#internationalconstruction

Text

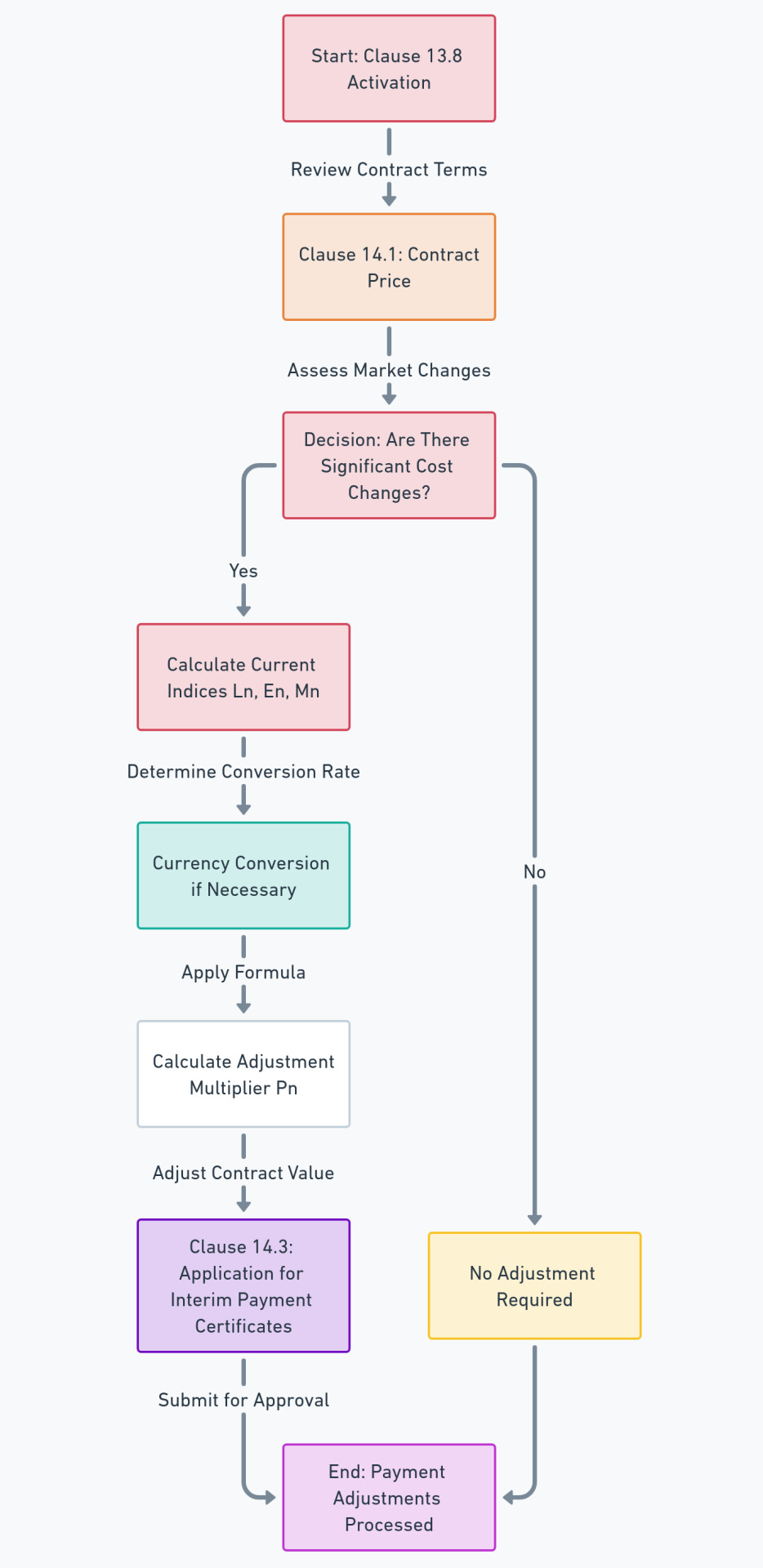

Clause 13.8 FIDIC Yellow Book 1999: Navigating Contract Price Adjustments

Overview of Clause 13.8 in FIDIC Yellow Book 1999 Clause 13.8 in the FIDIC Yellow Book 1999 is a critical provision that addresses the adjustments for changes in costs due to market fluctuations in labor, goods, and other inputs. This clause is essential for maintaining financial fairness and stability in construction contracts.

Key Elements of Clause 13.8

- Table of Adjustment Data: The foundation of this clause. Its absence negates the application of Clause 13.8.

- Adjustment Formula: Utilizes the formula Pn = a + bLn/Lo + cEn/Eo + dMn/Mo + …, where each variable represents different cost factors.

- Coefficients: 'a' is a fixed coefficient, while 'b', 'c', 'd' are variable coefficients linked to cost elements like labor and materials.

- Cost Indices/Reference Prices: These indices adjust the contract price in response to market changes.

- Provisional Index: Used for interim payments until the actual cost index is available.

- Completion Time Consideration: Adjustments after the Time for Completion are based on indices favorable to the Employer.

Implications and Practical Applications

- Protection Against Market Volatility: This clause is designed to protect contractors from unforeseen market changes.

- Ensuring Fair Compensation: It ensures that contractors are not financially disadvantaged due to cost fluctuations beyond their control.

- Budget Management: Helps in managing the project budget by accommodating cost variations.

Expert Perspective

- Vital for Long-Duration Projects: Its importance is amplified in long-term projects where market conditions can vary significantly.

- Need for Accurate Monitoring: Accurate monitoring of market indices is crucial for the correct application of this clause.

- Dispute Potential: Misinterpretations or disagreements over indices can lead to disputes, highlighting the need for clear definitions and reliable sources for cost indices.

Technical Standards and Building Codes in the US Context In the United States, where compliance with stringent building codes and environmental laws is mandatory, Clause 13.8's application is particularly relevant. Cost indices might need to factor in compliance costs, environmental standards adherence, and the availability of materials that meet specific codes.

Interpreting the Clause: "No Adjustment for Work Valued on the Basis of Cost or Current Prices" in FIDIC Yellow Book 1999

Meaning and Implications The phrase "No adjustment is to be applied to work valued on the basis of Cost or current prices" in Clause 13.8 of the FIDIC Yellow Book 1999 has specific implications:

- Definition of Cost-Based Work: This refers to work or components of the contract that are priced or valued based on the actual costs incurred or current market prices at the time of execution. It typically includes direct costs like labor, materials, equipment, and other expenses directly associated with the construction work.

- Exclusion from Price Adjustment: The clause explicitly states that any work valued on this cost basis is not subject to the price adjustment mechanisms outlined in Clause 13.8. This means that the contract price for these components will not be adjusted in response to changes in market conditions or cost indices.

Rationale Behind the Clause

- Simplicity and Fairness: Applying adjustments to costs already based on current or actual prices could lead to complexities and potential inequities. Since these costs reflect the market price at the time of procurement or execution, adjusting them again might result in double accounting for the same market fluctuation.

- Risk Allocation: This clause allocates the risk of cost fluctuation. For cost-based work, the risk is typically borne by the Employer, as the Contractor is reimbursed based on actual costs or current prices.

Practical Application in Construction Contracts

- Contractor's Perspective: Contractors need to carefully segregate work that is cost-based from other contract components to ensure accurate billing and avoid disputes.

- Employer's Consideration: Employers should be aware that for cost-based components, they bear the market risk, and these parts of the work will not benefit from the protective mechanism of price adjustments.

Expert Opinion

- Clarity in Contract Documentation: It is crucial to clearly define which parts of the work are valued on a cost basis to avoid ambiguity and potential disputes.

- Monitoring Market Trends: Both parties should closely monitor market trends for cost-based work to manage financial expectations and budgeting effectively.

Clarifying the Applicability of the Clause: "No Adjustment for Work Valued on the Basis of Cost or Current Prices"

- When the Clause Applies:

- Clause 13.8 is designed to adjust contract prices due to changes in costs like labor, materials, and other inputs.

- These adjustments are calculated using predefined formulae and are based on changes in cost indices or market conditions.

- Exclusion of Certain Work from Adjustments:

- The clause specifically excludes any work that is already valued based on the actual cost incurred or the current market prices at the time of execution.

- This means if a part of the work is priced directly based on what it costs at the time of purchase or implementation (like buying materials at current market rates), then these costs are not subject to further adjustments under Clause 13.8.

- Reason for Exclusion:

- The rationale is to avoid double accounting. Since these costs are already reflective of the market price at the time of procurement or execution, adjusting them again for market fluctuations would be redundant and potentially unfair.

- Determining Applicability:

- To determine whether Clause 13.8 applies to a specific portion of work, you need to assess how that work is valued in the contract.

- If the work is valued based on fixed rates or prices that were agreed upon at the time of contract signing (and not based on actual or current costs), then Clause 13.8's adjustments would apply to these parts.

- Conversely, if the work is valued based on actual costs incurred or current market prices at the time of execution, then Clause 13.8 does not apply to these parts.

Scenario: Construction of a Building

Imagine you are overseeing the construction of a building under a contract governed by the FIDIC Yellow Book 1999. The contract includes various types of work, each valued differently:

- Fixed Price Work: This includes tasks like architectural design, for which you have a fixed contract price agreed upon at the start of the project. This price was based on the market rates at the time of contract signing.

- Cost-Based Work: This involves purchasing materials like steel and concrete. The contract states that these materials will be paid for based on their actual cost at the time of purchase, reflecting current market prices.

Application of Clause 13.8:

- For Fixed Price Work: The price adjustment clause (Clause 13.8) applies here. Suppose there's a significant increase in labor costs due to market changes six months into the project. According to Clause 13.8, the contract price for the architectural design (fixed price work) would be adjusted to account for this increase in labor costs, using the formula provided in the clause.

- For Cost-Based Work: Now, let's consider the steel and concrete. Since their cost is based on current market prices at the time of purchase, any fluctuations in the market price of these materials are directly reflected in what you pay. Therefore, the clause stating "No adjustment is to be applied to work valued on the basis of Cost or current prices" comes into play. This means that even if the market price of steel and concrete rises or falls, you won't apply the Clause 13.8 adjustment formula to these costs, as they are already aligned with the current market prices.

Understanding the Context of Permanent Works

- Permanent Works: In the context of construction contracts, permanent works refer to the final output of the project, such as a completed rolling stock train in your example.

- Fixed Contract Price: Typically, the contract price for such permanent works is agreed upon at the outset of the project. This price is usually based on the cost estimates of various inputs (like steel) at the time of contract signing.

Impact of Steel Value Changes

- Cost Fluctuations: The value of steel, a key input material, can fluctuate due to market conditions. However, if the contract price for the rolling stock train is fixed, any subsequent changes in the steel price might not directly affect the agreed contract price.

- Clause 13.8 Relevance: The clause "No adjustment is to be applied to work valued on the basis of Cost or current prices" in FIDIC Yellow Book 1999 implies that if the work (like rolling stock train delivery) is valued at a fixed price, then fluctuations in input costs (like steel prices) post-contract signing do not lead to adjustments in the contract price.

Example for Clarity

- Scenario: Suppose you have a contract to deliver a rolling stock train at a fixed price of $10 million, based on the steel prices at the time of contract signing.

- Steel Price Rises: Midway through the project, the market price of steel rises significantly.

- Contract Price Impact: Despite this rise in steel prices, the contract price for the rolling stock train remains at $10 million. The clause in question means that the increased cost of steel does not lead to an adjustment in the fixed contract price for the train delivery.

Understanding Lump-Sum Contracts and Price Schedules

- Lump-Sum Contract: In a lump-sum contract, the contractor agrees to execute the work for a fixed price. This price is typically based on the contractor's estimate of costs for labor, materials, equipment, and other expenses necessary to complete the project.

- Price Schedule: The price schedule in such contracts often details the costs of various components of the work. It's filled out by the contractor during the bidding process and forms the basis for the lump-sum price.

Role and Need of Clause 13.8 in Lump-Sum Contracts

- Fixed Nature of Lump-Sum Contracts: The primary characteristic of a lump-sum contract is its fixed price nature. Once the contract price is agreed upon, it generally does not change, regardless of actual costs incurred by the contractor.

- Purpose of Clause 13.8: This clause is included to address situations where there are significant changes in the cost of labor, materials, and other inputs due to market fluctuations. It provides a mechanism for adjusting the contract price in response to these changes.

- Why It's Needed: Even in a lump-sum contract with a detailed price schedule, unforeseen economic factors (like inflation, market shortages, or significant changes in material costs) can impact the actual costs of executing the work. Clause 13.8 offers a way to equitably adjust the contract price to reflect these unforeseen changes, ensuring that the contractor is not unduly penalized or unfairly benefited by these market fluctuations.

Example for Better Understanding

- Scenario: Suppose a contractor agrees to a lump-sum contract of $5 million for a construction project, based on the current costs of steel, labor, and other inputs.

- Significant Market Change: Midway through the project, there's a significant increase in steel prices due to market conditions, which was not foreseeable at the time of contract signing.

- Application of Clause 13.8: In this case, Clause 13.8 allows for an adjustment to the contract price to account for the increased cost of steel, even though the original contract was a lump-sum based on a fixed price schedule.

Indian Example: Construction of a Highway Project

Scenario:

- A contractor enters into a lump-sum contract for constructing a highway in India at a fixed price of ₹100 crores. This price is based on the cost estimates for materials (like cement and steel), labor, and other inputs at the time of contract signing.

Significant Market Change:

- Six months into the project, India experiences a sharp increase in steel prices due to a combination of factors such as increased global demand, supply chain disruptions, and changes in import tariffs.

Impact on the Project:

- The sudden rise in steel prices significantly increases the cost of materials for the highway project. The contractor faces increased expenses that were not accounted for in the original lump-sum price.

Application of Clause 13.8:

- Under Clause 13.8, the contract allows for an adjustment to the fixed price in response to this unforeseen rise in steel prices.

- The clause provides a formula for calculating the adjustment, taking into account the increased costs and ensuring that the contractor is compensated for the additional expenses incurred due to the market change.

Relevance in the Indian Context:

- In India, where infrastructure projects often have long timelines, contractors are particularly vulnerable to market fluctuations.

- Implementing Clause 13.8 in such contracts provides a safety net against economic volatility, ensuring that contractors are not financially disadvantaged by unforeseen market changes.

This example demonstrates how Clause 13.8 can be relevant and beneficial in a lump-sum contract, especially in a dynamic economic environment like India, where market conditions can change significantly over the course of a project.

Understanding "Pn" in the Adjustment Formula:

- "Pn" Definition: "Pn" stands for the adjustment multiplier. It is a numerical factor used to adjust the contract value for the work carried out in a specific period, denoted as "n".

- Application Period: The period "n" typically represents a month. This means that the adjustment calculation is generally done on a monthly basis, unless the contract or the Appendix to Tender specifies a different time period.

- Role in Contract Value Adjustment: "Pn" is applied to the estimated contract value of the work completed in the specified period. It adjusts this value to reflect changes in costs due to market conditions or other factors outlined in the contract.

- Context of the Statement: This clause typically pertains to contracts where payments to the contractor are subject to adjustment based on various factors, such as inflation, currency fluctuations, or changes in cost indices. These adjustments are often calculated using predefined formulae.

- Meaning of the Clause:

- The clause indicates that the amount payable to the Contractor, as valued and certified in Payment Certificates, will be adjusted using specific formulae.

- These formulae are applied to each of the currencies in which the Contract Price is payable.

- Interpretation Regarding Multiple Currencies:

- Separate Application for Each Currency: The clause suggests that the adjustment formulae are to be applied separately for each currency involved in the contract. This means that if the Contract Price involves multiple currencies, each currency will have its own adjustment formula.

- Purpose of Separate Formulae: The reason for using separate formulae for different currencies is to accurately reflect the economic and financial changes specific to each currency. Factors like inflation, exchange rates, and cost indices can vary significantly from one currency to another.

- Application in Contracts:

- In a contract where payments are made in multiple currencies, this approach allows for precise and fair adjustments. For example, if a contract involves payments in both USD and EUR, the economic factors affecting each currency might differ, necessitating distinct formulae for each.

How "Pn" Works in Practice:

- Calculation: The value of "Pn" is calculated using the formula provided in Clause 13.8, which includes various coefficients and cost indices.

- Adjustment Process: Once "Pn" is calculated for a given period, it is applied to the value of the work completed in that period. This results in an adjusted contract value for that specific period.

- Monthly Review: Since "Pn" is typically calculated monthly, it allows for regular adjustments to the contract value, keeping pace with any changes in costs.

How is “Pn” Used?

- “Pn” is applied to the value of the work done in a specific time period. This period is usually a month (30 days), but it can be different if the contract specifies another duration in the Appendix to Tender.

- For example, if the contract states that the work done in January (one month) is worth $100,000, “Pn” will be used to adjust this amount to reflect current economic conditions.

Example for Clarity:

- Scenario: Consider a construction project with a contract value of ₹50 crores, scheduled to last 12 months.

- Monthly Adjustment: At the end of the first month, the contractor calculates "Pn" based on the current cost indices and other factors as per the contract. Suppose "Pn" for this month is calculated as 1.02.

- Application: The value of the work completed in the first month is then multiplied by 1.02, adjusting the contract value for that month to reflect the change in costs.

Detailed Understanding of "Pn" in the Adjustment Formula:

- What "Pn" Represents:

- "Pn" is the adjustment multiplier in the formula used for price adjustment.

- It is applied to the contract value of the work executed during a specific period, typically a month (period "n").

- Components of the Formula:

- The formula for "Pn" is generally expressed as Pn = a + bLn/Lo + cEn/Eo + dMn/Mo + …, where:

- "a" is a fixed coefficient representing the non-adjustable portion of the contract.

- "b", "c", "d", … are coefficients representing the proportion of cost elements (like labor, equipment, materials) in the contract.

- "Ln", "En", "Mn", … are current cost indices for these elements for period "n".

- "Lo", "Eo", "Mo", … are the base cost indices for these elements, set at the contract's base date.

- Calculating "Pn":

- To calculate "Pn", you first need the current and base cost indices for each element (labor, materials, etc.) and their respective coefficients.

- These indices reflect the current market prices and the prices at the contract's base date.

Example with Calculations:

Let's assume a construction project with the following parameters in its contract:

- Fixed coefficient (a)

Read the full article

#Clause13.8#ConstructionContracts#ConstructionLaw#ContractAdjustments#ContractManagement#CostIndices#EngineeringContracts#FIDICYellowBook#InternationalConstruction#PriceAdjustment

0 notes

Photo

Virginia USA welcomes Jemiclad. We are shipping our first of many more to come,, shipments of oyster white Jemiclad down to Henrico Virginia to be installed in another awesome hospital clinic upgrade. #Jemiclad #JemicladCanada1 #JemicladUSA #Pvccladding #HospitalLife #MedicalEquipment #MedicalEquipmentSupplier #Walk-inClinicUpgrades #Hygienic #WallProtection #WallCladding #CleanRoomDesign #CleanRoomConstruction #ClinicConstruction #DentalDesign #DentalConstruction #WelcomeToTheUSA #canadausa #InternationalTrade #InternationalConstruction #ArchitecturalDesign https://www.instagram.com/p/CSw_r90pJI7/?utm_medium=tumblr

#jemiclad#jemicladcanada1#jemicladusa#pvccladding#hospitallife#medicalequipment#medicalequipmentsupplier#walk#hygienic#wallprotection#wallcladding#cleanroomdesign#cleanroomconstruction#clinicconstruction#dentaldesign#dentalconstruction#welcometotheusa#canadausa#internationaltrade#internationalconstruction#architecturaldesign

0 notes