#i’m banking on automation helping where focus/willpower will not

Text

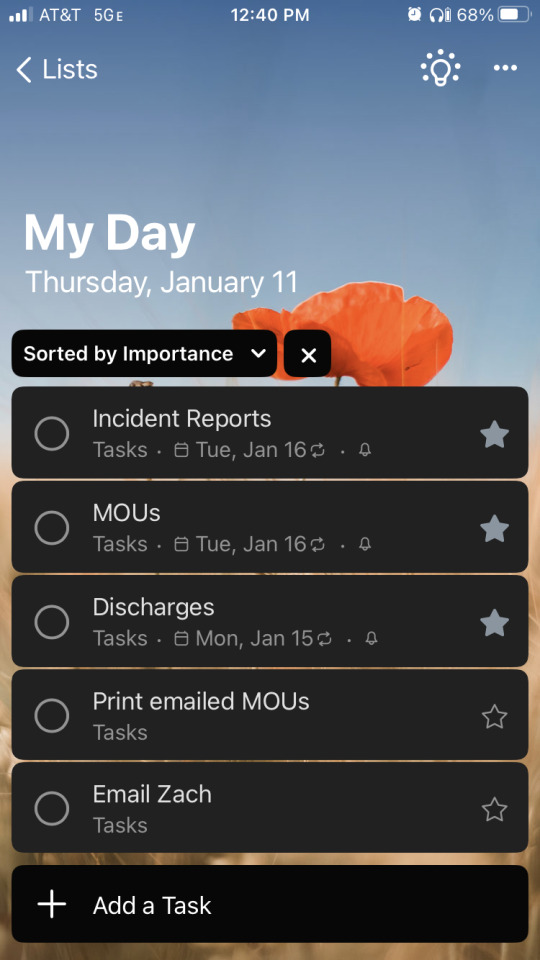

Today I am making a serious effort to get my shit in order!

I’m trying out a new to-do list app (To Do by microsoft) and revamping the point tracker app I’ve used for positive reinforcement off and on for years (Tally). My goal is to take advantage my adhd’s love of Cross Item Off List and Number Go Up with these. I have high hopes for the to-do app’s ability to automate some things for me but will need to poke around a bit more and see how it works.

The adhd meds are definitely giving me the focus/energy to get this all set up, but I’m hoping to establish things in such a way that it will continue to be helpful even when I’m struggling. Like for example, when the new semester starts kicking my ass 😅

#sincere hope! i really want to make a system that works for me and keeps working even when i’m not at 100% (which is often)#i also did some futzing yesterday and today with my alarms and calendar#and put time limits on my major distraction apps (tumblr and firefox)#i’m banking on automation helping where focus/willpower will not#for the tally app a cookie is basically a good boy point for completing a task#and the ily tally is just a positive reinforcement button to push a bunch#to encourage me to keep using it#we’ll see!#there’s multiple other things i’m gonna try but i have spent enough time writing this instead of working lol#sepulchritudinous

15 notes

·

View notes

Text

Financial Planning Guide For 2020

The key to living a rich life is taking control of your money.

You don’t have to have a six-figure income or own a business to build wealth. All you need to do is have smart money-saving habits and plan for your financial future.

I’ll teach you how to think about money in a different way than you’re used to.

Unlike most money “experts” out there, I won’t sit here and tell you to stop buying coffee at Starbucks or start cooking rice and chicken for dinner every night. Financial freedom means you have control over your decisions.

For myself, I know when to spend extravagantly and I know where to cut ruthlessly.

If you follow the tips and resources that I’ve outlined in this guide, you can say goodbye to money frustration.

Finance Planning 101: Basic Things to Sort Out

Financial planning isn’t about penny-pinching, massive budget spreadsheets, or working 90 hours per week to make ends meet. It’s about having the right systems in place to build wealth.

I don’t want to spend all my time thinking about money. I want to do the work upfront, put it on autopilot, then get back to living my life.

For some people, living rich means being able to travel and spend more time with their family. Others live a rich life by hiring a personal chef or buying designer clothes. But before you can get to that point, you need to sort the following things out first:

Money Mistakes

Avoiding money mistakes can save you hundreds of thousands of dollars, if not millions, throughout your life. Half of the battle is understanding what not to do with your money.

Mistake #1: Debating minutia — Focusing on minor and insignificant financial details without taking action will not get you rich. Saving $0.60 buying store-brand cereal instead of Cheerios won’t make a difference. Instead of debating about the best interest rates or hottest stocks right now, just set up a no-fee bank account with automatic savings and investments. Then allow your money to grow for 30+ years.

Mistake #2: Relying on willpower — So many people rely on willpower to prevent themselves from eating out or buying new clothes. Even if you save $2 per day on coffee by making it at home, That $730 at the end of the year isn’t significant unless you’ve actually put it aside and invested it.

Mistaking #3: Waiting — Procrastination is killing your money. Starting as early as possible is the best path to financial freedom. If a 25-year-old invests $100 per month for 10 years at an 8% return rate, their account will be worth $200,061 by the age of 65. If their co-worker starts investing $100 per month at age 35 for 30 years, their account would be $149,036 at age 65. Even though the second person made contributions for 20 years longer, they still finished with $50,000 less because they longer to start.

Automation

One of the main reasons why people fail to save money is because they rely on their future motivation. Moving money from a checking account to a savings account or investment account takes effort.

Setting up an automated personal finance system for your bills, payments, and savings will eliminate those manual tasks and allow you to focus on the things that truly matter. Automation is so flexible, so you can set it up to meet the needs of your situation.

I personally hate detailed budget plans. Having to constantly review all the transactions, categorize everything correctly, and review tiny budgets for obscure categories drives me crazy.

I’d much rather break everything down into a few core categories that’s simple to follow.

That’s what we call a Conscious Spending Plan.

To establish a conscious spending plan, you’ll look at the major areas of your spending:

Fixed Costs: 50-60% — Things like rent, utilities, car payments, and health insurance should be roughly 50% of your take-home pay.

Investments: 10% — Set aside 10% of your income for things like a Roth IRA and 401(k).

Savings 5-10% — This money can be used for a down payment on a house, vacations, and unplanned expenses.

Guilt-free spending 20-35% — Leave what’s left for things like eating out, drinks, clothing, and going to the movies.

Once you establish your spending recommendations, you can automate your finances accordingly. Here’s an example of what your automation could look like:

2nd of the month — Part of your salary goes directly into your 401(k) and the rest is direct-deposit into your checking account.

5th of the month — Automatically transfer funds from your checking account to a savings account. Automatically transfer funds from your checking account to your Roth IRA.

7th of the month — Automatically pay bills from checking accounts and credit cards. Automatically pay off credit card bills from your checking account.

Once you automate these payments and savings, you’ll know exactly how much money is left for you to spend each month. That’s where the guilt-free spending comes in. Spend freely until you’ve used up what’s left. You’ve already taken care of your investing and saving. Now you won’t have to think twice about buying a sandwich for lunch or getting that $5 cup of coffee.

Hidden Income

Most people don’t realize that they are throwing away “hidden income” each and every month. This is the next thing that you need to get sorted out.

Tapping into hidden income can be as simple as making a phone call. These calls can save you thousands of dollars every month.

You just need to put your negotiation skills to the test on fixed monthly costs:

Car insurance — Instead of choosing a car insurance once and never looking at it again, pick up the phone and negotiate your rate. All you need to do is analyze your current plan, check your coverage options, and shop around with different providers.

Cell phone — Compare your monthly usage (talk, text, data) to other plans offered by various network providers. When you call your cell phone carrier, start by asking what plans can give you a better value. If that doesn’t work, you can use the competitors’ plans as leverage.

Bank and credit card fees — Yes, you can actually negotiate fees from banks and credit cards. Getting an overdraft fee waived or lowering percentage points on interest payments can save you thousands over time. This can help you pay off your debt faster as well.

When you’re negotiating these costs, don’t make it easy for the customer service representatives to say “no.” Rather than asking, “can you lower my monthly bill?” phrase it as “what other plan options do I have?”

Be prepared to walk. In most cases, people are afraid of negotiating car insurance or cell phone plans because they don’t actually want to cancel the service.

In reality, threatening to cancel gives you the best leverage. Even if it means escalating the conversation to a supervisor, your plan won’t actually be canceled until you say the final word.

Investing

I know lots of people who are scared to invest money in the stock market. But there is definitely a winning formula to being a successful investor over time. This is arguably the best way to build wealth.

Stop focusing on trying to buy the hottest stock today and selling it next year for maximum profits. Trying to beat the stock market is not a viable investment strategy.

You should also ignore all of the media coverage about an impending financial crisis or stock market collapse. If you truly believe that the market will grow and recover in the long run, you should continue investing during all market conditions.

The three most significant factors for successful investing:

Start as early as possible.

Invest every month.

Go with index funds.

A regular investing account is good to have. I’m referring to accounts offered by Fidelity, TD Ameritrade, ETrade, or whatever. But these are taxable accounts. So when you sell a stock, you pay taxes on gains. Those taxes are even more substantial if you sell in less than a year.

But retirement accounts (401k, Roth IRA, SEP IRA, etc.) give you the most significant tax advantages. Max out these accounts first.

Eliminating Debt

If you have a negative net worth, the thought of investing or saving money can seem inconceivable. So the first thing you need to do is eliminate your debt once and for all.

There are five steps to get out of debt fast:

Step #1: Figure out how much debt you have.

Step #2: Determine what needs to be paid off first (based on interest rates).

Step #3: Negotiate a lower APR (annual percentage rate).

Step #4: Figure out where the money to pay your debt will come from.

Step #5: Start making a dent in your debts.

Like most areas of money, getting started right away is the best thing you can do. Even paying an extra $20 per month to start can make a huge difference over time.

Here’s a simple explanation to showcase the power of making larger payments. Let’s say two people each have $5,000 in credit card debt at 14% APR.

Person A pays $200 per month. It will take them 32 months to pay the debt, which will incur $1,313.96 in interest payments over that time.

Person B pays $400 per month. It will take them 14 months to pay the debt, which will incur $436.46 in interest payments.

The second person saved nearly $900 on interest fees by doubling their monthly payment payments. Imagine how much money you can save by if you have $10,000 or $20,000+ of debt just by paying extra each month.

Earn More Money

The best and fastest way to enhancing your financial power is by earning more money. You can budget, plan, and cut costs all you want. But if your income doesn’t increase, you’re path to financial freedom will always be limited.

There is a limit to how much you can save, but there is no limit to how much you can earn.

These are the three easiest ways to make more money:

Get a raise.

Earn money on the side using skills you already possess.

Start a new business.

What could you do with an extra $1,000 per month? What about $5,000 or even $10,000+? The only way to find out is by seeking ways to increase your income.

Financial Planning Advisors: Pros and Cons

Lots of people feel overwhelmed when it comes to financial planning, which is understandable. So it’s not uncommon to seek help from a financial advisor.

I know plenty of people who have had huge success working with a financial planner. But I know others who didn’t have as much luck.

Financial Advisor Pros:

You don’t have to learn all this stuff yourself.

Can get your money in the best accounts to save on taxes.

Save time by having an advisor manage a portfolio for you.

Create a personal wealth plan for your specific situation.

Can add an extra barrier to your money, preventing you from making a rash decision.

Financial Advisor Cons:

Costs associated with hiring an advisor.

Possible conflict of interest. Some advisors are also brokers, getting kickbacks on sub-standard products that they sell you. Make sure your financial advisor has a fiduciary duty to work on your behalf.

Tough to find the right financial advisor for you. Like all experts, it can take some trial and error to find someone who’s truly good at their craft.

Whether you decide to work with a financial advisor or not is entirely up to you. Just make sure you shop around and do your due diligence before making a long-term commitment. A good option is to look for a few and try them out on smaller projects for an hourly fee. That’ll give you a better sense before you have them manage your entire portfolio.

Financial Planning Guide For 2020 is a post from: I Will Teach You To Be Rich.

Financial Planning Guide For 2020 published first on https://justinbetreviews.tumblr.com/

0 notes

Text

Financial Planning Guide For 2020

The key to living a rich life is taking control of your money.

You don’t have to have a six-figure income or own a business to build wealth. All you need to do is have smart money-saving habits and plan for your financial future.

I’ll teach you how to think about money in a different way than you’re used to.

Unlike most money “experts” out there, I won’t sit here and tell you to stop buying coffee at Starbucks or start cooking rice and chicken for dinner every night. Financial freedom means you have control over your decisions.

For myself, I know when to spend extravagantly and I know where to cut ruthlessly.

If you follow the tips and resources that I’ve outlined in this guide, you can say goodbye to money frustration.

Finance Planning 101: Basic Things to Sort Out

Financial planning isn’t about penny-pinching, massive budget spreadsheets, or working 90 hours per week to make ends meet. It’s about having the right systems in place to build wealth.

I don’t want to spend all my time thinking about money. I want to do the work upfront, put it on autopilot, then get back to living my life.

For some people, living rich means being able to travel and spend more time with their family. Others live a rich life by hiring a personal chef or buying designer clothes. But before you can get to that point, you need to sort the following things out first:

Money Mistakes

Avoiding money mistakes can save you hundreds of thousands of dollars, if not millions, throughout your life. Half of the battle is understanding what not to do with your money.

Mistake #1: Debating minutia — Focusing on minor and insignificant financial details without taking action will not get you rich. Saving $0.60 buying store-brand cereal instead of Cheerios won’t make a difference. Instead of debating about the best interest rates or hottest stocks right now, just set up a no-fee bank account with automatic savings and investments. Then allow your money to grow for 30+ years.

Mistake #2: Relying on willpower — So many people rely on willpower to prevent themselves from eating out or buying new clothes. Even if you save $2 per day on coffee by making it at home, That $730 at the end of the year isn’t significant unless you’ve actually put it aside and invested it.

Mistaking #3: Waiting — Procrastination is killing your money. Starting as early as possible is the best path to financial freedom. If a 25-year-old invests $100 per month for 10 years at an 8% return rate, their account will be worth $200,061 by the age of 65. If their co-worker starts investing $100 per month at age 35 for 30 years, their account would be $149,036 at age 65. Even though the second person made contributions for 20 years longer, they still finished with $50,000 less because they longer to start.

Automation

One of the main reasons why people fail to save money is because they rely on their future motivation. Moving money from a checking account to a savings account or investment account takes effort.

Setting up an automated personal finance system for your bills, payments, and savings will eliminate those manual tasks and allow you to focus on the things that truly matter. Automation is so flexible, so you can set it up to meet the needs of your situation.

I personally hate detailed budget plans. Having to constantly review all the transactions, categorize everything correctly, and review tiny budgets for obscure categories drives me crazy.

I’d much rather break everything down into a few core categories that’s simple to follow.

That’s what we call a Conscious Spending Plan.

To establish a conscious spending plan, you’ll look at the major areas of your spending:

Fixed Costs: 50-60% — Things like rent, utilities, car payments, and health insurance should be roughly 50% of your take-home pay.

Investments: 10% — Set aside 10% of your income for things like a Roth IRA and 401(k).

Savings 5-10% — This money can be used for a down payment on a house, vacations, and unplanned expenses.

Guilt-free spending 20-35% — Leave what’s left for things like eating out, drinks, clothing, and going to the movies.

Once you establish your spending recommendations, you can automate your finances accordingly. Here’s an example of what your automation could look like:

2nd of the month — Part of your salary goes directly into your 401(k) and the rest is direct-deposit into your checking account.

5th of the month — Automatically transfer funds from your checking account to a savings account. Automatically transfer funds from your checking account to your Roth IRA.

7th of the month — Automatically pay bills from checking accounts and credit cards. Automatically pay off credit card bills from your checking account.

Once you automate these payments and savings, you’ll know exactly how much money is left for you to spend each month. That’s where the guilt-free spending comes in. Spend freely until you’ve used up what’s left. You’ve already taken care of your investing and saving. Now you won’t have to think twice about buying a sandwich for lunch or getting that $5 cup of coffee.

Hidden Income

Most people don’t realize that they are throwing away “hidden income” each and every month. This is the next thing that you need to get sorted out.

Tapping into hidden income can be as simple as making a phone call. These calls can save you thousands of dollars every month.

You just need to put your negotiation skills to the test on fixed monthly costs:

Car insurance — Instead of choosing a car insurance once and never looking at it again, pick up the phone and negotiate your rate. All you need to do is analyze your current plan, check your coverage options, and shop around with different providers.

Cell phone — Compare your monthly usage (talk, text, data) to other plans offered by various network providers. When you call your cell phone carrier, start by asking what plans can give you a better value. If that doesn’t work, you can use the competitors’ plans as leverage.

Bank and credit card fees — Yes, you can actually negotiate fees from banks and credit cards. Getting an overdraft fee waived or lowering percentage points on interest payments can save you thousands over time. This can help you pay off your debt faster as well.

When you’re negotiating these costs, don’t make it easy for the customer service representatives to say “no.” Rather than asking, “can you lower my monthly bill?” phrase it as “what other plan options do I have?”

Be prepared to walk. In most cases, people are afraid of negotiating car insurance or cell phone plans because they don’t actually want to cancel the service.

In reality, threatening to cancel gives you the best leverage. Even if it means escalating the conversation to a supervisor, your plan won’t actually be canceled until you say the final word.

Investing

I know lots of people who are scared to invest money in the stock market. But there is definitely a winning formula to being a successful investor over time. This is arguably the best way to build wealth.

Stop focusing on trying to buy the hottest stock today and selling it next year for maximum profits. Trying to beat the stock market is not a viable investment strategy.

You should also ignore all of the media coverage about an impending financial crisis or stock market collapse. If you truly believe that the market will grow and recover in the long run, you should continue investing during all market conditions.

The three most significant factors for successful investing:

Start as early as possible.

Invest every month.

Go with index funds.

A regular investing account is good to have. I’m referring to accounts offered by Fidelity, TD Ameritrade, ETrade, or whatever. But these are taxable accounts. So when you sell a stock, you pay taxes on gains. Those taxes are even more substantial if you sell in less than a year.

But retirement accounts (401k, Roth IRA, SEP IRA, etc.) give you the most significant tax advantages. Max out these accounts first.

Eliminating Debt

If you have a negative net worth, the thought of investing or saving money can seem inconceivable. So the first thing you need to do is eliminate your debt once and for all.

There are five steps to get out of debt fast:

Step #1: Figure out how much debt you have.

Step #2: Determine what needs to be paid off first (based on interest rates).

Step #3: Negotiate a lower APR (annual percentage rate).

Step #4: Figure out where the money to pay your debt will come from.

Step #5: Start making a dent in your debts.

Like most areas of money, getting started right away is the best thing you can do. Even paying an extra $20 per month to start can make a huge difference over time.

Here’s a simple explanation to showcase the power of making larger payments. Let’s say two people each have $5,000 in credit card debt at 14% APR.

Person A pays $200 per month. It will take them 32 months to pay the debt, which will incur $1,313.96 in interest payments over that time.

Person B pays $400 per month. It will take them 14 months to pay the debt, which will incur $436.46 in interest payments.

The second person saved nearly $900 on interest fees by doubling their monthly payment payments. Imagine how much money you can save by if you have $10,000 or $20,000+ of debt just by paying extra each month.

Earn More Money

The best and fastest way to enhancing your financial power is by earning more money. You can budget, plan, and cut costs all you want. But if your income doesn’t increase, you’re path to financial freedom will always be limited.

There is a limit to how much you can save, but there is no limit to how much you can earn.

These are the three easiest ways to make more money:

Get a raise.

Earn money on the side using skills you already possess.

Start a new business.

What could you do with an extra $1,000 per month? What about $5,000 or even $10,000+? The only way to find out is by seeking ways to increase your income.

Financial Planning Advisors: Pros and Cons

Lots of people feel overwhelmed when it comes to financial planning, which is understandable. So it’s not uncommon to seek help from a financial advisor.

I know plenty of people who have had huge success working with a financial planner. But I know others who didn’t have as much luck.

Financial Advisor Pros:

You don’t have to learn all this stuff yourself.

Can get your money in the best accounts to save on taxes.

Save time by having an advisor manage a portfolio for you.

Create a personal wealth plan for your specific situation.

Can add an extra barrier to your money, preventing you from making a rash decision.

Financial Advisor Cons:

Costs associated with hiring an advisor.

Possible conflict of interest. Some advisors are also brokers, getting kickbacks on sub-standard products that they sell you. Make sure your financial advisor has a fiduciary duty to work on your behalf.

Tough to find the right financial advisor for you. Like all experts, it can take some trial and error to find someone who’s truly good at their craft.

Whether you decide to work with a financial advisor or not is entirely up to you. Just make sure you shop around and do your due diligence before making a long-term commitment. A good option is to look for a few and try them out on smaller projects for an hourly fee. That’ll give you a better sense before you have them manage your entire portfolio.

Financial Planning Guide For 2020 is a post from: I Will Teach You To Be Rich.

from Finance https://www.iwillteachyoutoberich.com/blog/financial-planning/

via http://www.rssmix.com/

0 notes

Text

Financial Planning Guide For 2020

The key to living a rich life is taking control of your money.

You don’t have to have a six-figure income or own a business to build wealth. All you need to do is have smart money-saving habits and plan for your financial future.

I’ll teach you how to think about money in a different way than you’re used to.

Unlike most money “experts” out there, I won’t sit here and tell you to stop buying coffee at Starbucks or start cooking rice and chicken for dinner every night. Financial freedom means you have control over your decisions.

For myself, I know when to spend extravagantly and I know where to cut ruthlessly.

If you follow the tips and resources that I’ve outlined in this guide, you can say goodbye to money frustration.

Finance Planning 101: Basic Things to Sort Out

Financial planning isn’t about penny-pinching, massive budget spreadsheets, or working 90 hours per week to make ends meet. It’s about having the right systems in place to build wealth.

I don’t want to spend all my time thinking about money. I want to do the work upfront, put it on autopilot, then get back to living my life.

For some people, living rich means being able to travel and spend more time with their family. Others live a rich life by hiring a personal chef or buying designer clothes. But before you can get to that point, you need to sort the following things out first:

Money Mistakes

Avoiding money mistakes can save you hundreds of thousands of dollars, if not millions, throughout your life. Half of the battle is understanding what not to do with your money.

Mistake #1: Debating minutia — Focusing on minor and insignificant financial details without taking action will not get you rich. Saving $0.60 buying store-brand cereal instead of Cheerios won’t make a difference. Instead of debating about the best interest rates or hottest stocks right now, just set up a no-fee bank account with automatic savings and investments. Then allow your money to grow for 30+ years.

Mistake #2: Relying on willpower — So many people rely on willpower to prevent themselves from eating out or buying new clothes. Even if you save $2 per day on coffee by making it at home, That $730 at the end of the year isn’t significant unless you’ve actually put it aside and invested it.

Mistaking #3: Waiting — Procrastination is killing your money. Starting as early as possible is the best path to financial freedom. If a 25-year-old invests $100 per month for 10 years at an 8% return rate, their account will be worth $200,061 by the age of 65. If their co-worker starts investing $100 per month at age 35 for 30 years, their account would be $149,036 at age 65. Even though the second person made contributions for 20 years longer, they still finished with $50,000 less because they longer to start.

Automation

One of the main reasons why people fail to save money is because they rely on their future motivation. Moving money from a checking account to a savings account or investment account takes effort.

Setting up an automated personal finance system for your bills, payments, and savings will eliminate those manual tasks and allow you to focus on the things that truly matter. Automation is so flexible, so you can set it up to meet the needs of your situation.

I personally hate detailed budget plans. Having to constantly review all the transactions, categorize everything correctly, and review tiny budgets for obscure categories drives me crazy.

I’d much rather break everything down into a few core categories that’s simple to follow.

That’s what we call a Conscious Spending Plan.

To establish a conscious spending plan, you’ll look at the major areas of your spending:

Fixed Costs: 50-60% — Things like rent, utilities, car payments, and health insurance should be roughly 50% of your take-home pay.

Investments: 10% — Set aside 10% of your income for things like a Roth IRA and 401(k).

Savings 5-10% — This money can be used for a down payment on a house, vacations, and unplanned expenses.

Guilt-free spending 20-35% — Leave what’s left for things like eating out, drinks, clothing, and going to the movies.

Once you establish your spending recommendations, you can automate your finances accordingly. Here’s an example of what your automation could look like:

2nd of the month — Part of your salary goes directly into your 401(k) and the rest is direct-deposit into your checking account.

5th of the month — Automatically transfer funds from your checking account to a savings account. Automatically transfer funds from your checking account to your Roth IRA.

7th of the month — Automatically pay bills from checking accounts and credit cards. Automatically pay off credit card bills from your checking account.

Once you automate these payments and savings, you’ll know exactly how much money is left for you to spend each month. That’s where the guilt-free spending comes in. Spend freely until you’ve used up what’s left. You’ve already taken care of your investing and saving. Now you won’t have to think twice about buying a sandwich for lunch or getting that $5 cup of coffee.

Hidden Income

Most people don’t realize that they are throwing away “hidden income” each and every month. This is the next thing that you need to get sorted out.

Tapping into hidden income can be as simple as making a phone call. These calls can save you thousands of dollars every month.

You just need to put your negotiation skills to the test on fixed monthly costs:

Car insurance — Instead of choosing a car insurance once and never looking at it again, pick up the phone and negotiate your rate. All you need to do is analyze your current plan, check your coverage options, and shop around with different providers.

Cell phone — Compare your monthly usage (talk, text, data) to other plans offered by various network providers. When you call your cell phone carrier, start by asking what plans can give you a better value. If that doesn’t work, you can use the competitors’ plans as leverage.

Bank and credit card fees — Yes, you can actually negotiate fees from banks and credit cards. Getting an overdraft fee waived or lowering percentage points on interest payments can save you thousands over time. This can help you pay off your debt faster as well.

When you’re negotiating these costs, don’t make it easy for the customer service representatives to say “no.” Rather than asking, “can you lower my monthly bill?” phrase it as “what other plan options do I have?”

Be prepared to walk. In most cases, people are afraid of negotiating car insurance or cell phone plans because they don’t actually want to cancel the service.

In reality, threatening to cancel gives you the best leverage. Even if it means escalating the conversation to a supervisor, your plan won’t actually be canceled until you say the final word.

Investing

I know lots of people who are scared to invest money in the stock market. But there is definitely a winning formula to being a successful investor over time. This is arguably the best way to build wealth.

Stop focusing on trying to buy the hottest stock today and selling it next year for maximum profits. Trying to beat the stock market is not a viable investment strategy.

You should also ignore all of the media coverage about an impending financial crisis or stock market collapse. If you truly believe that the market will grow and recover in the long run, you should continue investing during all market conditions.

The three most significant factors for successful investing:

Start as early as possible.

Invest every month.

Go with index funds.

A regular investing account is good to have. I’m referring to accounts offered by Fidelity, TD Ameritrade, ETrade, or whatever. But these are taxable accounts. So when you sell a stock, you pay taxes on gains. Those taxes are even more substantial if you sell in less than a year.

But retirement accounts (401k, Roth IRA, SEP IRA, etc.) give you the most significant tax advantages. Max out these accounts first.

Eliminating Debt

If you have a negative net worth, the thought of investing or saving money can seem inconceivable. So the first thing you need to do is eliminate your debt once and for all.

There are five steps to get out of debt fast:

Step #1: Figure out how much debt you have.

Step #2: Determine what needs to be paid off first (based on interest rates).

Step #3: Negotiate a lower APR (annual percentage rate).

Step #4: Figure out where the money to pay your debt will come from.

Step #5: Start making a dent in your debts.

Like most areas of money, getting started right away is the best thing you can do. Even paying an extra $20 per month to start can make a huge difference over time.

Here’s a simple explanation to showcase the power of making larger payments. Let’s say two people each have $5,000 in credit card debt at 14% APR.

Person A pays $200 per month. It will take them 32 months to pay the debt, which will incur $1,313.96 in interest payments over that time.

Person B pays $400 per month. It will take them 14 months to pay the debt, which will incur $436.46 in interest payments.

The second person saved nearly $900 on interest fees by doubling their monthly payment payments. Imagine how much money you can save by if you have $10,000 or $20,000+ of debt just by paying extra each month.

Earn More Money

The best and fastest way to enhancing your financial power is by earning more money. You can budget, plan, and cut costs all you want. But if your income doesn’t increase, you’re path to financial freedom will always be limited.

There is a limit to how much you can save, but there is no limit to how much you can earn.

These are the three easiest ways to make more money:

Get a raise.

Earn money on the side using skills you already possess.

Start a new business.

What could you do with an extra $1,000 per month? What about $5,000 or even $10,000+? The only way to find out is by seeking ways to increase your income.

Financial Planning Advisors: Pros and Cons

Lots of people feel overwhelmed when it comes to financial planning, which is understandable. So it’s not uncommon to seek help from a financial advisor.

I know plenty of people who have had huge success working with a financial planner. But I know others who didn’t have as much luck.

Financial Advisor Pros:

You don’t have to learn all this stuff yourself.

Can get your money in the best accounts to save on taxes.

Save time by having an advisor manage a portfolio for you.

Create a personal wealth plan for your specific situation.

Can add an extra barrier to your money, preventing you from making a rash decision.

Financial Advisor Cons:

Costs associated with hiring an advisor.

Possible conflict of interest. Some advisors are also brokers, getting kickbacks on sub-standard products that they sell you. Make sure your financial advisor has a fiduciary duty to work on your behalf.

Tough to find the right financial advisor for you. Like all experts, it can take some trial and error to find someone who’s truly good at their craft.

Whether you decide to work with a financial advisor or not is entirely up to you. Just make sure you shop around and do your due diligence before making a long-term commitment. A good option is to look for a few and try them out on smaller projects for an hourly fee. That’ll give you a better sense before you have them manage your entire portfolio.

Financial Planning Guide For 2020 is a post from: I Will Teach You To Be Rich.

from Surety Bond Brokers? Business https://www.iwillteachyoutoberich.com/blog/financial-planning/

0 notes

Text

Financial Planning Guide For 2020

The key to living a rich life is taking control of your money.

You don’t have to have a six-figure income or own a business to build wealth. All you need to do is have smart money-saving habits and plan for your financial future.

I’ll teach you how to think about money in a different way than you’re used to.

Unlike most money “experts” out there, I won’t sit here and tell you to stop buying coffee at Starbucks or start cooking rice and chicken for dinner every night. Financial freedom means you have control over your decisions.

For myself, I know when to spend extravagantly and I know where to cut ruthlessly.

If you follow the tips and resources that I’ve outlined in this guide, you can say goodbye to money frustration.

Finance Planning 101: Basic Things to Sort Out

Financial planning isn’t about penny-pinching, massive budget spreadsheets, or working 90 hours per week to make ends meet. It’s about having the right systems in place to build wealth.

I don’t want to spend all my time thinking about money. I want to do the work upfront, put it on autopilot, then get back to living my life.

For some people, living rich means being able to travel and spend more time with their family. Others live a rich life by hiring a personal chef or buying designer clothes. But before you can get to that point, you need to sort the following things out first:

Money Mistakes

Avoiding money mistakes can save you hundreds of thousands of dollars, if not millions, throughout your life. Half of the battle is understanding what not to do with your money.

Mistake #1: Debating minutia — Focusing on minor and insignificant financial details without taking action will not get you rich. Saving $0.60 buying store-brand cereal instead of Cheerios won’t make a difference. Instead of debating about the best interest rates or hottest stocks right now, just set up a no-fee bank account with automatic savings and investments. Then allow your money to grow for 30+ years.

Mistake #2: Relying on willpower — So many people rely on willpower to prevent themselves from eating out or buying new clothes. Even if you save $2 per day on coffee by making it at home, That $730 at the end of the year isn’t significant unless you’ve actually put it aside and invested it.

Mistaking #3: Waiting — Procrastination is killing your money. Starting as early as possible is the best path to financial freedom. If a 25-year-old invests $100 per month for 10 years at an 8% return rate, their account will be worth $200,061 by the age of 65. If their co-worker starts investing $100 per month at age 35 for 30 years, their account would be $149,036 at age 65. Even though the second person made contributions for 20 years longer, they still finished with $50,000 less because they longer to start.

Automation

One of the main reasons why people fail to save money is because they rely on their future motivation. Moving money from a checking account to a savings account or investment account takes effort.

Setting up an automated personal finance system for your bills, payments, and savings will eliminate those manual tasks and allow you to focus on the things that truly matter. Automation is so flexible, so you can set it up to meet the needs of your situation.

I personally hate detailed budget plans. Having to constantly review all the transactions, categorize everything correctly, and review tiny budgets for obscure categories drives me crazy.

I’d much rather break everything down into a few core categories that’s simple to follow.

That’s what we call a Conscious Spending Plan.

To establish a conscious spending plan, you’ll look at the major areas of your spending:

Fixed Costs: 50-60% — Things like rent, utilities, car payments, and health insurance should be roughly 50% of your take-home pay.

Investments: 10% — Set aside 10% of your income for things like a Roth IRA and 401(k).

Savings 5-10% — This money can be used for a down payment on a house, vacations, and unplanned expenses.

Guilt-free spending 20-35% — Leave what’s left for things like eating out, drinks, clothing, and going to the movies.

Once you establish your spending recommendations, you can automate your finances accordingly. Here’s an example of what your automation could look like:

2nd of the month — Part of your salary goes directly into your 401(k) and the rest is direct-deposit into your checking account.

5th of the month — Automatically transfer funds from your checking account to a savings account. Automatically transfer funds from your checking account to your Roth IRA.

7th of the month — Automatically pay bills from checking accounts and credit cards. Automatically pay off credit card bills from your checking account.

Once you automate these payments and savings, you’ll know exactly how much money is left for you to spend each month. That’s where the guilt-free spending comes in. Spend freely until you’ve used up what’s left. You’ve already taken care of your investing and saving. Now you won’t have to think twice about buying a sandwich for lunch or getting that $5 cup of coffee.

Hidden Income

Most people don’t realize that they are throwing away “hidden income” each and every month. This is the next thing that you need to get sorted out.

Tapping into hidden income can be as simple as making a phone call. These calls can save you thousands of dollars every month.

You just need to put your negotiation skills to the test on fixed monthly costs:

Car insurance — Instead of choosing a car insurance once and never looking at it again, pick up the phone and negotiate your rate. All you need to do is analyze your current plan, check your coverage options, and shop around with different providers.

Cell phone — Compare your monthly usage (talk, text, data) to other plans offered by various network providers. When you call your cell phone carrier, start by asking what plans can give you a better value. If that doesn’t work, you can use the competitors’ plans as leverage.

Bank and credit card fees — Yes, you can actually negotiate fees from banks and credit cards. Getting an overdraft fee waived or lowering percentage points on interest payments can save you thousands over time. This can help you pay off your debt faster as well.

When you’re negotiating these costs, don’t make it easy for the customer service representatives to say “no.” Rather than asking, “can you lower my monthly bill?” phrase it as “what other plan options do I have?”

Be prepared to walk. In most cases, people are afraid of negotiating car insurance or cell phone plans because they don’t actually want to cancel the service.

In reality, threatening to cancel gives you the best leverage. Even if it means escalating the conversation to a supervisor, your plan won’t actually be canceled until you say the final word.

Investing

I know lots of people who are scared to invest money in the stock market. But there is definitely a winning formula to being a successful investor over time. This is arguably the best way to build wealth.

Stop focusing on trying to buy the hottest stock today and selling it next year for maximum profits. Trying to beat the stock market is not a viable investment strategy.

You should also ignore all of the media coverage about an impending financial crisis or stock market collapse. If you truly believe that the market will grow and recover in the long run, you should continue investing during all market conditions.

The three most significant factors for successful investing:

Start as early as possible.

Invest every month.

Go with index funds.

A regular investing account is good to have. I’m referring to accounts offered by Fidelity, TD Ameritrade, ETrade, or whatever. But these are taxable accounts. So when you sell a stock, you pay taxes on gains. Those taxes are even more substantial if you sell in less than a year.

But retirement accounts (401k, Roth IRA, SEP IRA, etc.) give you the most significant tax advantages. Max out these accounts first.

Eliminating Debt

If you have a negative net worth, the thought of investing or saving money can seem inconceivable. So the first thing you need to do is eliminate your debt once and for all.

There are five steps to get out of debt fast:

Step #1: Figure out how much debt you have.

Step #2: Determine what needs to be paid off first (based on interest rates).

Step #3: Negotiate a lower APR (annual percentage rate).

Step #4: Figure out where the money to pay your debt will come from.

Step #5: Start making a dent in your debts.

Like most areas of money, getting started right away is the best thing you can do. Even paying an extra $20 per month to start can make a huge difference over time.

Here’s a simple explanation to showcase the power of making larger payments. Let’s say two people each have $5,000 in credit card debt at 14% APR.

Person A pays $200 per month. It will take them 32 months to pay the debt, which will incur $1,313.96 in interest payments over that time.

Person B pays $400 per month. It will take them 14 months to pay the debt, which will incur $436.46 in interest payments.

The second person saved nearly $900 on interest fees by doubling their monthly payment payments. Imagine how much money you can save by if you have $10,000 or $20,000+ of debt just by paying extra each month.

Earn More Money

The best and fastest way to enhancing your financial power is by earning more money. You can budget, plan, and cut costs all you want. But if your income doesn’t increase, you’re path to financial freedom will always be limited.

There is a limit to how much you can save, but there is no limit to how much you can earn.

These are the three easiest ways to make more money:

Get a raise.

Earn money on the side using skills you already possess.

Start a new business.

What could you do with an extra $1,000 per month? What about $5,000 or even $10,000+? The only way to find out is by seeking ways to increase your income.

Financial Planning Advisors: Pros and Cons

Lots of people feel overwhelmed when it comes to financial planning, which is understandable. So it’s not uncommon to seek help from a financial advisor.

I know plenty of people who have had huge success working with a financial planner. But I know others who didn’t have as much luck.

Financial Advisor Pros:

You don’t have to learn all this stuff yourself.

Can get your money in the best accounts to save on taxes.

Save time by having an advisor manage a portfolio for you.

Create a personal wealth plan for your specific situation.

Can add an extra barrier to your money, preventing you from making a rash decision.

Financial Advisor Cons:

Costs associated with hiring an advisor.

Possible conflict of interest. Some advisors are also brokers, getting kickbacks on sub-standard products that they sell you. Make sure your financial advisor has a fiduciary duty to work on your behalf.

Tough to find the right financial advisor for you. Like all experts, it can take some trial and error to find someone who’s truly good at their craft.

Whether you decide to work with a financial advisor or not is entirely up to you. Just make sure you shop around and do your due diligence before making a long-term commitment. A good option is to look for a few and try them out on smaller projects for an hourly fee. That’ll give you a better sense before you have them manage your entire portfolio.

Financial Planning Guide For 2020 is a post from: I Will Teach You To Be Rich.

from Finance https://www.iwillteachyoutoberich.com/blog/financial-planning/

via http://www.rssmix.com/

0 notes

Text

Financial Planning Guide For 2020

The key to living a rich life is taking control of your money.

You don’t have to have a six-figure income or own a business to build wealth. All you need to do is have smart money-saving habits and plan for your financial future.

I’ll teach you how to think about money in a different way than you’re used to.

Unlike most money “experts” out there, I won’t sit here and tell you to stop buying coffee at Starbucks or start cooking rice and chicken for dinner every night. Financial freedom means you have control over your decisions.

For myself, I know when to spend extravagantly and I know where to cut ruthlessly.

If you follow the tips and resources that I’ve outlined in this guide, you can say goodbye to money frustration.

Finance Planning 101: Basic Things to Sort Out

Financial planning isn’t about penny-pinching, massive budget spreadsheets, or working 90 hours per week to make ends meet. It’s about having the right systems in place to build wealth.

I don’t want to spend all my time thinking about money. I want to do the work upfront, put it on autopilot, then get back to living my life.

For some people, living rich means being able to travel and spend more time with their family. Others live a rich life by hiring a personal chef or buying designer clothes. But before you can get to that point, you need to sort the following things out first:

Money Mistakes

Avoiding money mistakes can save you hundreds of thousands of dollars, if not millions, throughout your life. Half of the battle is understanding what not to do with your money.

Mistake #1: Debating minutia — Focusing on minor and insignificant financial details without taking action will not get you rich. Saving $0.60 buying store-brand cereal instead of Cheerios won’t make a difference. Instead of debating about the best interest rates or hottest stocks right now, just set up a no-fee bank account with automatic savings and investments. Then allow your money to grow for 30+ years.

Mistake #2: Relying on willpower — So many people rely on willpower to prevent themselves from eating out or buying new clothes. Even if you save $2 per day on coffee by making it at home, That $730 at the end of the year isn’t significant unless you’ve actually put it aside and invested it.

Mistaking #3: Waiting — Procrastination is killing your money. Starting as early as possible is the best path to financial freedom. If a 25-year-old invests $100 per month for 10 years at an 8% return rate, their account will be worth $200,061 by the age of 65. If their co-worker starts investing $100 per month at age 35 for 30 years, their account would be $149,036 at age 65. Even though the second person made contributions for 20 years longer, they still finished with $50,000 less because they longer to start.

Automation

One of the main reasons why people fail to save money is because they rely on their future motivation. Moving money from a checking account to a savings account or investment account takes effort.

Setting up an automated personal finance system for your bills, payments, and savings will eliminate those manual tasks and allow you to focus on the things that truly matter. Automation is so flexible, so you can set it up to meet the needs of your situation.

I personally hate detailed budget plans. Having to constantly review all the transactions, categorize everything correctly, and review tiny budgets for obscure categories drives me crazy.

I’d much rather break everything down into a few core categories that’s simple to follow.

That’s what we call a Conscious Spending Plan.

To establish a conscious spending plan, you’ll look at the major areas of your spending:

Fixed Costs: 50-60% — Things like rent, utilities, car payments, and health insurance should be roughly 50% of your take-home pay.

Investments: 10% — Set aside 10% of your income for things like a Roth IRA and 401(k).

Savings 5-10% — This money can be used for a down payment on a house, vacations, and unplanned expenses.

Guilt-free spending 20-35% — Leave what’s left for things like eating out, drinks, clothing, and going to the movies.

Once you establish your spending recommendations, you can automate your finances accordingly. Here’s an example of what your automation could look like:

2nd of the month — Part of your salary goes directly into your 401(k) and the rest is direct-deposit into your checking account.

5th of the month — Automatically transfer funds from your checking account to a savings account. Automatically transfer funds from your checking account to your Roth IRA.

7th of the month — Automatically pay bills from checking accounts and credit cards. Automatically pay off credit card bills from your checking account.

Once you automate these payments and savings, you’ll know exactly how much money is left for you to spend each month. That’s where the guilt-free spending comes in. Spend freely until you’ve used up what’s left. You’ve already taken care of your investing and saving. Now you won’t have to think twice about buying a sandwich for lunch or getting that $5 cup of coffee.

Hidden Income

Most people don’t realize that they are throwing away “hidden income” each and every month. This is the next thing that you need to get sorted out.

Tapping into hidden income can be as simple as making a phone call. These calls can save you thousands of dollars every month.

You just need to put your negotiation skills to the test on fixed monthly costs:

Car insurance — Instead of choosing a car insurance once and never looking at it again, pick up the phone and negotiate your rate. All you need to do is analyze your current plan, check your coverage options, and shop around with different providers.

Cell phone — Compare your monthly usage (talk, text, data) to other plans offered by various network providers. When you call your cell phone carrier, start by asking what plans can give you a better value. If that doesn’t work, you can use the competitors’ plans as leverage.

Bank and credit card fees — Yes, you can actually negotiate fees from banks and credit cards. Getting an overdraft fee waived or lowering percentage points on interest payments can save you thousands over time. This can help you pay off your debt faster as well.

When you’re negotiating these costs, don’t make it easy for the customer service representatives to say “no.” Rather than asking, “can you lower my monthly bill?” phrase it as “what other plan options do I have?”

Be prepared to walk. In most cases, people are afraid of negotiating car insurance or cell phone plans because they don’t actually want to cancel the service.

In reality, threatening to cancel gives you the best leverage. Even if it means escalating the conversation to a supervisor, your plan won’t actually be canceled until you say the final word.

Investing

I know lots of people who are scared to invest money in the stock market. But there is definitely a winning formula to being a successful investor over time. This is arguably the best way to build wealth.

Stop focusing on trying to buy the hottest stock today and selling it next year for maximum profits. Trying to beat the stock market is not a viable investment strategy.

You should also ignore all of the media coverage about an impending financial crisis or stock market collapse. If you truly believe that the market will grow and recover in the long run, you should continue investing during all market conditions.

The three most significant factors for successful investing:

Start as early as possible.

Invest every month.

Go with index funds.

A regular investing account is good to have. I’m referring to accounts offered by Fidelity, TD Ameritrade, ETrade, or whatever. But these are taxable accounts. So when you sell a stock, you pay taxes on gains. Those taxes are even more substantial if you sell in less than a year.

But retirement accounts (401k, Roth IRA, SEP IRA, etc.) give you the most significant tax advantages. Max out these accounts first.

Eliminating Debt

If you have a negative net worth, the thought of investing or saving money can seem inconceivable. So the first thing you need to do is eliminate your debt once and for all.

There are five steps to get out of debt fast:

Step #1: Figure out how much debt you have.

Step #2: Determine what needs to be paid off first (based on interest rates).

Step #3: Negotiate a lower APR (annual percentage rate).

Step #4: Figure out where the money to pay your debt will come from.

Step #5: Start making a dent in your debts.

Like most areas of money, getting started right away is the best thing you can do. Even paying an extra $20 per month to start can make a huge difference over time.

Here’s a simple explanation to showcase the power of making larger payments. Let’s say two people each have $5,000 in credit card debt at 14% APR.

Person A pays $200 per month. It will take them 32 months to pay the debt, which will incur $1,313.96 in interest payments over that time.

Person B pays $400 per month. It will take them 14 months to pay the debt, which will incur $436.46 in interest payments.

The second person saved nearly $900 on interest fees by doubling their monthly payment payments. Imagine how much money you can save by if you have $10,000 or $20,000+ of debt just by paying extra each month.

Earn More Money

The best and fastest way to enhancing your financial power is by earning more money. You can budget, plan, and cut costs all you want. But if your income doesn’t increase, you’re path to financial freedom will always be limited.

There is a limit to how much you can save, but there is no limit to how much you can earn.

These are the three easiest ways to make more money:

Get a raise.

Earn money on the side using skills you already possess.

Start a new business.

What could you do with an extra $1,000 per month? What about $5,000 or even $10,000+? The only way to find out is by seeking ways to increase your income.

Financial Planning Advisors: Pros and Cons

Lots of people feel overwhelmed when it comes to financial planning, which is understandable. So it’s not uncommon to seek help from a financial advisor.

I know plenty of people who have had huge success working with a financial planner. But I know others who didn’t have as much luck.

Financial Advisor Pros:

You don’t have to learn all this stuff yourself.

Can get your money in the best accounts to save on taxes.

Save time by having an advisor manage a portfolio for you.

Create a personal wealth plan for your specific situation.

Can add an extra barrier to your money, preventing you from making a rash decision.

Financial Advisor Cons:

Costs associated with hiring an advisor.

Possible conflict of interest. Some advisors are also brokers, getting kickbacks on sub-standard products that they sell you. Make sure your financial advisor has a fiduciary duty to work on your behalf.

Tough to find the right financial advisor for you. Like all experts, it can take some trial and error to find someone who’s truly good at their craft.

Whether you decide to work with a financial advisor or not is entirely up to you. Just make sure you shop around and do your due diligence before making a long-term commitment. A good option is to look for a few and try them out on smaller projects for an hourly fee. That’ll give you a better sense before you have them manage your entire portfolio.

Financial Planning Guide For 2020 is a post from: I Will Teach You To Be Rich.

from Money https://www.iwillteachyoutoberich.com/blog/financial-planning/

via http://www.rssmix.com/

0 notes