#stocks grpn

Text

Groupon (GRPN) reveals transformation plans as stock performance points to an impending positive turnaround

http://dlvr.it/SqZjQx

0 notes

Link

0 notes

Photo

Shout out to Austin. Thanks to him, I now own a share of #aksteel. How did I do that? I referred another friend to the #robinhoodapp so they could get a free share of stock. To date I have gotten $$152.32 in value from referrals in stock. 6 shares of Zynga (ZNGA) 3 shares of Sirius XM (SIRI) 1 share of Exxon Mobil (XOM) 2 shares of Groupon (GRPN) 1 share of Chesapeake Energy (CHK) 2 shares of Sprint (S) 1 share of AK Steel (AKS) If you click on the link below and sign up, you'll get a free share of stock and so will I. Don't leave stock on the table!!! I will post what I get as the shares arrive in my account. https://www.instagram.com/p/Bqs2g4gD0dK/?utm_source=ig_tumblr_share&igshid=p5xpr0gzcmxy

1 note

·

View note

Link

Uber is losing less money. But it still faces one big risk For months, government rules and fears about catching Covid-19 meant everyone stayed put. Finally, though, there are signs of change — and Uber (UBER), for one, is thrilled. “Uber has already begun to fire on all cylinders,” CEO Dara Khosrowshahi told analysts after the company reported earnings Wednesday. What’s happening: As the economic recovery picked up in key markets like the United States, the startup reported a net loss of $108 million for the first three months of the year. That’s a dramatic improvement from the $968 million loss it posted during the final three months of 2020. The company’s core ride-hailing business still looks weak, with gross bookings for rides down 38% compared to a year earlier. But major growth in food delivery, which saw bookings jump 166% compared to the same period in 2020, is helping Uber weather the storm. Even as customers return to the app, however, there’s significant uncertainty over Uber’s relationship with its drivers. See here: Driver supply has been a problem recently as the company tries to convince people it’s safe to start ferrying riders around again. Khosrowshahi said the company is offering incentives to get old drivers back on the road and to find new recruits. “There’s a greater hesitation for some drivers to come on board to drive other people versus, again, [driving] food,” Khosrowshahi said. The longer-term problem is how Uber compensates its workers. Earlier this year, the UK Supreme Court upheld a ruling that Uber drivers in the country should be classified as workers and not independent contractors. That means they’re entitled to the minimum wage, vacation time and a pension. Uber said Wednesday that it had to set aside $600 million to deal with these changes. It’s not the only place where the tide could be turning against Uber on labor issues. Chief Legal Officer Tony West acknowledged that the company is actively engaging on such matters with officials across Europe, which he said is “really is at the forefront.” But the approach from the Biden administration is increasingly under the microscope, too. On Wednesday, the US Labor Department said it was withdrawing a Trump-era rule that would have made it easier for companies to classify gig economy workers as independent contractors. “Legitimate business owners play an important role in our economy but, too often, workers lose important wage and related protections when employers misclassify them as independent contractors,” Labor Secretary Marty Walsh said in a statement. Investor insight: West said the current administration doesn’t have a uniform set of views, which “creates space for some meaningful dialogue.” But investors may not be as sanguine. Shares are down 4% in premarket trading. GameStop and Archegos drama could trigger new SEC rules A tumultuous start to 2021 has grabbed the attention of Wall Street’s top regulator, which is considering new rules in the wake of GameStop (GME) trading mania and the collapse of the hedge fund Archegos earlier this year. That’s according to Gary Gensler, the chair of the Securities and Exchange Commission. Gensler is due to testify Thursday before the House Financial Services Committee. His prepared remarks indicate a wide range of concerns about the functioning of markets and investor behavior, and a conviction that stricter oversight may be needed. The SEC expects to publish a staff report assessing recent market events this summer. In the meantime, here a sampling of what’s on Gensler’s mind: On game-like trading apps: “If we watch a movie that a streaming app recommends and don’t like it, we might lose a couple of hours of our evening. If a fitness app nudges us to exercise, that’s probably a good thing. Following the wrong prompt on a trading app, however, could have a substantial effect on a saver’s financial position.” On how Robinhood makes money: “Higher volumes of trades generate more payments for order flow. This brings to mind a number of questions: Do broker-dealers have inherent conflicts of interest? … Are broker-dealers incentivized to encourage customers to trade more frequently than is in those customers’ best interest?” On social media: “I’m not concerned about regular investors exercising their free speech online. I am more concerned about bad actors potentially taking advantage of influential platforms.” On the big picture: “Whenever there are major market events, it’s a good idea to consider what risks they might have placed on the entire financial system, even when the system holds.” Why Melinda Gates just received stock in a Canadian railroad In the divorce of Melinda and Bill Gates, the division of their vast wealth is unlikely to cause fireworks and fury. That’s because the pair has a separation contract in place, my CNN Business colleague Jeanne Sahadi reports. In the state of Washington, where Melinda Gates filed her petition for divorce this week, a separation contract promotes “the amicable settlement of disputes” and is binding unless, for some reason, the court finds that it was unfair to one party when it was executed. Such an agreement is typical in divorces of very high net worth couples, where the splitting of assets can be complex. “There is 100% reason to think the divorce is amicable,” said celebrity divorce attorney William Breslow. See here: Just this week, Bill Gates transferred roughly $2 billion in shares of AutoNation and Canadian National Railway to his wife, according to SEC filings from his firm Cascade Investments. The Wall Street Journal also reports that Melinda Gates now has a 4.9% stake in a Coca-Cola bottler worth about $121 million, and a $386 million stake in Mexican broadcaster Televisa. Up next ArcelorMittal (AMSYF), Edgewell Personal Care (EPC), Kellogg (K), Moderna (MRNA), Papa John’s (PZZA), Plug Power (PLUG), SeaWorld Entertainment (SEAS), Tapestry (TPR) and Wayfair (W) report results before US markets open. Beyond Meat (BYND), Datadog (DDOG), Expedia Group (EXPE), GoPro (GPRO), Groupon (GRPN), Live Nation (LYV), Monster Beverage (MNST), Peloton (PTON) and Square (SQ) follow after the close. Also today: The Bank of England announces its latest policy decision. Initial US jobless claims for last week post at 8:30 a.m. ET. SEC Chair Gary Gensler testifies before the House Financial Services Committee at 12 p.m. ET. Coming tomorrow: The US jobs report for April is a crucial test for the country’s economic recovery. Source link Orbem News #Big #Faces #investing #Losing #Money #Premarketstocks:Uberislosinglessmoney.Butitstillfacesonebigrisk-CNN #risk #Uber

0 notes

Text

Uber is losing less money. But it still faces one big risk

New Post has been published on https://appradab.com/uber-is-losing-less-money-but-it-still-faces-one-big-risk/

Uber is losing less money. But it still faces one big risk

For months, government rules and fears about catching Covid-19 meant everyone stayed put. Finally, though, there are signs of change — and Uber (UBER), for one, is thrilled.

“Uber has already begun to fire on all cylinders,” CEO Dara Khosrowshahi told analysts after the company reported earnings Wednesday.

What’s happening: As the economic recovery picked up in key markets like the United States, the startup reported a net loss of $108 million for the first three months of the year. That’s a dramatic improvement from the $968 million loss it posted during the final three months of 2020.

The company’s core ride-hailing business still looks weak, with gross bookings for rides down 38% compared to a year earlier. But major growth in food delivery, which saw bookings jump 166% compared to the same period in 2020, is helping Uber weather the storm.

Even as customers return to the app, however, there’s significant uncertainty over Uber’s relationship with its drivers.

See here: Driver supply has been a problem recently as the company tries to convince people it’s safe to start ferrying riders around again. Khosrowshahi said the company is offering incentives to get old drivers back on the road and to find new recruits.

“There’s a greater hesitation for some drivers to come on board to drive other people versus, again, [driving] food,” Khosrowshahi said.

The longer-term problem is how Uber compensates its workers.

Earlier this year, the UK Supreme Court upheld a ruling that Uber drivers in the country should be classified as workers and not independent contractors. That means they’re entitled to the minimum wage, vacation time and a pension.

Uber said Wednesday that it had to set aside $600 million to deal with these changes.

It’s not the only place where the tide could be turning against Uber on labor issues. Chief Legal Officer Tony West acknowledged that the company is actively engaging on such matters with officials across Europe, which he said is “really is at the forefront.”

But the approach from the Biden administration is increasingly under the microscope, too. On Wednesday, the US Labor Department said it was withdrawing a Trump-era rule that would have made it easier for companies to classify gig economy workers as independent contractors.

“Legitimate business owners play an important role in our economy but, too often, workers lose important wage and related protections when employers misclassify them as independent contractors,” Labor Secretary Marty Walsh said in a statement.

Investor insight: West said the current administration doesn’t have a uniform set of views, which “creates space for some meaningful dialogue.” But investors may not be as sanguine. Shares are down 4% in premarket trading.

GameStop and Archegos drama could trigger new SEC rules

A tumultuous start to 2021 has grabbed the attention of Wall Street’s top regulator, which is considering new rules in the wake of GameStop (GME) trading mania and the collapse of the hedge fund Archegos earlier this year.

That’s according to Gary Gensler, the chair of the Securities and Exchange Commission. Gensler is due to testify Thursday before the House Financial Services Committee.

His prepared remarks indicate a wide range of concerns about the functioning of markets and investor behavior, and a conviction that stricter oversight may be needed. The SEC expects to publish a staff report assessing recent market events this summer.

In the meantime, here a sampling of what’s on Gensler’s mind:

On game-like trading apps: “If we watch a movie that a streaming app recommends and don’t like it, we might lose a couple of hours of our evening. If a fitness app nudges us to exercise, that’s probably a good thing. Following the wrong prompt on a trading app, however, could have a substantial effect on a saver’s financial position.”

On how Robinhood makes money: “Higher volumes of trades generate more payments for order flow. This brings to mind a number of questions: Do broker-dealers have inherent conflicts of interest? … Are broker-dealers incentivized to encourage customers to trade more frequently than is in those customers’ best interest?”

On social media: “I’m not concerned about regular investors exercising their free speech online. I am more concerned about bad actors potentially taking advantage of influential platforms.”

On the big picture: “Whenever there are major market events, it’s a good idea to consider what risks they might have placed on the entire financial system, even when the system holds.”

Why Melinda Gates just received stock in a Canadian railroad

In the divorce of Melinda and Bill Gates, the division of their vast wealth is unlikely to cause fireworks and fury. That’s because the pair has a separation contract in place, my Appradab Business colleague Jeanne Sahadi reports.

In the state of Washington, where Melinda Gates filed her petition for divorce this week, a separation contract promotes “the amicable settlement of disputes” and is binding unless, for some reason, the court finds that it was unfair to one party when it was executed.

Such an agreement is typical in divorces of very high net worth couples, where the splitting of assets can be complex.

“There is 100% reason to think the divorce is amicable,” said celebrity divorce attorney William Breslow.

See here: Just this week, Bill Gates transferred roughly $2 billion in shares of AutoNation and Canadian National Railway to his wife, according to SEC filings from his firm Cascade Investments.

The Wall Street Journal also reports that Melinda Gates now has a 4.9% stake in a Coca-Cola bottler worth about $121 million, and a $386 million stake in Mexican broadcaster Televisa.

Up next

ArcelorMittal (AMSYF), Edgewell Personal Care (EPC), Kellogg (K), Moderna (MRNA), Papa John’s (PZZA), Plug Power (PLUG), SeaWorld Entertainment (SEAS), Tapestry (TPR) and Wayfair (W) report results before US markets open. Beyond Meat (BYND), Datadog (DDOG), Expedia Group (EXPE), GoPro (GPRO), Groupon (GRPN), Live Nation (LYV), Monster Beverage (MNST), Peloton (PTON) and Square (SQ) follow after the close.

Also today:

The Bank of England announces its latest policy decision.

Initial US jobless claims for last week post at 8:30 a.m. ET.

SEC Chair Gary Gensler testifies before the House Financial Services Committee at 12 p.m. ET.

Coming tomorrow: The US jobs report for April is a crucial test for the country’s economic recovery.

0 notes

Text

A portfolio of stocks being purchased by mom-and-pop investors is trouncing Wall Street pros– here’s what they’re purchasing

The Inform.

Published: June 15, 2020 at 3: 23 p.m. ET.

AP.

It’s clear that retail financiers have been stepping up their participation in the stock market lately, however the degree by which they have actually exceeded professional investors may be entering into higher focus.

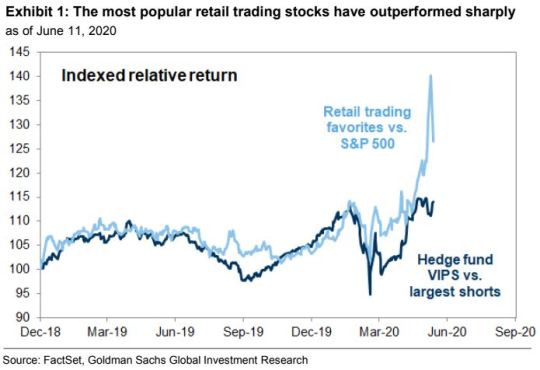

A basket of equities that have been excitedly purchased by individual financiers since the depths of the coronavirus-induced selloff on March 23 has actually returned 61%, compared to returns of 45%for a portfolio of investments owned by mutual funds and hedge funds, according to Goldman Sachs data, including popular expert David Kostin.

The Wall Street pros, who have actually consistently dragged the overall market since the last crisis in 12 years earlier, now might find themselves lagging behind mom-and-pop financiers by a tremendous 16 percentage points, according to the bank’s research.

The Goldman experts report that much of the outperformance by individual investors happened in the middle of May, as upbeat information on declines in the spread of the lethal pandemic and less-bad financial reports motivated bargain hunting in cyclicals, consisting of small-capitalization stocks, and shares of companies that are financially delicate and would therefore gain from signs of improvement in business environment.

Such stocks were “rapidly accepted by value-seeking retail investors, and now make up a large part of our retail basket,” Goldman scientists composed (see attached chart).

Source: Goldman Sachs.

Some of the investments that retail investors have scooped up include shares of Penn National Gaming.

PENN,.

5.80%,

Moderna Inc.

MRNA,.

7.51%

, Tesla Inc.

TSLA,.

5.70%

, MGM Resorts International.

MGM,.

1.06%,

Royal Caribbean Cruises Ltd.

RCL,.

-0.83%,

Marathon Oil Corp.

MRO,.

0.38%,

Snap Inc.

BREEZE,.

2.08%,

GoPro Inc.

GPRO,.

3.24%,

Norwegian Cruise Line Holdings Ltd.

NCLH,.

-2.43%,

Groupon Inc.

GRPN,.

9.74%,

Nvidia Corp.

NVDA,.

1.82%,

Ford Motor Co.

F,.

-0.04%,

General Motors.

GM,.

-1.03%,

Facebook.

FB,.

1.52%

and Apple.

AAPL,.

1.00%,

among others.

Take A Look At: Here are the biggest stock-market bets amongst institutional and retail investors, ranked

The performance of retail investors comes as the increased activity by retail financiers has drawn more examination in recent weeks, Some have argued that growing interest in markets by average Joes and Janes might signal that the stock market might be entering a frothy duration. The primary U.S. stock evaluates, the Dow Jones Industrial Average.

DJIA,.

0.17%,

the S&P 500 index.

SPX,.

0.46%

and the Nasdaq Composite Index.

COMPENSATION,.

1.14%,

recently registered their worst weekly declines given that March 20, amidst worries of abundant stock-market assessments, concerns about growing signs of the COVID-19 pandemic and grim financial outlook.

Read: It’s like the Wild West with ‘get-rich-quick crowd’ vs. Wall Street pros, however it’s too simple to blame retail investors for ‘rampant speculation’

%.

from Job Search Tips https://jobsearchtips.net/a-portfolio-of-stocks-being-purchased-by-mom-and-pop-investors-is-trouncing-wall-street-pros-heres-what-theyre-purchasing/

0 notes

Text

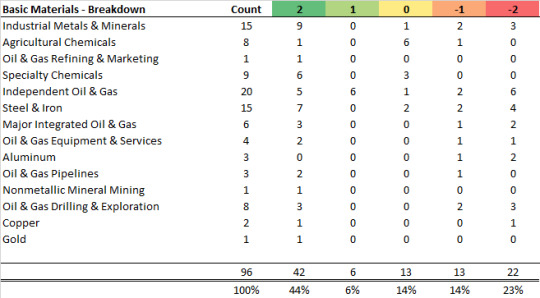

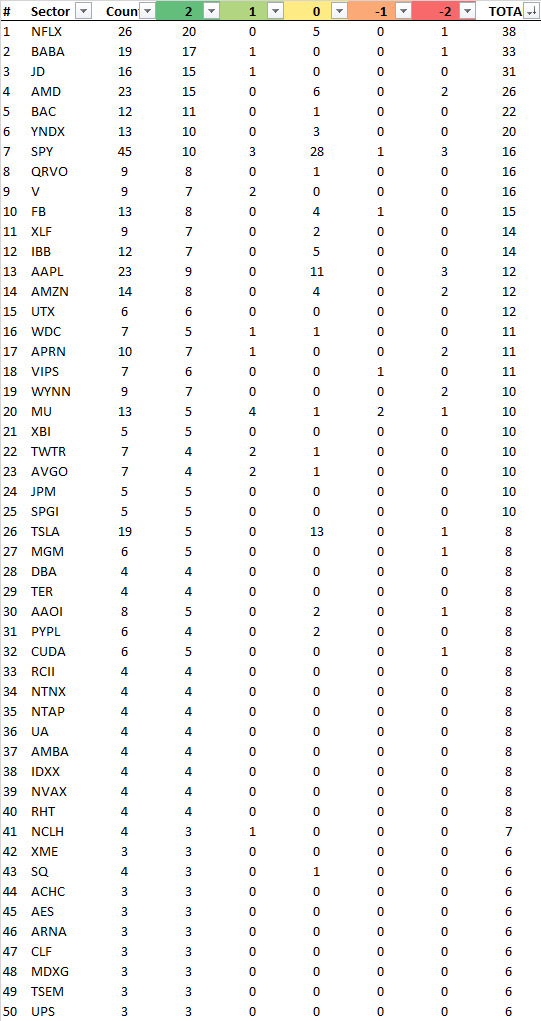

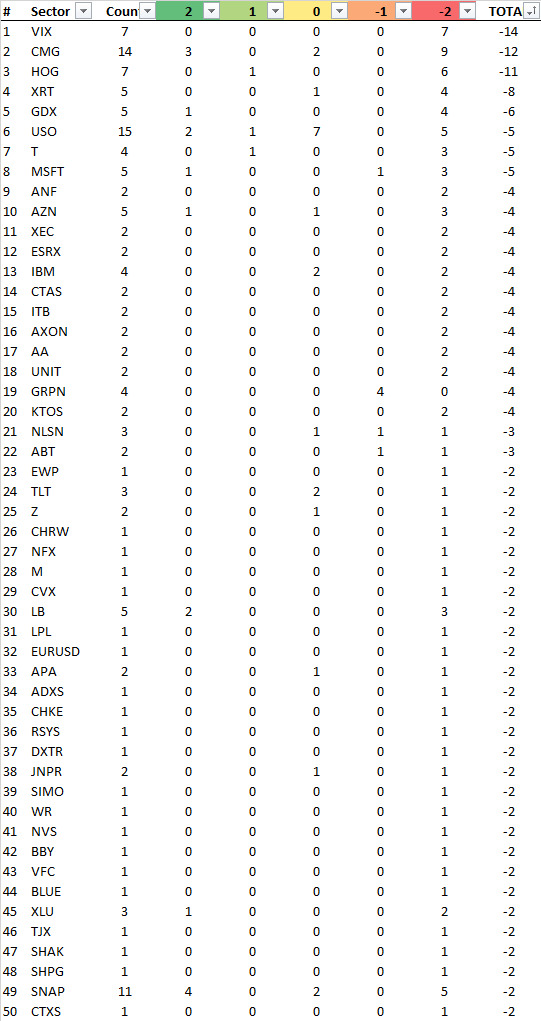

Options Flow: July 2017

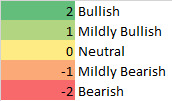

A recent project of mine is tracking the tweets of 12 Twitter users who tweet heavily for stock options. I will increase the sample size as I learn more about Python/SQL mining from Twitter.

A lot needs to be tweaked as curation of word choices to determine “bullish,” “mildly bullish, “neutral,” “mildly bearish,” and “bearish” sentiment is difficult from an Excel standpoint. Manual curation from self is necessary as of now but I will try to automate as much as possible. Also, some Twitterers seem to typo often and use buzz words that aren’t common like “bot,” “blood sweeper,” etc.

Here’s a legend for the ratings I give:

Below are the tables for data mined since 7/1/2017 (I have data dating further back, but more sorting/curation is needed).

We can see that “Financial”-related tweets have the highest count, but of the 283, most are ETFs (195), so true “Financial”-related stocks are only 88. More than half the tweets have a “Bullish” sentiment (53% = 2, 6% = 1).

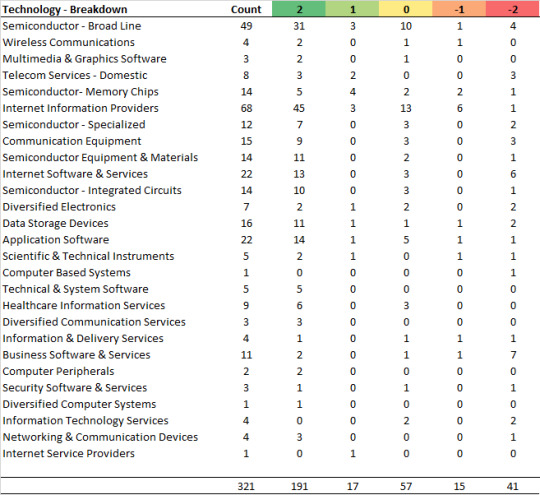

Tech-related tweets pose the highest count, with “Internet Information Providers” being the top tweeted from a “Bullish” standpoint. Top names in that breakdown are:YELP, Z, BIDU, GOOGL, JD, FB, TWTR, YNDX, GRUB, YY, GRPN, and CRTO.

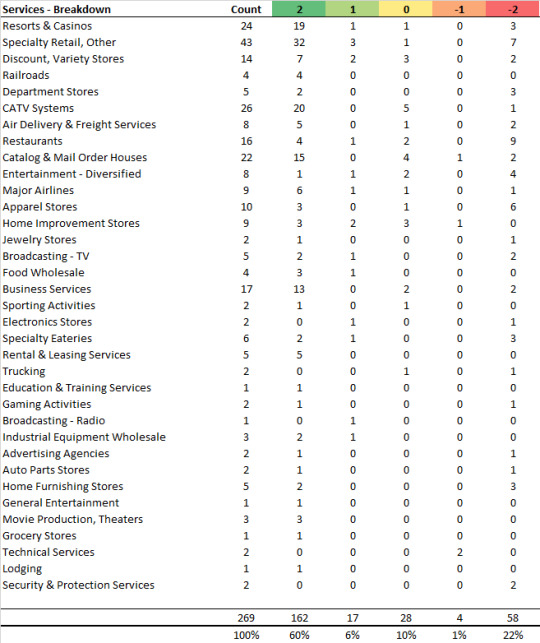

Services are up next. Top names were in the “Specialty Retail, Other”: BABA, ULTA, FINL, KAR, EBAY, APRN, TSCO, GPC, BKS,

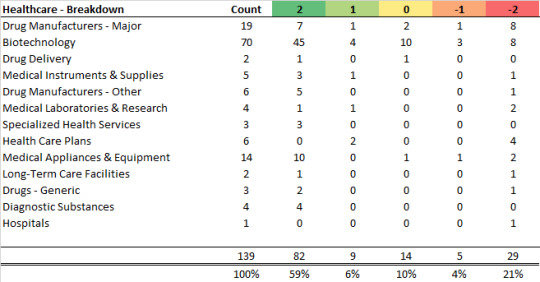

Healthcare:

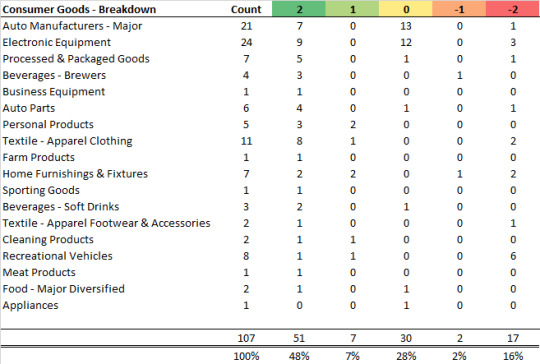

Consumer Goods:

Basic Materials:

For the entire sample size, the top 50“bullish”-tweeted stocks are as follows:

The bottom 50 are:

Caveat, this is as of 7/18/17, so the points might change from day to day.

Questions? E-mail me at [email protected].

3 notes

·

View notes

Link

0 notes

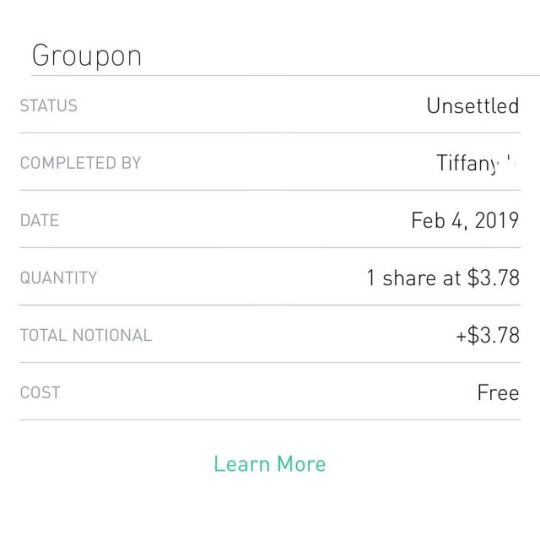

Photo

Shout out to Tiffany. Thanks to her, I got another share of @groupon for FREE. How did I do that? I referred another friend to the #robinhoodapp so they could get a free share of stock. To date I have gotten $157.50 in value from referrals in stock. 6 shares of Zynga (ZNGA) 3 shares of Sirius XM (SIRI) 1 share of Exxon Mobil (XOM) 3 shares of Groupon (GRPN) 1 share of Chesapeake Energy (CHK) 2 shares of Sprint (S) 1 share of AK Steel (AKS) If you DM/IM me for the link, you'll get a free share of stock and so will I. Don't leave stock on the table!!! I will post what I get as the shares arrive in my account. (at Winston-Salem, North Carolina) https://www.instagram.com/p/BtdxSlqlZww/?utm_source=ig_tumblr_share&igshid=1d38zhz2yn0l4

0 notes

Text

Stocks to watch today!

Stocks to watch today!

Stocks to watch today! $P, $LC, $FNSR, $NYMT, $GRPN, $ZIOP, $GEL. http://www.swingstocktraders.com

View On WordPress

0 notes

Photo

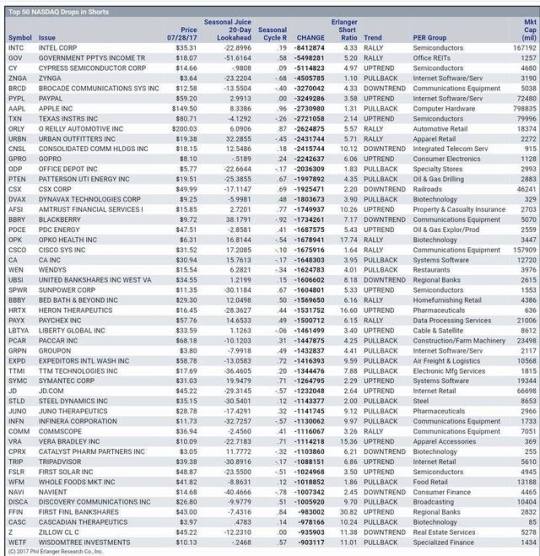

DROPS IN #NASDAQ SHORTS: $INTC $CY $PYPL $ORLY $GPRO $DVAX $AAPL $TXN $PTEN $CSX $BBRY $OPK $PAYX $AFSI $TTMI $CSCO $JD $GRPN $SPWR $Z $FSLR #tech #stocks #biotech #markets #stockmarket #wallstreet #sentiment #hedgefunds #funds #investing #traders

#wallstreet#markets#tech#funds#stockmarket#hedgefunds#traders#biotech#sentiment#stocks#investing#nasdaq

0 notes

Text

Trading Watch List 08.21.2020

Market keeps on ticking as dips get bought. Watch list names continues to perform well. RKT,SQ, AMD,OSTK,GRPN.,FSLY some nice runners.

Follow me on Twitter for real time trading setups@szaman and on StockTwits @szaman

Get started on the right path to trading success. Get access to our accelerated day or swing trading course with over 20 hours of content, access to our trading chatroom, live market commentary, and much more. Learn what it takes to succeed in the best profession in the world.

Here is the watch list and game plan:

CVAC Momentum IPO name. Watching on setup below 67 for continuation. Trends to work better buying on dips.

FSLY Coil resolved to the upside with volume. Continuation watch, ideally on a red to green.

FSLY Coil resolved to the upside with volume. Continuation watch, ideally on a red to green.

AMD 20 MA idea, bounced 20 MA on the dot. Continuation watch on intraday setup.

SHLL Consolidation after a big run. Watching 27 area.

PTON Coiling up again. Keeping an eye.

SQ 144 idea going well. Breaks out at 158.43.

FVRR Trending up. Breaks out at 126.33. Watching for a setup below.

Get Early-Bird Pricing on Our Next Live Trading Boot Camp

youtube

Learn all the day trading strategies we’ve been using for 2 decades in our Live Stock Trading Bootcamp. Limited seating, space will up fast.

Click here to get the early-bird discount for our next trading boot camp!

The post Trading Watch List 08.21.2020 appeared first on Bulls on Wall Street.

from Bulls on Wall Street https://bullsonwallstreet.com/trading-watch-list-08-21-2020/?utm_source=rss&utm_medium=rss&utm_campaign=trading-watch-list-08-21-2020

0 notes

Text

US Stocks That Surged Higher: $CNDT $GRPN $OPGN

ICYMI: http://dlvr.it/RdSBjr

0 notes

Text

Here is #THE_NET our trend indicator in action. You can quickly and clearly see how price loves to play off these important ribbons Avail for #TradingView and ToS https://t.co/A33UxhgoRb #STOCKS #trading $OPGN $CNDT $KZIA $Z $OCGN $GRPN $ANPC $TRUE $SPY $HBP https://t.co/whSLGknZ6x

Here is #THE_NET our trend indicator in action. You can quickly and clearly see how price loves to play off these important ribbons

Avail for #TradingView and ToS https://t.co/A33UxhgoRb#STOCKS #trading $OPGN $CNDT $KZIA $Z $OCGN $GRPN $ANPC $TRUE $SPY $HBP pic.twitter.com/whSLGknZ6x

— ScriptsToTrade (@scriptstotrade) August 9, 2020

from Twitter https://twitter.com/scriptstotrade

0 notes

Text

Coronavirus update: 1.87 million cases worldwide, 116,052 deaths; and Trump attacks Dr. Fauci and the New York Times

The U.S. death toll from COVID-19 rose above 22,000 on Monday, as President Donald Trump railed against the country’s leading contagious illness expert for suggesting more lives might have been saved if restrictions on motion had been imposed previously.

In an interview with CNN, Fauci conceded that “realistically” fewer individuals would have been infected if stay-at-home and social-distancing steps had actually been enforced in February, rather of mid-March. Fauci went to excellent lengths to discuss that the choice was based on lots of factors to consider, however Trump still retweeted a message from former Republican congressional prospect, DeAnna Lorraine.

” Fauci was informing individuals on February 29 that there was nothing to fret about and it presented no risk to the U.S. at big,” said the tweet, which had the hashtag: Time to #FireFauci.”

Trump likewise attacked Fox News Anchor Chris Wallace for covering the New york city Times article and for commenting that at his everyday rundowns, he’s been “entering fights with guvs he did not believe were adequately pleased or press reporters.”

It was not the very first time that Trump has bashed Wallace, whom the president stated will never ever measure up to his dad’s tradition and must go work for among the “phony news” networks.

A sailor from the warship Theodore Roosevelt died of problems from COVID-19, according to Navy authorities pointed out by the Times on Monday, the very first death for the crew of the ship, whose commander, Capt. Brett E. Crozier, was fired earlier this month after writing a letter to his superiors requesting assistance for crew members who had contracted the fatal health problem.

In Europe, there was positive news from Spain where the death toll fell to 517 on Monday from 619 on Sunday, the smallest daily boost because the health ministry started tracking it. There are now 169,496 cases in Spain and 17,489 deaths, according to the health ministry. Some non-essential workers were permitted back to deal with Monday.

There are now 1.

The U.S. leads the world in number of cases at 558,526 and 22,146 deaths.

The U.K. went beyond China in case numbers at 89,554 A minimum of 11,346 Britons have passed away of the health problem. China’s main case tally is 83,213 and 3,345 deaths, although some have suggested those numbers are understated. Iran, another hot spot, has 73,303 cases and 4,585 deaths.

New York stays the U.S. center and tape-recorded more than 700 deaths on Sunday for the sixth straight day, as the Associated Press reported. There have actually been 9,385 deaths from the infection in New York.

Gov. Andrew Cuomo said there are indications the curve of infections is flattening in the Empire State with the pace of hospitalizations and ICU admissions slowing. Cuomo and New York City Mayor Expense de Blasio are at chances over whether to resume schools prior to completion of the existing scholastic year, with Cuomo saying it’s too early to decide.

Don’t miss: America needs to be ready for 18 months of shutdowns in ‘long, tough roadway’ ahead, alerts the Fed’s Neel Kashkari

Viewpoint: Coronavirus, Pandemics and the Issue of Preparedness.

China reported another 108 COVID-19 cases and said 98 of them were cased by Chinese nationals returning house from abroad. Professionals are viewing carefully to see if China suffers a second wave of infections. The World Health Organization said at the weekend that is looking into reports of people checking favorable after recovering from the health problem, after South Korean authorities said 91 clients had tested favorable once again.

In medical news, the U.S. Fda released emergency use authorizations for medical devices, allowing them to decontaminate N95 or N95- comparable respirators so that they can be reused by healthcare workers. The first was granted to Steris Corp.

STE,.

-2.31%,

the 2nd to Advanced Sterilization Products INc., a system of Fortive Corp.

FTV,.

-3.09%

Separately, the FDA gave an EUA to CytoSorbents Corp.

CTSO,.

2170%

for its blood filtration system.

Read also: Fed’s Clarida says there is nothing fundamentally incorrect with the economy

An emergency authorization is ruled out an FDA approval however enables health care suppliers to utilize specific innovations throughout the COVID-19 pandemic provided the lack of alternative choices.

Business continued to withdraw guidance, draw down credit lines, furlough employees and cut pay.

Do not miss out on: Company in the Age of COVID-19: A special series by MarketWatch tracking the effect on major business and sectors

Here’s what companies stated about COVID-19 on Monday:

– Amazon.com Inc.

AMZN,.

6.35%

The company anticipates to invest more than $500 million in payroll increases, up from a previous estimate of $350 million, as per hour workers salaries are increased by $2 an hour, and as per hour base pay for overtime hours worked was doubled.

– Food services business Aramark’s.

ARMK,.

-4.25%

The business handled to convert its facilities in just one week and expects to produce millions of pieces of devices once it is fully operational. The PPE will be shipped from plants in Mexico to clients across the U.S. in the health care, pharmaceutical, biotech, medical gadget and other markets where it’s required

– Aurora Cannabis Inc.

ACB,.

-1372%

ACB,.

-1475%

is taking actions to improve liquidity and restore compliance with New York Stock Exchange listing requirements, after its stock traded below $1 for more than 30 days. The board has approved a 1-for-12 reverse stock split arranged for on or about May11 The Canadian cannabis business had $205 million in money at the end of March, including all amounts raised in an at-the-market (ATM) providing program initially announced in Might of2019 To boost its balance sheet, the company is preparing a restored ATM program to raise extra equity capital on the top the roughly $350 million that remains offered under its impressive shelf prospectus. Aurora is on track with its previously revealed company improvement strategy, that includes decreasing SG & A costs, cutting capex and simplifying its company structure. It is still anticipating fiscal third-quarter marijuana internet income to reveal “modest growth” compared to the 2nd quarter. The company’s Canadian and worldwide centers are fully operational.

– Baker Hughes Co.

BKR,.

2.91%

Uncertainty regarding oil demand is having a substantial effect on the investment and operating strategies of the business’s primary consumers. “Based on these occasions, Baker Hughes concluded that an activating event occurred which required the business to perform an interim quantitative impairment test as of March 31, 2020,” the company said in a statement. The business is preparing to decrease 2020 capital expenses by about 20%compared with2019

GE,.

-1.82%

– Burlington Stores Inc.

BURL,.

-6.46%

The off-price merchant formerly offered two weeks pay to employees for shuttered shops and circulation. Burlington is planning to offer $300 million of bonds that mature in2025

.

– Chubb Ltd.

CB,.

-1.82%

The company is offering a 35%superior reduction for April and May and will offer out additional discounts over the subsequent months.

– Danaher Corp.

DHR,.

-0.02%

anticipates revenue growth of about 3%for the quarter ended April 3. The business, that makes items for the healthcare, environmental and applied end-markets, expects positive results in each of its 3 operating segments, with specific strength in its Cepheid, Radiometer, Pall and ChemTreat services. “While we had a good start to the year, we saw a meaningful downturn in demand toward the end of the quarter, especially in our more instrument-oriented companies, as the COVID-19 pandemic spread worldwide,” the business said. It is withdrawing guidance used on Jan. 30 due to the fact that of the unpredictability brought on by the pandemic.

– Ford Motors Co.

F,.

-4.18%

alerted of a first-quarter earnings miss out on and stated it’s considering additional financing actions to boost cash as the pandemic has actually stalled international commerce. Ford anticipates to report profits of $34 billion for the quarter, below the FactSet consensus of $372 billion. Only its joint ventures in China are producing wholesale vehicles, and it’s considering a phased reboot of its factory and supply network starting in the 2nd quarter. Ford had $30 billion in money on its balance sheet as of April 9, giving it enough money to make it through “a minimum of the end of the 3rd quarter” without any car production and wholesales or funding actions.

– General Electric Co.

GE,.

-1.82%

revealed refinancing and deleveraging actions in an effort to reinforce its financial position, as the pandemic is having a “material adverse effect” on its company. GE is releasing financial obligation to money a tender offer for GE bonds growing through 2024, in order to extend the financial obligation maturities; it used part of the $20 billion profits from the sale of its BioPharma business to repay $6 billion of its intercompany loan to GE Capital; GE Capital is releasing a tender for up to $9 billion of debt developing in 2020; and GE Capital repaid $4.7 billion of financial obligation that matured in the first quarter.

– Groupon Inc.

GRPN,.

-3.03%

has embraced an investor rights strategy, likewise known as a “poison pill,” that will be exercisable if a financier or investor group ends up being an useful owner of 10%or more of the online-deals company.

– Grubhub Inc.’s.

GRUB,.

-1075%

orders fell in the last weeks of March, especially in its corporate company, and the company now expects first-quarter daily average grubs (DAGs) to be “up flattish” from a year ago. Earnings is expected to be “somewhat above” the midpoint of previous guidance. The FactSet DAG consensus of $5387 indicates 3.4%growth, while the income agreement of $3581 million is a little listed below the $360 million midpoint of its $350 million to $370 million guidance range. Far in April, DAG development has actually been about 10%. The second-quarter FactSet DAG agreement of $5212 million suggests 6.6?velopment.

– Live Nation Home Entertainment Inc.

LYV,.

2.37%

The business has gotten an additional revolving credit center of $120 million, providing it about $940 million in readily available financial obligation capability. As of March 31, Live Country had offered more than 45 million tickets for programs set up for 2020, down 2%from the very same period a year back.

– Efficiency Food Group Co.

PFGC,.

-5.56%

has furloughed about 3,000 employees across the business, suspended stock repurchases, even more reduced capital investment, delayed 25%of senior management’s base pay and board of directors’ money charges from April 6 through the end of the year and drawn $400 million from a $3.0 billion credit facility. The company is adding agreements with 13 brand-new retail partners, is now distributing groceries to about 1,000 grocery locations and is sharing over 1,100 workers to assist keep grocery shelves equipped.

– Purple Innovations Inc.

PRPL,.

-0.70%

Online sales have grown 35%year-over-year in the first quarter. Still, to protect liquidity, Purple has actually adjusted its production schedule and furloughed 35%of permanent staff.

%.

from Job Search Tips https://jobsearchtips.net/coronavirus-update-1-87-million-cases-worldwide-116052-deaths-and-trump-attacks-dr-fauci-and-the-new-york-times/

0 notes