Text

Talking points of Union Budget 2021

Union Budget 2021 is one of its kind. First, it is the first paperless Budget in Indian history. Second, it is more like a prescription to “get well soon” from the impact of the pandemic. Let us look at some of the proposals aimed to aid the economic revival.

Proposals impacting common people:

Better healthcare facilities

With a total outlay of Rs 2,23,846 cr as opposed to Rs 94,452 cr last year, the healthcare sector truly stole the show. Of the total outlay, Rs 35,000 cr is expected to be earmarked for COVID-19 vaccines. Well, its high time we realise health is wealth!

Better rail experience

Union Budget 2021 has proposed introducing 2 new technologies: metro lite and metro neo in tier II and tier III cities. If these are accepted, you would enjoy relatively cheaper metro services with the same convenience and ease.

Suraksha kavach for bank deposits

Thanks to the previous bank-related scams, Union Budget 2021 proposed a measure to protect depositors of funds from default risk. The proposal is to offer a cover of up to Rs 5 lakh per depositor on their deposits in stressed banks. In addition, streamlining the provisions may also be on cards so you have timely access to the cover.

Wealth creation for retail investors

LIC IPO has been long overdue now. But the FM has reassured that necessary amendments will be made to the law so as to divest LIC this year. In addition, 2 public sector banks would also be up for divestment during the year. If this happens, retail investors would get an opportunity to participate in wealth creation.

Tiny steps to fight pollution

In a bid to address the pollution, Budget 2021 has proposed a voluntary vehicle scrappage policy. As per this, personal vehicles and commercial vehicles would undergo fitness tests after 20 yrs and 15 yrs of usage, respectively. The policy would also spur the demand in the automobiles sector. On taking the year 1990 as the base, approximately 52 lakh passenger vehicles and 37 lakh commercial vehicles are eligible for voluntary scrapping as of now.

Because cleanliness is next to Godliness

The Budget 2021 also proposed the ‘Swachh Bharat 2.0’ campaign for which Rs 1.41 lakh cr has been allocated for 5 yrs from 2021. This mission would focus on wastewater treatment, complete faecal sludge management, reduction in single-use plastics, and segregation of garbage. Ultimately, it would result in a reduction in air pollution.

Shell out more for mobile phones

Budget 2021 has proposed to increase the customs duty on mobile phone parts from 0 to 2.5% and that of a battery charger from 10% to 15%. Although mobile phones would get costlier, the move would create opportunities for domestic manufacturers and promote the Make in India campaign.

Kyuki apna ghar apna hota hai

Budget 2021 has proposed to extend the tax holiday on affordable housing projects for a year more till 31st Mar 2022. Similarly, the additional tax deduction of Rs 1.5 lakh on home loans availed up till 31st Mar 2022 to buy a house under the affordable housing scheme would also be extended up till 31st Mar 2022. This will spur demand for housing and aid the related sectors.

On the tax front

Budget 2021 has exempted those aged 75 and above earning only pension income from filing returns, reducing the burden of senior citizens. Further, individual taxpayers are also relieved as the income tax rates are unchanged, if not reduced. What’s more, the Budget 2021 has also proposed a faceless dispute resolution system to fast-track the process.

Here’s an infographic before moving on to proposals impacting the businesses.

Proposals impacting businesses:

More foreign money and control in the insurance sector

Budget 2021 increased the FDI limit in the insurance sector from 49% to 74%. This proposal would not only attract more capital inflow into the sector but also aid the growth of the entire economy. It would also encourage new insurers to step into the market and create competition. Thanks to this, you may get access to new, innovative, and better insurance products.

Indian Railways to boost infrastructure

₹ 1.1 lakh cr is proposed to be allocated for the Indian Railways. Not only will this boost the railway sector, but also enhance the infrastructure. Further, 100% electrification of broad-gauge routes by December 2023 is also proposed.

Continue to read other proposals of the Budget 2021 here.

0 notes

Text

L&T Finance Ltd: Q3 results and rights issue

So far, Jan 2021 has been eventful for L&T Finance Ltd. Apart from reporting a ~50% increase in its Q3 FY 2021 loan disbursements, the private-sector lender also announced a rights issue of Rs 3,000 cr. Let’s discuss the details and prospects of the company.

Q3 results of L&T Finance Ltd

Q3 being the first quarter post lifting the COVID-related moratorium announced by the government was an eventful one for L&T Finance Ltd. A major chunk of L&T Finance’s borrowers who had defaulted EMI payments during the moratorium have started making the instalments.

Although L&T Finance Holdings’ Q3 FY 2021 results didn’t meet analysts’ expectations, an uptick in loan disbursements made up for the frowns on the street. Here are the highlights:

Quarterly disbursements of L&T Finance increased by 51%, the highest since Q1 FY 2021

Consolidated net profit declined by 51% y-o-y at Rs 291 cr

Disbursements during the quarter improved across most segments and were the highest in the farm and 2-wheeler segments since FY 2017. However, disbursement of micro loans was muted. Here are the details:

Farm Equipment disbursements increased by 43% q-o-q at Rs 1,554 cr

2-wheeler disbursements rose by 50% at Rs 1,652 cr q-o-q

Infrastructure disbursements recorded were Rs 4,641 cr, the highest in ~3 yrs

Rural disbursements zoomed by 49%

Net interest income (NII) rose 2% y-o-y to Rs 1,779.6 cr

Made additional provisions of Rs 1,739 cr on the standard book as of Q3 FY 2021

L&T Finance Holdings Ltd’s restructured assets were worth Rs 213 cr. The company holds a provision of 10% against these

The maximum potential restructuring will be or Rs 1,438 cr (1.4% of the total book)

L&T Finance rights issue

Recently, L&T Finance Ltd announced a rights issue of Rs 3,000 cr. The offer will open for subscription on 1st Feb 2021 and close on 15th of the same month. The company will offer rights issue based on an entitlement ratio at 17:74 as on the record date, at a discounted price of Rs 65 apiece. Meaning, as an eligible holder of an L&T Finance share, you will get 17 equity shares for every 74 shares you hold as on the record date.

Currently, L&T Finance Holdings Limited has outstanding shares of about 200.81 cr. This figure would increase to about 246.94 cr after the rights issue, if fully subscribed.

What is rights issue?

A rights issue gives existing shareholders a right to buy new shares at a discounted price during a predetermined period. In other words, it allows the company to raise funds by issuing additional equity shares to its existing shareholders.

Purpose of L&T Finance Holdings’ rights issue

Like banks, other financial institutions have also been raising funds to augment their capital buffers as a measure to safeguard themselves against the impact of the pandemic. So far, NBFCs such as Mahindra & Mahindra Finance and Shriram Transport Finance have raised Rs 3,089 cr and Rs 1,500 cr via rights issues. L&T Finance Ltd is following suit. Post the rights issue, L&T Finance Holdings’ Tier-1 capital is likely to increase from 17.8% to 19.6%.

Eligibility criteria to subscribe to L&T Finance Holdings Ltd’s rights issue

You are eligible to apply for at least 1 L&T Finance share of the rights issue if you currently hold 5 or more equity shares of the company. Once eligible, you will also be entitled to preferential consideration for the allotment of an additional L&T Finance share if you apply for stocks beyond your rights entitlement. However, this will be subject to the availability of shares after allocating the rights entitlements applied by all other shareholders.

Prospects of L&T Finance Ltd

L&T Finance expects a month-on-month (m-o-m) improvement in its collection efficiency (CE). Further, favourable liquidity conditions in the country have reduced the cost of borrowing. This would, in turn, push the demand for credit and present growth opportunities to L&T Finance. In addition, the company’s strong balance sheet and an increase in its disbursements would also help L&T Finance Ltd deal with COVID-related uncertainties and help grow its business.

Keep track of L&T Finance share price, financials, insider trading, and corporate actions, and latest developments on Tickertape, your favourite investment analysis platform.

For more articles on stocks, personal finance, and current events in the domains, visit Blog by Tickertape.

0 notes

Text

Union Budget 2021: expectations, hopes, and wishes

The Union Budget 2021 is set to be announced on 1st Feb 2021 and we thought why not compile a list of expectations that citizens have from it, especially during a time when hit by the pandemic. This time, Finance Minister Nirmala Sitharaman has promised India a Union Budget like never before, which has added to the anticipation and excitement of the citizens. Let’s understand what individuals and businesses are expecting, hoping, and wishing from the Budget 2021.

Investments ≠ savings

Experts are hoping for an increase in the tax deduction limit available under Section 80C of the Income Tax Act up to Rs 3 lakh, whereas the limit is up to Rs 1.5 lakh currently. Section 80C deals with several investments and expenses such as Public Provident Fund, Life Insurance premium, and so on. This would encourage taxpayers to invest more.

Because a house is a security

Taxpayers are expecting the government to increase the tax deduction limits for the repayment of principal and payment of interest on a home loan under Section 80C and Section 24b, respectively. The expectation is: the HRA limit for salaried taxpayers should match the tax exemption limit on the repayment of principal of a home loan. This would spur the demand for affordable housing and the real estate sector as a whole.

Sacred truth: health is wealth

Experts are also expecting a higher tax deduction limit under Section 80D for health insurance premium paid. This would aid deeper penetration of health insurance in the country and make individuals and households better-equipped to meet increasing healthcare expenses. This is to enhance the affordability of quality healthcare. Also, a special focus on enabling easier access to healthcare financing.

Long and short term: about time

Savings can be both short-term and long-term. Experts are hoping that the Budget 2021 makes a clear distinction between both so as to encourage individuals to save for the long term. Since the current income tax policy doesn’t have a provision for long term investments such as life insurance and pension funds, experts are hoping that the government introduces separate exemption limits for both the products in addition to Section 80C.

Much-needed MSME bonanza

MSMEs have been among the most impacted sector by the COVID-19. Ergo, the sector has high hopes from the upcoming Budget for its revival. First, they expect a hike in the limit of collateral-free loans available under the Credit Guarantee Fund for MSMEs. Next, they are wishing for a tax holiday of 1-2 yrs, which would help them revive.

Adjusting GST rates

A temporary reduction in GST rates is expected to boost the COVID-impacted sectors including hospitality, and tours and travel. Not only this, taxpayers are also hoping for a relaxation regarding the payment of GST on a receipt basis, which would ensure better cash flows. Further, taxpayers are also hoping for the inclusion of health insurance in the 5% GST tax slab to enhance the affordability of quality healthcare.

Continue to read.

0 notes

Text

HFFC IPO opens today: details and analysis

HFFC IPO will allow existing investors and shareholders including True North, Bessemer Venture Partners, GIC, PS Jayakumar, and Manoj Viswanathan to partially exit their investments in the company.

In Oct and Nov last year, HFFC had issued over 22.40 lakh shares to Orange Clove Investments B.V. and 1.22 lakh shares to its employees via preferential allotment. Ergo, HFFC has slashed its fresh issue size from Rs 344.08 cr to Rs 265 cr due to its pre-IPO placement.

HFFC IPO details

The housing finance company has already raised Rs 346 cr from anchor investors on 20th Jan 2021. Additionally, HFFC is looking to raise ~1,200 cr via IPO, whose details are:

The IPO is open for subscription from 21st Jan 2021 to 25th Jan 2021 and is to be listed on both BSE and NSE. The likely listing date is 3rd Feb 2021

HFFC IPO consists of a fresh issue of up to Rs 265 cr and an offer-for-sale of up to Rs 888.71 cr by promoters and existing shareholders

The minimum lot size of the subscription is 28 shares. The price band of the IPO is set at Rs 517 — Rs 518 apiece

50% of the IPO is reserved for Qualified Institutional Buyers, 35% for retail investors, and 15% for non-institutional investors

While KFin Technologies Pvt Ltd is the registrar of HFFC IPO, Axis Capital Ltd, Kotak Mahindra Capital Company Ltd, ICICI Securities Ltd, and Credit Suisse Securities (India) Pvt Ltd are the book running lead managers

Objectives of HFFC IPO

Home First Finance Company plans to utilise the net proceeds of the IPO to augment its capital base for future growth requirements

Enjoy the benefits of listing the company on bourses

Valuation of HFFC

HFFC commands a moderate to fair valuation of 38 times its annualised PE compared to its peer Aavas Financiers, which is trading at 62 times.

About HFFC

Founded in 2010 by Jaithirth Rao and P S Jayakumar, Home First Finance Company India Limited (HFCC) is a non-bank lender, classified as a housing finance company. HFFC is a technology-driven financier in the affordable housing segment. Today, it has a presence in the urbanized regions of Gujarat, Maharashtra, Karnataka and Tamil Nadu.

HFFC focuses on first-time homebuyers in the low- and middle-income groups and offers home loans to salaried and self-employed professionals for constructing or purchasing homes. While salaried customers account for 72.6% of HFFC’s gross loan assets, self-employed customers account for 24.6%. Over the last 10 yrs, the company has offered over 50,000 home loans to borrowers in 60 districts of 11 states and 1 union territory.

HFFC is a rapidly growing company. The deployment of technology in its day-to-day operations and going paperless in its processes have aided the company’s growth trajectory. HFFC is backed by private equity funds Warburg Pincus (WP) and True North, and Singapore’s sovereign wealth fund GIC. Earlier this month, Warburg Pincus raised its stake in HFFC by 5.03% to 30.62%.

HFFC has strategically expanded to geographical regions with substantial demand for housing finance. It has diverse lead sourcing channels including architects, connectors, affordable housing developers, loan camps, micro marketing activities, contractors, employee and customer referrals, and branch walk-in customers. HFFC’s is known for efficient collections management, superior underwriting standards, and a high growth momentum on a smaller base.

Continue to read the financials, prospects, and risk of HFFC here.

0 notes

Text

Indian Railway Finance Corporation Limited (IRFC Ltd) IPO

Indian Railway Finance Corporation Limited (IRFC Ltd), the Indian Railways’ dedicated NBFC is going public. The Rs 4,633 cr-worth IPO, which is the first one to go live in 2021, opened for subscription yesterday and closes tomorrow. In this article, we analyse IRFC’s business model, its financials, and IPO details to help you decide whether or not to apply for the same.

About IRFC Ltd

IRFC Ltd is registered as a systemically important NBFC under the category of an Infrastructure Finance Company with the RBI. It is the dedicated NBFC of the Indian Railways’, giving IRFC a monopoly in its field. Thanks to this, IRFC has played a vital role in enhancing the capacity of the Indian Railways by funding its annual plan over the last 3 decades.

Objectives of IRFC Ltd

Finance the acquisition of rolling stock and infrastructure assets

Lease railway infrastructure assets and national projects of the Government of India (GoI)

Lend to other entities under the Ministry of Railways (MoR)

Offer financial assistance to activities having forward and backward linkages

IRFC Ltd’s business

IRFC is a state-run non-banking financial corporation dedicated to serving the Indian Railways and other entities falling under the ambit of the Ministry of Railways. It is involved in borrowing, lending, and leasing activities, all relating to the Indian Railways. IRFC raises/borrows funds from the market and lends it to the Indian Railways, which uses the money to acquire rolling stock assets, both powered and unpowered vehicles including coaches, trucks, locomotives, containers, wagons, and trollies. This is one of IRFC’s sources of income.

The PSU NBFC also acquires assets required by the Ministry of Railways and offers the same on lease to the Ministry. In doing so, IRFC earns lease rentals. The lease period spreads across 15 yrs to 30 yrs, where the first 15 yrs focus on recovering the principal, the weighted cost of borrowing, and a margin; and the last 15 yrs generate revenue. IRFC also finances other entities under the Ministry of Railways (MoR) and facilitates priority capital expenditure (capex) for the national carrier.

Talking about raising funds, IRFC Ltd borrows from both domestic and/or international markets. It sources funds from diversified avenues including equity infusion, term loans from banks/financial institutions, taxable and tax-free bonds issuances, internal accruals, asset securitisation, ECB’s, and lease financing.

Cost-plus business model of IRFC Ltd

IRFC operates on the cost-plus model, which is beneficial in many ways. For one, it earns an additional margin. The expenses of IRFC Ltd relating to foreign currency hedging costs or losses and gains along with hedging costs for interest rate fluctuations are included in the weighted average cost of incremental borrowing. On this, IRFC earns additional margin as decided by the MoR. Further, the arrangement also gives IRFC Ltd a relatively higher margin, making its liquidity position favourable. Moreover, this arrangement guarantees IRFC a profit margin, which is an advantage.

Highlights of IRFC Ltd

IRFC gets sovereign support, which sets it apart from its peers

IRFC receives lease rentals from Indian Railways 6 mth in advance, that is, in Apr and Oct

Due to major exposure to the MoR, IRFC has 0 NPAs

IRFC enjoys the highest credit ratings for an Indian issuer for both domestic and international borrowings

IRFC’s Credit ratings from several entities

CRISIL: AAA and A1+

ICRA: AAA and A1+

CARE: AAA and A1+

Moody’s: Baa3 (Negative) rating

Standard and Poor’s: BBB (Stable) rating

Fitch: BBB (Negative) rating

Japanese Credit Rating Agency: BBB+ (Stable)

Continue reading about IRFC IPO here.

0 notes

Text

What is third party insurance?

An insurance policy offers monetary protection against contingencies. Insurance is of two broad types: life insurance and general insurance. In this article, we discuss third party insurance, a subset of general insurance.

What is third party insurance?

The name ‘third party’ stems from the fact that the beneficiary of the policy is someone other than the two parties of the contract: the insured (that is, you) and the insurer. Also known as ‘act-only’ or ‘liability-only’ insurance, a third party insurance policy offers monetary coverage against a third party’s losses or damages caused by you or your insured asset. However, you, being the insured/policyholder, will not receive any benefits or compensation on the occurrence of the event.

Inclusions and exclusions of a third party insurance policy

Inclusions of insurance mean the items/events covered by a policy and exclusions are those that are not covered. A typical third party insurance cover has the following inclusions and exclusions:

Inclusions:

Monetary protection against the damages caused to the third party by the insured

Damages include death, disability or physical injuries caused to the third party. In addition, damages sustained by the third party’s vehicle or property is also included

Exclusions:

Damages due to an accident caused when driving under the influence of alcohol

The driver is a minor or is guilty of driving without a valid motor driving license

The accident was planned

The vehicle was used for illegal activities or commercial purposes

The vehicle was stolen when the accident occurred

Terminologies used in a third party insurance policy

Understanding the terminologies used in a third party insurance policy is key to know how the policy works. Note these:

First party: is the insured or the policyholder

Second party: is the insurance company or the insurer

Third party: is the person who sustains damages and claims compensation for damages caused by the first party

Types of third party insurance

Talking about the insured property, it can be: a motor vehicle, a rented house or a business premise, depending on the type of the policy. These are called:

Third party accident insurance

Renters’ insurance policy

Business liability insurance

How does a third party insurance policy work?

A third party insurance policy doesn’t compensate the insured but a person not part of the contract. Let’s take an example of motor vehicle insurance. Having third party insurance for both two and 4-wheelers is a prerequisite in India as per the Motor Vehicles Act. Without it, you can face legal consequences. So this is how the policy works.

In case of an accident caused by your insured vehicle, you’ll be liable to compensate the victim, who will raise a claim against your insurance policy. The insurer will then assess the damage caused and compensate the third party who has sustained injuries/damages. But the policy doesn’t cover the injuries you sustain or the damages caused to your property/vehicle. It only covers your financial liability arising due to the death, disability, loss or damage caused to a third party property/vehicle.

In doing so, a third party cover indirectly protects you by reducing your financial burden. In case of an accident, the insured is required to immediately inform the insurer about the same. On filing the claim, the insurer appoints a surveyor to assess the damage caused and verify the estimated cost of repairs or compensation. After the completion of the verification, the insurer settles the claim. Continue to read the significance of a third party insurance cover, details to be furnished when submitting a claim, and the process to claim third party insurance here.

0 notes

Text

Are you liable to pay advance tax?

Paying income tax is more like a national responsibility. That said, paying your taxes in advance can relieve you of stress arising from keeping it for the year-end. In this article, we talk about everything you need to know about advance tax.

What is advance tax?

Paying a portion of your income tax liability for a financial year in advance or before the year-end is called an advance tax. It is payable when your income tax liability for a financial year equals or exceeds Rs 10,000. You only attract advance tax on the income generated in a year.

Advance tax due dates

Advance tax payment is to be done in instalments before the specified due dates.

For self-employed and individual businesses, the advance tax due dates and specified instalments are:

30% of advance tax liability to be paid on or before 15th Sep

60% of the advance tax amount to be paid by 15th Dec

100% of advance tax liability to be paid on or before 15th Mar

For corporates, the advance tax due dates and specified instalments are:

At least 15% of the advance tax liability to be paid on or before 15th Jun

At least 45% of the advance tax liability to be paid by 15th Sep

At least 75% of the advance tax liability to be paid on or before 15th Dec

100% of advance tax liability to be paid by 15th Mar

Who is liable to pay advance tax?

All categories of taxpayers including freelancers, salaried individuals, professionals, and senior citizens are liable to pay advance tax if the total tax liability for a financial year after adjusting TDS is over Rs 10,000. A list is:

Your tax liability after TDS is Rs 10,000 or more

You are a self-employed or a salaried individual

You have earned capital gains on the sale of shares

You have earned interest on fixed deposits

You have received lottery income

You receive rent or income from house property

NRIs whose accrued income in India exceeds Rs 10,000

Advance tax payment for taxpayers under the purview of presumptive income

Businesses or professionals including (architects, lawyers, doctors, and consultants) under the purview of presumptive tax regime of Section 44AD are required to pay 100% advance tax liability by 15th Mar of the financial year.

How to calculate advance tax payment?

You can compute your advance tax liability by following these steps:

Step 1: Ascertain your estimated income other than salary for the given financial year

Step 2: Deduct your expenses such as rent, travel, and internet

Step 3: Add your salary income, if any

Step 4: Subtract TDS already deducted or likely to be deducted

Step 5: Compute tax payable as per your applicable income tax slab

Step 6: In case your tax liability after deducting TDS payment exceeds Rs 10,000, then you are liable to pay advance tax

Alternatively, you can also calculate your advance tax liability using the advance tax calculator available on the income tax department’s website.

Continue reading what happens in case you delay advance tax payments, refund policy, and process of paying advance tax online and offline.

0 notes

Text

RIL and Mukesh Ambani’s gloomy start to 2021

Happy new year, folks!

Even as we ring into 2021 with excitement, hoping that the deadly pandemic finally bids a goodbye, business tycoon Mukesh Ambani and his empire Reliance Industries Limited had a rather shocking start to the year on learning about the hefty-penalty that arose from a 13-yr old case. Let’s find out more.

The gist of the case

On 1st Jan 2021, SEBI declared in its order that RIL and its agents were involved in alleged manipulative trading, which garnered them undue profits. SEBI holds Mukesh Ambani liable for this on the grounds of him being the Chairman and Managing Director of RIL.

Timeline of the case

March 2007: Ambani-led RIL looked to sell a 4.1% stake in RPL

Nov 2007: RIL appoints 12 unlisted agents to trade in Futures of RPL on its behalf. RIL itself trades the RPL stock in the cash segment. RPL’s derivatives holdings touched 95% of the permissible limit, attracting SEBI’s probe

Dec 2010: SEBI alleges RIL and the 12 agents of fraudulent trades by issuing show-cause notices

Mar 2017: SEBI penalises RIL and associated parties Rs 447 cr. The watchdog also bans RIL from trading in the F&O segment of Indian capital markets. RIL challenges SEBI’s order in Securities Appellate Tribunal (SAT)

Nov 2020: The SAT dismissed RIL’s appeal against the order

Jan 2021: RIL, Mukesh Ambani, and two other entities slapped with a hefty penalty. The penalty is in addition to the previous order to disgorge Rs 447 cr

The 13-yr old case in brief

Back in 2007, the RIL’s Board of Directors had passed a resolution that approved the operating plan for 2007–08 and resource requirement for the next 2 yrs, which was ~Rs 87,000 cr. In Nov of the same year, RIL decided to offload 4.1% of its stake in Reliance Petroleum Limited, it’s subsidiary. To undertake transactions thereof, RIL appointed 12 agents between in the 2 months that followed.

Reportedly, RIL and the 12 agents bought stocks of RPL and put their bets against the securities. That way, the trade would be favourable if the price of RPL declined and not increased. Now, SEBI alleges that RIL and the 12 agents had entered a prior agreement to take short positions in RPL and transfer the gains thereon to RIL. A short position means when a trader sells securities with the intention of repurchasing it at a lower price.

Accordingly, the 12 agents took short positions in RPL on behalf of RIL in the F&O Segment and Reliance itself conducted the transactions in the cash segment. By Nov 2007, RIL’s short positions in the derivative segment had exceeded 95%, the permissible limit. Put together, RIL’s outstanding position of 7.97 cr in the F&O Segment was settled for cash at a reduced settlement price, which resulted in undue profits. What’s more, these gains were then transferred to RIL by the agents.

These series of manipulative trades in stocks of Reliance Petroleum Limited in the Cash and the F&O markets triggered SEBI’s probe into the matter. After years of investigation, in 2017, RIL was directed to disgorge Rs 447.27 cr along with interest at 12% p.a. from 29 thNov 2007 to the date of payment. In addition, SEBI had also imposed a 1-yr ban on RIL from trading in India’s F&O segment, either directly or indirectly.

Securities and Exchange Board of India (SEBI) observed that the violation of trade was a well-planned operation:

To earn undue profits from the sale of RPL stocks in cash and futures markets

To bring down the settlement price of RPL by dumping a large number of stocks in the cash market during the last 10 min of trading on the settlement day

RIL appealed against the order but SAT dismissed the plea in Nov 2020. But grey days seemed to continue for RIL. In Jan 2021, SEBI imposed a hefty penalty on RIL, Mukesh Ambani, Mumbai SEZ Limited, and Navi Mumbai SEZ Private Limited. The latter two entities had allegedly aided RIL by offering funds to an agent appointed by the company. The agent in question, in turn, offered funds to the other 11 fellow agents to fund the margin required to take short positions in RPL November Futures. As per the latest SEBI order, the parties are fined as follows:

RIL: Rs 25 cr

Mukesh Ambani: Rs 15 cr

Mumbai SEZ Limited: Rs 10 cr

Navi Mumbai SEZ Private Limited: Rs 20 cr

This penalty is in addition to the earlier disgorgement order. Read how these violations affect shareholders and RIL’s stance on the verdict here.

0 notes

Text

9 Post Office Savings Schemes offered by India Post

Post office saving schemes are investments offered by India Post/Department of Posts (DoP)—a postal system operated by the government. These investments are known for their attractive interest rates and tax benefits. But what sets them apart from most other investments is the sovereign guarantee that they have. Meaning, Post Office Savings avenues are backed by the government, which makes them safe avenues.

Let us look at the various Post Office Savings schemes available for you to invest.

1. Post Office Savings Account (POSA)

Similar to a savings account offered by a bank, each individual can have only one POSA with one post office. However, this account can be transferred from one branch of the post office to the other. Post Office Savings Account offers an interest of 4%, which is fully taxable but it doesn’t attract TDS. However, you can claim a tax deduction of Rs 10,000 annually on interest earned from all your savings accounts combined including this under Section 80TTA.

The initial deposit required to open a Post Office Savings Account is Rs 20. Thereafter, you are required to maintain a minimum balance of Rs 50 for an account with a non-cheque facility and Rs 500 for an account with a cheque facility. You can also open POSA in the name of a minor. Recently, the government introduced the internet banking facility for POSA, making it convenient for investors to operate the savings account.

2. Senior Citizen Savings Scheme (SCSS)

As the name suggests, SCSS is a post office savings avenue specially designed for citizens aged 60 yrs. Nonetheless, those opting for voluntary retirement after the age of 55 can also open an account within a month of receiving their retirement benefits. Note that the investment amount, in this case, shouldn’t exceed the retirement corpus you receive therefrom. Talking about the benefits, SCSS offers a regular interest income to the investor, which is paid on a quarterly basis. This arrangement makes it quite convenient for senior citizens to meet their expenses in their sunset years. The current interest rate on an SCSS account is 7.4% pa.

An SCSS account can be opened individually or jointly with your spouse. While the maximum amount you can invest in this scheme is Rs 15 lakh, the investment should be in multiples of Rs 1,000. Talking about tax benefits, SCSS offers a deduction under Section 80C subject to the overall limit of Rs 1.5 lakh. However, interest income exceeding Rs 10,000 a year is subject to TDS. Although SCSS has a lock-in period of 5 yrs, it is liquid. The scheme allows you to make premature withdrawals of the principal on the completion of a year but only on paying a penalty of 1.5% after completion of a year and 1% after 2 yrs. If you wish to continue enjoying the benefits of SCSS after maturity, you can extend it for 3 more years.

3. Sukanya Samriddhi Yojana (SSY)

This Post Office Savings Scheme is specially designed for the welfare of girl children. The account can be opened by a girl child’s parents or legal guardians any time before she turns 10. SSY’s exempt-exempt-exempt (EEE) tax status makes the scheme extremely attractive. EEE means principal, interest, and maturity proceeds of the scheme are all exempt. The prevailing interest rate is 7.6%pa.

One girl child can have only one account registered under her name and parents can have a maximum of two SSY accounts in the name of 2 girl children. The maturity proceeds of SSY are paid to the girl child after the completion of 21 yrs. While the minimum investment for SSY is Rs 1,000, the maximum limit is Rs 1.5 lakh per year. In case you fail to pay the minimum deposit in a financial year, you’ll be liable to pay a penalty.

4. Post Office Monthly Income Scheme (POMIS)

This scheme offers a guaranteed fixed monthly income on a lump sum investment, making it a suitable avenue for risk-averse investors. POMIS can be opened only by a resident individual and they can do so individually or jointly. A minor can also invest in this post office savings avenue and if they are aged over 10 yrs, they can even operate their account. While the minimum investment is Rs 1,500, the maximum is Rs 4.5 lakh for a single account. In case of a joint account, the maximum limit is Rs 9 lakh. As the name suggests, POMIS pays a monthly interest for a maturity period of 5 yrs. On the completion of the tenor, you receive the principal amount.

While there’s no restriction on the number of POMIS accounts you can have, the combined maximum investment allowed is Rs 4.5 lakh. You can also make a premature withdrawal after the completion of a year, subject to a penalty, which is 2% on deposit if you withdraw between the 1st yr and the 3rd yr and 1% on withdrawals after 3 yrs. You can transfer a POMIS account from one post office to another. While interest received is taxable, it doesn’t attract TDS. Further, deposits are exempt from wealth tax. Although the interest rate is revised quarterly, your account will earn interest at the rate applicable to the quarter of your investment. The current interest rate is 6.6% pa payable monthly.

5. Post Office Time Deposit (POTD)

This post office savings scheme is similar to a fixed deposit offered by a bank. Although the Post Office Term Deposits are available in 4 tenors—1 yr, 2 yrs, 3 yrs, and 5 yrs—only the one with 5 yr term offers tax benefits under Section 80C. The interest rate on this FD is revised quarterly but your scheme will earn interest at the rate applicable to the quarter of your investment. Currently, the account earns interest of 5.5% for the 1st, 2nd, and 3rd yrs and 6.7% for the 4th yr.

While the minimum investment is Rs 200, there is no maximum limit. You can hold any number of POTD accounts singly, jointly, and in the name of a minor. The FD account can be transferred from one branch of the post office to another. On maturity, your account automatically renews for the same tenor and earns interest at the rate prevailing on the date of maturity. POTD can also be opened by a minor. Continue reading the other post office savings schemes here.

0 notes

Text

Decoding Form 16: significance, components, and FAQs

The deadline to file your income tax return for the Financial Year 2019–20 and Assessment Year 2020–21 is postponed to 30th Nov 2020. And if you are a salaried individual, sorting out Form 16 is a must before filing your returns. In this article, let us look at what Form 16 is and why it’s important to collect yours from your employer.

What is Form 16?

Form 16 is issued under Section 203 of the Income Tax Act, 1961 by an employer to their employee for tax deducted at source (TDS) from the latter’s salary income. It is the summary of the amount paid/credited to the employee and taxes deducted thereon.

Significance of Form 16

Form 16 serves the following purposes:

Since Form 16 has your TDS details for a financial year, it is an important source of information when filing your income tax return (ITR)

Form 16 is proof of TDS deduction on salary from your income and is an important document for tax compliance

You can furnish this form as proof during any income tax-related scrutiny

Some organizations require you to submit Form 16 from your previous employer as part of the onboarding process

Banks and other financial institutions accept Form 16 as a valid proof of income, which is crucial to get approval on loans

In case you are to travel abroad, certain visa checklists require you to submit Form 16

When is Form 16 issued?

As per the current guidelines, an employer is required to issue Form 16 annually on or before 15th Jun of the year following the financial year in which TDS was deducted. In case there was no tax deducted at source in a given year, the employer will not issue Form 16 for that year.

Components of the salary certificate

Form 16 has two components: Part A and Part B.

Part A of Form 16

This part mentions the details of tax deducted at source on the employee’s salary income:

Name and address of the employer

TAN and PAN of the employer

Assessment Year (AY)

Summary of the amount paid/credited to the employee

Date and amount of tax deducted at source on a quarterly basis

Date of tax deposited with the government

Acknowledgement number of TDS on salary

Your employer can generate and download Part A of Form 16 via the TRACES portal. Before issuing this form, your employer should authenticate its contents. In case you change your job or work with more than one employer in a given financial year, each employer will issue a separate Part A of Form 16 for the period of your employment.

Part B of Form 16

An annexure to Part A, Part B of Form 16 includes the following information:

Detailed salary breakup including gross income, house rent allowance, gratuity, leave travel allowance, and leave encashment

Allowances exempt under Section 10

Deductions under Chapter VI-A of the IT Act

Deductions under Section 80 C, 80 CCC, 80 CCD

Deductions under sections 80D, 80E, 80G, deductions for disability, and others

Net taxable salary

Education Cess and surcharge, if any

Rebates under Section 87, 89

Total tax payable

Tax deducted

Balance tax payable or refund

In case you change your job in a financial year, you need not ask for Part B of Form 16 from each of your employers. Requesting the form from either of them is enough.

In addition to the above, Form 16 has specific fields for the following deductions:

Section 80C deductions such as life insurance premium paid and PPF contribution made

Health insurance premium paid under Section 80D

Contribution made to a pension fund under Section 80CCC

Employee’s contribution to a pension scheme under Section 80CCD (1)

Taxpayer’s self-contribution made to a pension scheme under Section 80CCD (1B)

Employer’s contribution made to a pension scheme under Section 80CCD (2)

Interest income on savings account under Section 80TTA

Interest paid on higher education loan under Section 80E

Donations made under Section 80G

Details from Form 16 required to file ITR

You’ll require the following information from Form 16 when filing your ITR for FY 2019–20 (AY 2020–21):

1. TAN and PAN of your employer

2. Name and address of your employer

3. Your name and address

4. Current assessment year

5. Taxable salary

6. TDS deducted by your employer

7. Items exempt under Section 10

8. Breakup of deductions under Section 16

9. Income/loss from house property offered for TDS

10. Income under the head Other Sources offered for TDS

11. Breakup of deductions under Section 80C

12. Aggregate of deductions under Section 80C

13. Tax payable or refund due

Continue to read about Form 16A and Form 16B and FAQs on the topic you can’t miss here.

0 notes

Text

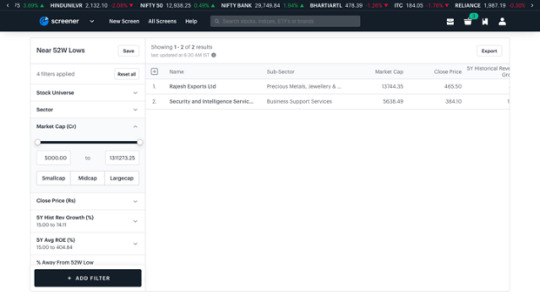

Now discover stocks and ETFs based on favourite metrics with Pre-built Screens

Hand-picking stocks and ETFs to invest from thousands listed on the NSE is not an easy ordeal. First, you need to come up with an idea or theme based on which you want to filter stocks/ETFs. Then, you need to apply filters that help screen them based on the idea. Finally, you need to research the filtered stocks/ETFs individually to make a decision. While this is an interesting process that aids you make well-informed investment decisions, it is highly time-consuming.

We at Tickertape, strive to make investing a rewarding and fulfilling yet a simple process for you. That’s why we launched Pre-Built Screens, readymade stock filtering tools that simplifies screening stocks and ETFs. This article focuses on the same: Pre-built Screens. But before understanding how Pre-built stocks can delight your ETF and stock investment experience, let’s learn more about Screener, a premise to understand Pre-built Screens.

What is Screener?

One of Tickertape’s most loved-products, the Screener filters stocks based on your chosen ratios and metrics. Screener has a collection of 130+ filters including Stock Universe, Sector, Market Capitalization, Profitability ratios, and Valuation ratios. Once you set the filters, what you see on the right-hand side is a list of stocks that are a result of applying your chosen filters.

Premise for Pre-built Screens: investing based on an idea or a theme

More often than not, when filtering stocks and ETFs, you start with an idea. This not only gives a direction to your stocks or ETFs selection process but also helps you quickly and mindfully pick those that complement your investment objective.

Let’s say you are looking to invest in largecap IT stocks that aren’t heavily funded with debt and have ample current assets to meet their short-term liabilities. That’s an idea — to invest in companies that are majorly funded with equity and less of debt, and can repay their current liabilities using their current assets. To arrive at such stocks, you need to filter all the listed companies based on 4 parameters: sector, market cap, debt to equity and current ratios.

Here’s how you can do it by using Screener by Tickertape:

Launch Tickertape’s Screener

Select “Information Technology” under ‘Sector’ filter

Select “Largecap” under ‘Market Cap’ filter

Add “debt to equity ratio” and “current ratio” available in the filter panel under ‘Financial Ratios’ metric

Set “Low” level for debt to equity ratio and “High” level for current ratio

Evaluate each of the resultant IT stocks for a detailed analysis before making an investment decision

Filtering stocks using Screener by Tickertape based on your favourite metrics is that simple. But what if you are a newbie in financial markets and have no idea about the metrics that go in filtering stocks/ETFs based on an idea? And what if you are a seasoned investor looking to quickly filter stocks/ETFs based on an interesting or a customised idea? Well, you can use Tickertape’s Pre-built Screens.

What are Pre-built Screens?

A Pre-built Screen is a smart solution to discover stocks and ETFs based on an idea or a specific theme. Meaning, you simply launch one of the Pre-built Screens whose idea or theme is in line with your investment objective and there, the screener will filter and return stocks/ETFs accordingly. Thus, you save time in researching filters to add and the levels of the metrics to be set to get the resultant stocks/ETFs.

How to access Pre-built Screens?

Tickertape has several Pre-built Screens including Money Minters, Near 52W Lows, and Wealth Emissaries. Here’s how you can access them:

Launch Tickertape’s Screener

On the top header, select “All Screens” tab

Choose the one that meets your investment objective and start an in-depth evaluation of each filtered stock. For instance, let us load Near 52W Lows Screen. Here’s how it looks.

Continue to read more about the various types of Pre-built Screens and how to build your own Screen on Tickertape here.

0 notes

Text

Ever wondered what are high beta stocks? If yes, read this.

Wouldn’t it be great if you had an indicator of how risky a stock is? It would make choosing a stock much simpler, right? You would pick one that best suits your risk appetite and minimise your losses. Well, you do have such an indicator and it is called beta. A beta value of a stock suggests the extent of its volatility as compared to the broader market.

Talking of beta, you may have heard about high beta stocks. And if you have the itch to learn more about this risk indicator of stocks and also what are high beta stocks, you have come to the right place. Let’s jump right in.

Risk: the premise for high beta stocks

Stock investing is a risky business and that’s true. But what comes without risk? Let us get this straight. Money only grows when invested. There’s no alternative to it. Naturally, when you entrust your money to someone else with a view to grow it, there is a risk factor associated with it. You may either not get your funds back at all or may have to accept lower than expected returns on it.

So, does this stop you from investing? No. You still invest in instruments that are relatively less risky. Or you may diversify thoughtfully. Same goes for stocks. While some are highly volatile, others may not be as much. The measure used to ascertain the risk associated with stock is beta.

What are high beta stocks?

Shares with a beta value or coefficient higher than 1 are high beta stocks. Simply put, high beta stocks are very risky. But it is a well-known notion that risk and returns are directly related to each other. As such, even though high beta stocks are risky, they have the potential to generate high returns as well. That’s why investors looking to create significant wealth by investing in shares, go for high beta stock.

Here’s some technical information, if you will.

What is beta in a stock?

Beta is a statistical measure of a stock’s volatility compared to that of the broader market. It is calculated using regression analysis, a statistical method used to find the relationship of a dependent variable with one or more independent variables. In the context of high beta stocks, the risk associated with stock is a dependent variable and the volatility in the broader market is the independent variable.

Significance and shortcomings of the beta value of a stock

A beta of 1 signifies that a stock’s volatility is parallel compared to the broader market or a related benchmark index. The stock in question will mostly move alongside the benchmark index. A beta higher than 1 means that the stock would be more volatile and rise more than the benchmark index in a bullish market. Conversely, a beta of lower than 1 signifies lower volatility and would fall more than the index in a bearish market.

Beta relies on past data. This makes it a good indicator of the past performance of the stock but doesn’t guarantee that the same trend would continue in the future. Let’s understand why. Assume that a well-established company, whose beta is less than 1, avails a huge debt for its expansion. Now, the beta accounts for the company’s risk profile before it took on the debt and not after the new development.

But the debt that the company has taken on adds to its risk. What if the proportion of debt is higher than the equity? It shows that the company’s debt-to-equity ratio is high. And if the company is unable to repay its debt on time, the creditors will have a higher stake on the company’s assets than its shareholders. As a shareholder, you will be at risk. See, how tables turn? That is why relying on beta information alone may not be a good investment decision when evaluating a stock.

High beta stocks are usually issued by high-risk companies

High beta stocks are typically those issued by small and midcap companies and are thus perceived to be risky. This is because companies having larger balance sheets or more physical assets are generally in a better position to survive economic disruptions than those with smaller balance sheets. As such, the risk associated with high beta stocks may accelerate in times of economic turmoil and eat into your returns.

Let’s understand this with an example. In order to flourish, small and midcap companies need cheap credit and high demand, both of which are scarce now, since the economy is hit by the pandemic. Once the economy shows signs of recovery — credit conditions get better and demand picks up — the performance of small and midcap companies could also get better (note that this is not a prediction, nothing in the stock market is predictable. So, always do your due diligence before relying on market-related information coming from any source).

A note on small and midcap companies

Small and midcap companies are sensitive to macroeconomic factors. Therefore, any ongoing problem in the economy can almost immediately impact these stocks. Small and midcap companies are usually risky businesses. They offer products that are in high demand and generate high turnover. Though their balance sheets are not large, the efficiency of their operations and internal management aid their growth and attract investors. Such steady inflow of funds via equity and debt fuel small and midcap companies and create high beta stocks.

Read more about how companies are classified into smallcap, midcap, and largecap stocks here. EQ is one of the NSE stock series that allows equity delivery and intra-day transactions. Learn more about NSE stock series here.

Continue to read how to find the beta of Indian stocks, list of stocks with high beta value listed on NSE, how to use Tickertape to filter high beta stocks, merits and demerits of investing in such instruments here.

0 notes

Text

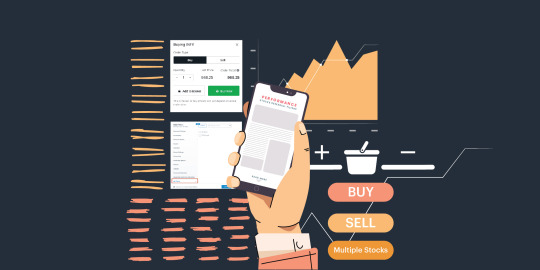

Analyse stocks and trade in multiple shares via Transactions

Isn’t it inconvenient to research stocks at one place, buy or sell them on other, and track their performance on a different platform? Isn’t it also inconvenient to transact multiple stocks individually? It is! Thanks to Tickertape’s Transactions and Basket features, you can now add all your favourite stocks to a basket and buy and/or sell them, all in a single go.

Transaction and Basket features work on the lines of online purchases. You add your chosen items in your cart and execute a single buy transaction. We took a similar approach when designing Transactions and Basket features.

Here’s a short description of what these do.

Transactions

Transactions feature on Tickertape allows you to trade in stocks directly from Tickertape. You don’t have to jump to another platform to place your orders. You can analyse your chosen stocks on Tickertape and transact from here via your broker account.

Basket

Basket is like a cart on an e-commerce site. It accommodates both Buy Orders to buy stocks and Sell Orders to sell scrips. It also allows you to modify your transactions, which is discussed a little later.

Enjoy a seamless, end-to-end stock investing experience with Transactions and Basket features on Tickertape

Transactions and Basket are perhaps among the most ground-breaking features in the Fintech space. Before starting out a transaction on Tickertape, ensure that your broker account is connected to your Tickertape account. Then, follow these steps:

Head on to Tickertape’s screener, filter stocks based on ratios and key metrics and evaluate each stock on the respective stock pages

Once satisfied with your evaluation, click on ‘Place Order’. Now select the type of order: buy or sell, and set the quantities you want to trade. Alternatively, you can also buy/sell the individual stock by choosing the Buy/Sell Order option

Next, click on ‘Add to Basket’ button to add the stock to your basket. Or click on Buy Now or Sell Now to trade the individual stock

After adding all your chosen stocks to the Basket, click on the basket icon on the top header bar. Wait to be redirected to the “Your Basket” page

Here, take a final look at your order and make the necessary changes to Your Basket, if any

Once all is set, click on ‘Place Orders’ button to execute the transaction

Finally, track the performance of your stocks by importing your current portfolio from your broker account

Executing multiple Buy and Sell orders for stocks on Tickertape and monitoring their performance is really that simple.

Other applications of Basket

Apart from facilitating a single transaction for multiple buy and sell orders of stocks, Basket has other applications too. Once on “Your Basket” page, you have the following options:

Copy the list of stocks to the watchlist, and vice-versa

Switch between Buy and Sell Order types for each stock. You can do this by launching the options dropdown menu: click on the ‘three dots’ on the respective stock row. Then select Move to buy or Move to sell, as is required

Place individual stock orders. Click on the options dropdown menu and select Buy or Sell for individual stocks

Place an order for the entire basket by clicking on Place Orders button

Things to note when using Transactions and Basket features on Tickertape

The amount next to the Place Orders button mentions the net value of the transaction, which you either have to receive or pay, based on whether the transaction is an overall Net Buy or Net Sell

Orders under Transactions are placed as market orders. Ergo, the final executed price of the trade may differ from the prices displayed here. Also, note that this amount is simply the net price of the transaction so it doesn’t include other charges such as brokerage and STT

Those were Transactions and Basket features for you folks. If you haven’t tried these features of Tickertape yet, do it right away! Also, we would like to know your thoughts on the features. Continue to read about other features of Tickertape here.

0 notes

Text

5 Better ways to invest in gold this Diwali

Since time immemorial, gold has secured a special place in Indian households, thanks to its financial, emotional, and social values. From a cultural point of view, many households in India follow the tradition of buying gold during Dhanteras and Diwali as it is considered auspicious. But from an investment perspective, gold is considered to be a safe haven as its value tends to increase when the stock markets are in turmoil.

As is evident, buying gold in the jewellery form and investing in the yellow metal has two different purposes. The first gives an emotional fulfilment and the second helps you secure your finances. So, this festival, choose to invest in alternate forms of gold to secure your finances rather than spending on jewellery alone. The common benefits these offer are cost-effectiveness and safety.

Here are 5 better ways in which you can invest in the yellow metal.

1. Gold ETFs

Gold exchange-traded funds (Gold ETFs) are like mutual funds but can only be traded on stock exchanges via a demat account. Though these attract broker charges and management fees, Gold ETF’s eliminate storage costs and risk of theft. Moreover, Gold ETFs are priced transparently as they are benchmarked against physical gold. Ergo, the price of Gold ETF moves more or less in line with the underlying asset.

However, there is room for a difference in the prices of the Gold ETF compared to that of the physical metal due to the tracking error, which is mostly a result of expense ratio. To know more about ETFs, expense ratio, and how to choose a fund that fits your portfolio, read our 4-point checklist to pick an ETF article.

2. Sovereign Gold Bonds (SGB)

Sovereign Gold Bond is like owning paper gold. These bonds are issued by the government and are only available to transact during a window period for sale, which is typically open once in 2 to 3 months for about a week. But if you can’t wait and wish to buy SGB outside the window-period, you can simply purchase the older issues of the bond listed in the secondary market.

3. Gold savings schemes

This works like a recurring deposit or SIP and is offered by jewellers. A gold savings scheme requires you to deposit a fixed amount every month for a pre-determined tenure. At the end of the term, the jeweller adds a bonus, which is typically equal to one month’s instalment, on his behalf to your accumulated funds.

You can then use the total amount to buy gold at their store at prevailing rates. Sometimes, the jeweller may not add a bonus but may simply offer a gift item. Investing in a gold savings scheme is a good way to buy gold if you don’t have a lump sum but are willing to set aside a fixed amount monthly so you can save to purchase gold at a future date.

4. Gold coin scheme

The Indian Gold Coin Scheme is the first national gold offering launched by the government in 2015. The coins under this scheme are hallmarked as per the BIS standards and are available in the denomination of 5 gm, 10 gm, and 20 gm at recognised jewellers, banks, NBFCs, and e-commerce sites. These coins feature the National Emblem of Ashok Chakra engraved on one side and Mahatma Gandhi on the other.

Indian Gold Coins have 24 karat purity and 999 fineness and are linked to the international price of the yellow metal. The coins also possess advanced anti-counterfeit features, which avoids duplication, and tamper-proof packaging. What’s more, you can also liquidate these coins easily via MMTC’s ‘buy back’ option at their stores across India at the prevailing base rate.

5. Digital gold

Digital Gold is offered by the joint-venture of MMTC and Switzerland’s PAMP SA. The product is available online in the form of coins, bars, and jewellery. Digital Gold is offered by various mobile wallet companies and financial services providers in India, who store it in a fully-secured vault for safety.

The storage charges depend on the party offering the Digital Gold. For instance, MAMP charges zero storage fees but requires you to either convert the Digital Gold into coins or sell it after 5 yrs.

No investment comes without risk and/or charges. Likewise, investing in gold, be it in any form, also has certain costs or risks associated with it. For instance, while physical gold comes with storage costs and risk of theft, Gold ETFs have management fees and tracking error. Nonetheless, avoiding such risks and costs or keeping them to a minimum is a good thing to do anytime. Read other Diwali-themed articles on Blog by Tickertape

0 notes

Text

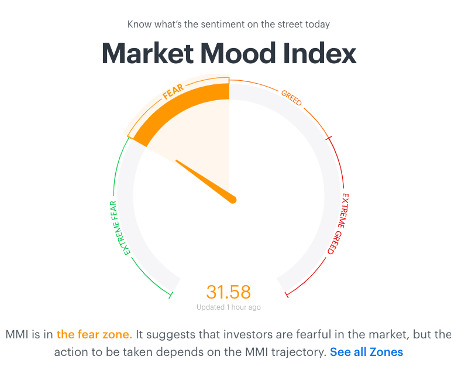

How MMI can help in timing your investments better

Presenting the third article in Tickertape Feature Series.

“Be fearful when others are greedy and greedy when others are fearful” is something that the followers of Warren Buffet practice religiously. Emotions play a vital role in stock investing. When in check and coupled with logic, we tend to make better investing decisions compared to when we act based on emotions solely.

Among others, entry and exit points are two important decisions to make when investing in stocks. In fact, new investors are often troubled with questions regarding when to buy and sell stocks. That’s why, we built the Market Mood Index, a tool that can help you time your investments better.

MMI and market sentiment

MMI tracks the market sentiment, the attitude of investors towards the overall stock market or a specific stock. The analysis of this sentiment works on the lines of the law of demand and supply. Keeping the supply constant, when the demand for a commodity rises, its price also increases. But when the demand decreases, the price falls.

Stock prices are heavily driven by two emotions, namely greed and fear. And the MMI puts out the market sentiment in 4 emotional zones: Extreme Fear, Fear, Greed, and Extreme Greed. A positive outlook on the market or a stock makes investors greedy and drives them to buy more stocks, which shoots the prices. Fear, on the other hand, is the outcome of bad news. This forces investors to sell stocks and thus brings down the prices.

Such an analysis of investor sentiment is considered to be one of the most reliable methods to time the entry and exit points in stock investing. The entry point means when you buy a stock and the exit point is when you sell it. That said, selling price minus buying price is profit or loss. Ergo, smart plotting of entry and exit points is crucial to streamline your investment plan.

Now that you have understood what market sentiment and MMI are, let us look at its 4 zones.

The 4 Zones of Market Mood Index

Extreme Fear

Fear

Greed

Extreme Greed

Extreme Fear Zone: index less than 20

This zone indicates that the market is suffering and so many investors are liquidating their stocks. An oversold market is a good time to buy stocks as they may be available at cheaper prices.

Fear Zone: index ranges between 30 and 50

This zone shows that the market is reeling but based on the MMI trajectory, you can infer whether the market is doing better or worse. Trajectory means the trend that the MMI follows. If the MMI is in Fear Zone and an economic development further dampens investor sentiment, then the market can slip further down, pushing the MMI into Extreme Fear Zone.

For instance, if you remember the stock market rallied when there was news of COVID-19 cases decreasing globally. This news boosted investor sentiment. And so, depending on further developments, the trajectory at the time, the MMI may have either moved from:

Fear Zone to Extreme Fear Zone

Fear Zone to Greed Zone

So when in the Fear Zone, it is best to wait till the MMI jumps to the Greed Zone before selling your stocks. But if the Fear Zone moves to Extreme Fear Zone and you’re afraid that the way forward is even worse, you could sell your stocks to stop your losses.

Greed Zone: index ranges from 50 to 70

This zone suggests that the market is doing well and as a result, investors are greedy. When the MMI is in this zone, the market is said to be in the overbought area. Like when in the Fear Zone, here also it is good to watch the MMI trajectory before entering or exiting the market.

Let us understand the mechanism with an example. Whenever COVID-19 cases rose after dipping for a bit, investors turned extremely cautious and liquidated their stocks. In this case, there are two possible trajectories of the MMI, depending on its current zone:

Greed Zone to Extreme Greed Zone

Greed Zone to Fear Zone

If the MMI is in Greed Zone, it is best to wait till it falls into the Fear or Extreme Fear Zone before buying stocks. But if the MMI moves to Extreme Greed Zone, it indicates that the market is in overbought zone and stocks are expensive. Ergo, buying new stocks is best postponed.

Extreme Greed Zone: index is over 70

This zone suggests that the stock market is extremely overbought. A good thing to do in this case is to wait for the market to stabilise before buying new stocks.

Now let us see how the Market Mood Index is built.

How is Market Mood Index built?

The MMI tool is built based on the 6 fundamental factors that influence investor sentiment:

FII Activity

Volatility & Skew

Market Momentum

Market Breadth

Price Strength

Demand for Gold

Let us look at these individually.

FII Activity in India

FII stands for Foreign Institutional Investors, international companies that invest in Indian stock markets. Markets perform well when the inflow of FIIs is more than the outflow. In other words, higher FII brings more funds to the economy and so boosts investor sentiment. At such a time, the MMI is in the Greed Zone. But when there is an exodus of FIIs from domestic markets, investor sentiment dampens and MMI in the Fear zone.

Volatility and Skew

The market is said to be volatile if benchmark indices fluctuate frequently. One of the ways to measure volatility is the India VIX index, which indicates the market volatility expected to prevail over the next 30 calendar days. Higher the VIX index, higher is the volatility in the stock market. But knowing the direction of volatility is equally important to analyse markets better.

Enter Skew, which shows the direction in which the market is expected to move. A high average value of Skew indicates that the market could move downwards. In terms of MMI, a higher value of Skew suggests that the MMI would slide into the Fear Zones whereas, a lower Skew suggests that the MMI would move into Greed Zones.

Continue to read the other constituents of the Market Mood Index and about the accuracy of the tool here.

0 notes

Text

7 Wise ways to use your bonus

Diwali is almost here and some of you may be expecting to receive a festive bonus. It’s easy to give in to temptation and spend your bonus on fulfilling your wishes and dreams. Although travel plans may not be on cards due to the pandemic, buying an immersive home theatre or a car that you’ve been wishing for long may be alternatives you select to pamper yourself. Regardless, there are other better ways to put your bonus to use.

If this intrigues you, below are 7 ways to use your bonus, which would go a long way in securing your finances.

1. Use the windfall to build an emergency fund

Life is uncertain and so are some expenses. But having an emergency fund in place helps you meet unprecedented expenses without:

Using funds earmarked for other goals

Dipping into savings/investments

Availing finance

So park our bonus in a liquid and high-yielding option to earn decent returns and access the funds easily when in need. If you are not familiar about an emergency fund, read “The fundamentals of building a contingency fund“.

2. Repay big and small debts with your bonus

With cost and standard of living and aspirations getting higher, savings and investments can fall short in meeting big-ticket expenses. That’s why availing debt—a loan or credit card—has become a part and parcel of life. A good way to close them is with your bonus. Tbh, this can relieve you from both financial and mental stress better than your vices do. A tip here is to start repaying loans with high interest-rate and then go on to close the low-costing ones.

3. Use the bonus to stack your retirement account/funds

The next best way to use your bonus is to beef up your retirement savings. This is a great way to secure your ripe years without having to depend on someone else for your financial needs. Depending on where and how much you invest, you can also enjoy certain tax benefits. Maybe consider Voluntary Provident Fund, Public Provident Fund or NPS.

4. Invest the bonus to meet your financial goals

Investing the bonus for your future is undoubtedly a smart way to use it. Read our article “The secret to growing your Diwali cash-gift” to learn why investments are vital to meet goals and create wealth. Goals are subject to individuals. But the common ones can be: buying a home, educating your children overseas, and taking a world-tour. The avenues to invest your bonus depends on 3 factors:

Goal

Risk appetite

Return expectations

In addition to the above, when choosing an investment option to park your bonus, also consider the kind of tax benefits that it offers. However, remember that your primary aim is to earn returns, so saving tax shouldn’t be the only significant factor in consideration.

Talking of avenues to invest in, fixed and recurring deposits are good options for conservative investors whereas equity is great if you can stomach high risk. When investing in stocks, use Tickertape to filter them based on metrics that matter to you. But if you are looking to enjoy moderate returns in exchange for medium risk, hybrid avenues such as debt mutual funds can be a part of your portfolio. Gold ETFs also make good investments if you wish to invest in the yellow metal. For those who have a girl child, you can go for Sukanya Samriddhi Yojana (SSY) to secure her future. Finally, Senior Citizens Savings Schemes (SCSS) is excellent for your parents.

5. Buy or enhance insurance coverage with your bonus

Insurance is not an investment. There are hybrid products that offer both financial coverage and returns but they can be insufficient. That’s why it is important to have a standalone insurance policy so you can benefit from comprehensive monetary coverage. Depending on what you want to secure against unseen circumstances, you can buy life insurance, health insurance, home insurance, vehicle insurance, and travel insurance. If you already have a cover that is insufficient, check if you can enhance it.

Continue to read the other smart ways to use your Diwali bonus here. If you know more ways to use Diwali bonus wisely, feel free to mention them in the comments 🙂

0 notes

Text

4-point checklist to choose an ETF that powers your investment portfolio

Hey peeps! We hope that you found our “How market indices can help you understand investment patterns” article useful. We are back with the second Feature Article on Tickertape’s ETF pages. This article discusses ETFs, the checklist to look at when choosing an ETF, and how Tickertape’s ETF Pages can aid smart investment-related decision making. Let’s start by understanding what an ETF is.

What are ETFs?

Known as exchange-traded funds, ETFs invest in a basket of financial securities such as equities and debt instruments and offer the benefits of diversification. That’s why ETFs sound like mutual funds however they aren’t the same. Unlike mutual funds, ETFs are traded on stock exchanges and designed to closely match the constituents of a stock market index. Such ETFs are called passive ETFs and therefore it makes sense that the returns of these funds ideally match those of the index.

But not all ETFs track an index. Actively-managed ETFs don’t replicate an index and are essentially managed by professionals as in the case of mutual funds, who would look to minimise risk by diversifying the portfolio. Now let us look at the checklist to refer when adding an ETF to your investment portfolio.

1. Look at how concentrated the portfolio is

A sector-specific ETF carries a high concentration risk as all its constituents belong to the same sector. This may drain your returns if the sector performs poorly. For instance, if an ETF follows the Nifty Bank Index, then its returns are more or less in line with the index. Meaning, if the index gains, the fund also does and vice-versa. So does this mean that an ETF tracking broad market indices is a better deal? Well, it may not be.

Broad market indices like Nifty 50 are also not entirely free from concentration risks. These are market-cap weighted indices, where the high market-cap stocks have proportionately higher weightage in the index than the others. This too results in higher concentration — if the particular stock plunges, the returns of the ETF would also be impacted to that extent. However, the opposite is also true. That is, if the stocks in the highly-concentrated EPF gain, the returns would also swell.

A way to minimise the impact of high concentration risk is to choose a fairly-diversified ETF. That is, its constituents belong to several sectors. Another way is to consider actively-managed ETFs instead of passive funds. Yet another way out is to invest in passive ETFs tracking equal-weighted indices. These allocate equal weights to all the constituent stocks. So the change in the price of an individual stock will not have a deep impact on the ETF’s returns.

But in the end, your appetite for risk matters. Because risk and returns go hand-in-hand. If you are expecting high returns, you will have to stomach high risks. To find a middle ground, you can invest in both active and passive ETFs, depending on your return expectation and risk appetite.

2. Look at the ETF’s tracking error

When an ETF is designed to closely replicate a benchmark index, its returns should be similar to those of the index. Still, there can be differences, which is called the tracking error. This may be due to:

High expenses

High cash flow due to subscriptions and redemptions

Different allocation of stocks

Corporate actions such as dividend

Lack of liquidity

Changes in the index

So, the lower the tracking error, the better it is. Because a higher tracking error suggests that the ETF doesn’t replicate the index and its returns are not in line with the index.

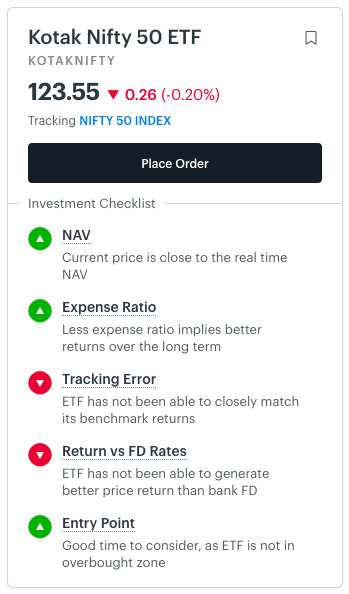

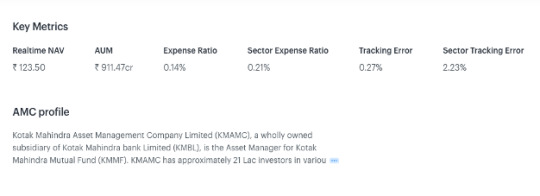

You can find the tracking error of all the NSE-listed ETFs on Tickertape’s ETF pages. Here, you can see the ETF’s and sector tracking error — an average of the tracking error of all the NSE-listed ETFs belonging to the sector. Following image displays the tracking error of the Kotak Nifty 50 Index.

3. Look at the cost of investing in an ETF

Like mutual funds, ETFs also have charges and fees, which are expressed as the expense ratio, which is a % of the ETF’s net assets. As such, the expenses reduce your returns and also the total value of the investment. Ergo, picking an ETF with a lower expense ratio would ideally optimise your returns.

In addition to the specific ETF’s expense ratio, Tickertape also displays the sector expense ratio — an average of the ratio of all other NSE-listed ETFs in the sector. This allows you to compare both the metrics to evaluate if the ETF is better than its peers in the sector.

4. Look at how liquid the ETF is

ETFs can only be traded on stock exchanges. Meaning, you can only sell units of an ETF if there are buyers. And buy an ETF when there are sellers. So when picking an ETF, look at how liquid it is. Typically, an ETF that has high trade volume is relatively more liquid than others. Head on to Tickertape to find how liquid an ETF is.

Application of Tickertape’s ETF pages

Now that you know the things to consider when picking an ETF, let us look at how Tickertape’s ETF pages can come in handy when doing so. Let us launch the Kotak Nifty 50 ETF as an example.

Go to www.tickertape.in

Look for your desired ETF in the search box

When on the ETF page, you can see an investment checklist on the left- hand side. This gives you a bird’s eye view of the ETF.

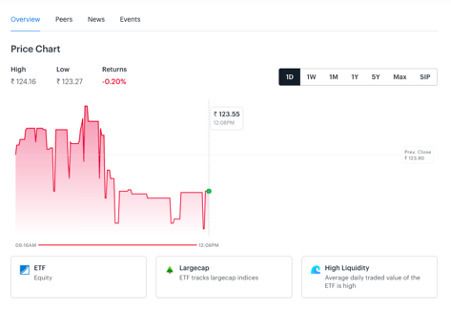

Next, in the overview tab of Kotak Nifty 50 ETF, you can see the following details:

Realtime NAV for various periods of time such as 1 Day, 1 Week, 1 Month, and 1 Year

Asset class of underlying securities of the ETF

Type of indices the ETF is tracking

The overview tab also mentions the Key Metrics of the ETF. In addition to the expense ratio and tracking error that are discussed before, the ETF page also displays the real time NAV, AUM of the ETF, and profile of the Asset Management Company.

But what really sets Tickertape’s ETF Pages apart from others is its “Peers” tab. Continue to read how ‘Peers’ information can add an edge to your ETF evaluation. Let us know how you like the feature :)

0 notes