Text

Increase your Wealth for Retirement via Investing into 2 stocks

Finding that ideal mix of stocks to boost your wealth for retirement requires a mix of development, a juicy pay, and some defensive appeal. Also, there's one stock that can offer every one of the three of those fixings: Fortis

Fortis is quite possibly of the biggest utility on the continent. The organization has operations situated across the U.S., Canada, and the Caribbean. Those operations are separated into 10 operating regions, including both generation and distribution arms.

Finding that ideal mix of stocks to boost your wealth for retirement requires a mix of development, a juicy pay, and some defensive appeal. Also, there's one stock that can offer every one of the three of those fixings: Fortis

Fortis is quite possibly of the biggest utility on the continent. The organization has operations situated across the U.S., Canada, and the Caribbean. Those operations are separated into 10 operating regions, including both generation and distribution arms.

Utilities are probably the best long haul investments available for investors. That allure can be traced back to the security of the utility business model. To put it plainly, utilities will undoubtedly long haul regulatory contracts to offer their types of services.

Those agreements, which can traverse quite a few years in term, give a common and stable revenue stream for the utility, which converts into a steady and growing for Dividend Stocks of Canada investors.

On account of Fortis, the organization has broken the cliche view on utilities and taken a forceful position on growth. Lately, that growth has focused on updating and progressing its facilities over to renewable energy.

Going to dividends, Fortis offers a succulent quarterly payout. The current yield works out to 4.25%. This means that a $40,000 investment will procure a pay of $1,700 in the primary year. Furthermore, that is not even the most amazing part.

Fortis has given a yearly increase to that dividend for an incredible 48 consecutive years. Fortis forecasts that training to proceed, with a yearly increment of 6% expected over the course of the following couple of years.

This factor alone makes Fortis a brilliant option to support your wealth for retirement as a purchase and-fail to remember up-and-comer.

You can bank on your retirement income developing quick

Canada's big banks are among the best long haul investments available. In Canada, they hold a massive, in the event that not overpowering revenue in the domestic segment. The big banks have additionally expanded into worldwide business sectors that hold massive development potential.

Thusly, both the domestic and worldwide arms assist the enormous saves money with giving a succulent quarterly profit. Truth be told, a portion of the banks have been paying out those dividends for almost two centuries!

Yet, which huge bank stock is appropriate for your portfolio? Today, that bank to consider is Toronto-Domain Bank. TD is one of the biggest of the enormous banks and has paid out dividends come what may for more than hundred years.

Following the Great Recession, TD gained a few U.S. banks and sewed them together. Today, that organization, branded as TD Bank, extends from Maine to Florida along the east coast.

If that is sufficiently not, TD is in that frame of mind of closing a deal to secure Memphis-based First Skyline. The deal will extend TD's presence in the south and bring the bank into a few new state markets in the southeast like Texas.

At long last, as of the time of composing, TD is trading down almost 5% year to date, making it an incredible limited stock to purchase now.

No investment is without risk. It's likewise a generally expected part of the cycle for there to be times of unpredictability where stocks drop in cost. What's essential to investors is to focus on arriving at those long-term investment goals.

As I would see it, the Dividend Stocks TSX are best ways to help reach those goals.

#Best Dividend stocks canada#Dividend stocks to buy#Dividend stocks in canada#Dividend stocks canada#Dividend stocks on tsx#stocks#marketing#investor#stock advisory company.#profit#trading#dividend stocks in canada#dividend#tech

0 notes

Text

3 Stocks in Canada to Purchase for Passive Income

Generate your strong month to month passive income by grabbing up Canadian stocks like Bird Development Inc. and others now.

The S&P/TSX Composite Index was down eighteen points in early evening time trading on Nov 2. Stock Investors in Canada have been compelled to navigate a volatile market since the TSX Index crested throughout the spring season. You might need to seek after an income-oriented procedure in this environment. Today, we need to focus on Penny Stocks Canada that can turn out month to month passive income in 2022 and then some.

Below is a Canadian stock set to ascend as the populace ages

Sienna Senior Living is a Markham-based organization that gives senior living and long haul care services in Canada. Investors ought to hope to target stocks that are geared up to post development notwithstanding the nation's growing senior populace. This Canadian stock has plunged 23 percent in the year-to-date period.

In the 2nd quarter of 2022, Sienna saw its retirement inhabitants rate rise to 88 percent in July 2022. In the meantime, absolute same-property net operating pay climbed 9.8 percent year over year to $33.1 million. The stock last had a strong P/E ratio of 31, which was in accordance with its industry peers. Sienna offers month to month passive income of $0.078 per share, which addresses a very 8% yield.

One monthly passive income stock that is equipped to keep shareholders cheerful

Freehold Royalties is another Calgary energy stock in Canada. This oil and gas royalty organization owns working interests in oil, natural gas, and potash properties in Western Canada and the US. Its portions have expanded 41 percent in such a long way in 2022.

The organization uncovered its second-quarter financial 2022 earnings on 9th August. Funds from operations climbed 109 percent year over year to $83.8 million. In the interim, funds from tasks per basic share bounced 81% to $0.56. Freehold expects to reward investors by creating positive income through its royalties. It last had a great P/E proportion of 15. Freehold offers a month to month dividend of $0.09 per share. That addresses a delectable 6.3% yield.

Why this stock in Canada is additionally worth grabbing up toward the beginning of November

Bird Construction is the fourth and last Canadian stock I'd hope to grab up toward the beginning of November for its passive income. Shares of this overall project worker have plunged 38% in 2022. That has altogether extended its losses in the year-over-year time frame.

In the 2nd quarter of 2022, the organization delivered development revenue growth of 3.7 percent to $576 million. In the meantime, this Penny Stock on TSX right now has a truly great P/E ratio of 7.6. Bird offers a monthly dividend of $0.033 per share. That addresses an extremely impressive 6.4% yield.

0 notes

Text

Must Have Dividend Stocks for Dream Retirement

Investing in Dividend Stocks Canada could be fully rewarding if you have any desire to see your well deserved savings grow consistently to plan your dream retirement. In this post, we will feature some of the best dividend stocks of Canada you can purchase at the present time and hold until retirement to multiply your cash.

The best dividend stock in Canada for retirement purpose

En-bridge is my most loved dividend stock pick in Canada for retirement planning, which has a strong financial base to help its energy transportation-focused, very much business model. It presently has a market cap of $107.4 billion, as its stock trades at $53.03 per share with around 8 percent year-to-date gains. At the ongoing market value, En-bridge stock offers an appealing dividend yield of 6.5 percent.

In case you don't know it as of now, En-bridge has been raising its dividend throughout the previous 27 years straight. Over the most recent couple of years, it has expanded its focus on diversifying revenue sources by extending its presence in crude oil export and sustainable or renewable energy portions. While these variables light up its drawn out growth outlook, the continuous growth trend in its financials as of now looks noteworthy, because of the reliably developing demand for energy items.

The best Canadian dividend stock from the banking sector

While investing into Dividend Stocks TSX to plan your fantasy retirement, you should consider broadening your stock portfolio, independent of your risk hunger. Taking into account that, we track down Bank of Nova Scotia truly amazing from the bank sector, which could assist you with enhancing your dividend stock portfolio for retirement. Scotia-bank right now has a market cap of $78.6 billion and an alluring dividend yield of almost 6.2%.

The bank's changed earnings developed by 4% year over year in the July quarter to $2.10 per share with the assistance of its solid credit quality and growing loan book across all business lines. While its profit from worldwide wealth management and capital business sectors segments have declined in current quarters, its core banking activities have helped Scotia-bank with conveying generally sure earnings growth. BNS stock as of now trades at $65.99 per share with around 26% year-to-date losses, in spite of its positive earnings development trends, making it look undervalued to purchase for the long haul to hold till retirement.

The leading dividend stock from the telecom area

BCE could be another top Dividend Stock in Canada to invest into for retirement. This Canadian telecom monster has a market cap of $56.1 billion, as its stock floats around $62 per share with 6 percent year-to-date losses. BCE stock has a dividend yield of almost 6 percent at this share cost.

Notwithstanding facing Covid-driven operational troubles over the most recent few years, BCE hasn't confronted huge financial difficulties because of its solid capital structure and reliable demand for its services. As the telecom organization keeps on focus on extending its 5G network across Canada and fortifying its digital media portfolio, its financial development is probably going to speed up essentially before very long, which ought to help its stock surge. Considering that, the new drop in its portion costs could be a chance to purchase this astonishing dividend stock now to hold as long as possible.

The online investing they've run for almost 10 years, Trade 11 Stock Advisors Canada, is beating the TSX by 16% points. Furthermore, at the present time, they think there are stocks that are better purchases.

#best stock advisory company in canada.#trading#marketing#investor#dividend stocks in canada#dividend stocks canada#dividend#profit#tech#stock advisory company.#dividend stocks on tsx

1 note

·

View note

Text

Why Should You Buy Stocks or Not Right Now?

Short-term investors may naturally be reluctant to invest now. I'd be careful about effective money management during economic conditions if I had a short-term time skyline. Yet, assuming you're willing to hold as long as possible, there are limits on the Dividend Stocks on TSX today that will seem to be outright takes right away.

For those investing thinking today, it's simply normal to re-think yourself prior to raising a ruckus around town. Consider the possibility that the market sells off another 1% tomorrow. It's extremely tempting to need to try to time the market's bottom — enticing, yet additionally truly challenging.

The advantage of investing for the long haul is that you don't have to sweat everyday variances in cost. Your long-term time horizon enables you to rather focus on tracking down quality organizations to invest in, as opposed to horrendously trying to time the market.

So, I'd urge Stock Advisory Company Canada to look past the short-term vulnerability and on second thought think long haul about their portfolio. This is the ideal opportunity to go chasing after quality organizations that are trading at rare discounts.

One TSX stock you can feel better about purchasing today

Brook-field Asset Management is one discounted stock that all Canadian investors ought to have on their watch lists today. Whether we're in a seething bull run or a spiraling slump, this is a stock you don't have to mull over purchasing.

The almost $90 billion organization is a worldwide asset manager, focusing on land, renewable power, infrastructure, and private equity resources. With a worldwide presence and an expansive portfolio, claiming shares of Brook-field Asset Management can give a portfolio a lot of genuinely necessary diversification.

Shares are right now down near 30% on the year. However, regardless of that loss, the Canadian stock has still figured out how to twofold the returns of the Canadian stock market throughout recent years almost. Also, the further you return, the more the market-beating gains proceed.

In case you're willing to be patient and not sell for basically the following five years, I'd firmly support putting some money into the stock market today. Begin a little, if you're worried about the volatility. There's no damage in leisurely adding to a small situation over the long haul.

Brook-field Asset Management is a brilliant organization to invest into both for new and prepared investors. It's been a trustworthy market mixer for quite a long time, and everybody's portfolio could constantly utilize somewhat more diversification.

The investing service they've run for almost 10 years, Trade 11 Stock Advisor Canada, is beating the TSX by 16% points. Furthermore, at this moment, they think there are stocks that are better purchases.

#investor#marketing#dividend stocks canada#trading#dividend stocks in canada#dividend#profit#dividend stocks#Dividend stocks in canada#Dividend stocks to buy#Dividend stocks tsx#Dividend stocks on tsx

0 notes

Text

Stocks that Could See Huge Growth in Next Year

Growth has been slippery in 2022. A few purchaser and innovation companies have lost huge market value this year, while energy and commodity stocks have flooded. In 2023, financial specialists expect that a downturn and constant inflation should compound the situation.

However, a few Penny Stocks in Canada companies ought to flourish one year from now, notwithstanding the headwinds. Here are the main growth stocks that ought to be on your radar for next year.

WELL Health

WELL Health Technologies couldn't keep away from the tech market selloff however has kept on conveying growth. The stock is down 42% year to date. Nonetheless, the organization has enlisted triple-digit development all through 2022. In the latest quarter, its U.S. organizations saw a 124% organic jump in revenue.

In the meantime, complete revenue has significantly increased from $87 million in the initial half year of 2021 to $266 million this year. For the entire year, the organization anticipates that income should exceed $550 million.

We expect that the organization's growth should go on as it adds more acquisitions and extends its impression in the US. Nonetheless, the valuation doesn't mirror this positive thinking. WELL Health stock trades at simply 1.2 times yearly income. It's a growth stock exchange at a serious deal. Watch out for it.

Aritzia

The unlikeliest example of overcoming adversity of 2022 was the fashion brand Aritzia. The organization's online business and U.S. extension endeavors have balanced any shortcoming in the consumer market. As a matter of fact, the stock is level year to date, and that implies it outflanked its peers and, surprisingly, the benchmark stock index.

The organization as of late revealed its second-quarter earnings. Income was up 50.1% year over year, while net gain was up 16.1%. Its net income has become 150% beginning around 2020.

The organization currently has a plan to support growth for the following five years. The organization hopes to send off eight to 10 shop stores consistently and grow three to five existing shops each year through fiscal 2027. That, as per the management team, ought to push complete revenue to $3.5 to $3.8 billion of every 2027. If it achieves this goal, the yearly development pace of income could be somewhere in the range of 15% and 17% for the following half-decade.

Dollara-ma

Dollara-ma announced 18% sales growth, year over year in its latest quarter. Income before interest, taxes, devaluation, and amortization were up 25.8% over a similar period. In the meantime, net earnings were up 37.5%.

These great growth numbers could go on in the months ahead, as expansion forces more families to shop at Dollarama's relatively reasonable outlets. The retail stock is as of now up 28.9% year to date and could have more space to grow. Investors of Penny Stocks TSX and others searching for a place of refuge learning experience should add this to their watch list for 2023.

#penny stock on tsx#investor#pennystockscanada#penny stock to buy#penny stocks#pennystocksincanada#investors

0 notes

Text

Why Should We Recommend Shopify Stock?

Holding onto Shopify stock during its severe cost decrease in 2022 has been an intellectually and genuinely trying experience for long haul growth-oriented investors. Shares declined as much as 80% eventually this year, inciting early investors to reconsider why they own Shopify stock, and if they ought to rescue.

Why I Recommend to Buy Shopify stock

Shopify stays a growth and Penny Stock Canada in spite of expansion headwinds and the standardization of e-commerce growth rates in 2022. The organization has kept on posting double-digit income growth rates this year paying little mind to extreme circumstances following record revenues and earnings in 2021.

Shopify's second from last quarter income developed 22% year-over-year to US$1.4 billion. The most recent results follow a 16 percent growth in the top line during the 2nd quarter.

Wall Street experts expect that Shopify should develop income by almost 19% year-over-year in 2022 preceding deals growth advances to 23% year-over-year in 2023. The organization is still in high development mode, giving investors certainty to purchase the plunges on SHOP stock this year.

Organizations that report supported double-digit development rates during extreme economic times ought to have significant and investable canals. Record inflation numbers and increasing interest costs undermine buyer spending, however Shopify is holding tight to its development direction. Business volumes could develop significantly quicker when the worldwide economy balances out, and as the tech organization proceeds to advance and send off new services.

Growing sales give the organization space to breathe to design sustainable operating productivity and create positive cash flow long term. Long-term investors can anticipate that Shopify should get back to benefit throughout the following couple of years as it defends its expense base, expands into offline commerce, and enters more geographical business sectors.

Potential Issues to Keep an Eye Out for With Shopify

Shopify keeps on filling in 2022, however its edges are shrinking. Gross profits are expanding at a more slow speed than income. Although ac-cretive to revenue growth, the new obtaining of satisfaction software developer Deliver includes lower-margin deals. Lower net margins defer progress toward working productivity and free generation.

Most critical, the organization could keep on producing negative operating cash flows throughout the following at least two years as it calibrates its satisfaction network. Nonetheless, Shopify's money, cash equivalents, and marketable protections surplus have declined to just US$4.9 billion.

Shopify's tasks ate almost US$400 million during the second from last quarter alone, and the organization is as yet investing in its growth projects. Liquidity has declined, and the organization might require new funding in case cash flows don't work on over the course of the following two years. Penny Stocks on TSX could be around the bend.

#penny stocks on tsx#investor#marketing#profit#stock advisory company.#best stock advisory company in canada.#tech#penny stocks canada#penny stocks in canada#penny stocks to buy

0 notes

Text

Can You Make Money With Penny Stocks?

One of the major rules of purchasing stocks is to consider Value; not Price. However, while the beginning stage itself is price, you are committing one of the central investment mistakes.

By default, in any case, the betting nature of people is an extremely serious area of strength. So regardless of realizing the risks involved and a wide range of warnings, individuals truly do get attracted to Penny Stocks TSX. The bait of hitting a big stake is basically overwhelming.

So we chose to present some simple rules while investing into penny stocks.

1. Put Just a Nominal Amount in Penny Stocks

It is comforting to purchase a stock of say company X valued at Rs.15/share, as opposed to Organization A's stock price at say Rs.750/share.

Second, it sounds more coherent and plausible to expect X multiplying to Rs.30 than say for A to double to Rs.1500.

Furthermore, third, with a small amount of cash you can purchase more shares of X (1000) than A (main 20). So even a Re.1 gain will give a benefit of Rs.1000 in X and just Rs.20 in A.

Consequently, low-priced shares give off the impression of being a generally simpler approach to making money.

Notwithstanding, remember that assuming it is not difficult to make 100 percent profits in X, it is similarly simple to try and lose 100 percent. History shows that Rs.15 can without much of a stretch become Rs.7.50 and you lose half of your interest in a matter of seconds. However, it will be challenging for A to fall to Rs.375.

Consequently, don't invest more than 3-5% of your corpus in Penny Stocks in Canada.

2. Broad Investment

One essential issue with penny stocks is the lack of data — particularly dependable info.

You need to truly chase after the stocks that are 'really' undervalued. With several brokers, a great many brokers and many analysts — whose everyday bread and butter come from the stock market — it is truly challenging for good scrip to stay cheap for quite a while. Just a carefully prepared everyday investor is in a situation to identify such stocks before they are found by the market.

You might need to concentrate on 20-30 organizations before you find something promising. Make compromises here.

3. Simple to Manipulate

Dissimilar to big stocks, penny stocks are more inclined to manipulation. Furthermore, considering that the greater part of us purchase just on informal exchange suggestions, the job of corrupt dealers becomes very straightforward.

Try not to get snatched up by hyped-up media reports through papers, TV shows, newsletters and so on. Try not to go by casual remarks in the train or in the workplace or at the parties. You should do your own research… completely.

Reconsider concerning why somebody is suggesting you an unknown stock if he is so sure of the organization. Might it be said that he is probably going to ask, get or take to invest into that organization as opposed to recommending it to you?

Large number of investors have been tricked before. Do you wish to be the following victim?

4. It’s Not True 'Can't Go Any Lower'

If the organization is facing serious business issues; or the advertisers have siphoned away the cash; or the manipulators have proactively made their wealth, the stock cost might very well at no point ever recover in the future. You can then fail to remember your investment in that stock. As a matter of fact, throughout some time-frame the stock exchanges will de-list that organization so you couldn't trade that stock.

In this way, work with extremely strict stop-loss targets. Don't live in myth.

Investing into Penny Stock on TSX can be harmful to your financial health. So it could be ideal to avoid them. However, in case you are as yet a game for it, tread with extreme caution. Kindly take great consideration of your money.

#investor#best stock advisory company in canada.#penny stocks#pennystockscanada#penny stock to buy#penny stock on tsx#pennystocksincanada#marketing#trading#profit

0 notes

Text

Best TSX Dividend Stocks for Retired People

Retired people never again need long-term income alone, however cash they can get from passive income. And, these Dividend Stocks on TSX have that.

Those in retirement have an alternate investment method once they go home. Without any pay coming in, they not just should be saving long term. Retired people need cash now. And that is the reason to find strong dividend stocks.

However, in addition to any dividend stocks. At the point when I say strong, it means you really want organizations that have been around for quite a long time and will keep on delivering dividends. More than that, you're searching for more significant salary outs at a lower cost if you want the money basically upfront. In light of that, there are four dividend stocks I would consider for those in or nearing retirement.

Energy Stocks

If you're searching for dividend stocks set to settle up right away, energy stocks have for some time been an incredible spot to begin. These organizations have a load of money rolling in from the energy sector, and at the present time oil and gas prices are close to all-time highs!

Presently, retirees are in an alternate spot from the ordinary investor. If you're hoping to hold these stocks north of five years or thereabouts, you might need to consider renewable energy all things considered. But, in the following five years in any event, oil and gas stocks are extraordinary ones to consider for Dividend Stocks Canada.

Two we would pick are Pembina Pipeline and Key-era. Both of these energy stocks offer month to monthly passive income. Pembina offers a 6% dividend yield as of composing, with shares up 19% year to date. Key-era, in the meantime, has a dividend yield at 6.78%, with shares up 6% year to date.

Real Estate Stocks

Presently obviously, in the event that you're a retired person, you're unavoidably likewise going to take a look at real estate investment. Furthermore, once more, the organizations that served you long haul may not really be the ones that will be the ideal choice in retirement.

Here, you again need to track down high dividends for passive income. In any case, you likewise need to ensure you're investing into REITs that have a long history of doling out dividends. For this situation, I would see profit stocks associated with organizations and sectors that are staying put.

For this situation, two I would consider are CT REIT and Choice Properties REIT. CT REIT is associated with all the Canadian Tire properties out there. The organization is doing very well, with rent agreements restored in any event, during the pandemic. It likewise as of now offers a dividend yield at 5.77%.

In case you need cash, these Dividend Stocks in Canada are the top choices to consider. Each has a long history of dividend pay, and in the following five years basically will keep on making heavenly payments. Retired people who need cash now and consistently would do well then to think about every one of these four dividend stocks.

The online investing service they have run for almost 10 years, Trade 11 Advisor Canada, is beating the TSX by 16%. Furthermore, at this moment, they think there are top stocks that are better purchases.

#Dividend stocks canada#Dividend stocks in canada#best stock advisory company in canada.#investor#trading#dividend stocks canada#stock advisory company.#profit

0 notes

Text

Penny Stocks Under 10 Cents in Canada

Is investing in penny stocks worth the effort? This would one say one is a question that rings a bell of many individuals, would you say you are likewise thinking something very similar? Well, it significantly depends on you as a trader. The less expensive the stock, the more the uncertainty, in various cases. Its reason is that small cost changes compare to greater changes in rate.

Penny stocks address the chance of huge growth, and different deeply grounded organizations have traded for under $1 in share, for instance, Ford, Monster Beverage Corp, and some more. You can likewise find the top-notch Penny Stocks in Canada for you without any problem.

Here is the list of the penny stocks under pennies, and this list has been arranged after exhaustive research of the market and company's balance sheet:

A. Medical Marijuana, Inc.

This one is a low-valued medical marijuana stock and is taken part in the creation, sale, and conveyance of hemp oil. This oil involves normally happening cannabinoids that incorporate cannabidiol in addition to different items containing CBD-rich hemp oil.

The items of this corporation are purchased for the most part by pharmaceutical, nutraceutical, and cosmeceutical undertakings. A couple of items made by this organization are CBD Tinctures, CBD Capsules, Vaporizers, and Hemp food varieties. This is an extraordinary stock to invest in under 10 cents yet be cautious as it has significant cost vacillations.

B. ToughBuilt Industries, Inc.

They design, create and make home improvement and development items for the building business in the US and universally. This stock has seen significant development for two or three months, however at that point the truth of the matter is their value change is simply one more level.

Subsequently, there are fair possibilities that the organization can thrive much more given its pipeline of new items and bloating worldwide reach.

C. World Series of Golf, Inc.

It is a games entertainment organization that is situated in Las Vegas, Nevada. It engages in unpracticed golf tournaments and occasions, and as of late it pronounced another business course by securing an organization called Vacaychella.

D. Great Panther Mining Limited

It is a developing gold and silver maker organization that is focused on the Americans. Over the most recent few years, its portion cost has expanded two times where it began. They own an expanded portfolio of assets in Peru, Brazil, and Mexico.

Up until this point, this organization is getting along nicely, however because of a few continuous issues with permits in Mexico, the costs could plunge if it is dismissed and can increase if they get the permit. Subsequently, the possibilities are it is possible that you procure excessively or fall, so the more the risk, the more benefit you make.

E. Ceragon Networks Ltd.

This is an extraordinary penny stock to invest in as it has ascended more than 22% in the last quarter. CRNT sees an extraordinary development, and according to investors, it has an enormous potential. They are related with different items and services like mobile and telecom, oil and gas, public wellbeing, local transporters and ISPs, and utilities.

F Virtual Medical International Ord Shs

They are in the business of clinical education through the web. It is a development stage organization and offers patients with clinical data with the assistance of electronic websites. They likewise have a virtual sitting area for patients where they can meet doctors for non-threatening consultations 24 hrs per day.

G. American Rebel Holdings

It is one of the most amazing Penny Stocks Under 10 Cents in Canada as it has had flawless development over the most recent few years, and individuals have acquired great benefit through it. They deal in the necessity of firearm safes and covered carry attire and backpacks.

This was about probably the best penny stocks under 10 cents with potential. Obviously, it relies upon your needs and research which one you pick to invest in.

0 notes

Text

High-Yield TSX Stock to Consider for a TFSA

The market correction this year is allowing retired folks an opportunity to purchase incredible Dividend Stocks of Canada at low costs. Telecom stocks and energy framework stocks presently offer high yields and developing distributions with a shot at a few pleasant capital increases when the market recovers.

BCA

BCE is Canada's biggest communications organization with a current business sector capitalization of $54 billion. The stock presently exchanges beneath $60 compared with a high of $74 arrived at recently. Taking into account BCE's recession-safe income stream and the viewpoint for revenue growth driven by investments in new organization infrastructure, the drop in the stock looks overdone.

BCE gets the greater part of its revenue from web and mobile services. Organizations and property holders need these no matter what the condition of the economy. The rest of the revenue comes from publicizing media businesses and device deals. Those are more helpless to an economic slump, as organizations would reduce marketing budgets to safeguard income, and telephone purchasers could choose to save old devices for longer.

BCE is putting $5 billion out of 2022 on the extension of its fiber-to-the-premises program and keeps on carrying out the 5G mobile network. Running fiber optic lines right to the structure of clients helps BCE with safeguarding its serious canal while setting the business up for higher subscriber fees as people access more broadband. The 5G network additionally opens up potential open doors for revenue development.

BCE is on target to hit its 2022 financial guidance. Financial backers ought to see another dividend increase in the 5% range for 2023. At the hour of composing, BCE stock gives a yield of 6.2%. This is appealing for investors looking for dependable passive revenue.

Enbridge

En-bridge expanded its dividend in every one of the past 27 years. The yearly payout development isn't however liberal as it seemed to be in the golden days, yet En-bridge is as yet expected to increase the distribution by 3-5% each year, supported by rising distributable cash flow.

Management has a $13 billion capital program set up and is making acquisitions to make the most of new open doors in the worldwide energy market. En-bridge bought a US$3 billion oil export stage last year to serve developing interest in American oil. Furthermore, En-bridge sees great potential in the liquified natural gas section. The organization is assembling new pipeline infrastructure in the US to transport natural gas to LNG destinations. En-bridge is likewise taking a 30% stake in the new $5.1 billion Wood-fibre LNG office being built in British Columbia.

The bounce back in the energy area is supposed to stay robust before very long, as domestic and worldwide fuel demand recovers. Airlines are sloping up ability to meet the bounce back in worldwide travel and organizations are getting back to workers back to the workplace.

Enbridge stock looks underestimated at the ongoing offer cost close to $51. The share traded above $59 in June. Now investors obtain a 6.7% yield.

BCE and Enbridge pay attractive Dividend Stocks on TSX that ought to keep on developing at a consistent speed. If you have money to give something to do in a TFSA focused on passive income, these stocks look undervalued at the present time and should be on your radar.

0 notes

Text

Dividend Tech Stocks to Purchase This Month

Tech stocks sure have been placed through a lot of ringer in 2022. After a delayed time of superb performance, 2022 has seen a shifting tide. It used to be not difficult to track down tech stocks to purchase, as they were all taking off higher than ever. Today, most have crashed down to the real world.

There are several examples of this. Yet, I might want to draw you to notice two Dividend Stocks on TSX to purchase that stand apart from the rest.

1. Evertz Technologies Limited

Evertz Technologies Limited stock was never a high-flying stock, even in the tech blast. However, this was by plan, as it centers around an alternate type of business than most - lower growth yet more significant returns.

Evertz plans, manufactures, and markets video and sound infrastructure solutions. It's a worldwide producer of broadcasting equipment and solutions like encoders, decoders, and blending consoles. The organization gives this broadcast stuff to the TV, telecommunications, and new media businesses.

The business has been a generally consistent one, as we can find in the organization's results. It's likewise a high edge one, with exceptionally impressive returns. Evertz's net edge is in the high adolescents (more than 16%), and rising. Return on value is practically 30%, with little debt. At long last, Evertz's cash flow from tasks is extremely sound. Last year, its income from operations, barring working capital, was barely short of $100 million. This addresses a 14% increase versus a long time back. Additionally, and significantly, this organization has been reliably free income positive for a long time now, as capital uses have been very low.

These are great numbers. They're obviously better than Evertz's companion group. So, they're an impression of a higher returns business. Add all of this to the way that Evertz has low debt and a high dividend yield of more than 6 percent, and we can recognize that may be inevitable. Evertz is a strong dividend paying tech stock, particularly in the present macroeconomic environment. It's likewise a cheap stock, trading at multiple times the current year's normal earnings.

2. Vecima Networks Inc.

Vecima is another Dividend Paying Stock with a somewhat unique focus - broadband and telematics. The broadband portion offers networks for cable and telecom operators to meet bandwidth needs. Its telematics section offers fleet management software to assist with monitoring trucks.

In this way, as you can imagine, these portions are very popular. This is proven by Vecima's new results. Income has as of late hit a record-breaking high (up 31% in 2021) and EPS expanded 30% in the organization's most recent quarter. Obviously, Vecima is an alternate sort of dividend tech stock.

This is to a greater extent a growth story as opposed to Evertz. Vecima's development is a lot more grounded, yet its edges are a lot lower. Likewise, cash flows are not areas of strength for as truth be told, Vecima is in a money consuming situation. Finally, its dividend yield is a simple 1.2%. However, essentially there is a dividend - something rare among high growth tech stocks.

Vecima's valuation is a lot higher than Evertz's. As a matter of fact, it trades at a P/E of multiple times the current year's expected income. This is exceptionally reasonable, notwithstanding, considering that profits are expected to be over two times this year.

In this way, we have two altogether different, however similarly attractive Dividend Stocks Canada here. The two of them surely have their benefits. One is a sluggish growth, yet extremely high returns business. The other is a quickly developing business with lower returns and cash flows, and at last, a lower dividend yield.

#profit#marketing#investor#stock advisory company.#dividend stocks canada#trading#dividend stocks in canada#top dividend stocks tsx

0 notes

Text

Why Sun-cor Looks Like a Major Bargain in Market

Most energy organizations are performing splendidly in the recent business sector environment. These ware makers are creating record free cash flow and earning development, much of the time. Moreover, the investors of these organizations have profited from share repurchases and extraordinary Penny Stocks Canada.

Among all the energy stock opportunities right now accessible on the lookout, Sun-cor seems to be a significant deal. Here are the main reasons why.

Sun-cor is smoothing out its energy openness

As indicated by recent reports, Sun-cor has declared the sale of its solar and wind resources for Canadian Utilities for $730 million. Quite, this deal incorporates the key 202-megawatt Forty Mile wind project situated in Alberta, which should be functional inside the current year.

Aside from this project, Sun-cor is additionally selling off stakes in the Adelaide, Jaw Chute, and Magrath wind facilities in the area of Ontario. By making this significant stride, Sun-cor is smoothing out its energy portfolio and improving on its concentration.

This deal’s end is supposed to occur in the main quarter (Q1) of 2023. In addition, this exchange is dependent upon standard shutting conditions, alongside outsider regulatory reviews.

Suncor's CEO and interim president Kris Smith, proclaimed in a statement that the organization's option to strip their sun powered and wind resources would empower it to smooth out its portfolio and furthermore center exclusively around their core business.

Mr. Smith likewise said Sun-cor would proceed with its advancement in its ESG efforts by introducing lower-emission co-generation units at base plant, which will replace the current coke-terminated boilers.

Sun-cor Surpasses appraises again in the second quarter

In Q2 2022, Sun-cor recorded areas of strength compared with the second quarter of 2021. Its changed assets from tasks rose to $5.345 billion from last year's $2.362 billion. Likewise, the organization's cash flow from operating activities rose to $4.235 billion from $2.086 billion a year sooner.

Shareholders keep on getting great returns from Sun-cor

Sun-cor keeps on helping its shareholders with growing returns. The organization returned nearly $3.2 billion in funding to investors, including share repurchases and dividend payments. Specialists additionally revealed that in Q2 2022, the pace of offer repurchases as well as dividends per normal share, were the most noteworthy to date in this organization's set of experiences.

Presently, Sun-cor is trading at around the $43 level. At this level, I figure major areas of strength of this endeavor will guarantee strong returns in the long haul. These are the factors that make Sun-cor a significant deal, when compared with other Penny Stocks on TSX out there.

0 notes

Text

Is It the Right Time to Start Investing?

New investors ought to be excited about the fantastic opportunities accessible in the stock market at the present time. It seems we're at the peak of an economic cycle with expansion and interest rates expanding, bringing about a decrease in buyer spending and business investment.

The US is now in a downturn. This can't look good for Canada, since the U.S. is our biggest export market. As per the Unified Countries COM TRADE database, in 2021, the United States imported US$363.9 billion from Canada. Here in Canada, RBC figures we will enter a downturn when the main quarter (Q1) of 2023.

This paints a bleak picture, yet they are cut out of the same coin. I'm totally serious in arguing that this moment is the best opportunity to begin Dividend Stocks in Canada investing.

The stock market has generally gotten investors the most money over the long haul, yet it additionally accompanies the most serious risk and instability. You need to purchase low and possibly sell high. Stocks are low now yet it doesn't mean they can't go lower. Furthermore, stock costs will go all over en route. It's difficult to figure the market bottom. Along these lines, your goal ought to be to build positions in quality stocks at lows.

At a significant level, the peak of the business cycle is when stocks begin falling, which go on into the compression stage that can transform into a recession. For reference, the Global Financial Crisis set off a downturn that went on around nine months until Q2 2009 in Canada.

Thus, this time span gives the right conditions to new investors to begin learning and applying stock investing.

Fortis: An extraordinary dividend stock to begin investing in

Fortis is an extraordinary Dividend Stock TSX to begin investing in. It has conveyed stable business results through economic cycles and delivered rising dividends for right around 50 consecutive years! It's a blue chip TSX stock you can rely upon.

Increasing interest rates have set off a significant sell-off of around 17 percent in the dividend stock year to date. The utility has a $20-billion five-year capital program to develop its rate base by around 6% each year. This ought to bring about dividend growth of 5-6 percent through 2026.

Fortis is one of the most minimal risk Dividend Stocks Canada you can find. At about $50 per share at writing, it gives a safe dividend yield of 4.5 percent. The dividend yield joined with a development pace of 6% approximates long haul annualized returns of around 10.5 percent. Additionally, analysts think the defensive stock is underestimated by around 18%. Valuation expansion ought to drive more prominent returns over the course of the following couple of years.

To be moderate, let’s assume an annualized return of 10.5%. By investing today, intensifying power magic can enable you to double your money in under 7 years as per the rule of 72.

After a pullback in stocks, this present time is an extraordinary opportunity for new financial backers to begin money management. I'm not kidding around! I suggest learning about value and dividend investing. Make sure to pick stocks wisely and aim for portfolio diversification to spread your gamble around.

#marketing#investor#trading#profit#tech#stocks#dividend stocks canada#best stock advisory company in canada.

0 notes

Text

Most Popular Dividend Stocks That are Appealing

Investors ordinarily search for the right mix of investments to turn out a steady and repeating income stream. And keeping in mind that investors will generally rush to the absolute most well known dividend stocks available, there are other, underrated Dividend Stocks in Canada that are similarly engaging.

Let’s Take a Look at Such Stocks:

The month to month income earner

Finding an incredible income stock that gives a steady and repeating dividend can be an overwhelming task for investors. Furthermore, finding one that pays out month to month is significantly more extraordinary. That is where Trade Pay Enterprise (TSX:EIF) becomes an integral factor.

Exchange income is procurement focused. The organization possesses more than twelve subsidiary organizations, which broadly fall into the aviation or assembling section. These organizations are one of a kind in that they offer essential support inside a separated specialty market. The way that they're in specialty markets means there is almost no competition.

Perfect examples of this incorporate giving passenger and freight services to Canada's far off north on the avionics side. Going to assembling, an interesting model incorporates a business that is liable for the installation of cell phone towers.

The other unique element of these subsidiary organizations is that they generate cash for Trade and exchange income. This thusly, converts into the juicy month to month dividend on offer. The current yield on that dividend works out to a liberal 5.94%. This means that a $40,000 interest in EIF will turn out a monthly income of $198.

Imminent investors ought to likewise take note that exchange income has given knocks to its profit throughout the long term, the latest of which came this previous summer.The main company that you've won't ever know about.

Saskatoon-based Nutrient is the biggest yield info and service provider in the world. The organization produces an incredible 27 million tons of phosphate, nitrogen, and potash items. The organization likewise flaunts a broad agricultural retail network compromising above and beyond 500,000 grower accounts.

Nutrien is one of a handful of the organizations available that has taken off this year. Year-to-date, the stock is up an incredible 25%, while the market is down almost 13%.

As far as results, in the latest quarter, Nutrient saw its sales surge 45% to US$14.5 billion, though profit took off 224% to US$3.6 billion. Part of the reason for the organization's ascent this year originates from the unavoidable vulnerability in the market.

Apart from the effect of the war in Ukraine, Nutrient is affected by rising fuel and energy costs, as well as progressing worldwide stock issues. The organization is additionally heading into its high season, as farmers collect their yields, and buy fertilizer for the next year.

These factors have helped push the stock higher this year, and likewise, prompted Nutrient knocking its profit. Nutrient's quarterly dividend presently conveys a decent yield of 2.5%, making it a strong underrated Dividend Stock TSX to consider for passive income.

Will you Purchase These Dividend Stocks?

No investment is without risk, and that applies to both Exchange Income and Nutrient. Luckily, the two stocks work in extraordinary sections of the market where there is little contest and a lot of potential gains, even in this volatile market.

As I would like to think, either of these underrated Dividend Stocks Canada should form a small part of each and every very much expanded portfolio.

#dividend#investor#marketing#best stock advisory company in canada.#dividend stocks canada#dividend stocks in canada#dividend stocks on tsx#top dividend stocks tsx

0 notes

Text

What is the Perfect Time to Purchase Cineplex Stock?

Cineplex's stock price has been crushed, and the consensus is that this is presently not a decent storyline. However, when assumptions get this low and desperate, it's not unexpected the right time to hop in. Let’s take a look:

The pandemic stunned Cineplex stock. It was the greatest business disturbance that no one might have at any point anticipated. However, more than two years after the fact, we realize that Cineplex endured. However, while the worst of the pandemic is behind us, the battle isn't over. Most investors are extremely distrustful about the film exhibition business. Streaming, they say, will be the last nail that seals Cineplex's coffin.

But, perhaps the pandemic has started a few positive changes. For instance, it appears as though studios are seeing renowned value in dramatic releases. The big deal that is made of a film release in theaters is important. As indicated by Cineplex, studios have understood that a dramatic window is urgent for them to accomplish the best financial reward and build their brand image.

A delineation of this realization is the expanded participation between streaming organizations and Cineplex.

The dramatic window is the time a film spends only in theaters. While the facts confirm that the business standard 90-day dramatic window has transformed into a 45-day window, everything isn't lost. The truth of the matter is that 75% to 80% of a box office collection is made in the initial three weekends of a film release.

Cineplex's stock cost is figuring in all despondency

Similarly as many organizations have had temporary chain issues because of the pandemic, Cineplex has too. This has come as on-set and after production delays. This has finished in an exceptionally feeble film record in the last part of 2022, generally August and September. We can see the impacts of this in box office numbers.

In July, box office incomes were 85% of July 2019 revenues. Be that as it may, this was trailed by August, when films were affected by Coronavirus delays. In August, box office income was just 64% of 2019 levels, and in September it was just 54% of 2019 levels.

We would like to underline how low expectations are for Cineplex stock. Furthermore, how unreasonable we believe these low expectations are. Its film business has given positive indications of growth this year, and after the pandemic deferrals are managed, areas of strength for the form prior in the year ought to proceed. Likewise, Cineplex is an expanded entertainment organization. Truth be told, 30% of its income is coming from different sections, for example, the entertainment and relaxation segment, which is posting record results.

Finally, Cineplex's stock price is cheap, trading at multiple times the next year's profit. Purchase when every other person is selling. It's not the end of the film - the climax is coming.

If you want regular stock updates, then visit to Trade 11 a leading Stocks Advisor Company in Canada or also consult to our Best Stock Advisors of Company Canada Anytime.

#investor#marketing#best stock advisory company in canada.#stock advisory company.#trading#tech#profit

0 notes

Text

Why to Invest in Green Energy Stocks in Canada

The renewable energy sector is exceptionally enormous in Canada, and picking the right company requires careful examination of some factors.

Above all else, it is essential to look at which sort of clean energy production they are engaged with. Diversification is essential, and the best renewable energy stocks in Canada are by and large organizations that have had the option to branch out into a wide range of clean energy creation.

Organizations that have invested in nations with green-energy friendly policies are probably going to see more noteworthy returns.

Investors interested in exploiting this ought to search for Canadian clean energy organizations that have active tasks in the U.S.

Are Renewable Energy Stocks a Better Investment Option?

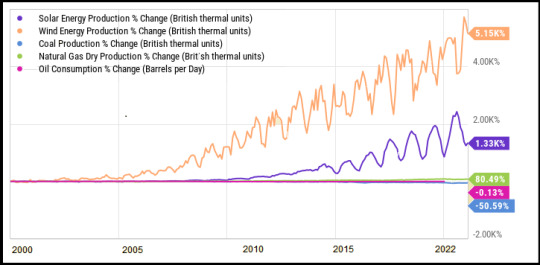

While each investment comes with risks and chances, renewable energy stocks are a developing area that ought to warrant thought from investors.

As of now, Canada’s share of energy production is 80 percent. The government authority has an expressed goal of expanding this to no less than 90 percent by 2030.

As climate change keeps on being a developing issue, Canada’s role as a clean energy pioneer means that the area will keep on getting huge consideration and investment.

Compared to the fossil fuel industry, Canada’s perfect energy area is still in its early stages. For those with long haul viewpoints, Green Energy Stocks in Canada is an extraordinary investment.

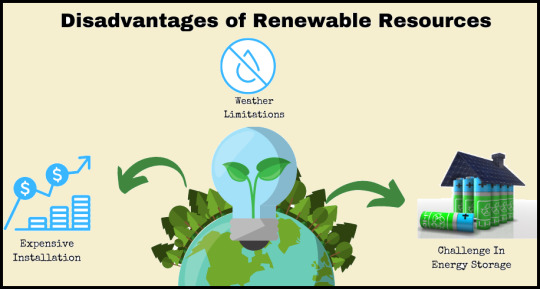

Disadvantages of Renewable Energy Stocks

While there has been critical attention placed on the decarbonization of the economy and the shift towards renewable power, the business industry is still generally new compared to traditional fossil fuels or products.

Institutional financial backers might like to secure their money in more traditional energy organizations, making fossil fuel makers a more secure investment.

Likewise, as a fresher industry that may at times depend on government help to keep them cutthroat with the traditional energy area, clean energy stocks are likewise dependent upon instability in light of political changes.

While Canada presently has an economic environment that is strong of environmentally friendly energy, that could change at any time based on political will.

In a world that keeps on searching for solutions for climate change, Canadian Green Energy Stocks are probably going to keep performing great comparative with the rest of the market.

#Renewable energy stocks in canada#investor#trading#best stock advisory company in canada.#stock advisory company.#Green energy stocks in canada#marketing#profit

0 notes

Text

Purchase the Best Small Caps Today

Small cap organizations will have a market capitalization between $300 million and $2 billion. These organizations normally offer higher development prospects and could convey more significant returns in the more extended horizon. Nonetheless, these organizations are unpredictable because of their weakness to market vacillations, accordingly making them less secure bets. In this way, investors with higher risk-resistance capacities can purchase the following small cap stocks, trading at a significant discount in the midst of the new selloff.

Docebo

Docebo offers multi-item learning suites to organizations around the world. The organization, which had seen significant development during the pandemic, has been feeling the squeeze throughout recent months. It has lost more than 65 percent of its stock worth, while its NTM (next a year) cost-to-deals various has declined to 5.1, which is below its historical average.

Go-easy

The 2nd on my list is Go-easy (TSX:GSY). The sub-prime lender has been conveying heavenly execution throughout recent years, with its income and changed EPS developing at 15.9 percent and 29.1 percent, separately. Notwithstanding the difficult environment, the organization’s finances have kept on rising this year. The organization’s top line decreased by 30%, while its changed EPS expanded by 12.1%. The extension of its advance portfolio in the midst of record advance starts and stable credit and payment performance drove its development.

Go-easy keeps on focusing on extending its item range, strengthening its dissemination channels, and adding new verticals to drive development. The organization is hopeful about its development and tasks its credit portfolio to develop by 65% to reach $4 billion toward the end of 2024. The organization could deliver a yearly profit of more than 22 percent through 2024. Likewise, its profit yield of 3.4% and NTM price-to-income of 8.1 make the organization an appealing purchase at these levels. Best stock advisory Company in Canada.

WELL Health Technologies

I expect that the development should go on as the organization’s addressable market extends. Great View Research expects the worldwide tele–healthcare market to develop at a CAGR of 27.8 percent until the end of this long period. The expanded adoption, developing internet entrance, and innovative advancements could drive the market. The organization declared an increase in its consolidation and procurement exercises in May by marking various letters of purpose. In spite of the difficult environment, it has raised its direction during the current year, which is empowering.

Notwithstanding, in the midst of the new correction, WELL health has lost over a portion of its stock worth and exchanges at an attractive NTM price-to-earnings of 12.3. In this way, taking into account this large number of elements, we are bullish on WELL Health.

#stock advisory company.#trading#marketing#investor#profit#tech#investing stocks#market#stocks to buy#stocknews

1 note

·

View note