#insurancesoftwaresolution

Text

3 Keys to Proactive Underwriting

What is the advantage of insurance technology built by insurance people? It has been designed with a passion to solve problems and meet your needs based on real-life experiences by people who have held your roles. Those who have done the job of producer, underwriter, product manager, CFO, and CIO, know firsthand the functions and features that impact speed to market and your ROI at a granular level. Welcome to Cogitate and an introduction to future-ready underwriting on a modern policy administration platform.

The following describes key elements of the intelligent underwriting workbench critical to managing the profitability of your book of business while excelling in the marketplace. We support a new balance between art and science in underwriting with tools to reduce premium leakage, make smarter pricing and selection decisions, and transition to a ‘predict and prevent’ model in a world of growing risk and uncertainty.

Stop the Premium Leakage & Reduce Loss Frequency You don’t know what you can’t see, and you can’t always trust what you’re told. That is an unfortunate truth – and why data validation is critical in the elimination of policyholder and agent leakage. The application of third-party data provides you with a source of truth to validate those data points most critical to your underwriting decisions. Real-time data prefill functionality also eliminates input errors and conclusions drawn from outdated information, which can lead to underwriter leakage. The integration of structured and unstructured data to enable advanced analytics in underwriting - before you accept the exposure - remains a challenge for the industry. The intelligent underwriting workbench solves this with its strong ecosystem of pre-integrated data sources, predictive modeling, and a flexible rules engine to facilitate automated recommendations based on your risk selection criteria and the data you want to rely on most. The advantage of the API-enabled platform is the ease of integration with API-enabled data partners and best-in-class solutions of your choice. This includes your billing and claims systems, for unified data sharing and 360-degree policyholder risk attributes for true exposure visibility. The extensibility of the platform is critical to future integrations as new data sets and solution providers emerge to further support underwriting risk assessment.

Driver & Vehicle Intelligence in Auto Lines POV from Confianza Undisclosed drivers represent a risk you are not being paid to take.

0 notes

Link

0 notes

Text

Are old underwriting techniques not working out? Implementing a modern insurance underwriting solution will help you out in bringing the business to the right track. Amity Software offers extremely effective insurance underwriting software to drive the business profit and take the brand reputation to the next level.

For more info, visit https://www.amitysoftware.com/insurance-underwriting-software/.

#insuranceunderwritingsoftware#InsuranceSoftware#InsuranceManagementSystem#InsuranceSoftwareSolutions#InsuranceManagementSoftware#InsuranceSoftwareSystems#GeneralInsuranceSoftware

0 notes

Link

ForceBolt is recognized as the best insurance software solutions company and we offer streamlined, integrated solutions for the insurance industry, the innovation that transforms insurance carriers of all sizes into advanced digital organizations.

0 notes

Text

Secure Our World

October is Cybersecurity Awareness Month and as providers of digital insurance solutions, we are participating in spreading the word to our industry. First, we share the official theme of 2024, “Secure Our World.”

The four critical steps CISA recommends for individuals to maintain a secure profile are outlined in this year’s theme:

Recognize and report phishing, delete messages

Use at least 16 characters in your passwords and use a secure password manager

Use multifactor authentication

Keep your software updated to protect against security bugs

The above are critical to each and every one of us to protect our personal and our business environments. Maintaining a heightened awareness of potential threats means questioning what looks legitimate and taking extra steps to validate and confirm the communications we receive.

Is that text message really from our founder?

Is there actually a package being delivered from UPS?

Has there truly been a $1000 charge on my Amazon account?

Is that actually Verizon calling with a discount?

Fraudulent messages like these appear across our email, text, and phone messages every day and at first glance, may seem legitimate. Remain on high alert as the creativity of these nefarious messages is always evolving.

What would we add to the above list, especially targeted to our insurance network? Know your solution providers and and choose like-minded organizations that prioritize security in design, implementation, and maintenance.

Work with an insurance digital platform with a trusted, well vetted ecosystem of partners that share your security framework. These partners should be mature, well-funded, best-in-class solutions to ensure their commitment to security matches yours. Make sure their knowledge of the insurance regulatory environment is advanced and compliance assured.

Cogitate’s digital insurance platform securely integrates with over 50 best-in-class, third-party data and solution providers. We take that role very seriously, vetting and evaluating all partnerships across policy, billing, and claims to ensure the security of our platform and your data. Meet our partners here and reach out for more information about Cogitate Adaptive APIs.

Secure Our World is a theme that extends throughout the year, beyond Cybersecurity Awareness Month. At Cogitate, it starts with our own personal vigilance and extends to every feature and function of our digital insurance platform and the ecosystem of partners we trust.

Originally published here: https://www.cogitate.us/blog/secure-our-world/

0 notes

Text

Ecosystem Partner Profile: Confianza on Intelligence and Underwriting Auto Lines

As research for the eBook, 3+ Keys to Proactive Underwriting, Cogitate’s team spent time with John Petricelli, Chief Data Officer of our ecosystem partner Confianza. Integrated with Cogitate’s DigitalEdge Platform, Confianza helps insurers accelerate digital transformation. One of their trending use cases is the identification and prevention of premium leakage and fraud. Confianza’s risk intelligence identifies key policyholder motivations and behaviors as well as scoring/flagging of submissions by risk appetite and selection criteria.

Combining over 50 accurate consent-compliant and non-FCRA data sources with submission data such as driver name, address, and birth date, Confianza’s proprietary risk modeling detects undisclosed drivers, false garaging, likelihood to exaggerate claims, prior vehicle damages, synthetic identities, and more.

At Confianza, John Petricelli has engineered the intelligence that produces a 360 view of your prospects and policyholders with underwriting quality, to make smart decisions for your company and offer your policyholders the best possible coverage. Our conversation is summarized to provide you with an overview of the how, what, and why of Confianza’s risk intelligence and the benefits brought to underwriting auto lines.

How vast is the database?

Confianza has been nicknamed by its clients as “the database of America.” The data includes every adult, every household, and every property in the US. With just a name, address, and date of birth, Confianza identifies all vehicles (VIN), members of the household, and much more. Confianza also maintains data on every business in the US and every commercial property, by type.

How does the risk modeling work?

The power of the data is in the proprietary engineering intelligence that interconnects and gives rise to real insights about people and their assets. For example, a very detailed utility that looks at addresses with 29 different conditions will trigger address exceptions, while some competing providers will not flag the error or omission which could lead to hidden, material risk indicators. Confianza will flag that submission as a failed lookup, signaling a requirement for corrective action.

The data intelligence will confirm the proper identity of the consumer presented, the territory, address, risk exposure, the asset – its current condition, use of the asset, details of the driver(s) presented – and uncover those not disclosed, rate variable integrity for all household drivers and share a motivation field, which indicates financial capability and the likelihood of purchase. The auto details also include full registry ownership, title status, and events. Confianza links this information to the people and households. It also confirms that the current personal or business use of the vehicle matches the registered use.

All of these factors provide the transparency required to evaluate price risk based on a source of truth that fact-checks possible omissions, unintended errors, and concealment of information that can lead to losses.

The fight against premium leakage

The first step Confianza takes with many clients is to scan their book for premium leakage based on a very conservative model. Most often, discovery finds undisclosed drivers account for a minimum of 15% premium leakage. Non-standard auto can be upwards of 25%. On-going book monitoring is extremely important as Confianza has found at least 15% of policies have a material change before renewal, which may not be captured at renewal if reliant on the policyholder to disclose the change. This illustrates the importance of data validation at renewal as well as submission.

Streamlining the underwriting process

Integration of Confianza with Cogitate DigitalEdge Policy streamlines the underwriting process by providing a digital 360 view by flagging the high conversion leads, eliminating the early no-goes, and reducing the time discussing exception handling with agents from an average of 20 minutes to 2-3 minutes. Insurers can screen submissions against very specific underwriting criteria for early decisions, saving time and investment in additional data. For example, if the model identifies a submission as a synthetic identity, the process stops before any additional data is called.

For more information on our technology ecosystem, visit our partner page here.

Originally published here: https://www.cogitate.us/resources/insurance-underwriting-software-risk-intelligence-ecosystem-auto-insurance/

0 notes

Text

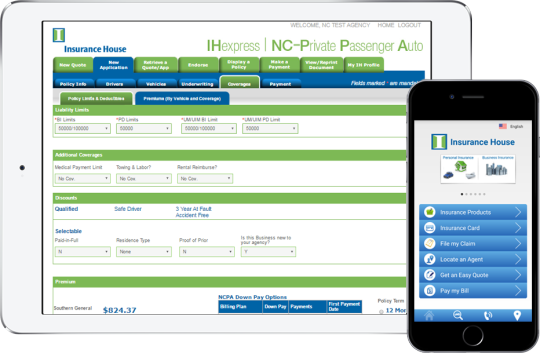

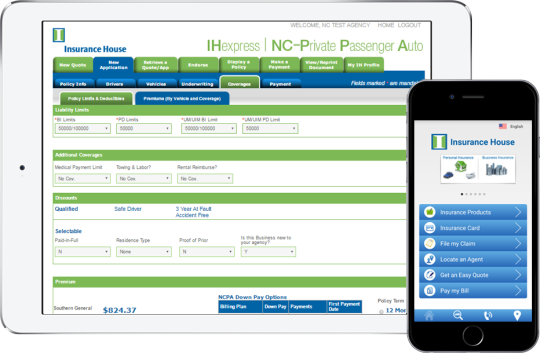

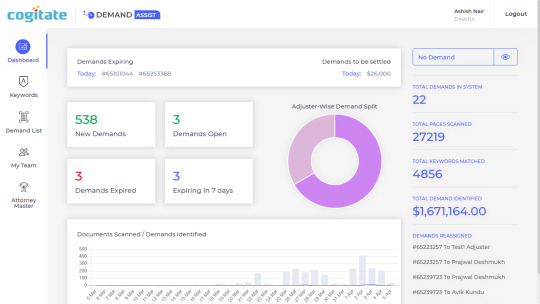

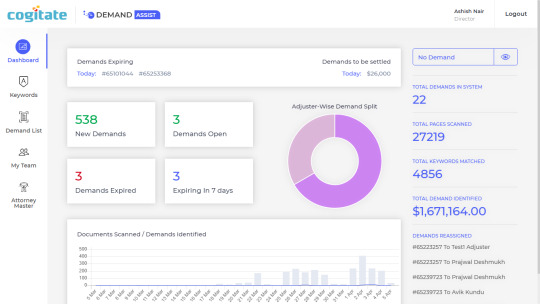

How Cogitate helped an insurance company overcome their challenges

Cogitate was the result of insurance veterans joining hands with tech experts, making them perfect for insurance companies that are looking to automate or digitize their services. We are leaders in accelerated digital insurance for wholesale brokers, MGAs, and carriers. In this blog, we will cover one of our clients, Southern General Insurance Company (SGIC), their challenges, and how our team overcame those challenges and improved their results. Let’s take a deeper dive into all of the details of this incredible journey.

About Southern General Insurance Company (SGIC)

Through MGA Wholesale Insurance Broker and Insurance House, Southern General Insurance Company (SGIC), a provider of property and casualty insurance, offers independent agents personal lines insurance products. Coverage is sold in Alabama, Delaware, Georgia, Florida, Maryland, North Carolina, Pennsylvania, South Carolina , Tennessee , Virginia , and Washington D.C.

Challenges faced by SGIC

SGIC faced slippage in the identification of attorney demand letters, and adjusters overlooked a number of cases that resulted in claims of bad faith. Their team also claimed that managing responses and keeping track of conversations with the claimants' solicitors proved to be challenging tasks.

The manual approach that they had been using was time-consuming, expensive, and prone to errors, and the danger of bad-faith exposures to SGIC was always substantial. In certain cases, these problems resulted in litigation with hefty defense and settlement costs. To automate the demand letter detection and monitoring process, SGIC chose Cogitate DemandAssist.

How we helped SGIC

One of the major factors that helped SGIC gain our trust was our understanding of insurance. After going through all the challenges they were facing using their previous methods, we instilled four features that could help them overcome all the challenges. Here is the list of those features:

OCR and text mining of documents from ImageRight (SGIC’s document management system)

AI and machine learning for high-precision pattern identification of attorney demand letters

Automated, integrated notification service to alert the adjuster team of demand letters and response deadlines for zero slippage.

Track negotiation details with attorneys, such as offer amounts and the dates presented.

All these features helped them successfully navigate through their challenges and get the desired results.

Results

These were the results that SGIC obtained after our input:

99.20% demand identification accuracy from their previous 64.36%.

$2.4 million in demands identified (monthly average).

A massive 48% reduction in demand handling cycle time

New demand identification is down from 5 days to less than 24 hours.

15,000+ pages of accelerated identification processed daily.

Conclusion

Our partnership with SGIC was an exciting project that turned out to be a massive success. "We have opted for Cogitate DigitalEdge for its future-ready digital insurance platform capabilities coupled with the wide range of state-of-the-art features," said Diane Boyer, Vice President of Operations at Southern General Insurance Company. You can visit our website to contact us or learn more about our services.

0 notes

Link

If you have been looking for great Insurance Solutions for your company, then the first step is to find which kind of software is best for you and your customers. It is of utmost importance to obtain a proper insurance software solution in order to assure the future of your company. That's why, Cogitate Technology is a leading insurance solutions providers in US which provides the upgraded software solutions to insurance companies.

1 note

·

View note

Link

If companies cannot afford a custom enterprise fraud analytics system, there are out-of-the-box analytics for Insurance Solutions available that can improve upon rule-based manual systems. For the power of analytics to be harnessed to its fullest potential, insurance companies must implement correct data-driven practices. They will need to break data silos, combine structured and unstructured data and cross-link multiple data sources to arrive at the full picture of the insureds across underwriting, Claims Management Software and policy management. To understand how Cogitate Technology Solutions can help you with implementing analytics for fraud detection, please visit www.cogitate.us.

#InsuranceSolutions#InsuranceSoftwareSolution#ClaimsManagementSoftware#InsuranceSoftwareCompaniesinUsa#PropertyCasualtyInsuranceSoftware

1 note

·

View note

Link

If you are responsible for making decisions around technology for an insurer, here are a few key aspects you must consider when choosing an insurance software solution.Insurance is a behemoth industry that continues to grow in size and complexity. Insurers today face unparalleled challenges. Customer needs are evolving rapidly as customer expectations continue to rise and retention surfaces as a key mandate.

#InsuranceSoftwareSolution#InsuranceSolutions#PropertyCasualtyInsuranceSoftware#InsuranceSoftwareCompaniesinUsa

1 note

·

View note

Link

When choosing a Claims Management Software, what aspects should an insurer consider? Cogitate lists the important factors to keep in mind for those involved in making insurance technology related decisions.Claims Management Software Finding the right claims management software that meet the organizational requirements can be a formidable challenge. An optimal claims management solution should not only improve claim servicing while reducing costs, but also be customizable so that it can be tailored to your specific needs when it comes to claims processing. Furthermore, it should not just be suited for the business needs of today, but also be flexible to handle the requirements that may arise in the future.

#ClaimsManagementSoftware#InsuranceSoftwareCompaniesinUsa#InsuranceSolutions#InsuranceSoftwareSolution

1 note

·

View note

Link

If you want to utilize modern Insurance Software Solution for stopping forgery cases in your company, contact to cogitate.us. Because, Cogitate having well experienced and knowledgeable staff can also help you in finding the right Insurance Solutions that suits your requirements.

#InsuranceSolutions#InsuranceSoftwareSolution#PropertyCasualtyInsuranceSoftware#InsuranceSoftwareCompaniesinUsa#ClaimsManagementSoftware

1 note

·

View note

Link

Choosing the right Insurance Software Companies in Usa is highly important. Because, there are so many companies available in the current market, but choosing the right one is very hard from them. Thus, Cogitate.us is a well reputed and and one of leading company in usa which is developing software for insurance company and agents since last decade.

#InsuranceSoftwareSolution#InsuranceSolutions#PropertyCasualtyInsuranceSoftware#InsuranceSoftwareCompaniesinUsa#ClaimsManagementSoftware

1 note

·

View note

Link

One of the most crucial in the workplace of insurance industry has been the introduction of Insurance Software Solution that can organize and handle many small tasks in the insurance company, freeing them up for more important tasks. So, Cogitate is a highly acclaimed insurance software which is used by well reputed and trustable company in USA for managing clients database.

#InsuranceSoftwareSolution#InsuranceSolutions#ClaimsManagementSoftware#InsuranceSoftwareCompaniesinUsa#PropertyCasualtyInsuranceSoftware

1 note

·

View note

Link

As we all know that, So many forgery cases listening around you that insurer did fraud against people OR some person involved in forgery case of insurance. That's why, The Claims Management Software system makes it simple to manage insurance products from application processing to managing clients and settling insurance claim. The software allows users the ability to manage insurance products by monitoring and judging the quality of the claims process.

#ClaimsManagementSoftware#InsuranceSoftwareCompaniesinUsa#PropertyCasualtyInsuranceSoftware#InsuranceSolutions#InsuranceSoftwareSolution

1 note

·

View note