 billion market cap and a dividend yield of 3.35%. GE is down about -6% year to date, but things could very soon turn around as it completes the acquisition of French company Alstom in a $17 billion deal.

#Warren Buffett#Coca-Cola#KO#General Electric#GE#John Deere#Deere & Company#Johnson & Johnson#DE#Berkshire Hathaway#icons#iconic companies#American companies#JNJ

1 note

·

View note

Text

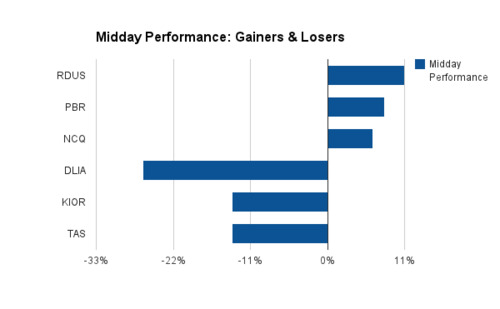

Midday Gainers & Losers (9/16/2014)

Radius Health Inc. (NASDAQ:RDUS), Petroleo Brasileiro Petrobras SA (NYSE:PBR) and Novacopper Inc. (NYSEMKT:NCQ) are today’s top-gaining billionaire stock picks midday. The losers are dELiA*s Inc. (NASDAQ:DLIA), KiOR Inc. (NASDAQ:KIOR) and Tasman Metals Ltd. (NYSEMKT:TAS).

Radius Health Inc. surged +10.98% early in the day this Tuesday. The biopharmaceutical company has had a stellar run in 2014, its price climbing +94.38% year-to-date and +91.28% in the past three months alone. Farallon Capital initiated a 1.3-million-share stake in RDUS in Q2 and has made a nice gain on the investment.

1 note

·

View note

Text

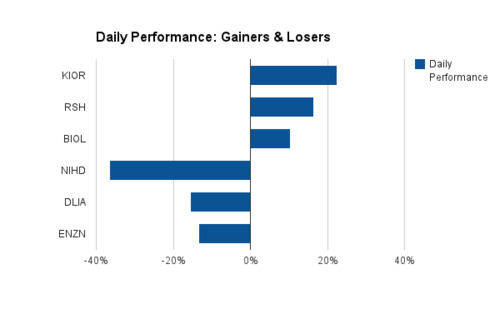

Daily Gainers & Losers (9/15/2014)

KiOR Inc. (NASDAQ:KIOR), RadioShack Corporation (NYSE:RSH) and Biolase Inc. (NASDAQ:BIOL) are today’s top-gaining billionaire stock picks. On the losing end are NII Holdings Inc. (NASDAQ:NIHD), dELiA*s Inc. (NASDAQ:DLIA) and Enzon Pharmaceuticals Inc. (NASDAQ:ENZN).

KiOR Inc. climbed +22.56% today. The renewable energy company has had a tumultuous go in recent weeks and ended the day trading at $0.22, well below its 52-week high of $3.10. Billionaire investor George Soros initiated a position in the company during the second quarter of this year.

1 note

·

View note

Text

Seth Klarman Goes for the Repeat in Biotech with These 3 Stocks

Seth Klarman has built his fortune under the mantra of prudent value investing. But lately, he’s had onlookers scratching their heads as he picks up positions in more volatile companies in the biotech field.

The billionaire addressed the shift in his second quarter letter to investors of the Baupost Group. “I view it as a substantial positive that our team has the background, talent, and drive to source opportunity in new areas of the markets, generally with very favorable results,” he wrote. “I am also pleased that this old dog (your Portfolio Manager) is still open (I’m always cautious but open) to learning a few new tricks.”

Klarman’s openness has led to some significant pay-offs, the most recent example being Idenix Pharmaceuticals. The billionaire pocketed an estimated one billion dollars on his investment when the company was acquired by Merck & Co. in June.

In recent quarters, the Baupost Group head has initiated stakes in some other biotech companies worth noting. Could one of these be Klarman’s next big hit?

Kindred Biosciences Inc. (NASDAQ:KIN). Seth Klarman initiated a position in Kindred Biosciences during the fourth quarter of 2013 and as of the second quarter of this year holds 2.76 million KIN shares.

The pet-focused biopharmaceutical company went public last December, its IPO price set at $7.00. Since hitting the market, it has climbed as high as $26.99, though in recent months it has come back down. Kindred closed the day on Friday trading at $10.52.

Keryx Biopharmaceuticals Inc. (NASDAQ:KERX). Keryx Biopharmaceuticals is a new 2014 pick for Klarman, who purchased 6.31 million company shares in Q1 and increased his allocation to 10.54 million in Q2.

A developer of renal disease treatments, Keryx most recently made the headlines with the approval of one of its new drugs. The FDA’s OK came with unexpected safety warnings, thus causing the biotech stock to plunge. KERX has declined nearly -10% over the past five days.

Theravance Biopharma Inc. (NASDAQ:TBPH). At the start of June, Theravance Inc. (NASDAQ:THRX) completed the spin-off of its biopharmaceutical discovery, development and commercialization (and less financially promising) assets in the form of Theravance Biopharma Inc. A long-time Theravance shareholder, Klarman in turn initiated a position in TBPH with 6.06 million shares.

Expectations were high for Theravance to thrive following the transaction, but since the spin-off was completed on June 2nd, THRX has fallen over -35%. TBPH, on the other hand, has climbed +21.30%.

#Keryx Biopharmaceuticals#Theravance Biopharma#TBPH#KERX#KIN#Kindred Biosciences#Seth Klarman#Baupost Group#Idenix

0 notes

Text

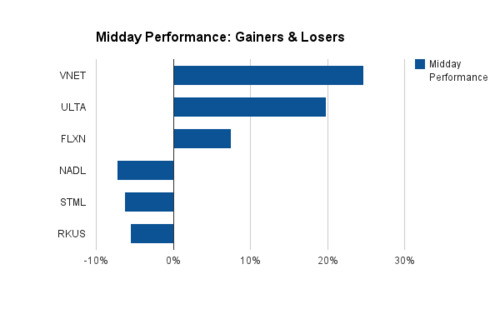

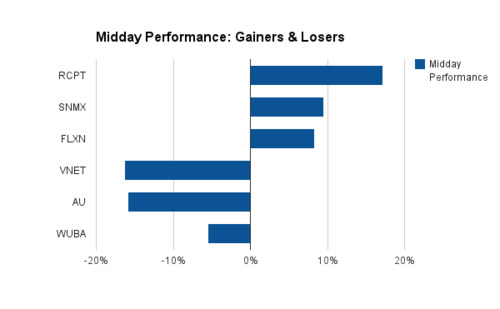

Midday Gainers & Losers (11/12/2014)

21Vianet Group Ltd. (NASDAQ:VNET), Ulta Salon, Cosmetics & Fragrance Inc. (NASDAQ:ULTA) and Flexion Therapeutics Inc. (NASDAQ:FLXN) are today’s top-gaining billionaire stock picks midday. The biggest losers are North Atlantic Drilling Ltd. (NYSE:NADL), Stemline Therapeutics Inc. (NASDAQ:STML) and Ruckus Wireless Inc. (NYSE:RKUS).

The share price of 21Vianet Group Ltd. soared +24.68% this morning, rebounding from a major sell-off this week spurred by Ponzi scheme accusations made by Trinity Research Group. George Soros initiated a position in the Chinese internet company during the first quarter of this year, and Farallon Capital picked up a stake in Q2. Today’s bounce comes as a relief to both parties, though this story is far from over.

0 notes

Text

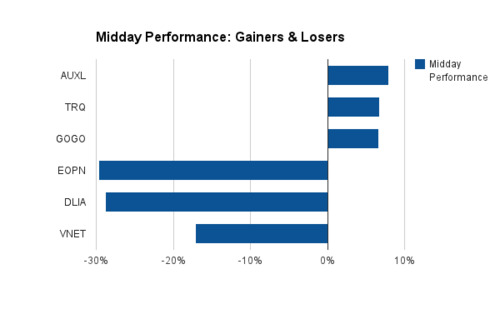

Midday Gainers & Losers (9/11/2014)

Auxilium Pharmaceuticals Inc. (NASDAQ:AUXL), Turquoise Hill Resources Ltd. (NYSE:TRQ) and Gogo Inc. (NASDAQ:GOGO) are today’s top gainers midday. The losers are E2open Inc. (NASDAQ:EOPN), dELiA*s Inc. (NASDAQ:DLIA) and 21Vianet Group Inc. (NASDAQ:VNET).

Auxilium Pharmaceuticals surged +7.9% early in the day today. This week, the company announced restructuring plans, including a 30% reduction of its workforce. Billionaire investor John Paulson initiated a position in the specialty biopharmaceutical company during the first quarter of 2014 with the purchase of four million AUXL shares.

0 notes

Text

Midday Gainers & Losers (9/10/2014)

Receptos Inc. (NASDAQ:RCPT), Senomyx Inc. (NASDAQ:SNMX) and Flexion Therapeutics Inc. (NASDAQ:FLXN) climbed on Wall Street this morning. Taking notable dives are 21Vianet Group Inc. (NASDAQ:VNET), AngloGold Ashanti Ltd. (NYSE:AU) and 58.com Inc. (NYSE:WUBA).

Receptos Inc. surged +17.17% today after releasing solid data from a mid-stage clinical trial of its multiple-sclerosis drug. The biopharmaceutical company, a Farallon Capital pick, is up an impressive +96.38% year-to-date and +29.95% over the past month.

0 notes

Text

Carl Icahn Didn’t Get Into the Investment Business to Make Friends

Carl Icahn has made a name for himself as one of Wall Street’s toughest players. Throughout his career, the often brash billionaire has engaged in highly publicized crusades against corporations and individuals alike (see him go to battle live with fellow billionaire Bill Ackman on CNBC in 2013), and he’s never been one to back down from a fight.

The investor isn’t shy about his attitude, either. In fact, it’s quite the opposite. These five Carl Icahn quotes evidence that the billionaire isn’t one to mince his words.

Oliver Stone went to visit Carl Icahn while making the 1987 film Wall Street. This line, recited by Gordon Gekko in the movie, comes from Icahn.

Icahn is a self-proclaimed advocate of shareholders’ rights – especially when he’s the largest shareholder. He recently outlined his take on and brand of shareholder activism via Tumblr.

For Carl Icahn, it’s not just about the win – he also enjoys the battle.

In the ‘80s, Icahn’s successes were often eclipsed by the magnitude of the deals being made by takeover king Boone Pickens. But his study of history told him his time would come. “The secret is reserves,” he once said. “You must have reserves stretched way out ahead. You have to know that you could buy the company and not be stretched.”

They say the way to a man’s heart is through his stomach. For Carl Icahn, it’s dollar signs.

0 notes

Text

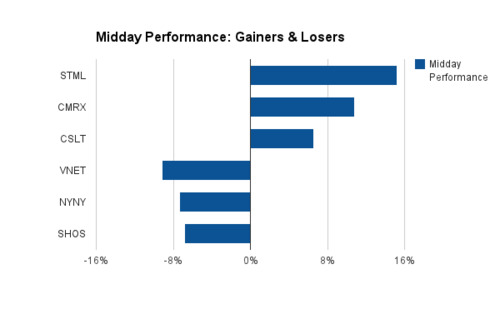

Midday Gainers & Losers (9/9/2014)

Stemline Therapeutics Inc. (NASDAQ:STML), Chimerix Inc. (NASDAQ:CMRX) and Castlight Health Inc. (NYSE:CSLT) are this Tuesday’s top midday gainers. On the losing end are 21Vianet Group Inc. (NASDAQ:VNET), Empire Resorts Inc. (NASDAQ:NYNY) and Sears Hometown and Outlet Stores Inc. (NASDAQ:SHOS).

Stemline Therapeutics Inc. climbed +15.19% midday today. The biopharmaceutical services provider, a Farallon Capital holding, has gained +23.78% in the past month and has been generating its fair share of buzz among Wall Street analysts as of late.

0 notes

Text

Not Everything Bill Ackman is Doing is All Over the News Right Now

From his crusade against Herbalife to his big win on Burger King, Bill Ackman has been dominating the headlines lately. But it’s not just his most public picks that are worth watching.

With just six companies in his equity portfolio as of the second quarter of this year, each and every one of Ackman’s stock picks are crucial to his fund’s (smashing) success. Here are four Bill Ackman stocks to take note of – even though they’re not the biggest newsmakers of the moment.

Air Products & Chemicals Inc. (NYSE:APD). Ackman has taken an activist approach to Air Products & Chemicals, in which he initiated a position during the second quarter of 2013. As of Q2 2014, he holds 20.55 million shares of the gas and chemical producer (more than 20% of his equity portfolio).

In February, Ackman expressed high hopes for APD in the months and years ahead. “This is a $200 plus stock over the next three years with new management,” he said at a conference. That new management arrived in June, when the announcement was made that Seifi Ghasemi would be taking over as CEO. And the shakeups continue, with one of the company’s top executives making his exit as recently as last month.

Since the billionaire revealed his 9.8% stake in Air Products & Chemicals in July of last year, the stock has gained over +25%. And while it is currently trading near its 52-week high of $136.90, it may have a lot more to give – at least Ackman seems to think so.

Canadian Pacific Railway Ltd. (NYSE:CP). In Q3 2011, Bill Ackman purchased 4.04 million Canadian Pacific shares. By the subsequent quarter, the investor increased his allocation more than five-fold to 24.15 million shares. By the following May, he succeeded in ousting company CEO Fred Green as well as five other CP directors. Soon after, the billionaire began to cash in.

Ackman has been gradually reducing his CP position since the third quarter of 2013 and as of the second quarter of this year holds 13.9 million shares. Canadian Pacific’s share price has more than tripled since the billionaire first bought in, meaning hefty gains for Ackman and Pershing Square investors.

Platform Specialty Products Corp. (NYSE:PAH). Platform Specialty Products is one of Bill Ackman’s newest plays. The billionaire disclosed a 30.9% stake in the company back in January, and the stock has gained nearly +80% since.

PAH produces specialty chemical products and provides technical services globally. This year, it has acquired two crop protection operations – Agriphar and the agricultural unit of Chemtura. Ackman maintained his position in the company in Q2 – an indicator he may expect its price to continue climbing.

Howard Hughes Corp. (NYSE:HHC). Bill Ackman is the Chairman of the Board at Howard Hughes Corp. and has largely called the shots at the company since it was spun off from General Growth Properties in 2010. The billionaire has maintained his position of 3.57 million shares quarter after quarter.

HHC’s share price has climbed more than +300% over the past four years. In 2014, it has continued to gain momentum and is up nearly +30% YTD.

#Bill Ackman#Pershing Square#Canadian Pacific Railway#CP#Howard Hughes Corp.#HHC#PAH#Platform Specialty Products#Air Products & Chemicals#APD

0 notes

Text

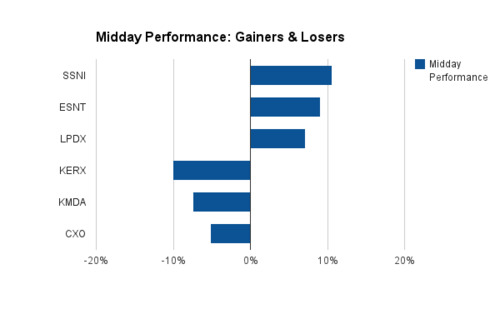

Midday Gainers & Losers (9/8/2014)

Silver Spring Networks Inc. (NYSE:SSNI), Essent Group Ltd. (NYSE:ESNT) and LipoScience Inc. (NASDAQ:LPDX) are today’s top-gaining billionaire stock picks midday. Having a tough start to the week are Keryx Biopharmaceuticals Inc. (NASDAQ:KERX), Kamada Ltd. (NASDAQ:KMDA) and Concho Resources Inc. (NYSE:CXO).

Silver Spring Networks Inc. surged +10.57% early in the day this Monday. The stock has a consensus buy rating from the eight ratings firms currently covering it and is currently trading close to its 52-week low of $9.05. Billionaire hedge fund manager Richard Chilton has had a position in the grid networks and security technology solutions provider since the first quarter of 2013, and as of the second quarter of this year, he holds 166,000 shares.

1 note

·

View note

Text

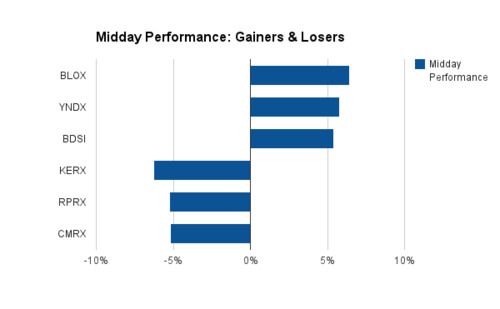

Midday Gainers & Losers (9/5/2014)

Infoblox Inc. (NYSE:BLOX), Yandex NV (NASDAQ:YNDX) and BioDelivery Sciences International Inc. (NASDAQ:BDSI) surged early in the day today, while Keryx Biopharmaceuticals Inc. (NASDAQ:KERX), Repros Pharmaceuticals Inc. (NASDAQ:RPRX) and Chimerix Inc. (NASDAQ:CMRX) posted significant losses.

Infoblox Inc. reached the middle of the day up +6.41%, getting a boost from its fourth quarter earnings results. The company exceeded expectations on EPS and revenues and issued improved first-quarter revenue guidance as well. The automated network controller has climbed +15.98% in the past 30 days.

0 notes

Text

Want to Be a Billionaire? You Might Not Need an MBA for That

Your average billionaire investor’s education entails bachelor’s degree from Yale in Economics, followed by a Harvard MBA. Columbia Business School is also a popular post-grad pick, and Harvard isn’t bad as an undergrad choice, either.

We recently delved into the educational backgrounds of the billionaire magnates we follow. Where and how did Wall Street’s best and brightest spent their college years?

Where Wall Street Billionaires Went to College

0 notes

Text

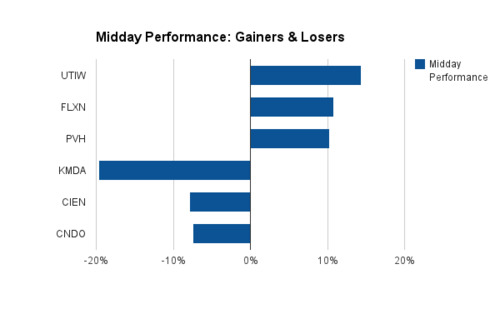

Midday Gainers & Losers (9/4/2014)

UTi Worldwide Inc. (NASDAQ:UTIW), Flexion Therapeutics Inc. (NASDAQ:FLXN) and PVH Corp. (NYSE:PVH) are today’s top-gaining billionaire stock picks midday. On the losing end are Kamada Ltd. (NASDAQ:KMDA), Ciena Corporation (NYSE:CIEN) and Coronado Biosciences Inc. (NASDAQ:CNDO).

UTi Worldwide Inc. reached midday posting a +14.33% gain for the day. This morning, the company reported fiscal 2015 second quarter results, including a -3.4% decrease in revenues and net loss of $16.3 million. Although it missed analysts’ expectations, investors were apparently largely unfazed by the news. As of the second quarter of this year, Tiger Global holds 5.13 million UTIW shares. The stock is down -40.66% year-to-date.

0 notes

Text

David Einhorn Colors Outside the Lines with These Five Investments

It’s no secret David Einhorn is a big fan of tech. The list of the Greenlight Capital founder’s investments in technology includes Micron Technology, Apple and Marvel Technology, and as of Q2 2014, the sector comprises 59% of his entire equity portfolio.

That being said, David Einhorn’s tech bets aren’t the only ones worth watching. Here are five of the hedge fund manager’s picks in other sectors you may want to consider, too.

Cigna (NYSE:CI) – Health Care. Einhorn initiated a position in global health services provider Cigna during the second quarter of 2012. As of the second quarter of this year, the billionaire holds just under 3.1 million CI shares, and the company comprises about 4% of his equity portfolio.

Cigna has had a relatively strong 2014, its price climbing more than +10% since the start of the year. It is currently trading close to its 52-week high of $97.28, and some expect its price to climb even higher. Competitor Aetna, also an Einhorn health care holding to watch, has had an even stronger year. It is up +22% YTD and approaching its 52-week high as well. Also worth noting – both companies are part of the iBillionaire Index, meaning Einhorn isn’t their only billionaire backer.

Oil States International (NYSE:OIS) – Energy. With a 2.46% allocation in Einhorn’s equity portfolio, Oil States International is the billionaire’s biggest energy bet. The company provides specialty products and services to oil and gas drilling and production firms worldwide.

Einhorn initiated his position in OIS in Q1 2013 and is still waiting for his investment to pay off, as the company’s share price has declined more than -30% over the past year. Oil States International has, however, seen a bit of a turnaround in recent weeks, its price gaining nearly +2% in the last 30 days.

Conn’s Inc. (NASDAQ:CONN) – Consumer Discretionary. This year hasn’t been a good one for appliance and electronics retailer Conn’s on the stock market. Its share price has declined over -60% year-to-date, including -25% in the past month alone. This week, the company reported second quarter results, and while revenues and same-store sales climbed, its adjusted earnings fell – the consequence of customer credit operations.

David Einhorn has taken a hit on Conn’s since picking up a stake the first quarter of the year with the purchase 3.3 million shares at an average price of $35.49. The stock is now trading at under $30, meaning a hefty loss for Greenlight.

Voya Financial (NYSE:VOYA) – Financials. Retirement, investment and insurance company Voya Financial has been on the books at Greenlight Capital since the second quarter of 2013. It’s had a nice run, as well, its price climbing nearly +35% over the past year.

Voya is David Einhorn’s most significant finance holding, with the company comprising 2% of his equity portfolio as of Q2. It is currently repurchasing $300 million of its shares from former parent company ING Group.

Spirit AeroSystems Holdings (NYSE:SPR) – Industrials. Spirit AeroSystems Holdings designs and manufactures aerostructures for commercial and military aircrafts. It’s been in Einhorn’s holdings since the first quarter of 2013, and as of the second quarter of 2014, the billionaire has 3.2 million SPR shares.

The company reached a new 52-week high this week, and Citigroup reiterated its rating on the stock as a buy. SPR is up +15% YTD and more than +70% over the past year.

#spirit aerosystems#spr#voya financial#voya#conn's#conn#oil states inernational#ois#cigna#ci#aetna#aet#david einhorn#greenlight capital#ibillionaire index

0 notes

Text

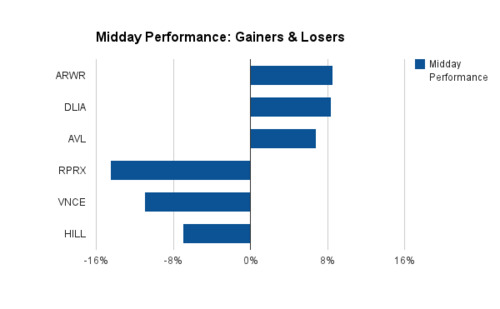

Midday Gainers & Losers (9/3/2014)

Arrowhead Research Corp. (NASDAQ:ARWR), dELiA*s Inc. (NASDAQ:DLIA) and Avalon Rare Metals Inc. (NYSEMKT:AVL) are today’s top-gaining billionaire stock picks midday. The biggest losers are Repros Therapeutics Inc. (NASDAQ:RPRX), Vince Holding Corp. (NYSE:VNCE) and Dot Hill Systems Corp. (NASDAQ:HILL).

The share price of Arrowhead Research Corp. climbed +8.54% early in the day this Wednesday. The biopharmaceutical company has gained +52.1% since the start of the year. Billionaire George Soros cashed out of his Arrowhead Research stake last quarter.

0 notes

Text

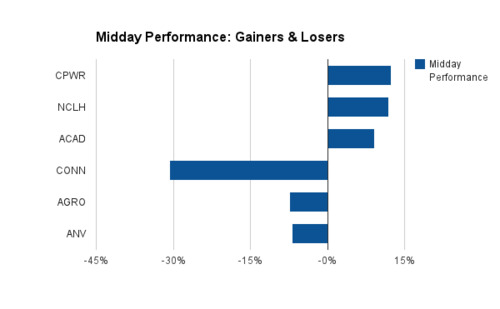

Midday Gainers & Losers (9/2/2014)

Compuware Corporation (NASDAQ:CPWR), Norwegian Cruise Line Holdings Ltd. (NASDAQ:NCLH) and Acadia Pharmaceuticals Inc. (NASDAQ:ACAD) are among today’s top gainers on the stock market midday. Posting notable losses are Conn’s Inc. (NASDAQ:CONN), Adecoagro SA (NYSE:AGRO) and Allied Nevada Gold Corp. (NYSEMKT:ANV).

Compuware Corporation reached midday with a +12.33% gain following news that it has agreed to a $2.5 billion private equity firm buyout. Billionaire hedge fund manager John Paulson has held 14.25 million CPWR shares since the fourth quarter of 2013.

0 notes