#models dot.com

Text

Robert Gigliotti - Photogenics Media

Photography + Direction: Lindsey Kusterman | IG

Styling + Direction: Emily Batson | IG

Model: Robert Gigliotti at Photogenics Media | IG

Photographed at my home studio in Los Angeles California- digital, medium format, & 35mm film.

#editiorial men#models dot.com#photogenics#photogenics men#lindsey kustermanlos angeles#los angeles film photographer#los angeles portrait photographer#los angeles beauty photographer#los angeles editorial photographer#lindseykusterman#lindsey kusterman photography#robert gigliotti#emily batson#robertgigs#calvin klein#ralph lauren#medium format film photographer los angeles#medium format#35mm film photographer#35mm film photographer los angeles#tmax100#fuji200#portra 400

0 notes

Text

The global crypto market currently has a capitalization of just over $1.08 trillion. It’s a fairly simple figure that’s based on the accumulated value of all digital tokens, but it doesn’t even begin to describe the value of the technological concepts that crypto has given birth to.

The value of innovation in areas such as decentralized finance (DeFi), stablecoins, non-fungible tokens (NFTs) and real-world assets (RWAs) is much harder to quantify, but it’s clear enough that they promise to deliver many tangible benefits to people’s lives.

DeFi, for instance, promises to create a new, more equitable and accessible financial system that will benefit everyone equally, rather than the so-called elite who manipulate the traditional financial system to amass even greater wealth at the expense of the rest of us. NFTs are wonderfully innovative things that can enable digital asset ownership and new business models, while RWAs, which use NFTs, promise to increase liquidity in traditionally illiquid asset classes, and make them available to even the smallest of investors.

A Nascent World

These wonderful crypto innovations are still nascent and are yet to live up to their promises. While crypto has been around since 2009 when Bitcoin was first engineered by Satoshi Nakamoto, the above concepts are much newer.

The newness of the crypto economy is plain to see by the growing pains it has experienced. In the last decade there have been numerous ups and downs characterized by incredible bull runs and unparalleled excitement, followed by soul-crushing bear markets that brought agony to thousands of investors across the world.

Crypto’s path to maturity mirrors the one taken by traditional finance, in many ways. Today’s banking institutions and the numerous regulations and compliance rules that bring oversight to the industry took decades to establish themselves and achieve the level of trust that consumers afford today. Crypto, on the other hand, is still taking its first baby steps, with even the best known decentralized protocols barely more than a few years old.

Just as the 2008 financial crisis helped to clean up the traditional financial world, it’s true that the ongoing market forces disrupting crypto today – which present themselves in the shape of hacks, scams and bankruptcies – serve a useful purpose. They are helping to weed out the industry’s insecurities and fragile actors, and remove excesses, paving the way for a more robust ecosystem.

The innovations we’ve seen in blockchain and crypto have already resulted in substantial growth, and yet they have a long way to go before they become mainstream. The distinctive features of the crypto economy, namely self-sovereignty, decentralization and transparency, are not yet fully understood. Yet, they continue to discover new market opportunities, helping crypto to overcome its constant setbacks.

For instance, concepts such as peer-to-peer transactions and tokenization can provide obvious benefits to the world, and they can only be implemented within the world of crypto. Technological innovation typically goes through cycles, and just as the Dot.Com crash failed to kill the internet, the disasters that befall crypto will not stop it from fulfilling its destiny.

Ongoing Evolution

Key to the success of the crypto industry is the ongoing research and experimentation being undertaken by its main participants, and it’s down to them to see it through.

Already we can see the game-changing benefits crypto will bring to the world. Crypto-based lending protocols can utilize RWAs, enabling anyone to borrow funds by using their existing, real-world assets as collateral. Crypto also brings new passive income opportunities with its unique concepts around loans via liquidity pools and staking to verify transactions. Blockchain gaming leverages NFTs to enable players to earn rewards for their progress in video games, while others, such as artists, can use the technology to ensure they’ll always receive royalties from any future sale of their work.

For now, the crypto industry stands at a crucible moment. It’s facing major challenges around security, confidence and trust as a result of the never-ending hacks and the collapse of major exchange platforms like FTX. It’s down to those who participate in the crypto industry to overcome these challenges and reassure the world that the benefits outweigh the negatives.

To build a more prosperous future, crypto platforms have a moral and pragmatic duty to contribute to the ongoing research of the crypto industry. Thankfully, the industry is acutely aware of this responsibility, and representatives from the biggest exchange platforms to the smallest DeFi protocols are all contributing towards it.

Binance Research is a fantastic example of a crypto organization fulfilling this duty. With its research arm, Binance strives to provide in-depth information and studies on hundreds of different cryptocurrencies and their purpose, while its affiliated educational arm provides lessons to everyone from beginners to crypto experts. The main goal is to increase transparency and the accuracy of information in the crypto industry, and it’s doing an excellent job of achieving that.

In the area of DeFi, the leading decentralized exchange Uniswap is leading the way with its advanced research into concepts around the competitiveness of liquidity pools, and the ways DeFi can improve the foreign exchange markets.

A similar effort is being made by Kunji Finance, which is a unique protocol that aims to bring hedge fund-like asset management to the masses. Its research department has a wide area of focus, studying the potential dangers of the recent Curve Finance exploit to participants in that platform and providing regular analysis on the dynamics of crypto price movements.

Just as important is the role of more focused research organizations, such as Messari. Its research plays a pivotal role in helping businesses, institutional investors, crypto builders and compliance teams to understand the latest technology innovations, and the opportunities and risks that reside within the wider crypto economy.

Everyone Must Contribute

As the crypto economy evolves, we’ll see yet more innovative products and services emerge to disrupt the existing financial markets. At the same time, many of the leading players have shown an awareness of the importance of research, helping the industry to better understand the dynamics at play and implement superior risk mitigation strategies to protect users and investors.

The ongoing crypto community research is critical to the industry’s growth. If Crypto wants to fulfill its great aspiration of creating a fairer and more inclusive world that serves billions of users, everyone involved needs to pull their weight. This is well understood, and as the crypto economy continues to grow, so too will the combined efforts of the community to understand exactly how it can fit into the modern world.

0 notes

Text

Bitcoin hakkında neredeyse her gün yeni bir efsane ve haber çıkarken, dünyanın birinci kripto para ünitesi hakkında insanların inandıkları en büyük efsanelerin ve yanlış kanıların kimilerini incelemenin, bunların bir desteği olup olmadığını görmenin ve yanlışları düzeltmenin yeterli olacağını düşündük.Örneğin Bitcoin’in bedelinin “bir desteği olmadığını” yahut Bitcoin’in gerçek hayatta kullanılabilmek için fazla dalgalı olduğunu düşünüyorsanız bu kılavuz tam size göre!Bitcoin Efsaneleri1. Bitcoin Bir BalonBazı insanların büyük getiriler için spekülatif bir yatırım olarak Bitcoin satın aldığı yanlışsız olsa da bu durum, Bitcoin’in kendisinin balon olduğu manasına gelmez. Balonlar, piyasa bedelinde sürdürülemez yükselişlerle nitelenen ekonomik döngülerdir. Bu balonlar, yatırımcılar tarafından fiyatların varlığın temel bedelinden çok daha yüksek olduğunun fark edilmesiyle en son olarak patlar. Bitcoin efsane anlatılarında ortada sırada makus şöhretli eski bir spekülatif balonla karşılaştırılır: 17. yüzyılda Hollanda’da görülen “lale çılgınlığı”. 1637’de spekülatörler, birtakım lale çeşitlerinin fiyatlarının 26 kat artmasına neden oldu. Balon altı ay sürdü, çöküş yaşadı ve fiyatlar asla tekrar bu düzeylere çıkmadı.İşin aslına baktığımızda ise Bitcoin 12 yılı aşan bir müddet boyunca birçok fiyat döngüsünden geçti ve her seferinde yeni rekorlar kırmak üzere toparlanmayı bildi. Tüm yeni teknolojilerde olduğu üzere yükseliş ve düşüş döngüleri beklenir bir şeydir. Örneğin Amazon payı, doksanlardaki dot.com devrinin sonunda 100 dolar civarından, ani bir düşüşle 5 dolara kadar indi, fakat takip eden on yıllarda dünyadaki en bedelli şirketlerden biri haline geldi.Bazı önde gelen Bitcoin yatırımcıları, Bitcoin dalgalanmalarının genç piyasalara has bir model sergilediğine inanıyor. Onlara nazaran Bitcoin, gelecekte muhakkak bir noktada izafi bir istikrar yakalayana dek daha uzun bir müddet istikrarlı seyredip daha küçük dalgalanmalar yaşayacak ve ortada bir artıp düşecektir. Lakin bunun gerçekleşip gerçekleşmeyeceğini elbette ki sırf vakit gösterecek.2. Bitcoin’in Gerçek Hayatta Bir Kullanımı YokBitcoin’e eleştirel yaklaşanlar, onun gerçek dünyada kullanışlı olmadığını, bir kullanıma sahip olsa bile bunun çoğunlukla gayrimeşru aktiviteler için kullanışlı olduğunu sav ediyorlar. Meğer her iki söz de yanlıştır. Bitcoin, ortada bir banka yahut ödeme işleyicisi olmaksızın dünyadaki rastgele birine ödeme yapma aracı olarak uzun bir geçmişe sahiptir. Ayrıyeten değerli kurumsal yatırımcılar tarafından giderek artan ölçüde altın üzere enflasyona karşı muhafaza sağlayan bir varlık olarak da kullanılmaktadır.Efsanenin bilakis son yıllarda Bitcoin, altın üzere enflasyona dirençli bir paha deposu olarak giderek artan ölçüde tanınan hale geldi. O denli ki BTC, “dijital altın” olarak isimlendirilir oldu. Sayıları giderek artan belirli başlı fonlar ve halka açık şirketler (Tesla, Square, MicroStrategy), varlıklarını daha düzgün direktörün bir aracı olarak milyonlarca hatta milyarlarca dolar pahasında Bitcoin satın aldı.Tıpkı altın üzere Bitcoin de az bulunur bir varlıktır (Asla 21 milyondan fazla Bitcoin olmayacaktır). Altın elbette ağır ve hantaldır, üstelik taşıması ve depolaması zahmetlidir. Bitcoin ise buna karşılık bir e-posta gönderircesine kolay bir halde dijital olarak gönderilebilir.Bitcoin birinci yıllarında karanlık ağda bir ödeme aracı olarak kullanılmasıyla olumsuz bir ilgiyle karşılaştı. Lakin birinci karanlık ağ piyasası kapandıktan sırf birkaç gün sonra Bitcoin fiyatları yükseldi ve bunun akabinde yükselmeye devam etti.Paranın başka biçimlerinde olduğu üzere, Bitcoin’in bir kısmı da berbata kullanılacaktır. Fakat ABD dolarıyla karşılaştırıldığında Bitcoin’in gayrimeşru kullanımı devede kulaktır. Yakınlarda yayınlanan bir rapora nazaran, 2019’da Bitcoin süreç hacminin yüzde 2,1’lik bir kısmı kabahat örgütleriyle alakalıydı.Üstelik tüm Bitcoin süreçleri açık bir blokzinciri üzerinde gerçekleştiği için, yetkililerin gayrimeşru aktifliği izlemesi klâsik finansal sisteme nazaran ekseriyetle daha kolaydır.

3. Bitcoin Gerçek Bir Pahaya Sahip DeğilBitcoin’in altın üzere fizikî bir varlık tarafından desteklenmiyor olduğu doğrudur. Lakin birebiri ABD doları ve neredeyse öteki tüm prestiji para üniteleri için de geçerlidir. Bitcoin’in tükenebilir olması özelliği, direkt kodlarına yazılmıştır. Bu özelliği onu enflasyona karşı dirençli kılar. Prestiji para ünitelerinde ise büyük ölçülerde para basıldığında enflasyon ortaya çıkar ve var olan arzın kıymetini azaltır.Piyasada yalnızca 21 milyon BTC olacaktır. Bu kıtlık, Bitcoin’in kıymetinin gerisindeki büyük bir güçtür.Arzın sonlu olmasının yanı sıra, madencilikle çıkarılan yeni Bitcoin ölçüsü da iddia edilebilir bir halde vakitle azalmaktadır. Dört yılda bir, “yarılanma” denen bir süreç sonunda ağdaki madencilere ödenen blok mükafatları yarıya düşer.Bu, arzın ebediyen azalmasını sağlamaya yardımcı olur. Bu süreç, iktisadın temel kıtlık unsuru uyarınca, Bitcoin fiyatının uzun vadede genel olarak üst istikametli bir eğilim göstermesini sağlamıştır.Bitcoin’in kıymeti, ağdaki bilgisayarların madencilik denilen bir süreç aracılığıyla katkıda bulunduğu çalışmadan da kaynaklanmaktadır. Dünyanın dört bir yanındaki güçlü bilgisayarlar, her bir süreci doğrulama ve inanç altına alma işi için büyük ölçüde işlemci gücü sağlar (bunun karşılığında da yeni Bitcoin ile ödüllendirilirler).4. Öbür Bir Rakibi Bitcoin’in Yerini Kesinlikle AlacakBitcoin hakikaten muvaffakiyet yakalayan birinci dijital paradır. Yeni kripto para üniteleri uzun müddettir yeni özellikler yahut öteki avantajlar yoluyla Bitcoin’i geride bırakmayı vadetmiş olsa da hiçbiri bu gayeye yaklaşamamıştır.Geçtiğimiz on yılda binlerce rakip kripto para ünitesi ortaya çıkmış olsa da Bitcoin büyük bir farkla piyasa kıymeti bakımından daima en kıymetli kripto para ünitesi olmuştur.Ayrıca kripto piyasasının yüzde 60’ını tek başına oluşturan en tanınan kripto paradır. Bitcoin’in “ilk hamle” avantajı ve merkeziyetsiz, açık bir para ünitesi misyonunun saflığı bunun nedenleri ortasındadır. Bu, rakiplerin piyasaya girmesinin güzel karşılanmadığı manasına gelmez. Bitcoin merkezi bir otoritenin yerine madencilerden ve düğümlerden oluşan global bir topluluk tarafından işletilir.Örneğin Bitcoin’in temelini oluşturan mimarinin yeni fonksiyonlar, özellikler eklenmek yahut yeni keşfedilen bir yanılgıya karşı korunmak üzere değiştirilmesi gerekirse topluluk, ağı yükseltmek için bir fork başlatabilir.Yükseltmenin kabul edilmesi için topluluğun yüzde 51’lik çoğunluğunun değişimi desteklemesi gerekir. Bu özellik, Bitcoin’in şartlara gerektirdiği formda ahenk sağlamasına ve dönüşmesine imkan sağlar. 2017’de yapılan Bitcoin’in Segregated Witness (“SegWit” olarak kısaltılır, “Ayrılmış Tanık” manasına gelir) yükseltmesi buna bir örnektir.Yazılım açık kaynaklı olduğu için, toplulukla fikir birliği sağlayamayan geliştiriciler, Bitcoin blok zincirinin bir hard-fork’unu bile oluşturabilir ve büsbütün yeni bir kripto para ünitesi yaratabilir. Örneğin Bitcoin Cash bu halde ortaya çıktı. Fakat şimdiye kadar hiçbir Bitcoin kopyası, orijinalinin yerini almanın yanına bile yaklaşamadı.Elbette kripto dünyasında büyük yenilikler gerçekleşiyor. Bu yüzden daha büyük bir rakibin ortaya çıkması akla yatkın bir ihtimaldir. Fakat mevcut şartlar göz önüne alındığında birçok uzman, Bitcoin’in yakın vakitte yerini öteki bir kripto paraya bırakmasının olası olduğunu düşünmüyor.5. Bitcoin’e Yatırım Yapmak Bir KumarBitcoin’in son on yılda kayda kıymet fiyat dalgalanmaları yaşadığı yadsınamaz olsa da bu, genç ve gelişen bir piyasa için beklenen bir durumdur. Bitcoin, 2010’daki birinci blokundan bu yana istikrarlı bir halde uzun vadeli bedel kazandı. BTC olgunlaşmaya devam ettikçe dünyanın dört bir yanındaki ülkelerde bulunan sağlam düzenleyici yapı, bir kurumsal yatırım dalgasını çekmeye yardımcı oldu. (Tesla, risk fonları gibi)Bir Bitcoin efsane için yatırımcısının, elinde tuttuğu varlığın bedelinin artacağına inanması için temel bir münasebet vardır. Bir kumarhanede ise zarların kasa lehine hileli olduğunu bilirsiniz.

Elbette gelecekteki performansına yahut bu sonuçların devam edeceğine ait bir garanti yoktur lakin Bitcoin’in son on yıldaki uzun vadeli eğilim çizgisi üst istikametli olmuştur.Dalgalanmanın tesirini azaltmak için kullanılan tanınan yatırım stratejilerinden biri ortalama dolar maliyeti stratejisidir. Bu stratejide piyasanın ne yaptığına bakmaksızın her hafta yahut her ay sabit bir ölçü yatırım yaparsınız. Müspet bir eğilim çizgisinin hakim olduğu ortamda bu strateji, dalgalanma ne durumda olursa olsun çoklukla müspet getiriyle sonuçlanır.Bitcoin dalgalanması yavaşlama eğilimi gösteriyor üzere. Geçenlerde yapılan bir Bloomberg tahlili, Bitcoin’in yakın devirdeki boğa koşusunu 2017’deki yükseliş periyoduyla karşılaştırdı ve dalgalanmanın bu sefer değerli ölçüde daha düşük olduğunu buldu. Neden mi? Kurumsal iştirakçilerin yükselişi ve kripto paraların “ana akım hâline gelmesi”, eğilim üzerinde istikrar sağlayıcı bir tesire sahiptir.Bitcoin yahut rastgele öteki bir kripto para ünitesinin yatırım portföyünüzde yer alıp almaması ferdî şartlarınıza, risk toleransınıza ve yatırımın vaktine bağlıdır. Bitcoin, geçtiğimiz on yılda istikrarlı bir formda üst istikametli bir eğilim göstermiş olsa da azımsanmayacak aşağı taraflı döngülerden de geçti. Yatırımcılar dalgalı piyasalara girerken dikkatli olmalıdır (ve büyük çaplı yatırımlar yapmadan evvel bir finans danışmanı ile birlikte çalışmayı düşünmelidir).6. Bitcoin İnançlı DeğildirBitcoin ağı asla hacklenmemiştir. Açık kaynaklı kodu, sayısız güvenlik uzmanı ve bilgisayar bilimcisi tarafından dikkatle incelenmiştir. Bitcoin tıpkı vakitte ikili harcama sıkıntısını çözerek “güvene dayalı olmayan” eşler ortası para ünitelerini gerçek kılan birinci dijital paradır. Dahası tüm Bitcoin süreçleri geri alınamaz bir nitelik taşır.Bitcoin’in güvenliğine ait birçok yanlış niyet, ağın kendisine değil, Bitcoin’i kullanan üçüncü taraf işletme ve hizmetlerine yapılan akınlardan kaynaklanıyor. Kusurlu güvenlik prosedürlerine sahip erken periyot Bitcoin şirketlerinin çok gündeme getirilen hacklenme olayları (Japonya merkezli erken periyot borsası Mt. Gox’u gaye alan hacklenme olayı gibi) ve ortada sırada gerçekleşen data ihlalleri (cüzdan sağlayıcısı Ledger’ın kullanıcılarını etkileyen data ihlali gibi), kimi kullanıcıların başında Bitcoin’in güvenliğine ait soru işaretleri oluşturdu.BTC’nin merkez protokolü, 2009’da ortaya çıkışından bu yana yüzde 99,9 çalışma mühleti ile inançlı bir formda faaliyet göstermektedir.Çok büyük ölçüdeki bilgi süreç gücü, ağın güvenliğini sağlar. Üstelik ağa güç veren madenciler 100 ülkede bulunan düğümlerle dünyanın dört bir yanına dağılmıştır. Öbür bir deyişle kusurun oluşacağı tek bir nokta yoktur.Bitcoin Etrafa ZararlıdırBitcoin madenciliği gücü ağır bir süreçtir. Fakat çevresel tesirinin belirlenmesi zordur. Öncelikle dijital iktisadın tüm tarafları güç gerektirir. Global bankacılık sisteminin tamamını düşünüp hem banka süreçlerinin gerçekleştirilmesi hem de ofis binaları, ATM’ler, mahallî şubeler ve başka pek çok şey için gerekli olan enerjiyi gözünüzün önüne getirdiğinizde durum anlaşılır olacaktır.New York merkezli bir fon olan Ark Investment Management’ın yakınlarda gerçekleştirdiği bir araştırma, şu sonuca vardı:“Bitcoin, global ölçekteki klasik bankacılık ve altın madenciliğinden çok daha verimlidir.”Bitcoin madenciliğinin değerli bir kısmının gücü, yenilenebilir güç kaynaklarından (rüzgar, su ve güneş dahil) sağlanır. Cambridge Bitcoin Elektrik Tüketimi Endeksine nazaran gerçek sayı, yüzde 20 ile yüzde 70 üzeri ortasında dağılım gösterir.Cambridgeli araştırmacılar ise şu sonuca vardı:“Bitcoin’in çevresel ayak izi en uygun ihtimalle değersiz bir seviyede kalmaktadır.”Bitcoin madenciliğinin tabiatında olan ekonomik teşviklerin, sürdürülebilir güç konusundaki yeniliklerin desteklenmesine yardımcı olduğu savında bulunmak da mümkündür. Çünkü madenciler, yenilenebilir gücün süratle en ucuz seçenek haline geldiği bir dünyada, elektrik maliyetlerini daima düşürerek karlarını artırma peşindedir.

0 notes

Text

How To Choose The Suitable Business Model

Just because your family loves the sandwiches you make at home doesn't mean you should run to open a store to sell them. It would help if you considered many aspects before trying your luck as an entrepreneur.

Many reasons businesses fail include poor market fit, lack of marketing knowledge, financial problems, and lack of a well-defined plan or how the money will be made. Choosing the suitable business model for your product or service, you will add business listing that makes money while fulfilling a need and providing value to your customers.

What is a business model?

A business model is a plan that describes how your company will make money. But there is much more to it than simply stating how much you will charge for your product. Your business plan should answer these questions:

• Who is your target audience?

• How will you generate interest in your products and your brands?

• How will you continue to add value to keep customers engaged?

• How much will it cost you to supply your products?

The answers to these questions will define the model you will use to create and deliver value to your customers while also providing value to your company. A good business model can enable new companies to attract investors, recruit talented employees, and energize current management and staff.

But business models are not just for startups. Established companies use business models to keep up with or anticipate ever-changing market trends.

Different types of business models

Many different business models can be used for a wide variety of businesses. This means that you do not need to create your model from scratch. Someone else already took care of most of the work for you. Please choose the one that best suits your business and adapt it to your needs.

• Franchises

In this model, an established company gives you access to their proprietary business model with the processes, products, trademarks, and names that made them successful. You are typically charged an upfront fee and then have to pay royalties to continue profiting from the franchise name and products.

• Manufacturing

Manufacturers make products at their plants from raw materials. They sell their products directly to consumers or other businesses to sell to their customers. Any company that wholesales its products to other companies uses the manufacturing business model.

• Crowdsourcing

The term "crowdsourcing ", translated as "distributed open collaboration", combines the collective with outsourcing. In this model, individuals or organizations look to outside participants to support them with ideas, microtasks, voting, problem-solving, and finances. Crowdsourcing often uses websites to attract visitors who can accept tasks, submit ideas and solve problems to obtain a particular result.

• Advertising

This model is used by companies that make money by selling advertising space or time. Media organizations use an advertising business model to provide free content to consumers.

• Affiliate marketing

Individuals or companies using this model can earn money from commissions if they refer their online visitors to the products or services of a partner orally. Links on the site encourage visitors to purchase the products, and the affiliate receives a commission for each sale referred.

• Merchant/physical store This is the model most companies used until the dot.com explosion of the 1990s. Retailers, wholesalers, and manufacturers sell their products through a brick-and-mortar store or an office they own or rent.

#list your business#business listing site india#small business listings#list my business#add business listing

0 notes

Text

Session 1. What is Infocomm Law and How is it Relevant to Society Today

READ: ICTL TEXTBOOK CHAPTER 1

A. TRANSACTIONS - ICTL AND SOCIETY

What is ICTL: What is “information technology” and what is “communications technology”? What is the law relating to ICT?

Different Perspectives of ICTL: According to a leading textbook on the subject, the subject can be studied from two perspectives -

“[As] a set of discrete topics linked solely by virtue of their transient novelty and relationship to information technologies”, or

“[As] a set of topics that raises new political, social, and economic issues, and this requires consideration of appropriate legal and regulatory approaches to tackling them, outside of traditional legal paradigms.” *

What is your opinion on the above perspectives? What are the issues that can arise in relation to transactions and activities using information technology and in relation to electronic forms of communications?

Is it accurate to label an “IT lawyer” a “generalist” in law? Is it fair to make the assertion that “IT Law” is merely a “collection of legal areas that happen to touch upon IT”? *

* Diane Rowland et al, Information Technology Law (Routledge, 4ed, 2011) at p. 3

The Digital Society and Online Community: We live in an age where we do not need to physically leave home in order to interact and transact with one another. We can order food using a food delivery app, work from home through communication devices and functions, read the news and socially interact through social media platforms and be entertained through various streaming platforms. During the pandemic and In the ‘new normal’ of a world with covid-19 as endemic, ICT is becoming even more important as a safe way for human interaction as well as to conduct transactions and do business. However, although the virtual environment provides a lot of benefits and conveniences, the same technology can be abused and can cause negative effects on society and the individual.

Because of the four (or some say five) ‘V’s of Big Data, the way that we interact (communicate) and what and how we do so (information) have fundamentally changed giving rise to problems stemming from the sheer “volume”, “variety” and “velocity” of data that we have to selectively filter and process (or have it done for us), and the type of information and the manner that we consume it and how that affects our thoughts and values. One of the biggest challenges is the “veracity” of data as well as the bias in how it is being received or transmitted to us. Other issues include the increased surveillance and loss of privacy that the Internet of Things have given rise to as well as the trustworthiness and ethics of applying Artificial Intelligence in our lives.

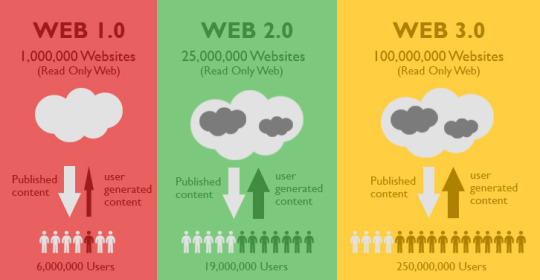

The Evolution of the World Wide Web: Consider the general understanding of Web 1.0 and Web 2.0. What were the fundamental changes and how have the law generally responded? What are the problems of regulating the Internet? What is Web 3.0 and is there a consistent understanding and meaning in the term? How do the buzzwords and catchphrases that have dominated ‘tech-talk’ in recent years (Big Data, Smart Contract, Blockchain, Cryptocurrency, IoT, A.I.) fit into the vision of the future of ICT? What further challenges will it pose to the lawyer and the regulator, and to law itself?

Class Discussion: Consider what areas of law are covered in the study of ICT Law relating to electronic transactions as well as any possible ‘new’ areas of law that have emerged or are emerging as a result of ICT developments. Take into account the socio-economic and cultural contexts and the regulatory aspects of the law as it has developed in response to the evolution of ICT, and in particular the “Internet society”.

Browse only:

Pew Research Internet Project Publications (Browse for a general understanding of the current and overall ICT issues, but note the U.S. slant to reporting; and see e.g., this article on Ethics and A.I. Design)

Lev Grossman, You – Yes, You – Are TIME’s Person of the Year (TIME Magazine, 25 December 2006) (How does this relate to Web 2.0 and what are the issues relating to the empowerment of the individual through the Internet Intermediaries?)

B. INTERMEDIARIES - ICTL AND THE ECONOMY

The Data Economy: What is the “data economy” and how does it relate to disruptions to business models and the development of new industries based on information as the core asset?

Disruptive Technology and the Impact of New Media: What is “disruptive technology” and how has such innovations affected the economic markets of the world? What are the differences and similarities between new markets and new business models in this context? What are the political, social and cultural impact of new media? For example, consider how social media has shaped the new political landscape and developments; how the configuration of search and newsfeed algorithms as well as I2B arrangements can shape the socio-cultural norms and thinking of a new generation; and how the debate over “net neutrality” is relevant to the same inquiry. Finally, what and where is the ‘push back’ from both the public and private sector to an otherwise free market to the development and use of such technologies and the operation of their developers and users?

Digital Economy and the New Dot.com: The digital economy can be compartmentalised into two categories of corporate entities -

The first set are the products and services sector that may pre-exist the Internet and WWW or that may have arisen because of it. These include bricks-and-mortar companies transitioning into online companies as well as new powerhouses performing much of the same function but on a greater scale and breadth, such as Amazon, eBay and Alibaba. It will also cover network access providers that provides the gateway to WWW accessibility, companies that innovate and provide both hardware and software for mobile access such as Apple and Samsung as well as related and often complementary services including app developers.

The second consists of content-non-generators that provide ‘free’ or subscription (or mixed) services tied to the storage and/or organisation of content (including cloud storage services like Dropbox and indexing/search engines like Google). Others include Facebook and Linkedin (social and professional networking platforms), news aggregation services (Google and Yahoo!), electronic mail and text transmission (Gmail and Twitter), Multi-media sharing services (YouTube and P2P), Blogging platforms (e.g. Tumblr) and new forms of B2B, B2C and C2C middlemen like Uber/Grab, AirBnB, Carousel, etc. (also called the “Sharing Economy” and the “Gig Economy”)

Governments and public organisations are increasingly providing public and non-profit services via ICT innovations as well.

The Internet Intermediary: What are “intermediaries” in the true sense of the word and how are intermediaries, which are often themselves organisations/corporations different from other organisations/corporations in the eyes of the law? What is the distinction based on? Why is the study of intermediaries law important? Are these facilitative or disruptive innovations (or both), and depending on whose perspective? What is an ‘owning’ versus a ‘sharing’ economy, or a traditional versus a data economy?

Class Discussion: Categorise “intermediaries” according to a set of factors that you consider relevant. Explain the reason for the categorisation and how, in your opinion, it is important to the issue of legal status and concomitant rights and liabilities. Second, factor in the diverse social, historical and cultural contexts within which these intermediaries operate; now, consider how the context can affect the way these intermediaries operate.

Browse:

OECD Publication: The Economic and Social Role of Internet Intermediaries (2010) [Browse for an idea of a type of categorisation of Internet intermediaries and related issues]

WIPO Studies: Internet Intermediaries and Creative Content [As above, but in the context of Intellectual Property]

Lev Grossman, Person of the Year 2010: Mark Zuckerberg (TIME Magazine, 15 December 2010) [How does this relate to Web 2.0 and what are the current (legal) problems facing Facebook and its ilk?]

Joshua Quittner, Person of the Year 1999: Jeff Bezos (TIME Magazine, 27 December 1999) [Consider the new and alternative business models to Amazon and the rise of Alibaba]

C. ARTIFICIAL INTELLIGENCE - AI AND THE REGULATOR

Artificial Intelligence, Ethics and Frameworks: Critically consider the analysis and recommendations made in the report on Applying Ethical Principles for Artificial Intelligence in Regulatory Reform, SAL Law Reform Committee, July 2020. Evaluate it against the Model AI Governance Framework from the IMDA. Take note of this even as we embark on the ‘tour’ of disparate ICT topics from Session 2 onwards, and its implications for each of those areas of law.

1 note

·

View note

Video

youtube

Shoshana Zuboff on surveillance capitalism | VPRO Documentary

Harvard professor Shoshana Zuboff wrote a monumental book about the new economic order that is alarming.

"The Age of Surveillance Capitalism," reveals how the biggest tech companies deal with our data. How do we regain control of our data?

What is surveillance capitalism? In this documentary, Zuboff takes the lid off Google and Facebook and reveals a merciless form of capitalism in which no natural resources, but the citizen itself, serves as a raw material.

How can citizens regain control of their data? It is 2000, and the dot.com crisis has caused deep wounds. How will startup Google survive the bursting of the internet bubble? Founders Larry Page and Sergey Brin don't know anymore how to turn the tide.

By chance, Google discovers that the "residual data" that people leave behind in their searches on the internet is very precious and tradable.

This residual data can be used to predict the behavior of the internet user. Internet advertisements can, therefore, be used in a very targeted and effective way. A completely new business model is born: "surveillance capitalism." Original title: De grote dataroof

5 notes

·

View notes

Text

Man I read a bit of Robert Mariani and I think he’s onto something about San Francisco but you keep reading and naw. We seem to be in a Moment of thinking there’s something wrong with SF, and as a cultural critic he’s got a decent eye and tongue so if he describes things with versimillitude and venom there’s a temptation to think of them as part of that, but if you look at the joints it doesn’t really connect to the Moment at all.

Like the points I see hit all the time are “with a strong tech sector and an imbalanced housing market, 200k/yr programmers are bidding everyone else out, the city’s growing monocultural and full of homeless who shit everywhere”, and he doesn’t hit any of that, his complaint is “as a young single with-it man in tech my social scenes are full of poly dorks who played Magic in high school when they should have been getting laid.”

And set aside the merits of the critique, and set aside that a big chunk of resentment is transparently displaced from himself and the world for not placing him in a deserved position above all this, and set aside that a big chunk of the rest comes from how they’re walking disproofs of the popular conservative trope that you can’t build a fulfilling human society on conditional connections and transactional value.

But if you’re serving up your critique in the form of a bitter aesthetic takedown of 2019 SF types, where’s the polar fleece finance guy? Where’s the shrill SJW? Where’s the fucking street-shitter? And on the other hand, what’s 2019 about your hate on flame shirt dorks, what does that have to do with the Moment? If you went back 10 years you’d run across the same guys, if you went back to the WIRED-reading Burning Man attendees of the ‘90s dot.com bubble you’d still run across them.

And zooming back, “people here mix their weirdo sexuality with their weirdo utopian philosophy and invest entirely too much of themselves in the combination”, like, okay, when’s the last time that wasn’t a well known, priced-in thing about San Francisco? Before both of us were born, at least. Complaining about airline food. Even the displacement concerns are about, like, the 40-year-old who can’t move here for the pet play community and support himself working at a hardware store anymore.

I guess part of why it really bugs me is that Portland getting rich, going tech, and turning crap has manifested in a noticeably reduced cultural prominence of sex freaks and awkward weirdos, so I know better than to treat this line of thought as usefully modeling “tech industry-driven urban development”, let alone “How We Live Now” or “late capitalism” or whatever.

(I suppose that makes sense, that if Portland is “a tech city, but lower cost of living/more space” – I’ve seen whole-house rental prices that locals called absurd gouging and Oakland expats called absurd steals – the tech workers who wanted the house/yard/white BMW SUV to drive the kids to soccer will selectively decant off to here, leaving SF to the polycular synthesis types. Honestly the change reminds me how original McMansion pioneers Toll Brothers built subdivisions around my hometown that drew New Jersey telecom and pharmaceutical types.)

23 notes

·

View notes

Text

Greatest Santa Monica Transferring Firm

Meet The Santa Monica Transferring Company

This easy step can occur in 3 seconds or you may spend days, weeks or months on a extra complicated plan. Regardless that I the place in my outdated home solely for 5 months. Movers Corp will make it easier to to search out and rent the most effective Santa Monica moving corporations and helpers comparable to packers and unpackers in addition to loaders and unloaders that may load and unload trucks, containers, trailers and PODS models. As a result, when you find an organization with a wealth of experience, you possibly can take that as an indication that they're doing something proper. I have all the time asserted that since the days of the “dot.com failures” of the last spherical of startups doing food ordering and meals supply that this isn't the enterprise most tech founders believe. Justin at SMMS was there point out that the company that would be doing the transfer was actually known as Excalibur Van Traces.

Free mattress covers, shrink wrap, tape, and Television packing containers

Modular Furniture Installation

10 years ago from California

2308 Schader Dr Santa Monica CA

santa monica movers

A+ Score with the higher Business Bureau

Fundamental value protection ($.60 per lb. per article)

Storage - Quick Term and Long term

There are number of glad customers who've posted their feedback. Lastly, we make sure that our companions have all licensing and insurance coverage as required by law. These refusers have all the time wanted low rents to survive and sought low cost, pre-gentrified hoods to subsidize their art-making and lifestyles. Our movers have plenty of follow and expertise that enable them to keep away from such dangers. Nonetheless these guys made the actual expertise not painful in any respect. You can request a quote by visiting the web site of Inside Moves Relocation. Effectively, we provide a complete range of services particularly geared towards making your Santa Monica relocation a less complicated process. Every year, we handle 1000's of residential moves of all sizes and requirements, offering price-efficient local, long distance and worldwide services with a commitment to excellence and buyer satisfaction. Each June through the Hollywood Fringe, the arts infiltrate the Hollywood neighborhood: totally geared up theaters, parks, clubs, churches, restaurants and different unexpected places host a whole lot of productions by native, nationwide, and worldwide arts companies and unbiased performers. Both method, you'll have quick access to town, as Interstates 10 and 405 and Highway 1 intersect right here and Los Angeles Worldwide Airport is just 14 miles from the town center.

After a drawn-out battle between Silicon Valley techies and city officials, Santa Monica accepted 4 e-scooter companies — Chook, Lime, Lyft and Uber — to operate in town, Curbed reported. Sadly, there are only a few women in the sector of entrepreneurs and Silicon Valley movers-and-shakers, so when a rockstar like Tammy enters the scene, let's simply say of us hear. The FAA couldn't contest this, because the numbers for closing it are there. That is no longer a situation the place our professionals are helping you. Maybe there are objects that you simply now not need or need that your folks or household would love. You may by no means know this till all of them get misplaced or they get damaged such that you may not use them. Emit cloak: The spinning society employed by you must ever use breathe wraps when packing weak objects suchlike objects prefabricated from porcelain, mirror and many others for relocation. 2. Use sandwich bags to retailer unfastened nuts, bolts, screws, and other small gadgets that you just want however are simply misplaced.

They did an unimaginable job fitting all of my things into 4 small pods. Whereas a small thing in comparison with different considerations on our checklist, the inclusion of shifting materials shows that the transferring company you rent cares about your enterprise. There is a typical saying amongst troopers who have seen reside motion: "In combat, a man's brains turn to water and run out their ears." I might say the same factor happens throughout a divorce, especially when children are involved! And final weekend my flip to rent movers has come. These minivan rentals come outfitted with automatic transmission, DVD participant, Tinted Home windows, Cruise Management, Energy Locks, Power Windows, Energy Steering and more. The attacker was in a full physique protection swimsuit so we could not harm him but he was coming at us utilizing full power and full speed. Use the tone you'd use when placing down his full meals dish. SITE SURVEYS AND Experienced MOVERS World Shifting & Storage Business Mover's employees conducts extensive site surveys, prior to the move, so we can cut down on "surprises" and become aware of any factors that may trigger an issue.

1 note

·

View note

Text

We are all SaaS Companies Now. - The Real Work Begins After the Sale.

There are now two types of businesses in the world, those who know that they are a SaaS business and those that do not know it yet. It is the message I have long been sending to the participants of the Owners Scaleup Program at IE Business School. If anything, the Coronavirus (COVID-19) pandemic has reinforced my view that this is the direction that all companies must go.

SaaS and me have a long history. Twenty years ago, at the height of the dot.com boom, I left the world of Management Consulting. Along with five others, we formed Marrakech, a SaaS solution for the back office problem of e-procurement. Seventy five million dollars in Venture Capital and over 250 employees later, the company was sold. Even people who worked there do not believe me when I sell them that the software they wrote still operates today. The lesson here is that a good SaaS solution can take a long time to reach its potential but once it does, it´s almost impossible to move.

Luigi Mallardo

So what is Software as a Service (SaaS) then? Here I turn to Luigi Mallardo, the Professor who teaches the classes on SaaS for the Owners Scaleup Program. The mistake, he tells me, is to think only about the technical implementation of running software in the cloud. Instead you need to think of SaaS as an mindset. It´s not so much what it takes to set up a SaaS platform but what having a SaaS platform enables you to do. You are not so much selling a product but instead creating a lifetime customer by delivering a superior experience. The real work begins after the sale.

One of my interests is adventure sports, specifically climbing mountains. I spend a completely indefensible amount of time reading the Gearguy on Outside magazine. Next year´s Arc'teryx hardshell jacket will be lighter! Are Lowe Alpine going to do a twenty five liter backpack without the annoying crossloop? These might mean nothing to weekend ramblers but to expedition climbers, the details are a very, very big deal. And once a new piece of kit comes out, the question arises as to the best place to get it? I drive my wife crazy with the amount of price watching I do at The North Face Outlet Store just outside Madrid.

But what if I decided that I would be Alex Honnold and only wear The North Face? What if TNF could be like Netflix whereby in exchange for paying them a monthly subscription, I got access to a superior experience beyond what was available to their retail customers? If I could engage with their product designers about what I liked and didn´t like, I could help design their future products. If I was prepared to give them some data on how I used their products, in time they would know what I needed before I did.

A good first question when I give a masterclass is “How did Warren Buffet make his money?” Everyone knows that he is a value investor but much less people know what sectors he has invested in. At least one of the answers is insurance. Buffett has said that had he not acquired an insurance business “Berkshire would be lucky to be worth half of what it is today.” And why? For the “predictable and recurring premiums”. The Sage of Omaha was into SaaS business models before there was even a cloud.

In almost every respect, the Irish retailer Primark has done what a Business School Professor would advise. Experiment until you find a formula then double down on that to the exclusion of everything else. This is what allows you to grow exponentially. When analysts pointed to the British online fashion and cosmetic retailer ASOS, Primark would point to the queues outside their stores on Europe´s major high streets. Then the Coronavirus (COVID-19) pandemic hit and all their stores had to close. Without any online channel, sales went from £650m per month to zero. Z-E-R-O.

Jason Lemkin

The scaling up phase of a business is what happens after you find a scalable and repeatable business model through experimentation. In particular, the benefits come from the tight integration of an ERP with your SaaS platform. It takes patience and time but the result is recurring revenue, low churn and high margins that grow every year. A great reference text for those new to this area is Aaron Ross and Jason Lemkin´s 2016 book From Impossible to Inevitable: How SaaS and Other Hyper-Growth Companies Create Predictable Revenue.

Jason likes to talk about the rise of the SaaS Decacorns, over 20 companies worth $5b or more. Here are their names: Salesforce $180bn, Shopify $90bn, ServiceNow $70bn, Zoom $48bn, Atlassian $45bn, Workday $40bn, Square $35bn, Veeva $30bn, Twilio $29bn, RingCentral $23bn, DocuSign $24bn, Okta $23bn, Datadog $22bn, Slack $17bn, CrowdStrike $17bn, Coupa $15bn, MongoDB $13bn, Wix $11bn, Dropbox $9bn, Cloudfare $9bn, Zendesk $9bn, Avalara $8bn, Hubspot $8bn, Five9 $7bn. And we are only getting started! The real benefits will come when the software world connects with the physical world. As with Apple, stores have a role to play in this as well.

Scott Galloway is a professor of marketing at the NYU Stern School of Business. You may know him from his twice weekly podcast with Kara Swisher on Vox, the weekly Prof G show or his new show No Mercy, No Malice on VICE TV. Scott likes to big up the “rundle” short for “recurring revenue bundle”. He argues that in truth consumers want LESS, not MORE choice in their busy lives. They are happy to go with one brand 99% of the time if they trust that brand will not let them down. It´s really an extension of Clay Christensen´s jobs-to-be-done methodology. In areas such as media, apparel, travel and health, we all want the “job” to be done for us. For a monthly fee and engagement via an app your FOMO disappears. Perhaps a rain jacket for another company is better, but no one was ever laughed at for wearing The North Face.

The more I checked in with the past participants of the Owners Scaleup Program, the more the challenges they were facing stayed the same. No predictable and recurring revenue, no real customer stickiness, no information on which to make product decisions about the future. I´m thinking in particular with one founder. Let´s call him Pierre (for that is his name). Pierre has been success at most things that he has done but he has never had to face anything like Coronavirus (COVID-19). The call started with a catchup but then the familiar issues emerged. As time ran out, he told me that the call had been very useful, when could we talk again? “Pierre, I love you man but I´m not in love with you. Call me when you are ready to admit to yourself that you are a SaaS company, until then you are just wasting my time.”

Professor Joe Haslam is the Executive Director of the Owners Scaleup Program at IE Business School. You can follow him on Twitter at @joehas

Read the article on the South Summit website here.

0 notes

Text

Session 1. Introduction to ICTL

READ: ICTL TEXTBOOK CHAPTER 1

A. TRANSACTIONS - ICTL AND SOCIETY

What is ICTL: What is “information technology” and what is “communications technology”? What is the law relating to ICT?

Different Perspectives of ICTL: According to a leading textbook on the subject, the subject can be studied from two perspectives -

“[As] a set of discrete topics linked solely by virtue of their transient novelty and relationship to information technologies”, or

“[As] a set of topics that raises new political, social, and economic issues, and this requires consideration of appropriate legal and regulatory approaches to tackling them, outside of traditional legal paradigms.” *

What is your opinion on the above perspectives? What are the issues that can arise in relation to transactions and activities using information technology and in relation to electronic forms of communications?

Is it accurate to label an “IT lawyer” a “generalist” in law? Is it fair to make the assertion that “IT Law” is merely a “collection of legal areas that happen to touch upon IT”? *

* Diane Rowland et al, Information Technology Law (Routledge, 4ed, 2011) at p. 3

The Digital Society and Online Community: We live in an age where we do not need to physically leave home in order to interact and transact with one another. We can order food using a food delivery app, work from home through communication devices and functions, read the news and socially interact through social media platforms and be entertained through various streaming platforms. In this pandemic environment and the ‘new normal’ of post-Covid world, ICT is becoming even more important as a safe way for human interaction as well as to conduct transactions and do business. However, although the virtual environment provides a lot of benefits and conveniences, the same technology can be abused and can cause negative effects on society and the individual.

Because of the four (and some say five) ‘V’s of Big Data, the way that we interact (communicate) and what and how we do so (information) have fundamentally changed giving rise to problems stemming from the sheer “volume”, “variety” and “velocity” of data that we have to selectively filter and process (or have it done for us), and the type of information and the manner that we consume it and how that affects our thoughts and values. One of the biggest challenges is the “veracity” of data as well as the bias in how it is being received or transmitted to us. Other issues include the increased surveillance and loss of privacy that the Internet of Things have given rise to as well as the trustworthiness and ethics of applying Artificial Intelligence in our lives.

The Evolution of the World Wide Web: Consider the general understanding of Web 1.0 and Web 2.0. What were the fundamental changes and how have the law generally responded? What are the problems of regulating the Internet? What is Web 3.0 and is there a consistent understanding and meaning in the term? How do the buzzwords and catchphrases that have dominated ‘tech-talk’ in recent years (Big Data, Smart Contract, Blockchain, Cryptocurrency, IoT, A.I.) fit into the vision of the future of ICT? What further challenges will it pose to the lawyer and the regulator, and to law itself?

Class Discussion: Consider what areas of law are covered in the study of ICT Law relating to electronic transactions as well as any possible ‘new’ areas of law that have emerged or are emerging as a result of ICT developments. Take into account the socio-economic and cultural contexts and the regulatory aspects of the law as it has developed in response to the evolution of ICT, and in particular the “Internet society”.

Browse:

Pew Research Internet Project Publications: See e.g. (1) The Web at 25 in the U.S. (2014); (2) Digital Life in 2025; (3) The Internet of Things Will Thrive by 2025 & Net Threats [browse for an overview of the issues, but note the U.S. slant to reporting]

Lev Grossman, You – Yes, You – Are TIME’s Person of the Year (TIME Magazine, 25 December 2006) [How does this relate to Web 2.0 and what are the issues relating to the empowerment of the individual through the Internet Intermediaries?]

B. INTERMEDIARIES - ICTL AND THE ECONOMY

The Data Economy: What is the “data economy” and how does it relate to disruptions to business models and the development of new industries based on information as the core asset?

Disruptive Technology and the Impact of New Media: What is “disruptive technology” and how has such innovations affected the economic markets of the world? What are the differences and similarities between new markets and new business models in this context? What are the political, social and cultural impact of new media? For example, consider how social media has shaped the new political landscape and developments; how the configuration of search and newsfeed algorithms as well as I2B arrangements can shape the socio-cultural norms and thinking of a new generation; and how the debate over “net neutrality” is relevant to the same inquiry. Finally, what and where is the ‘push back’ from both the public and private sector to an otherwise free market to the development and use of such technologies and the operation of their developers and users?

Digital Economy and the New Dot.com: The digital economy can be compartmentalised into two categories of corporate entities -

The first set are the products and services sector that may pre-exist the Internet and WWW or that may have arisen because of it. These include bricks-and-mortar companies transitioning into online companies as well as new powerhouses performing much of the same function but on a greater scale and breadth, such as Amazon, eBay and Alibaba. It will also cover network access providers that provides the gateway to WWW accessibility, companies that innovate and provide both hardware and software for mobile access such as Apple and Samsung as well as related and often complementary services including app developers.

The second consists of content-non-generators that provide ‘free’ or subscription (or mixed) services tied to the storage and/or organisation of content (including cloud storage services like Dropbox and indexing/search engines like Google). Others include Facebook and Linkedin (social and professional networking platforms), news aggregation services (Google and Yahoo!), electronic mail and text transmission (Gmail and Twitter), Multi-media sharing services (YouTube and P2P), Blogging platforms (e.g. Tumblr) and new forms of B2B, B2C and C2C middlemen like Uber/Grab, AirBnB, Carousel, etc. (also called the “Sharing Economy” and the “Gig Economy”)

Governments and public organisations are increasingly providing public and non-profit services via ICT innovations as well.

The Internet Intermediary: What are “intermediaries” in the true sense of the word and how are intermediaries, which are often themselves organisations/corporations different from other organisations/corporations in the eyes of the law? What is the distinction based on? Why is the study of intermediaries law important? Are these facilitative or disruptive innovations (or both), and depending on whose perspective? What is an ‘owning’ versus a ‘sharing’ economy, or a traditional versus a data economy?

Class Discussion: Categorise “intermediaries” according to a set of factors that you consider relevant. Explain the reason for the categorisation and how, in your opinion, it is important to the issue of legal status and concomitant rights and liabilities. Second, factor in the diverse social, historical and cultural contexts within which these intermediaries operate; now, consider how the context can affect the way these intermediaries operate.

Browse:

OECD Publication: The Economic and Social Role of Internet Intermediaries (2010) [Browse for an idea of a type of categorisation of Internet intermediaries and related issues]

WIPO Studies: Internet Intermediaries and Creative Content [As above, but in the context of Intellectual Property]

Lev Grossman, Person of the Year 2010: Mark Zuckerberg (TIME Magazine, 15 December 2010) [How does this relate to Web 2.0 and what are the current (legal) problems facing Facebook and its ilk?]

Joshua Quittner, Person of the Year 1999: Jeff Bezos (TIME Magazine, 27 December 1999) [Consider the new and alternative business models to Amazon and the rise of Alibaba]

C. ARTIFICIAL INTELLIGENCE - AI AND THE REGULATOR

Artificial Intelligence, Ethics and Frameworks: Critically consider the analysis and recommendations made in the report on Applying Ethical Principles for Artificial Intelligence in Regulatory Reform, SAL Law Reform Committee, July 2020. Evaluate it against the Model AI Governance Framework from the IMDA. Take note of this even as we embark on the ‘tour’ of disparate ICT topics from week 2 onwards, and its implications for each of those areas of law.

0 notes

Text

Begini Cara Berjualan Online Shop untuk Pemula

Berbicara tentang bisnis online ataupun offline, baik dalam hal fashion, makanan dan barang elektonik memang tidak akan pernah ada habisnya, sebab produk tersebut memang produk yang di butuhkan oleh setiap orang. Terutama bisnis online, bisnis ini memiliki peluang yang sangat besar bila kita menjalankanya dengan sungguh-sungguh.

Tapi untuk orang yang belum pernah memiliki pengalaman, mungkin akan merasa bingung bagaimana cara memulai bisnis online shop. Meskipun terlihat mudah, sebetulnya memulai bisnis online shop tidak semudah yang kita bayangkan. Diperlukan trik dan strategi tersendiri supaya online shop yang kita bangun bisa dikenal oleh banyak orang dan pastinya laris manis.

Untuk itu bagi anda yang ingin berencana membuka online shop, sebaiknya simak dulu Cara Berjualan Online Shop untuk Pemula berikut ini.

Tips dan Cara Berjualan Online Shop untuk Pemula

1. Memilih produk apa yang akan anda jual

Sebelum anda memikirkan lebih jauh tentang bagaimana caranya berjualan online, sebaiknya anda sudah tahu produk apa yang akan anda jual. Produk tersebut bisa berbentuk fisik atau juga digital.

Sebetulnya hampir semua jenis produk laku di jual meskipun ada beberapa barang yang lebih laku di pasaran. Barang-barang tersebut contohnya pakaian, jam tangan dan aksesoris, handphone dan laptop, produk elektronik rumah tangga, produk elektronik, makanan dan minuman, dll.

Baca Juga: Begini Tahapan Jualan yang Baik Agar Penjualan Kamu Meningkat

Bila anda masih bingung memilih produk apa yang sepertinya laris di pasaran anda anda bisa mengunjungi toko online ternama di Indonesia lalu lihat kategori produk yang banyak di jual disana. Setelah anda tahu produk apa yang akan anda jual maka sekarang saatnya anda menentukan di mana anda akan menjual produk tersebut.

2. Memanfaatkan Media Sosial untuk berjualan

Sebenarnya bila anda ingin menjadi seorang pedagang online yang sukses, anda harus memiliki toko online sendiri. Tapi cara ini memiliki kelemahan yakni anda memerlukan waktu yang lama agar bisa bersaing dengan toko online raksasa yang dimiliki oleh korporasi. Untuk itu anda bisa memanfaatkan media sosial untuk membangun online shop anda.

Media sosial adalah salah satu elemen yang saat cukup populer dalam masyarakat. Banyak fitur di dalamnya yang menghibur dan mempermudah kita dalam berkomunikasi.

Salah satu cara berjualan online yang paling ampuh adalah dengan menggunakan media sosial sebanyak mungkin dan memperluas jaringan pertemanan di media sosial sebanyak mungkin. Anda harus mengunggah produk anda secara rutin supaya media sosial bisnis Anda tidak akan sepi pengunjung.

Adapun contoh beberapa media sosial yang bisa anda gunakan untuk berjualan adalah Facebook. Untuk pebisnis online shop pemula, sangat disarankan untuk memaksimalkan pemanfaatn Facebook.

Facebook adalah salah satu medsos yang masih memiliki banyak sekali pengguna jadi cocok dijadikan tempat berjualan. Fungsinya berujualn di facebook adalah untuk meningkatkan brand awareness dan juga mendapatkan para pelanggan. Selain Facebook anda juga bisa memanfaatkan media sosial lainya seperti Twitter, Instagram, dan masih banyak lainya.

3. Jangan Spamming

Penggunaan sosial media sebagai media berjualan harus anda lakukan dengan benar dan bijaksana. Jangan sampai anda melakuakan spammingyang yang bisa membuat orang lain merasa kesal.

Hal ini bisa mengganggu pengguna lain dan bahkan anda bisa diblokir oleh mereka. Jika anda mengguanakan FB jangan sampai anda menandai teman-teman FB anda, sebab itu sangan mengganggu.

4. Cara Bijaksana

Sebaliknya gunakanlah cara yang bijaksana. Cara promosi memang sebaiknya harus begitu dan yang paling penting tidak mengganggu pengguana lainya. Caranya, anda bisa memilih dulu target market yang menurut anda benar-benar cocok, lalu giring merek ke Facebook saja dulu. Jika mereka sudah loyal, maka anda bisa menggiring mereka ke sosial media yang lainnya.

5. Informasi Harus Lengkap

Saat menjalankan bisnis online, Anda harus memberikan informasi tentang produk yang anda jual sebanyak-banyaknya. Hal ini dikarenakan para pelanggan tak bisa mencoba ataupun menyentuh produk tersebut.

Misalnya saja anda memiliki online shop yang khusus menjual baju, maka sebaiknya Anda menulis ukuran panjang baju, jenis bahan, lebar baju, serta detail baju tersbeut supaya pembeli takakan merasa tertipu saat memperoleh barangnya.

6. Gunakan foto dengan kualitas yang bagus

Foto merupakan kunci utama dalam berbisnis online. Foto yang memiliki kualitas buruk dapat membuat pembeli anda merasa kuramg nyaman, belum lagi dengan adanya perbedaan warna antara produk asli dan foto produknya.

Jangan sampai gara-gara foto produk yang tidak makslimal, konsumen Anda menganggap anda sebagai penipu karena menjual produk yang tidak sesuai dengan foto.

7. Usahakan untuk memakai model

Foto dengan memakai model akan terlihat lebih hidup, terutama utnuk online shop yang menjual produk fashion seperti pakaian. Dengan memakai model, pembeli bisa memperkirakan bagaimana produk tersebut terlihat ketikadikenakan . Selain itu, menggunaakn model yang sesuai dapat membuat produk anda terlihat lebih eklklusif dan juga menarik.

8. Buatlah Promo Menarik

Buatlah promo yang menarik. Contohnya anda bisa memberikan diskon, atau Voucher bila membeli produk di Online shop milik anda. Anda juga dapat melihat beberapa referensi agar bisa membandingkan harga yang anda buat dengan harga pasaran sekarangini.

Misalnya anda membandingkan harga produk yang anda tawarakan dengan produk yang sama di toko online lainya. Dalam menjual sesuatu, biasanya ada hal-hal yang dapat anda jual dengan harga yang rendah. Ini bisa anda manfaatkan untuk menarik perhatian pelanggan.

9. Membuat Blog Atau Website

Jika anda sudah mahir berjualan di Facebook dan media lainya, mungkin sudah saatnya anda melebarakan sayap dengan Membuat website atau blog. Jika anda memiliki website dengan tampilan yang menarik, maka akan meningkatkan kepercayaan konsumen yang membeli produk anda.

Membuat website juga tidak meembutuhkan banyak biaya, jika memiliki uang Rp 500.000,- itu sudah bisa anda gunakan untuk membuat website dot.Com. Tapi bila anda tidak mau mengeluarkan uang, maka anda bisa membuat blog.

Ini adalah salah satu cara berjualan online. Anda bisa menggunakan platform blog seperti blogger.com dan wordpress.com. Namun bila anda ingin terlihat profesional, sebaiknya buat website pribadi agar bisa lebih meyakinkan calon pembeli anda.

10. Promosikan Website Anda

Anda bisa menggunakan iklan gratisan ataupun sosial media untuk mempromosikan website anda. Contohnya saja Facebook, Instagram dan Twitter. Anda pun juga bisa melakukan promosi melalui Sosial Chatt dengan membuat BroadCast.

Baca Juga: Skill Dasar yang Harus Dimiliki Pengusaha

Tapi jangan membuat broadcast terlalu sering, sebab promosi anda bisa dianggap sebagai promosi sampah. Pada Iklan yang anda buat cantumkan juga nomor kontak dan nama website anda supaya calon pembeli anda mudah mengunjungi website anda.

Itulah beberapa Cara Berjualan Online Shop Untuk Pemula. Agar toko online yang anda bangun bisa sukses sebaiknya anda mengikuti cara-cara diatas. Dan jangan lupa juga untuk selalu konsisten dengan apa yang anda kerjakan dan tetap fokus, agar anda bisa berjualan dengan sukses.

0 notes

Text

The Beginning of the End of China

Hang folks, this could get messy:

A Failure of Leadership, Part III:

The Beginning of the End of China

By Peter Zeihan on May 15, 2020

The Chinese are intentionally torching their diplomatic relationships with the wider world. The question is why?

The short version is that China’s spasming belligerency is a sign not of confidence and strength, but instead insecurity and weakness. It is an exceedingly appropriate response to the pickle the Chinese find themselves in.

Some of these problems arose because of coronavirus, of course. Chinese trade has collapsed from both the supply and demand sides. In the first quarter of 2020 China experienced its first recession since the reinvention of the Chinese economy under Deng Xiaoping in 1979. Blame for this recession can be fully (and accurately) laid at the feet of China’s coronavirus epidemic. But in Q2 China’s recession is certain to continue because the virus’ spread worldwide means China’s export-led economy doesn’t have anyone to export to.

Nor are China’s recent economic problems limited to coronavirus. One of the first things someone living in a rapidly industrializing economy does once their standard of living increases is purchase a car, but car purchases in China started turning negative nearly two years before coronavirus reared its head.

Why the collapse even in what “should” be happening with the economy? It really comes down to China’s financial model. In the United States (and to a lesser degree, in most of the advanced world) money is an economic good. Something that has value in and of itself, and so it should be applied with a degree of forethought for how efficiently it can be mobilized. This is why banks require collateral and/or business plans before they’ll fund loans.

That’s totally not how it works in China. In China, money – capital, to be more technical – is considered a political good, and it only has value if it can be used to achieve political goals. Common concepts in the advanced world such as rates of return or profit margins simply don’t exist in China, especially for the state owned enterprises (of which there are many) and other favored corporate giants that act as pillars of the economy. Does this generate growth? Sure. Explosive growth? Absolutely. Provide anyone with a bottomless supply of zero (or even subzero) percent loans and of course they’ll be able to employ scads of people and produce tsunamis of products and wash away any and all competition.

This is why China’s economy didn’t slow despite sky-high commodity prices in the 2000s – bottomless lending means Chinese businesses are not price sensitive. This is why Chinese exporters were able to out-compete firms the world over in manufactured goods – bottomless lending enabled them to subsidize their sales. This is why Chinese firms have been able to take over entire industries such as cement and steel fabrication – bottomless lending means the Chinese don’t care about the costs of the inputs or the market conditions for the outputs. This is why the One Belt One Road program has been so far reaching – bottomless lending means the Chinese produce without regard for market, and so don’t get tweaky about dumping product globally, even in locales no one has ever felt the need to build road or rail links to. (I mean, come on, a rail line through a bunch of poor, nearly-marketless post-Soviet ‘Stans’ to dust-poor, absolutely-marketless Afghanistan? Seriously, what does the winner get?)

Investment decisions not driven by the concept of returns tend to add up. Conservatively, corporate debt in China is about 150% of GDP. That doesn’t count federal government debt, or provincial government debt, or local government debt. Nor does it involve the bond market, or non-standard borrowing such as LendingTree-like person-to-person programs, or shadow financing designed to evade even China’s hyper-lax financial regulatory authorities. It doesn’t even include US dollar-denominated debt that cropped up in those rare moments when Beijing took a few baby steps to address the debt issue and so firms sought funds from outside of China. With that sort of attitude towards capital, it shouldn’t come as much of a surprise that China’s stock markets are in essence gambling dens utterly disconnected from issues of supply and labor and markets and logistics and cashflow (and legality). Simply put, in China, debt levels simply are not perceived as an issue.

Until suddenly, catastrophically, they are.

As every country or sector or firm that has followed a similar growth-over-productivity model has discovered, throwing more and more money into the system generates less and less activity. China has undoubtedly past that point where the model generates reasonable outcomes. China’s economy roughly quadrupled in size since 2000, but its debt load has increased by a factor of twenty-four. Since the 2007-2009 financial crisis China has added something like 100% of GDP of new debt, for increasingly middling results.

But more important than high debt levels is that eventually, inevitably, economic reality forces a correction. If this correction happens soon enough, it only takes down a small sliver of the system (think Enron’s death). If the inefficiencies are allowed to fester and expand, they might take down a whole sector (think America’s dot.com bust in 2000). If the distortions get too large, they can spread to other sectors and trigger a broader recession (think America’s 2007 subprime-initiated financial crisis). If they become systemic they can bring down not only the economy, but the political system (think Indonesia’s 1998 government collapse).

It is worse than it sounds. The CCP has long presented the Chinese citizenry with a strict social contract: the CCP enjoys an absolute political monopoly in exchange for providing steadily increasing standards of living. That means no elections. That means no unsanctioned protests. That means never establishing an independent legal or court system which might challenge CCP whim. It means firmly and permanently defining “China’s” interests as those of the CCP.

It makes the system firm, but so very, very brittle. And it means that the CCP fears – reasonably and accurately – that when the piper arrives it will mean the fall of the Party. Knowing full well both that the model is unsustainable and that China’s incarnation of the model is already past the use-by date, the CCP has chosen not to reform the Chinese economy for fear of being consumed by its own population.

The only short-term patch is to quadruple down on the long-term debt-debt-debt strategy that the CCP already knows no longer works, a strategy it has already followed more aggressively and for longer than any country previous, both in absolute and relative terms. The top tier of the Chinese Communist Party (CCP) – and most certainly Xi himself – realize that means China’s inevitable “correction” will be far worse than anything that has happened in any recessionary period anywhere in the world in the past several decades.

And of course that’s not all. China faces plenty of other of issues that range from the strategically hobbling to the truly system-killing.

China suffers from both poor soils and a drought-and-floodprone climatic geography. Its farmers can only keep China fed by applying five times the inputs of the global norm. This only works with, you guessed it, bottomless financing. So when China’s financial model inevitably fails, the country won’t simply suffer a subprime-style collapse in ever subsector simultaneously, it will face famine.

The archipelagic nature of the East Asian geography fences China off from the wider world, making economic access to it impossible without the very specific American-maintained global security environment of the past few decades.

China’s navy is largely designed around capturing a very specific bit of this First Island Chain, the island of Formosa (aka the country of Taiwan, aka the “rebellious Chinese province”). Problem is, China’s cruise-missile-heavy, short-range navy is utterly incapable of protecting China’s global supply chains, making China’s export-led economic model questionable at best.

Nor is home consumption an option. Pushing four decades of the One Child Policy means China has not only gutted its population growth and made the transition to a consumption-led economy technically impossible, but has now gone so far to bring the entire concept of “China” into question in the long-term.

Honestly, this – all of this – only scratches the surface. For the long and the short of just how weak and, to be blunt, doomed China is, I refer you my new book, Disunited Nations. Chapters 2 through 4 break down what makes for successful powers, global and otherwise…and how China fails on a historically unprecedented scale on each and every measure.

But on with the story of the day:

These are the broader strategic and economic dislocations and fractures embedded in the Chinese system. That explains the “why” as to why the Chinese leadership is terrified of their future. But what about the “why now?” Why has Xi chosen this moment to institute a political lockdown? After all, none of these problems are new.

There are two explanations. First, exports in specific:

The One Child Policy means that China can never be a true consumption-led system, but China is hardly the only country facing that particular problem. The bulk of the world – ranging from Canada to Germany to Brazil to Japan to Korea to Iran to Italy – have experienced catastrophic baby busts at various times during the past half century. In nearly all cases, populations are no longer young, with many not even being middle-aged. For most of the developed world, mass retirement and complete consumption collapses aren’t simply inevitable, they’ll arrive within the next 48 months.

And that was before coronavirus gutted consumption on a global scale, presenting every export-oriented system with an existential crisis. Which means China, a country whose political functioning and social stability is predicated upon export-led growth, needs to find a new reason for the population to support the CCP’s very existence.

The second explanation for the “why now?” is the status of Chinese trade in general:

Remember way back when to the glossy time before coronavirus when the world was all tense about the Americans and Chinese launching off into a knock-down, drag-out trade war?

Back on January 15 everyone decided to take a breather. The Chinese committed to a rough doubling of imports of American products, plus efforts to tamp down rampant intellectual property theft and counterfeiting, in exchange for a mix of tariff suspensions and reductions. Announced with much fanfare, this “Phase I” deal was supposed to set the stage for a subsequent, far larger “Phase II” deal in which the Americans planned to convince the Chinese to fundamentally rework their regulatory, finance, legal and subsidy structures.

These are all things the Chinese never had any intention of carrying out. All the concessions the Americans imagined are wound up in China’s debt-binge model. Granting them would unleash such massive economic, financial and political instability that the survival of the CCP itself would be called into question.

Any deal between any American administration and Beijing is only possible if the American administration first forces the issue. Pre-Trump, the last American administration to so force the issue was the W Bush administration at the height of the EP3 spy plane incident in mid-2001. Despite his faults, Donald Trump deserves credit for being the first president in the years since to expend political capital to compel the Chinese to the table.

But there’s more to a deal than its negotiation. There is also enforcement. In the utter absence of rule of law, enforcement requires even, unrelenting pressure akin to what the Americans did to the Soviets with Cold War era nuclear disarmament policy. No US administration has ever had the sort of bandwidth required to police a trade deal with a large, non-market economy. There are simply too many constantly moving pieces. The current American administration is particularly ill-suited to the task. The Trump administration’s tendency to tweet out a big announcement and then move on to the next shiny object means the Chinese discarded their “commitments” with confidence on the day they were made.

Which means the Sino-American trade relationship was always going to collapse, and the United States and China were always going to fall into acrimony. Coronavirus did the world a favor (or disfavor based upon where you stand) in delaying the degradation. In February and March the Chinese were under COVID’s heel and it was perfectly reasonable to give Beijing extra time. In April it was the Americans’ turn to be distracted.