Text

THE BIG-SHORT

The financial crisis of 2007–2008, also known as the global financial crisis and the 2008 financial crisis, was a severe worldwide economic crisis considered by many economists to have been the most serious financial crisis since the Great Depression of the 1930s, to which it is often compared.

It began in 2007 with a crisis in the subprime mortgage market in the United States, and developed into a full-blown international banking crisis with the collapse of the investment bank Lehman Brothers on September 15, 2008.Excessive risk-taking by banks such as Lehman Brothers helped to magnify the financial impact globally. Massive bail-outs of financial institutions and other palliative monetary and fiscal policies were employed to prevent a possible collapse of the world financial system. The crisis was nonetheless followed by a global economic downturn, the Great Recession. The Asian markets (China, Hong Kong, Japan, India, etc.) immediately impacted and volatilized after the U.S. sub-prime crisis. The European debt crisis, a crisis in the banking system of the European countries using the euro, followed later.

Task in Hand:

You as an HNI were found by the US Fed investing in credit default swaps of the subprime mortgage bonds and are under severe allegation of fraud and insider trading because of which

You are under scrutiny by the US Government and you need to explain your investment strategy and analysis that you did before placing a short-bet on the bonds even when mortgages and real estate was booming in the United States of America.

0 notes

Text

Dear Wealth Managers

Formatting Guidelines for tomorrow

Times New Roman Text-12

Heading-14

Justified

Index Page

Borders

0 notes

Text

MOCAMBO KHUSH HUA

The Indian Government decided to demonetise the notes of Rs 500 and Rs 1,000 on November 8th 2016. The primary reason behind this drastic step was the funding made to terrorists in these denominations to run and operate terrorist attacks in the country. Most of this funding was done out of the unaccounted money of funders who had an enmity against the government of the country. There was a decrease in such attacks for a short period of time but certain intelligence reports suggest that certain terrorist groups have again started receiving such funding in denomination of Rs 2,000 notes. Due to this the Government of India in partnership with the Reserve Bank of India decided to stop printing of Rs 2,000 notes and started hoarding them. In such a situation you have been appointed by the Government of India to give a detailed presentation on

1. Sources of such Funding

2. Methods used to transfer money

3. Strategies to reduce such funding

4. Strategies to demonetise Rs 2,000 Notes

5. Estimated cost of the whole process

You are required to create PPT of not more than 10 slides.

0 notes

Text

CAUTION! CAUTION!

Update for your Tommorow's Presentations:

For the Round MERGER OR AQUIRE their will be presentation for total 30 minutes ( 25 mins+ 5 mins ) so make your reports accordingly with proper formatting and deliverables which are given in the tasks. It will be a discussion between the panel and the participants. So design your reports in a way so that it should have quality for discussion not quantity for the sake of making report.

Hint: Research is the key to success.

Extra deliverables carry brownie points.

This round will make the difference.

0 notes

Text

"SKYCOM"-MAKE IT OR BREAK IT!!

Spectrum demand of Indian Space Research Organization and the telecom ministry's proposed conditions to roll out mobile services in 26 gigahertz band are likely to make deployment of 5G services in the country challenging, according to industry experts.

International Telecommunication Union (ITU), under the United Nations, will hold a conference next month in Egypt to finalise use of 26 GHz band for 5G services. The 5G base station will be able to cover only 25-30 metre distance based on limitation of tilted BTS and low power requirement. If this proposal is accepted by ITU than deployment of 5G in 26 Ghz band will be 4-5 times more expensive than rest of the world.

The DoT has set a target to roll out 5G in 2022. Industry sources, however, do not see possibility of auction of spectrum for 5G services in the current financial year as it is yet to approach Telecom Regulatory.

A telecom company that wishes to offer services in any of the 22 telecom circles in India must purchase a Unified Access Services (UAS) license to operate that circle. Licences are awarded by auctions. The UAS, introduced in November 2003, is valid for a period of 20 years, which can be extended by an additional 10 years once per licence per circle. Initially, a mobile network operator that was awarded a licence to operate in any of the 22 telecom circles in India was allocated frequencies in that circle for a fixed time period. After the expiry of the licence, the company would have to bid to renew the licence. A new telecom policy announced by the government in 2011, delinked spectrum from licences. As a result, when an operator renews its licence it must also pay separately for spectrum.

Task at Hand:

You being the Financial Advisor to BSNL have to come up with financial plan that would help BSNL to launch 5G in India and help BSNL to gain an upper hand over the competitor in the market

The best proposal from the Top 5 proposals will be selected by the Board of Directors of BSNL and further investments will be made on the one selected proposal.

1. Current financial position of the company

2. Competitor’s analysis

3. Feasibility structure

4. Detailed Financial Plan

5. Revenue Structure

6. Future Prospects

Guys, This is the Final round If you think You can make it to TOP 5 Just Start Preparing for it.

0 notes

Text

MERGE OR ACQUIRE?

Continuing with series of interviews with All India Mixed Martial Arts Association (AIMMAA) National Commissioner Daniel Isaac, IMMAF is looking at the developing potential for a UFC event to take place in one of the promotion’s most significant untapped markets.

In 2012, UFC co-owner and CEO Lorenzo Fertitta discussed the promotion’s interest in making its way to India, but at the time highlighted that they would be starting from “ground-zero”. Fast forward to 2014 and the status of the UFC’s interest in India had become “a priority“in the words of managing director of international development, Marshall Zelaznik.

“The UFC is covered well in India through regular telecasts on Sony Six and Sony ESPN. We get to watch both live and post-produced telecasts of every UFC Fight Night, PPV and TUF season. These telecasts have definitely helped AIMMAA in our efforts to promote the sport through education, events and training”

When asked if he could visualise his country hosting a UFC event in the near future, the AIMMAA official expressed that he believes India to be more than ready.

“The UFC could have organised an event in India right from the time that Dana White first mentioned his interest in the Indian market. In my opinion, the IMMAF reaching out to India through the AIMMAA has increased the reasons why it would be beneficial to hold an event in India. The AIMMAA is the oldest government recognised MMA organisation in India, AIMMAA has the largest network of state associations affiliated under one national banner and is the only MMA body working under recognition from the highest sporting authorities in the country. AIMMAA is the only national federation in India recognised by IMMAF, so what better reason for UFC to physically come to India. I have had numerous meetings with Sony Six (MSM) and we have a good communication with them. They are the official broadcast partner for UFC in India.”

Mixed Martial Arts is a growing sport in India. Despite the negativity that’s been spewed all over, there isn’t much debate about the immense potential that India holds. The lack of knowledge about the sport is indeed one of the biggest problems that the Indian MMA scene is facing now. The atmosphere we have in the country is light years away from the one that exists in countries like the United States and Brazil; where the sport has flourished.

Amidst all these hurdles, the fighters have showcased dedication and hard work to make their mark internationally and it’s time that they got the limelight that they deserve. In this list, we are going to take a look at some of the most notable Indian MMA fighters out there.

Despite being a niche sport, the popularity of Mixed Martial Arts (MMA) has grown rapidly on an international level with a legion of fans across the world. And since Asia has a rich history of martial art, one might see the appeal that MMA has in the continent. But in India, where cricketers are revered as gods, MMA still has a long way to go although it is making slow progress.

Task in hand:

You are the head of the UFC (ultimate fighting championship) organisation. In order for UFC to prosper in India they would like to Merger/Acquire themselves with AIMMAA so that they can expand their horizon. You are to merge with AIMMAA (All India Mixed Martial Arts Association) and give a detailed structure of the merging process and its future impact on the sports industry of India.

Deliverables:

1. Determine the potential and feasibility of the Merger/Acquisition

2. Prepare the structure of the Merger/Acquisition

3. Assess the strategic financial position of the new body

4. Conduct Valuation of Assets

5. Perform Due-Diligence process, negotiate a definitive agreement for executing the transaction.

Call Pushkal Aggarwal only.

0 notes

Text

https://drive.google.com/file/d/15wIFFui6rNU5Rm_o4zywXeq_5wrC_Wcw/view?usp=sharing

0 notes

Text

GOLD RUSH!!!

The crux of this bank fraud is that the higher management of the PMC bank has given huge loan to the Housing Development and Infrastructure Ltd (HDIL) and its group entities. This fraud case is related to transfer of 70% of the total credit facilities of the PMC bank to HDIL and its associated companies. If i talk about the total amount of the bank fraud then it was Rs 4,355 cr. Now the total NPA of the bank has grown to 73%.

The PMC bank allegedly favoured to the promoters of Housing Development and Infrastructure Ltd (HDIL) and allowed them to operate password protected ‘masked accounts’.

It is found that around 21,049 bank accounts were opened by bogus names to conceal 44 loan accounts. The bank's software was also tampered to conceal these loan accounts.

Task at Hand:

You being the Chairman are a key player in fraud, says Mumbai police. You have to justify this statement and come up with compensation strategies for the customers in order to get back your job and prevent imprisonment.

0 notes

Text

SEESAW WITH SINGAPORE!!

The effects from the US-China trade war and mounting costs of doing business for companies are fuelling investor fears of the likelihood of a “flash crash” in financial markets. The deteriorating climate has forced cash-strapped firms to offload assets quickly and reduce debt to buffer profit declines next year that could be brought about by the trade war.

But these risks would be magnified by the rise of artificial intelligence-driven electronic trading as automation speeds up financial transactions, allowing them to be conducted across multiple markets at the same time. Any macroeconomic data shock that forces abrupt forecast downgrades for economic growth and corporate earnings could lead to rapid, violent market moves or “flash crashes”.

Already, a sell-off in US high-yield corporate bonds last month has signalled that headwinds are growing as the US enters into the end of the economic cycle after 10 straight years of expansion. Other warning signs include declines in corporate share buy-backs and dividend pay-outs that may trigger market turbulence.

The analysts cited a warning sign from the US index measuring the effect of buy-backs on stock prices – the index has declined despite a record US$800 billion in buy-backs this year. Apple stock, a tech bellwether, is down 20 per cent from its high as investor interest has been unaffected by a US$100 billion buy-back programme.

GIC’s portfolio returned 4.9% per annum in nominal U.S. dollar terms over a five-year period that ended in March 2019, versus 6.6% in the period that ended in March 2018. The firm’s reference portfolio of 65% global equities and 35% bonds returned an annualized 5% percent in the five years that ended in March 2019. GIC reported an annualized rolling 20-year real return — its main performance gauge — of 3.4% for the latest year, the same as reported in the previous year.

Due to low returns as a result of an outstretched trade war.

Task in Hand:

You as the Fund Manager of Singapore GIC have to come up with a resolution plan of your portfolio regarding your investments entitled to the following devastating situation leading to economic downfall of the globe as a whole.

The task must include but is not constraint to the following deliverables:

1. Exit plan from the investments to mitigate low returns

2. Allocation of funds considering political and economic relation between countries

3. Future plan of action regarding re-investments made in these countries

4. Restructuring Plan

5. Other relevant financials

0 notes

Text

Dear Wealth Managers if you want us to judge your report a little before and give you some suggestions before the presentation please mail us your reports by 2:00 pm

0 notes

Text

Help is Here!

Wealth Managers since you all have a lot of doubts about how an investment portfolio is made

Here is a sample report to help you out :

https://t.umblr.com/redirect?z=https%3A%2F%2Fdrive.google.com%2Ffile%2Fd%2F1t2GAv4_fDAoTARW4ifXk7Rhj8TAqhdcj%2Fview&t=NDYwYzFiMzc5ZWEwZDBmNGQ3NDZiMjYxNDNiOGMzMWFhOWY3NmY4ZSwzMjQ0N2NiMTVjZmQwOWYxMDBhNjE5NzAyZDkzODMxOWEwYWI3MDcy

0 notes

Text

READY TO TRADE!!

A portfolio manager (‘PM’) is a body corporate who, pursuant to a contract or arrangement with a client, advises or directs or undertakes on behalf of the client the management or administration of a portfolio of securities or the funds of the client.

A discretionary portfolio manager individually and independently manages the funds of each client in accordance with the needs of the client, whereas a non-discretionary portfolio manager manages the funds in accordance with the directions of the client.

Portfolio managers are required to be registered with Securities and Exchange Board of India (‘SEBI’) in order to undertake Portfolio Management Services (‘PMS’) and are governed by the regulatory frameworks laid out by SEBI under SEBI (Portfolio Managers) Regulations, 1993. On 2nd August 2019, a working group (‘WG’) constituted by SEBI released a report proposing various recommendations on reforms that are required in the existing Portfolio Management Regulations. Under the present regulations the investment products in which the PMS can invest include both listed and unlisted securities. However, the WG has proposed that PMS Manager should only be allowed to invest in listed securities and this poses a great threat in the near term for PMS Managers. With totally 321 PMS managers actively providing PMS services in India currently and with assets greater than 16.31 lakh Crores under management invested across both listed and unlisted securities, the new proposed change of investment only in listed securities poses to be a great concern as this will have a drastic affect not only on the composition of their portfolios but also on the returns these PMS mangers offer.

Task at Hand:

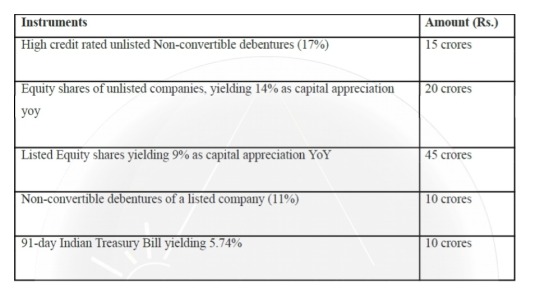

You are a PMS Manager with 100 Crores of assets under management, the breakup of your investment in different asset classes is provided below:

You are required to formulate a plan to:

Re - allocate the amounts invested in unlisted securities into listed securities in a manner which does not adversely affect the returns offered by you to your investors.

You are required to come up with the

1. New Portfolio

2. Return Analysis

3. Risk Analysis

4. Readons for Investing in Security

Please contact Pushkal Aggarwal for this task

0 notes

Text

Top 7

Nex 1

Nex 3

Nex 8

Nex 19

Nex 20

Nex 21

Nex 22

Guts it's Top 7 now. Pull up your socks and give your best. Also please be ready for your surprise tomorrow

0 notes

Text

GO PRO!

Amidst the trade war between China and USA, Donald Trump has announced high tariffs on Indian IT companies providing their Services in USA. In such a situation you as the Chief Financial Officer of an IT Company based in India are required to create a detailed plan to shift the operations of the company to some other country so that there is no such change in price at which the company was offering its services earlier. You are required to –

1. Decide the new location

2. Total Cost of shifting

3. Reasons for new Location

4. Change in Price at which services are offered

0 notes

Text

Dear Wealth Managers

You are required to bring 2 hard copies of Expo 2025 and 1 hard copy of Making a New Place in Sky tomorrow and submit it to us at L Desk at 12:00 pm. Also please be there at the venues sharp at 4 as it’s going to a be a long day tomorrow. Avoidance of any of the above 2 shall lead to negative marking.

0 notes

Text

Information!

Kabaddi Kabaddi is a report based task and therefore no presentations for the task will take place on Monday,

The performance in the task was not at all appreciated at this level of the fest, we expect the reports of Top 10 to be more detailed and you guys should work on your research.

A sample report of a similar task has been given below please read it carefully and realise where you went wrong.

We expect better performance for the rounds you submit next.

Report Link: https://drive.google.com/file/d/1lTOulB7hGNWsXT_sfwN0gUbhxuh5JzNG/view?usp=sharing

0 notes