#internal audit in india

Text

Income Tax Audit in India

What is an Income Tax Audit?

Imagine an independent assessment of your organization's tax returns. That's essentially what an Income Tax Audit in India is. A Chartered Accountant (CA) examines your income, deductions, and overall financial records to ensure everything aligns with the Income Tax Act. Think of it as a financial health check to maintain transparency and accuracy.

Why is it Important?

Tax audits ensure a level playing field for businesses and organizations. They promote honest accounting practices by:

Verifying the accuracy of income and deductions: The CA confirms if your reported numbers match your actual financial activities.

Encouraging proper record-keeping: Audits motivate businesses to maintain detailed records, improving their financial management.

Preventing tax evasion: The audit process discourages any attempts to underreport income or overstate expenses.

Who Needs an Income Tax Audit in India?

Not everyone requires an audit. The rules are laid out in section 44AB of the Income Tax Act. Here's who needs to get their accounts audited:

Businesses with a turnover exceeding Rs. 1 crore: If your business crosses this threshold, an annual audit is mandatory.

Professionals with income above Rs. 50 lakhs: Doctors, lawyers, and other professionals earning more than Rs. 50 lakhs per year need an audit.

Taxpayers opting out of presumptive taxation: If you choose not to use the simplified presumptive taxation scheme, an audit becomes necessary.

Specific situations outlined in Sections 44AD, 44AE, and 44BBB: These sections involve calculating income based on estimates. If your actual income deviates significantly, an audit might be required.

How Does it Work?

Here's the basic flow of an Income Tax Audit in India:

Hire a Chartered Accountant: Find a qualified CA experienced in tax audits.

Provide necessary documents: Share your financial records, including invoices, bank statements, and accounting ledgers.

The CA conducts the audit: They analyze your records, ask questions, and verify your information.

Audit report submission: The CA submits a detailed report highlighting their findings and observations.

You approve the report: Once you review and agree with the report, your CA electronically files it with the Income Tax Department.

Penalties for Non-Compliance:

Skipping an audit when mandated can lead to penalties. These can be a fixed amount (like Rs. 1,50,000) or a percentage of your turnover (capped at 0.5%). Don't let that happen!

Remember:

An Income Tax Audit in India is crucial for transparency and compliance.

If you fall under the audit requirement, be proactive and start the process well in advance.

Choosing a qualified and experienced CA ensures a smooth and efficient audit experience.

#internal audit in india#usaid audit in india#best due diligence services in india#best usaid audit in india#due diligence services in india#income tax audit in india#transfer pricing audit services in india#architecture#celebrities

2 notes

·

View notes

Link

The Internal Auditing Consulting Service in India is then used as a tool foranalyzing, evaluating, and ensuring the credibility of the information to be disclosed.

The profession of the internal auditor has evolved every day and with this evolution, the valuation with the corporate directors, who considering the complexity of the business and the increasingly changing transactions, seek the help of this team of professionals to ensure compliance with standards.

0 notes

Text

Can Blockchain Technology replace Chartered Accountants?

Auditing is undergoing a seismic shift, largely driven by the relentless march of blockchain technology. Blockchain technology is not replacing auditors; it’s empowering chartered accountants. The future of audit lies in a collaborative approach. Technology like blockchain handles tedious tasks like reconciliation through secure, shared ledgers. This frees up CAs from the time-consuming task of ensuring data accuracy, allowing them to focus on higher-level analysis and providing valuable insights that directly impact client decision-making.

This powerful synergy between Chartered Accountants and blockchain technology unlocks a new era of auditing:

⏩Enhanced Efficiency: Streamlined processes through automated tasks like reconciliation free up valuable Chartered Accountant time. This translates to faster audits and reduced costs for both CAs and their clients.

⏩Effective Risk Management: Real-time access to secure blockchain data allows for continuous auditing. This empowers Chartered Accountants to identify potential issues early on, enabling proactive risk management for clients.

⏩Perceptive Analysis: Chartered Accountants leverage their expertise to interpret the vast amounts of secure data generated by blockchain. This deeper financial health insight empowers them to provide clients with more perceptive analysis and strategic guidance.

This collaborative approach ultimately strengthens trust and transparency in the financial markets. Ready to Lead the Audit Revolution? Learn how Blockchain Empowers Chartered Accountants

#blockchain#technology#artificial intelligence#machine learning#chartered accountants#software#trending#bank audit#internal audit#india#finance

0 notes

Text

What is an APQP Checklist?

An Advanced Product Quality Planning (APQP) checklist is a vital tool used in various industries to ensure the systematic development of products and processes. It serves as a comprehensive guide to managing quality throughout the product lifecycle, from initial design to production and beyond.

Importance of APQP in Quality Management

APQP plays a crucial role in maintaining product quality and customer satisfaction. By following a structured approach outlined in the checklist, organizations can:

Ensure Product Quality: APQP helps in identifying potential risks and quality issues early in the product development stage, allowing for timely mitigation measures.

Reduce Defects and Rework: Through thorough planning and risk assessment, APQP aims to minimize defects and rework, thereby reducing overall production costs.

Understanding the APQP Checklist

An APQP checklist is a document that outlines the necessary steps and requirements for implementing APQP processes effectively. It typically includes:

Definition: A clear definition of APQP and its objectives.

Components of the Checklist: Sections covering various aspects such as planning, design, process validation, and production.

Benefits of Using an APQP Checklist

The utilization of an APQP checklist offers several benefits, including:

Streamlining Processes: By following a structured approach, organizations can streamline their product development and manufacturing processes.

Enhancing Communication: The checklist facilitates effective communication among cross-functional teams, ensuring everyone is aligned with project requirements.

Facilitating Risk Management: APQP checklist helps in identifying and mitigating risks early in the product lifecycle, reducing the likelihood of costly failures.

How to Develop an Effective APQP Checklist

Developing an effective APQP checklist involves several key steps:

Gathering Relevant Information: Collecting necessary data and information related to product requirements, customer expectations, and regulatory standards.

Involving Cross-Functional Teams: Engaging representatives from various departments to ensure comprehensive input and buy-in.

Establishing Clear Criteria and Metrics: Defining specific criteria and metrics for evaluating product quality and process performance.

Implementing the APQP Checklist in Different Industries

APQP principles can be applied across various industries, including:

Automotive Sector: APQP is widely used in the automotive industry to ensure the quality and safety of vehicles.

Aerospace Industry: Aerospace companies utilize APQP to meet stringent regulatory requirements and ensure the reliability of aircraft components.

Healthcare Sector: In healthcare, APQP helps in developing safe and effective medical devices and pharmaceutical products.

Common Mistakes to Avoid When Using APQP Checklist

While APQP checklist offers numerous benefits, organizations must avoid common pitfalls such as:

Lack of Stakeholder Involvement: Failure to involve key stakeholders from different departments can lead to oversight and suboptimal outcomes.

Failure to Update the Checklist Regularly: An outdated checklist may not reflect current industry standards or regulatory requirements, compromising its effectiveness.

Ignoring Feedback and Improvement Opportunities: Organizations should actively seek feedback from users and stakeholders to identify areas for improvement and refinement.

Examples of APQP Checklist Templates

There are various APQP checklist templates available, ranging from basic to advanced, tailored to specific industry requirements.

Basic Checklist Template: Includes essential steps and requirements for implementing APQP processes.

Advanced Checklist Template: Incorporates additional features such as risk assessment matrices and validation protocols.

Tips for Maximizing the Effectiveness of APQP Checklist

To derive maximum benefit from APQP checklist, organizations should:

Provide Adequate Training: Ensure that employees are trained in APQP principles and understand how to use the checklist effectively.

Regular Audits and Reviews: Conduct periodic audits and reviews to assess compliance with APQP processes and identify areas for improvement.

Continuous Improvement Initiatives: Encourage a culture of continuous improvement, where feedback is solicited, and lessons learned are applied to enhance processes.

Case Studies: Successful Implementation of APQP Checklist

Several organizations have successfully implemented APQP checklist, resulting in improved product quality and customer satisfaction.

Future Trends in APQP Checklist Development

As technology advances and industry requirements evolve, APQP checklist development is expected to incorporate:

Integration with Digital Tools: Increasing integration with digital tools and software platforms to streamline APQP processes and enhance collaboration.

Emphasis on Sustainability: Incorporating sustainability criteria and metrics into APQP checklist to address growing environmental concerns.

Conclusion

In conclusion, an APQP checklist is a valuable tool for organizations seeking to ensure product quality, minimize risks, and enhance customer satisfaction. By following a structured approach outlined in the checklist, businesses can streamline their product development processes and stay competitive in today's dynamic market.

FAQs

What is the role of APQP in quality management?

APQP plays a crucial role in maintaining product quality by identifying potential risks and quality issues early in the product development stage.

How can organizations develop an effective APQP checklist?

Developing an effective APQP checklist involves steps such as gathering relevant information, involving cross-functional teams, and establishing clear criteria and metrics.

In which industries is APQP commonly used?

APQP principles can be applied across various industries, including automotive, aerospace, and healthcare sectors.

What are some common mistakes to avoid when using an APQP checklist?

Common mistakes include lack of stakeholder involvement, failure to update the checklist regularly, and ignoring feedback and improvement opportunities.

How can organizations maximize the effectiveness of APQP checklist?

Organizations can maximize effectiveness by providing adequate training, conducting regular audits and reviews, and fostering a culture of continuous improvement.

#Software Development India#Software Company Chennai#Best Software Product Companies in Chennai#Software Service Providers in Chennai#software companies in Anna Nagar Chennai#APQP Software#ppap software#dms software#best document manager software#internal audit software#coq software#spc software#msa software#fmea software#ccm software#gcs software#vqms software#sqms software.

0 notes

Text

Mastering Withholding Tax in India: HCO & Co.

At HCO & Co., we provide expert withholding tax compliance services tailored to meet the needs of businesses operating in India. With our comprehensive understanding of Indian tax laws and regulations, we ensure that your withholding tax obligations are met efficiently and accurately.

Our team of experienced professionals specializes in navigating the complexities of Wtihholding Tax in India, helping you stay compliant while minimizing tax liabilities. Whether you're a multinational corporation or a small-to-medium-sized enterprise, we offer personalized solutions to suit your specific circumstances.

Our withholding tax services include:

Compliance Assessment: We conduct thorough reviews of your business operations to determine Wtihholding Tax in India obligations applicable to your transactions and payments.

Tax Planning: We develop customized strategies to optimize your withholding tax position, ensuring compliance with Indian tax laws while maximizing tax efficiency.

Preparation and Filing: Our experts handle the preparation and filing of withholding tax returns, ensuring timely submission and accuracy to avoid penalties and fines.

Advisory Services: We provide ongoing advisory support, keeping you informed of changes in withholding tax regulations and helping you adapt your tax strategy accordingly.

Representation: In the event of audits or inquiries from tax authorities, we represent your interests and assist in resolving any issues related to withholding tax compliance.

At HCO & Co., we prioritize client satisfaction and strive to deliver high-quality services that add value to your business. Trust us to handle your withholding tax compliance needs with professionalism, integrity, and expertise.

Contact us today to learn more about how HCO & Co. can support your business's withholding tax requirements in India.

Click here for more information: www.hcoca.com/understanding-the-concept-and-how-to-claim-to-withholding-tax-in-india.aspx

#tax consultant services#best ca firms in india#best ca firms in India#Accounting companies in india#Audit and Assurances services#best internal audit firms

0 notes

Text

Embrace Your Journey: Mrs India Auditions 2024 Now Open for Entrants

Ladies, it's time to embark on a transformative journey that celebrates grace, intellect, and empowerment—Mrs India 2024 Auditions are officially open, inviting you to be a part of a remarkable experience. In this blog, we explore the exciting prospect of joining Mrs India 2024 Auditions, the prestige of Mrs India International, and the allure of the coveted Mrs India Prize Money.

Mrs India 2024 Auditions: A Gateway to Empowerment

1. Celebrating Womanhood and Achievements

Mrs India Auditions 2024 are not just about showcasing outer beauty; they are a platform to celebrate the multifaceted achievements, talents, and aspirations of married women. It's an opportunity to embrace your journey, share your story, and inspire others with your unique narrative.

2. Empowerment Through Diversity

Mrs India embraces diversity, breaking stereotypes and fostering a community that appreciates the uniqueness of every woman. The auditions provide a stage for women from various walks of life, backgrounds, and ages to come together, share experiences, and contribute to the collective empowerment of women.

Mrs India International: A Global Stage for Elegance

1. Global Recognition and Sisterhood

Mrs India International extends the platform beyond national borders, offering a global stage where elegance, poise, and intellect converge. As a participant, you become a representative not only of your nation but also a part of a sisterhood that transcends cultural boundaries.

2. Networking and Growth Opportunities

Participating in Mrs India International opens doors to unparalleled networking opportunities. It's not just a pageant; it's a journey that can lead to personal and professional growth. Engage with like-minded women, build lasting connections, and explore avenues for self-improvement and empowerment.

Mrs India Prize Money: A Token of Recognition

1. Rewarding Excellence and Accomplishments

The allure of Mrs India Prize Money adds an extra layer of excitement to the journey. It's a token of recognition for the excellence, dedication, and accomplishments of the participants. Beyond the monetary aspect, it symbolizes the value placed on the efforts and contributions of every participant.

2. Investing in Personal and Social Causes

Mrs India Prize Money isn't just a personal reward; it's a potential investment in personal or social causes that matter to you. Whether it's supporting a charitable initiative, pursuing further education, or contributing to a community project, the prize money can be a catalyst for positive change.

Conclusion: Embrace the Opportunity

In conclusion, Mrs India Auditions 2024 beckon you to embrace the opportunity to stand tall, express your individuality, and contribute to a community of empowered women. Whether you aspire to participate on a national or international level, the journey promises personal growth, meaningful connections, and the chance to be a part of something extraordinary.

So, seize the moment—be a part of Mrs India Auditions 2024 today and step into a world where your elegance, achievements, and dreams take center stage. It's not just a pageant; it's a celebration of you, your journey, and the limitless possibilities that await. Embrace the opportunity, and let your radiance shine!

For Original Post Content: - https://www.pdfstudyhub.com/2024/01/embrace-your-journey-mrs-india-auditions-2024-now-open-for-entrants.html

0 notes

Text

The Value of an Internal Audit in an Organization

Auditing services in India play a pivotal role in assisting businesses to maintain their transparency, integrity, and accountability. Through their auditing services, companies aim to improve their business operations. An internal audit is a systematic process to check and improve the effectiveness of the internal control and governance process of the company.

Internal auditors are skilled individuals who specialize in financial, operational, and compliance-related matters and are responsible for conducting independent assessments of the organization. For a better understanding of the role of internal auditors, let us understand the importance of Internal Audit in an organization-

Enhancing Risk Management: Risk is an inherent aspect of any business venture that cannot be ignored. Identifying and managing these risks beforehand is vital for an organization's survival and growth. Internal auditors possess the expertise to assess risks across various aspects of the business, including financial, operational, compliance, and strategic risks. By conducting thorough risk assessments, they help management understand potential threats and develop robust risk mitigation strategies. This proactive approach allows organizations to respond promptly to emerging risks, thereby safeguarding their assets and reputation.

Strengthening Internal Controls: Effective internal controls are essential for a well-governed organization. They ensure that processes are efficient, reliable, and compliant with regulations. Internal auditors critically evaluate the design and implementation of internal controls, identifying weaknesses or gaps that could expose the organization to fraud or errors. Through their evaluations, they assist management in enhancing internal controls and making processes more secure and transparent.

Ensuring Compliance: In a highly regulated business environment, compliance is non-negotiable. Failure to adhere to relevant laws and regulations can result in severe consequences that result in financial penalties and reputational damage. Internal auditors regularly review the organization's compliance with laws, policies, and industry standards. They act as a safeguard, providing assurance that the organization meets its legal obligations minimizing the risk of non-compliance.

Uncovering Inefficiencies: As organizations grow, inefficiencies may be generated in their processes. This may hinder productivity and overall performance.

Internal auditors conduct operational audits to assess the effectiveness and efficiency of various functions within the organization. By identifying inefficiencies and recommending process improvements, they help streamline operations and optimize resource utilization.

Providing Objective Insights: Internal auditors maintain independence from the processes and functions they audit. This objectivity enables them to offer unbiased and impartial insights into the organization's operations. Management can rely on internal auditors' assessments to gain a fresh perspective on critical matters, enabling them to make better-informed decisions.

Safeguarding Assets and Reputation: Organizations invest significant resources in their assets, both tangible and intangible. Internal auditors evaluate the safeguarding of these assets, reducing the risk of theft, misuse, or misappropriation. Additionally, Internal auditors ensure compliance with ethical standards and best practices and contribute to protecting the organization's reputation.

Promoting Accountability and Transparency: Transparency is vital for building trust among stakeholders, including investors, customers, and employees. Internal audit fosters transparency by providing an objective evaluation of the organization's activities, financial reporting, and adherence to policies. This transparency helps demonstrate the organization's commitment to accountability and ethical conduct.

Internal audit is essential to identify opportunities for improvement. Through their audits, internal auditors offer valuable feedback to management to make changes that help them ensure continuous improvement across the organization. Overall, Internal audit plays a significant role and adds value to the organization. With a vast experience in offering top-notch Auditing Services in India, we at Z-mas understand the indispensable role that internal audit services play in enhancing organizational efficiency, mitigating risks, and fostering a culture of transparency and accountability. Through our experience as one of the leading Audit Firms in India, we have witnessed the transformative impact of a well-executed internal audit. By conducting comprehensive and independent assessments, our dedicated team at Zmas assists organizations in identifying areas of improvement, streamlining processes, and fortifying internal controls. If you also want to secure your business by exploring the benefits of Internal Auditing services in India, contact Zmas and schedule an appointment with us.

#Internal Auditing Services#Internal Audit Services#Auditing Services In India#Audit Firms In Mumbai

0 notes

Text

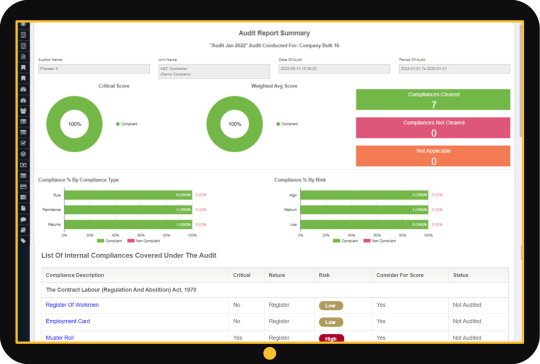

Internal Audit Management Software — Simpliance Audit Module

Simpliance Internal Audit Management Software is flexible to suit all your organization’s audit requirements. The tool can be tailored and customized as per multiple audit engagements and is simple and effective in implementation.

Simpliance helps businesses reduce costs and enhances overall productivity for both the organization as well as the auditor. Ranging from financial audits (as per the international accounting standards), assets audit to ISO audits, the Internal Audit Management application scope manages the auditing end-to-end. Detailed auditing reports with simplified work-paper management and risk-based auditing processes help businesses meet specific audit requirements in the most efficient method.

Request a FREE DEMO now!

#internal auditing#labour law audit#auditsoftware#labour law compliance#labour laws in india#labourlawcompliance#automated audit#auditing tools

0 notes

Text

International tax services can be a valuable resource for businesses operating in multiple countries, as they can help ensure compliance with complex tax laws, minimize tax liabilities, and manage risks associated with cross-border transactions.

IPPC Group will provide expert guidance on issues such as transfer pricing, cross-border tax planning, and foreign tax credits. Don't let international tax compliance issues hinder your business growth - contact our experienced professionals today to learn how we can help you navigate the complexities of international tax laws and regulations.

We are here to help you:

Email - [email protected]

Website - www.ippcgroup.com

#internationaltaxservices#taxservices#globaltaxplanning#crossbordertax#foreigntaxcredits#transferpricing#taxcompliance#internationalaccounting

#taxplanning#CAfirm#businessadvisoryservices#taxconsultancy#financialservices

#internationalbusiness#taxliabilities#corporatetaxation#tax#ippcgroup#ca

0 notes

Link

As a business owner, you comprehend the importance of having accurate financial statements. You also know that keeping track of your finances and ensuring everything is in order can be challenging. This is where an auditor can help.

An auditor is a professional who reviews your financial statements and assesses your compliance with laws and regulations. An auditor in Chennai can provide valuable insights into your business operations and help you identify areas of improvement.

While you are not required by law to have an audit, there are many benefits to working with an auditor. An audit can give you peace of mind knowing that your financial statements are accurate and up-to-date. It can also help you find potential problems early on so that you can take corrective action.

+91 91761 00095

#Audit Services#Financial Audit Services#Internal Audit Company#Statutory Audit India#Best Auditors in Chennai

0 notes

Text

Why in-house CFOs and Virtual CFOs are so different

Managing a business is a Herculean task. It involves an intricate process of planning, organization, and execution. A major chunk of managing a business revolves around the financial aspect of it. A Chief Financial Officer is in charge of bookkeeping, accounting, and just generally managing the overall finances of the organization. Whilst companies resort to hiring an individual who will take up the responsibility of the fiscal health of the company, a lot of companies are even looking at virtual CFOs that are outsourced, this is a common practice today, made evident by the many Virtual CFO Services in Chennai.

Company Costs

As mentioned earlier, CFOs deal with the money factor of a business. This is something all types of CFOs offer as a part of their service, but ironically, in-house CFOs charge hefty salary fees. Not only that, but it doesn’t account for the added costs like insurance and benefits. Companies that are fiscally healthy and well-established can afford to spend on an in-house CFO, but newer businesses or startups can vouch for Virtual CFO Services, which have proven to be the cheaper alternative as they usually only demand resource fees and cover employment costs.

Experience

To be a CFO means to have an extensive set of skills that are needed in a strenuous environment like a thriving business. With a job that has so much on stake companies want a seasoned CFO that’s experienced enough to deal with any problems that may arise in managing a business. Whilst a lot of CFOs are splendid at what they do, relying on an individual to manage the financial operations of a business is risky. A virtual CFO is usually a team that works behind the scenes and everyone in the team is qualified with the necessary experience that being a CFO necessitates.

Decision-making

Quite possibly one of the most important and stressful aspects of running a business or startup is the innumerable decisions that can go on to have major repercussions on the business. There’s a lot of consideration that goes into every decision of a company and it’s imperative that when it comes to financial decisions, only the best minds mull over it. Some companies may make their own decision after consulting with a CFO or even letting the CFO make the decision. Whilst both, in-house and virtual CFOs are good with the process of decision-making, Tax Market and their team of consultants can put all your problems to rest with their skill and expertise.

Convenience for businesses & startups

One of the many reasons why there are so many Virtual CFO Services that are so extensively available these days is because today’s rapidly competitive market demands them. The world of businesses has grown even more cutthroat than before. Virtual CFOs are a brilliant option to have, especially for newer businesses or startups trying to navigate their way to fiscal success. Whilst companies that have been around for decades are established enough to deal with the harshness of the business world, newer businesses must consult VCFO services to get the best possible help that a business can get.

Productivity

Productivity is what drives a workplace. Productivity is the biggest indicator of success for a business. Businesses are always looking for ways to boost productivity and Virtual CFO Services in Chennai help achieve this since the team of virtual CFOs take the brunt of the fiscal work and they do it with precision and finesse. Virtual CFOs taking such a big responsibility gives breathing room to the rest of the teams that work in the business and allows them to focus on the other aspects of a business more effectively.

Conclusion

The need for virtual CFO services is only bound to increase as businesses scramble around for newer ways to increase, or even create new streams of revenue. Whilst in-house CFOs are still the norm for many companies, virtual CFOs are increasingly common now.

0 notes

Text

Income Tax Audit in India

What is a Income Tax Audit in India? Under Section 44 AB of the Income Tax Act, 1961, provision of Income Tax Audit is covered. Income Tax Audit is a way to examine an individual’s organization tax returns by any outside agency. Income Tax Audit done to verify all income

Income Tax Audit in India | Income Tax Audit in Delhi

#usaid audit in india#best due diligence services in india#best usaid audit in india#due diligence services in india#internal audit in india#income tax audit in india#transfer pricing audit services in india#architecture#celebrities#art

3 notes

·

View notes

Text

Internal Audit Consulting Firms

Internal Audit Consulting Firms in India is an important tool for simplifying tasks and eliminating waste in the process so that there is constant internal control. Therefore, it plays a very important role in business management and is considered an essential tool in supporting managers.

0 notes

Text

Vessel Tank Inspection and Certification in India | UK | Canada

#Vessel Tank Inspection and Certification in India | UK | Canada#The International Maritime Organization India | UK| Canada#Draft Marine Surveyors in India | UK | Canada#Ship safety auditors and safety inspectors in India | UK | Canada#Solent marine surveyors in India | UK | Canada#Maritime surveyors and consultants in India | UK | Canada#ISM/ISPS/MLC audits n inspections SOLENT/UK PORTS#Solent Marine Consultants#TuesdayFeeling

0 notes

Text

#Software Development India#Software Company Chennai#Best Software Product Companies in Chennai#Software Service Providers in Chennai#software companies in Anna Nagar Chennai.#APQP Software#ppap software#dms software#best document manager software#internal audit software#coq software#spc software#msa software#fmea software#ccm software#gcs software#vqms software#sqms software.

0 notes

Text

HCO & Co. Shines Among the Best in Internal and Statutory Audits

Internal Audit Excellence:

Comprehensive Approach: HCO & Co. takes a holistic approach to best internal audit firms, delving into an organization’s processes, controls, and risk management systems. The firm aims to provide valuable insights that go beyond compliance, helping clients enhance operational effectiveness and identify areas for improvement.

Risk Management Expertise: With a dedicated focus on risk management, HCO & Co. assists businesses in identifying, assessing, and mitigating risks that could impact their operations. This proactive approach ensures that clients are well-prepared to navigate challenges in an ever-evolving business environment.

Operational Efficiency Enhancement: best internal audit firms by HCO & Co. are not just about identifying weaknesses; they are about optimizing processes and improving overall operational efficiency. The firm collaborates with clients to implement best practices and streamline operations for sustained success.

Statutory Audit Prowess:

Adherence to International Standards: HCO & Co. prides itself on conducting statutory audits in strict adherence to international accounting and auditing standards. This commitment ensures that clients receive accurate and reliable financial statements that meet regulatory requirements.

Industry-Specific Expertise: Recognizing the diversity of businesses in Oman, HCO & Co. tailors its statutory audit services to suit the unique needs of various industries. The firm’s team of qualified professionals possesses industry-specific knowledge, providing clients with specialized insights.

Timely and Transparent Reporting: Timeliness and transparency are paramount in best internal audit firms. HCO & Co. places a strong emphasis on delivering audit reports promptly while maintaining transparency throughout the process. This commitment builds trust and credibility with clients and stakeholders.

Why Choose HCO & Co.?

Proven Track Record: HCO & Co. has a track record of success, having contributed to the growth and compliance of numerous businesses across diverse sectors. The firm’s commitment to excellence is reflected in the success stories of its satisfied clients.

Qualified and Experienced Team: The success of HCO & Co. can be attributed to its team of qualified and experienced professionals. The firm invests in talent, ensuring that its auditors possess the knowledge and skills necessary to navigate the complexities of internal and statutory audits.

Client-Centric Approach: At the heart of HCO & Co.’s success is its client-centric approach. The firm strives to understand the unique needs of each client, tailoring its audit services to provide maximum value and contribute to the client’s success.

FAQs

Q: How does HCO & Co. ensure the accuracy of financial statements during audits?

A: HCO & Co. employs rigorous methodologies, cutting-edge tools, and a team of seasoned professionals to guarantee the precision of financial statements.

Q: What sets HCO & Co. apart in the audit sector?

A: The firm’s commitment to excellence, innovative practices, and a client-centric approach distinguishes HCO & Co. from its peers.

Q: Can HCO & Co. handle international audits?

A: Absolutely. HCO & Co. has a global perspective and the expertise to conduct audits on an international scale, ensuring compliance with diverse regulatory frameworks.

Q: How does HCO & Co. adapt to technological advancements in audit practices?

A: HCO & Co. invests in continuous training and technological upgrades, staying abreast of the latest advancements to deliver efficient and accurate audit services.

Q: What kind of clients does HCO & Co. typically work with?

A: HCO & Co. caters to a diverse clientele, including corporations, small businesses, and non-profit organizations, providing tailored audit solutions.

Q: What CSR initiatives does HCO & Co. participate in?

A: HCO & Co. is dedicated to making a positive impact through various CSR initiatives, focusing on education, community development, and environmental sustainability.

Conclusion:

In the realm of top ca firms for statutory audit, HCO & Co. stands as a symbol of trust, integrity, and professionalism. Through its comprehensive range of services and dedication to excellence, the firm continues to be a preferred choice for businesses seeking reliable audit solutions. As Oman’s economic landscape evolves, HCO & Co. remains steadfast in its mission to uphold the highest standards of audit and top ca firms for statutory audit, contributing to the financial well-being of its clients and the overall economic prosperity of the Sultanate.

Click here for more information: www.doing-business-international.com/partners/new-delhi-tax-specialist/

#audit firms#Audit firm in Oman#Wtihholding Tax in India#Accounting company in Delhi#best ca firms in India#Accounting companies in india#best internal audit firms#top ca firms for statutory audit

0 notes