#which vanguard funds are best for retirement savings

Text

10 Best Solo 401k Options

A solo 401k is a great way to save for retirement if you run your own business. It provides the ability to contribute more money than other retirement accounts.

It often comes with additional benefits such as matching contributions from your employer or a self-directed investing option that lets you choose investments based on your risk tolerance and future goals.

Best Solo 401ks Overall - Self-Directed Solo 401k

A self-directed 401k is the best option if you want complete investment control. It allows you to invest your money in various assets such as stocks, bonds, mutual funds, ETFs, real estate, and alternative investments.

The self-directed solo 401k allows you to invest in various investment vehicles, including mutual and exchange-traded funds (ETFs).

Moreover, it allows you to invest in alternative investments like real estate through a self-directed IRA LLC or an IRA trust.

Best Solo 401k for Straightforward Investing - Schwab Solo 401k

Schwab Solo 401(k) is an excellent option for those looking to invest their retirement savings in straightforward terms. It’s one of the most popular solo 401(k) plans, offering a long list of investment options and advice services.

To start, Schwab Solo 401(k) has low fees: It only costs $1 monthly (and no maintenance fees). Plus, there are no account minimums or complicated pricing structures—you pay based on how much you have invested with them.

In addition to these excellent features, Schwab offers a wide range of investment options—including ETFs (exchange-traded funds), mutual funds, and individual stocks—and access to financial advisors via phone or video chat.

Best Low-Cost Solo 401k - Vanguard Solo 401k

Vanguard's Solo 401k is one of the least expensive options available on the market. There are no trading costs or management fees, so your investments will grow tax-free consistently.

There are also several investment options to choose from, and you can use any broker that works with Vanguard or roll over your existing IRA into a Vanguard Solo 401k plan.

- No minimum balance requirements or account service fees

According to Vanguard, you don't have to maintain a certain amount in your retirement account for it to remain active. You won't be charged annual and no account maintenance fees either.

The only thing that could cost money is if funds are left in the plan when you stop working as an independent contractor. Then, they may charge an inactivity fee until you retake action on them (which could easily be avoided by moving those funds elsewhere).

Best Flexible Self-Directed Solo 401k - Fidelity Go Self-Employed 401(k)

If you want to be able to invest in a wide range of investments, the Fidelity Go Self-Employed 401(k) is a great option. You can invest in stocks, bonds, mutual funds, ETFs, and REITs.

The catch? It has limited investment options available for real estate if you’re looking for something flexible with opportunities for real estate investing. However, this is one of the best solo 401k plans out there.

Fidelity Go allows investors to purchase residential and commercial properties with their solo 401k plan through a Fidelity Real Estate Investment Trust (REIT).

Investors participating in these plans can even borrow up to 30% of their total account balance when purchasing property – so if your account value was $100K and you wanted to borrow $30K from yourself, then that would mean that you could use $130K worth of funds from this one account – not bad.

Best Low-Cost Self-Directed Solo 401k - TD Ameritrade Self-Directed Brokerage Account Solo 401(k)

TD Ameritrade is a low-cost brokerage that offers some of the best mutual funds and ETFs on the market. One of their most popular products is the TD Ameritrade Self-Directed Brokerage Account Solo 401(k) because it has a low minimum investment requirement, a low $10 per month fee for the account, and no trading fees!

If you are looking for an inexpensive way to invest in your business without hiring someone else to do it for you (and possibly pay them a hefty fee), this option might be perfect for you.

Best for No Trading Costs or Management Fees – Wealth front Roth IRA.

This account is excellent because it has no trading costs, management fees, or minimum balance required. There’s no account minimum or annual fee, account service, or transfer fee.

You also won’t have to worry about any inactivity or maintenance fees.

Best Solo 401k for Tax-Deductible Contributions - E*TRADE Retirement Plan Services Individual K Plan

This plan allows you to contribute up to $19,000/year (or $25,000 if you're 50 or older). You can also set up a Roth IRA for the same account.

This is your plan if you have an E*TRADE Individual Retirement Account (IRA) with more than $1 million in total assets. Otherwise, it's best suited for those looking for traditional retirement savings accounts and IRAs.

If your Solo 401k is connected with an E*TRADE checking or brokerage account like our online trading platform, then there's another great way to maximize your retirement contributions: Roth IRAs.

Best Solo 401ks for Multiple Accounts or Employer Matching - Betterment Retirement Account (IRA)

Betterment is a Robo-advisor, so you can set it and forget it. You don’t need to worry about rebalancing your portfolio or monitoring the market: Betterment will do all that for you automatically. It also has no account minimums or account fees, which makes this solo 401k option very affordable.

Betterment offers a variety of investment options beyond stocks and bonds—including real estate and alternative investments like gold—as well as personalized advice from financial experts based on your goals, risk tolerance, and other personal factors.

Once they have those details, they can recommend the specific funds that make sense for you.

Best Interactive Investment Planning Tool - Personal Capital IRA Rollover Account

If you’re looking for an easy-to-use and affordable investment planning tool, look no further than Personal Capital IRA Rollover Account.

Personal Capital is a free investment management service that quickly helps users track their finances. It makes managing your retirement savings—whether in an IRA or traditional 401(k)—easy by providing both a tool to manage investments and alerts that let you know if something needs attention before it becomes a problem.

The Personal Capital IRA Rollover Account lets you easily transfer funds from your former employer’s 401(k) into this new account with just one click of the mouse.

And because all transactions are done online through their website or mobile app, there are no paperwork hoops to jump through either.

Best for Long History of Outperformance - Fidelity Personalized Portfolios IRA

Fidelity Personalized Portfolios IRA is excellent for investors who want to invest in various asset classes. Investors can choose from Fidelity’s managed portfolio options, including:

- Fidelity® Tax-Managed U.S. Equity Portfolio

- Fidelity® Low-Cost Municipal Debt Fund (LMMXX)

- Fidelity® International Index Fund - Investor Class (FIIIX)

Vanguard solo 401k

The vanguard solo 401k is a great investment option for self-employed people. A tax-advantaged retirement plan lets you put money into stocks, bonds, and mutual funds.

You can use it to save for retirement and withdraw some funds when needed, like in an emergency.

If you are self-employed and have set up your own business, opening up a vanguard solo 401k account can be a great way to save up for retirement because it allows you to contribute more than other plans allow.

Also, if you have been self-employed for at least two years, you can take a loan from the account for whatever purpose.

This can be helpful if you need cash for home improvement or medical expenses.

Another thing is that if you have a terrible year in business and earn less money than usual, the account helps give you some security because it insulates your earnings from taxes until you retire.

Also, unlike other plans, there is no maximum age limit for opening a solo 401k account.

So even if you are sixty years old and still working on your own business, you can still open up this account and fund it with money that will be taxed when you draw it.

E-trade solo 401k

Knowing what a Solo 401k it is important, and how you can benefit from using this retirement plan.

The Solo 401(k) Plan was created by Congress primarily for the self-employed.

It offers many of the same features as other retirement plans, such as a Traditional IRA or SEP IRA. Still, it has some additional benefits that make it especially attractive.

In particular, the Solo 401(k) offers two significant benefits: Self-employed individuals can contribute up to $52,000 per year to the Solo 401(k), which is tax-deductible; and

The account grows on a deferred tax basis until account withdrawals begin at age 59½.

The most significant benefit is that there are no income limitations on who can contribute and deduct their contributions.

You can open and fund a Solo 401(k) even if you have no employees or only one employee.

Frequently Asked Questions

What banks offer Solo 401k?

Several banks offer Solo 401k plans, and the list grows yearly. You're lucky to bank with U.S Bank, Wells Fargo, or Charles Schwab.

These banks all offer excellent Solo 401k plans. Because you're self-employed and not part of a company, a Solo 401k can be useful for retirement.

If you bank with one of these companies and open an IRA CD (or CD- ladder), you can save for retirement and watch your money grow over time -- tax-free.

Can I put rental income in a 401k?

The short answer is yes. The longer answer is that it depends on the context. When discussing income from investments, a 401k is an investment like anything else. So if you can put your rental income in a 401k, why not leave it there?

However, there are tax implications to consider. Depending on your circumstances, you may be subject to taxes on the income as soon as it's received.

Keeping your rental income outside the 401k until you've paid the taxes makes more sense if this is the case.

In addition, if your employer offers matching funds for your 401k but does not offer anything for Roth IRA contributions (which your rental income would likely go towards), you'll want to keep your Roth contributions separate until after you've maximized the match in your 401k.

The bottom line: Yes, you can put your rental income into a 401k. And depending on your situation, it might make sense to do so. But there are some additional factors to consider beyond whether it's allowed.

Is real estate a better investment than 401k?

Whether you believe real estate should be a big part of your investment portfolio depends on several factors, including the amount of money you have to invest, what kind of investor you are, and your goals for retirement.

"Real estate is an excellent long-term investment," says Melissa Padgett, a financial planner in the greater Chicago area.

Looking at the numbers, it becomes clear that investing in real estate can help you build wealth over time and achieve your long-term financial goals.

Many people put at least some of their money into residential property, with most saying they bought their home. They liked living there as they did because they saw it as a good investment.

For example, if you're buying a home that will become your primary residence, and you plan to live there for the next 30 years or more and think it's likely that housing prices will continue to rise during that period, then buying a home could make sense for you.

On the other hand, if you think prices will level off or even fall when you plan to live in the property, then buying may not be such a good idea.

Should I max out 401k or save for House?

Should I max out my 401k or save for a house? That's a great question, and there's no correct answer.

You have to consider many factors only relevant to you and your situation. But if you're looking for some solid advice, here are the main points to consider:

How long do you plan on working? The longer you work, the more likely it is that 401k contributions will pay off for you. If you plan to leave the workforce in 5 years or less, your best bet might be to start saving for your house now.

If you plan on staying employed for another 20 years, then funding your 401k makes more sense.

How much can you contribute? The maximum amount allowed in 2019 is $19,000 (up from $18,500).

If you can put that much away this year, it makes sense. If not, you should consider how much you can realistically save towards a house per year. You might be able to contribute substantially more than $19K per year.

What kind of interest rate do you get on your 401k? A 401k is an investment account with an associated interest rate that fluctuates depending on the market.

At what age should you pay off your mortgage?

The idea of paying off your mortgage as soon as possible is common.

The logic is that you'll have more money freed up to invest in other things if you're not making monthly payments on a large loan.

However, by the time you reach retirement age, you'll be able to borrow from your 401(k) if you need the money for an emergency, so the benefit of paying off your mortgage early may not be worth giving up the money you could've been investing all those years.

The actual decision is whether or not to pay off your house during your working life.

You should only do so if you're comfortable with having no home purchase protection and possibly missing out on other investments that could help boost your retirement savings.

Is it wise to pay off your house?

You've probably heard the advice to pay off your mortgage early, but is it r a good idea? Paying off your home loan can seem like a pretty sweet deal.

It means you're free from the monthly payments, which is a big load off your mind in itself. You also have the satisfaction of knowing you've got nothing to pay.

If it were that simple, though, you'd probably be hearing from people who had been paying their mortgages for years and years with no end in sight.

For one thing, it's not possible to do. Suppose you're in an area where house prices are skyrocketing. It's a great idea to liquidate your equity into cash and invest elsewhere, where it will grow faster than any interest you could earn on a mortgage.

And if your job requires a lot of travel or you can't commit to living in one place for at least seven years, then it may not be feasible either.

But even if those issues aren't in play, there are still some questions you might want to ask yourself before diving right into paying off your house.

Summary

A solo 401(k) is a great way to save for retirement if you run your own business. You can contribute up to $55,000 each to the plan as an employer. In addition, employees can contribute up to $18,500 a year if they're under 50 or $24,500 if they're 50 or over.

And unlike other retirement plans that limit which investments you can use (like IRAs), there are no restrictions on the investment options available in a solo 401(k).

You'll also want to think about how much money you need when it comes time for retirement—and whether or not you should invest some of it now so there will be more income.

Research has shown that people who start saving early tend to have more giant nest eggs than those who do not (even when controlling for age).

The earlier one starts saving for retirement and investing their money wisely, the longer their savings will have time to grow and compound—and therefore, more cash at the end of their lives.

Solo 401(k) has many benefits but can also be complicated to set up and manage. If you're considering investing in one, ensure your financial advisor is a certified solo 401(k) specialist or has extensive experience with these plans.

An excellent place to start is by looking for an advisor who has worked with clients like yourself—someone who knows what's essential when planning for retirement and how best to meet those goals.

Read the full article

0 notes

Text

Make A Sensible Transfer And Invest in Sensible Gold

Not simply paper cash or coins, gold is money. https://lawdownunder.com/ prefers protecting their gold metals at house to feel protected and in case of emergencies. blog means that you need to have completely different investment types and you are not solely focusing on a single one. Roth IRA contribution limits are determined by your earnings, age, and modified adjusted gross revenue. It is best to keep away from taking out greater than 50% of your total IRA belongings yearly.

To assist you find solutions to those questions and extra a new and detailed mini-course was created. It tends to be a place of refuge useful resource that ensures the portfolio in opposition to the hardships of swelling. Multilevel safety methods in addition to disaster recovery plans ought to also be in place. Primarily, creating coins and bars takes work, which prices money. Choosing a retirement account is very important for a safe future.

An excellent IRA custodian can help you understand your investment. We help the client with the fitting service for his or her particular person needs. In addition they provide the most effective customer support in the trade. M1 Plus is a paid annual membership that confers advantages for services and products supplied by M1 Finance LLC, M1 Spend LLC and M1 Digital LLC, each a separate, affiliated, and wholly-owned working subsidiary of M1 Holdings Inc. "M1" refers to M1 Holdings Inc., and its associates. After reviewing your software, the corporate will ship you a affirmation mail. In conclusion, I am sure you have bought questions relating to self-directed IRAs. Of course, you could just purchase gold, silver, platinum or palladium, retailer them separately, and mentally earmark them “saved for retirement.” But a extra cheap possibility is perhaps to benefit from the tax benefits accessible via using self-directed IRAs and self directed “Roth” IRAs. Some of these accounts aren't provided by Charles Schwab and Vanguard. Any of the massive brokerages together with Fidelity, Schwab and Vanguard permit clients to set up a Roth IRA account and a taxable account at the same time, John Crumrine, a …

Mostly, it's a byproduct of nickel mining, as nickel is present in the identical layer of the earth that iridium is. GoldCo is a brokerage agency for valuable metals underwritten with IRAs and follows IRS laws. While you open a Roth IRA and contribute to it, your future withdrawals will probably be freed from tax as long as they adjust to the IRS regulations. You have to appoint a certified custodian to be the trustee of your account. The minimum amount permitted is $10,000 Beneath 59 1/2 years outdated, you cannot make any investments. It contains the whole lot from tax advantages to how simple it's to establish an account. To mine copper, mining firms dig pit mines and gather copper ore, that are materials known to contain copper and, in lots of cases, iron compounds. In most cases, they can be completed from end to finish in a matter of days (e.g., 2-5 business days) with your new account absolutely funded.

0 notes

Text

Time Running Out to Repay Funds Withdrawn from Retirement Accounts in 2020

Near the beginning of the 2020 Covid-19 pandemic, certain investors were allowed to withdraw up to $100,000 from 401(k) plans and individual retirement accounts without the usual penalties and restrictions. The federal relief law passed in the spring of 2020 provided savers with special tax benefits regarding those withdrawals. However, any San Jose tax lawyer could confirm that as of June, 2023, many individuals now have weeks, or even mere days, to repay those funds or forfeit the benefits.

Three-Year Repayment Window Soon to Close

Part of the federal relief package, also called the CARES Act, provided funds to cash-strapped households due to extraordinarily high unemployment rates resulting from the pandemic. Part of the Act included a break for those saving money in various types of retirement accounts. An Internal Revenue Service tax attorney explained that one benefit to owners of such accounts was a waiver of the typical tax penalty of 10 percent if money is withdrawn early from the account. Additionally, tax breaks for owners of such accounts were also written into the Act.

Advertisement

The CARES Act stated that investors would be given a three-year window during which they could claim a refund for taxes paid on the early withdrawal if all or part of the distribution was repaid within three years. This essentially made the withdrawals more like tax-free loans. These benefits were only available in 2020, and now that the three-year repayment window is closing, it remains to be seen how many individuals may end up needing a back-taxes attorney.

The downside of this type of benefit is that the repayment can easily slip a person’s mind. The clock began ticking the day after the funds were acquired, so most of the deadlines are looming in months, weeks, and days. A wage garnishment lawyer or an attorney who deals with complicated tax returns is probably the best individual from whom to seek advice if one has forgotten about this stipulation.

Most Distributions Taken Between June and December 2020

Florida CFP Sean Deviney stated that most individuals who withdrew money from their retirement accounts did so from June to December. Even though the CARES Act was passed in March, in most instances, it would have taken a month or two for retirement plan administrators and employers to create a system to facilitate the withdrawals.

Records suggest that hundreds of thousands of families and individuals impacted by the pandemic took such distributions if they were available, but not many have repaid the funds yet.

An Interesting Statistic

The Vanguard Group stated that about 268,000 of the 4.7 million retirement investors for whom they manage accounts withdrew some money from their retirement programs in 2020. However, less than 1 percent had repaid it by the end of 2021. This is Vanguard’s most recent data.

Refunds Must Be Claimed Through an Amended Return

According to the IRS, investors who repay part or all of the funds by the appropriate deadline are required to file an amended tax return to claim a refund. Savers had the option to take the income-tax liability over the course of three years, but the individual would be required to file an amended return for each of those years. If, on the other hand, the same person chose to report the entire amount withdrawn on his or her 2020 tax return, it would only be necessary to submit one amended tax return.

Interestingly, investors were not required to repay the funds to the original account from which they were distributed. This is because the person may have changed jobs, or may have stopped participating in the retirement plan, particularly if it was work-sponsored. A San Jose tax lawyer should be contacted by anyone with concerns about these, or any tax related issues. Contact Us for a Tax Attorney in San Jose.

0 notes

Text

retirement companies Navigating the World : Secure Golden Years

retirement companies Introduction:

Undoubtedly, in today's era, we must emphasize the significance of financial planning and pension management. Retirement companies, which are a backbone for employees, professionals, and individual trading professionals, serve as essential pension management organizations. Through this article, we will delve into the notable retirement companies and examine how their services can help individuals secure a successful and comfortable retirement, by using an engaging writing style with ample transition words.

Initially, let's comprehend the concept of Retirement Companies

- To begin with, retirement companies are specialized establishments concentrating on pension and wealth management. They facilitate various financial products and services for their clients.

- Furthermore, they come in different forms, including government agencies, financial institutions, and insurance companies.

Subsequently, we introduce some significant Retirement Companies

- Firstly, Vanguard is a prominent retirement company that offers diverse pension and investment products for its clients.

- Secondly, turning our attention to Fidelity, a financial organization providing a range of asset management strategies and index funds.

- Next, T. Rowe Price is worth considering as it presents numerous pension investment choices, managing assets such as stocks, bonds, cash, and real estate. retirement companies

- Lastly, Charles Schwab is another remarkable option for its one-stop solution for multiple retirement account alternatives and personalized wealth management tactics.

In addition, let's examine critical factors when selecting a Retirement Company

- To start with, investigate the company's reputation and track record to ensure trustworthiness and long-term performance.

- Moreover, it's essential to compare the fees and costs levied by different companies for managing accounts and investments.

- Also, it's worth scrutinizing the variety and quality of financial offerings and services provided by each company.

- Moving forward, planning for a stable and enjoyable retirement In conclusion, it is of utmost importance to prioritize financial stability and pension management for people from all walks of life. By meticulously choosing the right retirement company, you pave the way for a well-funded and stress-free post-retirement life. Be sure to extensively research each company, their services, and customer feedback before making a well-informed decision. Wishing you the best of luck on your journey towards a satisfying and secure retirement! retirement companies

Investopedia's Retirement Planning Guide

"Find useful tips on managing your personal finances here."

"Ways to Save Energy 5 Simple at Home and Reduce Your Bills."

Read the full article

0 notes

Text

ETFs

There are a variety of tax-advantaged saving plans for U.S. investors to save for retirement. These include 401(k) accounts, individual retirement accounts (IRAs), and Roth IRAs. Many investors favor a Roth IRA because, while they are funded with after-tax dollars, the money can be withdrawn on a tax-free basis provided that certain conditions are met.1

Like other retirement accounts, Roth IRAs are used largely for long-term buy-and-hold investing. A primary reason for this approach is that retirement accounts are designed to accumulate wealth over the long term for retirement. Thus, people investing in a Roth IRA typically have a similar long-term time horizon.

ETFs

Given this approach, Roth IRA investors may be best off by selecting a small number of inexpensive core funds to provide broad exposure to multiple asset classes. Three categories that together offer this type of broad exposure are U.S. stocks, bonds, and global investing. One way for investors to gain exposure to these three categories is exchange-traded funds (ETFs), which are a type of pooled investment security that operates much like a mutual fund. But unlike mutual funds, ETFs can be purchased or sold on a stock exchange the same way that a stock can.

For this story, we will look at the best ETFs in each of these categories. ETFs are especially appropriate investment vehicles to consider for Roth IRAs because these funds are typically designed to be low-cost and diverse.

KEY TAKEAWAYS

Roth individual retirement accounts (Roth IRAs) are tax-advantaged retirement accounts appropriate for long-term investment strategies.

Three categories that together offer Roth IRA investors broad exposure are U.S. stocks, bonds, and global investing. Exchange-traded funds (ETFs) are a good way for investors to gain exposure to these three categories.

The best U.S. stock ETFs for Roth IRAs are funds in a seven-way tie: IVV, VOO, SPLG, SPTM, ITOT, VTI, and BKLC.

The best bond ETF for Roth IRAs is BKAG.

The best global investing ETF for Roth IRAs is SPDW.

Investopedia’s methodology for selecting the best ETFs for Roth IRAs was based on a search of ETF Database for funds that trade in the United States, and then for funds tracking major market indexes for each of three categories: U.S. stocks, bonds, and global investing. All data below are as of March 13, 2022, except where indicated.

Best U.S. Stock ETF(s) for Roth IRAs: Multi-Way Tie

Best S&P 500 ETFs: iShares Core S&P 500 ETF (IVV), Vanguard S&P 500 ETF (VOO), SPDR Portfolio S&P 500 ETF (SPLG)

Best total market ETFs: SPDR Portfolio S&P 1500 Composite Stock Market ETF (SPTM), iShares Core S&P Total U.S. Stock Market ETF (ITOT), Vanguard Total Stock Market ETF (VTI)

Morningstar U.S. Large Cap ETF: BNY Mellon U.S. Large Cap Core Equity ETF (BKLC)

The funds listed above represent some of the best U.S. stock ETFs across subcategories that include the S&P 500 Index and total market exposure. All of the funds listed above have an expense ratio of 0.03%, except for BKLC, which has an expense ratio of 0.00%.2345678

In recent years, common index fund providers have engaged in a major price war to entice customers. This means that investors luckily have access to a large number of extremely inexpensive ETFs. In addition to offering similarly low prices, the stock funds listed above are in a seven-way tie because the general options that they offer investors are similar. This means that an investor’s choice may come down to which of these funds is most easily available based on their preferred broker.

As mentioned, some of the funds above track slightly different indexes across subcategories. Investors should decide if they want to track the S&P 500, which is exclusively large-cap stocks, or a total or broad market index, which offers more exposure to small-cap and midcap stocks.9 The latter may bring a bit more volatility to portfolios but also adds diversification.

The final fund listed above, BKLC, is notable because it is a zero-cost fund. It tracks a significantly smaller index of large-cap stocks, with just under 229 holdings compared to more than 500 for the S&P 500. Still, those roughly 200 stocks make up about 70% of available market capitalization, whereas the S&P 500 makes up about 80%. As a result, the difference in exposure is not as large as it may appear to be. Still, investors have reason to be cautious about BKLC. It launched in 2020, meaning that it is largely untested, and it is unclear how this relatively smaller portfolio will perform over a longer term.98

Best Bond ETF for Roth IRAs: BKAG

Expense Ratio: 0.00%

Assets Under Management: $256.5 million

One-Year Trailing Total Return: -2.35%10

12-Month Trailing (TTM) Yield: 1.61% (as of March 11, 2022)

Inception Date: April 22, 20201112

The BNY Mellon Core Bond ETF (BKAG) aims to track the performance of the Bloomberg Barclays US Aggregate Total Return Index, which offers broad exposure to the overall U.S. bond market. The passive ETF’s primary portfolio managers are Gregory Lee and Nancy Rogers, who have managed the fund since it was founded in 2020.11

As of Feb. 28, 2022, BKAG has roughly 2,112 holdings with a weighted average maturity of 8.69 years. Broken down by industry as defined by BNY Mellon, about 40.31% of the portfolio is Treasurys, followed by 27.79% agency fixed rate, with the remaining third in banking, consumer noncyclical, communications, tech, and other areas. All of the ETF’s bonds are investment grade, including 72.71% rated AAA and 14.72% BBB, with the remainder of the portfolio made up of AA and A debt.11

Bonds and stocks work together in a portfolio to manage risk, with bonds generally considered to be less risky than stocks. The proportion of each will depend on factors that include how far an investor is from retirement and how risk-averse that investor is. The traditional investing approach has been to build a portfolio with 60% stocks/40% bonds. But many investors recently have advised allocating a larger percentage of a portfolio to stocks. The thought is that a higher percentage of stocks will increase performance while only slightly increasing risk for most of an investor’s career, unless that investor is quite close to retirement. For this reason, many investors allocate only 10% or less of a portfolio to bonds while young, and even only 10% to 20% into middle age.

Best Global Investing ETF: SPDW

Expense Ratio: 0.04%

Assets Under Management: $12.0 billion

One-Year Trailing Total Return: 1.84%13

12-Month Trailing (TTM) Yield: 3.24%14

Inception Date: April 20, 200715

The SPDR Portfolio Developed World ex-US ETF (SPDW) aims to track the S&P Developed Ex-U.S. BMI Index, an index composed of publicly traded companies domiciled in developed countries outside of the U.S. As of March 13, 2022, the fund has 2,409 holdings. Among the invested funds, 17.47% are allocated to financials stocks, followed by 16.07% to industrials and 10.79% to consumer discretionary names. Japan-based stocks make up 21.6% of the fund’s portfolio, by far the largest share, followed by the United Kingdom, Canada, France, and Switzerland.15

Global investing funds help to diversify a portfolio so that an investor need not rely exclusively on the U.S. economy. If the U.S. is not doing well, investing in other countries that are growing can help a portfolio to better weather the volatility.

SPDW was tied with the BNY Mellon International Equity ETF (BKIE), according to Investopedia’s methodology. However, SPDW has significantly better liquidity, meaning that trading costs are potentially lower. However, BKIE still may have enough liquidity for most small investors. So if your preferred broker offers that fund instead of SPDW, it may be one option worth considering. Both funds are limited to developed markets, which are generally less risky and volatile than emerging market stocks. If you are looking for a global investing fund that includes both developed and emerging markets around the world, the cheapest option is the Vanguard Total World Stock ETF (VT).161517

The Bottom Line

U.S. stock and bond ETFs provide a balance of risk and stability to a Roth IRA portfolio, while global investing funds diversify a portfolio beyond the U.S. in case of U.S. economic turmoil. ETFs, which trade like stocks and are generally low cost, are an efficient way for investors to access these large investment categories. Regarding stock ETFs, there are seven equities funds that are tied as being the best choice for a Roth IRA. The best bond ETF for Roth IRAs is BKAG, while the best global investing ETF is SPDW. Buying one fund from these three categories will enable Roth IRA investors to maximize returns over the long term while limiting risk.

Trade on the Go. Anywhere, Anytime

One of the world's largest crypto-asset exchanges is ready for you. Enjoy competitive fees and dedicated customer support while trading securely. You'll also have access to Binance tools that make it easier than ever to view your trade history, manage auto-investments, view price charts, and make conversions with zero fees. Make an account for free and join millions of traders and investors on the global crypto market.

0 notes

Text

Unlock Investing Secrets: 5 Must-Read Books

Investing can be a daunting task, especially for those who are just starting out. There are countless books available on the topic, and it can be difficult to know where to begin. In this blog article, we'll recommend five of the best investing books to read and explain why they are worth your time.

1) "The Intelligent Investor" by Benjamin Graham

Considered by many to be the definitive guide to value investing, "The Intelligent Investor" was first published in 1949 and has since become a classic in the world of investing. In the book, Graham outlines a disciplined, systematic approach to investing that emphasizes the importance of fundamental analysis and risk management.

One of the key concepts introduced in "The Intelligent Investor" is the idea of "Mr. Market," a metaphor for the stock market as a whole. Graham argues that Mr. Market can be irrational and emotional at times, and that it is the job of the investor to remain rational and disciplined in the face of market volatility.

2) "Rich Dad Poor Dad" by Robert Kiyosaki

"Rich Dad Poor Dad" is a personal finance book that emphasizes the importance of financial literacy and entrepreneurship. Kiyosaki argues that traditional approaches to investing, such as saving and investing in mutual funds, are not enough to achieve financial success. Instead, he advocates for a more proactive approach to wealth creation, including starting a business and investing in assets that generate passive income.

One of the key takeaways from "Rich Dad Poor Dad" is the importance of building financial literacy and understanding the different types of assets that can generate income. This includes understanding the difference between "good debt" and "bad debt," as well as the importance of investing in assets that appreciate in value over time.

3) "The Little Book of Common Sense Investing" by John C. Bogle

John C. Bogle, the founder of Vanguard Group, is a pioneer in the world of index investing. In "The Little Book of Common Sense Investing," Bogle argues that the best way to achieve long-term investment success is to diversify across a broad range of stocks and bonds through low-cost index funds.

One of the key points made in the book is that it is almost impossible for individual investors to consistently outperform the market. Bogle argues that the best way to achieve long-term investment success is to focus on minimizing costs and avoiding unnecessary risks. This includes avoiding "chasing returns" and avoiding the temptation to try to time the market.

4) "The Millionaire Next Door" by Thomas J. Stanley and William D. Danko

"The Millionaire Next Door" is a personal finance book that challenges many of the common stereotypes about wealth. Through extensive research and interviews with self-made millionaires, Stanley and Danko argue that the key to achieving financial success is not necessarily through high-paying jobs or extravagant spending, but rather through disciplined saving and investing.

One of the key takeaways from "The Millionaire Next Door" is the importance of living below your means and focusing on building wealth through consistent saving and investing. The authors also emphasize the importance of having a long-term financial plan and avoiding the temptation to make impulsive financial decisions.

5) "Your Money or Your Life" by Vicki Robin and Joe Dominguez

"Your Money or Your Life" is a personal finance book that takes a holistic approach to financial planning. The authors argue that it is important to not just focus on financial goals, but also to consider the role that money plays in our overall happiness and well-being.

One of the key concepts introduced in the book is the "financial independence ratio," which helps readers determine how much money they need to save in order to retire and not have to work again. "Your Money or Your Life" offers a wealth of advice for achieving financial freedom, such as setting aside money for savings every month, living well below your means and lowering the costs of housing.

1 note

·

View note

Text

Opinion: Your portfolio needs diversification. Here’s the best way to go about it in these volatile times

New Post has been published on https://medianwire.com/opinion-your-portfolio-needs-diversification-heres-the-best-way-to-go-about-it-in-these-volatile-times/

Opinion: Your portfolio needs diversification. Here’s the best way to go about it in these volatile times

If you’re trying to figure out how to make sure you’ve always got the best mix of investments, there are general rules, questionnaires about risk and all sorts of academic approaches. But it can be hard to translate the conclusions to your situation, especially if you, like most people, have a complicated financial life with many unrelated accounts.

A working adult might have a 401(k), IRA, Roth IRA, a taxable brokerage account and a money-market account. You might also have a crypto wallet or two, a high-yield savings account with CDs, a TreasuryDirect.gov account for I-bonds and other Treasurys, pensions, or other retirement plans lingering at old employers. Double that if you’re married.

Take the classic 60/40 portfolio construction, which means putting 60% of your investments in stocks and 40% in bonds, or other fixed-income investments. If you were relying on that, you’d be pretty confused right now. In today’s market, the 60/40 portfolio is either dying or rising from the dead, depending on whom you ask. And if you have money in many different places, what parts of it count toward that portfolio ratio?

You can always value the underlying message of the 60/40 portfolio, which is about diversification. You need both stocks and bonds as a hedge, because typically when one is up, the other is down, and you can cut your losses this way.

The bull market run-up after the 2008-2009 Great Recession seemed to change that equation. People needed extra convincing to stay in bonds, given how minuscule yields were.

Then this year both stock

DJIA,

-0.10%

SPX,

-0.33%

and bond markets

TMUBMUSD10Y,

3.899%

tumbled (hence the death knells). Yet others already see the light at the end of the tunnel. “We think the long-term outlook has brightened quite a bit,” says Barry Gilbert, asset allocation strategist for LPL Financial.

Given today’s economic conditions, it’s time to think broadly about all of your accounts together and reassess what you need to do going forward into unknown economic territory, no matter what your personal ratio.

Messy accounts for a reason

It might seem like a mess, but you need an array of accounts because they serve different purposes for your goals, which have distinct time horizons. Your retirement, for instance, might be 20 years away, and you benefit from the tax deferment. But the money you keep in your brokerage account might be for a coming large purchase.

Diversifying your money across accounts also helps you avoid the biggest mistake most advisers see in a downturn, which is cashing out and missing the upswing. “A year ago, we were reminding people that fixed-income has a role. Now we’re reminding people that both stocks and bonds are important, because they all ask: Should I just be in cash?” says Nathan Zahm, head of goal-based investing research for Vanguard.

Consider those who have a trading account, like one of Robinhood’s

HOOD,

+2.11%

14 million monthly active users. Those accounts are mostly in stocks, as the platform doesn’t trade bonds (or mutual funds), although some might hold bond or money-market ETFs. These investors will want to calculate what portion of their financial holdings are in that taxable account and weigh that against their other money, to make sure they have a balance that’s appropriate for them.

Some brokerage overviews or services like Mint will aggregate a wide view for you. But at the end of the day, it might take a spreadsheet to really see what you have, because not all your accounts will talk to each other.

Remember that if you track this manually, it will just be for a moment in time. Your list would not update dynamically as the value of the accounts change, and that’s what matters most for the necessary rebalancing that would keep you aligned with your goals. You’d be 60/40 until the market close on that day, and then come what may.

Should your target asset mix really be 60/40?

For the most part, 60/40 is a philosophical starting point. “The 60/40 portfolio isn’t automatically best. Practically speaking, you’d want to be at the level that’s right for you,” says Gilbert.

That optimal mix will depend on your age, the size of your nest egg and your goals, and it’s not a magic or a static number. It doesn’t even have to be a round number. One way to figure it out is to look at the way target-date funds for retirement use a “glide path” that shifts more conservative over time. Even if you don’t invest in target-date funds, you want to create a similar slope for yourself, and not just stick with 60/40 for decades.

For instance, Vanguard explains that its target-date funds basically only hit 60/40 around age 60, and then continue getting more conservative from there.

Schwab generally sets its funds to hit 60/40 at about five to six years from the target retirement age. “It’s one point in time. For any allocation, you have to evolve,” says Jake Gilliam, managing director for research at Schwab.

A sample from Schwab’s Target 2065 Index Fund

Schwab also adjusts the stocks and bonds within the allocation. “Younger customers will have more international, small cap or emerging markets. As you move older, we’re adjusting those sub-asset class allocations,” Gilliam adds.

This kind of sloped setup still allows for side money if you want to take a portion of your holdings and put it in crypto, meme stocks or keep it in cash under your mattress. It’s just human nature. “We know behaviorally that it can actually drive better discipline,” says Zahm. “If somebody has a side pool of money that’s a few percent to have fun with, then they behave better with the main 95%.”

Just make sure to count your side account in with your big picture eventually and make sure you’re not letting those positions pull you away from your target asset mix, whether that’s 60/40 or another ratio.

“There’s nothing wrong with thinking in buckets, but eventually all the small buckets go into one big bucket,” says Gilbert.

More from MarketWatch

Investors have been tested this year — do you have what it takes to succeed?

Reset your retirement calculator now for today’s bleaker stock markets and make sure you’re still on track

No matter your age, here’s how to tell if your finances are on the right track

Why the 60/40 portfolio is a worthy strategy even though stocks and bonds are weak

Here’s one way to potentially get more from a 60/40 portfolio

Read the full article here

0 notes

Note

Please ignore if needed, as I know it’s a little personal, but how are you saving for retirement? I just got my first big-person job (at 27) and am feeling behind/overwhelmed. Any advice?

Well first off, congratulations on the job! Also I never mind talking about finance, but thank you for considering that when asking :)

I didn't really get to start saving saving until I was in my thirties, and even now what I do to plan for retirement is not necessarily the best plan for everyone. So I will talk about what I do, but first I'm going to recommend that if you really want to take retirement planning seriously you should speak to a financial advisor, especially if that Big Person Job comes with a significant salary. Your bank is a good place to start, or if the job comes with 401K, speak to the company administering the plan, who can generally provide you with someone who can at least advise you on your 401K. Also disclaimer, I am not a financial advisor and none of this is given in a professional context, these are just my thoughts.

There are a lot of ways you can plan for retirement -- a 401K through work, an IRA independent of that (basically a 401K you buy yourself), personal investments, savings accounts, and other more esoteric financial vehicles. The most common is the 401K, a retirement investment account where you put in a percentage of your paycheck and your company (usually) matches it. The money is then invested in various funds that will, at least this is the hope, earn enough interest to keep up with inflation.

My attitude towards my first 401K was that this was monopoly money, not real or meaningful. I had a fatalistic view of it, having just that year (2008) watched my parents, one of whom is a trained financial planner, lose half the value of their 401K in the economic collapse. But my work mandated a 3% contribution, so I bitterly paid in. Rather than throw the money in there and let Vanguard invest it for me, however, I decided to use this "fake" money to learn about investing. I studied how 401K investing works, learned about bonds and mutual funds and all the rest, and built a portfolio based on what I learned. In 2019 my account topped $100K, pretty decent considering I was paying in the minimum on a paycheck that was small to start with. It's not actually much to retire on yet, but I'm proud of having built it that far.

401K investing doesn't require the amount of research I did, to be fair. If you don't want to do a ton of work, most 401K administrators will have a "target" fund that you just throw your money into with the goal of retiring in the year attached to the fund. I still have a reasonable amount in my "2045" Target fund, which means in theory I should be able to retire in 2045, when I'll be 65. As I get older, the target fund's "risk tolerance" lowers, meaning I'll earn less but be less at risk to lose money should another economic catastrophe occur (frankly pretty likely). This is a perfectly decent way to invest if you don't care about investing or want a simpler life than mine. :D

ANYWAY the standard advice is to put as much as you possibly can into your 401K, because it comes out of your paycheck before taxes, and because your work will often match a certain amount, which is essentially free money (as long as you stay with the company until it "vests" which is basically "if you leave before a certain time period has passed, we get to take this money back"). This is not bad advice but if you're interested in striking out on your own, you should feel okay to take some and redirect it elsewhere, with the awareness that you're sometimes raising your risk of losing it in doing so.

You have a lot of options when it comes to investing outside of a 401K. I don't recommend the stock market because it's a mood ring we base the entire economy on, and it’s a dreadful way to try and make money. Right now is kind of a shitty time to have a savings account, honestly, since nothing is offering very high interest rates. I wouldn't do any long-term locked-in stuff like a CD, where you put $10K in and have to wait 10 years for a 2% return or whatever, because hopefully interest rates on savings will rise before 10 years are out. Right now, especially at the start of your career and given the economic climate, I would stay "liquid" if I were you. And for anything other than savings accounts, which is where I keep my non-401K savings at this point, you're really best off talking to a financial advisor, as I haven't done extensive research. (This will be "next steps" for me once I handle a few other issues.)

What I did was stash my cash in high-yield savings (high yield right now is earning like 0.5%, which is garbage compared to a few years ago but better than nothing). Because I really only just started having disposable income in late 2019, when I changed jobs, I currently have a lot of places I'm keeping money but no one place has a ton in it yet. Still, it may be instructional to talk about. Outside of my checking accounts, which I don't use for saving anything (they're just bills and expenses), I have as investments:

-- A traditional IRA. When I left my old job, I was going to a job where Vanguard wasn't offered as a 401K administrator. I like Vanguard, so instead of moving the money from my old 401K to my new one, I rolled it over into a Traditional IRA with Vanguard. It's the same setup as a 401K, it just now doesn't get any new money coming in (I could be paying into it pre-taxes but I'm not quite there yet).

-- My 401K with my new job. My job matches up to 3% so 3% is what I pay in. I should be paying in more but I'm not gonna because I like having a little spare cash to spend right now. Also some of the money I would be paying into this 401K was used to pay off all my previous debts and is now used to make extra payments on my mortgage, currently my only remaining debt.

-- A savings account with Chase, attached to my checking accounts. This account pays 0.1% interest, so I only keep $1000 in this account. This is an emergency fund if, for example, somehow I end up overdrawn on checking, or I'm in a situation where I need a few hundred dollars immediately. It’s not meant to earn much, it’s there to be a cushion in case of sudden falls.

-- Two savings accounts with a credit union, in my case DCU. One is extremely high-yield (6% interest on the first $1K, 0.25% on anything after that) and one is less high-yield (0.5% but there's no maximum). So I keep $1K in the first account, earning $60 a year, and every month I put $200-$500 from my paycheck into the second account. This is my primary savings at this point and will probably remain so unless I can find something as convenient with a significantly higher interest rate.

-- One savings account with Betterment, an online-only bank. I am actually slowly emptying this one because when I joined, 3 years ago, they were paying 4%, but when the pandemic hit it dropped to 2%, then 0.3%, and then to 0.1%, which to me says they're in trouble. And if money I kept there could be earning more over in DCU's account, why not?

-- In theory my home, which I bought and am paying a mortgage on, is an investment. Given I lived through the bottom falling out of the housing market in 2008, I don't view it as such, especially since while it is appreciating in value it's not keeping up with inflation. Still, I bring it up because technically purchasing a home is a huge investment, and you're likely to be told as such when speaking to a professional. I can't recommend viewing real estate that way, because a) it will make you insane and b) you can't depend on the housing market any more than the stock market. All that said I do recommend buying a home if you're in a position to do so and know you'll be somewhere for a while. Mine was a huge headache to buy and given my luck will undoubtedly be a huge headache to sell, but I don't regret it and I like being able to paint, install new appliances, have pets, etc.

Anyway, I hope this helps! It's one of those areas that require either a lot of research or the services of a professional, but that just means there's a lot of room to play. Good luck!

3K notes

·

View notes

Text

this is a very long post and I've been proofreading a lot- but if I made any spelling or grammar mistakes I am sorry.

This is my personal ending to the ME3 trilogy, and this is meant to be a nice calm closure to my Shepard but I tried to make sure it can be inclusive to all Shepards if you like this ending or want to add to it! Because this is kinda designed as a 'happy ending' things might not seem as action packed to others.

I also thought about side things, what could be included if this was a game.

This is just something I thought about and I wanted to share. :)

I will be using they/them pronouns for Shepard to try to be more inclusive for your Shepard!

Context for my Shepard has it has influenced this ending- you can skip it if you want.

J. Shepard is a earthborn, sole survivor, Vanguard.

My sheaprd is full paragon for the most part- I can only remember picking like. 3 renegade options through out the entire series so she is mainly blue :)

Romanced Garrus in ME2/3

Saved the Rachni queen in ME1/3.

Saved Ashely in ME1.

Saved the Council.

Destroyed the Collector base and cut ties with Cerbrus. Rewrote the geth heretics.

Chose to kill the clone.

Got the Geth and the Quarians to work together.

Saved Wrex in ME1 and cured the genophage.

Felt extremely guilty over destroying the Alpha Relay.

Feels even worse about killing the Geth and EDI.

8000+ Glatic readiness, galaxy rebuilt and recovered quickly.

----

1-

The first breath we see Shepard take is soon followed by them briefly waking up. If they have a sole survivor background, they use what they learned on Azuke to set up an emergency signal from their omi tool before passing out. If they don't have that background then they remain unconscious.

No matter what though, Shepard is recovered by the STG, major Kirahee to be precise. (If he is not around, you are saved by an different unit.)

Due to the nature of the Citadel being taken, civilian forces were locked down and protected to avoid being hunted and turned into goo - after the war STG and Asari infiltration teams were sent to the Citadel to recover both living and dead. Shepard was considered a high priority to find dead or alive. Annnnddd they found them alive :)

2-

Earth and it's mass relay recovered quickly, and soon species headed back to their home systems to recover. STG/Salarian government offerd to take Shepard to one of their top private STG hospital on Sur'kesh that avoided the brunt of the reapers, after some convincing Shepard is sent there with some top Allience Medics and Dr. Chakwas. (if she survived)

The treatment they receive is top of the line, with funding from the Allience to ensure Shepard's survival.

Shepard's legs need to be amputated from being crushed under rubble, but the medics on site use some cell regrowth treatment mentioned in the memorial hospital in ME3. Shepard's implants from Cerbrus have become redundant, due to the blast. However, the reason Shepard could survive is that by the end their body naturally recovered over the months they were resurrected to where they are no longer needed. Implants are removed during recovery, physical therapy must be done when they recover, normal healing process. Ect. This process takes months at best, and Shepard is unconscious in a medically induced coma for the majority of it.

3-

Now the Normandy crew! The Jungle planet they crashed on was rich in resources, but there were issues for the dextro crew members in terms of rations. How high your GR was depends on how rough the Dextro crew had it. But they overcame it and fixed the Normandy. As soon as they left the planet's system they got the news about the state of the galaxy and Shepard's location to which they immidently plot the course to the STG facility.

4-

Shepard is still in a coma by the time they get there, and a majority of the crew do try to stay with Shepard during the recovery but later on the crew had to leave to their own planets to help their people. Only Liara, Dr. Chakwas, Joker and your LI remain by Shepard until they wake up. I personally like to imagine that while in the coma, Shepard has dreams like in 3 to do with the Leviathans.

5-

Shepard wakes up, with their LI by the end of their bed.

Soon after all those who stayed meet up with them.

They reunite and everyone is really happy :) no pain here :) but Shepard and the LI get in some conflict as Shepard is immediately trying to get back into the front lines with the Leviathans.

Shepard spills the beans and says why they picked destroy, it also weighs greatly on my Shepard- maybe not to others.

This links into why Shepard is hellbent on getting the Lethvians. In order to make those who sacrificed their lives not be in vain, the Leviathans must be destroyed before they can regain their power and indoctrinate the galaxy. Only once they are destroyed will peace finally be achieved.

LI finally gets on board and they are like; sigh. Damn OK but after this you are retiring.

Most of the remaning crew understands why Shepard picked destroy, but Joker does not and he gets unbelievably angry he leaves the Normandy as their pilot (temporarily) as soon as they dock to the Citadel. Shepard understands why he is angry and lets him go.

6-

Shepard and pals go to the council and ask for their aid- but this time Shepard gives them the extended brief on the Leviathans and that they want a way to destroy them.

The council agrees without much convincing due to Shepard saving them.

They come up with a plan to nuke the Leviathans' homeworld- they destroy the mass relay but they do it with a much, much more powerful bomb that wipes out the entire cluster, not just the system. The next cluter's Mass Relay is a little damaged from it... but nothing that can't be fixed. Its a very top secret plan. And boom! Leviathans gone.

7. Shepard doesn't actually retire just yet, they are offered to be the human councilor but they reject it. Wanting to remain a specter. Offer is then extended to Admiral Hackett- he accepts it. Shepard becomes a advisor to the council at Hackett's request - but she is also promoted to the head of the Allience Fleet. Shepard then spends the remainder of their their with the Normandy and their crew, doing top missions for the allience as well as specter work. They do all the decision making for the Allience in the War Room and it's where they are seen most.

8-

At some point after they destroyed the Leviathans and between getting promoted- sheaprd has two options that can have two different outcomes. These are the the 'major' choices for the game.

1-

The Asari are facing discrimination for hiding the prothen AI even during the war.

If you choose paragon actions to vouche for the Asari- they will not be rejected as a whole but they have lost that superior image they always had. The Asari counciler will owe you a favour if you choose this action.

If you choose renegade actions, the asari will be pushed deeper into discrimination, loosing their council seat, not get hired and get fired from jobs outside of Asari space- becoming a 'fallen angel' of sorts. This leads to a lot of political unrest.

2

There's also a scene with joker, much like the quest in ME1 with the Turian General and the Consort, drinking away his grief for EDI. If you choose paragon actions, Joker feels better and understands why you had to chose destroy. He rejoins the Normandy as a pilot. (This might need a high charm check and for you to always be civil with him.)

Or you can use renegade options, where he rejoins the Allience as a pilot but he refused to return to the Normandy due to Shepard's cold attitude towards EDIs death.

9. And then once peace is achieved at last, Shepard retires to a tropical place with Garrus and live of the royalties from the vids. Adopt some krogan kids and teach them how to shoot. :D Happy ending!

The ending can change to who you romanced and what you talked about in your game :)

Other things that might happen/ 'side quests':

Major thing: you and all your crewmates from ME1-3 are now considered Reaper and Leviathans experts- if there are any issues with reapers all team mates are called for council when there needs to be a meeting involving reapers. Not everyone can join if there needs to be a physical presence, but you can often have meetings with them when needed in the com room.

1. Cerbrus gets fully destroyed- due to a majority of the troops being husks, they got killed during the blast. Those who were indoctrinated were sent to a galaxy wide rehab that focuses on helping all who were under the reapers' control.

2. All the races in the galaxy who united were offered council seats and the galaxy are 'permentaly united'.

3. There's a follow up 'joke quest', it's like the Citadel DLC but with a bigger focus on the clone. It is taken seriously when it needs to be but there is clone banter. If Miranda is alive, she can help you. If not but Brooks stays alive, you find her in the cloning facility you travel to. You force her to help.

This quest acts as closure for Shepard to how they were made, and they come out happy in who they are. But depending on if you killed or spared the clone, you can have different reactions to the facility and what to do with it. (Paragon salvaging the facility for medical purposes, renegade to flat out destroy it to ensure you're the "only" Shepard remaning.)

4. Political debate to make all VI illegal like AI, to reduce the risk of sentient machines- you can influence this with paragon and renegade options? This links into the Quarians being split from reviving the geth or keeping them dead. There's a lot on unrest towards technology, half the galaxy opting to a return to manual labour permently (mainly civilians) and others wanting to keep advanced technology. (military and government officials)

5. Military unrest from separatist groups, as a specter/head of allience you do a series of quests for species and reunite with your cremates (ie. Garrus for the Turians, Tail for the Quarians, Von Barla for the Volus, ect.)

6. Specter missions for Shepard to Solo, access to Pinnical Station again as apart of physical therapy/rehab back into the millitary.

7. The keeper scanning quest you do in ME1 makes a comback, with what you got the salarian you helped makes an offer to study the keepers further. He thinks about removing the keepers and replace them with matience workers to keep the Citadel running. You can choose to back this idea or reject it.

8. Companions

James becomes an N7. Javik, after defeating the Leviathans, goes to the graves of his soilders and joins them. Tail officially becomes an Admiral. Wrex and Eve lead the Krogan to the glory of the olden days. Garrus is chosen to acend in the turian line of power and he's not too keen on it- even more so if he's being romanced by Sheaprd. Mordin and Legion get respecting statues in the Krogan and Quarian homeworlds respectfully. Anderson gets a special statue where he went up the beam to the Citadel, too.

9. There maybe something to do with Omega, I'm not too sure. I feel like Aria would survive, and if you made her go 'soft' with the general or kept her on her renegade path she might have some interesting dioluge. Idk, maybe she should be left in 3. Just spit balling.

Annnnddd that's all I have! Here's my little slice of happiness I made up to make the pain of ME3 easier :")

Hopefully in the new installment we can get a nice closure like this with Sheaprd and their LI. Maybe if this was like a standalone game it would completely close of the trilogy for new installments- maybe even a ME5 game that brings the Milky Way and Androma together years after this interpretation of events.

#mass effect#mass effect commander shepard#mass effect shepard#mass effect ending#mass effect thoughts#mass effect legendary edition#mass effect 4#mass effect 5#mass effect series

5 notes

·

View notes

Note

Bitches, I have a question. So, I’m manic/bipolar. It has been a very long road for me, but I just figured out a formula for paying off my credit cards AND finishing saving $5k in an emergency fund for myself by the end of 2019. Manic spending is finally under control, I’m turning 24 soon, raised by 2 parents that grew up dirt poor and their adult jobs were in a factory (mom died when I was 15, so I haven’t had her around for a while). My jobs for the past few years have been in food service.

Right now I’m an AGM at a fast-casual restaurant, I bartend one night a week at a taphouse, and I cover shifts for pastry deliveries. Although I’ve never had an ‘adult’ job **mainly due to me not having a degree**, I’ve always been VERY about my money. Neither of my parents taught me to be financially literate, so everything I’ve learned I’ve had to learn myself. The thing I did learn from them was: DON’T SPEND ANYTHING. So… I’m a junior in college right now, and I’m trying to pave my way 2/4

for success. I feel like there’s a lot of bad advice out there for millenials for investing, like there’s a lot of bad advice on how to utilize credit cards (and those pesky news articles all blaming us for the downfall of bad restaurants and shitty dog food…) Essence of the question… what would your advice be on me investing? My jobs do not offer any kind of retirement account savings. Once I finish paying off credit cards, I’ll have a lot of available extra income. By the end of this year 3/4

I’ll still have under 20k in student loan debt (which I’m going to tackle next, trust me) but… how do I save? 401k? IRA? Apps you recommend for buying stocks/etc? Thank you!!! 4/4

First off, lambchop, we are SO FUCKING PROUD OF YOU. You are crushing life so hard and working your ass off to rise above your circumstances. Don’t ever let anyone call you lazy, stupid, or entitled, because you are a goddamn warrior who is getting shit done. I’m seriously in awe.

Secondly, make sure you read this, which gives you a bit of a road map for young people:

Ask the Bitches: How Can I Make Myself Financially Secure Before Age 30?

Now, on to savings! I think you should start yourself an IRA (Roth or Traditional). This is an Individual Retirement Account, and it’s a great way to save for retirement and comes with tax benefits. If your employer doesn’t offer you a 401(K), an IRA is the best option. Read all about it here:

Investing Deathmatch: Traditional IRA vs. Roth IRA

Dafuq Is a Retirement Plan and Why Do You Need One?

I also think you’re just about ready to invest! That said, I think you should focus on saving an emergency fund and paying down your student loans first. Here’s how to do that:

You Must Be This Big to Be an Emergency Fund

So when you’re ready to invest, I think a great move for you would be an index fund through a reliable, consumer-friendly, low-cost ETF. Basically, go start an index fund at Vanguard. You could also try out a micro-investing app like Acorns, that rounds up your purchases to the nearest dollar and invests the change. Or you could do both! The point is you’re right to start thinking about this now. Go forth and conquer, young bitchling. Seize your warrior heritage and bring the world to its knees!

30 notes

·

View notes

Text

Why the 15% Rule is Your Key to Freedom

15% of your income = freedom

What I mean by freedom: control of what you do with your money and the ability to reach your personal goals. Snazzy? Yes.

This 15% rule is also one of the core parts of the free 6 day email course. Read on to find out why…

Here’s what we’ll talk about today:

What is this 15%?

How do I implement it in college?

What should I use it on?

The future

What is this 15%?

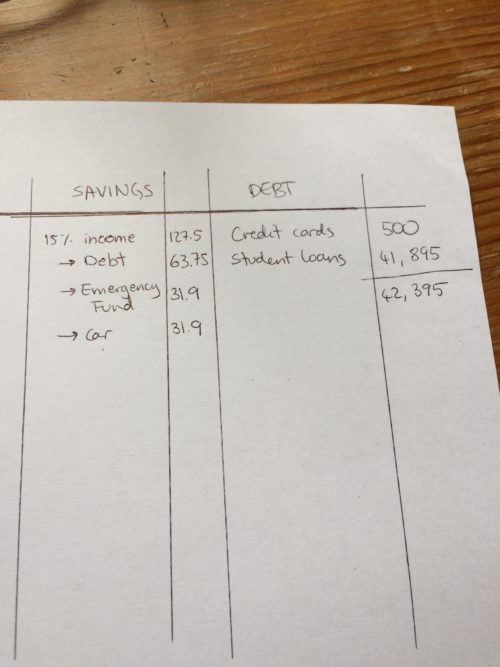

Very simple – it comes from the notion of Pay Yourself First. This means that every time you receive your income, you allocate 15% to yourself. Yourself means your goals: paying off debt, a new car, investments, a nice trip, etc.

The thing is, you allocate that money away the second you receive your paycheck/loan. You can’t spend it on going out, food or rent. That money is for the very personal goals, the ones with a future.

How do I implement it in college?

You work on your 15% through your budget. So the first step is to create a budget – yay! I go through this in my student budgeting guide, but here it is again just for you:

Very simple – get a nice big piece of A4 paper, a pen and a calculator (maybe even a ruler if you’re a perfectionist).

Start by drawing 5 columns:

Then fill these out with the following: Income, Budget, Expenses, Savings and Debt.

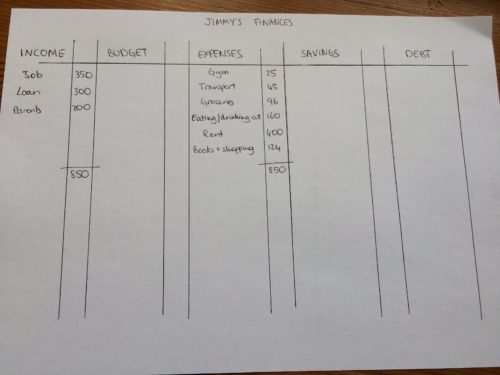

Then, very simple: slot in your income every month and then your expenses. Have no idea where your money goes each month? Do a rough estimate – check your bank account or try tracking for a week, see what happens. Below we have Jimmy’s expenses (he loves takeaway).

Everyone’s budget will look differently. Maybe you have irregular income, maybe you have a credit card and like overspending every month (not good!) or maybe you have some expenses that don’t happen exactly every month. For this reason I always like to start with a piece of paper – write down whatever you feel is necessary. Add extra columns, strange signs, whatever helps you understand what’s going on with the ££.

The Spending

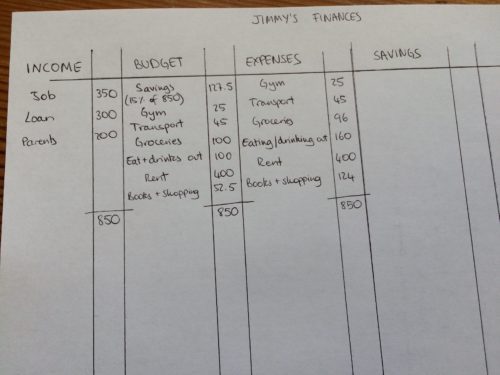

Now we get to the magical part:

Calculate 15% of your total income and add it to the budget column as ‘Savings’.

Do you see how the magic of the 15% rule works? Before you even have time to think what to spend your money on, 15% is off working on your goals and improving your financial life

The minute you receive your income for the month, calculate 15% of it and set it aside (check out the budgeting guide to find out what to do after)

Which brings us to the next question…

What do I do with the 15%?

Aha! Very good question. So this 15% is very valuable. It may not seem like a lot of money at the beginning, but as it accumulates it can produce a pretty neat pile of cash. If you want to take #responsibility to the next level, here are some steps to figure out the best way to use that 15%.

Pay off debt

If you’ve got credit card debt or other consumer debt, get rid of it immediately. It piles up very quickly and will only cause misery.

If you’ve decided you’re going to pay off your student loans, use this extra money to get rid of it as soon as possible. The 6 day course covers how to do this as well.

Investing

The next best thing to do with your money is invest it: put it into low cost index funds and watch the money pile grow. Set up a direct debit to the investing platform; the minute you get your paycheck and calculate that 15%, send it off to Vanguard or whichever platform you use. As the months go on, you’ll accumulate a nice amount of assets which will also be earning interest for you. You can then use this money for the future: buy a house, save for retirement, emergencies, etc.

Build an Emergency Fund

This goes hand in hand with investing – you can use your investment platform to keep your emergency fund, however make sure it’s in secure assets such as bonds. Read the emergency fund guide and then work on it with your 15%; building 2-3 months of expenses and putting it away somewhere safe: investment bonds, or simply a separate savings account.

Treat yo’self

Yes, it’s important to treat yourself. It may be the fourth in the list but I’ll explain later how you can be responsible and get some nice treats as well. What do I mean by treats? An exciting trip to the other side of the world, a car, a new laptop, etc.

The best part is that you’ll be turning this consumerism into delayed gratification: every month you put some money away for that exciting BIG THING until you can finally afford it. And you’ll proudly be able to say: I bought it with my own money and I bought it responsibly. #adulting.

Money Experiments

This is for the money geeks (#me). Really interested in learning more about the money and what you could do with it? Why not use some of it to experiment? This could mean starting a new side-hustle, something like peer to peer lending, investing in something riskier (crypto?). I do recommend doing the responsible stuff first: make sure you’ve paid your debt off and your emergency fund is in place. And then use the money for your financial education: try some new things, buy some books, attend some seminars. Many times that’s the money best spent; the future returns could be way higher than you imagine.

So these are 5 things you can allocate your 15% to. And once you see all the exciting things you can do with that extra money, you realise that it does not have to be 15%. It could be 20%, or 30% or even 50%. This isn’t the easiest thing to do on a meagre student budget, but once you graduate and earn some good money, working towards a high Pay Yourself First percentage will get you very far.

The thing is, it’s not easy to choose what to allocate that 15% to. You could say ‘But I wanna do all those five things!’. Well, the good news is: you can. It just takes a few more calculations and discipline to stick to the budget.

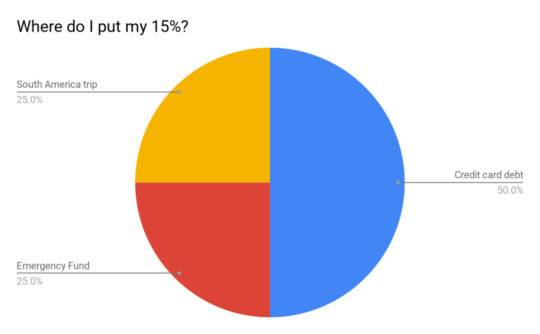

Jimmy wants to pay off his credit card debt, build an emergency fund and buy a trip South America. He has 15% every month to work with. Going on from his budget, this means he has £127.5 every month. He decides to divide it up:

Half will go to credit card debt.

A quarter will go to building his emergency fund

A quarter will go to a savings account for his trip to SA

Here’s a lil pie chart:

And so every month, he calculates his 15% and then makes sure the right amount goes off in the right direction. Pretty cool.

And if you want to use more of that money, you can! It’s all up to you where you put it. The more the money works for you the more you’re winning – freedom.

The future = freedom

Another great part of the 15% rule is how ready you’ll be once you graduate. Not only will you be used to allocating a percentage of your income to yourself, but you’ll have this cushion of money that’s been working for you. Thanks to the emergency fund you won’t be in too much rush to find a job, with 2-3 months of expenses ready for you. If you already started investing it won’t be so unfamiliar to you once you start working – and that money will keep earning interest. You also know how to get those treats in a more responsible way: by working towards them up bit by bit.

This is what I mean when I say freedom: you are no longer stuck to a job to get what you want. If you don’t get your paycheck one month, you’re ok. If something breaks down and you need to replace it, you’re ok. And you’ll (hopefully) aim to accumulate some wealth for the future, so future you will be ok.

This extremely simple 15% rule is the secret to being financially responsible, to being financially intelligent and independent. And you can literally start right now!

Ever heard of a similar version of the 15% rule? What’s yours?

Read more like this over at Financially Mint

67 notes

·

View notes

Text

Vanguard Digital Advisor: Best for Retirement Planning

Vanguard Digital Advisor: Best for Retirement Planning