Text

Efficient market hypothesis: A unique market perspective

You must have heard stock market pundits often emphasizing on the importance of research and finding the value in a stock. There will be people out there vouching for their expertise with fundamental or technical analysis. However, there is a 0theory in the market that rubbishes all these claims. It’s called the efficient market hypothesis (EMH).

EMH as the name suggests is a hypothetical theory. It essentially says that all known information is already factored into the stock price. Hence, no amount of analysis can give one investor an edge over the other.

As per the EMH theory, stocks always trade at their fair value on exchanges. Hence, it is impossible for investors to purchase undervalued stocks. Or, sell stocks for inflated prices.

It raises a few direct questions on popular analysis techniques. It asserts that with all new information priced in, neither technical nor fundamental analysis can generate excess returns. Therefore, it should be impossible to outperform the overall market. And, the only way an investor can generate higher returns is by purchasing riskier investments.

Forms of EMH:

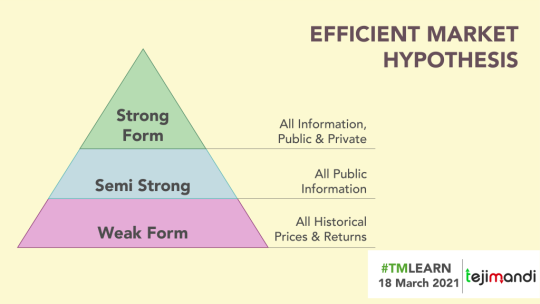

There are three forms of EMH: weak, semi-strong, and strong. Here’s what each says about the market.

Weak Form EMH:

This form suggests that today’s stock prices reflect all the data of past prices. And technical analysis can not effectively help investors in making trading decisions.

It further believes that fundamental analysis can help investors to generate above-average returns in the short term. But, there are no fixed patterns that exist. Thus, the fundamental analysis does not provide any long-term advantage.

Semi-strong form:

This efficiency theory suggests that since all the available information is factored in the current market price, no technical or fundamental analysis helps to generate higher returns in the market.

However, this form believes that there is some information that is not publicly available. Such information can help investors to generate above-average returns.

Strong Form EMH:

This version of the theory says that all information, both public and private, is priced into stocks. And no investor can gain an advantage over the market as a whole.

It says that investors can’t generate returns higher than the normal market returns. No matter what information they have or research they conducted. More about strong from EMH

#efficient market hypothesis#efficent market theory#market hypothesis#the efficient market hypothesis#three forms of efficient market hypothesis

0 notes

Text

Efficient market hypothesis: A unique market perspective

You must have heard stock market pundits often emphasizing on the importance of research and finding the value in a stock. There will be people out there vouching for their expertise with fundamental or technical analysis. However, there is a 0theory in the market that rubbishes all these claims. It’s called the efficient market hypothesis (EMH).

EMH as the name suggests is a hypothetical theory. It essentially says that all known information is already factored into the stock price. Hence, no amount of analysis can give one investor an edge over the other.

As per the EMH theory, stocks always trade at their fair value on exchanges. Hence, it is impossible for investors to purchase undervalued stocks. Or, sell stocks for inflated prices.

It raises a few direct questions on popular analysis techniques. It asserts that with all new information priced in, neither technical nor fundamental analysis can generate excess returns. Therefore, it should be impossible to outperform the overall market. And, the only way an investor can generate higher returns is by purchasing riskier investments.

Forms of EMH:

There are three forms of EMH: weak, semi-strong, and strong. Here’s what each says about the market.

Weak Form EMH:

This form suggests that today’s stock prices reflect all the data of past prices. And technical analysis can not effectively help investors in making trading decisions.

It further believes that fundamental analysis can help investors to generate above-average returns in the short term. But, there are no fixed patterns that exist. Thus, the fundamental analysis does not provide any long-term advantage.

Semi-strong form:

This efficiency theory suggests that since all the available information is factored in the current market price, no technical or fundamental analysis helps to generate higher returns in the market.

However, this form believes that there is some information that is not publicly available. Such information can help investors to generate above-average returns.

Strong Form EMH:

This version of the theory says that all information, both public and private, is priced into stocks. And no investor can gain an advantage over the market as a whole.

It says that investors can’t generate returns higher than the normal market returns. No matter what information they have or research they conducted. More about strong from EMH

#efficient market hypothesis#efficent market theory#market hypothesis#the efficient market hypothesis#three forms of efficient market hypothesis

0 notes

Text

How to determine portfolio risk?

Every financial investor will encounter a trade-off between returns and risks. The reward for greater risk is greater returns. However, it would be best to consider your risk appetite before making any investment.

Each investment has a different level of risk. The more you diversify your investments in your portfolio, the lower your overall risk will be. Let us understand what affects the performance of assets and how you can quantify the amount of risk you may face.

What is portfolio risk?

Portfolio Risk is the total risk determined by the individual risk associated with each asset you hold in your portfolio. The assets you own may fail to perform financially as expected. As a result, it leads to a substantial amount of loss. There are multiple causes for it and different ways to mitigate each category of risk. Let us see what the various types of risks are.

Types of portfolio risks

Risks involved with individual securities

To understand the overall risks involved in portfolios, let us first see the risks involved with individual securities.

Liquidity risk

It is the risk of not fulfilling short-term obligations on time. Short-term obligations are those that are due within a year.

Political and regulatory risk

It is when an investor suffers financially due to any sort of political flux in the country.

Default risk

It is a type of risk where a borrower cannot pay off his debts to the lender on time. Once a specific time has passed without any repayment, the loan converts to bad debt.

Style risk

It is a type of risk that is associated with your style of investing.

Duration risk

It is the risk associated with the time horizon of your investment. Over a period of time, you can find differences in interest rates. Eventually, the market value will either increase or decrease according to these fluctuations.

As you know, a portfolio is a combination of individual securities. However, certain kinds of risks are exclusively associated with the overall portfolio. Let us have a look at those.

Risks involved with the overall portfolio

The following risks affect the portfolio as a whole:

Systematic or market risk

It refers to the risk that affects the whole market or its segments. It is also known as volatility, undiversifiable, or market risk. The name undiversifiable implies that you cannot reduce this risk by adding a range of securities to your portfolio. It affects everyone in the market alike.

Unsystematic risk

This is also known as diversifiable risk. It is associated with a single company, market, or sector. You can mitigate this risk by diversifying your portfolio and adding various asset classes. In such a case, a loss in one sector may be offset by a gain in another. This reduces the overall risk of your portfolio.

The experts at Teji Mandi help with the Diversification of Your Portfolio and have garnered the trust of 10000+ subscribers. Contact us to get personalized advice on your portfolio.

Inflation risk

Also known as purchasing power risk, this occurs when the price of a commodity or a product increases to an unexpected price. Inversely, the prices may even fall below an expected level.

Concentration risk

This risk refers to the chances of an investment portfolio losing value when an individual or company moves in an unfavourable direction. The probability of facing this risk is higher when you have a less diverse portfolio, implying that your focus is on a small set of securities.

Reinvestment risk

It is a type of risk where an investor is unable to reinvest cash flows from their investment at a rate equivalent to the current rate they are receiving. This kind of risk is the highest in bonds. However, if they are zero-coupon bonds, there is no such risk involved due to no payments as coupons.

Currency risk

It occurs due to fluctuations in the exchange rates. This involves the movement of one currency against another currency, affecting those who operate or invest internationally. More about Default risk

#portfolio risk formula#how to calculate portfolio risk#calculate portfolio risk#calculating portfolio risk#portfolio risk calculation formula

0 notes

Text

What are ESG funds and how to invest in the best one?

Mutual fund investments come in various forms. You can pick equity funds for their potentially attractive returns or debt funds for their stability. If you want the best of both worlds, you can pick balanced funds that combine both equity and debt instruments.

Different funds, different characteristics. Each of these funds helps in fulfilling the different investment needs of the investors.

More and more investors have started investing in a more sustainable manner. Sustainable investing can be done in three ways – socially responsible investing, impact investing, and ESG investing.

know more about the first two categories, read our article on Impact Investing Vs Socially Responsible Investing on the Teji Mandi blog. As for ESG investing, let us get into its details here.

ESG investing involves ESG funds, which are a type of mutual fund scheme that follows the ESG investment theme. Let’s elaborate.

ESG Theme – the concept

ESG stands for Environmental, Social and Governance. The ESG theme encompasses companies whose activities and operations are conducive to the ESG trinity. Here’s how it works–

E as in Environmental

Companies whose activities do not harm the environment qualify under this category. Such companies take measures to reduce their carbon footprint, minimise pollution caused by their production or operations, have a good waste disposal system and also preserve natural resources like water.

S as in Social

Companies that contribute to the development of society, as well as their employees, qualify in this category. Such companies take measures to create gender equality, have pay parity between their male and female employees, provide employee wellness and benefit programs and also contribute to social causes.

G as in Governance

Corporate governance measures whether companies follow the regulatory framework of the industry that they operate in. Companies that have strong compliance measures, follow the regulations, conduct themselves ethically, have a strong whistleblower policy and take strict actions against internal wrongdoings are said to follow good governance. Such companies, then, qualify under the Governance parameter of the ESG trinity.

How are companies measured or ranked on ESG?

Organizations like Morningstar, MSCI, Sustainalytics judge companies on ESG standards. They allocate grades or scores to companies on their ESG practices. These grades and scores measure if the company is ESG compliant or not.

For example, as per MSCI grading, companies are graded as follows –

AA or AAA – Leader

A, BBB or BB – Average

B or CCC – Laggard

Needless to say, companies in the AA or AAA category are stronger on the ESG parameters than companies in the lower parameters.

Morningstar, on the other hand, scores companies from 1 to 50 where 50 denotes the highest risk and 1 denotes the lowest.

What are ESG Funds?

ESG funds are thematic mutual funds that invest in companies that are ESG compliant. They are equity-oriented mutual fund schemes which invest at least 65% of their portfolio in the stock of ESG compliant companies. The fund, thus, invests in sustainable and socially compliant companies across all market capitalisations.

Features of ESG funds

Some of the salient features of ESG funds are as follows –

These funds are exposed to volatility risks since they are equity-oriented. However, for the risks that you take, the return potential is also high.

You can invest in ESG funds in a lump sum or take the SIP route, wherein you can invest in installments. If you choose the SIP option, the minimum amount of each instalment might start from Rs.500.

ESG funds come in both dividend and growth options. While the dividend option pays regular dividends, the growth option reinvests the profit earned by the portfolio for higher returns.

ESG Funds attract equity taxation. Short-term capital gains earned on redemption within 12 months are taxed at 15%. Long-term capital gains, however, earned on redemption after 12 months are tax-free up to Rs.1 lakh. If the returns exceed this limit, only the excess is taxable at a rate of 10%

Benefits of investing in ESG funds

Some of the benefits of investing in ESG funds include the following –

Doing your bit for the environment and

If you are a strong advocate for environmental or social causes or you want to do your bit for the society at large, ESG funds can be a good choice. By investing in companies that resonate with your sentiments, you can take a step towards supporting the causes that you believe in.

Potential for good

According to a Survey conducted by the CFA Institute across institutional and retail investors, 60% of the Indian investors said that they invested in ESG funds for higher risk-adjusted returns.

Being equity-oriented schemes, ESG funds can give you attractive returns over the long-term period. Moreover, since the companies follow stringent norms, they are less likely to wind up the business. As such, you can enjoy the potential for higher risk-adjusted returns.

The returns are also inflation-adjusted so that your corpus keeps pace with the increasing economy. This can help you create a corpus for your financial goals and meet them. Read more about ENG FUNDS

#best esg funds#what is an esg fund#esg mutual funds#best esg investments#best esg funds to invest in

0 notes

Text

The Difference Between the Primary and Secondary Market

Are you new to investing and unsure how to navigate the capital markets? You have come to the right place. TejiMandi carries the legacy of Motilal Oswal Financial Services, as a direct subsidiary of the behemoth. As SEBI-registered portfolio managers, our teams of in-house experts have solutions to all your investing queries and are adept at provisioning tailored portfolio management services to you.

The capital market is a platform where buyers and sellers trade various financial instruments such as bonds, stocks, and other securities. It is a medium for transferring capital from investors to companies that need the money to finance business ventures and investments. The term ‘capital market’ includes in-person and digital trading spaces with further classification into primary and secondary markets.

Here’s an in-depth look into the primary market v/s secondary market differences and their meaning. However, it is pertinent to understand the types of securities that investors encounter in capital markets before discussing primary and secondary markets. Let us have a look at that first.

Types of securities in capital markets

Capital markets primarily deal with equities and debt securities. Both equity and debt securities are forms of investments with different risks and returns for the investor. Here’s a more detailed explanation of the two:

Equity Securities:

An equity security is traded on the stock market and represents the ownership interest of shareholders in a company or business venture. Equity securities translate to shares of capital stock, including shares of common and preferred stocks. Holding equity shares of a company means owning a portion of that company, and the shareholder is entitled to the company’s future earnings.

Although equity shareholders may profit from capital gains when they sell the securities, they may not receive regular payments. However, equity shareholders get some degree of control over the company via voting rights. Moreover, they get a share of the residual interest incase of bankruptcy.

Know more about investing in equities in our article on Equity Investments: Benefits, Considerations, And Must-Know Tips on the Teji Mandi blog.

Debt Securities: Unlike equity securities, debt securities entitle the lender to receive a stream of interest payments and other contractual rights, except voting rights, while requiring the borrower to repay the principal amount borrowed too. These are IOUs in the form of bonds and notes and represent the borrowed money that must be paid back with interest. Debt securities typically have specific terms stipulating the loan size, interest rate, debt maturity, and the renewal date.

Some examples of debt securities include fixed deposits, certificates of deposits, government and corporate bonds, and collateralised securities.

Now that we have a better understanding of the two kinds of securities, let us look into the two capital markets – the primary and the secondary market.

Types of Capital Markets: Primary Market v/s Secondary Market

Capital market transactions take place through primary markets and secondary markets. In other words, investors can buy and sell securities in two types of markets.

Primary Market

The primary capital market is where a company sells new bonds and stocks to the public for the first time. The initial public offerings – or IPOs – take place in the primary market.

The company that issues securities hires underwriters who help them correctly price their securities, buy those securities from them (which ensures all of their stock offerings are taken up), and then further sell them using their underwriting network. Say the underwriters, also known as book-running lead managers, determine the issue price of the stock at Rs. 100. Thus, investors in a primary market can buy the shares of the IPO at Rs. 100 directly from the issuing company. Any shares that are left in the market are purchased by the underwriters, thereby transferring the risk of buying the securities onto them.

The term primary market stems from the fact that investors can first-hand contribute capital to the company by purchasing the stock.

Secondary Market

If a primary market creates securities, a secondary market is where the securities’ trading occurs. Popularly known as the stock market, the secondary market includes the BSE, NSE, NYSE, NASDAQ, and all stock exchanges around the world.

Investors’ trade previously issued securities in a secondary market, but these transactions do not involve the issuing company. For example, if you buy a stock of Tata Consultancy Services (TCS), you are dealing only with another investor who owns shares in TCS. However, TCS has no direct involvement in this transaction.

Selling Primary Market Securities

Once the issuing company issues security and underwriters determine its value, it is ready to sell in the primary market. Investors have four options to buy securities through the primary market:

Initial Public Offering (IPO):

As explained before, an IPO or initial public offering is when a company makes its shares publicly available for the first time. While an IPO is a great way to raise capital quickly, it has its risks. If the company performs well, investors can expect solid returns. On the contrary, a struggling company would see share prices dropping below the offer price and investors taking a loss.

Private Placement:

A private placement is when a company sells its equity to a limited group of investors as bonds, stocks, or other securities. The company decides who they want to place their equity with. A private placement is different from an IPO since the former is not a public offering. Moreover, private placements typically have fewer regulatory requirements than an IPO.read more about secondary market

#primary market and secondary market#enprimary and secondary market#differce between primary market and secondary market#primary and secondary market difference#difference between primary and secondary market#primary market vs secondary market

0 notes

Text

How To Create a Monthly Investment Plan (and Stick to It)?

Welcome, October! Diwali is just around the corner. You might have some travel plans this month. Why not we together create a plan? Not a travel plan, but a monthly investment plan! Here are five guidelines for creating a monthly investment plan and sticking to it:

Take Note of Your Current Financial Position

To start something, you should first assess where you stand. Similarly, to create a monthly investment plan, you should examine your income, savings, and expenses.

If one’s standard of living is growing faster than income, then there’s a need to either increase income or decrease expenses. It will also help you prioritise which expenses are necessary and which ones you can cut down. Failing to do this can derail one’s financial well-being.

Account for Festive Expenses

With the onset of festivals such as Dussehra and Diwali, it is better to draw up a festival budget where you can list down all your necessary spending needs and thus make provisions for your investments to be made in advance.

Drawing up a budget will help you stay clear regarding how much to spend and how much to save.

Decide your Goals

As a golden rule of thumb, one should spend what is left after saving, not the other way around. This helps in practising financial discipline, as spending money on material things that provide instant gratification is effortless. Also, this ensures you do not compromise your savings and investment decisions.

After the necessary investments have been made, you are free to spend whatever is left over for the month without much thought! Read more about investment plan

#monthly investment plans#monthly savings plan#monthly investment scheme#create investment plan#monthly investing

0 notes

Text

Efficient market hypothesis: A unique market perspective

The efficient market hypothesis offers a unique perspective on how we look at the market. This TM Learn will simplify this theory for its readers. This is also an attempt to help investors make the most out of it.

You must have heard stock market pundits often emphasizing on the importance of research and finding the value in a stock. There will be people out there vouching for their expertise with fundamental or technical analysis. However, there is a 0theory in the market that rubbishes all these claims. It’s called the efficient market hypothesis (EMH).

Topics covered

EMH as the name suggests is a hypothetical theory. It essentially says that all known information is already factored into the stock price. Hence, no amount of analysis can give one investor an edge over the other.

As per the EMH theory, stocks always trade at their fair value on exchanges. Hence, it is impossible for investors to purchase undervalued stocks. Or, sell stocks for inflated prices.

It raises a few direct questions on popular analysis techniques. It asserts that with all new information priced in, neither technical nor fundamental analysis can generate excess returns. Therefore, it should be impossible to outperform the overall market. And, the only way an investor can generate higher returns is by purchasing riskier investments.

Forms of EMH:

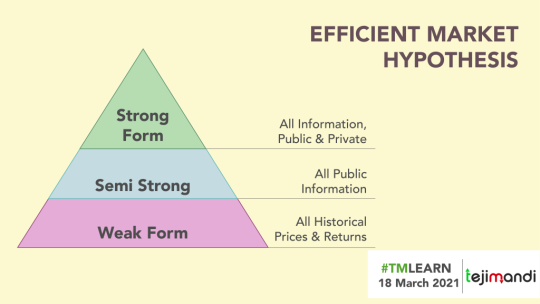

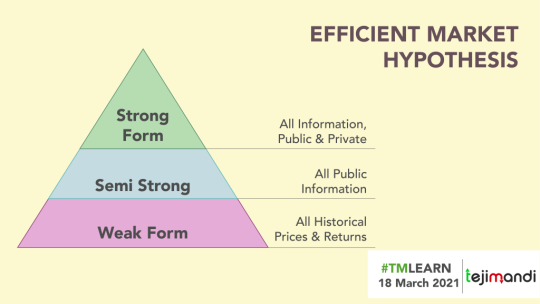

There are three forms of EMH: weak, semi-strong, and strong. Here’s what each says about the market.

Weak Form EMH:

This form suggests that today’s stock prices reflect all the data of past prices. And technical analysis can not effectively help investors in making trading decisions.

It further believes that fundamental analysis can help investors to generate above-average returns in the short term. But, there are no fixed patterns that exist. Thus, the fundamental analysis does not provide any long-term advantage.

Semi-strong form:

This efficiency theory suggests that since all the available information is factored in the current market price, no technical or fundamental analysis helps to generate higher returns in the market.

However, this form believes that there is some information that is not publicly available. Such information can help investors to generate above-average returns.

Strong Form EMH:

This version of the theory says that all information, both public and private, is priced into stocks. And no investor can gain an advantage over the market as a whole.

It says that investors can’t generate returns higher than the normal market returns. No matter what information they have or research they conducted. Read more about form of efficient market hypothesis

#efficent market theory#market hypothesis#the efficient market hypothesis#three forms of efficient market hypothesis#what is efficient market hypothesis

0 notes

Text

How to determine portfolio risk?

Every financial investor will encounter a trade-off between returns and risks. The reward for greater risk is greater returns. However, it would be best to consider your risk appetite before making any investment.

Each investment has a different level of risk. The more you diversify your investments in your portfolio, the lower your overall risk will be. Let us understand what affects the performance of assets and how you can quantify the amount of risk you may face.

What is portfolio risk?

Portfolio Risk is the total risk determined by the individual risk associated with each asset you hold in your portfolio. The assets you own may fail to perform financially as expected. As a result, it leads to a substantial amount of loss. There are multiple causes for it and different ways to mitigate each category of risk. Let us see what the various types of risks are.

Types of portfolio risks

Risks involved with individual securities

To understand the overall risks involved in portfolios, let us first see the risks involved with individual securities.

Liquidity risk

It is the risk of not fulfilling short-term obligations on time. Short-term obligations are those that are due within a year.

Political and regulatory risk

It is when an investor suffers financially due to any sort of political flux in the country.

Default risk

It is a type of risk where a borrower cannot pay off his debts to the lender on time. Once a specific time has passed without any repayment, the loan converts to bad debt.

Style risk

It is a type of risk that is associated with your style of investing.

Duration risk

It is the risk associated with the time horizon of your investment. Over a period of time, you can find differences in interest rates. Eventually, the market value will either increase or decrease according to these fluctuations.

As you know, a portfolio is a combination of individual securities. However, certain kinds of risks are exclusively associated with the overall portfolio. Let us have a look at those.

Risks involved with the overall portfolio

The following risks affect the portfolio as a whole:

Systematic or market risk

It refers to the risk that affects the whole market or its segments. It is also known as volatility, undiversifiable, or market risk. The name undiversifiable implies that you cannot reduce this risk by adding a range of securities to your portfolio. It affects everyone in the market alike.

Unsystematic risk

This is also known as diversifiable risk. It is associated with a single company, market, or sector. You can mitigate this risk by diversifying your portfolio and adding various asset classes. In such a case, a loss in one sector may be offset by a gain in another. This reduces the overall risk of your portfolio.

The experts at TejiMandi help with the Diversification Of Your Portfolio and have garnered the trust of 10000+ subscribers. Contact us to get personalized advice on your portfolio.

Inflation risk

Also known as purchasing power risk, this occurs when the price of a commodity or a product increases to an unexpected price. Inversely, the prices may even fall below an expected level.

Concentration risk

This risk refers to the chances of an investment portfolio losing value when an individual or company moves in an unfavorable direction. The probability of facing this risk is higher when you have a less diverse portfolio, implying that your focus is on a small set of securities.

Reinvestment risk

It is a type of risk where an investor is unable to reinvest cash flows from their investment at a rate equivalent to the current rate they are receiving. This kind of risk is the highest in bonds. However, if they are zero-coupon bonds, there is no such risk involved due to no payments as coupons.

Currency risk

It occurs due to fluctuations in the exchange rates. This involves the movement of one currency against another currency, affecting those who operate or invest internationally. Read more about portfolios risk formula

#portfolio risk formula#how to calculate portfolio risk#calculate portfolio risk#calculating portfolio risk#portfolio risk calculation formula

0 notes

Text

What are ESG funds and how to invest in the best one?

Mutual fund investments come in various forms. You can pick equity funds for their potentially attractive returns or debt funds for their stability. If you want the best of both worlds, you can pick balanced funds that combine both equity and debt instruments.

Different funds, different characteristics. Each of these funds helps in fulfilling the different investment needs of the investors.

More and more investors have started investing in a more sustainable manner. Sustainable investing can be done in three ways – socially responsible investing, impact investing, and ESG investing.

know more about the first two categories, read our article on Impact Investing Vs Socially Responsible Investing on the Teji Mandi blog. As for ESG investing, let us get into its details here.

ESG investing involves ESG funds, which are a type of mutual fund scheme that follows the ESG investment theme. Let’s elaborate.

ESG Theme – the concept

ESG stands for Environmental, Social and Governance. The ESG theme encompasses companies whose activities and operations are conducive to the ESG trinity. Here’s how it works–

E as in Environmental

Companies whose activities do not harm the environment qualify under this category. Such companies take measures to reduce their carbon footprint, minimise pollution caused by their production or operations, have a good waste disposal system and also preserve natural resources like water.

S as in Social

Companies that contribute to the development of society, as well as their employees, qualify in this category. Such companies take measures to create gender equality, have pay parity between their male and female employees, provide employee wellness and benefit programs and also contribute to social causes.

G as in Governance

Corporate governance measures whether companies follow the regulatory framework of the industry that they operate in. Companies that have strong compliance measures, follow the regulations, conduct themselves ethically, have a strong whistleblower policy and take strict actions against internal wrongdoings are said to follow good governance. Such companies, then, qualify under the Governance parameter of the ESG trinity.

How are companies measured or ranked on ESG?

Organizations like Morningstar, MSCI, Sustainalytics judge companies on ESG standards. They allocate grades or scores to companies on their ESG practices. These grades and scores measure if the company is ESG compliant or not.

For example, as per MSCI grading, companies are graded as follows –

AA or AAA – Leader

A, BBB or BB – Average

B or CCC – Laggard

Needless to say, companies in the AA or AAA category are stronger on the ESG parameters than companies in the lower parameters.

Morningstar, on the other hand, scores companies from 1 to 50 where 50 denotes the highest risk and 1 denotes the lowest.

What are ESG Funds?

ESG funds are thematic mutual funds that invest in companies that are ESG compliant. They are equity-oriented mutual fund schemes which invest at least 65% of their portfolio in the stock of ESG compliant companies. The fund, thus, invests in sustainable and socially compliant companies across all market capitalisations.

Features of ESG funds

Some of the salient features of ESG funds are as follows –

These funds are exposed to volatility risks since they are equity-oriented. However, for the risks that you take, the return potential is also high.

You can invest in ESG funds in a lump sum or take the SIP route, wherein you can invest in installments. If you choose the SIP option, the minimum amount of each instalment might start from Rs.500.

ESG funds come in both dividend and growth options. While the dividend option pays regular dividends, the growth option reinvests the profit earned by the portfolio for higher returns.

ESG Funds attract equity taxation. Short-term capital gains earned on redemption within 12 months are taxed at 15%. Long-term capital gains, however, earned on redemption after 12 months are tax-free up to Rs.1 lakh. If the returns exceed this limit, only the excess is taxable at a rate of 10%

Benefits of investing in ESG funds

Some of the benefits of investing in ESG funds include the following –

Doing your bit for the environment and

If you are a strong advocate for environmental or social causes or you want to do your bit for the society at large, ESG funds can be a good choice. By investing in companies that resonate with your sentiments, you can take a step towards supporting the causes that you believe in.

Potential for good

According to a Survey conducted by the CFA Institute across institutional and retail investors, 60% of the Indian investors said that they invested in ESG funds for higher risk-adjusted returns.

Being equity-oriented schemes, ESG funds can give you attractive returns over the long-term period. Moreover, since the companies follow stringent norms, they are less likely to wind up the business. As such, you can enjoy the potential for higher risk-adjusted returns.

The returns are also inflation-adjusted so that your corpus keeps pace with the increasing economy. This can help you create a corpus for your financial goals and meet them.

Potential to capitalise on changing preferences

Consumer preference is slowly changing as millennials are becoming more aware of the environment, social causes and good governance. As such, they back organisations that are in sync with their perceptions.

Moreover, the preference for investing in ESG compliant companies is increasing globally. As per a Report by Bloomberg Intelligence, ESG assets are expected to exceed the USD 35 trillion mark by the year 2025.

So, as preferences are changing, investors are likely to add ESG stocks to their portfolios which would drive up the market price of such stocks. When you invest in ESG funds, you can thus capitalise on the popularity of ESG stocks and gain on your investment.

Professionally managed portfolios

Like all mutual fund schemes, ESG funds also offer a professionally managed portfolio wherein the stocks are picked and managed by experienced fund managers. The fund is actively managed to capitalise on stock market opportunities.

Tax effective

You can enjoy tax-free returns from your investment if you hold the fund for at least 12 months, and your return is up to Rs. 1 lakh. Even if the returns exceed Rs.1 lakh, the tax rate is marginal at 10%. You can, thus, save taxes on long-term gains and get attractive tax-adjusted returns.

Affordable investing

Lastly, by choosing the SIP mode of investment, you can invest in ESG funds in small and affordable amounts and build up your corpus. Know more about esg funds

#best esg funds#what is an esg fund#esg mutual funds#best esg investments#best esg funds to invest in

0 notes

Text

The Difference Between the Primary and Secondary Market

Are you new to investing and unsure how to navigate the capital markets? You have come to the right place. TejiMandi carries the legacy of Motilal Oswal Financial Services, as a direct subsidiary of the behemoth. As SEBI-registered portfolio managers, our teams of in-house experts have solutions to all your investing queries and are adept at provisioning tailored portfolio management services to you.

The capital market is a platform where buyers and sellers trade various financial instruments such as bonds, stocks, and other securities. It is a medium for transferring capital from investors to companies that need the money to finance business ventures and investments. The term ‘capital market’ includes in-person and digital trading spaces with further classification into primary and secondary markets.

Here’s an in-depth look into the primary market vs secondary market differences and their meaning. However, it is pertinent to understand the types of securities that investors encounter in capital markets before discussing primary and secondary markets. Let us have a look at that first.

Types of securities in capital markets

Capital markets primarily deal with equities and debt securities. Both equity and debt securities are forms of investments with different risks and returns for the investor. Here’s a more detailed explanation of the two:

Equity Securities: An equity security is traded on the stock market and represents the ownership interest of shareholders in a company or business venture. Equity securities translate to shares of capital stock, including shares of common and preferred stocks. Holding equity shares of a company means owning a portion of that company, and the shareholder is entitled to the company’s future earnings.

Although equity shareholders may profit from capital gains when they sell the securities, they may not receive regular payments. However, equity shareholders get some degree of control over the company via voting rights. Moreover, they get a share of the residual interest incase of bankruptcy.

Know more about investing in equities in our article on Equity Investments: Benefits, Considerations, And Must-Know Tips on the Teji Mandi blog.

Debt Securities: Unlike equity securities, debt securities entitle the lender to receive a stream of interest payments and other contractual rights, except voting rights, while requiring the borrower to repay the principal amount borrowed too. These are IOUs in the form of bonds and notes and represent the borrowed money that must be paid back with interest. Debt securities typically have specific terms stipulating the loan size, interest rate, debt maturity, and the renewal date.

Some examples of debt securities include fixed deposits, certificates of deposits, government and corporate bonds, and collateralised securities.

Types of Capital Markets: Primary Market v/s Secondary Market

Capital market transactions take place through primary markets and secondary markets. In other words, investors can buy and sell securities in two types of markets.

Primary Market

The primary capital market is where a company sells new bonds and stocks to the public for the first time. The initial public offerings – or IPOs – take place in the primary market.

The company that issues securities hires underwriters who help them correctly price their securities, buy those securities from them (which ensures all of their stock offerings are taken up), and then further sell them using their underwriting network. Say the underwriters, also known as book-running lead managers, determine the issue price of the stock at Rs. 100. Thus, investors in a primary market can buy the shares of the IPO at Rs. 100 directly from the issuing company. Any shares that are left in the market are purchased by the underwriters, thereby transferring the risk of buying the securities onto them.

The term primary market stems from the fact that investors can first-hand contribute capital to the company by purchasing the stock.

Secondary Market

If a primary market creates securities, a secondary market is where the securities’ trading occurs. Popularly known as the stock market, the secondary market includes the BSE, NSE, NYSE, NASDAQ, and all stock exchanges around the world.

Investors trade previously issued securities in a secondary market, but these transactions do not involve the issuing company. For example, if you buy a stock of Tata Consultancy Services (TCS), you are dealing only with another investor who owns shares in TCS. However, TCS has no direct involvement in this transaction. Read more about the primary and secondary market

#primary market and secondary market#primary and secondary market#difference between primary market and secondary market#primary and secondary market difference

0 notes

Text

What is the new margin rule on selling stocks

Even those who do not regularly trade in the stock market are aware of how volatile it is. The uncertainty in the movement of share prices leads to a certain level of risk that all investors must undertake.

To ensure that the buyers and sellers take their promises (of buying and selling) seriously, and a safeguard against frauds, non-payment of dues and spiralling into debts, the regulatory body has established margin requirements.Is SEBI the sole market regulator in India? Are there others in the stock market that work towards smooth functioning, while protecting the interest of all players? Know more about the Role Of Market Regulators in our blog here.

Let us now see what margin is and what it means to trading.

What is a margin?

Margins come into play in intraday trading, also known as margin trading. Here, the investors can purchase more shares than they can afford by paying a part of the total share value, known as margin.

Margin also acts as a form of security that you must keep with your broker while trading in shares. This is a certain percentage of the share value that you must extend in cash as a trader. It is among the various other costs traders have to bear. Know more about other Stock Investing Charges.

Both the sellers and buyers must adhere to the margin requirements. This is because, for every fluctuation in price, there may be a buyer unwilling to pay for the shares or a seller unwilling to deliver the shares.

As per the old margin requirements, if you wished to purchase 100 shares with a 20% margin, you had to pay Rs. 20, with the broker putting in the remaining amount. However, the brokers extended lucrative discounts on the basic margin requirements. They gave an offer where you only have to pay, say 10% of the margin, Rs. 2. Effectively, you could purchase the shares by using a lesser amount and get a higher amount of leverage on the shares. For the broker, they could pull in more investors by extending this offer, earning more brokerage as the volume of trade increased.

However, this practice put the brokers at significant risk of insolvency. Even though they willingly roped in more traders, a fluctuation in price could lead to default from the end of the buyers or sellers, emptying the reserves of the broking house.

To avoid such a situation, SEBI introduced new margin rules, which came fully into effect from 1 September 2021. Let us see what these are.

What are the new margin rules?

The new margin rules restrict the amount of leverage that the brokers can provide. Announcing the change in a circular regarding peak margin requirements, SEBI gave the new rules for the same. A notice with the FAQs to provide clarification on certain points was also released.

Let us see how these new margin rules work.

For sellers

After you sell your shares, then as per the new rules, you would be free to use only 80% of the sale proceeds on the same day, also known as ‘T day’. The remaining 20% will be frozen and will only be released on T+1 day, which is the next trading day.

This 20% is kept as margin, ensuring that the brokers have enough margin before more traders place a buy order.

For instance, you own 100 shares of X Ltd. You place a sell order on them, giving them away for Rs. 200 per share.

The total amount that you earn is: Rs. 200*100 = Rs. 20,000.

However, you will only receive 80% of this amount, which is Rs. 16,000, for immediate use. The remaining Rs. 4,000 will be available to you on the next trading day.

0 notes

Text

PMS vs Mutual Funds: How to Make the Right Decision?

Investing in the stock market can be risky and intimidating, especially if you’re unsure where to start when picking out stocks. Thankfully, there are many options out there, including investing through portfolio management services and mutual funds, to help you understand what is right for you. To better understand these options, let us get into the details of Portfolio Management Services and Mutual Funds.

What are Portfolio Management Services?

Portfolio Management Services (PMS) are services offered by financial institutions, banks, and brokerage firms, to individuals who want to invest their money in a variety of assets but do not wish to manage the funds themselves. Instead, investors trust portfolio managers to handle their investments by predetermining their goals and preferences. While some investors work with a single portfolio manager, others choose to work with multiple managers at different financial institutions. Each of them oversees a separate part of the investor’s portfolio.

With the wide variety of investment options out there, figuring out where to invest your money can be tricky. Portfolio management services work with your personal situation and risk tolerance to create a custom portfolio designed just for you, making it more likely to work effectively to bring you closer to your financial goals.

There are four kinds of portfolio management services. These include:

Active portfolio management services: The investors who can take the high risk and quest for high returns can select this option. It involves actively analysing every fluctuation in the market.

Passive portfolio management services: This is a safe investment strategy for investors who are looking for stress-free gains. It is a long-term strategy that falls within a low-risk zone.

Discretionary Portfolio management services: This involves investors depending on the portfolio managers to make all investment decisions.

Non-Discretionary Portfolio management services: Here, the investors control all the buy, sell, and holding functions but take advice from the fund managers for suitable investments.

After an in-depth analysis of PMS, let us move on to mutual funds.

What are Mutual Funds?

Mutual Funds are investment funds that pool the money of various investors to collectively put it in stocks, bonds, and other types of investments. Mutual funds offer a diversified portfolio at a lower cost than individual securities and are a great way to invest in the stock market. All you have to do is select the right fund for yourself based on your financial needs. The prospectus of the mutual fund mentions the objective with which it has been set up and the kind of returns it will furnish.

You can put your money into Mutual Funds when you need to invest some extra cash that you don’t know what to do with immediately, or if you have some money saved up and are looking for an investment vehicle that can give you some returns while you keep your cash in savings.

Depending on investor needs and preferences, there are seven types of mutual funds:

Hybrid fund:

A hybrid fund is a mutual fund scheme where investment is made in multiple assets, including both equity and debt. This is suitable for investors who want a regular income through their investments. It involves lower risk as compared to other mutual funds.

Growth funds:

This is a diversified fund that includes assets that operate in the stock market, such as shares. The main goal is capital appreciation and involves significantly less or even zero dividend pay-out. The risk factor is average to high, and so is the return in the long run. It is ideal for investors who have just started their careers.

Income or bond or fixed-income funds:

This kind of mutual fund focuses on investment in bonds or other fixed-income securities. These are safer investments due to the fixed interest rates. Moreover, investing in Government bonds is safer as compared to corporate bonds.

Gilt funds:

This mutual fund scheme puts the entire investment amount in Government securities. Due to this, the credit risk is zero. This is a long-term investment most suited for investors with a low-risk profile.

Balanced funds:

These funds invest in both equity and debt. The return is moderate, and the risk is comparatively low. It is suitable for long term investment.

Money market funds or liquid funds:

A liquid fund is a type of debt fund. It is a short-term, low-risk investment that is more or less equivalent to a savings bank account.

Fixed income or debt mutual funds:

These funds invest a majority of the money in fixed coupon-bearing instruments like Government securities, bonds, and debentures. They have a low-risk-low-return outlook and are ideal for investors with a low-risk appetite looking for a steady income. However, they are subject to credit risk.PMS and mutual funds involve investment in assets that involve different levels of risk. To know How To Determine The Overall Risk Of Your Portfolio, read our blog here.

0 notes

Text

How to control your Greed in a Bull Market and Gain Confidence in a Bear Market

The most famous investor Warren Buffett once said – ‘Be fearful when others are greedy and be greedy when others are fearful’. This quote beautifully advises investors on market moods and how to navigate them. Whether in a bear market or bull run, investors should constantly question the reason behind such market sentiments. Also, one question should always be considered – Will the bull run or crash last forever?

Bull and bear markets are two phases in markets – high and low, which you can also call stages of boom and bust, which naturally affect your portfolio and investment decisions. To gain profit in the stock market, you should have a clear concept of bull and bear markets and understand their implications. Not just that, you must also train yourself to have a grip on your emotions – greed and fear – while investing or selling to avoid making any decision in haste that deteriorates your position.

There could be no better time to talk about bear and bull run than now. As Indian markets currently reel under an unofficial bear run, investors can be seen in a mood of panic as the market does any flactuation. To master investing in such situations, let us start with a basic understanding of what a bull and bear market is.

What are bull and bear markets?

Bull market

A bull market can be defined as an aggressive increase in stock prices and broad market indices over a period of time. There is a general uptrend that creates a lot of optimism and confidence among investors. A bull market can be caused by a variety of factors – a strong or fast-growing economy, GDP growth, reduced unemployment, better business performance, and rising corporate profits.

A high demand to buy stocks leads to rising average prices of shares. During a bull market, naturally, investors are eager to buy securities because of the thriving economies, resulting in a buyer’s market. The most recent example of a bull run can be the markets peaking around 61,000 points (Sensex), right after its fatal crash of 4% in March 2020 due to the pandemic!

Bear market

Unlike a bull market, which has no clear definition, A bear market is defined as a period of several months or even years during which stock prices consistently fall. The onset of a bearish trend is officially recognised when the markets are down 20% or more for at least two months. Events such as natural disasters, pandemics, or even wars can push forward a bearish trend in the market.

Bear markets can also be an economic trend in which the economy reels from stagnation or decline due to low confidence in the economy, high unemployment, reduced business operations, and meagre profits.

A bear market can also indicate recession (extended period of negative growth). Investors here prefer to sell rather than buy into the market. As investors lose confidence, a selling spree is triggered in the markets. As the demand for stocks falls, the prices fall further. As a result, a seller’s market develops.

But it is to be remembered that bull and bear markets work in cycles. Bear markets could very well be just a part of a stock market cycle and may not have a clear trigger factor.

Let us summarise the basics by tabulating the difference between bull and bear markets.

Difference between bull and bear market

Below are listed a few ways in which a bull and bear market differ: Basis

Bull market

Bear market

Stock market performance

There is a rising trend where the stock prices are increasing.

There is a downward trend, causing stock prices to fall.

GDP fluctuation

When GDP rises, the chances of a bull market are higher.

A bear market can be an outcome of falling GDP.

Unemployment

A reducing level of unemployment is a positive economic indicator, leading to a bull market.

Rising unemployment can lead to a bearish trend.

Interest rates

Low-interest rates allow businesses to borrow more and grow. Investors have a positive outlook, resulting in a bull market.

High interest rates stifle company growth and are thus associated with bear markets.

There are a few secrets for profiting in bull and bear markets. However, for that, the most important thing is to have control over one’s greed and also fear. These two emotions represent the two sides of investment risk. Let us see how they are associated with the two market trends.

Greed in the bull markets

Bull markets are typically fueled by economic strength, optimism and positive growth, which tends to fuel greedWhen stock prices are rising, an increasing number of investors become interested in purchasing the stocks. Increasing profits fuel more greed. Investors are encouraged to make more profits and pursue short-term profits. The most important aspect of a bull market is that most people regard rising stock prices as a sign of good things to come and optimism. However, there is always a chance that the prices will eventually fall, and investors who purchase stocks at extremely high prices as a result of the market’s aggressive growth are at a higher risk of suffering massive losses.

Fear in bear markets

A bear market is associated with a general sense of decline, which causes stockholders to be fearful. In a falling market (bearish trend), investors panic sell because they are afraid that the markets will fall further. Fear of losing all of their investments in a falling market leads to aggressive selling, and because the stock market is governed by the demand and supply principle, the market falls even further.

How can you control greed in bull markets and gain confidence in bear markets?

You can make wise investments in either a bull or bear market, but it all comes down to timing. If you can spot the market’s direction early enough, there are numerous opportunities to profit in either market.

Here are a few tips you can keep in mind during bull and bear markets:

Don’t rely on your emotions

Stock markets are a game of emotions, and sometimes, an investor’s emotions of greed or fear can overpower rational thinking. Bull runs may compel investors to keep buying, while bear markets may compel them to sell, regardless of any rationale or analysis.

Market attitudes can neither be controlled nor predicted. If your emotions and greed guide your investment activities, you are inviting a disaster for yourself. The most critical part of making a profit in the flux of the stock markets is not giving in to the public emotion that follows these changes. Taking a rational and realistic approach to investing is critical whether you want to capitalise on the euphoria or make most of the market fears.

Respond to the market with logic rather than emotions.

Conduct a fundamental analysis

Fundamental analysis can be defined as the process of viewing a stock holistically based on macro factors that include economy, industry, sector, and the company. Despite how the market sways, stocks that have strong fundamentals have the potential to withstand harsh falls and bounce back from them. Sure, they may experience volatility or undergo a downward trend during bear markets, but in the long run, they have known to remain stable and can generate wealth.

Fundamentals stand strong even in the face of the bear markets. So, conduct a proper fundamental analysis before investing, and then formulate your investment strategy. For instance, if you hold a fundamentally strong stock that, due to negative market sentiments, has fallen, then it would not be a wise decision to sell it. To sell in a bear phase and buy in a bull phase may not always earn returns.

Avoid impulsive buy and sell decisions in bull and bear market phases.

To get more insight into this, read our A-Z Guide On Analysing Stock Fundamentals on the Teji Mandi blog.

Make goal-oriented investments

Investment goals define your strategy and success in stock markets. Aimlessly navigating the markets, especially in the face of a bear run, can prove very costly.

Define your short-term and long-term goals. This will help you keep your greed and confidence in control, even when you spot favourable market opportunities. For instance, assume you sell a huge chunk of your portfolio to invest in a newly listed start-up stock. What do you think would happen here? In your greed for more profits, you have made a risky move that can very well derail your financial planning!

The best way to avoid such instances is to invest with a goal in mind. It can be as simple as investing to accumulate enough funds for your retirement or buying a house or a new car.

And thus, before you invest, define your goals, and pair them with the appropriate investment products that suit your risk profile. Once this is clear, you will have a better idea of how long you wish to stay invested and whether you have enough time to ride out the fluctuations in the market. It also relieves you of the burden of constantly monitoring the market.

Keep a sight on technicals

Technical analysis can be your best friend in bull and bear runs. By providing you with near-accurate entry/exit points and analysing movement and momentum, technical analysis can help protect your corpus and keep you in tune with the market moods.

Instead of being guided by greed and fear, rationalise your decisions based on technical information. Carry out the required analysis based on performance and not predictions.

Technical analysis can also be a window to understand if markets are in a state of bubble or are experiencing a true, justified bull/bear run. For example, if you see a spectacular rise in stock prices that very much resembles the run before a well-known crash, like the 2008 housing bubble, you may want to be careful with your investments.

Be rational in your approach, and never attempt to predict market movement.

Have a diversified portfolio

The importance of diversification, regardless of the market standing, cannot be stressed enough.

Allocating all your corpus to one asset or stock can be disastrous. Different stocks and industries react differently to market moods. For example, did you know that the FMCG sector stocks, during the pandemic phase (bear run), returned the highest for their investors!

The importance of diversification is that it can prevent heavy emotional reactions to market volatility. For instance, if you have a balance of equity shares as well as fixed income securities or debt funds in your portfolio, in a downward trend, you can rely on these secure funds when the value of your equities falls. On the other hand, in a bullish phase, you can benefit from the rising equity prices, knowing that you have other secure investments to fall back on in case of a bad decision or unwanted outcome.

A diversification strategy can provide protection during market cycles as gains can offset the losses in some investments.

Strategise your trading

Just because markets constantly reel in a negative space, it need not mean you cannot make profits. If strategically planned, every market phase can be used to generate profits.

For example, suppose the price of a stock you already own has fallen; instead of panicking and deciding on a sell-off, you can purchase more of it, lowering the overall average cost of your investment purchase.

Assume you had bought 1000 shares of a blue-chip company at Rs. 150 per share. The cost of investment at this point is Rs. 1,50,000. Now, you see a bearish trend in the market. With this, the share price of the blue-chip company has fallen to Rs. 100 per share. You decide to purchase 500 more shares, which costs you Rs. 50,000. With this, you now hold 1,500 shares of the company. But because of this transaction, your average cost per share now stands at Rs. 133.33 (Rs. 2,00,000/1500), which is much lower than your initial cost per share of Rs. 150!

Bull markets can be a great time to revise your investments and find new avenues. The bear market also provides numerous opportunities to invest in highly valued stocks at reduced prices. Experienced investors and trade pundits, in fact, enjoy bear markets as it allows them to indulge in large-scale stock purchases at nominal rates. And when these stocks experience bull runs, their profits can be exceptionally high.

Invest in fixed-income securities

Using fixed-income securities as a hedge against bull and bear market runs can be a wise strategy.

Fixed-income securities will not just give you more confidence in case your equity investments go south; they will provide you with consistent interest income (over the life of the bond). Fixed-income securities can also reduce the overall risk of your portfolio and protect against market volatility.

To know more about investing in fixed-income securities, read our article on ‘Risk And Return Involved In Fixed-Income Investment Strategies‘ on the Teji Mandi blog.

In conclusion

Markets, as any experienced investor would know, are constantly in a flux and consumer confidence has a significant impact on these fluctuations. When it comes to the bull and bear market, you should be cautious of how you react to these trends. You must also not lose confidence when the market goes down or give in to greed when the prices rise in your favour. Understanding the market’s fluctuations, as well as having a carefully constructed long-term plan with a diversified portfolio, can assist you in riding out unexpected market fluctuations. We at Teji Mandi are with you every step of the way. Get active advice on portfolio management from our team of trusted experts. Reach out to us on our website today!

0 notes

Text

How to determine portfolio risk?

Every financial investor will encounter a trade-off between returns and risks. The reward for greater risk is greater returns. However, it would be best to consider your risk appetite before making any investment.

Each investment has a different level of risk. The more you diversify your investments in your portfolio, the lower your overall risk will be. Let us understand what affects the performance of assets and how you can quantify the amount of risk you may face.

What is portfolio risk?

Portfolio Risk is the total risk determined by the individual risk associated with each asset you hold in your portfolio. The assets you own may fail to perform financially as expected. As a result, it leads to a substantial amount of loss. There are multiple causes for it and different ways to mitigate each category of risk. Let us see what the various types of risks are.

Types of portfolio risks

Risks involved with individual securities

To understand the overall risks involved in portfolios, let us first see the risks involved with individual securities.

Liquidity risk

It is the risk of not fulfilling short-term obligations on time. Short-term obligations are those that are due within a year.

Political and regulatory risk

It is when an investor suffers financially due to any sort of political flux in the country.

Default risk

It is a type of risk where a borrower cannot pay off his debts to the lender on time. Once a specific time has passed without any repayment, the loan converts to bad debt.

Style risk

It is a type of risk that is associated with your style of investing.

Duration risk

It is the risk associated with the time horizon of your investment. Over a period of time, you can find differences in interest rates. Eventually, the market value will either increase or decrease according to these fluctuations.

As you know, a portfolio is a combination of individual securities. However, certain kinds of risks are exclusively associated with the overall portfolio. Let us have a look at those.

Risks involved with the overall portfolio

The following risks affect the portfolio as a whole:

Systematic or market risk

It refers to the risk that affects the whole market or its segments. It is also known as volatility, undiversifiable, or market risk. The name undiversifiable implies that you cannot reduce this risk by adding a range of securities to your portfolio. It affects everyone in the market alike.

Unsystematic risk

This is also known as diversifiable risk. It is associated with a single company, market, or sector. You can mitigate this risk by diversifying your portfolio and adding various asset classes. In such a case, a loss in one sector may be offset by a gain in another. This reduces the overall risk of your portfolio.

The experts at TejiMandi help with theDiversification Of Your Portfolio and have garnered the trust of 10000+ subscribers. Contact us to get personalized advice on your portfolio.

Inflation risk

Also known as purchasing power risk, this occurs when the price of a commodity or a product increases to an unexpected price. Inversely, the prices may even fall below an expected level.

Concentration risk

This risk refers to the chances of an investment portfolio losing value when an individual or company moves in an unfavorable direction. The probability of facing this risk is higher when you have a less diverse portfolio, implying that your focus is on a small set of securities.

Reinvestment risk

It is a type of risk where an investor is unable to reinvest cash flows from their investment at a rate equivalent to the current rate they are receiving. This kind of risk is the highest in bonds. However, if they are zero-coupon bonds, there is no such risk involved due to no payments as coupons.

Currency risk

It occurs due to fluctuations in the exchange rates. This involves the movement of one currency against another currency, affecting those who operate or invest internationally.

Interest rate risk

This kind of risk is associated with the changes in the interest rate on various securities, primarily fixed-income securities. There is an inverse relationship between interest rates and bond prices. An increase in interest rate may result in losses due to a fall in the value of the assets. Now that you have understood the risks involved with individual securities and overall portfolios, let us know the calculation to determine the level of risk.

0 notes

Text

The Difference Between the Primary and Secondary Market

Are you new to investing and unsure how to navigate the capital markets? You have come to the right place. TejiMandi carries the legacy of Motilal Oswal Financial Services, as a direct subsidiary of the behemoth. As SEBI-registered portfolio managers, our teams of in-house experts have solutions to all your investing queries and are adept at provisioning tailored portfolio management services to you.

The capital market is a platform where buyers and sellers trade various financial instruments such as bonds, stocks, and other securities. It is a medium for transferring capital from investors to companies that need the money to finance business ventures and investments. The term ‘capital market’ includes in-person and digital trading spaces with further classification into primary and secondary markets.

Here’s an in-depth look into the primary market v/s secondary market differences and their meaning. However, it is pertinent to understand the types of securities that investors encounter in capital markets before discussing primary and secondary markets. Let us have a look at that first.

Types of securities in capital markets

Capital markets primarily deal with equities and debt securities. Both equity and debt securities are forms of investments with different risks and returns for the investor. Here’s a more detailed explanation of the two:

Equity Securities: An equity security is traded on the stock market and represents the ownership interest of shareholders in a company or business venture. Equity securities translate to shares of capital stock, including shares of common and preferred stocks. Holding equity shares of a company means owning a portion of that company, and the shareholder is entitled to the company’s future earnings.

Although equity shareholders may profit from capital gains when they sell the securities, they may not receive regular payments. However, equity shareholders get some degree of control over the company via voting rights. Moreover, they get a share of the residual interest incase of bankruptcy.

Know more about investing in equities in our article on Equity Investments: Benefits, Considerations, And Must-Know Tips on the Teji Mandi blog.

Debt Securities: Unlike equity securities, debt securities entitle the lender to receive a stream of interest payments and other contractual rights, except voting rights, while requiring the borrower to repay the principal amount borrowed too. These are IOUs in the form of bonds and notes and represent the borrowed money that must be paid back with interest. Debt securities typically have specific terms stipulating the loan size, interest rate, debt maturity, and the renewal date.

Some examples of debt securities include fixed deposits, certificates of deposits, government and corporate bonds, and collateralised securities.

0 notes

Text

Smallcase vs Mutual Fund

Mutual funds and Smallcases are the two asset structures in contention, and we’ll compare them over the course of this article to understand the fundamental difference between Smallcase and mutual funds.

As investors, most of us spend a considerable amount of time window-shopping for the right investment avenues. “Should I invest in the safety of debt instruments or should I stay equity-focused? Should I pick evergreen stocks or can I benefit more from trading the seasonal ones? What about adding some cryptocurrencies to my portfolio? How long should I stay invested?” Questions, so many questions. The truth is that unless you’re an exceptionally nuanced investor with well-rounded insights about multiple sectors, a diversified portfolio can hold the answer to most ‘what and why questions as far as investments are concerned. Two financial avenues facilitate this diversification optimally; the first is a household name and the second has emerged as a buzzword in the last year or two. Mutual funds and Smallcases are the two asset structures in contention, and we’ll compare them over the course of this article to understand the fundamental difference between Smallcase and mutual funds.

What are Mutual Funds?

A mutual fund is a pool of money collected from many investors to invest in securities like stocks, bonds and other assets. Professional fund managers, vetted and hired by mutual fund houses or Asset Management Companies (AMCs) are responsible for picking the constituents of the fund and allocating capital; they can attempt capital gains or income production based on the investment objectives of the fund as per the prospectus set out at the time of the fund launch (called NFO).

What is a Smallcase?

A Smallcase, on the other hand, represents a capital allocation structure similar to portfolio management services (PMS) that were previously reserved for wealthy individuals (Read: HNIs and UHNIs). As a product, this is an idea that has caught the fancy of many well-heeled millennials as well as on-the-brink wealthy, ever since SEBI hiked the minimum investment amount for portfolio management services (PMS) from ₹25 lakh to ₹50 lakh in November 2019. In some sense, Smallcase may be called affordable PMS – with a starting price as low as Rs199/month. Basically, a Smallcase is a basket of stocks or ETFs, decisively created by the top qualified and Registered Investment Advisors (RIAs) in India, based upon a theme, strategy, or objective.

David vs Goliath: A legacy product vs a promising challenger

If we have to compare the sheer size of the market with respect to Assets Under Management (AUM), mutual funds represent ₹36.74 trillion as of September 30, 2021. In comparison, Smallcases are a disruptive product that has been around for approximately 6 years now. Quoting the founder and CEO Vasanth Kamath “Our users multiplied three times from 9 lakh in March 2020 to 28 lakh in March 2021.” In FY21, the firm saw Rs 8,000 crore invested through its platform. A drop in the ocean, as far as the larger financial products industry is concerned.

Smallcase vs Mutual Funds: Points of Comparison

1. Exercise Control

Investing In Smallcases potentially offers investors better control over securities as the shares are credited directly in the Demat account. Having the portfolio right at your fingertips allows you to time your exit and know where each investment goes, which isn’t possible with mutual funds; you can cherry-pick which mutual fund you want to invest in, but the customization ends there.

2. Risk Mitigation Mechanisms

Smallcases are thematic investments; they invest in companies and securities that follow an underlying strategy or idea. For example, there can be a Smallcase that focuses on Clean Energy companies or fast-growing tech companies that focus on enterprise software integrations. Since these ideas are highly specific, diversification is restricted. For those intent on diversification, mutual funds offer a basket of good companies that are related by larger themes such as industry type and revenue benchmarks that may be a better hedge against volatility over several business cycles.

3. Cost of Leaving

In many mutual funds, there is an in-built penalty for liquidating your assets before the minimum stipulated time (generally just about a year)- this expense is called the exit load which ranges from 1-2% of the total investment. Typically, all mutual fund houses adjust this amount against the net asset value (NAV) of the fund. Smallcases, by design, allow investors to buy individual units of securities that are directly credited in the demat account like common shares. Since there is no exit load on selling shares, there is no exit load on selling smallcases.

4. Management Fee

Any asset allocation structure is only as good as the people managing it, i.e., the fund manager- who in these cases is typically someone who holds high repute in the financial markets. Understandably, this expertise attracts a certain cost, apart from the cost of monitoring and managing the fund. In the case of mutual funds, this cost, called the expense ratio, is a percentage of the total fund value, capped at 2.5% by SEBI. Smallcases have no fixed range – the cost differs from case to case and RIA to RIA, depending on the nature and theme of the basket of investments. For example, TejiMandi charges just Rs 199/month for its smallcases!

5. Access to Returns

Smallcases give investors direct access to their holdings since the shares are directly credited to their demat account. Hence, all corporate actions such as dividend distribution as well as the issue of bonus shares take place directly with the investors. In the case of mutual funds, the returns are collected in real-time but distributed quarterly.

6. Volatility