#sole proprietorship incorporation

Text

Company Incorporation Consultant in Lucknow | MY STARTUP SOLUTION

A company Incorporation consultant in Lucknow who is ready to take the leap and launch your own venture? Thank you for starting along the path to achieving your goals! But figuring out the complexities of company formation may be difficult, particularly for those who are unfamiliar with the business world. This is when MY STARTUP SOLUTION becomes involved as your go-to advisor, providing knowledgeable direction and assistance to make the process easier for you.

Never before has there been such a huge need for trustworthy company incorporation consultant in Lucknow is becoming a center for startups and small enterprises. At MY STARTUP SOLUTION, we are dedicated to offering complete solutions catered to your particular needs and we recognize the special obstacles encountered by entrepreneurs in this dynamic metropolis.

Our team of experienced professionals brings a wealth of knowledge and expertise to the table, ensuring a seamless and hassle-free experience for our clients. Whether you're a sole proprietor looking to register your business or a group of entrepreneurs forming a partnership, we have the skills and resources to guide you through every step of the incorporation process.

One of the key advantages of partnering with MY STARTUP SOLUTION is our in-depth understanding of the local business landscape in Lucknow. We are well-versed with the regulatory requirements and compliance standards governing company formation in the region, allowing us to offer strategic advice that is both practical and effective.

From choosing the right business structure to preparing and filing the necessary documents, our team will work closely with you to ensure that your company incorporation journey is smooth and stress-free. We believe in fostering long-term relationships with our clients, built on trust, transparency, and mutual respect.

Here's how MY STARTUP SOLUTION can help you with company incorporation in Lucknow:

Expert Guidance:

Our team will provide personalized guidance on selecting the most suitable business structure based on your goals, preferences, and industry regulations. Whether you opt for a sole proprietorship, partnership, limited liability partnership (LLP), or private limited company, we will walk you through the pros and cons of each option to help you make an informed decision.

Document Preparation:

We understand that preparing the necessary documents for company incorporation can be overwhelming. That's why we take care of all the paperwork on your behalf, ensuring accuracy and compliance with legal requirements. From drafting the memorandum and articles of association to obtaining the director identification number (DIN) and digital signature certificate (DSC), we've got you covered.

Filing and Registration:

Once the documents are prepared, we will assist you in filing them with the relevant authorities and completing the registration process. Whether it's registering your company name with the Registrar of Companies (ROC) or obtaining the certificate of incorporation, we will handle all the paperwork and formalities to get your business up and running in no time.

Compliance Support:

As your trusted advisor, we will continue to support you even after your company is incorporated. We provide ongoing compliance support to ensure that your business remains in good standing with regulatory authorities. From annual filings and tax compliance to regulatory updates and corporate governance, we'll help you stay on top of your legal obligations.

Strategic Advice:

Beyond the basics of company incorporation, we offer strategic advice to help you grow and scale your business in Lucknow. Whether you need assistance with business planning, financial management, or expansion strategies, our team is here to support you every step of the way.

At MY STARTUP SOLUTION, we believe that every entrepreneur deserves a trusted partner by their side to navigate the complexities of company incorporation consultant in Lucknow with confidence and peace of mind. Let us be that partner for you as you embark on this exciting journey of entrepreneurship in Lucknow. Contact us today to learn more about our company incorporation services and how we can help turn your business dreams into reality. Together, let's build a brighter future for your company in the heart of Lucknow's thriving entrepreneurial ecosystem.

Contact us for more details: +91 8795224400

Visit Now: www.mystartupsolution.in

#New firm Registration#Sole Proprietorship Firm#Public limited Company#Sole Proprietorship Lucknow#Company Incorporation Near

0 notes

Text

Companies House

New Post has been published on https://www.fastaccountant.co.uk/companies-house/

Companies House

So, you’re thinking of starting your own business in the UK but not sure where to begin? Look no further! In this article, we will guide you through the process of registering your business with UK Companies House. From understanding the importance of registration to the step-by-step process, we’ll provide you with all the necessary information to get your business up and running legally in no time. Whether you’re a budding entrepreneur or an experienced business owner, this article is here to help you navigate through the registration process with ease. So, let’s get started on your exciting journey towards establishing your very own business in the UK!

Overview of UK Companies House

What is UK Companies House?

UK Companies House is the government agency responsible for the incorporation, registration, and regulation of Limited companies in the United Kingdom. It maintains a database of all registered companies and provides a range of services to businesses and the public. The primary role of UK Companies House is to ensure transparency and accuracy in business information, enabling companies to operate legally and effectively.

Benefits of registering a business with UK Companies House

Registering your business with UK Companies House comes with a range of benefits. Firstly, it provides legal protection by establishing the company as a separate legal entity, which shields the owners and directors from personal liability for business debts. This protection offers peace of mind and reassurance to business owners. Secondly, registration with Companies House enhances the reputation and credibility of the business, as it signifies compliance with legal and financial regulations. This is particularly important when establishing relationships with suppliers, customers, and potential investors. Lastly, registering a business with Companies House enables access to various services and resources offered by the agency, such as easy access to business information, online filing services, and support for compliance with reporting obligations.

Types of Business Entities

Sole proprietorship

A sole proprietorship is the simplest and most common form of business entity. It is owned and operated by a single individual, who is personally responsible for all aspects of the business. While there is no legal distinction between the owner and the business, registering a sole proprietorship with UK Companies House is not mandatory. However, if the business is operating under a name that is not the owner’s legal name, it is advisable to register a “trading as” (T/A) name to protect the business name and establish legal recognition.

Partnership

A partnership is a business structure in which two or more individuals share ownership and management responsibilities. Partnerships can be either “general partnerships” or “limited partnerships.” In a general partnership, all partners have unlimited liability for the business’s debts and obligations. In a limited partnership, there are one or more “general partners” who have unlimited liability, and “limited partners” who have limited liability and play a passive role in the business. Registering a partnership with UK Companies House is not mandatory, but it is highly recommended to establish legal recognition and clarity on the rights, responsibilities, and liabilities of each partner.

Limited liability partnership (LLP)

A limited liability partnership (LLP) is a hybrid business structure that combines elements of a partnership and a company. It offers limited liability protection to its partners while providing the flexibility of a partnership in terms of management and taxation. LLPs are commonly favored by professional service firms, such as law firms, accounting practices, and consultancy agencies. Registering an LLP with UK Companies House is a legal requirement and involves the submission of specific documents and information, including a statement of compliance, a registered office address, and details of the designated members.

Private limited company (Ltd)

A private limited company (Ltd) is a separate legal entity from its owners (shareholders) and directors. It is the most common form of legal structure for small and medium-sized businesses in the UK. A private limited company has limited liability, meaning that the shareholders’ personal assets are not at risk if the company fails. Registering a private limited company with UK Companies House is mandatory and involves the submission of various documents, such as a Memorandum of Association, Articles of Association, details of directors and shareholders, and a registered office address.

Public limited company (PLC)

A public limited company (PLC) is a company that has shares available for public trading on a stock exchange. It offers limited liability to its shareholders and operates under stricter regulations compared to private limited companies. Registering a PLC with UK Companies House involves additional requirements, such as a minimum share capital, appointments of a company secretary and qualified auditor, and specific regulations governing the company’s operations and reporting obligations.

Requirements for Registering a Business

Choosing a business name

When registering a business with UK Companies House, choosing a suitable name is crucial. The business name should be unique, not already registered with Companies House, and should not infringe upon any trademarks. It should also reflect the nature of the business and be easily recognizable and memorable. Before finalizing a name, it is advisable to conduct a thorough search using the Companies House online database to ensure its availability.

Registered office address

A registered office address is the official address of a company, used for all formal communications and legal purposes. It must be a physical address within the same jurisdiction where the company is registered (e.g., England and Wales, Scotland, or Northern Ireland). The registered office address must be displayed on all company correspondence and must be accessible for public inspection. It can be the company’s actual place of business or a separate address provided by a registered office service.

Directors and company officers

Every business registered with UK Companies House must have at least one director who is responsible for overseeing the company’s activities and complying with legal obligations. A director must be at least 16 years old and not disqualified from acting as a director. In addition to directors, a company may also have other officers, such as a company secretary, who assists with administrative tasks and compliance with regulatory requirements. Directors and officers must provide their details, including names, addresses, and dates of birth, when registering the company.

Company shareholders

In a company limited by shares, the shareholders are the owners of the company. They own shares in the company’s capital and have certain rights and obligations associated with their ownership. When registering a company, the details of the shareholders must be provided, including their names, addresses, and the number of shares they hold. It is important to note that the shareholders’ personal details will be publicly available through the Companies House register.

Memorandum of Association

The Memorandum of Association is a legal document that sets out the company’s name, registered office address, nature of business, and details of its initial shareholders and share capital. It acts as the company’s constitution and defines the relationship between the company and its shareholders. A Memorandum of Association must be submitted to Companies House during the registration process.

Articles of Association

The Articles of Association are another legal document that governs the internal workings and management of the company. It outlines the rules and regulations for the company’s operations, including the rights, duties, and responsibilities of the directors and shareholders. While model Articles of Association are provided by Companies House, companies can also create bespoke articles tailored to their specific needs and requirements.

Steps to Register a Business

Online registration

The easiest and most convenient way to register a business with UK Companies House is through the online registration process. Companies House provides an online platform called WebFiling, which allows businesses to complete and submit the necessary forms electronically. This method ensures faster processing times and minimizes errors by providing real-time validation of information.

Completing the required forms

During the registration process, various forms must be completed and submitted to UK Companies House. These forms include Form IN01, which provides details about the company’s directors, shareholders, registered office address, and share capital structure. Other forms may be required depending on the type of business entity being registered, such as Form LLP2 for a limited liability partnership or Form SH01 for an allotment of shares.

Paying the registration fees

There are registration fees associated with registering a business with UK Companies House. The amount depends on the type of business entity being registered. The fees can be paid online using a credit or debit card, or by setting up a direct debit if multiple registrations are anticipated. It is important to note that the registration fees are non-refundable, even if the application is rejected.

Submitting the application

Once the required forms have been completed and the registration fees paid, the application can be submitted to UK Companies House. If using the online registration process, the forms can be uploaded directly to the WebFiling system. Once submitted, the application will be reviewed by Companies House, and if everything is in order, the company will be registered and receive a Certificate of Incorporation.

Processing Time and Cost

Standard processing time

The standard processing time for registering a business with UK Companies House is typically around 48 hours. This is the time it takes for Companies House to review the application, process the necessary documents, and issue the Certificate of Incorporation. However, it is important to note that the processing time can vary depending on the workload at Companies House and any additional checks or clarifications that may be required.

Fast-track processing options

For those who require a quicker registration process, UK Companies House offers several fast-track processing options. This includes same-day registration, which guarantees that the application will be processed on the day of submission. Additionally, there is a 24-hour expedited service and a same-day postal service for those who prefer to send their application via mail.

Maintaining and Updating Business Information

Annual filings

After registering a business with UK Companies House, companies have ongoing obligations to provide certain annual or periodic filings. These filings include annual financial statements and confirmation statements. The due dates for these filings are typically one year from the company’s date of incorporation, and failure to submit them on time can result in penalties and potential legal consequences.

Changes to business details

It is essential to keep the information registered with Companies House up to date. This includes notifying Companies House of any changes to the company’s registered office address, directors, shareholders, and other company officers. Updates can be made through the WebFiling system or by submitting the necessary forms by mail. Failure to update the information within a reasonable timeframe can lead to administrative issues and potential penalties.

Reporting obligations

Registered companies have reporting obligations to various government agencies, including HM Revenue and Customs (HMRC) and Companies House. These obligations include filing annual financial statements with Companies House, submitting tax returns to HMRC, and complying with other regulatory requirements specific to the industry in which the business operates. Understanding and fulfilling these reporting obligations is essential to ensure compliance with legal and financial regulations.

youtube

Documents and Records

Certificate of Incorporation

The Certificate of Incorporation is a legal document issued by Companies House after a business has been successfully registered. It certifies that the company exists as a separate legal entity and provides its unique company registration number. The Certificate of Incorporation is an important document that may be required when opening a business bank account, entering into contracts, or dealing with other organizations.

Statutory registers

Companies registered with UK Companies House must maintain various statutory registers. These registers include the register of members (shareholders), register of directors, register of charges, and register of persons with significant control (PSC). These registers must be up to date and available for public inspection upon request. Failure to maintain these registers can result in penalties and potential legal consequences.

Annual financial statements

Every year, registered companies must prepare and file annual financial statements with Companies House. These statements include a balance sheet, profit and loss statement, cash flow statement, and accompanying notes. The financial statements provide an overview of the company’s financial performance, position, and cash flows, allowing stakeholders to assess the company’s financial health and performance.

Shareholder and director resolutions

Shareholder and director resolutions are formal decisions made by the company’s shareholders or directors. They are required for certain significant actions, such as appointing directors, changing the company’s articles of association, amending share capital, or distributing dividends. Resolutions must be properly recorded and kept in the company’s records as they serve as evidence of the decision-making process.

Taxation and Legal Obligations

Corporation Tax

Registered companies in the UK have a legal obligation to pay Corporation Tax on their profits. Corporation Tax is based on the company’s taxable profits, which are calculated by deducting allowable expenses and reliefs from the company’s total income. It is important for companies to understand their tax obligations, keep accurate and up-to-date financial records, and submit their Corporation Tax returns to HMRC within the specified timeframe.

VAT registration

Value Added Tax (VAT) is a consumption tax that is added to the price of most goods and services in the UK. Businesses with an annual turnover above the VAT threshold (currently £85,000) are required to register for VAT with HMRC. VAT-registered businesses must charge VAT on their sales, file regular VAT returns, and make payments to HMRC accordingly. Registering for VAT can provide benefit to companies that sell goods or services to other VAT-registered businesses, as they can reclaim VAT on their purchases and expenses.

Employment law and payroll

Registered companies in the UK have specific legal obligations when it comes to employment law and payroll. These obligations include registering as an employer with HMRC, operating a payroll system, deducting and paying taxes and National Insurance contributions from employees’ salaries, and providing employees with certain statutory employment rights and benefits. Failure to comply with employment law can result in penalties and potential legal consequences.

Financial reporting requirements

Registered companies must comply with financial reporting requirements, which include preparing and filing annual financial statements with Companies House. The financial statements must comply with Generally Accepted Accounting Principles (GAAP) and provide a true and fair view of the company’s financial position and performance. Certain companies may also be required to have their financial statements audited by a qualified auditor.

Data protection and privacy

Registered companies must comply with data protection and privacy regulations, especially the General Data Protection Regulation (GDPR). This includes obtaining consent from individuals to collect and process their personal data, handling personal data securely, and providing individuals with certain rights to access and control their personal data. Compliance with data protection and privacy regulations is essential to protect the rights and privacy of individuals and to avoid potential legal consequences.

Additional Services Offered by UK Companies House

Company name availability checker

Before registering a business with UK Companies House, it is advisable to use the company name availability checker provided on the Companies House website. This free online tool allows businesses to search for existing registered company names and trademarks to ensure that the desired name is unique and available for use.

Companies House WebFiling service

The Companies House WebFiling service is an online platform that allows businesses to easily file and submit various documents and forms electronically. The service provides real-time validation of information, reducing errors and improving efficiency. It also offers additional features such as electronic signatures for certain documents and the ability to track the progress of submissions.

Company search services

Companies House provides various company search services that allow individuals and businesses to access information about registered companies. These services include searching for company details, such as registered address, directors, and shareholders, as well as obtaining copies of company documents, such as annual financial statements and resolutions. The information provided by these services can be valuable for due diligence, research, and decision-making processes.

Guidance and support

UK Companies House offers guidance and support to businesses throughout the registration process and beyond. This includes providing comprehensive guidance on the registration requirements, offering support in completing the necessary forms, and assisting with any queries or issues that may arise. Companies House also provides online resources, webinars, and workshops to help businesses understand and fulfil their legal and regulatory obligations.

Conclusion

Registering a business with UK Companies House is a crucial step for any business operating in the United Kingdom. It offers legal recognition and protection, enhances credibility and reputation, and provides access to various resources and services. By understanding the registration process, requirements, and obligations, businesses can ensure compliance with regulatory and reporting obligations and lay a solid foundation for their success. Whether it is a sole proprietorship, partnership, limited liability partnership, private limited company, or public limited company, UK Companies House is a valuable resource and partner in the journey of running a successful business.

0 notes

Text

Navigating the Landscape of Business Setup in Dubai: A Comprehensive Guide

Are you an entrepreneur eyeing the bustling opportunities of the United Arab Emirates (UAE), particularly Dubai? The thriving economy and strategic location of Dubai make it a magnet for businesses worldwide. However, venturing into the Dubai business landscape requires meticulous planning, especially when it comes to legalities like company registration and licensing. In this guide, we’ll delve into the essential keywords surrounding business setup in Dubai, providing insights into company registration, trade licenses, formation processes, and associated costs.

Company Registration in Dubai:

Company registration in Dubai involves a series of steps, starting with company registration. The process is overseen by several authorities, depending on the type of company you intend to establish. The Dubai Department of Economic Development (DED) is a key player in this process, handling registrations for mainland companies. Free zones, on the other hand, have their own regulatory bodies governing company registrations within their jurisdiction.

To register your company in Dubai, you’ll typically need to:

Choose a Business Activity: Define the nature of your business activity. Dubai offers diverse sectors, from tourism and hospitality to finance and technology.

Select a Legal Structure: Decide on the legal structure of your company, whether it’s a sole proprietorship, partnership, limited liability company (LLC), or a branch of a foreign company.

Trade Name Reservation: Select a unique name for your company and get it approved by the relevant authorities.

Submit Required Documents: Prepare and submit the necessary documentation, which usually includes passport copies of shareholders, a Memorandum of Association (MOA), and a lease agreement for office space.

Obtain Approvals: Obtain approvals from various government departments, such as the DED, Ministry of Economy, and relevant free zone authorities.

License Acquisition: Upon completing the registration process and fulfilling all requirements, you’ll receive your trade license, allowing you to legally operate your business in Dubai.

General Trade License in Dubai:

A general trade license in Dubai enables companies to engage in a wide range of trading activities within the emirate. Whether you’re importing, exporting, or conducting wholesale trading, a general trade license provides the flexibility to operate across various sectors.

The cost of acquiring a general trade license in Dubai varies depending on several factors, including the jurisdiction (mainland or free zone), the type of business activity, and the number of shareholders. Generally, free zone licenses offer competitive rates and additional benefits such as 100% foreign ownership, tax exemptions, and simplified incorporation procedures.

Company Formation in Dubai:

Company formation in Dubai encompasses the entire process of establishing a business entity, from conception to legal recognition. It involves strategic planning, compliance with regulatory requirements, and meticulous execution. Whether you’re a local entrepreneur or an international investor, understanding the nuances of company formation is crucial for a smooth and successful setup.

Business Setup in UAE:

The UAE offers a conducive environment for business setup, characterized by political stability, world-class infrastructure, and a robust legal framework. Entrepreneurs can choose from various business setup in UAE, including mainland companies, free zone entities, and offshore establishments, each offering distinct advantages tailored to specific business needs.

General Trading License Cost in Dubai:

Determining the general trading license cost in Dubai involves considering multiple factors, such as:

License Type: Mainland or free zone.

Business Activity: The nature of trading activities.

Share Capital: Minimum capital requirements, if any.

Government Fees: Application fees, registration charges, and annual renewal fees.

Additional Services: Optional services like visa processing, office space rental, and business support.

While the cost may vary, investing in a general trading license in Dubai opens doors to a dynamic marketplace with vast opportunities for growth and expansion.

In conclusion, navigating the intricacies of company registration, trade licensing, and business setup in Dubai demands careful planning, adherence to regulations, and a thorough understanding of the local business landscape. By leveraging the right resources and partnering with experienced professionals, entrepreneurs can embark on their Dubai business journey with confidence, poised for success in one of the world’s most vibrant economic hubs.

#Company registration in dubai#general trade license in dubai#company formation dubai#business setup in uae#general trading license cost in dubai

0 notes

Text

1. Market analysis and feasibility assessment: Recognize the Market Do extensive market research to determine the need for cold storage in your target area before launching your firm. Determine which essential goods—such as fruits, vegetables, dairy products, meat, seafood, and pharmaceuticals—need to be kept cool. d

Study of Feasibility Analyze your project's viability by looking at things like supply chain gaps and local demand. close proximity to farms, production facilities, and warehouses. examination of competitors and market saturation. Compliances with regulations and requirements.

2. A business strategy: Establish Your Business Model. Choose if you wish to specialize in one kind of perishable good or provide a variety of them. Describe your company plan, incorporating: Provided services (warehousing, packing, transportation, etc.).

Approach to pricing. market segments to aim for. Budgeting Create a thorough financial plan that addresses the following: Initial capital investment. operational expenses. estimates of revenue. analysis of break-even. sources of finance (loans, investors, and self-funding).

3. Requirements for Law and Regulation: Registration of Businesses Obtain a business registration from the relevant authorities. Select an appropriate business structure (private limited company, partnership, sole proprietorship, etc.).Permits and Licenses Get the required authorizations and licenses, such as the Food Safety and Standards Authority of India (FSSAI) license for the storage of food.

Approval for pollution control. Certificate of fire safety. Municipal permits on a local level. Observance of Standards Ascertain that your cold storage facility conforms to industry norms and guidelines, including those established by the National Horticulture Board (NHB) and other pertinent organizations.

4. Infrastructure and Location: Decide on a Strategic Location Select a site that distributors and suppliers can get to with ease. It can be advantageous to be close to ports, airports, and motorways. Equipment and Facility Design Plan your cold storage space to handle a range of temperatures.

Invest in insulation, backup power systems, and dependable, energy-efficient refrigeration systems. Integration of Technology Modern corporate technology uses temperature monitoring, security systems, and inventory management to guarantee smooth operations and reduce losses.

5. Investment and Funding: Safe Money Examine a range of funding sources: government programs and bank loans. Venture capital or private investors. grants and subsidies from industrial and agricultural organizations.

Allocation of Budget Spend your money carefully and distribute it among several departments, including marketing, technology, equipment, and construction.

6. Management and Operations: Employ Qualified Workers Hire qualified people for management, maintenance, and operations positions.

Give instruction on using specialized equipment and managing a range of commodities. Inventory Management: To keep track of stock quantities, expiration dates, and temperature conditions, implement reliable inventory management systems.

Visit site

Contact: 8866230337

Email: [email protected]

#cold storage manufacturer#controlled atmosphere chamber#cold storage room manufacturer#cold room manufacturer#cold room manufacturer in india#cold room manufacturers in india#cold storage manufacturer in india#cold storage manufacturer in gujarat

1 note

·

View note

Text

Simplifying Company Registration in Mumbai: A Step-by-Step Guide

Setting up a company in Mumbai, the vibrant commercial hub of India, can be a rewarding endeavor. However, navigating the legal intricacies of company registration requires careful planning and adherence to regulatory requirements. Whether you're an entrepreneur venturing into the business world or an established entity expanding your operations, understanding the process of company registration in Mumbai is essential.

Understanding Company Registration in Mumbai

Company registration is the process of legally establishing a business entity, enabling it to operate within the confines of the law. In Mumbai, this process involves adhering to the regulations set forth by the Ministry of Corporate Affairs (MCA) and other relevant authorities. From selecting the appropriate business structure to obtaining necessary permits and licenses, each step plays a crucial role in ensuring compliance and smooth operations.

Key Steps in Company Registration

Determine Business Structure: Before initiating the registration process, it's essential to determine the most suitable business structure for your venture. Options include sole proprietorship, partnership, limited liability partnership (LLP), or private/public limited company.

Name Approval: The next step involves selecting a unique name for your company and obtaining approval from the Registrar of Companies (ROC). Ensure that the chosen name complies with the guidelines specified by the MCA to avoid any delays in the approval process.

Prepare Necessary Documents: Gather and prepare the required documents, including identity proof, address proof, memorandum of association (MOA), articles of association (AOA), and other relevant paperwork as per the chosen business structure.

File Application with ROC: Submit the application for company registration along with the requisite documents to the ROC. The application can be filed online through the MCA portal, simplifying the process and reducing paperwork.

Obtain Certificate of Incorporation: Upon successful verification of documents and compliance with regulatory requirements, the ROC issues a Certificate of Incorporation, officially recognizing the establishment of your company.

Company Registration in Mumbai: Ensuring Compliance and Efficiency

Company registration in Mumbai follows a standardized procedure mandated by the MCA. However, navigating through the nuances of local regulations and administrative procedures can be daunting for first-time entrepreneurs or those unfamiliar with the legal landscape.

To streamline the process and ensure compliance with local laws, seeking professional assistance from experts specializing in company registration in Mumbai is advisable. Platforms like company registration in Mumbai provide valuable insights, resources, and guidance to simplify the registration process and address any legal queries or concerns.

Conclusion:

Embarking on the journey of company registration in Mumbai signifies the beginning of a new chapter in your business endeavors. By understanding the procedural requirements, adhering to regulatory guidelines, and leveraging professional expertise when needed, you can navigate through the complexities of company registration with confidence.

Whether you're launching a startup, expanding your business, or restructuring your company, the process of registration sets the foundation for sustainable growth and compliance with legal obligations. With the right resources and support, establishing your presence in Mumbai's thriving business landscape can be a rewarding experience, paving the way for success in the dynamic market environment.

0 notes

Text

From Ideation to Incorporation: Understanding Company Registration Types in India

In the dynamic landscape of the business ecosystem of India, the most important thing for the entrepreneurs as well as businesses is to choose the right company registration type. Each registration type has its own set of advantages, considerations, and legal obligations. Lets start the journey of navigating the complexities of company registration in India.

Different Types of Company Registration

Partnership Firm: This type of firm has been formed by two or more individuals who share profits & losses. Partnerships provide the flexibility & ease of formation. In this, all the partners are jointly & severally liable for the debts & obligations of the firm.

Private Limited Company: It is a separate legal entity having limited lability, distinct from its shareholders. It requires a minimum number of 2 directors & shareholders. It is subject to the stricter regulatory compliance as compare to the other registration types. Its benefits include credibility, scalability, and access to funding opportunities.

Sole Proprietorship: This type is ideal for the individuals who want to start a small scale business with minimal regulatory requirements. But it does not provide any distinction between personal & business assets, which means that the proprietor personally liable for any debts or obligations.

Limited Liability Partnership (LLP): It combines the benefits of a partnership and a corporation. It means that LLP offer limited liability to its partners while retaining the flexibility of a partnership structure. It is a popular among professionals and service-based businesses.

Public Limited Company: It is suitable for the large-scale businesses that have an aim of raising capital from the public via sale of shares. It is subject to the strict regulatory requirements, including mandatory public disclosures and shareholder meetings.

Conclusion

In India, various company registration types are available. It can be difficult to navigate the variations of the company registration in India, but entrepreneurs can make the informed decisions as per their business goals & aspirations with the right understanding & guidance. You can lay a solid foundation for a successful and compliant business venture in the dynamic Indian market, whether you aim at simplicity, flexibility, or scalability

0 notes

Link

0 notes

Text

Now Investors can start their business in Hong Kong and can choose to incorporate a Hong Kong limited company by share, limited company by guarantee, sole proprietorships/partnership, representative offices or overseas branch. KPC provides professional company formation services in Hong Kong to assist you to form the most suitable type of Company. Knot the basic requirements for your preferred company incorporation. Visit our page to know more. Contact: +852 2153 6555.

#company formation services#company registration#hong kong offshore companies#hong kong company registration#hong kong business address

0 notes

Text

UAE Corporate Tax: Expanding Scope of Business Restructuring Relief

In the wake of the UAE's robust economic growth and the implementation of a competitive corporate tax framework, significant transformations are underway across various sectors. We are witnessing a notable surge in mergers, acquisitions, and hive-offs, reflecting a dynamic shift in the business landscape.

At a granular level, individual entrepreneurs are transitioning their sole establishments into incorporated entities. Moreover, multinational corporations are actively considering the conversion of their UAE branches into limited liability companies (LLCs). Notably, the UAE's corporate tax system promotes tax neutrality through what is termed as "business restructuring relief," particularly in scenarios involving the transfer of existing businesses or independent segments thereof.

Under the business restructuring relief mechanism, the transferring entity is exempted from corporate tax on any gains or losses arising from the transfer. This entails that assets and liabilities are treated as transferred at net book value, thereby resulting in a neutral financial impact.

Recently, the Federal Tax Authority issued comprehensive guidance outlining the conditions, procedural requisites, and repercussions of non-compliance pertaining to business restructuring relief.

Eligibility Criteria: To qualify for this relief, both the transferor and transferee must be resident juridical persons or UAE-based permanent establishments of foreign entities. Furthermore, they should not fall under the category of exempt persons or qualifying free zone entities. Alignment in financial year and adherence to accounting standards are also prerequisites. Importantly, the business transfer should be driven by legitimate commercial or non-fiscal motives that reflect economic realities.

Scope of Relief: The scope of business restructuring relief encompasses transfers of businesses for consideration, primarily in the form of shares or ownership interests. Cash consideration should not surpass the lower of the net book value of transferred assets and liabilities or 10% of the nominal value of shares/ownership interests issued.

This relief mechanism covers a spectrum of transactions including the conversion of sole proprietorships into LLCs, business transfers, mergers, demergers, and hive-downs in exchange for shares. Additionally, it facilitates transfers between non-resident entities with permanent establishments in the UAE.

However, it's crucial to note that certain transactions such as subsidiaries merging with their parent companies resulting in dissolution and share cancellation, asset/liability transfers during liquidation, and transfers between group entities without share transfer do not qualify for relief due to the absence of share transfer.

For further details on eligibility criteria, procedural guidelines, and the scope of relief, please refer to the guidance issued by the Federal Tax Authority.

Stay informed with MAC and Ross Chartered Accountants for the latest updates on regulatory developments and tax strategies shaping the UAE business landscape.

0 notes

Text

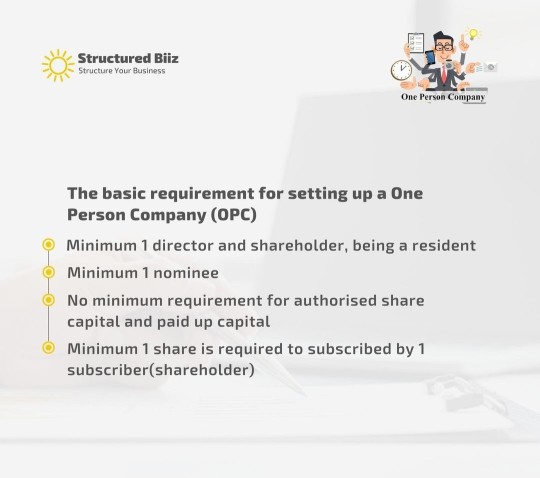

In-depth Guide on One Person Company

An One Person Company (OPC) is legally constituted with only one shareholder, who is acknowledged as the company’s sole member. OPCs typically emerge when there is a single founder or promoter involved in the company. Because of the numerous advantages they offer, entrepreneurs and businessmen launching a new venture often opt for this business structure instead of sole proprietorships.

If you want to register your One Person Company you can visit our official website https://structuredbiiz.com/

Requirements for One Person Company (OPC) Formation

At least one director and shareholder must be a resident.

Minimum one nominee is required.

The authorized capital should be a minimum of 1 lakh.

There is no minimum requirement for paid-up capital.

Features of One Person Company (OPC)

Distinct Legal Identity: An OPC possesses a distinct legal identity, separate from its owner. This autonomy enables the company to engage in contracts, own assets, and assume liabilities under its own name.

Mandatory Incorporation: Unlike other business structures, OPC formation is mandatory and governed by the Companies Act. This formal process ensures adherence to legal standards, enhancing transparency and accountability.

Single Ownership: A defining characteristic of OPCs is their single-member ownership structure. This arrangement allows a sole entrepreneur to own and manage the entire business, facilitating efficient decision-making without the complexities of a multi-member board.

Indian Ownership: OPCs mandate Indian ownership, restricting establishment and operation to Indian citizens and residents. This requirement ensures the business remains firmly rooted within the country's jurisdiction.

Limited Liability Protection: OPCs offer limited liability protection, a significant draw for entrepreneurs. This safeguard shields the owner's personal assets, limiting their liability to the extent of their investment in the company. Such financial insulation is a valuable advantage for individual business owners.

Requirements for One Person Company

Unique and Meaningful Name: A company's name is its primary identifier, crucial for building brand value. It must be distinctive yet indicative of the company's purpose.

Registered Office Address: An OPC must have a designated office for conducting business and official correspondence. The location, whether rented or owned, must be secure and lockable to safeguard important documents.

Adequate Capital Investment: Capital investment is essential for the smooth operation of an OPC. Since there's only one shareholder, the invested amount must be sufficient to sustain business operations effectively.

Single Shareholder Ownership: OPCs are characterized by a single shareholder who holds 100% ownership of the company. The shareholder, an Indian citizen, whether resident or non-resident, is entitled to all profits earned by the company.

Directorship Requirement: While the sole owner doesn't manage the company directly, they must appoint at least one director. An OPC can have up to 15 directors, with at least one being a resident in India for more than 120 days during the previous financial year.

Limitations of One Person Company (OPC)

1. Ineligibility for Certain Conversions: OPCs cannot be converted into Section 8 Companies (Not for Profit) or Non-Banking Financial Companies (NBFCs).

2. Resident Shareholder Requirement: Only residents of India, who have stayed in the country for 182 days or more in a year, are permitted to be shareholders of OPCs. Non-residents are not allowed to establish OPCs.

3. Restriction on Multiple OPCs: Each individual is limited to either owning one OPC or being nominated as a nominee in one OPC. Consequently, one person cannot simultaneously hold shareholder or nominee positions in multiple OPCs.

4. Conversion Limitation Period: An OPC cannot be converted into a regular company until two years have elapsed from the date of incorporation, except under specific circumstances. These exceptions include instances where the paid-up capital exceeds Rs. 50 lakh or the average annual turnover for the immediately preceding three consecutive financial years exceeds Rs. 2 crore.

5. Unsuitability for Investor Funding: OPCs are not recommended for entrepreneurs seeking investment from external investors.

1 note

·

View note

Text

Unlocking the Potential: Understanding the Private Limited Company

In the vast landscape of business entities, the private limited company registration in Telangana stands as a popular choice, offering a blend of flexibility, credibility, and limited liability. This article aims to shed light on the essence of a private limited company registration online in Telangana, exploring its structure, advantages, and key considerations for entrepreneurs.

Understanding the Private Limited Company:

A Private Limited Company, often abbreviated as pvt ltd company registration in Telangana, is a privately held business entity characterized by limited liability. This means private limited company registration provider in Telangana that the liability of its shareholders is restricted to the amount of their shareholding in the company. In simpler terms, the personal assets of shareholders are protected in case the company faces financial distress, thus offering a shield against personal bankruptcy.

Structure:

The structure of a Private Limited Company typically comprises new ltd company registration in Telangana shareholders, directors, and the company itself as a separate legal entity. Shareholders are the owners of the company and hold shares representing their ownership. Directors are appointed by shareholders to manage the affairs of the company. One of the notable aspects of a Private Limited Company is its autonomy to pvt limited gst registration services in Telangana operate independently of its shareholders and directors.

Advantages:

Limited Liability: Shareholders enjoy limited liability, protecting their personal assets from the debts and liabilities of the company.

Separate Legal Entity: A Private Limited Company is a distinct legal entity from its shareholders and directors, offering credibility and enhancing the company's ability to enter into contracts, acquire assets, and incur debts.

Flexibility in Ownership: Private Limited Companies can have a minimum of two and a maximum of two hundred shareholders, offering flexibility in ownership structure.

Ease of Fundraising: Compared to sole proprietorships and partnerships, Private Limited Companies find it relatively easier to raise funds through equity issuance and bank loans.

Perpetual Succession: The existence of a Private Limited Company is unaffected by changes in its ownership or management, ensuring continuity and stability.

Tax Benefits: Private Limited Companies often benefit from various tax deductions and exemptions, enhancing their profitability.

Key Considerations:

While the Private Limited Company structure offers numerous advantages, entrepreneurs should carefully consider certain aspects before incorporating:

Compliance Requirements: Private Limited Companies are subject to various statutory compliances, including annual filings, board meetings, and maintenance of statutory registers.

Costs: Setting up and maintaining a Private Limited Company involves costs such as registration fees, legal fees, and compliance costs.

Complexity: The regulatory framework governing Private Limited Companies can be complex, requiring professional expertise for compliance and governance.

Shareholder Agreements: Clear shareholder agreements are essential to manage relationships, rights, and obligations among shareholders effectively.

Conclusion:

The Private Limited Company structure offers a compelling blend of limited liability, credibility, and flexibility, making it a preferred choice for entrepreneurs worldwide. By understanding its structure, advantages, and key considerations, entrepreneurs can harness the full potential of a Private Limited Company to realize their business aspirations. In the dynamic landscape of commerce, the Private Limited Company stands as a beacon of stability and growth, empowering entrepreneurs to embark on their journey of success.

0 notes

Text

How Can a Singaporean Retail Company Be Started?

Exploring Market Trends and Crafting Business Strategies

If you find yourself unsure about the type of retail store to pursue, delve into our insightful article on the most popular retail business ideas in Singapore.

Once you have a retail business idea in mind, the initial crucial steps involve conducting thorough market research and developing a well-defined business plan. Here's a guide on how to approach these critical phases.

Conducting In-Depth Market Research

Identify Target Audience: Clearly define your target demographic, understanding their preferences, purchasing behavior, and the factors influencing their decisions.

Competitor Analysis: Scrutinize existing competitors in the Singaporean market. Identify market gaps and areas where your business can offer a unique value proposition.

Trend Analysis: Stay informed about current market trends, encompassing product trends, shifts in consumer behavior, and emerging technologies.

Creating a Comprehensive Business Plan

Executive Summary: Present a concise overview of your business, outlining its mission and key objectives.

Market Analysis: Incorporate findings from your market research, detailing the market size, target demographics, and competitive landscape.

Operational Plan: Outline the operational aspects, including sourcing products, inventory management, and customer service.

Marketing Strategy: Define how you will promote and position your business, encompassing both online and offline strategies.

Financial Projections: Provide realistic financial forecasts, covering startup costs, revenue projections, and break-even analysis.

Navigating Legal and Regulatory Aspects for Retail Business in Singapore

Starting a retail business in Singapore demands a solid understanding of the legal and regulatory framework. Here's a comprehensive overview:

Types of Business Structures Suitable for Retail in Singapore

Sole-Proprietorship and Partnership: Suitable for single-owner or multi-owner businesses.

Limited Partnership (LP): Comprising general and limited partners, less common in retail.

Limited Liability Partnership (LLP): Combining elements of partnerships and companies, suitable for professional services.

Company (Private Limited Company - Pte Ltd): Commonly chosen for retail, providing limited liability to shareholders.

Registration and Licensing Requirements in Singapore

Business Registration: Register with the Accounting and Corporate Regulatory Authority (ACRA), choosing a unique business name.

Goods and Services Tax (GST) Registration: Mandatory if annual turnover exceeds a specified threshold.

Licensing: Obtain specific licenses based on the nature of your retail business.

EntrePass for Relocation (Foreigner): A work pass for foreign entrepreneurs starting a business in Singapore.

Compliance with Consumer Protection Laws in Singapore

Consumer Protection (Fair Trading) Act: Ensure transparency in business dealings.

Lemon Law: Understand obligations related to defective goods and consumer rights.

Personal Data Protection Act (PDPA): Safeguard customer data and comply with regulations.

Choosing the Ideal Location for Your Retail Business

Selecting the right location is crucial and can significantly impact your retail business's success. Here's a guide to help you make an informed choice:

Factors to Consider when Selecting a Retail Location

Foot Traffic: Assess pedestrian traffic for increased visibility.

Target Demographics: Align with the local population's age, income, and lifestyle.

Competition: Analyze competitor presence in the vicinity.

Accessibility: Evaluate location accessibility for both pedestrians and vehicles.

Costs and Rent: Consider overall operating costs and balance them with budget and revenue projections.

Zoning Regulations: Ensure compliance with local zoning regulations.

Understanding Different Commercial Spaces Available

Shopping Malls: Ideal for businesses targeting a broad audience.

Street Retail/High Street: Offers visibility and foot traffic with potential higher rental costs.

Commercial Complexes: Blend of offices and retail spaces, providing varied foot traffic.

Pop-up Stores: Temporary spaces beneficial for testing new markets or products.

Online Presence: Evaluate the viability of an online store in the digital age.

Setting Up Your Retail Store

After selecting the ideal location, move on to setting up your store by following this step-by-step guide:

Store Layout and Design: Plan the layout for maximum visibility and create a welcoming atmosphere.

Merchandising and Inventory Management: Display products effectively and implement efficient inventory organization.

Point of Sale (POS) System: Invest in a reliable POS system with features like inventory tracking and seamless payment processing.

Technology Integration: Consider integrating your physical store with an online presence for a unified customer experience.

Employee Training: Provide thorough training on customer service, product knowledge, and operating procedures.

Grand Opening and Marketing: Plan a grand opening event, utilizing both online and offline marketing strategies, and consider loyalty programs.

Explore Swiftly for Effortless Incorporation Today

If you already have a retail business idea, Swiftly is your gateway to fast incorporation, transforming your concepts into a fully registered business promptly. With our cutting-edge technology, generate necessary legal documents in seconds, saving time and effort.

But it doesn't stop there. Swiftly offers a suite of services beyond incorporation, including accounting, nominee director, and company secretary service singapore, supporting every aspect of your business journey.

0 notes

Text

Unlocking Business Success: Navigating Business Startup Services for Online Startups

Launch of the internet-based business is a journey that could be very stimulating as well as frightening. Proper guidance and assistance would empower the online entrepreneurs to make a perfect start of their business. A major importance of business startup services is that they give excellent support to those who intend to establish and develop an online startup. Ranging from creating a business plan to using the right digital tools business consultants share their skills in order to aid entrepreneurs in avoiding common errors.

Crafting a Business Plan

A thoughtful business plan equals the formula of success for any startup as it provides goals and analysis of the market, financial projections and set the rate of growth. Online business consulting services component includes a strategy of bespoke plans which stipulate the business vision, customer personas, and user acquisition/retention tactics. Scalability and iterations rapid come in on the first plane. They give advice on models of business adapted for the internet.

Choosing a Business Structure

From sole proprietorships to incorporations, online startups have several options when determining their legal business structure. Business startup services provide clarity on the pros and cons of each, mapping out ownership stakes, liability, taxes, and ease of formation. For online companies especially, the ability to take on investors and scale quickly are key considerations. Experienced consultants share best practices on choosing a business structure that allows room for growth.

Leveraging Digital Tools

Today's online entrepreneurs have at hand about all these: the platforms, software and automation tools, that help their operations run ever so efficiently. Consulting for business ensures that entrepreneurs are aware of new tech advancements and can reach clarity in technology decisions with respect to the goals of their business and the budget they have. Tools like websites builders and e-commerce platforms as well as project management and accounting software assist in providing practical tips which lead to utilizing digital devices to increase the efficiency of the business processes.

Building an Online Presence

Establishing an engaging online presence is vital for customer acquisition and retention. Digital business consulting services provide strategic guidance on building a user-friendly website, driving traffic through search engine optimization and social media, and converting visitors into customers. Staying on top of changing algorithms and platform updates, consultants offer the latest best practices for startups seeking to organically grow their reach and establish authority in their niche.

Financial Planning and Funding

From startup costs to cash flow analysis, business startup services provide clarity on the key financial considerations for launching an online venture. Mapping out funding requirements, they advise entrepreneurs on bootstrapping strategies, loans, crowdfunding campaigns, and investor outreach. For sustainable growth, consultants emphasize financial planning including budgeting, expense tracking, billing, and setting revenue goals.

Digital Marketing Strategies

Online customer acquisition relies heavily on digital marketing across channels like pay-per-click ads, content marketing, email campaigns, and leveraging influencers. Business consulting services help startups create integrated digital marketing plans tailored to their offerings and target audience. With an emphasis on testing and optimization, they provide guidance on cost-effective strategies to attract and convert the right customers.

Understanding Legal Compliance

From privacy policies to tax registrations, online startups need to adhere to various legal and regulatory compliance standards. Business startup services break down the gamut of rules pertaining to e-commerce ventures, guiding entrepreneurs through mandatory filings and data protection best practices. Keeping track of changing internet regulations, consultants ensure startups have their bases covered as they scale.

Choosing Business Insurance

While often overlooked initially, adequate business insurance is crucial for protecting online startups as they grow. Digital business consulting services provide clarity on risks commonly faced by internet companies so entrepreneurs can secure tailored coverage. From general liability to cyber security insurance, consultants advise on choosing policies that safeguard startups without breaking the bank.

Scaling Through Strategic Partnerships

Forming synergic partnerships with other brands with a similar goal (but having a few niches in between) can really speed up the growth of new startups. Online business consulting services feature the entrepreneurs learning to choose and to assess their potential affiliate partners, influencers, directives for distribution, marketing platforms to cooperate with. By advocating relationship building, especially through engaging in cooperation agreements, here the author presents a strategy to structure deals where two or more parties’ benefit.

Currently, with the development in online business, new technologies and breakthroughs came out every day. For them, especially for first time entrepreneurs, constant knowledge and skills updating can compete for attention. Drawing on experienced startup firms is one route that provides the counsel to construct long-term online companies ready to withstand challenges in the future, and they are also designed for sustainable growth and profit. By providing research-supported suggestions, online startups can derive the right policy-driven strategy through digital channels, which will ultimately lead to profitability.

0 notes

Text

What are some other types of company incorporation in India?

Some Other Types of Company Incorporation in India:

Producer Company: A producer company is a unique blend of a cooperative society and a private limited company. Incorporated under section 465(1) of the Companies Act, it operates as a private limited entity. A producer company can be established by a group of 10 or more individuals, offering stakeholders limited liability.

Partnership Firm: A partnership firm is a business structure formed by two individuals who share both profits and losses. This setup is well-suited for small and medium enterprises due to its simplicity and minimal legal obligations. However, it's important to note that partnership firms carry unlimited liabilities, making them less advisable for long-term business ventures.

Sole Proprietorship: A sole proprietorship firm is owned and managed by a single individual. Unlike an OPC (One Person Company), it lacks a separate legal identity and is not governed by specific laws. Despite its ease of operation, sole proprietorship firms entail unlimited liabilities for the owner.

0 notes

Text

Unlocking the Process: How to Register a Company in Delhi with Legalari

Define Your Business Structure: The first step towards company registration is determining the structure of your business. Will it be a Private Limited Company, Limited Liability Partnership (LLP), Sole Proprietorship, or a Partnership Firm? Each structure has its own set of advantages and legal requirements. Legalari can guide you in choosing the most suitable structure based on your business goals and vision.

Choose a Unique Name: Your company’s name is its identity. It should be unique, memorable, and in compliance with the naming guidelines set by the Ministry of Corporate Affairs (MCA). Legalari can assist you in conducting a name availability search and ensure that your chosen name meets all regulatory requirements.

Drafting Memorandum and Articles of Association: These documents outline the rules and regulations governing the internal affairs of your company. Legalari’s expert team can help you draft these documents meticulously, ensuring compliance with the Companies Act, 2013.

Obtain Digital Signature Certificate (DSC) and Director Identification Number (DIN): As per the MCA guidelines, obtaining DSC and DIN is mandatory for all directors of the company. Legalari can facilitate the application process, making it hassle-free and efficient.

Filing of Incorporation Documents: Once all the preliminary steps are completed, the next crucial step is filing the incorporation documents with the Registrar of Companies (RoC). These documents include Memorandum of Association (MoA), Articles of Association (AoA), and other essential forms. Legalari’s experienced professionals ensure that all documents are filed accurately and promptly.

Obtain Certificate of Incorporation: After successful scrutiny of the documents by the RoC, your company will be issued a Certificate of Incorporation. This certificate marks the official birth of your company, granting it legal recognition. Legalari can expedite this process, minimizing the waiting time.

Apply for Permanent Account Number (PAN) and Tax Deduction Account Number (TAN): PAN and TAN are essential for opening a bank account, conducting financial transactions, and complying with tax regulations. Legalari can assist you in obtaining these numbers swiftly, enabling you to kickstart your business operations without delay.

Compliance with Regulatory Requirements: Post-incorporation, your company needs to adhere to various regulatory requirements such as GST registration, professional tax registration, and compliance with labour laws. Legalari provides comprehensive support to ensure that your company remains compliant with all statutory obligations.

Post-Incorporation Services: Beyond company registration, Legalari offers a wide range of post-incorporation services including legal advisory, accounting, taxation, and compliance management. Our holistic approach ensures that your business receives ongoing support at every stage of its growth journey.

In conclusion, the process of Company Registration In Delhi may seem daunting, but with Legalari by your side, it becomes a seamless and efficient journey. Our expert team leverages its knowledge and experience to navigate through the complexities of company registration, allowing you to focus on realizing your entrepreneurial dreams. So why wait? Embark on your entrepreneurial journey today with Legalari as your trusted partner.

#DelhiCompanyRegistration#LegalariAssistance#EntrepreneurialJourney#CompanySetupDelhi#BusinessRegistration#LegalariGuidance#StartUpDelhi#CompanyIncorporation#BusinessFormation#DelhiEntrepreneurs

1 note

·

View note

Text

Seize Your Opportunity: A Practical Guide to Online Business Registration in Hyderabad

It becomes smooth to fulfill the dream of starting your own business in the dynamic city of Hyderabad, where tradition meets innovation. Aspiring entrepreneurs can turn their business ideas into reality easily with online business registration. Here, in this article we will provide you the step-by-step guide to help you in navigating the process flawlessly.

Procedure of Online Business Registration in Hyderabad

Prepare Your Documents: First of all, gather all the essential documents including identity proof, address proof, and PAN card details. Make sure that all the documents have been scanned & ready for online submission.

Choose Your Business Structure: As each business structure has its own set of requirements & benefits, so choose your company structure wisely on the basis of your business goals, whether it will be a private limited company, sole proprietorship, partnership, or LLP (Limited Liability Partnership).

Access The MCA Portal: Create an account of online portal of MCA i.e. Ministry of Corporate Affairs if have not one. This portal is the central platform for all company registrations in Hyderabad & all over India.

Name Your Business: Before moving ahead with registration, select a unique name for your company as per the naming guidelines that have been provided by MCA and then apply for the name approval via MCA Portal.

Complete Forms & Submit Documents: Complete all the necessary forms for the company registration including SPICe form. Fill al the details accurately and also upload all the requisite documents.

Pay the Registration Fees: Pay the registration fees via online portal of MCA. The fees of online business registration in Hyderabad may vary on the basis of company structure and authorized capital.

Receive Your Certificate of Incorporation: After the successful submission, the ROC i.e. Registrar of Companies will verify the documents, and then you will get the Certificate of Incorporation that works as a proof of official commencement of your business operations.

Conclusion

You can navigate the process of Online Business Registration in Hyderabad efficiently & confidently with the help of the simple steps that have been mentioned above. Embrace the opportunities that wait for you in the dynamic business landscape of Hyderabad and start your entrepreneurial journey with clarity & determination.

#online business registration in hyderabad#pvt ltd company registration hyderabad#register a private limited company in hyderabad#register a company in hyderabad#private limited company registration process hyderabad#one person company registration in hyderabad#company formation in hyderabad#proprietorship firm registration in hyderabad#partnership firm registration in hyderabad#private limited registration in hyderabad#company incorporation services in hyderabad

0 notes