#p; winnie's outline progress

Note

who is winnie p this is history senior, are you gonna have a full draft by monday?? like how many pages are you at??? i was just thinking that i should really stay up til monday so i can turn in something as long as possible so my advisor will like me more... i feel like a longer draft is better for grade??? idk (you can respond to the previous post, idk if i want my name in the inbox lol)

Response from Winnie P:

lol that’s fair, honestly I’m in such a total piece of shit situation. I’m not going to have a full draft. My plan is to go to sleep now, finish chapter 2 tomorrow (lol have been saying this for 4 days!!!!) Then edit chapter 1 (my prof told me to reorganize it) and maybe start work on chapter 3 (my last chapter not including conclusion). Hopefully I can write the first half maybe of chapter three by working on it a little and all monday non-stop (i’m interpreting due monday as due monday at midnight :D – and if i make not enough progress sun I’ll probably do a minor almost all-nighter sunday-monday). Then i’ll for sure be able to turn in a re-edited intro + chapter 1 + chapter 2, and maybe drop a preview of chapter 3 (considering turning in an outline of the rest but not sure? think it might be looked down on). I also agree that a longer draft is better for grade. Definitely. I would turn in the absolute max you can.

Edit: I lied. Here’s my new life plan. I am actually going to work more on turning in good, but smaller amount Monday, and then rushing some crap really quickly afterwards. This way he won’t hate me if he starts reading my Monday stuff, but hopefully the rest is given to him fast enough that he’s still willing to read it.

0 notes

Text

The Intrinsic Value of Network-1 Technologies Inc.

Introduction

Network-1 Technologies Inc. is a U.S. based communications equipment company whose principal business involves the development, licensing, and protection of intellectual property. At the time of writing, the firm’s market cap stands at around $59 Million and its revenues and free cash flows for the previous financial year were around $16 Million and $6 Million respectively. The company’s common stock has fluctuated between a high of $3.25 and a low of $2.00 over the past 52 weeks and currently stands at $2.48. Is Network-1 Technologies Inc. undervalued at the current price?

The Intrinsic Value of Network-1 Technologies Inc.

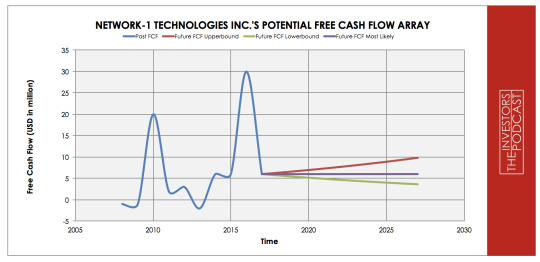

To determine the intrinsic value of Network-1 Technologies Inc., we’ll begin by looking at the company’s history of free cash flow. A company’s free cash flow is the true earnings which management can either reinvest for growth or distribute back to shareholders in the form of dividends and share buybacks. Below is a chart of Network-1 Technologies Inc.’s free cash flow for the past ten years.

As can be seen, the firm’s free cash flow has fluctuated significantly over the past decade. This is a result of the fact that the company receives money to license its patents in either lump sums or through ongoing royalty payments. The firm must also enforce its patent protection through legal proceedings which can result in delays in payments. In order to determine Network-1 Technologies Inc.’s intrinsic value, an estimate must be made of its potential future free cash flows. To build this estimate, there is an array of potential outcomes for future free cash flows in the graph below.

When examining the array of lines moving into the future, each one represents a certain probability of occurrence. The upper-bound line represents a 5% growth rate which assumes that the firm’s future free cash flow growth is driving by additional patent acquisitions and through the firm’s recently investment the clinical stage biotech company, ILiAD Biotechnologies. This upper growth line has been assigned a 20% probability of occurrence to account for the uncertainties associated with securing future profits from subsequent patents and investments.

The middle growth line represents a 0% growth rate which assumes future free cash flow does not increase. This scenario assumes that the firm does not successfully win ongoing legal proceedings and that its recent patent additions and investments do not progress favorably. This growth rate has been assigned a 60% probability of occurrence to account for the uncertainty which currently surrounds the company.

The lower bound line represents a -5% rate in free cash flow growth and assumes that the company suffers a period of contraction in earnings due to future patent expirations. This growth rate has been assigned a 20% probability of occurrence.

Assuming these potential outcomes and corresponding cash flows are accurately represented, Network-1 Technologies Inc. might be priced at an 8.4% annual return if the company can be purchased at today’s price. We’ll now look at some other valuation metrics to see if they correspond with this estimate.

Network-1 Technologies ’s current free cash flow yield, which is the inverse of its Price/FCF ratio, is 15.25%. This is based on a ttm free cash flow of $9 Mil, assuming a $6 Mil free cash flow, which the firm achieved in three of the last four years, would result in a 10.16% free cash flow yield.Finally, we’ll look at Network-1 Technologies Inc.’s book value growth and dividend yield to see whether this supports our other estimates of growth. Year-on-Year book value has grown at an annualized rate of around 6%, and the current dividend yield stands at around 4%. Assuming Network-1 Technologies can grow its book value at a similar rate for the next ten years and its current dividend yield can at least be maintained, the firm should return around 10% at the current price.

Taking all these points into consideration, it seems reasonable to assume that Network-1 Technologies Inc. may return between 8-10% at the current price if the estimated free cash flows are achieved. Now, let’s discuss how and why these estimated free cash flows could be achieved.

The Competitive Advantage of Network-1 Technologies Inc.

Network-1 Technologies Inc. has various competitive advantages outlined below.

Intangible Assets. Network-1 Technologies currently holds a portfolio of 28 patents which protect its proprietary technology. These intangible assets are the primary source of earnings for the company, and it aggressively protects them through legal action.

o The Remote Power Patent covering the delivery of power over Ethernet (PoE) cables for the purpose of remotely powering network devices, such as wireless access ports, IP phones, and network-based cameras;

o The Mirror Worlds patent portfolio (the “Mirror Worlds Patent Portfolio”) relating to foundational technologies that enable unified search and indexing, displaying and archiving of documents in a computer system;

o The Cox patent portfolio in relating to enabling technology for identifying media content on the Internet and taking further action to be performed based on such identification; and

o Patents covering systems and methods for the transmission of audio, video, and data over computer and telephony networks in order to achieve a high quality of service (QoS) (the “Qos Patents”).

Source: Network-1 Technologies Inc. Company Website

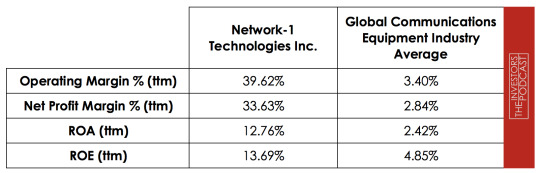

Low-cost Operations. Since Network-1 Technologies Inc. is an intellectual property company which generates earnings from the acquisition, licensing, and enforcement of patents it only requires a small workforce of under ten employees. These low-cost operations allow the firm to achieve performance metrics well more than the Global Communications Equipment Industry averages.

Strong Corporate Culture. Network-1 Technologies Inc’s management is closely aligned with shareholders with insider ownership currently standing at around 26%. The firm has also begun to pay dividends in recent years and has bought back around $15 Mil in shares since 2011. Considering the large levels of cash and equivalents on the balance sheet and the prospect of favorable outcomes in ongoing legal proceedings, the chance exists that these dividends may increase, or a special dividend may be paid.

Network-1 Technologies Inc.’s Risks

Now that Network-1 Technologies Inc.’s competitive advantages have been considered, let’s look at some of the risk factors that could impair my assumptions of investment return.

Network-1 Technologies Inc. currently has multiple legal proceedings in play including those against Hewlett Packard and Google. If these legal proceedings are not resolved in a favorable manner, then the firm stands to not only lose out on $100-200 Mil in potential damages but will be unable to collect royalties from other companies who are withholding payments while legal proceedings are ongoing.

Network-1 Technologies Inc.’s business is dependent on the acquisition and monetization of patents. A number of the patents which have accounted for a significant portion of the firm’s past earnings are set to expire within the next few years. If the company is unable to acquire and successfully monetize new patents, its economic future is likely to be negatively impacted.

Network-1 Technologies Inc. has recently invested in the clinical stage biotechnology company, ILiAD Biotechnologies. There is always an element of risk with the probability of success for clinical trials, and there is no guarantee that this investment will prove a useful allocation of capital for the firm.

Opportunity Costs

Whenever an investment is considered, one must compare it to any alternatives to weigh up the opportunity cost. At the time of writing, 10-year treasuries are yielding 2.63%. If we take inflation into account, the real return is likely to be closer to 1%. The S&P 500 Index is currently trading at a Shiller P/E of 29.4 which is 74% higher than the historical mean of 16.9. Assuming reversion to the mean occurs, the implied future annual return is likely to be -1.6%. Network-1 Technologies Inc., therefore, appears to offer a much better return for investors at present, but other individual stocks may be found which offer a similar return relative to the risk profile.

Macro Factors

Investors must consider macro-economic factors that may impact economic and market performance as this could influence investment returns. At present, the S&P is priced at a Shiller P/E of 29.4. This is 74% higher than the historical average of 16.9 suggesting markets are at elevated levels. U.S. unemployment figures are at a 48-year low suggesting that the current business cycle is nearing its peak. U.S. private debt/GDP currently stands at 202.80% and is at its highest point since 2009 when the last financial crisis prompted private sector deleveraging.

Summary

Network-1 technologies Inc. is currently selling at a discount to fair value due to negative market perception relating to the uncertainties surrounding court proceedings, cash settlements, and withheld royalties’ payments from other licensees. Investors should be aware that there is no guarantee that the company will be successful in its claims of patent infringement against Hewlett Package, Google, and other companies.

Network-1 Technologies Inc. does, however, have a very good track record in winning legal battles based upon patent infringement. The company’s most recent 10-Q notes that;

“In September 2011, we initiated patent litigation against sixteen (16) data equipment manufacturers in the United States District Court for the Eastern District of Texas, Tyler Division, for infringement of our Remote Power Patent. We settled the litigation against fifteen (15) of the sixteen (16) defendants. The remaining defendant in the litigation is Hewlett-Packard Company.”

Given that the company has a strong track record of winning legal battles against companies such as Sony, Motorola, Samsung, and Huawei, it seems reasonable to assume that Network-1 Technologies may be successful in one or more of its current patent infringement cases. If the Hewlett Packard case can be successfully won then, the firm will not only receive a significant sum from the ruling but will also be able to rightly lay claim to unpaid royalties’ payments from Cisco, Dell, and Netgear.

The company is currently in a very strong financial position with no debt to speak of and a formidable liquidity position as evidenced by the firm’s quick ratio of 26.72. As of the most recent quarter, around 93% of the company’s balance sheet is comprised of cash and equivalents. Given that the firm is currently trading at around 1x, book value investors have the potential to make an investment which offers the potential for significant upside with excellent downside protection.

The projected return of 8-10% is based on extremely conservative assumptions for the company and does not take into account the possibility for significant upside if the legal challenges are successful.

In summary, Network-1 Technologies Inc. in an investment with significant upside potential and credible downside protection. Investors must be prepared for continuing uncertainty and patience will be required to see this investment play out. Based on the conservative assumptions used in the analysis of the company, Network-1 Technologies Inc. may return around 8-10% at the current market price. If the firm is successful in the current legal battles it is engaged in, this upside could be much higher.

Disclaimer: The author holds fractional ownership in Network-1 Technologies Inc.

*

This article was written in collaboration with David J. Flood from “The Investor’s Podcast.”

Stig Brodersen is the host of the business podcast “We Study Billionaires.” You can find his free intrinsic value index here of popular stock picks.

0 notes

Text

I'm not doing NaNoWriMo this year.

Hopefully this doesn't sound too much like most of those YouTube videos we're all watching, figuring out who is and who isn't participating in NaNoWriMo this year. I added a "Keep reading" below for anyone who wishes to skip past.

The main point is that I'm not participating in NaNoWriMo this year, as the title says. Under the cut is explaining what I'm planning on doing in the following months (as the author behind this tumblr account).

I have always said I was an author of many unfinished stories. I just never said how many... and how I'm handling that.

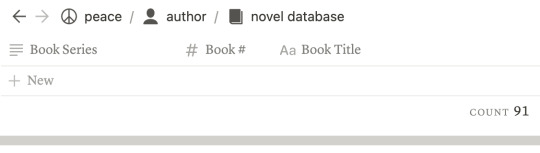

I use a Notion database to pile all of my story ideas together. As of today (November 6, 2022), I currently have a total count of 91 in the database.

As you can see, this author is stressin'. Instead of writing my current WIP projects that I have spent months to years struggling to write, I'm going to outline all of my story ideas and process them into different stages.

First step, I'm going through my stand-alone story ideas - I have 36 story ideas that are currently stand-alones. Each of them only have a gist of an idea, possibly a scene in mind, and/or a few characters with names I might need to change. I want to get them all through the outline stages.

I'm a plotter, if you can't tell. My outlining process is mostly using Save the Cat! Writes a Novel by Jessica Brody, from Blake Snyder's Save the Cat! I am also using the pen-to-paper method, as it's easier for me to get the words down when I'm in the outlining process. It's harder to count words this way, which is why I'm not being a rebel and adding up the outline words into the NaNo site.

For an example: I finished an outline for a story idea that was previously a stand-alone, but is now a duology. I started the outline process on Oct 17 and finished on Oct 29, taking 13 days to finish, but I only outlined on six of those days.

Because it's not a stand-alone anymore, I set the outline aside for after I finish outlining all of my stand-alones, and I will return to this outline when I go through outlining all of my duology series.

Second step, once I have finished outlining all of my stand-alones, I'm going through my series. I have four duologies and one trilogy. I have two short-story collections. I have an eight-book crime series and a ten-book family series. Lastly, I have an umbrella series, a Universe if you will, with three series - in total, the Universe has twenty books.

I'm still on the first step of outlining my stand-alones. I'm going in alphabetical order from the Novel Database, with the temporary titles I made for each story idea. That being said: on Nov 2, I started outlining my second stand-alone story idea.

I will start making update posts; to keep myself accountable, to keep track on how long it takes me to outline each of my story ideas, to keep my followers updated on where I'm at, among other things. I will also make a tag, that way all of the update posts are filtered together, and for those who wish to follow or to blacklist the tag.

The tag is - p; winnie's outline progress - it is in the tags below for clicking access.

In conclusion, I am truly hoping this will relax my brain and keep me productive. Who knows? Maybe I'll scrap story ideas once I realize there's nothing to make of them, and it'll slowly dwindle down from the 90s. On the other hand, maybe I'll just end up adding to the list and make it into the hundreds. We'll see when we get there.

Good luck to everyone participating in NaNoWriMo 2022, good luck to everyone not participating, but still writing, and good luck to everyone who may not be writing at all.

3 notes

·

View notes

Text

winnie’s outline progress - story idea 6;

To read more about my outline progress posts, read this post. To follow or blacklist my outline progress posts, the tag is - p; winnie’s outline progress - and the link is available below for clicking access.

Outline Progress Report for project; kill for ma:

February 3 to 19, 2023

I worked on the outlining process for 13 hours across 9 days out of the 16 day period.

1 note

·

View note

Text

winnie’s outline progress - story idea #5;

To read more about my outline progress posts, read this post. To follow or blacklist my outline progress posts, the tag is - p; winnie’s outline progress - and the link is available below for clicking access.

Outline Progress Report for project; elizabeth's recovery:

January 23 to February 2, 2023

I worked on the outlining process for over 7 hours across 4 days out of the 10 day period.

1 note

·

View note

Text

winnie’s outline progress - story idea #2;

To read more about my outline progress posts, read this post. To follow or blacklist my outline progress posts, the tag is - p; winnie’s outline progress - and the link is available below for clicking access.

Outline Progress Report for project; the gap year babysitter:

November 2 to December 5, 2022

I worked on the outlining process for 12 of those days.

AN: i adopted a kitten in november, so i pulled away from the project for the majority of november, and did most of my outlining on december 5. it took me four days to outline scene 11, due to not being able to pull away from my kitten long enough.

+: i also started creating an author/writing hub on Notion, and i will be creating outline databases to log how many scenes i work on each day - i might preview these when posting these progress posts!

1 note

·

View note

Text

winnie's outline progress - story idea #1;

To read more about my outline progress posts, read this post. To follow or blacklist my outline progress posts, the tag is - p; winnie's outline progress - and the link is available below for clicking access.

Outline Progress Report for project; two sides of the story:

October 17 to October 29, 2022

I worked on the outlining process for 6 of those days.

It started out as a stand-alone, but turned into a two-book series, or a duology. I will return to this outline after I finish outlining all of my stand-alone story ideas.

- im late posting this, but i will post the update posts the day i finished the outline. -

1 note

·

View note